Oil will decline shortly after 2015, says former oil expert of International Energy Agency

Posted by JoulesBurn on January 5, 2012 - 11:46am

The following interview is a guest post by Matthieu Auzanneau, a freelance journalist living in Paris. This article previously appeared in Le Monde.

Olivier Rech developed petroleum scenarios for the International Energy Agency over a three year period, up until 2009. This French economist now advises large investment funds on behalf of La Française AM, a Parisian assets management firm.

His forecasts for future petroleum production are now much more pessimistic than those published by the IEA. He expects stronger tensions as of 2013, and an inevitable overall decline of oil production "somewhere between 2015 and 2020", in the following interview.

Olivier Rech, responsible for petroleum issues at the International Energy Agency from 2006 to 2009.

Rech’s outlook serves as another significant contribution to the expanding list of leading sources portraying the threat of an imminent decline in global extraction of crude oil.

MA: What do you foresee? Let’s begin with the non-OPEC producers (which represent 58% of production and 23% of global reserves).

OR: Outside OPEC, things are clear: of 40 million barrels per day (mb/d) of conventional petroleum extracted from existing fields, we face an annual decline on the order of 1 to 2 mb/d.

MA: In your view, are we therefore close to the 5% decline per year from existing production mentioned by Royal Dutch Shell?

OR: Yes, that’s about it.

MA: And for OPEC production (42% of production and 77% of global reserves) ?

OR: It’s more difficult to say; the data are still opaque. We are stuck in a haze. Nevertheless, I note that Barclays and Goldman Sachs banks estimate that the spare production capacity of OPEC, more particularly that of Saudi Arabia, is significantly lower that what is officially claimed.

MA: Many new production projects are presently under development all around the world. What should we expect of them?

OR: There are new projects off the coasts of Brazil, Ghana and Guyana. The Gulf of Mexico is far from being depleted. The Arctic is far less certain, but there is real potential for natural gas there. Nevertheless, we must still expect a decade before seeing eventual and significant production of petroleum.

MA: In that case, what is your view on the timing of the global peak and decline of total world oil and alternative liquid fuels output?

OR: It is always delicate to project a precise date. The recovery rate of existing fields is increasing. The US on-shore production is declining very slowly (and one must add that they are drilling in a frenzy over there). It is an error to underestimate the know-how of drilling engineers.

MA: Taking account of all these factors capable of slowing a decline, what conclusion do you draw?

OR: We will certainly remain below 95 mb/d for the combined totals of conventional and non-conventional oil.

MA: Therefore, you are clearly more alarmist than the IEA and Total, the most pessimistic of petroleum companies. Total evokes the possibility of maintaining production on a plateau of about 95 mb/d until 2030.

OR: It's true. The production of oil has already been on a plateau since 2005 at around 82 mb/d. [NB: with biofuels and coal-to-liquid, we approximate 88 mb/d for all liquid fuels.] It appears to me impossible to go much higher. Since demand is still on an increasing trajectory (unless, possibly, the economic crisis engulfs the emerging economies), I expect to see the first tensions arising between 2013 and 2015.

MA: And after that?

OR: Afterwards, in my view, we will have to face a decline of the production of all forms of liquid fuels somewhere between 2015 to 2020. This decline will not necessarily be rapid, however, but it will be a decline, that much seems clear.

MA: You state “not necessarily rapid”. Why?

OR: This will all depend on the speed at which streams of non-conventional oil will be able to be developed. Conversion of coal and natural gas to liquid fuels will remain infinitesimal. For first-generation biofuels, I believe we are already approaching the maximal limit. As for second-generation biofuels, we are still at the stage of industrial pilot projects. It should take another quarter century before we achieve a significant production on a world scale, let’s say around 2.4 mb/d.

MA: In your view, will all of this be insufficient to compensate for the decline of existing conventional oil fields?

OR: Insufficient, yes.

The original article is at oil man, which is actually a blog on lemonde.fr and not the printed newspaper.

This gentleman has the necessary status as a professional insider to convince at least a few people of the truth in respect to oil among those outside the peak oil camp-perhaps a lot of people.

Too bad the interview didn't extend to the circumstances leading him to leave the soft cushy life of a bureaucrat and go into consulting.My cynical side tells me he "saw his chances and took'em" , having the status to succeed immediately as a highly paid consultant.But my idealistic side is hoping he is simply an honorable man who realized the truth and decided to act upon it.

Of course both scenarios may apply in such cases.

If he was a high ranked lifer in a govt agency, he probably has a cushy pension already worth far more than most of us peons could ever hope to earn.

It can certainly be both . . . he left to get a nice paying private sector job and once freed from IEA shackles, shared his private opinions more openly.

Can anyone venture a guess on what makes up his 82 mb/d? I am used to seeing a value for 'conventional' crude & condensate between 74-75 mb/d, on a plateau since 2005. That perhaps leaves 7-8 mb/d given over to 'semi-conventional' sources: perhaps NGLs and oil sands?

BP's footnote indicates:'crude oil, shale oil, oil sands and NGL, excludes biofuels and coal derivatives'.

BP shows world totals of 81.5 million bpd in '05 and 82.9 million bpd in '10.

thank goodness we had the IEA to give us a warning in time

Most important thing regarding the IEA is the work done by Lionel Badal :

http://petrole.blog.lemonde.fr/how-the-global-oil-watchdog-failed-its-mi...

Typically they tried to be more "factual" in 98, almost all the team got "sacked"(a lot from US pressure apparently) except for Fatih Birol who is now the head of it ...

The IEA in the form of Fatih Birol told us peak oil happened in 2006. I am surprised that another IEA guy has taken a contradictory position on the topic.

Just from memory I think Birol told us that conventional oil had peaked, not all liquids.

Delcine will depend on how countries react, I can see a situation where coutries refuse to trade with each other, they will shift into protectionist mode. This would result in both hostilities and economic contraction, this will change the economics of oil production.

A decreasing oil supply may cause a negative feedback loop, less money in the system, less oil, less money, less oil...

Perhaps, but not for some time. There is amazing slack in the system, as can be seen from the wildly different oil intensities of the industrialised countries. The US is particularly extravagant, Australia is not much less so, but Europe consumes much less per capita, even in rich countries like Germany or France.

What I foresee is a fat-tailed decline, with enhanced recovery, tight oil and heavy oil preventing rapid falls in production. They may never get massive flow rates out of the Canadian tar sands or Venezuela, but what they get can be sustained for a century. For decades, I expect that the consequences in industrialised countries will be ones that cause governments to lose elections rather than ones that bring on revolutions. In the meantime, people will get smarter with oil use and stop doing stupid things like commute 100km or more by car to their job.

In the longer term, renewable energy will probably become dominant. The human race just has to learn how to live within its renewable energy budget. It won't be terribly high, but it will be liveable. The downward spiral scenario with which the doomers are obsessed relies on no meaningful contribution from renewable energy.

ABlokeimet:

Please clarify what you mean by "Downward" in the last sentence "Downward scenario with which the doomers are obsessed [...]". Do you intend to say:

1. "An undulating plateau of economic activity for a century, with the political system, the food system and ongoing AGW remaining more or less intact and the changes inconsequential to our day-to-day lives"? (as understood from your statement "For decades, I expect that the consequences in industrialised countries will be ones that cause governments to lose elections rather than ones that bring on revolutions.")

2. "End of economic growth but no continuing on the path to mass extinction (of the species and a majority of the planet's biota). The end of economic growth will result in a reversal of the trend"? (as understood from "What I foresee is a fat-tailed decline, with enhanced recovery, tight oil and heavy oil preventing rapid falls in production. They may never get massive flow rates out of the Canadian tar sands or Venezuela, but what they get can be sustained for a century. ")

3. "End of many many comforts of humanity and a drop in populations but we will somehow continue to mine the needed resources, manufacture solar panels/wind mills/magnetic motors and figure out a way to transport them all... *somehow*".

