Tech Talk - Oil Production Within China

Posted by Heading Out on September 4, 2012 - 4:36am

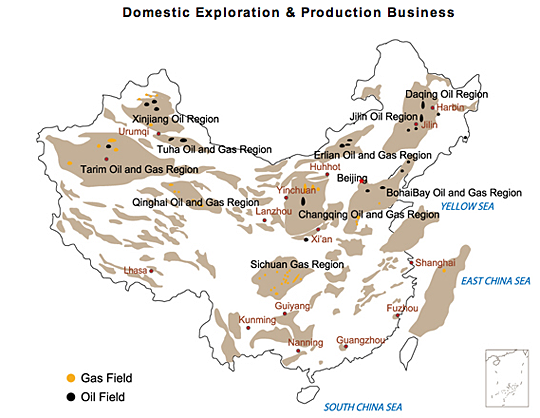

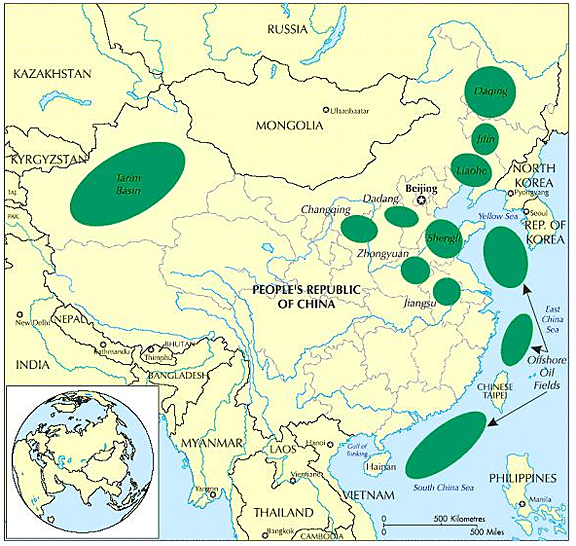

If one looks at a map of China, it seems at first to be a land heavily endowed with gas and oil fields. However, with the continued rise in demand for liquid fuel, exploration and development are being aggressively pursued inside the nation, as well as offshore and abroad. Current levels of production, and those planned, still leave an increasing volume that must be imported each year to meet the national demand.

And yet, as has been noted earlier, while demand has continued to soar, overall domestic production has not changed all that much. China has three major oil production companies, PetroChina, Sinopec, and the Chinese National Offshore Oil Company (CNOOC), where the last of these, discussed in an earlier post, deals – as the name suggests – with offshore deposits, and the other two are concerned with onshore production.

According to the 2012 BP Statistical Review, China produced an average of 4.09 mbd in 2011, which was a 0.3% increase over that produced in 2010. As mentioned in the earlier post, CNOOC is only able to project a sustained production level this year because of the increasing production from its overseas properties in Canada and Iraq. In the first half of this year, they produced some 127 million barrels of oil, close enough to 700 kbd in total, and similar to last year’s average.

Within the country the industry is split between two companies, the China National Petroleum Corporation (CNPC), which has PetroChina as its publically traded division, has some 60% of the oil production and 80% of the natural gas production. Just this year PetroChina was recognized as having passed ExxonMobil to become the largest listed oil producer in the world. With overall production of 2.43 mbd it exceeded the ExxonMobil total of 2.3 mbd in January. (Although it is suggested that PetroChina made only half the profit of its competitor).

One has also to distinguish between the production that the company is able to achieve in China, relative to that which it achieves through its acquisitions abroad. The company shows a domestic record of production that has averaged 2.42 mbd in 2011, with slight rises in production for the past two.

For the first half of this year, the company has refined an average of 2.69 mbd, which was expensive for the company given that the sales price for the resulting products are controlled in China. Additional production, to the tune of 343 kbd, comes from their foreign holdings. By 2020 the company intends that this amount (almost 10% of output) will be increased to 50% of the company production. Assuming that it can sustain domestic levels of production, this anticipates that it will need to be able to find roughly 1.4 mbd of additional production from sites abroad.

