Relocalization - Thinking about Imports from the Less Developed World

Posted by Gail the Actuary on June 24, 2010 - 10:20am

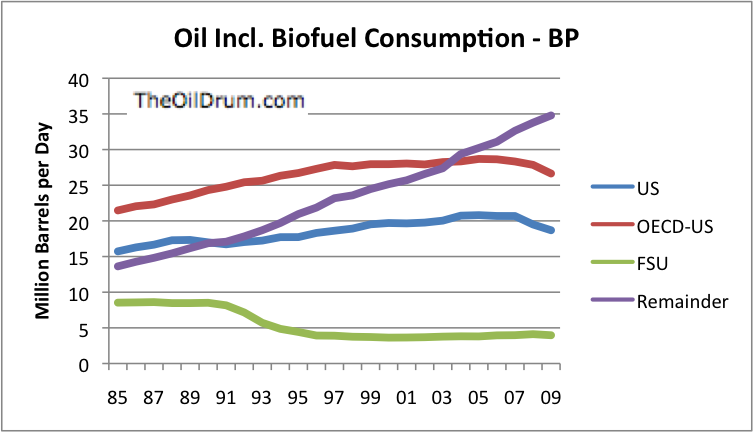

Since about 1970, the developed countries have shifted a huge amount of manufacturing to the less developed countries. This has given us the illusion that will can continue to get more and more goods without increasing fossil fuel use. In this post, I will show a few graphs showing this shift in fuel usage.

I thought we could talk a little about what our response should be to the current situation. There are a lot of things we import from less developed countries that are close to essential--clothing, shoes, some paper, books, and cooking ware. There are many other goods that are imported, too, including steel, computers, chemicals and solar panels. Should we thinking making substitutes locally, as part of relocalization? Or should we be scaling back purchases, and doing without, for some of these? Is there legislation that would be appropriate?

The remainder is what used to be the lesser developed part of the world. It includes China, India, Brazil, the OPEC countries, and many smaller countries. Obviously, a lot of this oil is used for residents' own consumption, but some of it is used for exports to Organization for Economic Co-operation and Development (OEDC) countries. (OECD countries are more or less the developed countries--Europe, Japan, Australia, USA, Canada, and Mexico.)

Clearly, there is a huge difference in the growth of oil consumption between the "Remainder" and the three parts I have broken out separately: the USA; the OECD excluding the USA, and the Former Soviet Union.

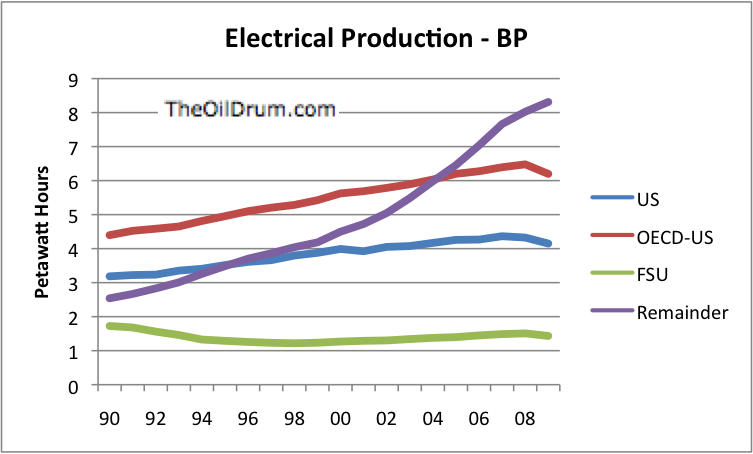

How about electricity consumption? Some of this is used for lights and radios and television, but quite a bit is used for manufacturing goods.

Here again, the remainder of the world has shot up in its consumption while the US and OECD minus the US has remained relatively flat.

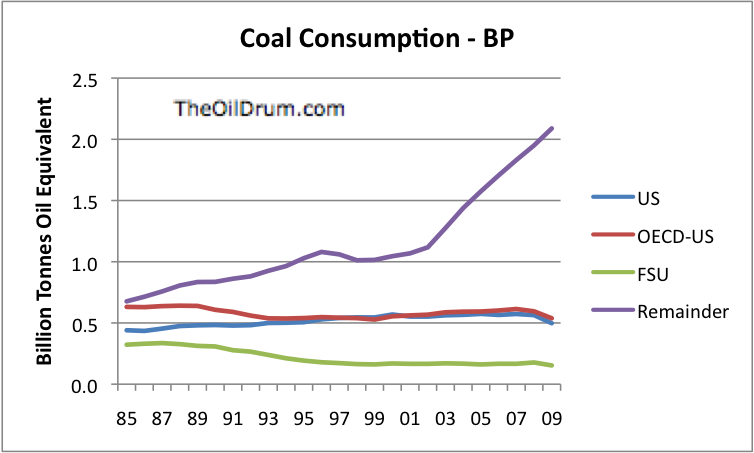

Where does much of this electricity come from? You probably can guess--coal.

And what does this do for carbon dioxide emissions? If we take BP's method of calculating emissions (based on fuel consumption) this is what one gets.

Needless to say, CO2 emissions are skyrocketing for the "Remainder" category. There is a saying, "You get what you measure." If what you measure is emissions associated with internal consumption (excluding CO2 embedded in imported or exported goods), there is a good chance that that is what countries will be focused on. The part that isn't measured is likely to be the problem area.

The lesser developed world with its heavy use of coal for electricity production really has two cost advantages over much of the remainder of the world:

1. Cheap electricity from coal. (In OPEC, it is cheap electricity from subsidized natural gas.)

2. Cheap labor costs

So it makes it hard for the rest of the world to compete on products that use a lot of electricity and labor in their production.

There are a number of reasons why one might want to bring manufacturing of essential goods back closer to end user:

1. Security of relocalization--can't always be sure of imports

2. Reduce CO2 emissions

3. More jobs for local people

4. Less oil used in transport of goods

As the world gets poorer, long term, there is probably is a need to scale back manufacturing in general. So it might be worthwhile thinking about how one should proceed in this regard.

Questions

1. Would it make sense to reduce our imports from "remainder" countries?

2. If so, what kind of legislation might be appropriate?

3. Are there ways we could set up manufacturing locally, with local materials, with little fossil fuels that might worK for some goods?

The coal consumption curve is scary.

