Secrecy By Complexity: Obfuscation in Energy Data, and The Primacy of Crude Oil

Posted by nate hagens on January 12, 2011 - 10:19am

The following is a guest post from Gregor Macdonald, adapted from his website Gregor.us.

The dramatic fall of Mexican oil production, and its largest field Cantarell, is often cited as a signature example of the problems facing Non-OPEC supply. Since the production highs of 2004-2005, Mexican production has lost over 800 kbpd (thousand barrels per day) which is fairly dramatic for a country that was producing around 3.4 mbpd as recently as 5-6 years ago. But as accelerated as these declines have been in Mexico, there’s another oil producing region has seen even quicker declines. The North Sea, which comprises “United Kingdom Offshore, Norway, Denmark, Netherlands Offshore, and Germany Offshore” has just lost 20% of its production in 24 months. Daily production is down 600,000 barrels per day in that period. | see: North Sea Crude Oil Production in mbpd 2008-2010.

.jpg)

I mention this because as 2010 comes to a close, it appears that for the fifth year in a row the peak production year of 2005–in which the world produced oil at an average, annual rate of 73.718 mbpd–will once again not be exceeded. This is truly an astonishing result given that a new pricing era for oil began in 2004 as oil rose above 40.00 dollars a barrel. For over five years national oil companies and publicly traded oil companies have been free to sell oil into an ever-rising price environment. But no increase in global crude oil production has been forthcoming. Moreover, during the five year period from 2006-2010, global crude oil production actually fell in three of those years: 2006, 2007, and 2009. Equally notable is that OPEC–which currently accounts for about 42% of global supply– has been roughly steady in producing 30-32 mbpd each year during the same same period while Non-OPEC, accounting for 58% of world production has struggled with decline. | see: Global Annual Average Crude Oil Production in mbpd 2001-2010.

.jpg)

Another region in Non-OPEC that has disappointed is Canada. While Canadian oil production soared coming into the last decade, its production halted starting in 2006 and since then has oscillated around 2.6 mbpd. There is much hope for future increases from Canada and there is even a kind of mini-myth taking place in the US right now that Canada will be a strong source of future supply to the US. However, what has happened in Canada the past decade is that cheap conventional barrels of oil have been replaced with expensive tar sands barrels of oil. The result? Running in place in terms of supply, but at a much higher cost structure. | see: Canada Crude Oil Production in mbpd 2006-2010.

.jpg)

Canada is worthy of discussion for another reason, however, and that’s the creeping tendency of the public energy-data agencies to engage in some some channel stuffing. In the case of Canada, the high-cost tar sands production has now been aggregated into that country’s measures of “crude oil.” While not as egregious as including ethanol into publicly released data measures of oil, the alchemy and energy inputs required to turn oily dirt into usable petroleum can hardly be deemed as conventional crude oil production. To this point, one of the core methods EIA Washington and IEA Paris have increasingly relied on in recent years–to obscure the very serious and now very real problem of oil depletion–is to include biofuels and natural gas liquids in the accounting of global oil production. The technique that both agencies use to conduct this obfuscation is a familiar one, in which the key information is aggregated (buried) into a much larger barrage of data and presentations. For a scholarly look at the methods governments use to work around their obligations to inform the public, do watch the one hour lecture that Jay Rosen gave to the World Bank earlier this year. Rosen’s deconstructions of the media have been very helpful to me, over the past two years. See his blog here: PressThink.org. Rosen describes the use of opacity as a kind of hiding in plain sight, or secrecy by complexity.

In order to rebut this Secrecy by Complexity it’s the obligation of responsible energy analysts to explain the falsehood of adding biofuels and natural gas liquids (NGL’s) to measures of oil production. The reason is simple: natural gas liquids are not oil. They are not oil in any sense and most important of all NGL’s contain only 65% of the BTU of oil. Worse, biofuels are barely an energy source themselves and are the product of a conversion process of other energy inputs. Accordingly, the world is not producing 84, or 85, or 86 million barrels of oil per day. The world is instead producing 73.436 million barrels of crude oil per day. The depletion of oil will not be solved by either by the production of biofuels and NGLs, nor their inclusion into oil data, as the world economy moves into the future.

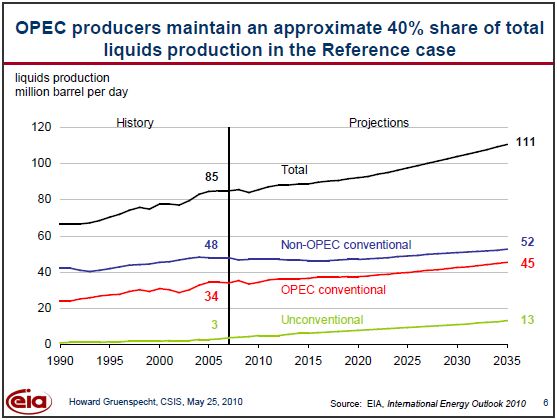

When the EIA in Washington falsely composes such forecasts, aggregating future natural gas liquids and ethanol into a supply picture for “oil” as they do each year in their various projections, this disables the public’s ability to accurately understand the true outlook for global oil supply. While it’s still the case that EIA Washington produces data each month for Crude Oil production only, the predominant reporting and forecasting is now weighted towards “liquids”, the unhelpful aggregation of oil with NGLs and biofuels. But most unhelpful of all is that, in forecasts, the EIA has essentially dropped projections for global crude oil supply. For example, in the International Energy Outlook (IEO) 2010 public press conference this May the EIA released to the press the following slide-deck: International Energy Outlook 2010–With Projections to 2035. No accounting or forecast of oil is contained in the document. | see: Slide 6: OPEC producers maintain an approximate 40% share of total liquids production in the Reference case.

Little information of any use is actually provided by the projection shown above for one simple reason: the chart does not tell us about the actual energy that will available to society. More egregious is that even in the main body of the IEO 2010 report, more false aggregation occurs with a yet another term of complexity: Conventional Liquids. Indeed, it’s not surprising that OECD governments use opacity and secrecy by complexity to handle this extremely important issue. OECD economies are now structurally short energy supply, having lost access to the cheap BTU in oil that built out their societies over the past 100 years. The loss of cheap energy, the loss of the cheap BTU that oil has provided to OECD nations for the past century, is a crucial factor in the dilemma the West now faces: a newly chronic economic restraint that refuses to go away.

Data Notes: All Data through September 2010, via EIA International Petroleum Monthly.

"The depletion of oil will not be solved by either by the production of biofuels and NGLs, nor their inclusion into oil data, as the world economy moves into the future."

In terms of the peak oil crisis, my understanding of oil is:

That which can be used to power an internal combustion engine and create plastics and other petrochemicals

Definitions based on the specific chemical structure of mined materials while chemically signficant have no economic significance or significance to civilization if they can power a car and make plastic.

My understanding is that both tar sands and NGL can be converted into fuel that is capable of both making plastic and powering internal combustion engines, albeit at a higher price.

While the price of producing oil is important it is not economically significant where those prices are incurred for example in deepwater oil most of the price is incurred during extraction with less cost involved in refining, with with venezualan heavy oil or tar sands, there is less cost involved in extraction and more costs in refining, nonetheless from an economic point of view, tar sands should qualify just as much as crude oil as deepwater oil (although less than Saudi Arabian oil)

Also I'm not sure how crucial it is for oil to have a high EROI, maybe its just important for something to have a high EROI. Maybe its acceptable and sustainable in the immediate future to use nuclear energy or gas extracted at high EROI to generate oil from tar sands (or through converting gas to oil or coal to oil), for use in transport and plastics manufacture. If this can be achieved below the oil spot price then I don't see why these liquids should not be included as oil.

jm - Whether one includes other liquids or not depends upon the information one is trying to impart. If the goal is to highlight the decline of crude oil production over time them including all other fuel sources is improper. You can't project a future production trend of one commodity by including other commodities in the analysis. OTOH if the goal is to project future available fuel sources than it's very appropriate. Thus whether including all liquids is the correct answer depends on the question. Studying the curves seperately can be enlightning. Combining the two projections only confuses the reality of the situation IMHO. And the point being that in some instances that may be the goal.

