Don't Count on Revolution in Oil Supply

Posted by aeberman on August 21, 2012 - 2:52pm

This is a guest post by Sadad al-Huseini, now a petroleum consultant and formerly executive vice president of Saudi Aramco for exploration and production, and is a response to the recent article in PIW (Petroleum Intelligence Weekly) by Leonardo Maugeri on his new study Oil: the Next Revolution, challenging his optimism about future oil supplies (PIW Jul.2’12). This article originally appeared in the July 23, 2012 edition of PIW.

Leonardo Maugeri's recent paper Oil: The Next Revolution on the presumed future abundance of oil supplies rejects the pessimistic outlook of limited increases in oil capacity over the next decade. It suggests global oil capacity will exceed 110 million barrels per day by the end of the decade, putting an immediate end to concerns regarding constrained long-term oil supplies. This conclusion is based on an assessment of new projects with a reported capacity of 49 million b/d before a downward adjustment to 29 million b/d to allow for completion risks and reserves depletion. Maugeri holds two PhDs, one in Political Science and one in Economics, and has extensive executive experience with ENI in strategies and developments and in petrochemicals.

In putting forth this optimistic thesis, Maugeri apparently sets aside a variety of technical realities, including the difference between natural gas liquids (NGLs) and conventional oil, reserves depletion versus capacity declines, and proven reserves as opposed to speculative resources.

The report mixes NGLs, which feed petrochemicals and domestic or industrial fuel applications, with conventional oil, which is the main source for transportation fuels. When fractionated, NGLs yield propane, butane and light naphtha. These products cannot replace oil distillates such as gasoline, diesel or jet fuel.

For example, NGLs grew from 7 million b/d in 2003 to an estimated 12 million b/d in 2011 but provided no relief to the demand for transportation fuels, which was surging across those years. The growth in NGLs is now forecast by the IEA to reach an ambitious 20 million b/d by 2030. Impressive as this may be, NGLs will remain at best marginally relevant to transportation applications until widespread changes occur in the technology and infrastructure of the auto and trucking industries. Given cost and complexities, there is no evidence that this is likely to happen within this decade.

In regard to capacity declines, the report appears to confuse oil reserves depletion with capacity declines. In the world of petroleum engineering, depletion quantifies residual reserves in the ground, while declines define a reservoir's ability to sustain a given level of production over time. Incremental reserves in modern discoveries are added early in a discovery's life while production declines are a subsequent development related to reservoir factors including changing fluid compositions and diminishing reservoir energy. Maugeri's suggestion that incremental reserves may offset capacity declines mixes up speculative exploration variables with reservoir engineering realities.

The report takes exception to the IEA's 2008 estimate of an average 6.7% global oil capacity decline and offers an equivalent estimate of less than 2% per year. This low estimate is apparently based on the observation of historical production rates from major oil producing countries. It is not clear how the author extracted the convoluted effects of offsetting market volatility, spare capacity utilization, natural production declines, and ongoing new capacity investments from such historical trends.

The IEA’s 2008 study, on the other hand, applies well-established petroleum engineering principles to 800 post-peak fields that make up the majority of global oil supplies. The natural decline rates of these fields were reported to average 3.4% for 54 supergiant fields, 6.5% for scores of giant fields and the 10.4% decline rate for hundreds of large fields. At the IEA's 6.7% level of capacity declines, the current 74 million b/d of conventional oil supplies (which exclude NGLs, biofuels, nonconventionals and various other liquids) would require 5 million b/d of supplemental new capacity annually just to maintain a flat level of supply. Based on these assessments, Maugeri’s 29 million b/d of "risked" new capacity would only replace declines through 2017. Even the full 49 million b/d of new projects would only extend current liquids production on a flat trajectory to 2021.

In regard to global oil reserves, the Maugeri report highlights the opportunity to convert trillions of barrels of unconventional oil resources into proven reserves. This is hardly a simple process, as he points out, given the realities of technical, environmental and economic challenges. Industry studies based on the IEA's published upstream oil and oil equivalent projects have shown that the capital cost of Canadian bitumen and Qatari GTL projects have averaged $97,000 per barrel of capacity. Had these prohibitive economics been otherwise, the resources alluded to in the Maugeri report would have entered into widespread development many years ago.

In regard to reserves growth and revisions to current estimates, the report needs updating. Leading oil producers only apply a low recovery factor of 20%-25% in those instances when this is in fact the limit to potential oil recoveries. On the other hand, major OPEC and non-OPEC producers frequently invoke 40%-50% recovery factors based on IOR and EOR technologies deployed within their operations or elsewhere in the world. In some advanced operations, reserves are actually estimated by complex reservoir modeling and simulation techniques which apply different production rules and investment strategies over time, not by average recovery factors.

Finally, the "explosion" in US oil shales and tight sands, which is assessed to grow to over 4.7 million b/d by 2020, is indeed a great technical and commercial success story. It is a welcome development given the constrained outlook for global oil supplies and the US' own consumption of 18.5 million b/d of oil and oil equivalent liquids.

Maugeri's report is right to emphasize the many risks that confront the energy industry today. Although national and international oil companies are doing the best they can to increase oil supplies, they are often operating in the shadow of profound technical challenges, adverse political restrictions and severe financial hurdles.

Not surprisingly, many oil executives have stated publicly that incremental oil supplies are now in a precarious balance with capacity declines and will remain so for years to come.

Much as all the stakeholders in the energy industry would like to be optimistic, it isn't an oil glut by 2020 that is keeping oil prices as high as they are. It is the reality that the oil sector has been pushed to the limit of its capabilities and that this difficult challenge will dominate energy markets for the rest of the decade.

Excellent post. Maugeri's errors were striking but could mislead policy makers because of institutional prestige. This statement, though cuts through it all and is simply marvelous:

Thanks.

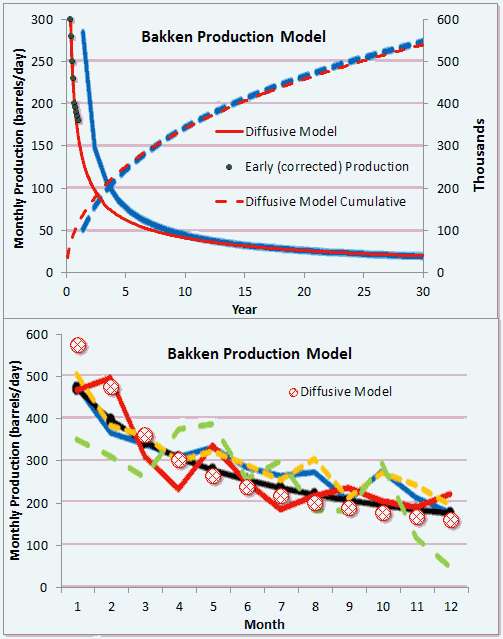

Very good post indeed. Along with the comment by svamp yesterday in the DB, clearly this is looking like a supply rate issue. I applied a reality check to the Bakken-like oil wells last month.

http://theoilconundrum.blogspot.com/2012/07/bakken-dispersive-diffusion-...

DC has also been doing some interesting modeling by taking larger crude oil URR values than currently imagined (2500 to 2800 GB as opposed to 2000 GB) and then upping the extraction rate to try to maintain a plateau.

http://oilpeakclimate.blogspot.com/2012/07/further-modeling-for-world-cr...

Certainly, the increase in price of oil has allowed the oil prospectors more incentive to either try to extract more out of existing areas or go to other areas that were prohibitively expensive in the past. These are similar in terms of end result, but the latter does assume that the actual URR is higher than estimated originally. Those may have not been included in the original discovery estimate.

The bottom-line is that whatever happens the math has to make sense, as all told it is simply a bean-counting exercise. That's also why Darwinian and Westexas are valuable as they try to make sense of the data that gets reported.

I am a great admirer of Westexas' math. His ELM model clearly shows that the issue for the rest of this decade at least is not so much how much oil, but at what price. Yet, as he admits, it is still just an extrapolation, like the cornucopians' endless rise based on previous growth, so therefore no predictor of future outcomes.

