Tipping Point: Near-Term Systemic Implications of a Peak in Global Oil Production -- Collapse Dynamics

Posted by Gail the Actuary on April 14, 2010 - 10:33am

Recently, a 55 page paper called Tipping Point: Near-Term Implications of a Peak in Global Oil Production (PDF warning) was published as the joint effort of two organizations: Feasta and The Risk/Resilience Network, with lead author David Korowicz. We have recently published two excerpts from that paper, which can be found at this link. This is a third excerpt.

4. Collapse Dynamics

4.1 The Dynamical State of Globalised Civilisation

The period since the end of the last ice age provided the large-scale stability in which human civilisation emerged. Climatic stability provided the opportunity for diverse human settlements to 'bed' down over generations. This formed the basis upon which knowledge, cultures, institutions, and infrastructures could build complexity and capability over generations without, by and large, having it shattered by extreme drought or flooding outside their capacity to adapt.

Within this macro-climatic stability, is the medium-term stability that we referred to above, the period of globalising economic growth over the last century and a half. We tend to see the growth of this economy in terms of change. We can observe it through increasing energy and resource flows, population, material wealth, and as a general proxy, GWP [Gross World Product]. We could view this from another angle. We could say that the globalizing growth economy for the last one hundred and fifty years has been remarkably stable. It could have grown linearly by any percentage rate, declined exponentially, oscillated periodically, or swung chaotically, for example. What we see is a tendency to compound growth of a few percent per annum. And at this growth rate the system could evolve, unsurprisingly, at a rate we could adapt to.

This does not mean that there is not unpredictable fluctuations in the economy. However, the fluctuations are around a small additional percentage on the previous year's gross output. By magnitude we are roughly referring to |∆GWP/GWP|. Angus Maddison has estimated that GWP grew 0.32% per annum between 1500 and 1820; 0.94% (1820-1870); 2.12% (1870-1913); 1.82% (1913-1950); 4.9% (1950-1973); 3.17% (1973-2003), and 2.25% (1820-2003)[i]. Even through two world wars and the Great Depression in the most economically developed countries (1913-1950) growth remained positive and in a relatively narrow band. Figure 4 shows growth rates of the global economy in frequency bands over the last four decades, again the narrow band indicates system stability. Of course small differences in aggregate exponential growth can have major effects over time, but here we are concentrating upon the stability issue only.

Governments and populations are highly sensitive to even minor negative changes in growth. The constraints felt by governments and society in general arising from only a very small change in GDP growth should emphasize to us that our systems have adapted to this narrow range of stability, and the impact of moving outside it can provoke major stresses.

4.2 Tipping Points in Complex Systems

Despite the diversity of complex systems, from markets to ecosystems to crowd behavior- there are remarkable similarities. For most of the time such systems are stable. However, many complex systems have critical thresholds, called tipping points, when the system shifts abruptly from one state to another. This has been studied in many systems including market crashes, abrupt climate change, fisheries collapse, and asthma attacks. Despite the complexity and number of parameters within such systems, the meta-state of the system may often be dependent on just one or two key state variables[ii].

Recent research has indicated that as systems approach a tipping point they begin to share common behavioral features, irrespective of the particular type of system[iii]. This unity between the dynamics of disparate systems gives us a formalism through which to describe the dynamical state of globalised civilisation, via its proxy measure of GWP, and its major state variable, energy flow.

We are particularly interested in the class of transitions called catastrophic bifurcations where once the tipping point has been passed, a series of positive feedbacks drive the system to a contrasting state. Such ideas have become popularised in discussions of climate change. For example, as the climate warms it drives up emissions of methane from the arctic tundra, which drives further climate change, which leads to further exponential growth in emissions. This could trigger other tipping points such as a die-off in the Amazon, itself driving further emissions. Such positive feedbacks could mean that whatever humanity does would no longer matter as its impact would be swamped by the acceleration of much larger scale processes.

Figure 5 shows how the system state responds to a change in conditions. The state of a system could represent the size of a fish population, or the level of biodiversity in a forest, while the conditions could represent nutrient loading or temperature (both effectively energy vectors). The continuous line represents a stable equilibrium, the dotted one an unstable one. In a stable equilibrium, the state of the system can be maintained once the condition is maintained. In Figures a) and b) we see two different responses of a stable system under changing conditions. In the first, a given change in conditions has a proportional effect on the system state; in the latter, the state is highly sensitive to a change in conditions. In c) and d) the system is said to be close to a catastrophic bifurcation. In both of these cases there is an unstable region, where there is a range of system states that cannot be maintained. If a system state is in an unstable regime, it is dynamically driven to another available stable state. If one is close to a tipping point at a catastrophic bifurcation, the slightest change in the condition can cause a collapse to a new state as in c), or a small perturbation can drive the system over the boundary as in d).

5. Three Peak Energy-Economy Models

5.1 Introduction

While discussions of peak oil have begun to enter the policy arena, and while it is generally acknowledged that it would have a major impact upon the economy, the discussion is often fragmented and lacking in a broad system synthesis. In general, discussion tends to focus on the direct uses of oil, and sometimes its effect on a country's balance of payments. Where economic impact studies of peak oil have been done, they are based upon the direct decline curve assumption such as the 4see model by Arup for the UK Peak Oil Task Force Report[v]. Nel and Cooper have used the decline curve assumption and accounted for EROI and peak coal and gas to look at the economic implications[vi]. The latter authors show a smooth decline in GDP but acknowledge that their modelling assumptions include that the financial markets must remain functional, state legitimacy remains intact, and international law prevails.

In most cases there is an intuitive assumption or mental model of what the effects of peaking oil production will mean economically and socially. In order to clarify our discussion, and introduce some working concepts, we will look at three models.

These should not be considered in isolation. In a very broad and general fashion we might consider that the linear decline model is valid for small energy constraints that have a very small effect on the overall magnitude of real GWP and level of complexity. This merges into a oscillating decline phase which cause larger perturbations in GWP/Complexity level. Finally, tipping points are crossed that rapidly cause a severe collapse in GWP/Complexity.

Finally, we note that what we are trying to do is clarify peak energy-civilisation dynamics and identify the major structural drivers in the process. The real world is more unknowable than can ever be engaged with here.

5.2 Linear Decline

Intuitively we tend to assume that most phenomena respond proportionately to some causation. This is mostly true. A change in price proportionately changes demand; an increase in population proportionately increases food demand; and increase in cars leads to a proportional increase in emissions.

Most commonly, there are two associated assumptions relating to the energy-economy relationship post-peak. The first is the Decline Curve Assumption. Thus oil production is withdrawn from the economy at between 2 and 3% p.a. The second element is that there is an approximately linear relationship between the oil production decline and economic decline. The combination of these assumptions is that the global economy declines in the form of the slope of the downward projection curve.

Thus we see the price of oil rise as oil becomes scarcer. Having less energy constrains economic activity. Bit by bit we become poorer; there is less and less discretionary consumption. The rising prices force more localized production and consumption, and there is growing de-globalisation. Jobs lost in the areas serving today's discretionary needs are over time deployed in food and agriculture, producing with more direct human effort and skill many of the essentials of life.

In such a case a longish period of adaptation is assumed in which gradually declining oil production and resulting oil price increases cause recession, hardship and cause some shocks, but also initiate a major move into renewable energy, efficiency investments, and societal adaptation. New energy production that was once too expensive becomes viable. The general operability of familiar systems and institutions is assumed, or they change slowly.

Even where the linear decline model is valid, it would be difficult to adapt. Consider a country's budget in energy terms, with some amount for health, business operations, agriculture, operations, education, and investment. As total energy available declined, less and less energy would be available in each sector. Because we discount the future (we favour short-term benefits), and the discount rate rises in economic stress, the ability to maintain investment in renewable energy would become increasingly difficult. In essence, there would be a choice between keeping some functionality in a crumbling health service, and stalling rising employment a little; or accepting job losses and a health crisis in return for a small energy return per annum in the future.

