Tech Talk - The Future Production from Canadian Oil Sand

Posted by Heading Out on October 16, 2011 - 5:58am

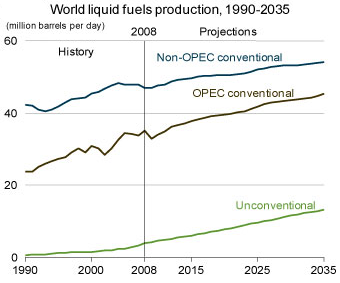

If one examines the forecast future supply of liquid fuels that the EIA projects in their most recent International Energy Outlook, the agency projects a considerable growth in unconventional supplies of liquid fuels for 2011.

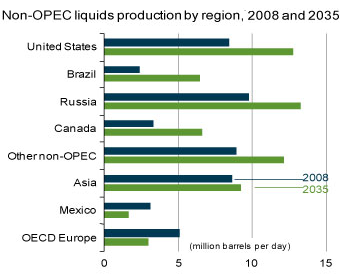

For North America, the projections foresee considerable growth both in production within the United States (rising from 8.5 to 12.8 mbdoe) and from Canada (rising from 3.4 mbdoe in 2008 to 6.6 mbdoe in 2035).

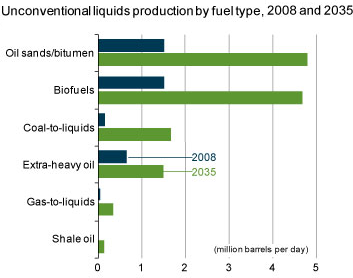

The growth in unconventional fuels is most critically anticipated as coming from oil sands, with biofuels (a topic for another day) close behind.

In passing, it is worth noting (for folks such as Dr Yergin, perhaps) that the EIA does not see much of a significant role for oil from shales through 2035. But it highlights the criticality of the Athabasca oil sands for the future well-being of the North American fuel supply chain.

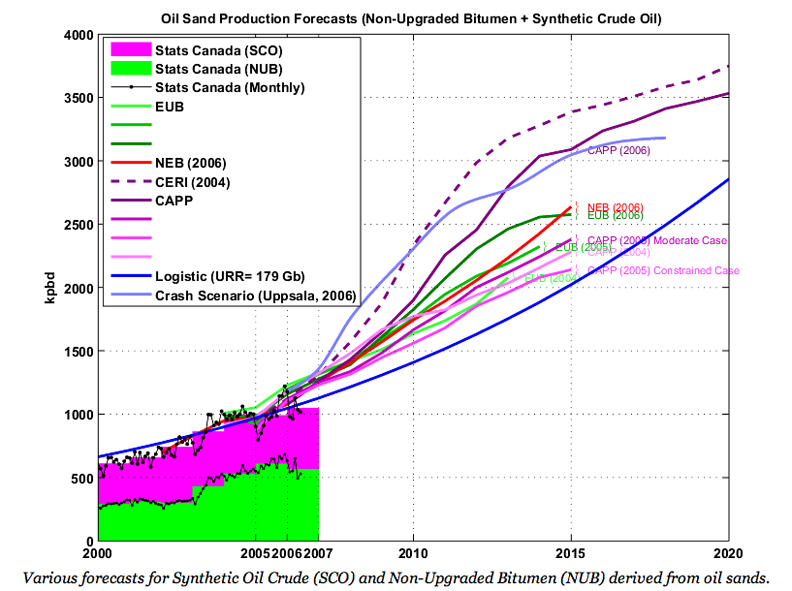

There have been a significant number of posts written both by myself and others over the years at Bit Tooth and at The Oil Drum about these reserves that play an increasing part in North American oil supply and that will likely grow to supply other nations as well, particularly China (a topic dating back to the start of The Oil Drum). In this particular post I will therefore discuss briefly an overview about the reservoirs and the technologies used to extract the fuel, in looking at the projected outlook for the future, – given that this has been reviewed and changed a number of times in the past. Some measure of that variation comes from the predictive curves that Sam Foucher posted back in 2006.

Consider first the resource, the amount of oil that exists within the oil sands of Alberta, estimated as being between 1.7 and 2.5 trillion barrels. It is found in three major deposits the largest of which is the Athabasca, and then Cold Lake and Peace River.

There are several different ways in which the oil can be recovered, The one generating the most visibility is where the sands lie close enough to the surface to be mined. Early use of single, large-scale bucket wheel excavators did not work out well, since production is tied to the well-being of a single machine. As a result, the sands are mined by perhaps 15 shovels within the mining pit, each scooping about 100 tons of sand at a time; and loading trucks, which then carry the material, 300 tons at a time to an in-mine crusher which breaks the rock into small fragments. These fragments (with waste rock largely removed) are then mixed with hot water and pumped to large tanks at the primary upgrader, where the sand, water, and bitumen are separated.

In loading a truck, it takes 2 to 4 shovel loads to fill the truck bed, depending on its size.

There is a Youtube video of the process available.

The sand also contains small particles of clay, which are difficult to settle out of the water, and the large tailings ponds used for this have been the focus of considerable controversy. This concern is recognized, and considerable efforts are being made to reduce the time that it takes for the settlement, and for site reclamation. That effort is continuing with a collaborative effort between the mining companies and four universities to improve the technology over that currently used.