It seems highly likely to me that the developing world's growth in oil consumption may plateau very suddenly. Gregor has a good post on this here:

http://gregor.us/

One day Saudi Arabia will cotton on to the fact that they could be, well, the Saudi Arabia of solar, and start substituting the electricity generation and desalination with solar instead of hydrocarbons and therefore arrest their export decline not with new fields but with new exports of foregone domestic use.

Just one example of how the 'bumpy plateau' could be extended some years further, along with, of course, the continued decline of the west.

But as in Gregor's post, the problem is not so much technological but policy capture by BAU industry and polities.... So it goes.

I can't help feeling that what we all need is a little hurry up, and bless them, the crazies in Israel and their American sponsors seem hell bet on providing it some time soon.... I wonder....

start substituting the electricity generation and desalination with solar instead of hydrocarbons

Solar efforts might be able to provide some greening of the desert depending on how the panels are deployed. The most obvious to me design choice would be to attempt to capture the dew via the nighttime lows - but to get that water would mean having to increase the complexity and add watts into the support system.

But given the KSA has a nuclear reactor push going on, taking a 50 watt here, 100 watt there approach doesn't seem to be the choice they will take.

In my view this is a poor choice, and probably an emotional rather than rational one. Only one thing gets close to saying 'power' like sitting on the world's biggest oil field and that's nuclear. I can see why the House of Saud would fall prey to the the most expense toy in the shop- they're rather practiced at that.

The time lag before they have a nuc. plant up and running, even assuming all goes well, will mean they will forgo a huge amount of exports. Then add the new vulnerability to their not very friendly neighbours and citizens etc that this technology will offer....

Solar is available technology, I really can't see an issue, except perhaps having seen the coating of sand on the buildings in the Gulf I wonder if this could be a real problem for big solar plants?.... wouldn't want to need to be spraying water around all the time....

And what of direct solar de-sal; evaporation and condensing the water vapour... anyone know of any work on that of scale?

Deploying enough Solar to substitute a nuclear plant does take years.

And in most countries, the power generation of solar peaks brutally around noon which makes it very hard to handle inside the grid.

However in AS, it may be more complex as the heat will reduce the production, which will be bad for the load factor, but may result in a flatter curve during the day than usual.

And if you have enough money to pay cash, nuclear is definitively cheaper than solar, at an equivalent *generated* power.

...including insurance? Sure you are price whole of life here? Risk and externalities too?

The cost of nuclear power ist not so cheap compared to PV:

1 kW PV costs less than 1800 USD, has almost 2000 FLH in Saui Arabia

1 kW of a modern nuclar reactor costs 5000 USD, and has less than 8000 FLH

This gives a ratio of 900:625, so production costs of one kWh PV is during daytime is only 1.4 higher. PV is perfectly scaleable, no insurance issues, and very short construction time compared to nuclear power plant ( produces already in the second year of construction almost 50%), is lowtech, has no political problems. PV has from a investor's point of view many advantages.

FLH?

'no political problems'

except when the political scene is sponsored by the fossil fuel industry

NAOM

full load hours = FLH

Thanks

"..the power generation of solar peaks brutally around noon which makes it very hard to handle inside the grid."

Dump excess PV production into your desalination plants. Cheap and easy. I have several ways of utilizing my excess PV production, like making hot water. KISS

And what of direct solar de-sal; evaporation and condensing the water vapour... anyone know of any work on that of scale?

We "know" part of it works on scale because of things like man-made salt flats. To actually collect that water vapor - note how no one does that in such operations. Water vapor phase change is done because either the condensate has value (salt from sea water) or potable water is in short supply.

What might be an interesting (but flawed) design would be to use solar power via heat and have the cooling load be an evaporation desalinization operation. Why flawed? As the global warming parts of TOD will point out - rising ocean levels. So if you cite and design a plant to minimize the water from the ocean -> partial separation -> salty water return to ocean what should happen is the rising ocean levels will 'swamp' your plant. Note how this idea could act as a dump load for fission plants also - yet no one does this.

And when your 'friends and neighbors' or even the locals decide to use the energy system in asymmetric warfare - A nuke plant gives you a 2fer of no energy AND toxic no-go area. Attacking some PV means broken glass in the desert.

I have noted several times that at the 2005 to 2011 rate of decline in the ratio Global Net Exports of oil (GNE) to Chindia's Net Imports (CNI), the Chindia region alone would theoretically consume 100% of GNE in only 18 years, around 2030:

http://i1095.photobucket.com/albums/i475/westexas/GNE-CNI_total-debt_PS1...

I also said that I don't think that will actually happen, but a crucial point to keep in mind is that the initial CNE (Cumulative Net Export) depletion rate tends to be very high.

For example, if we extrapolate the 2005 to 2011 rate of decline in the GNE/CNI ratio in order to estimate post-2005 Available CNE (Global CNE less the Chindia region's net imports), as much as half of post-2005 Available CNE may have already been consumed, through 2011.

If we go back to the original Export Land Model (ELM), it took nine years to go from peak production and peak net exports to zero net exports. In the first third of the decline, 60% of post-peak CNE were consumed. In the second third of the decline, 32% of post-peak CNE were consumed. In the final third of the decline, only 8% of post-peak CNE were consumed. In other words, the real damage to the Cumulative Net Export supply is done in the early years of a net export decline.

Here is a specific example of how an undulating production plateau can hide a ferocious CNE (Cumulative Net Export) depletion rate:

IUKE + VAM Case Histories

(Indonesia, UK, Egypt, Vietnam, Argentina, Malaysia)

The six countries’ final combined production peak was in 1998 at 7.0 mpbd (BP, million barrels per day, total petroleum liquids), with liquids consumption of 4.3 mbpd, and net exports of 2.7 mbpd, with an ECI* of 1.64, but they showed a combined five year production plateau from 1995 to 1999 inclusive, with production ranging between 6.9 and 7.0 mbpd.

Starting from the beginning of the production plateau in 1995, the combined initial six year rate of change in the ECI ratio was -2.7%/year. At this rate of decline, they would hit an ECI ratio of 1.0 (and thus zero net oil exports) in 2015. They actually hit zero net oil exports in 2008.

Estimated post-1995 Cumulative Net Exports (CNE), using the initial six year rate of decline in the ECI ratio, were 9.2 Gb (billion barrels). Actual post-1995 CNE were 7.3 Gb.

In other words, the actual net export decline was faster than what the initial six year projection predicted. This is a little more clear on the following graph which shows the 1986 to 2011 Export Capacity Index (ECI), which is the combined ratio of total petroleum liquids production to liquids consumption for the six countries:

http://i1095.photobucket.com/albums/i475/westexas/NewECIFiles.jpg

The 1988 North Sea Piper Alpha accident contributed a significant decline in UK production, which caused the overall ECI ratio to temporarily decline.

Note that the combined production rate in 1999 of 7.0 mbpd was slightly higher than the 1995 combined production rate of 6.9 mbpd; however, by the end of 1999 the six countries had already shipped 3.9 Gb of combined net exports in the four year period from 1996 to 1999 inclusive. Therefore, despite a slight increase in production from 1995 to 1999, combined post-1995 CNE were already 54% depleted, with a 1995 to 1999 post-1995 CNE depletion rate of 19%/year.

The following graph shows the ECI ratio for the IUKE + VAM countries. Also shown are the remaining post-1995 CNE by year.

http://i1095.photobucket.com/albums/i475/westexas/IUKEVAMCNE.jpg

I think that these six diverse and geographically diversified former oil exporting countries give us a pretty decent model for Global Net Exports of oil (GNE).

The GNE** ECI six year rate of change from 2005 to 2011 was -2.4%/year (3.75 to 3.24) as the top 33 net oil exporting countries showed a post-2005 "Undulating Plateau" in production:

http://i1095.photobucket.com/albums/i475/westexas/ECIPlots.jpg

*ECI = Export Capacity Index, or the ratio of total petroleum liquids production to liquids consumption

**Top 33 net exporters in 2005, BP + Minor EIA data

And Denmark's case history of successfully cutting their liquids consumption:

Denmark is a case history of a net oil exporter, showing a production decline, that taxes fuel consumption and that has successfully cut their consumption. Their 2004 to 2011 rate of change numbers (BP):

(P = Production, C = Consumption, NE = Net Exports.)

