Long-Run Trends in the Price of Energy and of Energy Services

Posted by Rembrandt on September 29, 2011 - 3:48am

This is a guest post by Roger Fouquet, Ikerbasque Research Professor at the Basque Center for Climate Change best known for his book Heat, Power, and Light: Revolutions in Energy Services. The post builds upon Fouquet, R. 2011a. Divergences in the Long Run Trends in the Price of Energy and of Energy Services. Review of Environmental Economics and Policy 5(2). 186-218.

His research shows that it is not the price of energy input (depletion) which matters for the economy, but the cost of energy input per unit of output (depletion + technology). Something which seems obvious but is often forgotten in the energy discussion. Also at The Oil Drum we often erroneously talk about effects of the oil price on the economy, and not the cost of an oil or energy service delivered to the economy. The latter not being affected just by energy prices, but by all inputs and the efficiency and cost.

Energy prices have risen considerably since the beginning of the twenty-first century. It is valuable to place these price rises within a historical context. Many peaks preceded the price hike of 2008, and there will, no doubt, be many more. However, if future trends follow past ones, then it is tempting to conclude that the long-run trend in individual and average energy prices will be generally stable or downwards.

This note also highlights the tendency for long-run trends in the price of energy and of energy services to diverge. That is, since the Industrial Revolution, energy efficiency improvements have led the price of energy services to fall far more than the decline in the price of energy. This is an important distinction because commentators have a tendency to focus on energy prices, even though consumers are ultimately interested in the services that energy provide, such as space and water heating or cooling, powering of appliances, illumination and transportation (Goldemberg et al. 1985). This divergence in the long-run has major implications for forecasts of future energy use and carbon dioxide emissions, welfare improvements and the evolution of economies.

Long Run Trends in Energy Prices

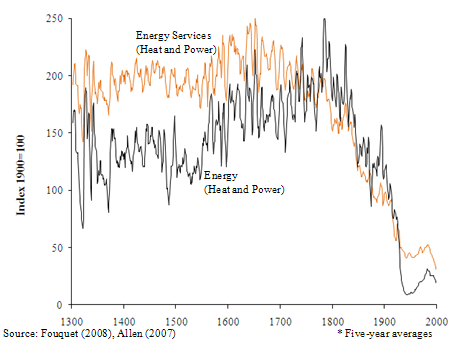

The broad trend over the last seven hundred years in British prices associated with energy and their services was first upwards, as the expanding economy faced increasing pressures from consuming mostly limited renewable energy resources, and then downwards, as fossil fuels replaced them (see Figure 1).

Energy prices - associated with biomass fuels and fodder for horses (known as provender), before the diffusion of coal and steam engines - rose up to the nineteenth century, reflecting the growing pressure on land and, thus, agricultural products and the lack of large-scale substitutes. It appears that economic growth met by renewable energy sources resulted in higher prices – although not as a national energy crisis as suggested by Nef (1926).

Figure 1. Average Price of Energy and of Energy Services (Heating and Power) in the United Kingdom (1300-2000)*. Republication from Fouquet (2011a).

However, these experiences in Britain – a small, densely populated island - do not imply that economic growth dependent on renewable resources is destined to suffer increasingly higher prices (Allen 2009, Fouquet 2011b). In fact, Figure 1 shows that the decline in the price of energy services (at the time, heating and power) began in the mid-seventeenth century. This was the result of more efficient horses being used. At the same time (but not shown in Figure 1), transport services were also improving. Thus, within the confines of the renewable energy system, there were attempts to resolve the problems posed by growing demands for resources.

As mentioned before, for energy prices, the decline occurred later, at the beginning of the nineteenth century with the increased use of the steam engine. The average price series for energy in Figure 1 is heavily dominated by the price of power fuels until the second half of the nineteenth century, as provender, the fodder for horses, (as well as food and water power, which are not included here) was replaced by cheaper coal. Without the switch to fossil fuels, the growth of the British economy (and possibly many other economies) would have been severely constrained and may have faced further increases in the average energy prices.

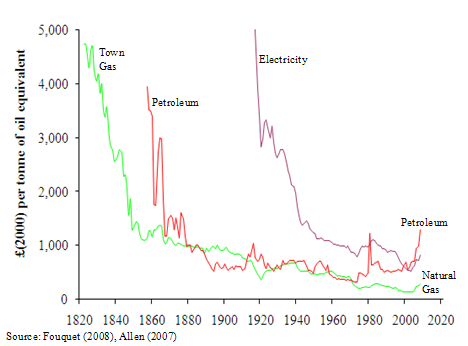

Economic transformations that were taking place in the nineteenth century led to the innovation, development and expansion of markets for a whole series of new energy sources and technologies. In particular, new fuels, such as town gas (which was derived from coal) and kerosene (made from petroleum), and then electricity were being used. Swiftly after introduction, their prices fell dramatically (see Figure 2).

For example, despite great volatility in the first decades, by 1900, the price of oil had fallen six-fold in forty years and remained comparatively stable for more than fifty years (Hamilton 2011). Like coal for heating in the seventeenth and eighteenth century (see Fouquet 2011a), the strong dependence on oil for transportation has led the United Kingdom government to rapidly increase the tax rate over the last twenty years – in 2000, three-quarters of the price of gasoline was revenue for the government (Sterner 2007) - and the trend in prices reflects this process, rather than providing clear evidence of growing long-run resource scarcity. So, while many have focused on the volatility in petroleum prices in the last few decades, and the signs of short-run supply shortages associated mostly with political disturbances, the history of petroleum has been (to a great extent) one of declining and then stable prices with occasional peaks.

Figure 2. Prices of New Energy Sources in the United Kingdom (1820-2008). Republication from Fouquet (2011a).

The tendency for markets to offer new energy sources and for consumer to substitute between them implies that even if individual fuel prices may rise in the long-run (and there is limited evidence to support this for fossil fuels), average energy prices reflect the substitution between sources towards cheaper energy services. Thus, in general, where resources are not limited by land availability and substitution is possible, we might expect average energy prices to trend downwards. The downward trend over the last two hundred years corroborates earlier studies (Adelman 1995, Livernois 2009) suggesting that, in the eyes of the market (and despite some commentators concerns), energy resources have been perceived to be `unlimited´.

A Comment on Future Trends based on the Past

However, energy prices have risen considerably since the beginning of the twenty-first century (see Figures 2). Undoubtedly, global demand for energy services and, thus, energy has soared, especially as the Chinese economy has expanded. This growth placed considerable pressure on energy supply infrastructure, which fed through into higher energy prices.

The global recession is allowing energy producers and suppliers time to expand reserves and, more importantly for short and medium-term prices, infrastructure (Maugeri 2009). Greater expansion of natural gas reserves will, no doubt, also assist long-term trends. And, the development of technologies to tap unconventional natural gas reserves at lower cost than would have been possible a decade ago implies very large fossil fuel reserves (Stevens 2010). In 2010, the current global primary (modern) energy consumption was 12,000 mtoe (million tonnes of oil equivalent) or 500 Exajoules (BP 2011). An estimate of global fossil fuel reserves is close to 30 million mtoe (Rogner 2000 p.168). This is nearly 2,500 times the current annual global primary energy consumption. Unconventional natural gas reserves are particularly important – roughly 80 percent of the total. But, even for oil reserves, the estimate is more than 450 times the current annual global oil consumption. Thus, even allowing for economic and population growth, fossil fuels are abundant (at least, for many years to come), and atmospheric limits for assimilating greenhouse gases will probably be reached well before fossil fuel limits.

Although there are abundant resources, many of them are at higher costs than Saudi oil or gas extracted in Qatar. So, there is likely to be a gradual shift over the next few decades to costlier fossil fuels. However, just like in past centuries, energy producers of the twenty-first century have strong incentives to lower their costs of production. In fact, they face fiercer competition than ever, and are only likely to keep their market shares and their shareholders happy if they find ways of lowering costs. So, future fossil fuel prices will be influenced by these two opposing forces, higher costs of production and the incentives to lower them, and it remains to be seen which of these forces will dominate.

