Tech Talk - Oil producing countries around 1 mbd, Kazakhstan, Qatar, Indonesia and Azerbaijan

Posted by Heading Out on March 13, 2011 - 7:41am

In this series of posts I have been taking a quick look at the current oil and natural gas production from the world’s top oil producers, using initially the table that the EIA developed for 2008. In just four posts (the top tier at above 3.1 mbd; the upper second tier, the lower second tier and those at about 2 mbd ) I have now reached the final few that produce above 1 mbd. As it is I have slightly re-arranged the order since back in 2008 India was producing more that Azerbaijan, but while Indian production stayed the same, Azerbaijan production has now risen above 1 mbd, so I made the switch.

This limited number of countries includes those whose production is waning, as well as those to whom we might look for improved output to meet the rising demand. That, I would remind you, has been predicted to be about 1.4 mbd more this year than last, providing of course that the recession continues to recede from the global markets, a question that rising prices for oil might throw in doubt. With civil war in Libya appearing more likely, there is a significant possibility that the 1.6 mbd that the country produces might disappear from the scene for a while. So where can the make-up to a total of an additional 3 mbd come from? Well let’s take a look at what these four countries are doing and see whether they are going to be able to help.

First let’s look at Kazakhstan, which was producing 1.43 mbd back in 2008. And to begin with, where is it? South of Russia, and north of China it lies on the Eastern shore of the Caspian Sea.

In 2005 Kazakhstan began sending oil to China through a pipeline and while some of the oil is locally produced it also provides a conduit for Russian oil flowing to China. The pipeline was originally planned to carry 10 million tons of Kazakh oil, and, by now, the same amount of Russian oil. However it was only at the end of last year that it reached the first target, (200,000bd) with the second now reset to 2013 but now dependant on Kazakh oil from Kashagan, rather than from Russia.

The country depends on pipelines to export its oil. The EIA notes that as production has increased, now at around 1.6 mbd, it will depend both on pipelines and barges across the Caspian to connect to that market.

There is still considerable potential for the slope of the production curve to continue upwards. Chevron has announced that the Tengiz field, which is now at 567 kbd will, in the next phase, ramp that up to 780 kbd. That oil flows to Russia through the Caspian Pipeline Consortium pipe. At Kashagan, which will in time produce up to 1 mbd, development is slowed as it faces government resistance to the high costs of the next phase of the program. Given that the field, located offshore in the Eastern Caspian is the main bulwark for the planned expansion of Kazakh production through 2020, postponing that development may reduce export capacities. There is other news that is also not positive, production from Karachaganak, currently the second largest field dropped 4% last year. Smaller production gains are anticipated from other fields in the country, such as the Tethys Petroleum development, which is going to use a radial drilling method that I might post on in some future time. But it is questionable whether any dramatic gains in production will be available to meet increased global demand in the short term. The target of a 3 mbd export level by 2020, set by the Prime Minister will depend on ironing out some of the current contract difficulties.

Kazakhstan has also participated in the natural gas pipeline that runs from Turkmenistan to China and which was opened in December 2009. That pipeline has increased the marketability of the products, and while all natural gas used to flow to Russia which thus had a considerable say on volumes and prices, the existence of alternatives is causing the Kazakhs to rethink the relationships and distribution of profits.

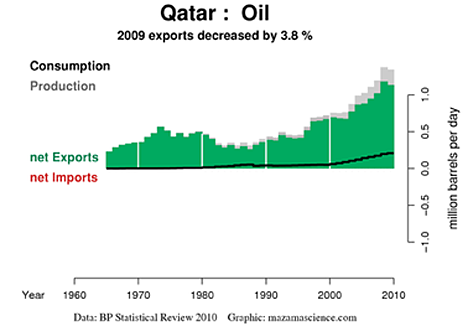

Qatar lies in those Middle Eastern countries whose long-term production might be threatened by domestic unrest. Within the past decade an increasing portion of the country's resource is being devoted to internal consumption.

Qatar is more widely written of in terms of its vast gas fields and potential, rather than for its oil, even though, in 2008, it averaged 1.2 mbd of production. In January of this year OPEC reported that Qatar produced 813 kbd of oil. However, with the large natural gas production the country also produced around 380 kbd of non-crude liquids to provide the overall 2008 volume. It is through an increase in the latter volume to 590 kbd that has raised overall 2010 production to 1.4 mbd.

It had been viewed as one of the more stable countries of the region, back in 2006. That ranking puts it just ahead of Oman, and Oman has now seen some disturbance and death. (And receiving support from the UAE to meet those threats, suggesting that they are perceived as deeper than reported.) Qatar has the second highest per capita income (at $95k) but it should be remembered

The royal family, the Al-Thani, has a history of internal conflict and competition over political power. The last three leadership transitions—in 1949, 1960 and 1995—came about as a result of forced abdications, due to in-fighting within the ruling family. However, this ruling family has maintained social peace in Qatar for decades.