P: -7.9%/year

C: -1.0%/year

NE: -19.9%/year

ECI (P/C): -7.0%/year

Given an ongoing production decline in an oil exporting country, unless they cut their consumption at the same rate as the rate of decline in production, or at a faster rate, the net export decline will exceed the production decline rate, and the net export decline rate will accelerate with time.

In Denmark’s case, their 2004 to 2005 net export decline rate was 12.5%/year, while their 2004 to 2011 net export decline rate accelerated to 19.9%/year.

In simple percentage terms, a 43% decline in production from 2004 to 2011 resulted in a 75% decline in net exports, even as consumption fell by 6.5%.

Fortunate for us the crazies in Israel are kept in check by the cool headed leadership in Iran, etc.

Islam, the religion of peace, is working very hard at many levels to maintain oil flows at rates and prices helpful to western economies. The Islamic mission is well explained in George Grant's "The Blood Of The Moon"; too bad US strategic planners are not reading this important background.

For America's part, we pretty well set the ball in motion in 1956, when Ike traded off our comprehensive railway matrix for the convenience of rubber tire based transport. Muslim oil has been an indispensable part of NATO country economic growth until present day geophysical and geopolitical perfect storm warnings...

webhubbletelescope

DC has also been doing some interesting modeling by taking larger crude oil URR values than currently imagined (2500 to 2800 GB as opposed to 2000 GB) and then upping the extraction rate to try to maintain a plateau.

http://oilpeakclimate.blogspot.com/2012/07/further-modeling-for-world-cr...

What is your view on DC work? Do you think oil production could peak as late as 2020?

It could, but I think that the brutal aspects of extracting oil from the Bakken and tar sands will be a big wake-up call to the consumer.

The other issue is one of semantics. If the plateau ends in 2020, isn't the peak really an average of 2004 and 2020 or (2004+2020)/2 = 2012? That will finally answer the question of whether accelerating oil production is the mechanism behind a debt-driven expanding economy.

Note that the optimistic scenario with a URR of 2800 Gb of Crude + Condensate and an extraction rate which rises to 5.2 % of mature reserves remains at the 2011 level of output to 2042, so that would put the midpoint of the plateau ("the peak") at 2023=(2004+2042)/2.

For the conservative case of a C+C URR=2500 Gb (Laherrere's 2200 Gb from conventional + deep water and 300 Gb from bitumen + Orinoco belt), the plateau ends in 2033 so the midpoint (peak) is (2004+2033)/2=2018.5.

See details at http://oilpeakclimate.blogspot.com/

Again I am skeptical about actually reaching a worldwide extraction rate from mature reserves (reserves which have been developed and have reached their maximum targeted output or are in decline) which matches the 5.2 % (or 5.5 % for the conservative case) level reached in 1973.

The most rapid recent rise in extraction rate was from 2002 at 3.0 % (and 3.3 % for smaller URR) to 2004 at 3.2% (and 3.6 %) for a 1 % (1.5 %) rise per decade. It is unlikely that such a rapid rise in extraction rate could be maintained for a decade.

In fact, the apparent rise in extraction rate from 2002 to 2004 was due to OPEC opening up the taps in an attempt to keep oil prices from rising too much as demand from China and India ramped up over this period.

A more realistic scenario IMO considers the rise in extraction rates over the period from 1998 to 2008 where for the URR=2800 Gb case extraction rates rose from 3.1% to 3.3% (for the URR=2500 Gb case it was 3.4% to 3.65%), this relatively small rate of increase in the extraction rate is consistent with the low scenario.

The low scenario peaks in 2013 and remains above the 2005-2011 plateau out to 2017 for the URR=2500 Gb case and for the larger URR case peaks in 2016 ans stays above the plateau out to 2023.

These scenarios are intended to answer the following types of what-if questions:

What if the rate of increase of extraction rates can rise at rates beyond what what we have seen in the recent past either because of technological progress or oil companies becoming convinced that high oil prices ($100 or more in 2011 US dollars for Brent Crude) were here to stay?

How long could a plateau be maintained under those circumstances?

Could the 2012 BP Outlook rates of oil production out to 2030 be attained if extraction rates are ramped up even faster? What happens after that?

In the future there is likely to be some increase in NGL output as Natural Gas output increases, this will help to a limited extent. Scenarios with NGL included will be presented in the near future.

DC

webhubbletelescope,

Thanks for highlighting my extension of your Shock model.

I have recently updated my model to reflected backdated discoveries. The earlier models had overly large extraction rates due to this oversight on my part.

Note that these models are not forecasts, but scenarios. If extraction rates can be increased to the high levels of 1973, and the oil sands and Orinoco belts are developed aggresively, could a production plateau be maintained? How long could such a plateau be maintained if URR is 2500 Gb or even 2800 Gb for C+C? Note that Jean Laherrere estimates about 2700 Gb when NGL is excluded.

A further improvement to this model is to model oil sands and Orinoco belt production separately. I haven't put the finishing touches on that yet, but my early work suggests that the CAPP forecasts should be possible especially if oil sands URR ends up at 340 Gb based on a 20 % recovery rate rather than the 10 % used as the basis for 170 Gb.

Comments from geologists (who know better than I what is realistic) would be welcome.

Part of the reason for this exercise is to show that even with very optimistic assumptions, we cannot maintain the current plateau beyond 2040 and if we follow the trajectory suggested by the BP outlook, output will crash shortly after 2030.

All of this assumes that demand for oil will be maintained. If the world economy crashes, not at all unlikely IMO, the low scenario may be too high. The plateau is the most likely scenario if we manage to muddle through with slow growth for a few more decades (note that on a worldwide basis the economy has continued growing since 2005 even will very slow petroleum growth.) If this slow growth causes the system to unravel, these scenarios will be much too optimistic.

http://oilpeakclimate.blogspot.com/

DC

IANAG (I Am Not A Geologist), but I have quaffed a lot of pints of beer with them since I was developing software for them to do what they wanted to do. They were metric pints (500 mL) since it was in Canada. It's all part of the job. You have to get inside their heads to find out what they need, rather than what they think they need.

The estimate of 340 billion barrels is realistic for the Canadian oil sands. The official government estimate of 170 billion barrels is ridiculously conservative and everybody knows it, but somebody had to draw a line in the sand, and the Alberta government didn't want to have more oil than Saudi Arabia. It's a Canadian thing. We don't like to be overachievers.

While the oil is there, Canada simply doesn't have enough skilled workers to crank oil sands production up to Saudi Arabian levels. You have no idea how empty the Canadian north is until you go there. Oil sands production is very labor intensive, and the people to produce the oil simply aren't there. You can't get them to go there unless you pay more money than you can afford, so it isn't going to happen. If Arabian production crashes, Canada will not replace it.

Venezuela has more people, but they have neither the expertise nor the capital to develop their oil sands, and the country is a complete political mess to boot. Oil production has been falling rather than rising in recent years, and it would take something more drastic than a military coup or revolution to change that. They've had them before and it didn't make much difference. It would take a paradigm shift to make a positive change, and I don't know if the Venezuelans even know what a paradigm shift is.

So I think the oil sands will provide a useful increment of production, and both Canada and Venezuela will be producing oil long after the Arab oil producers have gone back to herding camels as their main industry, but it won't be enough offset an Arabian decline in production, never mind cause an increase in global output.

Thanks RockyMtGuy.

Although you are not a geologist, you seem to know quite a bit about the oil industry in Alberta. Certainly more than me. What is your opinion of the latest CAPP forecast for the oil sands? Is there enough labor and capital available to make the forecast?

DC

Well, the CAPP forecast already allows for the labor constraints on the industry, since the people doing it are realists and know what the constraints are.

If you simply take all the proposed projects and add them up, you get some huge number which nobody believes, especially the CAPP. Unfortunately some people take all the company proposals, add them up, and assumes it represents something remotely achievable, which it is not. There just aren't enough skilled workers in Canada to do it. The numbers of welders and heavy equipment mechanics just aren't here.

Capital does not seem to be a problem at the moment since there seem to be huge amounts of Chinese money going into the oil sands. The Chinese have all those US treasury notes cluttering up their vaults and I suppose they have to turn them into more solid assets somehow. They might be a little uncertain about the future solvency of the US government.

