Tech Talk - Drilling off the Atlantic Coast

Posted by Heading Out on November 7, 2011 - 12:20pm

When the U. S. presidential administration changes, particularly when that change involves a different political party, the results relating to energy policy and ultimately energy availability and price can be - but are not always - significant. In recent posts I have cited Governor Perry’s Energy Plan were he to come to power, and have noted that for some issues, the change in power may not have much effect. This is particularly true where the energy reserve is already being produced, with production levels controlled to a degree by things such as price, rig availability, and the potential promise of a well.

But there are some regions of the country where government policies can have a greater impact on potential production. So the last region I have left to discuss of those included in the Governor’s Plan is the Outer Continental Shelf (OCS) and particularly that off the Atlantic seaboard. However, it is not only Governor Perry who recognizes the potential promise of the region. This is a theme that ex-Speaker Gingrich, another presidential candidate, has also sounded. His remarks were directed at the benefits of dredging Charleston’s port, thereby supporting the OCS activities and potentially adding 8,800 jobs in S. Carolina.

The most likely area to be leased first is that off the coast of Virginia, designated as Lease Sale 220.

At the time, it was estimated that the area might contain 130 million bbl of oil, and 1.14 Tcf of natural gas.

President Obama continued support, proposing to open the Atlantic Seaboard to drilling back in March, 2010. Unfortunately, while the initial plan had been for lease sales to begin off the coast of Virginia this year, that was put on hold with the Deepwater Horizon disaster.

Following the sealing of the well in the Gulf and after due review, the Department of the Interior released a statement last December that noted, relative to the Atlantic and other locations:

Based on lessons learned from the Deepwater Horizon oil spill, the Department has raised the bar in the drilling and production stages for equipment, safety, environmental safeguards, and oversight. In order to focus on implementing these reforms efficiently and effectively, critical agency resources will be focused on planning areas that currently have leases for potential future development. As a result, the area in the Eastern Gulf of Mexico that remains under a congressional moratorium, and the Mid and South Atlantic planning areas are no longer under consideration for potential development through 2017. The Western Gulf of Mexico, Central Gulf of Mexico, the Cook Inlet, and the Chukchi and Beaufort Seas in the Arctic will continue to be considered for potential leasing before 2017.

However:

Because the potential oil and gas resources in the Mid and South Atlantic are currently not well-known, Interior will move forward with an environmental analysis for potential seismic studies in the Mid and South Atlantic OCS to support conventional and renewable energy planning. No lease sales will be scheduled in the Atlantic in the 2007-2012 program or in the 2012-2017 program.

The current emphasis has been on the Mid-Atlantic States, particularly Virginia and South Carolina, where there is support for the idea. In contrast, New Jersey has expressed concern over the risks of offshore drilling in the past and Governor Corzine was particularly outspoken against offshore drilling or leasing acreage, feeling that it would threaten the tourism and fishing industries of the state. Governor Christie (who replaced Governor Corzine) has retained that opposition to drilling off New Jersey, but is apparently not as passionate about states further south.

The OCS was first surveyed by the USGS back in 1974, and from 1976 on some 40 wells were drilled, though none brought in commercial quantities. President Carter approved a five-year leasing plan in 1980 that saw an additional 50 leases sold over the next two years. But in 1990, President Bush withdrew the Atlantic OCS from lease potential. That action was in process of being reversed at the time of the GOM oil spill. (Linda Bennan.)

The possible change in the party that holds the presidency might therefore influence the opening of leases to develop the Atlantic OCS. However, given that it was a Republican president who withdrew the acreage in the past and that this has been advanced by Democratic presidents, it is not necessarily a conclusive declaration. This is particularly the case given the objections of some of the Republican governors.

