Tech Talk: Oil Shale, a Future Source of Oil?

Posted by Heading Out on February 14, 2010 - 10:58am

One of the large numbers that is often quoted in response to the concerns that some of us express over future energy supplies relates to the amount of oil that is present in oil shale. However, there seems to be a general consensus among many that write about world energy, that the 2 trillion barrels of oil potentially available out of the 4 trillion barrels locked in the United States oil shales are not, at the present time, a realistic source of supply. So for the next couple or more weeks these weekly tech talks will be discussing oil shale. The Federal Government is reviewing the leasing process for these lands, and so it might be timely.

To read previous posts in this series of tech talks, click here.

After an eleven year hiatus, Colorado School of Mines reactivated their annual Oil Shale Symposia in 2006, and has been hosting them since then, with the last one being held last October. And the resource is not quite the nonentity that it may at first appear.

Japan started oil production at Fushun in 1929, and developed, in less than ten years, the world's largest oil shale industry. Shale oil was a principal source of fuels for Japan during World War II. Fushun production continued to expand under Communist China and may be 40,000 bpd presently.

That quote was from a paper in 1964, more recently the USGS have noted an annual production of around 415,000 barrels. it is therefore justifiable to take a little closer look at this whole issue and try to explain some of the technical state of affairs, point out a little of the disingenuousness of some of the statements that have been made, but largely leave the political discussion to others. I will largely, at least initially, deal with deposits in the USA, though there has been a significant industry in Estonia since 1916, though the deposits are anticipated to be exhausted within the next 30 years.

Unfortunately the last time that a serious look was taken at the US resource was back in the 1970s and 1980s, when at one time, under the Project Independence Blueprint, a shale oil production target of 1 million barrels of oil per day was projected, in line with President Ford's State-of-the-Union Message of 1975. That program, in turn, was based on the considerable amount of research that had been carried out, both in the US, and abroad, and on an initial evaluation of practical means to meet the target. But before one looks at that target, and its feasibility, perhaps it is better to look a little more closely at the information which led up to the prediction.

To begin with, while the basic definition of an oil shale suggests the fine-grained rock that is often called shale, and implies it is impregnated with oil that might be easily recovered, unfortunately, in most cases the rock is not a shale, and the organic material that it contains is not yet an oil, and will not run out or separate out with normal treatment. It has been described as a precursor to oil, in that, it was initially formed in the same way, but has not undergone the natural high-temperature and pressure regimes of deep burial in the earth that are needed to turn it into oil. (However, if additional kerogen were to be added to the shale it would through time more likely end up as a coal.) The material is known as a kerogen, and to date the most successful method of removing it from the rock has been to heat the rock until the contents volatize, and then to condense the hydrocarbons back out (in the same fashion that one cracks the oil in a refinery - though there are some significant differences that I will get to later). However, since the initial natural process was not carried as far as with oil, then the amount of energy that is required is generally greater. The greatest deposits of interest are those found in relatively thick deposits around the point where Wyoming, Colorado, Utah, and Idaho come together.

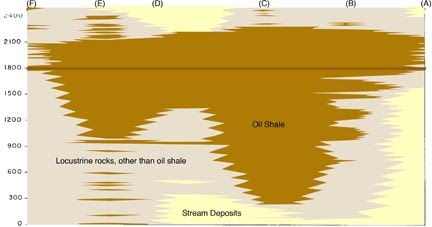

A section through the lettered points in the above figure gives:

The darker band shown is known as the Mahogany zone in which the Mahogany bed some 100 - 200 ft thick, is considered to be the richest layer, and is a marker for the deposit.

In oil shale from the Mahogany zone of the Green River Formation in Colorado, the ratio of oil yield to organic matter (weight percent) is 0.659; the ratio of oil yield to organic carbon (weight percent) is 0.818; the ratio of organic matter (weight percent) to oil yield (gallons per ton) is 0.580, and the ratio of organic carbon (weight percent) to oil yield (gallons per ton) is 0.467.

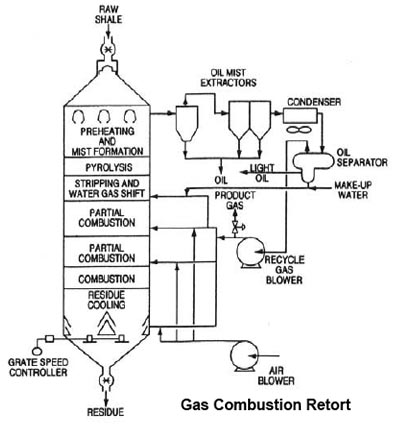

Shale oil has been used as a fuel source in a number of countries around the world, over the past 150 years, but only become of economic significance in the 1920s, as noted above. There have been over two thousand patents issued describing different ways to separate what, for convenience, I will call oil, from the shale (similarly called). Only a few have, however, been demonstrated, and later in this series of posts I will explain some of the peculiar problems that arise in retorting oil shale. But, as an illustration of the type of process that could be used, I will describe the Gas Combustion Process, as developed by the US Bureau of Mines for one of its original experiments. I thought it would be useful to describe this in a little detail, since it points out some of the potential benefits that can come from retorting the material.

The retort can be simply thought of as a vertical pipe with the raw shale fed into the top. As it moves down through the retort it passes through four zones. At the top of the retort the shale is cold, and the gasses rising from the lower parts of the process mix with this shale. This has two effects: it pre-heats the shale as it drops into the next zone, while at the same time the oil is condensed into a mist, and the product gasses are cooled. (They are both then collected as they leave the retort.) As the shale continues to move down the retort it reaches, about half-way down, a series of ports that inject air mixed with a portion of the produced gas that has been collected (call this the dilution gas). These two combine to cause ignition and to raise the temperature of the shale (to between 700 and 950 degrees F) so that the hydrocarbon contents vaporize and create the oil and gas combination that rises up out of the retort.

The shale residue continues down the retort, where it is now used to pre-heat a second supply of the collected gas (known as the recycled gas) that is moving up into the retorting zone. This cools the shale as it heats the gas, and the shale residue can then be collected and moved away. By using this form of heat transfer during the process, a relatively high thermal efficiency can be achieved, and the retort can produce about 90% of the original oil in the shale, as well as a secondary volume of gas, beyond that needed to energize the retort. The retort has been shown able to handle shale particles ranging in size from 0.25-inch to 3-inch. By design, it is possible to make sure that the oil mist that is the major product does not condense onto the shale particles that are being fed into the retort. You may note that this separation process does not require any additional external fuel, nor the addition of water to the process.

Using a slightly different method Union Oil Company ran a demonstration plant that ran at rates up to 1200 tons/day, using oil shale from the Piceance Basin. The crude produced was "a waxy, intermediate gravity, high nitrogen and intermediate sulfur crude" where the wax was removed and separately cracked, and the sulfur and nitrogen levels lowered before it could be considered a "commercial shale oil" with properties similar to that of a high quality Utah crude. A feed of crude shale oil at 26,900 b/d would yield 25,000 bd of commercial shale oil, and 500 t of green coke. The oil could then be cracked into 380 bd of lpg; 13,635 bd of gasoline; 1,300 bd of stove oil; 6,700 bd of diesel and 590 bd of fuel oil.

As I said at the beginning of the post, there is an awfully lot of oil shale in the United States. The beds can reach up to 2,000 ft thick, and the oil content can reach 90 gallons/ton. Unfortunately these do not occur at the same time. Rather the highest grade is found in relatively narrow layers in the Uinta Basin, although the oil-shale sequence in the area can be up to 1,200 ft. And unfortunately not all the oil in the shale is made up of the same material, or has the same sort of properties. This can lead both to difficulties both in mining and in retorting.

I will discuss those, and the issue of in-situ retorting, and some of its problems in the next post. But, given what happened, it is perhaps appropriate to close this first post with a comment by Harold Carver of Union at the first symposium.