4. Something else. Please explain.

... and I must admit, during my 'bargain' phase of dealing with peak oil, it was my own delusion that we can recycle all these cars and stuff into wind mills ;) The only question is "Where will you find the energy to smelt and recast and retool the cars"? Perhaps, not a bad idea to venture out for ourselves - perhaps we will be booming for a while in this new recycling economy but in the long term, I'd expect we'd have to deal with failing crops. IOW, Societal Collapse.

sunson,

What is the situation in India with regard to the power supply? I am hearing reports that the blackouts are getting worse and becoming more widespread. Is it true? What is your experience?

Out of the first three scenarios, I expect it to be closest to #2. Between #1 & #2, but closer to #2. There will be great changes that have to be made to the lives of people in industrialised countries, but over a period of decades rather than years. Eventually, the private car will go the way of the dinosaur - that's a big change. In 20 years time, though, most people will still have driver's licences and a large minority will still be driving as their main method of transport (though mostly with much more fuel-efficient vehicles than today).

That might cause a revolution if it happened in three years, but not over 20 or 30.

Really?! That's not what most competent ecologists and biologist seem to believe. Most of them are convinced we are on an accelerating trend to mass species extinction both of flora and fauna.

http://www.actionbioscience.org/newfrontiers/eldredge2.html

You have evidence to the contrary?

Yes we are on that path, but I don't think we'll stay on it too much longer. Total Fertility Rates around the world are in decline and the global human population will max out at about 9 billion in around 2050. Most industrialised countries will be in population decline well before that. Further, the increasing restrictions on energy use will indirectly act to preserve biodiversity by making habitat destruction uneconomic.

Too many people fall for the trap of single-factor extrapolation. There are a number of balls in the air which will affect outcomes. Peak oil is one. The decline of the Total Fertility Rate is another. And we haven't even begun to consider the changes that will flow from the fact that the Chinese countryside will run out of under-employed peasants in a few years, thus providing the trigger for a wave of union organising the likes of which the world has never before seen.

We will never reach 9 billion. Mass starvation long before then, due to climate change, soil degradation, collapse of industrial farming and food distribution, financial collapse and war.

We might even get a bit of pestilance.

Ralph, you are exactly right and Ablokeimet is so wrong it is sad. The extinction of large species will accelerate dramatically. People will actually eat the songbirds out of the trees. Every edible species in the wild will disappear in less than a decade. And the wild carnivores will die out due to starvation.

Ron P.

Yay, doom! Thanks guys, when I joined 1.5 years ago I felt like the outcast. Good to see how much embracing of doom there has been in the meantime.

Hey, it did not happen in the meantime. I have known the world is in deep overshoot with no (good) way out for decades. Overshoot was written over 30 years ago and I was a doomer twenty years before that.

I have always known that the exploding human population was unsustainable, even if fossil fuels lasted forever.

Ron P.

Many people currently living in a condition that we call "doomed" if we leave in it. It is just all those industrilized contries suck up a lot resources to keep themselves alive while let others get doomed. The problem now is that resources is bit limited and can not furfill all industrilized countries...

Hey Doomer_Dan,

I'm not a doomer, I'm a realist, as far as I'm concerned there is a difference.

Much like Darwinian, though, despite the fact that he does call himself a doomer, I began looking at the data and the evidence over 35 years ago when I was a biology student. While I didn't follow a career path in Bioscience I was able to actually spend a lot of time traveling around the world and visiting places like the Amazon and also spent time diving on many coral reefs, I still do! I have witnessed first hand the destruction of ecosystems. I have also read hundreds of scientific papers on this topic. I have seen sleepy backwaters transformed into energy sucking concrete jungles.

I've done a lot of different things in my life. I was a teacher, I worked for big oil as a commercial diver, I held a few positions at various corporations. I even worked for a time for the advertising industry in New York. I have seen what the stupidity, hubris and greed of my fellow man has wrought.

Reality is what it is, I can't change it but I'm smart enough to be able to read the writing on the wall!

Be well and at least try to do as little harm as possible while you are here.

Cheers!

Fred

increasing restrictions on energy use will indirectly act to preserve biodiversity by making habitat destruction uneconomic.

Could you expand on that?

Most habitat destruction is not caused by subsistence farmers or nomadic herders, but by commercial operations. The Amazon is being cleared for cattle farming, while the forests of Kalimantan and Sumatra are being cleared for palm oil plantations. Land clearing on an industrial scale is only affordable with cheap energy, as is the bulk of international trade in agricultural products. Therefore, Peak Oil will rein these phenomena in, rather than accelerate them.

Affordability of food in the Third World is a constraint and will remain one, but it will be mitigated by the decline of the US as a world power and the $US as a hard currency. As the greenback depreciates against most world currencies, demand for grain-fed beef in the US will have a lesser impact on the ability of city dwellers in the Third World to buy their staple grain to eat. Instead, the pressure will be on US meat consumption, and particularly on the obscene practice of raising cattle on grain rather than grass.

Land clearing on an industrial scale is only affordable with cheap energy, as is the bulk of international trade in agricultural products.

Ah. I was afraid of that. Sadly, I think that's unrealistic. The cost of diesel for such operations is a small percentage of their costs, and if the price goes up they'll just pay it (they'll outbid other things). Worse, palm oil will only become higher priced if oil prices rise - farms are energy exporters, and will only do better under PO.

Hmmm. The Malaysian Government's biodiesel strategy (which is what would cause the price of palm oil to be linked to crude oil) looks like it will create problems. Hopefully the strategy will be hurt by the debacle of the US experiment in corn ethanol.

the debacle of the US experiment in corn ethanol.

I'm not sure what you mean. I don't think there's a general consensus that US ethanol is/was a debacle (despite the objections of many about E-ROI, or environmental damage). My understanding is that the discontinuation of the ethanol subsidy isn't expected to hurt the ethanol industry much.

If that's the case, then the EROEI of ethanol is better than it looks. Activities with EROEI close to or less than 1 are never going to be economic unless they're using heaps of sunk capital (i.e. energy used at a time when energy was much cheaper). Otherwise, the increasing price of the output is countered by increasing input prices and the financial side will stay in deficit.

If they're taking away the subsidy, that's good news. And we'll see the result in time. It's possible that the subsidy has paid for the initial capital expenditure for the industry, so if that's the case, the full EROEI impact mightn't kick in till the plant has been significantly depreciated and new investment is needed.

This points up one of the problems of E-ROI: one must adjust for quality and recognize the effects of pricing and availability of different forms of energy.

Ethanol seems to have an E-ROI of about 1.25. The input energy is mostly process heat, and that can come from very cheap and abundant natural gas (or coal). So, ethanol is profitable.

Really, one must look at liquid fuel return on LF invested, which for ethanol is about 5:1.

They didn't need the subsidy all that badly because the mandate serves the same function. So it was a shell game, wholly typical of corrupt politicians. Cancel the mandate as well, and the corn ethanol industry would shrink to a very tiny scale in a heartbeat.

It's remarkable how different my view of China is from yours. In my estimation, the China manufacturing bubble is about to pop, sending wave after wave of people formerly in the cities back to the countryside to scratch out a living as best they can.

The whole world will be dealing with the following future, including China:

There will be no union organizing. China joined the party too late.

China is a lot less dependent on exports to the US & Europe than it used to be. It now has a larger internal market and is also developing its trading links with other rapidly growing countries which are not, like the aforementioned places, deeply over-indebted. Further, the Chinese Government has massive financial reserves (easy to do when consumption is still less than 50% of GDP), so it has the resources to institute the mother of all stimulus packages if it becomes necessary.

The world no longer revolves exclusively around the US & Europe. This is likely to come as a rude shock to most inhabitants of those places, but I live in Australia, which gives me a better vantage point from which to view the coming world.

But what about the capital expenditure bubble? If that pops, what can replace it? No amount of stimulus would work if there isn't a sector ready to replace the construction jobs that would be lost.

Do constructions in Africa, asking resources in return. A lot Chinese workers are doing it currently, with very few amount of USD involved.

Yikes. Can the Chinese find places for 50M Chinese workers in Africa??

