This Week in Petroleum (TWIP) - August 18

Posted by Heading Out on August 21, 2010 - 10:35am

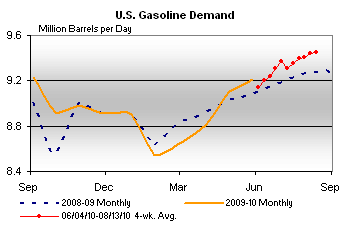

As the advertisements on television and the newspapers will tell you, summer is coming to an end, and school sessions are about to restart. Which means that we are coming to the end of the summer driving period and, as a result, demand will, likely in a couple of weeks, start to decline. As the latest TWIP (This Week in Petroleum) notes, we aren’t quite there yet, and demand is running some 250,000 bd above last year for gasoline, but we are close to the turnover.

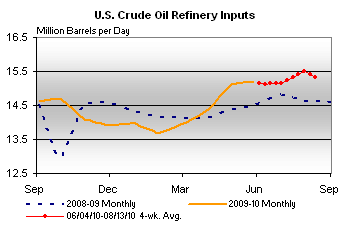

The oil companies can see the event coming, however since it occurs every year, and so the refineries are lowering demand for the season.

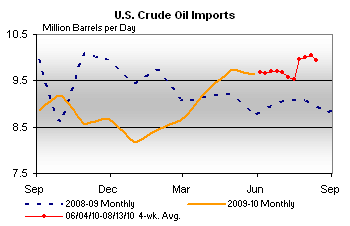

Which, given that domestic production continues relatively constant (but up around 200,000 bd over last year, at 5.4 mbd) means that there is a slight decline in imports. Though it should be noted that these are still running about 0.75 mbd above last year.

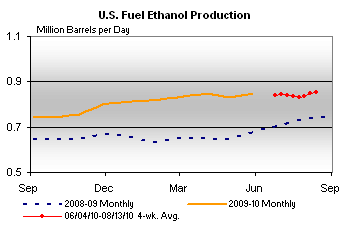

At the same time ethanol (which I haven’t tracked before so am less sure of the seasonal trends) continues at about 0.85 mbd.

As the driving season ends, so the US moves into the time when oil, particularly in the NorthEast is used for heating. TWIP this week is looking at the changes that may happen in that region as the various State legislatures look at reducing sulfur content of the heating oil to bring it into line with the regulations governing highway diesel, which are a lot more restrictive on sulfur content. (Note that it is the sulfur content of oil that gives it the “sour” designation, and the world is moving away from easy, cheap supplies of the preferable “sweet” crude which has a low sulfur content.) . As the TWIP notes:

Initially, the change to ULSD for heating oil may limit import supply sources, as many parts of the world do not produce ultra low sulfur distillate fuels. During the winter (December through February), high sulfur distillate imports into the East Coast account for about 20 percent of this region’s total heating oil demand on average, and about 50 percent of distillate imports. Furthermore, during past cold snaps when supplies run short, high sulfur imports have provided most of the relief to the increased heating oil demand.

The transition will present other challenges. Some refineries supplying the Northeast with heating oil will need to make investments to produce ultra low sulfur distillate fuel for this market. Terminal transitions to low sulfur heating oil will need to be made, as well as changes to supplies of low sulfur additives or blending components to create winter-blend heating oil.

Given that the world's supply is increasingly sour, this will only make the problem worse, and will further mandate changes in refineries to cope with the change in demand, without which a bottleneck may develop within the system of supply.

who is kristensponsler ? some of us would like to know who is spoon feeding us, ya know.

A quick google: http://www.energybulletin.net/editors

Kristin does a little tech support for us. If she does work on a post, she leaves her name on it. I am supposed to change it, but forgot today.

These are some other graphs from this week's TWIP that are of interest:

Crude oil stocks continue at high levels.

Distillate stocks (diesel and home heating oil) are at very high levels--perhaps coming down at bit this past week.

Distillate demand seem not to be dropping like before. The weekly data should connect up with the monthly data. The fact that it does not suggests that the export data is not well estimated in the weekly data. My guess is that when the monthly numbers are reported, they will be lower than the numbers shown as weekly, and will line up with the prior amounts.

Distillate production is headed down. With as much inventory as there is, that is not surprising.