Placed in a historical context, it is clear that many peaks preceded the price hike of 2008. Between the seventeenth and the nineteenth century, commentators anticipated coal prices to rise, with grave impacts on the economy. Temporary hikes were faced, but price trends, in the long-run, stayed remarkably stable. Suppliers continued to deliver - finding new and deeper reserves, and hiring more workers and capital to meet the demand. In the 1920s, the new energy sources, petroleum and electricity, temporarily struggled to meet the rapidly increasing demand for personal transport, power and lighting. Prices peaked, and then the capacity of petroleum and electricity industry expanded to meet the new needs. Similarly, in the 1970s observers were expecting permanently higher energy prices. Yet, from the mid-1980s, and despite more peaks, nearly twenty years of low energy prices followed. So, despite many peaks in the past, markets adjusted. Suppliers found new reserves and built greater infrastructure. Consumers, where possible, reduced wastage, increased efficiency and substituted to cheaper sources. And, long-run trends in individual prices continued a relatively stable and slightly downward trend.

It is possible that future trends will not follow the same patterns as past trends. But, if they do, then it is tempting to conclude that the long-run trend in individual prices will be generally stable or downwards, although peaks can be expected. And, the long run trend in average energy prices will be downwards, because of the tendency to substitute towards the cheaper fuel.

Divergences in the Price of Energy and Energy Services

As shown in Figure 1, the average energy price has fallen considerably since the Industrial Revolution. However, Figure 3 highlights the divergence between the price of energy and of energy services. This is the result of another aspect of energy markets, the tendency to introduce more efficient technologies in production, distribution and consumption, especially when energy prices start rising.

Figure 3. Prices of New Energy Sources in the United Kingdom (1820-2008). Republication from Fouquet (2011a).

William Nordhaus (1996) first identified this divergence for the price of lighting and of the fuels used for lighting. While the very broad trends in the prices of energy and energy services are similar (upwards then downwards), especially since the Industrial Revolution, Fouquet (2011a) shows that their trends have diverged. In other words, the divergence is general to all energy services (heat, power, transport and lighting) rather than specific to lighting.

The last two hundred years has been a period of exceptional technological innovation in history. The cost of generating services has changed greatly as a result of the ability to use resources more efficiently, rather than just from the price of the resource. Consequently, focussing exclusively on the long-run trend in energy prices might be responsible for misleading conclusions.

Divergences between trends in the prices of energy and their related services have major implications for the process of studying long-run trends in energy markets and climate change. First, as Nordhaus (1996) pointed out, focussing on energy prices in the long-run dramatically underestimates the welfare gains to the consumer and should affect traditional measures of the overall consumer price index. The data examined here indicate that, in the long-run, people have also been able to heat their homes, push and pull objects, and move people and goods, as well as light their homes, far more cheaply than a simple examination of the consumer price index would suggest. These services have radically altered people´s lives. This evidence further supports the argument that we need to alter the way consumer price indices are measured.

Second, as a result of the radical price decreases, the incentive has been for the economy and society to become more heat-, transport- and light-intensive. Looking forward, while more research is needed to ascertain whether heating and power prices will fall, we can anticipate substantial further improvements in transport and lighting efficiency. Thus, the global economy is likely to become even more mobile and dependent on lighting. This obviously has major implications for both energy markets and climate change.

Third, building on this last point, modellers need to try to estimate the income and price elasticity of the demand for heat, power, transport and light (see, for instance, Fouquet and Pearson 2011), as these drive the behaviour associated with energy consumption and greenhouse gas emissions. After all, focussing only on energy rather than energy services will produce misleading estimates of consumer responses to long-run income, price and efficiency changes.

Of course, all the price trends presented do not incorporate the externalised costs of energy use, whether related to air pollution or climate change. There is evidence that these external costs are not necessarily a constant, and change at different phases of economic development (Fouquet 2011c). Thus, to get a truer measure of the costs of energy use to society, it would be necessary to incorporate the long-run trends associated with energy markets, energy efficiency improvements and external costs.

References

Adelman, M.A. 1995. Trends in the price and supply of oil. In The State of Humanity, J.L. Simon, ed.. Oxford: Basil Blackwell.

Allen, R.C. 2009. The British Industrial Revolution in Global Perspective. Cambridge: Cambridge University Press.

BP. 2011. BP Statistical Review of World Energy. London: BP.

Fouquet, R. 2008. Heat Power and Light: Revolutions in Energy Services. Cheltenham and Northampton, MA, USA: Edward Elgar Publications.

Fouquet, R. 2011a. Divergences in the Long Run Trends in the Price of Energy and of Energy Services. Review of Environmental Economics and Policy 5(2). 186-218. http://reep.oxfordjournals.org/content/5/2

Fouquet, R. 2011b. ‘The Sustainability of `Sustainable´ Energy Use: Historical Evidence on the Relationship between Economic Growth and Renewable Energy’ In I. Galarraga, M. González-Eguino and A. Markandya. eds. Handbook of Sustainable Energy. Edward Elgar Publications. Cheltenham, UK, and Northampton, MA, USA.

Fouquet, R. 2011c. Long Run Trends in Energy-Related External Costs. Ecological Economics 71(1)

Fouquet, R. and Peter J.G. Pearson (2011) The Long Run Demand for Lighting: Elasticities and Rebound Effects in Different Phases of Economic Development. BC3 Working Paper Series 2011-06. Basque Centre for Climate Change (BC3). Bilbao, Spain.

Goldemberg, J., T.B. Johansson, A.K.N. Reddy and R.H. Williams. 1985. An End Use Oriented Energy Strategy. Annual Review of Energy and the Environment. 10: 613-688.

Hamilton, J.D. Historical Oil Shocks. NBER Working Paper 16790. National Bureau of Economic Research. Cambridge, MA.

Livernois, J. 2009. On the empirical significance of the Hotelling Rule. Review of Environmental Economics and Policy. 3(1): 22-41.

Maugeri, L. 2009. Understanding oil price behaviour through an analysis of a crisis. Review of Environmental Economics and Policy. 3(2): 147-66.

Nef, J.U. 1926. The Rise of the British Coal Industry. Volume I–II. London: Routledge and Sons.

Nordhaus, W.D. 1996. Do real output and real wage measures capture reality? The history of lighting suggests not. In The Economics of New Goods, ed. T.F. Breshnahan and R. Gordon. Chicago: Chicago University Press.

Rogner, H.H. 2000. Energy resources and technology options (Ch. 5). In World Energy Assessment (WEA), ed. J. Goldemberg, T.B. Johansson. New York: UNDP.

Sterner, T. 2007. Fuel taxes: An important instrument for climate policy. Energy Policy 35 (6): 3194–202.

Stevens, P. (2010) The ‘Shale Gas Revolution’: Hype and Reality. Chatham House Report. London: Chatham House.

A brief reading of this post suggests to me it is a conventional BAU economic analysis of energy supply. Of course, the end user of energy correctly is only concerned with the useful work done ( however that is defined) not by the cost per kilowatt hour of the energy source utilised, so GDP = energy * efficiency .

Is it really of great interest that we have much cheaper energy utility that we did in the year 1300? This post notices a recent uptick in energy prices, but then comes up with this

Is he really reporting global oil reserves at 450 years of current global annual consumption? If he is reading figures like this , no wonder he is a cornucopian, even if he is confusing resource and reserves.

If we are talking C+C here, global consumption is about 27 billion barrels per year. 450 times that would be over 12 trillion barrels. Where is all this oil? What nation, or nations have such massive reserves?

When people quote such absurd numbers with no facts to back them up, then their argument should be dismissed out of hand.

Ron P.

The OP did give a reference:

Rogner, H.H. 2000. Energy resources and technology options (Ch. 5). In World Energy Assessment (WEA), ed. J. Goldemberg, T.B. Johansson. New York: UNDP.

http://manowar.ma.ohost.de/chapter5.pdf

Did you even bother to read it before making this remark?

