The Link Between Peak Oil and Peak Debt – Part 2

Posted by Gail the Actuary on July 15, 2011 - 9:45am

In Part 1 of this post, I pointed out that an economy is closely linked with the resources that underly it. Because of this, if there is really is a limit that prevents oil supply from rising endlessly, then there is also a limit that prevents debt from rising endlessly. I talked about seeing a two-way link between peak oil and peak debt:

1. Peak oil tends to cause peak debt. This is what I discussed in Part 1.

2. Once debt growth peaks (shifts from growth to decline), we can expect a feed-back loop that will tend to make post-peak oil supply decline even more rapidly than it would otherwise.

It is this second point I want to discuss today.

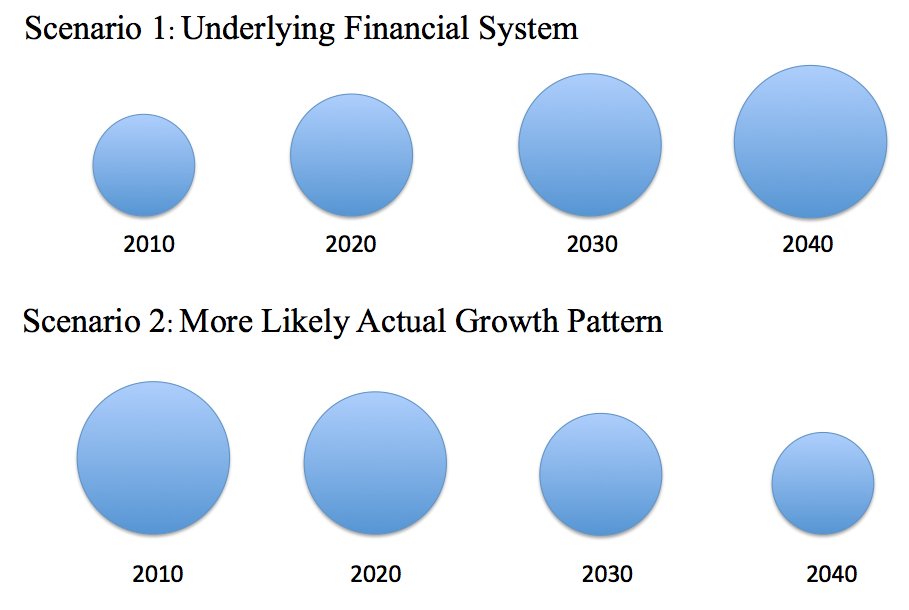

The basic issue is that more debt tends to cause more demand, and thus higher oil prices. At these higher oil prices, oil tends to get pumped out more quickly than it would otherwise. But once a shift occurs from increasing credit availability to reduced credit availability, as it does about the time peak oil production is reached, then prices for all types of commodities tend drop. At these lower prices, oil production drops off more quickly than it would have otherwise.

Let me elaborate a bit.

The Cheese-Slicer Model

We know that there is a cycle that permits oil production, that gradually changes over time. Professor Charles Hall has represented this cycle with his Cheese-Slicer Model. In 1970 he shows this view:

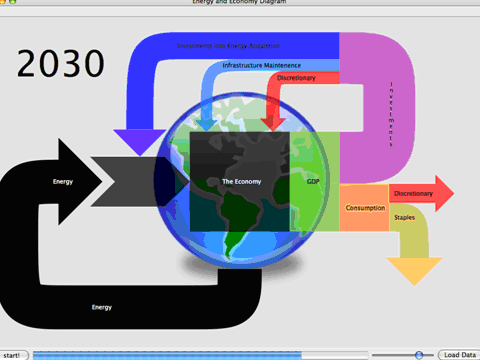

As of 2030, he shows the model:

What happens is that as we extract oil, we use some of it for investment (top big arrow with purple and blue) and some of it for consumption (arrows straight to the right).

Over time, as the “easy to extract” resources are exhausted, we have to use a larger portion of the oil that is extracted oil (1) to obtain additional oil (top dark blue arrow) and also (2) to repair the infrastructure we have built up over the years, like highways and water supply and electric power transmission lines (medium blue arrow second from the top). Since these arrows get bigger, there is less oil available for discretionary investment in manufacturing facilities for things like cars and new iPods (top red arrow).

As the size of this investment arrow grows, the size of the square orange “consumption” box gets squeezed. The size of the green arrow pointed down, called “staples” stays relatively the same size, but the size of the red arrow, called “discretionary” (for things like new cars, and trips to restaurants, and vacation trips) gets smaller.

With this scenario, discretionary goods and services we get from oil energy goes down over time. This relationship holds on a percentage basis, relative to the oil in the system. We are likely not to notice this issue much when total oil supply is rising, because total supply available remains fairly adequate. Even if oil supply is flat, this downward drift may not be too noticeable, because a shift toward greater efficiency, or a switch of some users from oil to electricity, can help cover a small drift toward less available oil for consumption.

The biggest impact of the shift shown in Figures 1 and 2 is post-peak, when users are faced with a combination of (1) declining oil consumption and (2) greater percentages needed for non-discretionary items. Thus, it is likely to be something we experience more in the future than we have to date.

Impact of Rising Debt on the Model

The model is set up based on the amount of energy coming through the system. In the real world, though, there are monetary transactions involved. These monetary transactions involved consider not only the oil that has come through the system, but also considerable lending based on the expectation of future energy resources and the goods they will produce.

In a situation with rising debt, people have more money to spend. Consumers can take out an auto loan to buy an auto; investors can take out a loan to build a new manufacturing facility, or to drill for oil and gas. It is not necessary to wait and see how much really comes though the cheese slicer, in terms of the materials that are generated by the operation of the cheese slicer; it is possible to spend in advance.

Because of the availability of loans, the demand for new cars (and many other goods using oil) is higher than it would otherwise be, and the demand for oil to operate those new cars is higher than it would be. This keeps the price of oil higher than it otherwise would be, convincing marginal producers that prices are high enough for their operations. This keeps oil production higher than it would otherwise be, enabling the use of more oil for both investment and consumption. In a sense, what the additional debt does is make the world look like it is at an earlier year in Prof. Hall’s Cheese Slicer models than is really the case.

So suppose we are in 2011, but because of rising debt, it still feels like we are in the 1991 version of the cheese slicer model. What happens when instead of rising debt, the situation suddenly changes to falling debt? Then many people can no longer get loans to buy new cars, and they cannot afford to go on the vacation trips of their dreams. It becomes more difficult for businesses to invest in new plants and equipment.

Because there is less economic activity, the price of oil drops. Suddenly, investments in oil which previously looked profitable, no longer look profitable. We find ourselves moving out on the years of the cheese slicer. As long as there is some debt, it helps keep demand up. So maybe we move rather suddenly from 1991 to 2001 in the cheese slicer models, when we really are at 2011.

As debt declines, the cheese slicer model gets more and more “gummed up.” It becomes more and more difficult to make investments, because investment funds need to come from accumulated profits, rather than be borrowed in advance. Potential consumers find it more difficult to buy cars and houses and new appliances, because they have to wait until they have accumulated funds.

These reasons are the primary ones for my statement at the beginning of the post that the switch from increasing debt to decreasing debt will tend to make the downslope steeper.

I should mention that there may be some other reasons that will also tend to reduce people’s ability to buy oil, besides the cutback in debt. As you will recall, the reason for the cutback in lending was related to higher oil prices causing businesses to raise prices on many types of goods, and requiring people to cut back on discretionary goods of all kinds–the types of changes that go with recession (see Part 1). In a finite world, oil supply shortages are likely to get worse over time. Other non-renewable resource may also be in short supply, as limits are reached on other resources, such as fresh water from aquifers that replenish very slowly. These issues are likely to make the recessionary influences worse over time. If many people are without work because of recession, they will find it impossible to accumulate funds to afford expensive new consumer goods. This lack of income will tend to produce a similar effect, namely reduced demand for oil products, and a move to lower outputs of the type expected in a later year of the cheese slicer model.