It should be quite obvious that if imports to the coastal states and from Canada suddenly increase disproportionately after a shale industry is started, the embryo shale industry would be placed in a severe competitive bind. Unlimited cheap foreign crude imports would make shale oil as well as a large percentage of domestic crude oil production non-competitive. What is needed is assurance that shale oil production will face a stable economic environment in which it can share in the spectrum of raw materials for our future energy needs.

Given what happened later that was quite visionary.

What is the theoretically possible maximum that oil production from shale in the US can be scaled up to within 10-15 years?

1 MB/d? 2MB/d? 3? 4?..........

shox -- my answer might sound a little snotty but don't take it away. Little ole me could be producing 5 or 10 million bbl/day in 10 years from the oil shales. I really could. But here's the snotty part. First, give me a blank check for my capex budget. And that isn't as unreasonable as it might sound. If the federal gov't guaranteed me a fixed rate of return on my investment any bank would give me a sufficient line of credit. Of course the only way the gov’t could do that would to guarantee a fixed sales price for my product. The only way for that to happen would be for the gov’t to purchase my oil for that price. The gov’t can’t force the refiners to do so. The gov’t would then resale the oil to the refiners at what ever the market could bear at that time. If we’re in a low price period the gov’t subsidy might be quit high. Conversely if we’re in the middle of a price spike the gov’t might actually make a profit on the deal. A novel situation for sure. But the actuality would be that the gov’t would lose money.

But as the system scales up significantly that differential would likely decline. But my scenario (fantasy?) would take more caveats. Additionally I would have to be released from environmental liability. Granted if I spend enough money I might be able to handle environmental damage. But that would require additional Fed money so my return on investment is achieved. Also, the Feds might also have to exercise domain rights to acquire water resources. This might require more capex to compensate from whoever we take the water.

Oil shale development will require huge capex budgets similar to that we recently saw applied to shale gas development. And then we saw what happened to that investment stream when NG prices dropped below support levels. Almost overnight many of the SG plays came to a halt. The decision to make any investment in any resource development project (both conventional and otherwise) depends on a strong confidence level in the price platform used to the economic analysis. When shale gas development took off there was obviously an optimistic price platform. It’s not difficult to imagine resistance to a repeat of that optimism even if we see NG rise the near future. Obviously if such a Fed supported effort were applied to the SG plays they would ramp up much quicker and survive low price periods.

The examples of previous war time efforts to utilize oil shales proves the viability of the process IF profit margin is not a controlling factor. We touched on this point before: the amount of in ground and "technically recoverable" resource is not very relevent. It will always be the profitability that will control that volume as long as free market pressures apply. I suspect that if we ever see a major expansion of the oil shale play it will require a similar war-time mentality.

ROCKMAN, That's clear. Money and water will be important limiting factors.

What amount of shale oil delivered these efforts ? From Wikipedia:

During the late 19th century, shale oil extraction plants were built in Australia, Brazil and the United States. China (Manchuria), Estonia, New Zealand, South Africa, Spain, Sweden, and Switzerland produced shale oil in the early 20th century. The discovery of crude oil in the Middle East during mid-century brought most of these industries to a halt, although Estonia and Manchuria maintained their extraction industries into the early 21st century. Worldwide exploitation of oil shale peaked in 1980 when 47 million tons were mined, over 70% of it in Estonia. In response to rising petroleum costs at the turn of the 20th century, extraction operations have commenced, been explored, or been renewed in the United States, China, Australia, and Jordan.

So these efforts mined 47 million tons/year at peak which is a good 300 million barrels/year.

To produce 1 million barrels/day from oil shales only in the U.S. within 10-15 years seems possible but needs something that ROCKMAN pointed out (producing 5-10 mbd in 10 years is theoretical, possibly even Iraq with a lot of 'easy' conventional oil will not produce that amount in 10 years). This will only happen in all the mentioned countries if finally the world has come to the conclusion that the only way for oilproduction to go is down. That will take at least a few more downturns and 'recoveries'.

Han: Very interesting history on oil shale develoment I never read about. Mucho thanks. That's one of the things I love about TOD: enough smarties around so I don't have to dig for all the info myself.

Eh? 47 million tons of mined shale is far less than even 47 million barrels of oil. I think you've taken the weight as if it was all oil and not mostly rock.

Right Undertow. At first I thought they must mean tons of oil produced. But after reading another link I realized that they were talking about tons of shale produced, not tons of oil. The reason they talk about tons of shale, not oil, was that they burned the shale in the boilers, like coal, to produce electricity. They did produce oil from the shale but not that much.

This link shows that the amount of actual oil produced from shale in China, Estonia and Brazil.

Review on Oil shale data Jean Laherrere September 2005

Actual oil produced, by Estonia, peaked around 1966 to 1968 at 11,000 barrels per day. The chart shows that total actual oil produced peaked in 1960 at about 24,500 barrels per day. (China and Estonia combined.) That comes to just under 9 million barrels per year, not 300 million as Han misunderstood from the Wikipedia article.

Ron P.

Undertow and Ron, thanks for the correction. The quantities seemed high to me because I never read that significant amounts of shale oil were produced but it didn't come to my mind that it wasn't only oil. To give the numbers that way is a little deceptive.

To produce 10 mbd it has to be scaled up so immense that this will take a long time, moreover it is very doubtful that oilprices will stay sustainable above $100/barrel.

Two other limiting factors; energy inputs (natural gas and/or electricity) and I think Rockman is *WAY* off on his time scale. Capital requirements of heavy equipment are likely to be a major bottleneck. And then add construction effort in an area with limited infrastructure (a la Ft. McMurray).

The inputs for oil shale are likely to be greater per barrel/day than the tar sands of Canada. And Canada was building with "Maximum Commercial Effort" (i.e. more $ be added would result no faster build-out) until the fall of 2008. Canada was not going to add anywhere close to 10 million b/day in a decade.

Alan

Alan,

Maximum commercial effort is right - back then (2008) it was simply impossible to get more done at Fort Mc - i.e. you couldn't buy any services from anyone (not even the hookers, I am told). The most optimistic forecasts were for 4mbpd by 2020, but that is now looking more like 2.5, from 1.3mbpd today.

But Rockman did say unlimited capital, and at the end, that it would require a wartime like effort - which amounts to the same thing.

In other words, we are not talking commercial effort, but national effort.

A government/military project can do things companies can't, and can not do things that companies have to do. This can result in much more resources being allocated, and more efficient use of said resources, in terms of achieving the objective. There are drawbacks, of course, like reduced environmental protection, and reduced wages and living conditions, compulsory acquisition of land, etc. In wartime people are prepared to make such sacrifices for their country, but few will make such sacrifices for their (or someone else's) company.

Another way of looking at it - if these oil shales were in China, would you be prepared to bet against them achieving 10mbpd within a decade? - I wouldn't. They might lose more people than they do in their coal mines (5,000 a year), ruin a few rivers, destroy panda habitat, displace millions of people, etc etc, but they would get it done.

We place higher regard on such things, and so we couldn't do it that fast if at all. But in war, or China, all these things are secondary.

Alan -- Yes, an absurd time scale but the implacation was for an effort on the scale of our build up from the beginning of WWII. With that type of effort it could certainly be done. But can you imagine any scenario under which the country would mount such an effort?. Perhaps I was being too subtle. And if the situation were to ever become so motivating I doubt we would apply that effort to oil shale. Killing a few hundred thousand as we took over the KSA oil fields would be much more efficient.

Without a floating tanker fleet and functional port and pipeline infrastructure in that region just what good would those far away fields do? The whole region could literally become too hot to handle. The world commerce situation can deteriorate and quite rapidly if just the wrong pieces fall at the wrong time and set off rapidly cascading events. Still, there is a heck of a lot of coal, natual gas and unused hydro on this continent. Wartime effort could build out generation and grid capacity awfully fast if it had to and all transport that could be readily powered by electric could become so fast, if we still have enough basic heavy manufacturing ability left that is. Trying to turn the oil shale fields into a middle east replacement would likely not be our wisest course of action regardless how ugly things got, which I think was your original tongue and cheek point.

