Tech Talk - Venezuelan natural gas production

Posted by Heading Out on January 23, 2011 - 5:12am

In the last two Tech talks I have been discussing the production of heavy oil from the deposits in the Orinoco Basin in Venezuela. Production of that oil requires, in part, the injection of large quantities of natural gas. In writing about the resources that the country has, it would be remiss not to concurrently note the recent discoveries of additional volumes of natural gas offshore Venezuela, and the volumes that are thus available, not only for the oil fields, but also for a rising domestic consumption.

In November 2009, Repsol announced that the Perla 1X well had found the equivalent of between 1 and 1.4 boe of natural gas, said to be the fifth largest hydrocarbon discovery in 2009. (The other four, in debatable rank are Miran West (Iraq), Poseidon (Australia); Abare West in the Santos Basin (Brazil) and Tamar (Israel). You can argue about the size of some of the others – such as the Keathley Canyon discoveries in the GOM, since it depends on whose list (see slide 11) or other list you use.

Since then, additional drilling reported by ENI in the same Cardon IV block has confirmed that this is a giant field with a potential size of 2.5 billion boe (14 Tcf of natural gas). To clarify who owns what:

The Cardon IV Block is currently licensed and operated by a Joint Operating Company named Cardon IV S.A. which is 50% owned by Eni and 50% by Repsol. The Venezuelan state company Petroleos de Venezuela S.A. (PDVSA) owns a 35% back-in right to be exercised in the development phase, and at that time Eni and Repsol will each hold a 32.5% interest in the project, which will then be jointly operated by the three companies.

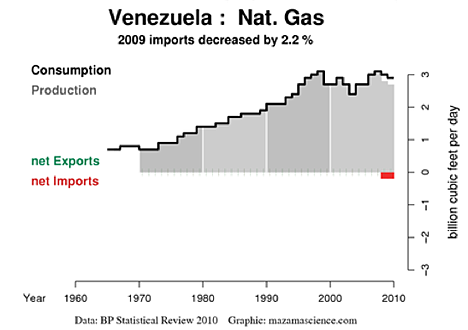

Given that the field is in relatively shallow water (70 m) it is anticipated that an initial production of some 300 mcf/day can be brought ashore and pipelined, by 2013. Now this may sound like quite a bit, but Venezuelan production has been declining to the point that the country has started to import natural gas.

That import comes about because of the Antonio Ricaurte gas pipeline constructed between Venezuela and Colombia. Begun in 2006 at a cost of $467 million to PdVSA, the 140-mile long pipeline was finished in 2007 with the initial idea that natural gas would first flow from Colombia to Venezuela; but then, within four to seven years, as the infrastructure in Venezuela improved, and the Guajira gas fields in Colombia declined, it would flow the other way. It has not had a totally smooth history, since just over a year ago Colombia reduced the flow, in part due to a rise in local demand.

The fields that are supposed to provide the surplus natural gas and thus to allow the flow to Colombia after 2012 included those of the Mariscal Sucre project to the East.

However, most recently, when bids were first issued for that project last January, there were no bids. As Wiki-leaks found, this was somewhat upsetting to the Venezuelan government, who need the natural gas to pump into the oilfields and maintain the pressure needed for production. The problem appeared to relate to the price to be paid for the natural gas, relative to the $8 billion development cost.

In the end PdVSA decided to go forward with the project themselves, using the Aban Pearl semi-submersible owned by an Indian-based company. But the semi-submersible sank back in May, a week after igniting the gas flare at the beginning of the development. Initially, in 2002, that project was to have been run by a partnership between PdVSA, Shell and Misubishi as part of an LNG project. This was scaled back and PdVSA began to develop the project alone. At the time of the sinking the rig was drilling in the Dragon area of the project, slated to produce between 600 and 700 mcf/day, with an ultimate target for the project of 1.2 bcf/day. The field (ultimately possibly of 8 wells) would deliver to shore through a 70-mile undersea pipeline. Since the sinking of the rig, PdVSA has contracted with Technip to build a production platform for the field, with construction planned so that the original target of production by 2012 could still be met.

