Arthur Berman talks about Shale Gas

Posted by Gail the Actuary on July 28, 2010 - 10:40am

Recently, ASPO-USA's newsletter printed an interview (Part 1 and Part 2) with Oil Drum staff member Art Berman (aeberman). Art is a geological consultant whose specialties are subsurface petroleum geology, seismic interpretation, and database design and management. The people doing the interview are members of the "Peak Oil Review Team," abbreviated POR in the text below. This is the shale gas portion of the interview.

POR: Can you give us your latest updated perspective on the shale gas story?

Art Berman: You have to acknowledge that shale gas is a relatively new and significant contribution to North American supply. But I don’t believe it’s anywhere near the magnitude that is commonly discussed and cited in the press. There are a couple of key points here. First the reserves have been substantially overstated. In fact I think the resource number has been overstated.

If you investigate the origin of this supposed 100-year supply of natural gas…where does this come from? If you go back to the Potential Gas Committee’s [PGC] report, which is where I believe it comes from, and if you look at the magnitude of the technically recoverable resource they describe and you divide it by annual US consumption, you come up with 90 years, not 100. Some would say that’s splitting hairs, yet 10% is 10%. But if you go on and you actually read the report, they say that the probable number-I think they call it the P-2 number-is closer to 450 Tcf as opposed to roughly 1800 Tcf. What they’re saying is that if you pin this thing down where there have actually been some wells drilled that have actually produced some gas, the technically recoverable resource is closer to 450. And if you divide that by three, which is the component that is shale gas, you get about 150 Tcf and that’s about 7 year’s worth of US supply from shale. I happen to think that that’s a pretty darn realistic estimate. And remember that that’s a resource number, not a reserve number; it has nothing to do with commercial extractability. So the gross resource from shale is probably about 7 years worth of supply.

For a project that a colleague and I did for a client, I actually went in and looked at all the shale plays and assigned some kind of a resource number to them. I also used some work that was done by Wendell Medlock at Rice University’s Baker Institute. He did an absolutely brilliant job of independently determining what the size of the resource plays in Canada and the US might be.

The resource hasn’t been misrepresented but the probable component has not been properly explained as a much smaller component of the total resource; I guess they just didn’t read the PGC’s report carefully enough. If you take the proved reserves plus the report’s probable technically recoverable number, we have something like 25 years of natural gas supply in North America, which is quite a bit. It’s a lot. I don’t say any of this to give shale gas a bad name.

The other interesting thing about the PGC’s report that nobody seems to pay attention is this: they said there is something like 650 Tcf of potential shale gas. Well, there’s 1000 Tcf of something else. What’s the something else? It’s conventional reservoirs plus non-shale/non-coalbed-methane unconventional reservoirs. So there’s 70 percent more resource in better quality rocks than shale. It just astonishes me that nobody has paid any attention to that.

So that’s the simple view. And then the other thing that we see empirically is that if you look at any of these individual shale-gas plays-whether it’s the Haynesville or the Barnett or the Fayetteville-they all contract to a core area that has the potential to be commercial that is on the order of 10 to 20 percent of the geographic area that was originally represented as all being the same. So if you take the resource size that’s advertized-say for the Haynesville shale, something like 250 Tcf-and you look at the area that’s emerging as the core area, it’s less than 10 percent of the total. So is 25 Tcf a reasonable number for the Haynesville shale? Yeah, it probably is. And it’s a huge number. But the number sure is not 250 Tcf, and that’s the way all of these plays seem to be going. They remain significant. It hasn’t been proved to me yet that any of it is commercial, but they’re drilling it like mad, there’s no doubt about it.

Those are sort of the basic conclusions. And when you look at it probabilistically, which I think is the only intelligent way to look at anything which you have any uncertainty about, what you realize is that the numbers that are being represented by all of these companies as “truth” are probably like the P-5 case, having a 5 percent probability of being true. So they say, “well, our average well in the Haynesville is going to be 7 Bcf,” and I say there will certainly will be wells that make 7 Bcf but there’s no way that the average is that high. My take is that there will probably be 5 percent of wells that will make 7 Bcf.

I just think everybody is caught up in this. I have a slide where I say, you guys need to get over the love affair and get on with the relationship. You keep talking about how big it is and how great it is, but at some point you have to live together and that’s hard work. You have to be honest with yourself and with each other and you have to do some work. I just don’t think we’ve moved past the love affair.

One other important thing is the Barnett shale. We keep coming back to it because it’s the only play that has much more than 24 months worth of history. I recently grouped all the Barnett wells by their year of first production. Then I asked, of all the wells that were drilled in each one of those years, how many of them are already at or below their economic limit? It was a stunning exercise because what it showed is that 25-35% of wells drilled during 2004-2006-wells drilled during the early rush and that are on average 5 years old-are already sub-commercial. So if you take the position that we’re going to get all these great reserves because these wells are going to last 40-plus years, then you need to explain why one-third of wells drilled 4 and 5 and 6 years ago are already dead.

POR: When you say one-third of the wells are already sub-commercial, do you mean they have been shut in, or that they are part of a large pool where no one has sharpened the pencil?