So, at this point in time, I would say the CAPP estimates are as good as it gets. Some of the Canadian banks seem to think the forecasts should be higher, but they might be overoptimistic. Or not, you never know.

RMG,

Thanks again for your insightful comments. I was hoping CAPP wasn't like the US EIA or CERA (i.e. over optimistic) because I used their forecast as a basis for modelling the Canadian oil sands with a variation of the oil shock model.

Basically I used dispersive discovery to model the discovery (as I had no discovery data) and a URR of 340 Gb. I increased the fallow, build, and maturation times from the standard oil shock model to account for the longer development times for oil sands projects and was able to match the CAPP forecasts fairly well.

I then used the oil sands as an analog for the Orinoco belt (a fairly dicey proposition for all the reasons you have given). This I justify as better than using a standard model or no model at all. Though in hindsight extending the development times for Venezuela even more than Canada to account for the political and other problems would seem wise.

DC

The Athabasca oil sands were discovered in the late 1700's by the first fur traders into the area, and they were not exactly a hidden resource - the explorers said they couldn't land their canoes at some places because there was so much oil pouring out of the banks into the river. The Indians had been using it for centuries to waterproof their canoes, and had walked into northern fur trading posts carrying samples 60 years before that.

Canadian oil sands production will probably not follow a typical Hubbert curve because there is no geological risk in them - their exact location and size are very well known to geologists. There are only economic, technical, and political risks involved, and so their development is highly dependent on the price of oil and future technological breakthroughs, not to mention a stable regulatory environment. The reason that oil men estimate the URR at around 340 GB is because of new technology - SAGD. Without horizontal drilling and steam stimulation the URR would be much lower. SAGD is very, very effective at getting high recovery rates out of oil sands.

There is also the possibility of future breakthroughs which will make even more of the estimated 1700 GB of oil-in-place recoverable. The Alberta government, whose scientists invented SAGD, has budgeted $3 billion in new research funding, and with that kind of money you can do amazing things in technology. What you cannot do is develop the oil sands fast because none of the methods are quick or easy.

I think to model the Canadian oil sands production, it takes a single discovery spike and then a gradually increasing proportional extraction rate. That would provide a single separate curve that one could overlay on top of the world curve.

DC, good job on the modeling. I always think of the dispersive discovery as useful for when there are many possible areas to explore. How many geological formations just like the Canadian tar sands will we find? That and Orinoco seem to be very unique and probably could be handled as individual spikes starting at the point of first oil. That would mean the fallow time would equal zero and from that point one would use a mixed build, maturation, and extraction model to show the broad peak. And I can imagine it would be pretty broad, as it seems unrealistic to imagine that vast acreage around Athabasca to be trashed in just a few years. No, they will have to take their time -- look to West Virgina mountain-top removal as a planning template.

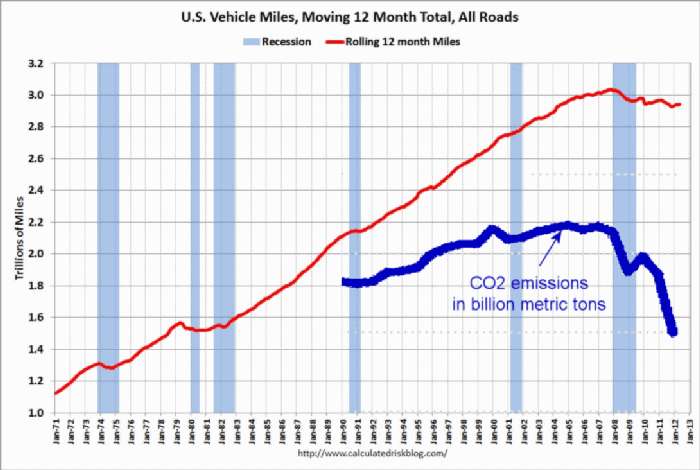

By the way, this is a very interesting plot of USA emissions of CO2 overlaid with a miles-driven chart:

It is incredible how much of a nose-dive CO2 emissions took last year, with the ostensible explanation that this is a changeover from coal to natural gas for electricity and heating generation (NG has ~60% of carbon per joule as coal). Someone also suggested that it was also some warm weather recently that could have reduced it. It also looks like the first big drop tied into the start of the recession.

EDIT: I found out the CO2 emissions for 2012 were "estimated" according to this article:

http://news.yahoo.com/ap-impact-co2-emissions-us-drop-20-low-174616030--...

Will have to watch closely if that value comes true. They don't actually measure that value but calculate it based on the various amounts of hydrocarbons that were combusted during that year.

Hi WHT,

Thanks for the tip on how the oil sands might be modelled, I will try your suggestions.

The chart in your post is a little misleading. The CO2 emissions are from coal only and not total US CO2 emissions.

I have an update to my Crude plus Condensate Model which you might be interested in:

http://oilpeakclimate.blogspot.com/2012/08/i-noticed-that-compared-to-mo...

DC

DC,

Thanks. Sure enough the figure caption had that disclaimer on coal only, whereas the news reports say it reflects total emissions. That clears that up.

All in all, I think you do a very thorough job in the data modeling. The interesting feature of the shock model is that it is self-checking -- the total integrated area under the curve has to equal the total URR. So the insight it gives WRT extraction rates is very powerful.

You are right in that the extraction rate may hit a ceiling well before 5%. If more and more wells start going hyperbolic or slower in the tails, the production will be forced to go into even more of a flow-limited regime. Diffusive transport takes its time. Offshore oil has extraction rates of ~15% or higher but that is out of necessity in reducing risk and long-term maintenance cost. And those don't make up a huge fraction of the total. I know that you have done some Norway production models, and we will have to watch how individual regions up their extraction rate, or will it be a mad frenzy in continuing to drill new wells in the Bakken, as svamp said, because the extraction rate is flow limited after the initial blast.

It gets more and more interesting everyday.

"The CO2 emissions are from coal only and not total US CO2 emissions"

Which is completely uncorrelated with VMT!?

There are only two oil sands accumulations on Earth on the scale of the Alberta and Venezuelan deposits. The geological processes creating them were the same.

It was the result of a collision of continental plates, the depression of a continental foredeep under mountain ranges, and the creation of a giant oil pressure cooker that turned the kerogen in the subsurface formations into huge amounts of oil. In both cases the oil migrated hundreds of miles and is now found in unconsolidated, high permeability sandstone reservoirs nowhere near the original source.

These types of enormous oil deposits don't escape the notice of geologists, so the chances of any more of the same size being found are zero.

Only about 10% of the Canadian oil sands, with 20% of the reserves, are shallow enough to surface mine. The other 90% will have to be developed using techniques like horizontal drilling and steam stimulation. None of the Venezuelan oil sands are shallow enough to mine.

The mines are nothing like the West Virginia mountaintop-removal mines. For one thing, there are no mountains, only forest and peat bogs. For another thing, the companies are required to restore the mined area to "as good as or better than original condition". The companies are going for the "better than original" option. At the end of it all, it is going to be an incredibly huge exercise in large scale landscaping to reclaim the mines - something like terraforming an alien planet. They are probably going to turn much of it into buffalo pasture, and most likely stock it with wood bison, the larger forest version of the better-known plains bison.

The companies are going for the "better than original" option.

I don't get this --how does mankind improve upon nature? Or more to the point, how would replacing forest with buffalo pasture be "better than original"? Based on mankind's past experience with "terraforming" the landscape in our never-ending quest for growth and profit, I'd say the odds of actually restoring the mined areas to "as good as or better than original condition" is somewhere between slim and none --and Slim just left the building.

It's not that subjective. If you restore class 3 farmland to class 2 farmland, it's considered an improvement. In the case of the oil sands, they will be restoring poor quality forest and peat bogs to pasture land, so that it is considered an improvement by the government.

I kind of doubt that. I am with Harm on this one. The energy it takes to restore will negate the energy return. It won't take long for the original pipe dream to be trashed, IMO.

It's actually one of the few areas that opinion holds court. Neither you nor I have any model to show how the rejuvenation of the lands will occur. Nothing has ever been done on that scale and with that kind of residue to deal with.

The thought experiment to consider is whether there is enough energy buried in the oil sands to lift the material up and then laterally over to a processing destination, and then replace that removed with other earthen material to cover up the residue. The latter also takes energy to move. And then the processed oil has to be moved to a refinery destination, thinned to reduce frictional flow energy losses.

