Tech Talk - Saudi Arabia and Production from Safaniya

Posted by Heading Out on June 24, 2012 - 6:29am

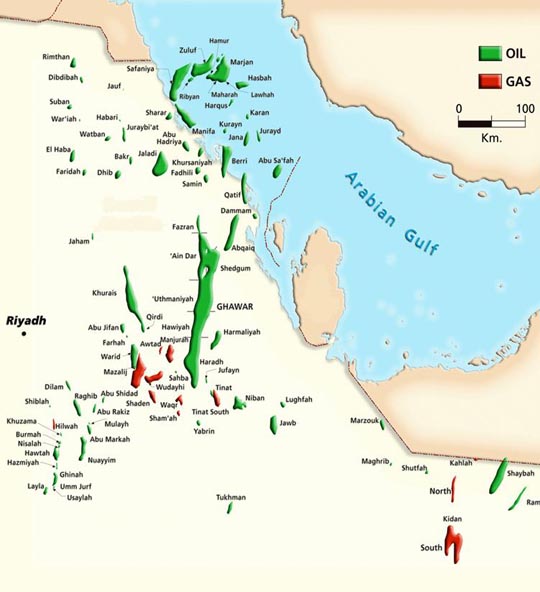

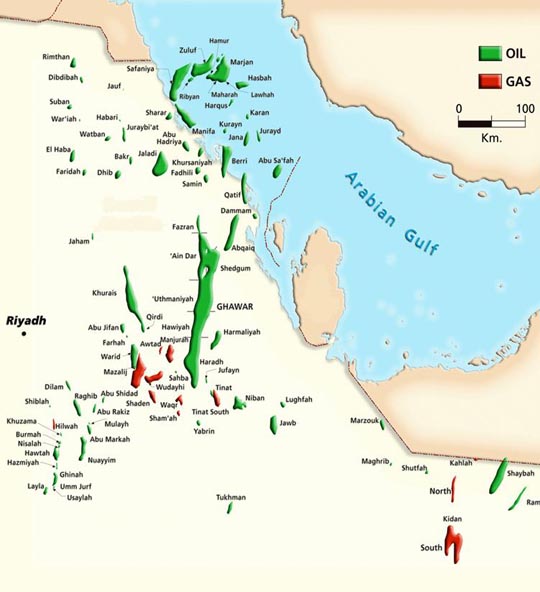

In recent posts I have been looking at the potential for the historically high-producing Saudi oilfields at Abqaiq, Berri and Ghawar to sustain or even to increase current levels of production into the future. This is particularly important when one considers the historic main oilfields in production within that country. And of these, the largest not yet covered is the offshore field at Safaniya, today's topic.

Because of the change in well design, long horizontal wells known collectively as Maximum Reservoir Contact (MRC) wells, many with a number of lateral feeds and located within the top five feet of the reservoir are now used, and initial declines in production in major fields have largely stopped. This is partially explained because as a vertical well through an oil reservoir sees the pool getting smaller, the length of well productively exposed to the oil in the reservoir reduces, and so there is a steady reduction in well performance over the years. However, where the oil is being pushed up the horizontal well by an under-flood of injected water (which sustains the differential pressure between the fluid in the rock and the well bore) then the exposed length and the driving pressure both remain relatively constant, and production is sustained at closer to a constant level until the water flood reaches the well and the well dies.

Aramco has changed the design of their MRC wells so that the arrival of water at one location along a lateral is no longer sufficient to kill the well. Installed valves isolate the region of the well where the water enters, and the rest of the well can remain in production. But it will produce at a reduced rate and is an early warning that water levels are nearing the well location. Before long, the well will no longer be able to sustain the x,000 bd production which has been the characteristic of most Saudi wells for over five decades.

This does not decry the efforts that have been made to recover residual oil left in those fields. As I have noted, Aramco has been diligent in seeking to find additional ways to extract the oil that has been left as the waterfloods progressed through their senior fields. But they are also smart enough to know that alternate fields would have to be developed and brought on line as the limits in the older fields are reached (as they now have been, in some cases, for years). There is an interesting feature to the sources of production, back in 1994:

The immediately obvious characteristic is that they are land-based, at least to some degree (as with Berri). Other less obvious differences are a change in the host rock and the quality of the oil.