8/3/2010

NASA climatologist James Hansen at Sydney Uni: "Australia doesn't agree now that they got to stop their coal, but they are going to agree. I can guarantee you that within a decade or so because the climate change will become so strongly apparent that's going to become imperative"

http://www.usyd.edu.au/sydney_ideas/lectures/2010/professor_james_hansen...

8/12/2009

James Hansen: Storms of My Grandchildren

http://www.crudeoilpeak.com/?p=767

Latest on Arctic Sea Ice is here:

http://nsidc.org/arcticseaicenews/

The Arctic sea ice VOLUME is now well below 2 standard deviations from a linar trend

Implications on weather on the Northern hemisphere are here:

http://www.arctic.noaa.gov/future/heat.html

http://www.arctic.noaa.gov/future/impacts.html

We face following scenario:

By the time the world wakes up to what global warming really means, declining oil production will have damaged our economy and our financial system to such an extent that the weakened economy can no longer generate the surplus funds to finance the massive projects needed to get away from oil and to replace our coal fired power plants.

If we have only 10 years as Hansen says, every month counts to turn around the ship.

I have tried to put it all together in a submission against another motorway project in Sydney, the M2 widening

Primary Energy Dilemma for cars

http://www.crudeoilpeak.com/?p=1631

Net oil imports of oil producing countries are here:

http://www.crudeoilpeak.com/?page_id=1571

IMO we are going to burn all the coal we can get as fast as possible. Within ten years I expect the beginning of a huge ramp up of coal-to-liquids facilities in the U.S. as imports of oil fall rapidly due to ELM2.

In the late thirties the Germans scaled up CTL very rapidly and for five years ran a huge war machine on diesel and gasoline made from coal. If memory serves, they required six or seven tons of not very good coal to make one ton of liquids. The U.S. still has a lot of coal reserves--which could be expanded by ignoring all environmental considerations, which is what I think will happen.

Global warming? You bet: I think by the century's end sea levels will rise by at least two meters rather than the one meter which is now the consensus view. Of course if China and South Africa and Australia all go to CTL, then global warming would go much faster--and that may very well happen.

In the quest for liquid fuels to keep BAU going I think protection of the environment will go on the back burner. Maybe there are some machines that can capture the carbon, but any method of carbon capture and sequestration will add to costs in a world of increasing scarcities and decreasing food production. Hence I think carbon capture will go nowhere. BTW, capitalism is not the villain: Communist China is increasing the burning of coal faster than any other country. (And East Germany when it was socialist burned far more coal than it does now as part of a unified and capitalist Germany. So please no lame "Capitalism is the problem." comments.

Increasing scarcity of liquid fuels is the biggest problem societies face over the next twenty years. By then oil production will be less than half what it is now--much less if westexas is correct, and I think he is.

"In the quest for liquid fuels to keep BAU going I think protection of the environment will go on the back burner."

Sad but true. Environmentalism is a rich country's luxury, and we're broke. Not that environmentalism didn't overshoot and cause some of this trouble (as in no nuclear power, and no more hydro dams) but now we are going to swing over the the other extreme again and make a big mess for marginal gains, because we need those tiny margins, having frittered away a chance for a more balanced approach.

German CTL production peaked at 16000 bpd in 1944.

Today Sasol produces 120000 bpd in the RSA.

You are talking about tens of millions of barrels of CTL per day.

Fischer-Tropsch is terribly energy inefficient.

Coal could be more efficiently converted to methanol as the Chinese are doing, but all these methods are net energy negative.

The best chance for staying on petroleum is unconventional oil from tar and shale which is slightly net energy positive.

The only hope for a relatively smooth transition off carbon is carbon sequestration which is only slightly more expensive than conventional coal.

The alternative is to deny the increasingly obvious fact that oil will soon be drying up and climate change is going to be a lot worse than anyone wants to admit.

"God hath numbered thy kingdom, and finished it.

Thou art weighed in the balances, and art found wanting.

Thy kingdom is divided, and given to the Medes and Persians."

Daniel 5:26-28

I am seriously doubtful carbon sequestration will ever work.

Also, given the high cost (both front end, and in energy inputs, and perhaps in water inputs if it is not designed correctly), I doubt that most countries would decide to use it, even if the technology were there. One line of thought might also be, "Why run through your coal deposits quickly, when by using the usual technique, the coal will last quite a bit longer?"

"I am seriously doubtful carbon sequestration will ever work."

CCS already has worked, is working, Gail and you know it.

You've got a mental block on that, IMO, because 'if' it does work that means that we must spend a lot of money on Climate Change.

You think nobody can afford CCS right now because deep down you want 'the american way of life' to continue even though you fear fossil fuels are drying up.

The first step is for you to acknowledge that there are more fossil fuels than Dave Rutledge or Aleklett think there are, not a lot more but enough to contaminate the planet. You need to take a more balanced view, after all somehow reserves keep increasing over time. Oil is certainly tighter than coal or gas but there is more than 1 trillion barrels left to be drilled (don't forget tar and shale).

Second, you must accept the science of Climate Change and that humans cannot adapt to a world 4 degrees warmer than this one, especially without energy for air conditioning and food and water for +9 billion people. The US is causing an environmental catastrophe so we can live in our accustomed way.

Third, you're going to have to admit that we have no excuse not to massively reduce our energy consumption--the US is soon to be behind China in manufacturing.

As Pickens said, 'Energy..we're going to need all of it' [to maintain BAU]. Nobody is going 'cold turkey' on energy.

Having admitted that Climate Change is our number one problem you must devise an approach that caps and reduces carbon. Renewables will help on the margins but direct CO2 reduction must be the focus.

The US has only recently been surpassed by China as the largest emitter of CO2, with the EU, India, Russia, etc. being far behind.

If your objection is that the US is so addicted to luxury, so degenerated from its heritage, that its people can't meet any challenges, that could well be the cynical case, but don't blame that on 'technical factors'.

Man is fully responsible for his nature and his choices.

Jean-Paul Sartre

Don,

You are probably right with the point of using a lot more coal. One method that will be used is Underground coal gasification (UCG). This process burns coal underground and supplies gas to the surface, leaving a lot of the carbon behind. The gas produced can then be used for generating electricity, methanol production, diesel fuel.

