Shale Gas—Abundance or Mirage? Why The Marcellus Shale Will Disappoint Expectations

Posted by aeberman on October 28, 2010 - 10:20am

Shale gas plays in the United States are commercial failures and shareholders in public exploration and production (E&P) companies are the losers. This conclusion falls out of a detailed evaluation of shale-dominated company financial statements and individual well decline curve analyses. Operators have maintained the illusion of success through production and reserve growth subsidized by debt with a corresponding destruction of shareholder equity. Many believe that the high initial rates and cumulative production of shale plays prove their success. What they miss is that production decline rates are so high that, without continuous drilling, overall production would plummet. There is no doubt that the shale gas resource is very large. The concern is that much of it is non-commercial even at price levels that are considerably higher than they are today.

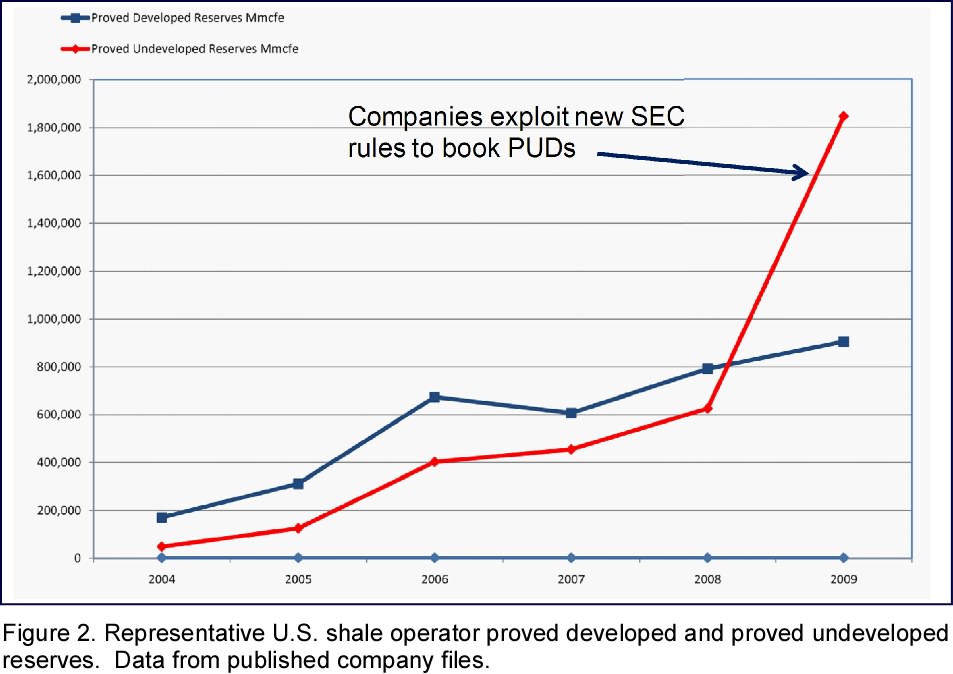

Recent revisions to SEC rules have allowed producers to book undeveloped reserves that questionably justify development costs based on their own projections in public filings. New reserves are being booked at the same time that billions of dollars in existing shale gas development costs are being written down because the projects are not commercial. Concerns about the logic of ongoing gas-directed drilling while prices collapse have been partly diffused by a shift to liquids-rich plays like the Eagle Ford Shale in Texas. These new ventures, however, produce significant volumes of gas which is partly why gas prices continue to fall.

Shale Company Cost, Debt and Undeveloped Reserves

Shale gas operators have consistently told investors that their projects are profitable at sub-$5/Mcf (thousand cubic feet) natural gas prices. Yet company 10-K SEC filings show that this is untrue. They have invented a new calculus of partial-cycle economics that excludes major capital draws for land costs, interest expense and overhead. They justify these disclosure practices because excluded costs are either sunk or fixed and, therefore, supposedly should not affect their decisions to drill. Their point-forward plans are made at shareholder expense since the dollars spent were very real at the time, and their costs cannot be charged to a profit center other than the wells that they drill and produce.

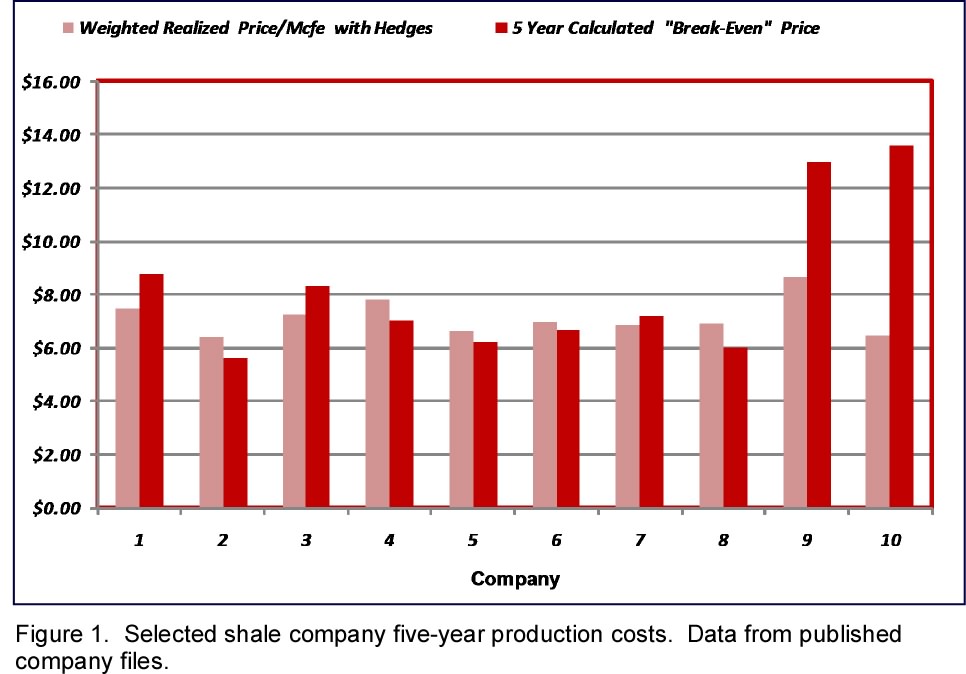

A multi-year evaluation of production costs for ten shale operators indicates a $7.00/Mcf average break-even cost for shale gas plays in the U.S. taking hedging into account (Figure 1). In other words, shale gas plays are not low-cost but comparable to conventional and other non-conventional projects. Despite claims to the contrary, the gas-price environment has been favorable over this period, in part because of hedging, and poor performance cannot be blamed on price. Over-production has changed this dynamic and hedging will not benefit operators in the second half of 2010 or in 2011, and possibly not for several years forward. This emerging trend will test the shale gas business model and show that it is unsustainable. The same ten companies that we evaluated have cumulative debt of more than $30 billion of which three have combined debt of more than $20 billion.

Some shale gas operators tripled their proved undeveloped (PUD) reserve bookings in 2009 because SEC revisions allowed them to do so (Figure 2).