Year to date, crude imports are about the same as last. That recent blip up in the charts is the result of oil stored in offshore tankers coming ashore, which happened after futures price differentials made it unprofitable to continue to hold oil in tankers.

The evidence for this is circumstantial, as those holding tankers of oil aren't making public annoucements about how they dispose of their oil. If this is what actually happened, we should see oil imports in to the US tail off rather soon.

In general, I note that even some here are surprised as to how strong demand is for various oil products. As I've been saying, this increase in demand is real, and the US economy is not about to enter some kind of 'double dip' recession - at least not in 2010 with oil well under $100. The tendency towards 'business as usual' and vehicle travel in the US is very strong.

Ironically, oil traders betting on a weak economy have pushed the price of oil lower, thereby facilitating an increase in demand for diesel and gasoline by making it cheaper, and are actually helping improve the economy. Let's hope these traders don't wake up to the fact that demand is increasing, and the prospect for additional oil imports into the US in 2011 don't look very likely.

Whats interesting is I have a running argument with many friends claiming basically what your saying.

I also don't agree we will have a "double dip" as long as oil prices are low. Now thats not to say some of the insanity going on won't wear off aka expectations of a V shaped recovery gross attempt to manipulate the system stocks prices for perfection etc etc.

What I mean is the global indicators are in my opinion not really indicating a double dip simply recognition of the real state of the economy which is flat as a pancake overall with housing still above average trends in many parts of the country and needing to fall below normal to make up for the past bubble.

So what I'm saying is if stocks weaken a good bit say 20% and housing falls 20% and unemployment stays fairly stagnant or edges up a bit its not a double dip. Our GDP growth should have been hovering around zero anyway.

I argue that even if this occurs oil demand will probably not change a lot as these changes are not "real" simply finally accounting for the reality of our current economy. The act of admitting if you will to the real state of affairs does not change the real state and oil demand is firmly tied to whatever fundamentals really are.

The flip side is we will trundle along like this until one of two things happen oil prices skyrocket or the US finally borrows so much money interest rates are forced up and we head into insolvency.

The second case of interest rates finally rising could take a long time to reach critical mass so that end game could be years out.

This of course leaves us with oil ?

Well what is the real state of affairs for oil ? Unloading a few million extra barrels off tankers is not going to change things for long. Perhaps we got and influx of 30 million or less barrels however whats interesting is gasoline imports where also strong so tankers unloading oil is not the whole story. Someone is also dumping gasoline.

I bring up the gasoline because its interesting. BP big player in both the gasoline and oil markets.

Given both went up it makes me wonder of BP is doing the dumping to raise needed cash.

Other players skittish of another collapse are simply following the herd in this case.

Of course as you note cheap gasoline will probably drive up demand heading into the end of the summer so most of this excess will simply get burned.

Then as usual we just have to see what happens next. I'd really like to see prices head towards 60. If the oil market is done which it seems to be from the technicals then oil prices should continue to fall below 70 and on to 60 and perhaps lower and have a hell of a time recovering.

Or this is yet one more head fake brought on by a big player making moves for other reasons aka BP.

I hadn't thought about BP being a big player in the gasoline and oil markets. I suppose if it is selling, it could be making oil more available than it otherwise would be, for a while.

Don't really have an argument with what your saying, but as I noted before, the direction of the price of oil doesn't always tell the true story about supply/demand. Prices may drop just because of speculation, usually in regards to the side effects of the speculation on the value of the dollar. Generally I don't think the price of oil can go in the 'wrong' direction more than about three months.

So if the price of oil drops from here and stays down, I would conclude that the world economy is getting weaker, because supply levels are fairly stable right now.

I just find it curious that the many analysts quoted from the media here are bearish about demand yet almost never mention supply. It's my conclusion that oil producers aren't going to step it up much, if at all, from current output levels - even if they have some spare capacity. The negative price analysts seem rather certain that extra supply is just around the corner. However my view is that new supplies are very limited, so even a very small increase in demand from here should have a positive effect on prices.

Thats the fascinating part really.

First and foremost if I'm right about how complex systems collapse the act like and egg under uniform pressure.

They can shrink some at first relieving the pressure for a short time then it builds relentlessly until the system shatters.