Changing definitions mid-stream is dubious -- in the world of scientific and clinical studies, it is a red flag that something is up (recent example, relevant to me, was the shift of the goalposts in the Zetia/ezetimbe study a few years ago -- followed sometime later by a negative result). Any time this happens, don't just watch your wallet, grab it and hold it tight.

One problem this can cause is accidental double-counting -- if the new definition of "oil" says we have enough "oil" (and by implication, energy, and perhaps even by implication, cheap energy) for decades to come, and we already "knew" we had enough "natural gas" (based on previous definitions and projections) to last for a century, why then we are golden, aren't we? But of course, if we are using NG to make "oil" then our consumption rate is going to go way up.

But if we change the definition of an oz of gold then we are all richer -- right?

Such is true - if you are trying to determine if crude oil production is declining, then adding in NGLs and biofuels just obfuscates the issue. However, I think it is possible that obfuscation of some politically inconvenient facts is one of the goals of these government organizations. I think some governments don't really want their people to know how bad things are getting in terms of crude oil supply.

There is an argument for including condensates from gas wells and pentanes plus (C5+) from gas plants in the "liquid fuels" category, since these are liquids under atmospheric conditions and can be blended into the crude oil stream going into the refinery. In fact, many refineries would want to do this because it improves their yield of gasoline, which will be low if they are processing a lot of heavy oil. This is particularly helpful in the US where the demand for gasoline and asphalt is high, but less so in Europe which wants a higher cut of diesel than a condensate+heavy oil mix would provide.

But the lighter NGLs - ethane, propane, and butane - are gases under normal atmospheric conditions. They have different markets, such as petrochemicals, or heating/cooking fuels where natural gas is not available. You can't just indiscriminately blend them into gasoline because they will cause fuel systems to vapor lock under hot conditions. A refinery would prefer to sell them to a petrochemical plant, which is why they are often built side-by-side.

And biofuels, which mostly means fuel ethanol, is problematic because it really involves some double-counting of "oil" production. Refineries are producing diesel fuel, which farmers then burn in their equipment to produce corn for ethanol which the refineries blend into their gasoline. This is just an indirect and expensive way of converting diesel fuel into gasoline. It would be more efficient for the refineries to enhance their refining processes to produce less diesel fuel and more gasoline, but then the total volume of "oil" produced would be lower.

So, the EIA in Washington and the IEA in Paris are producing numbers which are highly misleading. They purport to show that oil production is remaining stable, when in reality it is starting to decline. For the politicians, it does avoid the inconvenient question, "What are you doing about this problem?" and the even less convenient reply, "Well, nothing, really."

Well said RMG,

The bottom line that everybody should be closely looking at is the global amount of net energy generated from all available energy sources.

If the available amount of net energy is declining, in particular despite increasing extracted volumes of various types of hydrocarbons, then humanity is collectively in trouble...

JB

P.S: Another strategic issue to consider is of course the capacity of the existing society infrastructure to process the net energy that becomes available from various sources in various forms. For example, if the global energy mix starts to shift and net energy becomes mostly available in the form of exracted coal but most of the transportation infrastructure (cars, trucks, cranes, boats, trains and planes) cannot use the energy available in that form, then we also have a problem...because we have huge amounts of capital sunk into the existing infrastructure and replacing that infrastructure with something else requires a great deal of time and capital.

Jonaton said,

If the available amount of net energy is declining, in particular despite increasing extracted volumes of various types of hydrocarbons, then humanity is collectively in trouble...

===================================

The likely outcome -

It is! (declining)

And, WE ARE! (in trouble)

...and energy.

This is just plain wrong. Ethanol is a Gas-to-Liquids process, with a (small) net energy gain, a huge economic gain, and a lot of dry distillers grains feeding livestock. The bulk of the energy used is natgas to make ammonia fertilizer, and natgas to run the distillation. The diesel used to run farm equipment is damn near in the noise. Trucking feedstocks and products around takes way more diesel than minimal-tillage corn farming does *.

* Does not apply with diesel-powered irrigation pumps.

Well, granted, the use of natural gas to create nitrogen fertilizer is the biggest energy input into creating fuel ethanol. Coal to generate electricity is another big input. The use of diesel fuel for farm equipment is a smaller input, but the diesel fuel to transport crops and run irrigation pumps is also significant.

But it's not really a gas-to-liquids process, it is a food-to-fuel process and has the secondary effective of driving up world food prices. This is not a minor effect - much of the world has become dependent on imports of cheap American corn, which is becoming less cheap as it is turned into automobile fuel.

I don't see the economic gain, because agricultural production and irrigation are heavily subsidized in the US. Turning corn into fuel ethanol just adds even more subsidies to get rid of the corn surpluses caused by the agricultural and irrigation subsidies. It's piling subsidies on subsidies.

At the end of it all, the whole fuel ethanol system is just a huge mass of subsidies that could be eliminated by forcing car companies to build and people to buy more fuel-efficient vehicles. Instead of putting 10% ethanol into gasoline, Americans could just use 10% less gasoline by buying smaller vehicles - which of course people in almost all other countries already do. The main losers would be industrial-scale corn farmers, oil companies, and automobile companies. However the latter groups have much better lobbying organizations than taxpayers do.

Although you haven't mentioned the loss of an opportunity to allow land to rest and regain its composure, your comment, not just the sentences I've blockquoted, is about as good as response to the grain ethanol touts that I've seen.

Thank-you.

I hear a lot of talk about how it's better to let the let the land lie fallow from non-farmers, but the only place anyone puts their money where their mouth is are *government* Conservation Reserve Program subsidies.

Get rid of the 'take-the-land-out-of-production' subsidy, and all the tillable land will get planted. This is what happened when New Zealand eliminated farm subsidies. Intensity of farm operations went up, as farmers had to get produce more goods to maintain income.

I am working on business plans that eventually involve buying land. I'll believe the talk about how letting land lie fallow is good when I can start putting a per-acre revenue I can get for leaving it fallow into the business plan. Until then, I am digging up new markets that involve making my own fuel to transport farm goods directly to a city center.

Letting land lie fallow is a tradition that dates back to Biblical times. Allowing land to lie fallow serves to accumulate moisture in dry regions, and to discourage weeds and plant diseases. This reduces the need for irrigation and the use herbicides and pesticides.

The practice dates back to Biblical times.

Exodus 23:10

Obviously the Bible intended to discourage people from overfarming their fields, and in addition to feed the poor, and preserve wildlife. These are some concepts that have been lost in modern agriculture.

Letting land lie fallow was traditional in Europe during the Middle Ages - they originally used a two-field rotation system in which they grew crops on one field and left the other lie fallow, and then switched the fields the next year.

Later they switched to a three-field system in which they grew cereals on the first field, legumes on the second, and let the third lie fallow. Then they rotated the fields over the following two years. This allowed the legumes to restore the soil nitrogen removed by the cereals, and the fallow fields to restore the soil moisture before they put cereals back in again. The whole concept is to not destroy the land fertility or use up too much soil moisture, and does not depend on fertilizers, irrigation, or herbicides.

Paying farmers to take land out of production seems to be a uniquely American concept, which encourages farmers to maintain production by farming the remainder of the land more intensively. Other countries would just put quotas on crops. You're not allowed to produce more than your quota per hectare, which discourages overly intense farming and keeps costs down.

That being said, almost every industrialized country over-subsidizes agriculture. It seems to be motivated by nostalgia for a rural past rather than common sense. The whole concept of solving the problem created by agricultural subsidies by using using more subsidies to turn the surplus into fuel is something that bothers me. It's just basically wasteful. The EROEI of fuel alcohol is just terrible and it doesn't do anything to reduce consumption of fossil fuels.