Venezuela still has a large potential for producing natural gas, and from time to time has talked of developing LNG facilities to export some of this. The EIA cites three possible developments that were discussed in 2008, with the trains supplied from fields at Plataforma Deltana, Mariscal Sucre, and Blanquilla-Tortuga. Two years later Iran has just signed an agreement to help with the Delta Caribe project (which covers the first two trains) but while scheduled for 2014 it is interesting to note (along the lines of the swap arrangement that I mentioned in regard to Venezuelan oil last week) the first paragraph in the following release.

The official added that Venezuela has long-term contracts with Argentina and Cuba to supply the countries with their required gas by 2013, noting that under the agreements inked between Tehran and Caracas part of their gas needs will be procured by Iran's LNG plant.

Kheirandish stated that 40 percent of the project to construct Iran LNG plant is completed, expressing hope that the project will be half complete by the end of the current Iranian calendar year (March 20, 2011).

According to the Letter of Intent signed between Iran and Venezuela, Tehran will help Caracas to build an LNG plant in Delta Caribe area, and Venezuela will also cooperate with the Islamic Republic to build an Iranian LNG plant in Venezuela with an annual production capacity of 5.4 million tons.

Whether the LNG terminals get built is still likely a dubious question. The world market for LNG is becoming more readily supplied, though to a degree that depends on how the domestic production in the USA shakes out. (And the development of shale gas in countries such as Argentina). As a result though, Venezuela continues to find large quantities of natural resources; it will be the investment that brings these products to market in a timely manner that will validate the continuing promise of increased production at some future date.

Gas? We don't need to stinking gas. We need oil.

spec - Bless you for posting. HO offers such great work on tech issues even when they aren't on everyone's lips...at least not at the moment. Often his great Sunday efforts seem to go unnoticed. But hopefully he does have good readership that tends not to comment. I tend to respond only when he screws up. Obviously a very rare (if ever) occurence.

Run your car on stinkin gas spec (as opposed to gasoline). Mine is. Well at least LPG but conversion to NG is possible.

Gas may not solve all the problems of the oil downslope but it might help.

Thanks, Rockman - I need folk like you and Alan to keep me honest.

BP (in their new review) is not that excited about expecting the market for CNG use in vehicles to increase, but I suspect that Venezuela will continue to need increasing amounts to get their crude out and process it, just to keep spec happy!

HO- I appreciate your posts, and look foreword to learning from your vast knowledge on subjects I am illiterate on.

Thanks!

I read HO's posts because they always increase my understanding of the industry and technology. Like many readers here I have never worked in the energy industry in any meaningful capacity. HO helps me understand what would otherwise be mostly inaccessible jargon when, say, there is a blowout in the Gulf. Long wall coal mining, the penitent burning methane, Howard Hughes's fortune and the roller cutter bit, the details of fracking a well, keeping abreast of Venezuela's production, and the list goes on. I just wish I could get course credit.

Thanks Heading Out,

Tim

Rockman,

I always read what HO has too say, rarely comment, I usually don't need too as I agree with almost every thing he has too say, because it tallies with our shared experience. Both of us spent a great deal of our youth at the bottom of a hole in the ground looking up, while you oil grubbers spent it on the top of a hole in the ground looking down. Gives a whole different slant on things.

Deep Regards

YM

yorkie - I truly appreciate you tunnel rats. During my university days I went 1,800' down in a Mexican copper mine. I learned a very important lesson: I ain't never going down in no stinkin' hole in the ground ever again.

OFF

/Just wanted to say thank you for your answers the other day./

ON

Miner,

I believe most of us would appreciate it if you would relate more of your personal career experiences from time to time;I try to never miss reading anything you or Heading Out or Rockman has to say, although I rarely comment in this particular spot-I know too little about mining and wells and mostly know when to keep my mouth shut.