The most significant of the remaining four is Safaniya which came on line in 1951. But it was not immediately produced.

Aramco, in accordance with the terms of its concession, went ahead with the careful development of the field. Between 1951 and 1954, 17 wells were drilled, but they were not produced . . . When it was first put in production in 1957, it flowed 50,000 barrels of crude oil a day from 18 wells. At the beginning of 1962 it possessed the facilities to handle 350,000 barrels a day (almost 128 million barrels a year) from 25 wells.

It was found to be the world's largest offshore oilfield, and Matt Simmons has conjectured (in Twilight in the Desert) that it is connected to Khafji, and through that field into Burgan. When Saudi oil production peaked in 1980/81 he notes that it was producing at over 1.5 mbd.

Since then production fell to around 600 kbd, but then has increased back to 900 kbd with plans now afoot to bring it back up to full volume of earlier levels of production. This will require additional forms of artificial lift, this being the electrical submersible pumps that have already been introduced into Ghawar.

The phase 1 upgrade at Safaniya is anticipated to be completed by next year.

The oil is found in sandstone rather than the carbonates at Ghawar, and in the original development, Matt has noted that the weak nature of the sand was causing the wells to collapse as the oil was removed, and that the flow of water into the reservoirs was bypassing a lot of the oil being left in place. As other fields have been developed, they have largely been brought into production fairly quickly. This has not been the case at Safaniya, which as Matt noted:

. . .holds the entire remaining spare daily oil supply of any magnitude.

In the sense that other fields and opportunities take a little time to bring on line, this remains true.

Manifa, for example, will only start to bring in significant production as the refineries to accept the oil are brought on line in the years ahead. Yet it is still counted as part of the total volume that KSA can bring to the market.

Safaniya had, however, been integrated with secondary development of the nearby fields of Marjan and Zuluft into a Northern Area Producing Region (NAPR) back in 1995 and there are enough wells and Gas Oil Separation Plants available, to be able to handle flows of up to 2 mbd. However, because the oil produced is Heavy (relative to the Arab Light classification of the production from the land-based reservoirs initially) Aramco also found it sometimes more difficult to market, though that demand also fluctuates. And it has been this marketing problem that sometimes seems to produce the headlines when Aramco sees a world that is increasingly demanding more oil, but has not always been willing to use this heavier supply as an immediate fill-in for existing shortages. (It could not, for example, provide an immediate replacement for Libyan oil last year, even though it was available). As a result, the heavier oil is discounted against other Saudi oil.

At present, the major effort offshore is going toward development of Manifa, which will ultimately bring an additional 900 kbd into production (staged to coincide with refinery construction) but as those wells come on stream (starting next year) so the effort will swing back to Safaniya, Marjan and the related fields of the NAPR. (And as an aside I had mentioned at the beginning of this series of posts there was some talk of bringing Damman back into production, and those talks apparently still continue).

This additional production capability, with the further development of some of the other fields in the region (which I will discuss next time), leaves me believing that of the three largest oil producers, it will be Saudi Arabia that sustains its current levels of production (give or take 500 kbd), much longer than its two rivals. I would again stress the difference between production and export volumes.

A huge problem with the fields in Safaniya is sand coming up with the oil. I was told, when I was there in the early 80s, that the problem was far worse than in other sandstone reservoirs. I have no idea why this was the case. But in some cases it even damages the pipes and equipment.

Ron P.

Ron:

Matt Simmons had commented that they were using a gravel pack to try and get control, but it depends on the sand grain size as to how effective that can be. Somewhere I have a photo showing well failures in sandstone due to crushing, but can't remember when I posted it.

Is the problem with the sand coming up together with the oil so severe it will not be profitable to produce the oil for todays price?

No, it is not that bad. It just creates problems with the equipment, pipelines and such being "sandpapered" from the inside.

Ron P.

;)

Karl – There’s no direct significant cost due to sand production. But there can be significant indirect costs as well as diminished production rates. Depending on what type of down hole lifting equipment (if any) they are using sand can cause significant damage…especially with submersible electric pumps. It can also be a significant problem with some components of surface equipment. And if enough sand is produced it can completely plug the production tubing. All this damage can be repaired but beyond that cost significant production time can be lost. The only time sand production will kill the economics of producing the oil is when the problems can’t be solved and the well is shut in. Otherwise it doesn’t take much oil recovery to keep ops profitable.

