Tech Talk - The "Best of the Rest" in Saudi Arabia

Posted by Heading Out on July 9, 2012 - 9:40am

Fom the viewpoint of those who suggest that there is no problem, the discussion that swirls over the future of global oil supplies often seems to focus on the large volumes of oil that still remain in place around the world. The critical point, however, is not that this oil exists, but rather the rate at which it can be recovered. This is perhaps most obviously pertinent to the discussion of oil coming from the Bakken formation in North Dakota, where the rapid decline in individual well performance means that a great many wells must be developed and remain on line in the out years to sustain any significant flow past peak. As I noted last week, it is a point that clearly was missed by Leonardo Maugeri, and equally by George Monbiot, who has finally been swayed to the side of the cornucopians, after years of doubt.

But the issue of individual well flow rates are an increasingly critical factor when future oil production in oilfields around the world are considered, and this holds equally true when the fields in Saudi Arabia are discussed.

The history of oil production from Saudi Arabia has largely come from individual wells that produced in the thousands of barrels a day. In order to sustain that production over decades, it has been necessary to ensure that 1) the pressure differential between the well and the rock are sustained; 2) that the rock has an adequate permeability to ensure that flow continues at a steady state; 3) that the oil itself is of relatively low viscocity and is thus able to easily flow through the rock; and 4) that there is a sufficient thickness and extent in the reservoir to allow such sustained production.

All of those factors came together in the giant fields that provided high levels of production over many decades, most particularly in the northern segments of Ghawar.

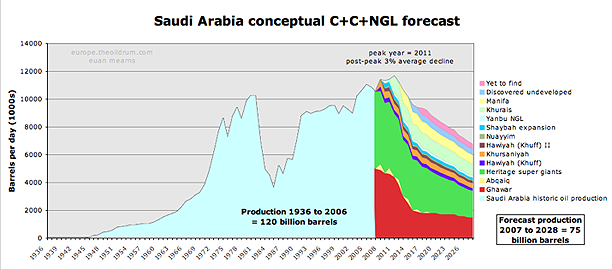

Yet those conditions are less commonly congruent in the fields that Aramco must now exploit to address the coming falls in production from the historic sources. These “best of the rest” (as the late Matt Simmons called them) must now increasingly carry the burden of sustaining Saudi production fail, individually, on differing grounds from meeting those earlier parameters. Collectively and in the face of Ghawar’s decline, they will only be able to sustain production to their original targets and will not provide replacement production as the oldest and larger begin to fade. I would remind you of the curve that Euan put up back in 2007.

Euan’s overall estimates for total production have not been met, rather KSA chose to reduce the volumes that they provided to the world market in order to sustain a higher price for their product. I would note that it was their recent production of an increased flow into that market that provided the cushion for the rest of the world, so that it can view the current sanctions on Iran (which came into full force at the beginning of this month) with considerable equanimity – at least for the next few months. That supply has provided the backup as Iranian exports are reported to have already halved. Now, if supply starts to get tight, it won’t be the fault of the KSA.

But in regard to the longer term question of total flow, will KSA increase their production to the 12 mbd that appears as some magic figure in the tables of the cornucopians as they look toward the end of the decade? I think not. Euan’s plot, if perhaps a little pessimistic over the rate at which Ghawar is declining, is nevertheless true from an overall perspective of the changes we can anticipate. Bear in mind that Aramco was only then moving to increase the size of their drilling fleet from historic levels of around 20 rigs to as many as 200 in the years since. And it is that change, with the underlying realities that it implies, that must be recognized when looking into the future.

As the largest fields are depleted, so production moves from them to smaller fields in the region. And as those fields are depleted, production moves to yet smaller and initially relatively uneconomic fields that now have value. But to achieve the same production, a greater number of wells must be drilled, as their individual production levels and operational lives are now shorter.

The Kingdom has been building production in a number of different regions over the past ten years. These have added considerably to overall Saudi capacity, but even if they are being drawn down at only 2% p.a. (as has been claimed in the past) slow reduction makes it more difficult for them to be the source of additional production to meet any future increase in demand/replacement of depleted reserves. As I list the fields, remember that when Ghawar‘s decline becomes evident, these fields are already in production, and so it must be the smaller fields that lie beneath them in the hierarchy that will then have to carry the burden.

Qatif has been producing 500 kbd since 2004, from a field that started with a projected 6.2 x 31 mile size, with 151 development wells, and an 8.4 billion barrel reserve. Both it and Abu Sa’fah lie near Abqaiq and Berri.

Abu Sa’fah, which was expanded at the same time as Qatif to 300 kbd, is an offshore field that covers 6.2 by 11 miles, and in the expansion had 90 wells and reserves of 6.1 billion barrels. (Half the revenue from Abu Sa’fah goes to Bahrain as JoulesBurn has explained and that arrangement continues with Bahrain getting the revenue from 150 kbd of oil.)

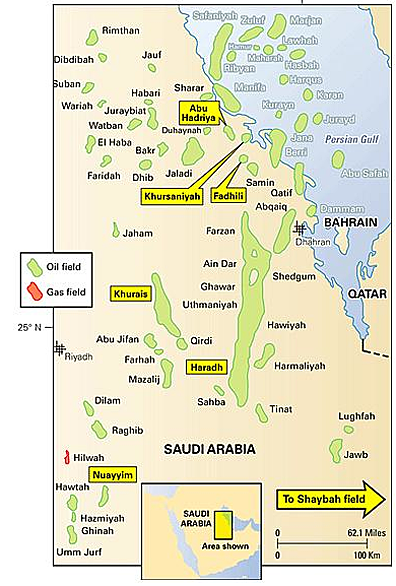

In 2007, Aramco brought 500,000 bpd of Arabian Light onto the market through the Khursaniyah development. This included the onshore Abu Hadriya, Harmaliyah, and Fadhili fields, though it first began production at a lower volume in 2008. The associated gas plant ran through some troubles and delays before coming on line in 2010, and this also delayed the time over which the field came up to full production.

Down at the other end of Ghawar, there are a group of oilfields found since 1967, including Hawtah and Nuayyim, in the Central Region. The group of fields, referred to as the Hawtah Trend or Najd Fields has had problems in the past with sand inflow into the wells, and there is some debate as to whether the reserves in the region total 10 billion or 30 billion barrels of light, sweet crude. Hawtah itself produces around 150 kbd, but the associated fields brought this up to 400 kbd.

Nuayyim came on line with an additional 100 kbd in August 2009

Figure 3. Named Saudi fields, with those coming on line or expanded in 2009 being emphasized. (Energy-pedia)

Haradh has been discussed earlier as part of Ghawar, and the major addition that came that year was at Khurais, which added 1.2 mbd to supply potential. Increase in production from Shaybah brought another 250 kbd to the total.

Khurais was mapped by JoulesBurn in 2008, and it was here that the need for additional drilling rigs became more evident to get all the wells brought on line in time for the scheduled start of the upgrade. With that completed, the increase of 1.2 mbd, which actually comes from the three adjacent fields of Khurais, Abu Jifan and Mazalij, began production in June 2009.

In terms of the production of the heavier oils that are taking a greater portion of the marketable Saudi product, it has been suggested that KSA has planned to increase production at Zuluf, which has some 8 billion barrels in reserve, to a capacity of 1.2 mbd from 500 mbd (but with 200 mbd mothballed).

Up on the Kuwaiti border lies the Hout oilfield, where work is now being developed to capture increasing volumes of natural gas now flared from the field. This is one of the four fields that the two countries share, and which includes Khafji, Lulu and Dorra. Most of the oil goes to Japan. Khafji came on line in 1960, and Hout in 1963. The fields have produced around 4 billion barrels of oil, and are now producing at around 610 kbd. Bids for the new development are now due in September.

I will leave Shaybah and Manifa until next time.

Hi Dave, here's how actual production stacks up against my forecast made in 2007. Saudi did indeed hold back production in the wake of the recession and have more recently opened up the spigots again faced with perpetual prices >>$100 (which our friend Monbiot seems to take as a sign of abundance).