Taking over the Saudi oil fields may sound like a good idea at first, but there are a couple of constraining factors:

1) Oil burns. Take over the oil fields and the locals (29 million of them) will get out the matches and rocket propelled grenades. It would be an incendiary situation.

2) There are about 1.2 billion Muslims in the world. Saudi Arabia is where Islam originated and it contains their most holy sites, Mecca, where Mohammed was born, and Medina, where he died.

I just thought I'd mention these in case someone was proposing a George W. Bush type of solution to the oil supply problem.

"Maximum Commercial Effort" is a term and concept that I have developed. The Hirsch report relied upon wartime urgency and efforts. I think that was incorrect, because people will do things in war (when relatives are off dying in the same cause, emotional appeals to patriotism, etc.) that they simply will not do for mere money.

I do not think that one can plan on evoking war time loyalty and devotion to the cause to just keep SUV tanks full and the price of gas below $XX/gallon. "Maximum Commercial Effort" is the most that I think can be expected in any effort to mitigate Peak Oil or any other national priority.

The military does NOT use materials and labor more efficiently BTW.

Alan

Two positive examples of more than "Maximum Commercial Effort" (IMHO). The Apollo program (excitement of space race & just "new frontiers") and utility linemen restoring power. Sure they get good paychecks, but restoring power to people and simple macho pride are important reasons to work 17 hours/day in terrible weather and dangerous conditions.

When I asked my question, I had it in mind that parts of the world, including the US may at some point of time be on the brink of civil unrest, starvation and war. Under these circumstances, it won't be difficult to mobilize people and to do whatever needs to be done to develop available resources.

I just wanted to know if shale could produce high flow-rates. If this is the case, the US will probably have some reprieve from total crisis. But who knows about the rest of the world?

ROCKMAN is almost certainly correct, given sufficient money and no concern for the environment, production of 10M bbl/day is possible. Above ground retorting is the only technology currently proven, so assume that. At least some of the retorting methods are self-fueling and require little outside water, which is good in the area we are talking about. Consider the scale of the operation.

I would argue that if you wait until the country is on the verge of starvation and large-scale civil unrest, it won't be possible to put together a project of this magnitude.

It's hard to argue with that.

Well that breaks it down rather nicely. Ten million barrels of day of shale production would be QUITE the undertaking, probably not the most efficient allocation of resources for energy production return. Any idea of the size of a yearly excavation footprint and emissions output say for million barrels a day? In-situ would of course give another whole set of numbers, so it will be interesting to get a comparison of those and these next week. I believe that nuclear fission was a suggested as an in-situ heating method back in the days of the 'Firecracker Boys" or were they talking fusion? Don't remember if any pilots were done with that, but the nuke explosions for peace concept does seem to have died a quiet death a while back. Seems radioactive residue always turned up its nasty head when the rubber met the road.

...and a robust economy with sufficient resources to back the effort. If all it took was money, the presses would be humming. If you really look at wartime efforts the human element is certainly important, but you have to have a strong productive economy backing that, and you have to have the resources available at a low cost, or everything grinds to a halt pretty quickly. Determined people and a printing press don't get you much shale oil.

The main problem being then, as in so many things we talk about, is that the conditions leading to a need for shale oil production also are the conditions that make significant shale oil development very unlikely.

BS. This is a circular argument: We need oil shale because we don't have oil. We can't afford oil shale because we don't have money (from oil).

There is going to be ebb and flow in the economy. But if oil shale is eroi positive and doesn't have huge hangups like needing more water than can be supplied, it will be produced. I'm not saying that the economy won't undergo discontinuities from peak oil, but the economy is not just oil production. How does shale gas play ino this? Coal? Nuclear? Conservation? Forced changed behavior of the unemployed?

Shale gas shut in because we don't need it all. This may not be as true with oil shale (or shale gas over time, I would argue). I just think the economy is more complex than your statement lets on... the market will figure it out. By market, of couse, I mean people.

If the government were to determine the price of oil in the US (say adding an variable import tax to bring the cost of imported up to the

cost of shale-oil), then it would be possible. This would be derided as communism however, so we won't do it. But it would have several benefits; high revenue for the government, high profits for domestic oil, high domestic oil product prices to encourage conservation, lower imports yielding better balance of trade, and a fairly stable future supply with predictable prices. Now would it be possible to create a political coalition to do this? There are lots of pluses:

high governmnet revenue : should be loved by deficit hawks

high industry profits : should be loved by international oil companies

high gasoline prices : should be likes by envirnmentalists

lower imports : good for the dollar

stable supply/prices : great for planning

But the ideological distase for a heavy government hand would be very hard to overcome. And the demogoues would have a field day with the concommitant increase in the cost of gasoline. I doubt our broken government would be able to push through something like this -or any coherent energy plan.

I would argue that this obvious beneficial step (import tax on petroleum and products used to reduce government debt and to reduce import consumption) has been well known for a long time. The only reason it has never been implemented is because certain well-placed interests would be hurt by it. Interestingly those interests have co-opted "anti-communism" to fight the move, and have brainwashed most voters with a carefully targeted propaganda campaign. (any tax is bad, esp. any federal tax, anything we say is communism is bad regardless of the rational analysis. Also interesting that voters still buy it even though communism as a political ideology has been dead for 25+ years and has never been a real threat politically WITHIN the US for 80+ years - Industrial Workers of the World,IWW or the Wobblies has declined strongly in the US after a split within its ranks in 1923).

The best thing for cool-headed people who wish to help the US and their families transition through peak oil to do is to combat this propaganda at every point it is seen. eg. a) Support for universal medical insurance operated at a state level is NOT communism, it is democratic socialism and simple common sense for all but a very wealthy minority and owners of private medical insurance companies. b) The average working joe white collar or blue is NOT part of any "middle class", (s)he is a member of the "working class". If you can loose your primary means of earning a living by a decision of anyone else eg. be fired from your job, then you're NOT part of the middle class. Period full stop. c) Every child deserves an even start on the playing field of life. Food, education, health care, decent shelter are all basic childrens rights.

Not going to ever happen for a number of reasons.

1) The U.S. basically has open borders, we're not going to support the world's poor

2) U.S. already has unsustainable debt

3) There are no such thing as children rights, when you subsidize the poor and import them you simply get more poor.

Your contention that everything useful is done by people raised in families of wealth is not only offensive to me since I didn't rise from a wealthy family but in fact a very poor subsistence farming family, it is offensive to a GREAT many pillars of accomplishment from M. Yunnus, founder of the Grameen Bank, to S. Freud, raised in poverty in turn-of-century Austria.

I have gone bankrupt three times (actually declared it officially once) starting up businesses to develop new ideas, largely because I couldn't raise sufficient investment capital from the wealthy. (I'm a very poor liar). In retrospect, the ONLY way to avoid poverty is to NEVER ACTUALLY TRY TO ACCOMPLISH ANYTHING, eg. always play safe and take no risks.

BTW, your attitude USED TO be considered extremely anti-american and rightly so.

It is extremely frustrating to read the comments on this subject. Everyone seems to take for granted that the only way to extract oil from shale (or oil sands) is by heating it -- which process requires massive natural gas pipelines from Alaska and Canada and the diversion of 3-barrels of river water for every barrel of kerogen recovered (that would effectively drain the Colorado River).

How ridiculously old school you guys are -- that the only way to extract oil/bitumen/kerogen from sand and rocks is to HEAT it.

Wake up and embrace the future -- there are new chemical-based oil extraction technologies that have been tested, demonstrated and are proving themselves to do what many of you deny they can do: cleanly separate and extract oil molecules from the sand, clay, rocks and water molecules that bind them and strands them underground.

Everyone is so quick to claim these chemical solvent technologies are all hype, trying to promote a stock, that they are "detergents" or some other petroleum-based blend to make the oil flow -- but in reality, you are the ones who are doing the hyping: You are hyping what you believe to be the only solution: heat-based retort and crazy insitu technologies that need Rube Goldberg-like freeze walls and Nuclear Power Plants to supply electricity needed to heat giant coils in the ground for 5 years!

