OPEC Going Sideways: Not a Good Time for Oil Importers

Posted by Gail the Actuary on July 17, 2010 - 10:31am

This is a guest post by Matt Mushalik from Australia. Matt writes under the name Matt. Matt's original article adds details on expected decline by country excluding megaprojects, and what the addition of those megaprojects will do when added to the adjusted total. It can be found at Matt's blog, crudeoilpeak.

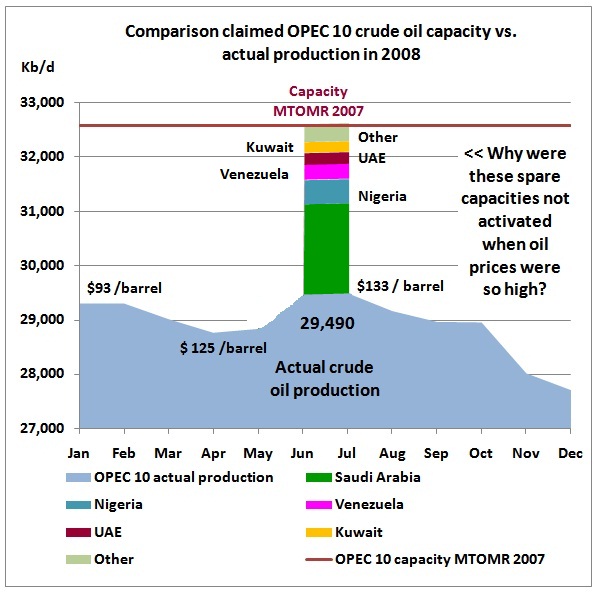

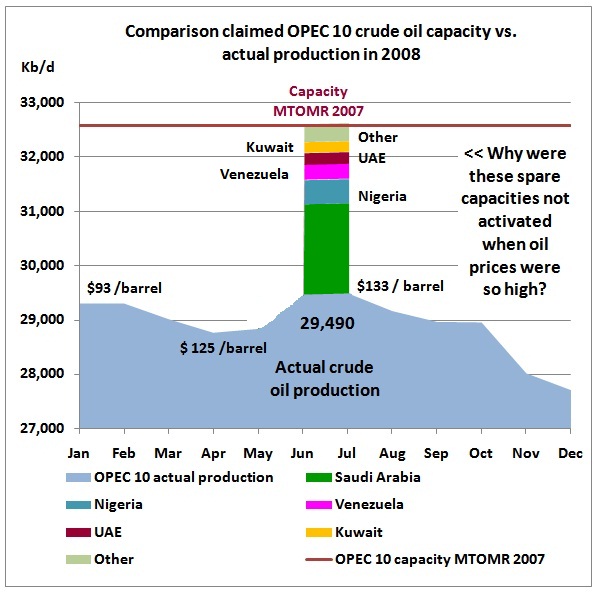

OPEC tells us it has lots of spare capacity, but how much should we believe them? Even when prices were much higher than they are now, back in 2008, they did not make use of all of the spare capacity that they supposedly had.

When one looks at a history of estimates of future productive capacity, we find too, that they have tended to decrease over time (up until the new 2010 report)--also raising questions about current estimates.

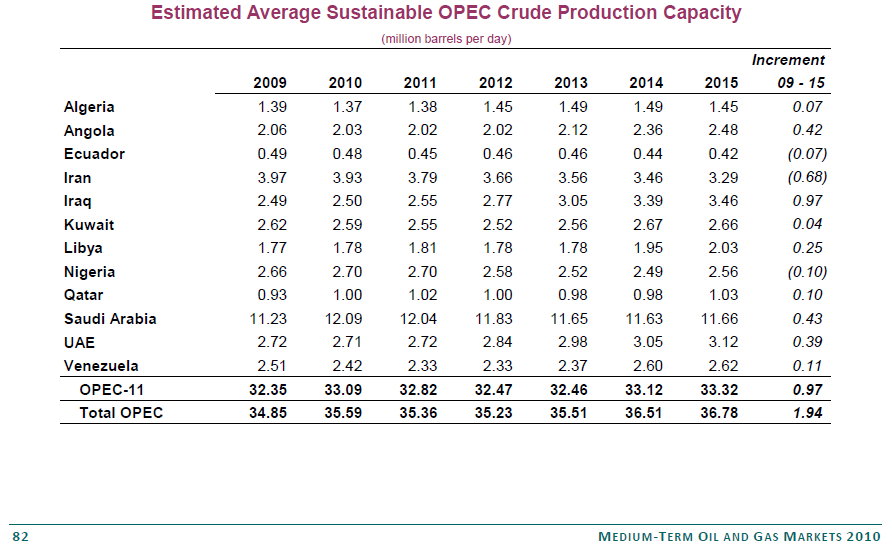

The International Energy Agency (IEA) recently put out its Mid Term Oil and Gas Market Report 2010 (MTOMR 2010). Although the report talks about a 7.1 million barrel a day decline between now and 2015 when all of the anticipated new capacity is added, total capacity is expected to increase from 34.85 barrels per day to 35.78 barrels a day (page 82) in that time period.

According to this table, the Iraq is expected to have the largest increase in capacity (amounting to .97 million barrels a day). The second largest increase in capacity is Saudi Arabia, and the third largest increase in capacity is UAE. Iran is expected to have the largest decrease in capacity.

The question is, "Will this large an increase in capacity really result in higher production?"

If we look at historical forecasts of capacity, alongside actual production, we discover a pattern not unlike that recently shown by Steve Kopits with respect to the EIA forecasts. The forecasted amounts keep coming down!

Each year, from the 2006 to the 2009 report, the medium term oil market reports bring the estimated capacity down by about 2 million barrels a day. In 2010, the capacity estimates increased a bit, but mainly because of Iraq.

More importantly, a huge gap between capacity and actual production has developed, suggesting there is plenty of spare capacity. While one may argue the 2009 drop in production was the result of less oil demand after Lehman Brother’s collapse, and financial turmoil and recession that followed, these adverse conditions did not exist in the 1st half of 2008 when the economy was booming and high oil prices encouraged maximum production. Yet, OPEC’s claimed oil production capacity did not turn into actual production!

The MTOMR 2007 estimated a capacity of 31.06 mb/d for OPEC 10 including Indonesia. (Indonesia is now no longer in OPEC as this country has become a net oil importer.) So without Indonesia, but including Iraq, the capacity in 2008 was supposed to be 31.06 – 0.88 + 2.4 = 32.58 mb/d, while actual production was 29.49 mb/d, a difference of 3 mb/d. Saudi Arabia alone did not deliver 1.7 mb/d during the critical period June/July 2008 – shortly before the Olympic Games when China went into the oil markets with an extra demand of 800 kb/d (see IEA oil market report October 2008, page 14).

So we have to be very careful with those capacity estimates. The safest way to estimate future supplies is by adding the net increments to the actual production for 2009, which we do in this graph:

According to the latest IEA Monthly Oil Market Report, crude oil production for OPEC 12 in 2009 was 28.69 mb/d. To this base we add 1.94 mb/d to make an estimate of 30.63 mb/d. If we assume a spare capacity of nominally 1 mb/d, there won’t be much more crude oil in 2015 than there was at the 2008 peak. Considering rising domestic demand in all OPEC countries, it is likely that crude oil exports from OPEC will shrink. This will not be a good time for oil importers!