Hands on guys are the people who make the world go round.Some of my family were coal miners in the early days in West Virginia, but old age and accidents got them all before I had a chance to get to know them except by family hearsay.

It must have been pretty damned rough, considering that the ones who moved down this way considered mountianside farming and logging by hand to be a much easier and safer way to make a living-at least such a living as provided a shack and beans, which seems to be about what they got in the mines in those days.

Dear Mac,

I don't really know, if it is a good idea to relate my personal experiences. Too much like reminiscing over your past, more suitable for sitting on your front porch with good old friends with a good full tumbler of sipping whiskey, and there hangs a tale. Not really suitable for the Oil Drum. Mac click on the link and you will find my E-mail address

http://www.blogger.com/profile/03364251607711042067

drop me a line and we can discuss it in private. Anybody else out there who wants to contact me feel free. make it quick because I will change my profile in a couple of days

Deep Regards

Yorkshire Miner.

Just another shout out: I love the tech talks--especially the ones about coal--I have some direct experience with oil and gas (mudlogger and MWD engineer) but none with coal. They're all really good, though.

I just haven't commented in a few months because once the Deepwater Horizon thing calmed down it seemed that I could learn much more from the discussions than I could add to them.

Oh we need gas until the food system radically changes. Corn prices are way up because of a short crop, and demand from ethanol (the largest gas-to-liquids process around).. This has in turn driven up ammonia fertilizer prices from $500-$550 a ton (farm delivered) to $750/ton for fall in Iowa because of demand for fertilizer.

If shale gas (and the entire drilling equipment supply chain) goes as the futures markets predict, we'll at least keep the input costs for ammonia low.

The danger is that if there's any hiccup in the gas supply chain (say a scandal about overstated reserves because a supposedly major reserve runs out), and gas goes up, we will then get hit with another spike in ammonia prices that will either push up the price of corn and food, or cause some kind of a serious mess in agriculture (repeat of the 80's farm crisis?). Nobody except the farmers noticed the farm crisis then because the economy seemed to be pretty healthy, but if it hits now, it will likely tip over a lot more than just agriculture.

A large part of the rising domestic demand for NG in Venezuela was to replace the drought reduced Guri (and all other hydropower plants) generation.

That was a relatively rare event, and when the 2160MW Tocoma hydroelectric and another 500 MW hydropower plant come on-line (2012-2014), the percentage of hydropower on the grid should increase from 73%, thereby freeing up more natural gas (absent another drought of course).

And Chavez is talking to Russia about a couple of nuclear power plants (another 2 GW).

Alan

Alan: nuclear power plants need some 10 years from inception to the first generation. And two Russian made nuclear power plants in Venezuela will put somebody more nervous than one in Nathanz, Iran.

On the other hand, in my conversations with Venezuelan friends, it is not so clear if the hydropwer shortages were just ddue to the effectively existing severe draught or also to lack of maintenance of turbines and other key pieces in the dams, apart from stealing HVAC power lines. Hard to say.

Thanks to HO for his contribution in the oil and gas prospects for Venezuela.

Hugo was warned a few years ago by energy engineers to start invest in the power system, or they would face upcoming shortages. He did not invest. The drought was a bad one, but it sure don't help when you don't listen to the engineers you pay to give you advise.

Hugo has invested in large scale projects. Usually delayed and over budget, but completed. Less glamorous maintenance appears to have been ignored.

He finished up one large (2.1 GW) hydro project he inherited and started Tocoma (another 2.1 GW) and also restarted a long dormant 514 MW hydro project (just now coming on-line). Without that completed hydropower plant (admittedly operating at low capacity factor, downriver from Guri), the grid would have required much more severe blackouts.

He appears to have learned his lesson from the drought and has a number of FF projects coming on-line as well.

Guri does have turbine problems which limit their peak power, but the water levels reported appear to be true. Regardless of issues with several turbines, there was just not enough liquid fuel to run the turbines still in good shape. And remedial work is underway on the problem turbines.