Yet, I promote the fact that there are new, simpler chemical-based technologies that work on a molecular level to do a much better job, cleanly and cheaply -- and the response from most of you were insults, denigrating and dismissing these new technologies out of hand -- when you haven't even done any research to even know what you are talking about.

I've done the research on a few of these chemical-based solutions and am very happy to report that, indeed, at least one of them has so far demonstrated everything it claims - and this chemical solution can also be recovered and recycled in the process of mixing and separating the oil/bitumen/kerogen from water, sand, clay, rocks, etc. Whereas other chemical methods are consumed in the process -- this technology has successfully demonstrated the recovery of its chemcial solvent with very high efficiency, thus reducing its operating cost significantly compared to other exotic chemical solutions that cost too much and cannot be reused.

Quite simply, this chemical solvent breaks the bonds that bind hydrocarbon molecules to sand, clay, rock and water--and encapsulates those freed hydrocarbons in a low-viscosity solution that easily flows through the formation to an exit well (if in-situ) or if surface-mined: cleanly separates the oil/bitumen/kerogen from the oil sands or oil shale rocks in which it is mixed.

This is not camera-trickery -- this is not lab-demos that can't be duplicated on a commercial-scale -- these are real chemical solutions for which scaled up equipment took raw oil shale and tar sand ore into its hopper, augured it to the mixing reactor -- and upon contact of the oil shale ore with the chemical solvent: it separated out the oil/bitumen/kerogen -- leaving clean sand and gravel that is 100% oil-free, no oil residues remain in the dry sand/gravel by-product.

What I don't understand is why a simpler chemical technology that does NOT consume natural gas, that does NOT consume precious river water resources and does NOT produce toxic SAGD waste water or microfine tailing pond waste water -- is dismissed out of hand by all of you -- yet it may be the one practical, low-cost solution that ultimately enables America to cleanly harness its vast unconventional heavy oil, tar sands and oil shale resources in the only environmentally-acceptable way.

Otherwise - the game is over -- America will never be able to produce enough oil domestically to replace foreign oil imports if we try to use heat-based oil extraction methods -- because it makes NO sense to sacrifice valuable natural gas and precious river water resources just to make a barrel of oil/bitumen/kerogen that can be extracted dryly, without the need for water or high heat.

America is not willing to do to Utah and Colorado what Canada did with its dirty oil sands industry. This is why American currently does not have a tar sands or oil shale industry today -- because it is too dirty and too wasteful of other natural resources.

Yet, thankfully, now there is a new 21st Century chemical solution to the oil sand and oil shale problem.

I did the math -- a chemical oil extraction facility may produce 7,000 barrels a day at a capex cost of $60-million per facility x 1,428 facilities = 10-million barrels a day of oil produced at total capex cost of $85-billion -- financed over 10 years = ~10-billion dollars a year to create a whole new unconventional oil industry in America to eliminate foreign oil imports that cost America >$220-billion per year.

Is that a good trade-off? $10-billion a year in costs to save America >$250-billion per year in American fuel dollars that are going to foreign governments?

That what is at stake here -- continue supporting heat-based oil extraction -- and America is doomed because you economically justify consuming half our natural gas supplies and fresh river water supplies to extract oil/bitumen/kerogen.

But using these new chemical-based oil extraction technologies will absolutely be acceptable to the American public - and so will the new American jobs that are created because of it, which will help the America economy and insulate us from future global oil supply competition with China and India.

Seems like a smart strategy to me.

Is this being developed by anybody (like Shell, with their big Green River leases)?

If not, why not?

No links, just hype.

I find the claims "technically implausible" at multiple points (except when he points out the problems with existing technology to extract oil shale).

Quite frankly the claims remind me of penny stock promoters.

BTW, Heavyoil007 had been with us for 3 weeks and 2 days.

Happy Mardi Gras, it has been an exhausting day !

Alan

Lucky for America that you are not deciding what technologies to develop for our collective benefit -- I bet, if you were there, you would have spread invective against Tesla and his "evil" AC machine because you were a disciple of Edison and Direct Current!

Seriously, though -- How can anyone advocate and be a disciple of retorting?

Retorting is an inherently dirty and energy-intensive 19th Century technology that should be replaced, don't you think, by more advanced technology that does not waste natural gas for heat and does not need water for steam and ore-washing?

Science marches on -- whether you know it or not -- there are 21st Century chemical technologies today that work on the molecular nano-scale to cleanly separate and encapsulate hydrocarbon molecules from virtually anything, without leaving any oily residue (like every other heat-based oil extraction technology leaves: hydrocarbon residues and microfine tailings).

Every retort-related, SAGD or in-situ method being used to extract oil/bitumen/kerogen from sands and rocks all create secondary waste effluence and toxic tailing ponds to which you and your children certainly would not want to live next door or be downstream.

Why would any of you on this thread defend heat-based retort technology when other, cleaner, smarter, cheaper and politically acceptable chemical technologies can do the job better?

That's why I don't understand your motives for your insults and derision against a technology about which you obviously do not know very much.

If you don't like my idea - you don't have to call me names and question my motives - my motives are trying to help America fix a problem it has ignored since first Arab Oil Embargo of 1973.

Remember when we used to take pride in using our American ingenuity to solve the problems that face our country and our families?

If you really cares about our environment and energy production -- then please tell us what your solution is -- show us a better way to solve these problems for America.

What would you do to replace 10-million barrels of oil a day - without creating an environmental disaster like the Canadian oil sands?

I explained what I believed to be the answer to replace America's oil imports in an environmentally-friendly way using the chemical oil extraction technology...

What is your faster or cheaper or better solution to make America independent of foreign oil imports???

Sounds great.

So, again, is this being developed by anybody (like Shell, with their big Green River leases)?

If not, why not?

And links ?

Or is it just snakeoil ?

Alan

Here are the links to discover the Truth for yourself:

www.Encapsol.com/media

and here's the scaled-up equipment -- oil sands input -- clean sand and bitumen output...using no water..burning no natural gas and producing no toxic tailing ponds...

www.Encapsol.com/tar-sands-and-oil-shale-extraction/

It's not snake oil, it's snake kerogen. The whole point of the retorting process is to upgrade the kerogen (a waxy organic polymer) into crude oil. In a conventional oil field, mother nature has already applied the heat and pressure by burying the source rock deep enough, and trapped the resulting oil in a convenient, easily producible oil reservoir.

"Oil shale" is a misnomer, since it is not shale and doesn't contain oil. However, "kerogen marlestone" just doesn't have the same marketing effect when you're selling shares.

What is your faster or cheaper or better solution to make America independent of foreign oil imports???

- Electrify, expand (double tracks, grade separation mainly) our existing freight rail system and shift freight from trucking to electric rail. Add more passenger service.

- Build out Urban rail at breakneck speed and stop building roads (shrink them actually)

- Encourage more bicycling

- Encourage walkable (and bikeable) neighborhoods connected by urban rail

Understand that that post-WW II Suburbia was, to quote Kunstler, the greatest misallocation of resources in the history of humanity.

MUCH less CO2, better and longer lives and a better economy with my approach.

Best Hopes for Efficient Non-Oil Transportation,

Alan

I like Alan's plan much more than heavyoill007's. This guy is talking about a "process" called Encapsol, that supposedly uses nanoparticles to separate the oil in situ. The process is owned by a company called Freestone resources, that looks just a like a shell company. In the information available, it is revealed that it owes $150k in licence fees to the original developer of encapsol, and $250k to another company that built the trial equipment. Freestone had cash on hand of all of $2112 at sept 30 2009 (all data from Yahoo finance).

This guy also appears to write on any Canadian blogs/newspaper sites that mention oil sands as Oil Trader, and basically repeats the same claims about encapsol each time. The Freestone website offers no third party verification, and there is no evidence of any oil company showing an interest in this. Looks like a textbook case of hyping a a junk stock to me.

Finally, he missed the point that we all seem to be pretty much agreed upon, that oil shale is uneconomic and it would take a wartime effort to get anything much out of, and in wartime (or the present) those same resources could be far more beneficially applied to other energy technologies and conservation.

