Oh, Canada! -- Natural Gas and the Future of Tar Sands Production

Posted by Dave Cohen on June 20, 2006 - 3:19pm

The "missing link" to the Uppsala paper (pdf) has been corrected.

I was investigating sour gas and it turned out that about 30% of the gas produced in the Western Canada Sedimentary Basin (WCSB) is sour. As things do, one thing led to another and I found that this gas can be "sweetened" and used although it contains H2S (hydrogen sulfide), which is toxic at levels as low 10 ppm (parts per million). However, the real path and story became natural gas usage to carry out production of the tar sands.

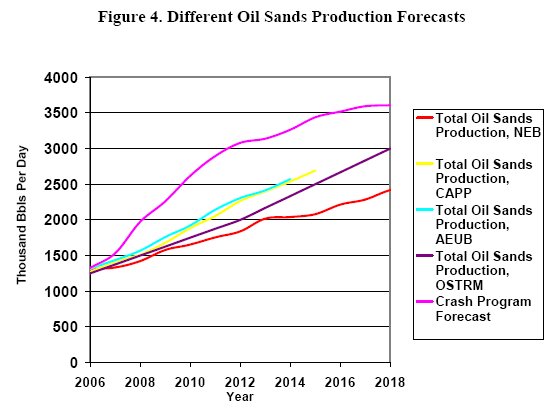

There turns out to be a worrisome supply issue. Here are some claims made about tar sand production going forward.

Predictions for Tar Sands Oil Production

Figure 1 -- Click to Enlarge

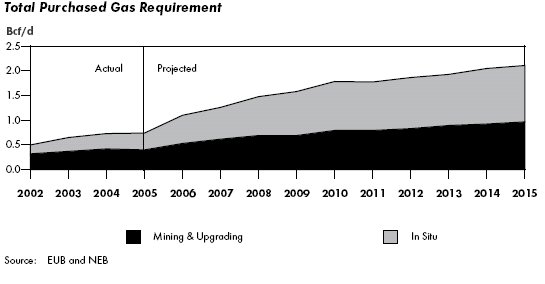

However, tar sands production of approximately 1.0/mbd in 2005 also used 0.72/bcf (billion cubic feet) of natural gas as I read in this brief press release.

According to the NEB's [National Energy Board of Canada] 2006 oil sands Energy Market Assessment, the amount of gas used in oil sands production will rise to 2.1 billion cubic feet a day in 2015 from about 700 million cubic feet last year....This story is about why I don't believe Bill."We don't see any issues on gas availability," said Bill Wall, oil technical specialist for the NEB.

The NEB's Assessment of Natural Gas Usage

Figure 2 -- Click to Enlarge

So, the main questions arising from this are

- What is the state of Canada's natural gas production?

- Do future projections support such a large increase in natural gas usage to support tar sands production?

- Are there are alternatives to using natural gas?

But first, we must discuss how and why natural gas is necessary for producing the tar sands. The newest most efficient in situ method for tar sands recovery uses Steam Assisted Gravity Drainage [SAGD]. As this important paper A Crash Program Scenario for the Canadian Oil Sands Industry by Bengt Söderbergh, Fredrik Robelius and Kjell Aleklett (Uppsala Hydrocarbon Depletion Study Group) tells us:

Natural gas-fired facilities generate steam [for SAGD] and provide process heat for bitumen recovery, extraction and upgrading. Further, natural gas also provides a source of hydrogen used in hydroprocessing and hydrocracking as part of the upgrading process.... Although there is considerable variation between individual projects, an industry rule of thumb is that it takes 1000 cubic feet of natural gas to produce one barrel of bitumen. The demand for mining recovery is a more modest 250 cubic feet per barrel. Current natural gas demand for upgrader hydrogen amounts to approximately 400 standard cubic feet per barrel. Future hydrogen additions for upgrading into higher quality SCO [synthetic crude oil], may reach another 250 cubic feet per barrel. In addition to this, if no coke burning is taking place, yet another 80 standard cubic feet of barrel for upgrader fuel is to be added. Therefore, a future barrel of in situ produced high quality SCO may require more than 1700 standard cubic feet of natural gas....This paper (henceforth, referred to as Uppsala) is the source of Figure 1 and subsequent graphs and information below. It is important to note that in Figure 1, the Uppsala "crash program" estimate is higher than the others, including that of the NEB and CAPP (Canadian Association of Petroleum Producers). However, it turns out that CAPP has just released a new report Canadian Crude Oil Production and Supply Forecast 2006 - 2020 (May 2006) that reflects or even exceeds the Uppsala scenario for tar sands production. Therein we find the following graph.

CAPP Canadian Oil Production

Figure 3 -- Click to Enlarge

In the fine print, we find that 2005 tar sands production was 0.99/mbd with an expected rise to 1.26/mbd in 2006. Tar sands production is expected to rise to 3.5/mbd by 2015 and 4.0/mbd by 2020. Since these numbers are in line with the Uppsala "crash program", their projections gain some credibility. You can find a summary of the CAPP report if you don't want to wade through the whole thing.

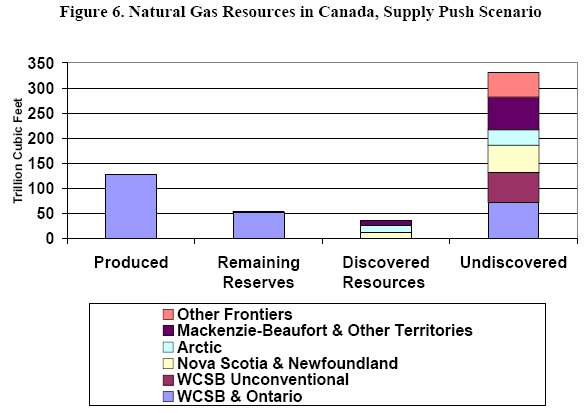

Has Canadian Natural Gas Production Peaked?

The answer is "yes" according to diverse sources. Here in Canadian natural gas reserves continue to fall despite record drilling activity, we find that the Canadian Association of Petroleum Producers records falling proven reserves. Canada's NEB, in agreement with Uppsala, put the peak figure at 16.8/bcfd in their latest report.The profile for Canadian natural gas production appears to have flattened and is expected to remain around 476.0 million m3/d (16.80 Bcf/d) through 2006. As Canadian conventional gas production declines, this may be offset by increases in natural gas from coal (NGC) production. Natural gas from coal, which is also known as coal bed methane, may become a significant contributor to Canadian gas supply in the longer term.For further confirmation, look at the Canadian natural gas country brief from the EIA. Regarding reserves, here's the big picture from Uppsala.By 2006, natural gas demand is expected to grow in Canada and the U.S. to approximately 1 980.7 million m3/d (69.92 Bcf/d) from approximately 1 950.7 million m3/d (68.86 Bcf/d) in 2004, an increase of 1.5 percent.