As noted in this interesting report, the largest increase in projected production comes form Iraq. What are the considered opinions of the well informed pundits on the forum about the likelihood that this will be realized?

Dhoboi, it depends on a lot of factors. The main upside potential is in the Kurdish areas to the north, and the fields near the Kuwaiti border to the South. The political climate is very erratic, because the US hasn't given up on meddling in Iraq - the neocon ranks seem to be quite powerful and the Obama administration is still playing the old imperial game to keep the lobby at bay. So the outcome over the next few years is a wildcard. I felt all along that, if he survived, Moqtada al Sadr would eventually take over. And this may lead to an atempt by the Kurds to secede. In which case the Turks will invade northern Iraq. And this means northern iraq's production would fall in Turkish hands, there would be a lot of fighting and so on. And with Moqtada al Sadr in charge in the south, then the Ayatollah al Sistani would be in charge, and the Iranians and Iraqis would enjoy a very close relationship. Which leaves the neocon gambit in a shambles.

But this is only one scenario of many scenarios we can paint. And who knows what we don't know. All I do know is our troops are being wasted there. That war was lost the moment we went in, just the same way Viet Nam was lost. And there's nothing we can do it about it. Nor is there anything we SHOULD do about it. The only thing we can do is build a statue of William Kristol and put it in a memorial which says: "This is the guy who got half a million people killed for nothing".

Dohboi, notice that estimated production numbers for Iraq from IEA chart above has little resemblance to the one produced by Stuart Stainford or other pundits who buy into the great Iraqi oil production explosion expected by Iraq. They expect OPEC to be producing 12 million barrels per day by 2015 if the chart below can be believed.

Obviously the IEA does not buy into that propaganda and neither do I. But I do think they could increase their production somewhat but I would guess only about half a million barrels per day by 2015, if that. Anyway their old fields are in decline and all this new oil is supposed to come from infill drilling. I simply do not believe it.

Iraq Could Delay Peak Oil a Decade By Stuart Stainford.

Ron P.

Stuart wasn't "buying into" anything, just speculating on what might happen if these projections come true, and what barriers exist that might prevent that from happening. He dug up a lot of very interesting data on the situation in Iraq.

I don't think the 12 mb/d forecasts will come to pass, either; giant fields like Samotlor haven't come back from the dead to surpass previous peaks at all, no matter how much pundits point to them as proof that EOR will make peak oil meaningless. But EOR has breathed a bit of new life into creaky old reservoirs, and that could well happen in Iraq, despite decades of really horrendous reservoir management.

I realize he was not buying into anything definite, but he was buying into the possibility that they could produce 12 million barrels per day in the next decade. From the link above:

No they could not!

Unlike Stuart I am definitely not buying into that possibility. Even that possibility assumes that those vast Iraqi (so-called) proven reserves are real. According to the EIA Iraq holds more than 112 billion barrels of oil. I am not buying into that either, not even the "possibility" that they could have that much oil.

Ron P.

Thanks, one and all.

So is the more modest increase claimed here for Iran well within reach?

If politics were not an issue, could it be much higher, or is this the highest reasonable amount we could expect out of Iraq?

Meanwhile the oil production boost should become almost vertical as Iraq's production DECREASED for some time this year. Allegedly due to "bad weather". So pray for "good weather" and an "exploding" production (unlike the explosion in the GOM) in this war-torn country - with a few drops left for us from the exports to China...

Here is what Peter Wells seems to be banking on (but he does put big question marks). It would push the peak toward the end of the decade.

http://www.neftex.com

Thanks, Matt!

It seems like part of Saudi Arabia's "spare capacity" is awaiting the completion of a specialized refinery needed for one type of oil that it can theoretically produce, but for which it has no processing capability.

Does anyone have a link on this showing

1. The amount of additional production that might be added.

2. The current estimate of timing.

I was thinking that was a significant part of Saudi Arabia's unused spare capacity in 2008. I should remember the details, but don't.

A fly in the ointment (petroleum jelly, of course) is the House Of Saud waiting to disintegrate. Further to that is the numerous bunker busters on Diego Garcia waiting to be used on Iran, the pipeline attacks in Iraq, and the anger of the Muslim world in general.

The list is hundreds of examples long and the US has expended its resources on Iraq and Afghanistan. There isn't much left to save the status quo of stand alone conjecture.

The graphs pre-suppose stability and the indications are more likely that some external force is simply ticking away.

My bet is on Saud disintegrating or another terrorist attack to stir up a hornets nest of disrupting action.

Latest issue of The Economist has an article about the Saud succession including helpful family tree!

Ever since the Arab Oil Embargo almost 40 years ago, I have heard countless pundits of all political persuasions anticipating the imminent demise of the House of Saud. (wishful thinking?) While the modern Kingdom of Saudi Arabia only came together in 1933, the House of Saud itself has been a major player in the politics of the Arabian peninsula for well over a thousand years. Unlike elected governments, they have the ability to take the long view, so I wouldn't count them out quite so quickly.

On another issue, sometime last year, King Abdullah announced that they were "going to save some oil for future generations, for our children and grandchildren; they will need it." or words to this effect. Anyone have any speculations of how much oil, certain oilfields, etc., and what timeframes could be involved?

Antoinetta III

Antoinetta,

I have no special information on the Saudi Royal family, beyond the gossip I got from a former student, who claimed to be (and probably was) a member of the Royal family. However, the legitimacy of the House of Saud to rule over Saudi Arabia is in serious questions; many consider them to be illegitimate land grabbers who stole the land from the current Royal family of Jordon.

What keeps the House of Saud in power is nothing more and nothing less than American support. In the waning days of World War II, FDR made a deal with the then king, and the terms of the deal are no longer secret. The Saudis develop the oil and keep the spigots open while the U.S. guarantees the Saudi Royal family from threats both within and outside the country. The first Gulf War was a clear example of this deal in action. Since 1973, the Saudis have never done much to restrict the flow of oil--so long as their target price was met. The current target price the House of Saud aims at is $75 per barrel, and it is no coincidence that that price has persisted for some months and may persist for some more.

I could be wrong, but I do not think the Saudis will close in more production to maintain the $75 price if (as I expect) it drifts down to the $60/barrel range over the next several months.

In regard to saving oil for future generations, well, there has been rhetoric to that effect before, but I think actions speak louder than words.

http://bittooth.blogspot.com/2009/09/future-of-oil-or-gentle-cough-at-ny...

From Heading Out:

Peter.

One of the things we found in the North American oil industry during the oil crises of the 1970s was that the idle capacity we though we had was that it was more theoretical than real. When the lineups formed at the gas pumps and the oil companies tried to crank up their production to the claimed maximum, the wells couldn't do it. This came as something of a surprise to the oil companies, because they really thought they had the capacity. The public just thought they were lying.

The production could be maintained for a while by drilling infill wells and putting in water injection systems to get additional oil out of the fields, but then another factor came into play. The decline rate on the wells became steeper as they were produced at higher rates, so it turned into a self-defeating exercise in the long term.

Eventually the ugly truth became obvious - the oil really was not there. It became an exercise in eking that last drops of oil out of old oil fields and drilling in places we had never been able to drill before. US oil production and reserves peaked in 1970 and has never reached those levels again.

I think that this is the thing we have to worry about most. Back in the 1970s, the US oil companies really thought they had the capability to produce more oil, and they were wrong. The same thing may apply to the National Oil Companies that control most of the worlds oil reserves. They probably really believe they have the capacity, but they may just be deluded.