That doesn't mean Freestone isn't allowed to try their process, and if they can make it work, profitably, they will be the richest company around, no hype necessary.

But until them, as they would say on Dragon's Den (or Shark Tank) - this process has no sales, no proof and no hope - and for that reason, I'm out!

Thanks Paul, heavyoil007's pitch seemed virtually unchanged from the last one or three he posted if memory serves, wonder if the editors can automatically link your reply to any such future posts?

The public policy levers to massively accelerate a shift from FF are mostly well known, simple and effective. We don't use them because of opposition from those whose careers and investments would be hurt.

Some of the biggest and most obvious include:

-consumer taxes: carbon & liquid fuel

-producer efficiency regulation: CAFE, building codes, appliances

-direct investment mandates: rail, smart grid, wind, etc

I prefer investment incentives as better means to allocate capital than direct mandates.

Property tax holidays (say 20 or 30 years), investment tax credits (invest $1, get 30 cents off your taxes), accelerated depreciation, gov't guaranteed loans (lowers the cost of capital), and even gov't grants for specific projects ($5 billion for CREATE to reduce rail bottlenecks in Chicago).

http://www.createprogram.org/

Best Hopes,

Alan

I'd agree in general, though I have to say, I like aggressive state mandates for wind.

Iowa has had success with a mix of things: a mandate early on to get the ball rolling, incentives and regulatory encouragement/promotion. http://online.wsj.com/article/SB1000142405297020448830457443121384880079...

I like Nick' first approach - i think you need a mix of taxes, mandates, and tax credits.

Taxes on things you want less of (i.e. oil). We already tax alcohol (beer) and cigarettes to the hilt, we can do that with oil too. higher taxes on bigger vehicles, this has worked well in Europe too.

Mandates only when they are clear, and enforceable. For example, the mandate eliminating leaded gasoline was clear and enforceable. A mandate setting a date the the phase out of incandescent bulbs is clear and enforceable. A mandate stating that every new car must have get mileage of greater than X mpg, or Ygal/mile/1000lbs vehicle weight, is clear and enforceable.

Mandates requiring "minimum % of renewables.., or an average fleet fuel economy of x" are much harder to make watertight and enforceable.

Tax credits to encourage new investments in wind or whatever are fine, as long as we find a way to replace the lost tax revenue. Is the wind operator willing to accept higher taxes on their sales in exchange for lower up front, of faster capital depreciation? That is one argument for the higher oil or FF taxes, and works until the oil usage decreases such that they have to tax something else. Remember that a tax credit is just a grant in another form - it represents a direct transfer of wealth from the taxpayer to the recipient - does the recipient acknowledge this, and are they willing to pay it back over time? If not, what is in it for the people? They can't just argue more jobs etc, as this argument can be applied to any and all industry and jobs, but we do still have to have something getting taxed, somewhere to support the government.

The recent example of the "biofuel" tax credit to the pulp industry shows how it can go wrong. $4bn just for companies to do what they were already doing - a massive transfer of wealth to a legacy industry that is shrinking. If the shareholders were not willing to pony up money for this, why should the taxpayers?

Of course, gov can play its part by not wasting as much of said tax revenue, but that's another story altogether..

I like Nick' first approach - i think you need a mix of taxes, mandates, and tax credits.

Alan and I were just talking about the "mandates" section. I think Alan agrees with taxes and efficiency regulations.

Mandates requiring "minimum % of renewables.., or an average fleet fuel economy of x" are much harder to make watertight and enforceable.

Yes, they are more difficult, but this is really only a problem when regulators can't do their jobs by adjusting regs as needed. For instance, when SUV's were introduced (to take advantage of the light truck loophole), the car industry was able to prevent regulators from reining them in.

Tax credits to encourage new investments in wind or whatever are fine, as long as we find a way to replace the lost tax revenue.

That's easy: replace income taxes with consumption taxes. Make the change progressive by taking the reduction at the bottom by reducing FICA, or expanding the individual tax credit.

Remember, FF's have a real cost (property damage, injury to health, etc, etc). When you tax them, you're simply recognizing that cost.

"that's easy"?!? You must not live in the USA

I'll second that Luke. It may be right, but definitely not easy. Here in Canada where we gave a consumption tax, the government has reduced it from 7 to5%, for political popularity.

In British Columbia, the provincial government had a 7% goods tax (in addition to the federal tax) and is now extending that to services too, so everything will be at 12%. It is sharing the tax burden so that it is not just income earners, but everyone, which I think is a good thing. However, people are screaming blue murder about it.

The right decisions are rarely popular, and almost never "easy".

Look above, where this conversation started. I said:

"The public policy levers to massively accelerate a shift from FF are mostly well known, simple and effective. We don't use them because of opposition from those whose careers and investments would be hurt."

So. "well known, simple and effective". Just politically almost impossible, due to "opposition from those whose careers and investments would be hurt".

We know what to do - we just can't find a way to handle the difficulty of change for those most directly affected. They fight back, and we're all paralyzed.

Imagine how hard a consumption tax, like the one Paul mentions, becomes to implement as the US boomers hit retirement with eroded nest eggs and shrinking SS income and shakey health care options. In my neighborhood we watched fire stations close rather than give ourselves a sales tax a decade plus ago--one person died a block from a closed fire station because of that, but fortunatley no "Our Lady of Angels" type event happened before we figured out how to fund the stations. Just had to comment on the 'easy' thing. I have never voted for a sales tax myself because I remember how easy it is to jack up the rates and remove items from the not taxed list once the sales tax is implemented. A very targetted graduated fuel tax is my preference--virtually no chance of getting any such thing without major disruptions in the oil supply occuring first.

Excellent heavy! Me and the rest of the TODers anxiously await our invitations to the ribbon cutting of the first 7,000 bopd facilites. I'll bring the beer!!

There may be cheaper forms of oil, it is hard to stay in business if operating costs exceed retail oil prices. The Bakken tight oil formation is well known. Parts of the Barnett Shale are being tapped for oil and condensates. The Maverick Basin -- Eagleford Shale near the Mexican border is being tapped for liquids although there is only a narrow fairway containing the liquids portion of the broader shale gas deposit. In Estonia they crushed the oil shale and burned it to produce steam turbine electricity. Like the heavy oil deposits in Arkansas and Kentucky, the Piceance Oil Shale of Colorado might not be of immediate importance.

"In Estonia they crushed the oil shale and burned it to produce steam turbine electricity."

I often wondered if this might be the method to use the American shales. It might not be as efficient but it would be a lot less trouble and only need a lower grade of technology.

Used this way, it's just really crappy coal -- low energy content per ton, high ash content, plus concerns over sulfur and arsenic content. The energy density is about one-sixth that of regular coal. The attraction of oil shale, outside of a handful of places with no other energy sources, is the hope of getting liquid fuel from it.

Estonia is so poor they can afford to use burn crushed shale. Brazil was doing some processing and refining of oil shale. It seems more of a strategic energy project like coal to liquids projects by SASOL in South Africa. The oil shale refining was started before they discovered their presalt oil fields.

I have always thought this was the show stopper for 'Oil Shales' - given that CTL is generally going to yield more oil per unit mined with less waste, why would anyone bother with oil shale as long as coal was available?

That's the key question - why would we use oil shale while we still have coal? And, we have a LOT of coal.

OTOH, the fact that we have so much oil shale that could be burned for electricity makes it really clear that we're not going to have electricity shortages because of lack of fuel.

For me, all these marginal energy sources have "potential". I logged for a while once. We'd go into a stand of trees and take the quick easy stuff first. The quickest money!! Then go back and "clean up". Slow, expensive, hard to harvest and time consuming for a much smaller amount of return. I figure it's the same thing here. The real problem for me is an ignorant public coupled with a quick news ignorant media will lull Americans into continued complacency. I see it happening around me. I take some time to attempt to explain to people the real situation but I just don't carry the authority of a Glen Beck or some other perceived "authority" figure on the evening news. As I told a neighbor the other day, we beg to be lied to. I'm getting old and will be gone, but I think this is going to get very ugly before it's done.

zeke -- Let me be the first to welcome you to POMA. Our numbers are growing daily. Any thought for the logo we might use on our Pessimistic Old Men Association tee shirts? I'm thinking of something similar to that old TV add with the Native American with the tear running down his cheek. Perhaps the face of an old gray beard with a tear running down his cheek as he thinks about the future for his grandkids.