I should also note that a major cutback in debt is likely to affect all aspects of the economy–not just oil and gas. I wrote a post in late 2008 called Impact of the Credit Crisis on the Energy Industry – Where Are We Now? In it, I surveyed all of the kinds of energy, from oil to gas to coal to uranium, and all of the prices were down, because of the credit contraction at that time. In retrospect, we find that even electricity use was down. US electricity generation showed a 5% dip between 2007 and 2009, instead of the 3.5% growth that might have been expected in that two-year period, in the absence of recession.

A Partial Offset

If we are moving from an expanding to a contracting resource base, saving and spending behaviors are likely also to change.

One reason for a change in savings and spending behavior is obvious–if there are more resources to buy now than later, it might be better to buy now while goods and services are available. Furthermore, if the economy is really declining, money will cease to be a store of value, in the way it is today, because less goods and services will be produced in the future than today. In this environment, it might make sense to spend money rather than save it, especially if it can be invested in something of long-term value to the person with excess funds.

There is a second reason for a change in savings patterns. There is a tie between debt and savings. The debt of one person is for the most part the savings of someone else. A bond sold by a company as financing for its debt may end up in someone’s pension fund, or on the balance sheet of an insurance company. To the extent that there is less in the way of debt, there is also going to be less in the way of savings.

With peak oil, what is likely to happen is that the default rate on existing debt will rise, so many people who own bonds (or other debt instruments) will discover that they are worth less than they thought, perhaps nothing. And banks and insurance companies and pension plans will discover that quite a few of their assets aren’t what they thought–they will never be repaid with interest.

In this environment, the world will change. Insurance companies are likely to stop selling annuities, because they really can’t make good on long-term promises any more, if there are too many debt defaults. Pension plans will become uncommon. People will figure out that they really can’t save very well for retirement–they will have to depend on their friends or relatives, or perhaps a government program funded by taxes.

In this environment, buying patterns will change. People with money may decide to take a vacation trip now, rather than waiting until later. They may make other choices as well–they may try to buy more land, for example. It may be that the price of land for farming is bid up. They may buy tools for working the land. With these new buying patterns, some of the demand for oil and other fuels may return.

The reason why this activity is not likely to completely offset the current bidding up of energy prices with debt is because quite a bit of current debt may ultimately vanish as worthless. It was created using assumptions that held at a different time–back when the economy was fueled with cheap oil–but are not valid any more. Prices of homes have dropped, so huge mortgages on them no longer make sense. Bonds from companies (and countries) in financial distress will not be paid back, especially if we stumble back into recession. We don’t know yet how this will play out, but we can see distress signs around the world, suggesting that more defaults are not far away.

This article originally appeared on Our Finite World.

Gail, I was wondering if anyone had done a study on what effect inflation will have on the overall picture. If we have runaway inflation, which I am expecting, will this make things worse, better or have little effect at all?

And another question is how will this affect inflation? This is not a chicken or the egg question but I am expecting inflation to increase because of different reasons. Will peak oil make it better or worse?

Question 1. What will be the effect of inflation on this model?

Question 2. How will declining debt caused by peak oil affect inflation?

Ron P.

I am not sure that we will have inflation, at least with respect to salaries, since that is where we will need inflation, in order to pay back debt with interest. We also need enough people working, so that they actually receive these inflated salaries.

The Federal Reserve at this point hasn't been able to do much on the salary side of things, to make things work. I suppose if the dollar drops enough, and the government prints even more money, there is a theoretical chance things could work--but the Euro is also under pressure, with so many countries having debt problems.

It seems to me that at all of the debt defaults make it harder to get the salary-inflation that one really needs for this approach to work. It causes a trend toward deflation, because the "assets" that people think they have keep disappearing. Also, companies are still very much in competition with cheap overseas suppliers, and consumers are still being stressed out by high oil prices, so there is not much room for a rise in prices/ sales of products.

Gail:

As more investment moves to infrastructure maintenance and energy production, so also will jobs. Of course, with less investment capital available to producing luxury goods and discretionary goods, jobs there will diminish. Eventually everyone will be working in energy, food, etc. In other words, necessaries.

This will have much to say about our activities at home, and where we work. The real crunch, it seems to me, is going to be when investment capital is not avaiable for energy production, maintenance, transportation of foodstuffs, etc. And, when food supplies drop, either from production shortage or impossibilty of transporting it all, the real unrest begins. This is the story in MENA; it is looming in SEA; eventually coming to a neighborhood near you.

Craig

When this video was made, Bailout Big Lies & Your Savings, in September of 2009, the share of government obligations was 2,250,000 per taxpaying household. Mind you that is not per person, or even per household, because many households do not pay government income taxes, but per taxpaying household.

The video makes the case that taxpayers cannot possibly pay this debt therefore it must be inflated away. That is there are only two options, default or inflation. And since there will be no default inflation is the only option left. And I believe it, inflation is a given.

True, salaries do not have to increase as the dollar inflates. That simply means that people get poorer. And the greater the amount of inflation, the poorer they get. But I think it will be a little of both. Salaries go up of those people lucky enough to be employed, but not as fast as inflation.

But concerning the government's debt obligations, something must give. It is already starting to happen today. That should be obvious to anyone who watches the news.

And you are correct about the Euro. Because of the heavy debt burden of many nations, like Greece, Portugal, Spain and Ireland are already having serious problems. Things are starting to crack all over the world. Any nation can only pile so much liability on future generations before that trick don't work anymore.

Yes, there will be inflation, serious inflation, unless the economies of the world crash first. But which will come first?

That reminds me of a cartoon I once saw. A banker was sitting in jail talking to his cellmate. The caption: "Actually it was a calculated risk. I thought an all out nuclear war would come before the bank examiners did."

Ron P.

Another cartoon, the Chairman of the board is addressing his board of directors, "Gentlemen, while the End of the World scenarios are quite grim, we have found that the Pre-End of the World scenarios can be quite profitable."

Click on below "i" for image of the board and then + for grim meeting notes:

[ i.mage.+]

Greece, Portugal, Spain and Ireland are having serious problems because Germany and the ECB won't allow the inflation that these countries need.

Austerity and unemployment is the worst possible response to this economic shock which may or may not have been triggered by energy constraints (I think it's likely but the evidence is not overwhelming) but whose severity was caused by the financial accelerator of debt. If there was work to do when we could share the burden with energy guzzling machines then there's certainly work to do when we have to do it all by overselves because we have no spare energy to give to the machines.

"Salaries go up of those people lucky enough to be employed, but not as fast as inflation" - that's a given in a contracting real economy, but governments could and should ensure that it's not a case of "lucky enough to be employed".

Now I understand your thinking Dcomerf. You believe the government has far more power than they actually possess. Perhaps you shouldn't make that assertion on your dissertation. I doubt seriously that your professors hold a similar view. Or perhaps I am wrong. Perhaps that is where you got the idea. If that be the case then they should call Obama and give him the formula.

But perhaps the government can do that. Just give all the "job creators", the millionaires, a big tax cut? Yeah, that's the ticket. ;-)

Ron P.

My formula would be public investment in renewable energy and energy demand reduction infrastucture, on a scale where this investment reaches the proportions of GDP that war effort reached during 2nd World War.

