Tech Talk - China's Coal Industry

Posted by Heading Out on September 20, 2012 - 4:45am

In this run-up to the election, the American energy future seems to have faded into the quiet background. Gone are the concerns of past years, as both parties seem to have bought into the idea that the nation is well on track toward a much reduced need to import oil. Wood Mackenzie is forecasting that tight oil production will rise from 1.5 mbd this year to 4.1 mbd in 2020, with the Bakken producing 1.3 mbd, the Eagle Ford 1.3 mbd, the Permian plays (Bone Spring, Avalon, Wolfcamp and Cline) will produce 440 kbd, and the Niobrara should be good for 90 kbd. With the decline in production from the impact of Isaac in the Gulf not yet over, it is not yet clear whether the plateau in US production that was starting to form will continue, or whether the gains in production that these projections require will continue.

But there are some signs that these projections are, shall we say, a little ambitious. Well costs are now running in the $9 - $11.2 million range and, to sustain production, in these formations where wells have a high annual decline rate, increasing numbers must be drilled each year to offset that decline, and the poorer quality of newer wells. But declining rig counts and other concerns are for the future, and if no one coughs too loudly we can pretend that everything remains fine until we get past November.

China does not have that luxury, since the country, having set its people on an upwardly mobile quality of life path, must continue to provide the power that such a ladder requires. As I noted last time, the potential gains from the increased use of natural gas have been noted. Actions have already been taken to make sure that future supplies will meet anticipated needs and work has begun to tap the gas shales of the country.

But despite those efforts, the underlying strength of the Chinese power industry comes from coal.

In 2007 Chinese coal production contained more energy than total Middle Eastern oil production. The rapid growth of coal demand after 2001 created supply strains and bottlenecks that raise questions about sustainability.

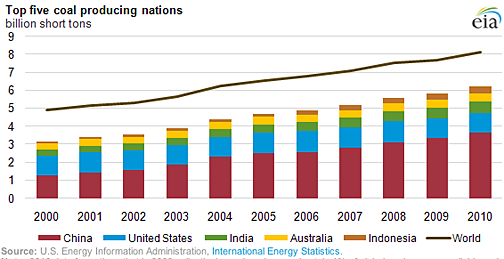

In 2010, China produced almost half of the world’s coal tonnage.

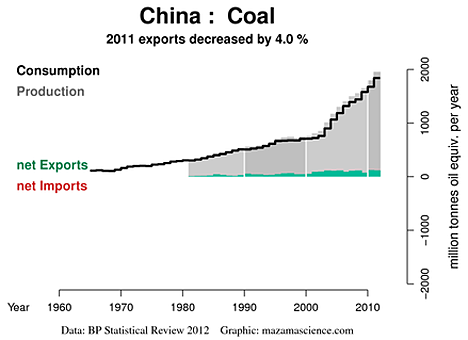

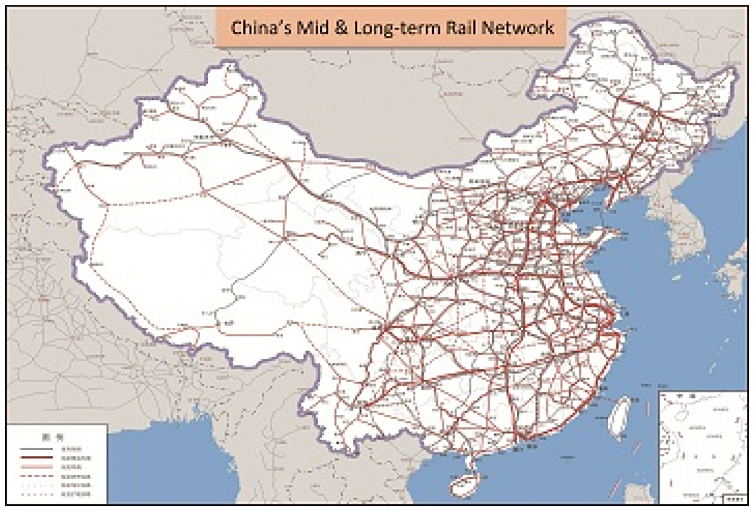

China produced some 4.52 billion tonnes in 2011 and some 45% of that was shipped from the mine to the customer by rail. As demand continues to grow those volumes will also increase.

Rail takes a much longer time to install than does a pipeline, and thus Chinese recognition of this need is timely. Between now and 2015, Government plans call for an increase in transportation capacity to 3 billion tons/year almost doubling current capacity, as production of coal is anticipated to decline slightly to around 4 billion tonnes domestically, which may only exist as a target value. Nevertheless to move the coal to the power stations where it is needed, not only trunk lines, but also a large number of shorter branches will have to be created. This will be particularly true if the market shakes out and many of the smaller companies, which are apparently currently seeing some cash flow problems may fade out of business.

The Chinese have always been willing to find creative ways to improve their mining technology. I remember back some 45 years ago, when the European coal industry was still strong though waning, and the Chinese arrived seeking to purchase up-to-date mining equipment. Given that coal demand and thus equipment demand was in decline, manufacturers were willing to meet the conditions of the sale. These included that engineers and technicians be at the manufacturing plant during the entire time that the equipment was being built, and that they fully how understand the process. (The argument was so that they would be able to maintain it after arrival). Well, needless to say, after those initial deliveries, further orders were rare, and Chinese versions of the equipment appeared, and many of those European manufacturers are no longer around.

New developments of technology in the West are much harder to come by these days. Research and innovation in coal mining in particular has fallen on hard times in both Europe and the United States (to the point of almost disappearance) and thus as China moves toward automation of its mining, particularly in thin seam conditions they are less able to draw on external sources, and must develop more of their own.