It also opens up even more coal to be burnt as deep coal fields that would not be economic to mine can be used. Whether we have enough capital to tool up for such projects will be the cruch point.

http://en.wikipedia.org/wiki/Underground_coal_gasification

I submit that we outsource the production of sustainable energy components to the third world (solar panels, wind turbines, etc.) to lower the cost to us as a facilitator of their implementation. I expect all of the economic models we are weighing in on for the various technoligies are based on domestic production values of the relevant components. Consider that leveraging the pertinent economies and scales, we could simultaneousley augment the forward affect on mitigating our issues as an industrially advance/oil dependent society while diminishing their propensity to experience the same end of that particular path; as it would seem to follow that the size of our market would facilitate an economical impetus to their parallel adoption of the same technologies. Even in the short run, instigating an inversion of our current import strategem of importing low tech, labor intensive products, will create jobs here for our burdgening underclass of immigrants well adapted to support the labor equity we are currently trading away at a loss. Meanwhile, we leverage the scale of our current consumption to wean ourselves from the oil economy and economically import the substite components required at a bargain, we are repositioning for basic product manufacturing opportunities that we have abdicated, and arguably foolishly, in the last half of the twentieth century.

Of course, there are complicated issues that can not be addressed in this forum, but the idea of swithcing to importing technologicial components while culturing a third world consumer to demand our low-tech exports, is a model that can hardly be discounted; witness China, India, etc.

Actually, to some extent Chinese manufacturers are coming in and undercutting other manufacturers, particularly with Solar PV, so the US and German manufacturers have a hard time competing.

I don't see solar or wind (at least of the kind being made now) getting us off the petroleum economy. They are pretty much a part of it. I think we have to look pretty much to energy that can be made with only local inputs--small wind perhaps, small water, maybe animal power.

Animal power, windmill, Winchester rifle and a log cabin?

A good clear running spring down in a nearby hollow.

A couple of acres of fine soil for gardening.

Lots of nearby woodlands to harvest firewood.

Lodgings set back far,far from nearby roads.

Bells to put on your stock to keep track of them when free range comes back.

The ability to shoot well and as necessary to defend your place.

You will find that hogs are the best way to store meat for the winter as well as canning your garden produce and saving your corn for meal. A good hand cranked steel burr grinder will be worth its weight in gold.Mine is the HomeStead brand. Adjustable burrs and lasts forever. Also a good corn sheller is nice to have. Save the cobs for fire starters.

I just picked up a small wood heater/cookstove for $30 yesterday due to folks shedding stuff rapidly as the economy beats them down. Yard sales are rampant around here now. Easy to heat a small wood shed and cook on. A large wood heater is not necessary and wastes wood.

A nation of hoboes and homesteaders, marauding gangs, home remedies instead of hospitals, survival of fittest and devil take the hindmost? Throw us back into the Dark Ages, post-industrial. No thanks.

Yes, those large waterfalls are useless, plese give them to me for free before you go broke! ;-)

As long as we can repair them, and the infrastructure they use, large waterfalls are great.

I am not certain we can keep them going without fossil fuels for the long-term, though. Eventually, parts wear out, and the area behind the dam gets filled with silt. Some of this can be handled without fossil fuels. I am not sure it all can, though. Imagine fixing the Hoover Dam with local materials.

Eventually, we may need to use new, simpler construction, that we can support with local materials (including recycled materials).

Local as in low cost for transporation can mean along a railway network servicing a continent.

Manny of the large dams in Sweden are located close to old railway lines built in the early 1900:s to expolit the power and get to minerals and timber. Those rivers still flow and the forests still grow.

Eventually it will come to daily/yearly photosynthesis

thanks matt

excellent links.

I'm not sure of the source of the coal data ( 2010 BPSRWE - Coal Consumption? Mtoe ), but maybe China ( ~800 ) and India ( ~94 ) are the obvious "remainder" culprits, responsible for about 80% of the steep recent increase.

The emissions issue then becomes, 'Does any gain in reduced transport emissions exceed losses from smaller production units in consuming nations?'. I doubt it. If retail price is a valid indication of production costs, then the answer has been already been found.

The more fundamental issue may be 'How do we monetarise true environmental costs into retailed globally-traded commodities?'. The shonky national Emissions Trading Schemes will not protect our planet at all, but provide an illusion of action by some nations.

The use of national tariffs to try and offset lower cost production elsewhere is severely distorting. If the punitive ETS systems were displaced by something that reflected all costs from cradle to grave, then small-scale local producers may be more competitive when producing less harmful products.

However nations will use ETS to support major existing industries as well as desired expansion ( eg nuclear power ), with little regard to comparative environmental harm.

China and India are the big ones, but also South Korea, Indonesia, Taiwan, and Hong Kong. South Africa also uses a lot, but is not ramping up the way the others are.

From yesterday's Financial Times: China set to become largest importer of thermal coal

China is set to overtake Japan as the world’s largest importer of thermal coal as soon as this year, only three years after China became a net importer of the mineral used to fire power stations, according to an emerging industry consensus.

The speed at which Chinese coal imports are growing is surprising mining companies, traders and policymakers, who had previously not expected China to overtake Japan before 2015.

Greg Boyce, chief executive of Peabody, told investors recently that the world economy was at “the early stages of a long-term supercycle for coal”.

Yingxi Yu, commodities analyst at Barclays Capital Singapore, said that even though China was moving towards more renewable energies, “coal will remain as a primary source of fuel for the foreseeable future, simply because of the stability of supply and the fact that China is pretty rich in coal resources”.

China is already the world’s largest coal producer but domestic supplies can’t meet the growing demand.

From this kind of news item one might be excused for thinking peak coal is looming. The figures for coal reserves are indeed enormous, but how real are they?

Coal production in China increased by 15% from 2003 to 2004, but only by 10% from 2007 to 2008. This looks to me rather like the peak is approaching for China. The difficulties the Chinese are encountering in trying to increase production to meet demand is underlined by the number of miners killed each year: 2600 last year, which is an improvement on what it has been. China is still the world's largest coal producer, by a large margin, but its production may well start to drop precipitously in the next few years. The easy resources are always produced first.

The largest reserves of coal in the world are reported to be in the U.S., but recent accidents at mines suggest that miners are pushing the margins, the same as oil producers are doing. A large part of the U.S. reserves are also in Montana and Wyoming, which are far from ports and from U.S. population and industry centers.

The price of coal is increasing in spite of recession in many countries (much to the joy of Australian mining companies).

I would not be at all surprised to find peak coal is approaching today as quickly as peak oil was approaching a decade ago.

If I'm right, global warming will be the least of our problems.

