Tech Talk - Venezuela after Hugo Chavez

Posted by Heading Out on March 10, 2013 - 5:30am

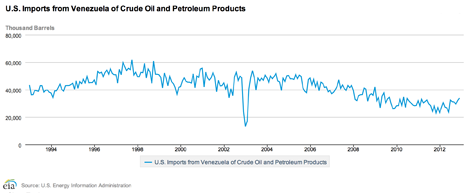

With the death of the Venezuelan President Hugo Chavez, the future production and exports of Venezuelan crude are gaining a little new attention. I had noted in the last post that there is a difference of around 400 kbd between the 2.379 mbd that outside observers report to OPEC that the country is producing, and the 2.768 mbd that Venezuela itself reported. The question now becomes one as to whether the new President will be able to resurrect an industry that has overseen a slow decline in overall production, with a more rapid decline in exports.

My short answer to that question is No! It is based on a number of reasons and may be swamped by the voices who note that the country has a vast remaining pool of oil in the Orinoco Basin, one that the USGS has estimated to be more than a trillion barrels in size, of which some 513 billion barrels are technically recoverable. But there have been a number of posts about those numbers and the more critical number, which is that of the rate of oil production.

Colin Campbell reminded us in his 2006 Review of the country that the Venezuelan Government was one of those urging the creation of OPEC, back in 1960. Back when that piece was written Colin expected that production, which had been falling as the reserves in the Lake Maracaibo region declined, would start to wind back up, as the heavy and extra heavy oils of the Orinoco were brought into a higher level of production. And he anticipated that, by now, the country would be producing around 3 mbd, which it is not.

One of the requirements before one can market the heavy oil is to have refineries that can process the oil. The United States, which imports around 1 mbd of Venezuelan crude, has the Citgo refineries that are wholly owned by PDVSA (the Venezuelan oil company). Whether that will influence their switch to Canadian crude if the Keystone pipeline is put in place is an open question. But easing the American demand might help with Venezuelan relations with China.

China, which has refineries Sinopec built that can also handle the crude, has stepped in here and spent over $40 billion with much of this in loans to be repaid through increased oil exports. Back in 2007 China had made the decision to pull out of Canada and to concentrate its investments in Venezuela instead. Since that time they loaned Venezuela over $20 billion in return for a commitment for oil exports that were to reach 1 mbd in 2012. The date to reach that target has now slipped to 2015 as overallproduction has continued to decline.

Last August President Chavez announced a $130 billion plan for investment in the Orinoco.

He said that there are 150 different clusters of oil wells in the Belt, but the goal in the next six years is to increase that number to 500. Before the nationalization of the Belt, there were just 37 clusters.

The clusters are comprised of 24 separate oil wells, each of which extract around 1,200 barrels per day. At these facilities, hydrocarbons are extracted using 45-meter drills purchased in Venezuela and assembled in Venezuela.

“All this has been nationalized, which before was the property of multinationals, and production has also been increased,” the president said. He recalled that before the government took control of the Belt, there were just 2,800 wells, while now there are more than 4,000.

Because the Orinoco crude is very heavy, to an API gravity of 9 degrees, it is difficult to produce and requires a considerable energy investment to extract and process the crude.

Last September two joint ventures came on stream. That at Petromiranda, where PDVSA has Russian partners who began producing 1,500 bd, after an investment of $800 million, with a goal of eventually reaching 45,000 bd. At the same time Petromacareo, where PDVSA is partnering with the Vietnamese, came on line at 800 bd, with an initial target production of 4,000 bd. (The project has slipped from a target start date of early 2011, and the ultimate goal of 200 kbd from Petrimacareo is in more doubt.)

The crude has to be upgraded and TNK-BP is partnering to double the capacity of the Petromangas upgrader from 120 to 250 kbd. Until that capacity is increased, Orinoco production may be limited.

There is thus a history of project slippage and missed targets that is unlikely to improve in the short term. New plans for further investment either by the Chinese, Indians or Russia are now on hold while the presidential election to replace President Chavez is decided, but the experience in the last couple of years is likely indicative that progress in increasing production will be difficult to achieve and when set against a rising domestic consumption (as the Export Land Model predicted) is already leading to a fall in exports.