5.3 Oscillating Decline

In this model, constrained or declining oil production leads to an escalation in oil (plus other energy and food) prices. But economies cannot pay this price for a number of reasons. Firstly, it adds to energy and food price inflation, which are the most non-discretionary purchases. This means discretionary spending declines, from which follows job losses, business closures, and reduced purchasing power. The decline in economic activity leads to a fall in energy demand and a fall in its price. Secondly, for a country that is a net importer of energy, the money sent abroad to pay for energy is lost to the economy, unless that country exports goods of equivalent value. This will drive deflation, cut production, and reduce energy demand and prices. Thirdly, it would increase the trade deficits of a country already struggling with growing indebtedness, and add to the cost of new debt and debt servicing.

Falling and volatile energy prices mean new production is harder to bring on stream, while the marginal cost of new energy rises and credit financing becomes more difficult. It would also mean that the cost of maintaining existing energy infrastructure (gas pipelines, refineries etc) would be higher, thus laying the foundations for further reductions in production capability.

In such an energy constrained environment, one would also expect a rise in geo-political risks to supply. This could be bi-lateral arrangements between countries to secure oil (or food). Such agreements would tend to reduce the amount of oil available on the open market. Energy constraints would also increase the inherent vulnerability to highly asymmetric price/supply shocks from state/non-state military action, extreme weather events, or other so-called black swan events.

When oil prices fall below what can be supplied above the marginal cost of production and delivery, and oil price is what can be afforded in the context of decreased purchasing power, then energy for growth is again available. Of course local and national differences (for example energy import dependence, export of key production such as food) can be expected to shift how regions fare in the recession and in their general ability to pick up again. Growth then might be assumed to kick off again, focusing maybe on more ‘sustainable’ production and consumption.

However, as growth returns, the purchasing power of the economy will not be able to return to where it was before. Oil production will be limited by natural decline and lack of investment, and entropic decay of infrastructure will reduce the supply-demand price point further. Again higher oil, food and energy prices would then drive another recession.

In the oscillating decline model: economic activity increases→energy prices rise→a recession occurs→energy prices fall→economic activity picks up again but to a lower bound set by declining oil production. In this model the economy oscillates to a lower and lower level of activity. From our discussion about the origins of the current recession, we see this process has already begun.

5.4 Systemic Collapse

This model draws on ideas from the general dynamics of complex systems and networks, and tends to see our civilisation as a single complex adaptive system by virtue of its connectedness and integration. Indeed the concept of globalization is about integration with a common singular network.

We associate systemic collapse of civilisation with a catastrophic bifurcation. The state of civilisation at a time is by necessity dependent upon the state of the globalised economy. The state of the global economy is dependent on the infrastructure that integrates the operational fabric. The state of the globalised economy may be parameterized by GWP, which implies a level of complexity. And GWP (and complexity) is absolutely dependent upon energy flows.

To argue that civilisation is on the cusp of a collapse, we need to be able to show that there are tipping points that, once passed, drive the system rapidly towards another contrasting state through a process of positive feedback that may in turn drive other feedback processes. We need to also demonstrate that it is a catastrophic bifurcation in which the state of the globalised economy is driven through an unstable regime where the strength of the feedback processes is greater than any stabilizing process. It acknowledges that there may be an early period of oscillating decline, but that once major structural components (international finance, techno-sphere) drop or ‘freeze’ out, irreversible collapse must occur.

In the new post-collapse equilibrium state we would expect a collapse in material wealth and productivity, enforced localization/ de-globalisation, and collapse in the complexity as compared with before, as an expression of the reduced energy flows.

The collapses in the Roman Empire occurred over centuries; collapse of the Greenland Viking settlements in decades. We suggest a hypothesis here that the speed of collapse is a function of the level of integration, coupling, and the key operational speeds of the systems that support the stability of the pre-collapse state. For us, that includes the behavioral change in financial markets, food flow rates, and replacement lifetime of key components in infrastructure. In discussing the feedback processes in the next chapter we will see processes are indeed fast.

References

[i]Maddison A (2007) Contours of the World Economy 1-2030AD. Page 81 Oxford Univ. Press.

[ii]Scheffer, M. (2009) Critical Transitions in Nature and Society. Princeton Univ. Press.

[iii]Scheffer, M et al.(2009) Early-warning signals for critical transitions. Nature Vol 461 3 Sept.

[iv] http://www.stockholmresilience.org/download/18.1fe8f33123572b59ab8000166...

[v]The Oil Crunch: A Wake-up Call for the UK Economy.(2010) Second Report of the UK Industry Taskforce on Peak Oil and Energy Security. http://peakoiltaskforce.net/wp-content/uploads/2010/02/final-report-uk-i...

[vi]Nel, W, and Cooper, C. (2009) Implications of Fossil Fuel Constraints on Economic Growth and Global Warming. Energy Policy 37 166-180.

Thanks, David!

I have never studied the systems theory underlying tipping point, but it seems fairly intuitive that in a complex networked system, a not-so-little thing going wrong can affect the whole system, and that multiple things can work together go cause bigger problems.

For example, we know that loss of electricity in our homes can be very disruptive. This can happen through something as simple as a falling branch during a storm. If repair equipment for some reason is not available, this loss could be long lasting.

We are very dependent on our international trade system. If at some little thing causes a disruption (say a Greece type problem x 10), it could be very difficult to work around the problems.

I'd suggest that maybe international trade is one of the least likely to be a tipping point - purely because of the time constant. While trade needs to keep happening, the rate with which things happens is slow enough that people can find fixes to 'patch it up'.

Something like the power grid is much more immediate and destructive. If there is disruption there, then lots of systems get stressed, coherently. People can pick up from a day or so, but as times stretch longer the changes ripple through all the connected systems, with their own interconnections. In addition electricity is used to mediate communication, slowing down potential response.

Obviously the connections between fossil fuels (particularly gas) and electricity are many, making it an ideal route for fossil fuel tipping points to couple into the wider economy. Given that real problems usually arise from the interplay of TWO system cockups, what we are probably looking at is a fossil fuel SNAFU coupled with an electricity related one.

Finance, as usual, has the characteristic of magnifying the base problem and spreading it through its unstable (and inherently risky) setup. However I suggest its time constant is again too slow for tipping pointness in its own right.

Food, trade, politics. People can get worried very quickly if food runs low and if it is moved from a distance then politics come into play.

The effects you mention can happen well into the decline process.

There might be all three types of decline that are evident, either at different times or in different sectors of the economy (or both). Oscillating Decline seems the most likely to me, as we lurch from one crisis to the next, without really looking at the long term view and tightening the belt (voters are spoiled by over-indulgences, setting up unrealistic expectations). Differing political parties will bounce in and out of office, as each successive cure doesn't completely take, and recessions continue to make the GDP curve look like a descending porpoise trail (or sine wave). New ways of measuring the economy (or even quality of life) would be needed to redirect governments into setting policy that makes sense, not overnight millionaires.

Eventually, it may simply get to the point that bandaids no longer work, and we experience Systemic Collapse. Welcome to global Somalia...

As complex systems collapse, don't they also simplify and revert to smaller isolated systems? I would imagine that if the electricty grid failed catastrophically nd the outgage became semi permanent, people in that are would ahveno choice but to adapt in place. This couldmean radically restricting use of water by ditching daily bathing and regular washing of clothes, a shake up of the local diet and a halt to most industry and daily activities. New distribution systems would instantly spring up and after a while would seem normal even though they are radically different from the more complex systems they replaced.