The EU uses roughly 50% of its budget to subsidicefarmers to grow stuff no one need. (And a good chunk of the remindre to translate every written document and every spoken word in the parlamant into all languages of the 27 member states). What a waste.

The question that ought to leap to everyone's mind is "if instability in the markets is the problem for farmers, why shouldn't the government guarantee a market for a certain amount of production depending on the amount of food in storage?" Farmers who planted more than their quota of acreage would lose their access to the system.

Unfortunately, interest rates, inventory taxes and other carrying costs mean that private entities can't fill that niche.

I fully agree about this with RockyMtnGuy. Part -or most- of the energy included in the bio-ethanol comes from oil or from natural gas, so we can not say that ethanol is primary energy. IMO ethanol should not be included in the "all liquids" statistics, if what we want to consider in this category is primary liquid energy directly extracted from the Earth.

This is not the same for NGL, and I disagree with RMG in this

and with Hagens in this

It is only partially true that NGL have different markets to oil; NGL is a direct substitute of many oil products. In many countries, NGL are used directly in vehicles equipped with standard gasoline motors and special pressurised tanks; also, propane distributed through local networks is also used as home boiler fuel instead of diesel oil. In the long term, this may become more common, so it is fair to consider that an increase of the production of NGL improves the security of supply of oil.

The main advantage of oil derived products with respect to natural gas is that they are liquid at atmospheric pressure and standard temperature. This is not the same for NGL, but the pressure required to store propane or butane at a normal ambient temperature is not a problem. In other words, it would be no problem that all the oil of the world is depleted if there is still enough NGL.

Trabirio

Production should be reported on a net basis - i.e. gross production less "liquids" inputs - for all supply, including crude oil. That may be more difficult, but I am sure suitable protocols could be developed. Not counting coal and nuclear that are converted into liquids without a deduction for these inputs is fine because they are not (yet) in short supply. NG is a bit more problematic. Supply seems abundant, yet its use to produce liquids from tar sands is absurd. It is the equivalent of turning gold into lead. On the other hand using gas that would flared off on a production platform for on board energy should not be counted.

Perhaps someone with the knowledge at TOD could estimate net production figures for all types of liquids production and produce alternative figures that challenge the EIA and IEA. TOD gets wide readership now and is highly respected.

No, any given ICE doesn't care (setting aside the issue of ethanol deterioration of rubber parts) where its energy comes from. It just wants BTUs. And will consume a given amount of BTUs per mile driven. The reason that it's obfuscation to include biofuels and NGLs in reporting 'oil production' as 'total liquids' is precisely because NGLs have only 2/3rds the amount of energy per volume as does crude. Worse, the production of a unit of ethanol requires the consumption of roughly one unit of FF. This is a combination of diesel, NG (others?). So including ethanol in total liquids is pretty much straight up double counting. What matters to society is how much energy is available to do anything other than acquiring more energy. This is what net energy means. When the total liquids number is flat, and includes biofuels and NGLs whereas before it did not, we have, shall we say, a less than clear picture of the net energy curve. But simply netting out ethanol and reducing the effective contribution of NGLs by 1/3 shows that it is declining, not growing, or even staying flat.

ICE care VERY MUCH about what the fuel is. . You can make/adjust engine components of a given engine, but the leeway is very small. There is all the hoopla about allowing 15% ethanol in gas, from current 10% and people are afraid that slightly older cars will not make it on 15% ethanol. Change octane number by a few percent and engines wear down so much faster. Gasoline, methanol, ethanol, diesel, liquid (compressed) propane and what have you else engines need quite different engineering.

Fair enough, CC, but utterly not my point. Note that I said they don't care where the fuel comes from. By that I mean they (these inanimate hunks of metal) don't care whether the gasoline that fuels them originated as crude oil, or was processed from tar sands (or whatever else is possible - I know nothing of the chemistry/engineering involved). But what matters hugely in this equation to society at large is how much NET energy is available to be burned in said engines, or used otherwise. And when we get reports such as these that combine inputs that have different energy values (NGLs vs crude), AND which require significantly more processing energy (ethanol), then the results/trend/scenario is horribly obfuscated. And because we exist in a corporatocracy, it shall ever be thus, right over the cliff or into the wall or pick your metaphor.

Yes and no. The yields of various fuels depend on the input. And if the inputs are very heavy (oil sands) and very light (gas liquids), they do not contain the carbon chains we want for gasoline, diesel, and kerosene. It is possible to crack longer chains and must be possible to deal with C4, C5, C6, but it costs $ and energy. But regular crude oil has "gasoline" and "diesel" and "kerosene" hydrocarbons in the mix already.

This is my point... net energy is what matters.

My ICE (unmodified 2001 toyota Prius, 180,000 miles) does just fine on anything from 0% to 50% ethanol. It's changing that concentration number quickly that confuses the control system.

The hoopla about 15% ethanol in gas is FUD (fear, uncertainty, and doubt).

In Brazil, everyone *expects* to be able to fill up with whichever is cheaper per-mile traveled. Sugarcane ethanol, or petrol. Are the wheels falling off of flex fuel cars in Brazil?

No, they are not exploding, but they are designed as flex fuel. Oxygen containing fuels have higher octane numbers and I am pretty sure that the compression ratio of your Brazilian Prius is higher than that of US or Canadian one.

A quick search on the net: Prius seems to have a compression ratio of 13.5:1 which is higher than normal 9-11:1 for gasoline cars, and they seem to be playing a lot with valve timing to get high efficiency and low power.

That's the geometric compression ratio. The actual compression ratio of a Prius is considerably lower because the intake valve closes late; this yields the asymmetric compression/expansion ratio of the Atkinson cycle.

Incidentally, the mechanical arrangement of the original Atkinson engine is inspired and worth looking at just for the wonderment. I'd post a link to the animation I like, but I can't find it ATM.

There is all the hoopla about allowing 15% ethanol in gas, from current 10% and people are afraid that slightly older cars will not make it on 15% ethanol. Change octane number by a few percent and engines wear down so much faster.

Modern engines are rather insensitive to octane rating. If you put low octane fuel into a car, the knock sensors will detect it and the engine management computer will back the ignition timing off a few degrees to compensate. The net effect will be a minor loss in power. You won't be getting full value out of that high-performance engine you foolishly bought without thinking about the cost of premium fuel. But it will last just as long.

However, alcohol levels above 10% can be a problem in a lot of cars that were not designed for it. It will dissolve gaskets, seals, and other components in the fuel system, screw up the fuel injection calibration, and cause other problems. Having to replace the entire fuel system is rather expensive, so don't use high-alcohol fuels in cars that were not designed for it. Read your owner's manual to be sure. If it doesn't say you can use high-alcohol fuel, assume that you can't.

That's true as far as it goes, but with technology like liquid petroleum gas injection (currently marketed by Hyundai) the thermal efficiency of NGL engines can be enough higher that all or much of the difference is erased.

It's true that we don't use most such fuels in that way. That's the big problem.

I'd very much like to read a post (or paper) that addresses just the utility aspect--or useful work aspect--of all liquid fuels regardless of source, just for the sake of the points you raise. I certainly agree that specific regions and countries, at certain times in history, have elected to optimize resource production merely to obtain liquids--regardless of whether that process was either barely positive in energy terms, or even negative in energy terms.

More broadly, I do alot of work and research on coal. But as I'm sure you would agree, neither coal nor natural gas will translate easily now for the benefit of societies/economies who have leveraged their built environments to oil over the past century. As a mitigation of the loss of expanding supply of energy-dense oil, therefore, the actual use of biofuels is to me a bit like additional credit-expansion to the economy. It introduces some fresh liquidity but it's not very sustainable.