The Ghawar forecast was indeed the low case but based on a semi quantitative analysis of all available data at the time. The key determinant for Ghawar will be the shrinkage / end of dry oil production areas in the north of the field. Back in 2007 we believed that dry oil production in N Ain Dar had already ceased and the dry oil areas in S Ain Dar and Uthmaniyah were shrinking fast. Once they run out of dry oil areas to drill, production will decline rapidly in Ghawar as shown to a new plateau maintained by Haradh - the south end of the field.

PS could someone maybe post links to what Saudi now claims production capacity to be - 12 mmbpd seems to ring a bell.

From October 2011: Saudis See No Reason to Raise Oil Output Capacity Behind a pay wall but available via Google.

And from November 2011 Aramco halts production capacity expansion

But personally I think they are producing at capacity right now.

Ron P.

Are you sure that isn't their announcement from 1979?

From Nehring and Hubbert's book "World petroleum availability 1980-2000", available at hubbertpeak.com.

Maybe they just keep changing the date on various boilerplate press releases. ;) Or there's some intrinsic limit to producing more from a given geographic region. Ultimate Possible Production, you could call it.

Perhaps but it was not a press release, it came from an interview in October last year with Aramco CEO Khalid Al Falih who wasn't around in 1979.

Anyway here is an article, by an Iranian, highly critical of Saudi's claimed production capacity:

Role of Saudi Arabia in Supporting West's Oil Sanctions Policy against Iran

Ron P.

At the 2007 Oil&Money conference (Energy Intelligence)in London Sadad al Husseini presented a slide with OPEC oil production up to 2030, including Saudi production. This was picked up in one of the Wiki leaks cables

2/3/2011

WikiLeaks cable from Riyadh implied Saudis could pump only 9.8 mb/d in 2011

http://crudeoilpeak.info/wikileaks-cable-from-riyadh-implied-saudis-coul...

25/2/2011

Acknowledging Peak Oil, featuring Sadad al-Husseini

http://www.youtube.com/watch?v=oZp-OxZuflE

http://crudeoilpeak.info/opec-paper-barrels

Monbiot has a reason for his point of view. As a hypothesis, I will suggest that he is swayed by formal arguments. Consider there is no real theory for "peak oil", and it is all heuristics as far as he is concerned. Why should he go with heuristics? For example, the Hubbert Linearization heuristic is terrible at predicting any kind of plateau, something that Rapier had predicted what would happen long ago on this site. Monbiot points out it is now a "roller coaster".

Also, no one has a model for predicting the growth of the Bakken. Monbiot looks at this situation and basically is saying that it's all been guess work.

Conversely, note that Monbiot still sides with the consensus climate science researchers because at least they have some formal math and physics-based theories.

So who has good fundamental models for oil depletion that have the formality of climate science?

Would that sway Monbiot to reconsider?

If memory serves, Deffeyes was predicting a global crude oil peak in the 2004 to 2008 time frame, most likely in 2005. Granted, we haven't seen a decline, but I think that it is pretty clear that Deffeyes was only modeling conventional production, and his point was that he did not think that slowly rising unconventional production would be sufficient to keep total crude oil production on an upward slope.

From 2002 to 2005, the EIA shows (rounding off to two digits) that global crude oil production increased from 67 mbpd to 74 mbpd, about a 3%/year rate of increase. In this time frame, Yergin was predicting a continued 3%/year of so increase in productive "capacity." At the 2002 to 2005 rate of increase in global crude oil production, we would have been at about 90 mbpd in 2011, versus the 74 mbpd that the EIA currently shows.

The EIA shows that post-2005 annual global crude oil production has not exceeded 74 mbpd for six straight years, ranging between 72 and 74 mbpd, despite a doubling in annual global (Brent) crude oil prices, from $55 in 2005 to $111 in 2011. This is in marked contrast to the rapid increase in production from 2002 to 2005, as global annual crude oil prices doubled from $25 in 2002 to $55 in 2005.

(Note that the EIA has slightly revised some of the numbers we used on the above graph. Realistically, I suspect that we may only have two significant figures of semi-accurate data for global production, e.g. the huge discrepancy between the EIA and the Texas RRC regarding Texas crude oil production.)

Deffeyes is a jocular writer with an engaging style, but when I read through his book, he didn't seem to take a really serious or formal attitude to the depletion modeling. I have no doubt that he is correct about the peak in crude oil around that time frame but the fact that it has plateaued instead of followed the HL profile indicates that this theory he advocated didn't pan out.

My point is that Monbiot may be judging peak oil theories based on the poor fit. I notice that no one is putting out Hubbert Linearization models for global production any longer. A broad plateau corresponds to a huge asymptotic URR in HL terms, and if Monbiot believes in the HL approach and sees a huge URR, he could be totally misdirected in what he believes is in store.

This stuff is pretty obvious to me, but people hate to admit that they were wrong, and would rather say nothing than to try to clear the misconceptions up.

Goes with the territory of modeling large-scale, long-term human-influenced phenomena...either the decision-makers don't like the model's predictions, especially when the predictions conflict with the decision-makers' baseline/fundamental/ingrained Word-views...even if those predictions are pretty darn good.

...or the modelers let their pride/arrogance/stove-piped mental frameworks inhibit them from admitting that their models are flawed/incorrect.

Many times a mixture of both.

What some folks don't get is that most large-scale 'solve World Hunger' models are not, and can not be, crystal balls. Too much dependence on incomplete process knowledge, unknown error bars in variables, incomplete variable stets, flawed assumptions, etc.

To paraphrase...some models can be somewhat useful... if the modelers don't oversell, and the decision-makers understand the boundaries of the models' suitability to purpose and do not read too much of their hopes/fears into the predictions.

It's not the size of the model that is the issue, it's that the Hubbert Linearization had the wrong premise to start with. It was never based on trying to map to a physical process. It was always just a convenient heuristic which involved convenient math.

The only thing that it had going for it is that it seemed to follow a few sets of data. That made it a heuristic. Yet, the rule-of-thumb for a heuristic is that you stop using it once it stops working. There is nothing to defend its use except that it fit data -- and now that it doesn't, move on.

Agree that HL is a heuristic...in my opinion it served (and still serves) as a simple first-order description of the phenomenon...after all, if one increases the breadth of the X-axis to hundreds, and certainly thousands, of years, the PO plot, even if there turns out to be a 50 year plateau, will come to resemble the curve printed on the T-shirts (the APSO logo).

But...we live and think in much shorter time scales...so at least some people are interested in getting as detailed as possible of a description of the future production curve (crystal ball), although I'm not sure why, since TPTB don't seem willing or able to act logically on such information.

Going beyond the HL heuristic, your methodology (indeed any attempt to model the actual processes involved in sufficient detail) is subject to limits of knowing what all the variables are, their mathematical relationships to each other, assumptions, etc. as is true for any model of this scope and complexity (meaning you are not modeling what goes on inside of a chemical plant or another industrial process, which is something much more constrained.

...although I have seen internationally-renowned organizations fall all over them selves with small armies of Green and Black Belts trying to understand why their yield rates producing certain kit are so abysmal, and struggling to understand why they can't improve their process yields, even though predecessor organizations achieved significantly and consistently better results...and struggling and failing consistently and hugely in estimating the costs of future infrastructure and product costs and schedules...

Compared to those examples, your model is dealing with nothing less than World-wide oil production over the course of the next several decades, with the many known and unknown variables and possible variable inter-relationships that go with that...not as gnarly as climate modeling I suppose, but not trivial!

Let's try applying a model to Bakken. We have a few parameters. One parameter is the average production cumulative for a well. Another parameter is the average effective diffusivity for the well

This is enough to get the production profile.

The third parameter is to estimate how many of these wells there are in the region.

Each one of these parameters is physically quantifiable and when combined will accurately model the projected oil production for the Bakken. Why not do this instead of just guess? Remember, Monbiot said:

I am with you on the Bakken example (or for any given 'field'...but how well does your model predict the existence, discovery, and oil in place/economical extractable oil from future fields?

For example, I have read assertions that there may be numerous 10

The comprehensive model does that. You can lead a horse to water but you can't make him drink.