The real problem is chaos theory is about dynamics not potential energy potentials are "classical" while real chaotic/complex systems can I think transmute kinetic/potential energy. Now I'm using the physics terms but what I mean sometimes forces are literally transmuted from a sort of motion to a structural form. As a sort of example using economics house prices where in a free fall but the US Government gave the GSE and open checkbook and direct stimulus. What this did was transform the housing market kinetics into a long term debt or "potential" force.

Thus basically the rules where changed.

Now to oil.

Same thing we had a major price spike and then the "rules" changed. The intervention in housing is in the open however what about oil ? This sort of "transmutation" event is not small and in general is desperate often with consequences in the medium and short term. Indeed back to housing the massive intervention is already failing.

This transmutation events are what allows a complex system to "shrink" if you will where a physical egg does not have access to this magical dimension possible with more complex systems that allow transmutation events.

You can also see that they are BIG events not small and fundamentally alter the system for a short term gain.

In economics they are often identified with moral hazards or more correctly the result of a cascade of ever larger moral hazards on after another.

So again back to oil given the above obviously some sort of massive intervention happened if I'm right and next it won't last "long" how long long is an open question. And next as it fails the system is under far more stress than it was before the intervention and is much closer to the cracking point.

For oil the cracking point is not high prices but outright shortages. One thing that did not happen regardless of how high prices rose was shortages in any of the major economies. They paid a price for oil but it was accessible.

Next of course the price spike itself was brief and hand little impact on real oil shipments.

Afterwards a series of interesting events have occurred.

Regardless this transmutation event whatever its real nature either simply the public financial collapse and follow on recession and demand drop or something else or more has simply served to shrink the egg.

But that puts you at the end game event if you will which for oil is shortages. Price probably will be a lagging indicator.

Now things get really really interesting. The price of oil has been amazingly stable for the most part trading within the 70-80 band that OPEC now claims to support even as demand has varied. This narrow price band is interesting because I simply don't believe its achievable via management of supply alone its literally to narrow and the supply lines to long to allow pure supply side moves to meet demand over a narrow price range.

The means drumroll financial moves are required to keep the price band in place to cover variability in supply.

That does not mean the supply is not there just means in my opinion at a minimum a mix of supply and market moves are required to get the narrow band.

Indeed the recent price history is practically a perfect match for classic price fixing.

All well and good but my crazy theory suggests that this will fail with shortages and indeed attempts to fix prices of goods that are in short supply almost always end in shortages. Price controls thus always fail.

Eventually :)

Of course this is all circular and it comes back to the central factor that oil supplies are not adequate and have not been for some time. How this is handled has varied over time but the central tenet is regardless of price oil supplies have been under tremendous stress except for short periods of time when the great shrink or transmutation event is in progress. No point before or after has resulted in any sort of stability regardless of price.

And last but not least this implies that the true situation today is dramatically different from whats public knowledge. I.e the entire oil supply situation is not what it seems and not even close.

Now of course such a result requires a lead foil hat however there is another fundamental issue at play.

Everyone recognizes that eventually peak oil will result in the end of our oil based civilization.

Not the end of some economic system or country but at some point the basic underlying oil driven economy will fail.

Perhaps to be smoothly replaced with another perhaps not.

Next all the players that have been rewarded by the current economic system have strong motivation to keep the system going at all costs. In the end everyone of the top players is mutually dependent on the other players no one can quit. So sure one can come up with some crazy lead foil hat accusations the problem is the intrinsic nature of the oil economy open up the required situation for the players in the game to actually make crazy moves to keep the game going.

It does not mean anything I'm thinking is true simply that the combination of the way the "system" works and the nature of oil in my opinion leaves plenty of room for some real insanity as you hit the end game. The only real question seems to be is this the end game and if so where exactly are we at. If I'm right about how it ends then you will get little real information about the real state of affairs as the system becomes so hopelessly gamed that lies force more lies which force more and more data to be fabricated and injected into the system as fact.

Truth becomes effectively unknown and your left with a crushed egg and worse no way to know when it crushes.

But you also know that this is exactly what should happen right at the end the collapse is "unexpected" :)

Nice learn stuff everyday.

http://en.wikipedia.org/wiki/G._William_Miller

And yes if you understand where I'm coming from this little tidbit is important.