Berman: Some of them never produced to begin with. No one talks about dry holes in shale plays, but there are bona fide dry holes-maybe 5 or 6 or 7 percent that are operational failures for some reason. So that’s included. There are wells that, let’s just call them inactive; they produced, and now they’re inactive, which means they are no longer producing to sales. They are effectively either shut-in or plugged. Combined, that’s probably less than 10 percent of the total wells. But then there are all the wells that are producing a preposterously low amount of gas; my cut-off is 1 million cubic feet a month, which is only 30,000 cubic feet per day. Yet those volumes, at today’s gas prices, don’t even cover your lease/operating expenses. I say that from personal experience. I work in a little tiny company that has nowhere near the overhead of Chesapeake Energy or a Devon Energy. I do all the geology and all the geophysics and there’s four or five other people, and if we’ve got a well that’s making a million a month, we’re going to plug it because we’re losing money; it’s costing us more to run it than we’re getting in revenue.

So why do they keep producing these things? Well, that’s part of the whole syndrome. It’s all about production numbers. They call these things asset plays or resource plays; that reflects where many are coming from, because they’re not profit plays. The interest is more in how big are the reserves, how much are we growing production, and that’s what the market rewards. If you’re growing production, that’s good-the market likes that. The fact that you’re growing production and creating a monstrous surplus that’s causing the price of gas to go through the floor, which makes everybody effectively lose money….apparently the market doesn’t care about that. So that’s the goal: to show that they have this huge level of production, and that production is growing.

But are you making any money? The answer to that is…no. Most of these companies are operating at 200 to 300 to 400 percent of cash flow; capital expenditures are significantly higher than their cash flows. So they’re not making money. Why the market supports those kinds of activities…we can have all sorts of philosophical discussions about it but we know that’s the way it works sometimes. And if you look at the shareholder value in some of these companies, there is either very little, none, or negative. If you take the companies’ asset values and you subtract their huge debts, many companies have negative shareholder value. So that’s the bottom line on my story. I’m not wishing that shale plays go away, I’m not against them, I’m not disputing their importance. I’m just saying that they haven’t demonstrated any sustainable value yet.

POR: How have analysts and investors responded to your studies and your viewpoints?

Berman: My biggest clients, for this kind of talk and work, are investment bankers and investment advisory companies. I gave two talks in Calgary over the last week-one to CIBC and the other to Middlefield Capital. I’ve given multiple talks to energy investment companies. They’re the people who are really paying attention to this. The answer is that a significant portion of the investment banking sector takes what I’m saying quite seriously, but what they do with that I can’t tell you.

POR: How has the gas-producing industry responded to your studies and views?

Berman: The U.S. companies have pretty much chosen to ignore me. Or they’ve made public statements that I’m a kook or I don’t understand or I’m hopelessly wrong. Some them-especially the Canadian companies for some reason-want me to advise them even though my message is not a message that they prefer.

It’s a fascinating process. My sense of it is that the level of interest, and whatever notoriety I have, has only increased. I credit the ASPO 2009 peak oil conference in Denver with really kicking that off. That presentation was a tipping point in awareness about the truth of shale gas reserves and economics. After my presentation, I had almost five hours of discussions with analysts that had attended the talk. Associated Press reporter Judith Kohler published an article -Analyst: Gas shale may be next bubble to burst‖ that was distributed to hundreds of outlets in the national press and that brought this topic into the mainstream. U.S. E&P executives responded with a series of ad hominem opinion editorials and earnings meeting statements that minimized the fact-based positions that were presented at the ASPO 2009 meeting.

Before that, I spent months making presentations to professional societies of geologists, geophysicists and engineers throughout the Gulf Coast. These are colleagues who do the work of the petroleum industry that gave me what amounted to a peer review. I know that there were silent people in those audiences who disagreed with me, but the overall response was supportive and enthusiastic. I also got hundreds of e-mails responding to my World Oil articles that included testimonials about companies’ experience with shale gas wells in the real world.

E&P executives don’t have any such base, nor do they know about this experience. In all of my presentations, I acknowledge people that include some of the most respected E&P CEOs, opinion leaders, and experts on oil and gas price formation, reservoir engineering, economic evaluation and risk analysis. In addition, there are also many industry analysts in research companies, financial advisory and fund management firms, and reporters in the energy press that consult and publish opinions about my position on shale gas.

The point is that I am not alone. I have a large community of supporters with impeccable credentials. I am a cautious and somewhat conservative person in my professional work because I advise clients on high-risk and very large bets on wells and investments. My reputation and future income depends on the credibility of my evaluations and the quality of my research. I do not believe that the same can be said for the CEOs of the U.S. public companies that dispute my findings.

I’m a fairly busy guy, and a lot of people want to hear the story; I talk to Bloomberg and Platts and others all the time. If anything, I feel as if I’m sort of slipping into the mainstream, in a weird way. It’s a scary thought. I’m now asked to participate in august panel discussions, albeit representing the radical fringe; but a year ago nobody even wanted to talk to me.

I don’t know where it’s going. It seems inevitable to me that it is sort of a bubble phenomenon; but bubbles can go on for 25 years or so, even though everyone knows that’s what’s happening. As long a capital markets continue to fund these things it’s going to keep on going. I’m not saying that’s even a bad thing, though I wouldn’t put any money in it, that’s for darned sure.

POR: Back in the 1960’s the phrase “too cheap to meter” was introduced, by some promoters, as being the future of nuclear energy. Over time, the reality obviously didn’t match the hype. It feels to us that there could be a parallel with the recent 100-year-supply statement…

Art Berman: It could be a big denial issue…

POR: Like that early era for atomic power, the shale gas story still seems so new that there are a lot of uncertainties about the shale gas bucking bronco, if you will. How will the industry respond to the uncertainties? How are they responding to the current tough price signals?