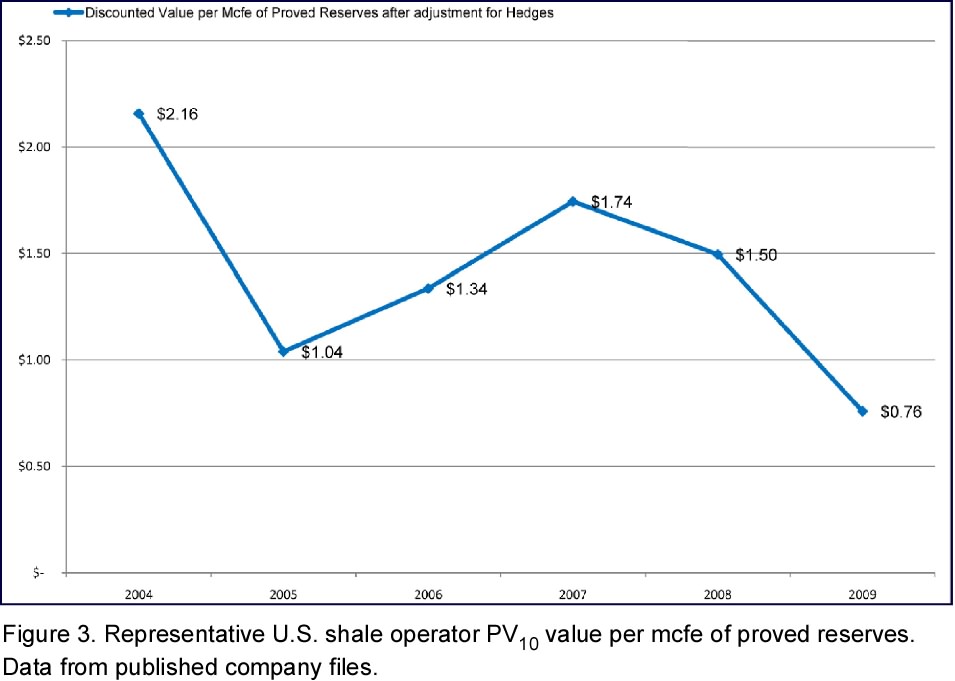

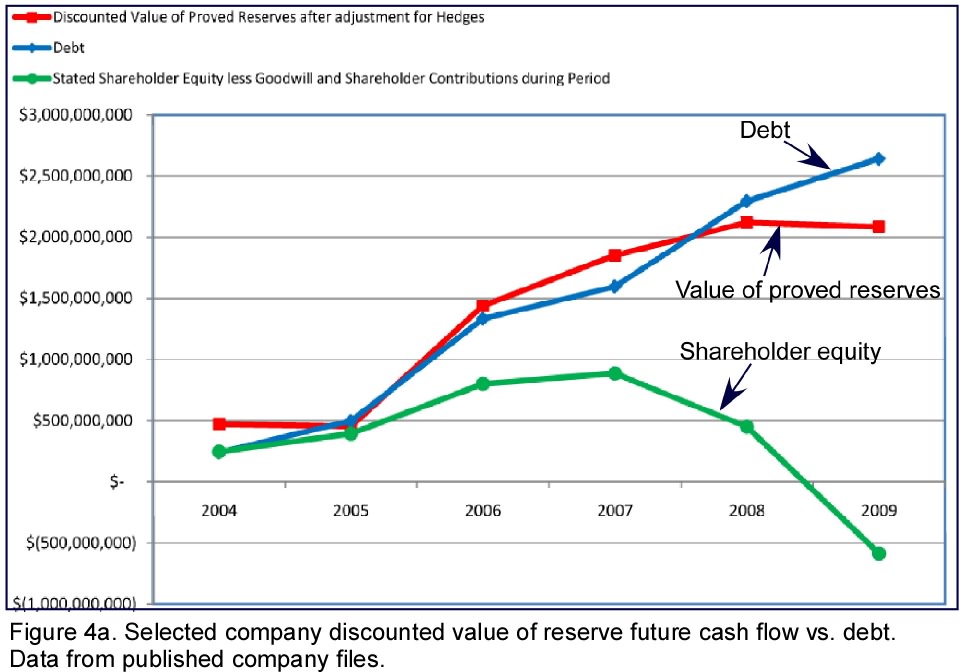

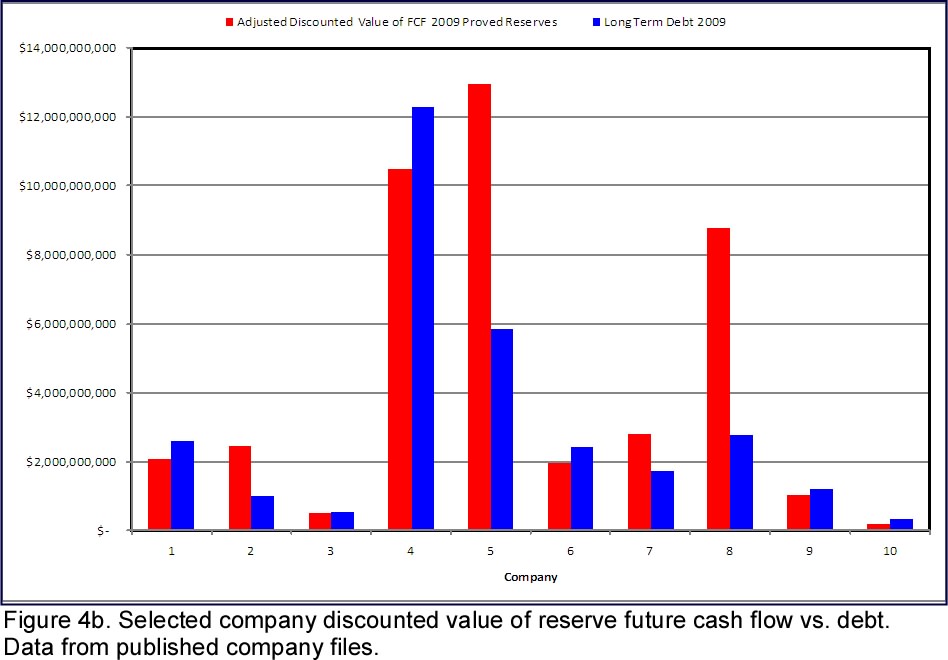

The stated value of these PUDs actually decreased over the same multi-year period (Figure 3) because of increased cost and debt. When the overall financial picture is considered, the pursuit of low-value shale gas assets has destroyed shareholder value (Figures 4a and 4b).

One Hundred Years of Natural Gas?

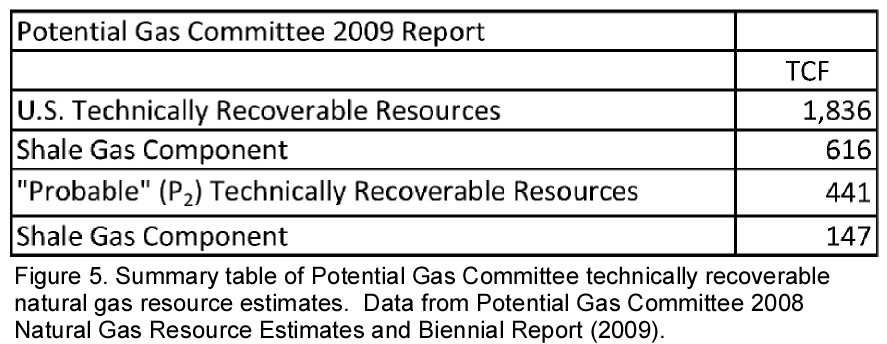

Many people now believe that the United States has an abundant natural gas supply that will last for 100 years. While it is true that the resource base is large and that approximately one-third is from shale gas, it is not 100 years of supply at current consumption levels. The Potential Gas Committee’s (PGC) June 2009 report estimated that the U.S. has 1,836 Tcf of technically recoverable gas resources. Technically recoverable resources are different than commercially viable reserves. Nonetheless, a more careful reading of the PGC report reveals that the probable estimate is 441 Tcf and the shale gas component is about 150 Tcf (Figure 5). That resource represents a lot of gas but, at 23 Tcf of annual consumption, it is about seven years of supply, assuming that this was the only gas available. Based on production to date, it is likely that the commercial component of this resource is between 50 and 75 Tcf assuming a $7.00/Mcf gas price.

The Failure of the Manufacturing Model

The marketing of the shale plays has relied on assumptions that the plays are both low cost, and that a manufacturing model ensures universally positive results that are repeatable and risk-free through engineering technology. We have shown that the commercial assumptions are questionable, and that the total resource is likely smaller than assumed. We will now address the technical issues about the manufacturing model and the reality of commercial reserves.

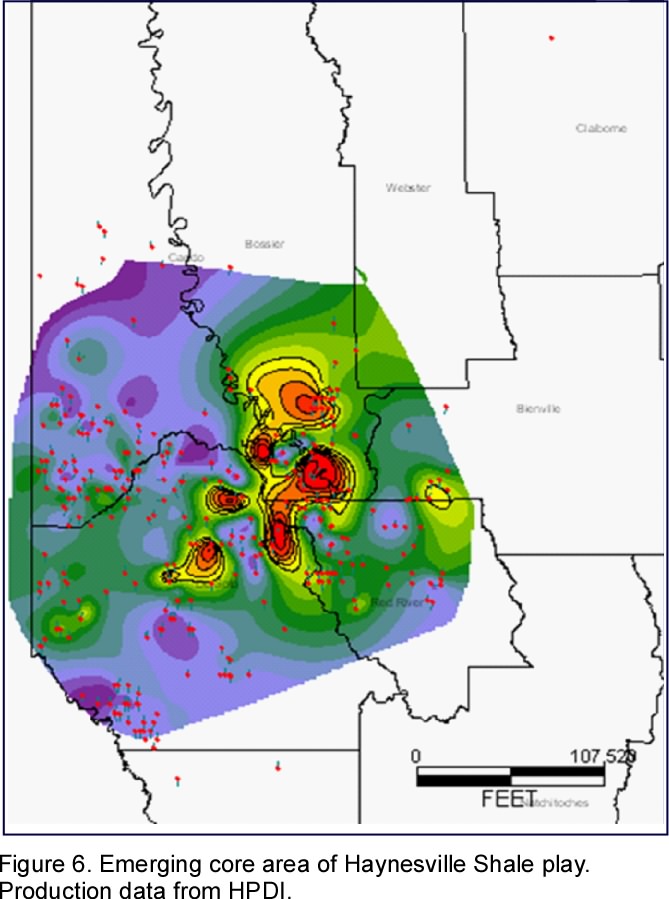

All shale plays contract to a core area or “sweet spot”. In the case of the Haynesville Shale, the emerging core area represents about 110,000 acres or 5 townships (Figure 6). This is a map of estimated ultimate recovery. The hotter red and yellow colors represent the emerging core area. This area is less than 10% of the total play area in Louisiana that was promoted several years ago as the largest gas field in North America and the fourth largest gas field in the world.

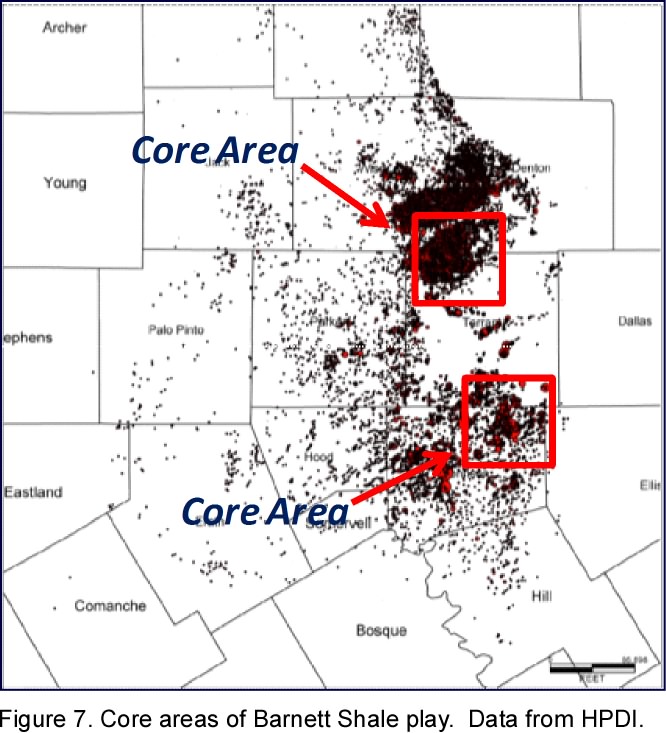

The Barnett Shale play has contracted similarly to two core areas (Figure 7). The Barnett was advertised as a 9 million-acre play that all held equal potential based on the manufacturing model. A year ago, Chesapeake CEO Aubrey McClendon told Bloomberg News (October, 2009), “There was a time you all were told that any of the 17 counties in the Barnett Shale play would be just as good as any other county. We found out there are about two or two and a half counties where you really want to be.”

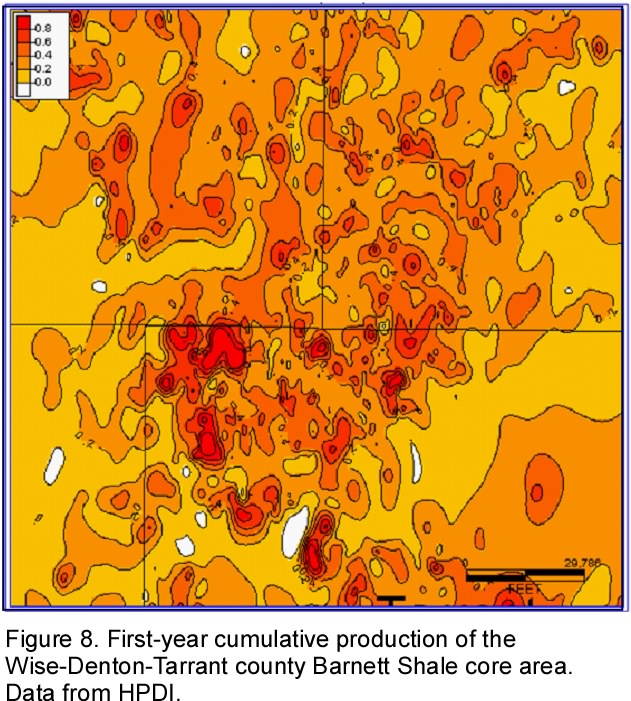

Because of the relative maturity of the Barnett Shale, we can learn from evaluating the northern core area in Wise, Denton and Tarrant counties, Texas (Figure 8).