Life is a little different in other ways also, and Western companies can now get into the country and collaborate on development. Peabody, for example, is now developing coal mines in China. It has also been working with the government of Mongolia and will help develop mines in the Tavan Tolgoi region. This may be the only growth region for the company at a time when the current Administration in the United States, not to mention those in Europe, seem bent on closing the industry down as fast as they practically can. Given the amount of power that will be required to sustain current qualities of life, and the disappointing, and expensive costs of recent alternatives, the question as to how long this long-term unrealistic view will prevail is a matter of conjecture. China seems to retain a more realistic view of what is going to be needed, and planning accordingly.

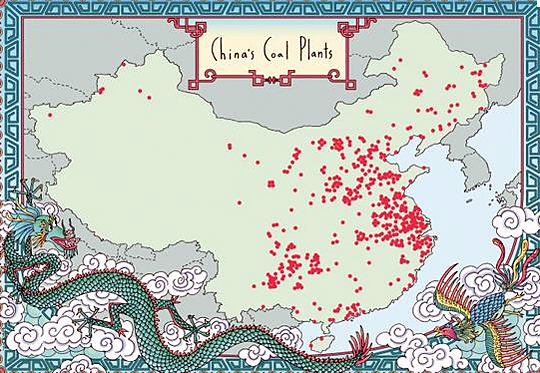

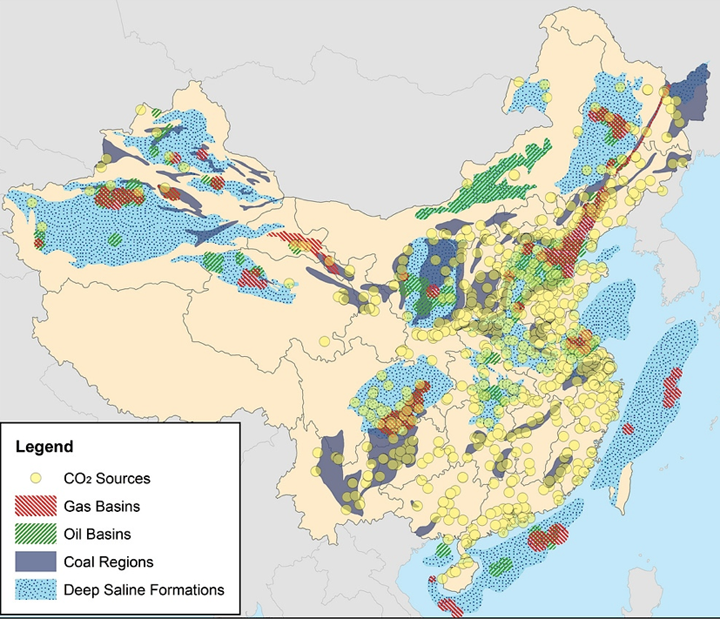

There have been some thoughts given to the possibility of sequestration of all the carbon dioxide that will be generated from the various power plants that use this coal. However the power plants are not necessarily close to places where it might be easy to sequester the gas.

The Oil Drum has been fortunate over the years to have had a number of high quality posts on the development of the coal industry in China. These include a review by Dr. Minqi Li, hosted by JoulesBurn. In this review of Peak Coal and China, Dr Li noted that Chinese coal production is projected to peak in 2027, at a level of 5.1 billion tonnes. He estimates a total ultimate recovery of around 257 billion tons. Euan Mearns wrote about Chinese Coal when their consumption first approached 50% of global demand, and followed that with a second piece on the role of imports.

In addition, Rembrandt has recently taken note of the developing Chinese coal to chemicals industry. As conventional oil becomes less available as a feed stock, so the growth of this effort will likely justify the development.

Although China has in the short term (perhaps the next ten to fifteen years) enough coal to sustain internal growth in demand, it is nevertheless also moving pro-actively to ensure that it will have adequate supplies in the out years. Much has been made in the past of their activities in Australia, but as I have noted, several times in the past, the Chinese are becoming well established in Botswana, inter alia, in a country with almost no coal industry yet, but because of lack of demand, up to 200 billion tons of what are not even counted as reserves yet. This may be a lesson for the rest of us.

So China has no concern about the global warming consequences of this increased coal production?

I don't think you can read that into their actions, rather that in the overall consideration of what they think most important, they have set priorities.

I've heard Chinese politicians make the claim that "yes, we understand all about climate concerns, peak oil, etc. But generally speaking, the major Western nations (USA, Canada, western Europe, Japan, etc) enjoyed at least 60 years or so of accelerating industrialization, electrification, universal personal transport, air travel around the world, exploding agricultural output and unprecedented infrastructure and institution building, most of it made possible by the ever increasing supply of new hydrocarbon energy from deep underground, at prices so low as to be essentially "free".

And the Chinese have made the point that we in the West all had our "day in the sun" of mostly booming economies fueled by low-price/high-quality energy supplies. Chinese leaders ask that we please "back off" just a bit while China enjoys a few years in the warm glow of wealth building and modernization. Despite harsh criticism over numerous new coal-burning power plants, China's growth is generally being pursued with a basic level of environmental concern (or is it just "lip service"?) which may be more than was observed during the early decades of the western oil boom period.

And to date, no other nation in the world has taken a more bold, serious and politically risky fight against the other half of the world's resource scarcity equations, which is overpopulation. China has controversially enforced one family/one child for many years now - while the rest of the world allows essentially unlimited human reproduction (though nearly all of the wealthiest world populations now take far less than full "advantage" of the births that they're allowed legally).

I don't necessarily agree with 100% of this, but it seems to be the way many in China see these issues (perhaps the "party line").