Berman: Not at all right now. I had a whole series of talks that I gave last spring called, “North American Natural Gas: Acknowledging the Uncertainty.” That’s all I want people to do. Not that they shouldn’t drill for it or that I’m right; all I’m saying is acknowledge the uncertainty.

A Few Related Links

Art Berman's Presentation at October 2009 ASPO-USA Meeting Shale Plays: A Time for Critical Thinking

Shale Gas Estimates Perhaps Optimistic - An Interesting and Worrying Talk at ASPO by Heading Out, October 2009

More Natural Gas Controversy by Gail the Actuary, November 2009

ExxonMobil’s Acquisition of XTO Energy: The Fallacy of the Manufacturing Model in Shale Plays by Art Berman, February 2010

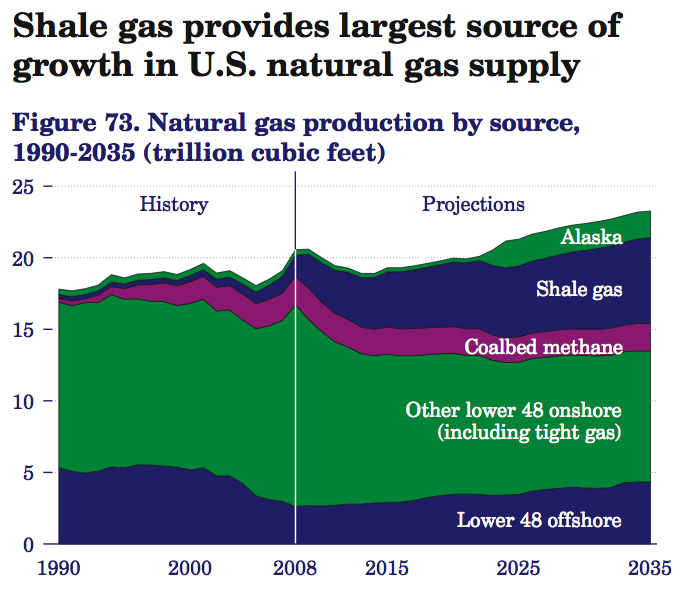

This is the EIA's Natural Gas forecast from the current Annual Energy Outlook. While shale gas didn't amount to a very large percentage of production through 2008, the forecast they are using is for it to provide a large increase. Without it, US natural gas production would fall.

Vital and thorough article about Art's work. Thank you.

Thanks Art!

Is there any good way of seeing exactly what is going on with respect to shale gas (in terms of rigs operating, and actual production), at a point in time?

I know that there are a lot of different counties involved, as shown on these maps.

While shale gas hasn't amounted for a very big share of gas production to date, the graph in the text indicates that the EIA is planning on a whole lot of growth, growing to something like 5 trillion cubic feet a year, or about a quarter of total NG production. So they seem to be buying into the shale gas hype.

Gail, the shale in Poland is the real deal. Huge resource. Most of the majors have signed leases and done their G&G and economic planning.

http://www.epmag.com/Magazine/2010/3/item53280.php

Wish the EIA would provide some more data so we could judge for ourselves whether it's got a leg up in this race - all we get for shale/coalbed is 07/08. Although we could just surmise that previous numbers were just a titch lower and steady for long periods, 500 bcf or something. Tight is wrapped up in dry although there's a spreadsheet with that given separately as well, forget where.

Found this 2005 projection:

That sure didn't happen. GeoPete's View: A Look At All Categories Of "Unconventional Gas" Supplies.

And this interesting item from 2007:

Long-Term Trends in Global Natural Gas and Crude Oil Supply and Demand Point to Much Higher Prices :: The Market Oracle :: Financial Markets Analysis & Forecasting Free Website. Also includes oil forecast with world peak about 2008. Shale must be thrown in with conventional or tight here.

If I'm not mistaken greater yields came in 2008 from conventional+tight than from shale. Why not blame the price crash on more associated from the GOM? And what part of conventional is declining, at what rate? Is this accelerating?

I was disappointed, too, with the EIA dumping tight gas in with conventional onshore. Tight gas was one of the recent sources of growth. Its drop-off and the expected timing are important. So is the trajectory on conventional onshore oil.

avon - Did any of these folks offer a price at which the various plays are economically viable? Your link is a great source of geology but offers nothing in the way of economic value of the different plays. As I've offered before any projection of recoverable reserves that doesn't include cost/pricing assumptions is less than worthless...it's very misleading IMHO. A huge volumn of NG that was once considered recoverable in the US is no longer in play. There are still economic sweet spots in some of the US trends but a large portion became unrecoverable when prices dropped below $5/mcf. There might be 50 TCF in a trend that is recoverable when NG is $12/mcf. But that number could drop to less than 1 TCF if NG is selling for $4.50/mcf.

according to this report, in the $5/mcf range:

http://finance.yahoo.com/news/FX-Energy-Sets-First-Quarter-iw-3324098545...

fxen's gas is sold in the poland market at a controlled price.

according to bp's statistical review, poland's '09 production was 4 tcm and consumption was 14 tcm. i doubt they will be exporting gas anytime soon.