The worst problem resulting from sand production is the loss of structural integrity of the formation supporting the casing. Someone pointed out that such has been a problem to some degree in the field. The common name for the phenomenon is point loading. The stress distribution in the rock shifts and the collapse rating of the casing is exceeded over a short interval. Even at modest depths this overburden pressure can exceed many thousand psi.

As mentioned “gravel packs” are used to control such sand production problems. Gravel is not a very good distribution. The material is usually sand size and a bit coarser than the reservoir sand grains. GP’s are used with poorly consolidated reservoirs. Many sandstone reservoirs are not really “stones”. They may have no cementing agent at all holding them together. The problems become significantly greater when water production reaches the perforations. Just as one can pile sand higher in the air than underwater, the reservoir grains become much more mobile when the water cut begins. Another problem is the pressure draw down across the perforated interval. Higher production rates produce greater draw downs. The higher the draw down the greater the velocity of the fluid moving through the pore spaces of the sand grains. The higher the velocity the more stress against the grains. The greater that strain the more easily the sand grains can be dislodged.

Horizontal wells have been mentioned. Obviously if the hz perfs are within the top few feet of the reservoir compared to a hundred feet in a vert well the water will reach the poorly consolidated rock sooner in the vert well. But there’s also a significant advantage with re: to draw down pressure. It’s much lower in a hz well when it’s distributed across several thousand feet compared to a hundred feet in a vert well. Thus another reason hz wells can be produced at higher rates than a vert well.

But many early hz wells in poorly consolidated reservoirs suffered from sand production also. Many were completed without casing but instead had long sections of production screens run into the hz boreholes. When unconsolidated sand began to move the finer particles would plug the screens and completely kill the flow. A very common problem when hz wells in unconsolidated reservoir became popular in the offshore Gulf of Mexico by the mid 90’s. I’ve not seen it documented but I suspect the Saudis had similar problems with such efforts. Every operator across the planet did. In the mid 90’s a number of efforts in onshore Texas to recover a portion of 4 billion bbls of stranded oil in such reservoirs were made. Even though these efforts proved the capability of flowing 100’s of bopd from a hz well compared to the 10 - 15 bopd from the existing vert wells they universally failed as a result of screen plugging. Eventually a successful completion method was developed by offshore operators. But that tech hasn’t been discovered by the smaller operators who produce those old worn out onshore fields. And the offshore players don’t know about the potential in these old fields. I’m not sure how significant the screening plugging problem has been for the KSA. But the fix for the problem was developed in the last 10 years and I have no doubt the KSA staff (or at least their consultants) is well aware of it. They may have started a second generation of hz completions in some of their old fields. Since bragging about any new approach could bring up early failures it might not have been info the KSA was willing to put out.

And thus the Rockman has talked his owner into giving it a fling. Wasn’t too hard after collapsing NG prices shut down most of our drilling program. In a few months we’ll drill 6 pilot projects to show the economics of such wells. They’ll work but that’s not what’s important. How quickly we can recover X bbls of oil is what we need to determine. These wells will be expensive…$3 million each. Like every other project the rate of return will determine if we expand the effort or not. My owner’s goal isn’t to feed our country’s gluttony for oil…it’s to make an acceptable profit. If it works there will eventually be hundreds of such wells drilled. If it doesn’t he’ll run my butt off and get a geologist with another can’t miss idea. LOL.

Somewhat early in my career in the Canadian oil industry, companies discovered that if you took all the sand filters off a heavy oil well and produced as much sand as possible, the oil production improved dramatically as well. They eventually determined that producing so much sand created what they called "wormholes" in the formation, and these allowed much more oil to flow to the well bore. This became a recognized technique called "cold flow", to distinguish it from the thermal (steam injection) techniques which could also be used.

Nowadays, with the high price of oil, companies will use thermal steam injection in preference to cold flow because it gives much higher recovery rates. Cold flow can recover about 10% of the oil in place, whereas steam assisted gravity drainage (SAGD) can recover 60% or more under the right conditions.