One can find claims from Chinese climate scientists that the current warming is roughly equivalent to that of the Medieval warming period. They also find plant/food productivity to benefit from higher CO2 levels. One must assume that the Communist Party supports these claims at least to some extent.

This quote should provide a clue as to the author's concern for such consequences, and resulting priorities. Apparently it is 'realistic' to expect that extracting and burning every drop and pound of fossil fuel that we can lay our grubby hands on will 'sustain current qualities of life' for as long as necessary. It then follows that investing in 'recent alternatives', or caring at all about a healthy ecosystem, makes no sense whatsoever.

Sorry if that's seen as inflammatory, but it's a line of thinking that just flies in the face of evidence, logic, and rationality, as far as I'm concerned.

Cliffy - I don't see it as inflammatory. But I read it somewhat differently but that's because I think I read " 'sustain current qualities of life' for as long as necessary" differently then you. IMHO it has nothing to do with sustaining BAU beyond the lifespan of the current power base which includes the vast majority of the public. IMHO that's what "... for as long as necessary" means. I'm sure some folks are earnest in their concerns for future generations but they are a very small majority IMHO. People today want what they want today whether they are willing to say so publicly or not. At the end of the day what counts more to you: words or actions? Do you see any significant actions today that address any of your concerns? I, for one, don't.

There does seem to be concern, and action, in some places. Germany comes to mind. The Germans seem intent on installing as much alternative energy as possibly, legislating efficient buildings and industry, as well as outlawing nuclear. There is a fascinating amount of information online about the German "mittelstand" and the intent of this most successful section of German industry to look to the future and not just the next quarter. It is almost enough to make you think there is a future for mankind, at least for German mankind.

The rest of us: "not so much"

The Germans seem to have gotten the distinction that consumable energy sources, be they oil, coal, gas or nuclear are apples to renewable oranges.

Once the renewable system investment is made, the free nature of their "fuel" is immune from price hikes and inflation. Even more, investments in conservation and other efficiency improvements cut long-term demand. That goes against conventional theory of economic "growth," but the money not spent on consumable fuels will be spent in other more beneficial sectors of the economy.

I'm reminded of 1972, when I got a summer job cleaning oil-fired boilers, a very nasty job. At our county library I was shocked when told the HVAC systems used the heating boiler in summer and the air conditioning in winter to balance the climate control needs of the building. The engineers who designed that system thought so little of energy efficiency and costs (which were low at the time) that I guess it made sense to them.

And that kind of thinking remains in place today, especially among policy makers.

In that they aren't different from anybody these days.

Anyway the almost exclusive CO2 rationale to limit fossile fuels energy use has probably been a terrible mistake of the last 10 years or so.

Switching to the peak oil rationale would most probably have brought more results.

After the first oil shock major volume based taxes have been put in many countries without talking CO2.

(and had the first oil shock been associated to its root cause which is the US 1971 production peak with necessary higher prices for new plays, and not the "arab embargo" joke, maybe would have been different even in the US, who knows ...)

Who cares anyway way too late ?

Yes most probably

Do you have any informnation on how much infrastructure will have to be built to turn a significant portion of the Botswana coal reource into reserves?

I read recently (in the NY Times I believe) that there is concern the current economic slowdown might take a big bite out of China's planned future investments in African infrastructure (1.57MB pdf. working paper by African Development Bank Group).

As i recall the major need, if this is to become a reserve that China can tap into, will be the rail link to the coast. The deposit is thick, and relatively close to the surface, and is currently being developed to replace the power loss when South Africa decided not to export electricity. The new power plant is supposed to come on line next year at 3 million tons/year, and in the short term anything over that is going to go to South Africa.

However it is likely that it will be the poorer quality coals that will be used for this and "stay in the neighborhood," the higher quality coals will, in time, go to China, or even perhaps to India.

Sorry, there is a reference for the options for the two likely routes that the rail might take to carry the coal to the coast. As the article notes, the rising price of coal is making the endeavor look much more attractive than in the past.

thanks for the link--a quick glance at Botswana's land locked position made me suspect some of the issues highlighted in the article, though I do believe the chance's of 'missing Asia's coal boat' may be not be as imminent as Professor Grybberg professes

Coal powers such a huge chunk of electrical generation now and both Japan and Germany, still industrial power houses, are phasing out nuclear...I will be quite surprised if climate concerns trump power appetite...especially since the enormous cost of rising sea levels (to little communities like NYC, Florida, and Netherlands just to name a few) due to the melting Greenland ice mass would/will lag behind the benefit gleaned from using relatively low up front cost coal power by several decades.

Of course there is no really good agreement in the scientific community currently on if/how fast the Greenland sheet is disappearing--though as a northerner who just happens to have a fairly flat metal roof (shown below as it looks on this glorious fall weekend) on half his subarctic house I personally have some insight on how quick the process might be once it gets 'rolling'.

Six months of snow accumulation can disappear from my subarctic 11° pitch roof in a/couple warm day/s. The quick melt produces a thin lube layer of water under the couple/few feet of accumulated dry but packed roof snow and after a couple/few earth shaking slides my roof is clear...a process that does at least appear to have an uncanny resemblance to what is now being observed as huge summer melt lakes on the Greenland glaciers disappear in flash through deep chasms as the water races to the bedrock and then out to sea under the Greenland sheets.

Beautiful woods Luke.

We like them too, thanks.

Of course you can see how they might give me a bit a shadow issue as far a solar capture is concerned. I'm essentially on the west slope of a 2000 foot hill about 500 feet elevation from the top and the ridge top curves west less than a quarter mile away (TAPS is buried just the other side of it). So we get late sunrises (for the area) and no direct sunlight at all from late November until the very end of January--pretty low angle sun at near 65° N. Installed panels would have to be less than half the current price to give me even a marginally acceptable rate of return on investment.