Thanks elwood. Scanned their report fast. As usual it's very difficult to tell if they're profitable or not in their shale gas play. Thanks to increased production they are posting record income. OTOH they're about $30 million in debt. So they might make a profit at $5/mcf or maybe maybe losing $2 on every mcf they sell. Same problem with US shale gas producers. Cash flow isn't profit. But with the Russian supply question I can see why they would try to make it work.

fxen's production is from conventional reservoirs. i dont know if they are involved at all in any shale gas acerage.

Hi Rockman,

Some time ago, we exchanged comments about the price of NG. I still find the current price to be a mystery.

Given the BTU value of NG vs Oil (say around 1/6 mcf vs barrel); NG at $4 to $5 seems like an exceptional bargain. At face value, it seems like the price of NG is artificially low. Fracking technology seems to have opened the flood gates - but, maybe not for long. You seem to be saying that this price is being driven by investment factors that are divorced from current profitability - how can this possibly last? Removing these investment factors, what would you speculate represents a "normal" price to balance demand/supply/profit in the next year or so?

Dave - Yep…a lot better value then when it was bouncing around $13/mcf. I don’t know I would call it artificially low. Domestic NG producers are essentially held hostage by the pipelines. Don’t like what the NG buyers are willing to pay then you’re free to shut your wells in. That’s what crippled Chesapeake and destroyed Devon. As soon as demand dropped the producers had to compete against each other for whatever market share they could get. Logic might say an operator should cut their production back especially when they are selling their NG for less than it cost them to develop. But few operators can survive such low cash flows.

It will last as long as supply exceeds demand to a significant level. I can’t put it in numerical terms but the demand/supply relationship swings on a rather small margin. Shale gas wells completed 2 or more years ago have declined significantly. But even at the lower rates there were a lot drilled so we’re not seeing a cliff in production. Also the Independence Hub came on line a couple of years ago and suddenly there was about 1 bcf/day added to the market from DW GOM wells. Those fields will show a significant cliff when they deplete. On average they last 4 to 6 years so we’re still a good bit away from that day. LNG imports still look like a minor factor given the infrastructure limits.

I don’t seriously ever offer a prediction for NG prices. In our current economic analysis we do as we’ve always done: use the current NG price and keep it relatively flat. I expect NG prices to be controlled by demand for the next several years. If the economy shocks everyone a grows real fast so will NG prices. But I wouldn’t bet lunch on that happening.

Hi Rockman,

What concerns me is how the pipeline cost translates to consumer prices for heat and electricity. If the price went from say $4 to $8 (which it often reached in 2006-8) then the local utilities would have to raise prices significantly (after allowing for some futures lock-in to unwind).

Perhaps our experience here in WI is not typical, but an average household budget in this area is very sensitive to NG prices because we use AC in summer (increasingly from gas fired power plants) and heat with NG in the winter. We have 2 or 3 months of AC time and 4 to 6 months of heating time. Today, a family home around here can easily have combined elec/NG bills of $300 a month during the heavier use months. An increase of say $200 would be a real strain and could well make the current economic woes even worse.

If I understand your thoughts - there is no immediate and obvious reason that there will be a dramatic change in prices for a few years. Unless, of course, any one of a hundred unforeseen factors changes the situation over night.

dave -- yep...gonna bite your folks in the butt when it swings the other way. In that sense the consumers and trapped by the pipeline situation also. When supplies get tight they can't go shopping for the cheapest NG out there...need the pipeline connection. And the utilities are somewhat insulated from the situation since they just pass thru the increased costs.

ROCKMAN,

Have you reviewed pipeline volumes in the Barnett Shale? I'm curious if overall decline is visible from the pipeline traffic or if volume is maintained by continuous drilling? Also - do you have an opinion on the economic viability of Re-Fracing Barnett wells?

Thanks

I am no geologist(applause) but it seems like there are large areas with thick beds of shale over much of the US, so the potential should be huge.

Are you saying the payback per well is too low(too much chemicals, too many dry holes)?

We can always drill more wells.

Maybe at $2 or $4 per therm we have 600 Tcf of shale gas(or more)?

The US has an abundance of relatively cheap energy by global standards.

If shale gas becomes more important will it drive up the price of gas in the next decade, can you predict likely prices base on present usage(loaded question)?

Unfortunately, shale gas carries a terrible cost - complete ruination of water resources by contamination of chemicals (used in fracking pumping) and gas entering into the water table. There is beginning to be ample evidence of the destruction of local water supplies in Colorado, Wyoming, Texas, Nebraska, Pennsylvania & other states due to fracking. And the special energy commission of the Bush years excepted this technology Safe Drinking Water Act in 2005. The technology is also exempt from the Clean Air Act and the Clean Water Act .... so no oversight, however minimal.

At a minimum, watch the trailer for Josh Fox' Gasland, the Winner of Special Jury Prize - Best US Documentary Feature - Sundance 2010. Screening at Cannes 2010.

http://www.youtube.com/watch?v=dZe1AeH0Qz8

Josh's full story on NPR's Science Friday: http://www.npr.org/templates/story/story.php?storyId=127932770

Also see:

http://www.npr.org/templates/story/story.php?storyId=128653935

http://www.scientificamerican.com/article.cfm?id=shale-gas-and-hydraulic...

Agree on water table damage as shown in numerous states in the movie Gasland, which is showing on HBO. Everyone chyming in on this issue should see it. The problem with long term damage to fresh water sources as a way of making short term profit, only makes sense to those not living on that land. A case of greed by disassociation.

