Tech Talk - Countries producing over 500 kbd - Malaysia, Australia, Colombia and Ecuador

Posted by Heading Out on March 27, 2011 - 9:09am

Over the past few weeks I have been briefly discussing the amount of oil that the major producers of the world generate each year. Starting at the top, with Russia and Saudi Arabia, I have now arrived at the bottom end of the list of countries producing more than 500,000 bd. I am concluding with Malaysia (727 kbd), Australia (586 kbd), Colombia (602 kbd), and Ecuador (504 kbd). For those interested, the list (the EIA top producers in 2008) would have continued with Sudan (480 kbd), Syria (401 kbd), Equatorial Guinea (359 kbd), Vietnam (337 kbd), and Thailand (328 kbd) to cover the countries that produce more than 300 kbd.

But my interest in these countries stems from the need that the world has for significant increased production, and the further that one moves down the list, the harder it is to see any country being able to produce an extra 200 kbd - say, to provide the additional power that Japan might need to replace the destroyed nuclear reactors, not to mention the 1.4 mbd that has been projected for growth in demand of the world economy this year, nor the 1.6 mbd that the loss of Libyan production will impose on global supply.

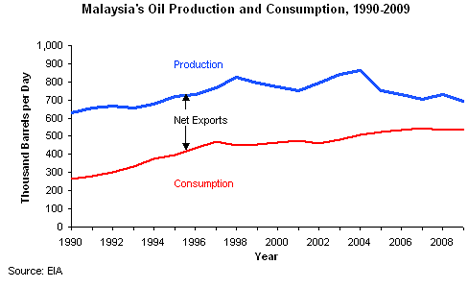

So let us begin by looking at the production from Malaysia, which seems to have hit a plateau in production of crude oil in recent years. Production levels are projected to stay about current levels, slightly below 700 kbd through 2020, with some of that coming from enhanced oil recovery techniques. Malaysia is also the second largest producer of palm oil, at around 300 kbd, though a lot of the latter is used in cooking.

Malaysia lies north of Indonesia (covered earlier in the series).

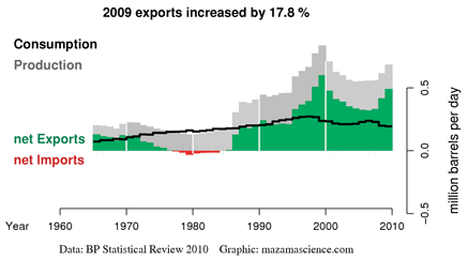

While production is holding relatively steady, consumption within the country is steadily increasing so that before too long, it is likely that the country will cease to export oil, in a similar fate to that of Indonesia. This despite plans to further develop offshore fields.

Natural gas, however, is another story, with steadily increasing production, to date, being able to out-perform increasing domestic consumption. Thus exports, which ran around 1 TCF in 2009, have continued to grow.

The country exports around 1 TCF of LNG, two-thirds of which went to Japan. With only one of the re-gassifying plants in Japan out of operation, LNG provides a way of meeting some of the current energy shortfall in Japan, and Malaysia is willing to help. Malaysia is also now supplying China with LNG, with flows into Shanghai anticipated to rise to 3 million tons/year next year.

Australia is next on the list and it appears to have passed peak oil production and as a result, exports have dropped from over 500 kbd in 2007 to just above 300 kbd today. The declines in production are expected to continue

"The recent start-up of BHP Billiton's Pyrenees oil field and Apache's Van Gogh field - both situated off Western Australia's north-west coast - will provide a boost in the short-term; however, the long-term trend is for production to keep falling," EnergyQuest Chief Executive Officer, Dr Graeme Bethune, said today.

(this from April 2010). Current production is at around 540 kbd, having fallen 40 kbd in 2010.

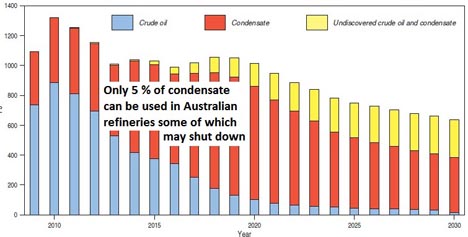

The decline with a projected drop of 85% in 10 years can be seen from this graph:

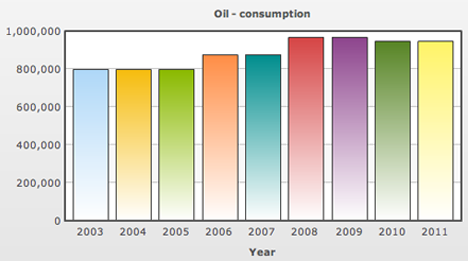

At the same time Australian consumption has been steadily rising, and is hovering just below 1 mbd.

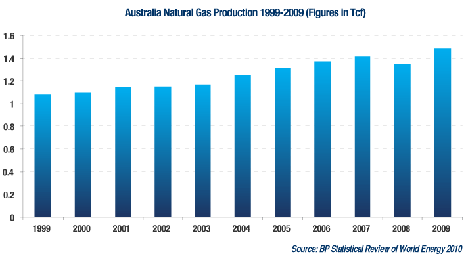

In contrast, Australian natural gas reserves are significant. As with Malaysia it has supplied LNG to Japan, starting in 1989 and has just signed a $41 billion contract for a 20-year supply of LNG from the Gorgon field, taking 2.25 million tons of the anticipated 15 million tons (0.75 Tcf) of annual production anticipated from the field, as overall gas production continues to rise.