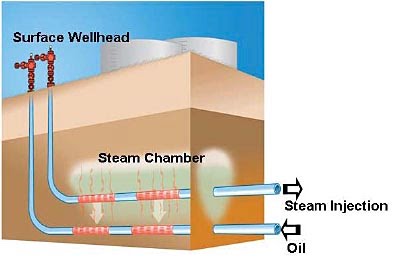

Some 80% of the reserves lie too deep for mining to be an effective solution, and with the bitumen in natural form being too thick to easily flow to wells, ways had to be found to encourage that flow. The most common and that most often projected for future development, is based on the use of Steam Assisted Gravity Drainage.

There is a video of the SAGD process on Youtube.

One of the problems with SAGD comes in the need to generate the steam that is fed into the upper pipe, and which migrates up into the sand to heat and thin the oil. The typical method to provide the steam is with natural gas, and as Dave Cohen noted some years ago, the supply of that natural gas becomes more of an issue, as the size of the operation continues to grow.

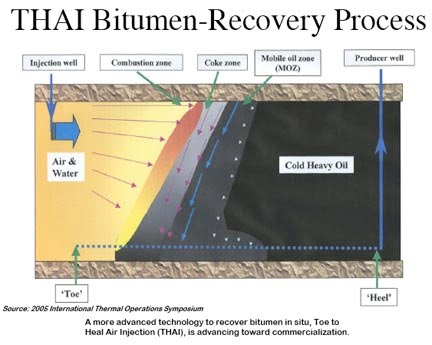

One of the more innovative of the techniques suggested overcomes that problem through burning some of the oil in place, in a process known as Toe to Heel Air Injection (THAI) . Igniting a section of the oil sand, and after using the heat to drive off the more volatile oil while continuing the burn with residual coke left behind, as the flame front progresses, has been shown to be viable.

It is an artist's impression of a side view of the site, with the blue dotted horizontal line representing the recovery well and air being fed in from a higher well into the formation.

The video showing the THAI process is also on Youtube.

However, at present it has only a limited planned future, though that may increase as information on the technique becomes more evident.

So what is the likelihood that, using these techniques, that production will rise to the levels which the EIA project? Well, in their October 3rd edition, the Oil and Gas Journal (OGJ) listed (registration required) those projects currently planned for Canada in the period through 2020 and beyond. The list contains 144 projects, many of which are defined as the separate stages of different developments. Taking just those that relate to oil sand production roughly 70% plan on using thermal methods to recover deeper oil (mainly SAGD, though there are small amounts of THAI, cyclic steam and electrothermal). 30%, roughly 2 mbdoe, of the increase in production is planned to come from surface mining.

It is unlikely that the total 6 mbdoe of increased production will all come to pass. However, given that these are all defined projects, many broken into separate phases that can be geared back or advanced, depending on market conditions and supply – particularly in the further out years – the projected increases that the EIA project would seem to be eminently reasonable to anticipate. (Caveats on water and natural gas availability are discounted at present).

I would be remiss in not thanking HereinHalifax who led me to the report on Eastern Canadian supplies, which pointed out that the flow of crude in the pipeline from Sarnia to Montreal, about which I wrote earlier, was originally Eastward, carrying western crude, but which was reversed as the market for the oil from Alberta developed in the United States, and Eastern Canadian refineries supply switched to tanker import.

The increasing plans to produce oil from Alberta depend, to a degree, on the ability of pipelines to carry the resulting product to market. Production is therefore likely to hinge on the success with which those advocating the various pipelines are able to achieve. And to a considerable extent these are political, rather than technical decisions.

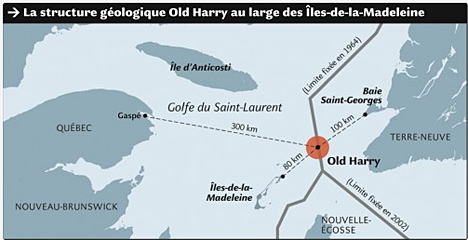

Postscipt: Emmanuel has pointed out that when I discussed the fields in Eastern Canada I did not mention the Old Harry Field, which has been the subject of much debate between Quebec and the Federal Government and which may be twice as large as the Hibernia field. With apologies (and thanks to Kristin) here is the location:

Here's a wild guess about alternative fuels based on hunches

oil sands: - will double (increase 100%) then peak as EROEI declines

biofuels: - will increase 20% then lose out due to food concerns and loss of subsidies

coal-to-liquids: - won't increase much due to CO2 concerns

gas-to-liquids: - won't increase much as gas will be used directly

That's maybe 6 mbpd short on the EIA projection to 2035.

I think it is important to recognise that the bitumin quality varies considerably both between and within the three areas. The key criteria for production is viscosity which, in the north around Fort McMurray, can be greater than 6 million centipoise (cp)and is generally several million cp. In the southern portion of the Athabasca area there are fields being produced conventionally with horizontal wells where the viscosity is 6000-8000 cp. In the Cold Lake area, cold flow has been done for years using PCP pumbs, where the viscosity typically ranges from 12,000 cp to 40,000 cp.