Create fiat currency and use to pay the wages of workers covering deserts with solar panels, give this currency to households as grants for insulation and microrenewables. Invest in trams and electric trains etc etc etc.

Creates productive assets and causes inflation which reduces the debt/balance sheet problem.

I don't see any "power" reasons why governments can't do this. The reasons they don't are idealogical.

Ya know I think something like that is more likely than what Gail outlines, because what she outlines ( falling debt ) is so bad if it were to happen. I think she's absolutely right about the effect falling debt would have, I just don't think it's inevitable that governments will let debt fall.

I think governments would rather stabilize or increase total debt by creating more government debt when push comes to shove ( remember that a fiat currency note IS government debt bearing 0% interest, and governments outside of Europe can print all they like, whether bonds bearing small interest rates or notes bearing zero percent interest rates ).

d - I think I understand your proposal. But then why stop half way: why not eliminate all taxes allowing all those monies to stay in the economy and just create more fiat money to replace that tax revenue? That would seem to be a simple and logical expansion of your idea. But, then again, I'm just an oil patch geologist and Ron will readily tell how we tend to not understand cr*p about economics. LOL.

In the absence of a debt problem to solve though it would be hyperinflationary - which has its own costs. The "opportunity" that a debt crisis presents is a way to justify, temporarily, such intervention.

d - Seriously...I'm out of my league: so since we have a debt problem printing lots of fiat money won't be hyperinflationary? And if popular opinion says doing so is "justified" and temporary it won't generate hyperinflation? Or are we talking about the lesser of two evils?

Hey, just printing lots of money works. Germany tried it in the 1920s and Zimbabwe has recently tried it. It causes a boom for the wheelbarrow business. Wheelbarrows are needed to haul all the money in. Works both ways also. You haul your money to the grocery store in a wheelbarrow and then you can haul your pound of rice and loaf of bread back in the same wheelbarrow.

Ron P.

Printing is so old fashioned.

All that is needed is for the Federal Reserve Bank to add some big numbers to the balance in the US Treasury accounts and then the US government buys lots of goods and services to put the money into circulation.

Seems that having the Fed in the loop says that they are getting paid interest on the money created?

Why doesn't Congress just print Treasury Notes to pay off debts, and then print them and mail them to each of us to inflate to their heart's content?

I think it is instructive to look at who benefits from debt interest flows as well as who is hurt by inflation and taxation.

Private debt interest goes to banks and individuals -- banks pay you a pittance, and charge a good bit more. If they don't make enough, they invest in the Fed, and get money from the gov't. It would be interesting to see what fraction goes to banks versus what goes to little guys.

Public debt interest goes to those who own bonds. A lot of the time that's Fed stakeholders, or foreigners, or private investors. It would be instructive to see what fraction goes out of the country, what goes to wealthy holders, and what goes to mom and pop.

Taxes come from taxpayers. We know it isn't the rich (they pay a lot in dollars, but not a major fraction of their income), and it certainly doesn't come from poor people who pay nothing. It comes from middle-class people.

Inflation penalizes savers, and favors those with fixed-rate debt. Banks don't care -- they make money on the spread. The gov't cares -- they like to borrow low and then inflate, so they walk the line. Middle-class people have home loans and credit cards. Those who are prudent will refi when inflation is low, and pay off their home with inflation. Those who are not, plus the poor, will ride their credit card rates up until they are at the brink of the default, or beyond.

So, rather than bailing out banks and keeping inflation low while funneling money to bondholders, why not print some money and give it to the people? Those with debt could pay off the worst; those without could spend some. Those with newly re-fi'd homes would get ahead. Those with low-rate bonds would probably take a bath.

If I'm correct in this, the big banks and investors (including China) would want to see a flat inflation rate and debt moving from private to public hands, paid by taxes. Taxpayers would want to see less Fed debt, lower taxes, and accept modest inflation if it meant getting jobs and raises.

I think this means the debt ceiling WILL go up, and so will taxes, to siphon money from the public to those who have (or can borrow cheaply) cash. Am I wrong in my thinking?

Deposits of the U.S. Treasury

I don't think that the Federal Reserve earns interest on balances in the Treasury's accounts. It just process transactions between those accounts and the accounts of other financial institutions.

When their is a treasury auction falling short, and the Fed steps in to buy them up, do they not earn the interest paid on those bonds?

If the Fed has Treasury Notes or Bonds in its possession as assets, then the Fed earns interest on them. However, earnings from all sources after expenses that exceed paid in capital are remitted to Treasury.

However, in the previous post I was referring to the Treasury's bank account at the Fed, and I don't think that the Fed earns interest on balances in that account. For example, if you get a paper check for a tax refund and deposit it at your bank, the check is cleared back through the banking systems to the Federal Reserve and settled against the Treasury's demand deposit account at the Fed. If you get an electronic deposit of a tax refund to your bank account, it is cleared via the Automated Clearing House networks and settled against the same account.

Their is no evidence of Peak Debt yet.

http://www.businessinsider.com/chart-of-the-day-issuance-of-aaa-assets-2...

De-leveraging by the private sector due to Peak Oil, if it is happening, is offset by government issuing more debt to make up for declining tax receipts and for funding attempts to restart the economy.

Issuing debt is the method the Empire uses to tax foreigners to maintain itself. The Treasury debt held by foreigners will be rolled over in perpetuity. This being the case, it amounts to a tax on them to support U.S. wars for oil security and other activities that are more beneficial to the debt holders than to the United States.

Foreign economies need oil more than the U.S. where oil consumption is falling. That is why the spread between Brent and WTI is so large. Except for Brazil, foreign economies have no significant alternative liquid fuel as the U.S. does with ethanol.

The wars for oil security must be financed with debt if the Empire is not to collapse overnight. Foreign bond buyers agree. The major alternatives are even worse than the dollar denominated bonds.

The Euro is not backed by any country. It has no fiscal policy. The yen is radioactive in that Japan's national debt is 200% of GDP compared to less than 60% for the U.S. if inter-agency debt is not counted.

Some think this can not continue, but there is no choice.

Prosperity through austerity is a myth when applied to the macro economy. I works for individuals, but when the government does it, it doesn't work. Paul Krugman comments on this frequently and he is correct. The government is not a business or a household.

Reducing debt is the same thing as taking money out of the system. If the government does this during a recession it just makes the recession longer and/or worse.

Republicans calling for a balanced budget and reduced deficits are nuts. They are calling for handcuffs on the government and permanent depression. Only the very wealthy will be able to survive in such and environment and they too will lose some of their wealth just as they did in the Great Depression.

We narrowly avoided a socialist revolution in the 1930's. We may not be so lucky again if Republicans get their way.

there is evidence of "peak debt" in my house.

Their is no evidence of Peak Debt yet.

Really?

In the US of A - regular reporting on the debt ceiling.

Iceland, Greece, Ireland and many other nation-states having national discussions on debt.

The lowering of credit card balances due to write-offs.

We narrowly avoided a socialist revolution in the 1930's.

Not at all.

How many of the planks of the Communist Manifesto are US National policy?

How about how the Democratic party adopted many of the planks of the socialists to prevent the Democrats becoming like the Whigs?

http://en.wikipedia.org/wiki/Iron_heel

From the article:

The Iron Heel is a dystopian[1] novel by American writer Jack London, first published in 1907.

Generally considered to be "the earliest of the modern Dystopian,"[2] it chronicles the rise of an oligarchic tyranny in the United States.

The Oligarchy are the largest monopoly trusts (or robber barons) who manage to squeeze out the middle class by bankrupting most small to mid-sized business

London predicting that the middle class would shrink as monopolistic trusts crushed labor and small to mid-sized businesses.