The estimates in Table 5.1 in that source paper are between 146 and 295 billion tons of oil. This is 1.1 to 2.2 trillion barrels. The lower estimate was from BP, 1999. Adding unconventional oil on table 5.2 roughly doubles this amount. These estimates are in the ballpark, but no way do they add up to 450 times current annual consumption. He may have made a math error somewhere.

Table 5.2:

= 482.3 GT[1]

+ 314.5 GT[2]

+ 658 GT[3]

Total is ~1450 GT; added to 295 GT[4] and 123 GT[5] from Table 5.1, the grand total is ~1870 GT. At 4 GT/year, that's about 467 years.

So it seems his number is supported by his reference. A more productive line of questioning, I think, is to stop avoiding his argument and engage it directly, by making and supporting the claim that this time really is different, and there are concrete and identifiable reasons why past history cannot be expected to predict the near future in this particular case.

There are strong arguments here; we should use them, instead of allowing ourselves to get lazy and rely on assumptions.

[1] Oil shale, total resources

[2] Heavy oil, oil in place

[3] Tar sands, oil in place

[4] Identified reserves + 5%

[5] Resources from enhanced recovery

One of the supplied references is Rogner, 2000. Everyone on this forum should know exactly what that means, and why 450 years of supply can be derived from it. Or not.

FOR ALL

Since most don't have time to study the entire report I've pulled some notable sections for your review. Each can decide on their own if it would be a worthwhile investment of their time to read the entire report.

"The fossil resource base is at least 600 times current fossil fuel use, or 16 times cumulative fossil fuel consumption between 1860 and 1998." So during the last 140 years we've only consumed about 6% of the resources we have availble.

"Thus the economic and environmental performance of fossil, nuclear, and renewable conversion technologies — from resource extraction to waste disposal — will determine the extent to which an energy resource can be considered sustainable." IOW their estimate does not take into account the cost to develop these resources nor any environment or political aspect.

"While the availability and costs of fossil fuels are unlikely to impede sustainable development, current practices for their use and waste disposal are not sustainable". So the development of alternatives is not dependent upon having FF available or, if available, even at very high costs.

"It has often been assumed that fossil resource limitations or the “running out of resources“ phenomenon would wean the energy system off fossil sources and bring about the necessary course correction towards sustainable energy development. Based on long-term global energy demand expectations, current understanding of the world’s fossil resource endowment, and production economics, this is unlikely to happen before the end of the 21st century." So there won't be much economic incentive to develop alts for another 89 years.

"...the transition will likely require determined policies to move away from fossil fuels. Large increases in fossil fuel prices as a result of rapid resource depletion are unlikely to drive the transition." So $150/bbl oil isn't an incentive to reduce consumption or develop alts.

"...society must first recognize that the current energy system is unsustainable and that adequate policy

measures need to be introduced. These measures may stimulate technological advances and development, change consumer preferences, or both. After all, the existence of enormous fossil, nuclear, and renewable resources is irrelevant unless there is a demand for them and unless technologies for their extraction and sustainable conversion to energy services are commercially available." So even though we have 16X as much energy resources available as we've consumed during the last 140 years, our current approach to developing energy resources are not capable of producing those resources due to an insufficient demand to do so.

Each can judge the merits of this report on their own. I have nothing else to add.

Somebody slipped a decimal point somewhere here. I don't know who.

The world's ultimately recoverable conventional oil reserves (URR) are generally estimated to be on the order of 1.2 trillion barrels. At 27 billion barrels per year, that would last about 44 years, more or less.

That is the ballpark we should be playing in. If you are playing in some other ballpark, you are lost.

1.2 trillion barrels of oil would contain about 7200 exajoules or 7.2 zettajoules of energy. In this ballpark, you should be playing in zettajoules. I think. I've never had to use zettajoules before.

"the incentive has been for the economy and society to become more heat-, transport- and light-intensive."

For arguments sake lets stipulate that this conclusion is accurate on average for the globe. But looked at from a global perspective there will be

some economies that will be below average and above average. Since, most of us will not be living in the "average economy" the interesting question is what are the attributes of the economy that will be below and above average.

It would appear that economies with concentrated population centers will make the transition more easily than those with distributed populations a.k.a suburbs. Those with high energy costs will do it more easily than those with low energy costs - although if the low energy cost economies had the political will to increase prices through taxes they would probably make make the transition more quickly.

I was one who voted "No" on this post. Maybe he has something to add, but he definitely is not aware of resource limits.

I am not sure what Figure 3 is modeling, specifically. If it is prices of new sources of energy services in the UK, I would think it would include the price of offshore wind. This is hardly cheap.

Too bad you didn't have veto power, like the US does at the UN. ;-) Anyone who states that the world has oil reserves of 450 times current production, over 12 trillion barrels of crude, does not deserve a special thread on TOD. Well that is my opinion, and apparently your opinion also.

However there are people out there who do believe this. But perhaps some editors believe that even totally absurd opinions should be aired with special threads on TOD. I guess a thread arguing that oil is actually abiotic, rising up from the bowels of the earth, will be next.

Ron P.

@Darwinian,

There are 12 trillion barrels of crude resources estimated, if we assume that the boundary to their exploitation is mainly economic the argument can be made that in principle there are for the foreseeable future sufficient resources available, as is made in this post. The question is whether the flow rates can be increased at sufficient speeds for economies to keep functioning (and energy prices or better said energy services costs to stay sufficiently low)

I still find it hard to believe there are 12 trillion barrels, even if you assume all original oil in place, and include deep sea, heavy oil, and tar sands.

I doubt the figure even if you include oil shale, which is not even chemically oil.

At the 2005 to 2010 volumetric per year increase in Canadian net oil exports (50,000 bpd per year), Canada could increase their net exports by one mbpd, in about 20 years.

Of course, combined net exports from Canada, Mexico, Venezuela, Brazil*, Colombia and Argentina fell by 1.1 mbpd, from 5.1 mbpd in 2005 to 4.0 mbpd 2010 (BP).

*Brazil is included because the media insists on talking about Brazil "Taking market share away from OPEC," even though their net petroleum imports increased from 2005 to 2010.

The Canadian Association of Petroleum Producers estimates that Canadian oil production will increase from about 2.5 million barrels per day in 2005 to about 4.7 million barrels per day in 2025.

That is an increase of 2.2 million barrels per day. Virtually all of this will come from the oil sands.

Nearly all of that will go to export since Canada will fall back on its much cheaper hydroelectric, natural gas, coal, uranium, and wind power resources for domestic consumption.

Of course, that won't compensate for precipitous production declines in Mexico, Venezuela, the North Sea, Saudi Arabia (just guessing) and other countries, but Canada will do its best to fill the gap.

Unlike Canada, Brazil will probably use all of its oil production increase internally.

We shall see what happens, but the fact remains that it would have taken an additional 12 producing regions like Canada to keep GNE flat from 2005 to 2010. And if we had wanted to maintain the 2002 to 2005 rate of increase in GNE, it would have taken an additional 54 producing regions like Canada.

That's true, and there aren't 12 regions in the world like Canada. There are only 2 - there's Canada itself, which has most of the world's deposits of bitumen, and Venezuela, which has as much extra-heavy oil as Canada has bitumen. In theory those two countries could make up for the decline in conventional production, but in practice, they won't. In fact Venezuela's oil production has been declining in recent years.

Americans like to point to their oil shales as a form of oil reserve, but in fact they contain kerogen instead of oil, and production facilities are nonexistent with no new ones planned.

Regarding oil shale, current techniques for making it into oil (as opposed to burning it directly, as a coal substitute) require large amounts of water. There is not enough extra water available in the part of the US where oil shale is located to do this.

The places where oil shale is used now, it is burned directly as a coal substitute to make electricity, as far as I can see. The US could use it in that way also, but we have coal reserves and resources which would probably be better. We would also need more train capacity or electrical transmission capacity to more populated areas. If it were burned where it was located, we would likely run into limits for water cooling of electrical plants.