In my post here, however, I try to keep the focus a tad more narrow. Instead of addressing energy transition itself I am simply taking a swipe at the information we're provided by our government, and the disabling effect of so much complexity. I'm actually not fully negative on biofuels per se, for example, and I see a role for them as a local fuel--not carried by pipeline. Also, in terms of all energy-source supply, I actually lean positive on that score. In my view the world has lots of energy. It's just that the world we built is not set up so well, to easily use it.

Best, G

Superb work Gregor. You honed in on the data and the graphs in much the same way I did on my energy blog. I was annoyed by the prominent graph posted in the IEA report that on first glance looked hopeful but a closer look revealed that it was a bit of a chimera. Thank you for pointing this out. I pointed out some other peculiarities of the report and of the IEA on my report as well. FYI

http://cal48koho.blogspot.com/2010/11/iea-2010-reportpeak-oil-exists-aft...

Exactly. Our civilization was built on super cheap abundant oil, and everything that goes along with that, including our credit system, high population, infrastructure, etc. And along with that come expectations. Look for example with State pensions, which were established during the cheap oil era but now make no economic sense. What about the trouble GM got into with their overweighted pensions? Look at the cost of a college education today compared with the cheap oil era. What about the cost of infrastructure replacement, like bridges. NY cannot figure out how to come up with enough money to replace some of their obsolete bridges connecting Manhattan to the other buroughs.

Civilization was easy to build on cheap abundant liquid energy, but increasingly difficult to maintain as the cost of energy rises. At some point, which we may have already passed, civilization decays around us as we fail to rebuild and maintain basic infrastructure needs. Roads, bridges, tunnels, power lines, communication lines, aquaducts, oil pipelines, buildings etc. can only decay to a certain degree, then as parts of it no longer work the entire system reaches a point of obsolescence, collapse.

At that point the mass production of food in plants where a quarter million loaves of bread can be cachunked out every day or a million gallons of milk production from just one plant stops. How do you go from an electrical, mechanized, highly complex civilization capable of supporting over 300 million in the case of the US, to simply surviving at the local level? How many people can make the transition? How many will that new way of living support? What's a realistic prognosis?

Well put. Someone should show this to MikeB and then ask him if still thinks Greer is so off the wall with his statement about people who depend on medication for survival dying due to peak oil. Given the above scenario it seems highly plausible that not even many fit and healthy individuals will be able to make such a transition, so what hope do those that can't survive without medication have? Granted we could all be completely off the mark with regards the possibility of our civilization collapsing due to peak oil... I just wouldn't bet on it.

MikeB has admitted to being a "hack," so why are you preoccupied with what he says?

Here is as elegant a statement of the problem as has ever been composed. I can quote it verbatim to people. I will not even need to cite the source:

Not you, not me, not anyone knows how this is going to happen. We could have people dying from lack of meds in one area of the globe, while conditions in another part of the globe actually improve. You just don't know.

And people who are not scientists have no business speaking out of their you-know-whats about it.

Another thing: If the patient is as dead and gone as the True Believers of Doom on TOD assume, then why are they continually shouting into the patient's ear: "YOU'RE DEAD! YOU'RE DEAD!"

Why aren't they telling fart jokes instead? The dying patient might appreciate it more.

Better yet: How many of those who actually believe Greer's doomer glossolalia are now hoarding medications for their drug-dependents Grandmas? If not, why not?

If there were a Cat 5 hurricane headed for Grandma's house, and you knew it was headed for her house, I bet you'd risk life and limb to drive to Grandma's house, drag her out there, thereby saving her from the path of the hurricane. If not, what kind of a grandson are you?

Grandma dying from lack of meds due to peak oil is a serious issue! I propose a key post that advises people on how to hoard all the necessary medications to keep her alive.

What earthly reason is there for the birth and death rates to equal out? Unless you refer to the momentary point when one value passes the other.

If the death rate is rising, it will almost certainly be at the expense of those that have helped lower it to begin with. So the average life span will drop. That implies old people will die sooner than if they had access to their 'meds' and the infant mortality rate will rise. These are the two main causes for the population increase.

The birth rate is less likely to change as much as the death rate, although it may come down some. There are far more ways to die once you have been born than there are to not be born in the first place.

As for Grandma in her house. Most meds have a use-by-date on them, so hoarding is less of an option. It's not even a lack of production of the meds that will be the initial problem but a disruption of supply. We will have to wean ourselves off the idea that everyone can and must be saved no matter what the cost.

What kind of Grandson leaves the poor defenceless old dear to live in a house that's likely to be flattened by a hurricane? Maybe it's time to rethink the family values.

I couldn't have asked for a more well-stated example of the moral bankruptcy of the strictly dogmatic doomer point of view.

Thank you!

I find it odd that youre reading of that wasn't to say - "Come and live with us Granny, it's obviously getting too dangerous for you to be living alone". But then my moral bankruptcy is of the UK variety not the US.

Your comment was in response to my specific question: If people actually believe what they say, then why aren't they taking the appropriate steps to deal with the situation?

Your comment and its context:

Now you're saying you didn't imply what you were implying.

It's like hearing Sarah Palin say those crosshairs weren't crosshairs but really surveyor's marks.

Your inference was that by not going to save Granny from the hurricane I must be morally bankrupt. My suggestion is that by leaving Granny to live alone out there in the first place I must be morally bankrupt.

You seem to believe that this mythical Grandmother has an inalienable right to live alone and yet be protected from everything that nature can throw at her. Hurricanes, medical problems, accidents etc.

It's time that our society grew up and started taking responsibility for its actions. Emergency service are a prime example. People insist in taking part in extreme activities and then demand to be rescued when it all goes wrong. Well, the time is coming when that rescue wont be there. In fact here in the UK the Coast Guard stations are being reduced to just 6 for the whole country. That's not going to bode well for some poor soul(s).

If you truly had Grannies best interests at heart you'd have her move in with you where you all have a fighting chance to look after one another. Hence my comment of rethinking family values. If we assume that Granny can't get her meds for whatever reason, then surely the best place for her to end her days is surrounded by a loving family. These "earlier" deaths through lack of meds, accident or even starvation will happen. The only question is the level of compassion shown by those around them.

Keeping people alive at all costs sometimes is moral bankruptcy. My father in law had advanced dementia. Although he

had little pain and very little if any self-awareness, when he got to the point of needing invasive hospital treatment to keep him alive, his wife and daughter asked that he be allowed to die naturally. His son, who could not accept his impending death because he could never cope with the reality of his personality whilst he still had one, insisted that he was kept on life-support at major expense (and opportunity cost to other needy patients) for more than a month before he died anyway.

The same son insisted on his widowed mother coming to stay with him for Christmas, driving 200 miles to collect her, despite our protestations that she was too frail. Then he failed to notice how weak she was, pushed her too hard to be sociable, and

she collapsed on Christmas day. If we had not been there as well she would have died in her bed, but we called an ambulance. She died peacefully a week later.

Sometimes the moral thing to do is not to sustain medication.

You've selected an example that simply dodges the issue. Not sustaining medication to someone with dementia is a completely different issue than not hoarding medications for those that need it, assuming the hysteria around peak oil-induced meds shortages is correct.

If a medications shortage is indeed around the corner, as so many of the oracles around here seem to believe, then why not hoard the medications that sick children need to stay alive?

I still don't think anyone really believes these developments are imminent. I believe they enjoy the pronouncements of the blowhards because they seem to confirm that their rigidly catastrophist point-of-view is right.

Ah, so now by saving meds for children you've put the value of life onto a sliding scale. Children therefore are more worthy for saving and therefore more important. So on this scale would severely handicapped children be more or less deserving?

That was a rhetorical question before you get all uppity about it. Based on a book called "Causing Death and Saving Lives". Well worth a read.

You seem to be struggling with the concept of coming to terms with a situation. A lot of issues raised on TOD have no techincal fixes, only a need to be mentally prepared.

My grandmothers are already dead but: Medications are on prescription. I can'tjust go to the drug store and by ten years of supply of the stuff. Secondly; if I could, they have an expiration date far shorter than that. 2 years or less is commonplace. Thirdly: I can not predict when the collapse will happen within an errorrange of 2 years.