This figure is a map of first-year cumulative production so it involves no interpretation of decline rates or ultimate recovery. Red or hotter colors describe areas of better production and brown to yellow, or cooler, colors show areas of poorer production. The map shows extreme heterogeneity within the core area where high Barnett production volumes are unevenly distributed and many non-commercial wells have been drilled adjacent to excellent wells. The claim of repeatable and uniform results by the shale play promoters cannot be supported by case histories to date. We contend that the factory model is not appropriate because the geology of these plays is more complex than operators claim.

Well Life, NPV and EUR

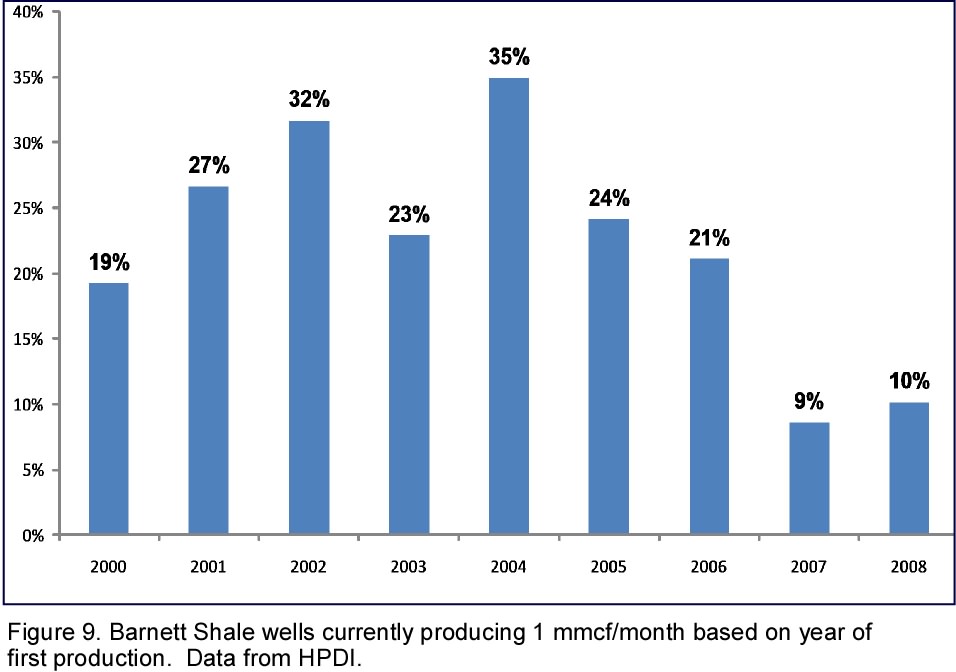

The high shale gas reserve forecasts by operating companies are based on long individual well lives of as much as 65 years. In the Barnett Shale, wells were grouped by the year of completion and evaluated based on current monthly gas production. The percentage of wells from each group that are currently producing less than 1 million cubic feet of gas per month is shown in Figure 9. This gas volume only covers the cost of well compression assuming $5/Mcf without royalty payments or other costs. In other words, 25-35% of wells drilled over the past six or seven years are not paying for the cost of compression so what is the justification for 40-65 years of advertised commercial production?

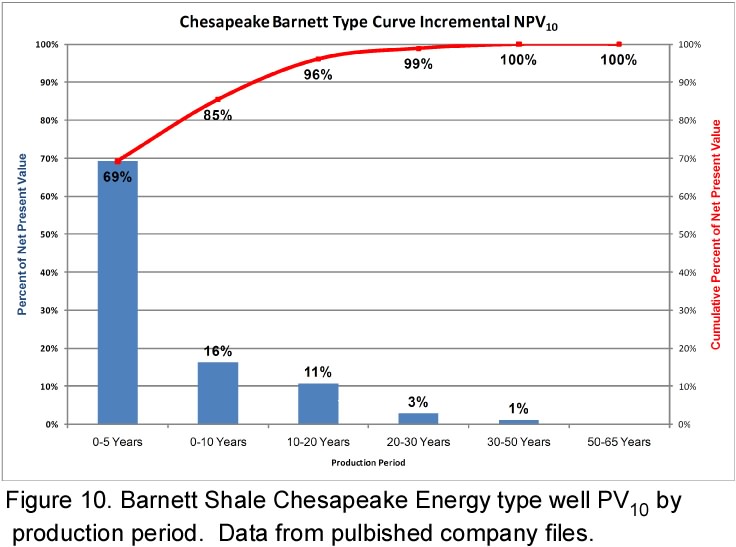

When we examined Chesapeake Energy’s type curve for the Barnett Shale and assumed that all parameters were correct--initial production rate, decline rate, well life, etc.--we found that most of the discounted net present value (NPV10) occured in the first five years and that there is negligible value after Year 20 (Figure 10). The type curve, however, forecasts about half of the reserves in years 20 through 65. Since these volumes have no discounted value, reserves are over-estimated by as much as 100 percent. There is clearly more risk in the shale plays than we are told.

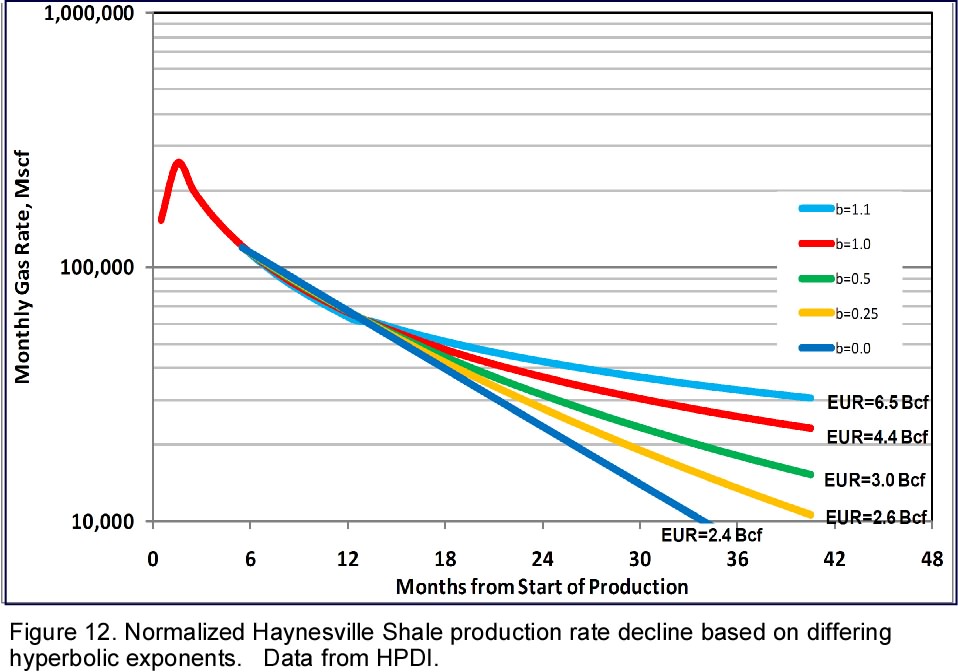

Consider also the Chesapeake type curve for the Haynesville Shale (Figure 11) which predicts that an average well will produce 6.5 Bcf of gas reserves.

The match with wells drilled by all operators that have 12 months or more of production is good. The problem lies in how future decline trends are projected and what hyperbolic exponents (curvature or b-factor) are assumed. At this time, we do not know how these wells will decline--only time will tell. It, therefore, seems reasonable to present a probabilistic range of possible reserves rather than a fixed value. Depending on a range of possible hyperbolic exponents, we can project reserves that range from 2.5-6.5 Bcf per well. We do not know which outcome to choose but it seems clear that small changes in the curvature of the hyperbolic exponent result in radically different reserve outcomes (Figure 12).

This implies greater uncertainty and, therefore, greater risk than operators represent. It seems more reasonable for companies to use an intermediate hyperbolic exponent (as recommended by Society of Petroleum Engineers peer-reviewed papers) to project their reserves and, later, revise them upward or downward when production has stabilized. Using a hyperbolic exponent of 0.5, the average Haynesville Shale well will produce 3.0 Bcf, which is not commercial at $7.00/Mcf. For reputable companies to say that the least likely case (b = 1.1) is the most likely case does not prudently represent uncertainty.

The Traveling Circus

Shale play promoters constantly try to divert attention and analysis from current plays to newer plays. Newer plays have less data to analyze and, therefore, reserve claims are more difficult to question. Because the Barnett and Fayetteville shale plays have under-performed expectations, we were invited a few years later to consider the future potential of the Haynesville Shale play. Now that the Haynesville looks disappointing, we are asked to consider the Marcellus Shale play. Since the State of Pennsylvania does not publish monthly production data for analysts to evaluate, no one can dispute or confirm the claims made by operators. With the shift to liquids-rich plays like the Eagle Ford Shale, we are again asked to trust the same promoters that sold us under-performing plays in the past that this time it will be different.

We should call a time out at this point and ask for a reality check. This will never happen because the capital keeps flowing and the promoters continue drilling and leasing. There appear to be a host of foreign investment companies that may provide capital for the shale plays now that operator debt has reached extreme levels, and most available assets have been sold at considerable damage to shareholders.

The Marcellus Shale Play Will Disappoint Expectations

What projections seem reasonable for the Marcellus Shale based on experience with other plays? We should expect that the play will contract to a much smaller core area, or perhaps a few areas, instead of the currently advertised expectations for the region as a whole. It is also likely that identification of core areas will be more difficult because of the large geographic extent of the play. This should result in a higher level of capital destruction in drilling and leasing than in other shale plays.

While the play may have built-in advantages because of natural fracturing and proximity to important natural gas markets, it also has disadvantages. The region currently lacks sufficient pipeline capacity to deliver gas to markets or storage, especially in northeastern Pennsylvania. While infrastructure is forthcoming, wells are being drilled to hold leases now and delays in sales connections will have a negative impact on net present value.