The idea of exempting fracking chemicals, (some of which are listed in Fox's movie), from the clean water act, is beyond outrageous! It's irresponsible, reckless and devoid of common sense. It rejects the value of 'The People', replacing it with the importance of the corporation and energy at any cost. I suppose that was the rationale of Bush/Cheney when they authorized that exemption.

However, I noticed that the water source for 13.5 million people in upstate NY down through Philly was temporarily protected from fracking. I suppose when there are enough people's water at stake the politics changes to protecting 'The People'. How very unfortunate for those in various states apparently with zero political representation.

*Sigh*

Frac fluid is not contaminating water sources because of the process of frac'ing a well. If that were the case you would see drilling mud contamination equally and I have yet to hear that complaint. The only argument that makes sense to me is that the sources of contamination are coming from old, decrepit water disposal wells owned by mom and pops that aren't checking the quality of their casing anymore and leaks have developed in them or for some reason the drill sites are spilling frac fluid indescriminately against all known federal and state laws (though I've yet to see any proof to that).

So no, frac'ing does not impose a terrible cost, bad disposal companies do (assuming accusations of contamination are true).

*Sigh* It matters not a twit whether the contamination comes from the fracing or from the disposal of the fracing wastes by improper manners. Since fracing has been exempted from the Clean Water Act how do we as citizens know that water is not being contaminated.

I would presume since NG is a gas and drilling mud is a heavy liquid that how they move subsurface is somewhat different. So your argument doesn't make sense to me.

The whole process from start to disposal of wastes needs to be monitored. If you have only a well to provide your family with water, it is a precious thing. The people with those wells have a right to have the fracing companies comply with the Clean Water Act.

I don't believe frac fluid itself is a big problem either. I do believe fracking with the currently allowed down hole spacings will usually destroy an aquifer by disruption of underground formations. If there is a lot of gas in the ground and fracking is necessary the aquifer will usually be destroyed. I am not a geologist, but the number of destroyed water wells already within the very limited time that the current legal down hole spacings and current fracking techniques have been used indicates to me that it is just a matter of time before many many more effects come to light.

I am a landowner in Colorado. I actually own some mineral rights. I would like to be rich too, and oil and gas is a huge part of the economy here. But what used to be a beautiful place is now a sacrifice zone even if only considering the surface impacts. People tend to accept it, but I wonder, what do you think the aquifer is worth?

I guess the bottom line is, do you think the people with destroyed water wells now and in the future care if it "makes sense to you"? I don't think it's about little spills or bad casings or ppm either. I think the underground physical destruction is disruptive of historical aquifers. My spring has a little natural gas in it, naturally. how many millions of years did it take to get to be what it is now? how much change in underground fissures would it take to ruin it? I'd say not much. The more that is learned the worse it will look.

I still am unconvinced that frac'ing at 5000 ft down shale destroys a 200ft down aquifer, which seems to be everyone's argument. Until someone shows me an example where the fac zone is anywhere near the aquifer in depth, I think its all a bunch of hooey from that regard.

However, I don't deny there could be other sources of frac fluid pollution, but nobody appears interested in that.

And I have no idea how frac fluid is exempt from the clean water act. You can't exactly dump frac fluid into a nearby stream.

Then watch Gasland and explain it away. One of the things that seems to be happening, is the fracking process is pushing NG into the drinking water. How else do you explain water coming out of faucets igniting? How else do you explain someone putting a cone on the ground and lighting the air coming out of the top of it? How else do you explain bubbles coming up in a nearby river and all the dead animals along and in that river? You can't just dismiss it like it doesn't exist. These people have had their water ruined. Maybe you want to drink their water and give us your medical status in one year.

Several key points, here in the Barnett the shale that is frac'd is BELOW the aquifer and the zone has a impermeable cap so any frac fluids in the water are from bad casing jobs or dumping or inadequate disposal wells. Oil companies can be held to be responsible for the first but not the other two as those are private contractors who haul off the fluids (such as salt water) and are licensed and controlled by the States. In Texas the state is also monitoring the frac jobs. Bad casing would leak mud and you don't want to be losing mud at what it costs per bbl.

A properly completed shale gas well will flow back the fluids and then when they are all back maybe a little bit of saltwater. I'd really like to see what the "contamination" is and compare that to the components and concentrations of frac fluids and to those things found in the natural environment where the problems are occuring..Contaminants like sulfur, metals and lime can be from nature, other organic chemical contaminants can be from old garbage dumps, service stations, abandoned farm tanks, old service stations,and others so you have to do the analysis of the contaminants AND the local environment.

FYI- Frac fluids can range from mild to really really nasty and can include polyacrylamide. Biocides, surfactants and scale inhibitors can also be in the fluid. Friction reducers speed the mixture. Biocides such as bromine prevent organisms from clogging the fissures and sliming things up downhole. Surfactants keep the sand suspended. Methanol and naphthalene can be used for biocides. Hydrochloric acid and ethylene glycol may be utilized as scale inhibitors. Butanol and ethylene glycol monobutyl ether (2-BE) are used in surfactants.

I live in the heart of the Barnett shale and we've seen no groundwater or surface water issues here in the around 7-10 yrs they have been actively drilling. The worry now seems to be about air pollution from the "leaky" wells which are supposedly putting benzene in the air.

Pray tell, how do they dispose of the processed water, the portion they can recuperate after having pumped it underground under high pressure?

I seem to remember seeing the use of fountains and sprayers to hasten the evaporation of water, before they can collect the remaining sludge.