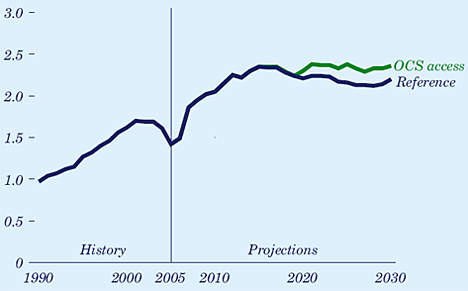

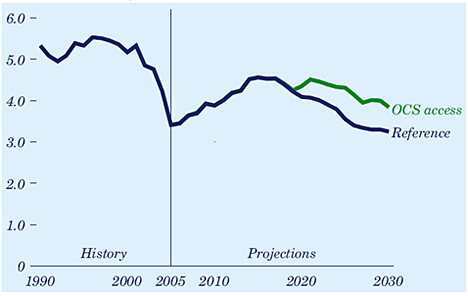

But even if the decision is made to go ahead, the EIA considers it will take at least four years from the sale of leases until production from any identified reserves can begin, and in some cases such an interval is considered optimistic. (Art Berman has pointed out that in the sequence of first carrying out new seismic work, then drilling an initial well, followed by appraisal wells, that if that first well were to be successful, then the construction of production platforms would likely move the timeline out closer to ten years). Estimates of the total oil and natural gas available vary quite widely. The BOEMRE thinks that there is 0.5 to 1 billion barrels of oil in the Mid Atlantic and 0.03 to 0.15 billion barrels in the South Atlantic. But with the slow rates of development, it is unlikely that the production will exceed the estimate of the EIA, which foresaw some years ago that this new OCS production might possibly only stabilize production of offshore oil.

It was not expected to stabilize offshore natural gas production.

In this regard, the model that the EIA uses in predicting production from these fields is:

For currently producing fields, a 20-percent exponential decline is assumed for production except for natural gas production from fields in shallow water, which uses a 30-percent exponential decline. Fields that began production after 2008 are assumed to remain at their peak production level for 2 years before declining.

In passing, lease sales are anticipated to restart in December for the Gulf of Mexico in waters ranging from 16 to 10,900 feet deep. The prospects are considered to have the potential to the production of between 200 and 450 million barrels of oil, and 1.5 to 2.65 Tcf of natural gas. However, minimum bids for the acreage bave risen from $37.50 to $100 an acre.

(H/t Gail and Art)

A quote from Congressman Roscoe Bartlett........."we are going to leave our kids a huge debt"......"Wouldn't it be nice to leave them a little oil, so that they might have something to work with, with that huge, huge debt"

http://www.youtube.com/watch?v=KWh85pJlB-U

"But even if the decision is made to go ahead, the EIA considers it will take at least four years from the sale of leases until production from any identified reserves can begin, and in some cases such an interval is considered optimistic".

"Art Berman has pointed out that in the sequence of first carrying out new seismic work, then drilling an initial well, followed by appraisal wells, that if that first well were to be successful, then the construction of production platforms would likely move the timeline out closer to ten years".

Whatever it is that they're smoking, I'd like some ...

I have worked on Hibernia, Shallow Panuke, Sable Island and Deep Panuke.

Hibernia:

(I can't remember when the leases were picked up, probably early 1970's); Oil discovered 1979, start of development 1986, start production 1997

Sable Island

Discovered 1979, development started mid 1990's, on production 1999

Deep Panuke

Discovered late 1990's by deep drilling at Shallow Panuke (and THAT was another story, an on-again off again pair of small, rather marginal condensate pools)), development started early 2000's, scheduled to be on production 2005 to 2012 and still counting.

So allow 2 to 3 decades, not ~4 years.

The one other major problem that sticks in my mind WRT Hibernia, Sable Island, Deep Panuke is that the P90 and P50 reserves kept getting smaller ...

The structure at Hibernia got ever smaller and more and more complicated.

There is a wonderful bright spot at Deep Panuke ...looked like Tcf's of gas .... unfortunately, it's a shale plug in the top of the reef.

The Atlantic seaboard is close to the GOM, so that the rigs can be brought around. But there is no supporting infrastructure. At least there's no icebergs.

(And anybody remember the Ocean Danger?)

Supposing a discovery will be made ... off South Carolina ... then there will be political pressure for jobs-for-the-good ole boys, just like in Nova Scotia and the New Found Land.

(However, a friend of mine was at a hearing regarding Sable Island development in the fishing port of X in N*v* Sc*t**.

He was approached by a group of angry fishermen. "We don't want the gas developed!"

"Why not, it'll mean jobs for you".

"We don't want the jobs, we want to fish for 12 weeks and go on pogey for 40!")

Note this progression. The Oil Shock Model uses a similar progression to estimate the production flows from a sequence of discoveries. The phases after discovery are fallow, construction, and maturation before production reaches a maximum. This sequence with mean delays is responsible for the temporal shift that we see between a discovery profile and the final production profile.

WHT,

I must admit that most of your previous commentary here has been over my head, as I have almost no training in your specialties;and that little bit has been slowly rusting away for four decades plus now.

But I can still get the gist of your arguments, most of the time.

