McMoRan Davy Jones Gas Discovery

Posted by aeberman on January 18, 2010 - 10:10am

This is a post by Arthur E. Berman and Joshua H. Rosenfeld. Art is new on The Oil Drum staff. He is a geological consultant with 31 years of experience in petroleum and natural gas exploration and production. This is a link to Arthur Berman's biography.-- Gail

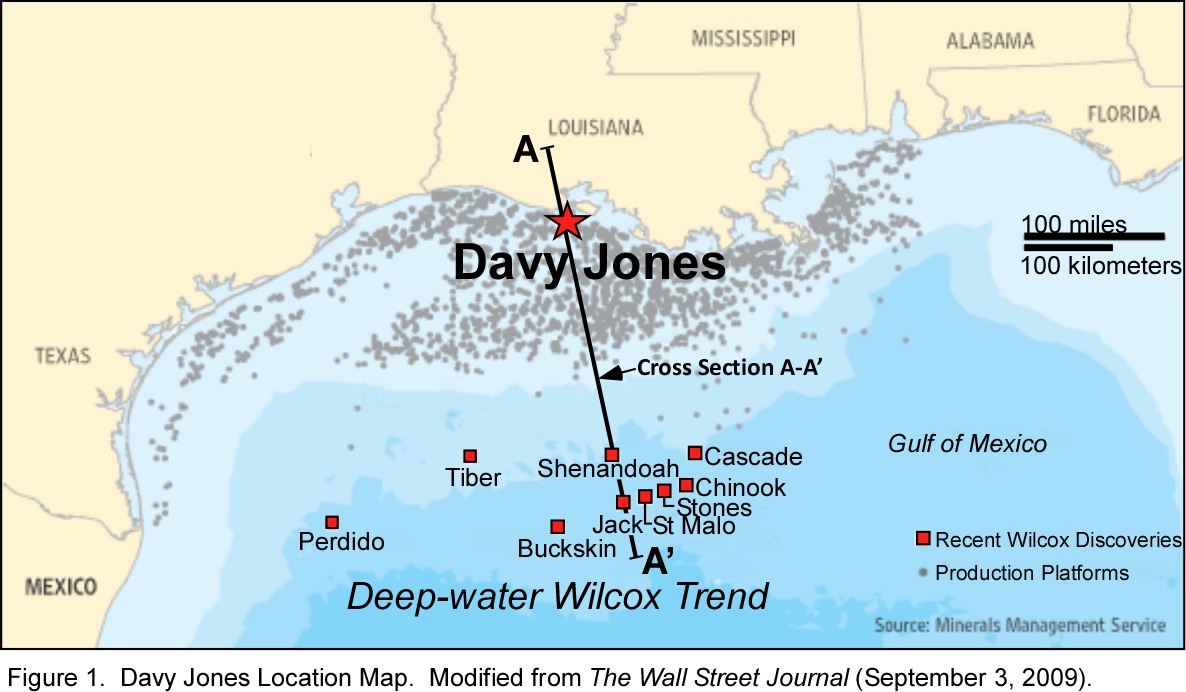

McMoRan Exploration Company has made a significant discovery in the U.S. Gulf of Mexico that may contain 2-6 trillion cubic feet (Tcf) of natural gas reserves. The well was drilled in 20 ft of water 10 miles south of the Louisiana coast on South Marsh Island 168 (Figure 1). The discovery by McMoRan (operator) and partners Plains Exploration & Production Company and Nippon Oil Corporation is very deep (28,125 to 28,262 feet drilling depth) but with excellent quality. The gas-saturated reservoir rock is located in the upper Wilcox Sandstone (Paleocene-Eocene). There is 135 ft of gas pay with as much as 20% porosity and 10-20 ohm-meters of resistivity.

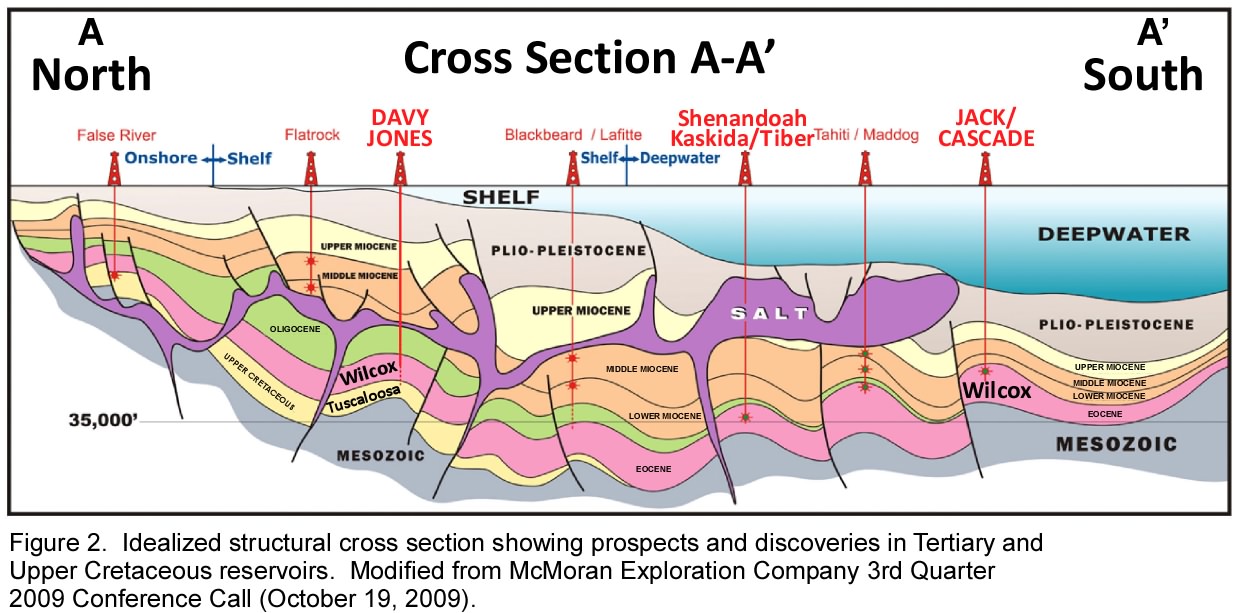

The Davy Jones well was drilled on a large anticlinal feature with approximately 20, 000 acres of structural closure at Wilcox level (Figure 2).

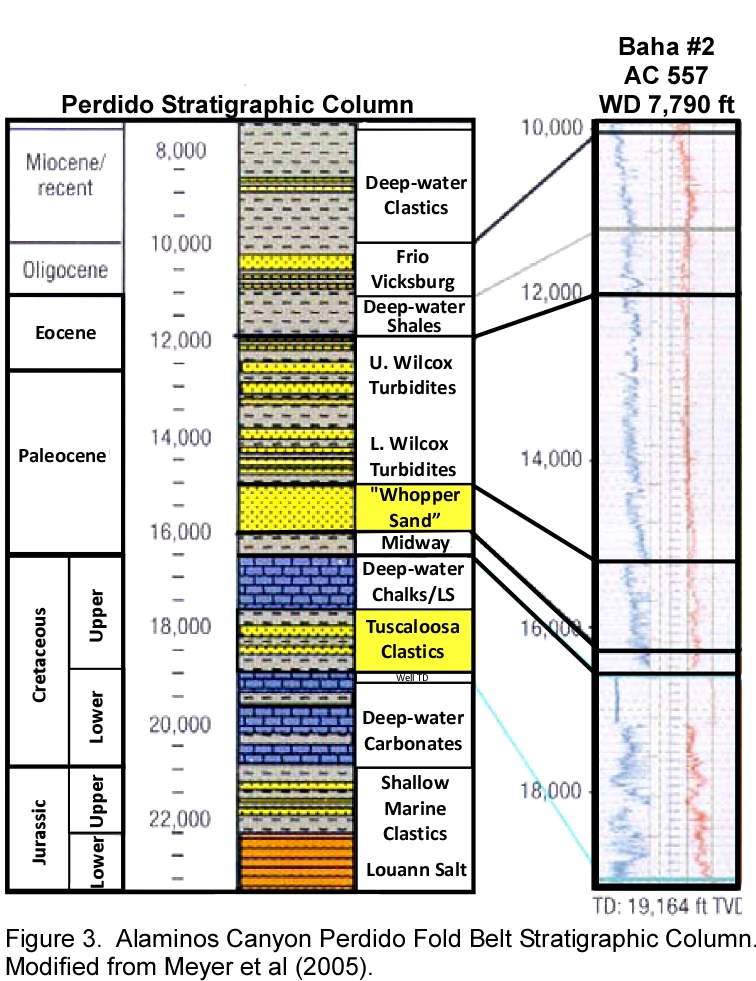

McMoRan intends to continue drilling another thousand feet or so in order to evaluate the next two potential reservoir strata known as the lower Wilcox “Whopper Sand” and the Cretaceous Tuscaloosa Sandstone (Figure 3). The Tuscaloosa is a prolific producing reservoir onshore.