There are very little room to play in this game.

In the US, at least, you can get an idea of how people would be affected by a diversion of resources away from medicine by looking at how funds are currently being spent.

About half of medical expenses are incurred during the last 18 months of life. So that implies that teminally ill people, mostly the old, would die about a year or so earlier than they do now.

Very little of the other half of expenditures are for acute care of illness or accident. Comparatively speaking, taking out an appendix or gallstones or setting a broken bone or sewing up a simple wound are simply not that expensive, even at current inflated prices. However, the patient on dialysis due to kidney failure or the auto accident quadriplegic require chronic, very expensive care. So people with expensive chronic illnesses and the severely injured would likely die. In fact, with a reduction in emergency services, more severely injured persons are likely to succumb on the spot. Without rapid response and intensive care expertise my friend would not have survived a severe stroke only to spend serveral months uncommunicative and immobilized and in intense anguish and pain before dying, a common and expensive current practice.

Lastly, another major chunk of expenses is incurred just after birth. Without extensive and expensive medical care, lots of premature and deformed babies would no longer survive. Some of these would not show up as increased deaths, because they would be declared dead before birth.

Another way of looking at it would be to consider the mortality impacts of going back to medical care as it existed 50 years ago. That level of medical care would be a small fraction of the cost of medical care in 2011.

I disagree, I think most fit and healthy individuals will survive the transition with some inconvenience. I think many people in America don't truly appreciate just how much slack they have in terms of loss of wealth, before people start dying.

You hear these U-Tube videos with people complaining about "Americas struggling middle class" but the GDP per capita in the US is $40,000, if a slight dent in thaty figure causes people to suddenly die in droves, then how do you fgure 90% of the rest of the world (who earn a fraction of that) manages to survive right now?

I think increased burocracy and regulation (health and safety etc.) and competition from China play a role aswell as oil.

Very good analysis. I have long complained about the lack of logic and over emphasis on numbers in energy analysis.

Energy analysis for some reason seems very susceptible to this. Grain analysts would never think of comparing things that are different, which energy analysts do all the time, such as with ethanol, conventional crude, tar sands, and natural gas. It would be like comparing, adding and subtracting from each other oats, soybeans and corn.

Nor would metal analysts ever compare iron, gold and copper. They would not add them together and think they have found new insight.

If they did they would be laughed at and it would be taken as a joke.

But when energy analysts do it, it is taken seriously.

The result is obfuscation, muddled thinking and bad policy decisions.

Energy is an abstract noun just like grain and metal. But for some reason, it is treated as concrete in analysis. This is the reification fallacy. I suspect it is purposeful obfuscation since there is money to be made if the stock market can be convinced that natural gas is equivalent to oil, for example.

And there is market share to be maintained if people can be convinced that the energy content is more important than the usefulness of a form of energy. Strangely this argument is applied selectively.

With electricity it doesn't matter and electrification of transport is even held up as a solution as in electric rail and autos.

But when it comes to ethanol, energy content is argued to be paramount over usefulness.

Energy analysis is so full of obfuscation IMO because there is big money and powerful business and national interests involved. We are talking about "to be or not to be" here. Energy unlike grain or metal is primary in exerting world influence in business and international relations.

The dollar is backed by oil since those who have dollars can buy the oil they need. They can buy grain and metal too, but they are not as fundamental to the needs of everyone. Some countries can get by with their own grain and metal plus a little imports.

But oil is used up and fast. Demand seems insatiable. Without adequate supply for transport, everything stops moving.

So the energy fallacies of comparing things that are different, comparing different forms to oil standards and regarding usefulness as irrelevant were created to maintain oil's primacy.

The trouble is that it makes moving away from oil very difficult. That is obviously the intent.

It means power and wealth to business and national interests who control oil. And they want to hold on to it. They will use any means necessary including obfuscation, lies and war to do it.

What's distressing is that EIA Washington data, for all practical purposes, is essentially of no use to the layman. This goes beyond even the points I've raised here. I've sat on the phone with money managers, and reporters, and others patiently guiding them through the morass of data. To put it mildly, you really need a strong motivation to get through it, understand it. And of course most can't even find it. This has raised a few questions for me, over the past 5 years:

1. Is it "right" that I have been able to market research susbcription material, largely based on my own slog through, and ability to make sense of, the data? In one sense, yes. But perhaps it would be better if we needed less translators for material that should frankly be more understandable.

2. Should I do something to help open up government data, like taking an interest in the work of Tim O'Reilly( Big Data, etc), writing "helpful" emails (Heh) to the EIA?

Well, I've done both of these and will try to do more.

G

Nota Bene: EIA just released in the last hour the latest International Petroleum Monthly report. It shows global production falling in October from 73.542 mbpd to 73.064 mbpd. But more to the point of our discussion, this is the last IPM report that EIA will produce. Starting with the next issue, the data will be "aggregated" into one of the EIA's DataBrowsers.

Notice: The Energy Information Administration is discontinuing the publication of the International Petroleum Monthly in its current format. The December, 2010 issue will be the last one to be available as a separate publication. Beginning with the January, 2011 issue, you may access the data in this report, as well as energy data for all fuels for over 200 countries, on our International Energy Statistics website . If you have any questions, please contact the National Energy Information Center at 202-586-8800 or infoctr@eia.doe.gov./

http://www.eia.doe.gov/ipm/contents.html

There appears to be an error in the data (check the end of the Drumbeat thread), but in any case it doesn't alter the fact that we are seeing a large cumulative shortfall between what we would have produced at the 2005 annual rate and what we actually produced from 2006 to 2010 inclusive.

Secrecy by complexity has been a very successful technique for reporting inflation and unemployment. Why not use it for oil production?

Very good point Micro.

Burying Fraud in Complexity became Standard Operating Procedure in the Mortgage Industry the past decade. Actually, it is SOP in the entire financial system (e.g. How many countries entered the EU courtesy of Goldman(Fraud)Sachs et. al. ???).

And FRAUD is now the main structural support of our current economy (i.e. it's legal to lie FASB 157, back-door bailouts hidden in the fine print the Fed desperately tries not to release to the public...the list goes on and on).

Our leaders have shown repeately that they have absolutely NO intention of being honest with us. It is that simple.

edit - The tragedy is that we no longer have time for the dozens of election cycles that would be necessary to remove the criminals (traitors?) embedded in our political system.

Here's to hoping for a non-violent revolution soon.

I took the time to watch the Jay Rosen lecture at the World Bank. OK, he was in the Lion's den and approached the subject of information exchange intelligently. I can not say that his Maxims were a great revelation to me but they do help to crystallize the mechanisms at work today.

The best part for me was to listen to him at the very end, right after a World Bank employee attempted to defend the authority and expertise of the World Bank (that's the way I understood her comments).

What Rosen did was to say that he is not impressed with today's "experts" who came out of the "best" universities and created the financial mess the world is in today. He told them that he was not impressed with the "professional" journalists who did nothing to try and stop this mess or the "experts" in regulatory agencies who did nothing to stop the "experts" brewing this mess. He said the something went awry. I suspect what he really want to say was this, "There is a lack of honesty in today's institutions and the "experts" working in them who should have been working to ensure that the system does not collapse." I seen no correcting mechanism on the horizon at this moment as the elites on that Mayan pyramid just don't see a need for it.

Yes, too bad there are too few Rosens in the world - they are outnumbered 1000-to-1.

That reminds me of Nigel Farage and "The Euro Game Is Up! Just who the hell do you think you are"' speech.

The ennemy of truth is of course confusing complexity...

Confusing complexity has become the standard operating procedure (SOP)in the area of finance and financial regulation and it is increasingly becoming SOP in the world of energy statistics.

Churchill once said that the truth is so important that it needs to be shielded by numerous veils of secrecy. He said that during a publicly acknowledged world war...