If Africa go through any kind of mordernizations like China (not even nearer US or europe), 50M is quite ok number. Of course, it will suck huge amount of resources that originally directed to europe and give EC headache.

A stimulus package for what reason? To resume growth?

Trading with other countries for what reason? To resume growth?

Keep the factories going via the internal market for what reason? To resume growth?

If any of those work to resume growth, they will do so for a very short period of time. Growth will stop on the planet despite what some people say (that the end of growth is "unrealistic").

Take a close look at the industrial output of the above scenario. That's everyone's future, including China's.

"To resume growth" appears to imply that growth isn't the current configuration? While the great recession of 2008 was certainly not growth, and individual countries have cycled between growth and non growth on occasion, as a whole growth appears two be the norm, even now. Some people certainly want MORE growth, but that is different than what is implied with the statement "resume growth".

No such implication. We are configured for growth right now. If we have any amount of contraction, however, every politician will proclaim that they want a return to growth and stimulus packages, increased trade, etc. are some of the tools available to them.

Andre,

Look beyond the theoretical model, and look at the reality: the US economy hit a wall in 2008 not because of resource limitations and a limit to production, but the exact opposite: over production. The US built too many homes! That oversupply was the real bubble, and it caused a classic business cycle of overshoot of production and then collapse. That collapse killed housing prices, which caused mortgages to default, which killed CDO's, which crashed bank equity and triggered credit swaps, which put Lehman and AIG into insolvency, which panicked investors (including European, Asian and Middle Eastern investorsin the shadow banking system), which froze credit...

That's what happened in the 1930's: the industrialization of agriculture caused farm production to rise beyond what was needed. Food prices crashed, farm income crashed, farms went bankrupt, and farm families started migrating to California...

The same thing is happening in China: they're badly overbuilding residential and commercial real estate, as well as manufacturing and transportation infrastructure. Their crash will come when it becomes clear that they have to stop building that stuff because there's just too much of it.

Interesting to think that in the midst of overshoot, peak oil and every other claim of either impending (or previous) disaster, we are still discussing abundance on a massive enough scale to have bubbles.

But if we had another contraction...recession...then sure, they would say that. And might even utilize some of those tools. Again. Maybe. Myself, I think we are overdue for a good "wringing out of the excess".

To be frank, instead of sending farmers back to country side, I think our gov would prefer just organize them into marine divisions and build some LHDs.... I think USN and JPNSDF would provide air cover if an agreement on how to divide returns from such operations is made.

Energy is key to the upside (growth), and the major contributor to the downside (environmental degradation, exploitation of other non and semi renewables, population growth...). Powering down and learning to live on a much lower energy budget isn't as much about economics as it is about our relationship to the rest of the planet. 85 mb/d = overshoot.

"Something else. Please explain."

All out nuclear war.....

???

There is certainly a lot of room for improved efficiency in the USA but it can't be done quickly. Cars last like 17 years. We can push our homes & offices closer together.

When prices go up people will drive less, combine trips, do some carpooling, use public transport more, etc. But people will be stuck with the cars they already own. Even if everyone buying new cars buys something much more fuel efficient, it will take a LONG time to improve the fleet average MPG. So it is going to get ugly.

Starting tomorrow, everyone stops discretionary driving. Same fleet, same people, and you can carve millions of barrels a day out of the US crude consumption alone. Changes of behavior have more to do with "solving" peak oil related problems than how fast infrastructure or fleets can be changed.

Sure, but you and Nick seem to assume that after we carve out that quantity of oil time completely stops. What happens after a bit more time passes?

The U.S. can cut out 5 mmb/d — 25% — and that will buy us only a few years. Then we're back in the same spot. Depletion marches on.

Sure. Carpooling and cutting out of discretionary travel is a short term tactic.

Longer term tactics include going to PHEVs, EREVs, EVs; moving from trucks to trains; electrifying trains; using wind, CNG and batteries for water shipping; etc, etc.

We really don't need oil for anything we do now, but replacing it does take more or less time, depending on what it is.

It's also worth noting that Eklett only projects a decline of total liquids of 11% in the next 20 years, so a 25% reduction would have a large impact. Not that I would suggest being complacent - we need to get rid of oil and FFs ASAP. My point: we can, and we'll be better off for doing it.

Let those of us who know better eat cake! Let everyone else find out the hard way.

As I've said before, he said that his 11% decline was "optimistic" AND it doesn't include the net export problem, which doubles the effective decline rate.

And, as I've said before, he didn't say that. See page 42 of the presentation - we see that this projection is precisely in the middle - between the "Standard Case High End" and "Standard Case Low End". http://www.aspo-australia.org.au/References/Aleklett/20090611%20Sydney4.pdf

Even his low case doesn't support TEOTWAWKI.

Yes, net exports are a different question. OTOH, doubling -.5% per year only gives us -1% per year.

Further, I invite you to look at "Net Imports": the US has reduced it's net imports by 25% in the last 4 years, and is continuing to reduce imports.

Finally, the ELM model has a lot of flaws: it assumes that oil exporters will continue their same policies even in the face of plummeting exports: that's not realistic.

Well, too bad that you're wrong. He said it during his presentation at Leeds University.

Everyone knows the ELM models breaks down at some point but it will hold long enough to cause a lot of trouble.

He said it during his presentation at Leeds University.

That contradicts his published work. Do you have a link to a more recent published work that supports that, perhaps a PowerPoint from the Leeds presentation that has been put online?

We can't really rely on a hear-say report that hasn't been published in any form. After all, what does it mean? That the median case is -13% decline? We need something quantitative.

Perhaps most importantly, we can see that the presentation I linked to was in fact too pessimistic - crude oil has stayed on a plateau, while the presentation shows a distinct decline from 2008 to 2011.

Everyone knows the ELM models breaks down at some point but it will hold long enough to cause a lot of trouble.

The fact that oil exporters control prices and subsidize the gap between market and controlled prices is a significant factor, no doubt. But, a "lot" of trouble? That needs a better analysis than the very simple straight line projections we have so far.

Keep in mind that oil exporter consumption is only a small fraction of world consumption, so the effect is limited. KSA, for instance, already consumes more oil per capita than the US - it won't grow forever. Further, they're mighty smart, and they've ignored the ELM effect so far because it's small - they won't do so forever.

WestTexas himself assumed that trouble would arrive in 2006. 6 years later, and as Nick has mentioned, here we all still are....

Todays reduction in demand because of price becomes tomorrows habit. And we aren't back in the same spot, someone else is, probably those who didn't pay attention the last time they were hammered by price. For example, those of us who made it through the rationing and shortages of the 70's should certainly be driving a Prius right now, bicycling to work and have homes which are pretty darn insulated. In which case you can double the price of oil and really, who cares?

Cars last like 17 years.

But new cars are used more: cars less than 6-7 years old account for 50% of vehicle miles.

We can push our homes & offices closer together.

Far cheaper and easier to buy vehicles that use less gas.

Is a bit of a time out moment....

Just to be a Devil's advocate, a few years ago Peakers were foaming at the mouth over CERAs prediction that oil wouldn't peak until 2020. Now we're treating this guy's prediction of 2020 as showing that he's on our side, unlike all those horrible optimists. (ducks for cover)

Just to be the Devil's Devil's advocate, here is what CERA is actually saying:

So rise until 2030 and no decline until 2050. That is about 35 years different than what is claimed above. I would argue that makes them substantially different.

http://green.blogs.nytimes.com/2009/11/17/no-peak-in-oil-before-2030-stu...

He said "The production of oil has already been on a plateau since 2005 at around 82 mb/d. [NB: with biofuels and coal-to-liquid, we approximate 88 mb/d for all liquid fuels.] It appears to me impossible to go much higher."

Sounds to me like he is talking about the decline being 2020 not the peak.

Worse yet, we are approaching the halfway point between Colin Campbells 1989 peak oil call, and the EIA prediction of 2037. Another couple years and the same question could be asked about that prediction, treated with more than derision only a few years ago.