In Canada the most significant growth in demand for natural gas is from oil sands operations, which could reach 28.6 million m3/d (1.01 Bcf/d) by the fourth quarter of 2006, an increase of 8.3 million m3/d (0.29 Bcf/d) over 2004.

Canadian Gas Reserves 2005

Figure 4 -- Click to Enlarge

This brings us to North America's Arctic natural gas and especially the Mackenzie Delta, which is supposed to be an important new source of natural gas to the Alberta region supplying as much as 1.2/bcfd. The three main fields in this region facing the Beaufort Sea, Taglu, Parson's Lake and Niglintgak, contain about 5.8/tcf (trillion cubic feet) of proven reserves and "undiscovered" reserves may be as high as 62/tcf.

The Mackenzie Valley Pipeline

Figure 5 -- Click to Enlarge

As you can see, the end point of this pipeline is Alberta and the reserves numbers are reflected in Figure 4. However, there are now the usual problems with the construction of the pipeline. No doubt the project will be completed but we can expect the usual delays, cost overruns and other logistical difficulties.

Future Availability of Natural Gas for the Tar Sands

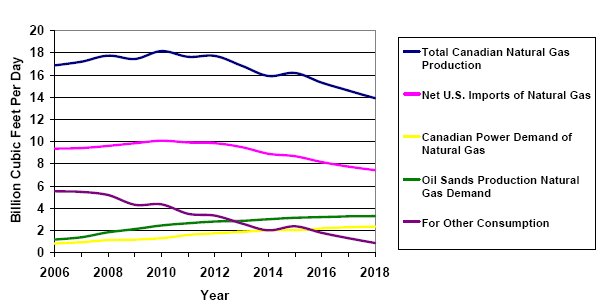

As the expression goes, a good picture is worth a 1000 words. Here it is, from Uppsala.

Available Canadian Natural Gas for Other Consumption

Figure 6 -- Click to Enlarge

Eyeballing the graph, we find that by 2018, Canadian natural gas production will be about 14/bcfd and consumption is projected to go something like this--numbers approximate, of course!

- Exports to the US -- 7.5/bcfd

- Canadian power demand -- 2.2/bcfd

- Tar Sands production -- 3.1/bcfd

- Other Consumption -- 1.2/bcfd

That covers it all, the whole shooting match, which is 14/bcfd. Incredibly, tar sands production is higher than internal Canadian electrical power demand and this leaves a paltry 1.2/bcfd for all other Canadian usage, which would include any industry, agriculture or manufacturing there that uses natural gas. Clearly, this is not going to work. Even if the MacKenzie pipeline comes online successfully in the 2010/2011 timeframe as projected and all the gas transported from the Arctic is used for tar sands production and finally, we assume the WCSB 2005 contribution of 1.1/bcfd (which is almost certainly very generous), there would still be a 0.8/bcfd shortfall of natural gas supply for tar sands production in the year 2018. Something's got to give.

Recall that Uppsala bases its projections on its "crash program forecast" which in terms of tar sands production is equivalent to the latest CAPP longterm forecast of May 2006.

[editor's note, by Dave] Tar sands natural gas usage will reach 1.01/bcfd by the 4th quarter of 2006 from 0.72/bcfd in 2005. According to the CAPP production data, there will be an increase of 0.225/mbd of oil production from 2005 to 2006 accompanied by an increase of 0.29/bcfd of natural gas required for that new production, an astonishing 29% increase in just one year. This is related to increased use of SAGD for in situ bitumen extraction.

Unfortunately, the NEB report only covers the short-term out to the end of this year, so at present I do not know their longer term projections. But we know this much...

Canadian gas produced from the WCSB contributes almost 98 percent of the total gas produced in Canada and will remain the mainstay for the outlook period. Alberta, British Columbia and Saskatchewan contribute roughly 80, 16 and 4 percent, respectively, to the production from the WCSB, while natural gas from offshore Nova Scotia provides most of the remaining production.Regarding Issue #2, I would say "no kidding!" Where's the extra gas going to come from in the longer term? LNG (liquified natural gas) imports? How are you going to get them to Alberta, which is geographically in the middle of nowhere? Natural gas from coal (NGC) [as described by the NEB], also known as coal bed methane (CBM)? A potential source that is almost completely undeveloped in Canada.Issue 1: Canadians are facing high and volatile natural gas prices over the outlook period. Although high gas prices have benefited Canadian economic growth, higher energy costs present a challenge for consumers and the industrial sector.

Issue 2: For oil sands producers, high and volatile natural gas prices have added uncertainty to the cost of their operations. Consequently, suitable alternatives for natural gas are being investigated by oil sands producers and they will make investment decisions based on the overall economics of their operations.

Development of the resource is at an early stage with the production in 2004 at 4.3 million m3/d (0.15 Bcf/d) or less than 1 percent of Canadian gas output.But, most importantly, why would Canadians put up with this politically unacceptable situation in which their scarce natural gas resources are either 1) exported to America or 2) used to produce synthetic crude oil which is then mostly exported to other countries to their detriment and for the profit of corporations like Suncor Energy? To me, the future scenario is completely untenable, both logistically and politically. It is a fantasy world for those who espouse it.

Alternatives to Using Natural Gas?

Uppsala summarizes the alternatives to using natural gas.There are alternatives to natural gas as hydrogen source as well as energy source. However, alternative hydrogen sources, predominantly partial oxidation gasification of coal or oil sands residues have low efficiency, negative environmental impacts and a more complicated process for purification of hydrogen. (Alberta Chamber of Resources, 2003)The first alternative, which uses coal or involves a kind of "bootstrapping" of the operation is obviously costly and has low efficiency. The viable alternative is to build a nuclear power plant there. Jerome a Paris at Daily Kos reported on this back in the fall of 2005 in Big oil getting desperate: Making oil with nuclear energy.Coal combustion in advanced boilers or gasification of residue bitumen, is an option to replace natural gas for energy although greenhouse gas emissions would increase significantly. However, nuclear energy is another possible source of electricity and steam.