If we think back to Katrina, after a while the people reaming in New Orleans started to self organise and solve problems. I remember seeing the story of a doctor who went to the convention centre and just started treating people. There was no complex bureacracy to check the status of your insurance and the sterilization of equipment was non existent but the people recieved the highest quality care avaialable and were grateful for it. They fed the guy so he could keep working. In a complex world that sort of spontaneous exchange is quickly monetised and subordinated to the needs of the system for control and growth to further complexity.

The most recent thread on TOD EROEI examined a particular tipping point in transportation as being 3:1 EROEI. There was much debate about if this meant the total collapse of industrial civilization or just adaptation on a linear scale. Personally I think linear decline is unlikley, but I also think that we could collapse back to more simplified local systems that become less complex with each collapse phase. Being able to anticipate the collapse and position yourself or community to prepare for it is going to be the real challenge. After speniding too much time here in 2007, I moved all my retirement savings into gold and have done pretty well out of the GFC. That strategy however won't work for the next colllapse phase which will be different to 2008. I really have no idea how the next collapse will manifest but I'm pretty sure that oil prices will herald it's coming.

I am not an expert but just my gut intuition tells me that the level of simplification correlates to the degree of dependencies. In the 1930s and 40s, the TVA undertook a rural electrification project in the US. Had your grand-parents or great grand parents experienced the changes introduced, then experienced a power outage, they probably would have simplified their lives and adjusted less than we would have to. It is easy to imagine they may still have a wood burning stove, axe, kerosene lanterns (not just for decoration) and even a local well on their property. The same location today, now part of a McMansion suburb, with all electric central AC/heating, and community water, etc, would not be equipped to manage the same disruption.

Respectfully,

ej

I've added numbers above to make it easier to reference. We could say we are in stage 5, but it specifies declining oil production, when in fact we have been experiencing a plateau of oil production since mid 04. I suppose the question is; Will the economy continue to oscillate to a lower level with a plateau of production vs. declining production? Does it make much of a difference? I would think they are one in the same, except the latter would cause faster oscillations.

Earl, Hi

Maybe Oil Production may not necessarily infer Total Oil Production but Relative Oil Production.

So relative to either Global Population or GWP, then "Oil Production" indeed has been declining now for many years.

In which case as you say yes, we could be in Stage 5. And the economy sure as hell could be oscillating to a lower level.

Got that feelin' to it don't it?

From The Automatic Earth 4-12-10 this link on The Future of American Jobs

http://robertreich.org/post/515783472/the-future-of-american-jobs

"So relative to either Global Population or GWP, then "Oil Production" indeed has been declining now for many years."

I believe this is a (if not THE) key. And it jumped out at me way up top when the periodic GWP growth rates were given, and shown to have risen through industrialization, then peaked in the late-mid 20th century, falling off since. This correlates reasonably well with the rise and decline in net per capita global energy.

My crunching of the numbers (population, gross oil extraction, and declining EROEI from 100:1 about 1930 to perhaps 12:1 today) yields net per capita oil availability of less than 1 barrel per person prior to WWII, quickly rising to 3 bpp in 1960 (as the automotive and suburban lifestyle began to explode), peaking at about 5 bpp in 1980 (having fueled the 'green revolution, rapid population growth, huge buildout of infrastructure...) and having now declined to about 4 bpp.

I believe this relative availability of surplus energy underlies what we are seeing in the response of 'the economy'.

Given UN population projections, ASPO projections for gross oil extraction, and my assumed 3.5% per annum decline in the EROEI of oil, we will be back to 3 bpp by 2020, and down to 2 bpp by 2030. I do suspect these 'changing conditions' will provide for ample tipping points along the way.

I put together a graph of US consumption per capita consumption of energy products, using recent EIA data (Table 1.3).

The information leaves out energy imbedded in imported products, and as is of course not on a net energy point of view. The high point (at least for the period shown) was between 1996 and 2000. US per capita energy consumption in 2009 is about 11.5% below its high in 2000, and lower than at any other point in the 1985 to 2009 period. Oil and coal use are down especially, but even natural gas and nuclear are down.

It seems to me that the financial system is the system that telegraphs problems in one sector to other sectors, and that is a big part of what we are seeing. We are not producing enough with the energy we use to justify our high level of imports.

The world energy situation seems to be fairly different. Energy use through 2008 continues to ramp up because of increased coal use, even on a per capita basis (this graph isn't per capita, but population isn't growing at 2.9% per year). Most of the growth in coal use is outside of OEDC, but it has affected imports available to the rest of the world.

I can certainly relate to it, even though I work in the oil industry and so, one would expect, benefiting from high oil prices.

I'm now working full time for about 70% (in unadjusted dollars) of what I earned in 1985, and with no benefits instead of a very nice benefits package. Meanwhile, the consumer price index has approximately doubled, and instead of paying 7.05% FICA on less than half my salary, I'm paying 15.3% on all of it (the self-employed gotcha).

Of course, the company I worked for in 1985 went out of business in 1988 after a severe attack of Pickens.

My daughter, in her late 20s with a graduate degree and a secure job, has a salary very close to the median for a woman with a graduate degree. But she has a large student loan debt, and after payroll deductions for taxes and health insurance, and loan payments, she has only about 40% of her nominal income to live on. Of course, that's a lot more than most people have, but she is certainly feeling "oscillating to a lower level".

It's interesting to see how her financial situation has affected her political views: she has become almost libertarian, seeing nothing but confiscatory taxes in the future, combined with runaway profits for financial institutions such as banks. She does not see government at any level providing value for her taxes: from ineffective local law enforcement to massive waste at the federal level. She has contempt for the mayor (a Democrat), the county judge (a Republican), the governor (a Republican) and the President (a Democrat), as well as for numerous other elected officials.

Fascinating how that works. My son also, works as the manager of QA in a machining company, now at significantly lower income than early 2000's, became a fan of Ayn Rand, Fox Network and staunch libertarian. Since rehabilitated. My own income has been stagnant since 1991. It still bugs me to hear CNBC -BNN commentators demanding "higher productivity" of Canadian workers (code words for "lower wages").

Our country is broken. It is a victim of neglect. This is a list of problems, many of which are not part of the public conversation. In some cases, policy makes the problems worse.

The media suggests the country's economy - and the world's as well - is on the mend. I suggest that until the following problems are fixed, there will be no recovery. Any single one of these problems is sufficient to derail the ambitions of a state. Here are eighty- eight!

POLITICS AND POLICY MAKING

- Public corruption and the purchasing of influence by corporations and special interests.

- The 'revolving door' of officials taking jobs with companies that they formerly regulated.

- Unprincipled partisanship.

- Undisciplined populist- style pandering to extremists

- Concentration: 'Too Big To Fail', support for monopolies and cartels.

- Accelerating concentration of wealth and resources in the hands of the (inept) few: the widening gap between rich and poor and the erosion of the middle class.

- Corporate welfare.

- Uneducated policy makers.

- Bottomless conflicts of interest.

- Election processes corrupted by private funds and advertising.

- Erosion of Constitutional protections limiting intrusions of state power into the lives of the citizens.

- The rise of 'Shadow' states- within- the- state such as private militias and security departments.

- A wasteful and incompetent military establishment which is rewarded for failure after failure.

- The shift from a public military to a mercenary military.

- 'The Untouchables': unquestioning support for the defense/security industrial complex and its excesses.

- Unaccountable intelligence services and opaque intelligence gathering activities, including torture, domestic spying and detention- without trial.

This is just the beginning of the list. The rest is here.

These are old problems, all relate to the desire of Americans to live larger than their energy and finance balance sheets. That these problems began so long ago suggests that energy availability hasn't kept up with the Jones's for quite some time.