Much of the Marcellus gas contains natural gas liquids (NGL), apparently necessary to justify the economics of the play. These NGLs must be removed before delivering the gas to a pipeline, but fractionation plant capacity is limited. Even after plants are built, demand for ethane (about 60% of NGL volume) is limited, so wells may have to be shut in, further destroying present value and slowing development of the play.

Water needed for hydraulic fracturing and disposal of produced load water are becoming serious obstacles for Marcellus development. The problem with water sourcing is not availability but getting water management plans approved for the high volume withdrawals (drilling requires about 100,000 gallons and completions use another 3-4 million gallons). There are few waste treatment plants and the cost of transporting disposal water from the well may add $250,000 to the cost (Tudor, Pickering and Holt, 2009). Also, there is widespread belief that hydraulic fracturing will contaminate aquifers and that this is a risk that cannot be tolerated.

The population density is high in many areas of the play, and this will heighten sensitivity to perceived drilling and producing hazards. Any spills or blowouts have the potential to shut down or curtail operations in a larger area than the problem well. Drilling in suburban areas will complicate putting acreage blocks together. It will also mean more potential objections to drilling the thousands of locations necessary to hold leases and prove reserves. These factors do not mean that development won’t proceed, but it is likely to move forward more slowly and at greater cost than in other shale plays.

The Drilling Continues Despite Low Gas Prices

Returning to the broader subject of shale plays in general, why do operators keep drilling while their own over-production has depressed the price of natural gas by half of its value since January 2010? It seems fairly clear at this time that the land is the play, and not the gas. The extremely high prices for land in all of these plays has produced a commodity market more attractive than the natural gas produced.

Foreign companies invest in U.S. shale plays for different reasons but the most often-stated reason is to learn about the technology that they may be able use to their advantage in future shale plays around the world. It is possible that some companies enter into joint ventures with U.S. shale operators for strategic reasons based on fears of future resource scarcity particularly as China expands its efforts to control everything from petroleum and minerals to rare earth metals around the world. Diversification of their global portfolios also enters into consideration because their view of the economics of U.S. shale gas is generally different than the domestic developers. Their implicit cost of capital is usually much lower, as well.

Closing Thoughts

The so-called shale gas revolution promises E&P opportunities that are geographically immense with no barriers to entry. These ventures supposedly have no risk. Because of shale plays, we are told that there will be an abundant supply of inexpensive gas for 100 years. And the E&P companies involved will all earn big profits. Is there precedent for this improbable combination of make-believe business assumptions that did not end in disappointment?

U.S. shale plays have been over-sold and are unlikely to deliver the results that investors now expect. In fact, shareholders have already lost most of their investment. The shale gas resource is huge but the commercial portion is likely to be much smaller than what has been claimed or hoped for. At higher gas prices, more of the resource makes economic sense but that depends for the near term on production discipline that seems to be absent in the U.S. E&P companies. It also assumes that attendant service costs do not escalate at similar multiples to gas prices.

For many companies, there is no turning back--the entire company has been bet on the success of shale plays. This seems to violate what has been learned in the E&P business about the importance of having a balanced portfolio. In some cases, companies do not have sufficient shareholder value to justify being bought and, therefore, saved.

Our evaluation suggests that there is limited commercial value from these plays despite public enthusiasm and operator claims. E&P company shareholders have subsidized low natural gas prices and have little hope of recovering their investment in the near term. The underlying problem is a failure to grasp the concept of discounting. Reserves that are produced in small volumes over decades have little future value and are, therefore, not reserves. The shale plays are called resource plays for a reason: they are all about resources but not profit or the shareholder.

Links to 10-K SEC Filings for Companies Included in This Post

Petrohawk: http://www.petrohawk.com/sec/secfilings_html_list.php?id=0001193125-10-0...

Southwestern: http://investor.shareholder.com/swn/secfiling.cfm?filingID=7332-09-4

Carrizo: http://www.crzo.net/uploads/Latest%2010-K.pdf

Chesapeake: http://services.corporate-ir.net/SEC/Document.Service?id=P3VybD1odHRwOi8...

Devon: http://services.corporate-ir.net/SEC/Document.Service?id=P3VybD1odHRwOi8...

Quicksilver: http://www.sec.gov/Archives/edgar/data/1060990/000095012310024674/d71421...

Range: http://services.corporate-ir.net/SEC/Document.Service?id=P3VybD1odHRwOi8...

EOG: http://investor.shareholder.com/eogresources/secfiling.cfm?filingID=8211...

EXCO: http://services.corporate-ir.net/SEC/Document.Service?id=P3VybD1odHRwOi8...

Goodrich: http://services.corporate-ir.net/SEC/Document.Service?id=P3VybD1odHRwOi8...

Clearly natgas is too cheap but the producers' share prices are too expensive. Question becomes how to gain exposure to the resource itself without investing in the producers. UNG doesn't work for various reasons.... What can a less sophisticated investor do to make a little on the knowledge?

Great article, Art. The thing for small investors to do is sell.

Well done, Art. Bravo. Great work putting together the good detailed data for your argument. If the shale operators were doing half as good a job in presenting their data, we might be more inclined to believe them. But they aren't, and that speaks volumes.

IMO the big question is how long will it be before they are no longer able to maintain the minimum operating pressure to keep the system going?

Just ordered 3 more chords.

The three easiest that I know are

1. C-Major

2. F-Major

3. G-7th

Craig

1. E-Major

2. A-Major

3. D-Major

After that, power barchords...

Funny thingg about nat gas prices in the NE US. The DOE (don't have link) has forcast that NE nat. gas consumers will be paying higher heating cost for this year due to higher oil costs (heating oil) and higher natural gas prices. If spot price for nat. gas has been hovering around $3.50 to $4.00/mm BTU, which is about the same as last year IIRC, then why do gas users have a price increase?

Someone must be making money on this gas.

The $3.50-4.00/mmBtu is the Gulf Coast (Henry Hub) price, while you all in the NE need to pay a premium to move the natural gas up there (which traders refer to as a 'basis differential', where Henry Hub is the 'basis'.) Last winter the supply glut was so great and the economy so weak that both the Henry Hub price and the basis differential were low. Going into this winter, the market expects a little higher Henry Hub price and a much firmer basis value. Presto, higher natural gas prices!

As you say, though, Henry Hub is trading at very low levels right now, so if the weather turns unseasonably warm we may see that basis value collapse as well. Folks on heating oil are stuck with high oil prices either way, I'm afraid...

In north central PA, my sportsman's club, Western Clinton Sportsman's Assoc. has already sued Anadarko, and lost, once. We intend to be back. I have found that there is an instinctive skepticism among our membership to the whole viability of these gas plays. Members have been very open to hearing my own comments regarding the viability this drilling activity, which have been based upon what I have learned from Rockman and others on the Oil Drum.

But we are up against everyone from the Governor of Pennsylvania on down to the local Board of Supervisors. Everybody thinks that everyone is going to get good paying jobs and get rich quick. Except, of course, us at WSCA. The drilling creates difficult issues for the local community from water extraction from the West Branch of the Susquehanna to safety issues on the local, small, steep and winding roads never meant to handle very large trucks and drilling rigs. We know that it all boils down to one more exploitation play. A tiny group will get rich, the rest of us will suffer a trashed wilderness environment.

We'll just try to keep the law suits happening as long as we can; try as best we can to slow them down.

The tiny group - would that be the directors and officers? 'Cause the shareholders, they are going to be left holding the bag.

Were I an owner, I would be doing a derivative suit against the corporation; and demanding a criminal investigation of the operators, officers and directors! This has all the earmarks of a criminal scheme...

Craig

Yeah, them, the Wall Street traders and also the oil & gas service companies that are getting the subcontracts to execute all the actual nuts n bolts. When I was up there last, at the hotel I was staying at in Wellsboro, there was a Slumberger crew washing all the mud off with the hotel's hose before entering the building. There are people making money, but the actual shareholders of most of the gas companies and of course, the American public in general, are being sold a bill of goods.

Sounds like what is done to nuclear power!

jabber - I made the comment before and was serious: your regulatory folks should spend a month in Austin with our Rail Road Commission. Maybe I'm a bit prejudiced but I think our regs are a good compromise. Yes...there will be negatives to SG development in your area. And not everyone will benefit. A few may actually suffer some losses. But, if handled properly, there can easily be a net gain for the region. Again, your group may gain nothing if you don't own any royalties. Development may cause you some grief. But I can't think of any commercial activity anywhere in the country where that might not happen.

FYI: Not sure what you club is into but down in Texas every mineral owner down here in the know will have activity restrictions in their lease with respect to hunting season. We likes drilling wells in Texas but we also likes our hunting so we know how to keep both from interferring with the other.

ROCK / GAIL. Just dropped in for a bit of info if you have it. The Bartlit letter to your OSC casts doubt on the cement job at Deepwater Horizon Well.

http://www.oilspillcommission.gov/sites/default/files/documents/Letter%2...

You may remember that back in September, I posted the following:- "So what happened to all the bits of debris that landed on the boats in the area during the blowout? Who has got those. Did they "accidentally" find there way to the bottom of the Gulf. It was reported that there were bits of cement in that debris."

Have you seen any comment locally on what happened to that debris? Was any taken into evidence?

Acorn - never did hear any more details. But I would bet you a month of lunches that the boat captain hung on to an cmt chunks. We luvs souveniers in S. La. Now what he did with them and who has them now is another question. OTOH any engineering consultant should be able to explain any integrety issues due to violent nature on the ejection. The best cmt job in the world may well yield debris that lloks suspiciou. The only bit of useful data might be the chemical compostion of those cmt pieces.

Thanks Rockman. I am now back to being a pensioner. If anyone wants me to crunch numbers on another wind turbine project, they can stick it where the sun don't shine. Apologies to Gail the Actuary for mentioning Deepwater Horizon again.

Interesting factoids I have noticed recently. The wind turbine money, is now getting interested in Solar Photo Voltaic, mainly because the cost of the hardware is coming down. HVDC transmission is raising a lot of interest, particularly North Africa to Southern Europe. Shale gas is hitting the "hydraulic-fracturing will poison the drinking water" barrier but; little old Poland is sitting on 3 trillion metres of the stuff.

I guess you guys will all be voting for Tea Party candidates next week??? (lights fuse and retires to safe distance).

Jabberwock: would you be willing to be contacted off-thread about the sportsman's club? I'm becoming active in the Pittsburgh-area group (www.marcellusprotest.org), and would like to know more about what's happening around the state. Thanks! John Detwiler, P.E. (jdetwile-at-earthlink-dot-net)

Interesting piece, particularly the discussion of the 'manufacturing model' for natural gas.