French oil giant Total SA, amid rising oil and natural-gas prices, is considering building a nuclear power plant to extract ultraheavy oil from the vast oil-sand fields of western Canada....Unfortunately, my brief searches have not turned up much information about Total's plan--it seems to be moribund for now. Quoting from this Rigzone article, "The extraction process is so labor intensive and requires so much heat, in order to extract the oil from the tar sand that 'Total briefly floated the idea of building a nuclear-power plant' in Fort Mc Murray". So, for right now, the idea seems dead. Also, I suppose it would be possible in theory to provide the required energy with wind, solar, and the rest ... just kidding! -- this would probably require most of Saskatchewan.At the same time, prices of natural gas -- which oil-sands producers have relied on to produce the steam and electricity needed to push the viscous oil out of the ground -- have risen 45% in the past year. That is prompting Total, which holds permits on large fields in Alberta that contain oil sands, to consider building its own nuclear plant and using the energy produced to get the job done....

In conclusion, I do not see where the extra natural gas is going to come from to scale up tar sands production to levels forseen by agencies like CAPP. From the supply side, the logistics (pipelines) and the political side, there are major obstacles at every turn. This will be especially true as more natural gas is required to produce a barrel of oil using the in situ SAGD method. I recommend great skepticism toward claims that this miracle resource will replace a large part declining conventional oil from existing fields. And I haven't even mentioned the water problems. Oh, wait, that's the Canadian Chamber of Commerce knocking at my door.... Gotta run.

A few images:

Steam Assisted Gravity Drainage (SAGD)

Cyclic Steam Stimulation (CSS)

Toe to Heel Air Injection (THAI)

src: oilsands.infomine.com

Terrific job! Kudos! So the key question is how many in Canada are Peakoil aware, who will then logically seek to hoard their resources for future generations? Going environmentally and energetically broke so Americans can continue their Energy Fiesta makes no sense. Mexico and Canada's withdrawal from NAFTA energy export rules is only a matter of time, unless the US strongarms them. But this did not work on Mexico and Presidente' Lazaro Cardenas in the 1930s, therefore we should not expect it to work in this century either. See my earlier postings from yesterday for details. The upcoming Mexico elections could be a key turning point in Westexas & Khebab's export depletion theory to the US-- I expect Mexico to turn Hugo Chavez-style.

At crunch time, expect Canadian eco-terrorists and detrito-terrorists to constantly disable energy flows south. If people are rioting now because energy blackouts prevent them from watching World Cup Soccer, just imagine the violence when Canadians start freezing.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Matthew Simmons, in his interview with Jim Puplova, called the entire process "turning gold into lead." He said the synfuel crude was low quality. (www.netcastdaily.com)

The rather pathetic and alarming potential that oil companies may use nukes to extract oil indicates the lengths the powers that be will go to in order to continue the parasitedigm.

Also, good post, Bob Shaw in Phx,AZ.

The upcoming political contractions will accelerate the undoing of any polity we may see remaining in the world. As the oil producing countries realise that it is not in their interest to continue funding a parasite like the US through currency reserves and unfavorable trading terms. Eventually they will shift their focus inward and will no longer worry about the world's largest consumer market. The corporations who have been shifting their manufacturing facilities offshore for the past 25 years will complete the process and move even their corporate headquarters overseas to more amenable countries -- a process that has already started with much of corporate wealth being offshored for tax breaks. It is only a matter of time before the dollar collapses due to a shift to PetroEuros and PetroRoubles.

We will find ourselves friendless in this cold cruel world with either our hands out, begging for the oil and gas we took for granted, or we will have our weapons pointed, demanding that our "friends" provide us what we want.

My guess is we will use the latter technique. More lives squandered. More energy wasted. More time sifting through our fingers as we continue the parasitedigm.

I hope the Canadians wise up and stop the foolish destruction of their environment designed to fuel our silly lifestyle. But, greed is an international trait and the chances that humans will see the continued track as a dead-end are slim to none. Having just read a very good history of the Spanish Flu, I see that cronyism, greed, political machinations, ego, a tenacious clinging to the old ways even in the face of new understandings, all contributed to the horror of that epidemic, and so it will this crisis.

How can we hope to wise up when there are no stacks of bodies to the ceiling in every corridor of today's hospitals, no steam shovels digging mass graves in Philadelphia, no people collapsing in the streets, and even then the people in power in 1918 did not heed the experts of the time? How can we expect change when cheap oil still reigns?

The countdown is on. We are witnessing a grand and disturbing confluence of events, all destined to result in a reduction of the human population. Anyone with a basic understanding of our pyramidical economic and physical infrastructure realizes that if enough blocks at the base are pulled out, the entire edifice will collapse like so many cans of peas at the market.

God help us.

As a rule of thumb, nuclear heat in the reactor costs $0.50/mmBTU compared to $7 to $15/mmBTU for wholesale gas at Henry Hub (Canadian prices might be lower.)

One problem is that turning nuclear heat into steam requires (so far) rather expensive water. One would have to have secondary heat exchangers but extensive water treatment of the feedwater would be needed since these schemes are one way trips for the steam. Figure maybe $1/gallon for water treatment.

Nuclear process heat has been attempted - Midlands plant in Michigan was to make electricity and supply process steam to an adjacent Dow Chemical plant. Bad building foundations killed that idea and lead to abandonment.

The proton sources (hydrogen) would still need to be methane for the next 20 years at least unless one used expensive electrolysis.

As to Canadian export gas, here in California we're major buyers. I've been telling any one who would listen that our current sources are peaked and depleting but the California Energy Commission seems in denial. Canadian gas also fuels Washington and Oregon and feeds a number of combined cycle plants in those states.

A nuclear plant lasts a long time and produces a LOT of steam (process lots of tar), steam can not travel far cost effectively (a few miles at most). Tar sands need to be brought to the reactor. A reactor will process major quantities of tar sands in 40 or so years.

IMHO, the nuke will consume the tar sands in the neighborhood in a decade or so and the cost of bringing the tar sands to the reactor will climb and eat into the economics.

The only economic reactor would be a electricity producer with "minimal" steam by-product.

It makes more sense to build reactors elsewhere, burn less NG to make electricity and use that NG in Alberta instead.

The real issue with nuclear as I see it is the long lead time and the significant R&D expenses needed to develop the technology. I feel that oil companies still don't have the confidence the prices will stay at such heights in the next couple of decades, needed to justify those investments. NG or coal/coke boilers will be the fuel of choice until their inadequate supply becomes apparent.

I don't see the political will and leadership for such enterprises, and I even doubt that we will have the resources for them.

