Gold, Infinite Debt, and the Problem of Capital Storage: Has The Hotelling Moment Arrived?

Posted by nate hagens on March 9, 2011 - 11:37am

The following is a guest post from Gregor Macdonald, adapted from his website Gregor.us.

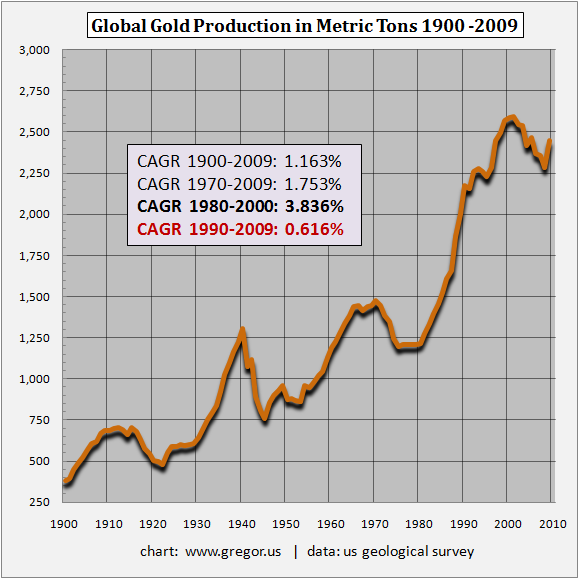

One of the reasons that gold retains its competitiveness as a capital-storage unit is the rather slow and plodding rate at which supply is brought to market. Since 1900, compound annual growth of world gold production comes in at 1.163%. That particular rate is below the growth rate for a number of other natural resources. But in particular: it’s well below the rate of credit production–the “resource” which now plagues the developed world. Indeed, the over-production of credit the past twenty-five years has once again driven capital back into hard assets such as gold. This brings up an intriguing subject: the conversion of resources into financial capital, and the conversion of financial capital back into resources. First, let’s take a look at a century of gold production. | see: World Gold Production in Metric Tons 1900 – 2009.

From 1980 -2000 global gold production grew at a strong, compound annual growth rate (CAGR) of 3.836%. But that was after a very slow production rate for forty years, between 1940 and 1980. In the past decade global production of gold has not only slowed again but fallen steadily, with a notable uptick in 2009 as the decline temporarily reversed. Indeed, since the new millennium, the story of gold will be familiar to those who have watched oil: as prices steadily rose, supply growth fell.

The migration of capital, between the world of natural resources and the world of finance, has been addressed by any number of thinkers, one of the more compelling being Harold Hotelling. Writing in the Journal of Political Economy in 1931, Hotelling proposed that a rational producer of resources would only be inclined to extract and sell that resource if the investment opportunities available with the capital proceeds were greater than simply leaving that resource to appreciate in the ground. So, given Hotelling’s theory of resource extraction, what has happened to gold production since the year 2000? Does the chart reflect geological and cost limits to increasing gold production, even as the price rose from $250.00 to $1000.00 per ounce? Or, has there been some moderate yet gathering decision on the part of global gold producers to extract gold more slowly? After all, why extract gold to merely convert gold into paper currency, beyond the need to pay for the cost of production and provide, say, a dividend to shareholders? In other words, at the rate at which the price has been rising, why hurry to extract the gold?

The migration of capital, between the world of natural resources and the world of finance, has been addressed by any number of thinkers, one of the more compelling being Harold Hotelling. Writing in the Journal of Political Economy in 1931, Hotelling proposed that a rational producer of resources would only be inclined to extract and sell that resource if the investment opportunities available with the capital proceeds were greater than simply leaving that resource to appreciate in the ground. So, given Hotelling’s theory of resource extraction, what has happened to gold production since the year 2000? Does the chart reflect geological and cost limits to increasing gold production, even as the price rose from $250.00 to $1000.00 per ounce? Or, has there been some moderate yet gathering decision on the part of global gold producers to extract gold more slowly? After all, why extract gold to merely convert gold into paper currency, beyond the need to pay for the cost of production and provide, say, a dividend to shareholders? In other words, at the rate at which the price has been rising, why hurry to extract the gold?

These same questions have long been asked in the world of energy extraction as well. Why did global oil production advance so quickly into late 2003 as the oil price was rising towards the high 30′s, only to peak out for the past six years as price skyrocketed? We must assume that oil producers in the West, governed mostly by for-profit enterprises, were doing everything possible to lift production. The conclusion is rather easy: they couldn’t lift production, even with a doubling of price. But in contrast to BP, Shell, Exxon, Total, Chevron, and Conoco, what about the NOCs–the National Oil Companies? Is it possible they were inclined to apply some form of scarcity rent, holding back production slightly? Echoing statements made at least twice last decade, King Abdullah of Saudi Arabia repeated himself last Summer when he remarked about future Saudi oil production: “I told them that I have ordered a halt to all oil explorations so part of this wealth is left for our sons and successors God willing.” | see: Global Crude Oil Supply 2002 – 2010 in mbpd (updated through November 2010)

As lovely and reasonable a view offered by Hotelling in his The Economics of Exhaustible Resources, there is little evidence that oil producers are any more rational than individuals. The history of global oil production would appear to be governed more by geology, than any future projections of how to best invest oil revenues. North Sea oil was largely extracted in the cheap oil era, and peaked as oil prices began to take off earlier last decade. This was also true for Indonesia, and of course several decades before with the United States. Indeed, the bulk of world oil production was sold too cheaply. I discussed this phenomenon in my 2009 piece, The Fate of An Oil Exporter. By contrast, one of the few modern states that has spoken openly about husbanding scarce energy resources is Brazil. President Lula declared in 2009, as Brazil changed its resources policy that year, that the country’s new offshore discoveries were a “passport to the future.” Misunderstood by right-leaning commentary at the time as a form of resource-nationalism, Lula’s remarks were instead very much in the Hotelling vein. “We don’t have the right to take the money we’re going to get with this oil and waste it,” Lula remarked. But Brazil has been an exception.

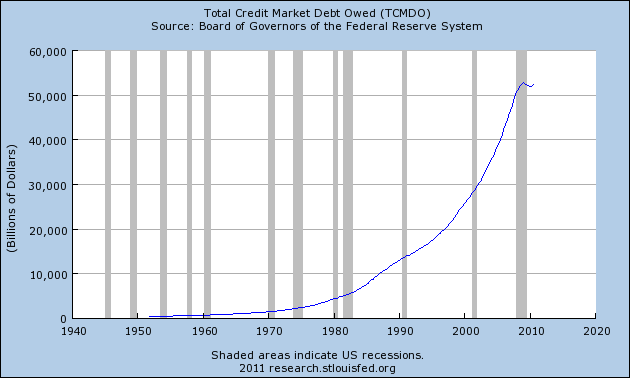

Given that both gold and oil production are now either flat or falling, what should a producer of these two commodities do with the proceeds of their sales? Let’s again consider the insurmountable problem at hand. Western economies and especially the United States have been on a credit binge for decades. When that bubble burst in 2008, punctured in large part by rising energy prices, the response from OECD governments was to create more credit. In Eric Zencey’s terrific New York Time’s essay on Frederick Soddy, which captured the views of the 1921 Nobel Laureate, the connection between debt limits and energy supply was made plain for a general readership:

Problems arise when wealth and debt are not kept in proper relation. The amount of wealth that an economy can create is limited by the amount of low-entropy energy that it can sustainably suck from its environment — and by the amount of high-entropy effluent from an economy that the environment can sustainably absorb. Debt, being imaginary, has no such natural limit. It can grow infinitely, compounding at any rate we decide.

Whenever an economy allows debt to grow faster than wealth can be created, that economy has a need for debt repudiation. Inflation can do the job, decreasing debt gradually by eroding the purchasing power, the claim on future wealth, that each of your saved dollars represents. But when there is no inflation, an economy with overgrown claims on future wealth will experience regular crises of debt repudiation — stock market crashes, bankruptcies and foreclosures, defaults on bonds or loans or pension promises, the disappearance of paper assets.