This is important because the identified in-situ projects will be brought on stream when the total cost structure makes them economic and they access to markets. Those with lower viscosity oil have lower cost structures, due to lower steam-oil ratios and therefore lower costs to generate steam (therefore lower EROEI.) Some of these projects like Foster Creek and Christina Lake are already in commercial mode with many years of phased developments ahead of them.

There are other factors that are also important (reservoir thickness, pool size, access to diluent, proximity and access to infrastructure) that affect the cost structure, therefore will also affect development.

Currently there are many projects that are economic and ready to go now, but will be delayed due to limited or no access to markets that can handle the bitumen. This is neither about available projects nor economics, but about politics.

Dear Calgary Oilman:

thx for these notes about viscosity and new technology and access to markets and also...

as always...politics..

The proposal to move bitumen to the existing and capable Valdez tidewater port via a state-of-art railway owuld need to handle all these different bitumen products.

CNRail and Altex plan (and are doing it right now) to ship bitumen hot to the USGC or use special viscosity reducing agents to allow load - unload facilitaion.

Special design insulated (and therefore near crashproof) railcars are to be used.

Having said this, and the fact that the Alaska Canada Rail Link is very much a "political" project also....

Another aspect driving rail as an altenrative to tradictional pipline transport is that this flexible and scalable transport methos appeals to the ~ 40% of the oilsands players who are just too small to participate in these Big Upfront Deposit pipeline projects....

Is this part of the equation also?

"coal-to-liquids: - won't increase much due to CO2 concerns"

I think you are wrong about that one. I think as energy supplies tighten, concerns over energy will trump concerns over CO2. Even if that isn't true in the U.S. (and I think it will be) it will be true in developing countries. After all, it's true i developing countries right now.

The only thing in my view that can stop CTL is a complete, permanent crash of the global economy. These CTL plants will require a lot of capital, and that may not be available.

In his book Blackout Richard Heinberg noted the massive scaleback in Chinese CTL projects - not due to emissions concerns, of course, but simple economics, primarily stemming from lack of available supply (demand for power generation being of primary concern) and also the huge amounts of water needed in the process.

Point taken. We seem to be ignoring rising global coal prices in this forecast, nevermind that there are no commercially viable, unsubsidized CTL facilities outside of South Africa.

I just don't see how these technologies that require huge energy inputs will hold up in a future of increasing energy demand.

Thanks for all the explanation and links.

The first graph is very funny...seems awfully convenient for the EIA to take the plateau from 2005-2011 and stretch it up for the future.

Third graph is also a bit weird, even if we assume that the rest of the estimates will turn out correct, hard to imagine 5mbpd of bio-fuels when 1.5mbpd is straining food production.

About THAI production of tar sands:

This process uses high pressure air injection to create a fire in the tar formation and drive it toward the collection wells. Any time hydrocarbons are burned using high pressure air (like auto and diesel engines) NOX emissions are the result. This is especially true of the THAI process where heat level is hard to control. By mixing the resultant emissions with natural gas then burning the mixture, the NOX can be reduced, but more CO2 is then produced.

I have heard that 85% of the energy in the tar sands deposit can be recovered by THAI method, but without any large scale production of perhaps 10,000 bpd or more, I doubt the recovery rate can be accurately forecast. Just from my knowledge of combustion in transportation engines, my guess is the uncontrolled environment of the tar sand deposit will produce more like 50% recovery. This would allow for tar left behind, tar burned in process and account for CH4 used to eliminate NOX.

Could the resultant heat from combusting the NOX with CH4 be used to drive SAGD?

The heat from combusting any oxides of nitrogen would have to be pumped to the area where SAGD was being done. Don't think you can combine THAI with other processes for tar sands recovery.

There is significant thermal cracking of the bitumen which gives plenty of produced gas from THAI. This can be burnt locally to power the site, or could be exported.

Fixing nitrogen in combustion requires higher temperatures than occur in in-situ combustion. Internal combustion engines will have temperature many hundreds of degrees hotter than the THAI combustion front and consequently the oxidation of nitrogen doesn't happen.

If fuel was being burnt on the surface to heat steam, as in SAGD, the combustion in the boiler would need to be controlled to avoid production of NOx, but in-situ combustion has the opposite chemistry, and its reduced forms that are produced, rather than oxidised forms. The whole point of ISC is to have a reducing environment so that fuel is produced, while on the surface the objective is to produce heat. The produced gas does require treatment but different gases are involved.

Significant NOX forms at temps above 1200deg. C. In most air - hydrocarbon combustion the temps are well above this. Because the air is pumped undrground at several atmospheres (20 to 30 IIRC)(edit) these temps are to be expected. Why would the burning of bitumen not be at these NOX forming temps. Show me the data that gives temps at flame front.

Furthermore, the tests of the THAI process have been continuing since 2006. Why is no oil produced from this process in any commercial amount (over 2000 bpd)? If emissions are not a problem what is the problem that keeps this technology from producing any significant amounts of oil?

THAI has emission problems, IMHO. Your opinion versus mine.

THAI isn't an air hydrocarbon combustion. Its an in-situ combustion. Its not a fuel/air mixture that is being heated, its a coke/sand/tar/air mixture. The amount of energy from the oxygen consumption doesn't change much, but its got a whole lot more stuff to heat up, so it gets heated to a much lower temperature. In the lab THAI ran at 500 C, 600 C was common, but rarely did the peak temperature go over 700 C.