I think oil is likely to be a limiting factor for coal, both because of impacts oil has on the credit system (lowering demand for all fuels, including coal) and because oil is currently used in the extraction and transportation of coal. While theoretically coal could be used for these purposes instead, as a practical matter the change would be slow and expensive. So I really expect that peak coal will happen almost simultaneously with peak oil, and the downslope will be steeper than Hubbert's curve would suggest.

One thing to remember is that peak coal seemed to be an issue back as far as World War 1, according to this post by Ugo. According to Ugo, it was difficult to ship coal very far without water transport, so much coal was stranded.

I think that there really is quite a bit of coal left--in the Western US and Canada for example. If there really were demand, and oil dedicated to making extraction and transport work, it theoretically could be made available. It is hard to see this actually happening, though.

Interesting thoughts here.

The last two big coal mine disasters were at mines that had atrocious records for prior safety violations. I think that while mines are being pushed deeper, and perhaps under more difficult conditions, a bigger problem is that some owners are cutting corners. The same could be said, of course, for the current mess in the Gulf: BP appears to have approved cutting a lot of corners there. I have about convinced myself that the fine-appeal-negotiate cycle we have now for safety violations is no longer sufficient, and that we need to start making corporate officers serve modest jail sentences instead.

Estimates for recoverable reserves show Illinois with reserves almost as large as Wyoming. It's high-sulfur coal, but for export purposes that might not matter. Barge shipping via the Ohio and Mississippi Rivers to the big ports on the Gulf is relatively cheap and easy. Ocean shipping is also relatively cheap, but I would think India and China would look to investing in Australia well before they look to the US.

A lot of the coal in Montana is fairly crappy stuff. Large amounts of lignite, high water content, etc. Also problems with extending infrastructure for mining and transport into the area -- not difficult technically, just that there's a lot of work that would have to be done. Some Hubbert-style analyses suggest that "peak coal energy" will occur well before "peak coal" itself. The Mountain West states of Montana, Wyoming, Colorado, New Mexico, and Utah can fairly easy remain "electricity rich" based on their local coal supplies; whether they will be allowed to do so is a different question entirely.

"It's high-sulfur coal, but for export purposes that might not matter."

Why does it not matter? Is it because it is exported outside the environment:-)

Wow! Their coal use is growing even faster than I thought it was.

I wonder when China will experience Peak Fresh Air? On a visit to Shanghai a few years ago, the smog was so bad they closed down the airport and some highways.

"I wonder when China will experience Peak Fresh Air?"

It happened a long time ago - before they were burning so much coal!

It's nice to know one can still buy underware made in the USA......

http://unionlabel.com/socks--underwear.html

.....but not much else as far as clothing or shoes go:

http://www.seiu.org/2009/10/must-see-tv-workers-united-in-hbo-documentar...

Hi Ghung,

I guess I will be all alone here again tonight in pointing out the folly of enacting policies that drove so many industries out of this country, including textiles.

Many members of my family earned thier living for three generations in the clothing industry;a few still do, it has not altogether vanished-not just yet.

Now of course it is very handy for all the teachers and firemen and cops and home builders and cpas and autoworkers and doctors and lawyers and Indian chiefs of every description, including OFM HIS VERY OWN SELF to be able to buy clothes cheap.

But we just exported the environmental and labor abuse problems.we didn't get rid of them , we ust offshored them.

The nanny state kept doing things to raise domestic producers costs-with the best of intentions of course-until the manufacturers simply had to pack up and leave in a race to the bottom chasing cheap labor.This would have been fine and commendable, had the increased regulation of labor and environment come with matching protective tariffs or other offsets.

No busy busybody ever stopped to ask whether the people who worked in the mills would rather have a job sewing blue jeans or no job at all.

This cheap labor is and was only a stop gap that temporarily increased profits of the former domestic manufacturers that managed the move.They have found the competition overseas to be just as brutal as it ever was here.

Even companies that used to have hundreds or thousands of employees and own vast manufacturing enterprises now own often only brand names and marketing expertise-niether or both are very effective as entry barriers against new competition.

Most of them simply folded up or merged again and again until the merger trick failed too.A hell of a lot of these companies were small enough that the hourly employees were on speaking terms with the owners and often had considerable social intercourse with them.

Only the big boys were able to swing the overseas move, and they only went when it became unprofitable to stay here.Nobody who owns a company in his right mind wants to go to the bother and expense and risk of off shoring if he can stay here and make a go of it.

But once the regulations were in place that encouraged the exodus to start, it was unstoppable.

Now we have millions of people formerly employed in these offshored industries who will never find a decent job again.Such educational opportunities as are available to them are mostly a very unfunny joke.

The tea partiers don't want to support them on tax money;and so far as I can tell from talking to my liberal acquaintances, who are mostly govt employees, none of them are interested either, except in the abstract;they all want raises, rather than higher taxes and lower salaries.(Out in rural areas it is not uncommon for govt to be the largest single employer by far and away.)

But support them we will, as we have no choice.We can't offshore THEM.

I do really and truly believe we have only begun to realize what a mistake we have made in this respect.I certainly would rather pay more for clothes and less in taxes , but taxes are only the tip of the iceberg.

Hi Mac,

On TOD we often talk about off shore outsourcing of menial labor jobs. However, we have also off shored many technical jobs that require highly educated and skilled employees. Regular TOD folks (like Mac) know that I worked in India for some time - I never really explained why I was there.

Once again, I don't claim any expertise in the broader outsourcing issues - I can only contribute some personal observations. In my case, I was working for a computer software company the produced high-end software for supply chain automation. It was a start-up company where every day was a drama about financial survival (like finding money for the payroll). We sold a couple of big deals that meant the difference between staying alive and closing the doors. I was the technical guy who was responsible for getting our software customized for these deals - I need 50 programmers with very technical skills and I needed them yesterday.

Having spend many years working in a large technical college as a computer guy, I assumed I could call around the country to folks I knew who had computer science programs. What a surprise - many colleges and universities had dropped courses for lack of student interest. Industrial level computer programming is hard work - once the initial glamor wears off, students tend to migrate to less demanding majors. I called all of my connections in the software contracting world - extremely high prices and few available programmers.

Then I talked to an Indian contractor - 50 programmers in my speciality next week? No Problem!

So, I guess I'm a guy who contributed to off-shoring. My choice was to do that or bankrupt our company because few US students and working programmers were willing to do this kind of intellectual ditch digging work (I'm sure there are some other TOD folks that know what I mean). At least I kept many more jobs going here in the US because we did not close the doors.