Given that the ends often justifies the means, we may be going through a period of human history that is comparable in importance to an unacknowledged global confrontation.

The remaining geopolitical titans are currently fighting for the remaining net energy reserves of the planet and unless a miracle happens (a new very high EROEI energy source soon becoming commercially available), it is likely to be a fight to the finish in a last man standing scenario.

JB

Indeed. And when I wrote the first version of this post on my website, a number of readers who follow my work made that very same point: http://bit.ly/fd9n7u | Accordingly, I await the Tainter-described rapid simplification, which I regard almost as an inevitability.:-)

G

Regarding inflation, the govt. does not include cost of energy and food. When I heard that some time ago I was aghast. They don't?!, I exclaimed. Like you say, maybe that form of secrecy will work for oil as well.

Where do you get that?

Food items and various fuels are mentioned here for the CPI market basket:

http://www.bls.gov/cpi/cpifaq.htm#Question_6

I'm not going to track it down but there are regularly disseminated inflation figures that do exclude food and fuel, and the if memory serves these are the monthly inflation figures most often quoted by mainstream media.

Your article confirms that I am on the right path to focus on crude oil on my web site which I update every month with the latest EIA data from here: http://www.eia.doe.gov/ipm/

Latest crude oil graphs (incremental production relative to January 2001)

http://www.crudeoilpeak.com/?page_id=51

For example, this is the OPEC graph:

It is also good you mention the tar sands being included in the EIA definition of crude.

According to the IEA (International Energy Agency) WEO 2010 and also WEO 2008 actual crude oil production is in the order of 70 mb/d only

10/11/2010

IEA World Energy Outlook 2010: Global crude oil production will never grow again

http://www.crudeoilpeak.com/?p=2060

The inclusion of biofuels in IEA statistics is documented here:

20/9/2010

IEA corrects oil statistics containing bio fuels

http://www.crudeoilpeak.com/?p=1876

"According to the IEA (International Energy Agency) WEO 2010 and also WEO 2008 actual crude oil production is in the order of 70 mb/d only"

Can you make a chart of this?

Crude oil is the dark blue area, WEO 2008, from this article: http://europe.theoildrum.com/node/4829

WEO 2008 can now be downloaded for free:

http://www.worldenergyoutlook.org/2008.asp

Thanks for this, Matt. I was hoping for something a bit more fine grained and up to date. I would like to be able to show people a clear, up-to-date graph that clearly indicates how conventional crude has peaked, and that we are now falling away from that peak/plateau.

I welcome this type of post because it highlkghts the ignorance of our so called leaders. Whilst NGL's might be considered as liquid fuels the use of them in transportation fuels is rather limited. The global population of vehicles using NGL,s is so low they barely register, and are never really likely to. Moreover NGL's are finding ever more use as chemical feedstocks (i.e. Saudia Arabia)

Meanwhile oil demand grows, especially in the far and middel east and Europe and North America apply belated energy conservation measures that have for a while offset the demand from the developing nations. But soon the crunch will really bite and fiddling of the figures will be exposed and probably result in another price spike as reality dawns, large.

This will result in a huge flow of capital from consuming nations to producing nations and trigger another financial crisis. The potential for political unrest looms large, along with uncontrolled migration.

Alongside we have the effects of depletion eating away at conventional oil, and the spectre of diminishing EROEI making every barrel produced and processed into finished product ever more costly.

A quick look at Aramco's annual buttletin 2009

http://www.saudiaramco.com/irj/portal/anonymous?favlnk=%2FSaudiAramcoPub...

is not exactly comforting. Along with the population of Saudi Arabia, the oil Saudi consumption is growing, rapidly. Moreover exports are static. Even worse there are near on 1 million b/d of crude oil which its not exported or processed. It is probably burned for power and water production.

I for one am not convinced of OPEC's true spare capacity.

Peak Oil exports are closer than peak oil.

GM compact crossovers, Chevrolet Equinox and GMC Terrain, increased sales by 110 percent

http://media.gm.com/content/media/us/en/news/news_detail.html/content/Pa...

For people in UK not familiar with US vehicles

http://www.gmc.com/terrain/terrain/index.jsp

It has been argued that $90 barrel oil will cause terrible hardship in the USA, I got to say, when we read how sales of vehicles doing 22mpg are going up, we no longer believe you.

Perhaps no amount of information will change people only price will.

In the UK we pay equivelant $7.50 a US gallon, if we paid $3.00 a gallon, we might buy the sort of cars you do.

I just ran a check on UK petrol prices - using the price at the station by the office.

129.9 pence/litre = 7.67 USD per US gallon. More or less. My 8 year old car gets around 38 mpg (UK)/30.4 mpg (US) and I drive at 70mph most of the time (or possibly a little faster!). If I do buy a new one, it will have to be up over the 50 mpg (UK) mark.

Note to US readers: He will probably have a choice between 1 or 2 different models from most major manufacturers in his search for 50+mpg. This includes US based Ford, GM (Vauxhall/Opel) and Chrysler affiliate Fiat as well as major European brands like PSA (Puegot/Citroen) Renault and VW/Audi. Granted more than likely, most of them will be oil burners(diesels).

Alan from the islands

What they don't sell the Prius in Europe?

It doesn't sell as well as it does in the US (relatively), largely because of the existence of these significantly cheaper and almost as frugal alternatives. Most Prius drivers in Europe, as a result, are making a statement rather than effectively trying to reduce their carbon footprint.

Alan from the islands

I drive a Prius in the UK and the car sells well. It also competes well on a size basis with a diesel car. Not many diesels can touch it for economy. Our diesel Yaris does about 10% less in fuel consumption. The Prius does about 13 miles per litre winter and 14.5 miles per litre summer, based on fuel use records.

diesel Yaris

Any hope of these soon in the USA?

I must, of course deffer to your personal experience. My sister lives in London so my experience in th UK is limited to what I glean from my visits with her. Otherwise my main source of information is www.autobloggreen.com.

I did some digging on autobloggreen and came up with the following two articles:

Germany's top 20 lowest CO2-emitting models

20 fuel sipping diesel SUV/CUV/crossovers available in Germany

The first reinforces my point, in that the Prius is 11th out of the 20, in terms of mpg and probably sells for quite a bit more than just about all of them.

The second article is interesting in that it highlights jaz's point that the mileage of the latest mid size SUV out of GM in the US is still relatively poor by European standards. ALL the models in the list do at least 33mpg (50% better).

A Google search brought up this more recent article from uk.autoblog.com

Top ten most economical cars on sale

Finally an interesting tit-bit:

Passat BlueMotion enters record books after going 1,527 miles without refueling; that's 74.8 mpg

This in a car that is considered fairly large by European standards (similar in size to a Toyota Camry or Honda Accord). Even though the driving techniques used might be considered hypermiling, 74.8mpg in a car this size is downright amazing.

Alan from the islands

OK, sure vs a two seater vehicle the 5 seat prius is a monster big car in comparison. How many cars in that list even have 4 or 5 doors? (5th door being the hatchback)

When you said there were 1 or 2 cars per company were you thinking of 2 door vehicles or are you including them only because they were in the list at green.autoblog.com?

Just so we are on the same page for terminology http://en.wikipedia.org/wiki/Car_classification You are comparing

Microcar, Bubble car, "A-segment mini cars", Supermini and

Subcompact car, City car, "B-segment small cars" and

Compact car, Small family car, "C-segment medium cars", Small family car

versus the Prius which is on the border between that C segment and the D segment known as

Mid-size car, Large family car, "D-segment large cars", Large family car

Which by the way the Passat is in the same size classification as the Prius (both Mid Sized D Segment).

And even though it's very much so larger than many of those A and B segment cars it holds it's own coming in 7th in CO2 and 11th in MPG

I have nothing against A or B segment cars I just want to be sure you intended to make that comparison.

I'm not surprised that you can get a A or B segment car significantly cheaper than a C or D segment car.