The reaction happens on the surface of the coke, not in the gas phase. Oxygen absorbed onto coke does not react with gaseous nitrogen. Any NOx produced from nitrogen in the coke, reacts with the fuel in-situ, just like the oxygen does. Long residence time while cooling in a fuel rich environment, THAI is pretty much the perfect conditions for NOx destruction.

THAI produces plenty of gas, because the bitumen is cracked. Treatment of it is required, but its treatment typical of a fuel gas (CO2, CO, H2S).

Tooder's, I will start with a bit of an admonition. Over the past year, once in a while I will interject with a head's up about two critical developments in the oil sands that seems to get conveniently ignored because I am not a member of the echo chamber. So here it is (again):

1. An all electric process is set to go to commercialization by the end of the year. It requires 75 kWh per barrel to extract. Initial calculations show about 1 million barrels per day requires 3 GW base load. Keep in mind that we can supply about 6 GW base load (18 GW capacity) from wind power in NE BC. And it can be done at a price not far above the current Alberta Power Pool that primarily uses FF generation. AB can supply about another 10-12 GW capacity of wind from the south.

More electrical capacity is available if SAGD growth complements the electric extraction. SAGD uses CCGT for electricity and heat. The electric generators can supply the all-electric extraction processes also. There is symbiosis.

The all-electric process doesn't really use water, but does require some reinjection.

2. An export line to the west is under development using a special purpose built unit electric train that will have capacity for 3 million barrels per day. The port will be Valdez - not BC's west coast, ain't gonna happen.

The next critical component is getting the Upgrader capacity increased. The Northwest Upgrader (northwest for AB) is a carbon neutral process and modular for scalable expansion.

Therefore, it is conceivable the oil sands can increase capacity by 6 million barrels per day, and half of that is slated to be carbon neutral extraction through transport. Although it is a bit of a dichotomy to claim carbon neutral for a FF.

Note: The electric train development will have hydroelectric developments constructed along the pathway to supply energy.

It helps readers to get a better understanding of your comments if you provide references to the subject matter.

For example the electrical method that you mention is, I believe, the electrothermal method that I do reference in the piece. The technology, based on an initial development by The McMillan-McGee company is planned to be introduced at Poplar Creek in two stages, the first starting in 2014 is for 10 kbd, and the second starting in 2017 is for 40 kbd.

The current experimental site is just north of Fort McMurray and the location of the various projects can be found at the Alberta Energy listing . The project list is in small enough letters that I did not think it would be legible if I posted it here.

The $20 billion electric rail idea looks as though it would be competing with a $100 million CN alternative that is claimed to be faster and cheaper than the pipeline and not requiring the thinning of the bitumen that pipeline transport would require.

The Alberta Energy site also lists and locates the plans for Upgraders. The Northwest Upgrader has shrunk a little from its original target of 231 kbd to current plans for 50 kbd.

As mentioned in my previous posts.

The liklihood of any of these pipeline and rail ideas,.... that would allow supertanker traffic to impose the risk of an inevitable spill off the BC coast....getting social license is zero.

So I don't think the rail link to Alaska idea has any competition. It appears to be a bold statement, but if one investigates the local sentiment, you find they support LNG pipelines and LNG tankers, but not if they carry oil.

Yes $15-25B railway will be expensive, but what I ask the nay-sayers and skeptics is this:

What if these proposals just cannot ever achieve social license?

or

How expensive is the current WTI-Brent price spread to the Canadian economy?

The discount will continue until a real market for the oilsands emerges. The rail link to Pacific Tidewater will do that.

www.unrailco.com for more info.

“First the AB oil patch Boyz ignored you." This is understandable, in the early days...2-3 years ago, prior to the Gulf spill, the Kalamazoo river spill, and all the other Pipeline Leak a Week events.

"Then they laughed at you" (in a nice way) while you went into the communities and "asked first" if a railway was a good idea, then obtained initial tentative (not stopping you) support from locals all along the route.

Some major engineering firms, upon being approached years ago to become early JV partners.... patted you on the head and informed you that CN Rail tells the PM what to do, not the other way round.

Things have changed now.

"Then they fight you." (Well, not really, because the Pipeline Co's and many AB MSMedia think writing a bigger cheque will "fix" the Problem, which is supertanker spill risk).

The industry offered equity in the pipeline which only offended the FN's further as if they accepted this plan, in the event of a spill, they would be on the hook for the liability...

So the oil patch and Corporate Canada just relentlessly continue the pattern of spending a huge amount of money trying to manufacture consent for their pipeline to Asia thru BC.

"Then you win.”

Only if the Powers That Be realize they could avoid all this acrimony by supporting a reasonable alternative.

A mode of infrastructure that is flexible, can get the job done for the small guys in the oilsands who cannot get involved in big huge pipeline projects and is supported by Alaska who have wanted a link to the Lower 48 for a 100 years.

I think in this particular case, we all win.

The liklihood of any of these pipeline and rail ideas,.... that would allow supertanker traffic to impose the risk of an inevitable spill off the BC coast....getting social license is zero.

Well that is with the current population metric. Since you are throwing a far in the future possible rail line from Fort McMurray to Delta Junction hooking up with a yet to be designed facility to blend tar sand product with a yet to be found and brought into production future TAPS oil supply and then shipped to Valdez...