It is the only option that:

- Is technologically possible. All you need is a uniform designed battery-electric vehicle capable of up to 20 miles of range. (yes) It can be driven short distances off of batteries but is best utilized when driven to an access point (think a monorail like on ramp) and then driven off of direct current. (also possible) While on the rail portion, all vehicles are controlled automatically via computers with programs directing each vehicles movement allowing following distances of maybe an inch or two (also possible)

- Not dependent on liquid fuels. No part of dual mode requires gasoline/ethanol or diesel/biodiesel. All energy arrives via electricity during charging or direct operation. You could attach a liquid-powered generator for extra range tho.

- Solves congestion issues. Even if we made H2 super duper easily, you still have the problem of congestion. By using computer controlled rail movements, you can dramatically increase capacity and speeds and instantaneously load balance without any human interference.

- Can be built today. The infrastructure is not beyond our capabilities. The steel can be procured. Ditto for the electronics and battery equip. No exotic materials are required. Since most tracking would be elevated, limited land acquisition costs are also a plus.

- Can be powered by anything. Electricity is the only source of energy the system uses. As it stands now, our best alternative fuel prospects produce just that. Why worry about biofuels and their pathetic efficencies or Hydrogen and its complex infrastructure needs when you can generate the electrons and use them directly. Plus as our electrical generation mix changes, more fossil fueled now, more renewable later we dont have to reinvent the system. Heck it would even give us several decades to really figure out fusion.

- Can serve private transportation AND public transportation needs simultaneously. A dual mode system would be used by privately owned cars and minibusses that would take advantage of the flexibility. Plus, attaching offline "stations" at strategic points, you could also run totally automated cars that never leave the rails as peoplemovers. This system also opens up new rental possiblities much like airport luggage cart rentals whereby you pick up a cart at any given rental station, use it and deposit it at any other station.

Those are just some of the things I can come up with. Unfortunately you will need governmental buy in and I just dont see that happening anywhere.Great summary. I have always thought that this could be the best solution available now, if only if we had the political will. The costs will probably be in the trillions, but when you look at the benefits, any price will not look that high.

I just want to add one other major advantage that again could allow the idea to be the way forward: compliance with existing infrastructure and scalability. It is not needed the whole thing to be builded at once. We can easily start with local government funded pilot projects in some cities, where existing highways are added rails, being utilised by plug-in hybrids (again startup subsidised by govt). Many competing designs will yield the best possible solution and with time the technology will evolve, pulling forward the battery technology as well. Thus the transition will not be that expensive and can be almost seemingless.

Streetcars serving as circulators and feeding Light or Rapid (subway type) Rail will work well without any technology developments issues. Add bicycles & shoe leather. Much of suburbia will likely be abandoned in any case. No great loss since it was not built to last, takes tyoo much to heat, cool and service (postal, police cannot walk or bicycle due to ultra low densities, plumbers & UPS deliveries take lots of fuel getting around).

It will take decades to get the technological & logistic issues out of some new gadgetbahn. Lets build what works, and workd well today !

Unfortunately this is very unlikely because of the contraints of battery technology. Virtually every battery (except Iron-Nickel) batteris have a short lifespan of about 5 to 7 years. Second Hybrid have all but been proven that they are less efficient than similar sized Internal-Combustion (IC) Engines only powered vehicles. The extra weight and power train conversion (mech-to-electricity-to-mech) outweights the gains of the hybrid (braking losses, idleing losses). Like using NG to extract oil from tar-sands, it would more efficient to build vehicles will less engine power, and make them burn fuel more efficiently (such as Direct Gas Injected IC Engines).

Finally the issue with electric distribute becomes an issue with plugin type vehicles. As the costs of NG and other fuels becomes more expensive (or if supply declines), more and more people and business will use electricity. Demand for electricity will likely rise putting even more stress on a national grid that is already near the breaking point.

All but proven where, exactly?

I've saved this table of well-to-wheel efficiencies for a wide variety of fuel types, with and without the hybrid option. According to the scientists, they all gain from the hybrid technology:

Image, well to wheels efficiencies

http://digg.com/technology/_Hybrid_Cars_Not_Always_More_Fuel_Efficient

What I hate doing is looking up information that is easily accessable via a search engine.

The bottom line is that sticker mileage isn't anywhere near typical results of consumers. Generally the hybrid get better mileage than traditional vehicles because the engines are much smaller. If traditional vehicles where equipped with the same size engines as hybrids, their milage would be better because of the lower vehicle weight (batteries) and without the conversion losses (mech-to-elect-to-mech).

http://www.iangv.org/jaytech/files/Pathways_Part_A.pdf

pathways

The fact that this article is in support of fuel cell and hydrogen and doesn't discuss any of the major issues, leads me to believe this simply a marketing paper, and has no scientific worth.

While I admire your effort to dispute my arguements against hybrids, you need also apply this same effort on questioning hybrids. I believe that if carefully research and understand the issues, you will reach the same conclusions that I have.

Thanks.

http://www.fueleconomy.gov/mpg/MPG.do?action=browseList

It's interesting actually. That previous table shows that a non-hybrid diesel does have higher engine efficiency than a gasoline engine (15.5% efficiency vs. 12.4%), and the gasoline hybrid only touches that non-hybrid diesel efficiency (15.4% vs. 15.5%).

The nice one is the one we can't check in the US market yet, the diesel hybrid (with 18.6% well to wheels efficiency). On the other hand, prototypes of that type do seem to confirm the stellar results:

So you know, when hybrids break the records ...

http://www.greencarcongress.com/2006/01/psa_peugeot_cit.html

I wouldn't recommend relying on a auto manufacturers numbers, as their main objective is to market these cars to groups of people either trying to save money or conviencing themself that they are better for the enviroment. In either case, I believe hybrids do neither.

As I've said many times before, better technology isn't the solution, it simply a path to denial about our future.

For one, people aren't going to simply trade in the SUV for a hybrid. The majority of US american drivers have SUVs and they aren't likely to let go. They'll keep on driving them, until they cant afford to, at which time they won't have money to buy an expensive hybrid. Even if everyone did abandon their gas guzzlers for more efficient cars, the amount of energy to construct them would exceed any savings.

Reduced oil consumption in the West won't lead to a decline in global consumption. The new industrialize nations like China and India will continue to expand their consumption until the system breaks. There are over 2 billion people living in India and China, and every single one of them wants to enjoy the american dream. For every Westerner that wants to conserve there are more than 100 in India and China that want to consume more.

Rather than focus on trying to figure out a way that we all can continue to live our fabulous livestyles on a world with declining energy reserves, you should be focusing on what you can do to prepare you and your family for a permenment energy crisis.