______________________________________________

http://en.wikipedia.org/wiki/Daily_Worker#1930s

Because Congress does not actually work for you and me?

Merrill or dcomerf,

The mechanism the FED uses seems like it has serious limits.

Would the Fed be taken seriously if its asset sheet suggested it was half the size of the Federal Government?

Using the FED would mean the Treasury must first subject itself to the tender mercies of the bond market. In an inflationary environment treasury notes might work, recent experience (negative real interest rates) suggests these notes might be the asset of last resort.

In a deflationary environment a simpler savings option is available (From above: a fiat currency note IS government debt bearing 0% interest).

On the other hand, the direct equivalent of printing money is for the Treasury to simply insert money into the bank accounts of US employees, contractors and transfer payment recipients.

The choice seems to come back to whether collapse is inflationary or deflationary.

The Federal Reserve's balance sheet is about $2.8 trillion, which isn't a lot larger than one of the top tier banks. See http://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

JPM's balance sheet is about $2.25 trillion by way of comparison.

The Fed is simply acting as Treasury's banker. In this respect Treasury can send and receive payments like a Federal Reserve member bank since Treasury maintains its account directly at the Fed, something that non-banks cannot do. Thus, it has direct access to the payment clearing and settlement electronic networks including the Fedwire, which provides immediate transfer of good funds.

The Fed also acts as the Treasury's investment banker, and provides the service of selling, paying interest on, and redeeming Treasury Notes and Bonds on behalf of the Treasury. It does so primarily through a smaller number of financial institutions who are Primary Dealers, although there is also the Treasury Direct program. http://www.treasurydirect.gov/

Can't eliminate taxes or excessive printing of money is hyperinflationary. For the most part, government needs to be spending the same money it taxes out of the economy or the number of notes skyrockets.

I think other options are

1. Current government is replaced with entirely new government. New government does not assume prior debt, and starts from $0 on programs.

2. Current government goes the way of the USSR government, at the time of the split.

If the options for fixing the problem get too painful, and there is too much unrest over, say, short food supply, it seems like options such as these may occur, both in the MENA region and in formerly stable good-sized OECD countries.

In principle you could now do away with money altogether. You can calculate the amounts of available raw material, labor hours, etc., that are available to the economy and the amounts of goods and services that are needed by the population.

Then you can solve the equations for the optimal allocation of primary and secondary production of goods and services needed to approximate the needed goosd and services.

All goods are rationed and all labor is forced according to the plan.

The economic optimization problem is very likely solvable with the computers now available. The electronic record keeping and police surveillance techniques are also now up to the task.

Progres in information systems now makes a completely planned economy possible.

Who would decide the value of which type of labor, raw materials, and assets? Would there be disagreements about the values from parties with different points of view?

As an actuary, Gail probably has some insight into valuation considerations.

No money = no value.

Labor would be matched to jobs based on skills, talents, and location. All people who are able to work would be required to work.

Raw materials are allocated to uses as indicated by the optimal production solution for the economy's overall input-output matrix with constraints.

You can't define optimal, and so your idea doesn't work. Besides, it's just a restatement of classical socialism or communism.

"Required to work." By who?

"Needed goods and services." Very little is actually needed. Given that we massively overproduce, how do we allocate excess production?

Are you proposing cutting back on non-essentials, such as limiting entertainment to text, which is so cheap that we could easily give everyone worldwide a simple reader and/or access to paper?

Any solution which proposes a hard, government-based curb to human consumption seems unworkable. Why would anyone vote for less pleasure?

I realize that consumption != pleasure and the hedonic treadmill is a large part of society's problem, but good luck getting people to get off the treadmill willingly once they're on it.

"Required to work." By who?

By the computer. No labor input = no right to output = starve to death.

Are you proposing cutting back on non-essentials

Cutting back on non-essentials would be good. Overproduction of non-essentials is required by a money economy where access to money (and thus a livelyhood) is mainly achieved by requiring everyone to be employed. We could cut way back on non-essentials and simultaneously cut way back on labor hours and/or fraction of the population employed.

Why would anyone vote for less pleasure?

The tradeoff is really less goods and services for more leisure time, more sports, cultural activies, community activities, social equality, etc.

I think you just proposed a benevolent SkyNet...

It is more or less what you must have in order to reformulate economics on the basis of physical flows of various types of energy, materials, labor and information instead of relying on obsolete and inadequate concepts like money and debt.

It is somewhat puzzling that the Chinese decided to adopt Anglo-American financial concepts at about the time when computing was well enough developed to create a more refined planned economy. It is probably because the Anglo-American system optimizes productivity and rate of expansion the best, and they needed to exploit their population to the maximum in order to defend themselves and keep some degree of military parity with the US.

You are confusing the technology of the day and the degree to which the leadership believes/trust them. Take a look at the biography of Deng Xiaoping the person believed to be most responsible for this choice.

From an applied mathematics course at RPI long ago, the story was told concerning the Russian who invented the mathematics for the logistics space explaining to Stalin what couldn't be done. He ended up in

Siberia.

Must not have been Leonid Kantorovich

I loved operations research and linear programming.

This sounds like the Technocracy movement from yesterday's threads.

Technocracy springs not from Yesterday.

It comes from the 1930's when various thinkers were looking about at the destroyed-by-bankers-and-wall-street economy and the excess of consumer goods (excess VS what was in the past anyway) and asked: Is there a better way.

The 'sovereign individual' movement has no love for Technocracy.

What is the 'sovereign individual' movement? References?

Why don't you read the message at:

http://www.theoildrum.com/node/8135#comment-820472

Or how about use a search engine:

http://www.google.com/search?q=soverign+individual

What Exactly is a Sovereign Individual?

Ah! A member of the rentier class who hides all his assets off-shore and becomes a traveler of the world paying taxes to no nation-state?

Thanks for the link. This reminded me of Nicholas Shaxson's book "Treasure Islands: Tax Havens and the Men who Stole the World". Amazon UK or USA.

A fascinating, if not depressing, book to read...

A large bank will have literally thousands of subsidiary corporations domiciled in various tax-friendly jurisdictions set up to optimize the tax benefits of their major customers.

Besides taxes, there is other accounting magic to be done, depending on how certain items can be classified under the legal systems and accounting standards of various places.

Wealthy Britons prepare to flee

But note that where one goes to live is not necessarily where one keeps his money.

Houston, I think we have a problem...

Seriously, who are these people, and why are they not safely locked up, away from the rest of society?

Oh wait, some of the geniuses who think like this, are actually launching campaigns for the Presidency of the US...

Some of them are President.

It wouldn't be benevolent for long. Merrill and his buddies would quickly be pulling the fingernails off people and screaming, "WHY WON'T YOU FOLLOW THE PLAN?"

"The plans differ; the planners are all alike." - Frederic Bastiat

"No labor input = no right to output = starve to death."

Wouldn't the free market with no social safety net and no charity do the same?

With a lot more yachts and lot less distribution of wealth to actual workers.

Not that I think the proposal is in any way a good one. It might work for robots, but not for humans.

In the gulag, if you didn't work, they didn't let you in at night, out of the snow. Главное Управление Исправительно-трудовых Лагерей

"A distinctive incentive scheme that included both coercive and motivational elements and was applied universally in all camps consisted in standardized "nourishment scales": the size of the inmates’ ration depended on the percentage of the work quota delivered. Naftaly Frenkel is credited for the introduction of this policy. While it was effective in compelling many prisoners to work harder, for many a prisoner it had the adverse effect, accelerating the exhaustion and sometimes causing the death of persons unable to fulfill high production quota."