Since I started following the peak oil issue in 2000, Campbell was generally forecasting 2010 as the peak year. For a period he dropped that to 2008, then back to 2010. CC's 2010 prediction looks far closer to actual peak/decline and especially to max flow rate than EIA ever did. I think almost all have agreed that trying to pick a year is bad policy given the long plateau we have been in and the various factors that affect any given year's production. A more important point is that we are reaching (or are at)the plateau at dramatically lower production rates than EIA or CERA had projected, and much closer to CC and other "peakist" predictions.

Colins first peak oil call was 1989 or 1992, depending on how you interpret the figure provided in his 1989 Noroil article. According to that article, global production today should be 30 million barrels a day or so.

Ever heard of terminal decline...?

This article is not about Peak it's about terminal decline.

Or, when world oil production starts heading down the backside of the bell curve....

Got a link for that CERA prediction? I don't remember any such prediction from CERA. Here is what they are actually predicting. Google brings up several links with this same prediction by Yergin and CERA.

Peak Oil: Problems And Possibilities

Not even a decline after 2030 but a plateau. That is far from the decline of 1 to 2 million barrels per day that "this guy", as you put it, is predicting after 2020. Actually he is predicting is: "we will have to face a decline of the production of all forms of liquid fuels somewhere between 2015 to 2020."

Got that? He is predicting the decline to start sometime between 2015 and 2020. CERA, on the other hand is predicting no decline at all but a bumpy plateau to begin sometime after 2030.

Ron P.

Rech was at the 2004 ASPO meeting in Berlin when he was working for the Institut Français du Petrole (in fact he had already been working prior to that in the IEA) and made a presentation titled "A dynamic approach of oil production", sadly, I can't find the presentation online nor in my archives ;-(

But I found some notes and his basic conclusions were that if the remaining total reserves were around one trillion barrels, the peak was imminent (that was in 2004). But if IEA and others who believed that there may be up to 3 billion barrels of oil (including non-conventional enhanced recovery and yet to find reserves) were right, the peak would be unavoidable in 2020 or 2022.

The thing is that Rech was presenting a mathematics approach to oil depletion (he is an economist by training although although he has a MSc in Energy Economics), can't remember now the details.

This moreless confirms that peak oil is a matter of rates of extraction and not reserves volume.

Only a member of IEA would presume to guess anything about 2015. Geez, Hormuz could be shut by midnight and this might change the dynamics of this market for years.

They could indeed be shut by midnight, and WWIII substantially finished finished this upcoming weekend.But we don't normally feel the need to qualify our bau scenarios so closely.

All the regulars here must know that I am in the more or less doomer camp, but I make many comments based on the likelihood of old man bau hobbling on for some years, maybe for several decades yet.

I would like to see somebody do a mathematical analysis of the -um- what shall we call it?- the legitimacy curve of peak oil , they y axis being the measure of the number of professional business analysts, economists,geologists, military planners,, licensed engineers, and any and all persons of recognized professional standing who have come out in favor or recognizing a near term peak.

I suspect this curve will shortly assume an exponential upward trajectory-probably within the next five years at the latest.Once it does, all the people who may be quietly convinced will be able to "come out" shortly afterward as they will no longer fear being ridiculed and/or losing their customers or jobs.

The inflection point might very well be a superlative marker in respect to timing an exit from the stock market and cashing in bonds and that sort of thing.

Where are you when we need you, WHT?

I said my piece, and put a stamp on it.

Same for Robert Rapier. He will get his missive out there in short order, then we can wait several years and see what the outcome is.

If Rech has something neat, it will join the queue.

Speaking of Military Planners, I seem to recall that several Militaries of several countries have been saying basically the same thing for quite some time now. As for the subject of DOOM, I'm pretty sure of it, I think I'd rather just get it over with by the weekend rather than doling it out it little depressive bits for the next couple of decades...

"As for the subject of DOOM, I'm pretty sure of it, I think I'd rather just get it over with by the weekend rather than doling it out it little depressive bits for the next couple of decades..."

Ditto. A couple more decades of wasteful human habits would be nice to avoid.

Cheers, Matt

He said non OPEC oil production is declining by one or two mbp per year, but the data from the eia for C+C shows it is perfectly flat for the last five years, around 42 mbd. There is something I don't get...

I think Rech is refering to the decline of existing production. IMO, a lot of effort has been poured into (and wasted) on defining this mythical all-encompassing decline rate.

$100 oil is bringing new projects out of the woodwork.

So it is - the market at work. Rech will be well aware that new production is coming on stream all the time. He could hardly fail to know that.

I think Rech is saying that this "Red Queen" strategy - running harder and harder to stand still - will work, more or less, up till some time between 2015 and 2020. I don't see too much wrong with his "all liquids" (?) peak of 95M b/d. Somewhere between that and de Margerie's 100 would be my guess.

Let us hope that 2015 - 2020 is enough time for the other market responses to work: telecommuting and televisiting (Thanksgiving by Skype), moving closer to work, teleshopping, buying smaller or electric cars, vacationing at the town swimming pool or by train, using public transport - all the thousand and one adjustments people can make, once they see other people doing it too.

No, that is not at all what he said.

Is declining is past and present tense. We face is future tense.

Ron P.

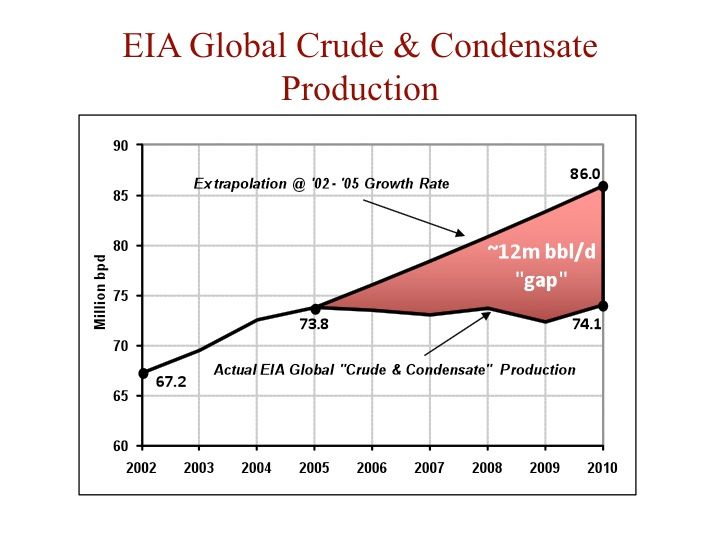

Five annual "Gap" charts follow, showing the gaps between where we would have been at the 2002 to 2005 rates of increase, versus the actual data in 2010 (common vertical scale):

EIA Total Liquids (including biofuels):

http://i1095.photobucket.com/albums/i475/westexas/Slide1-18.jpg

BP Total Petroleum Liquids:

http://i1095.photobucket.com/albums/i475/westexas/Slide06.jpg

EIA Crude + Condensate:

Global Net Oil Exports (GNE, BP & Minor EIA data, Total Petroleum Liquids):

http://i1095.photobucket.com/albums/i475/westexas/Slide07.jpg

Available Net Exports (GNE less Chindia’s net imports):

http://i1095.photobucket.com/albums/i475/westexas/Slide08.jpg

I would particularly note the difference between the first chart, total liquids, and the last chart, Available Net Exports (ANE).

Two GNE & ANE scenarios:

0.1%/year Production Decline (2010 to 2020), Top 33 Net Oil Exporters:

http://i1095.photobucket.com/albums/i475/westexas/Slide10-1.jpg

1.0%/year Production Decline (2010 to 2020), Top 33 Net Oil Exporters:

http://i1095.photobucket.com/albums/i475/westexas/Slide11.jpg

There will be a much more gentle decline because of the demand destruction that will take place among the emerging economies/BRICs/call it whatever you like.

The western world will slowly be dragged in by austerity, which will provide the perfect cover for a strike on Iran. This will not spare the BRICs. We are looking at a decade of continued depression, although slowly and incrementally increasing rather than with a big bang.