While commercial nuclear power reactors being sold today offer 4400 MW-thermal outputs, submarine reactors come in ~60 MW-th sizes.

Here's is a market for the Russians! They have scrapped their fleets of nuclear subs and I've often thought that they had a missed market opportunity for marine propulsion (high speed transPacific container ships) and in process heat.

One could package a mobile process heat reactor but it would need shielding for operation and defueling capability. Do-able - in fact, done. The US built packaged reactors for field outposts in the '50s. Our Antarctica base had a reactor for many years. More applicable, the Army designed and tested a reactor for powering DEW line radar installations - the infamous SL-1 that pinned an operator to the ceiling with a control rod from an overpower excursion event.

Too bad my employer is so focused on the electric markets - comes from having "Electric" in its name I guess.

Its unlikely that a rail based reactor would be large enough to supply the quantities of steam required. Small HO naval reactors use highly enriched uranium (or plutonium) which isn't permitted in commerical reactors.

Plus, NG is still required to upgrade bitimen to higher quality crude.

I suspect that in the future operations could switch to syngas (CO & H2) for production. A pipeline could be constructed to transport syngas from a gasifier located near coal fields to the tar-sands. However it might be more pratical to just convert the coal to liquid fuels instead of trying to extract oil from tar sands.

Any chance you'll discuss the water situation? My understanding is that they are using too much water to sustain the forcast levels of production, but I'd like to see a more in depth analysis.

I'll second that request. I gather that the water situation is precarious, but don't know much about the details.

Great post Dave, as always.

But having just found the 2006 NG EMA, I am off to read it (and the Upsalla Report).

This figure doesn't seem right. I have a feeling that a large amount of steam will be absorbed in the sand/soil and won't be recoverable. Plus the water will pick up minerals from the soil and cause issues for the boilers (scale buildup). Sure it could be treated but that would add significant costs.

We don't have a choice. Brian Mulroney and his Conservative gov't sold us out.

Under Chapter 6, Article 605 of NAFTA, Canada:

"may not impose a higher price for exports of an energy or basic petrochemical good to [the US] than the price charged for such good when consumed domestically, by means of any measure such as licenses, fees, taxation and minimum price requirements"

and

"may not reduce the proportion of the total export shipments of the specific energy or basic petrochemical good made available to [the US] relative to the total supply of that good of [Canada] as compared to the proportion prevailing in the most recent 36-month period"

Pulling the plug on NAFTA cuts both ways. If that pipeline shut down, northern Mexico (with much of its industry) would shut down.

I am assuming from your reply that you are a Canadian Citizen. Can you inform us on how many Canadians are becoming Peakoil aware, and are any politicians starting to discuss NAFTA changes? I forget the name of the Nova Scotian cable millionaire turned politician--is he gaining political strength to lead energy reform? Canada needs to nationalize its energy industry, like Putin did GAZPROM, and Cardenas formed PEMEX, to help force energy conservation upon the unwashed American masses. Our US politicians are spineless bastards by allowing the Energy Fiesta to continue its wasteful ways instead of reinstalling Pres. Carter's ideas from long ago.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

How many Canadians are becoming Peakoil aware?

I have no hard numbers to offer you, only anecdotal evidence. Our national broadcaster, the CBC, has aired both The End of Suburbia as well as it's own documentary. The chief economist at one of our largest banks, CIBC World Market's Jeff Rubin, came out earlier this year and suggested conventional oil production peaked in 2004. So it's out there. But when I speak with people, for the most part I here crabbing about our gas taxes and the usual "The oil companies are ripping us off" arguments. Generally speaking I'd say we are more PO aware than the US, but rather less than the Swedes.

Are any politicians starting to discuss NAFTA changes?

Crikey, we can't even get up the gumption to fight for a fair deal on our NAFTA softwood lumber dispute, so I wouldn't hold your breath waiting for a serious NAFTA energy discussion. The US is our largest trading partner - it's difficult to negotiate with your economic nuts in a vice.

I forget the name of the Nova Scotian cable millionaire turned politician--is he gaining political strength to lead energy reform?

Not sure who you mean. Sorry! In Ontario (where I am) the NDP do a lot of talking about energy reform. But the chance of them forming a government are about the same as my winning the lottery next week. Looks like we're going to nuke up - two new reactors are planned.

Canada needs to nationalize its energy industry, like Putin did GAZPROM, and Cardenas formed PEMEX, to help force energy conservation upon the unwashed American masses.

Been there, tried that, with Prime Minister Pierre Trudeau's National Energy Program back in 1980. The Albertans didn't think it was so funny, and suggested "the Eastern bastards freeze in the dark". Not a hope in hell with Prime Minister Harper and our current Conservative government in power, nevermind "King Ralph". I think American Anschluss would be more likely. You can call it Manifest Destiny if you prefer.

There have been many screenings of the End of Suburbia documentary (produced in Toronto) with audiences in the hundreds. EOS has also been screened in the suburbs. EOS has also been shown on cable on the Vision Channel. The new documentary Oil Crash was shown recently at a documentary film festival and drew an audience of over 700 for a late night (1:00am!) screening and panel discussion.

Last year the Globe and Mail, which styles itself Canada's newspaper of record, ran a seven day special feature on peak oil in its business sections, titled "Crude Awakening". A number of journalists, including Eric Reguly of the Globe have written on peak oil.

In the financial community, economist Jeffrey Rubin of CIBC World Markets and Eric Sprott of Sprott Asset Management (a respected portfolio management firm) have written on peak oil.

Awareness is slowly percolating up to the political classes. Last week I attended a showing of EOS by the East Toronto Climate Action Group that was followed by a panel discussion that included two provincial and one federal politican. All were aware of the issue, but it doesn't yet have much profile. They just are starting to think about policy implications.

The City of Hamilton, Ontario, has been conducting a long term economic planning execise. The commissioned a report on the implications of peak oil from consultant Richard Gilbert that was presented to the council a few months back.

The City of Ottawa, Canada's capital, last fall held a one day citizens conference and consultation on peak oil.

Canada is in a difficult situation. Domestically, we produce more crude oil and natural gas than we consume, so we are a net exporter. The reality is more complicated. When it comes to oil and gas there are really two Canadas. Western Canada is self sufficient in oil and gas and exports about 2/3 of its production to the US. Eastern Canada (Ontario and all provinces to the east) is an importer of oil, from the international markets (North Sea, Middle East, Nigeria and Venezuela) and gas (from Western Canada). As I understand it even the oil and gas that is produced in the east, offshore of Newfoundland (oil) and Nova Scotia (gas)is mostly exported to the US.