But now that my schedule has opened up I should be able to finally get my wood pellet boiler installed--it has been sitting in my basement looking like an over sized paperweight for nearly two years--as the warranty evaporates!!

Interesting side note-I heard robins this morning. I don't ever recall them being around this neighborhood this late before. But the ice is out half way to North Pole from Barrow--that is a lot of open Arctic Ocean. NSIDC tentatively has set September 16 as the date minimum sea ice extent was reached. By far the lowest since 1979 satellite recording began. But there still is one good sized raft of sea ice (10-50% concentration but still melting) that is hanging around a bit off Point Lay that is keeping Shell's drill teams on their toes.

If the coal is there, it is a significant find on a world scale. More than Russia and China, nearly as much as America.

Proved recoverable coal reserves at end-2008 (Wikipedia) Best So-so Lignite Total World % United States 109 99 30 237 22.6 Russia 49 97 10 157 14.4 China 62 34 19 115 12.6 Australia 37 2 37 77 8.9 India 56 0 5 61 7.0 Germany 0 0 41 41 4.7 Ukraine 15 17 2 34 3.9 Kazakhstan 22 0 12 34 3.9 South Africa 30 0 0 30 3.5 Botswana 71? 141? 212?I can't see much happening unless the Chinese build the railway, probably from Mozambique up the Limpopo, across southern Zimbabwe, and down to the coal fields.

They've done it before. See the Tanzam railway, 1860 km from Dar-es-Salaam to Zambia, a similar length, completed 1976.

This time they'd manage it themselves to avoid the usual fate of projects in Africa: "Although it remains in operation, TAZARA is now in a state of near-collapse due to mismanagement, financial difficulties, and inadequate maintenance."

http://en.wikipedia.org/wiki/TAZARA_Railway

That table substantially understates the real availability of coal.

Geology will not save us: we will either deliberately choose to stop using coal, or raise CO2 levels unimaginably high.

The fact that the US is phasing out coal (as HO mentions), and China is building renewables and nuclear just as fast as possible, are signs of hope.

The US is phasing out coal?

I know what the stats say: its share of electricity prodution is declining. But I think that this could well be temporary, and happened more or less by accident.

The coming into force of mercury emission regulations made utilities look at the economics of their summer-time peaking coal plants.

For a plant that you only use three or four months a year, capital cost is the dominant factor. The capital cost of NG plants was less than the cost to upgrade the old coal plants to meet the regulations, so utilities switched to gas for peaking. These decisions were made well before the current gas bubble showed up.

The fact that NG plants have low capital costs is just a happy accident of nature. If peaking coal had turned out cheaper, then coal would have been used.

The current low price of gas may, or may not, be influencing decisions about new/replacement baseload power generation. I think that when the gas bubble bursts (as most people here believe it will) the US will go back to coal for new baseload plants.

The presence of wind and solar complicate the picture, but it remains to be seen what their costs will be. For solar plants, land, installation, and grid connection costs now dominate; they won't fall much, if at all. In the absence of prohibition or mandatory carbon sequestration, coal will remain competitive.

greg - Valid point. It would be interesting to see the stats on how e- generation breaks down over the years based upon capability and not actual utilization. IOW if a plant can burn both coal and NG but is burning NG because it's cheaper than it's still a coal fired plant. As you point out one day coal may be the more economic source. Or if a plant switches to NG from coal because the cost the meet environmental upgrades is too high it might one day pay for the upgrades and switch back to coal, again for economic reasons. If the alts don't develop fast enough (as they appear to not be doing) and the economic advantage shifts back to coal will we see a reversal of trends? IMHO it's a certainty not only in the US but globally.

As pointed out many times before, the current "green" White House gave the final Clean Air permit (an oxymoron?) to build a coal fired plant in Texas on top of a NG field I'm developing. Did they do so because they see coal in our future? Or because it will burn coal for the next 30 years shipped from Illinois and its just good ole Chicago politics? Either way it's a new coal fired plant in the US.

Here's an important question:

Are you Rocky I or Rocky II??

Seriously...

I'm not aware of electric generation that can fuel-switch between NG and coal. I believe the two are pretty different. It is possible to mothball a coal plant against future need, though I think most are being scrapped.

Wind has already "developed" in the US, and if pollution costs are included it will mostly be much cheaper than coal.

I'm not aware of electric generation that can fuel-switch between NG and coal.

I'm fairly sure that there are cases of this for boiler plants (versus turbine) though I don't know how common. The plant in the middle of Washington, DC downtown switched from coal to gas.

Nick/Falstaff - I hear folks talk about fuel switching but don't know anything specific myself. But I do recall some folks reporting that much of the apparent "fuel switching" recently wasn't so much switching fuel types as coal fired plants being shut down with NG fired plants being pushed to the max. But back to the original point: I would like to see the stat for the POTENTIAL utilization of each fuel source vs. the current utilization mix. IOW how many coal fired plants are still functional yet idled.

In an ideal world we might keep a lot of nat gas and coal capacity, but only use it for backup. That could mean using NG for 7.5% of kWhs, and coal for 2.5% (perhaps just used once per year, for a seasonal lull).

That would require a relatively trivial cost for maintaining the plants for use.

That could be maintained for 1,000 years, which would give plenty of time to transition to renewables.

The coal-fired boilers at MS&T also had gas burners along the walls of the furnace. They had been closed off when the campus went to a coal/wood combination and gas prices were higher than the solid fuel combination. To turn the gas back on to replace the coal would have only required a little restorative plumbing.