To Soddy’s point on the problem of infinitely created debt, let’s take a look at 60 years of debt growth in the United States. | see: Total Credit Market Debt Owed 1940 – 2010 (updated through December 2010).

As the United States has now (long) embarked on a massive dollar devaluation program, in part to bust the CNY-USD peg, but mostly to mitigate the next leg down in real-estate and debt deflation, we should consider how resource extractors might behave in such an environment. Two obvious possibilities are as follows. First, oil producers rather than chasing higher prices in dollar-terms might start to demand full or partial payment in gold. Meanwhile, gold producers might consider banking some of their capital not in cash, but also in gold. And yes, both oil and gold producers could simply leave more of the stuff in the ground. What may become more clear is that, beyond the need for operational cash, turning excess production of resources into paper currency will increasingly become, per Hotelling, a losing proposition.

Data Sources:

USGS Historical Statistics for Mineral and Material Commodities in the United States (includes global data).

What an odd view of the world. Although you mentioned that oil production doesn't follow "Hotelling" at all, you didn't mention why. I would suggest that it's simply that Hotell wuz rong.

The reason that oil folks produce oil through good times and bad is the same reason that folks who make giant anchor chain keep making anchor chain and Port-a-Potty makers continue to make Port-a-pottys is because it's what they do--it's what they know. Sure, in modern times some mega corp. will put their money into commodities or ETFs or DOT-COMs or whatever, but most businesses stick with what they know.

It is thru that the NOCs only have to operate as a quasi-business, so ROI, dividends, cash flow, EBITA and so on, while not irrelevant, do not need to be driven by the same metrics as IOCs. So yes, it's true that Saudi has made several important discoveries if scattered press reports, the grapevine and Yamani and Abdullah statements to that effect are true. Beyond that, the only "redirection of capital," even by the NOCs, seems to be foot-dragging on drilling/investment as a way of OPEC quota compliance, especially by Venezuela.

Mostly, there simply isn't any evidence of any economic theory actually working in the last 30 years.

When Reagan nearly tripled the federal deficit and more than tripled the annual debt, I thought for certain that inflation would raise its ugly head. But Volker was successful in breaking inflation via massive unemployment (first started under Carter), and even when government spending and size grew under Reagan, inflation remained low. But surely inflation had to come back under H.W. Bush, who again doubled both the annual deficit and the national debt. Again, no significant inflation.

But surly when G.W. Bush turned a $4 trillion surplus into an $8 trillion debt, with massive government growth in spending and size, inflation must come roaring back, right? Rong!

Now under Obama, again, massive growth in spending and deficits MUST result in rampant inflation, right?

The truth seems to be that nobody knows. But since 1932, when the U.S. went off the gold standard, it's been a pure faith proposition. And that's what Bernake is counting on: pure faith, confidence. And he might just get it. The right paradigm in MHO lies more in Black Swans shaking (or bolstering) confidence in unexpected, dramatic ways. The asset bubbles that form and bust--from DOT-bombs to Mortgage Backed Securities (and CDOs) to Whatever Bubble Comes Next--I doubt that it'll be in keeping with economic theory from the 1930s.

Interesting article,

Perryeh

Perryeh,

I agree with your idea about prevention of inflation somewhat. Indeed more and more "debt" was made to cover the lack of growth in production. But these debts cannot stack eachother indefinetely. I am quite certain that one day there will be no more "belief in the relief efforts", and creating more debt and with that more promises will simply not work. You say that there have been many of these schemes made to prevent inflation from rising. But what prevents this one moment from being the last scheme?

And going on in that line of thinking, why would this moment not be the one moment for the hotelling theory to work? Possibly, and probably, not "cashing in" on resources because of the major bust coming up seems like a reasonable bet.

Perryeh has it pegged correctly.

Hotelling suggested a very naive theory. The idea of discounting is most often applied when studying how drug addicts will reason about getting their next fix. That is the problem with potential riches: what idiot is going to let some resource lay fallow in the ground when the possibility of immense riches awaits them? It's the same theory as a drug fix.

So does that rule really tell us much, or is this another indication that economics is not about studying scarcity but about studying the exploitation of resources to maximize profit?

WHT, call me dumb, but I don't understand what you mean.

I have a bit more elaboration elsewhere in this thread. I don't know what you mean when you say I don't know what you mean.

Or else read the link.

There is a key ambiguity in the idea of owning "a finite resource". It can, in theory, mean two things. Either you own a finite amount of some infinite resource, or you own a finite share of a finite resource.

In practice, the world has acted as if mine-owners own a finite share of an infinite resource. When in that situation, you say to yourself, "I've got my capital tied up here, so I want the best return I can get on it as quickly as I can, so I'll mine it at the fastest rate my capital equipment will allow". When the you realise that the resource itself is finite (and won't be replaced by something better & cheaper before it runs out), your thinking changes. You say, "Why should I sell cheap today when I can sell dear tomorrow? And if somebody undercuts me and steals my market, the more fool them, since tomorrow they'll have less themselves and I'll be able to sell even dearer".

Certainly, people will admit in abstract that certain resources are finite, but the ubiquity of technological progress has encouraged people to assume that "Well, X may eventually run out in theory, but we'll find something even better than X before we get near that point". With oil, this is demonstrably not the case, so some actors in the market are starting to think in terms of the coming scarcity. Some, but not yet all. And, of course, rational players in the market who have twigged to Peak Oil (and gone long on reserves) don't want everyone else to do so, since the more oil is consumed today, the more expensive it will be in the years to come.

Adam Smith had a wonderful fable about the "hidden hand" of the market ensuring that people's greed ensured that they'd do the right thing by others. The fable had certain assumptions. One of them, the relevant one in this context, is the assumption that everyone had all the relevant information. When that assumption doesn't hold, however, the "hidden hand" rewards people who do things that are very wrong indeed. Or, in the famously (but doubtfully) reputed words of P.T. Barnum, "There's a sucker born every minute". So a "rational" Peak Oil investor wouldn't discourage cornucopian illusions.

So Hotelling had his theory back in 1931, and it has taken 80 years for a degree of discounting rationale to come true for oil?

Yes, that's true. And there's another factor at work, too. Keeping your resource back from the market in the hope of higher prices tomorrow only makes sense if the resource will still be yours tomorrow. In Australia & most other industrialised countries of which I am aware, mining & drilling licences are issued on a "use it or lose it" basis. Governments have disapproved of hoarding reserves and wanted them brought to market ASAP. Companies that just sit on reserves, therefore, are in danger of having their permits revoked and re-issued to a competitor. This happened in Australia a few years ago with a large bauxite deposit.

The assumption behind th "use it or lose it" policy is cornucopian & may take some time to be rooted out by reality. The National Oil Companies in the Third World are better able to follow Hotelling's logic.

Bauxite -> Aluminum.

Big deal.

Just telling it like it is.

No ... Aluminium. Webster got it wrong, so all Americans now do.

Just telling it like it is.

How can dropping an extra vowel ever be wrong?

It's just another example of America acting unilaterally, and ultimately causing more confusion in the world for no real benefit, in the same way as not using metric.

Interesting history of the spelling is here;

http://www.worldwidewords.org/articles/aluminium.htm

Seems the discoverer, Sir Humphrey Davy, did call it "aluminum" at one point but the decided the real name should be "aluminium", which was adopted by the rest of the world, though Webster had already put the wrong spelling in his dictionary. And so Americans used it, just taking what they were told at face value, instead of verifying the facts - just as well the American people never let anything like that happen these days!