It would be a very good thing if you, or somebody of your choosing, were to go over your work, and put together a dumbed down version of it accessible to the general public.The large majority of us lack not only the training but also the time and enthusiasm necessary to following a long, highly detailed mathematical model through to the end.

If this has already been done, somebody please post a link to it.

"The phases after discovery are fallow, construction, and maturation before production reaches a maximum".

Uh, no.

Offshore oil and gas fields are always run at facilities throughput capacity as soon as possible to recover exploration and development Capex ASAP.

What happened at Hibernia:

1.Discovery in 1979,

2. field delineation in the early 1980's including several expensive D&A's (O-37 WAS NOT MY LOCATION, OK??? So it was as wet as the ocean, it was NOT MY FAULT)

3. 1986 oil price crash nearly killed the project,

4. Gulf Canada bailed out around 1987 because they were over-extended with too many big frontier projects (Hibernia, oil sands, arctic islands) and nearly killed the project,

5. PetroCan took over Gulf's interest and then bailed after privatisation in the early 1990's because they were overextended with too many big frontier projects (Hibernia, oil sands, arctic islands and one other, I forget) and nearly killed the project,

6. facilities design took forever because of the hostile environment and it's a heavy waxy crude stored in a concrete caisson in cold water,

7. and I think there were the usual problems with the Newfie Gov't AS USUAL.

Hibernia was never fallow, there was always work going on despite several near project abandonments for financial reasons.

Sable Island and Deep Panuke have had similar trajectories.

The problems here were that

1. neither field reserves were as big as had been hoped,

2. Sable Island gas (ExxonMobil operator) is wet sweet gas and Deep Panuke gas (Encana operator) is dry sour gas, so they absolutely cannot use the same gas facilities.

3. ExxonMobil wanted Encana to run its gas through the Goldboro facilities which were designed for a totally different gas chemistry. Encana now has an offshore facility and a sour gas disposal well.

Sable Island was run at 500 MMcf/d for as long as they could, until the bottom fell out of the Triumph field.

Then I lost interest and went on to other things

Offshore oil and gas fields are always run at facilities throughput capacity as soon as possible to recover exploration and development Capex ASAP.

Do they keep running at these rates after they recover the CAPEX or do they switch to rates that will optimise the overall life return?

NAOM

ExxonMobil gas processing facilities at Goldboro NS had (still has?) an intake capacity of 603 MMcf/d raw gas, sales gas capacity at the export pipeline to that part of the Canadian Maritimes along the route (not Halifax, Cape Breton, or PEI) and US Northeast (Boston City Gate) of 557 MMcf/d plus 10,000 bbls liquids per day.

Even when Thebault, Triumph, and North Venture were running at full capacity between January '00 and January 03 it only broke 600 MMcf/d raw gas input in 2002 Q4.

So they were running it sensibly at ~550 MMcf/d raw gas input (90% capacity), ~500 MMcf/d sales gas output for 3 years.

(Remember, in all gas production, raw gas does not equal sales gas, you're selling BTU's not Mcf/d).

Then the 3 original fields started to decline after 3 years production, and the consortium brought on South Alma and South Venture in late '03 and late '04 respectively.

Each time a new field was brought on, raw gas peaked back up at just over 500 MMcf/d and then dropped back down again.

I do not know what the payout time that Exxonmobil would have required on the infrastructure, which was basically an automated platform per field, the gathering systems tied in at Thebault (which I think is manned), ~150 km transmission line to Goldboro NS where the onshore gas plant is built, and then the tie-in to Maritimes and Northeastern (M&NE) gas transmission line across NS, NB to the US and Boston City Gate.

I lost interest in Sable Island after 2005, went on to other things.

However, a Gathering and Processing operation will be run at ~85 to 90% input capacity for as long as reserves can be tied in (ideally 10 years minimum), less time out every 2 years for a plant turnaround. Worn out parts (and some are very big) get replaced when required.

If more reserves are available and can be contracted to that plant, then the plant will be expanded. This of course, presents certain problems offshore. Can the required expansion justify the cost of another platform?

Now there's plants and plants.

In the WCSB there a large number of simple processing facilities, a larger number of even simpler compressor plants and a significant (~50+) more complex processing facilities.

Some bigger plants have been around since the 1960's.

An industry rule of thumb in the WCSB is that no new sour plants will ever be permitted and built. What's built will remain open until the surrounding fields are deplete, e.g. Shell Waterton, etc. etc.