However the campus is currently rebuilding its parking lots with some hundreds of geothermal wells that will replace that boiler combination in about eighteen months, and it will be interesting (I will try to post as data becomes available) to see what the results will be. It is anticipated to save both fuel and water. (Not to mention money).

Looking forward to your postings on the geothermal project.

HO - Is that a low temp geothermal project? I saw a story on such a project being conducted on a very small scale in Atlanta: wells just 200' or so were going to provide heating to a small nursing home under construction. Done using water heat pumps if I recall correctly. Not as sexy as drilling holes into the Geysers Field in CA but could be applicable in literally hundreds of thousands of sites around the country. Last time I looked we didn't have that many Geysers Fields to tap. LOL.

Fuel switching between oil and natural gas is quite common in industry, although at this point in time I'm sure that every plant which can switch to NG has switched.

The big cement plant down the valley from me (it is one of the biggest in the world) added NG/coal switching back when the price of NG was high. It was a major renovation and they had to add a lot of new pollution control equipment to burn coal. At this point in time it is probably burning NG. The coal is going to Asia instead.

I don't know how many power plants can fuel switch. Nowadays they're just shutting down the old coal-burning plants because they are at the end of their life, anyway, and building new NG plants instead. The NG plants are much cheaper to build because they require fewer pollution control measures.

Yes, there's no question that the US is suppressing coal consumption.

The EPA is explicitly limiting CO2 emissions for new plants and plant upgrades, and mercury and other emissions are being regulated much more forcefully than would be the case if coal was the favored source of power.

Similarly, CTL isn't being built in the US because of official lack of encouragement - investors won't put large long term investments into something that clearly is against public policy.

Cheap NG is indeed a happy accident, but some coal plants are closing that wouldn't if coal were still favored. Wind power costs in the US are very clear, and very competitive once pollution costs are factored in.

Chemically it is not absolutely necessary to produce CO2 in order to remove the energy from coal. There other methods aside from straight combustion that might become economic. Coal gasification is one trick that might work, with the carbon released as CO only.

3C (i.e., coal) + O2 + H2O → H2 + 3CO

And what do you intend to do with the CO?

An approach from Sec. Chu, June interview:

He's talking about tri-generation.

OK, you want to use the thermal ernergy of the exothermic reactions of the reformation (and shift reaction, which gives not a lot) to produce electricity, this gives a better overall result. In principle you can also combine as done by others the highly exothermic first step with another endothermic reaction.

Now, what are we doing with the CO2?

The advantage of that particular example is a great deal less CO2 is produced per unit of useful work than would be by standard combustion. Also, the CO2 that is produced is pure, i.e. it does not require further chemical separation of some kind so that, if the CO2 is to be captured and stored, the capture process is more economic.

Carbon monoxide is extremely toxic, and if you release it into the air on an industrial scale, it will kill all the people and animals for miles around. You could burn it as a component of coal gas, which was commonly done a century ago, but then it just gets turned into carbon dioxide and released into the air.

The best thing to do with the CO2 from power plants is to sequester it in underground formations, and if you provide it to oil companies, they will happily use it in CO2 flood projects to improve the recovery efficiency in their oil fields. The main drawback is that the overall economics of it don't work for companies, so somebody has to subsidize it - e.g. the taxpayers or the electricity consumers.

But other than that it is technically feasible to sequester the CO2 in an oil field. I did some consulting on a project like that myself - taxpayer subsidized, of course (not me, the CO2 flood). I can give details if you want.

If I recall the numbers last year China produced 9.4 billion tonnes of manmade CO2 out of about 34 billion globally. A lot of that CO2 was for exports and didn't appear as an emissions debit to the importing country. Therefore much of any world emissions decrease has to come from China. Supposedly serious attempts at emissions reduction such as Australia's weak carbon tax are almost irrelevant in comparison. The US has been switching from coal to gas fired generation and deserves brownie points for now. However both the US and Australia export coal to China saying the CO2 is not their problem. I think it is in the sense that drug dealers are a problem. Reduce major supply routes and new supplies get harder.

Therefore I think countries that are making an effort at emissions reduction should slap a carbon tariff on goods made in China. It shares the pain as we pay more they sell less. Critics will argue China is still a developing country trying to lift its people out of poverty and they have installed umpteen gigawatts of new solar etc etc. That's great, all the more reason to get there sooner without burning coal.

As to the practicality of carbon tariffs it would be an administrative nightmare to evaluate every single product. Take slab aluminium with an FOB price of ~$2,200 per tonne. If it used 15 Mwh of electrical energy assume that generated say 12t of CO2. if the CO2 price was $20 that would add $240 or about 10% to the landed price. The tariff gets lifted when China adopts a similar carbon regime to the importing country.

Restraint of trade, can't be done some will say. Then what's your answer to 9.4 billion tonnes of CO2?

I have thought for a long time that one of the reasons that China gathered up so much of US manufacturing in the first place was the imposition of environmental and worker safety laws in the US without the addition of import restrictions on countries without such laws. Do we have an obligation to China and India and VietNam, etc. to take their products built without regard to any of these controls just because they are "developing"?

jj - "Do we have an obligation to China and India and VietNam, etc. to take their products built without regard to any of these controls just because they are "developing"? Of course not. But the US govt has the obligation (for the sake of its selfinterest) to keep the purchasing power of its citizens as strong as possible in order to feed the illusion that our economy is doing OK. With the aid of cheaper imports and lower cost outsourcing the govt has been successful. Up until now anyway.

From all over the place I'm reading how "natural gas is a green alternative to coal" or something similar. Even those few places that are plugging wind power are falling back on natural gas as the necessary backup system for when the wind doesn't blow (which is actually most of the time).