These off shore issues are sometimes very complicated and lead to many unintended consequences. Those US programmers that we only available at $90 an hour in the mid 90s - now, many of them are unemployed. I'm not sure what is the answer to this, but I think it is a very real risk that so much of our technical skills are in other countries.

Hi Dave,

Of course you are correct that thses things are complicated to say the least.

But if the programming couldn't be finished any other way, exporting the work or importing the workers can be justified.Or perhaps your company should have gone broke-nothing personal of course.Millions of others have, and will.

In your case there was a genuine need;in my example, there was only a shortsighted run for profits-which was and is as I pointed out, a race to the bottom with every body suffering as a result in the end.It took longer of course, but now the programming profession has begun its own long race to the bottom too-the only people who are really halfway safe from this self cannibalizing monster are govt employees and the handful who work in industries that simply cannot be offshored or the product imported.

Chinese apple juice concentrate, anyone?

Been cared for by a Filipino nurse recently?

The chattering classes who reaped the (temporary) benefits are now feeling the effects thought they were INSULATED by thier educations and thier specialties training and a country big enough and wealthy enough that it could NEVER become poor.

They peed and moaned self righteously about the wage and salary gap getting wider all the time, while studiously and hypocritiucally ignoring the two most important real causes-immigration of unskilled workers, legal and otherwise, and the export of manufacturing jobs.

Has anybody ever specifically pointed out here how the NYT runs a superb blog called "green" and "about energy" and yet it mentions peak oil only obliquely at LONG intervals?

It is literally impossible for the writers to be ignorant of the facts;they are OBVIOUSLY highly skilled writers and researchers.

Of course the long sharp teeth of the MBA army had a lot to do with this too, and while a fat and comfortable company would have rather stayed here so long as it was profitable to do so, the "free market" theory and the rise of international banking and multinational corporations are fundamentally implicated.

In the end , the stockholders of these institutions will-if they haven't already-discover that thier fat juicy profits have turned to ashes in thier greedy jaws as the whole big pile of money fails to buy them what they had before-a safe secure and strong country.ust where they are planning to run to when it gets too hot for them here is a great mystery to me.

Of course it's a Darwinian world and I'm simply unhappy because MY relatives were among the first to pay the price;But I have had the very poor consolation of watching some of the smart alecs such as a building contractor I know well go broke.

Nothing pleased him better than to be able to hire cheap labor due the closing of the mills so long as HE was still busy.The problem with my enoyment of his comeuppance is that he is so dumb he doesn't understand WHY he is bankrupt;he is technically competent and simply thought that there would never be an

end to the stream of new building permits.He can';t get his head around the fact that HIS customer's customers are broke because of his short sighted view of offshoring work and industry.

Prosperity in the end depends on somebody making REAL STUFF and providing REAL SERVICES rather than bloodsucker services such as credit cards.

Well, the whole thing was destined by physical laws to be temporary any way.

But if we had taken a different path, we wouldn't owe the world our future, and we may yet fight WWIII as a result of our debts.

And had we taken the different course we might have held on long enough to find the money for a serious renewables foundation of a new economy.Time in matters of technical progress is as important or more important as money-no amount of money thrown at a given problem in the short term will create the breakthroughs in other fields that eventually allow progress to be made in a given field.Biologists didn't invent the electron microscope and doctors didn't invent the xray machine.

Prosperity, we hardly had time to get to know ya, and we never learned how to look after you.

ps please as usual excuse my two finger typing folks.

"I'm simply unhappy because MY relatives were among the first to pay the price;"

Relax, Mac. They'll also be the first to have adapted to the new normal. I have friends who are clueless about where they're headed, the same friends who have critisized and scorned my self-imposed reduced "income", reduced energy lifestyle. The future will likely be kinder to those who have been forced to accept the change early, while many of those who have clung to BAU the longest will be wandering in the wilderness of what's to come.

Time to go to work. Hot enough for ya?

You can't beat Carhartt and Red Wing. Overalls and work boots. One needs to lay in several pairs of work boots and lots of winter clothing. Bibs are the preferred dress otherwise, OshKosh or Carhartt.

Better stock up while you can. When the 18 wheelers stop moving it will be far far too late.

Mac...I agree with your comments and always respect your opinions.

"I do really and truly believe we have only begun to realize what a mistake we have made in this respect.I certainly would rather pay more for clothes and less in taxes , but taxes are only the tip of the iceberg."

A more northern version.....

In the nearest city to where I live they just opened a WalMart super centre. Time to make choices.

As a Canadian, when I buy something (new) I look for made in Canada. I look for Union Made. If it is not Canadian I look for US made. Not everyone goes for the absolute lowest cost.

I submit it was business who forced consumers to buy offshore, and not the other may around. Simple competition in the race for the bottom as an attempt to increase profits and beat that low low lower price. When the consumer goes into a store and sees nothing locally made he/she has no choice but buy what is available. If the consumer is a jerk who doesn't give a rats ass about anything but his/her own hairy belly needs, there will be little grey matter to sift out a decision. "Me want, me buy". If you have a family and limited income you have to go inexpensive.

It may be a chicken/egg thing, but many consumers have values and stick by them to the best of their ability.

Tomorrow we go into town to shop for pending family visit. We already know where we will go and what we will buy. It won't be walmart and we won't buy Chinese sweat shop junk. I think we'll skip the melamine milk, too.

By the way, in a fight for a decent wage Canadians have unionized three Walmarts. The company shut them down every time and walked away from their investments.

And many Govt enterprises have been off-shored for us. We got some right wing bastards in power 10 years ago and they sold BC gas to Terasan. We have a great medical system but they contracted out admin to private. Our BC HYdro was broken up and the office portion was Accenture (ized). It took threats of a general strike to stop a mass sell off of BC hydro. All new power projects were legislated to be built by private....yet we would have to blend the higher costs with our current Hydro rates. (We call this offshore American). Our BC ferries quasi-privatized and now buy ferries from Germany instead of buying from local shipyards. Our rates have doubled in 9 years and it wasn't the fuel....that gets surcharged when it goes up

Follow the money, the kickbacks, or Board jobs after the politicos leave office. It smells to high heaven up here.