At best the manufacturing model should imply less risk (although you have demonstrated this may not be the case), but at the very least the manufacturing model implies a higher cost for natural gas produced. For natural gas from shale, it's not hard to understand: drilling through solid rock down and then sideways in many directions, and them pumping a viscous fluid into the holes to force out natural gas, is going to cost more than conventional plays.

Condensates can influence the economics, but the 'sweet spot' for condensates is probably even more limited than the core areas for shale gas you highlight.

What's left for shale producers? I don't see what they can do other than to lobby for federal and state subsidies for shale gas to move the effective floor to $6-7/mcf, perhaps in the name of energy independence or climate change mitigation. Without a big move in this direction in 2-3 years, the whole industry may have to fold.

"....lobby for federal and state subsidies for shale gas to move the effective floor to $6-7/mcf, perhaps in the name of energy independence or climate change mitigation."

Jeeeeeez!

.....or they could invest in something that doesn't involve me helping to pay for their BAU pipe dream.

+10

-10 for unintended pun. ;)

Ghung/FM - y'all are so selfish! Here I am running a commercial operation and you won't let the gov't guarantee me a profit. How un-American. I have lost so much respect for you. The next thing I know you'll want our oil companies to pay taxes. Oh wait...you already do...you bastards!

OK, Rock. You wouldn't have respected me in the morning anyhow :-(

I guess this means that we, the US taxpayers, get to 'bail out' another bunch of criminals. Who are paying billions to buy our political system!

Craig

Here is the EIA annual wellhead NG price chart for the US:

One can see why so many shale players are shifting to oil plays. The average price of oil to date for 2010 is the second highest in history, while NG prices are still bouncing around the $4 range.

Perhaps professional investors in shale gas understand the broader energy market better than the average Oil Drum commenter? Or has no one else but me heard about the impending crisis in the coal power plant industry? Don´t trust me. Here is a quote from The Christian Science Monitor. It can be easily confirmed with other sources.

http://www.csmonitor.com/Environment/2010/1020/Is-coal-power-headed-for-...

By Mark Clayton, Staff writer Christian Science Monitor/ October 20, 2010

"Tougher federal air pollution rules coming next year could prompt electricity companies to close as many as 1 in every 5 coal-burning power plants in America, primarily facilities more than 40 years old that lack emissions controls, according to a recent Wall Street analysis.

The regulations now being crafted by the Environmental Protection Agency (EPA), expected to go into force next April and November in accordance with the Clean Air Act, are part of a long ratcheting back of mercury, acid-rain, and smog-forming emissions from utility smokestacks.

What's surprising is the extent to which those EPA rules – combined with a recent drop in the price of natural gas – could over the next four to five years cause the utility industry to accelerate retirement of old coal-fired power plants rather than spend to upgrade the plants' emissions controls, says the study by Credit Suisse, a Wall Street investment banking firm.

"If the EPA rules were not bad enough for coal generators, we think a large chunk of the US coal fleet is vulnerable to closure simply due to crummy economics where we see coal pricing at a premium to natural gas," says the study, released late last month. "We see the company specific implications of EPA policy as interesting when considering that 15-30 percent of the US coal fleet is at risk of either closure or needing significant [capital expenditure] to stay in operation."

Deca - Good point about the potential fate of many coal plants. And I'll assume by professional investors in SG you're talking about the companies who drill these plays. Employed by a company whose prime target today is NG I can assure you we understand the broader energy market. And I can assure you that my company as well as just about every other exploration company doesn't care in the least about the future of those coal plants with respect to leasing/drilling decisions made today. Not ignoring the future impact on NG of these potential closures but it is not factored into future pricing platforms. It's completely irrelevant what NG prices will be in 4 or 5 years when it comes to deciding to drill a SG well today. The great majority of a SG well's profit comes out of the ground in just several years. A company's profitability (and thus incentive to drill) is a function of short term NG prices. If coal plants closures run NG prices up in a few years the SG driller will respond accordingly...at that time...not today. Making my living by selling NG I'm all for closing every coal fired plant tomorrow. Anything that runs NG prices up is great from my perspective. But the SG industry just had its back broken a couple years ago when those absurdly optimistic NG price expectations failed to materialize. It is a lesson the surviving SG players (and the folks how invest in them) will not forget soon.

My apologies for underestimating your insight. I suspect you are the exception to the rule. As much as I dislike the coal industry, I am convinced the shale gas upstream players must steal 2 pages out of the playbook of the coal monkeys.

1. Deliver NG on long-term contract with predictable prices that make sense for the both the parts and the whole value chain of shale gas drillers to utility operators.

2. Organize a massive lobbying effort to show how SG can power large parts of the grid, replace a lot of coal and that everyone will benefit except the big investors in coal, who have no friends except the politicians they buy.

If you SG upstream asset developer folks need x $/MCF, then go get a NG power plant operator on board and make him an offer! T

hen go to your state EPA rep and tell him you support him to shut down the filthy coal mines and coal power plants in his area and can help replace the coal-sourced electricity with NG-sourced.

Deca - actually the type of arrangments you describe were't that uncommon 30 to 40 years ago. The NG drilling side of the fence needed a fixed buyer to justify development. The pipeline companies, to justify expensicve expansion of their infrastructure needed the security of long term NG supplies. Back in those days the NG buyers actually maintained a geological/reservoir engineering staff to evaluate projects. The producers would have their optimistic projections so the gas buyers/transporters needed to make sure they were getting a reasonable estimate.

I know it sounds odd but the industry as a whole would be very happy if there were a long term fixed price for their oil/NG even if it missed the peak price periods. The high peaks do fatten the income report but those low days can put companies out of business. The politics and details would make the process very difficult IMHO but a deal that would fix long term SG prices for producers could make for a more stable transition. But what are the odds of the govt forcing consumers to pay more for NG during the low price days in order to secure future supplies that could keep NG prices lower during the next peak? It might make sense on paper but too many folks in this country can't/won't read the deatils.

While I certainly respect Mr. Berman's position, It would be nice if he would disclose whether or not he has any skin in the game.

http://www.aspousa.org/index.php/2009/08/lessons-from-the-barnett-shale-...

Any questions?

Craig

Art Berman is no longer with World Oil, apparently because the publishers did not wish to be associated with his analysis of shale gas.

So his "skin in the game" is a principled search for the truth, even when it costs him part of his livelihood.

Art's analysis is believable, and completely in accordance with what I know of the industry.

Speaking of "skin in the game," I guess that Art is suggesting that the Shale Gas Emperor is less than fully clothed:

http://senecacountyblog.files.wordpress.com/2008/10/emperor-copy.jpg

Yup... the SOP for dealing with views contrary to yours (and especially if those views might enlighten investors) is to squash it. Fire the guys who disagree; oh, and if one of them shows up you could always shove her to the ground and stomp on her head.

Craig

Yes. When some makes this public statement:

"U.S. shale plays have been over-sold and are unlikely to deliver the results that investors now expect."

I would like to know if they have a financial stake tied to it.

Steve,

It's a fair question. If by "skin in the game" you mean do I have investments that would benefit if shale gas suffered, the answer is an unequivocal "No."

I am a consulting geologist. Because of my published opinions about shale gas plays, I have probably closed dozens of doors for consulting with companies that are either involved with those plays or who mistakenly believe that other big companies are smarter than a solitary geologist.

Luckily, my clients don't employ me to work on shale projects so they don't really care about my public views as long as I do a good job for them. Most of what I do is basic subsurface geological and geophysical interpretation--well log and core interpretation, mapping, production and reserve analysis. I also evaluate the technical and economic risk of prospects that others bring to my clients.

As a result of the low-level notoriety that I have gotten because of my shale gas views, I now have clients in the investment and financial services sector, but not because of those views--they are interested in the data-based analysis that I do. They believe that the methods that I use are useful in their efforts to decipher supply, demand and price trends. I don't do forecasting but focus on describing the current state. Understanding the present is obviously a prerequisite for guessing about the future.

I hope that answers your question.

Art

Thank you for your reply and for your willingness to speak out, much like M. K. Hubbert did many years ago...

>> A multi-year evaluation of production costs for ten shale operators indicates a $7.00/Mcf average break-even cost for shale gas plays in the U.S. taking hedging into account (Figure 1).

What are the names of those 10 companies if someone wants to do more investigation on them?

I nominate aeberman's posting for the "best of year", awesome research.

In other news, did you see Bob Cox's article in the Star Telegram on Barnett Shale. Range is selling off money losing fields after reporting a loss. Could this be the canary in the coal mine?

Range Resources to sell Barnett Shale holdings

Posted Wednesday, Oct. 27, 2010

Send us a news tip

By Bob Cox

rcox@star-telegram.com

Range Resources said Wednesday that it will sell all its holdings in the Barnett Shale and use the cash to invest in more profitable ventures elsewhere.

The sale by Range, which also reported a loss of $8.2 million, or 5 cents a share, is part of a strategy to invest more heavily in fields that can also produce crude oil or natural gas liquids, which are getting higher prices than natural gas.

Also Wednesday, EnerVest Ltd. said it agreed to pay $967 million for the Barnett Shale properties of Dallas-based Talon Oil & Gas. EnerVest, based in Houston, said the properties produce 87 million cubic feet of gas a day from 212 wells and have 1.1 trillion cubic feet of reserves.

EnerVest expects to close the transaction by year's end.

Range has 360 producing wells and 1,000 drilling locations in the Barnett Shale, mostly in core, peak-producing areas, company President John Pinkerton said in an interview.

"Our theory is, we'll take the money out of the Barnett and deploy it in areas" where production includes significant quantities of natural gas liquids, which track oil prices rather than dry natural gas prices, Pinkerton said. He declined to speculate on what the Barnett Shale properties might sell for, but said the Barnett accounts for about 25 percent of Range's production.

Pinkerton said he expects a sale can be completed sometime in the first quarter. "We think we can make up the lost reserves by the end of 2011."

Range's move isn't totally unexpected.

Forbes magazine recently speculated that Range, the largest producer and holder of drilling rights in some of the prime areas of the Marcellus Shale in the eastern U.S., would likely sell assets to raise cash to further develop the rich field. At the same time, other producers have been selling stakes in natural gas holdings to larger energy companies and investors.

Pinkerton said Range's presence in Fort Worth, about 150 employees, is likely to grow even after it sells its Barnett holdings. Still, Range expects to double its Marcellus production this year, from 100 million to 200 million cubic feet per day, and then double it again to 400 million next year.