The discovery is especially important because it provides a link between onshore Wilcox production and a series of discoveries from equivalent strata in the deep-water Gulf of Mexico including the Tiber Field announced by BP in September 2009. In 2001, the announcement of a Wilcox discovery in Unocal’s deepwater Trident-1 (Perdido) well came as a complete surprise to most of the industry. Since then, these reservoir sands have been found in a 300-mile long and 50-mile wide fairway parallel to the present-day shelf margin beneath 5,000 to 10,000 feet of water, containing more than 20 fields. The stratigraphy of the undrilled gap between the onshore and the deepwater Wilcox under the coastal plain and continental shelf of Texas and Louisiana, however, has remained conjectural. This “down dip” Wilcox play has been ignored by drillers until McMoRan’s test because structural complexity and deep targets involve high risk, expensive exploration.

Recent discoveries of oil and gas in the deep-water offshore region of the Gulf of Mexico may have recoverable resources of up to 15 billion barrels of oil equivalent. Reservoirs consist of Paleocene to Eocene submarine fan and turbidite sandstones whose thickness exceeds 1000 feet. This sequence has been correlated with the onshore Wilcox Group. The considerable thickness, and wide areal extent of the deep-water offshore Wilcox interval challenges the common perception that most sandstone in the Wilcox was deposited within shelf and upper continental slope environments with only thin, channelized sands reaching the deep basin within shale-dominated turbidites.

For the last decade, curious geologists have struggled to explain the counter-intuitive presence of hundreds of feet of massive Wilcox sand across a wide swath of the Gulf of Mexico so far from the contemporaneous shoreline, and whether this sand trend is continuous from the onshore into the deepwater (Berman and Rosenfeld, World Oil, June, 2007). Conjecture also swirls around whether the Wilcox extends southward and underlies Mexico’s deepwater and shelves.

The news from the Davy Jones well appears to open an important new gas play in the Gulf of Mexico. McMoRan’s findings will undoubtedly encourage more deep drilling for Wilcox targets in this trend. Meanwhile, the next 1,000 feet in the Davy Jones well may yet reveal the highest quality reservoir sands that correlate with the basal Wilcox “Whopper Sands” in the deepwater.

Some analysts have said that this discovery proves that concerns about peak oil and gas are unfounded. This is common whenever important discoveries are announced. It is, therefore, worthwhile to place the Davy Jones discovery in the context of broader petroleum supply, demand, cost and timing factors. While 2 Tcf is a lot of gas, it is about equal to one month of U.S. consumption during peak winter months, and we currently have an over-supply of natural gas that may persist for some time.

It is worth mentioning that the announced discovery is based on sketchy information from well logs and is does not represent an actual flow test. The reason for this incomplete data is the extreme depth, pressure and temperature of the Wilcox reservoir in this well.

Bottom-hole pressures are 27,000 pounds per square inch, according to comments by J.R. Moffat in Houston on February 18, 2010, by far the highest pressures known in Gulf of Mexico wells, and almost 10 times the rocket engine chamber pressure required for spacecraft liftoff. In Moffat's question-and-answer session at the same meeting in February, he said that bottom-hole temperatures are 440 degrees Fahrenheit. Gas has never been produced at these temperatures and pressures, and may present engineering obstacles. In addition, gas reserve volumes will shrink at surface conditions. There is also a possibility that the gas will contain carbon dioxide, which will reduce the volume of commercial gas and present a disposal problem.

The Davy Jones well has cost almost $200 million so far, and development drilling is expected to cost $1.5-2.0 billion. Production facilities will add to that cost. There are few rigs in the world that are capable of drilling at these depths and temperatures, so Davy Jones will have to stand in line with all of the deep-water Wilcox discoveries in the Gulf of Mexico and the pre-salt fields in Brazil’s Santos Basin for rig availability. The earliest estimates for first production are in 2013.

At the same time, the apparent discovery opens a new trend in the Gulf of Mexico that could contain considerable new reserves. The Davy Jones discovery announcement comes at a time when few oil and gas companies are pursuing objectives other than shale plays. Fortunately, there are wildcatters that are willing to pursue these high-risk, high-reward plays, this time with apparent success. Stay tuned because this is a promising development.

Arthur,

Welcome aboard. Clearly, World Oil's loss is The Oil Drum's gain.

Arthur & Joshua,

Very good article. The way I have characterized the oil & gas industry in the context of our remaining resource base is that while the industry can and will make money exploiting remaining economically recoverable conventional and unconventional resources, this does not mean that we can maintain a virtually infinite rate of increase in our consumption of a finite fossil fuel resource base.

A case in point is the North Sea. Since peaking at about 6 mbpd in 1999 (EIA, crude + condensate), the region has shown a decline rate of about 4.5%/year. However, Sam Foucher took a look at oil fields whose first full year of production was in 1999 or later, i.e, coming on line as the region peaked, or after the region peaked, and this group of oil fields showed a combined production peak of about one mbpd in 2005. So, new fields--at peak produciton representing about one-sixth of the regional peak--only served to slow the net rate of decline in total production. In other words, as you gentlemen know, Peaks Happen, even in the best of circumstances, such as regions like the North Sea, which were developed by private companies, using the best available technology, with virtually no restrictions on drilling.

Jeffrey J. Brown

The PO critic, when reading this, may ask:

1) What will the best technology be when oil goes for $400-$500 a barrel? Surely not the same apparatus that was developed for oil at $30 a barrel.

2) How far can the envelope be pushed, how many natural restrictions can be broken, and what will world production look like if, at the very least, North Sea technology and no restrictions are adopted universally for all fields around the world?

He might then go on to point what out what is happening to US natural gas production "post peak," after 2005:

Of course, there is a difference between oil and natural gas, especially in regard to unconventional extremely low permeability reservoirs, but are you arguing that we can maintain a virtually infinite rate of increase in our consumption of a finite fossil fuel resource base?

In any case, one of the huge problems that the industry faces is the rapidly aging workforce, especially since the recent increase in natural gas production required a vast increase in the number of (rapidly depleting) producing wells.

I'm saying that in the short term, PO might be "disproved." In the long term, catastrophe will be more severe, without a doubt, if more fossil fuels are consumed.

I suspect that, in the coming years, oil-people will soon hold the same status that investors, bankers, financiers and CEO's do today. There will surely be a revitalization and re-engineering of the oil and gas industry.

shox -- I must assume you and I define PO differently. For me PO is that point in time when we’ve reached the maximum flow rate of oil to ever be achieved. Unless one believes in an infinite resource the concept can’t be “disproved”. We can certainly debate when that point is reached: 4 years ago…next year…50 years.

As far as the status of the oil patch you are way off base. We had already achieved the status of “world class scum” 34 years ago when I began my career. Back when even bankers were respected. And we do wear that mantle proudly. The only change I see coming is to be raised to “universe class scum”. Of course at that time we will have absolute control over all of you and then you’ll realize how easy we’ve been on you all these years. Prepare thyself for absolute domination!!!

Very interesting, Peak Oil is debunked ... excuse me, Peak Oil Theory is debunked in a few paragraphs, with one lousy, stinkin' gas well. How easy was that?

God is on our side!

- 25,000 psi!? Don't have to burn anything, just let the gas spin a turbine!

- 400 F? You have a geothermal well, too! Two for the price of one!

- CO2 present? No problem, use a compressor to put it back down the hole ... (what was that about 25,000 psi? I couldn't hear that last part for all that hissing ...?)

- Keep the autos away from that stuff.

- Sell the gas to England. They need it more than we do.

- Drill a little further and you will find abiotic oil. You guys are almost 'there'. Another 20,000 feet or so ought to do the trick! Think positive.

Intuitively there is less oil available the higher the cost of recovery. Counting on high oil prices - higher than current - to produce oil flows equal to flows of 2005- 2008 is a false hope, IMO.

Were talking not PO, but PH (peak hydrocarbons). Clearly PO and PH have peaked or will peak very soon. If one looks at production curves over the 20th century, it is a fairly rapidly rising curve, plateauing in recent years perhaps. Clearly the world production curve cannot be symmetrical. It is bound to drop off far more sharply on the downside than it rose on the upside. Population and resource curves preclude that. But beyond that, peak is not strictly geological. There is no reason that intensified exploitation cannot push peak forward a little at the expense of a more rapid decline (or even collapse) later. And that is what is happeding IMO.

The simple fact that drilling now goes down miles through all the obstacles outlined here and elsewhere means that the oil business has become capital intensive on a unprecedented scale, even by its own very high standard. One cannot just count the direct capital expenditures. One must also include "security" (i.e. military) expenditures, if not in this particular case, at least in general. But leave that aside for now.