Compare that to old-fashioned conventional crude whereby the bore-hole material was the only material removed, whence the extracted oil only needed to be transported with minimal refinery processing in comparison.

What ought to be done is determine the number of Joules per square meter sitting underneath the tar sands, or better an average kiloWatts per m^2 over the lifetime of the resource after it first gets delivered to the customer. That will become the new metric, I guarantee you, something to demonstrate what kind of value we are getting per square meter of the commons.

It's not that complicated. Strip the A layer, strip the B layer, and stockpile them separately. Remove the oil sands and send them to the processing plant. When the cleaned sand comes back, put it back in the mine, put the B layer back, and put the A layer on top. Add fertilizer and soil conditioners, plant alfalfa, water, and stand back. The final result is pasture land.

In the case of the oil sands the returned sand will be about 20% more voluminous than the sand that was removed so you can't really restore the original land profile. You might have to do something creative about it, but landscape architects like that kind of thing.

It's not really much different than landscaping an urban subdivision. Usually the developers completely re-contour the landscape, and this is the same thing on a much larger scale.

The main energy consumption is in the original mining operation. Restoring the mine doesn't involve much energy at all, other than the solar energy required to make the alfalfa grow. Why alfalfa? It's just great for restoring the soil in old mines.

Since you obviously know much more about the process than I do, I'll give it the benefit of a doubt. However, the part about adding (petrol-based) fertilizer and soil conditioners makes me wonder how it will hold up long term. Has anything like this been done far enough back to tell us if the "terraforming" really holds up or for how long? It would be a shame if we have alfalfa fields and buffalo pasture now, then barren sand dunes 20 years from now.

I would still like to see a joules/m^2 or watts/m^2 over a time period as a metric to compare against conventional oil.

In other words, under a meter square of tar sands land, what is the energy equivalent that we can expect?

Is it enough to run a 1000 Watt hair dryer or a typical homes energy usage continuously for 1 year? Take an oil sands patch of 10,000 meters time 10,000 meters. That would be 100 GW of power if spread over one year.

A typical nuclear power plant can produce 1000 MW continuously, or 1 GW continuously over the life of the plant.

Or equivalently, and perhaps a snap for someone that seems to know everything about Canadian oil, one could ask how much crude lies underneath a square meter of earth. After processing is it 1 Barrel or is it more?

That 10 K x 10 K patch would have 100 million barrels if there was just 1 barrel to be extracted.

From the Wikipedia entry:

1 square meter 50 meters deep is 50 m^3 or 314 barrels worth of mass to sort through. Then using the equivalent ratio of volume to mass, 1/8 / 2 of 314 barrels is 20 barrels of oil. So 20 barrels sits underneath that square meter of land.

The 10k by 10k patch then contains 2 billion barrels of oil.

Yet, that 1 meter square of tar sands has to be lifted and transported somewhere and then brought back after being processed, using prodigious amounts of natural gas to liquify the bitumen.

A typical homeowner might own a patch of land 20 meters by 20 meters. If his home was on oil sands, it would have 8000 barrels or somewhere less than $800,000 dollars worth of oil at today's prices.

How much would it cost that homeowner to dig down 50 meters and move that earth a certain amount and then bring it back? If you hired landscape contractors to do the job, I am sure the quote they would give you is well over $100,000, as just moving some rocks around is sometime a $30,000 job. Thank goodness for the scaling efficiencies of big earth movers. 50 meters is a lot -- an average maximum lake depth where I am is around 10 meters (that is unscientific, just by looking at fishing topo maps).

My point is that lots of people do not have a good feel for what the payback is and what is involved in all this. Since it is in the remote Canada wilderness, out of site, out of mind .

These are rambling dorky questions I know, but again, no one has ever attempted something on this scale before ... unless one considers mountaintop removal. It is ending up looking an awful lot like that.

What machinations civilization will go through to extract energy.

I don't think those are dorky questions at all, and those are some pretty good ballpark estimates of the scale of what is going on.

Fortunately, they don't use landscape contractors to excavate the oil sands, they use 100 ton power shovels and 400 ton dump trucks. To put it in perspective, a power shovel like that could excavate your example homeowners 20 m by 20 m lot about 1 metre deep in 4 scoops of the shovel, and the dump truck could haul the whole thing away in one load. Economies of scale are very important in oil sands mining, and the shovel-and-truck technique was the one they settled on after trying a lot of bad ideas on how to do it.

As for the value of it - take your homeowner's $800,000 lot, obviously in a very upscale suburb, and imagine that upscale suburb is the size of Florida - completely covered in luxurious mansions, coast to coast and north to south. And there you have the approximate value of the oil sands.

Now, the oil sands are not an upscale suburb, they are an oil field, albeit one that outcrops on the surface. The mineable area is only about 10% of the total, but that's still a lot of really big holes in the ground. The US has even more really big holes in the ground in the form of open-pit coal mines, but I don't think Americans really realize they are there. I have seen them, but most people don't go the places I do.

The other 90% of the oil sands will have to be developed using underground wells. For an image of what that will be like, look at some of the early pictures of Los Angeles. LA has some pretty big oil fields under it and the early development was rather intense. Nowadays most of the wells are gone and the ones that are left are tastefully disguised. Take the more modern picture and enlarge it to the size of Florida.

As for the amount of oil that underlies a square metre of the Earth, I don't know. I think it would be fairly easy to do a ballpark estimate, though. Just take an estimate of the URR of the world's oil, and divide by the surface area of the Earth. I think that the ultimate result will be approximately, "very little".

When speaking to groups of people about peak oil, I start out with a slide of the earth as photographed from space. I ask the audience to close their eyes and imagine that it is not a small image on a screen but in fact a 25 foot diameter hologram of the earth. When they have that image in their minds I ask them to open their eyes, between my finger and thumb I am holding a small black marble.

On the same scale as a 25 foot globe that is the volume of our original endowment of 2 trillion barrels of oil.

It helps set the tone for the rest of the talk.

However, the part about adding (petrol-based) fertilizer and soil conditioners makes me wonder how it will hold up long term.

This is SOP (standard operating procedure) for reclaiming a surface coal mine, of which Alberta has many, and companies are getting better and better at it as time progresses. There's not much difference between a coal mine and an oil mine. The fertilizer is just to get the revegetation process started. Once the plants are established, nature takes it from there.

The reason I mentioned alfalfa is that it is a legume that puts nitrogen into the soil rather than taking it out. Once the alfalfa is established, they don't need chemical fertilizer to provide nitrogen. With the right mixture of plants, it's self-fertilizing. The company can just walk away.

The thing about the "as good as or better" standard is that there was very little soil fertility to begin with in the forests up there. Any fertility is better than no fertility.

Because cutting down trees is always an improvement... ugh.

Well, you can plant trees, too, but up there they take 50 years to grow to a reasonable size. Buffalo pasture is faster. If you just walk away and forget about it, it will turn into forest eventually.

In other places it will turn into forest a lot quicker - or not, depending on where it is. In some places in the American desert, if you come back 50 years later, your original tire tracks will still be there and there will still be nothing growing.

Well it's not quite a simple as all that.

Large scale is the way of the north. In two dry fire seasons 2004 and 2005 over 17,000 square miles of Alaskan forest burned in wildfires--for comparison Florida's area is a tad over 58,000 square miles. If only 10% of the tar sands region is surface mined that is around 6000 square miles or about 1/3 of what burned in Alaska wild fires in two big fire years. Canada has a whole lot more forest than Alaska and the tar sands mining/reclamation process will be spread over scores of years.

The idea of 'better than original' is no doubt somewhat more subjective than RMG admits--the true value of the huge, monotonous (my subjective viewpoint) not so very biologically diverse northern forests is not something modern science claims to have a good handle on. Personally I can easily believe reclaimed mining terrain shaped to encourage myriad micro habitats within the alfalfa seeded 'prairie' (some of which the forest will quickly reclaim) that is to be turned over to the wood bison's 'management' will appear 'better than the original' to my mind's eye. And remember the whole mined area will still only be a large island in the middle of the sea of Canada's northern forest.