Choosing an Argentine supplier for turbines at Tocoma appears to be a political decision that may bite later.

Alan

HO,

Thank you once again for an informative article.

Your technical insights are a real stand-out feature of TOD, and I look forward to more 'Tech Talks' on a broad spectrum of energy technologies and issues from both you and other authors.

My compliments as well. This is shaping up to be an excellent series for those of us who want to understand energy issues at the national level.

The world is a very heterogeneous place and peak oil & gas will play out very differently depending on where you look.

Jon

We concur with kudos, -with appreciation & thanks for HO and the other knowledgeable fossil fuel go-to people posting on TOD.

Natural gas finds have to be positive thing for transportation, the serious kind: trucks and trains! Boone Pickens' proposal for a family of LNG trucks certainly makes more sense strategically, than just hoping for battery and hybrid cars to come en masse. Maybe a reasonable car fleet can be in the picture, but first & foremost- commercial truck & railway victuals and necessities of life freight MUST keep on rolling, that is crucial.

Battery energy storage down-sized to mass and volume of gasoline and diesel is bomb-like... Analogous devices, electric capacitors are known for blowing mechanics arms and hands off! LNG even with its problems still makes much more sense than batteries intended as prime movers in commercial vehicles, farm equipment, etc.

Pickens and ex-CIA R. James Woolsey alerted last year of possible motor fuel rationing per Federal Executive Emergency Orders. This could come by supply/demand squeeze; military or weather impact on supply route(s) or terminals; possible case of dollar foreign exchange value unable to deal with price levels. Britain has now brought the motor fuel rationing subject into public discourse for 2020 time frame. The cat is out of the bag...

Another angle sure to keep the Middle East bubbling is the possibility of significant oil and gas reserves in Israeli sovereign territory. This would certainly inflame Arabs seeing supply-demand problems owing to population growth and domestic consumption increases. Not to mention remote clients of Arab oil, China coming to mind...

Railway line expansion in the USA is a critical part of transportation worklist in the solution set. Robust ability to maintain movement of strategic victuals and goods is paramount: makes us less vulnerable to economic and social strife from outside events. High Speed Rail is a political beanbag, it should be passed over to private investment as much as possible. Airlines have the most serious stake in protecting short distance schedules; look for Southwest to crunch the numbers as Jet A prices climb...

Federal and State planners must lobby in reverse, seeking rail corridor partners from the private sector to expedite regional & local link railway upgrades around the country. Pickens Plan LNG trucks are requisite too, but with less dedication to long haul-trucking, more as needed complement to increased long and medium distance rail goods movement. Will the President get closer to intellectually honest mention of "Energy Emergency" details in the State of The Union?

TOD can be sure the Feds and State planners are looking at you- keep it up!

Ha! Politicians "getting" the need for rail? Fat chance! Toronto just ran an election for mayor, and the main plank of the winner's platform was to "tear up all the electric streetcar tracks, to improve auto traffic lanes".

There's a huge amount of public informing remaining, and not as much time IMHO (no matter how far in the future the changed attitudes of voters may be required, BAU politics will ensure that the discussions and information will happen too late).

Hugo Chavez "gets" rail.

A new subway line was opened in Caracas a couple of months before Election Day. It did not stop at several stations (still under construction) but he was beaming in his red shirt as he cut the ribbon and talked about the benefits to the people.

Further aggressive expansion plans are going forward.

http://upload.wikimedia.org/wikipedia/commons/1/14/Mmap1vg1.gif

Solid lines are open, "Bar" lines are planned or under construction

He built a useful (and difficult & expensive) 41 km electrified commuter rail line through the mountains around Caracas (also used for limited freight outside peak hours). Now being expanded to 109 km. It opened a couple of weeks before Election Day, but with only one of two tracks ready for operations. (A single train shuttled back and forth for a while).