One of the drivers for this increase in domestic consumption is that the price of gasoline in Venezuela is $0.04 per gallon (four cents). In contrast, in Saudi Arabia it is around $0.61. The low price of gas means that there has been a significant increase in demand, exceeding that domestically available. As a result the country has been importing gas at up to $100 a barrel to sell it for $5 – you can’t balance those books by increasing the volume of sales!!

Yet cutting back on domestic consumption or increasing prices could prove difficult for the incoming President. So maybe it would be a good idea to invest in the Keystone pipeline as a simple precaution??

Venezuela's Export Capacity Index (ECI, ratio of total petroleum liquids production to liquids consumption) fell from 7.3 in 1998 to 3.3 in 2011, a -5.3%/year rate of change. Extrapolating this rate of decline suggests that Venezuela's post-1998 CNE (Cumulative Net Exports) would be on the order of about 20 Gb. I haven't totaled up the post-1998 CNE through 2011, but a rough rule of thumb suggests that they may have already shipped about half of post-1998 CNE.

Needless to say, these numbers are "somewhat at odds" with conventional wisdom, but the fact remains that the BP data base shows that for every barrel of petroleum that Venezuela consumed in 1998 they produced 7.3 barrels of total petroleum liquids, while in 2011 for every barrel that they consumed they only produced 3.3 barrels. It's easy to visualize where an extrapolation of this decline leads, absent an increase in production.

Of course, Canada is frequently used as an example of what is possible regarding bitumen production, and the average volumetric increase in Canadian net oil exports from 2004 to 2011 was about 50,000 bpd per year (BP), as rising Canadian net exports served to slow the overall decline in combined net exports from the (2004) seven major net exporters in the Americas (as they fell from 6.1 mbpd in 2004 to 5.1 mbpd in 2011).

A link to my recent 5,000 word essay on "Net Export Math" follows:

http://aspousa.org/2013/02/commentary-the-export-capacity-index/

wt – Just a hunch but I suspect not too far into the future the govt will have to let foreign companies in to access capex and expertise. Too many years of delayed expansion and falling revenue. My first pick would be the Chinese. Vz already has a long term sales contract tied to special built tankers and refineries in China. Thus the govt might be able to extend the social support system well into the future. Otherwise the citizens could become very upset. Not a good situation as the Arab Spring proved.

Canada is indeed an example of what is possible regarding bitumen production. However, people don't realize that a lot of this is due to what is NOT happening on the consumption side - Canadian oil consumption is no higher than it was in 1980, so virtually all of the slow-but-steady rise in Canadian oil production since that date has gone to export to the US. Unfortunately, this has given the Americans the mistaken impression that they are awash in new oil supply.

This puts Canada in stark contrast to other major oil producers, who have shown a substantial increase in domestic oil consumption. This is largely due to consumer subsidies in oil producing countries. Venezuela is something of a worst case scenario, since while its production of oil has declined in recent years, its consumption has increased considerably because of its subsidies.

Venezuela definitely needs to charge consumers more than 4 cents per gallon for gasoline if it wants to turn the situation around. In Canada, prices are closer to $5.00/gallon. The difference from both Venezuela and the US is that Canada taxes both consumers and producers of oil quite heavily, which discourages domestic use. In Canada, consumers tend to buy smaller cars and use public transit 2-3 times as much as Americans, freeing up enough oil for export to allow Americans to believe they can drive big gas guzzlers and avoid using public transit forever.

Good point. If Canada's consumption had increased at the same rate as Venezuela from 2004 to 2011 (5.1%/year, BP), then Canadian net oil exports would have declined at 13%/year from 2004 to 2011.

Note that the overall (2005) top 33 net exporters' rate of increase in consumption from 2005 to 2011 was 2.7%/year.

Out of Canada's production of 3.6 mbpd, 2.3 mbpd goes to consumption. That leaves 1.3 mbpd to be exported, mostly to the US. I believe that most of the Bitumen crude goes directly to American refineries, while the conventional crude, that is declining, goes to Canadian refineries. Any increase in Canadian consumption will just mean increase in imports of American made petroleum products.