A small number of plants have been shut down, dismantled and the sites cleared and cleaned up. Some sites are known to be cleaner than others, and if you're inside the industry, you'll know which ones. If you want a gas plant, I think I could get you several - if your specs match what is in store in Red Deer. Compressor stations get shut down and dismantled.

WRT optimising return, the producer (not the plant owner, altho' the producer should have an interest in the plant) will (almost always) produce the gas using good production practice, i.e. the producer will not pull on the well to cause water coning and a very quick end to the well.

There was a famous small field up in the Rainbow area where several pinnacles had been babied for decades by the original producer and plant owner, who retired. He sold to a group of investors from Montreal who promptly (that winter production peak, which coincided with a high gas price) reefed on the wells and coned them all. Result: an abandoned field and an abandoned facility. The value of the remaining un-produced gas was less than drilling any new wells. And the wells could not be worked over. The company also went tits up and the Montreal investors lost a packet.

But this was and is unusual in the WCSB.

Thanks for that, makes the situation much clearer. Investors seem to be a mixed blessing.

NAOM

Like Rockman, West Texas, myself, we're in the awl bidniss to make money for a living, whether we are with a PrivateCo or a Pubco on TSXV / TSX / AIM / London / AMEX / Frankfurt / etc.

Harry - Yeah it's funny how upset some folks get when I explain we're not responsible for providing society with the energy it needs at a price it can afford. We're just in it for they money. Like I tell them: it's just business...nothing personal.

I figured, "If you can't beat 'em, join 'em", and am now successfully in the energy biz, with perhaps the best job and corporate opportunities I've had in decades.

It's just business, but it's a good business. EBIT is easier to come by, customers are knocking on the door checkbook in hand, competitors are weak, and future opportunities abound. The only hard part is everybody wants product NOW!

Man, everybody wants to drill in the shale plays now, it seems. Every thing from dry gas to gassy oil to oily water seems to be a target play.

Yup, I can understand that. I chose my nym to emphasise that I am not in the business, I just try and understand what it is you guys do and sometimes ask silly questions to try to do that. Thanks for helping.

NAOM

NAOM - Yep...but we don't live in a vacuum either. I tease folks but it's not easy to see what we're doing to the country with our poor attitudes about energy, especially conservation. I've made a good living during high price periods and also got by OK during low periods. How well you do in the oil patch has much more to do with how well you do your job than the price of oil/NG. I've mentioned before the best rate of retrun I've ever generated for a client was when NG was selling for less than 20% of today's current low price.

That will not work.

They will just pass the cost onto the consumer, like they always do. Then the talking points on the news will be about how those mean environmentalists fucked up the free market and made costs high, and that this is a plot to control the lifestyle of americans, etc. The less educated (most people) will fall for this if it is put on repeat enough times. Our infrastructure is built around needing their oil to do anything. Shit is all decentralized and trucked out to everywhere, people need to do things like buy groceries and get to work in order to live. There aren't alternatives and the oil companies know that. They are going to squeeze every cent of profit out of a scarce resource because legally, they have to. They have to try and get as much money as possible. Discouraging alternatives and charging people as much as possible for a resource is what they are going to do. Honestly, they have us by the balls here. I have reduced my use of gasoline as much as possible but it still isn't zero, and even if everyone reduced their usage the amount needed would still be huge because of the sheer amount of people and tasks that must be done.

And hey, even if they did get massive fines and punishment, maybe the government could make it up to them by giving some other portion of their gigantic corporate network a big fucking military contract that the public won't be privy to. That is unfortunately the best we can hope for with public outrage because then something would actually be done about the unsafe conditions, not that there aren't a million other accidents waiting to happen as a result of corporate greed. If they bend to our will the government is going to have to make it up to those guys somehow.

The problem here is that a small number of business elites own everything, and the majority of people have no say at all in how our economy functions. I am not sure how to solve this problem, but thinking that we could actually knock BP down in any substantial way is a fairy tale. The power in the country is concentrated in such a way that they can basically do whatever the hell they want to gulf coast claims facility.

I must presume that "on pogey" is the local vernacular for unemployment compensation and whatever other welfare programs are available to the fisherman.

While I am generally in favor of developing whatever domestic oil resources we can,safely and economically,that hundred to two hundred million barrels of the Va coast represents only a couple of weeks national supply.

This hoary old conservative relic gets it-we AREN'T going to drill our way out of the energy crisis.