Ah, here's a favorite discovery of mine from the Google News Archives:

The Bulletin - Mar 17, 1972. April 1st, eh?

Not much of a lag to the unleashing of the oil weapon the next year, but this stuff made the news, never mind that no one paid any attention to it. Remember Deffeyes recalling the one line mention of a 100% allowable in some newspaper?

So, is the world "wide open"?

That's true. In 1972 the state of Texas removed all its limits on production. In 1973 the Arab oil producers embargoed the US, and the oil companies could not increase production to cover the shortfall because they were already producing at their maximum possible rate. They thought that if prices went up, they could rush out and drill more wells to find more oil, but when they rushed out to drill after prices went up, the oil was not there. That went over extremely badly with the consuming public.

In fact, US oil production had peaked in 1970, although it took a long, long time for people to realize it. (Many people have still not realized it.) Nixon and every other President in the 40 years since then has had independence from oil imports as a stated objective, and none of them has achieved it. It's basically impossible - the US does not have the oil.

Now, the question at this point in time is, Does the rest of the world have the oil? The OPEC countries think they do, but like the US in the 1970s, maybe they don't.

Interesting observation!

Yes and that is exactly what is happening right now all over the world, not just with OPEC but with Russia and everyone else. Saudi has even stated such. From 2006:

Saudi Arabia’s Strategic Energy Imitative

That is crystal clear. Their tired old fields were declining by an average of 8 percent per year but with massive infield drilling of horizontal and MRC wells, they got their decline rate down to almost 2 percent. But the decline will come fast and furious when the water hits those horizontal wells.

And to use your words, eventually the ugly truth will become obvious.

Ron P.

Ron,

What would be considered the best 'canary in a coal mine' oil field for people like me to watch for, in the news?

IMO, the Saudis' net export response to rising oil prices from 2005 to 2008, versus their net export response to rising oil prices from 2002 to 2005, is very significant, but the myth of non-depleting oil fields in Saudi Arabia is quite persistent.

Regarding new production that Saudi Arabia is bringing online, it's useful to remember the North Sea case history. The North Sea peaked in 1999, but Sam Foucher looked at the fields whose first full year of production was in 1999, or later. These "Post-Peak" fields had a peak of about one mbpd in 2005, compared to a total peak of about 6 mbpd in 1999, but the post-peak fields only served to slow the overall decline rate to about 4.5%/year.

Saudi Cumulative Net Oil Exports Versus US Oil Prices

2002-2005 & 2005-2008 (EIA, Total Liquids)

One of the primary contributors to the 2002-2005 increase in global crude production, followed by the 2006-2008 decline was Saudi Arabia, but let’s look at Saudi net oil exports, which are defined in terms of total liquids, inclusive of natural gas liquids and refined products.

Here are the average Saudi net oil export numbers per day by year, versus average annual US spot crude oil prices:

2002: 7.1 mbpd & $26

2003: 8.3 mbpd & $31

2004: 8.6 mbpd & $42

2005: 9.1 mbpd & $57

2006: 8.4 mbpd & $66

2007: 8.0 mbpd & $72

2008: 8.4 mbpd & $100

Relative to the 2002 net export rate of 7.1 mbpd, in the following three period, 2003-2005 inclusive, the cumulative three year increase in net exports was 1,716 mb, versus a three year increase in oil prices of $31. dollar, again relative to the 2002 rate.

But then we have the 2006-2008 data.

Relative to the 2005 net export rate of 9.1 mbpd, in the following three year period, 2006-2008 inclusive, the cumulative three year decline in net oil exports was 841 mb, versus a three increase in oil prices of $43.

Note that in early 2004, the Saudis reiterated their support for the stated OPEC policy of maintaining an oil price band of $22 to $28, and they made good on their promises to support lower prices as they significantly increased net oil exports in the 2003-2005 time frame, but then in early 2006, they started complaining about problems finding buyers for all of their oil, “Even their light/sweet oil,” even as oil prices continued to increase. Apparently no one thought to ask them in early 2006, as oil prices traded over $60 per barrel, why they didn’t offer to sell another two mbpd of oil for $28 per barrel.

Sorry to be so late replying Mr. Flash but I have been out of pocket since about noon Saturday. I would watch Ghawar if I could but Saudi is publishing little to nothing about Ghawar production. After that I would watch all of Russia. Russia are bringing on Megaprojects like mad but increased production only slightly this year and their production in the second half of 2010 is supposed to decline. That is because their older fields have a very high decline rate.

Ron P.

OPEC latest demand projections for 2010 and 2011 are well below that of the IEA:

http://www.zawya.com/Story.cfm/sidZW20100715000107/OPEC%20Report%3A%20Ca...

Is it possible that OPEC is downplaying prospects of economic growth so it will not be called upon to dip into its 'spare capacity'?

While demand for oil in the US has only grown 370,000 bpd for the year to date in 2010 over 2009, more recently the growth has been about 840,000 bpd. If demand continues at recent rates, then US demand alone will account for at least half of the total 2010 world demand gain OPEC expects. China already is showing similar gains in 2010.

Therefore the OPEC demand forecast basically implies that the world economy will not grow at all in the second half of 2010. While available information indicates economic growth rates may slow in the US, Europe, and China, there are no clear indications that demand for oil will stagnate in the second half of 2010.

Therefore the OPEC demand forecast basically implies that the world economy will not grow at all in the second half of 2010.

From 2004 to 2008 world GDP growth was about 5% per year, with almost flat oil consumption. German and Japanese consumption was falling, while German GDP growth continued, and Japanese GDP was flat.

I don't see flat oil consumption as a predictor of flat GDP.

Your comments do not agree to what the EIA has told us, unless you are implying the offical statistics are wrong.

Also, if you are implying that economies can grow with no growth in oil use I also diagree. I do think that efficiency gains of up to 2% a year can be made in a growing economy, but not in a no-growth eocnomy.

Your comments do not agree to what the EIA has told us.

Are you disagreeing with what I said about German and Japanese oil consumption trends? I'm going by Rembrandt's TOD presentation of EIA/IEA data http://www.theoildrum.com/files/2010_June_Oilwatch_Monthly.pdf Charts 27 and 33.

I do think that efficiency gains of up to 2% a year can be made in a growing economy,

That's with no special effort. Much more can be done.

but not in a no-growth eocnomy.

From 1978 to 1982, US oil consumption fell by 19%, while GDP grew. US GDP is at the level of 2007, while it's oil consumption is 10% lower. US oil consumption currently is at the level of 1979, while GDP is 150% higher - that's 3% efficiency gains per year, with very little special effort. There are many more examples.

We don't need oil for prosperity.

There is a serious problem here. The crude capacity estimated by the IEA here is nowhere near the actual crude capacity. As I posted a couple of days ago on Drumbeats, only three OPEC countries currently have any spare capacity at all. They are Saudi Arabia, Kuwait, and the UAE. All the rest are producing flat out.

Flat Outs

Algeria, Angola, Ecuador, Iran, Iraq, Libya, Nigeria, Qatar and Venezuela

Holding Back

Saudi Arabia, Kuwait and the UAE

Monthly production in thousands of barrels per day from January 2005 thru June 2010.

Crude only. Does not include Condensate or NGLs.