New subway lines in Maracaibo (one open, one under construction) and "light metro" in Valencia (Phase 1 open, Phase 2 almost completed (scheduled 2010). Phase 3 & 4 planned).

In addition, grand plans to expand the rural rail systems of Venezuela (modest amount of work done) and a plan for a rail line south to Argentina, serving the foothills of the Andes (and alternative to trucking over the Andes).

I doubt that Hugo Chavez does planning that would pass muster on TOD, but he appears to be building a non-oil alternative transportation system that can attract car & truck traffic. And later, he can force many (i.e. middle class, not his "base") to use this alternative to save oil for export.

One thought of mine. If he is clever enough, once the Caracas subway is expanded, he restricts parking near any office area, medical complex or university. Parking only for those with decals. Guess who might get the decals ? Who cares how cheap fuel is if you cannot park ?

If I had to guess, like Iran, the 12 cents/gallon gasoline will be rationed with additional gallons sold at much higher prices. Later the cheap gallons will be further restricted and allocated towards his supporters.

Alan

I was told that taking one of those huge capacitors found in amplifiers and the like, tying its leads to a standard 120V AC cord and plugging it in will cause a rather nice bang. Haven't tried it yet, myself. Probably dumb to do so in this paranoid post-911 climate. Come to think of it, anyone else think that the choice of day for 9/11 was just a sinister parody of the US emergency phone number - "let's give the infidels another reason to call 911!"

that is a fairly common thought, though the variablles that layed down when the attack actually occured make it unlikely the date 9/11 was of undue significance. I have wondered if looking from the proper angle (maybe using the upper atmosphere as mirror) at the flight path/pentagon hit and the twin towers might make them look like a '911' in smoking 3D. The earth was dialing or better sending smoke signals. Play the theme to the 'Twilight Zone' or better to 'Dr. Who' and 'whoosh' may this subject forever disappear.

It does make a nice bang. I knew someone who worked on a repair bench where there was a habitual button pusher who would not accept 'No'. They built your setup into a box with a switch and a label 'Do Not Touch'. It was not long before there was a huge bang and a button pusher who was cured. I have had many power supplies that have filled the air with 'confetti' and 'fire in the hole' is a common phrase when bench repairing them.

NAOM

Matt Staben said: Come to think of it, anyone else think that the choice of day for 9/11 was just a sinister parody of the US emergency phone number - "let's give the infidels another reason to call 911"

I can think of another reason for picking 9/11 as a date.

Early in he morning before the attack, I looked out our bedroom window (from here in Europe) and saw a perfect crescent moon with Jupiter in a very close position to it. I remarked to my wife that morning that it was exactly the same image as seen on flags of many Islamic countries. (Jupiter was not on top of the moon of course but extremely close and the similarity was striking).

Well you all know what happened later that day. Interestingly, I could not find a single mention of this anywhere on Internet news.

Every herder in the Islamic world would have seen the obvious significance - that Islam was all powerful and could strike anywhere at will.

Since that date I have checked the sky's on clear nights and never seen that phenomenon again. Tell me that was a coincidence.

Check astronomical maps of the sky for that night and you will confirm my observation.

HO, I continue to follow your posts faithfully. They are so well done and educational for the non FF extraction specialists such as me and I suspect for the specialists too ;-).

Cheers,

bio1

took about 20 seconds to pull up a post on the subject-deep on this page credited to a a Robert Scott Wadsworth, November 2001.

Hi Luke,

Wow, crazy site.

The day after the event, I sent a message to the editor of the NY Times outlining my observations. Thought it might be newsworthy or of use to be on extra alert if similar alignments occurred in future.

No response. Checked newspapers for a week or so and decided most were not aware of the "coincidence" or for one reason or another it was taboo to publish such information.

Didn't bother to check after that.

Cheers,

bio1

Why is NG used for maintaining reservoir pressure? NG is not always free. And even when it is "free" to obtain, there can still be an economic cost from the lost opportunity to sell it (should local infrastructure allow). And of course there are major explosive dangers with large volumes of NG at a work site.