Remember one of Monbiot's all-time famous quotes and the one that adorned his personal web site for the longest time:

And he has now replaced that quote with this:

The guy is obviously trying to get a rise out of the the populace and shake them from their complacency. Same with that other rabble-rouser Greg Palast.

As far as suggesting complexity gets in the way, that can't stop the climate scientists from giving it a go. What we are talking about here is veritable bean-counting exercises compared to what predicting climate involves. Why we have settled for heuristics really boggles my mind.

You make your case well, thanks to your math skills, communication skills, and the fact that you have staked out solid ground to stand and build on.

Keep up the great work on your model.

I, for one, will be very interested to see WHT's model and I'm glad that someone is doing the difficult but needed work of attempting to model the complexities.

But one point to make is that HL assumed much less original oil in place than what we know of now. It also only assumed conventional oil supplies. Not supplies like tight oil or tar sands or even oil shales (should that become a future source). And that doesn't even begin to take into account biofuels and natural gas (which are now included in all liquids).

The conventional oil wells will behave differently from the fracked wells. The fracked wells won't look at all like the tar sands and oil shales (mining). Natural gas depletion looks a bit different than oil depletion. And agricultural resources rely on healthy soils, climates, fertilizers, pesticides, and, in many cases, industrial farming equipment.

Might want to break depletion model functions down into conventional oil, tight oil, natural gas liquids, and tar sands. A more difficult element to model would include demand response. For example, how much of these increasingly fungible fuels can be produced at a given price? And, generally speaking, an interesting exercise would be to model an infinite price limit. IE, at an infinitely high price what are the ultimate limits of geology?

I suppose I may be asking too much. And I would certainly be happy with a model that takes good data from a resource like the Bakken and gives a good prediction. But, I suppose, it doesn't hurt to ask?

Best to you, and good luck in your efforts.

-R

I thought gathering the data bottom-up was a noble endeavor; you can't produce the oil without making an announcement of some kind. Unfortunately I took a crack at documenting megaprojects myself, and found out what a turgid nightmare it is, parsing all these company websites.

Now I think I can envision a better way of going at this - create a script for searching Google News for the names of the companies likely to be involved, check every other month. You'd save all the search strings in a folder, open all of those searches at once. I'd assume that someone bringing on >50 kb/d would be newsworthy, that's a few bucks at work there.

Skrebowski should make his findings public, speaking of disclosure. Assuming he's still at it.

Models, eck. HL seems to have identified the correct decade, that's good enough for me. People who want to know the precise year when we're going to have empty shelves, burning cities, cats and dogs sleeping together, are just missing the point.

HL is handy in that even a dullard like myself can play along with it, too. ;)

I always presumed HL was simply applying math to describe an observable curve -- the logistic function for oil production. HL's usefulness is only as good as how well the real world follows the Hubbert Curve. If it doesn't, then HL isn't very useful on a short, near term basis. There is no underlying real world analysis going on there, it's just fitting a curve to data and extrapolating what we think that curve will do in the future, based on previous examples of depletion. But it can still provide good long term insight because the URR shouldn't have too much bearing on the rate at which we get there. Is this right?

A model is just that, a model.

Hubbert's models were of the pre-computer genre. Ie: they had to be solvable by manual calculations.

They simplified the hell out of the underlying system.

However, if one magnifies the hell out of the peak of a bell shaped curve, one gets a plateau.....

Of course, this plateau extends months in time, and indeed varies in time, depending upon political decisions.

Then again, Hubbert's model, and Deffeys' work is limited to "CONVENTIONAL" oil. To complain that

it doesn't adequately consider, fuels made from agricultural crops, which actually create no new energy, merely transforming existing stocks, because the complainer wants to count the energy consumed in making them twice, seems a bit much to me.

By the phrase "counting them twice" I mean the practice of counting the fuel allocated to producing

bio-fuels as produced, and the bio-fuels themselves as produced, with no subtraction of the amount of fuel consumed in producing the bio-fuel on either a volume basis, or better yet, a net-energy basis.

In that regard, I believe one could create ever onward increments in liquid fuels production, given one constructs an infinite number of wind turbines and solar arrays, and uses the energy from these to convert CO2 emissions from coal plants into liquid fuels.

However, such numbers would not negate the fact that conventional petroleum production continued to drop, even if it dropped to nothing.

The more salient point, is that at which sufficient new energy entering the system fails to provide sufficient energy to run the system. Or EROEI, goes negative.

So, when is this?

INDY

I see all predictions as a measure of thumb. They may or may not be good but they are better than nothing. Basically then oil is produced in a region it will rise and eventually peak and if only production data is available Hubbert linearization is better than nothing.

Hi WestTexas,

The period from 2002 to 2005 was a relatively fast rate of increase compared to 1993 to 2005 (though it was not nearly as fast as the rate of increase from 1960 to 1972). Consider the following chart:

I have plotted the average of BP and EIA data for C+C (I subtracted NGL from the BP production data using NGL data from the EIA). The linear regression is on the data from 1993 to 2005, and is extended to 2010. Regression data (1993 to 2005) is red and data in green is 2005 to 2010. When done this way there is still a gap but it shrinks from 12 mb/d to 3.5 mb/d.

DC

My point of course was that I was comparing the crude oil production responses to two annual crude oil price doublings, 2002 to 2005 and 2005 to 2011:

Also, the 2002 to 2005 rate of increase was about 3%/year, which is precisely what Daniel Yergin was predicting--in the 2005 time frame--that we would see going forward. In fact, I frequently refer to these charts as "Yergin Gap" charts. Here are links to all five (through 2010):

Five annual "Gap" charts follow, showing the gaps between where we would have been at the 2002 to 2005 rates of increase, versus the actual data in 2010 (common vertical scale):

EIA Total Liquids (including biofuels):

http://i1095.photobucket.com/albums/i475/westexas/Slide1-18.jpg

BP Total Petroleum Liquids:

http://i1095.photobucket.com/albums/i475/westexas/Slide06.jpg

EIA Crude + Condensate:

http://i1095.photobucket.com/albums/i475/westexas/Slide05.jpg

Global Net Oil Exports (GNE, BP & Minor EIA data, Total Petroleum Liquids):

http://i1095.photobucket.com/albums/i475/westexas/Slide07.jpg

Available Net Exports (GNE less Chindia’s net imports):

http://i1095.photobucket.com/albums/i475/westexas/Slide08.jpg

I would particularly note the divergence between the first chart, Total Liquids, and the last chart, Available Net Exports (ANE).

More fallout from the Monbiot article:

http://www.express.co.uk/ourcomments/view/331447/Jimmy-Young

THE WORLD IS OIL RICH SO LET’S ALL ENJOY IT WHILE WE ARE HERE

EIA data for annual Saudi crude oil production (mbpd, Crude + Condensate):

2002: 7.6

2003: 8.8

2004: 9.1

2005: 9.6*

2006: 9.2

2007: 8.7

2008: 9.3

2009: 8.3

2010: 8.9

2011: 9.5

BP data for annual Saudi net oil exports (mbpd, total petroleum liquids):

2002: 7.3

2003: 8.3

2004: 8.7

2005: 9.1*

2006: 8.7

2007: 8.2

2008: 8.4

2009: 7.3

2010: 7.2

2011: 8.3

*"Twilight in the Desert" is published

WT, does anyone have daily world oil production data (C+C) for the first three months of 2012. Be interesting to see if it managed to poke it's head above 74 million, or even 75 million. If not, it would indicate that shale oil abundance may not be quite what its cracked up to be.

The monthly data are preliminary, subject to revision, and I suspect more susceptible to inventory changes. I think that average annual data give us the best (semi-accurate) data. Having said that, the EIA shows that global monthly crude oil production is above 75 mbpd in the first quarter of 2012, but just to cite one example, there is more than a 500,000 bpd discrepancy between what the Texas RRC shows for Texas crude oil production in January, 2012 versus what the EIA estimates (the EIA uses a sampling approach).

EIA country & global data:

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=50&pid=57&aid=1&...

EIA have learnt from the oil business and have started to sample from the sweet spots.

I once received a form supposed to be signed during an ISO certification and are pretty sure the questions where chosen to giva a good answer. Management got a good score before the paper was signed but I think some where not able to chose the right score since later on the workforce where reduced.