Excellent points.

As a coal substitute, a value commonly given for the heat content of oil shale is 4 million BTU/ton. Sub-bituminous coal (eg, Powder River basin) comes in at about 18 million. So at least four times the tonnage to be moved and, if I remember the figures properly, about 12 times the ash volume to be disposed of. No one in the US is going to use oil shale as coal until all the real stuff is gone.

when you talk about shale oil do you mean the baakan shale and texas shale?

sparky - I'm fairly sure they are speaking of the western “oil shales” that actually contain no oil but a solid hydrocarbon called kerogen. The kerogen is mined out of the ground, separated from the rock and then refined into oil. This has never been an economical process developed to do this even at today's high prices. Shell Oil has been experimenting with a process to refine the kerogen into oil while still in the ground and then flowing it out thru wells. No significant progress along this line has been reported AFAIK.

The Eagle Ford Shale and Bakken Shale are just that: shale (mud rock) formations. There is actual oil trapped in these rocks that's produced typically thru horizontal wells these days. “Oil shale” is very poor nomenclature and is constantly being misused by politicians and the MSM.

Exactly. Calling the Green River marlstone "shale" and calling the kerogen contained in this marlstone "shale oil" has led to lots of confusion. Marlstone, or marl, is like dirty limestone. That is limestone that formed in shallow inland seas but a lot of dirt and other stuff mixed in with it. There was also alga that settled into this marl and it would become oil if it were ever buried deep enough for a long enough period. But it was not, it is still kerogen.

But there is a lot of the stuff. People have dreamed for years of turning this stuff into oil. It can be done but not without a lot of money and a lot of water. It takes more money to turn it into oil than they get from selling the oil. That is the killer, not to mention the Colorado River water it would take. Already so much water is pumped from the Colorado that it never reaches the sea. There is none left for turning even one barrel of kerogen into oil.

So why does MSM and people like the author of this article keep counting it as "oil reserves". It is a mistake even to call it a "resource" and an outright lie to refer to this marlstone mess as "oil reserves".

Ron P.

Also it is not clear that there visn any net energy yield.

Rembrandt, with all due respect, I have never seen any such crude resources estimate. Such a wild and crazy estimate, even assuming money to extract them is unlimited, cries out for documentation. Who made this estimate and on what basis was it made?

I fully realize the problem is flow rates and also that more money will extract more oil. But we need to start that argument from a reasonable base. 12 trillion barrels is a totally unreasonable base.

Don't you see what such an unreasonable starting point does to the argument? Such an amount of resources would posit that resources are not a problem whatsoever, that the problem is entirely economic and technological. That is simply not the case. The amount of extractable reserves are the problem, or at least 90 percent of the problem.

Flow rates will increase, provided we have enough capital investment, if we have the resources in the ground. But more money and more horizontal MRC drilling can only extract what is in the ground. All the money in the world will not put 12 trillion barrels in the ground. It is simply not there.

And even if we start mining bitumen, oil sands and kerogen we still do not remotely come close to 12 trillion barrels regardless of the money we throw at the problem.

Ron P.

@Darwinian

The resource base estimate in this post is derived from Rogner (2000) who wrote chapter 5 of the last World Energy Assessment. This can be found here: http://www.undp.org/energy/activities/wea/drafts-frame.html.

The source of the figures in the WEA used come from a variety of geological sources including the United States Geological Survey and The German "Geological Survey" (Bundesanstalt fur Geowissenschaften und Rohstoffe). These have both their own databases and are informed by a variety of sources.

>And even if we start mining bitumen, oil sands and kerogen we still do not remotely come close to 12 trillion barrels regardless of the money we throw at the problem.<

I think that if we would have the resources available to do so (money is a marker for resources) we could mine/pump up 12+ trillion barrels. We don't have those resources available though.

Thanks for the link. Looking at the charts in Chapter 5 and converting gigatonnes to barrels it states that proven oil reserves are 1.066 trillion barrels with an additional of .898 trillion barrels from enhanced recovery. That brings us to a total of 1.964 trillion barrels if all that enhanced recovery really works.

However about 1.14 trillion barrels of this is in the Middle East and North Africa and another .32 trillion barrels in South America. I think most of that would be in Venezuela. Anyway the lions share of their estimate comes from those highly suspect OPEC reserve estimates.

All of the rest, over 10 trillion barrels, comes from Oil Shale (kerogen) and heavy oil (bitumen) with about 60 percent of that over 10 trillion barrels from Oil Shale. And about 75 percent of the Oil Shale, they say, lies in North America. That would of course be the Green River Shale.

Bottom line, even their estimate of conventional crude oil reserves are way overestimated. 1.964 trillion barrels, even with enhanced recovery is way, way too high. That would be almost twice as much as has already been pumped out. With almost every giant field in the world in steep decline, claiming that we still have twice as much as has been recovered is just not feasible.

And with four fifths of those massive estimated resources coming from Oil Shale and Bitumen...?

Money is not the problem with almost half that 12+ trillion, (the Green River Shale), it is EROI and water. The EROI is less than 1, as proven by those who have already tried to mine it, and the water. The water is just not there. The Green River water, a major contributor to the Colorado, is not just already spoken for, but is being argued over as we speak. And the kerogen mining folks are not even part of that argument.

Ron P.

The above discussion went to talking of the total oil resource but the key post author only used the term 'reserves' in the paragraph being discussed.

But, even for oil reserves, the estimate is more than 450 times the current annual global oil consumption being the specific sentence that started this ball rolling,

This is one forum in which at least the key posts should be expected to properly differentiate between 'reserves' and 'resource.'

Note: No quibbles with what you are saying Darwinian but I felt this had to be posted somewhere here so I placed it as a reply to you. Luke

No problem Luke, I agree with you. Calling oil shale, or kerogen such as is found in the Green River marlstone, "reserves", is really beyond the pale. We might expect such nonsense from some far right cornucopian but finding it here, in a key post, is really quite shocking.

Ron P.

+1 Ron, a disclaimer might be in order. He must like Yergin.

...but seriously, anyone who's been reading here for more than a month would have started having real questions after only a couple paragraphs. I'd like to think it's innocence of the wider issues, but not knowing about kerogen (or not being intellectually honest enough to at least footnote such things) sort of rules you out of the group who should be allowed to make assertions about oil reserves or based on reserves, and be unquestioned. I can't become engaged in the merits of the rest of the article, if the assertions are clearly unreachable (EROEI < 1 can't be economically used as an energy source, no matter how high or low price may get). It's not as if we have another 50 years of 100:1 EROI oil to invent a way to crack kerogen.

This is an anti-peak oil piece posted on a peak oil website. Huh?

Maybe we can get an essay on how oil prices are controlled by speculation next.

I sent the following critique to the publisher's of the Rogner report way back in 2001. It is still applicable.

WORLD ENERGY ASSESSMENT REPORT

PART II THE RESOURCES OF ENERGY

CHAPTER 5

AUTHORS: HANS-HOLGER ROGNER ET AL

A CRITIQUE

(Murray Duffin 21 April 2001)

ABSTRACT:

While the authors have done a commendable job of extracting a large amount of information from a vast number of sources, and of organizing, summarizing and presenting their results in a very accessable way, the chapter suffers from several analytic deficiencies that render its value questionable. The deficiencies seem to stem mainly from an excess of optimism resulting in a lack of critical thinking about the source material, although there are also some failures in data, correct summarization and complete analysis. A more balanced and careful effort could have produced a very authoratative source document for other researchers. A summary of 12 example deficiencies is presented.

A CRITIQUE OF CHAPTER 5 OF THE WORLD ENERGY ASSESSMENT REPORT

INTRODUCTION

The version of the report addressed here is that available on the Internet at www.undp.org/seed/eap/activities/wea/drafts-frame.html. There is no intent to summarize the chapter, or to address it’s overall value or accuracy. Rather the purpose is to point out several weaknesses as a cautionary service to future readers, so that they will study the report with due care and critical thought, rather than simply accepting it as definitive. This chapter contains a great deal of useful information and data in a quite accessable form, but has clearly been produced with a certain a priori bias, requiring that it be considered with caution. A set of representative examples follows.