Brian Mulrooney (Conservative who brought in the GST) took cash kickbacks in the hundreds of thousands, hid the dollars in a New York safety deposit box, got caught and does a mea culpa, avoids prosecution and pays only 1/2 of required unpaid taxes and still gets paid off with company directorships. You guys have Bush buddies, we have Conservatives and Liberals. Scratch them and they all smell of the same beholden bought odour.

Buy from friends and neighbours....buy from community or from countries with decent values. Buy products made by people who are paid a decent wage. These are things we can do to improve our network and the quality of our goods.

Just an opinion.

I know that if the economy goes "Automatic Earth" localized, individuals won't go far exploiting neighbours. They'll get shot.

first time poster, long time reader of the site. I have a question on the issue of outsourcing raised by this post. In the peak oil literature it is frequently mentioned that rising oil prices will lead to relocalization of production. I really worry whether this assumption, at least in the short term is correct.

If the consequence of rising oil prices is recession, this will mean that both business and consumers will be tightening their belts. So barring, a quick collapse and rapid decline in oil availability or a trade war, if the reason for outsourcing has been lowest cost wont a recession, caused in part or in full by energy issues, lead to an acceleration of outsourcing?

As the energy cost is only part of the equation in determining the location of production, couldnt production in China become even more viable?

To give an example, in Australia there has been a growing import of fruit and vegetables from China. The low labour and production costs from China and a lack of concern by the consumer over where food comes from means that increasingly local horticulture producers are uncompetitive. Local farmers have to pay high wages and jump through all the food safety hoops and have prices dictated ultimately by our retail duopoly who dont care a whit about the farmers.

On the down slope of peak oil the farmer will have to pay more for their inputs and there is no guarantee that they will be able to pass that increase on to the consumer and get higher farm gate prices due to real power in the market lying with the retailers.

In the short time I could see local production evaporate but ultimately China wont be able to feed itself and its food exports will dry up and we will no longer have any knowledge or skills as the producers have been driven to the wall due to short termism.

The same logic could be applied to any business decision. Faced with reduced sales and lower profit margins isn't it even more incumbent on the businessperson to send work which is labour as opposed to energy intensive offshore?

I think this may very well depend on the business in question. There is a big difference between say farming and computer programming in terms of transport.

In general though I think the oil prices rising will begin to weaken this attraction for most businesses. This will also happen because the chinese factory workers will start demanding better jobs (just as we did in the past), all the while as America goes down the pan, it's the americans that will be happy for any job they can get.

One very big issue I rarely see addressed also will contribute to the decline of outsourcing. The vast majority of low-cost exporting countries (ie. China et. al.) subsidize their gas cost to an unbelievable amount. I expect that as things change, these subsidies will go away and a lot of businesses will fold. of course, this will mean unemployment and perhaps afurther pressure on labour cost downwards... I don't know.

How long can developing world governments continue to subsidize gas?

"How long can developing world governments continue to subsidize gas?"

For as long as we outsource jobs?

:-)

I like the symmetrical look of it!

"To give an example, in Australia there has been a growing import of fruit and vegetables from China"

Interestingly in China some people look for known Western brands because they believe those brands will not be contaminated e.g. with melamine.

You are probably right about the temptation for outsourcing being there. It may just get worse and worse until we hit a brick wall, (financial crisis or something similar) and discover we are losing huge parts of our imports.

It seems like there should be a way to move away more quickly, but that would require legislation which would raise costs to buyers (one way or another--taxes or higher prices of local products), so I am guessing it would not pass. But ultimately, it seems like that is where we are going to have to end up, and some transition would be helpful.

Climate catastrophe?

Energy crisis?

Where are Pons and Fleischman?

Over here.

www.personalgrowthcourses.net/video/cold_fusion

www.cbsnews.com/video/watch/?id=4967330n -

Two light weight videos from Leanan worth watching.

Who knows? Just maybe.

Aren't labor costs in "developing" countries lower because workers there use less personal energy? (Mainly, they don't commute dozens of miles to work in cars, or spend their off time driving...)

I'm no economist --probably not seen as a bad thing here on TOD ;-) -- I've just been pondering this question a little and I'm wondering what others think. As I see it, the price of labor in the US and China is probably going to even out at some point, although I have no idea when.

Anecdotally, I've heard that some factories in China are having trouble finding workers. (And yes, prices have gone up for some items.) Not sure why, perhaps this is because the government is encouraging people to go back to the farm, although that's just my speculation...

Being in a "developing" country, I can say that people here get lower salaries, in part because they are poorer, but in part because they have lower expenses.

Those lower expenses are caused by lower needs of energy (people use more mass transit and leave nearer to work than USians; people don't need to heat their homes, their food travel a lot less), but also by a lower number of intermediaries on consumed goods (eg. lots of times there is only 1 intermediary between the food producer and the end consumer, nearly all times, it is less than 2.), and lower prices of housing (where end consumers compete with each other).

I don't see coal to liquids going prime time outside China as it is too blatant a back flip for the West's middle classes. I think natural gas could become the fuel of choice, some converted to liquid jet fuel. Since coal is about to peak in China and demand for NG will skyrocket all energy must get expensive. Labour costs may become less relevant, more like who has carbon taxes and who doesn't.

As of today traded CO2 permits are back on the political agenda in Australia. Since China needs to increasingly import coal Australia might see the contradiction in carbon penalising local industry but not China. Incidents like the Chinese coal ship gouging a hole in the Great Barrier Reef don't help. I think there will be problems in just a few years.

I expect biomass to liquids to go full scale within a few years.

It could handle 10:s of % of Swedens current use of wehicle and aviation fuel.

Its small volumes on the global scale but significant for the local economy.

And it is nice to have local production of essential fuels in place before the

Norwegian oil runs out. I realy hope the initatives work out well.

Gail wrote:

Since about 1970, the developed countries have shifted a huge amount of manufacturing to the less developed countries.

Gail, I know this is a very popular belief, but it happens to be false. Manufacturing output in our economy has continued to grow and is much higher today than it was, say, 20 years ago. The U.S. is the world's leader in the export of manufactured goods -- that's right, we export more manufactured goods than China or anyone else.

http://cafehayek.com/2006/02/we_dont_make_an.html

http://www.pittsburghlive.com/x/pittsburghtrib/opinion/s_622201.html

http://global-economy.suite101.com/article.cfm/the-good-and-bad-of-ameri...

Manufacturing employment in the U.S. *has* fallen -- but this is due to much higher levels of productivity achieved through automation and other capital equipment.