Of course, very interesting volatile substances are mixed in with the water, such as toluenes and benzenes, some of which are known to be highly toxic. They vaporize even better than water.

Apparently, some operators don't even bother with letting the poisonous liquid settle in open air, plastic lined pits. Just let it go with the flow.

A man and his family have been using a well for forty years. A company starts drilling, a hundred yards from his home. Days later, dark mud smelling of hydrocarbons comes out of his faucet. The man demands an explanation, and the company replies that he better prove they poisoned his well...

To all of you guys denying the water and health hazards, are you being payed by somebody?

lukit - I'm not being paid by anyone. In fact it would benefit my company greatly if there was never another shale gas well frac'd. We drill for conventional oil/NG in the Gulf Coast. Our business plan is simple: spend around $300 million drilling and then when the market peaks again in a few years sell out and go to the house permanently. Anything such as a frac'ing or Deep Water drilling moratorium benefits me financially.

Having said that I see little danger to your water resources from the shale gas drilling. I’ll skip the tech explanation. You either take my words as they are or not. But you are correct to be very concerned about your water resources. But not directly from the drilling/frac’ing. It the disposal of any frac fluids recovered as well as any salt water produced with the NG. I’ve seen a number of aquifers contaminated in Texas over the last 30 years. And the source was always been improper disposal. You need to keep a watching eye on those tanks trucks rolling down the road… especially at night. It costs money to send waste to a disposal well. The companies hauling the waste fluids are typically not the drilling companies. They pay the disposal folks to get rid of their problem. Many operators could care less how these companies do it. Once the title of the fluid changes hands they don’t consider it their problem. And operators pay a lot of money for disposal. But the haulers can make a much bigger margin by making a “midnight haul”. That’s what we call illegal dumping at night when there’s no one to see you.

But also remember that frac waste aren’t the only danger. There are millions of gallons disposed of from many other industries. And this has been going on for decades. Protect your aquifers. We protect ours with a passion in Texas. But be sure you know who the enemy is and not waste efforts fighting an imaginary evil. There’s enough evil rolling down your highways every night for you to focus on IMHO.

Rockman, Thank you for a straight answer.

The problem with fracking is this : even if we have perfect control over how far the fractures, and where the fracking liquid go, gas exploration is exempt from EPA and water protection agency rules. Nobody even has to ask whether there is a working water well near the workings. So they don't. People and animals get sick, and faucets explode.

Please see 'Gasland', the documentary. Mostly, it's just plain americans, testifying. Testifying to what happened to their wells, their animals and themselves.

lukit -- You’re welcome. But let me point out the obvious. Why do you care what the EPA rules are? We could care less in Texas. I honestly couldn't tell anything about the fed rules because they are not relevant in Texas. Texas makes the rules. And they not only make the rules but enforce them with a vengeance. Doesn't make sense, does it? We're obviously very pro oil industry here so why hammer ground water polluters so hard (and trust me, we really do). It’s very simple: we drink that water. In my career I’ve help bust two illegal dumpers. One tried to run me off the road…and that got him a couple of .45 slugs in his rear tire. We really don’t put up with that crap down here. A lot of the folks in Texas, including many in the oil patch, drink from private wells. Our children drink from those wells. My 10 yo daughter drinks well water every day and there are oil/NG wells within a couple of miles from that well.

So why isn’t your state making and enforcing rules to protect your drinking water? You don’t need any thing from the feds to do that. I think the big problem you’ve had was state govt’s not prepared to deal with this new activity. All your governors had to do was send some folks to Austin for a few weeks to study our regs and go back home and pass the same for your state. It really isn’t that hard to do and could actually add some revenue to the state budgets from the permit fees/fines. I think we've found a happy compromise in Texas. The economy gets a huge boost from the oil industry. Operators would still pollute like the bad old days if the laws weren't inplace. That's just the nature of all businesses. But if you have good laws and enforce them with a heavy hand then the companies will comply.

Rockman, I know your position on Gasland type incidents must have occurred due to illegl dumping, but after watching the documentary I was not convinced. Those people have no knowledge of how the business is conducted, and in none of those cases was there any alleged illegal dumping. With all due respect, you sound like you're defending the business from the standpoint of being someone involved in the business, with little regard for the people who have had their water source 'permanently' ruined. They are simple observers - they had clean water, then a big operation occurred usually on a closely adjacent property, then they started getting sick and discovered weird anomolies, like faucet water that ignites, or farm animals dying, or family members getting sick. They're not stupid. They know if they are getting sick and the sequence of events that took place leading up to getting sick.

In one case the drilling company installed a reverse osmosis set of filtering equipment in a shed they installed for one guy, yet it didn't help because one of the fracking chemicals goes right through the filters that were being used. See what he has to say about the business of fracking in the movie.

Have you actually watched Gasland? If not, please do and then get back on here and comment. I'm sure those people getting sick that have no representation would love to know their problems can be easily solved technically, or by way of a good psychiatrist.

OK Earl...I'll look at it. I tend to avoid what I think will be biased reports whether they or pro or anti oil. But I'm heading to a well site in a few minutes and it will have to keep until tonight/tomorrow.

A man and his family have been using a well for forty years. A company starts drilling, a hundred yards from his home. Days later, dark mud smelling of hydrocarbons comes out of his faucet. The man demands an explanation, and the company replies that he better prove they poisoned his well...