I'll throw in another far in the future possibility.

Here goes:

Chinese investments in BC and Alberta are tied to increasing Chinese immigration quotas by said provinces. Dual citizenship will be afforded these migrants. This combination of Chinese industry and Chinese workers really takes off in western Canada, creating a voting block that will over time increase in power...enough to eventually push approval of the pipelines to and oil terminals from the BC coast so the Chinese migrants' families back in the homeland can benefit.

We are talking pretty far in the future here. Personally I like the rail extension to Delta to hook up with the pipeline to Valdez idea but far less farfetched scenarios than I just presented could shift the social license probability of a supertanker port on the BC coast from 0% to 99% certainty in the next twenty, thirty, forty...years.

Oh by the way, we have broken ground for the rail bridge over the Tanana River that will extend the Alaska Railroad from the ice free deep water port of Seward to Delta Junction--so the tar sand product wouldn't have to go to Valdez by pipeline. What is a another few hundred rail miles to Seward after the trip from Fort McMurray to Delta Junction. Just another possibility for the yet to be completed feasibility studies.

"1. An all electric process is set to go to commercialization by the end of the year. It requires 75 kWh per barrel to extract."

What is recovery rate with "all electric " method?

Mining is nearly 100% while SAGD is maybe 70 to 80%?

THAI method is said to be 80 to 90% recovery but probably much less in commercial application. No commercial production at this time by THAI.

Recovery rate will effect the value of the reserve and cost of the oil made from the tar sands.

The Whitesand expansion is listed as moving to 2 kbd this year by the OGJ, with May River coming on next year at 10 kbd, and expanding by another 90 kbd after 2014.

ET Energy suggest as much as 70-75% recovery with new improved electrodes.

Just for added effect as to its gamechanging impact on GHG reductions....and costs

If BC Hydro "industrial" power was available via powerline intertie with Alberta, at $70/KWh per barrel and at a bulk rate in the $40/MWh range (4 cents/KWh..you have per barrel energy cost of only $2.80 to finesse-lift a barrel of bitumen out of the ground.

Of course, this is not available to Alberta customers....but it could be if a merchant intertie was built.

Combining with Alberta wind resources, and large stranded BC Wind resources could powerup this extraction technology with AB-BC grid integration synergies....

Under this scenario, cost to extract this (near) zero emissions bitumen would rocket all the way up to $6-7 per barrel.

Subtract GHG credits for NOT doing BAU SAGD and surface mining and you have great load sink for all this intermittent wind energy...

This would help out BPA also as they often have no where to sell their excess power during Spring at high water flow and high wind farm output periods....

So chart 4 was created in 2006 and appears to be updated through 2007 for actual production. It's 2011 now. Actual 2010 production appears to be 1500 kbpd. http://www.capp.ca/aboutUs/mediaCentre/NewsReleases/Pages/2011-Oil-Forec... This is below all the predictions except Mr Foucher's Logistic. Given the success of the simplistic logistic in the past it doesn't seem "eminently reasonable to anticipate" 6 mbpdoe instead of the 3000 kbpd projected by the logistic curve by 2020.

Sam has been shown to be more accurate in prediction in other circumstances also (though I can't remember the post where I pointed this out). However you have to look at the end dates of the plots which change from 2020 for Sam's plot to 2035 for the EIA comparisons - hence my comment.

Sorry, but this article is severely lacking.

We are shown a prediction from 5 years ago, but it is not updated with actual production.

Why not show a more recent forecast?

What is the current ratio of in-situ and strip mining methods? Energy needs for current and future production?

------------------------------------

Oilsands EROEI is way too low for an industrial society, the coming economic collapse (bringing an oil price collapse) will propably make the oilsand operation (or at least the expansion) unfeasible. Most of the expensive oil will stay in the ground. Thankfully.

Grin:

One of the great pleasures in writing for this site is that the readership is knowledgeable enough that when I miss things out or get them wrong, I am quickly corrected. Note the comments above that give answer to your question on current production, as an example.

The reason that I wanted to show Sam's plot was to illustrate the difficulty, even for fairly knowledgeable folk in being able to make predictions, even 5 years into the future.

And while I think predicting the economic future is even more of a problem, I will say that I see the world dependence on liquid fuels continuing to grow, rather than diminish, and that the oil sand reserves will likely, in consequence, play a greater role in that future.

The BP data base shows that combined net oil exports from Canada, Mexico, Venezuela, Argentina, Brazil* and Colombia fell from 5.1 mbpd in 2005 to 4.0 mbpd in 2010.

*BP classifies Brazil as a net importer of petroleum liquids, with a recent trend of increasing net petroleum liquid imports, but since the media prefers to believe that Brazil is "Taking market share away from OPEC," I included them in the list.

Canada's net oil exports increased by 250,000 bpd from 2005 to 2010, or by about 50,000 bpd per year. It would have taken the incremental five year increases in net oil exports from about 8 regions like Canada to offset the five year decline in net oil exports from just Saudi Arabia.