Early Warning: 2012 Global Fuel Supply Still Flat. All liquids, mean is ca. 90 mb/d. EIA has world C+C >75 mb/d this year, 75.7 mb/d in Jan.

Take the hypothesis that we have ~ 20 more years of a relatively stable or even slowly rising 'plateau' of oil and all liquids productions, albeit at at least moderately increasing production costs...if we (humanity) sit on our fat rear ends and don't use this opportunity to use the next 10-120 years to institute a new post-plateau way of life...well, then we collectively will reap the bitter harvests of apathy and short-sightedness.

Shale oil hasn't provided anything to anybody, outside of EOG etc and a bunch of sodbusters/good ol' people.

when we collectively will reap the bitter harvests of apathy and short-sightedness

The funny thing about such intergenerational "collective" legacies: the rewards and penalties are distributed so unevenly, much in the same way that financial markets "distribute" profits and losses today. If you find yourself part of the 1% clique (or even better the .1%), it's highly unlikely that your descendants will reap anything but a lifestyle of abundance, ease and power over everyone else. Should you have chosen your parents poorly, then... not so much.

Some 225 years ago, the French peasantry eschewed their traditional role of being compliant doormats for society's elites, but the sad truth is they were the rare exception that proves the rule. I look around me and I see very little evidence of collective anger (correctly) directed at the elites literally robbing and defrauding the rest of us. In 21st century America, the heroes are the same talented sociopaths trying to destroy an already fraying, threadbare social safety net to further enrich themselves, while the villains are ordinary working class citizens, women, minorities and Godless hippies. Hence the Tea Party, and patriotic battle cries of "get'cher gubermint hands off mah Medicare!".

Don't expect the great unwashed masses to rise up and band together anytime soon --they are fully anesthetized with 24/7 cable TV, pro sports, and video games, comatose with cheap fast food and alcohol, and not about to peel themselves from the couch to meet their neighbors, much less go marching arm in arm with them.

"Some 225 years ago, the French peasantry eschewed their traditional role of being compliant doormats for society's elites..."

And in essence they decapitated their society, bequeathing us the interminable, and on the whole rather sad, list of names memorialized to this day in the Palais de Justice basement/catacomb for any visitor to see. And not all that long after the killing spree was finally over, they wound up being ruled by Napoleon. The average peasant or coach driver certainly wasn't up to any such task, or any significant part of it, but yet the population, even back then, was far too large to go back to the nostalgic "simplicity" of non-agricultural Stone Age tribalism. So yes, go fools and idiots! Let loose the dogs of murder and pillage! Onward to Pyrrhic victory!

It seems to me more likely that Monbiot (like most people) is swayed by the news of the day. I actually like Monbiot on most issues, but in this case he follows many others in yielding to an urge to judge peak oil's validity on a day by day basis (...how was PeakOil trending at the closing bell today??).

As for scientific models outside of the lab, when they try to model anything where human behavior is central to the process in question, models have a tendency to fail badly at being predictive to any useful degree. Perhaps this has changed over the last couple of decades, but during my college economics studies in the previous century, I was not at all impressed with most such models.

For one thing, the human mind has never been (and may never be) modeled to anything approaching a scientific standard. This leaves many such models with a vital, yet highly variable "black box", placed right at the helm, driving most of the real world events supposedly being modeled.

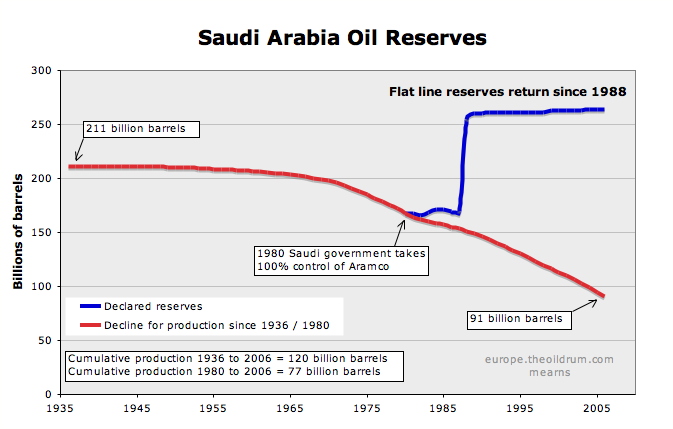

This is a chart from Euan Mearns August 2007 Oil Drum Article: Saudi Arabia - production forecasts and reserves estimates Saudi has produced an average of just above 9 mb/d since then, or just over 3 billion barrels per year. So they should be down to about 75 billion barrels of reserves today.

But of course according to Saudi their reserves never decline, they only rise gradually every year. Nevertheless Saudi Arabia is now in second place for reserves. They have 265.4 billion barrels of reserves while Venezuela has 296.5 billion barrels of proven reserves. ;-)

Saudi official reserves and their decline

Ron P.

Eyeballing "Decline for production since 1936 / 1980" will give about 50 to 60 billions of barrels left. Around 17 years at a production rate of 9 million barrels per day. If I remember correctly a lot of countries are worse than this.

I've been using the IUKE (Indonesia, UK, Egypt) and VAM (Vietnam, Argentina, Malaysia) as a combined model for net export declines. Their combined absolute production peak was 7.0 mpbd in 1998, but from 1995 to 1999 inclusive, they were on a multi-year production plateau, ranging between 6.9 and 7.0 mbpd (BP, total petroleum liquids).

The extrapolation on the following graph is based on extrapolating the 1995 to 2001 decline in the combined ECI ratio*. The extrapolation predicted they would hit a 1.0 ECI ratio (and thus zero net oil exports) in 2015. They hit zero in 2008. Based on the initial six year extrapolation, estimated post-1995 Cumulative Net Exports (CNE) were 9.2 Gb. Actual post-1995 CNE were 7.4 Gb.

The extrapolation on the following Saudi graph is based on extrapolating the 2005 to 2011 decline in the Saudi ECI ratio. The extrapolation predicts that they will approach a 1.0 ECI ratio (and thus zero net oil exports) in 2034 (which is more optimistic than what prior ECI decline extrapolations showed). Based on the initial six year extrapolation, estimated post-2005 Saudi CNE are about 45 Gb. Saudi Arabia shipped about 17 Gb of cumulative net exports from 2006 to 2011 inclusive, putting estimated remaining post-2005 Saudi CNE at about 28 Gb, or about 38% depleted (in six years).

*ECI = Export Capacity Index, or the Ratio of total petroleum liquids production to liquids consumption in exporting countries (generally using BP data base)

Trends are fun:

Where did you get that data for the earlier part of the century?

EIA numbers for the country as a whole start in 1900. For the individual states it's 1981, exception is Alaska for some reason.

How do you deal with the the relative population size in your two groupings?

IUKE+VAM has a population of 538 million people. Saudi Arabia, the other grouping, has a population of 27 million.

Since you are talking net export math the size of internal populations are a, if not the, major determinate of just how much oil a grouping can consume. Obviously the larger population grouping was able to accelerate its domesitc oil consumption faster than your trend line anticipated. Any chance that Saudi Arabia's, with only about 5% of IUKE+VAM's population, domestic consumption might increase a 'tad' less than your trend line projects?

Net export math is not about production alone--the population's potential consumption capacity must be factored in as well.

The following is a mathematical observation, not a theory: Given an ongoing production decline in an oil exporting country, unless they cut their consumption at the same rate as the rate of decline in production, or at a faster rate, the resulting net export decline rate will exceed the production decline rate, and the net export decline rate will accelerate with time. Also, net export declines tend to be "front-end loaded," with the bulk of post-peak Cumulative Net Exports (CNE) being shipped early in the decline phase.

Empirically, absent a clear voluntary cutback in production in response to declining oil prices, e.g., Saudi Arabia in the early Eighties, or a major political event, e.g., the collapse of the Soviet Union, or a production disaster, e.g., the Piper Alpha explosion in the North Sea, multiyear declines in the ECI ratio (ratio of production to consumption) tend not to end well. Also, the predicted CNE numbers, based on the initial declines in the ECI ratio, tend to be more optimistic than what the final CNE numbers show, e.g., the six case histories that we used for IUKE + VAM.