PetroChina runs inter alia, the largest field in China, that at Daqing. After the discovery of commercial oil at Songji No. 3 well in September 1959, the field was brought into production over three years. The field was where “Iron Man” Wang Xinji gained national fame through his efforts as an oil driller with the 1205 Drilling Team to bring in the first production well. Production at the field peaked in 1976 at roughly 1 mbd with more than 14 billion barrels of oil now having been produced. Oil recovery is cited at 50%, a rate that is about 10-15% higher that the average in Chinese reservoirs. Just this week the company completed an addition to the refinery there that raises capacity to 197 kbd at that refinery of Daqing Petrochemical. Production at the field itself has now fallen, in overall average for 2011, to roughly 790 kbd, and relies on tertiary recovery using a polymer based flood in a field which has an over 80% water cut. The company believes that more than 70% of the recoverable oil now has been.

Next door to Daqing lies the Jilin Oil Province, containing some 21 oil fields. Of these the Fuyu field was first discovered with the well Fu-27 in September 1959, with full exploration in 1961 though it was not developed to full potential until 1970. CNPC, PetroChina’s parent, runs the Province, which is the seventh largest in China. Last year it produced some 148 kbdoe and this is to be raised to roughly 200 kbd by 2015. CNPC also began production in Iraq this past year, and anticipates some 59 kbd from that source.

The Changqing Oil Field is also operated by CNPC. Discovered in 1971, it reached a total of 800 kbdoe in 2011 with a year-on-year growth in production of some 7 million barrels.

Far out west in China lies the Tarim Oil Field, which has been set a goal of producing sensibly 1 mbdoe by 2020, though more recent announcements have lowered that target by 20%. Operated by PetroChina, achieving that target will move it toward the front of the fields in the country, from its current fourth place. It has a reserve estimated at 100 billion barrels of oil equivalent, and is the largest natural gas producer in China.

Shengli (Sinopec) Shengli field, which is, at around 557 kbd production in 2010 is currently the second largest producing field in China.

Sinopec anticipate that by 2020, it will produce more than half of its oil and gas from abroad and by 2015 expects that it will be close to that goal.

China Petrochemical, Sinopec’s parent, seeks to produce 50 million metric tons of crude a year overseas by 2015. Last year, foreign production was 22.9 million tons. Sinopec said it boosted first-half crude output 4.3 percent to 163.09 million barrels and overseas production jumped 82 percent to 11.13 million barrels.

If Sinopec sustains domestic production at some 895 kbd through 2020, then it will need to find nearly 1 mbd of overseas production to match that in just three years.

In short, while China is working as hard as it can to sustain current levels of production into the future, in order to meet the growth that they anticipate they will be looking to buy (combining all three company goals) close to 2.5 mbd from overseas deposits.

The big question, of course, remains as to where that production will come from, if we are at a world plateau in overall production, and at whose expense will that supply need be met.

P.S. On a continuing note, it is worth remarking that the Alyeska pipeline flowed at an average volume of 430,967 bd in July.

HO – “...while demand has continued to soar, overall domestic production has not changed all that much.” And you offer that China is trying their hardest to increase production. Pure speculation on my part: maybe they aren’t...at least with respect to domestic production. I recall after the oil price crash of late ’08 China significantly increased their oil imports. Why not import cheap oil and leave your reserves in the ground? China is reportedly expanding their SPR capability. But will they fill it with domestic production or imported oil? At least, compared to the US, China is playing the long game. In doing so wouldn’t it be logical to slow play domestic development, as some have argued for the US to do, to save it for future generations? Some folks debate how secure those foreign FF assets China has acquired will be in the future. There can be no debate as to how secure future FF assets will be on the Chinese mainland.

Rock:

I believe that once the Chinese government decided to unleash the industries in the way that they have, with the consequent huge increase in the general standard of living, that they have a tiger by the tail that they cannot climb down from. Thus (and we have seen this in coal) while they can try and set a general policy they are at the mercy of the markets and the desire by the individual Chinese at all levels of government and industry to make a buck. As a result they have to find as much energy as they can to support their economy, but they are also more willing to look to the long term than most of us in the West. Hence their trying to line up all the different ways that they can continue to meet that demand in the future.