Regarding projections, following is a draft of a slide for ASPO showing production curves for top 33 net oil exporters, for Global Net Exports (GNE) and for Available Net Exports (ANE). The colored regions respectively refer to top 33 consumption, Chindia's combined net oil imports and ANE. The 2010 to 2020 projections are based on 2005 to 2010 rates of change:

GNE = Net Exports from top 33 net oil exporters in 2005, BP + Minor EIA data

ANE = GNE, less Chindia's combined net oil imports

ANE fell from about 40 mbpd in 2005 to about 35 mbpd in 2010. If we extrapolate the 2005 to 2010 rates of change in top 33 production and consumption and in Chinda's net oil imports, ANE would be down to about 21 mbpd in 2020. In other words, for every two barrels of oil that non-Chindia importers net imported in 2005, they would have to make do with one barrel in 2020, while Top 33 total petroleum liquids production in 2020 would be basically the same as 2005, under this scenario.

If we assume a 1%/year Top 33 production decline rate from 2010 to 2020 (and leave other assumptions unchanged), ANE would be down to about 15 mbpd in 2020, versus 40 mbpd in 2005.

The main article shows the uncertainties of the future developements of the tar sands, westexas now comments about the potential reducing of available net exports for the OECD countries.

This arises several questions:

-Would the OECD countries accept such a downfall of available oil within only ten years?

-If not, would the OECD - possibly leaded by a (republican) US government - try to squeeze out more net exports of the top exporters, at the cost of OPEC's own consumers?

-Would this happen by trying to install autocratic regimes in OPEC countries - even more autocratic than they are today?

I would not in any way considering such attempts as helpful, as the "collateral damage" would be immense. Local unrest could spread even more. China and India access to "liquids" supply could be severely reduced, which in turn wouldn't be acceptable for these top asian industrial countries. In fact I hope, the time for such neocolonial politics should definitely be over - just some "forbidden" thoughts.

Eek! From your Available Net Exports we need to check which importers are in line to get the lion's share of the ANE.

My best guess...

http://oilshockhorrorprobe.blogspot.com/2011/10/when-might-new-zealands-...

... finds the top ten largest net importers plus the net exporters consume maybe 65 mbpd (all liquids) and of course this is increasing monthly, while the 150 smallest importers (like where I live) only use 12 mbpd (2010).

This approach extends the Export Land Model by including an appreciation of who will get the oil that remains.

So when you say net exports are heading down with ANE only 15 mbpd by 2020, then of course well before then the exporters and the most powerful importers (USA, Japan, China, Germany, India...) will suck the supply dry, leaving nothing for the other 150 minnows. Maybe five years and its all over for them, assuming a best case steady decline (which is most unlikely). Dreadful.

Thus forewarned we have about two harvest seasons to get the perpetual spinach in ready for the day the tanker doesn't arrive! Or maybe our governments will plant it for us? Slim hope!

FOR ALL

Air injection of the oil sands could be a great development. Or an overall financial loss. I’ve studied in situ combustion (ISC) for over 20 years. It truly is in a league all its own in the world of enhanced oil recovery. In the right circumstance recovery can exceed the primary production phase and do so at a higher rate. Or a completely noncommercial effort. It is also in a league of its own with regards to complexity. Folks tend to think of the heavy oil fields of CA as the main arena of such applications. But by far the most successful ISC projects have been conducted in S. Texas and N. La.

The reservoir dynamics are so complex I won’t even try to explain even in general. Not that the TODsters aren’t a clever group but for more than two decades I’ve routinely failed to get very experienced geologists/engineers to appreciate the potential. I presented actual field efforts when even a small scale pilot project increased production 10X in less than 12 months and would increase URR 4X to 6X. And I could also present well documented cases when ISC was applied to inappropriate reservoirs that produced no production increases at the costs of $millions.

I can ready give a rough guess as to the potential of any reservoir to benefit from ISC. But It is extremely site specific. One cannot generalize that ISC would or wouldn’t be applicable to the Canadian oil sands. It could provide great results in one portion of the region but just 10 miles away be a complete economic failure. I don’t know the play anywhere close enough to even give a WAG. Maybe 80% of the OS would benefit from ISC…or maybe just 10%.

In either case ISC is a very expensive proposition. The capex for new injectors and producers is just a portion of the costs. Increasing air pressure at normal levels to the appropriate injection pressures(maybe only 600 psi), especially for the volume required, is very costly. Uses a lot of diesel if NG isn't available. But you can take that as an indication of how fruitful such a project can be when it works. Sadly almost all my efforts to get any operator to take on such a project were complete failures. I did get one old operator to commite to fund a pilot project but he had the bad sense to timing to die from cancer just as I was about to begin. Perversely one of the biggest obstacles was convincing companies that the results could be as great as my models showed…just too good. I eventually scaled back my model not because I lost faith in them but because they exceeded on paper what was needed to be viable.

Any OS operator that does the research and thus gives it a try where appropriate AND does it exactly right could develop a true game changer.

@Rockman:

Thanks for the info! Could you suggest any books for those of us who'd like to learn more about ISC? I've got time :)

Greenie - I'll send you some links from my office puter tomorrow. Most of the significant ISC projects were conducted in the 60’s. But there is one recent example of Amoco injecting air into a S. La. reservoir expecting to acomphlish one thing and inadvertently starting a “fire flood” (ISC). I contacted one of the Amoco engineers and asked, now that they had reinvented the wheel, if they were going to expand the program. Nope…it was a Dept of Energy supported project and it was done mostly for PR. And they didn’t really understand what they did. So they stopped the air injection and the oil ceased flowing.