But this doesn't mean that conservative thinking is altogether irrelevant.

For many years, I have watched quite a few acquaintances play the welfare and unemployment game, taking various seasonal jobs during the summers, such as asphalt paving, and collecting a check thru the winter.These friends and acquaintances have enjoyed some very generous vacations courtesy of the system.Some of them have probably managed total compensated time off in excess of ten years.

Depending on their personal values and their ambitions, they mostly have either spent the off seasons hunting , fishing, playing cards, building their personal hot rod, etc, or else put nearly all the time in on uncompensated , legally acceptable work on their homes or homesteads.

A modest minority spend the off seasons working for cash, well out of sight of the public, as loggers, farmers, or indepe4ndent tradesmen in some nearby town.It is a very rare thing for one of them to be prosecuted, virtually unheard of in fact.

Personally I could care less;if it were possible to force the rest of the country to "play fair" I would care.Whats fair for the goose is fair for the gander.Anywhere you look, you will find numerous people and companies playing this same game, manipulating the rules for personal or corporate gain.

Just in case anyone wishes to question whether I have PERSONAL experience playing the unemployment game, I can truthfully say that IF I might have done so, the statues of limitation would protect me; and furthermore, my response would be to chuckle and take the Fifth. ;-)

It's a Darwinian world, first , last, and foremost. Not a single one of the "cheaters" known to me personally feels more that the slightest hint of guilt, if any at all-which is easily assuaged by taking notice of the subsidies handed out directly to the better connected folks they know of by watching the news on tv.

A local businessman who lives in a million dollar house and owns the local country club, for all practical purposes, and owns a large ( by local standards) profitable manufacturing business free and clear without a dime of debt, according to his own words recently spoken in front of his assembled employees, has enjoyed a couple of WELL PUBLICIZED seven figure handouts within the last year or two.

Local scuttle but has it that he also owns a few thousand acres of land and a number of smaller investment properties, but I am not sure if this is true.

From the point of view of a logger, the idea of a deputy getting paid to just ride around all day , with a pension, holidays, medical bennies, etc, and so forth, while earning more on average, is a travesty of unfairness-they know without any doubt that what they do is more dangerous.

The American working class used to buy into the American dream of endless opportunity, and as a result buy into the "I can get rich too" , or at least comfortable , paradigm.No more.The sons and daughters of the loggers, factory workers, and janitors of this country are no longer willing to believe that the playing field is even remotely level. Those days are fast receding into history.

The playing field has never been level,in realistic terms.The children of a teacher or a doctor or any successful businessman have always had a huge head start in life;the children of the ghettos haven't a prayer of catching up as a group.

Within ten to fifteen more years, unless we collapse first, we will see probably a social revolution in this country similar to the one that took place in England right after WWII.

The people have the vote, and nowadays they have the net to enable them to organize.

I wonder if the big players will be able to strangle them in the way that the big boys have strangled Wikileaks.I trust that enough

capable programmers and other IT people will join up to prevent that from happening.

Remember this guys-you can take it to the bank from someone who was there in the sixties-the most passionate women say yes to the guys who say no. ;-)

OFM,

Wisdom and humor and insight into how the world of humans really works. Keep it up. I really appreciate your perspectives from a place that seems worlds away from my gentrifying urban neighborhood.

Jon

Thought you might like this:

http://www.wired.com/wired/archive/6.01/hillis.html

Danny Hillis is a very interesting person. He has a book on the fundamental concepts of CompSci called "The Pattern on the Stone". This book does not require a technical education to read and is both short and excellent.

I did a quick google ...

http://www.google.com/search?q=%22the+pattern+on+the+stone%22+filetype%3...

... and located a free PDF ...

http://www.cs.rutgers.edu/~mdstone/class/503/readings/hillis-pattern.pdf

Save a copy, as you never know how long it will be there!

I am not sure what will happen to the "internet" going forward. It can be turned off pretty easily enough, but the economic implications would be devastating. But desperate folks do desperate things.

Regards,

Cooter

"Pogey" is Canadian slang for:

1. Unemployment insurance, or

2. welfare, "social assistance." That is, money received from the state due to low income.

It originally mean "poorhouse". It is related to the word "pokey" meaning prison cell.