That energy companies even contemplate such projects as these is a slam dunk argument for not merely the imminence (or occurrence) of peak, but also for a catastrophic collapse once these kinds of projects cease being feasible. And they will. The industrial infrastructure is of a piece. Not just aging workers, but rigs, ships, steel, and even the societies in which undergird this infrastructure. The rest of society must suffer the massive diversion of resources to the funding of such projects, and at a certain point it is no longer able to.

Once things begin retreating, once these extraordinary means are no longer sufficient to keep up, then things may very well snowball into collapse. That's what I foresee.

Have a nice day.

Aren't we entering a period where relaxed SEC rules about declaring reserves are likely to lead to growth of officially reported reserves. This is the eyes of the public will constitute the disproof. Then we have the use of barrels of oil equivalent for any announcement of hydrocarbon discovery. So the takehome for Joe6P, is lots of "oil" being discovered. Why if this keeps up we will be eligible to join OPEC before long!

EOS -- I wouldn't call the SEC rule changes a "relaxing". It's much worse then that IMHO. They've made the reporting categories more complex. Even within the industry it will be a little confusing. As you imply, Joe6P is not going to pay attention to details. And now the SEC has armed the talking heads with enough ammo to confuse even the literate.

The best technology when oil reaches $400-$500 a barrel will be solar PV or wind turbines or coal gasification or wood gas or walking.

Society will never be burning much $400 oil as a source as energy. Industrial chemical feedstock maybe, but not a source of energy.

I object to this. Take a look at what other countries are paying for fuel compared to the US:

http://en.wikipedia.org/wiki/Gasoline_and_diesel_usage_and_pricing

The Western European countries all price their fuel from about $6/gal upwards, compared to the $2.70/gal that people in the US currently pay. This roughly translates to $200-$300 per barrel of oil for the consumer, after bearing the heavy taxes, .

Norway, which exports about 10 times the amount of oil it consumes, has among the highest prices in the world, nearing $8/gal. Even Russia, which produces upwards of 9MB/d and exports about 70% of it, and whose economy is still in the revival stage, prices its fuel higher than the US, at over $3/gal.

I believe that, although globalized trade may well be undone by prices exceeding $300/barrel, prices upwards of $300-$400/barrel are still tolerable, indeed reasonable. They already effectively pay that much in much of the EU, and their economies fare just fine. They have higher efficiency standards, good conservation practices and stricter environmental regulations.

From what I've read (on TOD) the high price of fuel/gal in certain countries is deceptive. When it is due to taxation, those taxes, in a

sense, come back to the payer in the forum of public services. Or in the absence of other taxes, if your view of public services is as negative as much I've read here.

Of course fuel taxes in high-tax countries comes back to the taxpayer in the form of public services.

This is why some exporters, such as Norway, have such high fuel taxes. They have other sources of energy for their own internal use (in Norway, hydroelectricity) so it is economically efficient for them to export as much oil as possible and use as much of their own sources as possible.

High fuel taxes cause domestic users to consume less, which frees more oil for export.

In return they get free health care, free pensions, free everything. The drawback is that they have to use public transit rather than drive everywhere, which is not necessarily a drawback depending on your priorities.

Norway also have high taxes on cars and fees for roads but people are driving anyway.

Matthew Simmons made a compelling case that if oil does not rise to about $500-$600/barrel, the industry will not have the revenue to renew its operations into more difficult-to-produce oil, making the long term situation even worse. Here is his interview:

http://www.youtube.com/watch?v=Gem872xH_7s

Robert Hirsch shares the same view that oil needs to be at several hundred dollars a barrel, with fuel priced at $15/gal:

http://www.youtube.com/watch?v=489IEnzg6GU

http://www.youtube.com/watch?v=ipfEE9Y4jCM

I have no doubt that such figures will cause riots initially, but people will settle down in time and get used to the new realities.

And it won't be a 100M bbl/day reality, either.

The motor fuel tax is neutral. It offsets some other form of taxation. The problem is the trade defecits for importing nations. The US is at the maximum usually experienced before a masive devaluation. UK turned from exporter in the last few years, so they don't have good prospects for the future either.

I consider the import/export situation most critical with respect to US. The current recession is said by some to have been triggered by the spike in oil prices. I say, triggered since the debts and their growth were already there waiting for a match to be struck. My speculation is that as much as a first order market effect was the cognition on the part of well placed parties that oil prices that high signaled the end of neo-mercantilism.

I think you may have it precisely reversed. The EU can withstand its consumers paying circa $8gallon, because the lions share of that price is tax, which stays within the EU zone. If they had to pay it out as foreign exchange instead the results would be significant. The cost of fuel for shipping is still pretty small, and we have documented many ways that it can be made cosniderably more efficient. I don't see ocean shipping collapsing because of high bunker fuel costs. It will probably decrease as a result of gloabal economic retrenchment, but that is a different matter than not being able to afford shipping.

But recall that Europe has lots of money, and tends to import things in whose production fuel is important from countries where fuel is cheap; also, many industrial users of fuel get to use untaxed fuel. So looking at the tax burden on gas for cars isn't particularly relevant, unless you're trying to explain why European commutes tend to be shorter than American ones.

It's only when bunker fuel is expensive enough to make up for the wage differential between England and Cambodia that globalized trade stops working, and that's really a long way out: ships just don't use that much fuel per container shifted - say one barrel for ten kiloton-miles of freight.

Hi Shox,

I'm not sure if your arguments hold water in regard to the upper limits of the oil prices the economy can stand.

Europeans have an auto and truck fleet that is far more fuel efficient than ours,and they are also better provided with mass transit.Furthermore the istorical context is different-urban sprawl and long distance commutes are not a big part of the Europen picture.

Furthermore the high fuel taxes the Europeans pay are returned to the economy in terms of increased social spending and /or lower sales , property , and income taxes as I understand the situation.Furthermore the balance of trade situation is obviously inmproved by importing less highly taxed petroleum.

Now as I see it if we gradually increased fuel taxes here , some of these same good effects would apply.In the short to medium term, however, we are a nation of sprawl and auto commuters, with a fleet of inefficient cars,and relatively little built mass transit.A fast increase in gasoline taxes might push a heck of a lot of workers and businesses over the edge into insolvency, given current conditions. Millions of people are living right on the edge of insolvency and a lot of businesses dependent on the automobile are in the same shape, including lots of restaurants, tuorist traps,convenience stores, and others.

Now if oil prices, or more specificall gasoline prices , rise sharply due to really serious new taxes,SOME of the ill effects would be offset by the tax revenue of course.

But -and this is a really BIG BUTT- if oil prices rise into the two hundred dollar class simply because the oil is in short supply, and the money winds up in the coffers of foriegn govts, where nearly all of it appears to go after all production expenses are paid, then it looks as if the economy would be in really deep doodoo.

A related scenario-two hundred dollar oil because the cost of producing it rises to that level for a large part of the total production might be relatively a little better or worse, depending on where the production money is splent but it would still be very very bad.

My guess is that prices are headed into that range , and that nothing can be done to prevent it, if production declines as fast as some of us think it will.Otoh if production declines more slowly, it might be possible that the economy can adjust in a lot of ways and we might not wind up quite so crippled up as Humpty Dumpty-maybe we can put ourselves together again after a fashion.

I think that over the long run your position is defensible-assuming we are able to hang on thru the crunch and build lots of windfarms,install lots of insulation,tighten up fuel economy standards, etc and in general start moving in a big way to a lower energy lifestyle.

But it's going to be very hard and I'm not at all confident that it can be done without a crash that will preclude it getting done occuring before it happens.

Anybody who wonders why I outline so many scenarios and jump all over the future map should take note of the fact that I at least an humble enough to to admit that I don't KNOW what will happen-only a few of the many relevant inputs into the future can be predicted with any high degree of confidence.

There is little doubt in my mind for instance the the ff joy ride is at or near it's zenith but the duration of the plateu stage is open to question-and the speed at which compensatory and remedial measures can be and will be implemented is an entirely open question.

I got in this late and would not have posted it if I had read the rest of the thread first.

Thanks for that. It didn't occur to me that a great deal of it is recirculated into the economy instead of being sent to other countries. In effect the money does find its way back to the local consumer.

Shox, if that happens, that is if $400-$500 oil makes any recovery of oil economical, then the cure will have been far worse than the disease. The peak oil debate is really about the consequences of peak oil. We peak oilers claim that the decline in oil production, and as a result a decline in oil consumption, will lead to the end of growth and therefore eventually economic collapse.

Four to five hundred dollar oil would bring about total...complete...economic collapse! Just look at what $100 to $147 dollar oil did to the world economy. If you don't understand this then listen to Jeff Rubin At ‘The Business of Climate Change’ Only a small part of this video is about the business of climate change, it is mostly about the business of peak oil. And, I might add, it is the best commentary on peak oil that I have heard in over ten years.