Colombia sits next to Venezuela, and I referred to some of the interplay between the two countries in an earlier post on Venezuela. Production of oil has fluctuated but has recently been increasing, so that it is now running at 800 kbd, and this is anticipated to increase to 1.2 mbd by 2012. It is thus one of the few countries that might be able to increase supply to the United States as some of the more traditional sources lose production.

The problems that currently exist relate to the need for additional pipeline capacity to carry the newly developed reserves to a point where they can be exported. Investments in the country from China, among others, support a prediction of further growth to 1.4 mbd by 2014.

As I referred to in the Venezuelan post, some of Colombia’s natural gas has been exported to Venezuela, with the intent that in 2012, as the Colombian reserves start to decline the flow can reverse. Much of the natural gas has been used for improving oil production in the past with the country consuming some 265 Bcf while producing 318 Bcf.

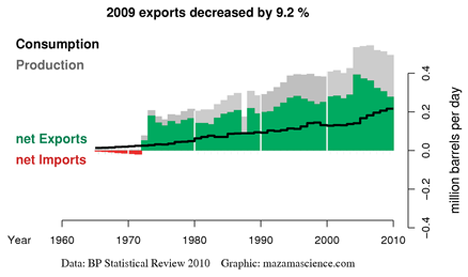

And the final country producing more than 500 kbd is Ecuador, although that was in 2008, and by last year production had fallen to 485 kbd. The country shows the more standard shape illustrating the Export Land model with an accelerated decline in exports as consumption rises, even as overall production now falls.

It would seem, since Ecuador exports to the United States, that the increase in Colombian production is timely.

In regard to natural gas, perhaps the EIA says it best

Ecuador has relatively small proven natural gas reserves and a limited natural gas market.

The supply that it has is used internally, mainly for electricity generation, while much of that associated with oil is either flared or reinjected to help with production.

In the graph above, Australian crude oil production seems to be all but anihilated in just 20 years from peak production. That is a realy big fall. How will they cope with that?

They'll cope with it by switching over to using their enormous natural gas deposits instead. Retrofitting the car fleet to use methane is eminently doable. A Team of 5 - 7 technicians can convert 5 - 7 vehicles in one week.(1) Both petrol and diesel vehicles can be converted.

And also by continued increase of LPG (2/3propane 1/3 butane) fueled cars - plenty of that available from all that condensate.

There are over 700,000lpg vehicles on Australian roads - my family has had at least on LPG vehicle at any time since 1986 - has saved a lot of $$ over those years.

I think the powers-that-be in Australia reason that increasing coal and gas exports will pay for oil imports. The ~$25 carbon tax that is supposed to start July 2012 is likely to mean new baseload power stations will be gas fired rather than coal with nuclear being prohibited. If compressed natural gas CNG comes into favour with truckers as diesel gets expensive I think that could start a gas price war with power stations. Truckers will win as they can pay more.

A major anomaly is that domestic coal and gas users will pay carbon tax but export coal and LNG customers won't. I guess that helps pay for future oil imports. Despite some early talk of a conservation protocol for natural gas in practice it will go to who ever can pay the most. Thus I believe most Gorgon gas will be exported even if the rest of Australia is in fuel poverty.

The carbon tax exemption on exports highlights what farce this whole policy approach is. I would rather the export customers pay for future oil imports!

It is funny to have a carbon tax and then prohibit one of the most carbon neutral sources of energy - nuclear.

Really, a better policy would be to just tax oil more, to discourage its use, and favour lng/cng. There is no point in carbon taxing coal, as we have only one other large scale alternative - NG, and if we substitute valuable NG for cheap coal, we have more cheap coal to export and less valuable NG to export. Either way, world emissions of Australian carbon will not change one iota.

Better still would be to move to a lng/cng/electric (even if coal fired) economy as much as possible and avoid the oil imports altogether. Given we such huge reserves of natural gas, a long term investment in an lng/cng economy, to get out of the oil import game, is a pretty good bet. Much better than a redundant national broadband network!

Also, a large scale ammonia/fertiliser plant wouldn't be a bad idea either - lots of regional customers for that (i.e. China), and ourselves. Do the value adding here instead of just exporting the raw commodity, but it seems we have long ago given up on that concept.

Heading Out,

Have you outlined Bolivia in one of your previous Tech talks?

Or has it not made the cut since its main FF supply seems to be NG?

Bolivia ranks 58th in global oil producers, according to the EIA. It produces only around 50 kbd and that is declining. My main goal in the initial survey was to look at where most of the oil is coming from, and the countries on the list that I have covered so far produced some 79.3 mbd in 2008 and since that is the great majority, it is where I will draw the line for the moment.

Thanks for this post -and the series in general-.

Would like to contribute my two cents on oil & gas developments in Colombia:

Although it is true that pipeline capacity is the most significant constraint for achieving 1 mmbpd production, it is worthwhile to recognize the fact that a significant proportion of the incremental production comes from assets discovered decades ago. Additionally, there have been no significant discoveries in the past decade.

I would like to address the reference to the Chinese companies. Although they do have investments in the Colombian E&P sector, by no means they are a major player or responsible for significant production/investment increases. Ecopetrol is almost completely responsible for these increases. However, Talisman and Repsol (and a couple others) have moved aggressively and this could change the E&P landscape.

Columbia was the place where Collin Campbell first begun understanding the Peak Oil problem. That was back in the sixties. They have had it comming a long while ago.