"Ocean Danger" -> nickname for "Ocean Ranger"?

http://en.wikipedia.org/wiki/Ocean_Ranger

CBC on the 19th anniversary of the sinking/loss of all hands.

http://archives.cbc.ca/environment/extreme_weather/clips/1878/

I remember the Ocean Ranger sinking in 1982 quite well because my next-door neighbor was negotiating for a job on it when it went down. He was holding out for more money, and while he was dickering with the company, the rig sank with the loss of all hands. It was quite disconcerting for him.

On a similar note, when I was in Norway one time, I saw a floating hotel they were preparing to go out on the North Sea. In 1980 it sank with the loss of 123 of the 212 people on board.

Offshore drilling is not really a safe business. At least on land you can run for safety when things go wrong, and when they go really wrong, people can run very, very fast. Swimming in ice-cold water just isn't the same.

.53-1.15 Billion barrels of recoverable oil...is that it?

That doesn't seem worth the bother, unless it is in one, or a handful, of large formations...if it is scattered among scores or hundreds of smaller formations, save all the steel for the rigs and pipes for a more enduring use.

As I write this, I am thinking of Gail's recent blogs on the misleading information being put out by official sources of oil resource forecasts.

Of what use is such a small amount of recoverable oil? Especially when one considers that the estimate, like all estimates from official sources is likely wildly optimistic. Surely such a small amount will delay the day of reconning on renewable energy only slightly.

I think this oil must be found and produced, not to 'solve' our oil thirst, but to clear the field of resources that we would have to defend from foreign invaders. In the near future, our first priority will be learning to live within our endowment of renewable resources. At that time, foreigners stealing our oil will be politically unpalatible but something that we will be unable to prevent without destroying ourselves in the process. It is somewhat like a retreating army destroying the ammunition dumps that it must abandon. (The analogy is not perfect, but it helps understanding, I hope.)

geek7,

Of all the things on our list to worry about, foreign invaders stealing our oil off the coast of VA, from goodness knows how far under the sea floor, doesn't even make any list...

I have come to understand that there are more people than I imagined who have no idea of how difficult it is for countries to conduct complex, sustained military operations thousands of miles from their homeland.

Do you actually think that forces from China or some other far-flung country would have the ability to steam up right off our coast, set up drilling platforms, and offload the oil on tankers, all without even a greatly reduced U.S. military sending everything to the bottom?

I can see more clearly, every day, based on information such as this, why so many folks have drunk the MIC Kool-aid to believe that ever-increasing military budgets are necessary to prevent out imagined destruction/invasion/etc.

Good gravy, if anyone has reason to be concerned about receiving foreign attention, it might be Venezuela from the U.S. down the road...

Glad you see my point about all this obsessing over the future.

By the way, the oil in question is on the east coast, rather inconvenient for the Chinese, but what about the Vatican?

Ahhh, you are pulling our legs!

I didn't grok the sarc, my apologies!

In my part of the world, we use the expression "You stole it! " to indicate that somebody bought something extraordinarily cheap in relation to the true value of it.

Of course neither the Chinese nor anybody else can actually steal the oil, if there is some, off our coasts, in the criminal sense of the word.

But if there is a way for them to gain control of it through corporate ownership and to skim off any windfall profits due to sharply rising prices, we should expect them to do so-and as some bright red head commie once famously said, we will sell them the rope they are planning on using to hang us.

There is no doubt in my mind that the brightest and most devious minds in the employ of the banking monsters will sell us out for a few more millions of bonus money if they can find a way to do so.

Judas was a two bit piker compared to modern bankers.

But I will say this in their defense-taken as a group, they are probably no worse than politicians.As a matter of fact the "average banker' will not intentionally start a war which seems likely to directly involve his own home turf;he would like to have at least one good buffer zone between HIS house and place of business and any stray bombs or bullets.

If ONLY people would read novels as commentary on the nature of man, rather than accepting the word of the authors philosophical enemies that they are intended to be blue prints for building a society!

Most of us would do well to read Ayn Rand with an open mind rather than filtering her work through the dogma of the liberal gospels, which are in some ways as unsuited to the realities of our species as any other gospels She did after all have considerable personal knowledge of totalitarian govts and the way they operate in collusion with "connected" businessmen.

There is a lot to be appreciated in such works;we don't usually stigmatize other writers or philosophers in the same way because they were wrong in some portions of their work.We just incorporate the god parts into our current intellectual models, and utilize the bad parts to demonstrate the shortcomings of the author.

Or perhaps it is more accurate to say that we do this after a suitable period of time has passed; any writer or thinker who is in some serious way opposed to any current powerful group of thinkers is invariably demonized in real time.