I had heard long ago that what is being called the American spelling was a trade marked spelling, the trade mark being owned by the precursor of Alcoa. My source was, I think, a teacher in middle school. I remembered it because I had already learned the such factoids were often featured in quizzes. Now at age 78, I still don't know if it is actually true.

uhmmm...I was kidding, mostly. On the one hand, this is really unimportant. OTOH, simpler spellings really are a good idea. I had a friend in high school who named his magazine "ghoti", pronounced "fish".....

English weights and measures didn't come from the US, and came long before metric. Further, it's certainly useful to have a consistent base (10) in all of the weights and measures, but the base that was more or less used by English measures (12) is a heck of a lot more useful.

We're clear that language is arbitrary, not "real", or "right", right?

No question about where the English units came from, it's just that everyone else has already adopted the better system.. In almost any technology you can name, most countries adopt the better systems when they are ready - think digital cellphones and tv. Yet with Metric, the US persists in using an archaic system, that, while perfectly useable for everyday length and weight measurement, is unwieldy and cumbersome for engineering and scientific use. It is an unneccesssary encumbrance on those working in such areas, and is a factor in the lower level of science/engineering competence in the general public - if the measurement system is too complicated to understand, people just give up and leave it to the experts, just like the tax system.

Ask someone to calculate the energy in a moving mass or the power of a falling stream of water - in metric it's a piece of cake, but in imperial units, how do you convert mass and speed into btu's? You can;t do it by reasoning, you have to look it up somewhere - thus it discourages people from trying to work it out for themselves, where as with metric, since it is an integrated system, you can work out the answer from first principles.

But how is base 12 more useful than base 10? It may be easier for dividing into fractions, but that is an unwieldly system in itself, and encouragages rounding errors. In the digital age, base 10 is the way to go, though even the Romans worked that one out 2k years ago.

In almost any technology you can name, most countries adopt the better systems when they are ready - think digital cellphones and tv.

I hope you're right. By that logic, the world should move to PHEVs, EREVs and EVs very, very quickly.

the US persists in using an archaic system...unwieldy and cumbersome for engineering and scientific use. It is an unneccesssary encumbrance on those working in such areas

True. I'm not suggesting that sticking with english units is a good idea, overall - just that they deserve more respect than they often get from metric-philes.

is a factor in the lower level of science/engineering competence in the general public

That's an interesting thought. I seriously doubt that it's a major factor - things like cultural anti-intellectualism are far, far more important. Still, it probably contributes a bit.

But how is base 12 more useful than base 10? It may be easier for dividing into fractions

A simple example: think how annoying it would be if there were 10 hours in the day, and we had to divide the day into three shifts of 3.3333333333 hours. 24 hours convert to 8 hours per shift quite nicely.

Another example of the daily usefulness of english units: volumes are base 2. There are 2^7 ounces in a gallon. That's very, very useful for daily use, and far closer in spirit to "the digital age" than is base 10.

Again, a standard base is very, very useful, but let's not kid ourselves - they could have chosen something far more useful than base 10 (which is, after all, based on the number of fingers...). Their choice of base 10 is a classic example of traditional use overpowering a better idea.

Finally, if you like the simplification of SI units, than surely you agree that aluminum is better than aluminium?

I hope you're right. By that logic, the world should move to PHEVs, EREVs and EVs very, very quickly.

The key words there were "when they are ready", and by they, I mean the technologies. I don;t think EV's are ready yet - or perhaps people are not yet ready to adjust their expectations of their vehicles.

just that they deserve more respect than they often get from metric-philes.

Ask a Prius driver how much respect they give to a Suburban driver. Within the context of one quantity ,e.g. length, imperial units are fine, in and of themselves, but the crossover between quantities (mass, energy etc) is terrible. Metric was designed to work logically, and it does imperial units simply grew, independently, in their different areas, and are just not a good system for the technological age.

I seriously doubt that it's a major factor - things like cultural anti-intellectualism are far, far more important. Still, it probably contributes a bit.

I think it starts in high school, and yes, the desire to not want to be seen as a geek is a part of it. But when everyone actually has an understanding of basic physics (not just maths) I think they can make much better decisions on things like energy use. Ask a yr 11 student from China, Japan, Australia, almost any OECD country other than America, to calculate power available from a stream of water of 1L/s falling 100, or the energy required to get a 1 ton car moving at 100km/h and I'll bet the non Americans will more often give you the right answer.

There is also the issue that if you are educated in the imperial system, in a technical field, how competitive are you or your company if you are competing on an international project? Any US company working on anything in Asia, for example, has to deliver everything in metric. So there is additional time, training, potential for mistakes, etc that the American companies have to do, that the others don't. I know personally of one US water engineering company that was working on an irrigation water project in China, about 15yrs ago. They delivered their report in terms of acre-feet of water - the normal US unit. The rest of the world, of course, works in ML or GL (megalitres/gigalitres). The company concerned got kicked off the job for not showing any respect for the client and the way they worked. I think this summed up the attitude of the company concerned in general, but not putting ANY of their work into the units the client uses all the time is a good example.

A simple example: think how annoying it would be if there were 10 hours in the day, and we had to divide the day into three shifts of 3.3333333333 hours. 24 hours convert to 8 hours per shift quite nicely.

Well, if a day had ten hours, a the workday would likely be three to four of them. 8 hrs was just an arbitrary selection. Teachers work less, most shift workers work more, and self employed types more still. I don't think the length of an hour makes any difference. if we tried to get teachers to work 8 hrs because that is a round number, I don;t think they would do it.

Another example of the daily usefulness of english units: volumes are base 2. There are 2^7 ounces in a gallon. That's very, very useful for daily use, and far closer in spirit to "the digital age" than is base 10.

C'mon - walk onto the street and ask a few people what 2^7 ounces is -see how many know what the number is, or that it is a gallon. is it really that useful in everyday use - how often do you do a 2 to the power of calculation? How does it help you determine the energy requirement in lifting 2^5 ounces of water 100 feet?

Now, a base 2 number system would have it's advantages, but 10 is OK. That to me is a case where it doesn;t necessarily have to be the best system, but it is good enough, and the fact that everyone uses it s the biggest achievement.

As for simplification of units, I am all for the simplification of the system. I think the naming of units should respect the origins or the discoverer - we don't have the right to change the spelling of them. We wouldn;t change a Newton to a Nuton for the sake of saving a letter - though the texting generation might want to do that, assuming they know what Newton is...

I guess I'm just a traditionalist, but I did have both a high school physics teacher and a university engineering prof who gave excellent examples of where poor/conflicting choices of notation, units etc had caused confusion in various scientific/engineering areas. At least they agreed on the periodic table!

. I don;t think EV's are ready yet - or perhaps people are not yet ready to adjust their expectations of their vehicles.

Hybrids clearly are ready. PHEVs will be in months. EREVs are too. EVs? Yes, it's mostly cultural - very few people drive more than 75 miles per day. Which points out the importance of cultural barriers to change.

Ask a Prius driver how much respect

Again, we agree that moving to standard use of SI units are a good idea. OTOH, english units have a lot of good qualities - see below.

Ask a yr 11 student from China, Japan, Australia, almost any OECD country other than America, to calculate power available from a stream of water of 1L/s falling 100, or the energy required to get a 1 ton car moving at 100km/h and I'll bet the non Americans will more often give you the right answer.

Of course - very few high school students in the US have a good understanding of the physics. The ones that do also understand SI units.

if you are educated in the imperial system, in a technical field, how competitive are you?

Of course. OTOH, any good engineer or scientist in the US also knows SI units.

Well, if a day had ten hours, a the workday would likely be three to four of them.

There are many industries, like hospitals, that have to cover the 24 hour period. Three 8 hour shifts are the logical, universal solution.

C'mon - walk onto the street and ask a few people what 2^7 ounces is -see how many know what the number is, or that it is a gallon.