How doe this sound -

"A man and his family have been using a well for forty years. For all of the 40, a dark mud smelling of hydrocarbons has been coming out of his faucet. A company starts drilling, a hundred yards from his home. Days later, the man decides he can get a new well. The man demands of the rich out of town company an explanation, and the company replies that he better prove they poisoned his well..."

Before you get angry realize both situations happen in this world. Bad journalism happens too - pays the bills as well as good journalism & makes better use of sensational images, which are entertaining.

Do you remember the 60 minutes story about the Suzuki Sidekicks that cartwheeled and exploded if turn too sharply? Played on the public's fears, outrage and sense that corporations must be held accountable. It was a good story, I saw it - only problem was that 60 Minutes had rigged the Sidekick to explode with a flare.

Cause & effect is a tricky subject. Asthma has greatly increased in the last 40 years. So also has the use of Dental Floss. Coincidence? A good documentary could convince many that eg a chemical in the floss is responsible.

That said, I see no reason why there cannot be full disclosure about what toxics are being pumped into the ground, no reason that each drilling company should not be required to spectroscopically or isotopically label their drilling fluids - inexpensive & would naturally lead to some self policing by the industry ie insurance industry of the drillers, drillers of the disposal people - no one wants their name attached to a contamination problem - seems only prudent.

it sounds like the man and his family have been drinking a lot of water contaminated with dark mud smelling of hydrocarbons.

Realistic for me as I grew up with bad water - not unhealthy, but nasty w. iron,sulfer,manganese. That's why I have a water softener, sulfer filter and a 50 gpd rev osmosis filter. Everything works great & is cheap to operate. Very reliable too. Most people around here who use shallow wells lack the money & knowledge to install a system like mine though. Drilled wells are normally excellent water here, but no guarantees. Also, drilled wells are expensive to install, expensive to run if very deep, & aren't the best choice if you live where the power often cuts out. I'll take a shallow well anytime.

Okay. There are two possibilities:

1) You've got natural contamination. If you've got gas, you've got gas. The natural gas in the underground formations the water runs through gets into the water and contaminates it with methane.

2) They didn't properly case the wells, and natural gas is leaking up the wellbores from deeper gas formations into the shallower water formations.

In either case the solution is simple. Vent the methane from the wells into the atmosphere so you don't get explosive concentrations, and put filters on your water taps so the water doesn't taste funny.

Methane is not toxic, and in fact human beings emit methane, particularly after eating a lot of beans for dinner. The solution in the case of either water or beans is simple - vent the gas in a safe manner which doesn't cause complaints from your fellow occupants.

Frac fluids are not likely to get into the water supply because they're typically fracing formations a mile or so underground, separated by impermeable rock from the much shallower water formations, and they watch carefully to see what happens to it.

I'm mentioning this because you guys are going have a number of options to choose from in the future, one of which is freezing in the dark, and I just don't want it to come as a complete surprise to you when it happens.

Personally, I have only a theoretical interest in shale gas, and I have a lot more options as regards water supply, home heating, and electricity supply than you guys do, so it doesn't affect me one way or the other.

Oh I know people who will be nice and cozy next winter, comfortably dying of cancer while their faucets explode.

No worries at all. Everything will be just fine.

Man, if they just got to work on the Hudson aquifer, we could seriously prune the population of New York! What a boon that would be...

I've got a degree in chemistry and 35 years experience in the oil industry. I've seen the Hudson River, I've seen New York Harbor, and I've seen the oil refineries and petrochemical plants around them. Trust me, methane contamination in the water is the least of your problems.

Great post lukitas. Yeah, if 13.5 million people might be affected by fracking for NG in shale, then, and only then, when it might affect so many well represented people, is there a concerted effort to halt fracking. I say, if the nimrods running this country are so dingdang sure that fracking shale has absolutely zero possibility of infecting the water source for all those good people, then frack away with billions of cubic meters of a concoction of toxic chemicals and then when people get sick and sue, then act like it must be all in their minds, because fracking couldn't ever cause those kind of problems. In fact, while I'm ranting here, let's toss those malcontents in with the people that actually think that AGW is a real problem. We can call it a mass hoax slash mental breakdown of the masses.

Look, the reason many people here are highly skeptical of the documentary, "Gasland", is that many of us have worked in the oil and industry, we come from areas where companies have been frac'ing shale formations for 60 years, and we know what can and can't go wrong.

The presentation in "Gasland" is highly dubious - the things they claim are happening just don't happen in the real world. The problems people are having must come from different origins other than mile-deep hydraulic fracturing operations. The producers have just ignored the experts and concentrated on normal, everyday people whose most important asset is their lack of knowledge. It makes for good TV, but like most TV, it doesn't reflect reality.

This may be a huge issue in some parts of the US, but that's because these kind of operations haven't happened there before, and their journalists and reporters don't have a clue what is going on. If these had been major oil and gas producing areas in the past, it would just be business as usual.

In the US, probably 90% of gas wells have been frac'ed to improve production. Worldwide, over 1 million wells have been frac'ed, so it's nothing new in conventional oil and gas producing areas. It's just new in some areas where the only gas to be found is non-conventional shale gas.