The nine "Flat Outs" are Algeria, Angola, Ecuador, Iran, Iraq, Libya, Nigeria, Qatar and Venezuela. They peaked in December of 2007 and despite oil prices in excess of $140 per barrel the combined production of these nine nations had declined by 170 thousand barrels per day by July of 2008, the month OPEC as a total peaked. And notice that the nine did cut production in October of 2008 but soon began cheating until they were producing flat out and are now in decline.

But here is the June production numbers, in kb/d, of all OPEC nations and their production capacity according to the chart above. The June data is from the OPEC Monthly Oil Market Report and is crude only. If the IEA data is not crude only then adjustments would have to be made but Figure 2 above clearly states crude production capacity and not "liquids" as is their custom when speaking of all liquids.

June Production Nation Production Capacity Difference Kuwait 1,272 1,370 98 Angola 1,843 2,030 187 Ecuador 463 480 17 Iran 3,738 3,930 192 Iraq 2,348 2,500 152 Kuwait 2,322 2,590 268 Libya 1,572 1,780 280 Nigeria 1,975 2,700 725 Qatar 815 1,000 185 Saudi 8,207 12,090 3,883 UAE 2,234 2,710 836 Venezuela 2,326 2,420 94According to the IEA the countries I believe are producing flat out, currently have a spare capacity of 1,764,000 barrels per day. That is a joke, they have zero spare capacity.

And according to the IEA the countries that are holding back have a combined spare capacity of 4,537,000 barrels per day. I am of the opinion that their spare capacity is really somewhere between 1 million barrels per day and on 1.5 million barrels per day.

Ron P.

These is my latest OPEC crude oil graph (up to April 2010)

The other graphs are here:

http://www.crudeoilpeak.com/?page_id=51

And on Saudi Arabia:

12/7/2010

Saudi King ordered oil exploration to cease. But will it matter?

http://www.crudeoilpeak.com/?p=1710

Excellent summary.

The KSA has recently made a series of statements about its reserve capacity from 2015 to 2020 (which I can't post due to copyright laws). While the statements were somewhat vague, they implied that as soon as 2012 they would have to start work on increasing 'capacity' due to depletion of older fields. Also from 2015 to 2020 a major financial investment would be required to maintain 'capacity'. The plan until 2020 includes development of known discoveries, with exploration of new oil fields locations basically halted - as we recently discussed,

It does not seem that they want to make the computation of potential loss of capacity very easy to compute, as they are still developing/reworking other fields until also about 2012. But relying upon statements just made by KSA, and not any speculation on my part, they are basically stating that capacity diminishes quite fast and that the only way to maintain such capacity requires major investment. So I am concluding that the 900,000 bpd they expect to bring online in the next two years to be about roughly equal to overall depletion in the same time period - therefore capacity will not be increasing now or in the future.

Charles, I think you are very incorrect in that opinion. Such is posted every day on this very list and the copyright law is on our side.

Copyright Fair Use Clause

Basically it boles down to "Are you using it for commercial purposes and is your use denying the original copyright holder of profit." No, on both cases and you are allowed to post it.

Ron P.

I agree, but apparently the editors of TOD think otherwise. I've had some posts removed even though they clearly stated the attribution. Apparently since a subscription was required, they felt I was in violation of some copyright rule. These would be subsciptions to petroleum related publishers such Platts, Petroleum Intelligence, etc.

Copying text from petroleum related publishers verbatim is a violation of copyright law.

However, quoting short passages of text or completely rephrasing it in your own words, especially telling people what you think it means, as distinct from what the original author thought it meant, is fair use.

You can only copyright the way data is presented to the reader. You cannot copyright raw data itself.

That's why I will always tell people why I disagree with the original author about what his data means.

Copying text from petroleum related publishers verbatim is a violation of copyright law.

However, quoting short passages of text or completely rephrasing it in your own words, especially telling people what you think it means, as distinct from what the original author thought it meant, is fair use.

You can only copyright the way data is presented to the reader. You cannot copyright raw data itself.

That's why I will always tell people why I disagree with the original author about what his data means.

Is it copyright laws or KSA state secret laws? Saudi Arabia considers oil production and reserve data to be state secrets.

In the US there is a certain latitude under the First Amendment, since its citizens have the right of freedom of speech. The copyright laws reflect that under the "Fair Use" doctrine. The citizens of the KSA do not have the right of freedom of speech. It's an absolute monarchy, after all.

The thing that occurs to me is that the reason production may be down is because the production that was removed does not make economic sense at today's prices.

Suppose Saudi Arabia has some production that it needs to have oil prices to be at the equivalent of $110 barrel to make money on. Saudi Arabia won't tell the world that. Instead, it tells the world that it is holding back production, to keep prices up. (But it is really holding back production, because it figures, if if it wants to make money on it, there is no point in producing it now.) So the production may be back, if the price is high enough.

Or there could be other issues as well. Perhaps temporary production was being added, that couldn't be sustained. A drop in price would be a good reason to take it off line.

Suppose Saudi Arabia has some production that costs $40 / barrel and sells for $80 / barrel.

If they produce it now and invest the $40 profit at 6% for 5 years, they have $53.53.

If oil prices go up at 6% of year and they produce it 5 years from now, they have $67.06.

Since financial assets of high quality are providing very poor returns, and since the prospects for a further rise in oil prices are pretty good, the best alternative seems to be to leave oil in the ground.

Of course, besides investment risk and price rise risk, there are also foreign exchange risk, sovereign debt risk and geopolitcal factors to consider. But I think that a rational view of things favors keeping the oil in the ground, unless you are getting ready to flee Saudi Arabia and join your money in London or Switzerland.

Interesting point.

Do the capacity estimates rely on particular oil prices? It seems to me that they should? There is probably almost zero capacity at $1/barrel and quite a bit more at $150/barrel.

More likely the rate of production without damaging a reservoir.

Really be interesting to get an insight as to what the KSA engineers feel about rates.

http://www.onepetro.org/mslib/app/Preview.do?paperNumber=SPE-100754-MS&s...

Production rate ought to be determined by variable costs. So long as price exceeds the additional variable cost, that barrel will be produced. As the marginal costs in the Middle East as so low, it is rational to produce at nearly any price. Which is why OPEC has so much difficulty maintaining discipline when the market is soft.

Which underlies this entire discussion starting with the post. Once the production capacity is built (fixed costs), it generally makes sense to produce at maximum.

Saudi Arabia is often called the "swing producer" because of its alleged excess capacity that it maintains even in time of high prices. The purpose of this excess capacity -- which would be costly to maintain if indeed that's what they do -- is to bolster Saudi Arabia's political status as master of the cartel.

Here's another way of looking at the problem - given that the $147 price was so de-stabilizing to the world economy, why then did the Saudis not increase production in to head off the price surge? Perhaps they wanted to let the speculators shoot themselves in the foot.

Either way one looks at it, the notion of Saudi excess capacity seems questionable in the absence of independent verification..

This is true for societies like the United States, driven by a "pump it up, burn it up, live it up" ethos.

If you are a royal family (or a dictator, despot, clan, cult, or oligarchic elite) intent on staying in power as long as possible, you may want to go slow in pumping and exporting the source of your wealth and power. The standard of living of the average citizen is not something to be maximized. Instead, their standard of living should be the lowest possible compatible with the maintenance of order by rigorous means.

My recollection from 2008 is that the OPEC spokespeople were saying that the physical supplies of fuel were entirely adequate to satisfy physical demand. The prices of WTI and other exchange traded crudes were said to be the result of futures speculation by traders. Given that belief, there is no reason why OPEC would have either increased short term production or made investments in additional capacity. In the past, responding to price spikes with increased production has led to over capacity and lower prices following the price spike. Consequently, the wise choice was to pocket whatever revenues their supply contracts would allow, considering that the contracts reference exchange prices.