Why not use carbon dioxide for pressure maintenance and reservoir flooding, instead of NG? I realize that CO2 is already used in some such cases. But is it simply a question of local CO2 availability? Very soon it may become possible to be well paid for burying the waste CO2 of others.

Or for that matter, why not just use AIR for this purpose? Earth's air contains a large percentage of nitrogen gas, and nitrogen has been used for enhanced oil recovery at major oil fields. Why wouldn't "free" air be nearly as good for this purpose as nitrogen gas?

BTW, our air is clearly a finite earth resource, yet it has always been free for the taking by anyone and everyone, in completely unlimited, non-metered quantities, and I would expect that it will remain so far into the future.

You'll see it start in California first. "Bottled air". Just like water.

I was thinking about the explosive dangers of LNG, well, actually, my lack of solid knowledge the dangers of LNG. What are the dangers of a LNG storage site - are we talking about a (I seem to remember the reference) "daisy-cutter" effect should one develop a leak - some kind of future super-catastrophe? What kind of regulations shall there be for rolling LNG tanks through towns? The US rails are so ill-maintained, should I be picking up my family and moving farther than the two miles from the tracks we already are?

You are MUCH greater risk just driving your car than your are from hazardous cargo on rail.

Alan

Or even the "children playing by rail" risk scenario is far greater. Or a de-rail scenario.

oxygen combusts with fuel at a partial pressure above about 1 atm. insitu combustion has/is being used in a limited number of applications. and then there is that thai process for recovering bitumen from canadian oil sands.

yes availability at an economical price is the problem.

ng is used for pressure maintenance, but the real benifit to ng injection in an oil reservoir is the superior recovery when ng is used to displace oil at a pressure above miscibility pressure. at high enough pressure ng becomes miscible with the oil and displacement is very efficient. the same is true of co2 flooding, displacement efficiency is high above miscibility pressure.

you also mentioned nitrogen and nitrogen is sometimes used for pressure maintenance. nitrogen has also been used for miscible displacement of oil at high(above miscibility) pressure. nitrogen can be generated cryogenically from the air, but that too consumes natural gas.

most of the ng used for pressure maintenance or miscible displacement, either one, is not lost and is recovered at the end of the project. sometimes called blow down.

it all boils down to maximizing present value of the resource. maximizing present value does not generally mean maximizing recovery.

Is any/much of the natural gas used to maintain pressure in an oil reservoir able to eventually be recovered and sold?

It is known as "blowing off the gas cap" and all but a small % of NG (with entrained NGL) is typically recovered. It is usually the last step before abandonment.

Alan

most of the gas is recovered, depending on the abandonment pressure. some gas is burned for compression.

Why not use carbon dioxide for pressure maintenance and reservoir flooding, instead of NG? I realize that CO2 is already used in some such cases. But is it simply a question of local CO2 availability?

Well I can't speak to Venezuela's situation, though if the country is getting 73% of its power from hydro (see Alan's comment) it would seem large volumes of CO2 may not be available or at least not available anywhere close to the oil fields that need the pressure.

On the North Slope, natural gas is what is there. It is found near the oil so its relatively cheap to pump out of one hole and into another nearby one. The only talk I've heard about getting a CO2 supply to Alaska's North Slope was when it would be a byproduct of a plan to develop more Alaska coal by setting up liquefaction plant/s. It seems big, long (hundreds of miles) loop/s of pipes and some hydro were all in the presentation on the subject when it was given to the state legislature last year.

Venezuela used it's petrowealth to build some massive hydroelectric plants (the largest, Guri, took over 20 years to build). Energy for centuries after the oil is gone.

Another petrostate, Alaska, could have built a number of small & medium size hydroelectric plants with it's oil wealth (and a few geothermal units in addition), but it chose to mail a check every year and eliminate taxes instead, without diverting even a small % to sustainable energy.