Pinkerton said the Marcellus, as well as oil and gas properties Range holds in South Texas and the Permian Basin in West Texas, all produce significant amounts of gas liquids such as propane and butane. Last week, Range said 23 percent of its third-quarter production was oil and gas liquids, up from 16 percent a year ago.

The low price of natural gas, held down by burgeoning production in the continental U.S. from fields like the Barnett, has weighed on Range and other gas producers. Natural gas futures have dipped below $3.50 per 1,000 cubic feet recently, down from around $6 in January.

Range's third-quarter loss was a considerable improvement over a $30 million loss in the same quarter a year ago. Both figures reflect write-downs in the value of hedges, rather than cash losses. The company's third-quarter results were affected by a 22 percent drop in realized prices, offsetting a 16 percent decrease in costs and a 15 percent increase in production.

Range produced an average of 503 million cubic feet of gas and gas equivalent in the quarter, a record, and generated $140 million in cash flow from operations.

Range's shares (ticker: RRC) closed Wednesday at $36.66 a share, up 93 cents.

".....Still, Range expects to double its Marcellus production this year, from 100 million to 200 million cubic feet per day, and then double it again to 400 million next year."

Like the guy trying to make his company profitable: "sure we lose money on every sale (mm BTU of nat. gas here), but we will make up for it in volume!"

The big companies like XOM, Chevron, Shell, CNOOC can afford to lose a few hundred million $$ on some shale gas plays this year because in three or five years prices may be double the present $3.50 to $4.00 and will later make billions $$. The smaller nat. gas producers cannot afford several years of loss, even ones like XTO have sold money losing gas projects.

mb - there's one little hitch to your model for the majors: Within 3 to 5 years after they drill a SG well it will have declined 50% to 80% of its initial flow rate and would have already recovered the majority of it URR. The CEO of Devon, one of the original big SG players, made an announcement a couple of weeks ago: even if NG prices were to suddenly rebound it would be of little value to Devon: the big SG wells they drilled 3 to 4 years ago would generate much income now even if NG suddenly doubled.

Folks made much to do about ExxonMobil's acquisition of all those undrilled SG leases that XTO owned. NG prices today warrent very little drilling of those leases. And within several years most of those leases will expire due to non-drilling. Maybe NG will rise high enough in 4 or 5 years but it will be too late for XOM to monitize much of those undrilled XTO assets IMHO.

A lot of horizontal shale wells decline 60% in the first year. HK had a 10-K disclaimer to that effect. Meanwhile, from Rigzone Sept 28, 2010:

This article is NOT the article some of us are interested in. While the article demonstrates that shale natural gas is not going to be a major source of cheap natural gas and the companies are losing lots of money, we don't see any future major sources of cheap energy anywhere else either. So we are interested in things like how much can be extracted at no more than double or triple or quadruple current prices.

A major question is if converting the automobile sector to natural gas is a feasible option. Better or worse than electric cars?

I would choose none of the above, and go with selective abandonment of outlying suburban areas, combined with Alan Drake's electrified rail plans. Basically a triage operation.

Actually, the pricing does make a significant difference in terms of selection of energy sources already, as at NG prices 3-4 times today's price alternatives e.g. wind power are far more attractive. Low NG prices, and claims that these prices and abundant supplies will persist, have been recently used both implicitly and explicitly as reasons to delay moving toward a renewable energy-based economy. Art's analysis is invaluable in demonstrating the Ponzi-scheme nature of current investment in unconventional gas, as the same low prices being used to sell the public on the industry's expansion into shale etc. are also much too low to support production absent massive shareholder subsidies and accounting practices that are questionable at best. It also goes a long way toward explaining interest from Chesapeake, Range and other major shale players in selling off assets and focusing more on liquids-rich plays.

And the numbers also don't bode well for any EROEI analysis of unconventional gas, which, at least according to the recent Fracture Lines report on Canadian shale gas, has yet to be undertaken in a meaningful, comprehensive way.

pasttense,

I have clearly stated that the marginal cost of production of natural gas today averages $7.00 at least for the 10 companies that we evaluated.

That's your cost today regardless of what companies claim, and I expect that will continue to be the cost for as long as the current over-supply exists. Regardless of what may happen in the relatively near term, companies are drilling like there's no tomorrow and there are probably 100s or 1000s of wells that have not yet been connected to sales. That means that for the next 18-24 months it is unlikely that supply concerns would result in an increase in price above $7.00/Mcf, and probably price will stay a lot lower.

According to a friend who is an expert on cost formation, if 100 gas-directed rigs were laid down today, it would result in a 3% or about a 1.5 bcf/d reduction in supply after one year. In other words, it takes laying down a lot of rigs to change the supply. Sentiment and storage are other matters that can affect price more immediately.

I expect to see some significant re-structuring in the composition of companies in the shale gas plays over the next year or two at the distress of a few current participants. Hopefully, this will lead to a more balanced and rational exploitation of the resource that would allow the price to rise to the marginal cost of production but not higher. As I said, I'm not a predictor but that is my sense of the answer you want.

Art

The low price of natural gas is part of what is propping the economy up, right now. If the price were double or triple its current level, consumers would have that much less to spend on discretionary goods, and the economy would be that much worse off.

Maybe if oil prices would go down, consumers would have more income they could spend on natural gas. But in order for that to happen, we would need a lot worse recession than we have now, and it would lower gas prices as well.

So I am not making bets that gas prices are going to rise above $8 mcf in the near term.

By my calculation, the yearly cost of natural gas at $4 per tcf for the US economy is $7.6 billion. Small percent of GDP is not going to be a main driver in the economy. Maybe my maths are off.

($4 / tcf) * (1.0 ^ 9 bcf/1.0 ^ 3 tcf) * 1.9 bcf

EDIT1: My maths are off by 10^3 since it is ~22,000 bcf annually. Now, I come up with $88 billion per year. So if the price doubles, $166 billion per year.

($4 / tcf) * (1.0 ^ 9 bcf/1.0 ^ 3 tcf) * 22,000 bcf

EDIT2: Ouch. That conversion is inverted. I'll figure this out later...

EDIT3: Also, the residential price has not fallen as much as the spot price so the savings to the consumer would have to be scored by the retail pricing.

Cars in the interium have the potential to have half of the emissions per a gasoline receipe of 1 ounce of diesel to 10 gallons of gasoline. Not to go off subject on the economics of what I feel is the next great bailout/natural gas bubble to burst... google Mr John Mullinix or see his youtube video. I got this from a related blg...

'Mullinix's provisional patent explains the process this way: The gasoline has oxygen atoms in the molecules within diesel fuel lending to better ignition for the combustion with the gasoline engine. This gasoline combustion with the exhaust carbon soot traces into the catalytic converter causing high temperature flashes that burn the oxides continuously along with the upstream flow of oxygen through the tailpipe from the outside atmosphere depending on the fire's demand within the catalytic converter."

So while we talk about converting vechicles CNG, lets explore how to get this formulation to the pumps and cut through the red tape if this is for real.

John Mullinix see his youtube video

http://www.youtube.com/watch?v=TkJxf7hScw0

So one big question is, how many aquifers are going to be ruined (and wilderness trashed, as Jabberwock mentions above) before the scam becomes evident to enough people to make the whole thing collapse? Never mind prosecuting anybody; that won't happen any more than it has happened with the derivatives traders, mortgage fraudsters, etc.

The water utility that serves Murrysville, PA and some other areas has just leased land for shale drilling right next to their reservoir! This is in western PA, just east of Pittsburgh. Apparently this is totally governed at the state level in PA and there is no mechanism for protest or recourse of any kind. I am going to forward this post to someone there who has mentioned trying to get something organized. They may be contacting Jabberwock's club, if they haven't already.

How many aquifers have been ruined due to fracking?

While polluted aquifers seem to be the main fear with shale gas extraction, there are other environmentally destructive consequences of the process that have already had a significant impact. I have attended a couple of meetings organized by a group of concerned local citizens here in Southwestern PA. I have met people who have had their water polluted by drilling on their property, and are now engaged in battling with the drilling company to fulfill their legal obligation to provide them with clean water.

In addition to providing a first hand look at how shale drilling negatively affects the local community and landowners, the local meetings I have been to have involved some professors from the University of Pittsburgh and representatives from other community groups, and have generally been very informative.

In my opinion, the worst environmental offense of the shale gas drilling companies in PA (out of a significant list of offenses) is the handling of the used “fracking fluid” that is pumped back out of the well after rock fracture. Some of the fracking fluid and water used in fracking the shale stay in the ground, but some of it is pumped back out. The fracking fluid itself is a mad chemist’s brew of questionable chemicals, but after it has been schmoozing around down in the shale layer for awhile, and then pumped back out, it brings with it amounts of things like benzene, toluene, xylene, VOC’s, and (by the looks of an article I read yesterday about some research at the University of Buffalo) uranium.

What do the drilling companies do with the millions of gallons of this cancer juice? Well, sometimes they take it to local water treatment plants – but very few if any local plants are equipped to deal with the shear multi-faceted toxicity of the used fracking fluid, so a lot of the harmful chemicals just wind up in whatever freshwater creek or river the plant discharges into. Other times, they build a giant lagoon, and fill it up with this stuff. They don’t always put a liner in the lagoon, which will obviously lead to the fluid seeping out, but many times they line the lagoons with a thick liner that supposedly will contain the fluid until a state of the art water treatment plant is built in Western PA, or forever.

In my opinion, spills and seepage of used fracking fluid is the worst environmental offense of shale gas drilling in PA, and probably is to blame for many of the water pollution problems we’re seeing. These chemicals unchained from deep within the earth must go somewhere. We all know that matter cannot be created or destroyed – and it often takes a great deal of energy and money to make it change forms from carcinogens to something innocuous, if it’s even possible at all. The cost of running any semblance of a reasonably environmentally safe drilling operation (oxymoron?) is obviously too much for these companies to bear.

I’m less sure about the potential to pollute aquifers, because I’m not a geologist, but intuitively I can understand concern about longer term migration of the fracking fluid that’s left in the ground into aquifers.

Lorax - I commend you for recognizing the real risk of frac'ing. I won't repeat my explanations to how that actual frac'ing process has very little chance of damaging aquifers. Those fluids won't migrate up thousands of feet of rock nor will it induce earth quakes or make your cows go sterile (just a little humor there to keep it light).