This is the hazard of pricing the main flow of oil by referencing it to a small flow that is traded in a thin market that is easily manipulated by financiers.

The US economy was not in robust shape in 2008. US housing prices had peaked in April 2006 according to the Case Schiller Index. US liquid fuels consumption peaked in 2005 and was declining in 2008, although spending on energy was increasing sharply, both absolutely and as a percentage of GDP. This meant that GDP was still increasing in 2008 due to personal consumption, although the investment component of GDP had already begun to decline.

Investment bank troubles began in late 2007, when Citigroup had to take $10s of billions of SIVs back on to its books. Bear Stearns collapsed in March 2008, and Lehman Brothers and the major financial crisis happened in September 2008. Merrill Lynch, Wachovia, and WaMu, among others, were all history. Not a good year.

Gail, Matt, and others, many many thanks for all the insightful posts. My question is, how do non-OPEC producers affect the capacity picture? I read that Russia recently became both the largest producer and largest exporter. Seems like they could be poised to replace OPEC declines and extend the current meta-stability of supply-demand, at least for a while. Could this be true, and if so, is Russia so inclined?

Russia's crude oil production is close to flat in recent years with a small upward slope.

Regarding future production, I have read that Russia (like a lot of other countries) is thinking about raising taxes on oil companies. Higher taxes will make production at a given oil price less profitable, so I expect that marginally profitable fields will be taken off line, reducing production. I expect this to happen around the world, pretty much where ever taxes are raised. So I think it is quite possible that production will decline in Russia, and in other countries that decide to raise taxes on oil companies.

I expect another factor affecting future production / consumption (around the world, but in Russia too) is the degree to which the economy falls back into recession. Many countries realize that they need higher taxes on consumers to make up for tax shortfalls with their stimulus programs. The problem is that these tax increases on consumers will tend to reduce spendable income for consumers. This will tend to reduce discretionary spending, and is likely to lead to further recession. Recession will tend to reduced demand, and force oil prices lower. With lower prices, oil producers will have less incentive to produce, and this will further reinforce declining production.

This is a little chart I put together recently of crude and condensate production, using the latest EIA data from International Petroleum Monthly.

As you can see, while Russian production is rising, it is "nothing to write home about". It is more that Saudi Arabian production has fallen. It may be that on another basis (including natural gas liquids, for example), Saudi Arabia would have been ahead of Russia at some point. But mostly, I think Saudi Arabia is ahead of Russia in exports, since it has fewer people.

World production is pretty close to flat, with 2010 YTD close to 2008 levels.

Gail, thanks for those numbers. I'm sure I saw that Russia just recently passed KSA in exports, and that they have started significant shipments to refineries on the US west coast that have relied up to now on Alaska (unfortunately I didn't save those news articles, and I'm not astute enough in this area to access primary sources). Some say Russia's production technology is 1970's and that they are courting western companies to increase exploration and to get the technology to be able to substantially ramp up production and improve recovery rates and distribution. Of course, if they could pull it off, this would give them considerable leverage over western economies.

Sam Foucher's best case is that the 2005 top five net oil exporters--Saudi Arabia, Russia, Norway, Iran and the UAE--will have shipped about half of their combined post-2005 CNOE (Cumulative Net Oil Exports) by the end of 2013, on their way to collectively approaching zero annual net oil exports around 2030.

Our early 2008 paper on the 2005 top five:

http://energybulletin.net/node/38948

And Sam's outlook for Russian net oil exports:

One wild card for Russian production is the contribution from frontier basins, but I suspect that Russian frontier basins are to Russia as Alaska was to the US, helpful, but no panacea.

http://www.youtube.com/watch?v=iO6HUwlIS_Y&feature=channel

This 60 Minutes investigation put forth the notion that the run up to the $150 a barrel price was the result of another Wall Street Ponzi type scheme. They discovered that the futures markets were 27 times the size of the physical supply actually being delivered. Wall Street traders were driving the price, not supply and demand.

Another report asserted that the Saudis attempted to add supply to the market at the high point and were unable to get buyers, even at the high price. Indicating the normal market mechanisms of supply demand were not at work.

The market distortions by wall street like this are evident in all the commodities markets I have been researching. I don't see how this level of greed and dishonesty turns out good for anybody but the few that end up living on yachts in the Mediterranean.

It sounds like the criminal energy traders from Enron ended up landing their golden parachutes on Wall Street at places like Goldman Sachs and Morgan Stanley.

One key point to look at is how reliable estimates of oil reserves are. I would argue that there is a lot of influence from different agendas to show lower oil reserves.

1. The environmentalist want to show an early date for peak oil (near term short supply) for their agenda to put pressure on a switch to alternative energy.

2. The oil industry wants to understate or not state its reserves for competitive reasons. I have heard rumors from industry insiders that "secret" exploration off the books takes place as to not alert competition of new finds.

3. Market Traders have an interest in exaggerating news one way or the other in the short term to facilitate their market manipulation tactics. Although it sounds like there is so much manipulation now that their ability to manipulate markets may be completely disconnected from reality.

These are just three examples of different agendas that tend to create a bias toward a dishonest accounting for world oil reserves. I'd bet there are lots more.

I personally would sure like to see us shift our dependence on oil to a more rational sustainable path in a thoughtful measured way. Unfortunately history shows us that our industrial civilization has a kind of inertia that leads it to hold onto unsustainable paradigms until they collapse.

I have come to the conclusion that it is going to take a new kind of collaboration among the masses to come together and demand, discover and distribute the truth about issues like our myopic short term thinking that supports our unsustainable use patterns of oil and other even more important commodities like fresh water and healthy food. All these problems are interlinked and if we are to avoid the normal boom and bust destructive path that ignorance and greed seem to visit on "the little people" with such regularity throughout history.

It seems to me that if we don't get an honest enlightened debate on the table about what is good for most of the people we are headed for a collapse on a global scale.

The economy is not based mainly on "the market", where many buyers and sellers openly buy and sell standardized products for publicly disclosed prices.

The economy is mostly based on "the deal", where buyers and sellers with asymmetric access to information and resources get together and attempt to take advantage of each other in private.

Wow, that should be the quote of the month. Can I have your permission to use that?

Yes, go ahead.

I don't understand how this could be true. In my opinion it's always supply and demand that determine oil prices. How can it be otherwise? The speculators simply bet between themselves what future oil prices will be. How does this effect the price of real oil being bought or sold? The Saudis or any other producers can easily bypass the futures market and sell directly to refineries, and this is what determines the price of oil.

The price between a producer and a buyer would typically not be negotiated bilaterally, but would be written into the contract as relative to some reference price. For example, the reference price might be the average published bid/ask price for spot deliveries at Cushing, OK over the last five days. They would be some adjustment factors on the reference price due to the location of the transaction and the quality of the crude relative to West Texas Intermediate.

So most oil trades hands between buyers and sellers using the exchange prices as the reference price, even though the physical oil never goes near Cushing OK or the other locations specified for other oils, such as Brent, Lousiana Sweet, Tapis, Dubai, etc.