I am surprised that people don't realize how big a Prius is compared to other cars that get good fuel economy.

and a Gen II Prius made 1,680 miles/tank (2,704.5 km Japanese Prius fuel tank has no bladder and can hold up to approx 15.9 US gallons, 60 liters) giving him over 100 MPG.

another Gen II Prius did 1,455.9 miles on 12.978 gallons of fuel for a grand total of 112.2 mpg!

Details include a total distance of 2,343.1 km (1,455.9 miles) on 49.13 L (12.978 gallons) at 47.69 km/L (112.2 mpg) actual from fillup to fill up. 49.1 km/L (115.5 mpg) was displayed on the Japanese Prius II’s FCD.

If all you want to see is record hypermiling you aren't going to win the stats by quoting the Passat in Guinness.

I spent some amount of time composing a reply To this but somehow didn't press save before navigating away from the page and losing it. The gist of my reply was that there is a cultural difference between the US and most of the rest of the world that results in a different perception of what a normal car is. I pointed out that in most old world settlements there are streets that would have difficulty accommodating a fairly normal full size US car like a Crown Victoria, while accommodating a normal size European car just fine.

I pointed out that design techniques in wide use outside of the US for decades have resulted in small, light fuel efficient cars that have surprisingly generous amounts of interior space and that the Prius benefited from these techniques. As a result, the Prius does not look larger than the average car in the city where I live. My views are heavily influenced by opinions put forward on autobloggreen which generally suggest that in Europe the Prius is an unremarkable car in a crowded field of reasonably fuel efficient cars. This is in contrast to the US where the Prius is the undisputed mileage champion, nothing even coming close.

I then suggested that we had gone way OT except for jaz's original point that obfuscation was leading American to nurture an unsustainable cultural preference for larger vehicles an leading to purchase decisions that might have been considered unwise if the truth were known.

Alan from the islands

Diesel is a much better alternative than a Prius and diesels are more available in Europe.

I beg to differ as we have both. I bought one diesel and petrol to hedge my bets. If every new car sold in Europe is diesel then we will have one hell of a problem. Already Europe is a net diesel importer and higher fuel prices will make the situation a lot worse. Thw ability to export the European gasoline surplus is also becoming more of a problem as the US blends more ethanol. Morevoer since January 1st Germany has moved to 10% ethanol in gasoline displacing yet more material from the gasoline pool. The effect has been no less than 7 refinery closures in the past 18 months and probaly more to come. The danger to Europe in the long term is that increasingly we will not only be reliant on imported crude oil but imported finished product. Still think diesel is best.

The Prius engine achieves its fuel economy by using the Atkinson cycle in which the power (expansion) stroke is longer than the compression stroke. Therefore comparing compression ratios is not exactly accurate between Otto and Atkinson cycles.

Also in UK we pay an annual car tax depending on what co2 the car emits, is there something similar in US. I think it does get people to think about the car they buy, but will need to be increased in the future.

http://www.vcacarfueldata.org.uk/search/vedSearch.asp

you can see the cars £0 rated and those that pay the highest.

Maybe not even that. Continuing physical shortages will wake up the public.

19/10/2010

NSW government acknowledges peak oil but continues business as usual regardless

http://www.crudeoilpeak.com/?p=1948

Is there an Import Land Model that would help with analysing how international price and supply changes would affect the economies of Import Lands?

First, the amount of oil that an Import Land will buy is limited by the share of foreign exchange earnings/borrowings that the IL is willing to allocate to oil imports. This share may be fairly flexible if the foreign exchange earnings/borrowings are being used to import luxuries (e.g. iPods to the US) and fairly inflexible if the earnings/borrowings are being used to import essentials (e.g. rice to Bangladesh or wheat to Egypt).

An exception to the foreign exchange constraint is the US, which can create dollars and use the profits of seigniorage as part of its import budget.

Second, the ILM should account for the difference between internal prices and world prices. The internal price of oil-derived products may be higher due to high taxes (such as with most OECD countries) or lower due to government subsidies (such as with many developing countries). Due to these differences, a change in global prices will result in a smaller or greater percentage change in internal prices, unless the taxes or subsidies are varied, in which case the IL economy is sheltered from changes, but the government has to absorb a fiscal impact.

The impact of peak oil on Import Lands would appear to be significantly different depending on how they are positioned with respect to foreign exchange earnings and the fiscal soundness of their governments.

It has been argued that $90 barrel oil will cause terrible hardship in the USA, I got to say, when we read how sales of vehicles doing 22mpg are going up, we no longer believe you.

You're looking in the wrong place. The people who can afford new cars (even on credit) are not the people who are suffering hardship. They are completely different groups.

You might like to read the reports produced by two Citigroup analysts in 2006 that are linked from here.

Or google for "plutonomy", which is shorthand for the fact that the US has divided into two groups: one, the relatively rich, is doing all the consuming, while the other group is living on the minimum wage, food stamps, and charity. Some people's budgets are so tight that an extra $10 per week on gas will cause hardship.

I am simply looking at how current fuel prices are affecting the car buying choices of people.

http://www.autoblog.com/2011/01/04/americas-best-selling-cars-and-trucks...

These people obviously do not care about increasing fuel costs, nor where the imports come from.

I know several poor people and they cannot afford a car, they get buses or train to work, we know several people who cycle to work, it takes them about 40 minutes, one person journey is just over an hour.

This is why I argue for massive investment in public transport, it would enable people to do without cars.

The 'hardship' stuff is kinda funny... I just had a 'freegan' pizza today that 90% of the ingredients were gotten by picking up stuff that stores would otherwise throw out, or harvested in an urban environment. (Acorns, for instance).

It was better tasting than any pizza I've ever paid for.

Now, what this group does may not scale up well, but it convinced me that a doubling of gas prices would be a wonderful thing as it would force those that are currently 'on the edge' to actually change something substantial, instead of depending on minimum wage, food stamps, etc.

Now I'm seriously considering writing a business plan for edible grain crops that includes providing transportation from metro areas out to the farm for anyone willing to help hand-harvest. Agri-tourism, charity, and low-cost farm labor all rolled into one.

Acorns? Better check on those, down here in Texas they are well known to be toxic to cattle. Tried one once myself; bitter as could be.

Acorns were a staple for Native Americans, at least where there were Oaks. They leached out the tanins or whatever it is that makes them slightly inedible, then mashed up the result to make porridges and breads. Supposedly nourishing but a bit bland is the end result.

Geez. don't people have any skills these days? I have lots of oaks (black oak, tan oak and live oak) and make some acorn meal every year just for fun.

Here's how you do it: Collect your acorns (any kind of oak will work), shell them (you can whack them with a hammer or use a nut cracker), put the shelled nuts* in a blender (or food processor) with enough water to cover, whiz them until they are in fine pieces, empty them into a sprout jar with a screen on top (or you could decant the water when you rinse them), place in the refrigerator, each day for the next week, dump the old water out and put in new water, at the end of the week dump them onto a paper towel to dry them.

Your can grind it finer if you want flour. Acorns are a GREAT food source. You can make acorn mush or use it in baked goods.

Todd

*I suppose I have to say this; don't use moldy nuts.

I'll take acorns with tannins any day over commodity crops with glycophosphate residue. Have you tested your cereal to see how many PPM of roundup is present? ;)

(I think these guys processed the tannins out anyway.. Personally I'll let someone else glean for acorns. I've got enough trouble trying to figure out how to direct-market grain)

I'll take acorns with tannins any day over commodity crops with glycophosphate residue. Have you tested your cereal to see how many PPM of roundup is present? ;)

Before you start chowing down on a diet of acorns, you might want to consider more carefully the problem of Tannin Toxicity

The lethal dose of glyphosate herbicide is about 3/4 of a cup. So don't drink a whole bottle of it. Or eat more than 6% of your weight in raw acorns.

As noted down the thread, I think that global net exports effectively peaked in 2005.