It wouldn't do the same. If you have money, then some people will accumulate more money than other people. The people with money will lend it to the people without money and charge interest on it. Eventually, if they accumulate enough, the people with money will be able to acquire a stream of interest big enough to live on and they won't have to contribute to society any more, i.e. they will be living off of economic "rents" (in this case the rent of money, although there are other economic rents, such as the rent from ownership of hard assets like land and buildings, patent, copyrights, etc.).

Eventually, if they accumulate enough, the people with money will be able to acquire a stream of interest big enough to live on and they won't have to contribute to society any more, i.e. they will be living off of economic "rents"

Isn't that exactly what the "financial" sector of the economy is, which is now 20% of GDP, and the single largest division?

And those that don't make their livings from these rents, or work fro the government, are not making much at all (on average)

So it seems to me we are already well down this path...

"Eventually, if they accumulate enough, the people with money will be able to acquire a stream of interest big enough to live on and they won't have to contribute to society any more, i.e. they will be living off of economic "rents""

I get it, what your saying is either motivate or kill off the people that aren't productive on the very top and the very bottom of our society. The problem is that some would argue with your arbitrary thought of who the productive people are. Accumulation and saving of excess money or even durable goods and food is like a battery saving excess energy. Without savings and a process to redistibute that savings at some point, there would be wanton waste with no regard of what that product is. Without a mechanism for people to use excess production for their personal benefit their would be inefficient use of excess capacity, that's one aspect that separates us from other animals.

I don't think that it would be necessary to kill anyone.

Without money, there would be no possibility of, for example, inheiriting daddy's millions and thereafter living a life of leisure and enjoyment without contributing to society. Note that it is usually the rich person's private banker who puts forth the effort of actually investing the money, accumulating the savings not disbursed to the heir, etc.

Oh there would be some "die off" in the system your talking about, at least to get started with it.

The cycle of accumulating money by the wealthy is supposed to be self correcting. The 1930s depression did a lot of equalizing by wiping out wealth in the stock market and real estate. The same should have happened this time except that the elites were responsible for socialization of the losses.

A problem no one discusses is the lack of investment opportunities. Returns today are mostly inflationary gains. The historic low dividend yields, P/E ratios and interest rates are symptoms of mature industries and saturated markets. This is what Marks predicted would happen to capitalism.

Most of great innovations like electrification, mass production and internal combustion transport matured a half century ago. The green revolution and agricultural mechanization were the last great innovations and they matured by the 1980s. Computers and the Internet barely moved the needle.

Yes.

It is time for the next great thing.

A massive die-off also reseeds exponential growth.

Or an abandonment of the amazing lifestyles.

Fusion

Plague

Simplicity

Around and around the discussions go.

Some believe in Aliens.

Some pray to God.

Me? I'm anachronistic. It's a solution for me.

You? Really, just make sure you are living life.

There is only one pass. One grows old.

Enjoy the show.

No money = no value.

More BS.

The website that TOD runs on is Open Source. FreeBSD base. Apache for the Webserver. MySQL as the database. PHP for the scripts.

None of that software costs money to get. $0.

Under No money = no value. - there is no value in that software. Yet, there is value.

Right on.

The fundamental economy is the "gift economy" (e.g. motherhood, family and social obligations, filial piety and usually, artists, who produce for the public but are rarely paid). We have had that discussion before on many occasions on TOD

The "market economy" is useful, and up to a point, can run parallel with the "gift economy", but eventually it becomes parasitic and destroys everything. That is where we are headed now.

Ugh. You've hit one of my pet peeves. Every attempt I've seen to formalize or expand the "gift economy" in a fair way inevitably finds it needs some sort of system to track generosity, and ends up re-inventing money.

Gifts are important, but they're no basis for an economy larger than a few dozen people.

Gifts are important, but they're no basis for an economy larger than a few dozen people.

*points to the left of your computer screen*

See that box that says Google?

Why don't you go and ask Google how the gift economy of Open Source is working out for them?

The "gift" economy doesn't track generosity. That would more properly be a "barter" economy, which I believe to be a subset of the "market" economy.

The "gift" economy is what makes everything in the world -- except modern human industrial civilizations -- work.

Funnily enough I think that's a good anology, as a parasite the formal ecomony feeds off of the main (household) economy, thus adding greater energy overheads. It is two way though as items of greater amounts and distances can be got through the formal economy. So it is somewhat necessary and easier in some ways.

The problem then is not the formal economy itself, but the fact that if it is too successful then it will strangle its host, and it also seems to develop parasites of its own.

Well, that's the way I look at it, too.

I don't have any fundamental distaste for the "formal" economy -- I do well enough in it to provide me and my family some comfort, and I like comfort as well as anyone.

The natural or "gift" economy is also subject to parasitism, and sometimes it requires the "formal" economy to kill off the parasites!

There just aren't any simple answers, and no "best" way. The only way forward is to foster a civil conversation, which is what is so great about TOD

"Capitalism is great, as long as it isn't for anything you really need." Like electricity (Enron), health care (!)...

Systems of people are highly adaptive. A natural goal is to gather and stock against the unknowable future. This becomes distorted in the aberrant. By gathering too much to themselves, they lower the reproductive chances of those around them while improving their own. Great unrest, war, can result. The stresses of war are transmitted to the newly born through the mechanisms of epigenetics.

I wonder just how inbred human misery is?

There were many different economic systems practiced by native peoples. Money seems to have replaced them, just as the suit has replaced native costume.

Kananginak Pootoogook

This made for an economic monoculture. The blight swept through most of it.

Since the beginnings of mass production we have required fewer and fewer worker hours to provide almost all goods and services required by the population. An exception is healthcare. The answer to unemployment since the late 19th century has been to reduce the work week. The problem we have now is that the working portion of peoples lives is shrinking in proportion to their life expectancy. People need to save more to provide for themselves in their old age. Since they will not all save voluntarily, perhaps social security and medicare taxes need to be raised, and by quite a lot. Of course that would cut disposable income of those working, but would prevent a collapse of the financial system and the government. Political instability is not something anyone should look forward to.

Prior to the 20th century it was very uncommon for people to save for old age. People generally were supported by their families and communities in their old age. While life expectancy at birth was shorter, someone who lived until 60 could expect to live for quite a while after 60.

Even social security was not instituted as a means of savings. Instead, it was set up on the basis that social security payments by working people would pay for the benefits to old people.

Attempting to base individual retirement on individual savings is possible only with very high savings rates. If these savings are invested in land, buildings, equipment, and other productive assets, you get hugely inflated asset prices. Alternatively, the government can run a huge deficit and the savers can buy bonds, as in Japan. But this amounts to essentially the same as having current worker pay for current retirees, since the bonds have to be paid off to the retirees out of current taxes. Another solution is to have the excess savings invested off-shore. These investments can be in stocks, bonds, real estate, etc. but they are often in government bonds, e.g. Chinese buying US government securities.

So paying current retirement benefits out of current receipts with a big enough trust fund to smooth out fluctuations in age cohort size and business cycle effects is really the best way to go.

What Happened to the $2.6 Trillion Social Security Trust Fund?

http://blogs.forbes.com/merrillmatthews/2011/07/13/what-happened-to-the-...

"the federal government has borrowed all of that trust fund money and spent it

If the budget crisis has done nothing else, it has exposed the decades-long lie about the solvency of the Social Security trust fund. The trust fund may be backed by the “full faith and credit of the federal government,” as defenders constantly remind us, but if it had real assets the president wouldn’t be talking about seniors missing their checks."

It was used for the Vietnam War and for Oil.

Yes, but consider if the social security trust fund was big enough to be solvent and had been invested in US stocks. The price of stocks would have risen much higher, the government would control a big chunk of business through the social security investments (in a bigger way than activist pension funds like CALPERS), and the ones picked by the social security adminstration would do poorly as the baby boomer retirement caused a lot of stock to be dumped.