... POMA ..

Not as spry as

... a PUMA..

But we still Purrrr.

...

cheers,

Charles.

+1. I did a presentation at a local college on rhetoric in the media regarding our country's oil situation. You should have seen how shocked these kids were when they found out that mother nature and our own consumption habits were the impediment to the U.S. being oil independent, not political will.

I'm barely middle aged now, so I'll get to live the decline or collapse!

leduck says, "I'm barely middle aged now, so I'll get to live the decline or collapse!"

So you have the timing of the decline and collapse all figured out do ya'? Good job! :-)

Heck, as far as the American middle class is concerned, we've been living the collapse since the 1970s.

Precisely. The problem is that the rate of decline is likely to ratchet up significantly in the near future.

Interesting that the retort can reach efficiencies >90%. I never would have guessed. Still, it takes quite a bit of energy to extract the shale and convey it to the retort. The problem I have with shale is EROI. If the U.S. were to be dependent on shale for all its oil needs, 1,000,000bpd at an EROI of 5:1 only leaves 800,000bpd for consumption outside of the shale industry. Now in theory you could use coal fired electricity to power your excavation equipment and have 100% of the shale production be available outside the shale industry but I doubt the infrastructure build out would make it worth while.

GP -- Your comment reminds me of a story a couple of years ago with regards to a plan by the Canadian gov't to improve the EROI of their tar sands: build 10 nuke plants in the tar sand fields to supply to supply the heat for extraction. No doubt it looked good on paper especially if they didn' take into account the problems associated with nuke energy. The first I heard of the plan was when the gov't announced they had cancelled it. I suppose someone reran the numbers with a little more reality input.

Actually, the nukes are still under consideration at the deeper Peace River deposit. A recent documentary is here.

From an efficiency perspective i think this makes sense. The operating temperature of a water-cooled nuclear reactor sets an electricity production efficiency limit of about 30%, but a combined cycle gas plant can reach 60%. If nuclear can displace gas for SAGD steam generation, then the gas can be used more efficiently.

Gas is also more dispatchable than nuclear, and will allow a higher proportion of wind and PV power in the grid. Without new gas storage and load following plants, wind penetration in the North American grid will be limited to about 20%, so new nuclear capacity dedicated to oil sand and oil shale production, where it can be used as 'base load' supply makes more sense than trying to co-exist with renewables in the electric market.

Rockman, that idea is still being discussed in private circles. The Alberta government poured cold water on the idea, but next door in Saskatchewan, home to a major chunk of the world's uranium production, they like this idea.

Given the increasing "public pressure" on the oilsands over it's CO2 footprint, this idea will not die.. If you are going to build a nuke somewhere to make electricity, you might as well build it somewhere that the waste heat can be made useful, and that fits the oilsands precisely.

If natural gas gets back up in price,you can expect to hear about this again, but I won't hold my breath for it to happen.

Thanks for the update hf and Paul -- I'm sure the plan looks a lot better on paper then the reality. Maybe going nuke is the only way to really ramp it up. But someone is going to have to put their gonads on the line big time to commit that much capex combined with the environmental risks IMHO. Seems like that war-time mentality discussed earlier could be the only push strong enough to get it going.

"If natural gas gets back up in price"

Ah, there's the rub on all of these plans, is it not?

The fact is, NO ONE has any idea how much gas we will have avalable at a competitive price. In the short time, all projections, whether cornucopian or doomer, have to be scrapped, because the speculation (I know, I know, it doesn't exist, but let's just assume for this argument it does) and the economic situation outside the gas industry (I know, I know, that has no effect on the geology, but just for the sake of this argument let us assume it does have an effect on forecasted gas production) have so muddied the waters that no one can deliver a forecast of gas prices and future into the future, even the short term future. We are all guessing, and I will be frank, if I had not hedged and bet on my own projections of natural gas prices going ever upward (I goofed and bet with the paranoids on this one) I would have lost my ass.

Natural gas is the dream fuel, clean, relatively easy to access, no great expense in "retorting" or refining...but how much is out there?

As Rockman pointed out, with no assurances against competition, the oil shale industry dream is dead in the water.

RC

I'm not nearly as optimistic as the natural gas industry when it comes to domestic reserves. Personally, I think shale gas is going to turn out to be one of the larger scams of the century (one of the presentations I saw at the 2nd annual BioPhysical Economics conference convinced me of this) but with that said, one of the advantages to building infrastructure around natural gas is that we can alway produce more from biomass. Not necessarily at the same level, but so long as we have decaying plant matter we can produce methane. IIRC, using biomass for methane production is about twice as efficient as using biomass for ethanol production (2x the energy per unit of biomass) and that's without any substantial research/optimization.

"the Canadian gov't to improve the EROI of their tar sands: build 10 nuke plants in the tar sand fields to supply to supply the heat for extraction."

This was a private proposal (Bruce Power) for one nuclear plant, not from the Alberta or Canadian governments. The provincial Tories are generally against it on the issue of waste disposal.

I am no uranium expert, but couldn't the waste go back down an empty uranium mine in Sask?

Though I'm sure if it was that simple, it would be happening already.

Given the average 10 year construction time for nukes, and their history of cost overruns it makes oilsands investments look fast and cost predictable - not an easy thing to do. You would run the risk that by the time your nuke is built, the market conditions may have changed that oilsands are not done anymore (for environmental reasons) or other technology, like THAI, has made the nuke obsolete (though not for electricity production).

And, in Canada anyway, it seems that every nuke has had huge government subsidies anyway, so if the governments aren't behind it, it simply won't happen - but I'm OK with that.

The BEST we can hope for is a move away from oil into Thorium based nuclear power. That is the only hope i'm holding on to right now. Sooner or later the fossil fuels (even coal) will run out (probably sooner) and our grandchildren, great grandchildren will have to either do without or embrace an "electric" world.

Frequently asked question: What about the EROEI for shale oil ?

I have a well-known graph of the energy content of fuels in MM Btu per ton, which I am unfortunately unable to cut and paste onto TOD.

Natural gas ~46 MM Btu / ton

Crude oil ~38 MM Btu / ton

Coal ~25 MM Btu / ton

Cattle manure ~15 MM Btu / ton

Firewood ~15 MM Btu / ton

Municipal trash ~12 MM Btu / ton

Oil shale ~3 MM Btu / ton

Baked potato ~3 MM Btu / ton

This is a useful proxy, and you can eat the baked potato.

Regards

Harry Flashman, presently in Kh*rt**m

Best. "Oil Shale." Article. Ever. (PDF)

Cattle manure is where it's at! :)

GreenPlease says,

"Cattle manure is where it's at! :)"

Ha, ha, ha, but don't laugh too loud! I have yet to see any real usable statistics on the energy potential of agricultural waste methane, but the potential is great, and the projects recovering methane waste from agricultural by product and landfill and sewer gas are already underway.

This is important, because along with some modest conservation/efficiency engineering (no new ideas, just applying the "EnergyStar" type higher efficiencies and LEEDS style architectural ideas) the market for natural gas could continue to be soft...now combine this with the recaptured methane...the question becomes who you are going to pedddle expensive, troublesome and dirty oil shale fuel too? The Pentagon maybe...this is just the type of project they love, expensive, complex and delivering marginal benefit.

RC

Harry - please provide link to shale oil vs baked potato energy

It is based on oil content per ton. Oil shale may be fool's gold

Also: The Oil Shale Promise: A Trillion Tons Of Tater Tots

Google shale oil baked potato and you will find hundreds of such comparisons.

Ron P.