Alan

According to the Sovereign Wealth Fund Institute the Permanent Fund gets about 11% of the states total oil revenue added to it per year. The dividend is based on the five year earnings of the fund. The principal is in excess of $34 billion right now. So its not like all the money has been pissed away. Just most of it. I believe, through good years and bad, (the 2008 crash hurt) the Permanent Fund has managed to average just under 6% yearly earnings. The Fund gets inflation proofed from its earnings.

The last few years a small portion of the oil revenues finally was directed into renewables. This year the long talked of Susitna river hydro project is slated to get enough funding enough to get it through the permitting process. I'm looking forward to watching the process.

The talk of dams on the Yukon disappeared long ago--there is some value to leaving a huge river system wild too.

A lot of oil wealth has been poured into Alaska's far flung way off the road and grid villages. Schools, clinics, water and sewage systems, and on (of course plenty of Fed money followed it). The debate on just how wise that all is/was gets heated, especially as higher fuel prices makes many a village that has emerged from this wash of cash less than a likely candidate for continuing very long into the future.

How big a bank account is Louisiana holding right now? Remember Alaska has to do with the state only having title to about 28% of the land within its borders. The Alaska Native Claims Settlement Act got another 10% of the state titled to those most unusual of entities, the Alaska Native Corporations. The Federal Government still holds title the rest of the state, almost 2/3. To give you a little more perspective. The total acreage in private hands in Alaska (about 1%) is very close to amount of acreage the Federal Government controls in Texas (about 2%).

Yes we could do better, but we could be doing much, much worse. Fortunately we aren't quite out of resources yet, but there are trade offs, very large trades offs, every time a new large project is considered. I'm guessing Chavez doesn't deal with much of a permitting process for or legal challenges to his projects.

joss - The simple answer is that if you don't have CO2 available at a viable economic cost you can't use it. Yes...the purchase price of buying CO2 from a generator might be cheap...maybe even free...might even pay you to take it. But the potential several hundreds of millions of $'s to lay the pipeline from the source to the field is what will typical kill such a plan. You can generate or acquire it but that will be an economic cost. On top of that acquistion cost is the injection cost. The compression of any gas to a sufficient level to inject into the higher pressure reservoir often represents a major expense. So if the NG exists at a higher pressure than CO2 it has that additional advantage. Another big advantage is that eventuall much of the injected NG is recovered and sold. And then what do you do with the CO2 produced with the oil: release it to the atmoshpere or spend money to dispose of it properly?

N2 is a good choice if the economics work. Mexico's Cantarell Field has the largest N2 generating plant that has ever existed. But forget air. Two problesm with air. First the little one: it takes a huge amount of energy intensive horse power to raise air at atmospheric pressure to the appropriate injection pressure. I know those economics well due to my experience with the really big problem with air injection: it DESTROYS THE OIL. This is actually an enhanced oil recover method developed in the 1960's. Air is injected into a pressure depleted oil reservoir and the result is "in situ combustion". The air oxidizes (burns) the oil. This also produces a multiple volume (of the injected air) of combustion gases, including CO2, and increases the reservoir pressure. The process consumes around 15% of the oil in the reservoir. While it can greatly increase recoveries in certain types of reservoirs it is probably the most complex and difficult reservoir management method ever attempted in the oil patch. So difficult that the majority have been net money losers. I tried for years to talk several companies into trying it but frankly it scared the hell out of them. N2 injection is more expensive (and only works well on a very large scale) but is much easier/safer.

pipeline cost is a problem that has an easy solution - if the project is not big enough to justify a pipeline, the project isn't big enough to worry about.

the u of wyo and doe both use cumulative recovery as a primary screening criteria. one pipeline can service several smaller fields and that is what is planned for the powder river basin.

having a coal fired power plant in the middle of your oilfield doesn't mean that co2 is available, technology to recover co2 isn't widely available, pipeline or no pipeline.

the co2 for eor that has been done and is being done in wyoming and colorado has had but one source -riley ridge and fogarty creek in western wyoming.