It is hard to predict the day- to- day movements in markets. It looks like the finance bubble is picking gaining momentum. One outcom is a price spike in crude oil as central bank funds are forced into the economy to create inflation. What will the outcome be?

Just like the last time! A fuel price spike leading to a downturn with thousands of business bankruptcies and more millions unemployed, followed by a fuel price crash, another 'green shoots' period and the subsequent rise in fuel prices again as demand revives.

None of the problems will be addressed.

Your being inconvenient Steve. That will get you nowhere.

This forum is more about self gratification through the process of level discussion and debate.

Get with the program.

Your being inconvenient Steve. That will get you nowhere.

This forum is more about self gratification through the process of level discussion and debate.

Get with the program.

Her taxes will go up from here. She's got to live on less than that 40%.

I've been psychologically preparing myself the last couple of years by lowering my living standard before I have to. Having cut out lots of types of purchases I'm currently working toward cutting out cable TV. I'm reducing the number of days I turn on the TV. I'm cutting down on what I watch and looking for more entertainment on the internet. Plus, I've upped my book reading.

The government has become more of a parasite. US federal government salaries are going up while many of the rest of us have experienced big cuts (e.g. 401(k) match cuts, salary freezes, bonus cuts or elimination, higher medical co-pays). I am very unsympathetic toward the government. They too should experience pay cuts, benefits cuts, and lay-offs.

Maybe it looks something like this...until it hits a bigger step, (see aangel's charts) all of a sudden, at which point all bets are off and the economy just sits there writhing in a vibrating tangle until it stops completely.

Ten to one that "biggest step" is when the CARS no longer are able to be driven around.

What a nightmare for almost everyone! Yes, even for people like me and my family, who have no car, and dislike them.

We are all going to find out the hard way what a local economy looks like and it won`t be a pretty sight for those in a cement jungle. Where I live is almost a cement jungle.....

Fmagyar,

I know you didn't mean the moving slinky to be distracting, but it is.

In general... do you think we all might refrain from moving graphics here?

The internet is full of dancing widgets, dancing doodads, and other visual violators. Hate to see them here too.

Will, I apologize for causing you such irritation with my graphic.

You are right, it was not my intention to distract you or anyone else.

I posted that particular animation only because I found it to be a very good representation (IMHO) of how I think the economy will descend in step like fashion combined with the whiplashing effect as it is thrown to lower and lower levels with no chance of recovery.

While I agree with you that The internet is full of dancing widgets, dancing doodads, and other visual violators. It also has animations that convey perfectly valid information that can not be as easily conveyed in static form or in text.

A picture can be worth a thousand words and if you multiply that by frames per second you might be able to convey information in a way that can not be accomplished otherwise.

Whether or not this particular animation that I happened to choose does or does not accomplish that can be up for debate. However it does not invalidate the use of moving images in general.

Furthermore if it is so offensive or distracting as to cause distress to a particular viewer then it shouldn't be very difficult for said viewer to scroll away from the distraction.

If I had posted an animation of say a lewd sex act I'm sure the moderators of this site would have been very quick to remove it and ban me as well. Obviously I think that the animation I posted was both relevant to my point and innocous.

So I guess we will just have to agree to disagree with regards posting animations at least until the moderators decide that they are completely without merit.

Cheers!

Magyar, I loved the graphic - it said it all. Still, I was hoping it would have contained aangel's long step down and we would have seen it writhing on the floor.

Good work.

Antoinetta III

Thanks for the vote of confidence! Maybe I'll actually create some animations like that. This one isn't mine.

It would be instructive to show how a bifurcation diagram leads to an oscillating activity pattern. I suggest that we have had one rapidly damped oscillation, namely the global stimulus packages in response to the 2008 meltdown. For now there seems to be a reluctance to repeat that so perhaps linear decline is on the cards. That is we will accept 10%, 15%, 20%... unemployment under business-as-usual until the BAU model is revised. Thus previously fully employed people will have their mortgages largely forgiven and they will work part time on urban farms. That will be the new normal so economic activity will have to be rescaled.

In Australia things are a bit different because other countries keep buying shiploads of crushed rock. However when those countries cut back I think we might see scenario b) of steep or exponential decline. That is we'll do it later but tougher than the rest of the world.

Government will try to control the movements in the economy by reacting to events as they happen. This will only accentuate the oscillations as they occur bringing the tipping point fowards in time. The only way to avoid this is to have a paradigm shift in state policy thinking, which is not likely to happen any time soon.

Well it might happen soon or not, but it has to happen all at the same time. The collapse has to be simultaneous. (Tainter explains why)

I think people will readily understand what happened and be mentally prepared for the new paradigm.

Found myself in the local shiny new, way oversize Centrelink office today wondering exactly the same thing. There was the regular line up of ordinary folk waiting for there moneywhich is now largely provided by the mining industry. If that goes caphut, how is the government going to support all these people? By creating such a generous welfare state, these people have effectively been rendered helpless and deskilled in basic survival techniques. Mos of them it looked to me barely new how to open a can (of food that is, beer is different story), let alone grow something.

Hi All,

Thanks Gail.

Two things.

1) A friend sent me the following:

"

Thousands of freight train wagons and locomotives shunted into sidings

during last year's economic slump have developed rust in their brake

cylinders and need to be repaired just as demand for freight transport

is picking up in line with Germany's economic recovery.

Germany faces a shortage of usable freight locomotives and goods

wagons as the economy picks up steam following the worst recession

since World War II. Schenker, the freight logistics unit of railway

operator Deutsche Bahn, put up to 50,000 wagons in sidings last year

as the demand for goods transport slumped during the crisis.

http://www.spiegel.de/international/business/0,1518,687291,00.html"

Once things fail for any significant period-it becomes more and more difficult to re-boot, one of the reasons is entrophic decay as above. Another is you may no longer have the supply-chain coordination to re-supply.

2) Boof

Try and get a hold of the Scheffer Nature reference above-it discusses general tell-tale signs that a critical transition is approching. I've no doubt there are people on TOD who could make good use of it.

D

What does "entrophic" decay mean? Do you mean "eutrophic" decay as in the description of habitat succession? Or do you mean "entropic" decay as in increase in entropy or in general disorder?

You may have invented a useful new word that describes something. What that something is I am not too sure of.

Here is one of the Scheffer papers:

http://vtcite.info/~cems/complexsystems/tri/pdf/TippingPointsnature08227...

It's not a very good paper. Differential equations such as they show hardly ever describe the actual situation. Instead they describe the artifacts of the mathematics involved as the solution passes through different dynamic ranges of numerical accuracy. That's a well known problem with these approaches. IMO, it keeps people from making any progress on the problems, i.e the Verhulst equations revisited.

WebHubbleT,

You've go me there-spelling I do not do well. But entropic is what I meant, though the amalgam does sound promising!

http://www.youtube.com/watch?v=PFcGiMLwjeY

Entropy is a measure of how organized or disorganized a system is:

When a living system either an organism or an ecosystems dies or decays

it becomes disordered and less complex and tends to break down into it's component chemistry.

Trophos, is Greek for nourishment.

Eutrophication is an increase in the concentration of chemical nutrients in an ecosystem

I guess a good use of "entrophic" would be to mean that a previously complex organized system has now been simplified and broken down into its basic building blocks and is therefore available for a new system to organize it into something different.

I imagine one could even quantify and graph the delta "entrophy" of a system which might be able to give us some insight as to where in the progress of a system from complex and ordered to simple and disordered it might be. I think it would be much harder to imagine what kinds of new systems might self organize out of the remaining chemical soup.

Perhaps we would get abiotic oil ;-)

I am game to this strategy and will try to incorporate the word where I can. I sense what you are getting at since eutrophication has a very specific definition whereas entrophication would be more general.

Yes, though I imagine a lot of people would think it was a typo.