The ratio of Global Net Exports of oil (GNE) to Chindia's Net Imports (CNI) is analogous to the ECI ratio, and the 2005 to 2011 GNE/CNI data indicate that, at the recent six year rate of decline in the ratio, China and India would be consuming 100% of GNE in 18 years. I don't think it will actually happen, but that is clearly the direction in which we are headed, and the rate of decline in the ratio accelerated from 2008 to 2011, versus 2005 to 2008.

The following is a mathematical observation, not a theory:

keep working at it and you might get to the theory level...however the likes of Einstein and Darwin have set that bar quite high ?-) Of course the over a couple beers 'theory' (the type you seem to be referring to) is a different animal--much more a akin to hypothesis.

Also, net export declines tend to be "front-end loaded," with the bulk of post-peak Cumulative Net Exports (CNE) being shipped early in the decline phase.

Saudi Arabia would seem in a position to buck that tendency because of its relatively large per capita oil production and the huge portion of its domestic oil consumption that it currently uses for electrical generation. Lots of untapped solar potential to add to its planned nuclear generation, and that is just a starting point. It all rides on how enlightened the despots they have running the show...I'm not holding my breath on that one.

That's the problem with any of these models and Saudi Arabia..

- Long history of constrained production

- Patchy field-by field data

- Very high per-capia usage already (scope for increase here?)

- Scope for substitution in oil use.

So applying the ELM is a bit problematic.

You wrote: - Long history of constrained production

While it is true that Saudi, from time to time has restrained production. But right now, and many times in the past they have produced flat out. And their fields have a very high depletion rate. In 2006 they announced that their average natural decline rate was 8 percent they, with infill drilling, had got that decline rate down to almost 2 percent: Saudi Arabia’s Strategic Energy Initiative: Safeguarding Against Supply Disruptions

You wrote: - Very high per-capia usage already (scope for increase here?)

Yes, most definitely there is scope for increase here if the Saudi Gazette is to be believed. From November 2010:

Saudi oil consumption seen to double by 2023

Ron P.

When I first starting reading peak oil literature a decade or so ago, I remember Campbell and other ASPO folk referring to the concept of a peak in oil production, then a decline, and then a reversal of fortune as oil production increased b/c of rising prices to create a "Maximum Effort Peak". The idea made intuitive sense to me, and still does. Basically you're rolling along thinking everything's hunky dory and then realize you're running out of something... so you do everything you can, bringing everything to table to fight the decline. But geology, of course, wins the day. I wonder if we're not seeing such a MEP in places like Saudi Arabia, USA, and Russia after the huge run up in oil prices since the start of the millennium and everyone in the biz pretty much realized oil depletion is for real (even if they're not allowed to talk about it). Anyone have any thoughts on that?

Thanks,

Stephen

Exactly! That has been my argument all along. That is as prices rose to three to four times their previous levels there were heroic efforts to bring more oil on line. Of course oil that was not economical to produce before now becomes economical. That is what has kept us on this seven year plateau.

If the world had a lot of excess capacity that could be produced but was not being produced because of low prices, should now be out there. And it is, every barrel possible.

Ron P.

eh = extra heavy oil from oil sands and Orinoco belt, pg = refinery processing gains, other is other liquids that are not c+c+ngl such as biofuels, coal to liquids, gas to liquids, and blending components, c+c is crude plus condensate, ngl =natural gas liquids. Fuels such as ngl(75 %), ethanol (57 %), and biodiesel (88 %) are discounted by the levels in parentheses due to their lower energy content per barrel relative to crude oil to get a “barrel of oil equivalent”.

sorry about this chart I could not get it to line up:

oil types URR(Gb) up to year 2200

c+c-exthvy 2272

c+c+nlg-eh 2682

cr+con+ngl 3098

natgasliqu 410

extraheavy 416

totalliqui 3462

The extraction rate profile is below and thanks to WebHubbleTelescope for producing The Oil Conundrum upon which this analysis is based (Generalized Shock Model fallow=6 years, build= 8 years, maturation= 10 years):

Hi Ron,

I agree that heroic efforts are being made in an attempt to maintain BAU. It occurred to me that oil companies may attempt to ramp up their extraction rates to try to maintain the plateau, so I produced the following highly optimistic scenario to see how far the plateau might be maintained under ideal conditions which are unlikely at best (most here would say impossible, but think back to 2008.)

This scenario attempts to avoid the likelihood of underestimating future oil output and is intended to present an upper bound on future liquid fuel output. It assumes there will be no oil shale output from the Green River kerogen deposit in the western US and that oil prices will remain high enough to prompt oil companies to produce the large extra heavy oil deposits(or bitumen) in Canada (255 Gb at 15 % recovery) and Venezuela(165 Gb at 15 % recovery) and continue pursue deep water projects and Arctic oil. (Note that Venezuela assumes 20 % recovery from the Orinoco resource and that Canada assumes 10 % recovery from the oil sands resource, I have assumed that each will achieve 15 % recovery to model extra heavy oil production.)

It further assumes that natural gas peaks in 2038 at 157 trillion cubic feet(tcf) per year (URR= 16500 tcf based on Steve Mohr’s middle case for natural gas) and that the world rate of ngl per cu ft of natural gas increases to the US level by 2030 (this is another optimistic assumption). It also assumes that biofuels, coal to liquids, or gas to liquids (or some combination of these three) can increase from 640 mboe/a (million barrels of oil equivalent per year) in 2011 to 1200 mboe/a in 2030 while refinery processing gains worldwide approach US levels over this period.

The issue is likely to be a lack of demand as high oil prices may reduce the growth rate of world income eventually leading to a recession (on a worldwide basis I don't think we are in a recession yet). See the IMF World outlook (2011 World GDP Growth 3.9 %) http://www.imf.org/external/pubs/ft/weo/2012/01/index.htm In addition, the world may begin to take climate change more seriously which could curtail demand for oil due to public policy (it would make more sense to focus on reducing coal, oil, and natural gas in that order because carbon dioxide per unit energy decreases as we move from solid towards gaseous fossil fuels.) Another potential problem is that natural gas prices may increase to a point that production of steam for in situ oil sands and extra heavy oil may be too expensive and make extra heavy oil unprofitable.

Excel and Open Document spreadsheets "worldoil plateau" at:

https://sites.google.com/site/dc78image/files-1

DC

I have intuited, by looking at the example of the U.S. peak oil plot, with the secondary lower peak from the Prudhoe Bay and environs production, that the post-'absolute peak' portion of the oil production graph for the U.S. (and likely other areas) might feature numerous 'sub-peaks' resulting from the confluence of desperation, periodically spiking prices, and incrementally improved technology available to be paid for by those price and desperation surges.

And then there are various above-ground factors (government upheavals, natural disasters, holding back production to stretch the life of the golden goose (KSA?)to complicate the shape of the production curve and confound predictions....

Price spikes bring out the drillers, yes. For instance in 1991 the US gained 62 kb/d YOY, after 5 straight years of triple-digit declines. It's nothing to be surprised at in the least. Much of that was offshore but it also included a bit from TX and AK, interrupting otherwise continuous declines. To read some doomers you'd think the industry would just completely keel over for no reason whatsoever. This is the absolute peak, that includes drilling, in all likelihood, spurred on by unconventional fossil fuels. The first 4 years of the 1980s saw a huge number of wells drilled, too.

Yup. Those new developments look like relief for a few years, but in the larger picture they're just a pimple on the downward slope. If you look at the integral under the curve the total is how much? A few percent at most.

No argument on the overall effect of decline from me...I just intuit that the back half of the curve may have numerous sub-peaks, looking remarkably like the plot of electromagnetic emissions from an antenna...a 'main lobe' with a number of harmonics/side lobes...

...in human terms, each of these sub-peaks will in turn re-invigorate the folks inclined to jump on 'evidence' of a resurgence of oil discovery and production, of course to be simple-mindedly extrapolated up, up and away.

Most of the population does not have the talent, experience, or inclination of many of those on TOD to do the research and even the most basic historical data visualizations, let alone any effort for even first-guess intuits about future patterns, let alone doing any real (if even simple) math.