Re: Mith's desire to have more fed oil shale leases put on the market. Guess no one pointed out to the boy that there are 100's of thousands of acres of privately owned OS leases that can be had by writting a check tomorrow. All you need is someone willing to take the lease and spend the capex. Problem solved. Sleep well.

When the price of oil was above $140 a barrel an oil major toyed with the idea of developing the oil shale deposits of Madagascar. As the price of oil dropped the plans were canceled.

Very rough calculation

1Kg potato approx 1000 Calories = approx 4000 BTU

Therefore 1 metric tonne potato = approx 4 MM BTU

Which is roughly in line with the figure quoted (3 MM BTU/short ton)

[One short ton = 0.9 metric tonnes]

Approx Calorific content baked potato taken from http://caloriecount.about.com/calories-potato-baked-flesh-skin-i11674

Thanks for the useful info. I will pose the obligatory follow up question. If you fuel the oil shale processing retort by the output of the oil shale processing retort is there anything left over for the rest of us to use? In other words, the EROEI issue.

I've seen EROI estimates on shale that range from negative all the way up to 5:1. I guess it depends on how rich the shale is in kerogen and how comprehensive the EROI analysis is.

We have previously discussed the material on so called shale oil presented by Dr. Walter Youngquist in his book GeoDestinies and in the Hubbert Center Newsletter http://hubbert.mines.edu issue 98-4. Presumably this material will be updated in the 2nd edition of GeoDestinies should this book see the light of day.

Truly what goes around comes around.

Oil Shale in Scotland

I live in a flat in a grand house looking out over Linlithgow, and built in 1907 by a geologist who made a small fortune in helping establish the oil shale industry in West Lothian, Scotland.

From this window, I look out towards Edinburgh - about 15 miles as the crow flies - and there are still a few of the massive spoil-heaps known as 'bings' described above. One of them looks for all the world like Ayers Rock.

I'm not sure how much oil shale is left to be mined - the industry was pretty much wiped out almost overnight by the discovery of crude oil in the US and elsewhere.

I lived in mid-calder for 6 years as a young teenager and we used to play in the caves by the River Almond which I think were the caves from the shale mines. We used to dare each other to go further and further into the caves with torches. Rumour had it they were up to a mile long but I think we soiled ourselves at the 300m mark.

Yep I was right, they were shale mines. Found this in Wikipedia:

This was based on oil extracted from shale, and by 1870 over 3 million tons of shale were being mined each year in the area around Mid Calder. Output declined with the discovery of liquid oil reserves around the world in the early 1900s, but shale mining only finally ceased in 1962

Very intersting.

Marco.

Before the invention of the oil tanker(1890s), retorting oil shale was the major source of oil in the UK(Lothian) and France(Autun).

http://en.wikipedia.org/wiki/History_of_the_oil_tanker

You need to crush 1.5 to 2.5 tons of Colorado oil shale to produce a barrel of shale oil, roughly the same as oil sands. The 150 foot thick tar sands mines cover 50 square miles and produce 1 mbpd. The EROI is between 4 and 7, about the same as tar sands mines.

The Colorado deposit borders some of the most beautiful parks in the US(Arches, Yellowstone, Capitol Reef, Natural Bridges) and lies at the headwaters of the Colorado River.

An alternate to retorts is Shell's instu method which requires lots of electricity(EROI 3.5) but doesn't disturb the surface or use much water. As I have suggested several times, using abundant Wyoming wind (a 800 Twh potential) could for electricity could greatly reduce CO2 emissions and not require any cooling water.

In an emergency, the US could ramp up a 2-3 mbpd oil shale program (2 or 3 Albertas) but given a 20.7 mbpd demand this is small potatos. A coordinated series of measures( ethanol, oil shale, natural gas, electric/hybrid cars) is needed.

Creative use of wind power. I suppose the thermal nature of the process wouldn't really care too much about variability. If the wind wasn't blowing just shut off a few of the wells. IMO, I think there's a killing to be made in harvesting "stranded wind power"

Right. You store the electricity as heat energy which averages out over time. The temperature is very high 500 deg C but the rock strata itself would insulate the insitu retort. If you've ever driven across Southern Wyoming, it's a 24 hour wind tunnel. The main problem is building 30-50,000 1.5 GW wind turbines with transmission lines to provide the 175 Twh of electricity for the electric heaters.

Back in 1992 I lived in Logan Utah, and drove to Laramie, Wyoming to go on a date with my then girlfriend, 800 mile round trip. Wind, Wind, and more wind. She had family out in the middle somewhere and when visiting them there were stories told of newbies to the area complaining of going crazy at the wind. But they said that one day the wind stopped and everyone in town was in a panic, they'd never experienced a wind free time.

I-80 is one nasty road for folks getting blown off it, by the wind.

I miss Laramie, I finally moved there when my girlfriend found me a place to stay, she was doing the traveling every other date, and disliked it more than I did. I love driving. Longest drive I have had was 1076 miles in about 16.5 hours Sterling Col, to North Little Rock Arkansas, via Nebraska, and getting lost while going through tulsa.

Wind would be a great use of the land besides cattle.

Charles.

Bingo. What's the EROEI look like when costs associated with those wind turbines to generate the 175 terawatt hours are factored in?

It doesn't change much. Long distance transmission to bring wind power to market costs roughly $.25/Wp, which is about roughly a 12% overhead factor. Not a big deal.

I had a chance to see a Shell presentation at School of Mines on their in situ process. If I recall the numbers correctly, the amount of electricity required to produce a million barrels per day was just about equal to all current electricity use in Colorado. I asked the engineers if they could estimate whether putting the same amount of energy into a coal-to-liquids process would produce more or less fuel; they thought coal-to-liquids would have slightly greater yield if you had the water to support the process.

Ramping up Shell's process is going to be limited by the availability of electricity and drilling rigs. The spacing for the "freezer" wells is, IIRC, about eight feet -- that's a lot of drilling. Plus, they have to "bake" the rock for upwards of four years. I suspect that in an emergency, some place like southern Illinois with lots of coal and lots of water could ramp up a million barrel per day coal-to-liquids operation much faster than anyone could with oil shale. Not to mention that Illinois is significantly closer to major population centers.

CTL is 33% efficient so to produce 1 mbpd(2 quad per year) you'd need to mine 6 quads or ~300 million tons of coal.

Burning 300 million tons of coal could produce 600 Twh of electricity which would then produce 7 quads(3.5 mbpd) of Shell's shale oil given their announced EROI of 3.5.(gotta watch my conversions here)

It's still easier to make auto fuel from kerogen than auto fuel from coal.

Shell's process is net energy positive, CTL is net energy negative.

It's a little bit of apples-to-oranges. On the one hand, you get about a barrel of synthetic crude per ton of input for both, and the amount of energy you need to apply to "extract" that barrel is about the same for both (as I recall, Shell doesn't claim that they use less energy to extract a barrel of liquid fuel, only that they avoid the need for most of the process water and don't have "ash" disposal problems). If you calculate EROI based on the process energy to get the barrel of crude, both come in at about 3:1.

OTOH, the ton of coal contains lots more energy than the ton of oil shale. In some absolute sense, yeah, you're throwing away a lot of the raw material's original energy content. But that energy only counts if you have some non-liquid use for it. If you're an Illinois or Montana, who have a lot of coal that no one wants to buy as "coal", do you count those wasted BTUs or not?

I simply do believe that the energy requirements of insulating a 500 degrees c oven inside a freezer amounts to EROEI stated by shell. Let me get this straight I stick my oven in the freezer switch it on and expect my freezer to just trundle on as normal.... one hell of a freezer, the notion this is self insulating for years seems hard to believe

how many years does it take to cook this stuff insitu?... area vs volume does support bigger is better I suppose..

if all the electricity was generated by burning raw shale then at least your energy energy inputs are self sustaining from the resource, but still!

someone earlier had retort energy requirements at 25% of final product.I find that hard to believe

According to Rand (based upon Shell) it would take 1200 MW plant running 24 hours per day to produce 100,000 BPD. Converted to TWh, thats a little over 10.5 TWh (over the year) per 100,000 BPD for a year or ~105 TWh (over the year) per 1MMBPD (for the year).