I have to wonder if one could find a correlation between the increasing or decreasing amounts of plastic detritus floating in the ocean and the increasing or decreasing "Enthrophy" of our economic systems.

They've found a new patch, this time in the Atlantic...not pretty.

A 2nd garbage patch: Plastic soup seen in Atlantic

http://news.yahoo.com/s/ap/20100415/ap_on_re_la_am_ca/cb_atlantic_ocean_...

Scheffer's book isn't in the local library and the smallest pdf seems to be the one cited by WHT. The differential equation models are thought provoking because we see everyday examples of those behaviours in real life. It appears that patterns such as 'the calm before the storm', 'shifting to a new level' and 'fizzling out' can all be modelled by DEs. However the real world has many more independent variables and unknown parameters. It would be a brave or foolish person who would interpret certain signs as leading to a particular outcome in a large system.

Boof,

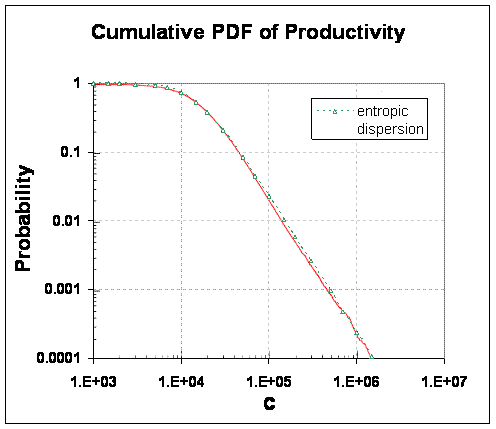

It takes a degree of insight not available to Scheffer to make sense of a large system. If you want to get your mind boggled, take a look at this post that I just finished up tonight. http://mobjectivist.blogspot.com/2010/04/business-as-entropic-warfare.html

The post is titled "Business as Entropic Warfare" and I think I did the impossible and modeled the entire Japanese labor productivity sector in terms of entropic dispersion, with only a hint of differential equations involved. This was what Volterra had said all along: the stochastic elements are much more important than the deterministic components.

Here are a couple of figures with model fits:

The key to the agreement with my model fit is that 15 million data points are available in which case the noise completely disappears and we are left with a pure econophysics picture of what is going on.

The fact is that humans may amount to mere statistical billiard balls in the entropic universe. All the individual game-playing relationships constituting the micro-economics of productivity get swept into a bigger econophysics picture that fit better than anything I have so far seen describing the statistical mechanics of economics. The warfare of business acts precisely like an entropic swarm of ants filling in all of space. Mind boggling.

In economic terms i would assume that in the long run most of the developed world (US, EU, etc) would end up with a Japan model to cope with the problems of lower and lower energy input to the economy:

* Government and public debt evaluation would be degraded and the interest requested (on the bonds) would be much higher than today. That would put a big constraint on the ability of governments and banks to service that debt.

* Eventually, central banks would drop basic interest rates close to zero.

* Government debt would be bought by the central bank and other government/state organizations (pension funds etc) with low or almost zero interest rates. Foreign debt would gradually disappear.

* The amount of this government debt would be of no importance, as long as the FED could finance it with new, zero interest rate money.

* This government debt would be the placeholder for any bank bad debt created by falling prices and economy. Obviously, the banks would also lower their loan interest rates along with their profits. In the long run, most of the banking/financing economy would end up being state owned and giving out almost interest free loans.

* The problem of course would be inflation, due to increased money available with diminishing quantity of goods.

As for the energy input gap, transportation, tourism and commerce would be the first to suffer the most, as there's really no alternative to oil for moving ships, planes and large trucks. One thing that we should have in mind when evaluating alternative energy sources (renewables, bio-fuel etc) is that we don't just have to find an energy source with the same EROI, but with the same EROI PER YEAR.

Today, we may be wasting 1 barrel of oil for every 15 barrels extracted. That does not mean that we can replace it with a Wind turbine with an EROI of 15:1. In the case of the wind turbine (as far as i understand things), we ''ll have to invest 1 barrel of oil on year one for manufacturing and setting up the energy plant and get 15 barrels back during the total *life-cycle* (30 years). That means that we 're gonna get an energy return of 0,5 barrels of oil per year. In other words, if we 're pass peak oil and our oil input falls every year, we 'll just not have the energy surplus in order to install those wind turbines (unless we sacrifice other parts of the economy).

Personally, i 'd give a closer look to coal and some form of high energy surplus algae-based oil production mechanism (which would not compete for agricultural land).

the experience of major crises in the past (for example, WW2) suggests that even our very complex modern civiization can be greatly stressed and greatly simplified without actual collapse.

many actions that we could easily take, are resisted because they are inconvenient or personally unwelcome. we could reduce gasoline useage massively almost overnight with mandatory car-pooling. we don't do it because we don't WANT to, it would violate our privacy and make us late to work etc etc.

but in a true emergency such concerns would be seen at their true (very small) value. I perfectly accept that a long period of economic adjustment and decline is now likely. but don't expect it to lead to James Kunstler's fantasy of a "World Made by Hand". there will be enough energy so that we can live at least at the level of our parents or grandparents, and in those days the trains still ran, people had enough to eat, and the government could function.

There was an incredible abundance of fuel in the US during WWII (Gas rationing was actually to conserve tires and vehicles by limiting total mileage.) Any coming crisis won't have that benefit.

Why, then we should be building locomotives and passenger cars...oh, and public transit to feed into the stations...and making people work closer to home...

I want to know just how you think mandatory car pooling could be instituted and enforced ('cause there's no "mandatory" without enforcement.) I drive a 2001 Swift. A 2 person carpool with the driver of an SUV would result in a net loss of fuel efficiency for me on the days we went in his car. Would I have to take the ride? Would we be required to use my car? What about financial compensation, in such a case? (this is actually complex and interesting, because in such a situation, my Swift would be worth more than the SUV, despite original cost, and using it more would result in the more rapid devaluation of the more valuable asset...I would be pissed if I had to support some inconsiderate bastard who didn't prepare or consider the environment in his vehicle choices.) What about shopping trips, and visits to relatives? What if I couldn't find someone who wanted to go to the grocery store for 35 minutes at 2:47pm? Would I not be allowed to go? Would a black helicopter (fueled with algael biodiesel, perhaps) swoop down and block the driveway? A gps and phone-enabled starter interlock that would check the passenger seats for occupants before allowing me to move?

Your "true emergency" will be a dollar short and a day late. People tied to the car culture (and unless you live in a major transit-served city, that's you) will not give up driving without being forced to. And the most likely scenario is that they will change their minds too late to deal with the problems.

A more structured critique of carpooling is here: www.ptua.org.au/myths/carpool.shtml.

While the report referenced looks interesting, I've got to say that I think it probably wrong.

For a start it ignores the context of most car pooling - commuting to and from work. That means that the end point is determined, and give suburban architecture the start point is fairly closely defined too. Compare that to public transport. First the public vehicle never starts from where you are; never goes where you want; and usually seems to require at least one change to make the entire journey. And you have to pay the driver's wages.

Upshot is the time taken for the journey is usually much higher, the cost is higher, and the fuel economy is worse because the actual miles travelled are many more than the car would take.

Thus car pooling for commuter journeys comes down to one main problem: start times of journeys. Well, maybe the second of not wanting to share a car with people you don't like, but public transport has that too.

So the fix is fairly obvious, no flexitime means no issues with start and end times of the journey. Reasonable targets would be 2/3rds of staff car pooling, and average pool numbers of 3, resulting in an overall halving in fuel used across the workforce. The only way you are going to beat that is with a 'work bus' shifting large numbers of people on simple journeys.