شات الود

منتديات الود

منتديات

شات

منتدي

شات كتابي

شات كتابي الود

شات سعودي

شات الود الكتابي

دردشة الود

الود

دردشة

saying that suddenly you can light your water on fire is not proof that frac'ing is effecting your aquifer. Correlation is not causation and from a geological standpoint, it doesn't make sense. Like I've said before, frac'ing at 5000ft depth does not effect 200ft depth aquifers. Its impossible. Give me a geologist that can explain how that can happen and maybe I'll buy the possibility. Until then, it doesn't make sense. People need to stop jumping to conclusions.

Prairie, could not agree more. (Some) people must be absolutely brain dead, more likely greedy,

to intentionally poison any fresh water. As the bastivtches that are making the $ are certainly not living in

the immediate area, drinking/using the polluted water.

Didn't folks get hanged in the past for such an act?

Denial by the masses about all the ramifications of our wasteful/selfish lifestyles is exactly what

makes me doomerish.

How do we awaken the masses?

Perhaps when the die off starts?

Hope "we" smarten up real soon.

thanks art berman. i staked out the position that the haynesville is overstated by a factor of 10 several months ago. my approach was different than what you apparently used.

here is my basis. 1)public traded companies are beating their chests about 6 - 7 bcf/well, which may be a good average for the sweet spots, but much less for the average. 2) these same public traded companies are almost universally claiming that they can drill 8 wells per section with the same results as what they are projecting for 1 or 2 wells per section.

they dont call these tcf's "reserves" but sometimes use the term "resources" or in the case of chesapeake "unrisked reserves". the public and a large part of the analysts dont seem to get the joke !

the last time i looked at historical production for the haynesville in la, there was a serious shortage of history. i plan to take another look when june, 2010 production data is in.

i have also noticed and ranted about the misunderstanding of pgc's report here on tod.

I've come to the same conclusion about the "100-year supply" as Mr. Berman. That's because (as he suggested) I read the fine print. AND you also have to assume no growth whatsoever in usage.

If all the resource was there and economically recoverable and there is growth in the consumption rate (as is being promoted almost everywhere you look with the "wake up moment" commercials), you get an even shorter time to resource exhaustion.

Yeah, it feels a lot like a bubble.

Have come to a different conclusion. The Shale gas people, CHK, DVN, ECA, RRC etc., say the gas volumes are for real, and their presentions and documentation seem to bear that out. T. Boone says there is 4000 trillion cubic feet of recoverable gas, and he is very knowlegable when it come to natual gas. I think it's there, and it's a game changer, that will be good for the U.S. and the rest of the world.

As far as fracking is concerned, it's been done for years with no evidence of water contamination. However, I will defer to Rockman on that obsevation.

I have to say I love this site and read it regularly, but sometimes,I get the sense that people are rooting for the collapse. An abundant supply of ng would defer or mitigate the effects of peak oil which I think is a good thing.

Absence of evidence is not the same as evidence of absence.

Please take the trouble of looking at Gasland.

There actually is evidence of health and water table hazards.

Some might even be concerned enough to ring the bells in alarm.

I became active on the Pickens Plan site several years ago partly because of knowing Boone since 1945. We played basketball and other activities in Amarillo Texas and I became a small invester in Mesa Petroleum I have added this current TOD link to a PP string that suggests that natural gas resources have been exaggerated. The Pickens Plan discussion board is not too active. If any TOD postors are Pickens Plan members or desire to become so consider joining the discussion. You might even get Boone's attention.

http://push.pickensplan.com/forum/topics/are-us-natural-gas-resources

Pickens is a notorious crook and liar. I wouldn't have anything to do with him personally or his site.

Flawed plan or not he has done as much or more than anyone to publicize problems associated with peak oil.

And a very quick back of the envelope calculation on that number says that there are only about 214 billion tons of CO2 from that use to be dumped into the open sewer that is our atmosphere.

But as a "game changer," it runs into a rather solid resource wall very, very quickly. It's a lot of gas (and a "long-term supply" IF you don't really increase the usage above present rates), but if you do anything to substantially increase it's use (which is what Picken's wants to do) the dynamic of substantially increasing quickly shrinks the length of time you have to use gas as a bridge to some other technology (and you have done nothing to decrease the total energy flow that the society uses).

We know the absolute maximum volume of this resource (and other fossil fuel resources) AND that it is very unlikely to be anywhere near this number (just out of pure physics and curvature of spacetime which we call "gravity").

It not the rate of consumption that is of concern, nor the rate of growth of rate of consumption. It's the size of that value when you reach the sudden stop at the end and whether you saw it coming and took steps to stop on your own rather than BE STOPPED by resource constraints.

Art,

Thank you for your insights and congratulations on "slipping into the mainstream, in a weird way". More time and data will support or refute your case. Please keep publishing updates as more data becomes available.

Regarding "too cheap to meter"

I heard an assertion that this referred to fusion energy, not fission. But more interesting is this article on the topic, which points out that 'flat rate' plans are available for many services, and when the fuel component of electricity is small, unmetered service makes sense.

I am quite new to this kind of subject, what is the explanantion for the 450 Tcf of technically recoverable resource to be divided by 3 ?

i think berman means 150 tcf (1/3) from shale gas and 300 tcf (2/3) from other conventional and not so conventional gas sources such as coal seam* methane.

* i don't use the term coal "bed" methane because i think coal would make a lousy bed, probably a lousy seam too !

Art - thanks for your input!

Can you comment on the viability of Re-Fracing these shale wells and whether they actually return to original IP levels of production when re-stimulated? Early in the Barnett Shale "period" this ability to re-frac was touted quite a bit.