The current maximum annual generation capacity for the US grid is ~8800 TWh @ 100% utilization.

I said 175 Twh per year for 1 mbpd, you said 105 Twh for 1 mbpd. Mahagony is the richest grade of oil shale. I think my conservative estimate is more likely for major production.

There was a piece on news recently about potential viability of using spent nuclear fuel rods to heat up oil deposits underground in order to make them 'pumpable'. Could this work for shale oil as well?

goldy -- The prime problem with that approach would be the nature of the rock itself. Shale has virtually no ability to flow any liquid through it. This near zero permability is for the martix (the main body of the shale). Those high flow rates you hear about from the shale gas plays are from fractures in the shale. These fractures can have very high flow rates. Unfortunately only a relatively small volume of the matrix is in contact with these fractures. This is why horizontal wells were critical to getting the SG play up an running. Think of the hz wells as long man-made fractures.

Thus even if you can retort the shale oil inplace you're still left with the problem of getting it to flow out. You could try hx wells to help but you've just bumped your capex up big time. Then you're back to the same old problem": $'s in vs. $'s out.

Sorry Roc, but until you can get Steve to recant his resevoir models using dual porosity systems, including the matrix porosity, I ain't buying the "all fracture, only fracture" argument.

This isn't new, and has been examined since the days of the Eastern Gas Shales project.

http://www.onepetro.org/mslib/servlet/onepetropreview?id=00014509&soc=SPE

Decline curve analysis alone does not support fracture only production characteristics, shales often exhibit a decades long hyperbolic decline profile as the system transitions from primary fracture drainage to matrix perm and porosity.

Shale does have permeability...maybe not all of them ( some in the Rockys spring to mind), but certainly every one of the producing shales I've examined to date does.

Good for you reserve guy. Let me know later how much flow volume you get out of the 0.1 md shale matrix. I don't think I said shale had no perm. I just implied I could pee more fluid then you could push thru the matrix....and still do. Not denying the tail end of the hyperbolic decline. I just don't think you'll get too many folks excited when you're producing a few bbl per day at that point. But if you think you can flow a few million bbl of oil per day thru the matrix then I bow to your abilities. LOL

TODers -- excuse the insider debate. Pretty common amongst us nerdy types. Doesn't really make much practical difference IMHO

I've pressure and flow tested wells with microDarcy level perms, call them 0.01 to 0.1 md, without trouble. And the flowrates on shale gas wells which have transitioned into pseudo steady depletion profiles primarily dependent upon matrix drainage are well established, you might not be familiar with them but I'm sure the Barnett has plenty which can be easily referenced by anyone with access to IHS. Of course, the lower perms don't bother gas flowrates as much as oil flowrates, but the primary production from shales in the US has been natural gas more than oil over the past century.

As far as flowrates through shale, it isn't difficult to compensate for a low perm by substituting height, something I'm sure you are well aware of.

I'm guessing that you are not a fan of Arthur Berman's work. I believe that Arthur is estimating an average commercial life of about 7.5 years for Barnett Shale wells, and if memory serves, he said that about 15% of Barnett Shale gas wells have already been plugged.

In any case, a link to a recent article by Arthur follows, in which he comments on some problems with data access:

http://petroleumtruthreport.blogspot.com/2009/11/showing-data.html

Berman's economic parameters are wildly conservative, and contradicted by the actual producing lifespans of at least a few thousand Barnett wells which I've done decline curves on. Operators certainly don't enjoy losing money on wells, and doing it for decades irritates them even worse. Also, his assessment that there is no EUR difference between the groups (horizontals versus verticals) on a well basis (versus any analysis based on lateral lengths, which can be construed to incorporate drainage area to some extent) is incorrect as well.

Berman might have data access issues. I certainly haven't.

I suspected that you might disagree with Arthur. Do you have your own number for average commercial life expectancy for Barnett Shale gas wells and do you dispute his estimate that about 15% of Barnett Shale gas wells have already been plugged?

Incidentally, an excerpt from Arthur's comments, linked above:

Do I have an estimate of average commerical life? No. I haven't done audited SEC proven reserves since the 80's and 90's. Can I calculate one in approximately 15 minutes or so from the data I have? Sure. Do I dispute that 15% of ANY particular well group has been plugged? Why would I try, such an estimate is nothing more than bookkeeping. The last 5 well groups I looked at had between 5-40% of their wells non producing within 10 years time, the Barnett wells would actually be closer to the bottom of that range than the top.

I'm guessing this conversation doesn't belong here though, I don't recall Berman's expertise related to the shale oil accumulation in the Rockys.

And exactly how many bbl/day of retorted oil shale product do you anticipate flowing from from that microDarcy shale matrix, let's say, that's 200' thick? And remember we're not discussing producing oil from the Barnett. We're talking about producing oil shale retorted product. And, since I'm not too savvy on oil shale recovery, what is the flow characteristic of an oil shale that has been retorted inplace? Sincere question: have never seen anyone offer such a characterzation.

Speaking from memory, which seems to get less reliable every day, I believe that the total oil recovery from the Shell in-situ project was something like a few hundred barrels of oil--not per day, total recovery.

I have been talking about the producing shales in general, versus the "shale oil" kerogen. The only information I have related to "shale oil", the rock, is when Shell stopped by the office and did an afternoon presentation on their in-situ process. I haven't paid much attention to the process since that point in time.

The Bakken, Barnett, Woodford, Fayetteville, Caney, Haynesville, Devonian and Ohio, New Albany, Marcellus and Eagleford are certainly not the same animal as the "shale oil" handled in this evaluation.

http://energy.cr.usgs.gov/other/oil_shale/

For the benefit of the audience, the Bakken, et al, Shales are thermally mature, producing liquid oil which is ready to be transported to a refinery.

The kerogen "Shale Oil" deposits have to be "cooked" in order to yield something than can be transported to a refinery.

Got it reserve man. I started to suspect we were getting crosswise. I was strictly talking about the oil shales. I worked a little in the Haynesville and understand exactly what you're talking about. It was amazing to see a well the conventional core indicated wouldn't make one mcf and yet come on at 6 million/day. Drilled it 4.5 pounds underbalanced and not a whif of gas on the mud log. Told them they could have drilled that 14.5 ppg reservoir with air and not seen a show. Truely amazing.

what did you use for fracture compressibility in your analysis ? stright, etal took on this problem in spe 24320 and from memory, they concluded that in one case 10 % of porosity and 99% of permeability was contributed by the fractures. yeah, even nanodarcy permeability rock can provide some flow, but what is the point ?

just curious, was your decline profile based on a "type curve" (an averaging of older wells with newer wells). "type curves" of the variety presented by many public traded companies are an abuse of reservoir engineering science, imo.

Fracture permeability is like a super highway compared to most matrix perm, and very rapidly these conversations evolve into the density of micro fractures and their contribution versus what shale matrix perm/porosity is like, or worse yet, sorbed gas contributions. To simplify the issue when doing a production based analysis in unconventional formations like the shales, I tend to apply the old Appalachian Basin quote from SPEE, "The single best indicator of future performance for any well is past production performance"....resource plays like the gas shales sometimes end up becoming a complicated statistical exercise.

Currently the only formation which I have a high degree of interest in related to fracture compressibility is the Haynesville, and this is because of the anomalous behavior they display in relation to other gas shales, both in their size and decline behavior. Fracture compressibility would explain some of it, but on general principles I consider it unlikely to be the only explanation.

As far as the basic analysis for shale gas wells, I do whatever I can dream up for comparative purposes. Individual wells in volume, any and all type curve sub groups based on spatial or temporal relationships, operator or completion technique, geographical groups, whatever I happen to need.

I'll get to one of the nuclear options in a couple of weeks.

Funny.

Nuclear reactor rods run at about 300 deg C and the heat for retorting oil shale is 450-500 deg. Also the heating is for chemically changing kerogen into oil whereas in Alberta they are heating up oil/bitumen to make it flow.