It IS true that progressives and environmentalists have waged a relentless war against business, particularly manufacturing businesses, in this country over the last 30+ years, and have succeeded in getting a great deal of very damaging legislation passed that greatly hinders employment and capital accumulation. It is virtually a crime these days to create a job -- for doing so places you under vast federal employment legislation that strips the employer of his rights and leaves him utterly defenseless in the face of any employee that wishes to bring charges of discrimination of otherwise "unfair" treatment. Were it not for this anti-business war against employers, manufacturing would have grown even more than it has.

For your statement ("but it happens to be false") to be correct, "a huge amount of manufacturing" would not have been sent to less developed countries.

I state emphatically that this is not the case.

I sit at my desk and look at 2 Korean monitors, a Keyboard and mouse made in China, a Mac made in China. Sneakers made in China. A Socket set made in China. Ikea coat racks and shelves made in Poland and Slovenia. I could go on. My first Mac was made in Cuppertino; I worked for furniture companies. I used to wear Vans sneakers custom ordered (in cool patterns) and made in California.

I therefore suspect all your references and statistics.

By what metric? Unless you quantify it, this statement is meaningless.

This would be relevant if superior automation and technology were bringing me cheap shoes from Omaha and Nanimo... but they're not. The dogwork is being sent to the third world.

If this were true, then various levels of government would not be falling all over themselves to have automotive plants and similar enterprises locate in their area, usually with huge tax incentives.

More libertarian boilerplate. If shoes were still made in North America on the scale they were 30 years ago, the Industrial sector would be larger. Same with computers.

I will agree that there are still things manufactured in this country, and probably on some scales, there is more manufactured in this country now than there was 20 years ago.

But if you look at Index Mundi, at something like raw steel production, US production is flat, while Chinese is skyrocketing (and several times production of the USA). We may take credit for assembling a car made with some of this foreign steel in the USA, but the energy-intensive part of the manufacturing has been moved abroad.

Walmart is filled with goods made in China and by other cheap manufacturers. It is hard to find clothing made in this country any more. Even some goods that you would expect to be made in this country, like furniture, are made abroad now.

So I think what I said is true. There is now a lot of heavy manufacturing that has been moved abroad.

I might be wrong, but if memory serves, textiles and clothing are light manufacturing, not heavy. I think our steel production is level with or higher than it was twenty or thirty years ago; I remember the mass layoffs from Minnesota's iron and taconite mines in the early seventies and all the protests about steel being dumped in the U.S. by foreigners at subsidized and unfair low prices. Auto production is down, but that is mainly due to the recession. Note that BMW, Toyota, Honda and other overseas manufacturers have built U.S. auto assembly plants, so we have not been losing as much car assembly production to other countries as might be thought. Our chemicals industry is intact and doing well, as is agricultural and road building equipment, heavy generators, coal, and natural gas industries. Domestic oil is in a slow decline, as we know.

One industry that is mostly off-shore is electronics manufacturing. Most electronic products, from cell phones to servers and routers are manufactured by companies like Foxconn, Flextronics, Sanmina, Solectron, Jabil Circuits and others. These companies are also leaders in the technology underlying the manufacturing processes. More recently, they have also added design capabilities so that they can design and offer complete products for branding by retailers.

I don't think that this industry requires a great deal of energy. It's main impact on energy consumption is that it raises the living standard of people in developing countries, and this in turn, raises the energy consumption considerably.

The early off-shoring of environmentally undesirable industries, like steel-making and ship building, did result in high consumption of carbon emitting activities like smelting of iron ore. There are also huge petrochemical plants in the Far East to provide plastics for electronic goods, toys, fabrics, etc. that are exported, but by now they are probably producing primarily for domestic consumption.

Off-shore producers are rapidly moving into doing their own R&D and providing more value-added. They are also addressing huge markets worldwide -- cell phone production is nearing 1.2 billion annually.

One process that is irreversible is the diffusion of technology world wide, given the development of world wide information technology.

Another process that is nearly irreversible is economic development. This can be reversed locally by companies going out of business or by individuals and small groups choosing to revert to simpler life-styles. It can also be reversed at the nation state level by the destruction of assets through warfare.

Absent warfare, it is probable that what we will see is a gradual leveling of economic development globally with GDP per capita somewhat above the current world average. Economic inequality between countries will decrease. Economic inequality within countries will increase. India and South American countries are good examples of the likely intra-country inequality levels.

I am surprised that you don't think an Electronics Fab doesn't require a lot of energy.

Injection moulding machines and metal stamping presses are energy intensive pieces of equipment; the main component in plastic is fossil fuel. Chip fabs require huge amounts of power for air conditioning, clean rooms and kilns; even things like disposable or laundered work clothtes take up energy.

If that were the case, then my Mac would be made in California, and I wouldn't find "Made in China" tags on my kid's Lego.

No metric or reference here, or even an "I think" or "I hope". This is a peak oil site! I think you're talking out of your hat.

Power consumption of semiconductor fabs in Taiwan gives the power consumption for producing semiconductors as 1.432 kWh/cm^2. So for a 3 cm^2 processor, that would be about 4.5 kWh.

The processor, if operated 2000 hrs per year at 15 watts average power dissapation, would consume 30 kWh/yr in use or 150 kWh over a 5 year life. It takes more energy to run them than to make them.

Note also, that semiconductor wafer processing is one of the few steps done in volume in the US. So part of the industry consist of cooking the wafers here, and then sending them offshore for dicing, wire bonding, packaging, and assembly into the finished products. These processes are all pretty efficient in terms of GDP/kWh, compared with smelting iron ore and making steel.

One of the reasons that IT hardware and software could be offshored is that the installations could be made self-sustaining off the grid when needed. You need to engineer the facility with uniterruptible power even in the US, so the added costs are not too high.

The graphs in the main post may lead some to think that the main problem is with undeveloped countries. But they are still using a fraction of the ff PER CAPITA that the OECD countries are. OECD and FSU make up less than 2 billion, so "the remainder" means the other 5 or so billion, those who have mostly not participated in the benefits and the destructiveness of the industrial revolution.

Add to this the point made in the article that much of the production from this ff use is going back to the OECD, and the fact that historically, over the last 150 years or so, the OECD has used huge quantities of ff, and the scale tips further.

So, in a just world, the 'remainder' should be given a chance to rise to some reasonable fraction, at least, of the developed worlds per capita use of ff. This has been discussed under various headings in various places--Contraction and Convergence being one of the more common phrases--the OECD has to contract their use as the 'remainder' catch up a bit.