1)PROBABILITIES

Figure 5.1 presents the familiar “McKelvey Box” presentation of the terminology used to classify oil (petroleum) data. It is accompanied by a description of terms that is generally accurate. However neither the box nor the description refer to the fact that there is a probability vector implicit in the classification that goes from “reasonable certainty” (authors’ words) in the upper left corner to “highly speculative” in the lower right corner. Using Laherrere’s description, this vector moves from “proven” (90% probability) through “proven plus probable” (50% probability- the most likely value), to “ proven plus probable plus possible” (10% probability). Masters et al, 1994, use 95%, mode, and 5% probabilities.

2)ECONOMISTS

In discussing the views of economists vs geologists the author’s point out that economists believe that more resources will be discovered or developed at higher prices, but fail to present any historic correlation of price vs discovery rate. The theory seems reasonable, but it is doubtful if it is fulfilled in practise.

3)TIGHT GAS

A figure is presented for “tight gas” resources in the USA of 13.4 tcm (terra cubic meters) corresponding to 455 tcf (terra cubic feet). The American National Petroleum Council, in their 1999 report, present total unconventional resources (which include tight gas and coal bed methane) as 371 tcf ( See www.npc.org page 43 of 91). This may be a simple error, but there are no examples of errors on the low side

4)PETROLEUM EUR

In discussing petroleum EUR several sources are presented accurately, but Odell is presented side by side with Campbell as though they were equally authoratative. Anyone who has read Odell knows that he pulls numbers out of the air without appropriate computations or supporting references, whereas Campbell uses confirmable data. Their qualifications as oil authorities are similarly unequal.

5)SOLAR PV

In discussing solar PV as an alternative energy, considerable analysis is given of the surface area that would have to be covered to be a useful source. However no attempt is made to compute the size of the task of actually producing the needed silicon. This is typical of the whole report which presents vast possibilities without discussion of probabilities, feasabilities or difficulties. In fact, to produce enough silicon PV modules to generate one quarter of the world’s present annual energy demand of 400 exajoules, would require 1500 large PV factories in full production for 30 years. If the factories had a useful life of 40 years, and if we could build them at the rate of 50 per year, we might have enough silicon by 2060. Nothing quite like that has ever been done, not even in WWII, but clearly it is not impossible.

6)WIND

In calculating available wind energy, the authors use all winds of class 3 or better. In practise, noone else give serious consideration to winds of less than class 4, and actual installations are in class 5 or better. There is probably still plenty of wind, certainly enough to be a major contributor, but the tendency to exaggerate should be considered in reviewing all the other analyses. As for solar, the magnitude of the task is not quantified either. To produce 100 exajoules of wind energy, using 3 MW rated turbines and 35% duty factor, would require 3 million producing turbines. To achieve that installed base during 20 years, would require a production capacity two orders of magnitude greater than the present. Again doable, but not easy.

7)ENHANCED PRODUCTION

Particularly in discussing natural gas resources, the authors apply an enhanced recovery multiplier to come up with a very large total resource figure. They fail to mention the experience in the USA, where enhanced production practises have been applied extensively in both old and new fields. The results have been an initial increase in recovery, followed by a greatly accelerated depletion, with no evidence of increased yield. Data for a very large number of wells in Texas shows a yield decline averaging 16% in the first year, and 15%/yr. average in the first 5 years in the 1970s before enhanced recovery, compared to a 56% first year decline and 28% 5 year average in the late 1980s with enhanced recovery. See http://oil.server.com/tx-depletion.htm.

8)OIL IN PLACE

Discussing enhanced recovery of oil the authors state that normal experience is that only 35% of “oil in place” is recovered naturally and conclude that another 35% could be recovered with advanced technology. However they never define “oil in place” and provide no identifiable reference for this amazing statement (who or what is BGR?). In explaining “ultimate recovery appreciation” the American EIA notes that 90 to 95% of reserves are “certain to be recovered” (See ftp://ftp.eia.doe.gov “The Intricate Puzzle of Oil and Gas Reserves). Evidently “oil in place” is not reserves. It must then refer to resources. But we know that resources are 5-10% probability oil (see1) above). Five to ten % probability means that in most cases it is not there to begin with, as clearly explained by Ivanhoe (www.dieoff.org/page90.htm). In other words 35% recovery, if this is even a valid statistic, rather than suggesting that anothe 35% can be recovered, merely illustrates the improbability of the initial large resource estimate.

Worse the authors apply the enhanced recovery factor to a total resource base that is grossly exaggerated by incorrect statistical accumulation. (see 12) below).

Laherrere also presents evidence that enhanced recovery accelerates depletion, but does not increase EUR.

9)STATIC VS DYNAMIC a

The authors refer to the geologists’ view as static and the economists’ as dynamic. They then mention that the economists see a seamless transition from conventional to unconventional oil supply. The dynamics they omit to discuss involve rate of recovery. Oil flows from the ground today at a rate of 77 Mb/day, while Orinoco bitumen and Athabaska tar sands yield oil at a rate less than 1Mb/day. Even with massive investment, unconventional oil is unlikely to ever exceed 10 Mb/day.

10)STATIC VS DYNAMIC b

The key dynamic in the whole discussion of oil availability is the discovery rate. In the decade from 1957 to 1967 discovery averaged 39Gb/yr, even if the average was 3 very high peaks averaged with 7 low years. In the decade from 1990 to 1999 discovery averaged 6Gb/yr, in spite of increased effort. With some delay, production must follow discovery as the night follows the day. In mature provinces production has begun to decline about 15 to 35 years after the discovery peak. World discovery peaked in 1963. Why is this dynamic never even mentioned in the entire chapter?

11)RESERVE TO PRODUCTION RATIO

The authors mention that the world’s reserve to production ratio has remained essentially constant for decades, even as production has increased, to demonstrate that there is no end to plenty. They omit to mention 2 other pertinent data. Several OPEC countries had major “reserve” increases between 1987 and 1989, without corresponding exploration and discovery, and these same countries have reported unchanged reserves annually for a decade in spite of production. The USA has displayed a nearly constant reserve to production ratio for 3 decades, as both reserves and production have declined in lockstep. Reserve to production ratio tells us exactly nothing.

12)STATISTICS 101

In table 5.1 the authors add the 5% probability resources of of the world’s major regions to generate a total 5% probability resource. Any freshman statistics student knows that the statistical total of a set of 5% probability occurances is much less than the sum of the 5% probabilities. Said another way, the probability of the sum of a set of 5% probabilities is much lower than 5%. The EIA has made the same mistake estimating the resources of a province by adding the low probability estimates of the fields in the province, at least in their published figure for the Caspian. If this error is compounded for provinces, regions and the world, the resulting sum is a meaningless number of vanishingly small probability.

CONCLUSION

The above 12 cases are a non-exhaustive sampling of the questionable analyses presented in this chapter. It is unfortunate that, while presenting a lot of useful data, the authors also present both erroneous data and questionable information , thereby reducing the credibility of the entire chapter.

Thanks for putting that up. Curious, as ten years have passed since you first wrote this and you mentioned the effort needed to achieve the massive solar PV (in 30 years) and wind (in 20 years) capacity that Rogner projected, how has it gone so far?

Murray,

Your critique probably needs updating especially due to advances in solar PV and wind power, and the very dramatic increases in manufacturing capacity.

Furthermore, you are missing the main point of the paper, the focus on energy SERVICES not consumption. The major US consumption of energy is to provide land transport(oil) and electricity(coal and natural gas. Wind and solar are providing electricity that can replace nearly all coal and NG and a major portion of oil using considerably less than the 90EJ presently used in consuming these FF's(more like 30EJ).

Neil, I would have to say that you missed the point, which is the folly of basing anything on Rogner. The advances in solar and wind are real and valuable, but not remotely near what would be required to lend credibility to Rogner.