Ron P.

I watched the video yesterday. Pretty charming presentation.

Not to belabor the point, but at $400 the oil peak would be well behind us. There is zero chance of the world paying to produce MORE volume than we are today, but at such prices. Mostly like such costs would say the EROEI was so low that the useful energy from such production would be low anyway.

The only useful discussion would be for technologies that come in at about $100 - $200 per barrel, IMHO.

Hi Ron,

Thanks for the Rubin link - I did watch all of it (very good).

I remember in the 70s, after reading books like the Population Bomb, how rational and obvious it seemed that we should all work for global population reduction. The so called Green Revolution aside, I really expected family planning to become a serious subject. It did not - people just kept having babies regardless of the misery caused by breeding beyond their environments carrying capacity. Also, wealthy countries continued to breed unabated without regard for the environment stress they were transferring to poor countries.

So, it seems that Mr Rubin's otherwise excellent speech has one shaky premise: What if we fail to value the "common good" like air and water. What is to prevent us from repeating the 70s, 80s, 90s in regard to environmental degradation? What consequences will force us to pay attention to Mr. Rubin's suggestions for taxes and tariffs?

"Wealthy" countries have below replacement fertility, the problem is immigration and the large families these people have.

Hi Floridian,

You mention "Fertility" but, I think it is more complicated than that.

"Fertility Rate" http://en.wikipedia.org/wiki/Fertility_rate

"The total fertility rate (TFR, sometimes also called the fertility rate, period total fertility rate (PTFR) or total period fertility rate (TPFR)) of a population is the average number of children that would be born to a woman over her lifetime if (1) she were to experience the exact current age-specific fertility rates (ASFRs) through her lifetime, and (2) she were to survive from birth through the end of her reproductive life.[1] It is obtained by summing the single-year age-specific rates at a given time."

Replacement fertility is the total fertility rate at which newborn girls would have an average of exactly 1 daughter over their lifetimes. In more familiar terms, women have just enough babies to replace themselves.

I find the fertility rate analysis to be less meaningful than a straight analysis of "Growth Rate".

So, to define "growth rate" http://en.wikipedia.org/wiki/Population_growth

"Population growth rate (PGR) is the fractional rate at which the number of individuals in a population increases. Specifically, PGR ordinarily refers to the change in population over a unit time period, often expressed as a percentage of the number of individuals in the population at the beginning of that period. growth rate = crude birth rate - crude death rate + net immigration rate"

And then "Birth Rate". http://en.wikipedia.org/wiki/Birth_rate

"Crude birth rate is the nativity or childbirths per 1,000 people per year.

According to the United Nations' World Population Prospects: The 2008 Revision Population Database, crude birth rate is the Number of births over a given period divided by the person-years lived by the population over that period. It is expressed as number of births per 1,000 population. CBR = (births in a period / population of person-years over that period)"

So the growth rate of the US is nearly one percent which will result in a population increase from a little over 300M now to around 500M in 2050 (roughly).

You can see growth rates here: http://chartsbin.com/view/xr6

You can see birth and fertility rates here: http://flagcounter.com/factbook/us

Wiki does mention your thinking:

" However, the fertility of the population of the United States is below replacement among those native born, and above replacement among immigrant families, most of whom come to the U.S. from countries with higher fertility than that of the U.S.[citation needed] However, the fertility rates of immigrants to the U.S. has been found to decrease sharply in the second generation, correlating with improved education and income."

But the bottom line is that the US is growing in population with a significant increase projected by 2050. It is the policies of the US government, corporations and religious organizations that determine to a large degree the growth of its population. George Bush's policy regarding sex education did not help; lack of public support for birth control does not help; companies hiring the cheapest labor (non-citizens) does not help; preachers than never mention family planning does not help.

I'm not comfortable with just pointing a finger at immigrant families when we have no sensible national plan regarding population growth.

I'm very comfortable pointing the finger, because that is where the growth has come from and I will not shy away from saying it as it is obvious. Here's a wonderful way to fix the situation, deport everyone of post 1965 stock. If you were to extrapolate on present trends, the U.S. population would be nearing 1.2 BILLION come 2100. How is that even remotely intelligent? How could the standard of living be anything like it is today? By 2100, that's well past peak oil and most likely peak coal and uranium. It seems like we are heading straight towards an unmitigated disaster.

How about deporting everyone of post-1492 stock ?

Racism, pure and simple to talk about deporting US citizens !

Alan

I do not agree with that, at the end of the day we are headed into a brick wall and something must be done. In a lifeboat scenario something must be done, I refuse to go down with the ship. If I feel I have a greater right to be in this country as my forefathers fought in WWII and the Vietnam war than so be it. At the end of the day Democracy may fail; your ballots could be just like your federal reserve notes and worth only the paper they are printed on. I can dictate quite a bit with real force, and enough people dictating something with real force tends to shut down any universal suffrage scheme. As Mao said "Power flows from the barrel of a gun.", I believe that holds true today as we are still humans living on the planet Earth. We can attempt permaculture, we can attempt localization, but if in the end it fails I would not like to be within 100 miles of any major city. Maybe living under a military junta won't be that bad, how was Francisco Franco? I do not see how this is racism, what will the world look like with nearly 1.2 billion people in the U.S.? I think preventing the U.S. from growing in numbers as it has been post 1965 could save lives else where. Is this number even possible or will resource depletion make this impossible?

Your "solutions" speak of racism and fascism.

Alternative solutions are to reduce subsidies for children (past perhaps one) and try and delay the age of childbirth, encourage Americans to emigrate to anyplace that will take them ($50,000 bonus if under age 30, $20,000 over age 40 ?) as well as control illegal immigration (which I agree with) and reduce #s of legal immigrants (perhaps charge them the same as the bonuses for leaving).

Reduced medical care, more smoking (say cut cigarette taxes) and less exercise/more sugar in diet also works to reduce the population although I do not advocate them.

And NO, you do NOT have any greater rights because of what you fathers did. NONE !!!!!

Alan

Mine fought in the US Revolution. Lets deport all those that cannot show at least two forefathers that fought with Washington ! (I have six). *WE* have greater rights than those that came in through Ellis Island.

Alan, some of these ideas would probably work well. But rather than reduce all children subsidies we should remove them entirely unless a parent is college educated. We should encourage highly educated parents to have more children and discourage those who cannot provide for children from having more than one child. The only problem with bonuses for leaving the country is by the time those who run the U.S. realize they have a problem on their hands, other countries will most likely have closed shut their borders.

In regards to the forefathers argument, perhaps those of older stock who served in the military should receive some sort of benefit. I would not object to you receiving preferential treatment since your forefathers fought in the revolutionary war. In fact, I would say you deserve it, as long as I am viewed as "more American" than those who came after me (late 1800s). Many countries have different sorts of social hierarchy, it's not necessary a bad thing. Take the Kingdom of Saudi Arabia for example, the nationals in the country receive lavish entitlements and any newcomers who go there to work do not get much of anything.

Ultimately though, what is fascism? It is the melding of governments with the corporations, and isn't that what we have now? The government bails out the auto industry, banks, hedge funds, etc. Powerful lobbies are able to essentially write bills. I think the confusion between nationalism and fascism is a result of WWII. Nationalism does not have to mean the industrial extermination of groups of people. The end result could be a true sense of community, not one bound together only by economy. I do not know what will unfold in the U.S., but Europeans are an interesting group of people, I believe national pride burns deep in them. I would not be surprised to see some sort of shift in the politics of those countries as economic woes increase.

I am no fascist, I am a Paleoconservative. I do not like the Republican party and I abhor the Democratic party. I recognize limits, I recognize science, I am not Pat Buchanan denying climate change. I would like to end U.S. Imperialism, close all overseas bases, hand Hawaii back to the natives, make Puerto Rico independent, and throw the U.N. out of the New York. I fear the American Century is over and it is ending with the passing of the oil age. When the smoke clears I hope it is not so bad that the living envy the dead.

If your forefathers fought in 'nam your fairly young. Maybe you just need to chill away from that tower of babel down there. Get your self out into the wide open spaces of North Dakota maybe. Some times a change of scene is good for ones mental health. You don't sound too sound just now.

I'm pretty sure I'm sound, we've got people forecasting wholesale population die-offs down to a few hundred million humans, going back to the 19th century way of life, breakdown of the electric grid via Olduvai theory. Yet, I suggest deporting a few million people and I'm the crazy one...

You suggested deporting US citizens to nations that they never even visited (and assume that another nation will take these foreign Americans) AND suggested INCREASING births for a large segment of the US population.

Hep,

Alan

A large MINORITY, and a decrease for the majority.