But there is a problem I see which doesn't get talked about much. At least in the USA, but even elsewhere, natural gas is being obtained by fracking. I'm sure that many of you saw the movie "Gasland" and might remember the scene where natural gas was bubbling out of a creek in a fracked location. A traffic safety cone was put over the creek and the narrow end lighted, to show that the bubbles were natural gas. There was also a scene where infrared photography was used at night showing natural gas (which is warm when it comes right out of the earth) leaking from a well. And of course, all those scenes of faucets that could be lit.

My point being - isn't all that leaking methane a significant contributor to global warming? Of course, I realize that it's probably impossible to quantify how much actually leaks in a fracking operation, since it's spread over such a wide area. Is there not a possibility that the natural gas green alternative may not be so much greener than coal after all?

Of course, natural gas obtained from a conventional field would not have this problem.

For those who don't come from oil country, it is probably a surprise that gas bubbling out of a creek is not unusual when you have an oil or gas field under it. Hydraulic fracturing has nothing to do with it.

About 100 years ago, a cowboy saw gas bubbling out of a creek in southern Alberta, lit it on fire, and cooked his breakfast over the flame. Then he rode into town (Calgary) and told everyone. They rushed out and drilled a well, and that was the discovery well for the Turner Valley oil and gas field.

They flared so much gas at Turner Valley producing the oil - at least $20 billion worth at today's prices - that the ducks stopped going south for the winter. It was more local warming than global warming, giant outdoor space heaters for ducks and rabbits.

Some years prior to that, the Canadian Pacific Railway was drilling for water for its steam locomotives east of Medicine Hat. Its drilling rig exploded and burned down the station, and thus was found the Medicine Hat shallow gas field. The City of Medicine Hat used to leave its gas street lights on all day because it was cheaper that hiring someone to turn them on at night and off in the morning.

And, yes, the farmers in the area had flaming well water, but they didn't think anything of it unless it burned down the house. It's easily corrected by venting the water before it comes in the house. Methane is non-toxic.

ozone - I agree: burning NG is not green...just not as black a burning coal. Also I gather you must be new to TOD: "But there is a problem (frac'ng) I see which doesn't get talked about much." It's been discussed extensively on TOD, including discussions about "Gasland". It has also been a huge political battle in the NE US that has been covered in thousands of stories. I guessing you don't live in the US otherwise it would have been impossible for you to miss the coverage. It's also been repeatedly reported that much, but not all, of the NG contamination is natural. Folks in PA have flared NG from their water wells long before the first NG well was drilled in the state. Same goes for Texas and La. But there have been documented cases of oil patch activity damaging water wells but more commonly with drilling mud and frac fluids and not NG.

"There was also a scene where infrared photography was used at night showing natural gas (which is warm when it comes right out of the earth) leaking from a well". Absolutely not true. When NG is produced from the well head the expansion actually causes freezing. Every NG well I've drilled in my 37 years had to have a "heater-treater" installed at the well head to keep the NG from freezing the pipe. I have no idea what the satellite pics are showing but it's not NG.

"Of course, natural gas obtained from a conventional field would not have this problem." You might want to Google the satellite pics of the hundreds of billions of cu ft of NG flared from platforms off the coast of Nigeria ...all from conventional fields. You might scan a bit southeast and see one platform off the coast of Equatorial Guinea (which I once worked on) that's flaring over 7 billion cu fit of NG per year...just one platform. You might also want to search the amount of NG being flared and vented in N. Dakota. The Bakken may not be a conventional reservoir and all the wells may be frac'd. But not's not the cause of those emissions: the state wants the oil produced now and doesn't want to wait for NG gathering systems to be installed. Nor do the companies want to pay for those gathering systems. Essentially the same reason all the NG is being flared off the coast of Africa.

You're correct: the extraction and burning of NG being developed adds to the AGW problem. The amount of damage from NG leakage during frac'ng operations is tiny compared to the overall effort of NG production and consumption. An effort led by the US and Russia which together produce more than 50% of all the NG consumed on the planet.

Rockman, thank you for the explanation. BTW, I'm not new to TOD, but I am mostly "absentee" and only occasionally pop in. You are indeed right that I don't live in the USA, I'm in Taiwan and "fracking" is unknown here - it never gets discussed in the news media, and when I explain it to Taiwanese, they are amazed that such a technology exists.

Actually, we have no fossil fuel industry here at all. At one time coal was mined, but it's now exhausted and all energy here is imported.

One of our two major political parties is pushing a green agenda, vowing to shut down our three nuclear powerplants (and a fourth under construction) if elected. Since that's 30% of our electrical power, they have to propose an alternative which is of course wind. But we are pretty windless here too, and this being a crowded place, we have precious few sites for wind towers. So their promise to shut down the nukes is really a promise to import more coal and natural gas.

ozone - I understand now...thanks. "...and when I explain it to Taiwanese, they are amazed that such a technology exists." Don't feel alone. Many in the NE USA weren't very aware of it either until the Marcellus play boomed. OTOH frac'ng has been done extensively in Texas for more than half a century. That's one reason I think companies were surprised by reactions up north. Not that there weren't occasional problems with frac'ng down south or in the west but they were relative rare compared to the number of operations. Also, Texas learned the hard way and now has very rigorous regs about frac'ng. Additionally there are dozens of law firms in Texas and La. that specialize on suing the heck out of the oil patch when it screws up. And they almost always win. I've worked as a consultant on both sides of that fence and typically if there's a gray area the court usually decides in favor of the land owner. In NE I think some operators saw the lack of regs and enforcement as an invitation to cut corners. Now they are paying a price for it.