Very few politicians who have the requisite skills and interest, politicians of any real influence anyway, would dare try to educate the masses....these folks wouldn't get elected in the first place, and if they had a post-election epiphany, they would be quickly and expertly marginalized.

H – “I just intuit that the back half of the curve may have numerous sub-peaks”. Sound like an undulating plateau to me. For some time I’ve been unconcerned about the repercussions on the actually day of PO (which we’ll only be able to definitively tag long after the fact.) Peak Plateau is not defined universally. Is it a 2% variance over X years? Is it 10% variance over Y years? Or maybe it’s like porn: can’t define it but you recognize it when you see it.

Maybe a non-numerical definition would be better. Maybe it’s when high oil prices don’t last long enough, due to their damage on the economy, to result in an increase in resources that can generate long term economic growth and preserve BAU. Political instability (ala ELM) could be used to shade the definition. And maybe tossing in some numbers could be added. Numbers like the body count as a result of bringing democracy to oil exporting countries.

IMHO we’re at PP and are getting a view of what it means. Some folks seem to be looking so far down the road to see the bad times they aren’t seeing what’s going on today. Perhaps it’s like the story of slowly bringing that pot with frogs in it to a boil slowly. Not too bad especially if you’re one of the frogs still floating on your air mattress. Sure…your buddies don’t look very comfortable. But that’s their problem…not yours.

Bimodal distributions are not unusual for oil production curves, just like the normal distribution curve, where you often have one curve for men and another for women, superimposed on each other. Or as I found in university, the students who understand the course material, and the ones who don't. The Faculty Dean called it the "Maidenform Distribution" after the bras (he may have had too much to drink at the time).

In the US curve there is one big peak for the low 48 states, and a secondary peak for Alaska, which if you recall is physically disconnected from the lower 48. There's no reason they should peak at the same time.

For other oil provinces, there is often a peak for primary production, and a secondary peak for secondary production. They can extract a lot of oil from old oil fields using modern production techniques. In Russia, you see two peaks - a communist peak and a capitalist peak, the latter using infill drilling and EOR.

However, for the world as a whole, I think this is pretty much it. Unconventional production can slow the decline and stretch out the production curve, but it can't really create a secondary peak. The capital costs are too high and countries can't afford it.

Rockman and RMG, thank you for your well-considered replies. I Agree.

Russia's 1st peak was brought on by societal collapse, the UK's by Piper Alpha, correct? I've never seen a rigorous analysis of the first example, but have always read that that this was the major factor; although the USSR's production did decline on its own 1988-1991: 12053/11715/10975/9992 mb/d C+C. That's a 6% average decline rate.

Yes, thank you all for your insight!

I feel that we are in the phase of fine-tuning the picture of what peak oil looks like in the flesh, rather than wondering what it will look like in the future. It is not surprising to me that as we approach what I feel is most likely the "Maximum Effort Peak" or "Peak Plateau" or whatever the best name for it is, that there will be many who will take the opportunity to discredit the notion of resource depletion and peak oil and try and reassure all that BAU is possible and even inevitable. And even some like Monbiot who will fall for the apparent reversal of fortune. It is my strong suspicion that he will be eating his words once again before the end of the decade.

But on a personal level I also see acquaintances whose belief in BAU gets shaken with every price spike, despite what the pundits yell. Accepting peak oil requires a crises of faith for most, on par with abandoning an overly strict religion or finally getting the courage to leave an abusive spouse. Many never summon the courage to do these things, even when their destructive effects are apparent to everyone else. But many do, and as more become aware of it there is no choice but to begin the long struggle towards a more sustainable world.

Thanks again,

Stephen

Here's my response to George Monbiot:

Peak Oil: A Dialogue With George Monbiot

The essential point to me is that unconventional fossil fuels are caught in a paradox - that their EROEI is too low for them to sustain a society complex enough to produced them.

Well lets see whether it turns into a real dialogue (in the sense that he makes more than one brief reply to you).

Frankly I am disappointed with Monbiot primarily at the intellectual level. I have come to the conclusion (having read his article) that he never really understood resource depletion, nor much about hydrocarbons as energy sources. I think he grabbed on to Peakoil as a concept in 2008/9 when it was at its most 'popular' as an idea. I dont think he even researched it properly. He seems prone to intemperate knee jerk reactions (witness his sudden volte face concerning nuclear power)- unfortunately because he is a well known spokesperson his intervention will have harmed the resource depletion cause. Ironically he will also have harmed his central cause (AGW) as his abandonment of peakoil will be used by his opponents as a stick to beat him with (if he is wrong on peakoil, then he is wrong on AGW blah, blah). I wonder if he even thought about that issue (strategically even if he believed peakoil theory was now flawed he would have done better just to refrain from comment). All in all he comes out looking like a lightweight.

EDIT: There again maybe I have had him wrong all along - maybe he was only ever another lightweight journalist who one day was short of copy and so thought - 'I know this new report saying oil depletion is bunkum is out, and I can quickly cobble together a piece on it.....etc etc'

Or maybe I am just too cynical.

I think he, like many commenters, viewed PO as relief from the dreadful outlook on global warming (like Kjell Aleklett), not seeing that they are independent of each other since there's plenty of carbon in the form of coal to screw the climate. My view was always that PO may increase CO2 output as some countries resort to CTL. Tar sand is the first humble step in that direction, followed by oil shale.

I think he, like many commenters, viewed PO as relief from the dreadful outlook on global warming

He's gotten the base theme right - humans and their consumption habits screw things up, yet some how looks past the screw ups of Fission electrical power in his desperate BAU support while trying to address global warming.

But worry not citizens, the saving of the planet will happen once its profitable for the venture capitalists.

What is his background? Anything scientific? I find that generally those without a technical underpinning to provide a framework to these kinds of issues are more likely to be swayed by the wind based on the latest mass group think trend or some obscure new technology or idea that's reported in the media. Without a fundamental understanding of what the issues revolve around, they have no reference frame from which to analyze all the bunk that's thrown around the media by other people of equally poor or worse credentials. This is not necessarily an ad hominem criticism, but more like assessing someone's qualifications. You don't let someone operate on you if they haven't gone through med school, so why should we trust the analysis of energy to journalists with arts majors? Nothing wrong with journalism arts majors of course, but we have to question when so many of these types feel qualified to report on energy issues.

I wonder what he's going to answer.

Your response appeared a little abstract and didn't point out the elephant in the room completely clear: That cheap (high EROEI) energy like natural gas has to subsidize syncrude production from tar sand so it's just a tradeoff, wasting one form of energy (via an inefficient process) to make a high value fuel.

I'm waiting for the first syncrude manufacturer to ask for loan guarantees now that crude prices hover just a little above their hypothesized break-even of around $80/bbl.

(long time lurker and first time poster)

Ralf

The following is from G. Monbiot's personal blog..

If he really is about the above, then he would be upset at finding the truth if someone with authority from this site can show him the real numbers and scenario, especially about where Maugeri's funding came from.

A combination of Westexas's work along with Darwinian's recent work on OECD production and consumption, has to be telling for anyone looking for the truth, especially as it is based on actual numbers, not theory.

Stoneleigh

Do we know the EROEI for the different types of unconventional oil?

A ratio such as 5:1 still means that of 100 barrels or equivalent output, more than 80 are a surplus return on input.

Granted that the phenomenal expansion of industrialisation took place when the energy returns were much higher and also that lower EROEI must have economic implications, but 10:1 or even 5:1 might still be sufficent to stoke further expansion of the energy gathering process? I think of the expansion of coal and NG retrieval and in particular an expanding 'oil mining face' in Athabasca?

This appears to be what is happening, though economic adjustments are likely to be fairly dramatic from time to time.

Thanks as always for your thoughts

Phil

It is not very easy to calculate the EROEI of most forms of non-conventional oil, because companies do not report (or even record) some of the relevant data. The values will range from very high for some of the better wells to 0:1 for all the dry holes that are drilled. Its hard to figure out what an average would be.

Oil sands is the easiest to calculate because companies track their fuel consumption and oil production, and report it to government. You can get the reported numbers if you know where to look, and calculate the EROEI with a fair degree of accuracy.