Most important was Rogner's inability to recognize the difference between resources and reserves, and to understand the probabilities related to resources. The authors reliance on Rogners resulting giant estimate of petroleum, without recognizing the vanishingly small probability of the estimate is what led to most of the objections raised above.

That's a valuable point.

Still, the oil estimate is just a distraction: it's the historical analysis, and the overall emphasis on the difference between primary energy and useful work that's meaningful here.

It might be useful to consider Kenneth Deffeyes' estimate. He put conventional global URR at about 2.0 trillion barrels of oil, and predicted that conventional production would peak between 2004 and 2008, mostly likely in 2005. Furthermore, he did not think that slowly rising unconventional production would be sufficient to keep total crude oil production on an upward slope. Note that at the 2002 to 2005 rate of increase in global crude oil production, we would have been at about 86 mbpd in 2010, but of course, that is not what happened.

Following is a graph showing North Sea and global crude oil production (EIA, C+C in both cases), on different vertical scales of course and on time shifted time scales. What if 2005 was to global production as 1996 was to North Sea production? (Global production in 2005 is lined up with 1996 North Sea production on the following graph.)

Note that the North Sea was primarily developed by private companies, using the best available technology, with virtually no restrictions on drilling. In other words, Peaks Happen, even in the best of circumstances, and global production is of course the sum of discrete producing regions like the North Sea.

Kenneth Deffeyes thought that the sum of global conventional production--the sum of discrete regions like the North Sea--would be about 50% depleted around 2005. In any case, the North Sea (in blue) and global production curves (C+C):

And then we have a measurable decline in Global Net Exports (GNE), measured in terms of total petroleum liquids, with Chindia consuming an increasing share of a falling volume of GNE (BP + Minor EIA data):

Rembrandt

A slippery slope indeed. We could also technically mine asteroids for precious metals out near pluto. It's only really economic problems that prevent us doing so.

I have to believe that included here is shale oil (kerogen). Anyway, I really wonder where the editors of the oil drum are coming from.

As we have discussed, the volume of Global Net Exports (GNE)available to importers other than China and India dropped by one-eighth in only five years, from about 40 mbpd in 2005 to about 35 mbpd in 2010, as 21 of the top 33 net oil exporters showed declining net oil exports from 2005 to 2010. And if we extrapolate Chindia's 2005 to 2010 rate of increase in their combined net oil imports as a percentage of GNE, Chindia would consume 100% of GNE in about 20 years.

Other than that, everything looks swell.

Are you sure about that? Anyone referencing Rogner, who was assembling resource limit estimates before most of the people on this forum ever heard of peak oil, is certainly after a resource limit number, without the microscopic fascination with only one type (conventional) of one density (light) of one composition (sweet) of crude oil, mostly onshore, mostly contained in anticlines or standard structures, with solution gas drive or water drives, mostly already discovered.

Rogner's work, primarily his 1998 work I believe, is trying to calculate a limit. Which makes this particular reference one very well aware of resource limits.

As I have noted above, Rogner adds 5% probability resource estimates to get a total 5% probability resource estimate. The result you get adding several 5% probabilities is a very large number with a vanishingly small probability.

That certainly isn't the only issue with Rogner's work.

Our knowledge of fossil fuel reserves is adequate to our needs, without a lot of obsessing. Of course we're improving and finding new pockets, new methods for oil and gas and coal, but we know enough to know that ... we need to shift gears. Our problem is that we WANT to keep the old boat and fix it but unfortunately we NEED a new boat. Our thinking is fossil genre centered, along with electrical grid centered thinking, that will not work scaled up with sustainable forms of energy, except of course for nuclear, which can't be insured.

There are not adequate efforts, just in thinking let alone money, to put sustainable forms of energy on a new green grid. Pneumatics and hydrogen could be central to a grid for all of the green energy forms such as wind, wave, tidal, current, geothermal, and solar. Storage of energy, and the shipment of energy, is a requisite NEED for a new scalable energy system. Pneumatics CAN do this, and this is a fact. Would it have problems? Yes. But how can we not think of investments of time and money into systems that CAN centralize and grid locate the horsepower from the green energy forms? I think keeping the old boat is wishful thinking. Theoildrum is spinning its wheels.

For those on theoildrum, I would say to you that you should have me as a guest to cover this base. But you seem a proud and stubborn bunch, and your thinking is stuck. The Tripe System Report is 11 pages, illustrated. As far as I know this is the ONLY comprehensive and unification centered system for green energy that is on the table. Correct me if I'm wrong. The system is non-electrical. Conversions of horsepower will be the key. I'm giving theoildrum a second chance, to think out of the box, and to help to model up a super green system.

www.environmentalfisherman.com

Tripe=Track+Pipe. Composite pipes, four or five or six feet in diameter. The track pipes go along the rail system easements and form new "200 year design" rail infrastructure for regular standard gauge cars, new cars, and mono-rail systems. The composite pipes back up the steel to ground rails for normal cargo. You should see the simple illustrations, before shooting from the hip please on this point which some on theoildrum have worn out. Pressures are very high, 8,000psi and diameters are large and doubled as the pipes are also rails. Four rails, a double line, would mean four two foot at least diameter mains, water and compressed air, but for the compressed air at 8,000psi, and I can't see this as being weak on transmission capacity. Like a water system, if draw downs are not extreme then the system has excess capacity and equilibrium. The multiple rail lines, that we have, are the key. Hybrid offshore systems of my design, the Georges Bank Mega Mill System, can covert wind and wave and tidal to compressed air efficiently, with non piston systems. Cars can run on compressed air and also hydrogen. Power plants can use compressed air to augment fossil fuels, or be 100% compressed air. The tripe system is designed to be everywhere: on the utility poles, using mono-rail systems, large car rail systems (luxury), dedicated water and compressed air mains, air for fuel all over the place especially available to fill up cars and trucks, which will have "tank frames".

The multi conduit nature allows us to carry, in the imbedded thick wall, twelve smaller diameter, 3-8 inches, many more needs. Broadband can be given a conduit, very simple snake it through. This is a cash flow. Natural Gas, easy enough, and we need more capacity. That's a cash flow. Sewage in green forms so we can grow fuel, easy, and a cash flow, in that we need and want better sewage systems. Oxygen rich compressed air, as a byproduct of hydrogen, has a use in the internal combustion engine, for hybrid cars. This is a cash flow, as car fuel is very very expensive now. The conduits can also carry specialty items in pelletized form.

?????

Hi Steven,

This post would be better placed in the current Drumbeat.

Best,

Kate

Thank you Moderator, My main point was this: Bean counting is not problem solving. Problem solving entails coming up with new ideas and improving on technologies, and this is a place to put efforts. For instance the bane of my work in fisheries, similar to attitudes on theoildrum, is this heavy short term effort, in a way obsessing on the problem definition. I'm saying that's done. The problem is we're running low on oil. OK that's figured out. We can stop flyspecking. Flyspecking is for people who lack direction. Thanks.

I felt I had to comment on this opinion

I suggest you check out Nuclear risk insurance Posted on 21 August 2011 by Barry Brook for a discussion of insurance and nuclear power plants, with special attention paid to the Price-Anderson Act. Barry writes

And while you're at Brave New Climate, I think it's worth reading the Thinking critically about sustainable energy (TCASE) series of fourteen posts. These supplement and extend David MacKay's excellent online book Sustainable Energy – without the hot air.

For the benefit of TOD readers I've pulled a couple of quotes from the 11 page PDF report at the Environmental Fisherman's Corporation site linked above. I went looking for the energy source for the system first:

and

and some idea of the cost

I don't think I need to say any more.

Andrew thanks for having a look at the Tripe System Report. If five nuclear plants were bombed, and that radiation were spread like a chernobyl or Japan recently, ( demonstrated low risk?? ) then who could ever underwrite this? I think it's a good idea to build some new nuclear plants, as I've expressed before, but however you slice it, given the worst case, no sane person would posit that these extreme losses and costs could be born by even by a consortium of all the insurance companies worldwide. I will have a look at you links thanks. I realize the CO2 risks with failing to go nuclear, or other, are real issues.