West Texas Intermediate, in particular, is used to price a lot of oil -- much more than ever goes through there. Consequently, by manipulating the amount of oil for sale in Cushing OK, the traders can move the spot prices up and down. The futures market, relative to the spot market, can also be manipulated to change expectations of spot buyer and sellers, incenting buyers to buy ahead and store or sellers to store and hold oil off the market in anticipation of a higher price. For traders, price volatility is a good thing.

Excellent short explanation, Merrill!

Thanks, Matt, Gail, Ron—everyone today, really. After following these matters closely for 15 years, or so, I still don't have much to contribute to threads like this one... but you make me the smartest guy in the room, everywhere else. ;^)

Remember, we had this post from Chris Cook in January this year

Saudi Arabia and the Oil Bank

http://www.theoildrum.com/node/6145

Saudi Arabia's ability to control oil prices already waned in 2003, when they couldn't offset production losses in Venezuela (strike) and Iraq (war). From that moment on, when oil prices left the long established band of up to $28 a barrel for good, speculators had an easy game.

So the speculator's argument does not invalidate the problem with spare capacities. We have both factors working at the same time.

There is somewhat of an analogy between the 2008 oil price spike and the 1980 gold price spike up to $800/oz. In both cases the speculative market 'jumped the gun' so to speak in driving the price spike. The spike was followed by a crash and then, over the longer term, a slower rise back to the earlier speculative levels, possibly supported by real fundamentals. I still expect oil will rise at least to $100 or so, possibly not to $140+ level it achieved in the spike.

EDIT: Actually, silver is probably a better example in that it is a consumable as well as a precious metal bought for investment (speculative) purposes. And it has only climbed back to about 1/2 the level of the 1980 spike, just as oil has come back up to about 1/2 of the big spike.

I like how Colin Campbell expresses it in this interview:

http://www.cbc.ca/thecurrent/2010/06/june-18-2010.html

"Speculators spotted a rising trend."

In other words, there has to be a fundamental tightness in the market before the speculators can really bid up prices.

Of course. The fundamentals indicating upward price movement is what caused the speculators to then all pile on in the first place.

Antoinetta III

Futures markets don't really dictate oil prices. They're mostly like the canary in the coal mine. They tell you what's in the air.

Other than that, they're just the average trader's guess on where the market is going. If you're a lot smarter than they are, you can beat their guess, but most likely they're a lot smarter than you are.

Secret exploration is the way any sensible oil company would do things. The local governments don't like it, so they force disclosure after a period of time to encourage production. When you drill you are in a race to get results, lease more property, and then start production.

They know what they are doing.

JODI data for May is now available. Production from Saudi Arabia fell 104,000 barrels from April. Also, stock levels in Saudi Arabia are almost half of last year.

I took the EIA 2010 prediction for the OPEC-12 and subtracted out Angola and Equador to get the OPEC 10. It looks like they include NGL to confuse things. Anyways, here is the result. It looks more optimistic than IEA in terms of growth. There is no evidence for a dip in 2009 as shown above. Can anyone explain that??

The data I used in my chart above is from OPEC's own Monthly Oil Market Report. I track the data every month and put it into my spreadsheet.

Of course the EIA data shows the exact same dip as does OPEC's own data.

OPEC yearly production in thousands of barrels per day. EIA C+C from the International Petroleum Monthly.

That is a year over year drop of 1,844,000 barrels per day.

But the drop becomes even more pronounced when you plot the monthly data. In July of 2008 OPEC, according to the EIA, produced 33,138,000 barrels per day. In February of 2009 their production had dropped to 30,223,000, a drop of almost three million barrels per day. OPEC's own data, according to secondary sources, showed almost the exact same percentage drop.

Yes, there is hard evidence for the dip shown above for 2009. It is just that the monthly data accentuates the drop.

Ron P.

I notice NPR (National Public Radio) has a little write up about this post on its web site.

Spare Capacity is merely a claim. Whether it can be delivered upon, in whole, in part, or on a sustained basis is always the question. There is no doubt a spectrum ranging from mendacity to ignorance, to political and corporate factors influence the impulse to state such a claim. When Lee Raymond thought XOM had enough spare capacity to bury oil prices above 40, it seems most likely he believed it. As a broader point, we make the mistake of thinking that governments are experts on their own oil resources: are Washington and Tehran and Ottawa really operating at high levels of knowledge and awareness, when it comes to the potential of their own resources? Hardly.

I've watched the claim to spare capacity unfold on both the country and the corporate level for 10 years now. It's pretty iffy stuff. I prefer the record of actual production--especially between 2003 and 2008. A full five years of data laid over steadily rising prices.

G

I think it's fairly apparent that OPEC is a cartel created to maximize profit for it's members, not vice versa. Why would they increase production when all it could do is hurt the bottom line? Oil prices averaged ~$100+/bbl from April to August of 2008 and had fallen to ~$30+/bbl by December of 2008. This was associated w/ a ~2-3mbpd drop in oil consumption, so unless we're affixing blame for the oil price spike on the commodities/credit bubble, then it must be that a ~2-3mbpd drop in consumption reduced oil's price to a third of what it was.

Even if OPEC had ~3mbpd of spare production capacity, why would they use it when it would crater the price of oil? ~29.5mbpd*$100+/bbl is ~$3+ billion dollars per day. ~32.5mbpd*$30+/bbl is ~$1+ billion dollars per day. Maybe it's just me, but I think OPEC is more interested in getting ~$3+ billion/day than they are interested in ramping up production and getting ~$1+ billion/day.

Oil production worldwide flatlined in late 04 into an undulating plateau for several years moving forward. Oil supply did not increase while the price kept rising towards a peak of 147 in July 08.

So, are you saying then that OPEC could have produced more during those years as the price kept rising, but they were somehow knowledgable about the impending drop in price that would take place in July 08, and thus kept production steady? So, you're saying that instead of taking advantage of selling their product for over a hundred dollars a barrel, which was a price unprecedented in the history of the oil pit, they instead sat on spare capacity knowing some day in some year hence the price would drop?

Hypothetically, if I had a warehouse filled with widgets that I sold in the 90's for $20-30, but later when they are selling for over a 100, I just sit on the spare capacity production, with every other worldwide competitor also doing the same thing? That isn't the way business works. They tend to get as much as they can for their product.

In fact, if you remember, when oil was over a hundred a barrel, Bush jr. went to Saudia Arabia to beg on concerned knee for them to raise production, and was told they couldn't help out. Which either means they were unable to accomodate, or (your scenario: They held production steady, knowing somehow the price of oil would drop at some point, and best not to have too much product on the market when that finally does occur.)

Figure 1 in this guest post is where the rubber meets the road. It shows graphically that when opportunity struck opec waived it off, clearly indicating they didn't have the spare capacity claimed.

Not quite. They sat on their spare capacity (if they had any) knowing that if they increased production by a few mbpd the price would have fallen from ~$100+/bbl a lot sooner than December of 2008. From their perspective, every month they don't increase production, if they could increase it, is another ~$50+ billion extra in their pockets. Course, if consumers cut back then sooner or later price will come down, which it did, but they can at least cut back on production to bring price back up after that, and at $100/bbl they make an extra ~$50+ billion per month for every month they don't increase supply (if they can).

The data on consumption wrt price also gives them useful data on what level of production is most profitable. If they produce too much then the drop in price isn't enough to justify the increase in volume. If they produce too little then drop in consumption isn't enough to justify the increase in price per bbl. They, like any other cartel, are interested in maximizing the amount of cash they make, so they want to maximize the product of price and production. There's no reason for them to increase production if it hurts price more than it helps consumption.