None will. That's not the point. If you have a gallon, you know that it consists of four quarts. If you need to divide a quantity in half or double it, it's easy. This goes from gallons to quarts to pints to cups to ounces to tablespoons (2 per ounce). This is extremely useful, as any cook will tell you.

I guess I'm just a traditionalist

And there's nothing wrong with that. My point: let's be respectful of our differences, instead of being judgemental about them. We can agree that the SI system is better than english units, and that simpler spellings (fewer syllables and silent letters) are better, without being disrespectful of those who hang on to different traditions.

I beg to differ. On weblogs like this or Energypulse or any other involving engineering (as opposed to physics or astronomy or any of the other sciences, which are universally done in SI even in the US), I can almost always immediately identify the posters from the US, as they all still use the antiquated bbls, btu, lbs, acre-feet etc. etc. instead of rational units, often it appears in deliberate attempts to confuse discussions (or is that just my frustration showing?). Oh well, at least we've finally gotten the stock markets to stop quoting in eighth's.

And who thought a base two number system was more efficient than base 10? We'd spend our entire lives counting digit positions on any numbers with any precision.

I didn't say they used english units for everything, I said they know them. And, of course, if you live in the US, most of your clients will use english units in their daily business.

For instance, farmers measure their land in acres, and rainfall in inches. If they need 6 inches of rain on 640* acres, that's...320 acre-feet. Kind've makes sense.

who thought a base two number system was more efficient than base 10?

As I said above, it's easy to use a base 2 system of units: one place is gallons, the next is quarts, the next is pints, the next place is cups, then ounces, then tablespoons....!

* 10 x 2^6

As I said above, it's easy to use a base 2 system of units: one place is gallons, the next is quarts, the next is pints, the next place is cups, then ounces, then tablespoons....!

That sure is a lot of different names for units of volume. You have to know how many tablespoons are in a pint or quart, you can't work it out unless you know the intermediate unit of ounces. And step above gallons and then the system stops...

But with litres, and the the standard prefixes of milli, mega and giga, as soon as you see the word you know exactly how many litres it means.

SI farmers, like my brother, measure land in hectares (100mx100m, one hundred hectares to a square km), and they know one mm of rain over a hectare is 10kL, and 100mm is one ML. ML are the standard units for water measurement in irrigation (- and one ML is about 0.81 ac-feet).

Then when you are looking at moving water through pipes or open channels, with flows in L/s, the conversion is very simple - the 100mm pipe carrying 10L/s will move 36,000L/hr, or 0.036ML/hr. It is also an easy calculation to then work out the water velocity in said pipe - V=Q/A, or V={0.01cu.m/s}/[0.1x0.1x3.142/4] = 1.33 m/s, which is below the nominal limit of 2m/s, where the friction loss becomes excessive.

Starting with acre feet, to get velocity in that same pipe (4") requires many more calculation steps - , you have to know how to convert acre feet into cubic feet, or cubic inches, to get the velocity. And if you are working in standard pipe units, of gpm, how many cubic inches are in a gallon (230.1)

When it gets this complicated, you tend to just turn to tables that someone else has already done, because working it out yourself just gets too complicated - the thinking, even at this low level, has been outsourced.

Now, there is nothing wrong with saving time by looking up pre-calculated standard results, but the problem comes when the person loses the ability to work it out themselves if they have to (e.g out in the field). Howe does the American farmer then work out how many hp of pump/engine is needed to lift their 320 acre feet by 100 ft over a one month period - it's an easy process in SI.

This sort of thing is why I am such a big proponent of SI - it encourages thinking and problem solving because the system makes it easy and intuitive to work with different quantities (volume, mass, energy etc). A classic example is what is the work out put of an engine that burns fuel at a certain rate. If the engine is 25% efficient, what is the mechanical power produced by burning 115,000 BTU of gasoline (one gallon) per hour? You have to know that one HP is 2559 BTU/hr to get a meaningful work unit, of 11.25 HP but in SI that fuel is 33.7kW and the work output will simply be 25% of that = 8.4kW.

Just as the reliability and serviceablility of an engine design can be improved by minimising the number of parts, so too for the measurement system - less parts = less chances for breakdowns.

Howe does the American farmer then work out how many hp of pump/engine is needed to lift their 320 acre feet by 100 ft over a one month period

like about anyone else he picks up the phone and calls his trusted supplier--with luck someone there knows or at least knows someone who can get back to him<?- )

There has a been a beauty to living in the most powerfull nation the earth has ever known while still using an incredibly ancient and arcane system of measurements that almost no one else on the planet understands. We weren't going to remain on top forever, we get blamed for everything that is wrong in the world so why not have a bit of fun with our measurements. We could afford it<?- ) for a while anyhow <?- (

like about anyone else he picks up the phone and calls his trusted supplier--with luck someone there knows or at least knows someone who can get back to him

Yes, he can't work it out for himself so has outsourced that thinking to a supplier. He runs the risk of someone trying to sell him an oversized pump/pipes etc. Not that this would ever actually happen in reality, but what if the parent company of the supplier has told its sales team to increase sales by "upselling" - trying to get the customers to buy bigger. The salesman wants to help the farmer, but his job is on the line for how much he sells, so whose interests come first? He ends up with an oversized pump that costs more and may not operate at its most efficient point. I see this all the time with pumps and boilers. The farmer does not know exactly what he needs and relies on the salesman to tell him - I wouldn't want to place the means by which I make my living solely in the hands of the salesman.

There has a been a beauty to living in the most powerfull nation the earth has ever known while still using an incredibly ancient and arcane system of measurements that almost no one else on the planet understands

Exactly - no one else understands, or uses it. while you may enjoy working in feet inches etc, consider the few remaining companies in America that make equipment and stuff. Try exporting a US made pump to a metric country (i.e. the rest of the world) - the receivng place will find that the pipe threads are different, all the bolt sizes and thread pitches are different, they need to have a complete set of imperial sized tools, and maintain a separate inventory of imperial sized bolts and parts. Sure sounds like a lot of effort, doesn;t it.

The aluminium smelter that I worked at in New Zealand for a time had a metric only policy, so when they were procuring new industrial equipment for a $1bn plant upgrade that was happening, how successful do you think American companies were in getting any supply contracts? The only one that did, had to make everything in metric, use al metric bolts and bolt patterns, etc, which cost them a lot,but not as much as all the other companies that were shut out.

Ditto for American cars - one of the reasons why hardly an are exported is that they are not metric. A fleet manager will have to have a whole separate inventory of imperial sized nuts and bolts etc. So the fleet manager will simply say its too much trouble.

So as the rest of the world moves on, America made stuff will find it increasingly difficult to gain acceptance worldwide. The American companies then have to make two lines of stuff, one domestic, and one for export, and if you are going to do that, you might as well locate your export line in the country that is, or is close to, the major export markets. And this is increasingly what American mfrs are doing - companies like GE and so on are doing well, because of all the stuff they make overseas, good for the shareholders, but too bad for the domestic factory workers. Of course, metric is not the only reason for this, and often is not even a major one, but it is just another factor stacked against the American companies, and one that wouldn;t exist if the country went metric.

Australia and NZ took their metric medicine decades ago and are much better off for it. Had they not, they would have been much more reliant on the US for supply of mfrd goods, and who wants to be in that situation, when you buy stuff from everywhere else in the world?

As for the beauty part, well it is in the eye of the beholder, and I can tell you how the service mechanic in any metric country views any piece of non-metric American equipment, and beauty is not one of the many words used to describe it.

It's a free country and the US can choose the measurement system it wants to use - staying with the one that everyone else has discarded just makes it that much harder to participate in the global economy.

And right now, I'd say the US needs help, not hindrances, to get its export economy going.