"feed" the tripe. This refers to the three green fuels fed into pipelines, these then to come ashore and join the rail system, track-pipe. Highly charged compressed air, hydrogen, and orca. These fuels can also be stockpiled and stored at depth cheaply, under the great pressures of the sea. So the storage of energy issue and the intermittancy issue are solved. But we gained a conversion issue in the process, as we do not have large scale pneumatic, hydrogen systems up and working now. Feed is another word for input.

"Sea and land based ..." So I'm a futurist. The real raw power of wind and wave is down in the Southern latitudes. I'm also a fisherman. So I say we need to go with big systems where the power is, as fishermen or whalers go to where the catch is. The third generation systems, my designs, use bollard pull rather than rotary power to engage flywheels, or to drag air down to depth, hence compressing it. Undersea pipes able to carry enormous pressures are cheaply made, because there is the factor of the seas pressure to contain the pressures, and so a pipe undersea can be made of the most flimsy of materials in theory. So this could even be extruded plastic, collapsable and resilient.

"Tripe System acquisitions ... " I'm designing a new system to overlap the old. They are both competitive and cooperative systems. Takings by eminent domain for the system, protects and preserves the utility monopoly way, pre enron. Tripe purchases, or more correctly the consortium purchases, as it goes in, would be for power plants, gas lines, transmission lines, and railroad lines. I do of course realize this is radical thinking, perhaps unprecedented in scale, but the justifications are based in old utility and monopoly thinking, and not in making business or political entities happy. My politics is Republican party with some libertarian and some socialism, but little. My complex systems designs are comprehensive. The premiums paid will be I hope welcomed, as entities and such get absorbed into a more efficient system. Worldwide three hundred trillion may be too low, because the aggregate of inputs, then the conversions ashore (output systems), then the transit systems, are all quite expensive. But compare at not having a green grid to tie in all the sustainable energy; wind wave geothermal, etc. Perhaps Andrew you have an over riding loyalty to nuclear that causes your obtuse objections to what you don't, or don't want to, or can't, understand. Thanks. Steven JF Scannell (facebook)

The assertion that technology can provide energy services at a much lower energy cost is not unreasonable. An electric bicycle can get a person to work as well as an SUV in many cases. Most families can live just as well in a 1,000 sq. ft. house insulated at R60 as in a 2,000 square foot house insulated at R19. If oil taxes were set to pay for that portion of the US defense budget dovoted to insuring our supply of oil, we would move that way a lot quicker.

We need to remember, however, the time frames outlined in the Hirsch report. It takes 17 years to renew our vehicle stock.

"Unconventional natural gas reserves are particularly important – roughly 80 percent of the total.".

Regarding 'Unconventional natural gas reserves': estimates of recoverable shale gas have been sharply reduced downward. Recoverable gas estimates in the Marcellus Shale play, the largest such resource in North America, have recently been reduced by the EIA by 80%. To whit:

"At 410 trillion cubic feet, the Marcellus has the highest shale gas resources by far. . . But last week, another report released by the U.S. Geological Survey said the Marcellus formation has only 84 trillion cubic feet of undiscovered recoverable gas. That’s about 80% lower than the estimate provided by the EIA. . . Following the new study, the EIA said, “We’re going to be taking this number (84 trillion cubic feet) and using it in our model.” In other words, the EIA is admitting its estimate was wrong."

Many other geologists and energy experts have challenged and sharply reduced the gas industry's estimates of recoverable 'unconventional' gas. Depletion rates are much faster than expected, and total recoverable resources have dropped to as low as 20% of original estimates.

If 80% of his "total energy supply" estimate is coming from 'unconventional natural gas', then he's way off base. I am not an expert in these matters, but I would appreciate hearing from the experts on this site as to the reality of his 'unconventional natural gas' as 80% of his 'total energy supply' estimates.

It might be useful to think of articles such as this as representing a token bit of space for those on the "other" side of the argument.

Any forum which wishes to be percieved as evenly remotely even handed needs to make such gestures from time to time.Several useful goals may be accomplished by doing so at low cost.

First off, those who are on the other side of the oil and energy depletion question can no longer claim TOD tells only one side of the story.

Second, such articles will attract a bit of attention simply because they are contrary to the usual message, and attract new readers, a few of them from the opposite camp.

Third, it stirs up the regulars, and keeps the pot boiling.

Fourth, these kinds of articles should serve to remind us that we just concievably might be wrong about depletion, at least in the short run.My personal estimate of the odds of oil production continueuing to grow for more than a few more years are 99 plus to less than one against it happening, but I am old enough to have been wrong about many things, and humble enough to admit it.

And in the end, no harm is done.Those who able and willing to think will read the commentary, and enough of the articles written from the pessimist's pov, to come to the same conclusions held by most of the regular old time troops.

In short, I believe the editors are applying some generally accepted rules of communication theory that apply to establishing contact and opening a dialogue with an opposing or neutral camp.

Also keep in mind the old saw about never argueing with a fool in public, as the public generally cannot distingiush who is the fool.In this case, when the supporting arguments for both sides are laid out in black and white, and the audience is the sort willing to actually take time to read them, there is no doubt in my mind as to who will be awarded the dunce camp.;-)

And it ain't gonna be Westexas or Darwinian, or even OFM!

Just try to remember that, strange as it may seem to us, those who think differently are generally sincere in thier beliefs and have what THEY percieve as good sound reasons for believing as they do.

The astronomers of bygone times were all wrong about the Earth being the center of the universe, but they still got pretty good results in a lot of respects, such as creating good calenders and predicting eclipses.

The cornucopians have a long record of success to give them faith in their philosophy.

OFM,

This piece is more than just a cornucopian straw man for TOD readers to poke fun at. One of the important points this article makes, and one that doesn't get aired that often at TOD, is the distinction between "energy services" and "energy". Technical and social innovation is not dead and the relationship between some number of Joules derived from fossil fuels and some amount of service provided by that energy is bound to change.

Yes, the article is pretty cavalier in assessing that fossil "fuels are abundant". He pulls his numbers from a report by the United Nations Development Programme that seems to have a pretty flawed analysis of fossil fuel resources and it's fine to take him to task for that. (But at least he referenced it!) So, while I choose to ignore his comments on fossil fuel abundance, I was intrigued by the focus on "energy services".

One of the points that I like to reinforce is that the level of energy waste in the US is absolutely mind boggling once you've travelled overseas. Europeans live quite well on about half of our per person energy consumption. The biggest issue in the US is cultural preference and misallocation of capital. If the energy service one desires is heating, we should be looking at passive house design. It the service is lighting, we should all hire HereinHalifx to do a retrofit. It the service is transporting a single human, we could start off by switching to smaller cars or buses, then to motorcycles, then to scooters.

So the United States could maintain the same level of energy service (warm house, light to read, personal transportation) at a fraction of our current energy use. The question is how we get there from where we are with the least amount of pain.

Jon

Thanks Jon. I also like the energy services approach. It covers the fact that we could have declining energy consumption, but steady or rising services, if only we push efficiency gains faster than depletion. Its mainly a matter of will. Currently we have only the search for what is cheapest in the short term, and even then, in for instance transportaion, what is being marketted to the public, is excitement and style -not basic transport. So we see a major disconnect right there. Then we see massive waste in retailing, simply because conventional business analysis, says "leave doors open on a hot day, the stream of cold air will draw customers in". So we have a lot of narrow minded decisions going on, and drawing in customers (to purchase stuff they don't really need), takes precedence over conserving our basic resources.

Agreed.

More fundamentally, it points out that we often get stuck on measuring the wrong thing; people aren't consuming gallons of gasoline, they're consuming vehicle miles travelled, and gasoline is only the means to that end. It's true - and important - that right now gasoline (+diesel) is the overwhelming supplier of that service, and that rate-of-change constraints may make moving to another supplier (CNS or EV) difficult or even impossible, but it's vital to keep in mind that "gasoline" isn't an end unto itself, just a means.