The only problem was that we had a huge problem disposing of all the sand we produced - it could be as much as 30% of production. Eventually we settled for injecting it into deep salt caverns, but an innovative technique someone came up with was to spread it on county roads.

The engineers noticed that the rural counties were buying oil from us to spread on their roads to settle the dust, so we offered to take over maintenance of their roads from them, which appealed to cash-strapped counties. Eventually the provincial government environment departments noticed what we were doing and investigated, but they ultimately determined that it was no different than the counties spreading oil themselves.

The only thing was that they made us account for all the sand we produced, disposed of into salt caverns, and spread on roads. We had to do a sand produced vs sand disposed of report and give the GPS coordinates of all the oily sand we spread on roads. In fact, the government would tell us where to put the sand, and they would take core samples of the roads to make sure we had put the right amount of sand in the right places. You would be amazed how complicated accounting for all the sand got. Sand is not that easy to measure, either. Imagine trying to gauge the sand level of an oil stock tank, or how much sand is going through an oil meter.

Rocky – Part of my plan is to move in that direction. Screens are very expensive but I know they work. Have you worked with progressive cavity pumps? They handle abrasive sand very well. Gas lift is good but many fields don’t yield enough and compression isn’t cheap any way. I’m going to try to move towards screen wrapped slotted liners. Sands disposal will still be expensive. But we might find an asphalt layer to work a deal with.

Yes, I think about half the progressive cavity pumps in the world are in use in Canada. That was just about the only way they could handle the mixture of sand, water, and heavy oil (10°API) that came out of the wells. They're weird but amazing pumps. They'll pump anything including gravel and rocks if they have to.

Other than spreading it on roads, we used to dispose of sand in salt cavities, as I said. We used to create the cavities by injecting water into an underground salt formation and dissolving the salt to create the cavity. Then we would dispose of the produced salt water by injecting it into a deep brine reservoirs. Once we had a cavity about the size and shape of a large skyscraper, we would start dumping oily sand down the injection well, and keep on doing it until the cavity was full of sand. We would do seismic from time to time to see how our cavity was doing. When it was full, we would plug the well and start a new cavern going. We would have about five of them in various stages of operation at any one time.

This, mind you, was a big heavy oil operation - Lloydminster.

I would love to see the geologist in a distant future era, trying to figure out how those oily-sand-in-salt formations ever came to be.

Dr. Elmer L. Dougherty, an emeritus professor from USC, disputes that.

http://www.maraco.info/articles-by-%20Dougherty/Evolution.Aramco.pdf

Around 1960, he worked on the ARAMCO Reservoir Behavior Simulator, an early effort in modeling reservoirs, and this was tried on Safaniya. He was given data (shown in the above pdf) with evidence that Aramco produced the reservoir before then before a halt brought on by the 1956 closing of the Suez canal due to war. (See pages 10-11). And the data could only be explained by a alrge compressibility of the sandstone.

Yes I see that - he notes the ref I used where Aramco employees stated that it started production in 1957, but provided data from wells that were in decline in 1955

.It is interesting that Dougherty reported that Safaniya and Khafji are the same reservoir. I see that they were some of the first places in KSA to use horizontal wells with a doubling of production over verticals, but also because they reduced the problems of water coning. So by 1994 they had already learned of the need for high injections volumes of water (including some potential for enhanced production with bio-plymers).

It tends to confirm that Safaniya has been one or the reservoirs that they use for controlling the volumes that they put out for sale.

I think it has long been acknowledged that Khafji is an extension of the Safaniya structure. The fields obviously are adjoining. But the oil is distributed differently between the multiple reservoirs in the respective fields, and they only share one currently producing formation (Khafji). Most of Safaniya's production comes from the Safaniya reservoir.

Joules – You probably know this but for the benefit of a few others some common nomenclature. A field is typically a geographic area identified with a specific structural feature…but not always. A field may produce from more than one formation…a formation typically being a uniform rock type separated vertically from other formations. A reservoir is that portion of a formation containing hydrocarbons. But two separate areas of the same formation may be producing from the same formation such as two separate fault blocks. These would be two different POOLS. So Fields A and B may be producing on the same structural feature, the Y Anticline. Field A may be producing from only the Rabbit Reservoir but from 4 different pools of the Rabbit. Field B may be producing from two pools in the Fox Reservoir, 1 pool in the Hound Reservoir with no production from the Rabbit.