An interesting hypothetical.

Would one invest 2,700,000,000,000 dollars all in the stock market?

And, fearing the conjectures of the hypotheses, one is better off without a retirement fund?

FDR was accused of being a socialist. It would have been impossible for him to propose a retirement fund which could buy up a good part of US industry instead of a pay as you go "old age insurance" approach.

One case is that the fund had no value.

The other case is that the fund had value.

I remember the raids. I remember the IOUs.

In some real sense, all you have in the year 2030 or the year 2050 is what is produced that year.

For the government to own bonds of businesses - that is, pieces of paper related to someone these businesses debt (which may very well not get paid back) is all that helpful.

Buying a share of previously issued stock does nothing for real investment in companies. It may decline in value, especially with peak oil.

What will have to happen is in the year 2030 or 2050, some portion of what is produced will have to be allocated to the elderly and disabled. If there is barely enough to go around for those doing the work, it will probably be very difficult to find support for giving very much to the elderly and the disabled. Current promises are likely to be way too much.

There would be much difficulty in arriving at equations that all interested parties could agree on the accurately describe the economy. Should the equations favor the near future as in a week from today, or a year from today, or ten years from today? Should the equations favor old people, middle age people, or young people? How do people with disabilities factor in? Should global warming be a concern? How does one factor in risk due to natural or other disaster? How does a persons self interest factor in?

Linear equations of multiple unknowns are very easy to solve if they are well defined as shown here : http://stattrek.com/matrix-algebra/linear-equations.aspx

However there are non-linear aspects to the economy which would make solving them more difficult. If a good equation model could be developed, there are approximation solutions that could be done. But I think you would find that getting a common consensus on what the equations should look like would be all but impossible as there would be so many different opinions about the variables and their weightings and there would be resistance to a transition from what we currently have.

I do find that it is very possible that most economies will be transitioning at some point in the future to some flavor of what is called a "command economy" which is very similar to the situation you describe but it would not be equation based. When the current business models no longer work, governments and militaries will likely try to adjust to keep stability and there are aspects of a command economy that do provide more stability in ways.

There are instabilities in an economic model that I would like to amusingly characterize by a comic I saw recently that opined "Socialism for the Rich, Capitalism for the Rest". I would think that places like Egypt, Greece, and a few other countries are getting close to the need for command economies.

Here is a definition of command economy.

http://www.investorwords.com/951/command_economy.html

First, your reference to a command economy says that the government sets prices. With the elimination of money, there is no need to set prices.

Money must be eliminated because it is too simplistic a concept to be used in managing a future economy. Associating a scalar number as the "value" of something is not adequate to describe the potential uses of the thing, and the leverage that using a thing in different ways has on the downstream productivity of the economy.

Values are also very imprecise and approximate. If you invest $50K in a machine, then five years later it has some value X, determined by your accountant and tax specialist, based on the original investment minus accumulated depreciation determined by expected life and a depreciation schedule. In fact, you might be able to sell it for more or less than that number. Land and buildings, for example, are often carried on the books at values wildly different from the market values.

The equations would be developed so as to first satisfy the needs of the population while minimizing the inputs (materials, energy, labor, and information), subject to constraints on availability of the inputs and constraints on the rejection of wastes back into the environment. Any production beyond the needs level would have to be done with left over inputs, but subject to the same constraints. Divergent needs of population sectors would be accommodated. For example, some number of dialysis machines, supplies, dialysis center operations, etc., would be planned in order to satisfy the needs of people with kidney failure. This can be calculated. Global warming would be a constraint on the amounts of greenhouse gases emitted by the economy.

Clearly, setting this up and running it is a big job. But the financial sector and the part of the government sector that currently manages the money financial system and its transactions is also a significant fraction of the total economy.

A fully computerized non-monetary economy would be simpler and easier to run that the ad hoc approaches of typical military dictatorships, etc.

Consider trying to set a value in your equation for religion or politics. Talk about disagreement! Should abortion be allowed? Should gambling? Do we need police or an army? At what point will the equations specify that plugs should be pulled on people that are sick?

Or how decisions should be made for tearing down old infrastructure, and where to build new infrastructure and how much of it to build.

Or what purposes we should fund research and development for.

Most of these are already big public policy questions that are being worked through the political process. The size of the police force in many communities is being reduced in budget debates. While money is involved, the debate is really about the tradeoffs between police, fire, education, parks, social services, and the other services funded out of the municipal budget. So the size of the police force is set politically today.

There were some interesting research results on a new treatment for prostate cancer recently. IIRC, the drug extended a patient's life about 5 months on average and cost about $50K. Given a prostate cancer patient who is 75 years old, should society spend $10K/month to extend such a patient's life. Questions like this will have to be answered in the negative at some point as new treatments with ever higher price tags become available. Maybe it is yes for $10K/month, but would it be yes for $100K or $1000K/month?

The local furor over whether to tear down an old bascule bridge and whether to replace it with another bascule bridge (expensive to operate) or a high fixed bridge (cheap but affects scenic views) has already brought out the worst of the political process.

About half of R&D spending is already funded by the government and is determined politically.

Here's one. We could start by funding research to define a value for a completely new kind of 'Constant', CS or (common sense), once that is accomplished, (it was probably easier to prove Fermat's last theorem), it can be plugged into all of those difficult equations that will be used for calculating when to pull the plug on those that are already brain dead, such as certain politicians.

Granted we should clearly stipulate that this 'Constant' may never be defined as a fraction or C/S where C and S are integers, with S being non-zero... because that, would just be plain irrational!

BTW the values for religion and politics are both no-brainers, they will always be less than, or equal to, zero!

>;^)

There was a lot of enthusiasm about linear programming a few decades ago, but it seems not much enthusiasm remains today. It seems to me that the non-linearities are an emergent phenomenon. To create a linear programming model of the economy, one needs to model each different way engineering approach to making each product. We have all that engineering knowledge, but nobody has had the drive to actually pull it all together in a collection of linked simple models, with inputs of some models fed from the outputs of others. The non-linear aspect emerges by virtue of modeling the start-up and shutdown of production runs in the process of adjusting supply to market demand ( with suitable time lags in the perception of changes in demand ). I'm told that, in practice, it is very hard to actually make the people on the shop floor, or in the agricultural field, perform as planned. Things happen that bollix up the performance. Equipment breaks. People call in sick. It doesn't rain when needed. It rains during harvest. Etc.

Still it seems to me, a well worked out LP model should give good limits for what is humanly possible, together with good indications of why the failures to reach the upper bound are happening. It seems to me it could be a useful management tool.

But putting it in the position of issuing commands to be executed by recalcitrant de-humanized workers is maybe not such a good idea.

LOL; it's been tried, failed miserably.

To optimize anything you must set priorities. There is much disagreement about priorities. There is much disagreement about needed goods, for that matter. Some one decided I "need" an airbag in my car. And I will soon "need" traction control. But I will not "need' a manual transmission. And there is always some group or another claiming I don't "need" a handgun, assault rifle (although they can't seem to define exactly what one is) or any weapon for that matter. Others claim I don't "need" to eat meat, and certainly not shoot Bambies (even with a bow an arrow) even where there is a great local surplus of Bambies.

Some people call this determination of my "needs" by others to be slavery, but you already have that covered in "all labor is forced according to the plan."

So, now that you have identified yourself as a slavemaster wanna-be, I can now ignore you, unless you actually succeed in becoming a threat, that is.

Somebody had to say it.