I once worked eight-hour rotating shifts. No one I worked with lived close enough to make a car pool viable. No other plants in the area worked rotating shifts, let alone finding someone on the same rotation. Flextime impossible in this case. I could do the same analysis for almost every job I have had, but I'll cut to the chase.

The reason for this is the because the longer the allowable commute, the larger the geographical area you can draw from. Many jobs are in small and medium-sized businesses; flex time is harder for them (phone coverage, etc.) and the employees from a 20 person company may be from 20 different neighborhoods, which, in the greater Toronto area, can be anywhere in a 2,750.6 sq mi area (and yes, I once did a 60 mile commute(one way!), and have known others who did.) A distance commute usually requires using an expressway; getting on and off (say, to pick up a passenger)adds a huge time penalty. Going as little as 2 miles out of your way in Toronto's core or inner suburbs can easily add 15 minutes to a commute (because it's two miles out and 2 miles back through traffic and stoplights.)

From the study:

This is the schedule for the streetcar that runs 24 hours a day in front of my house: http://www3.ttc.ca/Routes/506/Westbound.jsp (I hadn't looked at it in a while; the feature showing the estimated time for the next three cars is new, and cool; probably based on GPS.) It costs far less than to park in the downtown core(my usual destination) and times are comparable, especially if you are likely to walk to several locations (say the Central Reference Library, a shop, a movie and a restaurant.) Did I mention that it was right in front of my house? (The TTC mandates a maximum walk of 15 minutes to a transit stop; house prices in Toronto are affected by public transit availability.) If commuting to work, the cost and time savings are probably greater.

My point? There is nothing inherently wrong with public transit, if it is done correctly. The problem here is bad choices on the part of about 90% of American homeowners and politicians.

Do 2 of your co-workers live next door to you? Otherwise, it's a huge pain in the butt, and effectively, an unreasonable target. And once again, that ol' devil relative fuel efficiency comes into it. If people drove small cars (Honda Fit and Suzuki Swift size) they would also halve the fuel usage, without the rigamarole of car pooling. And a system that banned cars and provided public transit (which is at least as reasonable as the mandatory car pooling you originally posited) would cut the fuel usage by an even greater percentage.

And I notice that you have ignored that I think the de facto nationalization of the private car fleet (which is what forced car pooling is) would place a disproportionate cost on drivers of efficient vehicles, and would be difficult to administer (as well as being anti-democratic.)

_____

So why do I allow myself to be drawn into this topic? Because people think that they will be able to turn on a dime and continue forward after a fuel shock by car pooling or some similar magic solution, and so don't consider where they live, what they drive, or who they elect. My opinion? There is no low-hanging fruit: wholesale transportation change is wrenchingly hard. To avoid having to do it, move closer to work, fight for population density and the transit it allows, and buy smaller vehicles. Don't depend on others to share the cost of your folly. Prepare for the new normal. If you want to take public transit in the future, you've got to fight for it now.

But I've been through this before.

(http://www.theoildrum.com/node/5954/563564)I'll just quote my first response in the stream; (look it up before you comment on anything below this line, please.) The block quotes are from a response from Nick to an "attaboy!" comment from oldfarmermac to me re: my thoughts on how collapse might happen in stages.

Canuckistani on November 25, 2009 - 1:49am

Nah, not hard at all. Carpooling! It's the answer! Just change the average North American's inbred sense of entitlement, educate him as to why he should change, convince him that this is the best way to deal with peak oil, and make him not feel like a sucker if the majority of his peers don't do it. And Mike Vandenbergh, director of Vanderbilt University's Climate Change Research Network (http://www.nytimes.com/gwire/2009/11/

10/10greenwire-your-neighbors-saving-energy-why-arent-

you-4546.html)agrees with me and has a heap of technical reasons as to why carpooling is not easy, and is, in fact, really, really hard: "Carpooling, it turns out, is frustrating. Vandenbergh was part of a research team that examined 17 environment-saving behaviors, finding carpooling the second most effective in potential energy savings but dead last in potential consumer uptake."

Uh, I don't know how to break this to you, but that's not "carpooling, enforced by compulsory WWII style rationing". It's gas rationing. If you've got some magic way to get this accepted by the American public, you should share it with us.

My opinion remains the same: Widespread carpooling is a sign of the apocalypse. It means people are really suffering and are out of options. Because that is the only way you're going to get Americans to share cars.

OK, I get it - you're afraid of complacency. Well, let me reassure you - I don't see the availability of carpooling as a reason to forget about the problem - I just see it as a clear indication that PO won't cause the collapse of society. No, I see a lot of good reasons to be urgent about getting rid of oil before we're at the point of needing to carpool.

Does that help? Now, read the rest of this note, which I wrote previoiusly, in that light.

-------------------------------------------------

Boy, we've had this conversation before.

The fact remains: should fuel for personal transportation become scarce, we could get everyone to work using 1/3 the fuel with carpooling. Those are the physics of the situation.

Yes, carpooling is currently very inconvenient. It doesn't have economies of scale, or any serious kind of organization. If there really were serious demand for it, it could be made much, much easier.

People wouldn't have to work together to be matched online - heck, you could design a system that matched people on an ad-hoc basis. A form of this used to be common in the US - it was called "hitchhiking". Another form of this, called "slugging" is in use in some places where people show up at bus stops, and drivers pick them up in order to drive in the HOV lane (bus drivers, of course, aren't excited about this system - that's why they called those who used it slugs, as in fake coins).

I agree - carpooling is inconvenient, and it may not be accepted unless there's an emergency of some sort.

OTOH, that's what you were talking about, right? Some dramatic event that convinces people there's an emergency, like Pearl Harbor, or 9/11?

My point: "the apocalypse", or the Plague, suggest something terrifying and fundamentally hard to fix: a disaster, that kills many people and can't be solved even after we get people's attention

Carpooling is very, very annoying. It's inconvenient. But it's millions of miles from social collapse. How can we describe something as "the apocalypse" when it can be fixed by something as trivial as carpooling (combined with other slightly longer-term options, like ramping up PHEV production)?

10% of commuting in the US is done via carpooling. A lot of people who complain about fuel costs just haven't tried it. That may not apply to you, yet it's stil true.

It means people are really suffering and are out of options.

Uhmm...you mean options besides carpooling...

There is no low-hanging fruit: wholesale transportation change is wrenchingly hard.

Not on a personal level. Buy a Prius, Leaf or Volt. If you want to avoid a long wait, do it now. If you wait until everyone wants to, then you might have to carpool for the interim.

On a national level, of course, it's harder only because we haven't decided to do it yet. It's just a choice.

how you think mandatory car pooling could be instituted and enforced

Make most, or all highway lanes HOV. Also, fuel taxes. Besides, why does it have to be mandatory?

There's enormous potential in online matching services, perhaps augmented by cell phones.

The U.S. will not do mandatory carpooling because the plan for the last 30 years has been the US DOE's Standby Gasoline Rationing Plan. The government would issue freely transferable ration tickets to the people based on state automobile registration records and who would have to adapt to using a lessor amount of fuel. Certain categories of users would be given priority. There is no need to compel a particular method, such as carpooling, to reduce consumption.

The Japan model worked because Japan used exports to maintain some low level of growth...also oil prices were still low from 1990 (bubble burst) until 2008.

The Japan model won`t work when the global economy falls apart.

And one point about Japan that many people overlook is that while their oil consumption has fallen in recent years, their total primary energy consumption has been slowly increasing (at least through 2006). EIA total primary energy consumption for Japan:

Versus oil consumption through 2008:

Looks like Japan's management has seen the realities of oil production.

You are right on that. Imports imply lowering your money supply by sending the money abroad (to the manufacturer). The best thing to do next is to persuade the exporter to buy equal amount of bonds. If you 'create' the money exported with new zero-interest debt, the total supply of your currency (including the one maintained by the exporting countries) will increase and the dollar value will decrease. Well, you can't have it all in life, you 'll have to stick with US (EU etc) made products. That's a monetary explanation for localization of economies due to peak oil.