Peak Oil is a continued fact, a slow-moving situation. That is why the 'date of irreversible consequence' is a fictional fantasy. It doesn't happen that way. He has 'between 2015 and 2020' which should be interpreted that he leaves the possibility open for peak oil as late as 2020, granted that the BRICs demand for oil remains as high as it is now, and it if doesn't? Will peak oil be moved to 2020 to 2025? That's quite close to what the cornucopians think.

And this fellow doesn't strike me as a blindly optimistic cornucopian. CERA is wrong and was always destined to be wrong, but the peak oil folks have it wrong too, at least those who subscribe imminent production decline. We're looking at a long, slow decline in living standards across the world but still far better than what our grandparents had.

In 2020, nanotechnology could easily have made much of this discussion a faint relic of the past. My point is that the doom and gloom squad have been thoroughly discredited, as well as the blind cornucopian side. What's emerging from the rubble is the hardnosed view of a decade of malcontent, all over the world, depressing oil demand and stretching out the peak even further while at the same time not increasing production very much(if much at all). This will probably hold for a decade or more, and then decline unless there is genuine progress in robotics/nanotechnology, which is far closer than people on the outside think.

Can you elaborate a bit on how robotics/nanotechnology will save the day?

Nanobots will be deployed to re-program the laws of physics.

;-)

We will be able to drive really small cars on teeny-tiny highways.

That'll conserve energy..., I don't know how we'd fit in those teeny tiny cars though.....

We'll send our personal Nano-bot to go to work for us. It will drive our Nano-car on its commute. Our paycheck will be denominated in Nano-dollars!

Someone once asked Ray Kurzweil about peak oil; he completely hand-waved away any significance to it. Nanosolar too cheap to meter will make it a total non-issue. Whew!

Save the day?

He said universal malcontent will decline after a decade or so unless there is progress in robotics, i.e., robot-induced unemployment would continue to make things worse.

I agree with you when you say that cornucopians are wrong as well as those who predict a massive decline rate starting right now.

But my feeling is that with th increase in the oil constraint, we are reaching a much more chaotic process. By chaotic I mean unpredictible. It is possible to forecast some kind of smooth transition, but the contrary is highly probable too.

Leaving aside the predictions, chaos theory suggests that complex processes never go smoothly. Chaotic systems display a 'tipping point' phenomenon where nothing happens for a long time and then suddenly the whole system changes behavior.

Robotics is already there but how exactly will it save the day is something that baffles me, automation will only end up killing even more jobs and spreading more discontent.

wise

robotics is like all our other technology - a form of evolutionary information accretion - like DNA. it may, and probably will, survive the steep decline, but in a form that is unrecognizable from its current form. like organisms it will be subject to evolutionary pressure, with most of its indulgent and superfluous forms dissolving and its truly advantageous ones emerging to dominate.

as for jobs, the word bugs me. i like to consider the whole "jobs" concept in common with the ideas of "career", and "vocation", to put things in perspective. What is a "job" anyway? It's some unit that's measured by the fact that you get paid to do it by an established institution. It's also something you do in exchange for something else: the odd job. That's two different and competing meanings in one word. Confusing.

Meanwhile a "vocation" is a distinct calling, while "career" is sort of a meta tag that describes a consistent set of jobs that make up a life's work. In my opinion, the idea of vocation trumps the idea of jobs and careers in our declining future. Jobs will always exist in the sense of work being done, but they have a somewhat abstract connection to survival, especially in an advanced technological civilization. The idea of a job as a fixed and secure employment with a permanent company goes out the window in hard times - just ask anyone scraping by today. A career is an even greater luxury.

Does a farmer choose a career on the farm? Do the Amazonian natives hold jobs? Sure there's a division of labor, but if your primary goal is producing food and other basic needs, your "job" depends on season and a bunch of other factors far more than it depends on the collective action of the rest of humanity. That's likely to be the case in the future, as agriculture becomes again a primary mode of life and work for most folks. People with particularly useful talents will find their vocation, but the specialized status of "career" IMO will be something of a relic.

If we have solar-powered nanorobot slaves, we will not need jobs. Also, genetic engineering should be able to give us skin with chlorophyll so we can produce our own food just by lying around.

It all depends on which group of people you are in. For instance, when the current retirement accounts that are invested in stocks fail, the about-to-retire people will find money very scarce. Then they'll try to sell their homes and discover that they are worth half or less what they were a few years ago and a flooded market (already happening). This group will find money very tight and, if they can, will keep working as long as possible. If they lose their job, they are in bad shape and will join the next group.

Another group is the already unemployed. 90% won't ever get decent jobs again. They will just scrape by and hopefully retrain or do menial work. Maybe they can buy health insurance, but mostly they won't be able to afford it. Seeing a doctor will be a luxury. This group will grow from the current 10% of the population (a number no one really believes) to 20% then 30% and higher.

If you have a chunk of cash OR you can manage to keep employed, life will be very stressful. You'll likely have to support between 3 and 8 other people with a single income. Parents who were supposed to have a retirement nest egg will move in. Children who can't find decent work won't move out. If you lose your job, that's it: everyone is out on the street because you have no buffer. Worse yet, there will be no hope for the future because the world will be a mess of riots (at least until they burn themselves out), shortages, broken infrastructure, missing governmental services and demagogues.

I can't possibly believe this will be better living than our grandparents. Both of my grandfathers were gainfully employed for all their lives and lived while the world was being built, decade by decade, even with a war in between (WWII). We will watch the world decay.

It's important to understand that all this happens even if we were simply to stop growth because the financial system must grow or it fails. Actual contraction makes everything happen faster and the impacts will be worse.

I would say what we will see is something like living our grandparent's lives in reverse. My grandfathers lived through incredible hardship as youths (one born on the reservation with lots of difficult times, the other living through the depression and working on the railroads), but as they got older life got consistently easier and better... While my generation and those somewhat younger (I'm 30) have grown up with wealth and ease but have had things get worse, and will probably get to see things get much worse.

On the other hand, we can never see the end result. I can imagine a very good life (possibly even a better life) that is materially poorer than what my parent's have and had. I can also imagine a much worse one. Even seeing a year out is increasingly difficult.

We simply can't know how good , or bad, the future will be, because while resources set hard limits on what is possible, random chance-chaos- plays a huge role in what will actually come to pass.

The hard limits restraining us , the limits delineated by climate, ff depletion, soil depletion, and so forth, combined with our huge numbers, will prevent the next few generations, collectively from enjoying a life even remotely as prosperous as we here today enjoy.Life is going to be hard and short for billions of us before too much longer.

If we are VERY lucky, some of us, the ones of us living in well endowed countries such as the US or Brazil, might experience only a slow steady decline in our living standards.

I agree wholeheartedly with aangel about the value of stocks and most real estate.Houses and most stocks are valued at several times the actual prices anybody can hope to pay for them in a shrinking economy.If I owned a house in some high dollar neighborhood, I would cash out in a heartbeat.

There will be a huge inflation, overall, in the prices of any consumable or durable goods as various governments continue to print more money, because consumables are grown, mined, manufactured, transported, and sold in "real time".It is not possible to farm, or make furniture, or run a grocery store,or a taxicab, unless the short term cash flows approximate the short term expenses.

The price of apples necessarily must go up as the price of fuel, cardboard boxes, and fertilizer go up.

Modern houses are not consumed, they ordinarily last for a century or more, and they MUST fall in price to match the ability of future owners ability to pay for them.

Eventually , inflation will prevail, and even a peon will be able to afford a three hundred thousand dollar house, even though he will not be able to afford to get his teeth fixed or to purchase fresh vegetables.

Anybody who has a problem with this statement should reflect upon the fact that within my lifetime the price of a given size candy bar at the closest store has risen about twenty times, from a nickel to a dollar plus or minus a dime or so.The smallest soft drink has risen from a nickel to eighty cents.