While western canadian gas is moved to eastern markets over pipelines on Canadian territory, the limited amount of western canadian crude that does reach Ontario must travel through US pipelines.

Canadian internal politics will hamper any attempt to retain oil and gas in Canada for Canadian use. In the late seventies, the Liberal government under Trudeau attempted to bring in a "National Energy Policy" (NEP) that would have provided Eastern Canada with domestic oil at a price lower that world prices. The govenment also set up its own nationalized oil producer, Petro Canada. When the oil markets crashed in the early 80's, Albertan's blamed the NEP. When the Conservatives took power under Mulrooney, they cancelled the NEP and gutted the powers of the National Enery Board, instituting "market driven" policies.

Further, they negociated the Free Trade Agreement (FTA, precedessor to NAFTA) that, IMO, traded eastern Canadian access to US markets for manufactured goods and commodities for guaranteed US access to Albertan oil and gas. The deal is structured to limit any Canadian Federal government control over oil and gas production, sale and export. This made Albertans, who had vowed to "let the eastern bastards freeze in the dark" happy.

Canada could retake control (at the federal level) of oil and gas production if were to withdraw from NAFTA, but the price would be very high. I doubt that the US, agreement or no agreement, would tolerate any decrease in oil and gas supplies.

Big thanks for your replies! Never realized how divided Canada is in the political realm [West vs East], and also in its energy infrastructure. Sad to read that some of the west-to-east NG flow is thru pipelines on the American side. I suggest building your own trans-Canadian pipeline to send native NG eastward, so then when internal NG finally depletes: you can then offload imported LNG in Newfoundland or Nova Scotia, then send it westward at some future time. If not, your reliance on American NG pipelines means that the US can unilaterally impose an uncomfortably cold, future 'Ukrainian transit fee'--Yikes!

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

There was an article a few months ago on Energybulletin.net that discussed Canadian legislature to end energy exports (both oil and gas). Although I haven't read anything new recently about it.

Well, let's see if we can make use of that to calculate a rough EROI. Presuming natural gas is the lion's share of the energy input (that is, coal is not yet making inroads), and 1 cubic foot of natural gas contains 1,000 BTUs, and 1 barrel of oil contains 6 million BTUs, that gives an extraction EROI of 8 to 1. Of course the overall EROI will be worse, because that just considers a single aspect of the process. The low side of conventional extraction is down in the 10 to 1 range, so that gives an indication of how tar sands extraction compares.

I wouldn't be surprised if the total EROI is in the 5 or 6 to 1 range. Of course this neglects any environmental considerations, as well as the remediation of the damage. But it does give a ballpark for the process.

RR

The article also has some info about Suncor's attempts on cutting down on natgas use.

Please take this the right way, but your EROEI comment misses my main point, which is -- where is the gas coming from in the future? I don't think the EROEI is the issue currently and I didn't discuss it for that reason, given that natural gas supplies remain sufficient and the costs are reasonable to keep the EROEI profitable in current circumstances. However, that begs the question. What will future natural gas demand be to produce the tar sands and what will be the cost of the required natural gas going forward? Much higher, I'll bet. In this case, EROEI goes down and down....

And of course I agree with your comments about the "hidden" costs to the environement.

best, Dave

Well, if the EROEI is really 8 to 1, then I would anticipate that they would eventually start cannibalizing part of their production in order to drive the process. You can't do that with a low EROEI process.

But the reason I calculated the EROEI is that I have only seen estimates, and I had never seen a report on natural gas required to make X barrels. I have heard EROEI for tar sands quoted as low as 1.5 to 1, but it looks like it may be a bit better than those reports.

Regardless, I don't advocate tar sands development. I think it is sad that we are willing to go to these extremes to ensure that the oil keeps flowing.

RR

1700 Cubic Feet to make 1 barrel of crude

1 Cubic foot = 1031 btu

1 barrel of crude = 5.8 mmbtu

5.8 mmbtu / 1.752 mmbtu = EROI 3.3

But this doesn't include energy expenditures in process operations. In the case of current tar sand production, heavy machinery is used to mine and transport the tar-sands to the processing plant, and the tailings also need to be transported to a dump site. If I recall correctly, a scientific report on EROI for the Canadian Tar sands was estimated to be about 2.

1 Cubic foot = 1031 btu

1 barrel of crude = 5.8 mmbtu

5.8 mmbtu / 1.752 mmbtu = EROI 3.3

You have 2 errors in your calculation. The first is that the 0.72 bcf was per day. The second, is if you presumed it was per year, you get an EROI of 3,000, so you were also off by a factor of 1,000.

Here is the calculation. 1e^6*6e6/(0.72e9*1000) = 8.33.

RR

I am assuming that it takes about 1700 cubic feet of NG to extract and upgrade (hydrogen enrichment) to make 1 barrel of crude. I am not factoring in any other estimates.

I wouldn't recommend using the daily volume NG gas consumption, since some of the oil is liquid enough to be extracted using progressive cavity pumps or other extraction technics where steam (or heat) isn't required to recover the oil. Eventually the limited volume of tar-sands that these processes can be used will be depleted and the remaining oil will require NG or some other heat source for extraction.

You quote the new CAPP forecast but it is clear they do not believe it themselves. They say

They then go on to produce a far more modest forecast called "constrained development case" As constraints they quote restrictions on qualified manpower, limited refining capacity, economic competition from other industries for such things as steel and fabrication facilities and the uncertainties of steam assisted gravity drainage(SAGD) as a new technology. They do not list natural gas shortages.

The new graph is not much different to their earlier forecast and that of Uppsala. Perhaps someone can reproduce this (chart 6).

This has echoes of the IEA tactic of having an optimistic, supposedly main forecast and hidden in the back of the document a much lower (restricted investment) forecast that is clearly judged by them to be a more likely.

Re: "the cost of a small amount of surplus pipeline capacity is preferable to the lost revenue from shut-in production due to insufficient pipeline capacity".

Huh? Where is this surplus pipeline capacity coming from? The costs of insufficient pipeline capacity are potentially very large eg. the MacKenzie pipeline. There is apparently a trade-off here. The oil sands producers like Suncor must take into account how much it will cost them to get sufficient gas into the Athabasca region to make the oil sands production operations work ie. profitable.

I did not quote the "constrained case" but gave the reference so people like you could check it out.