Yes, that's true, and while we're on the topic of large scale forest fires, I should mention that most of the forests in the oil sands area burned down during the 1960's. It was a truly epic fire event that had to be seen to be believed. Relating it to the above, you could think of it as a forest fire the size of Florida.

The people who worry about the destruction of the forests in the oil sands don't realize the the forests up there get destroyed by fires about once a century in the normal course of nature. The trees there are just now growing back to being a commercially loggable size. As I say, it takes about 50 years.

And while we're on the subject of logging, I should mention that the oil sands forests are also all commercial timber land. The government fully intends for companies to log it if it doesn't burn down first. And, trust me, the logging up there is done on a huge scale.

It isn't protected wilderness at all. There are protected wildernesses up there, but this is not one of them.

What exactly do you mean by 'poor quality forest'?

By what criteria can a forest be described as poor quality?

Small, slow growing trees, weedy species with little lumber value. These are timber company evaluations.

If you compared a Northeastern Alberta forest of peat bogs mixed with stunted black spruce and jack pine to a BC coastal forest of 200-foot cedar, hemlock, and coastal douglas fir, you would see what I mean. The latter are far more impressive.

If there were enough trees in the BC coastal forests to satisfy the demand for lumber, they wouldn't bother logging the NE Alberta forests at all.

However, from a biological diversity standard, the NE Alberta forests aren't very good either. Count the number of grizzly bears in the forests of BC (about 25,000) versus those in Alberta (about 900), and that will give a good indicator. The difference is in the supply of grizzly food available.

Thankyou for your reply.

So the forests are of value purely for their worth as lumber? There is so much to respond to in your comment but if we stay purely within an economic framework I read today that

The 'ecosystem services (of Canada's boreal forests) have an estimated $700 billion annual value.'

These services being a 'vital bulwark against the global loss of biodiversity, irreplaceable food and cultural benefits to rural communities, and (slowing) the impacts of global warming.' http://www.pewenvironment.org/news-room/reports/A-Forest-of-Blue-Canadas... (page 4 2nd paragraph)

I don't know how this figure compares with the projected net value of the extracted oil after the costs of clean-up, restoration, compensation and all the other externalities have been factored in. Does anyone know?

RMG,

I interpreted WHT's reference to mountaintop removal to mean that the oil sands would take a long time to develop relative to conventional oil. Hopefully you are correct that the areas affected by the mines will be restored to "better" than before, more easily done than rebuilding a mountain for sure.

I was curious about your guess for how long it takes to develop an average in situ oil sands project relative to an average on shore conventional project from initial build to the time the project reaches maximum daily output. Would it take 2 times longer? I know without details it would be hard to guess, but I'm fishing for a ballpark figure(imagine both projects are in Alberta and similar in all respects except that one is conventional crude and the other is in situ bitumen.)

DC

I would guess that it takes 10 or 20 times as long to build an oil sands project as it does to do a conventional oil development. It generally takes about 10 years from first proposal to first barrel of bitumen out of the oil sands. This is why most oil companies prefer conventional oil.

However, conventional oil projects vary considerably in timelines. A shallow onshore well in an established area might take only a few weeks, while a difficult offshore one might get up in the same decades-long range as an oil sands project. This is why many of us were dubious about the Brazilian offshore discoveries - the time frames and costs are in the same range as oil sands, while the risks are far greater. There's no guarantee they can get any oil out at all.

The flip side of oil sands projects is that once they are up and running, they keep producing oil at the same rate for decade after decade, whereas conventional oil wells show a steep decline curve, particularly in offshore developments. You are always on a treadmill that is running faster and faster, trying to find enough new oil to offset the decline in your existing production

And that's why the shock model is useful. The uncertainties in maturation time and build time is included in the model, just as DC is experimenting with respect to modifying the parameters for unconventional oil.

For instance, the extraction rates for oil sands will be much less than 1% of the estimated total. That is why the extraction can go on for a long time, with little decline. It also won't be a massive flow, which will lead to a lower broad peak.

One can't find this approach (the oil shock model) in any reservoir engineering textbooks. I wonder why? It's likely that they didn't care, they didn't figure it out, or they did and it is proprietary knowledge. And the latter does not count for the advancement of scientific knowledge.

It also looks like the first big drop tied into the start of the recession.

Yes, and the simultaneous dramatic drop in natural gas prices brought on by shale gas.

Falstaff – Actually NG production had been declining slightly in the run up to the recession. It wasn’t until 2008 that NG production in the US had recovered to the rate in 2001.

http://www.bing.com/images/search?q=natural+gas+production+rates&view=de...

After a peak of $6.82 in Jan 2001 (www.eia.gov/dnav/ng/hist/n9190us3m.htm)

prices fell to $2.19 in Feb 2002. From there prices erratically rose to $10.79 in July 2008. But prices did start to free fall in 2008 just as the recession started. The shale plays started to add to production around 2005 or so but thanks to the national decline rate there was no net gain going into the recession. So the shales didn’t have much to do with the price collapse. Most analysts at the time attributed the price decline due to a drop in consumption related to the recession.

Interesting though: from 2008 to the end of 2011 NG production rate increased around 15%. Some of this production was brought on by the shale gas drilling but the DW GOM did add a lot also. When the DW Independence Gas Hub came on line US NG production increased almost 1 bcf/day over night. So in the face of continually falling prices the rate increased. Time lag has to be considered when studying the stats.

Interesting. Bubbles are powerful economic drivers.

Shale gas production is a bubble? Or the low price of gas is a bubble?

Falstaff - IMHO: Yes to both questions.

I think of the salient characteristic of a bubble as being a sudden change of price point/availability/production, with sudden defined as no more than some months to a couple years, versus a longer term decline over many years. Agreed? For instance, the price of crude fell by half in six months in 2007-8, so that certainly qualified as a bubble. Do you really expect the shale gas production in the Marcellus to collapse over a year, or do you mean, say, 10-20 years instead of ~100 year supply commonly mentioned? Do you really expect US natural gas prices to return to the $6-$8/mmbtu average of the last decade in a similar time frame, with gas in storage at an all time high?

RMG says: "and the country [Venezuela] is a complete political mess to boot."

Realworld (that is, non-USAmerican) translation: Venezuela has something like real democracy, and increasing, where politicians get elected by actual majorities of voters, and are obliged to be responsive to them; and it has serious social provision for the populace, and increasing, especially for the poorest. (USAmericans living at home will need to go foraging for reliable information outside the dreamworld propaganda hologram of their corporate media and politicians' pronouncements to get a solid handle on this reality, as must we Brits; but it can be done; the internet is such a wonderful thing!)

Wish we could retain the sort of complete democratic/socialistic political mess in Britain, that the common people are now acquiring in Venezuela. But the Cameron 'led' junta usurping power here, without the slightest popular mandate from the mere electorate, is removing all that. Following the example of their US imperial masters, as usual, and going down the tubes with them...

Still, at least as the US empire accelerates into its (already-begun) collapse, the states of SAmerica are struggling free of its hegemony, and increasing both their democracy and their socialism. Wonder when we in Britain will actually wake up enough to follow suit. When Scotland takes its independence, perhaps?

In these circumstances, Venezuelans can hope that the bulk of petro-production from their national endowment might get used for their own social needs; and might also be restrained and conserved by calculations of national benefit, rather than get used for the enrichment of the capos of the (mainly US) corporate-gangster baronies, for futilely propping up for just a bit longer USAmerica's ridiculous energy splurge, and for the further acceleration of the (already begun) climate catastrophe.

The more of that sort of complete political mess around the world, the better for all of us -- erm -- especially for the average US citizen.

All of the above observations apply in spades of course, now that the world -- despite the intricate denialism of such as Maugeri -- is heading into the new era of energy decline.

Apparently the message is being heard in Beijing.. . .

Per China Daily

" China plans to invest 2.37 trillion yuan (US$375.6 billion) in major energy-saving projects during the 12th Five-Year Plan period (2011-2015), according to a document released by the State Council.

The projects are expected to save the country an equivalent of 300 million tonnes of coal during the five-year period, according to the document published Tuesday at the Chinese government website.