In Brazil, consumption is about as big as production, but because of heavy use of bio fuels, a lot of the crude oil get exported.

according to this brazil is net importer:

http://mazamascience.com/OilExport/

That webpage doesn't include biofuels used for domestic consumption, which leads crude oil to be exported. Brazil is the world's second largest producer of ethanol fuel.

But based on the EIA total liquids production data, which includes biofuels, Brazil's net liquids exports were basically zero for 2011.

Its a very narrow fluctuation between Brazil as an exporter or importer. They export both ethanol and crude, though sometimes crude is not exported but used eternally instead. Ethanol is basically always exported.

From EIA: "EIA projects that Brazilian liquids consumption will roughly equal Brazilian production in 2012 and that the country will return to being a net liquids exporter in 2013, largely driven by expanded crude oil production."

There are many optimistic articles/reviews out there when it comes to Brazilian capabilities, maybe a bit too optimistic.

"...that Brazil will be able to export 1.5 million barrels of oil per day within ten years, a twofold increase over current levels." http://www2.anba.com.br/noticia_petroleoegas.kmf?cod=19620069&indice=0

"Continuing to open new oil provinces, Brazil is poised to increase its oil production by more than 250% by 2035." http://www.epmag.com/Production/Brazil-Worlds-Major-Oil-Producing-Countr...

When it comes to refined products like gasoline, they still have to import as they dont have the capacity to meet domestic consumption.

i don't understand your logic. if a certain country imports x barrels of crude oil, and produces y barrels of biofuels, then these 2 numbers are independent. imports are imports whatever the production of biofuels.

The point is that they dont import. They export. But when you use the link that you use, which only takes into account crude oil, then more consumption than production automatically means imports. Which in reality is false, as they consume biofuels and regular crude, more than they produce regualr crude. Therefore they dont have to import any oil and can export the crude.

Bz will never be an energy net exporter. They are (and are planning to be) tolarge a consumer for that.

Your data is somewhat at variance with my sources.

I don't have up to date figures, but in 2011, according the CAPP Statistical Handbook, Canadian "Apparent Consumption of Crude Oil and Products" was 1.55 million bpd, compared to 1.81 mbpd in 1980. The all time high was 1.86 mbpd in 1979. You can only get to 2.3 mbpd by counting as consumption crude oil that was refined in Canada and exported as products to the US for American consumption. Some Canadian refineries specialize in doing that, notably the Irving refinery in New Brunswick, which happens to be the biggest oil refinery in Canada.

That is a decline in Canadian domestic consumption of 14% over the last 3 decades. It is not the easiest number to calculate because Canada is both an importer and exporter of both crude oil and products, so I relied on CAPP to do the math for me. See http://www.capp.ca/library/statistics/handbook/Pages/default.aspx

According to the NEB, in December 2012, Canada produced 3.427 million bpd of crude+condensate. See http://www.neb-one.gc.ca/clf-nsi/rnrgynfmtn/sttstc/crdlndptrlmprdct/stmt...

According the US Energy Information Agency, in December 2012 the US imported 2,502 kbdp of Canadian crude oil and 629 kbpd of Canadian products, for a total of 3,131 kbpd of crude and product imports from Canada. At the same time the US exported 58 kbpd of crude oil and 365 kbpd of products to Canada. So, Canada is actually a net exporter of products to the US, not the reverse. See: http://www.eia.gov/petroleum/data.cfm

It's worth noting that 57 kbpd of those US product exports to Canada were jet fuel and only around 50 kbpd were gasoline. 100 kbpd of the exports of 325 kbpd were pentanes+ which were probably used for diluent to move bitumen through pipelines, and most of that was probably immediately reexported back to the US.

So, the picture you drew from your data is not correct. Canadian refineries which have access to Canadian bitumen are processing it wherever possible. The problem is that the pipelines do not reach Eastern Canada, so refineries there have to use much more expensive imported oil, and the volume vastly exceeds Canadian demand. Canada is also a net exporter of refined products to the US.

Canadian domestic consumption of crude oil and products has fallen to around 1.55 million bpd, while exports of crude oil to the US have reached 2.5 million bpd. The imbalance between Canadian consumption and exports has gotten even greater than the last time I checked it.