US mechanics have had to have both kinds of wreches to work on US 'made' cars for decades so it would be good to hurry the system along some, no argument there. Then again why do all these little countries like France and Germany insist on using their old languages instead of English, since they all had to learn the latter anyway--it just confuses people <?- )

On that note: Glad you guys who have to look at a picture of the queen on your currency had a bit of fun with the bone I threw you, remember to genuflect and bow--we don't have pictures of anyone on our money whom we have to bow to--just the money itself...

It's fun to razz you a little--yes we have to put all of our products on metric some day (sooner better than later).

But our economy is still larger than that of the entire commonwealth so the inertia is much greater than you might imagine. Still we only have to deal with 300 million people so it would seem to be easier to get us all on the same page than it would be if we had the 2 billion the commonwealth has--but I guess we haven't felt the pressing need to do it yet--irritating, eh<?- ). Interesting thing about gdp in Wikipedia--an IMF table in an article on worldwide gdp shows India'a in 2010 as $1.4 trillon, another article about the Commonwealth of Nations puts it at $3.6 trillion--quite a difference.

You can enjoy looking down on us primitive provincials using a backward system of measurements if it eases your complexes some <?- )Still it's been more fun than you might think--you'd have to have been here riding the crest of the wave your entire life to know. The baton looks like it's going to be passed so far west the next time that it will be in the East--the world turns.

Yair...but why did they stuff up the measurement system by using "centimeters"...all we need are millimeteres and meters.

A sheet of ply or sheet metal is 2400x1200 millimeters...simple,yes? It is maybe 2.4x1.2 meters but it is definately NOT 240x120 centimeters.

Not even that. A tad under 2.44 x 1.22 meters as the size is 8 x 4 feet :) I couldn't work out why my dimensions wouldn't match on some 6 meter lengths of steel, they were actually 20 feet :(

NAOM

If the US had dumped inches, gauge and a few other units and moved strictly to the engineer's scale a century or better ago construction would certainly have been much simpler. Except for the fact (and it is a big except for) that metric linear measurement folds so nicely into the other measurement categories metric has no advantage over a linear meaurement system that uses only feet and decimal 'fractions' thereof.

That sure is a lot of different names for units of volume.

Sure. I learned them at age four, and still remember them, along with truly obsolete measures like rods, chains, furlongs, leagues, etc.

A base 2 system is very useful for practical things.

This sort of thing is why I am such a big proponent of SI - it encourages thinking and problem solving because the system makes it easy and intuitive to work with different quantities (volume, mass, energy etc).

I agree. I think it's easy to overstate the effect: many people are simply uncomfortable with simple math, and easier units won't help; others are very comfortable with math, and more difficult units won't stop them. But...you've got a perfectly good point.

Let me say again: I agree that SI is better.

My point: english units have some virtues that are unappreciated, especially their use of base 2, base 3, base 12, etc. SI went with base 10 for historical reasons,

If you look at history, you get a better sense of just how irrational the choice of base 10 was. For instance, the French tried to impose a base 10 time and calendar system: 10 hours in the day, 10 days in the week. This was a bridge too far (especially because there's no way to decimalize 365.25 days per year), and it failed almost immediately.

Base 12 or 16 would have been a much more useful choice, but of course the cultural obstacles to that would have been far too large. But let's not kid ourselves about how "rational" metric units are.

Well, it seems like we are in agreement here - metric is better, though it is not perfect. The advantages come from the way the system was designed, but no question some things could be designed better.

As for the French and a 10 day week, well, they are French - they would probably have still only wanted a five day workweek!. They invented metric and it is possibly their single greatest contribution to the world - they just didn;t know when to stop.

The 365.25 days shows that nature does not follow an base system, and it doesn;t really matter. The second is the base unit of time, and as long as there is a standard definition of it, then we go from there, and there will be x seconds in a day

A second was originally defined as 1/86400 of a mean solar day, but this was not accurate enough, when you get into atomic measurements. The current definition is:

The second is the duration of 9 192 631 770 periods of the radiation corresponding to the transition between the two hyperfine levels of the ground state of the cesium 133 atom.

Certainly not decimalised there!

All the definitions, and their historical origins are at: http://physics.nist.gov/cuu/Units/current.html

The fundamental units always need some arbitrary definition, and a historical one, like the second, is fine - it is the derived units (force, energy, velocity etc) that work so well in metric.

Since America is trying to get more people into science and engineering, why not make life easier for them and ditch the system that is the worst to use in these fields.

Every mornin' at the mine you could see him arrive

He stood six foot six and weighed 2-45

Kinda broad at the shoulder and narrow at the hip

And everybody knew you didn't give no lip to Big John (Dean and Acuff)

just kinda hard to give that up

He stood a hundred ninety eight and weighed and weighed a hundred eleven

is okay but just doesn't have that get down and grab ya quality <?- )

could be why entertainment is one of the things we seem to do best

You are absolutely right that American students should be immersed in the metric system early on but we needn't give up our 'standard' system. After all most everyone else in the world must learn at least two languages, we Americans should be sharp enough to become proficient in two measurement systems since we only need know one language. Using the 'standard' system for our less formal social situations--which should include getting from here to there--gives at least the illusion of some distance from the devour all machine we have created.

we don't have the right to change the spelling of them

we have been locked into the most insane spelling system since the mass production of 19th century dictionaries. Language itself has been somewhat fixed by the printing press--the new media will make their own lasting marks in the realm

He stood a hundred ninety eight and weighed and weighed a hundred eleven

Well, you could say it as he stood one ninety eight, and weighed one - eleven.

But a great ballad, and we don;t have the right to change the words as originally written...

On the topic of two systems, when I was growing up in Australia in the 70's, learning only metric, my parents, who had grown up in imperial units, did find it a little hard to adjust, but that was decades and, when I asked them while back in Oz at Xmas, they said it was a good change, and they wouldn't want to go back. The only criticism is the sometimes unwieldly names, like hectopascals, decilitres etc. It is an engineers dream and a marketers/linguists nightmare!

Here in Canada, there are elements of both systems in use - particularly noticeable in the construction industry. It's not big deal, but I did notice how simpler it was in Oz when no one has to bother converting anything, measurements on any label are just written once. Here they are written in two sets of units in two languages - talk about a waste of space!

As for spelling, well, I think with new words you can choose the spelling, but the existing ones should have their spelling maintained. n We can and do use abbreviations, acronyms, etc, and the kids are inventing new ones daily, and that's fine - so did the early telegraph operators.

I'm not sure the printing press is entirely to blame - the words in Egyptian hieroglyphics or Roman Latin haven't changed spelling in thousands of years - they are, after all, set in stone.

Spelling does change when words migrate from one language/alphabet to another - there isn;t even agreement today on how to spell Ghaddafi/Qadaffi

Languages can and must evolve, but I don't see the rationale for changing spelling of long established words - and life would be easier if everyone could agree on standard spellings for them.

Language stopped evolving with the advent of dictionaries around the year 1650.

Look at the difference between middle english and Shakespeare's english!

And yet Shakespeare is still very understandable!

Well, you could say it as he stood one ninety eight, and weighed one - eleven.

maybe He stood two point 0 and weighed one-eleven would be a better translation.

As for spelling, well, I think with new words you can choose the spelling, but the existing ones should have their spelling maintained

I don't know I rather like some of the more varied spelling from the 18th century--we became lock step regimented when the upwardly mobile middle class all became locked into specific Oxford spellings, with only minimal across the ocean variations, to show they had good breeding. And talk of anachronisms--here we sit using kqwerty which was designed to slow the strokes down so the keys wouldn't jam up on the early typewriters. Legacy is a funny thing. Business may want efficiency but there are deep parts within us that loathe too much of it.

And that in a round about way brings us back to gold<?- )

And that in a round about way brings us back to gold

Only if someone brings up that gold is measured in troy ounces and is called ounces, thus a nod to even more non-metric units.

(unless the gold is in a small amount then you say milli grams.)

Only if

The amount of gold in vaults will have almost NO bearing on Japan's ability to regenerate. Legacy and inefficient are excellent terms to use when talking of wealth said to be stored in gold.