In a previously unveiled blueprint for energy-saving programs, Chinese authorities established a goal of cutting energy consumption per 10,000 yuan of GDP by 16 percent by 2015 compared with 2010, saving 670 million metric tonnes of coal equivalent. "

INDY

How they gunna do it? If anyone can, the PRC can....

Force traditional light bulb factory shut down. Governmental subsidy for energy saving light bulbs (every beijinger can buy 5 energy saving light bulbs for 5 yuan (80 US cents or 0.5 pounds) with their household register。 Cut off powerplants if they consumed too much coal (and left people ration electricity)

coldhot3, I wonder when there will not be any "traditional" light bulb factories left in the world. Demand has to be dropping.

Not quite sure about the comment on NGL. Propane can be used in a similar manner to CNG and is a lot easier to use.

Propane is a gas at std temp. and pressure, so it must be pressurized to keep in liquid form. Energy density is much less than diesel fuel (about 60% IIRC), so more must be stored aboard transport vehicles for same range. So you still have many of the issues of converting vehicles to use propane, just like with CNG. I think price per BTU or Joule is also much higher than CNG. Until propane gets far below price of diesel on a BTU basis, not many trucks or cars will consider converting to use it. I think one reason for the high price might be the distribution problem of getting it from wellhead to the consumer. Can't go in a pipeline like natural gas (ch4), but has to be moved in separate pressurized containers.

My guess would be that the reason for propane not going by pipeline is that the huge infrastructure of piping, pumps, etc to support any level of widespread propane movement by pipeline has just never developed, for whatever reasons, as it obviously has developed for natural gas. I think it must be this lack of infrastructure, rather than any physical property of propane gas that prevents its shipment by pipeline.

Whatever physical disadvantages are claimed for propane, would also seem to apply to natural gas. NG is likely to have even less energy density than propane. And due to this low energy density, I believe that NG (like Propane) also requires a form of compression/cooling before it can serve a practical role in powering road vehicles over typical daily routes.

To some extent, I would agree with Mr. Sadad al-Huseini that NGLs are not equal to, or interchangeable with, crude oil. But I would also suggest that NGLs do in fact provide some direct input to the supply of transportation fuels in the US (at least for gasoline; for diesel and kerosene fuels I'm not so sure). One of the main components of NGLs is light naptha, which is sometimes called "natural gasoline" and it is used in gasoline blends. And the slightly lighter NGL components of propane and butane can be added to U.S. gasoline (how? I don't know) during the winter months of the year. As a way of replacing some expensive gasoline with these cheaper NGL components, this policy allows a nice winter cost savings for gasoline refiners. Also, the tendency of propane/butane to quickly vaporize gives drivers an easier engine starting experience on very cold days. If I remember correctly, the federal government permits refiners to add these gases to their winter blends, so that they constitute up to 2% or 3% of the total gasoline, somewhat higher percentages may be permitted in the more northern U.S. states.

It is perfectly feasible to move propane by pipeline, and it is quite commonly done as part of the natural gas stream or as a separate product.

Natural gas is usually methane plus ethane, but often the ethane is stripped off and sold as petrochemical feedstock, so all you can count on in NG is methane. It may optionally contain ethane, propane, and butane.

Natural gas from the well consists of methane, ethane, propane, butane, and pentanes-plus (the heavier fractions). Pentanes-plus are liquids at room temperature, so they usually go into making gasoline. Butane is on the borderline, so it goes into lighters, BBQ fuel, and into "winter" gasoline because of its rapid vaporization - in summer it tends to cause fuel systems to "vapor lock".

Propane is useful as a NG substitute and is used where pipelined NG is not available. The reason it is usually sold in tanks (1 pound cylinders, 20 pound tanks, 100 pound tanks, 500 pound "pigs") is that it is feasible to do so. It is a natural gas component that can be shipped as a liquid by simply compressing it. That is its main advantage.

The pipelines and compressors that move wellhead gas may be able to handle some small quanities of propane and other longer chain hydrocarbons in the nat. gas mix. But the distribution system to the end user would have problems handling propane as it would be in liquid form due to the pressure in the pipe. Trying to mix liquids with gas creates problems such as liquid slugging and flow disruptions as the liquid settled out in low spots or cold spots.

Thus my statement about having to move propane in trucks is correct.

I used to design software to manage pipelines transporting propane. It is complicated by the fact that propane moves back and forth between the liquid and gas phases depending on temperature and pressure, so the pipeline has to be designed to handle that. On the upstream end of the business, almost all the propane moves by pipeline.

Propane

I'm looking at one of these dual fuel kits for the farm truck:

http://www.gotpropane.com/p539.html

I'd like to increase my odds of finding some kind of fuel during a shortage. With a change of jets it will run natural gas too. I think you can have a lot bigger propane tank on a suburban lot than what's allowed for gasoline storage, which is something to think about.

I believe that it should be possible to convert a typical pickup for around $2K. Not exactly cheap, but a whole lot cheaper than a new truck. If the demand is there, converting a significant portion of the US vehicle fleet to propane is quite doable. So NGL could make a rapid impact. That still doesn't change the big picture, but it could buy us some time.

I happen to have one of those exact kits (except propane-only) on my truck. You do have to expect the decrease in mileage & power though. That said, it runs great and the engine stays nice & clean. I'm looking to rebuild so I can take advantage of the increased 'octane' with a 11:1 compression ratio (which you can't do with dual-fuel). If you have technical questions, contact Franz Hoffman in TX, he's pretty much the world expert as far as I can tell, his diagnostic guide is a must-read. A single warning: propane doesn't boil fast enough at STP to run an engine. Therefore the heat capacity of your engine coolant is used in the vaporizer/regulator, and when it doesn't have a steady supply of coolant, it ice-blocks and freezes open, flooding your engine. Happens every other year or so to me - once the radiator was cracked, once the thermostat jammed, etc. etc. If you can find a used tank on the cheap, and you're competent with a wrench, the gotpropane kit is all you really need. Really nice guy that owns that shop too, if you're ever in Phoenix, he's a regular mechanic. I bought some extra fittings as well so I can use forklift tanks as 'gas cans'.

/OT

Desert

Thanks for the scoop! I'll check it out. Turbocharging is another good way to get some power back. That's on the back burner for now, though.

I've also read about liquid propane fuel injection systems that come with their own engine computer. But that sounds like a whole nother level of cost.

I have often wondered if one could use the compressor and condenser coil from an old refrigerator to compress the natural gas piped to houses to condense it for use as fuel. I realize there may be some non-condensables in the mix, and those may have to be vented back to the gas line, maybe routing it to something that could use it, like the water heater or furnace. From what I see a propane tank could be modified to act as a receiver vessel, and having your own source of LNG may come in damn handy if "house gas" is available, but the local gas station is out. ( There is also a lubrication issue, but it looks trivial ).

A by-product of this process is the heat released by the condenser coil. It might be recoverable with the caveat that its subject to contamination with NG should the condenser coil spring a leak.

"I have often wondered if one could use the compressor and condenser coil from an old refrigerator to compress the natural gas piped to houses to condense it for use as fuel"

The refrigerant in a refrigerator is non-flammable, completely unlike natural gas. I would strongly discourage you from trying this.

If you're going to do it, I would strongly recommend something from one of these vendors: Refuelling Appliances

His post is good. Given the background that this is the same man who threw cold water on Saudi's own mythical 'spare capacity' back in 2007 to the U.S. embassy(later leaked in a Wikileaks memo), this evolution is logical.

Although he doesn't say it outloud, he does make clear that he is skeptical.

Also, if we take Maugeri's astronomically optimistic estimate of 29 mb/d, as al-Huseini points out, this new capacity is just enough just to cover the current baseline production up to 2017.

What did annoy me what his passive acceptance of the shale oil myth. I'm not going to rehash the arguments I've made in previous Drumbeats at nearly the same length, but it's suffice to say that while al-Huseini cites the IEA estimate of 6.7 % decline rates per year(note: not to be confused with depletion, which is a different metric) for the world, the replacement for this rate are oil fields with decline rates around 40 % or above.

I'm willing to concede that tight oil has done well, in part because the U.S. has a lot of well-managed resources.

For example, China can't get the same production the U.S. will be able to because the delta where their shale deposits(both gas and oil) are very water scarce in comparison and they already have a fresh water problem due to irrigation practices.