As noted by one of the responses above, I was sort of inspired by the discussion of Technocracy in the previous discussion. See also http://en.wikipedia.org/wiki/Technocracy

The propsal therein:

seemed too limited, since it just replaces the scalar "money" with the scalar "energy".

The "cheese slicer" was also reintroduced in the original post. This is just a graphical version of the input output model which originated with Wassily Leontief. It is even more limited that the IO models developed using money, since it only considers one factor of production. However, when you build an IO model using money, you have thrown away a lot of information about how industrial and business processes utilize inputs of multiple types to create outputs of multiple types (along with more or less toxic waste of multiple types, but which is rarely captured in a monetary IO model of the economy).

Consequently, to really model the economy, you need to do the IO matrix in actual types of materials, types of energy, qualities of labor, informational parameters that express technological advances, characterization of wastes, etc., and the nodes of the flow graph have to model the implementable processes. Which is all a lot more complex.

But even then, alas, there is the problem of human behavior.

So probably the best that can be done is something similar to the existing monetary system, with a business system that uses money both for transactions and investments, and a financial system that allocates capital and provides for taxation and the running of a fiscal policy. Along with that is a political process that regulates the economy and provides fiscal and monetary incentives to steer financial, industrial, and business policy, science and technology, and public opinion in useful ways.

Let's hope that it doesn't break down completely.

I was sort of inspired by the discussion of Technocracy in the previous discussion.

VS the last 5 years when Technocracy has been mentioned?

So probably the best that can be done is something similar to the existing monetary system

So no real change then?

with a business system that uses money both for transactions and investments

No change here.

and a financial system that allocates capital and provides for taxation and the running of a fiscal policy.

Considering the Federal Reserve is a Corporation owned by the banks and with Citizens United the banks have even greater input into the legal system - how is what you are thinking of is different mechanically than things are now?

Not much dfferent, since many countries have converged on essentially this same economic system.

However, the economic and political systems of the US are probably among the most sclerotic, since they have not been recently reformed.

Plus, there seems to be a greater tendency towards adopting atavistic or heterodox theories in economics and politics in the US. Many other countries are less wedded to past concepts, and they give less credence to off-beat theories that have been already discarded by mainstream thought based on observation, rational thinking, and critical analysis.

"In principle you could now do away with money altogether."

In principle, you could do away with jobs altogether. Every thing made by robot. People live off of the value of their labor as distributed through welfare. (For the present case, just replace "robot" with "Chinese".) What we have now is a sort of non-functioning transitional case.

For illustration only

Please tell me you are talking about Greece, Portugal, Spain and Ireland and not the USA. It is not clear from your post whether or not you are making this proposal for the USA or just the other countries I mentioned in my post.

If the US were to default on all debts foreign and domestic, it would mean the end of globalization. The collapse of the world as we know it would be the result.

Ron P.

Actually, for the US, my option 2 above is a bigger concern. It is hard to take over and change a big country.

I tried to come up with a list of options in How can a government fix its debt problem?

Globalism collapsed once before for the West in the 20th Century. What it meant is that people in the UK could no longer source cheap product from the entire world, but they still went to their same churches, family holidays, stores, and concerts

albiet poorer. Admittedly in some of the other sides of the UK transactions things were much worse, but the end of globalism is not the end of the world. Having your infrastructure in place (being a rich country) helps a lot in these pivots.

There are potentially other examples such as the introduction of the Portugueuse into the Indian Ocean and others in history ending globalism......

Globalism, as it exist today, has never collapsed because it has never existed, as it exist today, before. If globalism collapsed today then every nation would have to get by on its own resources, its own oil production, its own food production and only things grown and manufactured within its own borders.

Now that may sound great but if you think about it for a moment it would mean catastrophe. Japan imports virtually all its fossil energy just as Taiwan, the Philippines and at many other nations. Virtually every nation on earth imports something vital whether it be fuel, fertilizer, food or something else.

Ron P.

I am a little less sanguine about the uniqueness of the American situation and times, especially when compared to the English Empire and what happened to globalization from banking to shipping following WWI. Globalisation can turn into regionalization and even localization (including falling off the "map" as it were). I think the Japanese were trying to deal with their energy situation based on nuclear power, including breeders and transportation electrification, alas that didn't work out as planned. Continuing with the regionalization theme beside the Philippines is a huge store of coal in Indonesia, etc.....

san·guine –adjective

1. cheerfully optimistic, hopeful, or confident.

Good Lord, did my words sound like I was sanguine? I thought they were as doomerish as they could possibly be. And the word "American" is not to be found anywhere in the post you replied to. I was talking about the World not America.

Ron P.

Apologies for adding America. You are optimistic (in my mind) about the uniqueness/specialness of this globalisation and I am not. It will play out in the manner

of the past. You definitely cast a doomer shadow on the removal of globalism, I think this has a relatively small impact and will not be the doomer forcing function

as evidenced by history.

Right, the US can get by just fine on 5 million barrels of oil per day. Japan, South Korea, Taiwan and a few dozen other countries that produce NO oil at all can get by just fine with none. Yeah right!

Globalization, true globalization, is something new. True there has been a slight form of globalization since the first sailing ships circled the world. But never before in history have we had such interdependence of nations on each other. World fertilizer trade has enabled countries with no natural fertilizer other than animal manure to expand their agricultural output many fold. Many countries have no iron oar and even countries like China imports over 30 percent of its iron oar.

The US imports virtually all its tin, most of its bauxite or aluminum oar and virtually all its precious metals. Most of our manufacturing would shut down without global imports. And of course there is oil as I mention above.

Nothing, absolutely nothing, like the current globalization has ever existed in the past. And if it were to shut down tomorrow the economy ofevery nation on earth would collapse.

But you don’t think so. So then explain how Japan and about 40 other nations could get by with NO oil imports. And many of those nations don’t even have coal. But if you can explain all that then I am all ears.

Ron P.

The way the current America operates it will not be just fine, but then again the way America operates is not fine either. If the target is to return to the "good old days" of 2007 then we are truly doomed, and unfortunately too many people

(in the US and elsewhere) think that this is the target. I (personally) am simply not interested in the rapaciousness of the US/WTO/IMF/WB/et al model of "comparative advantage" which strips the world of all resources to feed consumerism

such that countries in Africa and Asia lose all knowledge of how to feed themselves to produce industrial agricultural products such as Palm Oil (to use in our favorite beauty products) etc...

I am aware of the differences, you'll find my engineering credentials all over the creation of this thing called the Internet, but China imports iron oare to create consumer goods that it ships to others who might not really need them, they

just want them (badly). I am arguing for planned descent and deleveraging globalisation. This will require some form of industrial policy, even if it is a return to coarse import duties on manufactured goods. We actually did this once, it

was called Sematech, and it was very successful.

Until we get beyond attempting to replicate and maintain some idealized 2007 we're simply burning time and energy, one of my favorite whipping boys is Detroit and its five point theology of AUTO-ICE: power, speed, luxurious comfort no matter

what the conditions, range, size. I sat on a board for years with GM's CTO, what unimaginable backwardness he represented. For Detroit to make electric cars they need to support the five point theology, which of course requires lithium batteries,

and of course then costs unimaginable amounts of money. I own a LEV that uses lead acid batteries invented 150 years ago, of course I don't have airconditioning, nor do I go 65mph, but It takes care of 90% of the trips I need to make.

Your NO is a false choice, it is not what I have represented, regionalization and focused localization in descent is what I am talking about. Globalisation can decrease dramatically and people will still have good lives.

I totally agree.

There isn't much about "globalism" in the present incarnation, at least, to cheer about.

I suppose it is fun to have color flat-screen TV's made possible by europium from China, or cell phones made possible by tantalum from Congo, etc., but anyone over 50 can remember when these things didn't exist, and life was good then, too.