What really happened back this is critically important to whats happening now.

For oil the cracking point is not high prices but outright shortages. One thing that did not happen regardless of how high prices rose was shortages in any of the major economies. They paid a price for oil but it was accessible.

Next of course the price spike itself was brief and hand little impact on real oil shipments.

Yep, I said this before, the next big squeeze in supplies will see shortages and higher prices - but government assisted shortages when prices start rising too rapidly. People actually have an easier time accepting shortages than high prices - since high prices are always considered some sort of conspiracy or lack of political will. Well there is a conspiracy, but that's about how not to tell the truth about supplies.

You only need a basic high school degree to realize the EIA and IEA can no longer add. Their demand and supply projections are so far off that it borders on criminal intent. On a side note, I hope someone here at TOD can seriously challenge the EIA about where they get their figures and estimates from.

Thanks for your post and hopefully you will update on your views of the coming oil supply chaos as it develops. I agree that there will be an oil supply problem that will lead to an economic system failure, more simply said as a chaotic situation. However I am fairly sure that we will still enjoy new year's 2011 in relative peace. It's what comes after that I'm worried about.

As far as 2011 goes whats really interesting is things are a bit more complicated.

Back to my squeezed egg for a bit. The surface of the egg is not smooth but beats like a drum in a sense.

One reasons complex systems can undergo overall contraction is that their "potential" surface is fluid sometimes that can lead to overall shrinkage in general its also the mechanism for growth when the pressure is internal if you will not external. Often these fluxs result in a net canceling.

For example much vaunted globalization probably resulted in net job/wage loss globally. In regions where jobs increased numerically earing power or wages where much lower. Extremely deflationary for purchasing power of course since in the end wages determine what people can buy. This deflationary event was offset by concentration of wealth and expanding debt. Overall depsite the mad flux the system itself probably did not actually grow once you do all the net accounting its close to a big fat zero. Indeed changing dynamics of oil usage illustrate this with demand doing more shifting than growth.

Now on to 2011 what really intresting is it seems economic systems have intrinsic beats or rythyms or time scales.

And obvious underpinning reason is the steady march of the seasons and key regional holidays. The pulse of life if you will imposes a steady beat on economics. On top of this are fairly constant lead times to accomplish certain tasks building home, buildings, factories etc etc. All the way through fundamental economics you have fairly invariant timescales. This of course extends up into financial flows etc.

Now for 2011 do these intrinsic frequencies in our economic system allow a sort of weak 2011 to occur ?

I actually don't think they do in other words to many parts of the system are moving at certain rates to allow another year to go by effectively similar to the recent past.

From the European crisis to oil and food and esp new events like the flooding in Pakistan and Mexico's deteriorating situation I don't think the global system can pass another year without serious events coming to a head. I'll refrain from guessing which ones are the real issues I have my top picks but more importantly way way to many situations are set to devolve rapidly over timescales of months not years.

This quickening pace of events is itself a symptom of the overall strain on the system as the eggshell gets squeezed the natural frequencies tend to increase in frequency the beat picks up exactly as it does if the system is expanding rapidly aka China. In all cases you see things speed up steadily not slow down.

Indeed if you think about it the world spun from one of benign globalization in the late 1920's to global war over a pretty short period of time. It took about 3-4 years depending on how you do your history for the world to be firmly on the path of collapse and war.

I'd argue modern times things happen faster. But even with that if we take 2005 as a starting point even using historical norm the chances for our current autumn summer to extend through 2011 are slim.

Objects in the mirror are much closer than they appear if you will. Indeed the complacency itself plays a big role in why the real situation will erode even faster.

Even if I've misjudged things it does not matter the intrinsic theme right now is everything is a lot worse than it looks like it is on the surface. Real conditions have deteriorated far worse than it seems.

As and example unemployment benefits are running out for millions right now its not a huge issue nothing seems to have changed however under the covers whats probably really happening is a pressure cooker is rapidly reaching and explosive point. Historians will if I'm correct be able to look back and see this but we don't and thats whats important its our own blindness that eventually is the critical problem be it oil or whatever does not matter.

In general we have all deluded ourselves indeed even if I get the real course of events correct it will be nothing but a lucky guess amongst and almost inifinite number of bad outcomes.