Note that BP shows Saudi internal oil consumption going from 2.0 mbpd in 2005 to 2.6 mbpd in 2009 (the EIA shows a slightly lower increase).

imo, we need more data, not less. the blind aggregation of energy sources is a problem, however.

'conventional' crude oil, measured volumetrically, is all over the map too. i sometimes wonder why the us and most of the world wants to measure oil by volume, instead of mass.

on the other hand, does your diesel engine care if the fuel came from conventional, gtl, bio-diesel or bitumen ?

and wrt crude oil, does anyone on here have a rough estimate or range of estimates of energy input/output for refining of crude oil ? in other words, how much energy is burned up in refining a barrel of say 35 deg API oil ? bitumen ?

Elwood,

I agree with you on the data and why on earth in the US volumetric units are used. In the main, in Europe, we use mass units and thank goodness to because it makes much better for comparison.

With respect to energy used in processing there is no really simple rule of thumb. In general the more complex the refinery ( Nelson Index) then the more energy it will consume. Likewise processing heavier crude will on balance require more energy.; more heating, more desulphurisation and more conversion. A loose rule of thumb would be to take the Nelson Index and multiply by around 0.7-1 as the % oil (energy) consumed during refining. It is a rough measure but generally the more complex refineries will run heavier crudes, and a Nelson Index of 14 (very complex) would probably burn about 10% of the oil a fuel, while a less complex refinery of NI 5 might burn 5% of oil as energy. Very much depends on the refinery configuration and product specs.

There is a more detailed article here

http://www.sciencedirect.com/science?_ob=ArticleURL&_udi=B6V2S-4M1D9XT-6...

and here

http://www1.eere.energy.gov/industry/petroleum_refining/pdfs/bandwidth.pdf

There is no simple answer as refinery efficiencies vary widely. Energy per barrel would range from 300 - 600 MJ/barrel ( crude oil about 6.3 GJ per barrel). This might be of some help.

imo, we need more data, not less. the blind aggregation of energy sources is a problem, however./

Agreed. And let's consider how easy it would be for EIA Washington and IEA Paris to simply highlight oil supply in their annual forecasts. I mean, after all, it's still the primary energy source globally. (Though not for much longer.)

G

Good point about the decline in both gross and net energy content per "barrel" as sources like bituminous sands, ethanol and NGL's are added to supply figures to give the impression of a continuing plateau. One additional point I find interesting, though not directly related to the central topic, is the relationship between price and supply. As Gail pointed out in a recent post, supply optimists tend to assert that as prices increase, new supplies will become available, when there is not much evidence to support this assertion on relevant timescales. It may be true over longer periods of time, for instance the peaking of US oil supplies and OPEC embargoes and price shocks in the 1970's helped spur exploration in Alaska and the North Sea, but it took a decade or two before the full effect of the new production was seen on available supplies. In other words, due to the time lag of bringing new fields into production, the effect of price is not as pronounced as the optimists seem to believe.

There is a small effect in the short term (witness a slight bump in production for 2008, for instance) but the change in available supply is not even close to proportional to the change in price. Moreover, it's not at all clear that new exploration efforts motivated by rising prices will be successful, and it is far less likely if the net energy of exploration is declining. With the North Sea and North Slope we may have just lucked out, plain and simple.

The following post, in the Drumbeat thread, seems relevant:

I like to put the 2006 to 2009/2010 production/net export data in terms of cumulative shortfalls between what would have been produced/exported at the 2005 rate and what was actually produced/exported, because it puts the ongoing parlor game discussions of monthly production peaks in perspective.

In any case, here's an interesting metric--the cumulative shortfall between what would have been net exported to non-Chindia countries at the 2005 rate (40.8 mbpd) and what was actually net exported to non-Chindia countries. Following are the relevant data for 2005 to 2009. For 2010, I am assuming global net exports of 44 mbpd and Chinidia net imports of 8 mbpd, which puts non-Chindia net imports at about 36 mbpd. Note that net exports are calculated in terms of total petroleum liquids.

Based on the following data and on the above 2010 estimates, I estimate that the cumulative shortfall between what would have been net exported to non-Chindia countries at the 2005 rate and what was actually net exported to non-Chindia countries for 2006 to 2010 inclusive is on the order of five billion barrels of oil.

If we assume a 5% (0.5%/year) decline in exporting countries' production from 2005 to 2015, and if the exporting countries consumption continues to increase at the current rate, and if Chindia's current rate of increase in net oil imports continues out to 2015, then non-Chindia net imports are projected to be down to 27 mbpd in 2015, versus 40.8 mbpd in 2005.

Regarding Chindia's increase in net oil imports as a percentage of global net exports (from 11% in 2005 to 17% in 2009), we have the following news item:

Indian airline orders 180 aircraft from Airbus (apparently single largest commercial aircraft order in history):

http://www.reuters.com/article/idUSLDE70B1MK20110112

That seems to jive with their long range forecasts and business plan, though quite frankly I really can't see how demand for airline services can possibly continue to grow in post peak oil world, even in India. I must be missing some crucial piece of the puzzle.

It just seems to me that the airline manufacturers, the airline companies and the consumers of airline services are all living in some parallel fantasy reality universe. Do any of them seriously believe their own forecasts out into 2050?!

Cognitive Dissonance at work!

Alan from the islands

Hi Fred.

Many years ago I read a book about Boeing (can no longer remember the title.) The author's thesis was that the sale of airliners was an instrument of foreign policy and vital in areas of currency exchange and balance of payments, and that in some cases the price of airliners was structured to what the buyers could pay, as opposed to a fixed cost- that Boeing was concerned about the total volumes and cash flow, and that the government assisted in this undertaking, as Boeing provided a huge amount of foreign exchange- my memory says 50% in some years, but I read this a long time ago(probably in the eighties...My apologies to this author if I have misstated his ideas.)

I think some variation of this may be happening here. The EU certainly doesn't want to create the impression that the industrial capacity to build airliners is not growing, or that there may not be fuel to fly them (despite the fact that the German military seems to know.) Plane contracts run over decades, and frequently (always?) are filled with weaselly provisions; how many of these planes are firm and what are the cancellation costs? If we knew these things, I'm sure that we'd see this contract in a different light. This kind of deal is a bet on all kinds of things: airline demand, exchange rates, global economic health, and the continuing health of Airbus and the European economy.

In short, I think it's less about the actual planes than trying to show that everyone is supporting global trade flows, and that BAU is just fine. Indian Airlines is a government body, and Airbus is even more akin to a government subsidiary than Boeing is. This is essentially a political move, IMO.

Lloyd

Lloyd,

This was an order by Indigo Airlines which is a private airline and completely different to Indian Airlines.

And you're gonna let the facts interfere with a great theory?

But seriously...I still suspect some of these concepts have a bearing on the order, though without such a tidy bow on the package.

Lloyd

Great Point Fmagyar. I wondered at the $28 million expansion of our tiny airport this year as well and the most egregious example is the US Military tanker order totaling hundreds of billions. Where are they going to find the oil to put in those air to air tankers? Oh sorry. Stupid me. Iraq. Using the existing tankers patching them up as necessary would be far more cost effective . In another 10 or 20 years, you wont need very many tankers anyway.

I imagine Indigo have looked at the transition from rail to cheap flights in Europe, particularly eastern Europe, and decided to get enough planes to be Easyjet on the scale of the subcontinent ... 180 planes is almost exactly the current count of Easyjet's planes.

Aviation is a really high-value use of oil products: you can run trains on nuclear power, you can substitute a lot of car journeys with trains in somewhere as densely populated and well-reticulated as India, but aviation offers desirable things that are otherwise unattainable.

"NGL’s contain only 65% of the BTU of oil"

Is it possible to convert the IEA charts projecting the future to show future liquids supply based on net energy per barrel?

But Gregor, didn't you read this article http://www.radetzki.biz/rapporter/Peak_75.pdf

There is nothing to worry about.....(sneer sneer sneer).

Dave