It sounds like Taiwan is essentially in the same position the US finds itself: importing a large percentage of its energy. Fortunately we are the largest producers of NG on the planet. I suspect many here don't realize how unique (and lucky) we are for that fact. Eventually our NG resources will diminishes every finite commodity does. Then we'll face a choice: expand use of domestic coal regardless of its quality or import more energy. Probably more expensive energy. Nuclear does appear to be a strongly favored option here just as in Taiwan. It does sound like we have more alt possibilities than your country.

Thanks HO for the update.

I remember Euan Mearns called his 2010 TOD article http://europe.theoildrum.com/node/6700 "The Chinese Coal Monster". Too right.

My life happens to have spanned both the decline of British coal and the ramping up of the Oil/NG Age.

As a child in WWII we still ran on coal (and on oil from Texas for the war) and in my boyhood only a smallish minority had regular access to a private motor car. The economic modernisation we had achieved by installing a national electricity grid and local town 'coal-gas' grids using coal distributed to power stations by rail and barge was not, however, by the mid-1950s sufficient to maintain industrial momentum and competitiveness. I well remember at school circa 1957 the new New Scientist magazine discussing the options, and concluding that a more 'modern economy' could not be achieved on coal. In those days production of British coal was still running at a substantial fraction of Peak Coal achieved early in 20thC, so depletion was not yet really on the agenda. Costs were not that high; my guess is that miners on the Durham coalfield probably did not have much greater purchasing power than the average Chinese coal miner has today. It was just that coal production could not increase enough and was not an efficient enough power source to carry an expanded 'modern' economy', despite the greatly improved efficiency of power generation and distribution and electrification. The New Scientist answer was of course nuclear. The economics of nuclear under British conditions turned out not to be an economic game-changer, and by 1963 I spent an interesting few months on the construction site of, for those days, a large 1GW oil-fired power station next to the landing terminal for Middle East oil in Southampton Water. The economics of that, however, did not work out either by the 1970s and the station was moth-balled until Thatcher used it during the Miners' Strike in the mid-80s.

However, oil and NG more generally did prove the game-changers for British industrial modernisation and for our so-called post-industrial life. Interestingly, mechanisation and automation in the British coal industry, which raised the rate of production for a while in the 1960s, hastened the depletion of significant coal fields. The subsequent decline of British coal production rate to something like 6% of its Peak has been well discussed here and elsewhere.

The question of economic advantage and disadvantage and the ratios of the mix of coal, oil and NG in an economy is important but difficult to be definitive about. Chinese average purchasing power runs well below that of our 'modernised' economies, but this has changed and is changing. China now approaches a number of inflection points, and models of industry and empire have already proved elsewhere to have serious limitations. China may not have the luxury of following our advanced albeit in global terms minority economies, nor be able to match the partial successes that we achieved as we all attempted to follow a broadly 'American' model. In my mind, questions remain very much open, and I have not come to any conclusion on what may prove "realistic".

China does not produce 4.5 billion tons per year. They peaked last year at 3.52 billion, and will use half the coal in a decade. Tad Patzeck was right, peak coal was in 2011.

Your source on 2011 production is a typo--the figure should be 3.52 billion, not 4.52 billion (http://www.reuters.com/article/2012/02/28/china-coal-output-idUSL4E8DS4A...), and the mooted 3.9 billion tonne "cap" for 2015 still represents nearly 400 million tonnes additional growth in output. A number of trends, though, suggest that further increases are going to be a lot more difficult than before: mechanization in state mines has reached nearly 100%, so productivity gains are falling; growth output per worker as a consequence is also leveling off; costs of production have reached the level where the sales price of coal was in 2006, meaning that the cheap coal days are past. Investment per ton of capacity is rising after 20 years of decline, reflecting the shift westward of production centers into deeper more complex mines (over 90% of China's coal is still underground mined); quality is declining as lignite production has grown 6 fold this past decade (albeit from a small base)and anthracite has declined. Financial losses are mounting again, growing from near zero in 2004 to over ¥4 billion in 2009 (in 2000 RMB). Also, the ratio of the energy content of coal production to the direct energy use by the coal sector peaked in 2005 (at a little over 20:1) and continues to decline. This may make the 3.9 billion tonne cap laid out in the coal industry's 12th Five-Year Plan more of an acknowledgment of limits rather than planned restraint.

I also checked this number for Chinese coal production in 2011 in the BP statistical review of world energy:

http://www.bp.com/sectiongenericarticle800.do?categoryId=9037184&content...

The correct number is 3.52 Billion metric tonnes for China's coal output in 2011 or 77 % less than the 4.52 billion tonnes in the article.

At the EIA website the 2011 value for China's coal output is 3.474 billion metric tonnes (3.829 billion short tons).

Heading out, could you please correct this mistake? Most people don't read the comments so we should try to make the article accurate. Thanks.

DC

And if the EIA graphic presented as Figure 1 is accurate, then 3.52Bt in 2011 would appear to represent a small decline, after coal production seemingly grew from about 3Bt in '08, to 3.25Bt in '09, to what looks to me like more than 3.6Bt in '10. This would seem to corroborate what sparaxis says about growth bumping into limits.

Clifman,

The EIA uses short tons in its graphic, the 3.52 Bt is metric tons which converts to 3.88 short tons, so Chinese output continued to grow from 3.52 Billion short tons in 2010 to 3.88 (BP) or 3.83 (EIA) billion short tons in 2011.

I agree with sparaxis that coal output will reach a maximum in China sometime soon, the analysis by Li suggests a maximum in 2027 at 5.1 billion metric tons (my guess would be 4.5 billion for a maximum between 2015 and 2020, but this is mostly speculation.)

I think the maximum will likely be between 4 and 5 billion tonnes and will occur between 2015 and 2025. This guess assumes the World limps along growing at about 2 % on average between 2012 and 2025. If world wide economic collapse occurs before 2025, the maximum will be the coal output the year before collapse.