Nonetheless, almost 5 mb/d for U.S. shale oil is a complete fantasy. I'd wouldn't bet against production rising to even 3 mb/d by 2015 but at that point the decline rates come back to haunt them. It takes an average of 6 years for a typical Bakken well to become a 'stripper well'(i.e. 90 % of production have been produced already).

Unless someone can find several new Bakkens for the next few years, shale oil production in the U.S. will start to fall at the end of this decade.

The EIA predicts 1.3 mb/d from U.S. shale oil production by 2035. And this is the über-cornucopian EIA which has often competed with CERA of who can be the most outlandish on future oil production.

They were wrong in the initial phase(they predicted 1.3 mb/d by this year and then hold steady, while tight oil production is now at 2 mb/d already) but they won't be wrong in the long run. And by 'long run' I mean within less than a decade from now.

Other than this quibble, his post is high-quality.

It would be interesting to see if he was willing to come out as a peaker in a few years. He's taking baby steps...

Then again, it's just a matter of basic math and a mental ability to resist the herd and be a contrarian.

http://seekingalpha.com/article/311805-the-bakken-oilfield-real-oil-prod...

What of these 'potential other Bakken-like plays'? Somewhere else I had read the speculation of numerous other oil-bearing tight shale 'layers' either below and/or nearby laterally the Bakken.

No corocopian here...just wondering if the Bakken and plays like it have ignited a final 'feeding frenzy' to find and extract other such plays and 'keep the flame alive' (maintain the bumpy plateau) through sometime in the 2020s?

I know of a few Bakken-like plays out there, but unfortunately not in the US.

Alberta has its Cardium Formation, which is Bakken-like in size, although it is a tight sand rather than shale, and has resulted in a rise in Alberta conventional oil production in the last few years. That is probably what they mean when they say "The Alberta Bakken" above, because while the Bakken extends under Saskatchewn and is a big producer there, I don't think it gets as far as Alberta. Maybe it does, but if it does it's small potatoes. Of course the Alberta oil sands are vastly bigger than any conventional oil deposit, so it's mostly small oil companies drilling up the Cardium. Alberta already produces twice as much oil as Texas and the people are used to oil rigs popping up like mushrooms all over the countryside, so it doesn't get much notice in the press. Hydraulic fracturing has been used in the Cardium Formation since the 1950's, so that doesn't attract much attention, either.

There is also the Canol Formation in the Canadian Northwest Territories, which is a tight shale formation like the Bakken, and of similar size. The problem is that it is in the NWT, there are no roads except ice roads leading to it, and developing it will be expensive. Shell is interested, though and is drilling a couple of wells to test it out.

Other than that, I don't know of any Bakken-like formations in North America. US geologists may have some ideas. Keep in mind that the Bakken was discovered in the 1950's, and the only reason it is being developed now is that the price of oil is high enough to pay for the costs, which are oil sands-like.

In Alaska, a company called Great Bear Petroleum currently has a drilling program underway to evaluate oil from shale plays on the North Slope. For more information see Great Bear's presentation. Many Alaska geos (myself included) are somewhat skeptical that the economics will work up here, for the same reasons that RMG questions the Canol play.

On the other hand, in contrast to the Canol play, Great Bear is starting their program next to the Dalton Hwy and the Trans Alaska Pipeline. This makes it at least possible that it could work for them. Note also that Great Bear has partnered with Halliburton in this venture. Note that if it works, there is a huge potential area for expanding out from the TAPS/Dalton corridor. Great Bear has said they may have initial results by September.

Edit: fixed typo

Great Bear has said they may have initial results by September.

How recently did they say this? Originally (2010 I believe) Duncan said Great Bear would have producing wells by 2013--last thing I was able to find said they wouldn't be drilling the first exploration well/s until the 2012-2013 season--that was said this spring if I recall--do you have anythying more current?

I just got the most recent Petroleum News today, which included one of their periodic special sections. In "Fortune Hunt Alaska" it said:

It goes on to say Great Bear plans to complete the two laterals plus a third vertical well by the end of 2012.

Thanks. I've thought about subscribing to PN again, it's been a few years. Anything else real interesting in the current issue?

Shell's drill ship Noble Discoverer set sail for the Chukchi yesterday

The ice is quickly disappearing in that neighborhood right now

here is a bit more detailed look

Nothing else too profound in the current Petroleum News. An article about the state pushing BLM to take care of the old federal legacy wells in NPRA. Anadarko letting many of their N Slope leases expire.

If you don't want to subscribe, you can often find the full articles on google a week or so after they are published.

Yeah, the sea ice is going fast. Our glaciers are disapearing fast too. I went in to Exit Glacier near Seward awhile back. The last time I'd been in there was about 4 years previously. Incredible how much it has retreated in just 4 years.

RMG

Doesn't the south and north canol road access this? Or is the actual formation past Norman Wells?

I used to fly into the shell strip at the top end past Ross River, and big game outfitters regularly transport tractor trailers of horses, feed, etc up towards O'Grady lakes south Nahanni area.

Having said this, I hope it never gets developed as it is still wonderful access for prstine fishing trips.

Paulo

RMG can fill in the details, but I believe the Canol Road is only open as far as the Yukon/NWT border. I think they kept that part open to serve several mines in the area. The road beyond the border was abandoned long ago, and would require considerable effort to reopen.

That's correct. East of the Yukon border, the bridges on the Canol Road that were built during WWII have collapsed and never been rebuilt. People have bicycled and hiked it, but they had to swim the river crossings. The best way to do it nowadays is to wait for winter when the rivers are frozen, and do it by snowmobile.

That being said, Norman Wells and other towns on the Mackenzie River are supplied by river barge during the summer. The Mackenzie is a river the size of the Mississippi, so this is a perfectly good way of shipping supplies to them. In the winter, ice roads are the standard way to deliver supplies. And of course you can always ship in supplies by air.

It is not impossible, but it is expensive, which is the main issue with developments in the Northwest Territories.

No more Bakken-like plays in the US?? I don't quite understand that statement...

For one, I would suggest that the Eagle Ford formation in South Texas has certainly proven itself as another viable "Bakken-like" play in the USA, with significant oil-rich and mixed oil-gas areas. The IHS (I know, not everyone's favorite) recently published a study saying that the Eagle Ford, although it trails the Bakken by a large margin in well count, still may soon surpass the Bakken in total oil production, due to the Eagle Ford's higher oil production per well.

http://www.businessinsider.com/north-dakota-shale-oil-boom-state-texas-2...

There are also strong reports about the Utica shale formation in eastern Ohio and beyond. I've read that the Utica formation co-exists with the Marcellus formation over large areas, which is possible since the two formations are at much different depths (with the Utica shale being deeper than the Marcellus). And it seems that many of these shale formations (perhaps hydrocarbon-bearing formations in general) exist above additional, older, deeper formations, often with some amount of oil/gas content - sometimes several of these exist in a vertically "stacked" sequence.

There are others, with some only now being fully mapped-out for commercial value. Perhaps some of these are more carbonate, etc than Bakken-like shale?, but as I understand it, they are all "tight" and require a very similar sort of fracking technology to produce.

Other possible Bakken-like plays in the US (in addition to Eagle Ford and Utica) would be Niobrara (Colorado/Wyoming), Monterey (California), Cana Woodford (western Oklahoma) and the Tuscaloosa Marine Shale (Louisiana/Mississippi). These have all been identified as large and promising US shale/tight areas, known to be especially rich in oil content, which can be produced using the latest American fracking techniques (i.e. Bakken-like).

Actually I edited that to, "I know of a few Bakken-like plays out there, but unfortunately not in the US." and then invited the US oilmen to chime in because they know the country better than I do - which they did. I mentioned a couple in Canada that I do know of.

The Bakken does, however, get overhyped in the US because of its theoretical potential, and in that sense it is unique in the US. The ones in Canada are mostly overlooked in the media because Canadians are not into hype, and the Canadian oil sands are far bigger than any conventional oil play.

Ok, I see what you mean by this distinction. I believe that I started to write a reply, and then after getting side-tracked on other duties for a day or two, I came back to finish the reply, but without first getting a fresh copy of your updated post (which didn't occur to me). Anyway, please accept my apologies for quoting you on the older comment, since revised.