What exactly are the elements of the Japan model?

What I have found is that the Japanese government provides a huge amount of statistics concerning labour productivity, etc.

As I said elsewhere on this thread, the amount of deep understanding that one can get from this data is mind boggling. It really illuminates the underlying simplicity/complexity dichotomy of large scale systems that I have written about before.

Keep these important TOD posts coming! We actually may figure out something.

@WebHubbleTelescope

1) Exports larger than imports. Means that you do not end up sending your money abroad (and your currency devalued)

2) Zero interest rates from the central bank.

3) Really large debt compared to the GDP (around 200%) but it is not foreign debt. State and Japanese people own the bonds. So the country can ultimately service it by making new loans with almost zero interest rate.

Should be interesting understanding the statistics in the context of the new econophysics models coming out.

Ah yes algae, like fusion, the energy source of the future and it always will be. Read some of Robert Rapiers blogs to get an idea of the realistic problems with algae. It is good at sucking money out of the Government though. Kind of like hydrogen was, and fuel cells were and, and.

treeman

I 'd totally agree, i 'm just (like everyone else) trying to look into the feasible alternatives to the oil energy output and ease of use. Biomass is the only truly renewable type of energy source, which also does not demand a huge energy investment upfront. All the oil alternatives clearly show the finite boundaries of energy. You need land for PV or biomass, you only have so many high production wind sites, uranium will be depleted in the not too distant future and so on.

I don't see algae as a primary source for gasoline for our cars. Oil will still be needed though for planes, ships and heavy transport. Something along the lines of:

* Really efficient hybrid/electric cars.

* High use of mass transport and electric trains.

* Much heavier use of coal, nuclear etc.

* Probably stronger use of renewable energy sources (especially wind) in the places where the output will be high enough (so the EROI is enough to have a net energy gain from year one).

* A sustainable and steady output of oil will be needed for heavy transportation, agriculture etc, probably coming from biomass.

* I don't know if and how much tar sands and oil shale can help.

This intro is interesting enough to give a cautious thumbs up.

Greenland hardly qualifies as a good example. According to the Sagas, the colony faced extremely cold weather and attacks by skraelings(Inuit).

Historically, war is far more dangerous than 'depletion'.

Easter Island was devestated by internecine war for centuries.

http://archaeology.about.com/od/skthroughsp/qt/skraelings.htm

So a better question is, 'does depletion lead to war?' and even 'How can we face depletion without resorting to war.'

I think Greenland is a very good example as the Colony expended much time and energy building worship structures and refused to adapt to the climate, as well as the attacks, etc. Generated wealth was transferred back home in trade.

Our Province has just spent billions on new road infrastructure, a winter olympic party, and now plans to build a 1/2 billion dollar retractable roof on a stadium for the CFL and soccer, which needs a 25,000 venue vrs the 60,000 seat albatross. It is beyond belief. (All on borrowed money, of course.)

When an industry fails in BC they say, "nevermind, the future is......"

The Vancouver rail yard was touted to become silicone valley north, forestry was to be replaced by tourism, declining tourism is now 'the gateway to the Pacific' (read increasing global trade), and the once thriving fishing industry remains only as fish farming. Day by day the pinch is on and our way of life declines into a failed middle class.

Our skraelings are represented by declining civility, the rise of gangs, mass media entertainment for the entitled, and if I had to guess, ever accelerating decline in direct relation to a loss of economic opportunity.

It seems that the report by US Joint Forces Command regarding peak oil and the possibility of oil shortages (which was already discussed on the Oildrum some time ago) is making the news around. Today there was a nice post on Zerohedge.com, the most important financial blog around:

http://www.zerohedge.com/article/us-military-warns-oil-shortages-2015-si...

Well, is this finally the good time for the message to start reaching also the general mass media (from the blogosphere) and the general public? Frankly speaking, I am not so optministic, but never say never!

As long as our political Price System runs things and controls the societal template we are doomed http://www.facebook.com/group.php?gid=2205039391

The problem, restated, is:

All economies on Earth are Price Systems (money systems), which are essentially an elaboration of the barter system, based on exchange values of commodities and services among individuals, communities, nations, and continents. Deferred exchanges became debts and debts became tradable substitutes for real wealth (resources). The virtual world of debt has now grown to such a size that its validation is the focus of national and world emergency measures, which, if unsuccessful, will bring us to confrontation with the survival of modern civilization itself

This is an unprecedented crisis, manifested in a variety of problems which the Price System has been unable to manage http://www.eoearth.org/article/Biophysical_economics in a non market economy and non political government is a viable way out. Investigate the Technocracy technate design.

This is interesting, from a very preliminary point of view, but it's disappointing that the authors appear to believe that they have sufficient information to suggest that collapse is likely.

There's really very little evidence to suggest that the world economy will decline significantly because of Peak Oil.

Robert Hirsch is perhaps the most visible advocate of this idea.

He has published several studies. The last one suggests that oil consumption is related to GDP in a 1:1 ratio - in other words, if oil consumption drops by 10%, GDP will as well. Here is what he said recently: "So then if one calculates a range of 2 to 5 percent, some people think the number may be larger, 2 to 5 percent per year increase in oil shortage, one comes up with a rather disastrous indication world GDP will decline by 2 to 5 percent a year in tandem with increasing oil shortages."

Is this realistic?

No. We can see this from economic history: in the US, oil consumption fell by 19% from 1978 to 1983, and yet GDP grew slightly. Similarly, world oil consumption was flat 2004-2008, but GDP growth was been quite strong, stronger than for the US (which itself grew 8% 2005-2008, with flat oil consumption).

Hirsch seems to have looked at the relationship between oil and GDP over the last 20 years, noticed that the ratio of oil increase to GDP increase has dropped from the previous 1:1 to roughly 1:2.5 (an analysis which he attributes to the DeutcheBank, but which can be derived straightforwardly from IEA statistics). In other words, in previous decades as the economy grew, oil consumption grew as quickly, while lately less oil has been needed. Hirsch drew the very strange inference that GDP has become more dependent on oil, rather than less.

An important and relevant researcher here is Robert Ayers . We see that he showed that GDP is related to applied energy (exergy), and only very loosely linked to energy, let alone to oil consumption. The research indicates that BTU's only explain 14% of GDP,and that the source of those BTU's can change (coal to oil to wind, for instance). Both energy efficiency and energy intensity can change. Further, oil is only one source of BTU's. Oddly enough, many energy commentators seem to misunderstand Ayre's research, and think that it supports the idea of a strong causal connection between oil consumption and GDP.

US (and world) GDP could grow much more quickly than it's energy consumption (even including electricity). The best example of this is California, which has kept per capita electricity consumption flat over the last 25 years, while growing it's GDP relatively quickly.

Ayres used "exergy services", which are not "very close to BTU parity". Exergy services are work performed. So, for instance, a Prius performs the same work as a similar vehicle with half the MPG, but uses half the BTU's. Strictly speaking, a Prius can perform the same work as a Hummer (transporting people), and use 20% of the BTU's. An EV also does the same work as a Hummer, and uses about 1/3 of the BTU's as the Prius, and 1/15 of the Hummer's...and so on.

Another source for this argument is here: http://www.postpeakliving.com/downloads/Sill-MacroeconomicsOfOilShocks.pdf from the Philadelphia Fed. It concludes that a 10% decline in oil availability would reduce GDP, on a temporary basis, by about a cumulative 2%. This means that GDP growth would be 2% lower than otherwise in very roughly the 2 years following the oil shock, then go back to it's historical growth rate. Interestingly, it finds no impact on inflation.