Paying incentives for e.g. dropouts to be sterilized would pay for itself with the first avoided Medicaid baby, more so given possible complications from prematurity or drug use. In a country that's broke, we probably don't have any real choice about this.

Come now, the force that would have to be put in place to implement that deportation would answer to who? Whoever leads the most recent junta to gain control of it that's who. Sounds lovely.

Yes, lets emulate the Saudi plan, where oh so many of the native sons get some sort of divinity degree which qualifies them to do no useful work, and then have third world work permit holders to do all the actual work that keeps the country functioning. That is most certainly the formula for stability and sustainability.

Disconnects all over the place. You sure you haven't been talking that Fox news analyst that used to be gov up here. Her ideas usually form about as coherent a whole as yours appear to, and hey she is a college grad with five kids, what kind of subsidy does that kind of production earn?

The US plan appears to be to make US-born low-skilled workers unemployable and dependent on social services, while the jobs they are qualified to perform are done by illegal aliens. The middle-class taxpayer gets socked for the taxes for the social services used by both the unemployed and the illegal aliens' children (and the criminal justice costs of the aliens themselves), and the wealthy skim off the increased margins as privatized profits.

Not exactly sustainable either. There are at least a couple tens of millions in the USA who could be deported at a profit, and should be.

In order for oil to go to $400 or $500, you have to have people (or companies or governments) who can pay that much for it. At some point, it starts consuming most of their income, and the process must stop. Long before that, the world goes into terrible recession, as people cut back on their discretionary spending in order to buy oil and gas products, and also default on their loan repayments, as purchases of oil and gas products (considered necessities) squeeze out other payments. Such a recession would cause prices to drop. So the process of continuously rising prices is iffy--at best, the price path is a sawtooth upward trend.

We think of peak oil and peak gas as being defined by geological processes, and in a way, they are. But I think that it will really be the financial markets that will send the signal as to the maximum price society can really afford. I think the recent recession is an indication we are close to hitting this point. Once recession becomes too great a force, the price rise will stop.

It is easy to envision a scenario where developed countries have an economic and currency collapse where, in thoes currencies, oil is $400/bbl, but in developing countries growth continues because they have more economic driving force in the way of unexploited opportunities such as agricultural mechanization, taransportation infrastructure and manufacturing.

Oil depletion may seem to take place on a geological time scale, but it will happen much faster than previous economic transformations like building the railroads (85 years) or the highway system (100 years).

All good till the last sentence "Such a recession would cause prices to drop"

Why ?

I'd argue all it does is squeeze all the debt out of system and steadily reduce or economy to a food/clothing/shelter based one.

Not that it gets there exactly but that basic needs become more and more important. Providing those needs requires oil thus you can and will pay for it.

Higher and higher oil prices steadily erode discretionary income and purchases esp those made with debt but if it results in lower prices is not clear. I'd have to go check months but we have to be close or past the point where prices where actually rising most of the time during our current recession. The fell for about six months and rose for a year.

As time passes the percentage of the time where prices fell significantly seems to be falling steadily i.e a one shot six month time period. Thats not to say we won't see it again but it does not follow that it has to happen. If economic contraction and more importantly resulting actual declines in consumption result in supply exceeding demand then prices will fall. If not then prices will be high regardless of what happens to demand.

Its the relative rates of the two and its sensible that as the economy shrinks remaining demand will become more inelastic. Thus the rate of decline in demand slows as the economy itself shrinks.

If high oil prices are the problem then the basic equation seems that high prices cause economic shrinkage leading to increasingly inelastic remaining demand leading to even higher prices.

Cases where demand shrinks quickly leading to low prices are actually abnormal not normal.

The fact that something abnormal actually happened does not make it normal or even the most probable future event.

If oil demand turns out to be very elastic as prices increase then your basically saying valid substitutes exist as no other reasonable explanation holds well if it turns out they do then they do. If so then one expects once they became widely used then they would have their own infrastructure support thus a return to lower prices would not bring the demand back quickly. I.e its a fundamental structural change thats not readily reversible.

Indeed this argument is what I feel actually underlies the argument that high prices lead to low prices. I.e oil demand has a lot of flexibility left and as alternatives are chosen they are not abandoned quickly regardless of oil prices.

Certainly the argument has merit but its not clear if its true or not. So far at least non-oil based transportation is rare regardless of the percentage income particular markets pay for oil. Oil based transport remains vital to the world across a tremendous range of economies and wealth. I'd argue if it was really flexible then other nations that import oil would have chosen alternatives long ago esp as their overall GDP is often low.

Certainly the fact the wealthy nations which actually create the forms of transportation could block this as they don't need to turn away from oil and perhaps this is the real problem perhaps not.

Regardless I'm not convinced that high oil prices are certain to lead to a recession and falling prices. I'm not saying it can't happen but it seems to be a side effect of the rate of change of a number of complex variables and not a intrinsic result. Aka a fluke.

Walking or bicycling, or (my favorite) wind-powered light rail transit. The former are available everywhere, in theory, but unfortunately most modern suburbs are neither walkable nor bicycleable. You may want to consider abandoning your house in a non-walkable suburb and moving somewhere you can actually get places without driving. The older, inner-city neighborhood are better in that regard.

I am fond of wind-powered electric trains because I rode them to work for years (when I didn't walk or bicycle), but they may not be available in your area. If they aren't, you may want to vote in politicians who will build them, because at $500/barrel for oil (probably $20/gallon for gasoline) you aren't going to be driving very far.

California would be a bad choice to live in this context because 1) they dismantled their electric interurban rail system to build freeways, and 2) they are cutting back public transit in their budget current crisis, a textbook example of a counterproductive, knee-jerk reaction kind of like a frightened deer running directly into the path of your car.

The envelope cannot be pushed much further than it has already been pushed, natural restrictions are things you can do nothing about because natural laws can't be overridden by legislatures, and world oil production would look pretty much like it does now, because, frankly, most of the world has fewer restrictions than the North Sea.

The key factor is that, while historically gas production has been a side-effect of oil production, there is a great deal of "non-associated" gas in the US, and also in the rest of the world. Historically, most of this gas has been "stranded gas" with no pipeline connections, but if the price of oil becomes unaffordable, people can bring this non-associated and stranded gas on production.

The key point to realize is that natural gas is not oil. You need to make some technological changes to use it. You can't just drive up to the pump and fill up your SUV without converting it to NG, and finding a pump that delivers NG. Both these things are non-existent in the current world.

I used to stop fairly regularly at a station on I-94 around Gary which had NG pumps. This was some years ago; I'd hardly say that NG infrastructure is "non-existent". Any station which uses NG for heating ought to be easy to equip; you don't even have to worry about scheduling tankers for delivery.

Edit: OTOH, I just looked at the DoE's map of CNG filling stations and the one of my memory isn't on it. Missed by the mappers or shut down, I don't know; regardless, it appears to be impossible to use that site to drive as short a distance as from my place to Chicago on CNG. That would have to change; there would have to be more public CNG stations and they'd have to all be on the map.

Ironically, it appears to be easier to drive a Tesla roadster coast-to-coast on electricity (charging at RV parks and private homes) than a Honda Civic GX.

We know what happened to Texas production when the price of oil went from $3/barrel (Texas produced 3.87 million b/day in it's peak month in 1972 with oil @ $3/barrel) to 1.1 million b/day when oil is (looking at sidebar) $78.40.

$400/barrel will not bring back 3.87 million b/day in Texas.

#s from memory but close.

Alan

Alan Drake said,

"$400/barrel will not bring back 3.87 million b/day in Texas."

Exactly, and that to me is the correct definition of peak: When no price will bring back the flow rate in any foreseeable future, i.e., not a logistical peak but a genuine geological limit. I owe it to Westexas for opening my eyes to this, that if you take Texas and the North Sea as examples, you have areas that have no real political limits on drilling, no real captital limits as the price rises, the best talant and methods in the world, and the flow still shows no sign of getting back to the old peak highs.

RC

And to add to your good points Imout: Texas also has a class of oil companies that's exceedingly rare in the world: small independent oil companies. Often only 3 or 4 employees/owners. Can't back it up but my gut tells me the US would be no where near to the thrid largest oil producer had it not been for these ma and pop outfits. With the average US well making less than 10 bopd most would have been abandoned by the majors long ago.

2mbd of US production comes from stripper wells. Its safe to classify basically of of these as Mom/Pop or marginal producers. Certainly some outfits are larger but for above ground reasons. So 5md - 2mbd = 3mbd.

I'd argue at least 500kbd of additional production comes from small outfits not found anywhere else in the world. Not mom and pop but not a structure thats viable in other countries for legal reasons.

That puts us at about 2.5 mbd adjusting US production to whats possible in the world.

Now you can consider that the US also benefited from being the first to peak and new technologies really added to production simple ones like using water injects instead of natural flow.