My personal strategy is to do everything I can to protect myself from inflation by making our homeplace and little farm as efficient as possible.I put a thousand dollars and a considerable amount of labor in building a solar domestic hot water system because I believe that I could earn a better long term return in this fashion than I could in any other fashion.

We built a sunroom onto our house that requires no heat at all on sunny winter days even at ten degrees F.It helps warm the rest of the house in milder weather, and it will eventually save us more in terms of labor and purchased fuel oil or firewood than it cost us-I won't always be able to cut firewood.

Our domestic water and sewage system is earning an effective ten percent cash free return,given that folks in a nearby town are paying upwards of a hundred dollars a month for water and sewer.When their bill doubles, my effective return will double, excepting for the very minor expense of running the pump.

Hi, OFM.

No, not exactly. But we can make some very, very good educated guesses. For instance, high unemployment and the loss of a specialized economy are sure bets. What's less known is:

a) how long the rioting will last

b) how many regional or other wars we get into (scarcity brings conflict — guaranteed)

c) the precise date we experience an oil shock from something like the shutdown of the Straight of Hormuz

d) when a specific person loses their job

e) when the fiat currency system fails

So it's really just a matter of being ready for all those things because they will all happen...we just don't know exactly when. My bet is most of them occur this decade (rioting from discontent has already started around the world).

Everyone has to make their bet and take their chances.

Hello Aangel,

I agree wholeheartedly that the scenarios you outline are so highly probable as to be virtual certainties, although I am not so sure about the time line of within the decade;on the other hand, I am an armchair guy, and not directly involved in any sort of research or anything of that nature, and will give your timeline considerable weight in formulating my personal long term plans.

I'm the only person in the neighborhood who REALLY takes collapse in the near term seriously, and only talk about this sort of thing in hypothetical terms with local guys and girls, but just about everybody foresees tougher and tougher times ahead.

My personal expectation is that collapse with be DIRECTLY precipitated by either financial shenanigans or war, although resource depletion will be the most likely by far primary or root cause of either or both.

I can't really bring myself to truly believe we are going to go gently into the night, we just aren't made that way, but as I said up thread, if we are VERY LUCKY... maybe a few of us will escape a chaotic sudden collapse of industrial civ.

Financial collapse will almost certainly be followed by war if it comes first.

I have a backhoe, and I have an excellent spot to dig a fallout shelter, and enough steel and other stuff to rough it in.

Maybe I ought to get onto it-it would be useful storage space in any case.

Old farmers can do things along these lines for five or ten cents on the dollar compared to contracted costs, given enough time.No permits, no plans, no insurance, nothing financed, nothing fancy, a little labor swapped out here and there.....

Mac get a shipping container and bury it, they will be cheap at the moment,

save a hell of a lot of time and buggering about. Might not be a bad idea to start right now. It seems that your lot are moving thousands of troops into Israel at the moment. Its for the largest joint exercise between America and Israel called "Austere Challenge 12",quiet like the name. I see you are also moving a Carrier force off the coast. Anyway Mac you can read it for yourself.

http://www.debka.com/article/21629/

Another point you might consider when making a decision. We have seen a hell of a lot of over the top puffing a strutting from the Iranians about what they can do and will do, it seems they are going too repeat the exercise again in February. Now I don't know about you, but it seems to me they are running scared that they wont get there Atomic bomb before sanctions crater there economy and then those vicious clowns in there ball gowns and silly hats end up hanging from a crane. They are playing for big stakes and remember these are end of Days loons, and they will play there hand come what may, because to them it is a win win situation if they get the bomb they will will be able too blackmail and dictate the world price of oil just by threatening to use it, if they don't and get wiped out, by what ever means, they end up in a heavenly brothel with 72 virgins, and all the Vaseline they can use.We are not talking rational people her. I suspect, that the USA and Israel know exactly the time table for the Iranian bomb and that the date is sometime around the end of the year give or take a month or two. I am certain that this has been planned for a long time. You don't have any friends near Norfolk to tell you what is leaving or Fort Bragg to tell you if thousands of clean cut Americans are marching through the gates and not coming out again. Now I have worked out in the Gulf and I can tell you Mac in the summer the temperature gets up into the upper 40s centigrade with the humidity in the upper 80s, you don't sweat you melt. This is not ideal weather for some poor overloaded Marine to run up a beach, let alone walk. I suspect that they will try and lance this boil sometime in late February early March, when they have got everything in place, most likely by provoking the Iranians too do something stupid, we live in interesting times.

Aircraft Carrier Locations

http://www.gonavy.jp/CVLocation.html

There is only the Stennis in the Arabian Sea, but there are about 4 carriers that could move from Norfolk or the West Pacific. Under normal conditions, it takes several weeks to get from Norfolk to the North Arabian Sea. Faster transit would set off various alarm bells in capitols around the world.

But it is not clear whether aircraft carriers would be involved in an attack on Iran. Land-based stealth aircraft and cruise missiles from submarines and bombers are more likely to be used.

The "End of Days" loons seem to be rather thicker on the ground in the US than in Iran, according to my observations. It's also standard practice for those in the US Government who are pushing for war to allege that their opponents are not rational, so we shouldn't fall for that line. The Ayatollahs are a truly nasty bunch who lock people up at the merest hint of sedition and torture most of those they lock up (the international union movement recently won a campaign for the release of an official of the Tehran bus drivers' union), but they're not crazy. They saw what happened to Saddam, who got rid of his WMD as demanded, and was then toppled by a US invasion and executed by the regime they installed. They also saw what happened to Kim Jong-il, who was treated with kid gloves by Uncle Sam precisely because North Korea has developed nuclear weapons. He died peacefully and his regime, decrepit as it is, has been inherited by his son. In these circumstances, it is perfectly rational for the third member of the US-labelled "Axis of Evil" to learn from the fate of the other two and to choose the path which leads to survival. And if they get the Bomb, I'd expect them to sit on it and use it as a deterrent rather than to take out Israel (just as Israel has sat on its nuclear weapons, rather than using them to take out its enemies).

On a slightly different note, I'd recommend taking whatever the Debkafile says with a grain of salt. Its contents seem to consist of whatever Israeli hawks think it would be convenient at the time for people to believe. Check out what Wikipedia has to say.

Hi, OFM.

Not all of those will happen this decade, just most. For instance, the collapse of the stock markets I put at a 50% chance of happening before 2015, 100% before 2020.

The collapse of the fiat currency system could take much longer. By "collapse" I include hyperinflation, which essentially makes the paper worthless and a significant portion of the economy moves to bartering and other arrangements.

The chance of an oil shock from some sort of cutoff event increases as the world gets more chaotic. Could happen any time.

I don't think nuclear war is inevitable, like it appears Matt Savinar thought/thinks, but it certainly can't be ruled out as a real possibility. I'm preparing for the run-of-the-mill problems like a rapidly contracting economy, an earthquake (I live in San Francisco and am a trained earthquake recovery volunteer), etc. If nukes start flying, well, so be it. My earthquake kit will have to do for me.

This is just a quibble, but I want to point out that technically, Chaos and Random Chance are two different things.

Random Chance is neither describable nor repeatable; Chaos is simply not repeatable. Usually, a chaotic system can be described exactly with only a few expressions.

In fact, history does not repeat itself - but it does seem to like certain neighborhoods better than others.

Also consider the term 'stochastic' - Wikipedia's definition says this means 'based on the laws of probability'.

aangel,

You are not considering any adaptation of the economy to changes in supply and demand. Case in point, "doctors visits will become a luxury" is it not likely that doctors fees will decline or perhaps the US will actually reform health care to look a lot like many other developed countries ( ie ration expensive operations, improve prevention and provide wide access to basic care)?

With higher underemployment many services will become cheaper, but it is very unlikely that things will be as desperate as in the 1930's depression as my grandparents described it to me.

Neil,

that may happen but the conversation here precludes collective healthcare right now. There are simply too many people who see that as an unwarranted intrusion of the state into their lives and they are quite vocal about it.