Generally, oil sands projects have an EROEI that ranges between 3:1 and 12:1. Every project is different. The ones with the 3:1 EROEI are working hard to improve that number because fuel is not cheap. I usually use 6:1 as a generalized average, but the number is gradually improving. If you see lower values, it is based on older data.

It's also worth noting that the fuel is almost all natural gas, which is widely available in the oil sands areas and costs a tiny fraction of the price of oil on energy equivalent basis.

Thanks for that Rocky.

However, Stoneleigh does have a point about economic upheavals and their effect.

The deflationary tsunami she and TAE have talked about for years might actually happen.

The coal at the moment is piling up in China, it seems.

http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/100018475/ch...

How it might play out is way beyond me.

RMG,

At what price ratio would the oil sands become unprofitable? For example if bitumen sells for $70/barrel and the barrel is 6.1 GJ, that is about $11.5/GJ. If we assume all other energy inputs into equipment and maintenance are a negligible part of overall enegy costs (especially true of in situ projects) and 1 GJ of Natural gas is needed per barrel of bitumen produced. then prices could rise a lot before a given oil sands project became unprofitable. This however ignores the initial investment to get a project up and running. Do you have any idea what the average cost per barrel of the overhead for the newer (more efficient) in situ projects? What kind of ROR do companies look for and how long do the projects expect to produce? At what oil price would it not be profitable for new in situ projects to go forward if natural gas prices were 75 % of oil prices in energy terms (WTI= $75, natural gas = $9/GJ)? Thanks.

DC

An additional question: if natural gas goes sky high, then at what oil price would in situ projects still be profitable if they instead burned 1/6th of the produced bitumen instead of gas?

With oil at $70/bbl and NG at $11.50/GJ, I would think oil sands would still be profitable and they would continue to use NG as a fuel. They still have $58.50/bbl left after they have paid for the NG. Of course, then they have all the other expenses

If you doubled NG to $23/GJ, so it was trading at twice the price of oil on an energy equivalence basis, they would still have $47 left, so it would not be as profitable, but it would probably still be marginally profitable. However, at that price, I think that they would start burning bitumen as fuel because it would be cheaper. I doubt that NG will ever trade at twice the price of oil, though.

If the price of oil went down to $50/bbl, that would be different. It would no longer be profitable to start new oil sands projects, although the existing projects would still keep operating.

Thanks RMG. That $50 number was exactly what I was looking for! Is the $50 price assuming that NG prices are on a par with crude prices in $/GJ, or are you assuming current price ratios, which are about 5/1 (oil prices being higher than natural gas, obviously)? It seems around $45 is the cost besides energy costs to make new projects profitable, we would need to add to this about 1 GJ per barrel for in situ operations and whatever the cost of that 1 GJ would be added to the $45, today it is around $2.5/GJ so a total cost of $47.5/barrel, if prices of natural gas rose to $10/GJ that price (to make new projects profitable) would rise to $55. Am I in the ball park? (Just making sure I understood you correctly.) I realize that for existing projects that prices could fall lower and oil would still be produced, but we would be unlikely to see output increasing as new pojects would be held back.

DC

The economics you cited are a simplification of what is required to do an oil sands project. Fuel costs are only part of the picture, and the big oil sands producers hedge their fuel costs by producing most of their own natural gas.

The $50/bbl price was one that Shell quoted as the price below which they would not do any new oil sands projects. Suncor and Syncrude, the other two big oil sands producers, have quoted current operating costs in the range of $30-$40/bbl.

The truth is that high capital costs and long periods to recover that capital are the biggest barrier to entry into the oil sands business. Only the big companies can afford to play, and big companies typically have a lot of other options - one of which is to go exploring internationally.

In international plays, oil companies can recover their money very quickly, so that's what they will do in preference to projects with capital recovery times measured in decades. Oil sands plants are competing for their investment dollars with a lot of conventional oil projects with lower capital cost and shorter payback times.

A company which took the long view (which most don't) would start new projects at $40/bbl or less. Suncor, for instance, didn't make any profits for the first 7 years of its oil sands production, but now it is the biggest oil company in Canada.

On the flip side, the big oil sands producers can ride out long periods of low oil prices by just hunkering down and controlling costs. Suncor had reduced its operating costs down to $12/bbl a decade ago. A conventional oil producer might well be bankrupted by a long period of low prices because it has less control over its operating costs, and if it stops drilling to save money, its revenue will rapidly decline toward zero as its oil wells deplete.

So, it really depends on whether an oil company wants to be in business 50 years from now. Most oil sands producers will still be producing then, but the vast majority of the conventional oil producers will be out of business because they will have no oil to produce. I've worked for a lot of oil companies that no longer exist, so this is nothing new to workers in the industry, although it may be news to a lot of people in the general public.

RockyMountainGuy,

Thanks for the insights, I am always having trouble understanding how the term "cost" is used in the oil industry, with "finding costs", "capital costs", and "operating costs". When a company says operating costs are $35/barrel, I assume capital costs are not included. I also realize that if a company invests $100 million on a project they consider the rate of return they will be getting on that investment and time is an important factor. If I produce 10 Gb over 50 years, the value of that oil is less (from an investment point of view) than 10 Gb produced in 20 years. Between your comments and Rockman's, I am understanding it better. Thank you.

DC

Companies use various kinds of costs to determine how well they are doing in various areas. Finding costs are the costs of finding oil. Capital costs are the costs of the plant and equipment needed to produce it. Operating costs are the wages and other ongoing costs incurred in producing and marketing the oil. Companies use these to fine-tune the decision-making process.

One of the best indicators of how "profitable" a project is would be net present value (NPV).

The slide is from the talk I gave on unconventional oil and gas at ASPO 10 in Vienna - I'm sure you can find the full slide deck if you hunt around a bit. The Shale Oil number of 4 is anecdotal from a reliable source.

For those interested in Bakken production data - REAL NUMBERS! - Rune sent this link round a few days ago. WARNING there is so much data here you could get lost in numbers for months.

https://www.dmr.nd.gov/oilgas/stats/statisticsvw.asp

Thanks very much Euan.

If I might borrow a quote from the last slide in your presentation set http://www.aspo2012.at/wp-content/uploads/2012/06/Mearns_aspo2012.pdf :

Sounds about right to me - this could be a formula for a big turning point in human history.

It depends rather, still, on numbers and whether your reference Hall et al have got their numbers at least half right.

Your point about an adapting system seems to me to be roughly what we see going on, and Athabasca etc. looks like rather a thin slice on one of your pie-charts?

best

Phil

Have small fry ever taken up the slack? That would make for an interesting bit of research, various nations blessed with giant fields, and the profile when those giants went into decline.

I've been looking into finding numbers for US states' production pre-1981, which is the earliest the EIA provides. Some of those states' output positively goes through the roof at various stages, due to big fields coming online. Sometimes they positively go through the floor in short order, too.

Have small fry ever taken up the slack?

Oh yes, in a big way in the US, and even in Canada. The output of the small producers in aggregate is very impressive.

The problem is that in the countries with the biggest oil reserves, there is usually only one big government-owned oil company, and no small fry to drill and produce the marginal oil fields.

The result is that the fall in production, when it comes, will be steep for these countries. You only have to look at Mexico, with its government oil company PEMEX, to see an example.

This is where theory becomes important. One can derive and calibrate the distribution of oil reservoir/field sizes and show that the total volume of smaller fields will never match that of larger sizes. The fact that the smaller fields take much more overhead illustrates that this will not take up the slack.

This is the kind of theory that Monbiot needs to be swayed by, otherwise the point he made rings true:

Yes, what WHT is more what I was asking about; by "taking up the slack" I meant matching overall production declines in large fields, at least to the point of matching them, or, knock on wood, surpassing them. But all those stripper wells in NA are just mediating our decline rate, not that that isn't worthy in of itself. I wonder how many of them were brought on post-decline, too.

One striking thing I'm noticing digging up pre-1981 production numbers for various US states is that a lot of them very obviously peaked in the late 60s. Seems like the subsequent lower 48 peak wouldn't have been much of a surprise to anyone paying close attention. If you liken those states to big fields then it wouldn't be startling to further observe the country as a whole decline.