Re: "... the IEA tactic of having an optimistic, supposedly main forecast and hidden in the back of the document a much lower (restricted investment) forecast that is clearly judged by them to be a more likely".

Yes, indeed. CAPP does not consider natural gas issues at all as far as I can see -- although the Canadian NEB does. Note that their forecasts are much more conservative than those of CAPP.

The rediscovery of the entire global deepwater resource (52 bill barrels) would only provide 3 years of the current annual drawdown on global liquid reserves, ie difference between current production over new annual discoveries.

Holy hell batman we have a problem!

http://www.iht.com/articles/2006/06/18/news/environ.php

it goes on to say that this stuff used to be exported for further refinement before the war, and if the situation doesn't improve iraq's currently working refinery's and i would also guess they would stop or at least further slow down extraction as well.

By the way, I left an apology to your comment back at the oil shale thread. Sorry!

It actually is even more complicated than Dave makes out. Ottawa, for example, has decided to remove 7,500 MW of coal-fired plants. The presumption is that this will be replaced by a gas-powered plant, in much the same way as almost all the new generating capacity in the US has been based on natural gas.

However, to put the increase in demand for natural gas for the oilsands in context, the increase in demand that the Canadians anticipate (from the current 0.8 bcf to 1.5 bcf by 2010) is not that great, relative to the overall picture. It is on the same level as the anticipated increase in demand for NG in the Western US according to the EIA. Some of the supply to meet this need will likely come from the new LNG plant that is going into Costa Azul in Baja California. Given that Canada currently exports, in the west, some 2.8 bcf to the US, I would rather think that the topic of the natural gas supply to the oil sands cannot be separated from the looming problem of natural gas supply to North America in general. (I am getting my info from the current EMA on Natural Gas that came out this week, and which can be obtained as a 4723 kb pdf file here ).

The EMA points out that the oilsands folk are already initiating co-generation (to the tune of 1,568 MW) and other energy-saving steps in their move to conserve demand and keep operating. There is, after all, some gas generated during the refining process that can also be used to help with power generation.

Oh, and in closing, I can't help but include this map from the EMA, which seems to have an awful lot of arrows pointing at the location of a certain individual (grin).

I was aware that the NEB conflates the Canadian/US natural gas situation since it makes no sense to do otherwise.

However -- and you and I can argue over this -- it makes little sense to me at this point (and to EXCEL Energy back in Colorado, where I used to live, who want to put a coal-fired plant in Pueblo) to plan for a natural gas future in North America based on LNG since gas production has evidently peaked on this continent and increased LNG imports are not available at this point. Who knows, perhaps you better than I, how that's going to work out when the going gets rough in the world market. I suppose the contracts have been worked out. Qatar, Our Saviour. But where are the additional LNG processing plants here in North America, today, as I type this? When and where are they coming?

Re: "The EMA points out that the oilsands folk are already initiating co-generation (to the tune of 1,568 MW) and other energy-saving steps in their move to conserve demand and keep operating. There is, after all, some gas generated during the refining process that can also be used to help with power generation".

Given that I said the following,

I am therefore not yet impressed with "co-generation" efforts or other energy-saving steps that replace natural gas in tar sands production.best, Dave

I think what you are referring to here is Premier Dalton McGuinty's promise to close Ontario's coal fired generation. This decision is provincial rather than federal and so came from Queen's Park (Toronto) rather than from the federal government in Ottawa (although McGuinty's own provincial constituency is in Ottawa just to confuse matters). The coal plants were originally slated for closure in 2007, then 2009 and now their closure date has become open-ended. The Lakeview plant in Toronto has closed already, but I understand that it's gas conversion has not yet been completed as planned.

It recently became clear to Energy Minister Dwight Duncan that closing the rest of the coal plants would result in insufficient generation capacity to meet demand (it had been clear to everyone else from the beginning). What's more, closing coal plants in southern Ontario would result in higher power imports from the US, where it would be generated near the border using dirtier coal plants than ours and the smog produced would promptly pollute southern Ontario anyway. As the justification for the closure was meant to be air quality, it is obvious that it would an own-goal on at least two fronts (supply and pollution).

The blanket closure promise would also have been a huge blow for Atikokan in north western Ontario, where they have a clean and modern coal plant which also provides much-needed employment in this remote area. Closing it would have been completely pointless. The plant isn't entirely off the hook, but it has been promised that it will be able to continue operating for at least the next three years.

As for conversion to gas-fired generation, I don't think McGuinty is really aware of the potential for problems with gas supply and price volatility. His last energy minister (Donna Cansfield) was recently suggesting providing public subsidies for people to convert their electric appliances to natural gas. Either she was unaware of the potential for price/supply issues with gas or she was cynically trying to shift demand from a subsidized energy source (electricity) to an unsubsidized one (gas) in order to dump the problem into the laps of unsuspecting consumers. If the Ontario government would just stop subsidizing power consumption they would buy themselves some time to mitigate the looming supply shortfall - far better than convincing consumers to jump from the frying pan into the fire for no good reason.

What I would like to see McGuinty doing is offering a pre-payment metering programme like the one in Woodstock. It's voluntary, popular with consumers, lowers utility costs by doing away with billing, eliminates bad debt, empowers consumers to manage their own consumption through feedback, and lowers consumption by 15-20% even in the absence of special education or incentive programmes. McGuinty is planning to introduce smart meters with time of day pricing, but should go one step further and bring in pre-payment with feedback.

Apparently, a water squabble really put a stake through its heart.

SCE will have the coal-fired Intermountain project coming on line is a few years but that's 1200 MW as I understand it. There is also some geothermal potential, maybe a whole GW, that could be developed to feed SoCal.

One still gets the idea that ultimately, natural gas will be the replacement fuel, and probably LNG at that.

There are a number of pipelines, existing and not... between the Pacific and Alberta. An LNG import/export facility is also being installed at Kitimat, BC... that's the one... I believe, with significant Chinese investment.

I have no doubt that in the next decade, if the City Council in my town get their collective heads out of their bums.. you'll be seeing an LNG import/export plant at Port Alberni BC as well.. there is already a sizable Terasen/Kinder Morgan pipeine here for the Paper mill.

What pipelines run from non-existing but planned LNG processing facilities on Canada's west coast to Alberta where the tar sands are?

I'd be interested to know. A map would be helpful.

So some gas will follow a "V" with Kitimat at the point.

Good quality natural gas is already 95+% methane.

Methanex has plants in politically stable places with cheap NG.

Question .......is any new project not using the *OPTI process in the feasibility studies?