You're right, I was just reading the production and consumption numbers of the EIA website.

Still as of January 2012 Canada was consuming 64 bbls/day/1000 people, Venezuela 27. That puts Venezuela about on a par with the UK which came in at 26 bbls/day/1000 people. It would seem a very good idea for Venezuela to start inching up (centimetring up just doesn't have the ring) the price of petrol to at least hold the line. Is oil fired power generation still a big user down there?

Canada is spread out and pretty far north, it likely has lots of the population off the gas distribution grid burning lots of fuel oil for heating. It certainly has huge driving distances but then oil producing giant Russia does get by on 15 bbls/day/1000 people and it is even more spread out with its people living at least as far north. Canada need not pat itself on the back for its frugal use of oil just yet.

I wasn't surprised to see the world's uncontested champion oil slurper (by total volume), the US, come in just behind Canada at 61 bbls/day/1000 people but I was surprised to see Belgium and Netherlands right behind it a 60. Lots of oil fired power generation in those small flat countries??? Their petrol prices are more or less in the middle of the European pack but possibly industrial users aren't taxed near as heavily. Luxembourg came in at 119 bbs/day/1000 people but maybe I figured they just drive lots of Bugatti Verons there?-)

No doubt China is still the elephant in the room sitting down at 7 bbls/day/1000 people. Well at least Singapore has good demand reduction potential, they came in at whopping 202 bbls/day/1000 people, but with a population only a shade over five million their reductions won't flow very far into China.

But even Singapore isn't the top per capita consumer. We here in Alaska actually use a bit better than 2/10 of a barrel a day each as well but a huge chunk of ours is jet fuel, 20 million barrels a year--we go through 48 million barrels of crude--a lot of jet fuel goes into refueling air cargo flights so that portion is really a value added export product. The people of Gibraltar and Virgin Islands use better than 8/10 of a barrel of oil per person every day! They don't produce or export any oil as far as I know--good thing there aren't many of them.

I have been interested for a while in the high per capita consumption of oil in Belgium and Holland and came to the conclusion that Rotterdam and Antwerp vast petroleum and petrochemical industry hubs distorted the figures in otherwise smaller countries. I doubt whether individual consumers are very different from others in most prosperous parts of Europe. Electricity power from oil is negligible across EU except for Greece, Portugal and Spain and Italy. Whether numbers have changed much since 2005 I am not sure. UK is back to importing high levels of coal for power generation.

See this 2005 chart, Figure 1. http://www.iea.org/publications/freepublications/publication/En_Efficien...

EDIT Ireland also uses substantial oil for power generation. Oil is a very expensive fuel for mass power generation. All those Euros to buy an essential input? It can't help when trying to cover for the fiscal deficits racked up recently in attempts to cope with bank collapse / vulnerability and other imbalances?

Petrochemical industry certainly would skew the stats, but what is the story for Luxembourg? I do see chemicals listed as an export for it--it doesn't take much industrial oil use to skew things when the population is small.

Singapore has refining and petrochemical industry and is a huge port. Not hard to a imagine ships refueling there would skew the numbers dramatically.

One intersting tidbit I noticed on real high per capita oil use countries Singapore, Gibraltar and Virgin Islands and even Luxembourg--all have very large financial sectors relative to their populations. I don't think that industry is know for oil consumption but it might be interesting to see how per capita oil use and per captial financial industry volume correlate around the globe.

It's fairly obvious the "oil consumption per capita" table is not based on actual consumption, but on some simplistic calculation like production + imports - exports. In countries such as the Netherlands and Begium, which have huge refining complexes supplying the global market, the exports to other countries must be counted as consumption in the county with the refinery despite the fact that the fuel is consumed elsewhere. This makes the table highly misleading, particularly given their small population.

Canada is similar to those countries because it also has refineries dedicated to importing oil and exporting the products to other countries, notably the big Irving refinery in New Brunswick, which is the largest in Canada. If the table doesn't net the exports off the imports, which I'm pretty sure it doesn't, it would badly skew the numbers. In addition, the Canadian oil and gas industry is a very big consumer of oil - all the diesel fuel for all those drilling rigs and oil trucks, etc. Most of the oil is exported but the oil company consumption is counted towards Canadian per capita consumption. Given Canada's low population, this can skew the per capita numbers quite badly.