I'm, not so sure if it is inefficient - anyone who has has their wealth stored as gold cannot have the capital dissappear, ala Bernie Madoff, or the company go broke, or the bond issuer default, etc etc. You give up yield potential in return for security, and liquidity - i'd say it is one of the best ways to store wealth, but not necessarily the best way to grow wealth.

But these days when investors are often more concerned about return of capital, rather than return on capital, gold is not a bad bet.

Storing wealth in fat is efficient--in gold???? Because we haven't chopped it to its industrial value doesn't mean we won't do that in the future--legacy very much desribes gold. Since storing wealth is not particular efficient, (at least storing beyond seasonal and cyclical necessity) storing in a commodity that must be be converted to a useful storage medium like a bushel of grain or a barrel of oil is even less efficient than storing wealth in the latter.

Your right it's not a bad bet these days but if you are betting on gold you are still betting on some sort of BAU to keep gold valuable. So storing in gold merely indicates fear being stiffled by sloth (storing in gold is a completely unproductive activity). Heck of companions to keep for the little time we have here.

storing in a commodity that must be be converted to a useful storage medium like a bushel of grain or a barrel of oil is even less efficient than storing wealth in the latter.

But the "usefulness" of those commodities changes. Coal is not useful to anyone these days except a power station or steelworks. Uranium might be less useful now than it was a few days ago.

But gold has always been (effectively) useless, but has held its value as a currency over thousands of years. After the last major collapse of BAU (the Roman empire) into the Dark ages - the most valuable thing was still - gold. It has persisted as a currency for about 6000 years now - if we have a post collapse world, it is likely to emerge again as the only true currency.

Now, it is not a resource, like grain, oil or land, but viewed as currency it is one of the factors of production (land, labour, capital and enterprise/knowledge).

Gold has been a currency in every civilisation in history - i would not be willing to bet against that trend.

if we have a post collapse world, it is likely to emerge again as the only true currency

Don't forget silver. It's far more useful as a currency.

Are you really sufficiently worried about collapse to make a real investment into gold that you wouldn't do otherwise (for investment purposes)?

Not sure what makes it more useful as a currency, but agreed, it has a long history as one, and likely a future too.

No, I am not that worried about a real collapse - but I am worried about uncontrolled (not hyper) inflation. All these governments are printing money, and trying to devalue their currency against everyone else - a real race to the bottom. Those that have lots of cash are trying to find real things to invest in, be it gold, farmland, etc, which is driving up prices for those things. Despite what we may hear about official inflation rates, real inflation is happening - look at the prices of consumables (food, energy, commodities etc), and essential services (medicine) The only things going down are those in oversupply which is real estate values and lawyers rates, and discretionary luxury items (boats, vacations etc).

Price out some of these commodities in gold, not $, over the least decade or two, and you will see their intrinsic value has been flat or even declining slightly - it is the currency that is devaluing.

If I had money to invest, I would put about 20% into gold. The best result would be that the price of gold does not change - that means inflation is not happening. The worst result is if gold keeps going up, because that means everything else is going down.

Not sure what makes it more useful as a currency

It's less rare, so it's price is lower, and that means it's useful for much smaller transactions.

Plus, it was used for real currency very recently, so there are a lot of familiar coins (dimes, quarters, etc) that people will recognize.

Not that I think that hoarding silver is a good idea...just sayin...

All these governments are printing money

They're just trying to prevent deflation. Central banks are pretty committed against inflation - just look at the ECB raising rates.

Those that have lots of cash are trying to find real things to invest in, be it gold, farmland, etc, which is driving up prices for those things.

That's what the Chinese have always done - that's what caused the Opium wars.

real inflation is happening

You'll have to give me a really good argument to not accept the PCE/CPI. Sure, commodities are rising, but people in the OECD don't buy commodities directly. The CPI isn't even at 2% even including food and energy.

Price out some of these commodities in gold

That's the goldbug argument, and it's circular: gold is better than "fiat" because "fiat" is inflating, but it's only inflating when measured against...gold.

They're just trying to prevent deflation. Central banks are pretty committed against inflation

Personally, I'd be happy to see some deflation, I really don;t see why they are so worried about it. The conventional theory goes that people will put off buying stuff because prices will be lower in the future, but, really, how much can you put off into the future? You still have to buy food, fuel, pay the mortgage, insurance, health care etc etc. The prices of flat screen TV's have been deflating for as long as they have been around, and everyone knows that, but people have been buying...

It is only the discretionary things that people might put off, like a holiday, but even then, a family only gets one summer holiday per year, and if they can afford to take it, they probably will.

Of course, we have housing deflation right now, but that is really an oversupply cause by .. inflation!

That's what the Chinese have always done - that's what caused the Opium wars.

Can you expand on that? My understanding is the British essentially created the Opium Wars to regain the wealth being transferred to China by the tea trade. Hmm, could their be a parallel with the oil trade today...?

You'll have to give me a really good argument to not accept the PCE/CPI. Sure, commodities are rising, but people in the OECD don't buy commodities directly. The CPI isn't even at 2% even including food and energy.

Well, I'm not convinced the current basket of goods and services really reflects today's consumer spending - while it includes prices for "medical services" it does not include prices for "health insurance" and that has been very inflationary. Perhaps more importantly is that average non-government wages are falling, so the "affordability of living" is decreasing for many.

And, the CPI does not include government taxes (it does include some user fees for water, car rego etc). And in many cases, even when taxes have not gone up much, the services received for them have been decreasing, so I would call that inflationary, but the CPI does not pick that up.

That's the goldbug argument, and it's circular: gold is better than "fiat" because "fiat" is inflating, but it's only inflating when measured against...gold.

Well, don;t take my word for it;

At Royal Bank of Canada, we trade gold bullion off our foreign exchange desks rather than our commodity desks. Because that’s what it is – a global currency, the only one that is freely tradable and unencumbered by vast quantities of sovereign debt and prior obligations.

It is also the one investment and long-term store of value that cannot be adversely impacted by corrupt corporate management or incompetent politicians, each of which is in ample supply on a global basis.

Don’t measure the Dollar against the Euro, or the Euro against the Yen, but measure all paper currencies against gold, because that’s the ultimate test.

-- Tony Fell, Chairman, Royal Bank of Canada, February 2007

It is only the discretionary things that people might put off

I think durables, like vehicles and appliances, might be the most important thing. A big drop in car sales can really hurt the economy.

we have housing deflation right now, but that is really an oversupply cause by .. inflation!

We have a physical oversuppy: builders just built too many houses.

My understanding is the British essentially created the Opium Wars to regain the wealth being transferred to China by the tea trade. Hmm, could their be a parallel with the oil trade today...?

Absolutely. The Chinese created a currency crisis because they accepted payment for their exports in gold, but refused to allow imports to China. The opium trade was illegal, but it succeeded in circumventing the trade barriers, so that's what the British went with.

Something similar occurred in 2008 when the credit crunch stopped the flow of CDO's. In general now the Chinese are accumulating t-bills - the modern equivalent of gold. Fortunately, the supply of t-bills can be adjusted as needed.

while it includes prices for "medical services" it does not include prices for "health insurance" and that has been very inflationary

Interesting. I haven't heard before the idea that health insurance prices are rising faster then medical costs. Do you have more info? Keep in mind that the market for individual/small business coverage isn't representative of the overall market.

the CPI does not include government taxes (it does include some user fees for water, car rego etc).

For better or worse, overall taxation levels are falling.

Royal Bank of Canada

So, RBC is run by gold bugs? hmmm...well, we've certainly seen that banks can be as stupid as the rest of us.

The idea that gold can't be manipulated is highly unrealistic. The Spanish flooded the market in the Siglo de Oro, much to their long-term unhappiness.