Of course I am over 50, 73 to be precise. And I very well remember how things were when we did not have those things. And when I was born the population of the world was one third the population today.

At least two billion people are employed producing things we did not have in 1938. And if these people did not produce all that stuff we could easily do without, they would be unemployed. They would be hungry, very hungry.

People who are always carping about how much we waste and how much we could do without never stop to think about where all that stuff comes from and who makes it. If everyone made do with much less, as they did during the Great Depression, we would have another Great Depression. Only it would be much, much worse because the world has so many more people now.

The industrial evolution has enabled our population to explode, not just because it has supplied much more food, but it has also supplied the employment that has enabled people to buy that food.

Globalization is basically world trade. Globalization is oil and coal imported by Japan and many other countries. Globalization is the haves of the world supplying energy, fertilizer and food to the have nots of the world. Globalization feeds about half the world's people and provides the means to feed the other half, there is not much to cheer about.

Ron P.

I think that "globalization" in its present incarnation, at least, is a very powerful way for the "haves" to strip even more from the "have nots".

A good argument can be made that industrial agriculture has impoverished and miserified many billions who used to be self-sufficient, and that the global "misery index" has increased, rather than decreased through industrialization and globalization. The fact that previously self-sufficient Chinese peasants can make a few dollars by manufacturing Mardi Gras beads does not mean they are better off for it.

Of course, I have never been either a Chinese peasant or a producer of Mardi Gras beads, so I really don't have a dog in this fight -- but I'm just saying.

In any case, evolution proceeds without any conscious direction (so far as we know), and the evolution of peasant economies to industrial economies will continue, and the results will be unpredictable. Neither the American military nor the IMF control the future, George Orwell notwithstanding (“he who controls the past controls the future, and he who controls the present controls the past”)

I have no doubt that "you think that", but the opposite is the case. Of course there are horrific cases of plunder, especially in Africa. But by and large globalization have enabled the "have nots" to more than triple their population since 1950:

It was the globalization of the green revolution that enabled this to happen. This chart goes out 2050 and everything beyond 2010 is, of course, an estimate. I think the chart will turn down starting in about ten years. World Population Growth, 1950–2050

And as for China, good lord man, are you serious? Have you any idea what China was like before WW2. Anyway check out this PDF file: Rural Poverty Reduction in China and India. Check the chart 2 on page 7. And that only goes back to 1978. If I had one that goes back to 1950 I am sure it would shock you. Every Chinese is way better off today than at any time in history. And it is largely because of globalization.

Ron P.

Yes, industrialization and "the green revolution" have allowed populations to blossom in many areas of the world.

Increased population is not the same as increased happiness, however.

"China" is a big place, with a long history.

I try to be careful about generalizations, but I suspect there may be far more unhappy people there now than at many times in the past-- if only because there are so many more people.

On a percentage basis there are probably fewer unhappy people now.

For the last few thousand years China has been at the Malthusian limit except for short periods following plagues, famines, and wars.

Never, there was a reason that the population of undeveloped countries did not grow very fast before 1950. They had very little resources, very little food. There is a very good reason their population boomed after 1950, after the green revolution. They had a lot more food to eat so their population just naturally boomed.

But if you think very hungry people were a lot happier than people with a full stomach then... Well I guess everyone is entitled to believe what they desire to believe.

The Good Old Days-They Were Terrible

And it would have been far worse if you had lived in rural China. Those were the days when farmers often sold their daughters because they could not feed them.

Ron P.

Well, it is really silly to assert that "very hungry people were a lot happier than people with a full stomach..." and I did no such thing.

But you know as well as I do that the "green revolution" is based on "fossil" fuel and "fossil" water and will come to an end.

Furthermore, it is beyond specious to try to compare the "happiness", or lack thereof, of a 17th century Chinese peasant with a 21st century Chinese slum dweller.

I have read credible accounts that the percent of unhappy people is higher now than it was a specific times and places in the past -- but that too, seems like specious speculation.

The real question is-- if we care, that is-- how can we pull together to make life happier for as many human beings as possible without destroying our environment.

I don't have the answer, but I am quite certain that whatever it is, it is not in continuing BAU, and quite likely, not in further extension of industrial globalization and financialization.

Of course it will come to an end. That has been my whole point for years. And when it does those poor Chinese, those left alive, will likely be just as hungry and miserable as they were a century ago.

Who brought up the 17th century? We are talking about the early 20th century. But as I post in a link below we do have history, and that history does go back to the 17th century. All we must do is read history for goodness sake. That can give you a pretty good indication for how happy people were. (See my link below.)

Now I would just love to read that credible account. Got a link? Have you noticed that I almost always post links that prove my positions while you post none? You have opinions that, I think, are no more than that. You really believe that back in the "Good Old Days" people were generally much happier than they are today. Nonsense, they were, far more often than not, flipping miserable, just like the residents of Sennely.

After the Black Death: A Social History of Early Modern Europe (Interdisciplinary Studies in History)

You can click on "Look inside" and read the first six pages of the text. It is a real shocker for those who think that in those days and times people were, in general, much happier than people are today. Imagine just how happy the residents of Sennely must have been.

Ron P.

Well, I can play the sophist game as well as you. My personal opinion is admittedly of no value, but how about the Guardian. Is that better?

The Guardian

Different places have had different histories, different resources and different economies-- and one can always cherry-pick to prove a point. I said the "17th century" to get away from modern colonialist and industrial incursions into the discussion.

In an agrarian society based on patrinomial kinship groups, women had few rights.

Men also were fettered by numerous responsibilities to their ancestors, parents, kin, landlords, etc.

And now we are fettered by obligations to the banks and the government.

Ancestors and kin relationships are so passe'.

But I suspect that will all come back, because that is really the primordial economy. The money economy and "liberal" thought depends on a lot of cheap energy.

Ancestors and kin relationships can be very onerous. A common arrangement is for a woman to leave her own kin group and live with her husbands. She has no status within here new kin group until she has born an heir, in which case she now has status as the mother of her son.

That sort of sounds like the modern soccer mom.

I was told that the usual greeting in China, somewhat equivalent to, "How are you?" is "Have you eaten?" This is a holdover from the time when people often didn't have food. Now I have been told it is most commonly used as a greeting around meal times.

And if these people did not produce all that stuff we could easily do without, they would be unemployed. They would be hungry, very hungry.

Right - because Human beings are SO rigid in their habits and place in the world that they would not take the time or effort to grow their own food.

Or find some other thing to do.

But again, if 'the hungry' is the worry - The lack of potable water and the limits of Phosphorous are hard limits that no amount of jobs making cheese doodles are gonna fix. Some kind of neigh-infinte energy source that can extract both from sea water would be a fix - but then what's the plan for population reduction? The other horseman who ride with Death - War and Pollution (pollution got pestilence's job) are still gonna have a job.

Only it would be much, much worse because the world has so many more people now.

Thus showing that Malthus was right.

Population reduction is gonna happen, its happening already with 1/7th of the world being hungry on a daily basis. And when people in places with a history of hunger - Ethiopia - are willing to grow food to send it to Saudi Arabia for money .... how seriously should outsiders worry about people who'd send their soil fertility out of their home for 30 pieces of silver?

http://www.guardian.co.uk/environment/2010/mar/07/food-water-africa-land...

It is pretty hard to make things like computers and today's automobiles and cell phones without imports.

The imports are "more economical" to obtain outside the borders.

Water is 'the universal solvent' and the Sea has a whole lotta dissolved minerals in it.

Any nation-state with access to the Sea would be limited to mineral access via how badly it wanted to extract from the Sea.