Qatari political stability is baffling.

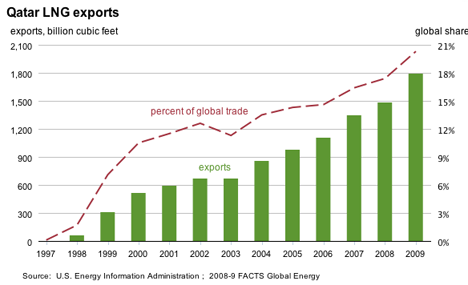

The production of natural gas from the country is increasingly going into liquefied natural gas (LNG ) and the significance of the production can be seen from the EIA report

RasGas and Qatargas have 13 LNG trains currently online, with a total LNG liquefaction capacity of 3,400 Bcf/y (69.2 MMt/y). Five of these trains were added in 2009 and 2010. RasGas III, Train 7, with a liquefaction capacity of 380 Bcf/y (7.8 MMt) of LNG began operations in February of 2010. Qatargas III, Train 6, came online in November of 2010 with the same liquefaction capacity. The 7.8 MMt train is considered a mega-train, and is currently the largest operating size in the world.

In March of 2011, Qatar will complete its monumental cycle of LNG infrastructure expansion with the inauguration Qatargas IV, Train 7 (80 Bcf/y (7.8 MMt)), which will bring the total capacity to 3,750 Bcf/y (77MMt/y). Qatari government officials have noted that they do not anticipate building any more LNG facilities in the near-term future.

Whether those decisions will affect the slope of the increasing levels of production will have to await the test of time, but with 70% of production going into the LNG market, that still leaves room for growth elsewhere.

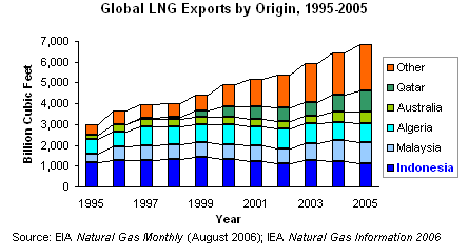

Indonesia left OPEC in May 2008, since it had become an oil importing country. (This also saved them the $3 million annual membership) Recent production has been down around 1 mbd (similar to that of 2008) but a recent dispute over cabotage may cut this dramatically. Cabotage is the requirement that fuels be transported in domestically-owned vessels, and Indonesia proposes to ban the use of foreign-owned vessels next May. This will affect both oil and gas production with cuts that threaten to be about 157 kbd of oil, and 2.5 bcf of natural gas.

At present the country is third in LNG exports after Qatar and Malaysia. The world’s largest buyer of LNG is the Korea Gas Corp (KOGAS) and they have agreed, with Mitsubishi to build a new processing plant in Indonesia to help supply the Japanese and Korean markets. With an estimated reserve of 112 Tcf , the country has the potential to grow this export, though it is quite likely that this increased production may end up in China, which is looking at increasing imports to over 9 Tcf over the next 5 years.

Domestic demand for energy continues to grow, and Indonesia plans to build a second LNG receiving terminal on Java, using domestically produced gas to meet the demand.

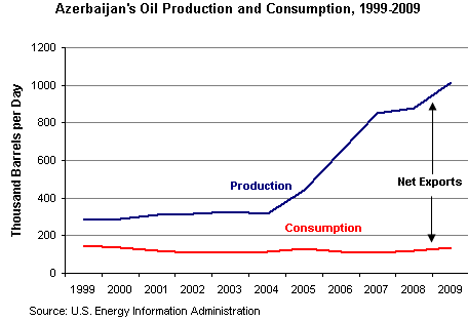

And that brings us to Azerbaijan, on the other side of the Caspian from Kazakhstan. Baku, the capital, has hosted oil development since the late 19th Century. In 2008 the country produced 876 kbd of crude, at the time just below India. However, with the increased development of the Chirag, Azeri and Guneshli oilfields the country is hoping to exceed (if only slightly) the 1 mbd mark this year. However it did fall a little short of predicted volumes in this past year. Current plans are for production to continue to increase, with a target of 1.25 mbd in 2014. The difference between those numbers and that of the EIA figure for the country comes from the inclusion of other non-crude liquids.

The majority of the oil is shipped through the Baku-Tbilisi-Ceyhan pipeline with smaller amounts being sent to Georgia.

Natural gas production is expected to continue to grow with the development of the Shah Deniz field., to the point that additional pipeline capacity is being planned. The plans call to treble capacity, but may require some $3 billion of additional investment. The pipeline carries a flow, at present, averaging 770 mcf/day. One of the issues as Shah Deniz increases total production (it is considered the 9th largest gas field in the world) concerns how the natural gas produced will get to its customers. One of the ongoing options is the Nabucco pipeline. The planned increase of 565 bcf by 2017 can be shipped by possibly three pipelines, but the Nabucco needs a volume of about twice this, and so is currently looking for an additional supplier to make up the numbers. That search has been going on for a while.