I agree with your speculation. China is NOT trying to increase oil production. Unlike us in the USA, their leadership understands, despite the corruption among their elite (ours too), that renewables must totally replace nonrenewables in order for mankind to have a future. It is rather obvious that the effect that an ICE (internal combustion engine) run in a closed garage has on you will eventually do the same to oxygen breathers all over the planet. The five year plans that we ridicule because they are "communist boondogles" actually ARE being used to meet goals in renewable energy. The somewhat lenghty and boring five year plans always state which goals were met and which goals weren't in each previous 5 year plan. They are now going ahead with a power use reduction goal in households so they do not have to beef up transmission lines. They are attempting to do this by increasing decentralized energy input from solar panels and wind at the neighborhood level. This is ongoing as we speak. This is not some plan far off in the future. They have horrendous pollution problems and birth deffects issues from heavy metal that don't make the papers here (or there!) much but word gets out. This forces them to deal with issues our leaders have put off. They aren't better than we are; just farther into the future with the IN-YOUR-FACE effects of burning hydrocarbons. I am saddened to learn that they are planning construction of several nuclear reactors they claim cannot melt down or leak radiation(where have we heard that before?). To all this I say that political and industry leaders need to take a course on the laws of thermodynamics. They need to learn what entropy is after they have reviewed their favorite, the law of conservation of energy. It's the second law that is blatently ignored in addressing the "merits" of hydrocarbon uses or fissionable product.

The Second Law of Thermodynamics states that "in all energy exchanges, if no energy enters or leaves the system, the potential energy of the state will always be less than that of the initial state." This is also commonly referred to as entropy.

This is not just about clocks winding down, folks. It's about poisons and pollution disorganizing and destroying life through entropic effects of high energy transfer rates. The biosphere is a closed system of complex energy transfer mechanisms called life forms. Energy certainly can and is being transferred from rapid oxidation and or fission but any discussion of their cost must FIRST be studied scientifically in terms of entropy and poisons generated in the thermodynamic tradeoff.

I address the issue of energy use, carbon footprint and our future in a politics free manner which is accurate from a scientific view of thermodynamics in the biosphere in the following articles.

Learn what a proper formulation of the EROI should be composed of free from propaganda, politics and the petroleum profit motive.

Renewables, why they work and fossil and nuclear fuels never did

http://www.doomsteaddiner.org/blog/2012/07/17/hope-for-a-viable-biospher...

Carbon Footprint and how the 1% skew the per capita numbers in the USA (Joe 6 pack uses much less energy than is claimed) is discussed, among other subjects of interest to Oil Drum readers, here:

http://www.doomsteaddiner.org/blog/2012/08/13/sexual-dimorphism-powerstr...

Latest article hot off the presses:

http://www.doomsteaddiner.org/blog/2012/09/06/high-energy-love-the-short...

Unlike most sites, the comments on these article do not get shelved or disappeared into dusty archives. The thread is preserved and you can read through the whole thing. You can tear the articles to pieces and use profanity if you wish to accentuate your prose. As long as you don't conflate opinion with facts and vice versa, you will be listened to. Come one, come all and show us your debating skills.

thanks for the hard numbers HO

Of course personally I find the 430,967 bd the hardest to digest. Far below the lowest daily average flow for any year to date. I'm not sure what the producers and Aleyeska are doing to try and keep TAPS flow up during the long and critical winter months but it does seems the monthly averages have been lower during the summer months of late.

I find the 430,967 bd the hardest to digest.

I'm hoping it's an "Oops!" moment rather than one of those "Oh, sh*t!" moments which are rather common in the oil industry. No explanation on the Web site, so only time will tell.

Luke:

Since this is at least the second year when I have noted the summer drop (and I wasn't looking before then) I suspect that you may be right, given that they need the higher winter flows to keep cooling problems at bay.

But, that being said, . . . . . . .

Or they do maintenance during summer.

no doubt summer maintenance plays a part but shutdowns are generally less than 24 hours. The 2011 average daily flow, lowest other than the first year of TAPS operation (1977, and that is a deceptive number as the first oil did not reach the Valdez terminal until July 22) was above 580,000 bd. The July average of just under 431,000 bd indicates something much more significant happening than a day or so of no flow due to maintenance shutdowns.

They claim a 98.24% reliability facor for the same month.

The Tarim basin is predicted to produce about 800 kbd by 2020 but has an estimated 100 billion barrels of OIP. Either this is a very difficult resevior to produce or China wants to drag out production over a very long period. If a field containing 100 billion barrels were found in Alaska I thnk production would be more like 2 million barrels per day. So, HO why the low production level from the biggest reserve in China?

Looks like China will be importing more oil as time goes on, thus driving prices higher on the world market.

It is unlikely the Chinese will continue to experience the type of exponential growth they have experienced in Energy Consumption since they became the defacto Industrial Sewer of the world. Regardless of whether they produce Oil internally or import it, the cost of the Energy to produce the products they sell has become too great for the Consumer of those products to bear.

As the credit markets implode, a mercantilist economy like China's is served a Death Sentence. They can't sell Iphones or Carz to workers they pay slave wages to, and if they raise their wage levels the cost of the products will rise commensurately. They will remain unaffordable.