As you point out the real danger is the proper disposal of the produced fluids. Folks up there shouldn't be watching those drill rigs and frac trucks with their binoculars. They need to keep an eye on those harmless looking tankers going up and down the highway. In the end it's up to your regulators to keep the disposal folks honest. And not just by regs but by serious and painful enforcement. In Texas the oil patch disposes of billions of bbls of toxic fluids every year. And the great majority is done properly/legally. But there are still a few crooks in Texas that make "midnight hauls". That's the slang we use for illegal dumpers. Fluid disposal is rather expensive. But the operators pay it because the regs require it. But then the operators will hide behind the law because they aren't responsable for those fluids once title is transfered to the disposal companies. The "blind eye' approach some companies utilize. And when an operator gets caught cheating the penalties are truly painful. But if the disposal companies can illegally dump they reap a huge profit. And no one in the oil path cares much for crooks. Twice in my career I was able to help bust a midnight hauler. Most of the folks driving around the Texas country side at 3 AM are oil field workers so they are the ones would end up catching the illegal dumps.

So bottom line: don't let your folks get distracted by what isn't happening 10,000' below the ground. Get your regulators in the faces of the disposal folks and at the first opportunity nail them to a cross when they are caught cheating. Fear is the only thing that can dissuade them from the profit potential. That's how it works in Texas...I'm sure it will work in your part of the world.

The Marcellus play was made possible in large part, as I understand, by a professor at Penn State U who is an authority on natural fractures in shale formations who postulated that fracing would be particulary useful in the Marcellus. Fracking hopefully induces horizontal fractures and it would be an expensive failure if vertical fractures occurred. I think it is thought that vertical fractures would only extend a few hundred feet anyway, not nearly enough to affect the shallow aquifers.

However, the recent multitude of threads on the GOM incident underlined the somewhat questionable quality of casing cement jobs without remedial work and cost cutting in well casing designs. I just wonder what the chances of frack pressures causing a path up the casing annulus and releasing frac fluids into aquifiers - before the frac pressure fracked the shale.

edit - aebermans post below shows he knows a lot more than I do. But the current debate in the PA legislature and govenors office on a severance tax and its funds to beef up drilling enforcement to prevent environmental harm is not settled. One of the candidates for Govenor in Nov is against any new taxes incl severance tax on SG.

ez - good point. As you say, the induced fracs have zero chance of reaching up to the aquifers. But a bad cmt jump might let those nasty fluids leak up. But in general there's an even great risk: eventually the csg can rust and devlop holes up shallow. And salt water being produced with any well (SG or otherwise) has a potential to contaminate the fresh water zones. In Texas the regulatory body has no concern about the frac'ing efforts causing aquifer problems. But the Texas Rail Road Commission has very tough (and well enforced) rules to prevent just this sort of contaminantion. And that includes making sure the aquifers are protected from bad shallow cmt jobs. We have a Water Board that regulates this activity. They make the rules and enforce them with a vengence. They are not viewed as friends of the oil industry by anyone. There is no appeal process: you follow their mandates to the letter or you don't get a drilling permit. And if they catch you breaking the rules they take away your license and you will never drill another well in Texas again. My concern would be that your citizens and regulators aren't focused on the real dangers (leaking csg years down the road and illegal fluid disposal operations) but are being distracted by the hype over frac'ing perceived dangers.

Rockman,

Thank you for imparting your professional opinion on this issue, and describing some of your experiences in Texas.

From what you are saying and what Mr. Berman confirms in a post below, it seems like there is probably very little additional risk of aquifer contamination caused by shale drilling IF the process is performed correctly. I will be sure to take this information to the next meeting I attend and attempt to help my local community understand where the real risk lies, and where we should try to work to put the focus of the regulators.

The problem is that a few people around here most definately HAVE had their drinking water tested before and after drilling, and found that toxic pollution arrived after drilling. News of this spreads throughout the community, and since aquifer pollution is talked about by far the most in the mainstream media, people just automatically assume that is what is going on.

Thanks again,

-Bill G

Bill - I'll mention who else your folks might model their oil/NG regs after: Louisiana. They exercise great control especially over surface activities. In many cases you can't even pump rain water off of a drill site. And no open/unlined earthen pits. They are either lined pits or metal tanks. And disposal of all fluids is highly monitored. Tell your folks to be more focused on the fluid disposal industry as far as certification and record keeping. By far the biggest polluters in Texas have been the disposal companies and not the oil/NG operators. These disposal companies get rid of a lot of nasty stuff from other industries also.

Someone on another site asked me a few days ago why oil patch hands would care about bandit disposal companies. Very easy answer so I'll use myself as an example. Most oil patch field workers live in the country. I don't but my 10 year old daughter does. And she drinks well water every day. Most take a very dim view of folks who might poison our kids and live stock

In the south hills of Pittsburgh the water tasted funny late this summer. As I recall the water company blamed it on algae caused by the hot weather,

but I wonder???

Metzengerstein,

There is what I would call anecdotal evidence of well-water contamination with methane in one locality in Pennsylvania. The problem with these situations is that no one monitored the situation before the supposed problem so we don't really know what to compare the current state with.

The only way that fracking can contaminate an aquifer is 1) if the surface casing was improperly set and cemented, 2) if too much pressure was applied while pumping the frack and the surface pipe ruptured, or 3) there were faults that allowed the fluid to go from the formation to the aquifer. There are areas of the Marcellus play that are adjacent to the Appalachian thrust front where there is a high level of deformation and faulting. Here, there is some probability of faults providing a pathway from reservoir to aquifer. Most of the play is in relatively undeformed structural areas.

Bear in mind that Colonel Drake drilled his well in 1859 near a natural oil seep. The oil was generated deep in the section and probably migrated to the surface along faults. I mention it because oil has been seeping to the surface, and probably into aquifers, all by itself long before man arrived and certainly before the shale play began. Is it possible that the new drilling activity and fear of the unknown produced an awareness of a pre-existing condition that had not been noticed previously? I'm not trying to defend the industry but I think it is reasonable to maintain some objectivity and not let the "frack attack" fanatical true believers prematurely bias our view.

Art

With horizontal drilling, it would make it much easier for fluid to find a "fault pathway" from reservoir to aquifer, being as so much more horizontal distance is being covered, compared to the older vertical, non horizontal wells, and most of those from the last 50 years.

The more the I read about both sides of the issue, I would err on the side that water wells are being contaminated much more then people realize, as a lot of smaller contamination will not be detected until many more wells begin to be specifically tested for contamination.

My opinion at this time is that the risk is far too great, to risk any contamination of water, and safe drinking water is far more valuable then the gas extracted.

see the referenced article at this page.

http://www.energybulletin.net/print/54776

,

,

,

,

,

,

Sure You Want Shale Gas?

Take a look at the trailer to the upcoming documentary "Gasland". When filmmaker Josh Fox is asked to lease his land for drilling, he embarks on an investigation.

http://bit.ly/df5qCQ

Gasland has been released for some time now and DVD may be for sale or viewable at author's site and can be linked from here: http://www.hbo.com/#/documentaries/gasland

This isn't spam - just a courtesy. Very much worth watching IMHO - g

Gasland is a must-see. It's to be released on DVD on Dec. 14, according to Amazon. In the meantime, there's the 23-minute PBS interview with filmmaker Josh Fox, for a preview.

http://video.pbs.org/video/1452296560/

NPR's Terry Gross interviewed Fox on Fresh Air, too. The archived interview is here: http://www.npr.org/templates/story/story.php?storyId=127593937 .

Inky,

Gasland is journalistic junk. There is almost no substance in the piece. It is mostly Fox's rather uninformed opinion with no balance from the other side. I am not taking a side on the topic--just saying that, as a writer on TOD, I would be hammered if I presented anything with as little fact-based information and as little fair discussion of the opposing side. It is BAD journalism. For example, what about the tens of thousands of wells that have been fracked over the last 50 years with no incidents?

Apparently, the scene where the guy lights the water in his trailer is biogenic gas according to the state geologist. That is typical of the poor journalism in this so-called documentary.

Art

Terrific work, Art. What's the status of conventional production? I'm at a loss to find current numbers, EIA just hand out graphs for you to squint at. Is offshore still in decline - will this lead to an inevitable call on shale?

I also notice from the NG Annual that 2010 consumption topped 2008 - was that an all time high?

It is very interesting that the EIA has NG consumption so far in 2010 at an all time high surpassing the previous peak 2008. In fact EIA reported consumption is up 5.25% on last year so far this year. Which is just as well as if real consumption was only up say 2% then production would have actually declined to balance reported storage.

I recall after some leading industry figures claimed the EIA was overestimating NG production, the EIA announced they had found a flaw in their methodology and to expect substantial downward revisions. So far that has not happened and all we have seen is a tiny tweak to previous figures.

But it is interesting to see that US claimed NG consumption has rebounded out of the "recession" to an immediate all time high in the space of one year - if you believe the numbers.

With all due respect, it seems there is no one on the board of the opinion that Shale gas is abundant, and will be so for decades. If there is anyone with an viewpoint on shale gas opposite to Art Berman, I would sure like to hear it.

If there is any evidence that shale gas is abundant, economically viable, and that Art is wrong, you or anyone else is free to post it here. We would love to see it. Unsupported viewpoints and opinions have limited value here.

Charles Maxwell presented with Mr. Berman at ASPO in DC. In this regrettably noisy recording, Mr. Berman goes first then Mr. Maxwell rebuts.

Joe,

I didn't say that shale gas is not abundant. In fact, I said that is was in the first paragraph:

"There is no doubt that the shale gas resource is very large. The concern is that much of it is non-commercial even at price levels that are considerably higher than they are today."

Did you miss that?

It's not about abundance. It's about the cost to produce it, and the cost to the shareholder.

Art

Here we go again . . .

1. I was disappointed with the article. The headline said it was going to be about the Marcellus, but it merely touched upon it, and mostly reiterated the same things Art has touched upon before regarding *all* shale plays. I was expecting some detailed analysis of Marcellus wells, but the only wells discussed were in the Barnett and Haynesville.

2. The claim was made that everyone was once telling us these shales would be uniform and you could drill anywhere in a very large area and get the same results. A quote from Aubrey McClendon was posted, supposedly from Bloomberg in October 2009. I conducted a search of Bloomberg's site and did not find the quote. I then conducted the same search for everywhere else on the internet and only found articles of Berman repeating the same quote elsewhere. If Aubrey McClendon did in fact state that about the Barnett shale somewhere on Bloomberg in October 2009, please provide a link. Otherwise, one has to question Art's credibility. Is he making up quotes from McClendon, or not?