So you think that selling 10% more widgets is worthwhile even if it drops the amount you get per widget by 70%? That doesn't sound like the way any successful business works. You'll cut your net by a huge amount if you do that. I suppose that may not stop you or whoever else from doing so in an attempt to bankrupt your competition, which is why in that case it would be a good idea to form a cartel so that y'all can keep prices and your net high as opposed to selling more trying to compete with each other and hurting prices more than you help volume.

I suggest rereading my post. They held production steady because they knew an increase in production of only a few mbpd would drop prices dramatically, just like a decrease in consumption of only a few mbpd cut prices dramatically.

All figure 1 shows is that they didn't increase production, not that they couldn't increase production. Considering that a difference in consumption of ~2-3 units (mbpd in this case) resulted in a price drop of ~$70+/unit (bbl in this case), I don't see why any business cartel would increase it's production by that amount when they would loose money doing so.

Roffle Waffle, to your way of thinking they knew exactly what would happen in the future, which is a huge stretch.

However, let's say they did have a crystal ball to show them precise details of future events based on exact flow characteristics. Wow, they have Ghawar and a crystal ball! Then why didn't they know 147 was too high a price, and use supposed spare capacity to increase the flow to keep the price down at say 110 a barrel, to keep the massive profit party lasting longer than it did?

They don't have a crystal ball, just some common sense. They understand basic economics. They, like a lot of others, observed that a gap of just a few mbpd between supply and demand resulted in oil prices jumping to $100+/bbl. Unless oil happens to be unique in that it doesn't follow the law of supply and demand once it reaches a certain price, then the inverse will also hold true that a reduction of the few mbpd gap between supply and demand would cut prices, which is exactly what happened recently and exactly what happened back in the late seventies/early eighties. They don't have a crystal ball, just a basic understanding of economics and a history book to provide an example of this.

The biggest difference between now and the price spike a few decades ago is that now OPEC can effectively function as a cartel, whereas a few decades ago they didn't have the production capacity to consistently do so. The only way they would be wrong in terms of this assumption regarding oil's behavior would be if oil's price/supply elasticity of demand changed radically over the course of a few months, but that didn't happen and they made a lot of money by not increasing production initially (if they could) and cutting production to bring price back up after oil dropped to $30+/bbl. Either way, not increasing production only proves that they didn't increase production, not that they couldn't increase production. Something like that requires cataloging all of their facilities/flow rates.

I think it is true that the Saudi oil ministry does understand basic economics, and they do understand supply and demand. More so, I would say than most people on this site.

I think they understood the consequences of $147/bbl oil, because they've been through this kind of oil spike before and they knew what would happen (demand destruction, collapse of the US market, failing financial institutions.)

All of that is highly counterproductive from their perspective (they have huge international investments in the countries that took a financial hit from the ensuing economic debacle). The reason they didn't act to stop it is because they couldn't. They didn't have the production capacity they claimed to have.

Personally, when the "global financial meltdown" happened, I was watching it on Al Jazeera satellite TV in Nepal. They have a really good news network. Much more informative than you would find on Fox TV, for instance. High in the Himalayas, you can get better news coverage than in most of the USA.

I don't think it's terribly counterproductive, they brought prices back to ~$60/bbl in six months unlike the last spike where normal prices never went past ~$40-50/bbl after they fell. As for whether or not they have the production capacity some, for instance the EIA, say they do, and others, for instance the author of this thread, say they don't, but the only way anyone can establish that is to go field by field and they need a lot more info than I've seen any present to do that. Does OPEC even present hard info about their own production capacity? The most I remember reading is an occasional press release about how they plan to add so and so amount that may or may not be online within a few year window and they never mention drops in field production.

It's interesting to compare global crude oil production in the 2005 to 2008 time frame, versus global crude oil production in the 2002 to 2005 time frame, in response to six straight years of year over year increases in oil prices. And then we have the Saudi response (see my post up the thread).

Global crude oil production, inclusive of rising unconventional production, has shown a cumulative shortfall relative to the 2005 rate (in response to rising oil prices), at about the same stage of depletion (See Deffeyes' work) at which North Sea production fell, in response to rising oil prices. Similarly, Saudi Arabia started producing less oil and shipping less oil, in response to rising oil prices, at about the same stage of depletion at which the prior swing producer, Texas, peaked in 1972.

US annual oil prices have exceeded the 2005 rate of $57 for four years for 2010 to date. The price through the first half of 2010 exceeds all prior annual prices, except for 2008, when we averaged $100.

Global Cumulative Crude Oil Production Versus US Oil Prices

2002-2005 & 2005-2008 (EIA, crude + condensate)

Here are the average total global crude oil production numbers per day by year, versus average annual US spot crude oil prices:

2002: 67.16 mbpd & $26

2003: 69.43 mbpd & $31

2004: 72.48 mbpd & $42

2005: 73.72 mbpd & $57

2006: 73.46 mbpd & $66

2007: 73.00 mbpd & $72

2008: 73.71 mbpd & $100

Relative to the 2002 production level of 67.16 mbpd, in the following three period, 2003-2005 inclusive, the cumulative three year increase in production was 5,164 mb, versus a three year increase in oil prices of $31.

But then we have the 2006-2008 data.

Relative to the 2005 production rate of 73.72 mbpd, in the following three year period, 2006-2008 inclusive, the cumulative three year decline in production was 632 mb, versus a three increase in oil prices of $43.

Thanks for the statistical and time-line back-up on the point of; Why would producers not increase supply over that long a period of time, when much bigger profits were there for the taking?

They wouldn't be taking bigger profits if they increased production. The only reason oil prices increased were because of a large gap between supply and demand as well as a drawdown of inventories. If they increase production then that gap vanishes, inventories start to refill, and price drops. Basic economics. No sane business would sell more if it hurts price more than it increases volume.

So, global producers decided to increase production as oil prices went from $26 in 2002 to $57 in 2005, but they decided to not increase production as oil prices went from $57 in 2005 to $100 in 2008?

It's always nice to have visitors from Fantasy Island.

Robert Rapier's says that KSA observed a combination of higher storage levels and higher prices and feared that they were in a bubble.

He says they thought that the bubble was about to burst, and were afraid that raising production would cause a deep plunge in prices.

Not only did OPEC increase production from 2002 to 2005 as prices rose, they increased production from 1996 to 1998 by ~3mbpd, when oil prices dropped from $20/bbl to $12/bbl. That's not fantasy island, it's documented fact from the mainland! ;)

That's why it's important to look at production (and competition) w/o a functioning cartel like I mentioned earlier. The big difference between the the 1990s and 2000s was OPEC gaining the ability to function as an effective cartel recently as opposed to torpedoing the price of their own production in the 90s. At the end of the 90s until ~2002 they started to get their act together and kept production in check so they could bring prices up from $12/bbl in 1998, and once demand appeared sufficient they kept increasing production.

If they had increased production from 30mbpd to 33mbpd in 2004 and prices had dropped, you bet your behind they would have cut production, just like they did a few years earlier, but even w/ the increase in supply of 3mbpd, price still remained fairly stable at ~$35-40/bbl in 2004. When they didn't increase production from from 2005 to 2007 they saw prices climb from ~$40/bbl to $80/bbl, and demand was still increasing. By the time oil was in the $130/bbl range even OPEC thought oil prices weren't justified, not that they complained much or increased production w/ oil at $100+/bbl. It wasn't until demand started to level off in mid/late 2008 and prices dropped radically did they even think about cutting back production, by 2mbpd by 2009 in this case.