As the Texas comedian Rob White says:”You can’t fix stupid.”

I believe you are correct in the variability to the recovery possibilities using THAI method (you call insitu combustion). I am an engineer that has some experience in oil transport methods along with handling oil product. But I know from my days of being involved with diesel engines that emissions from burning hydrocarbons can be a problem, especially today with far greater restriction on NOX than 30 years ago, plus the likelyhood of CO2 restrictions.

As the comustion pressure goes higher (600 psi is high) the combustion temps go higher. If high combustion temps cause significant amounts of NOX to form, then controls are required, which add to the expense.

For over 8 years the THAI process has been studied, planned and tested, yet no oil is produced this way commercially in Canada. THAI does not seem to be commercially viable with current technology, IMHO.

See my comment above about the planned expansion at Whitesands and May River .

PetroBank's public disclosure statement for May River Project (from Dec. 2008) indicates that commercial production was to start in late 2009 at about 2k bpd and and eventually ramp up to 100,000 bpd.

If they are now (late 2011) producing 2k barrels per day that is three railroad tank car loads, which is hardly viable amount given the investment. When they get to 10,000 bpd then they are approaching statisticaly significant amount. Until then I would not call this company's technology a success or rate the THAI process commercially viable.

One interesting piece of data in their public disclosure is that slightly more than 30% of the emitted gases are "expected" to be methane, which will be incinerated (not flared). It is not economically feasible to separate the methane to use in combustion processes.

mb - Actually the complications I'm referring to don't even involve the chemical reactions and thermodynamics. Just the geologic factors alone can render the method worthless. Check the diagram. One of the worse circumstances is depicted: a thick reservoir with a rather flat structural dip rate. Mother Earth cares little how we show the picture. In this case there is "overburn": the injected air, thanks to the relentless nature of gravity, migrates to the top of the reservoir with the distillation front following. Thus very little of the reservoir is sweep. Additionally this causes the front to reach the producing wells much faster and causes them to "gas out" and thus be shut in. The ISC successes have typically been in relatively thin (50' or less) reservoirs with steep dip. Thus the front burns along the base of the oil column.

On the temperature side of the problem the combustion gas are rather poor conductors of heat. One beneficial approach is to periodically inject water with the air. The water is much more efficient in carrying the heat to the combustion front. But you can imagine the risk: too much water and you can kill the front. And there is no method to calculate the correct volume..all trial and error. Just one more reason for managements to shy away from the technique.

Even the example of the Amoco ISC shows the lack of understanding by "experienced" hands, First, they weren't trying to do ISC. Their goal was a "dual displacement": inject air into the top of the reservoir's NG cap pushing it down which, in turn, would push the oil down to the producing well. Your basic "gas cap expansion drive" commonly found on salt domes. Unfortunately their simplistic view of the NG ignored there was some oil/condensate in the pore spaces of the NG cap. They apparently also failed to understand that the oil/air mixture would spontaneously combust at temperatures found below 5,000'...this reservoir was at 7,600'. Thus they were shocked when the oil began flowing much earlier than their model predicted. That was because the volume of the combustion gases produced in situ was around 10X the volume of air injected. Thus reservoir pressure increased much faster than modeled. BTW: that is the "secret" of ISC: any gas can be injected into a reservoir to raise its pressure. But the ISC method requires much less injected volume. And injected volume is directly related to costs.

Amoco engineers/geologists are not stupid (a generalization, of course. LOL). But this example shows the lack of fundamental understanding of this methodology. Virtually nearly every hand that has had experience with succesful ISC projects is dead. Except for a few hands in Europe that have been running one of the most successful ISC projects for decades. I'll find that link later. It could be applicable to the tar sand situation.

If any company had a decent idea of what they were doing when they injected air it was Amoco. They did quite a bit of in house ISC research but it was for lighter oils. They weren't interested in THAI, and BP shut down their ISC research after they took over Amoco.

I'd guess the reason they shut it down in a hurry was that they were worried oxygen was about to break through. The oxidation front tends to be not that far behind the oil bank, and if you start producing the oil bank a lot earlier than you expected you ought to be worried that oxygen breakthrough is imminent.

Air injection in lighter oils works rather differently than THAI. With lighter oils, you push the oil ahead of the front, but the bitumen ahead of the front is too viscous to move. In THAI the produced oil moves across the front, not ahead of it. There is a fair amount of similarity upstream of the front, but once you get past the reaction zone the flows go in 90degree different directions.

hot air - I spoke directly to one of the authors of the report and the lead engineer on the project. He admitted they had the entire concept wrong. The reasons they abandoned the project were several. They didn't coat the air flow line to the injector well causing rust contamination. The rust contamination was continually plugging the gravel pack in the injector well thus inhibiting air injection. They didn't rework the injector well and pull the gravel pack out because the well was in the marsh and it would costs a lot to get a rig in there. They also only had one compressor in the plan and two different zones to test ISC on and thus had only enough air volume to do one at a time. So they had no choice but to shut the oil producer when they switched to the other reservoir. As he explained given how much egg they had on their faces and that Amoco didn't have a serious interest in ISC at that time there wasn't any interest in doing anymore ISC.