Demand collapse has already begun in Europe, and it will accelerate around the world here as time goes by. China will be as unable to afford the cost of Oil as anybody else is. They are TOAST.

RE

http://doomsteaddiner.org

That's exactly it.

Chinese economic growth has slowed the last six quarters to a three year low of 7.6%. This is not a collapse but persistent weakness. That is not to say collapse isn't coming. Export growth also more than halved in the first six months of 2012 compared to 2011.

China GDP figures

The other thing to watch is that overdue loans have risen 27% in the first six months of 2012 for the five largest Chinese banks. This is especially concerning if this trend continues to accelerate. ICBC is the world's largest lender by market value and if an increasing number of clients cannot repay their loans we could see another 2008 style financial collapse.

If Chinese oil consumption rose the same way this decade as it did in the last, with the same speed, China would consume about 17-18 mb/d by year 2020.

But China won't do that since as the West linger in their recessions, it turns out that China isn't an isolated island(and never was) and that their export growth is plummeting, bringing a substantial part of their economy with it downwards.

So therefore Chinese growth will not, as you suggest, be the same. Using the Compound Annual Growth Rate(or CAGR), the average oil consumption rate has been about 7% per year.

Now BP's 2012 Statistical Energy Report stated that Chinese oil imports(not merely consumption) increased by about 9.5 % in 2011.

This too, is completely unsustainable and will not be kept up.

This is probably one of the biggest points many people miss, that China isn't in an isolated box shielded from the rest of the world and if Europe, which is still China's biggest trading partner, goes into permarecession then China will be slowly dragged down with it, not completely, but to a large extent. If America also is dragged down, which would be necessary for China to grow it's oil consumption even at more modest rates, then China will slow even further.

In this sense the system is selfbalancing. China can't 'eat our growth' forever, whether oil or economic, as the resource wall is slowly being hit.

easier to see ?-)

Careful what you choose to believe, Luke H

China's GDP is "man-made," unreliable: top leader

Bank lending collapsed, but was swiftly propped up by the zombie banks that the CCP controls. Electricity growth has been growing at 1-2 % per year(instead of above 10 % during the boom years), export growth grew just 1 % in July, rail cargo has been slumping since the export engine is faltering(that's why there's so much spare coal at the terminals piling up).

Whatever the true growth rates of China, even their own leaders admit that it's not the official number.

I just reposted Southern Limits graph so we all could see it--I've made a typo or two that botched the code and killed the graphic when posting here myself, so your comment would be best redirected to Southern Limits--I have a tough enough time trying to figure out what mature economies' (like the US) posted GDP figures are really telling us, I always assumed the meanings China's numbers would be far more difficult to fathom.

In that light the NY Times ran Construction and Real Estate Hinder China’s Growth today.

Lets take a loan to pay the electricity bill, bank lending may as well be a way to bankruptcy as a sign of economic progress. Rail cargo volume however seems to make a lot of sense.

If I remember correctly they recently started to use the three gorges dam although I do not know if it may have a significant effect on need for coal generated electricity and shipping of this coal with train.

As the credit markets implode, a mercantilist economy like China's is served a Death Sentence. They can't sell Iphones or Carz to workers they pay slave wages to, and if they raise their wage levels the cost of the products will rise commensurately.

I think you're naive about what is really going on in China. Millions of Chinese are entering the middle class every year, and they are not being paid slave wages, although wages are lower than the US or Europe. Wages in China are rising rapidly, hence the huge demand for cars (more sales than the US), mobile phones, and other consumer goods. Chinese workers save about 25% of their incomes on average, so they often pay cash and don't use credit for purchases.

An important factor in future growth is that in recent years China has graduated far more engineers than the US or Europe, and they are extremely good at cost control and automation. Chinese factories are often state-of-the-art and highly automated, notwithstanding their low wages.

"Millions of Chinese are entering the middle class every year, and they are not being paid slave wages"

I used to believe this, but the Chinese are being paid slave wages. From:

China: Broken Dreams

As many as three million young Chinese professionals toil in slum-like conditions in cramped housing on the outskirts of big cities. They are known as 'ant tribes,' a term coined by scholar Lian Si, China's foremost researcher on post-80s graduates.

"They share every similarity with ants," writes Lian. "They live in colonies in cramped areas. They're intelligent and hardworking, yet anonymous and underpaid."