The rest of article is interesting, if not necessarily applicable, but that one key point - that unless we look at services instead of particular ways to acquire those services we're myopically fixating on just part of the situation - is extremely valuable.

I think we must think beyond "vehicle miles traveled". Beyond that, we are consuming getting from point A to point B. And our need to get from point A to point B is dependent on a number of things including how we structure our towns, cities, suburbs and our addiction to moving through space. Using the term "vehicle" probably focuses on the auto and not other vehicles such as buses, trams, trollies, subways, bikes, and our feet. Our choices are bad for resources and the planet, including our own poor health engendered by our sedentary lifestyle.

Efficiency is not enough. Doing the wrong things efficiently is the road to hell.

"One of the points that I like to reinforce is that the level of energy waste in the US is absolutely mind boggling once you've travelled overseas. Europeans live quite well on about half of our per person energy consumption".

The problem is that most of the waste in the US supports tens of millions of jobs. If we could reduce our per capita consumption to European levels, unemployment would skyrocket.

Antoinetta III

I fundamentally disagree. Energy efficiency is terrible in the US. Simply making houses more energy efficient could keep the existing construction workforce busy for decades. Retooling all car factories to build small European style cars would take hundreds of thousands of engineers and mechanics. Wind turbines require more engineers than coal power stations. Educating the US public in the basics of domestic energy efficiency and driving style will require millions of trainers.

All it will take is political will and a restructuring of the financial system. The latter is being forced on us anyway, so that just leaves the politicians.

And yet the Europeans are employed. Maybe we should find out what they are employed at.

Well Denmark employed between 30,000-40,000 in the wind energy sector as there are only one Dane to every 60 Americans that would translate into nearly 2,000,000 jobs in America.

Of course it helped the Danes wind development to have a handy tie in to Norway's extensive hydro, but they are no fools and weren't fond of nearly giving away periodic excess wind generation, the Danes have integrated district heating with wind to very good effect.

I've a feeling a straight across comparison like you have done might be off some but probably by less than a factor of two--lots jobs regardless.

Your comment interested me in the relative worker productivity of the two countries. The chart below shows a few more metrics than that but is rather instructive

It certainly belies the truism so oft preached from the pulpits such as the Wall Street Journal--the true social welfare states economies have hardly hit the wall. (sorry about the blank space that is what came with the jpg url)

I'm doing solar panel administration work for residential installations.

A - Thanks for pointing this out again. Whether one calls it waste or economic job stimulus it's all the same IMHO: capital transfer to businesss/workers. It's not just about inefficiency. Let’s take one of the biggest complaints out there: our huge defense budget. This isn’t to encourage debate as to how much we spend and if it’s necessary...just the financial impact. Millions of folks either directly or indirectly benefit from the portion of the govt budget. Likewise many retired folks benefit through the dividends pay by defense contractors into their funds. Eliminate a large portion of this budget item and unemployment goes up. One cannot argue otherwise if they accept the logic that any govt stimulus plan can lower unemployment. One could make a good argument that these monies would be better spent to support alt industries. But such a transition would be difficult, slow and probably filled with many missteps. But, again, that's not the subject of this post.

Folks disagree about what caused the current economic downturn and associated unemployment. IMHO higher energy prices weren’t the soul cause but certainly seem to have made a significant contribution. If one believes that position to some degree they can’t logically argue that reducing cash flow into the system by reduces energy consumption won’t equate to some level of job loss. I fall back on my favorite whipping boy: Starbucks. In the world of $100/bbl oil they just aren’t going to sell as many $5 cups of coffee. And that means fewer workers. If I recall correctly a year or so ago they announced shutting down many shops and firing many thousands of workers. Thus less disposable income, either by increasing efficiency (which reduces worker demand) or just cutting out the dispensable aspects of daily life (3 cups/week = $800/yr) it means more unemployed at a time when the system is less able to help them.

Rock, There is no question that the US MIC supports many, many jobs both inside and outside the military. But the question isn't really about Eliminate a large portion of this budget item and unemployment goes up.

The real question is, could [a decent portion of] this money be better spent on other things, like domestic energy supply projects, electrified rail, urban transit, etc etc

If we adopt the argument that government spending on X is good because it creates jobs, regardless of whether X is useful, then we can go the Keynesian extreme of paying one guy to dig holes and another to fill them in. And we could double everyones taxes and spend twice as much as it would create twice as many jobs - the argument just doesn't hold water.

So if we assume the gov money is always being spent, then there are always some jobs created. The trick is to also have that spending achieve useful /productive ends - and this could be done much better than it is today.

The problem of course, is that while new jobs will be created, some existing ones will dissappear - and those legacy industries are defending their (government paid) turf fiercely.

I whole heartedly agree that the tax payer dollar does not grow on a tree and that spending must first make sense. Keeping people working is shallow, as in that hole you mention. We need a well rounded austerity program. First things first. Such a program would include a reset for the four classes of Americans as I define them: Rich, Poor and Disabled, Government Workers, and the Middle Class. With respect to the rich we need reform to make taxes make sense, and a pro USA foreign policy to compete, for real. Poor and disabled can be governed better locally, using town nurse based systems of caregivers and empowering them to make the calls. The social welfare systems are absurd, and I should know. Government worker reset would include a pay as you go for local, state and federal, no more gifts or perks. It's not immoral. The middle class has slept while the boat has taken on water and this is the weakness for America: deference. I come from a town meeting background and the middle class needs to shape up, and act like a New England town. The middle class is to blame with letting the boat go to rack and ruin, in other words to take some responsibility would be in order. If we can somehow get our house in order, and reset the classes together, to value for value relationships, then we can start to think about efficiency of rail systems or other investments. We're a bit out of control. But I would say we could do well to count our blessings. Yes we can do this. But we must regroup.

Paul - "The real question is, could a decent portion of this money be better spent on other things, like domestic energy supply projects, electrified rail, urban transit, etc, etc". That was the point I was trying to make. We could take the entire MIC budget and spend it on alts. But how would that transition work? Obviously not very quickly. There are many $billions of infrastructure tied up in the MIC. Some could be converted to alt production but not quickly/cheaply and certainly not completely. And some of the MIC employees might work in the AIC (alt industrial complex) but certainly not all of them. And where will the new AIC workers come from? Former Starbuck’s employees? They need to be trained...more time and money. And the MIC workers who are now AIC workers have no pay check because the AIC hasn't been built yet. OTOH some of the MIC workers could be employed building the new AIC.

You probably see where I’m going. All the “transitional plans” (ICE to PV; track transport to rail; etc) suffer from the same problem: the time and cost of the transition. Had we started any on the potential “solutions” 30 or 40 years ago we would be in a different place today. CAFÉ standards are an easy example. But we didn’t. Now we’re deeply in debt, the economy is hurting, energy costs have zoomed, natural resource are getting short, the population (domestic and global) has increased and politics are more divisive then ever IMHO. I’m sure other TODsters could add more negatives.

I don’t like knocking anyone’s idea of what COULD be done. But COULD BE DONE doesn’t become WILL BE DONE unless the appropriate time and monies are committed to the effort. And that will typically have to be done by someone other than the folks who come up with the “solutions”. And that’s where I see nothing substantial happening today.

Hi ROCKMAN,

Amen!. As we've talked about before, problem recognition and goal setting are absolute prerequisites to "solutions". I agree - "nothing substantial happening today." The question is: how can such an intelligent species not understand simple math and the concept of "limits to growth"?

I think that discussions like our URR at a favorable EROEI are critical to analyzing our energy problem. Along with a realistic analysis of alternative energy potential coupled with efficiency/conservation measures. But, it seems to me that the research and math have been sufficiently credible (for some time now) that any rational people would be taking the problem seriously, setting some useful goals and, at least, testing possible solutions. For the most part, we are not reacting in any really useful way. We see lots of side-show antics with goofy political and religious movements, but precious little to face our problems squarely.