Other regions developed later employed these technical advances smoothly into their production efforts as they became common practice.

Obviously they won't benefit in the future as they have already deployed these methods. And obvious example water injection won't boost Ghawars output because it already has. Same for the most part for horizontal drilling these methods are already deployed.

One has to imagine if you could take the US back in time and redevelop the oil resources using methods developed since the 1980's that we would have seen a significantly higher peak production and now be a lot lower. Lets guess by 50% which is not unreasonable.

This puts US production using "world" standards at 2.5*0.5 or 1.25mbd.

Thus by the time the World is depleted to the extent the US is from peak it probably won't be producing 50% of its peak production but much less closer to 10%.

Just for illustration assuming the decline period is the same 2010-1975 = 35 years with peak right now.

If the world is at 80mpd at peak then 35 years from now it should be at about 8mpd. Or basically see a linear decline of 2mbd every single year from peak.

Obviously right or wrong it makes you suspect that using the US as and example of future world production is probably not a good idea.

If it actually works that way then a lot of things have to change and one thing that cannot be changed is when technology was introduced you can't reverse this decision no matter what you do above ground.

Back to the US itself. We could easily see a production collapse effectively any day as its production has been bolstered by slowly declining marginal production. At some point of course this production simply becomes too marginal and the stripper wells are shut down as they simply don't make money at any price as rising oil prices increase production costs. Sooner or later these stripper wells are themselves not going to work. Its hard to even know when this point will be reached but at some point after decades of production marginal production literally becomes to marginal.

Its hard to know when the population of stripper wells in the US will begin to cross this threshold in large numbers and how it will happen but one day sometime in the future we will be actually out of oil.

memmel -- The death knell for many strippers come during a low price period. But not so much as an inability to pay for production ops but repairs. Most ops cost are a relatively small portion of income even during low price periods. Much of the ops is sweat equity. Even if a well is making only $1/month the small operator will still produce it. Even if it costs him a few $'s/month to keep it producing. I've even seen them cheat and assign production from a producing well to a non-producer to keep it qualified as "productive". If he doesn't then he'll have to plug and abandon it. Might cost $1000 or so to do so. Might not sound like much but if he's only netting $2000/mth it's a lot. But if the well breaks down it might cost $5000 (and sometimes much more) to get it back on production. If the production rate vs. price means it will take him several years to recover his investment he'll likely plug the well. And most stripper wells once plugged are seldom economic to bring back on line should prices jump up significantly.

Gross withdrawals don't show the whole picture, since more of the gas appears to be going into the extraction itself. Dry gas is closest to the supply of gas to the end user, and this has a less rosy picture:

That shows annual figures, up to 2008, but the monthly figures for 2009 show an undulating plateau, with the recent peak in March 2009:

So don't count your chickens, just yet.

Thanks for the welcome, Jeffrey. I have no regrets about my decision to stop writing for World Oil but I also have no hard feelings about my experience with the magazine (other than it was wrong to fire Perry Fischer).

The Oil Drum is a natural forum for my research and writing because of all the astute and knowledgeable people who contribute and comment. Kudos to Nate Hagen for taking a risk by inviting me (the antichrist of shale plays!) to become a contributor.

Art

Art - My only agenda in the shale gas debate is to form a conclusion on the probability of the decline rate and EUR of a well or portfolio of wells. I appreciate your work as it offers a different perspective from the "party line" and has made me more critical in evaluating a shale gas deal.

In a Oct 5 OGJ article on shale plays, the authors, who appear to be independent of any conflicts, analyze various aspects of the shale plays and seem to come to the same conclusion as the "party line". http://www.ogj.com/index/article-display/3739013961/articles/oil-gas-jou...

I assume you have access to the online article. Can you comment on the article and specifically Fig 1.

I want to welcome Art also. We have quoted him quite a bit on some of our natural gas articles, such as this one. Nate had the good idea of inviting Art to write for The Oil Drum.

Art is a person of many talents. One of them is modifying images posted by others, so as to show additional features. The images above are ones that Art modified.

We look forward to his posts on a range of subjects. I know he is working on a second one, to be finished in the not too distant future.

Hi Art, Peter Wang (ex-Amoco) here.

Peter Wang, PG

Hi Peter. It is good to hear from you and especially gratifying to know that you are part of The Oil Drum universe. Ex-Amoco diaspora are everywhere. I had a call from Ralph Schofield (ex-Amoco Canada) asking me to give a talk on shale plays to Huber Energy where he is President!

Art

My theory is that we have one degree of separation in the Oil Patch--we know virtually everyone through no more than one intermediary.

Incidentally, Peter & Art, maybe you can help me with something. I heard, from a reliable source, that BP was having oil production problems at Thunder Horse, specifically that they were seeing rising water cuts because of very high vertical perm. Have you heard anything to confirm or contradict this?

You're basically right. It's a cosy little business in which everyone knows everyone else, and if you don't know someone, you probably know someone who does.

Speaking of which, my brother would know what was going on at Thunder Horse, since he is in the upper noseblood levels of BP management. Not that he would tell me, and if he did he might lie. Blood doesn't run as deep as oil.

Great up date especially the current cost of $200 million. This compares well to the cost of a comparable Deep Water GOM well. The significant difference between the two trends is the time span between discovery and production. A similar DW GOM field might take 5 years to begin producing. Davy Jones might take as little as 6 months: shallow water and pipeline proximity. This is a huge economic advantage given how the industry greatly discounts reserve value vs. time.

Using basic “back of the envelope” oil patch economic analysis this is around 50 to 1 play: 2 TCF/$200 million dry hole cost/$5 per mcf. Though a 50:1 return might sound exorbitant one must remember that the probability of success is proportionately low also. Assigning a probability of success to such a prospect is rather arbitrary. There’s no real math involved. You just pull a number out of your butt. I would be surprised if any of the players assumed a Ps much greater then 10%. Even if the play concept was correct and there were huge NG reserves present this first well might have drilled in an area with no reservoir quality rock (been there…done that). If that had a happened it might be many years before another well was drilled. Even with the discovery now behind them the next few wells might be failures (been there…done that too). Regardless of the value assigned you have to assume you’re going to dry a dry hole. 3d seismic data can help visualize the structures at this depth but that’s a minor hedge. It’s more of a regional framework that’s needed to develop such a concept. Thus a decision to drill such a wildcat will be based upon accepting such a model as reasonable. Any way you cut it much credit has to be given to the risk takers.

Not sure if the scuttlebutt is correct but this same location was supposed drilled by ExxonMobil originally. But they stopped drilling too soon. This happens: 30 years ago a friend drilled in an area with no previous deep efforts. Stopped drilling 400’ about a $5 billion NG field. Within a year another company twinned his location and made the discovery (Chaukley Fld...Cameron Ph, La). Coincidentally enough it was ExxonMobil that drilled the well. The ultra deep NG play along the La. coast has been speculated upon for many years. A few have gutted up and tried. About 5 months ago I reviewed a similar prospect based upon the same model. A valid concept and 3d seismic to support the picture. But we were not in the position to take a risk on a well that would most likely fail. I’ll look at the deal again even though the risk hasn’t really changed. But when you have a discovery like Davy Jones you can talk yourself into taking a swing. But there are a very limited number of players who can take such risks today. McMoRan (who I once partnered with decades ago) is lead by Jim Bob Moffit (the ‘Mo” in McMoRan). He truly is the consummate wildcatter. A huge ego with skills to back it up. It’s no surprise to me that he’s behind this effort.

As many understand such a discovery doesn’t change our over all energy deficit to any great degree. But it is truly is great news for the country and the oil patch. Even if no more then 2 TCF that’s a deduct from out NG imports by $10 billion ($5/mcf). It also represent 100’s of millions of $’s in royalties going to our taxpayers. Also a $billion+ going into domestic companies and salaries. Given the current downturn in the oil patch it does offer a bit to be positive about.

Rockman,

The ExxonMobil well was the nearby Blackbeard prospect. McMoRan has a slide (#17) in their Q3 Conference call presentation that compares Davy Jones with Blackbeard: http://www.mcmoran.com/presentatn/2009/3Q09ConfCall_OCT09.pdf

Thanks aeberman...good find. I need to research Blackbeard now

A few peak oil naysayers have pointed to this discovery and mentioned how much oil may be produced from this discovery. Will any oil ever be produced from the McMoran Davy Jones field? With temperatures above 400 degrees Fahrenheit, would not any oil be cracked into gas after only a few million years?

And indeed with the cost of natural gas what it is in the US and the cost of producing gas from this field what it is likely to be, will any gas ever be produced from this field?

Ron P.