And be sure not to miss the stat that "Suicide has become the biggest cause of death for Chinese between 15 and 34 years of age."

---------------------------------------------

"China has graduated far more engineers than the US or Europe, and they are extremely good at cost control and automation. Chinese factories are often state-of-the-art and highly automated"

About the "highly automated" factories - Maybe the robots are going to buy all the products they are so good at making? From:

Will the Unemployed Really Find Jobs Making Robots?

"Well, common sense tells you that you don't replace five $30K-a-year workers with a $250K robot only to reemploy those five workers in other, higher-paying jobs to build and maintain the robots that just replaced them. There will be skilled jobs in designing, operating and servicing the assembly lines. But obviously not as many jobs as the robots replace, and, taking nothing away from the potential for retraining, most likely not to be filled by the unskilled workers who just lost their jobs."

The Industrial Revolution is in it's final lurches and gasps for air - and China showed up to this party very late in the game.

JoeP

http://doomsteaddiner.org

No. I don't think China's economy is stable, but they do have a new "middle." You just can't compare their middle class to the same segment in western economies (many who are still raiding their middle for fun and profit). Slave wages to us may be far better in the short term for the guy who was facing hand-to-mouth farming at the whim of the weather.

As an anecdote, my oldest works there in an industry that sprung up in the last few years due to the the new "middle." The company was founded in 09. The kid is making just north of 40K USD a year + rent right out of college. Back home, that would be upper 20s or low 30s, no rent or medical, if a job was even to be had.

Can it last? Nope. No more than any other economy built nearly entirely on cheap energy.

the Chinese are being paid slave wages

By my definition, slave wages are being paid no money at all. By that definition, most Chinese were paid slave wages half a century ago. They were rural peasants, worked for food, and had no money at all. That has changed drastically. The Chinese have huge amounts of money.

It requires a lot less money to be middle-class in a third-world country than a first-world one. For what the average American makes, the average Indian could live in a palatial house and have servants, which is more the definition of "upper class". It isn't quite that way in China, but standards for being "middle class" are much lower than in the US. You don't need a 3,000 square-foot house and two gas-guzzling SUV's to be middle class.

See The Chinese Dream: The Rise of the World's Largest Middle Class and What It Means to You

Definitions of middle class vary, but one definition is that the middle class have at least 1/3 of their income available for discretionary spending after the necessities of life (food, shelter, clothing, transportation) have been paid for. By this definition at least 25% to 35% of the Chinese population is middle class, or more people than live in the United States. How many people in the US are "middle class" by that definition? A lot fewer than in China.

"Well, common sense tells you that you don't replace five $30K-a-year workers with a $250K robot only to reemploy those five workers in other, higher-paying jobs to build and maintain the robots that just replaced them.

I saw a documentary on a robot designed in China to make noodles for Chinese restaurants. Apparently Chinese restaurant patrons insist on fresh noodles in their soup. It wasn't a $250,000 robot, it was more of a $2,500 robot. But it did make noodles and it made them very fast. It even had flashing robot eyes, but that was more of a gimmick to impress the customers than anything else.

Even Chinese restaurant workers don't want to make noodles if they don't have to, so they were quite happy to let the robot make the noodles and just serve them up to the customers themselves. This is probably a different level of automation than you had in mind, but very effective in a low-wage economy.

mb – I’m not familiar with those reservoirs enough to give a definitive answer. Maybe the nature of the rock, technical inabilities of the Chinese or a lower priority as far as capex allocation. But as HO pointed out above the Chinese have had to maximize their acquisition of energy to sustain their high growth.

But, again pure speculation on my part, that doesn’t necessarily mean maxing their internal production of oil. For instance when oil prices fell so low in Dec 2008 they quickly ramped up their oil imports. Even if those imports costs a bit more than internal oil China had the capital to spend. In the US private enterprise is driven by short term considerations. But China has been much more focused on the longer term...just like my private company. As I’ve mentioned before we’ve shelved a number of NG prospects due to low prices. But not because they wouldn’t be profitable...they would. But we allocate capex where it maximizes our ROR. Those projects have been delayed...not abandoned. This rationale is true for most NOC’s and private companies IMHO. Public oils, especially those in the US, are more driven by the need for reserve additions (regardless of potential low ROR) to satisfy Wall Street’s demands.

But China has an advantage my company doesn’t: we’re designed to disappear (liquidate) in a few years. China will be in the game for ever. They know in the future their internal oil reserves will be worth much more and be more critical to maintaining a healthy economy.