Amoco may have had a world class ISC research group at one time. Only ran across the one publication I just described. These weren't the folks running this project. In the 60's Texaco probably did have the most knowledgeable ISC group on the planet. Just before he died I was able to dig out a lot of unpublished details from the lead man on one of the most technically successful ISC projects ever done. And when I die that info will be lost for ever. Unfortunately the logistics of the field made it uneconomic for Texaco to continue. They only fire flooded about 105 of the field but bumped production up 10X in less than a year. Texaco knew exactly what they were doing. Amoco didn't...and that was 30 years later.

The Romanians did a lot of ISC, which was technically successful in that they put air in and got oil out, though I suspect the oil it produced was actually pretty expensive. Thats where I'd go for experience of how to make it work in the field.

I agree that its the people you need to talk to, the devil is definitely in the details that never get published.

hot - Thanks...couldn't remember what EU country. Haven't had time to dig it out but I seem to recall it was a very big project. Still ongoing?

Though finding the expertise might be tricky, the bigger problem IMHO is getting management to buy into it. You obviously understand the complexity and know tutoring an experienced engineer would be a challenge.

To say I got frustrated world be a great understatement. There are a number of large shallow (250' to 3,000') of pressure depleted oil fields in S Texas that contain 100's of millions of bbls of high quality oil. Rodriquez Fld was the Texaco pilot project...at a depth of 250'. They only injected into two wells in the middle of the field so the big production increase came from only a handful of wells immediately surrounding them. Hand they down a line flood they could have ramped up fro less than 100 bopd to many thousand bopd in just 6 months. But the field was so remote and oil prices so low at the time they gave up on it despite being an obvious engineering success.

BTW water flooding these fields is a waste of money. Perms are so good the water front channels immediately with zero sweep. Watched one company inject 250,000 bw and produced less than 500 bo

Suplacu de Barcau still produces of the order of 10,000 bpd. Its a significant chuck of Romanian oil, but not much in global terms. There's a good 40 years of experience there.

Williston is the place to look on your side of the Atlantic. There are a few operations that have been injecting air there for a long time. Several in the few thou bpd range. You ought to be able to find some companies there with management that are comfortable with air injection, though I don't have any contacts myself.

hot - Yep..I think the Williston project was White Horse Field?. I've pretty much given up pitching ISC. Getting a horizontal EOR project in a sandstone reservoir going now. Much easier to get folks believing in this technolgy after 15 years.

Has anybody looked at (or quantified) the obstacles of caprock integrity and permeability to the scale and prospects for future oil sands expansion and development? I found the following project, but they are in the early stages of research:

Oil Sands Cap Rock Integrity Project in Alberta

I have a friend who works up there, at a fairly high level ... but we avoid talking about oil sands issues directly (because I'm not sure I would get a straight answer from him). My general sense is that he doesn't see an industry with an unlimited potential for growth (although people are coming up with new approaches and technological solutions all the time). I remember he stated there was a great deal of interest in oil sands in Saskatchewan, but development was a problem (because the area lacks a cap rock to allow cost effective development through in situ processes). He seemed certain oil sands production was going to continue to expand, but not to the high heights projected by many developers and industry proponents in the region. Any thoughts on this would be appreciated.

Dear Idyl:

ET-Energy can access these reserves.

They do not need 150-200m + of cap rock.

[Instead] they finesse it out of the ground without the brute force of high pressure steam.

Pressures are low and they apply the MED principle. The Smallest dose that will produce desired outcome

Minimum Effective Dose....anything beyond the MED (energy used) is wasteful.

I would prefer to hope that the next phase of oilsands development will reflect more intelligent growth with many and varied limits to this growth in production from a resource that may triple in size if ET Energy works as advertised...

[Sidebar: ET Energy suggests they can access more than 3 times the 180 Billion barrels taht are officially booked...]

Water use, land impacts, GHG reductions without CCS, avoiding regulations markets that will preclude oilsands BAU production....

and local community acceptance of appropriate extraction rates.

All these factors should favour ET Energy deployment and SA TOTAL, who are hoping this new technology will help extract their oilsand reserves...

It looks to me like power density away from electrode, careful control of power input, boiling away thermal conducting fluid (water), and close spacing of electrodes (driving up costs) are still some fairly significant technical hurdles that remain to be worked out for ET-DSP.

http://etdsp.com/technology.php (click on "The Not So Good News").

So far as I know, Oilsands Quest Inc. and other companies involved in Saskatchewan Oil Sands exploration are not looking at unconventional approaches, they're still trying to locate their production reservoirs (and estimate extractable reserves) underneath cap rock. But it sounds very interesting … any additional technical details or independent research on this beyond one company's proprietary control of technology (it seems to be used to remediate soil contamination as well) would be welcome.

Thx for the weblink

I didn't know they were heading to Australia!

Sounds also like you don't hold out much hope that this will be resolved.

I'm curious, not many people are aware of the new technology, although I first heard of it 4 to 5 years ago.

Which is when I first began to think it would help out as a large load sink for intermittent renewables (wind)...

I am not able to follow the the technical math issues on the website....

Are you saying it won't acheive commercial status?

curious of course, as there are some big plans to take advantage of this new way of extracting bitumen and meeting or exceeding Low carbon Fuel Standards....so we can sell a premium product into California for example...