The supply of gold is unrelated to the size of the economy - I really, really wouldn't want to see it used as a primary currency. That would cause endless recessions and depressions.

Is gold a good investment? Who knows? It certainly has its own risks. It depends entirely on the psychology of investors, so this is really a question of psychology, culture, fears about economic stability, etc, etc. If I were going to invest in a precious metal, I think I'd go with silver, which has appreciated much less than gold from historic levels.

I guess the question that seems most interesting to me is whether the rising price of gold tells us anything about the stability of "fiat" currency. It seems to me that the answer is no: it tells us much more about the psychology of those buying it: the Chinese have always been gold bugs, and now they have more money to buy it. The elites in oil exporting countries are looking at becoming fugitives, kicked out by their angry citizens - it makes sense they'd be buying easily portable, hard to trace assets.

I think durables, like vehicles and appliances, might be the most important thing. A big drop in car sales can really hurt the economy.

Well, sales of cars have already fallen off the cliff. I don't have official figures, but I suspect car prices have been fairly flat for a few years now - but sales fluctuated wildly for reasons totally unrelated to their price. Fuel inflation, and unemployment, will decrease car sales much more than a slightly declining CPI

And appliances - they have been deflating, in real terms, for decades. Given that so many of both cars and appliances are imported, I think a drop in sales of both is not a huge impact to the economy.

We have a physical oversuppy: builders just built too many houses.

Yes, they were betting on inflation, and people buying more houses than they can live in!

In general now the Chinese are accumulating t-bills - the modern equivalent of gold. Fortunately, the supply of t-bills can be adjusted as needed.

That is why t-bills are not quite the equivalent of gold. With the US pursuing devaluation, they are not truly stable. Mind you, China is being far more coy about their own currency manipulations - it's funny to see the US gov complaining about China manipulating currency and markets - pot calling the kettle black!

Interesting. I haven't heard before the idea that health insurance prices are rising faster then medical costs. Do you have more info?

No, I don't have hard info, just anecdotal evidence. Keep in mind, CPI is based on unit costs for services, and ignores whether or not more of those services are being used - which appears to be the case, especially with drugs. While individual/small health care may be representative of thew whole market, they they are the whole market to individuals and small business - those people then have less money for everything else. I did hear a story on NPR a year or so ago about Aetna health insurance struggling with increasing health insurance costs for its own staff!

For better or worse, overall taxation levels are falling. Taxation rates, or collections? - there is a big difference. Tax rates here have not changed, but collections have as people and companies are generally earning less.

Is gold a good investment?

No, it's a currency. if you are going to keep something under the mattress or in the cookie jar - are you better with paper money or gold? When you "cash out" investments, should you hold paper money or gold?

Now, buying shares in a gold company is an investment, but then you have all the normal risk factors of management etc.

the Chinese have always been gold bugs,

Keep in mind the Chinese invented fiat currency... Not surprisingly, this also led to the government "printing" money, and subsequent inflation...

Perhaps, if they have the longest history of fiat currency inflation, that is why they are gold bugs - they just don't trust their government, not even the government insiders trust it.

sales of cars have already fallen off the cliff.

They hit bottom, but have been recovering pretty well.

Given that so many of both cars and appliances are imported, I think a drop in sales of both is not a huge impact to the economy.

Cars are still more than 50% manufactured in the US, and the whole industry is about 10% of the US economy. Hamilton thinks that the psychological impact of the recent oil shock on car sales accounted for most of the depth of the recession.

With the US pursuing devaluation, they are not truly stable.

Devaluation doesn't change the value of the dollar. It still buys the same amount in the US. A dollar represents a claim on the US economy.

CPI is based on unit costs for services, and ignores whether or not more of those services are being used - which appears to be the case, especially with drugs.

Yes. Hopefully, if people use more drugs, they get more benefit. Hopefully...

Taxation rates, or collections? - there is a big difference.

Rates have fallen in the US. That's the primary reason for the US budget deficit - tax cuts.

gold...it's a currency.

It's really not. You can go very, very few places and buy things with it. You can't buy a car with it, or a house, or groceries, or gasoline, or pay your taxes.

Hamilton thinks that the psychological impact of the recent oil shock on car sales accounted for most of the depth of the recession.

Really? It had nothing to do with overleveraged home buyers and a real estate bubble? Or the failure of dozens of banks, and the bankruptcies of untold business and rapidly increasing unemployment?

I don't think the car industry is that big of a deal, even for the US. But iof it is, then the US needs to do something, as oil shocks are likely to be part of the future.

Hopefully, if people use more drugs, they get more benefit. Hopefully...

Well, the drug companies certainly get more benefit, but I'm not sure the health of the people has matched the increasing volumes of spending on (prescription) drugs. How much Viagra and Cialis do people need? Should these be included in the CPI same as movie tickets?

Rates have fallen in the US. That's the primary reason for the US budget deficit - tax cuts.

I don;t study US tax rates very much - my understanding was that they had been stable for the last 10yrs, but maybe not. if the rates have been decreasing, and the deficit increasing, then I'd say the reason is not reducing spending in line with reducing taxes.

It's really not. You can go very, very few places and buy things with it. You can't buy a car with it, or a house, or groceries, or gasoline, or pay your taxes.

I disagree - it is the ultimate travellers cheque. You can go to any major city in the world, and find someone who will pay you close to the current world price for gold - same as i can travel with bunch of Australia $, and change them into the local currency in any country. It is like a currency that is not from any particular country, but in any country you can exchange it for that countries' currency. Yes, you can't use it to buy gasoline, but then, many gas stations won;t take a $100 bill either.

i think it meets the basic definition of a currency - something that has no value in and of itself, but can be exchanged for other things that do have value. The fact that you may need an intermediate like $ does not change this.

For the record, I did hear of a house in Sydney that was paid for in gold - apparently the tax dept was very interested in this. But then, this is in a city where, less than 200 years ago, the primary currency was rum - soldiers and police were paid in it and a hospital was built and paid for by rum! At the time it could not be counterfeited, and could not be "printed" by government, or anyone else - same characteristics as gold, though it could be consumed, of course...

Nobody has gone broke/suffered massive devaluation by holding gold for many decades - the same cannot be said of paper money.

It had nothing to do with overleveraged home buyers and a real estate bubble? Or the failure of dozens of banks, and the bankruptcies of untold business and rapidly increasing unemployment?

Actually, I kind've agree with you - I think it's easy to overestimate the impact of oil on car purchases. On the other hand, those factors you mention had their impact on the economy largely from a decline in consumer spending, and a major part of how that decline showed up was in cars.

iof it is, then the US needs to do something, as oil shocks are likely to be part of the future.

I strongly agree.

I'm not sure the health of the people has matched the increasing volumes of spending on (prescription) drugs. How much Viagra and Cialis do people need? Should these be included in the CPI same as movie tickets?

Sure. How is recreational sex not as good as recreational movie watching?

if the rates have been decreasing, and the deficit increasing, then I'd say the reason is not reducing spending in line with reducing taxes

The primary cause was tax cuts. Now, you could fix it by reducuing spending, but the logical solution is proper tax levels, with the major exception of military spending - have you looked at the increase in US military spending?

it is the ultimate travellers cheque.

Traveller's cheques can be spent in a grocery store - gold can't. Sure, it's fairly liquid in major cities, but it's definitely not a currency.

The fact that you may need an intermediate like $ does not change this.

It really does. Stamps, old coins, art, etc can all be sold in major cities, with varying broker commissions. That doesn't make them currency.

Nobody has gone broke/suffered massive devaluation by holding gold for many decades

Sure they have. There have been periods when gold's value plummeted for various reasons. You could make the same general statement about land, but that wouldn't be true either.