A silly but real life example: a lifetime ago I was walking down a trail on a very hot day. While taking a sip from my canteen a buddy next to me asked for a sip and I complied. Getting my canteen back I commented it was rather early in the day to run out of water. He said he didn’t run out of water...just wanted to conserves his. I had to laugh. Still brings a smile after a these years. After all he didn’t say he didn’t have any water. The Chinese haven’t said they couldn’t be producing more internal oil than they are today. We’re just making that assumption.

A quick Google scan of web sources reveals that the Tarim Basin is one of the most remote and expensive oil provinces in the world. Most of the reservoirs are more than 4000 metres (13,000 feet) deep - that may be why they are so slow to develop it. Also, at those kind of depths you would expect them to be gas prone rather than oil prone.

Lack of skilled workers is a problem, particularly since the Chinese are bringing in ethnic Chinese rather than using indigenous people - who are mostly Muslims. That could become a political problem, but the Chinese are quite good at suppressing minority dissent and bringing in enough ethnic Chinese to overwhelm the local population.

Also, the estimate of oil reserves may be overoptimistic. Even if the 100 Bbbl of OOIP is correct, assuming a 30% recovery rate that would translate into 30 Bbbl of recoverable oil. We need to know the reservoir characteristics and the development strategies to guess the recovery rate.

So, it's a nice big play and should give them a large (but expensive) increment of production, but given the size of the Chinese population, it's not a game changer. That's why they're combing the rest of the world for oil.

If any sufficiently large field were found in Alaska production would be like 2 million barrels and match the capacity of the pipeline. I am little puzzled about why a lot of fields have a prononounced peak. It does not feel very economic to design for a capacity only used once or for a very short period of time.

China is communistic country with a central government and could not be expected to behave the same as a company trying to achieve the maximum profit.

In the case of Alaska, oil companies sized the TransAlaska pipeline on the assumption that that more fields the size of Prudhoe Bay would be found in the North.

Unfortunately, Prudhoe will probably remain the biggest oil field ever found in the US, and nothing else will be found to match it. If they had known that, they might have made the pipeline smaller and stretched the life out longer (The government might have done that, oil companies will always go for the maximum production rate.)

The pronounced peak occurs because oil companies try to achieve the maximum production rate and maximum profits on the annual report. Unfortunately, the peak doesn't last very long and production quickly falls off. In many cases oil fields have a double peak, because once production starts to fall off, the operators put it on secondary recovery (water or gas injection) and production goes back up. Unfortunately, that doesn't last very long, either.

China is a communist country in name only. The economic system they have in reality is rather close to pure laissez-faire capitalism, with a certain amount of central control. The technocrats that run the country do have longer planning horizons than the US or EU, though.

Karl – It’s the nature of NPV economics…Net Present Value. Used by virtually every for profit oil company. The value of future cash flow streams is reduced by the DR...Discount Rate. A 10% DR is not uncommon. So cash flow a year from now is valued at only 90%. The second year: 10% less than the previous year. And so on. After the 7th or 8th year the NPV of cash flow becomes relatively insignificant. But this is what the ROR is based upon. And investment decisions are typically dominated by ROR.

Which is exactly why offshore fields, especially DW, spend much more capex than actually required to bring a field into production? The extra capex is spent to increase production rates to increase ROR. And often at the expense of URR. Folks like to criticize this approach. But answer this question: if I borrowed $100 from you would you prefer me to repay you $130 or $200? Be careful how you answer: I’ll pay you the $130 in two weeks and the $200 in 20 years? Which deal would you agree to? Whether we do the math or not most instinctively take rate of return into account IMHO.

China has a complex geology especially in Sichuan basin which contains huge gas resources but is highly fractured, making it difficult to drill horizontal well. Country also has scarcity of water resources keeping in mind fracking requires huge amount of water. Water issues and environmental concerns are already a issue of headache for shale gas producers. ..

They have tons of challenges to deal. Its easy for them to take over company like NEXEN and get hold of the assets then developing the asset at home.

g - Seems like China's big edge in the future might be NG. But the big IF there is whether they can afford the distribution infrastrucutre fast enough. Not so much the major transport lines but local distribution system. Sorta like why cell phone sales boomed: cheaper to build towers than lay a gaudzillion miles of landlines. Maybe NG fueled electrical generation is the best angle. May be a lot cheaper to upgrade the grid than lay all those local NG residential lines. Either way a lot of capex and time. OTOH a lot of local labor required...not a bad thing given their pop size.