You're probably correct Ron. At 400 degrees oil isn't very likely. Even NGL remains to be seen. Really need to see the analysis of the first flow rate to determine the value of the discovery. Contaminants such as CO2, nitrogen, H2S, etc will have a big impact on the bottom line. It may turn out that the drilling side might have been easier then the production side. The temps and pressures along with NG composition might make this one of the most difficult completions/production efforts ever seen. A long way to go before profitability is determined for sure. But I'm sure Jim Bob is happy to have these potential problems to deal with: a lot more interesting then setting a cement plug and abandoning the hole.

At those temperatures it would take a lot less than a few million years to convert oil into gas.

If you boiled the radiator in your car dry and ran the engine at 400F, how long do you think the oil in the crankcase would last? Not very long. It would turn into hot gas and solid carbon in a very short period of time. Bearings don't work very well on hot gas and solid carbon, so your engine would quit running fairly quickly. Some of you may have experienced this.

The common practice of converting all discoveries to barrels of oil equivalent makes the press statements for these kinds of discoveries very misleading. Below a certain depth you are likely to find no oil and all gas, but most people don't realize that. These very deep discoveries are going to be all gas. That's going to be no help in running your car unless you do a natural gas conversion.

Historically, oil and gas have tended to trade at the same price on an energy-equivalent basis (the basis for the barrel-of-oil-equivalent conversion), but if gas discoveries vastly exceed oil discoveries, this relationship is likely to become disconnected. Given all the recent gas discoveries, at least in the medium-term gas is going to trade for a lot less money than oil. Anybody making business decisions or debating how to heat their homes should take that into account. People driving a car should think about doing a natural gas conversion and buying a home NG compressor (which they probably can't afford), or buying a very small, fuel-efficient car.

Or get a bunch of pigs and build one of these:

http://www.neatorama.com/2008/07/01/supergas-biogas-brewed-from-dung/

Yes, you can extract gas from the hog operations, but then you have to realize that you have to take industrial-level safety precautions.

Some years ago, I did a study of the effect of natural gas drilling on nearby farms. Although natural gas from wells contains gases (mostly hydrogen sulfide) that are extremely dangerous, nobody but oil company employees had been killed by poison gas from gas wells. However, several farmers had been killed by poison gas from their own agricultural operations.

In some cases, farmers opened the door to their hog barns, walked inside, and the gas knocked them down and killed them. In other cases, they opened a hatch on a silo to look inside, took a breath, and died as a result. In still other cases they went down in a well to check the pump, and dropped dead because gas from their farming operations had settled into it. This is a serious issue and farmers really should take more safety precautions.

You have been warned. Just because it is natural doesn't mean it can't kill you.

My post was mostly in jest. There actually is a small market for home NG compressors. Your warning is valid. I have many hours in ships' holding tanks, manholes, fuel tanks, etc. We took testing and ventilation very seriously. A friend in the chicken business spent a few days in the hospital just because one of his feed silos developed a roof leak. Another friend was experimenting with brown's gas from PV and didn't realize how explosive it was. He wasn't hurt too bad, but it took a while to rebuild his shed. I lost a buddy in the Navy to phosgene gas from burned refrigerant.

I put that commentary in just in case someone here actually decided to start their own pig methane operation. Even pig gas is potentially dangerous, so people should not go into it without researching the safety aspects first. Farmers often do things without thinking first, and get themselves killed in the process. I've known a lot of farmers to kill themselves in different and novel kinds of ways.

Single worst day in my construction career-and I have been subjected to some nasty stuff--was doing a bandaid retrofit of a failed (due to record cold weather) air ventilation system in a commercial Illinois hog barn. Wasn't too bad till they turned the heat back on because a couple pigs died. We couldn't get it done and get out of that place fast enough.

Installing a biogas generator on a confinement animal operation won't significantly decrease dependence upon fossil fuel grain.

You can avoid all this trouble and drastically reduce fossil fuel dependence by switching to Tamworth pigs that graze with cattle. No grain, confinement, sewage, gas, or danger. Heck of a lot lower yield, but also lower input.

But the entrenched interests in the farm lobby insure that we give farm credits to industrial agriculture for things like biogas generators, which suppresses food prices and makes alternative food production uneconomic. Hence the industrial dangers. We are still headed down the wrong path. It will be a long time before Tamworth pigs are economic.

Cold Camel

The point about suffocation is a good one. I know of similar cases in industry, including a project I worked on. We always tested enclosed areas before people were allowed to enter; however, one curious worker just stuck his head through a manhole in a tank with low ozygen. He was unable to be revived.

A more entertaining tale of biogas:

http://en.wikipedia.org/wiki/Mad_Max_Beyond_Thunderdome

Very true. But honestly, for those of us hoping for electrification and to see alternative infrastructure built out, that's a good thing. I don't really want low oil prices if they aren't going to stick around... I'd rather see a build out of an electric system with somekind of backup for crucial needs during outages (i.e. syncrude/gas/ammonia generators or something I'm not thinking of). An electric infrastructure will be useful no matter what we use to produce electricity.

So while I welcome any great oil find (Iraq?) my hope is that it DOESN'T result in cheap oil for any amount of time. I want cheap energy, not cheap oil. Japan has proven that a society can grow without growth in liquid fuels, it just needs energy.

In what respect is Japan "growing"? 2007-pop. declined by 10,000 souls; 2008- it declined by 50,000; 2009--the decline accelerated to 75,000.

So far in three years the population has declined by about 130,000 people!

Schools are half full and some are shutting down. Many kindergartens have half the enrollment they did just 7 years ago.

Despite all the publicized "deflation" food remains COSTLY and I`ve trimmed all sorts of other things out of the family budget to focus on food because we can`t stop eating.

Japan is slowly coming to a halt, in my opinion, not growing in any way. People may be using less fuel but it`s an older population that doesn`t move around a lot. I see the economy shrinking here. I see some signs of retail panic.

There is no message for "reverse course" ---people can`t go back to villages at this point. You have to try to stay in the city and find some sort of job and keep costs to a minimum by staying single. So people use as little energy as possible by keeping their lives bare and minimalistic.

So pi, it sounds like Japan has made the transition to a steady-state economy, without even realizing it.

Some advantages to a gently falling population.

Japan has a large and high quality infrastructure (although the Tokyo subways are undersized for the population). There is no need for further expansion of this infrastructure except for some shifting that may happen. Only replacement, and most Japanese infrastructure was built to a high standard so that should not be an excessive burden.

The money saved on schools and children can pay for the elderly.

There will be more to go around. One or two fewer riders on your subway car, less crowded parks, a bit more space.

Japan will be able to compete more effectively for the resources it needs because it will need slightly less.

Best Hopes for Japan,

Alan

Hi Pi

In my part of the world we have a saying that two can live as cheaply as one-food has always been cheap here whereas housing and other expenses are not.

How much does an apartment or house plus utilitues in Japan cost compared to food?

In my part of America you can eat exclusively purchased food including meat and fruit in reasonable quantity and excellent quality for nor more than fifty to sixty dollars per week per person.A cheap apartment or rent for a cheap house plus utilities is not less than six hundred dollars and usually more.

So a sonle person here must spent at least three times , and probably four or five times, as much for shelter as for food.Two people splitting the rent and utilities can easily afford plenty of birth control out of thier savings.

I think everything is more expensive here in Japan, housing, food, you name it. An apple costs 500 yen. Milk (1 liter) is 300 yen. Food costs per week? Not less than 10,000 yen (that`s $100). That would be near starvation.

Apartments are about 90,000 yen a month for a family (that`s three tiny rooms) or 50,000 for a single person (2 tiny rooms).

No wonder the birthrate is so low! No one can afford a large family! They`d all starve!

For napkin numbers, 6MCF equals 1BBL oil , but somebody here suggested the financial balance (real) should be 10:1. I don't remember the reason, but it was convincing to me. Anyone else have a better ratio?

If 10:1 is an accurate estimation of the future price ratio, then, I would agree, convert to NG as much as possible. Also it makes the IOC BOE numbers optimistic. Even at 10:1, NG is cheap today.

Cold Camel

6MMCF (M=1000) is the BTU equivalent of one barrel of oil. At one time (pre 1970's) there was fuel switching in the US, especially in manufacturing. I remember when the facility I was working for sold the inventory of the large fuel oil tank back in the early 1980's and only kept enough oil on hand to provide back up during gas curtailments due to hurricanes.

Fuel switching requires both oil and gas burners. Heavy fuel oil requires suction heaters on pumps and heat traced piping for winter. Also, fuel oil storage tanks are costly. Gas firing requires less capital.

The last major new billion dollar facility I worked at installed a coal fired boiler when the plant was completed in 1982. Unfortunately for the US, there have been few new manufacturing plants of that scale built since.

I believe that you meant that 6 MMBTU is the approximate energy equivalent of one barrel of oil. At 1,000 BTU/CF this would be a volume of 6 MCF.

Yes Westexas. Thanks for that correction.