That's the bottom line argument against gold as having any value at all. There is simply NO reason except hope and blind faith, for gold to hold any relationship to currency in circulation, money supply, or any other feature of the modern world economy. The argument that gold should be the final measure of all value only makes sense for holders of gold. Gold-backed currency is a proposition of the wealthy and the miserly. For EVERYONE else, it is a loosing proposition without validity or merit, see (multivarious) weaknesses in propositions above. (1) gold supply increases in direct proportion to the market value of gold measured in fiat currencies, e.g. direct relationship to mining costs measured in fiat currencies, obviously therefore not with any absolute value. 2) gold is disproportionately held by citizens of economically backward societies, India, China, where the concepts of modern currency are late arrivals. 3) many others.)

Well, the word ran on gold back currencies until 1971, and it seemed to do fine - some would argue, better.

I kinda like a currency that is not at the mercy of the Government of the Day.

Look at Greece with Euro, they finally had to face up their hopeless mismanagement and corruption, instead of being able to take the easy way out and keep devaluing. For the central American countries that use the US dollar, they are in the same situation - they have to focus on real economic management.

You can't devalue your way to prosperity.

I care not that China, India etc hold lots of gold - they hold a disproportionate amount of rice producing farmland too - so what? I would suggest that where citizens hold gold instead of paper money, it means they do not trust their governments, and in the case of China and India and other backward countries, I can understand that. if I was in Zimbabwe I would definitely want to work in gold. If people in the US are starting to hold gold, i would see that as a sign of distrust of the US Government, though there appear to be other signs too.

You are correct in that gold is only valuable because (some) people perceive it as valuable - but it has an outstanding track record of remaining valuable. We'll see where $ are in another 1000 years...

Well, the word ran on gold back currencies until 1971, and it seemed to do fine

it ran very, very badly. There were repeated recessions and depressions caused by gold deflation.

If people in the US are starting to hold gold

Do we know that's the case?

Since storing wealth is not particular efficient, (at least storing beyond seasonal and cyclical necessity)

I noticed you didn't try and deal with my underlying statement about the efficiency of wealth storage in the first place. Nor my original point about the virtually non existant effect gold stored in vaults will have on Japan's regeneration.

You are merely adressing the 'faith' aspect of gold's value-it is virtually the same type faith required for any of the other currency/credit mediums we have today. I'd far rather put my faith in something that engaged much more of human potential. I guess you could sit in passive heated gold cored bunker if you like but its a heck a place to spend what little time we get.

Ok, so lets look at the efficiency of wealth storage. Store it as grain, and you have a limited shelf life, plus you need a large storage facility. Store it as farmland, and you have to look after it. Store it as steel - and it can rust. All wealth storage mediums have their own limitations, but the key thing is that anything physical needs a physical storage facility - gold needs less of that than almost anything else.

As for the conversion efficiency, yes there is a commission when you convert it to currency, but that is true of any other commodity too.

I am not saying that gold is a productive "investment" like operating a farm, producing electricity etc - I am saying that as a currency, it is far more resilient and stable than anything else. And as means of storing wealth, it is better than any other currency, and most commodities. Choose any other commodity and you making a bet on the future market for it. Gold has no market (for productive use) that is why it is such a stable currency.

if Japan wants to pay for reconstruction in gold, and i don;t think they will, I'm sure the contractors will be happy to take it.

if Japan wants to pay for reconstruction in gold, and i don;t think they will, I'm sure the contractors will be happy to take it.

That is the essence of my point--barring total collapse gold is almost totally superfluous to the business at hand. And of course with total collapse it might be equally superfluous--not looking to see how that plays though.

All wealth storage mediums have their own limitations, but the key thing is that anything physical needs a physical storage facility - gold needs less of that than almost anything else.

of course I qualified efficient storage temporally--enough to cover both

seasonal and cyclical necessity

So I will grant gold some value as a storage medium to help meet cyclical necessity--the cycle of that entails burning up the savings made during the productive portion of a persons life.

When viewed from that perspective in a world at its population limit storing in gold might be more attractive than storing your productive years in the upbringing of your children thus counting on a portion of their production to sustain your unproductive years. But storing in gold is quite a bit different than that--wealth stored in gold is removed from the economy (except for the pittance it take to maintain the storage--not a small pittance if that means maintaining your own security force--so this keeps getting more twisted) wealth stored in bringing up your children becomes the economy.

Gold is a legacy wealth storage medium--its value relies on faith, and its a funny kind of faith when you sit down and examine it. In the case of traders the faith is fully in the trading system and the convertibility of gold back and forth into currencies--the same currencies the traders have fled because of lack of faith. In the case of the hoarders the faith is a bit more convoluted--but mostly it's merely faith that gold will be valuable in the future because hundreds of generations of the dead thought it was valuable in the past.

When viewed from that perspective in a world at its population limit storing in gold might be more attractive than storing your productive years in the upbringing of your children thus counting on a portion of their production to sustain your unproductive years.

I would not suggest short changing your children in order to accumulate gold - though some probably do that to accumulate $, I am saying that as a currency, it has merits that fiat currencies do not.

I was going to say that the model of your children looking after you in old age has gone, in western countries, but actually that's not the case. At least, if you are a government employee it seems you can rely on everyones children (i.e. future taxpayers) to pay for your retirement, regardless of whether you have saved anything.

But storing in gold is quite a bit different than that--wealth stored in gold is removed from the economy (except for the pittance it take to maintain the storage--not a small pittance if that means maintaining your own security force--so this keeps getting more twisted) wealth stored in bringing up your children becomes the economy.

I'm not quite sure it is "removed" from the economy. As store of wealth, it can be used as collateral against borrowing (possibly the best collateral you can have). Banks that have gold deposit accounts can count the gold as part of their reserves for lending purposes.

Gold is a legacy wealth storage medium--its value relies on faith, and its a funny kind of faith when you sit down and examine it. In the case of traders the faith is fully in the trading system and the convertibility of gold back and forth into currencies--the same currencies the traders have fled because of lack of faith. In the case of the hoarders the faith is a bit more convoluted--but mostly it's merely faith that gold will be valuable in the future because hundreds of generations of the dead thought it was valuable in the past.

I think the word I would use is "confidence" rather than "faith", but in any case, yes it is based on peoples perception of its worth. But that is true of everything - it is only worth what someone is willing to pay for it. And, I would suggest that gold has the longest track record of anything, for being perceived as something worth paying for. Whether this should be the case is beside the point - gold as a currency has worked for all of human history, and I just can;t see anything changing that.

Doesn;t mean it;s the only currency of course, but I'll bet it is still around after many others have gone.

That is such an obvious appeal to emotions it has no place in any rational debate. The set of government employees, unionized or not, have relativly zero intersect with persons wasting resources due to superflous wealth. Yachts with helicopters onboard or with tender boats on davits more luxurious than any boat any teacher might hope to afford, lining the harbours of every Carribean tax haven. Those who argue that overpaid teachers are the core of the US financial difficulties are clearly simply those who a) hope to join the yacht owners or b) are too stupid to see reality.

That's a breath of fresh air in this world which has been so badly misrepresented by entities like Fox news and Koch brothers' think tanks.

The set of government employees, unionized or not, have relativly zero intersect with persons wasting resources due to superflous wealth.

Quite so. But they do have an interconnect with their next door neighbour, who, assuming they still have their ordinary private sector job, is paying the taxes that provide benefits to gov employees that the private employees (not capital owners) are unlikely to ever enjoy. Go to any country town in Canada, and the local government employees are probably, as a group, the best off - that is certainly the case where I live.

The way the super rich choose to spend their wealth is up to them - that has nothing to do with the average taxpayer - you or me.

If you are saying that these wealthy people have been able to game the system and avoid paying taxes, etc, that may well be true, and governments should be closing these loopholes - but that is not the fault of the average taxpayer.

But that does not alter the fact that many governments are spending more than their taxpayers can afford. I am not saying overpaid/overstaffed government employees are the only cause of this, but it is a factor.