DC

Ah - hadn't noticed the units diff. Thanks for the clarification. But this still leaves HO's 4.52 in the text incorrect, correct?

Correct. The 4.52 billion tonnes in 2011 is incorrect based on data from BP and the EIA. It should have read 3.52 Bt according to BP and 3.49 Bt according to the EIA. (All of these numbers are in metric tonnes, which are 1000 kg.)

DC

PS It would be nice if Heading Out corrected the text of the article, but so far he seems to be ignoring that suggestion.

Sparaxis,

You make a lot of really good points. Do you have some links supporting these facts? It would be really helpful as it is domestic coal that is powering China's ability to outbid the OECD for oil.

Thanks,

Jon, this is my team's research (at LBNL) for a report that is not publicly available yet, but all the underlying data are available. The three major sources of data are the China Energy Statistical Yearbook 2011, the China Coal Statistical Yearbook (various years), and the China Statistical Yearbook (various years). All the data on productivity, investment, mechanization, energy consumption, industrial deflators, etc. are all published, but since the source materials are in Chinese, few take advantage to pull it all together to look at what the trends are. When I calculated these indices and put them together to see what story the data are telling, it was pretty clear China had reached a turning point in the development of its coal industry.

Hi Sparaxis,

It sounds like quite an interesting report. Any hint when it will be out?

The first question that jumps to mind is if something similar has been done with coal in the UK or with US anthracite to see if the indices can predict peak?

The next question, because EROeI is near to my heart, is do you mean to say direct energy usage for coal production has already risen to 20:1? I am very interested in the relationship between EROeI and rates of growth. This is falling toward oil about 10 years back. That is a good sign for climate change, but a poor sign for world GDP.

-Jon

Jon,

I think the report won't be available until at least December because of the slow pace of review. I'm not familiar with similar studies for the US or UK, but assume they exist since data availability is much better in those counties.

I assume these indices do relate to peak since you do find that the second derivative of trends goes negative before peak, as all these are doing.

Here's the graph we produced for China on what we called "energy return on direct energy investment" or ERODEI:

What we did was to compare the direct energy use by the coal mining sector itself to the energy value of the output. A full EROEI calculation would, I should think, be even lower, accounting for the embodied energy in coal mining inputs. In contrast to the US, this is already quite low and another sign to me that China is pushing limits.

Thanks. When I went back far enough in Canadian oil production I found a pattern where EROeI actually rose as the largest oil fields were put into production. During this period oil production was rising rapidly. Then oil production peaked and drilling increased markedly. EROeI plunged. They never recovered the prior production rate.

It seems like something similar is happening in your graph. Production and EROeI were rising together. Possibly new large coal mines going into operation. If 2007 represents a true downward tip in EROeI then China will soon have a very difficult time.

Looking forward to the report. Hopefully there will be a post here about it!

Sparaxis,

Thank you. Your comments are quite informative.

If we assume world real GDP continues to grow slowly for another 20 to 30 years, without a major world recession (or worse) and without major wars, would a peak in Chinese coal output of 4 to 5 Gt in the time frame of 2015 to 2025 sound reasonable?

In your research do you look at likely scenarios for World coal prices as the peak in coal output is approached?

From a climate change perspective, rising coal prices would be good.

DC

Jon - I suspect the EROeI of domestic drilling has plunged even more than most estimates because they often don't account for energy spent drilling drill holes and other prospect generation costs. But when you say China will soon have a very difficult time are you speaking of their ability to generate an increase (or even maintain) in the absolute amount of energy created from coal or due to a decreasing EROeI? Regardless of how it's calculated I think few would disagree that the US EROeI of oil/NG has consistently decreased over time. But that hasn't prevented the US from becoming the largest producer and consumer of NG on the planet. NG which has become, thanks to lower prices, a more significant source of domestic energy. And the US is still the second or third largest oil producer despite our average well making less than 10 bopd. The EROeI of that production may not be very high but it could still supply most of our liquid hydrocarbon needs if we were't so wasteful. I don't have a good fix on China's coal reserves but decades from now couldn't coal continue to be a major, if not larger, energy source for them just as NG is for the US today? As the Sparaxis data seems to imply China has a long way to go before the EROeI of the direct energy reaches zero.

Yes, what I am saying is that EROeI might be a signal for a coming peak in production, not a halt of production.

I have not seen a really good EROeI time series for coal, so I cannot say for certain what will happen. What it sounds like is happening is that they automated mines (increased energy investment) and face an issue that costs are rising (which are going to have an energy component so energy costs are likely rising), but domestic consumers cannot (or will not) pay higher prices (thus they are reporting losses).

Higher prices (higher energy investment) must be paid, or production will stop growing. Where will the energy come from? It can either come from cutting consumption by slowing or reversing growth or it can come from higher efficiency of usage (which also allows a higher price to be paid so it is good for the producer).

During the growth phase of fossil fuel usage, the extra energy can also come from ramping up more production, but eventually EROeI falls enough that net energy starts to fall. At that point society is forced to either contract or become more efficient. Typically both - a price induced recession cuts demand and the threat of high prices encourages efficiency investments. (Natural gas producers in the US need higher end user efficiency if the end user is going afford drilling for higher cost gas.)

US natural gas had a high EROeI until about 2000 when it hit an early peak and drilling rates were forced up. In Canada the net energy started to fall in 2002 while peak of production was not until 2006. In 2002 EROeI was 25:1 while it plunged to 15:1 by 2006.

The high EROeI large fields and high production wells subsidize the investment in the low production wells. I would guess coal works the same way, but perhaps Heading Out has a clearer idea.

I think that US has to discover new technologies in order to become independent from Asian market