I think this would have been a worthy goal thirty or forty years ago, especially if the developed world had really taken the lead and radically reduced their use (see the Carter thread.)

But now, our only chance if for everyone to reduce their use of ff as much as humanly possible. We will likely get snuffed out anyway, given the feed back loops (death spirals, really) that are already underway. I know, it's easy for me to say as a beneficiary of the profligate use of ff of the US, but I can't see that there is any wiggle room left. We need to vastly scale down use of all ff "immediately if not sooner" as my mom used to say.

But others are probably right, that we will continue to ignore the enormous existential threat before us and put the collective pedal to the metal as we drive off the cliff.

http://www.reuters.com/article/idUSTRE65I11B20100624

Maybe a trade war ahead:

If we didn't get all that stuff from China perhaps their Coal use would not have gone up at all. Question: How much of their coal use is for domestic consumption and what is for exportd good production , 50/50 perhaps?

So the flat line of OECD energy growth is wrong, we just exported the usage. When Schumer gets his way with above bill and we relocalize production then all all those cheap goods will be gone and OECD energy usage will go up if we are to maintain our standard of living, i.e our massive consumption of junk now locally produced. So the cheap coal financed(see energy as real money) our cheap Chinese goods consumption in the West: Either due to a trade war or coal peaking will this consumption splurge be over.

We will be back to classical economics where inflation is caused by higher demand and wage pressure in a particular market. For too long the rules have been able to have been ignored due to the fantasy of unlimited production growth with zero inflation.

Cheap Chinese and other produciton is perhaps due to cheap local enrgy cosurces in the various countries for the factories. Local energy is subsidized. Imported energy is at world market prices. So when China , Indonesia, Malaysia, India, Bangladesh, Pakistan have to import massive amounts of expensive energy just to keep factories running to export cheap goods they will see no sense in the business and quit. Germany/Japan sell high end goods so it makes sense. Low end goods will go back to Europe /USA for our lower classes to do some hand work again when the calculation works for the business. You just have to eliminate stuff like overhead costs for workers (40% of pay for unemployment and pensions and so on) and then put everyone on a minimum wage of sorts.

The coal curve in particular is indicative of something that may lead to relocalization even before rising oil prices make intercontinental transportation problematic: electricity. It takes a certain amount of oil to move a ship load of electronics from China or Malaysia to the US, but it takes electricity to keep the factories running. This is true even for low-tech products. India has shut down various steel-production operations due to power shortages. Viet Nam and China textile plants have struggled to deal with power shortages. Venezuela's oil production is threatened by drought-induced shortages of hydro power.

China is busy in Africa, the Caspian, and the Middle East, working to obtain future oil supplies. But those activities look quite modest compared to their frenzied domestic proposals to provide more electricity: more than a dozen large hydro projects, hundreds of coal-fired plants, NG-fired plants, 30 nukes, wind farms, etc. India has set a goal to expand its generating capacity from 147,000 MW in early 2009 to 225,000 MW by 2012, and to a staggering 950,000 MW by 2030.

The US and Canada combined have the resources to maintain reliable electricity supplies for at least decades. The same cannot be said for much of the developing world. It seems to me likely that that alone will eventually bring significant manufacturing back to North America.

Yes, but Canadian energy resources are for sale to the highest bidder. If the Chinese outbid the U.S., China will get them. Canadian authorities will make sure that Canadian manufacturing doesn't run short, but they don't have much interest in subsidizing U.S. manufacturing. Australia is in a somewhat similar position, but Australia is much closer to China.

To put it in perspective for Americans (who are often weak on geography), Canada is bigger than the U.S. and Australia is somewhat smaller (but not a lot smaller). Both countries are awash in energy resources and have small populations (Canada has fewer people than California, Australia has fewer people than Texas).

Unfortunately for the U.S., the Chinese have lots of American dollars that they don't really know what to do with. They would prefer to get rid of them somehow.

In other words, bring cash to the table and be prepared to bid high.

Global Wage Arbitrage replaced by Global Energy Arbitrage as local energy sources become unavailable for manufactures electricity. Local energy allows existence of cheap local energy subsidized manufacturing base. With massive unemployment people will work for next to nothing everywhere on earth (World is Flat). Energy costs will become key. Will companies send expensive coal to China-billions of tonnes per year- at world price rates to keep those factories humming and sending back expensive goods or will USA keep its own coal and build its own goods with cheaper and cheaper USA labour, considering Chinese /Bangladeshi labour unrest and the transport costs of coal and goods?

High wage countries vs. low wage countries with/without resources

Japan/Germany/Korea/ post war 50-70s- low resource countries with limited populations go high tech quickly due to high cost labour force (wage inflation) and limited energy/minerals

1980-2010s Eastern Europe / China/India, etc.- Low wage countries with seemingly vast populations and nearly unlimited resources- takes due to higher resource/population base 10-20 years longer to reach resource limit (coal/immigrant farmers).

Japanese and Germans were competition for Americans, invigorating system (better cars, etc.). Chindian system wiped out US manufacturing sector by sector (cars would be next) and extreme consumption could only be supported by easy credit (multiple credit cards and Fed bubble blowing).

Manufacturing in America is still robust. It still represents about 20% of our GDP as it has for the last 50 years or so. What has happened?

Simple: America is a high wage country and the JOBS have been automated away.

And China faces the same problem as a low wage country. It has got to suck to be them:

http://blogs.the-american-interest.com/wrm/2010/06/23/marx-awakes-as-chi...

Uh. Yeah. Putting lawyers in charge always improves the situation. For lawyers.

If you think laws, regulators, and bureaus are the answer how do you explain the lax regulation of BP? Or the results of the Interstate Commerce Commission?

When you think of government the question to ask is: can men with guns improve the situation?

"Government is not reason; it is not eloquent; it is force. Like fire, it is a dangerous servant and a fearful master." Geo. Washington

In the USSR government was Master of everything. How did that work out?

====

If something is to be done the only question to ask is: how can we produce X for less than the competition? I think robots may be the only answer. Or there may be no answer. Which of course sucks. As does much of reality. Deal with it.

I'm going to go all squish and let my (few) humanitarian impulses take over for a while.

If we take jobs away from third worlders to solve our problems will the results be pretty? Or will we be starving little children?

I'm all for starving other country's children to help our own. But, you know, it is not very nice. Not nice at all.

fds