And sometimes just for the fun of confusing folks Texas and La. will sometimes allow wells drilled in amongst each other to be classified as different fields.

Safaniya early on was first produced from the Bahrain Sands (also produced in Khafji), and there was some concern on the parts of the Arabian Oil Company and Aramco that each would be stealing the other's oil. So, perhaps there is a common pool between the fields there.

Joules - Could be. I suspect if a field straddled a border the countries would give two different field names. But if the fields were fully developed I'm sure each country knows exactly where the pool starts and ends. Division of ownership is a varied animal. In Texas as long as my well is XX’ from the lease line all the hydrocarbons produced from my well belong to me even if the offset lease owner can prove they are migrating from his lease to my well. Called the “right of capture”. But the offset lease owner has the right to drill his well XX’ feet off the line and compete with my well.

OTOH jump a mile across the Sabine River into Louisiana and it’s a very different rule. If the offset land owner can convince the state commission that 30% of my production is coming from his lease I have to give him 30% of the revenue. He has to reimburse me for 30% of the cost of my well but he didn’t have to take any of the initial risk. If I had drilled a dry hole the entire loss would have been mine. As a result we always try to get a “predrill unit” defined first. But an offset owner can still file a claim. There's an entire class of consultants that specialize in such hearings. Sometimes 100’s of $million are at stake

Obviously such problems won’t arise with NOC’s especially when there’s no private mineral ownership. OTOH border disputes have not been uncommon and may become more volatile as PO conditions worsen. And more likely in offshore regions. Trinidad and Venezuela argued for many years over ownership of 100’s of trillion cubic ft of offshore NG. I’m sure there have been similar arguments in the ME. Many years ago the US and Mexico delineated the DW GOM long before anyone seriously anticipated production out there. Now Mexico is trying to play catch up as US companies have been producing along the border for years. Recently countries have been trying to define boundaries in the offshore Arctic.

Another newcomer: South China Sea.

Iraq (under Saddam) essentially emasculated itself with war against neighbors it suspected of stealing oil - first Iran and later Kuwait. In both cases, the borders were either in dispute or not clearly demarcated on the ground. Or both. The extent that reservoirs extend across borders wasn't clear, either. The tragedy is that Iraq has so much untapped oil well within its borders that tens of thousands of bpd wouldn't matter a bit. Sad.

In Sudan, they more or less know where the border oil is. They just don't agree on where the border should be.

Safaniya is now being produced with MRC type wells that couple with water injection to get better recovery factor. This is an offshore field, so how do they go about using water injection? Do they drill injection wells from a platform or use ship mounted rig? Then they have to install pipe system to these injection wells which I assume are using seawater. Sounds complicated and would be expensive to produce this oil.

I wonder if the development of Safaniya will progress if oil falls to $70/barrel as some analysts predict.

mb - EOR utilizing water injection is a long term proposition so they would be drilled from a fixed platform. And a typical injector well will cost as much, and often more, than a producing well. And then there is the cost of high pressure pumps and the space needed for them on the platform. And to recover many millions of bbls of oil might require injection of BILLIONS of bbls of water. But even adding the fuel requirements to the infrastructure capex the cost of injection may just be dimes or quarters per bbl of water.

There’s is a truly amazing water injection EOR project going on in an offshore Persian Gulf field being conducted by Maersk today. They are drilling 30,000’+ MRC producers and injectors. Last I heard they had planned to drill 900 such wells. About 8 months ago they set the world record for a hz bore hole: 36,000’+. Yep…almost 7 miles. At one time I was up for the contract to be one of the 12 geosteering well site geologists to work on the 6 rigs they had planned to use. A better opportunity came up but I often wonder how much fun that might have been.

Safaniya has dozens of platforms of different sizes that can be seen using Google Earth. They range from those with single wells to ones with as many as eight. The water is rather shallow (<50 ft.) in most of the field, but deepens to about 100ft. in the far northeast corner. Here is one platform where boats are likely gathering for some sort of party:

http://maps.google.com/?ll=28.028131,48.725701&spn=0.003201,0.004265&t=h...