But thats my point what really happened right now even though the situation appears calm is that and infinite number of "bad" outcomes have sprung into existence. Indeed the calm is effectively the result of so many ways to crash competing with each other. Think of a sea tossed by winds that vary so rapidly in direction that the surface appears smooth.

Using my frequency analogy the pitch has increased to the point that most can no longer hear and think there is no noise.

Another example is a singer capable of very high frequencies trying to break a glass at first you hear it but eventually it goes out of range and the glass remains unbroken and you don't hear the singer then suddenly it shatters.

And back to my egg scenario right before it breaks what happens is the waves get so small on the surface that its effectively rigid the corrugated cardboard effect. Thats what actually causes it to collapse as the system crinkles if you will on such a fine scale it becomes effectively rigid and shatters. I believe without proof that for our global economy this scale is weeks and months not years.

I can of course be wrong about where/when we are but I think eventually after the fact people will find that the global economy did go from basically functioning to collapse over a matter of weeks and months.

And last but not least lots of reasons exist for why this might not be the big one. Probably one of the biggest ones is paradoxically housing despite the fall in home prices they still have a long way to go before they reach any sort of bottom if Detroit is and example. If housing prices are important and are a controlling variable then I'm wrong and the collapse is still years away. Same for that matter Government debt etc. All of these variable are critical parts of our economic system and assuming they are the drivers we are years if not decades away from collapse. I just don't think they are the controlling variables because at the end of the day how much a house costs and how much the government spends are secondary variables despite their magnitude. But I'd like to add this in because they represent a class if you will of solutions driven by very large long frequency waves that take a very long time to form a tsunami. This collapse mode is different from my cardboard collapse instead its very much like a tsunami or monster wave instead of microwaves causing collapse your focus or lens to one huge one that explodes/implodes the system at a single critical point. Exactly the same as if it had been shot with a bullet.

This is of course the collapse mode most people think of but I think in real world complex systems its rare and the cardboard mode invariably wins. What people think are collapses like this aka WWII are actually post shattering events not the actual collapse which had already shattered under cardboard mode.

Think about safety glass thats shattered completely and then falls into small pieces the cardboard collapse was real and the grand explosion/implosion was simply how the pieces fell after they where broken.

Anyway perhaps enough about cardboard eggs :)

Not every bride is comfortable paying the price to live a princess wearing an elegant gown, that too, just once. They find it impractical, considering a fact that they’ll have just a day to flaunt the dress, they spent a fortune on! But that definitely doesn’t douse her fantasy of wearing a royal wedding dress as she walks down the aisle, while her beloved glances back at her, in just the way she wished. In that case, wholesale wedding dresses might just prove to be a savior and you won’t have to compromise on any bit of your dreams.

The best part of buying a wholesale wedding dress is that you may choose your dream dress without compromising on either the elegance, or the quality. Maybe, if you are lucky enough, you may end up buying a dress even more royal than you dreamt of at an even lesser price you had put aside to buy it! Wholesale wedding dresses come in a variety of designs and patterns. One may choose one that suites their taste. They come in a varied range of sizes too. It would always be advisable to get yourself measured by a professional before ordering a dress for yourself. This would save a lot of time that would be spent in altering the dress in case you happen to purchase the wrong size. One may also look out for a tailor, who would alter the dress in case anything went wrong, well in advance to avoid any delay later.

None need to bother themselves about the quality of the dress as it would only be similar or even better that the customized, designer dresses, in spite of the less price. There is also a wide range of variety enough to fit a theme wedding or simple wedding, whichever you dream of. Our collection covers a wide range of new and unexplored designs along with the traditional ones. We also cover a variety of hues (close to white) so as to satisfy the exact tastes to the bride. So, all the bride has to do is pick one and do it with an incomparable glow of happiness and satisfaction on her face.

We would be more than happy to be at your service while offering you the choice of picking one from the range of dresses that would definitely qualify as your dream dress and that too, in spite of your price constraints. wholesale wedding dresses wholesale wedding Apparel wholesale intimate apparel phiten x50 wholesale Formal Wedding Dresses Wholesale Strap Bridesmaid Dresses wholesale clothing and apparel