Camel -- Just recently the financial ratio was 15 ($75 per bbls vs. $5 per mcf). But that's from a Gulf Coast producer perspective. A 10 ratio was passed some time ago. But a consumer has a much more difficult time: he has to balance what he pays to the LDC for his NG compared to what he pays for gasoline. Or what he pays for heating oil. Then that has to relate that to the price of crude oil. But even that isn't to straight forward: the price of a gallon of heating oil or gasoline isn't always constant to the price of oil.

Bottom line: I've never seen the oil/NG ratio ever used to represent anything really meaningful. Not too long ago NG was selling for less than $1/mcf in Colorado when it was selling for $4/mcf in the Gulf Coast. So the ratio was 4X times greater depending on what NG you were referring to.

The consumer also has to pay the local utility and their service charges can be as much as or more than the gas. When I lived in Atlanta in winter I typically paid twice the spot price as a residential customer. In summer when I used almost no gas I still had to pay almost $35/mo just for service. My new hause has a heat pump. My next house will have a geothermal heat pump. I'll be able to heat and cool it all year for less than one winter of utility gas used to cost.

Ron P.,

For me, temperature is the key risk factor in this well. McMoRan has another Webcast scheduled for tomorrow (Tuesday, Jan. 19) at 10 a.m. EST. I plan to call and ask about temperature.

My guess is that the bottom hole temperature may be around 450 degrees F. Using a published graph (Forrest et al, 2007), I project a temperature of 550 degrees F @ 30,000 ft--that seems too high. Using standard Gulf of Mexico 1.17 degrees/100 ft gradient, I project 350 degrees which seems too low. My understanding is that pure methane is very stable at very high temperatures (up to 800 degrees F), but small amounts of impurities lower this considerably and some of the methane cracks to carbon dioxide.

Some interesting work was done by Don Timco a few years ago on temperature floors in the Gulf of Mexico. Here is an excerpt:

For all practical purposes, the limit for oil reservoirs is bounded by a formation temperature of 270º F. and a pore pressure gradient of 0.7 psi/foot. For gas the limits are larger, from 300º F. and a pore pressure gradient of 0.73 psi/foot. This translates into a maximum depth for commercial oil of 14,000 feet and for gas, 19,000 feet. Below these depths, electric logs were deceptive. Zones that looked good failed to produce as expected.

This goes to my point that all we have right now are wireline logs indicating pay but no flow test.

Art

Art -- There are a few sediment dumps (high depositional rates) along the coast that have rather low temp gradients. I know the Terrebonne Embayment to the east of the discovery is one such area. An Eocene basin might imply a similar dump in the area but that's pure conjecture.

More to the point about temps and pressures: they have to be working right at the edge (and maybe a little over) of technology. Everything from cementing to perforating can't be taken for granted under these conditions IMHO. About 30 yeasr ago I drilled a well that was at the edge of completion technology for the time. After a couple of failed attempts the operator walked away. Being able to drill a hole didn't guarentee the ability to complete/produce the well.

BTW: with regards westexas' degrees of separation: Dom Timco once did petrophysical analysis for me.

Thanks Art. You wrote in another post above:

You flatter us all but unfortunately not all of us are so astute and knowledgeable. However those of us who are not so knowledgeable are very fortunate to have access to this list and the knowledge of those like yourself and all the other oil professionals on TOD.

Thanks again and I am looking forward to your contributions to The Oil Drum.

Ron P.

Yep. Promising to be another nail in the coffin of the biosphere. Finding all this gas is not a good thing for the atmosphere...

Beats the crap out of coal.

I don't know that we have evaluated whether it "beats the crap out of coal". The huge amount of energy (with its own CO2 contribution) that goes into extraction needs to be taken into account. There is also the issue of natural gas that accidentally escapes (in the initial production and in distribution to customers)--methane is itself a global warming gas.

I think that people hear that coal, or oil sands, or whatever is bad, and assume that other things are a whole lot better--maybe they are, and maybe they aren't. The issue is a lot more complicated than the statements we hear from environmental organizations. The analysts really need to evaluate the whole production, distribution, and consumption chain for a given fuel source, and compare them side by side. Then one can really say which one is better and which one is worse, and by how much.

Perhaps there are some good studies for other natural gas that this could be compared to. It is not really something I have looked into.

Hi, Gail. I was basing my statement on this:

http://www.rff.org/wv/archive/tags/Natural%20Gas/default.aspx

..and other sources:

http://www.eia.doe.gov/cneaf/coal/quarterly/co2_article/co2.html

,etc.

You have a good point in that the true carbon impact from extraction to consumption is a lot harder to ascertain. IMO this would be a great subject for a future post. Include all sources of energy and "clear the air", so to speak ;-)

Stuart -- You must be one of those rugged individuals who now live off the grid and utilize no FF. Congrats. I truly envy you.

But unfortunately you'll still have to breath the same foul air as the rest of us. With luck you might have a few more years to avoid the black lung (thanks to more NG discoveries) before we begin burning coal all the more as the other FF run out.

The biosphere has survived for at least 3Ga through anoxia, asteroid impacts, ice houses, green houses, mega volcanic eruptions, colliding tectonic plates, etc. Surely it will survive a few extra ppm of CO2. So don't worry,......be happy!

What is in question is not the survival of the biosphere but the survival of humans and most other species alive. I wouldn't be surprised however if cockroaches survive pretty much anything.

Mythbusters tested cockroaches, flower beetles and fruit flies using high radiation Cobalt 60 therapy fields. The cockroaches came in third place though at the 1000 rad (10Gy) level they clearly were less vulnerable than humans.

http://www.edutube.org/en/video/mythbusters-do-cockroaches-outlive-nucle...

Is Davy Jones in State or Federal waters ?

Any idea on how rich in NGL this field is ?

Thanks,

Alan, Louisiana & Federal Taxpayer

I'm almost certain block 230 is >3 miles from offshore, hence Fed; Offshore oil and gas in the United States - Wikipedia, the free encyclopedia. MMS has a big .pdf of active leases and infrastructure: Gulf of Mexico: Maps and Spatial Data.

Dunno about the propane window; imagine it would reside where the two gradients of diagenesis cross, which is itself dependent on the thermal conditions of the locality.

Alan – The discovery was on South Marsh Island Block 230…a Fed lease. According to the press release the structure spans 4 OCS blocks. Unless there’s been an exemption (I doubt on these blocks) that will be a 16.66% royalty to the Feds. That’s a little over $800 million/TCF produced (@ $5/mcf). Feds do share the royalty with the state now but I’m not sure what the number may be. More good news: a big chunk of those 100’s of $millions of capex will be paid to La. companies.

Need to get an analysis after a flow test but I would be surprised to see much NGL.

At those depths and temperatures, almost all methane, not much NGL's.

Thank you for this post and the excellent discussion by oildrummers that follows.

To me the most important point is the following:

This tells me that the Davey Jones discovery is important for: 1) the company that owns it (assuming it is commercially viable and productive some day), and 2) academic/industry interest in various geological formations in the gulf and their potential to hold fossil fuels.

It also tells me the Davey Jones discovery is a drop in the bucket and is insignificant terms of peak oil/gas.

All true aardvark. But it's good to remember that we're the third largest oil producing country in the world thanks to those thousands of "drops in the bucket". The bad news is that there are fewer and fewer such buckets to develop. Even the great N Slope discovery is rather punny compared to global consumption. A hundred thousand wells making 10/bopd each is three times better than a DW GOM field coming on at 300,000 bopd.

True, the drops in buckets add up. But not enough to sustain a growing global economy. Just enough to tease us into complacency until we run out of wiggle room.

Maybe the world will take Rodney Kings advice and "just get along." But I doubt it.

Rockman,

Suppose we were to encounter a brave new world in the future-one in which all the present cultures and govts in the middle east are either no longer in existence or radically changed in values and organization.

Is the geology of the general area, and the existing heavy infrastructure, such that little independent operators could pull off the American trick and get a few million barrels a day for decades out of the existing wells?

Of course if that is possible it probably also means the local economies of the area would comsume it locally but it's still an interesting thought.

I think your scenario is reasonable and even likely, especially the local consumption part. I think the hard part will be the period of change we have to go through before we get to that "brave new world."

mac -- Fortunately I'm not encumbered by excessive knowledge of ME geology So I'm free to speculate to my heart's content. HELL YES!!!! Not just small operators but the big guys would give anything to play in that arena under US standards. Best real life example I know: back in the early 90's a company (Bennington?) took over a Venz field making less than 400 bopd. With horizontal drilling technology (just really developing at that time) they brought production up to 40,000 bopd in a few years. It would have been producing more but the concession required that any production over 40,000 bopd would go 100% to the Venz gov't. Talk about getting in the way of expanding production. After the big guys had the way in these underdeveloped areas the little ones would slip in and do their thing.