Like I said before, OPEC has been (at least recently) functioning like any good business cartel should. If the demand was present they increased and held production provided it didn't hurt price. If demand and price waned they cut production in order to bring prices back up. That's a text book example of a cartel if I've ever seen one, unlike the OPEC of the 90s.

That is misleading and an exaggeration. The actual increase was 2.353 mb/d and 1.571 mb/d of that came fro Iraq who were still recovering from the pounding they took in Desert Storm and at that time not subject to quotas. The increase from the rest of OPEC was only .782 mb/d.

International Petroleum Monthly Spreadsheet 4.2

All OPEC was producing flat out during those years. They cut production in 1999 because of low prices. That is how OPEC operates. They cut prices for awhile and then members get greedy and start to cheat. Then everyone starts to cheat.

In 2003 some OPEC members started to cheat. Then by 2005 all OPEC was producing flat out. They continued to produce flat out until September and October 2008 when the price collapse caused them to crack the whip again. Then only after a couple of months some members started to cheat. And by February of this year nine of the 12 members were producing flat out.

OPEC does not act like a good business cartel at all. They cut production only when prices collapse as they did in 1998 and 2008. Then as prices start to creep back up again, one by one they begin to cheat on their quotas. Right now only Saudi Arabia, Kuwait and the UAE are holding the line. (See my chart above.)

Ron P.

How is that misleading? It's not like the U.S. smacked Iraq so hard they knocked the OPEC out of them. If they produce excessively and hurt price, just like if anyone else in OPEC does so, then OPEC isn't functioning as an effective cartel. The increase was also ~2.5+mbpd since I was referring to all liquids production just in case I didn't make that clear before. Don't mind the ~3mbpd reference, I was just eyeballing the EIA data.

Nnot all members of a cartel have to operate effectively for the cartel to operate effectively. As per your chart above, just three countries acting have allowed OEPC to bring oil prices from $30+/bbl to ~$70/bbl. Just because a cartel isn't functioning optimally doesn't mean it's not functioning well, or at least as intended. The problem w/ the 96-98 period was that OPEC didn't have the capacity to cut back production, and couldn't operate as a cartel at all, as opposed to recently. As for spare capacity, OPEC has had at least 1mbpd since 1996 according to EIA estimates. They certainly had much more spare capacity when prices were low and much less when prices were high and that's consistent w/ producers who want to take advantage of price or cut production to bring prices back up AFAIK.

Incidentally, Deffeyes was of course modeling conventional crude oil production (putting global conventional reserves at about 50% depleted in 2005), but his point was that rising unconventional production could probably not fully offset the decline in conventional production, and so far he has been right.

And regarding CMV--Canada, Mexico & Venezuela, three of our four largest sources of imported oil into the US--their combined net oil exports fell from 5.0 mbpd in 2004 to 4.0 mbpd in 2008, and probably down to about 3.7 mbpd in 2009.

U.S. demand also dropped from ~20.7mbpd in 2004 to ~18.7mbpd in 2009, so a drop in imports from our largest importers seems likely. The alternative is that we cut imports from our smaller importers or cut domestic consumption, which we probably did too, but to a much smaller extent. I can't really see why people differentiate between unconventional and conventional these days. What matters in terms of the supply curve is the reserves and production rates at whatever point in time/price, and whether or not something (unconventional or not) gets developed depends on the production costs.

Where do I begin?

For starters, ever hear of the Cantarell Field? The largest contributor to the CMV decline in net oil exports (from 5.0 mbpd in 2004 to 4.0 mbpd in 2008) was Mexico, and Mexico's net oil exports have been falling since their production peaked in 2004. In most cases oil is pretty fungible, and any oil that the US was unable to afford was purchased by other buyers as annual oil prices went from $57 in 2005 to $100 in 2008. Furthermore, it's more likely that the US reduced its imports from halfway around the world rather than from close suppliers like the CMV group.

In any case, I think that the long term picture for the US is that we are well on our way to gradually becoming free of our dependence on foreign sources of oil, as we, and most other developed countries, are outbid by developing countries for access to declining global net oil exports.

Maybe you should begin by rereading your previous posts? Specifically this...

Isn't correct. You even posted that...

So... If U.S. oil consumption fell by ~2mbpd from 2004 to 2009, and like you mentioned before, CMV reduced imports by ~1.3mbpd, then it's not a matter of it being more likely that the U.S. reduced it's imports from halfway around the world rather than from close suppliers, it's a matter of what actually happened. The U.S. reduce their CMV imports by ~1.3mbpd, while they reduced their other imports from countries halfway around the world by ~.7mbpd from ~2004-2009. Regardless if your opinion as to which is more likely, it's fact that the CMV imports dropped more than other imports.

What's really neat is that if you look at the EIA data you can see how price didn't start to really take off until commercial inventory started to drop noticeably. Then it went from about where it is right now to nearly $150/bbl in a little more than half a year, and fell down to ~$30+/bbl once consumption dropped and commercial inventories popped back up to normal.

When did KSA's desire/willingness to swing-produce suddenly come into question?

We don't need to treat the 2008 oil spike as if it was some kind of Black-Swan economic calamity that our grandparents warned us about in folk tales. It was just a typical temporary price spike. It called for the typical KSA response of raising production for a few months to flood it out. Then a typical production cut a few months later to draw down the stores and level things out. We expected KSA to do this because they're KSA. That's what they do. They pride themselves on it. They have made this their national "thing" for decades.

The huge question is, WHY DIDN'T KSA DO IT THIS TIME?

My guess is they just didn't have the excess capacity.

Exactly, when Bush jr. begged the KSA on behalf of the US economy for the usual raising of production to stabilize pricing, he was rebuffed. And that's when anyone following said events should have had enough information to realize KSA was no longer the swing producer they historically had been. The only poster on this thread that seems to think differently and with determined conviction, is roflwaffle. We shall see if his position is later proven accurate or completely erroneous.

For the love of Pete! Did you really read anything I posted or did you just skim over it?

I'm not saying that they actually had the production capacity, just that they could have had it. I don't know, you don't know, no one but OPEC knows, and even then that may only be on a country by country basis. All I'm saying is that not increasing production isn't proof that OPEC didn't have the production capacity, it's just proof that they didn't increase production. It could be because they didn't have the capacity some sources estimated they had, or it could be because there was an economic incentive, no one except for OPEC (possibly) knows. The only way they would is to go field by field and show that those fields aren't capable of producing however many bbls/day.

P.S. Yes I'm being grouchy, but jeez, after at least a few posts on this subject I would hope others would at least read one of them.

Great posting. The question why the OPEC may not produce more got an easy answer from the IEA itself in one of their annual IEOs: The OPEC simply doesn't want to, as this would "damage" the price level. Unlike in an open market situation, where a higher production means higher revenues, in a cartel (or monopoly) situation a lower production means higher revenues due to higher prices. So this is good for OPEC but bad for the importers. However according to the IEA we shouldn't worry, as the OPEC doesn't want to damage the global economy, which would affect their own. But anyway we can rest assured that 0pec now again has become the world's superpower of power supply.

Well, that's OPEC's story. It's not the one I buy into.

As the 1973 embargo demonstrated, KSA and the rest of OPEC have already had the ability to permanently raise the price of worldwide oil since the early 1970s. So what changed in 2008?