3. Speaking of Aubrey McClendon, the inference in this article is that these plays are a bust because the price of gas is too low. Well . . . duh! No one has ever claimed these things would be profitable with $3.70 gas. McClendon himself told us more than two years ago:

Now that I've provided an actual quote by McClendon, complete with link to source, in which he tells us his gas plays are viable at $8 or more, I would appreciate it if Mr. Berman could respond in kind and provide us a link to his source for McClendon's quote.

4. In summary, this entire argument is a strawman, because it infers something(s) which no one ever claimed. No one ever claimed shale plays were uniform over the entire geography of the shale formation, and no one ever claimed they'd be profitable at $3.70. However, as Art himself pointed out at the end of his article, these plays make more economic sense at higher prices . . . but that's hardly news, because Aubrey McClendon was already telling us exactly that more than years ago.

So, where do I invest in this no lose play?

Inquiring minds want to know---

OK. I’ll take the bait and present a somewhat different view on this matter. We can commend Art Berman for his work debunking some of the more extreme hype about shale gas plays. But as anyone who has followed this issue closely should know, Mr. Berman is no fount of divine wisdom on the matter of gas reserves from the shale plays. Perhaps the best way to illustrate this is using his own words from previous articles. The following are direct quotes from his previous articles on the subject of EURs from the Haynesville shale play.

World Oil, April 2009, “Haynesville Sizzle Could Fizzle”

“I used standard rate-vs.-time methods to determine estimated ultimately recoverable reserves (EUR) for 14 horizontally drilled wells that had sufficient production history to project a decline rate. Production was extrapolated using a hyperbolic decline, and an economic limit of 1.0 MMcf/month. The wells had an average EUR of 1.5 Bcf, and 67% (10 wells) had reserves less than 1.5 Bcf.”

Petroleum Truth Report, April 21, 2009, “Haynesville Sizzle or Fizzle: Let’s Be Fair”

“That new information modifies my view of the Haynesville play somewhat, and requires an update to my observations and conclusions. Also, there is now a month or two of additional production history since I did the research for that work. Based on this information, approximately 59% of Haynesville wells may have ultimately recoverable reserves of 0.5-2.0 Bcf (16 wells), while 41% may produce 2.0 Bcf or greater (11 wells), according to my analysis. The mode of 27 wells is 1.5 Bcf and the mean is 2.2 Bcf.”

Petroleum Truth Report, June 4, 2009, “A Long Recovery for Natural Gas Price: revisiting the Haynesville Shale”

“I now think that the Haynesville Shale reserve estimates that I presented previously were too low. I have evaluated 43 horizontally drilled wells with some production history, and 14 wells with initial production rates only (Figures 3a and 3b). The most-likely average EUR for all operators is 3.6 Bcf per well within a probabilistic range of 2.8-3.6-4.4 Bcf/well.”

The Oil Drum, Oct. 28, 2010, “Shale Gas- Abundance or Mirage: Why the Marcellus Shale Will Disappoint Expectations”

“Consider also the Chesapeake type curve for the Haynesville Shale which predicts that an average well will produce 6.5 Bcf of gas reserves. The match with wells that have 12 months or more of production is good. The problem lies in how future decline trends are projected and what hyperbolic exponents (curvature or b-factor) are assumed. At this time, we do not know how these wells will decline--only time will tell. It, therefore, seems reasonable to present a probabilistic range of possible reserves rather than a fixed value. Depending on a range of possible hyperbolic exponents, we can project reserves that range from 2.5-6.5 Bcf per well.”

To summarize, Mr. Berman’s best guess about future average EURs from Haynesville gas wells has, in the course of the last 18 months, gravitated from 1.5 bcf, to 2.2 bcf, to 3.6 bcf, to “we do not know” but can project a “range from 2.5 to 6.5 bcf per well.” Companies such as Chesapeake have been pretty consistent about projecting 6 to 6.5 bcf during this entire period. In other words, according to Mr. Berman’s own analysis presented here, the companies’ original EUR estimates are still within the range of plausible outcomes based on his analysis, while his own original estimates, as well as his first revision to them, are no longer even in his current range of plausible outcomes.

Perhaps most importantly, what is Mr. Berman’s real point? If it’s to prove that shale gas isn’t going to be very profitable at $3or $3.50 per mcf, I’d argue that’s essentially a strawman since I don’t think too many people are arguing that it is. Even putting aside the fact that natural gas is a premium fuel (with characteristics such as being half as carbon intensive as oil) that should be priced at a premium to oil, and accepting every word of Mr. Berman’s latest take on the situation as gospel, what he has done here is “prove” that there is not a 100-year supply of a premium fuel at the oil btu-equivalent cost of $18-21 per barrel. As Shania Twain would say, that don’t impress me much. The real story here is that there appears to be an enormous shale gas resource that is economic at somewhat higher prices, and far below current oil prices, that can be tremendously helpful in transitioning the economy to a less carbon-intensive future when oil supplies will likely be in serious decline. Can someone please explain to me how that is not relevant and important news to the peak oil community?

I'll start by answering your question with another question. How will natural gas "be tremendously helpful in transitioning the economy to a less carbon-intensive future when oil supplies will likely be in serious decline"?

Maybe the real point here isn't about the size of the resource (since Mr. Berman never disputed that in the first place) but just that the claims I see being advertised everywhere about how American natural gas will be cheap and abundant indefinitely and how we've used "barely a fraction" of its potential and how it "achieves clean energy goals" are oversold? Perhaps even covering up for some serious weaknesses in the industry's overall outlook and financial picture? These are, of course, direct quotes from the ads up all around the Capitol South Metro station here in Washington (the Clean Sky people bought all the ad space in the entire station). You know, the one that services the Capitol, and no I can't imagine why that they would have chosen that particular location. So perhaps the real issue being raised here, if indirectly, is one of skewed policy priorities and about a lobbying and PR campaign designed to sell politicians and the public on the "transition fuel" concept.

And I understand the Pickens Plan, at least how it was originally supposed to work - keep in mind though, if you want enough natural gas to replace oil for transportation, you'd still need something to replace all that natural gas-fired electricity and other uses of gas to free up the trillions of cubic feet per year you'd need to make a real dent, which you'd need to do at some point anyway, and it would still only be a temporary fix since all you'd really have done is add more soon-to-be-obsolete fueling infrastructure and delay a move away from highway-based transport. I'm not really certain how the "low-carbon transition fuel" concept really works - no real transition there, unless I'm missing something. At best it's very temporary life support for BAU, and at worst it's a bubble and a distraction from the real meaningful aspects of energy and climate policy that is starting to have real serious consequences on the environment even as it's being sold as an environmentally benign "alternative" fuel.

Maybe it really does make a difference whether gas is $3.50, $7.00 or $20.00. I think it is disingenuous to use low gas prices as a reason to avoid investing in real transition technologies if that gas isn't really as cheap as we're being led to believe, especially over the timeframe an energy transition would actually take. If it's going to be used as another reason to keep delaying for another few decades, I'd certainly like to know as close as possible to how much it's actually going to cost.

I'll just add that the potential consequence we are facing here at some point is a very real and scary shortage of gas due to an over-reliance on a fuel that was mistakenly thought to be cheap and abundant and resulting misguided policies that incentivize and offset the cost of natural gas production at the expense of viable replacement technologies. At some point supply and demand will be out of balance because of short-term fluctuations in price giving the wrong signal. One need only look at California in 2000 to see how vulnerable the system is to financial gaming and the kind of risk exposure that situation creates for the average Jane or Joe Consumer. At that point, get ready for a very long cold winter...

Wasted Energy -

I'm all in favor of transitioning to renewables as fast as possible, but would you rather have a decent amount of less polluting fossil fuel left to build out that new efficiency/wind/solar/geothermal/biomass or whatever infrastructure or not? Do you think it will be easier to build a new energy infrastructure without access to fossil fuels?

Catman-

No, I'd rather not face supply shortages in the short term. But those shortages look more likely if price signals are out of whack and supply and demand can't properly align. In the meantime, cracking down on accounting loopholes and subsidies for fossil fuels would have the dual benefit of correcting price discrepancies and properly incentivizing alternatives. Plus part of the problem with the "transition fuel" concept is I don't really see what you describe, i.e. remaining and cleaner fossil fuel used for transitioning to a clean tech economy. If the talk coming from the gas promoters were less about extending BAU and more aware of the bigger picture, I might be more convinced. Maybe some of them are in the know about overall fossil fuel decline but not speaking out because of business or political concerns, I don't know. But most of what is happening right now in this area smells less like clean energy transition and more like rising financial and environmental costs of another fossil fuel without much attention beyond the short term. Perhaps the eventual disappearance of shareholders willing to subsidize cash-losing operations and ensuing lack of options will start to change the industry's outlook on this issue.

On a somewhat related note, the largest outstanding issue right now, of applying an appropriate level of scrutiny at both the state and federal levels to potential environmental harm, would, far from shutting down the industry, have the effect of promoting cleaner drilling practices and convincing the public of the safety of unconventional gas. Fears of widespread water contamination and air pollution are far more likely to cause problems as the industry tries to expand drilling. Demand for natural gas can probably survive a rise to $7 or more (and the price has been known to spike quickly and unexpectedly, so $3.50 gas might not last as long as some around here believe), but can a secure supply be achieved if the loudest voices belong to the NIMBY crowd, and the government does nothing to allay their fears and instead creates the appearance of taking the industry's side? Eliminating the subsidy of environmental regulatory exemptions seems like the least that can be done, and would be a win-win for both the public and the industry if it allowed the industry to bring benefits to new areas while helping to correct the low price signal telling us gas is so abundant and cheap that it can be wasted.

I don't think we disagree that there are benefits to natural gas development, but I do think it's worth taking the time to debunk some of the bolder industry claims about how long the resource will last and what the costs might be, environmental or otherwise. If people really do want a clean transition fuel then they should be willing to pay what it actually costs to develop it, and take full account of the consequences of doing so, as with any resource.

I agree with WastedEnergy, and would go farther to state:

The "transition fuel" concept is a lie.

It is only an excuse to delay transition.

The oil, gas, coal that we have and are using right now, SHOULD BE the "transition fuel".

People do not want to transition because they know, or think it will cost more then wasting what we have and are using right now.

,

,

,

Catman,

I do evaluations in real time and explained the uncertainties in those early assessments. Unlike some, I admit when I am wrong. Since I am not a politician but a scientist, and you don't like people who change their views with new information, don't vote for me.

So what is your point? That because I have been intellectually honest in the past, and you take that to mean wrong, that the data presented here should be dismissed? The data comes from SEC filings by the companies. What part of that do you want to refute?