Such thinkers only come into their own a few generations or in some cases centuries after they are dead.

I can remember older members of my family, now long since dead, who thought of folks such as Newton and Galileo as emissaries of the Devil , when they happened to hear of them at all -which was seldom, as the local preachers themselves at that time mostly hadn't heard of them either, until the advent of television and radio.

All good points on Ayn but then there is always the chance a blinkered disciple with talent and focus will end up assigning way too much weight to the mechanics the author used to convey such commentary. Eventually through hard work and good luck that disciple might even end up holding the handle to one of the most powerful financial control levers the world has ever seen...then whammo! Ah that does seem to be too far fetched

...but then...

♫ Go ask Alan...

when he's ten feet taaallll ♫'

thought Grace would dress this up a bit more than Greenspan--you did bring up the sixties ?- ) No argument about Rand being a worthwhile read though.

[edit]darn seems I floated off to sea while everyone else was talking about Atlantic offshore oil

?- )

At current U.S. consumption rates for oil, that 1.15 billion barrels could completely supply the needs of the entire USA for about 2 months (and much longer with imports). And even using a very realistic oil price estimate of $90/barrel, 1.15 billion barrels is worth over $100,000,000,000 USD ($100 billion) and that should be enough to get the undivided attention of a few men with access to drilling rigs.

joss - "...and that should be enough to get the undivided attention of a few men with access to drilling rigs."

Not really. Oil patch management could care less what anyone estimates to be out there. The industry is way beyond poking holes offshore based upon "maybe's". Once an area has been designated for a lease sale the industry will evaluate the potential and decide if it merits the 100's of millions for seismic data. No company will even look at a drilling idea out there if state of the art seismic isn't available. If some companies do go forward it will take several years at a minimum to acquire and evaluate the data. Then the lease sale and then a couple of years for the first wells to be drilled. As others have already pointed out the exploration phase will take at least 5 to 7 years if it were started tomorrow. And it isn't starting tomorrow...maybe in a few years...maybe.

The development phase is too speculative to estimate IMHO. It might take 5 to 10 years before a discovery large enough to justify development. How valid the guess is I don't know but the expectation is more likely for NG than oil. Oil could be developed in the next 10 years or so. NG is a very different matter. A significant NG field could be discovered and never developed. It might be a very commercial discovery in the offshore GOM with its extensive pipeline system but of no economic value off the east coast. Depending on exactly where the discovery is made a pipeline system could easily costs many times the amount needed to develop the field. It could require several major discoveries before a NG gathering system could be justified. If there is actually commercial NG reserves out there to develop it could easily take 15+ years before the first mcf hits the bank.

So should the east coast be opened up for exploration? IMHO...why not? If there's nothing there the industries loses some capex....we got it. If there are commercial reserves to add to our domestic supplies it's a win-win. The oil patch makes money, the govt gets royalty checks and the country gets a little more oil/NG. And folks shouldn't pooh-pooh the relatively small amount of reserves that might be added IMHO. By the time those reserves hit the market it's easy to imagine we'll be in a rather desperate state in the next 15+ years. Might even reduce the amount of blood the American people will be willing to swap for oil then.

Based on what ?

b - Don't have the details but over the last 35 years there have been test wells drilled of the east coast including shallow sea floor cores. Geochemical analysis was not very positive for oil generation. But I think the data is thin and wouldn't argue too hard one way or the other.

For starters:

I'd want deep tests, to ~3500 - 4500 m or to basement, with thick mature source rock in the oil window or the gas window.

Source rock is key.

If there's no mature source rock in say 4-6 wells, pack up and go home.

Then find good quality reservoir rock, seal and trap, migration path and timing - and not another emptied trap like Bristol Bay.

and not another emptied trap like Bristol Bay.

I suspected the oil industry wasn't too upset by the current Bristol Bay exclusion from offshore leasing.

But since you switched oceans, Escopeta is making some noise about Cook Inlet gas of late. Local news anyway as the fields Anchorage relies upon are pretty darned beat up. A bit of Jones Act sideshow to this story. Fun, fun fun no doubt.

Harry - Another sad/stupid tale. Back in the 70's a consortium drilled a stratigraphic test off the east coast. The primary goal was to test for source rocks. Mobil Oil, my then employer, was one of the majors participating. They showed me the geochemical analysis of the cuttings. Each sample report was identical: No analysis...sample contaminated. The drilling contractor early on had switch from water based drilling mud to oil based drilling mud. The partnership contacted the drilling contractor and complained. The drilling company explained their contract allowed them to choose the drilling mud they wanted and they wanted OBM because they could drill the well faster/cheaper with it.