Berri is another (almost) exclusively offshore field which uses water injection. Injection wells are drilled similar to oil wells with the same rigs (the equipment varies depending on the water depth). Much of Berri is in shallow water, but the eastern half deepens such that big jack-ups are used:

http://maps.google.com/?ll=27.24501,49.73243&spn=0.003224,0.004265&t=h&z=18

Where and when were ESPs used in Ghawar? They have been deployed in Abu Safah and Khurais, and now Manifa - but I haven't seen any reports of them used in Ghawar.

Safaniya had ~ 60 billion bbls of reserves and the prod'n system was badly in need of overhaul from the original development. This field was always one of the marginal producers. During the 1st Gulf War we bumped production up to 2.5 million b/d, but after the war ended, we cut that back to <0.5 million b/d by using price as a tool. That is, because in brought the least revenue, we raised the price for this grade, relative to its market value. This caused customers to nominate lighter, more expensive grades, thus optimizing the Kingdom's revenues. It is NOT hard to market. Crude oil is a feedstock, it is only worth what a refiner can make out of it. Lighter crudes generally make more of the more valuable light clean products than do heavier crudes. AHvy is not difficult to process: very crackable although the sulfur content is pretty high. The resid isn't very viscous and the TAN is very low. As with all crudes, marketability is mostly a function of price. We sold it to refiners who had the proper metallurgy, but it didn't require exotic metals as do the high TAN crudes like the Canadian oil sands or some of the West African crudes. There are plenty of refineries already built which can handle the Safaniaya or Manifa grades. The only reason these fields are low on the production priority is just that they bring in less revenue. Why would you sell AHvy if you had prenty of ALt capacity available from Ghawar and Khurais?

Welcome back, Carl.

Why does oil from Safaniya bring in less revenue? Is it just a case of maximizing total dollars in under the quota (since it is sold at discount) or are production costs involved?

Because Safaniya crude has less light components and more residual fuel, it simply produces less valuable products than do lighter crudes like ALt. Refiners can only pay what they can make out of the crude oil feedstock, less some small deduction for operation cost and profit.

Yes it is mostly a case of maximizing total dollars under the quota. The differences in the variable operating cost betweem Ghawar and Safaniya are slight and in practice for short-term decisions, not considered.

Interesting, though, that in Khurais, there is a slight production cost difference between the Khurais field and Abu Jifan/Mazalij such that when they do throttle back, they shut in the latter two.

Also, the revenue maximization quest make the decision to tackle Manifa at this point more of a puzzle. Why produce more of a revenue-challenged oil, as opposed to some other field which might yield something better? The refineries are expensive, and even before that, the Manifa development cost per bpd is double that of Khurais (which was above that of earlier projects, etc.)

Carl, Are you saying that Safaniya by itself produced 2.5 million b/d during the 1st Gulf War? If so, I didn't realize that Safaniya had ever reached such a high level of daily oil production (half of Ghawar's legendary 5 million b/d) if only for a much shorter period of time than Ghawar. I was under the impression that Safaniya's peak output was only about 1.5 million b/d, back in the early 1980's.

However, the 2.5 million b/d level would actually provide a clearer basis for the claim that Safaniya is the largest offshore oil field in the world. If Safaniya's peak was only 1.5 million b/d then it might appear that Mexico's Cantarell oil field would have the better claim to being the world's largest offshore field, with its output exceeding 2.1 million b/d in 2004. This peak was just before large declines took hold - reducing Cantarell's oil output way down to only 0.4 million b/d at present.

Also, in "Twilight in the Desert" (page 188) the late Matt Simmons suggested that not only is Safaniya connected to Khafji, it may also have connections to the giant Burgan field in Kuwait! And when Iraqi forces set fire to Kuwait's Burgan oil field (and others) in 1991 "...a pressure drop was immediately observed in the Khafji field, and possibly Safaniya too...".

Yes Safaniya did produce 2.5 million b/d during that period. In order to get back to that level again, Aramco planned to install gas lift equipment, not ESPs. However, after the war Aramco cut production back quite a bit and because of the revenue issue, much of the cut came from Safaniya. That was doubly desirable as they got better revenues from ALt and they didn't have to intall $2 billion of gas lift equipment at Safaniya.