I would argue that the paper exaggerates the short-term effect, due to an over-emphasis on the 1980 oil shock (which was made much worse by a simultaneous change in Federal Reserve policy under Volcker), and underestimates the long-term effect of a permanent price/supply change due to the cost of imports, but the overall magnitude of the effect would be roughly the same.

----------------------

One might ask, does this blog post add helpful information on this subject?

This strongly advocates for the idea that peak oil will "crash" the economy. However, it provides very little support. The discussion simply accepts Hirsch's arguments. It discusses both Hirsch's findings as well 4 other reports. Oddly, three of those other reports actually disagree with Hirsch's thesis of a strong causal connection between oil and GDP - like others, the post seems to misunderstand Ayres in the manner that is discussed above.

Here is an example of an unrealistically pessimistic perspective: "oil is peaking or will soon peak. I don't quibble over 2012 or 2020 — either date is a disaster for humanity because we can't get ready in time." source: http://thefraserdomain.typepad.com/energy/2008/02/yergin-climate.html .

On the contrary, a difference in timing of 8 years makes an enormous difference - an additional 8 years would dramatically reduce the cost and disruptions of the transition away from oil, allowing many car owners, for instance, to smoothly replace their old vehicles with ErEV's. This may explain the blog author's perspective - there seems to a confusion about short-term vs. longterm effects: he assumes a large short-term effect predicts an even larger long-term effect, whereas, as shown in the Philadelphia Fed paper, the reverse is the case: a large short-term effect will generally be followed by adaptation which will eliminate continuing impacts on the economy.

In one place there is a request for proof that the US economy can survive a 20% reduction in oil supply. Here are two: the Fed paper above, which shows that a 10% reduction would only reduce GDP by 2%, and the 5 year reduction of 19% discussed above, where GDP managed to grow slightly.

One might ask about imports - hasn't the US out-sourced it's high-energy-consumption manufacturing to China?

Germany is a good counter-example to the argument that OECD countries are showing a higher ratio of GDP to energy because of out-sourcing, given that's it generally understood that Germany hasn't out-sourced it's manufacturing.

We can see it easily in energy use vs. GDP graphs. Till around 1970 it was linked very closely, after 1970 not so closely anymore and after 1990 not at all.

A chart of oil vs GDP would be even more dramatic, given Germany's fast declining oil consumption.

US oil consumption is falling quite sharply, but growth is continuing. From 2005 to today, world GDP grew strongly even as oil production plateaued. US oil consumption today is lower than it was in 1978, but the economy (including domestic manufacturing) is much larger.

---------------

I'm willing to believe that a dramatic decline in energy availability would over-stress our economy, but that would require decline rates much, much higher than we're seeing. Unfortunately, we have plenty of coal for the next 30 years; and ASPO projections are for only a 11% decline in all-liquids by 2030.

That's not nearly dramatic enough to cause anything to collapse outside of the very poorest countries.

Your funny.

Our entire present industrial civilization is built on oil and peak oil/fossil fuel,, shreds our current debt token based Price System into a cascading death spiral.... or didn't you know? http://www.youtube.com/user/TBonePickensetc#p/f/33/ImV1voi41YY

You can't burn it, because it destroys the climate... and you can't burn it, if there is not enough to go around.

Google Hubbert Peak. It applies to a lot more than oil.

John Carter said:

I try not to read or respond to Nick's stuff, because life's too short to waste on those whose opinions are so steeped in pollyanna-ish dogma and so resistant to fact ...your response, however, sets a tone I like.

Lloyd

I try not to read...resistant to fact

Heck, you might learn something. You may have noticed I always respond to replies: I listen carefully, give specific answers, and provide statistics and sources.

pollyanna-ish dogma

Nothing pollyanna-ish about it. For instance, I think AGW is an enormous problem - much bigger than PO.

Our entire present industrial civilization is built on oil

Not really. Oil is only about 40% of our energy.

You can't burn it, because it destroys the climate

We shouldn't..but we will if we need to. Which means that climate change is a bigger problem than peak energy.

Google Hubbert Peak. It applies to a lot more than oil.

Actually, it doesn't. It doesn't apply to coal, or natural gas (Hubbert tried to forecast gas in the late 70's, and his forecasts were completely wrong). We may have problems with a few minerals - copper is probably the biggest problem. Fortunately, there are a lot of substitutes for copper.

Peak Oil, itself probably won't "crash" the economy. But it will put the lid on growth. And without growth, the inherent design of the economy will likely cause it to crash.

Antoinetta III

And that, Antoinetta III, is a very wise insight that cannot be repeated often enough on this web site.

Although a free enterprise economy can exist in a steady state world, or even an age of declining net energy, capitalism is addicted to growth, for without growth interest becomes a vampire that drains the vital juices out of an economy, concentrating wealth and unbalancing a society. This is why the old solar based economies were so hawkish against what they called “usury.” It is also why the modern capitalist apologists get so apoplectic when this simple truth (now a heresy) from yesteryear is raised, and why economists refuse to “get” the concepts of how net energy and EROEI negate their eternal cornucopia.

Capn Daddy

interest becomes a vampire that drains the vital juices out of an economy, concentrating wealth and unbalancing a society

Could you given some examples?

Why couldn't a zero growth society have zero interest rates?

Finally, regarding energy: see http://energyfaq.blogspot.com/2008/09/can-everything-be-electrified.html

A zero growth economy could have zero interest rates. Or even tiny interest rates. But over the long haul that is not capitalism. It can be free enterprise but not capitalism, which requires growth and interest.

But over the long haul that is not capitalism. It can be free enterprise but not capitalism, which requires growth and interest.

Could you expand on that? Why does capitalism require growth and interest?

You are being a bit of a casuist, Nick. If you don't understand the reliance of the "ism" of capital on interest and growth you slept through your Econ 101 course. The old solar based economies (most of human history)enjoyed free enterprise in steady-state economies. Bursts of rough early capitalism sometimes came with the discovery and harnessing of new sources of energy. Even in solar societies there were warm decades of growth and prosperity, followed by cold periods of want and desperation. See David Hackett Fischer's "The Long Wave." Or read the multi-volumned research into early capitalism and economies done by Fernand Braudel.

It is an old debating trick to constantly ask people to explain this or that. Makes you look inquisitorial, and if they continue to "bite," they look defensive. Do you use "free enterprise" and "capitalism" interchangeably?

The fun thing about economics is that you can throw all the Econ 101 textbooks out the window. I remember taking an econ class and watching the TA write a long equation on the board and then promptly erase it, explaining that we will likely never see another equation in econ again.

That attitude has been turned upside down based on the ideas of econophysics that have gained some steam recently. This is related to but not the same as the math quants do on wall street; valid econophysics deals with macroeconomics to justify the approximations of dealing with large ensembles of economic measures.

Everyone slept through econ courses. Now it is getting interesting.

Abstract http://www.jstage.jst.go.jp/article/eier/4/1/143/_pdf

Econo-physics.

This article marks some potentially fruitful dimensions of economic research based on principles of economic theory but using more analogies with physics. Molecular structure of society with its different states, principles generating spontaneous order different from “invisible hand”, social analogies of the concepts of temperature and pressure in physics are investigated.

Some analogies between phase transitions in physics and transition between different social regimes can reveal the areas of stability of liberal regimes as well as possibility of spontaneous emergence of different social orders.

I am in this deep. It turns out the physics analogies are not what's important about econophysics, its the statistics and randomness and how we leverage the smart thinking of scientists over the years.

I didn't sleep through the econ courses, and I didn't take Econ 101 because we did all the "100" level courses in high school in my school system. We started with the "200" level courses, which is why they didn't let Americans into our university without taking the "100" level prerequisites in an American university first.