This may change in time but not before 2050, in my estimation. The current generation of people who are used to living in a rich, abundant society and who view collective action as "communist" or "socialist" or simply "anti-freedom" must die first. The generation that replaces them will see that when a society is not rich, collective action is the most efficient way to operate in certain sectors and the only way for many people to gain access to certain services, like healthcare.

aangel,

you may be correct, but this assumes that the majority can keep their present health cover ie BAU.

I dont think that a big reduction in oil availability ALONE will trigger doomer scenarios. The US and Canada have vast energy and food resources in addition to oil, with a lot of fat in the system (and on the bodies).

The weak point is the present high consumption of oil for land based transportation, but a lot of that consumption is for single person travel in low mpg vehicles (commuting to work) and multi-person travel for low priority trips(unnecessary shopping trips, vacations, dropping children to school and sporting activities).

Introduce rationing at say 25% current average consumption(or increase price 100-400%), people will rapidly adapt in BAU ways. What I would not expect would be any doomer scenarios. The lights and other utilities will stay on, most food transportation will continue(except air freighted food), most people will get to work by either car pooling, using mass transit or driving a higher mpg vehicle and cutting down on non-esssential trips or walking/cycling. People will not abandon their homes in the suburbs because suburban living is very viable even with $10 or $20/gallon gasoline. Junking the SUV for a EV or high mpg small ICE vehicle is not really going to be life changing any more than kids having to walk to and from school through snow storms.

When it takes more than a barrel of oil to get a barrel of oil,

it will stay in the ground...

There will be lots of oil (in the ground)

One possible exception: airplane fuel, especially for military jets. Aviation is one oil use for which there is no substitute --no petrol, no planes. *If* alternatives can be brought online quickly enough, there's nothing preventing the government or large businesses from using nuclear, solar, wind, other generated energy to extract enough oil to keep critical air transport running. Of course, it will probably be limited to CEOs and keeping the copters airborne to deal with all the resource wars and rioting crowds of starving people --certainly not so Joe Sixpack can jet off to Cancun for a cheap 3-day weekend.

Again..., this article is not about when we reach PO

This article is about when we leave the plateau we've been on since 2005 and head into TERMINAL DECLINE....

You don't know how PO will unfold anymore than I do....

One thing I do know..., exponential growth on a sphere just under 8,000 miles in diameter is going to continue forever.....

The doubling of population, consumption and population will stop soon.... One way or another....

There is no scientific or technological solution to infinite growth on a sphere....

Fortunately, no one is really relying on those things to happen.

For instance, car sales in the US peaked in 1973, due to peak demand.

If you look at the MegaProjects Database, it plainly shows that expected additions to production peaked during the 2006-10 period at ~4.5 MBpd, which held production constant. Projects coming on stream during the past two years are bringing half that. Those in the pipe in the next few years half that again.

If 4.5 MBpd kept liquids constant, depletion assures a decline at lower rates expected for the immediate future.

Add to that the imminent shutdown of the Trans Alaska Pipeline, due to insufficient production > 350,000 Bpd, with much of that

resource stranded, and you have a recipe for a "pickle".

I disagree that the BRICs will suffer in this environment. The marginal price payable by them exceeds that which causes major economic dislocations in the OECD by at least $20/bbl. It is the OECD, and in particular, the USA which will suffer the consequences. The US in particular, has been bloodied by Iraq and Afghanistan. Mulla Omar is opening a mission in the Emirates to facilitate dialogue with the US. "Regarding their capitulation" I imagine.

The US will attempt to hijack shipments to themselves, and this will backfire big time. FYI, the latest Iran sanctions are backfiring with South Korea being hit hard. How long before the North, mostly independent of Imported anything, makes them the deal they cannot refuse: "Access to Russian Oil" on their terms.

INDY

Part of that may be accounted for by the way Megaprojects are scheduled. As far as I can tell, a project is scheduled according to the start-up year with peak rate occuring in that year. That is not always the case.

An example:

Indonesia's North Duri Area's startup was scheduled in '08 at 34 kbpd. Yet the peak rate is not scheduled to occur until 2012.

If the mega projects during that period actually added ~4.5 million bpd and production increased by 1.4 million bpd(BP data), then 'decline' is > 3.1 million bpd, because of not-so-mega projects. For example, ND Bakken added in the neighborhood of 400,000 bpd in that period. Colombia's production increased by about 250,000 bpd. Niether ND or Colombia made the list. There are many more.

Bottom-up analysis has its limitations.

If you're referring to the wiki page, it's badly out of date. In the last 23 months, the only update to 2011's "New Supply" total has been increasing Brazil's number by 100, and the only update to 2012's total has been to fix an addition error.

Is there another list of mega's ?

A public one? I don't think so, though if you ask nicely perhaps Chris Skrebowski might let you see his. I've never asked.

IHS has one, but it's very expensive to access.

There are some other ones, too (Wood Mackenzie might maintain one) but, again, you'd have to pay license fees to see it, most likely.

Chris presents summaries of his work regularly. You can see the recent summary at:

http://peakoiltaskforce.net

Skrebowski stated in the 12-14-2010 interview on FinancialSense with Papluva that his website was not very active at the moment, but that he planned to update his Peakoilconsulting website Feb - Mar.

What I think is needed is more transparency in the Oil Mega Projects.

That or stop using it to make forecasts.

Discussion on here sometimes start with dire predictions based on Mega Projects and end with the statement that the Mega Projects aren't up to date.

Sounds similar to using a decade+ old discovery graph, without updating. It makes sense if there is something to hide of course.

Bruce and Banned, the charts are up to date as of November 25, 2011. See my post below.

Ron P.

Yes, I've seen that. One question is who is updating the list ?

The Megaprojects was clearly authored by Skerbowski, but the updates appear to have been provided by Samuel Foucher, Stuart Staniford and Tony Erickson. They claim to be using the annual reports of Major Oil Companies and apparently news reports.

I think the Mega Projects should be viewed as only qualitative.

Iran, Saudi Arabia ink deal to develop joint oilfield

http://www.tehrantimes.com/component/content/article/94287

Perhaps I am being thick, but I don't see any charts in any post below your comment?

I meant the chart, or charts at Wikipedia Megaprojects They were updated on 25 November 2011 at 07:19, just as it says at the bottom of the page.

Ron P.

Got it. When I was referring to discovery charts earlier, I wasn't referring to megaprojects. The chart I want to see updated is this one. Haven't found actual data yet replacing that extrapolation.

http://www.gebweb.net/growingGapB.gif

There is this through 2008:

Future World Oil Supply

http://planetforlife.com/oilcrisis/oilsituation.html

That report is full of inconsistencies. I Don't believe any of it.

As Michael C. Lynch quoted in CRYING WOLF: Warnings about oil supply:

Data Presented in Future World Oil Supply quotes liberally from BP, but the chart presented in Future World Oil Supply doesn't appear to be supported by an historical reconciliation of BP reserves and production.

"full of inconsistencies" strikes me as just the start. I like how the global peak oil in 1979 is presented as a ho-hum event. Those who refuse to learn from history are doomed to repeat it, etc etc.

Well no, this was copied and pasted directly from the Megaprojects page:

You are looking at the date up top. I don't know what that is but I have been following the megaprojects very closely. It is updated every couple of months. The date of last modification is printed at about an inch up from the very bottom of the page.

Ron P.

No, I'm looking at the actual history of the document.

It's a wiki document, so you can see all the changes made since its creation by clicking the "View History" tab. There have been no significant changes to the "New supply addition per country from oil megaprojects" table since Jan 30, 2010. See for yourself.

Pitt, that is simply not the case. I did see for myself. Between the January 2010 and the last update there were many, many changes. Here is how you can tell.

If you bring up the Megaprojects page in Internet Explorer, then you can copy and paste everything directly into Excel. (It don't work with Firefox because it puts everything into one cell.) Then you can subtract every cell in the 2010 page from the corresponding cell in the 2011 page. I did and there many changes in several countries. There were many additions as well as many subtractions. The subtractions were of course projects that did not pan out as expected or delayed. Here is the overall changes.

