Tech Talk - Ukraine Tries to Escape Gazprom's Grip

Posted by Heading Out on February 19, 2013 - 5:54am

You know it is winter when Russia and Ukraine publically row about supplies of natural gas. On Tuesday Ukraine completed the signing of an agreement with Turkmenistan for the supply of natural gas. In the past the purchases have been for up to 36 billion cu m per year, although this was historically through Russian intermediaries. That deal ended in 2006, and Turkmenistan has been able to find a customer in China that now provides an alternate sale that does not leave it dependent on whatever price Russia was willing to provide.

But this does not mean that Ukraine has been able to escape having to pay whatever price Russia wished to impose, since to get from Turkmenistan to Ukraine the natural gas still requires passage through a pipeline that runs through Kazakhstan and Russia. There is no prize for guessing that Gazprom owns those pipelines.

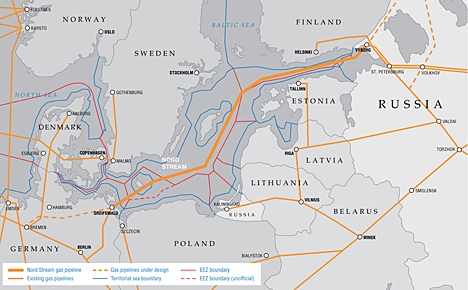

This continues to give Gazprom leverage over Ukraine, and with the North Stream pipeline now approaching its full potential after the second string was commissioned last October, Europe can receive up to 55 billion cu m per year without the gas having to pass through Ukraine.

There is now talk of adding additional capacity so that there can be a direct feed from Russia to the UK. BP is taking the lead on this, apparently with Gazprom support, although previous experience would suggest that Gazprom may end up as the major shareholder in the end, after all the bills have been paid. And speaking of which, their current dispute with Ukraine involves payment for $7 billion worth of natural gas, that Ukraine contracted for but did not, in the end use during 2012. Ukraine is paying $430 per thousand cubic meters ($12.18 per thousand cu ft) for a fixed volume per year, whether they use it or not, under an agreement signed in 2009.

There is some implication that this pressure may be related to the recent 50-year production sharing agreement that Ukraine signed with Shell to develop natural gas from shale deposits. The country is believed to have the third largest shale-bound natural gas resource in Europe (behind France and Norway ) estimated at around 42 trillion cu ft (1.2 trillion cu m).

The deposits are centered around the Yuzivskaya region, with production anticipated to start in 2017, rising to levels of around 8 – 10 bcm in ten years. Although there is some domestic opposition to the development, the schedule is aggressive.

Shell is to work with Nadra Yuzivska, a joint venture in which the state-owned resources company Nadra Ukrayiny owns 90%. SPK-Geoservice, a small private company, owns the remaining 10% in Nadra Yuzivska.

Shell is expected to invest $410 million to drill the first 15 wells, Oleh Proskuriakov, the environment and natural resources minister, said earlier in January.

The total area of the Yuzivska field is 7,886 sq km. The deposit could hold 4.05 Tcm of gas, according to the government. Proskuriakov has also projected output from Yuzivska could hit 10 Bcm/year in 10 years and 20 Bcm/year in 15. Ukraine's Stavytskiy characterized the latter figure as representing the "optimistic scenario."

"We can project that in an optimistic scenario, the project will produce 20 Bcm/year of gas, while under a pessimistic scenario, 7-8 Bcm/year," Stavytskiy said.

An adjacent well drilled by Hutton has shown promising signs of “interpreted pay in three intervals.”

Chevron is expected to develop deposits in the Olesska region with start dates of around the same time. Opposition to their plans seems to be growing, and they have yet to sign a production sharing agreement. They are, however, hoping to get the same sort of deal that Shell negotiated.

It is worth injecting a note of caution into this optimistic view of the future. Just a year ago Poland was anticipating a similar bonanza from the natural gas in its shale deposits. Events have limited that dream. Although a 2011 EIA report stated that Poland had 187 tcf of technically recoverable natural gas, the Polish Geological Institute has now cut the estimates of the viable size of the resource by 90%, and there are other problems.

Difficult geology, an uncompetitive service sector, poor infrastructure, and lack of rigs have hampered development. Poland has a venerable oil and gas sector, but most of the transmission pipelines are based in the southwest, while major shale gas areas are in the northeast. Strict EU environmental laws, as well as unclear regulatory and tax frameworks have further eroded prospects. And while exploration has been going on for a few years now, only 33 wells have been drilled, with just eight of them fracked (at least 200 would have to be drilled in the exploratory stage, just to assess the actual size of reserves).

Preliminary results have not been encouraging, either: This summer, resource giant ExxonMobil withdrew from Poland after the failure of commercial gas flows, while its competitor ConocoPhillips decided not to exercise its 70 percent option in three concessions in northern Poland. Overall, costs per well have increased to $15 million, according to interviews with industry officials, roughly three times the cost in the United States.

And there are two more factors that should be considered. Ukraine is planning an LNG plant on the Black Sea to be ready by 2015, but even this is controversial. To reach the Black Sea tankers will have to pass through the Bosphorus and Dardanelles straits, and Turkey has intimated that it may not allow LNG tankers rights to that passage. That is because the terminal would compete with two that already exist in Turkey.

Secondly Ukraine is working with the Chinese to gasify some of their coal from their large deposits, with the intent of producing the equivalent of 4 bcm of natural gas to displace Russian imports.

The projects are two-fold: first, heat-producing facilities will be converted to use coal-water slurry as fuel; second, new plants will be built to enable the gasification of brown and bituminous coal in three regions: Luhansk, Donetsk and Odessa. While most of the media reports claim that Ukraine will be using Chinese coal-slurry technology, it’s actually Shell’s technology.

How soon Ukraine (and Poland) can stop imports of energetic fuels from Russia is not clear. But obviously this should happen before long, and the winters of their discontent may well disappear from the headlines.

Here's another alternative not mentioned in the article:

Ukraine Considers Importing Gas From Slovakia

Interestingly, the slovakian pipeline has been recently bought by the billionaire Peter Kellner, which seemed as a surprising decision due to its declining importance (the pipeline which connects western Europe with Russia through Ukraine is on its way to be replaced by Nord and South Stream).

The way Russia jerks its trading partners around, I'm surprised that Europe hasn't caved and started fracking for its own natural gas. Perhaps they lack the needed geology?

Here you make the mistake and see Europe as one unit:

The shale gas resources are quite different in size and it makes for some coutries not really sense to develope them, see Germany, Austria.

And more important, the dependencies on Russian gas are quite different. While Poland and other former coutries of the Soviet sphere of influence are under pressure and sometimes caught in old contracts, German industry gets contracts that are real improvements compared to older ones (e.g. NG price is not longer pegged to oil), we have with more upcoming LGN capacities some aspects of a buyer market.

BTW pipelines are a double edged sword, they tie the seller to one buyer, if this buyer gets alternatives there is a problem for the seller. From the Russian POV there is the ugly situation that some of the big German utilities have no pipeline network or at least did not invest into Russian pipelines, i.e. they do not make losses when switching to LNG from the Netherlands, and there is a decreasing German energy demand, couple this with the Russian dependency on NG exports I bet we will see a lot of "contradictions" in the next years, a mixture of coercion and brown-nosing.

Interestingly, this situation was predicted in a strategy paper published by a German thing tank with strong links to industry and did not include shale gas. The authors expected in 2004(!) a clear weakening of the Russian energy strategic position due to LNG and Russian industrial weakness.