I don't know who with the consortium wrote/approved the drilling contract but they obviously didn't know much about how drillers like to do their thing. A great waste of time and money.

Aaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaaagggggggggggggggggggggggggggggggggggghhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhh

Probably $25 MM down the hole!

My first offshore well in 1981:

(I inherited the location - no well name given to avoid bad feelings).

I got the logs on the Friday night of a long weekend in November.

3250 m, all the Cretaceous and Jurassic sands as wet as the ocean. No source rock.

I get very depressed, come in Tuesday morning, give my presentation to the VP Exploration and the whole East Coast offshore group. The VP Exploration says: "Never mind, Harry, we budgeted $29 MM, we've spent $19 MM, so we're $10 MM ahead".

I was marginally comforted.

I've worked three big projects on the East Coast of Canada, and I remember the Ocean Danger.

I've had a look at Baltimore Canyon.

East Coast of the US turns my crank so much I'm now on Mecca time and looking at a project on Singapore time.

It seems that a pattern is emerging across media and perspectives: not only are the marginal reserves being increasingly tapped but they continue to prove disappointing in size, flow, and recoverability, and the number remaining to exploit is falling fast. It has been clear that this would happen, but the curve sure appears to be sharper and more marked than may have been suspected even by insiders and those who are aware.

I also see signs blended into the history of OCS that environmental concerns have had and are having some restraining force. It seems that the support or marginalization of that force is what will truly determine how political changes affect the petroleum future on the short term. Gov. Perry's energy plan and general perspective don't seem to favor those forces.

It's easy to convert folks to peak resource thinking when price spikes are sharp. When they're gradual, people blame other things, often silly things, for their woes.

So if the curve is indeed sharp (or sharpening) maybe folks will seriously look for adjustments (lifestyle) and alternatives (to FF). I doubt it though.

Gov Perry and all the rest aren't serious about any of this. Politicians only care about power -- how to get and keep it. They come up with an "energy plan" because they think it sounds good to voters. So they have a staffer slap together a few powerpoint slides and write a few dozen pages of nothing.

Folks like us get suckered into wasting countless hours debating them as if the details really mattered. All that matters is some oil company thinks they can hit pay dirt. If that were true the leases would magically open up and be sold. Until then, they'll just blame the "greenies" or the Saudis... or whom ever they think said dumb voters will get excited about. Profit motive is the only real driver.

I think the prospects for a big petroleum play along the U.S. Atlantic continental margin are dim. During the 80s I worked on the USGS-BLM coop project to characterize the seafloor in the lease sale area from the Canadian border to Hudson Canyon. The objective was the "great Jurassic reef", comparable in extent to the Australian Great Barrier reef; its estimated oil content was going to free us from OPEC. It was probably the main reason Ronald Reagan declared the EEZ - to ensure the Great Jurassic reef was entirely within US jurisdiction The forereef, and the most desirable targets, lay beneath the outermost shelf and the upper continental slope, from about 200 to 2000 m depths. In 1981 I was able to use the phenomenal 30 kHz SeaMARC I sidescan sonar, which otherwise was being employed to search for the Titanic. High-resolution seismic profile data from the slope are an unintelligible jumble of nested hyperbolae, but the sonar image data showed for the first time that the slope is a geomorphic nightmare of badlands, canyons, and mass movement channels and scars. The floor of the Gulf of Mexico is like a pool table in comparison. In 1984 Shell drilled three holes in the Baltimore Canyon trough near the shelf edge; the holes were dry. It was believed that Shell happened to hit a gap in the reef. Later, Exxon drilled a hole spot-on the reef off Georges Bank. Shortly after the well was completed, an Exxon geologist called me - a wrong number. I told him I would give him the MMS number he wanted if the told me what they found at the reef horizon. He said they went through 350 feet of ashfall tuff and bottomed in zero porosity dolomite. There was no interest in subsequent BLM lease sale auctions. I then went to worrk on the Yucca Mountain project for the following 17 years, but that is another strange story of failure. I suppose there is some oil and gas beneath the Atlantic OCS, but it would take a long, expensive, dangerous effort to find it and develop it. The seafloor and the weather are formidable hazards of the U.S. north and mid Atlantic OCS. Harry Flashman has it right.

Doc - Ash, eh? Interesting detail. Thanks