Another interesting item from the Nehring/Hubbert book (published 1980) I linked to elsewhere is that they mention the Mexican government's high hopes for bringing on large-scale production from Chihontopec. 31 years later and they're still trying. Amusingly enough, the Wiki article's 1st section says 13.5k wells needed, then in the 2nd they bump that up to 20k. Chicontepec Formation - Wikipedia, the free encyclopedia Sounds like a job for the mighty independent company.

Chihontopec is a Bakken-like play in that the oil is held in impermeable rock and oil companies will have to look for the "sweet spots" in the formation; and then drill horizontal wells and fracture them to get decent production.

It's also interesting in that there are over 6,200 producing oil wells in North Dakota alone, which are numerous and small. If it was in the US, Chihontopec would attract a feeding frenzy of small oil companies which would develop it. In Mexico, the national oil monopoly, PEMEX, is a huge, inefficient bureaucracy that just can't cope with developing something like that.

Negative comments coming from Business Insider where this article was also posted. Someone even labelled Heading Out as a liberal idiot who is lying about peak oil. I have noticed the title has been altered to make it sound more dramatic which could attract such comments but I wonder if Heading Out would be happy to continue posting on that site after receiving such negative comments. Well here is the link if he is interested in reading:

The Rest Of The Oil Fields In Saudi Arabia Are Pretty Disappointing

Thanks, you know you can never tell who the readers of a piece are, or which fraction will choose to respond. I have felt very fortunate to be blessed with the kind of contributors who comment on my posts at this site, and they bring a wealth of information to it that exceeds the initial bit that I contribute. After a while you realize that many other sites are not that lucky.

The trouble with the discussion on a lot of sites is that few people know much about the oil industry, and even fewer have ever been trained in logical reasoning. The result is that when you present an argument such as, "The Rest Of The Oil Fields In Saudi Arabia Are Pretty Disappointing", which someone in the oil industry would consider pretty obvious, at least compared to Ghawar, they don't know any facts to respond with, so they respond with logical fallacies.

Ad hominem attacks are informal logical fallacies and are irrelevant to any argument, but they have no clue what that even means, so they become upset when you reject their argument out of hand.

There are a long list of logical fallacies which people commonly use, even when they have good facts and a good logical argument they could present. I have tried to itemize them when they use them, in the interest of getting the debate back on subject, but this gets them even more irate.

Most likely they have become used to politicians presenting speeches which consist of nothing but logical fallacies, and think this is some kind of valid debating technique. "If you can't dazzle them with data, baffle them with B.S."

See List of fallacies - Informal fallacies

Yeah, gotta love this particular comment from someone named Hans...

LOL! D'Nile runs very deep in some places! "The Oil Drummers know nothing about 'PRODUCTION, TECHNOLOGY and GOVERNMENTAL REGULATIONS' He forget to mention that they don't understand geology and science in general and can't do 'MATH' either...

It's my impression that most here are ex- or current petroleum engineers, or other kinds of engineers or related scientists. I guess the techies who are actually doing the "production" using "technology" don't actually understand it... The journalists understand it much better.

Null – And don’t forget the age factor. We formerly technically competent types did have our day in the sun. But none can avoid the eventual ravishes of age. Today I can’t remember half of what I was taught. Or is it 1/3? I’m not sure…I forget.

Obvious the frostbite is finally reaching RMG’s brain as well as all those chicken fried steaks have eventually caused westexas to stroke. And obviously as the MS rots away more of the nerve endings in my brain I’ll deteriorate even further. Who knows…if it rots away quickly enough I may become the first Democrat petroleum geologist on TOD.

You mean Jeffrey Brown, is a Republican? I don't believe it. ;-)

Seriously I don't think party affiliation has much to do with geology. Does it?

Ron P.

Ron – For a while now I’ve actually suspected westexas was a communist. Ya even notice how he downplays Russia’s potential trying to lull us into a false sense of security?

Seriously though yours is an interesting point. Is there a connection between one’s choice of majors and political leanings? Or is the fact that the majority of geologists go to work for oil companies and thus slowly evolve to conservatives? I grew up with no political affiliations. OTOH I was raised with the expectation of being career military. Did that flag waving diet precondition me towards the right? OTOH didn’t major in earth science with any expectation of working for an oil company. I just liked the science and my injury killed any chance of being a lifer. I just didn’t really have much else to do with my life at that stage.

I offer this long response in hopes of soliciting stories from the other TODster about this chicken and egg question. Especially those members more focused on AGW than PO. A curious mind would like to know.

ROCK

I'm inclined to say egg before chicken. My folks are good West Coast Liberals (and proud of it). Science as a major was actively encouraged as it dovetailed with ecology, earth day, anti-war, not especially religious, equal rights save the world type politics. There was no finance but if I'd gone into banking or religious studies they would have doubted by liberalism.

There is the age thing - people start out liberal and poor and grow conservative and wealthier as they age.

But it sounds like the opposite with you - no? Drifted into geology and met up with a bunch of crusty Texas conservatives who sort of rubbed off on you?

Geology was considered a pretty liberal major out here on the west coast. Not quite as liberal as biology but close. Environmental studies was probably the liberalist. Geology drank the most beer. Biology had cute girls.

got - Thanks. Long ago I had an old engineer make the same comment: Most are born Democrats and die Republicans. LOL. certainly something must have rubbed off in Texas. But I grew up in a poor Union household that's difficult to define as lib or con. Didn't trust the govt...didn't think Food Stamps was a good idea. Didn't like foreign aid. But didn't like money lenders or corporations either. Pro military but didn't like over seas military bases.

My college group was maybe even more liberal: not geology majors but earth sciences. Strong on geology but also biology, chemistry and physics (the curse of all geologists). And whn I began in 1970 evironmentalism was just starting to kick in big time. In my geology classes we were talking about AGW and climate change over 40 years ago. But I think it's somewhat more natural for geologists to appreciate since we study huge climate swings in the geologic history. Heck: a sea level change of a few meters in a 100 years? Colorado was once under a warm tropical sea. LOL.

I'm just politically confused. I lean libertarian, but voted Republican until 2004. For the 2012 election (focusing on the two major parties), I have four points of view.

From a business point of view, I should probably vote Republican.

Based on personal freedom issues, I would vote Democratic.

As a Texan, my vote for president really doesn't count (at least for the time being, demographics in Texas are changing very fast).

But at the end of the day, I think that we are simply talking about changing the officers on the Titanic, after the ship has hit the iceberg, and the primary debate among the officer candidates is over how fast we should proceed to New York, while ignoring the water flooding into the ship.

westexas - just the type of answer I would expect from you, COMRADE

I started out as a Marxist, but then drifted to the left.

Reformist politics is currently a choice between Pepsi, and Pepsi Lite.

Time is getting short comrades!

I started in science -- biology and ecology. Then I moved into engineering. I've never really thought about my political views based on liberal / conservative lines. For me it's always been about investigating the world to understand where the bread and butter and energy really comes from, within the larger reference frame of wonder at the amazing world we live in, and this then leads into political views. In today's world, that would place me somewhat to the left, although in the greater perspective I'm not really too left wing, more like center of the road, but today's ultra-corporatized world has moved so far to the right, anything seems left in comparison.

I've noticed a fairly consistent distinction over my changing career between scientists and engineers -- they generally are divided up between liberals (scientists) and conservatives (engineers). My father was an engineer and very right wing. I of course rebelled, and I think that opened up my eyes to understanding the strange ways the human mind can work to simplify the complex real world into simple left versus right stereotypes, and choose one and go with it.

Every day I get to listen to my closest coworker's right wing rantings against "the socialists". He's an old timer that came from eastern Europe and the communist regimes there, then worked in Quebec and had dealings with inefficient unions. Of course, since communism doesn't work, then the only thing that could work is ultra right wing unregulated free market capitalism, right? He seems quite muddled up in his political beliefs, not being consistent in who these "socialists" really are. I see a lot of fear and lack of understanding out there, especially after the 2008 crash, and people tend to formulate scapegoat groups and blame them. In Vancouver there are a lot of homeless and they usually get the blame for all the problems, really quite sad actually.