2008 2009 2010 2011 2012 2013 2014 Total 25 215 1710 100 200 95 170 OPEC 0 0 1835 0 200 0 0 Non-OPEC 25 215 -125 100 0 95 170There were many changes in several countries but the total doesn't look all that great because there the additions were cancelled out by the subtractions. The huge addition for OPEC in 2010 was Iraq's grand additions. Of course these are planned additions with that much oil supposed to come on line sometime in the future.

Again, the Wikipedia Megaprojects have been updated frequently, every two months or so with the last update the 25th of November.

Ron P.

You do realize that's exactly what I said, right?

The only change to the estimate for 2012 in the last 23 months has been correcting an addition error. Do you honestly think that's the full and complete list of changes to 2012 megaprojects in the last couple years?

Not for 2011 and 2012 there weren't.

From the wiki page history:

You're factually wrong here - the megaprojects table is badly out of date. If you wish it was otherwise, go update it.

how about Iraq? no mention of it as incremental supply can be anoth 8mb/day

peak oil is not just about the supply but also the demand.

Oh yes, Iraq. One must factor in the discrepancy between how much it costs to blow up something compared to how much it costs to fix it. Can they pump oil as fast as the fanatics can destroy the ability to do so?

"8mb/day" after all the fanatics retire. Sometime after 2100?

A stagnant U.S., Japanese and EU are the clear results of a static energy supply. Our job now in the developed world is to downgrade our economies to clear energy space for Chinese, South American and Indian growth.

The way this plays out I think for the next 5-10 years is ongoing economic stagnation among the G8 nations. In the U.S. it will be ongoing erosion of the political atmosphere, a lot of volatility in the composition of Congress, switching back and forth between parties, a continued ratcheting up of partisan language and ideological rigidity.

But there's a whole lot of room to downgrade the energy intensity of the U.S. economy before we get to the collapse of civilization.

The great bulk of responses to this type of dialog seems to be a measured business analysis. What would we think if we analyzed alcohol or other drug addiction with some form of business analysis? We would probably think the analysis was missing something. If society is addicted to oil then we need the type of discussion that analyzes how an addict responds to a scenario where less and less of the addict's drug is available over a period of time. There is, after all, plenty of that type of material available.

Interesting point. I think if we clarify that it's not an addiction for society as a whole but for sectors, like oil and cars, then we begin to see what's going on.

Addicts are notorious for lying, for example.

Uh oh Nick. That is a form of denial. ;)

It would surprise the hell out of a lot of people to find out what is made out of oil. We are overwhelmingly addicted. Even health care is affected by the addiction to oil in surprising ways.

The average person doesn't really care very much whether they have an ICE or an electric motor in their car, or whether they use NG or a heat pump in their home. It's the oil & gas, car and FF industries that care.

There are good substitutes for every use of oil. Even aviation can be weaned off of it, though that's a bigger and longer-term project than most.

The average person really, really, really cares what his transportation costs him/her. They care a lot. What would it cost the average person to convert to to an electric or hybrid car? How many of them would a hybrid or total electric car cost one year's salary when a good used junker would cost them one to two months salary?

You guys who think it would be so simple for the public to convert to electric or natural gas vehicles really amaze me. You assume everyone has the finances that would enable them to convert tomorrow.

It will take at least two decades for any kind of conversion to become complete. And in the meantime millions of poor workers will be laid off because the economy is in the dumps because of declining oil production.

Hey guys, wake up and smell the coffee. It just ain't all that simple.

Ron P.

I think you're focusing too much on the poor. Yes, they deserve our help and compassion, but...they're not representative of drivers (many of the poorest quintile use mass transit). The median driver is precisely the driver at that median point of vehicle miles: a 6-7 year old vehicle.

If you take a look at Carmax, you'll see that:

1) the median price for all their US used 2006 model year light vehicles is about $15,500 (search the whole country for 2006 models, and then narrow it to under $15k - you'll see the number drops by a little more than 50%), and

2) the median price for a 2006 hybrid is about $19k. Higher than for all vehicles, but not dramatically so - a couple of years of gas savings would pay for it.

3) it's possible to get hybrids for around $13k (search for hybrids under $14k).

Well, there are always highly-affluent folks looking to flaunt environmental pseudo-cred (even as many of them fly here, fly there, and fly everywhere upon the most trivial provocation.) Since the market for old hybrids is very, very thin, there could be enough of them to drive the price to such irrational levels. But leaving them aside, why on Earth would any rational person even think about a 2006 hybrid when the bloody-expensive battery pack is likely to be approaching end-of-life?

battery pack is likely to be approaching end-of-life

My understanding is that very, very few Prius batteries have needed replacement, even after 10 years. Have you seen anything specific to the contrary?

To understand the market behavior it simply does not matter how specific anything you or I might or might have seen might or might not be. For starters, "very, very few" 10-year-old Prius batteries exist to need replacing.

But more importantly, no sane person of ordinary means is likely to gamble on having an unsalable/unusable used car on account of a likely need for an insanely expensive battery. There's no positive evidence that the batteries can reliably be expected to long outlive the warranty, and that is the sort of evidence that's needed - not the negative kind. And by the time positive evidence shows up it will be useless, as the batteries actually on the market will be constructed in a different manner from the old ones anyhow.

So perhaps the battery in a new car will be just as good or better as the old one with its now-known life, but perhaps not. There will be no evidence except for speculative extrapolations from accelerated life-cycle testing, and such extrapolations are subject to all manner of "spin" beyond the ken of anyone but a battery engineer.

In other words, there's no way for the customer to be reasonably certain. Instead, the customer must place a bet that is so unknowable that it cannot even be characterized by odds. Bets of that sort are best suited to Hollywood stars, rich lawyers and executives, and other folks swimming in money, rather than to ordinary folks who have to watch their budgets closely. Which is probably why the EVs and hybrids are still in the early-adopter stage and seem likely to remain there for a bit longer.

"very, very few" 10-year-old Prius batteries exist to need replacing.

Not at all - there are 10's of thousands, and only a very small portion of those have needed replacing. As indirectly referenced below, the supply of batteries from wrecked Priuses seems to be exceeding the demand for replacements.

insanely expensive battery.

You really should do 3 minutes of research instead of speculating wildly and "dissing" such an important idea (that drivers should move to hybrids ASAP).

"As the Prius reached ten years of being available in the U.S. market, in February 2011 Consumer Reports decided to look at the lifetime of the Prius battery and the cost to replace it. The magazine tested a 2002 Toyota Prius with over 200,000 miles on it, and compared the results to the nearly identical 2001 Prius with 2,000 miles tested by Consumer Reports 10 years before. The comparison showed little difference in performance when tested for fuel economy and acceleration. Overall fuel economy of the 2001 model was 40.6 miles per US gallon (5.79 L/100 km; 48.8 mpg-imp) while the 2002 Prius with high mileage delivered 40.4 miles per US gallon (5.82 L/100 km; 48.5 mpg-imp). The magazine concluded that the effectiveness of the battery has not degraded over the long run.[81] The cost of replacing the battery varies between US$2,200 and US$2,600 from a Toyota dealer, but low-use units from salvage yards are available for around US$500.[81]"

http://en.wikipedia.org/wiki/Toyota_Prius

It is good to see some 10-year data presented on the durability/suitability/repairability of the Prius.

It seems to me that Toyota did their engineering homework and made a good product that stands and delivers...performance, utility, and price are winners.

And now they have several different Prius models...

Seems to me that something like a Nissan Leaf should be a low-maintenance machine...electric motor, no gasoline, no oil, no transmission fluid, ...and the absence of attendant pumps, belts, hoses, filters, seals...it has a cooling system (hence coolant), and brake and windshield washer fluid.

Seems pretty straightforward...wash and wax it, drive it conservatively/don't abuse it, and the machine out to run a long time without a lot of fuss, keeping in mind an eventual battery change...if a few EV types are mass-produced, there ought to be a workable dealer or third-party refurbishment/exchange market at reasonable cost.