And as it uses no NG a lot of the conversation here would have been fascinating two years ago

but seems a bit curious in 2006...as for ....heel toe......im a doubter..... lets see how the test goes but the Opti method works.

swale13 mentioned the so called "OPTI process...for those not yet familiar....

http://www.aapg.org/explorer/2005/05may/dinning.cfm

Kicking the (Natural Gas) Habit

According to Dinning, "injecting natural gas into the oil sands to produce oil is like turning gold into lead."

In a 2004 report on Canada's oil sands, the National Energy Board stated that natural gas costs can comprise up to 50 percent or more of total operating costs in a thermal -- or steam assisted -- in situ project.

Dinning described gasification technology that offers an elegant solution to the natural gas crunch that Alberta's heavy oil producers will face during the next decade. According to a 2004 Canadian Energy Research Institute (CERI) report, natural gas consumption for oil sands extraction and refining -- currently sitting just below a billion cubic feet per day -- could skyrocket to between 2.2 and 3.7 billion cubic feet per day by 2017, leaving many wondering where the gas will come from to fuel future expansions.

Even the proposed Mackenzie Valley pipeline -- scheduled to ship 1.8 billion cubic feet per day from the Canadian Arctic to Alberta -- would not feed the oil sands producers' growing appetite for natural gas.

In 2004, Alberta's oil sands industry produced about a million barrels per day, or close to 50 percent of Canada's total daily oil production. Based on CERI's most likely growth scenario, daily production from Alberta's oil sands could hit 2.2 million barrels of synthetic crude and unprocessed crude bitumen by 2017.

The OPTI solution....

OPTI's unique combination of extraction and upgrading technology makes it the poster child for the new wave of energy efficient oil sands mega-projects.

At Long Lake, the liquid asphaltenes are sent to the gasification unit where they are converted into synthetic gas (or refinery off-gas), steam and hydrogen. The synthetic gas, or "syngas," has a heating capacity of about 300 British thermal units per standard cubic feet, as compared to 1,000 British thermal units/standard cubic feet for natural gas.

The syngas will be used to generate steam for the SAGD process. Instead of flaring excess syngas, this "free" energy source will be harnessed to generate power onsite in the cogeneration facility.

Excess power will be sold to Alberta's deregulated power grid.

Of course, all this relies on what no one wants to talk about....substitution of natural gas with bitumen, or essentially, coal.

But what about the Greenhouse Gas problem? To continue quote:

"Using coke as an alternative energy source -- while seemingly attractive -- presents some challenges for Alberta's oil sands industry:

* On the one hand, a coke pile represents a waste by-product from the upgrading process that can be gasified to produce energy.

* On the flip side, a coke pile is a valuable carbon sink, and a commodity that can be used in the future to offset greenhouse gas emissions under the Kyoto Protocol.

Suncor has been burning sulfur rich coke in its boilers for decades at its mine near Fort McMurray. However, the gasification of the coke -- which will liberate carbon dioxide gases -- must be offset by carbon dioxide capture and sequestration. And, that might require the construction of a pipeline to transport carbon dioxide south where it could be used in Enhanced Oil Recovery (EOR) projects or sequestered in depleted oil and gas reservoirs.

The challenge, according to Lewis, "is how do we build this gasifier and fulfill our commitments to Kyoto?"

"Suncor is weighing the balance between a good business decision and long-term environmental responsibility," she added."

---------------------------------------

So we are somewhat back to where we started. The use of the bitumen gas as driving fuel cuts the amount of BTU's available by two thirds compared to natural gas, and we will have to try to find some way to sequester the carbon, in other words, the same problem we would have if we did CTG (Coal to Gas) or CTL (Coal To Liquid). But, as mentioned at the opening of the piece, despite early assurances that "there is plenty of gas", there now seems to be considerable concern that there is not.

So far, we have come up with the most complex Rube Goldberg contraptions possible to get to use the tar sands. But who needs them? If you are going to burn first, natural gas, then switch to bitumen, essentially coal, then convert the coal to gas, and then have to sequester the carbon from the coal....(!!!!!), the whole thing gets more farcical as more and more parts are bootstrapped to it!

Again, it would be much less damaging to just burn the nat gas directly, or, as much as I hate to have to say this, you would almost come out ahead by going CTL and burning the coal (described in the article, forebodingly as "almost infinite"), and trying to sequester the carbon without the added annoyance of the tar sand...

How much more complicated does this mess have to get before even the investors start asking quesions? And how long before everyone admits that if global warming is a real threat, we are up that old proverbial creek, because almost nothing will stop us from releasing that carbon....?

Roger Conner known to you as ThatsItImout

Always a pleasure to read that we're all uninformed.

Number 1, that's a pretty wide net you are casting. And number 2, insulting "this group" is not an effective way to communicate your message.

Having said that, look above at the post in which I calculated a rough EROEI. I said that in that case, they would probably start cannibalizing part of their production in order to drive the process. That appears to be exactly what the OPTI process does. I didn't know they were doing it yet, but it is the logical way to go if the EROEI is in the 6-8 range, since natural gas supplies are scarce.

RR

I'm having problems getting Uppsala report after update. Am I the only one?

I'm trying to pin down the movement of the numbers represented in figure 6 in the shorter term.

Oils sands production is slated to double from 1 to 2 mmbpd in the next 5 years. This will roughly double gas usage from 0.75 Bcf to 1.5 Bcf in 5 to 10 years. But these are just projections. We don't really know how things are going to turn out. Although I agree with your assessment that it doesn't look good.

14 Bcf number for total Canadian production in 2018. This relies on the assumption that Canadian production has peaked and entered an irreversible decline. How confident can we be that this will be the case?

How much do these numbers reflect the possible substitution of nuclear and coal-driven electricity generation? How much do they take into account possible changes in the transfer of energy to the US?

Re: How confident can we be that this [irreversible decline] will be the case?

Even NEB admits a peak. Your question depends on successful E&P of "undiscovered" natural gas resources, including Coal Bed Methane. There are the usual questions about investment, logistics (equipment or location--the Arctic) and timeframe, ie. resources put online versus almost certain declines in the WCSB, where 80% of Canadian production comes from.

There is a experimental drilling project called Mallik 2002 in Canada. It apparently produced gas for a few days before they capped it. Whenever I try to look for followup plans there seems to be nothing there. There is a site about that project but that is not updated since 2003.

Anyone here has some knowledge about this? I vaguely recall reading that this was hydrate that was formed when content of a NG field got in contact with permafrost, allthough that might have been with regard to another project..