Looking at the numbers that I have just gone through, it is clear that the world is going to see an abundance of natural gas likely continuing through the decade. In the shorter term, however, there does not seem to be that much capacity for an increase in oil production. For while countries such as Kazakhstan and Azerbaijan can increase volumes over the present, the increases are not that great, when compared with the need. (The slopes look good, but the vertical scale less so).

But on the other hand the aggregation of a hundred thousand here, and a hundred thousand there can add up to a significant volume in the end. So I will continue this set of posts, looking next at those countries which just can’t quite make that 1 mbd.

Solid overview. Kazachstan and Azerbaijan have indeed huge export potential. Production will most likely more than double in 2020 (if they can overcome the obstacles you mentioned), while consumption levels will be stable thanks to a very low population growth. Some of the current top exporters will see consumption levels rise and production peaking at the same time, moving them further down the list of top exporting countries. Then you have countries like Brazil with big production potential, but at the same time lots of domestic consumption, making it less interesting as an exporter.

My top 10 of oil exporting countries in 2020:

1 Iraq

2 Russia

3 Saudi Arabia

4 UAE

5 Kazachstan

6 Angola

7 Azerbaijan

8 Canada

9 Venezuela

10 Qatar

If Iraq becomes a little bit more stable and can attract investments, then it has the potential to become the new Saudi Arabia. As for the current ~1mbd producers like Kazachstan, Azerbaijan and Qatar, they are not past peak yet and will probably surpass countries like Norway, Kuwait and Nigeria. Libya and Algeria have potential as well, but lets first see how the situation there will unfold.

Will these supposed top 10 countries in 2020 export as much oil as the current list is doing right now? Most likely not. But there will be new oil leaders, no doubt.

The North Sea, which peaked in 1999, is an interesting case history of new fields coming on line in a post-peak region. Sam Foucher found that oil fields whose first full year of production was 1999 or later had a production peak of about one mbpd in 2005, versus the regional peak of six mbpd in 1999. But the post-peak fields only served to slow the overall North Sea rate of decline from 1999 to 2009 to 5%/year.

Note that net exporters showing production declines tend to show an accelerating rate of decline in net oil exports (check out some net export decline rates down the thread). So, net oil exporters with increasing production have to offset countries that are tending to show accelerating net export decline rates. A case in point is graph showing combined net oil exports from Canada & Venezuela (BP):

A look at the net export statistics for Indonesia (as well as the ELM, UK & Egypt):

Appears to be time for me to emulate my friend Alan Drake and move on. In my case, one too many deleted posts.

This is crazy. Westexas is one of the most valuable commenters here.

It is possible that some cabal of users is doing it?

wt - hope you don't slip away in the middle of the night. Your the only wildcatter I have to tease on TOD. W/O you I'll have to tease Web more. And that could get ugly fast.

Web - A cabal, eh? If I got hooked up with this cabal would it include the ESPN package?

As was Alan Drake. I didn't see any more posts from him, but I didn't know he left. It's sad.

Westexas:

To the best of my knowledge I have never deleted one of your posts, rather I have quoted from you quite consistently over the years. I might suggest that, if you wish, you might want to continue commenting on my posts over on Bit Tooth Energy if you are determined to leave, but it does not have the audience of TOD, and so I would like to continue to see your comments on my posts here.

Dave

I for one would be very saddened if westexas were to leave this forum.

AOL

Kazakhstan figures back to 1002 ? Good record keeping :)

NAOM

I saw that too. It is a graficalcompression error; when you squeezethe picture, some pixels are lost. In this case the ones that distinguis a 9 from a 0.

Gee! And here I was thinking that you were all impressed with my perspicacity. Sorry about the compression, it was not noticed when I transferred the figure over.

Don't know about that. But as one who have english as a secondary language, I am impressed by your vocabularity.

Hmm, my reply disappeared as fast as it was posted.

That's why it helps to put the thumbnail in the article linking back to the full size original. BTW, it shows we actually pay attention to the details :)

NAOM

Thanks for continuing the roundup H. O.

At Kashagan, which will in time produce up to 1 mbd, development is slowed as it faces government resistance to the high costs of the next phase of the program

There would certainly be every encouragement not to expand production if the country is getting what it considers sufficient oil revenue now. Longer revenue stream with likely a higher avg. price/bbl.

but the country in this case looks very much to be one man

Critics say he has become a de facto "president for life."

Over the course of his twenty years in power, Nazarbayev has repeatedly censored the press through arbitrary use of "privacy" laws, and refused demands that the governors of Kazakhstan's 14 provinces be elected, rather than appointed by the president. However, there are still no cases based on this law

from Wikipedia

Seems we've seen this sort show before