Venezuela would be skewed the other way because it doesn't have enough refining capacity and has to import much of its fuel supply. It exports oil to other countries, refines it there, and imports the products back to Venezuela. I suspect this oil consumption is credited to the county with the refinery rather than Venezuela. Venezuela happens to own a lot of oil refineries in the US and imports much of its fuel from the US.

As for Luxembourg, see http://www.iea.org/publications/freepublications/publication/luxembourg_...

The bottom line is that the table is highly misleading for counties with small populations but large product exports - or imports.

The bottom line is that the table is highly misleading for counties with small populations but large product exports - or imports.

That is likely true but Canada doesn't fit the bill

Canada only refines about 10% more petroleum products than it consumes and it does appear a rough sort of subtraction is included in the table. Canada's population is not small. It rates 35th in the world, only five western European countries are larger and only five western hemisphere countries are larger. No doubt tar sands production ups Canada's per capita oil consumption, your point??? If a country exports a product it generally profits from the export, but it does get charged with whatever it uses to make that product, that is domestic consumption.

I went to the CIA factbook link given as a source, this is the note on top of the Oil Consumption page

This entry is the total oil consumed in barrels per day (bbl/day). The discrepancy between the amount of oil produced and/or imported and the amount consumed and/or exported is due to the omission of stock changes, refinery gains, and other complicating factors.

If the US Virgin Island used oil for its refinery cooking and for domestic power consumption (good bet that has been the case with a huge refinery right there) the per capita oil consumption would still be very large after subtracting exports from imports. That refinery cooking only gets spread over 100,000 people. The per capita consumption would be exponentially larger for Virgin Islands if exports weren't subtracted from imports. I'll hazard a guess that Netherlands and Belgium petrochemical industry consumes enough oil itself to push those countries' per capita oil consumption close to that of the US. Whoever's account is getting debited for oil product sales gets credited for the oil it uses in making the product it sells. It is a dirty business you know.

The gray area I see would be for cases like Luxembourg's or Alaska's. I highly doubt jet fuel leaving in an air cargo transport that only stopped in Anchorage to fuel up midway in its Europe/Asia flight, or that diesel that leaves in a trucks tank that only stopped in Luxembourg to fuel up on a Berlin/Madrid trip is counted as exported fuel and subtracted from the locale's consumption total. Canada's oil consumption numbers likely benifit a smidge from cheaper US fuel coming back home in topped off tanks but the amount wouldn't be enough to move the nation's needle.

I can only speculate on how they arrived at their numbers, but whatever they did, it produces misleading results. The Netherlands, Belgium, and a number of other countries have much higher consumption than you would expect given their culture and small population.

As for Canada, 35th most populated country (35 million people) counts as "small" in my lexicon when you have behemoths like China (1.4 billion people), India (1.2 billion), and the US (315 million) in the table. Industrial use is a major consumer of oil in Canada, there is a big petrochemical industry. If you lived in the oil producing regions you would notice hordes of oil trucks running here, there, and everywhere; and drilling rigs popping up like mushrooms across the landscape. It's a big business keeping the US supplied with oil.

It is a dirty business you know.

I grew up in coal country in pre-pollution-control days. Compared to coal mining, not much else can be called "dirty". Not even oil sands.

Time for you to expand your lexicon some. Canada has a middle sized population, not small. 35.7 million is the average assuming 7 billion people and 195 countries (state department official number). Canada comes in with 34.2 million people, only Uganda with 35.4 is closer to the average population size for country at the moment. The median country shows up way down and number 98. I'll let you chart out the mode. Area wise of course Canada is a very large country just like population wise China and India would be considered very large.

It's a big business keeping the US supplied with oil.

Well you and the rest of Canada can always just take your ball and go home if you are all so upset by the fact your industrial usage piled atop your great transport distances and extensive winter heating needs gives you a higher per capita oil consumption than that big ugly neighbor to your south. Don't produce any more oil than Canada needs, I'm sure the country won't miss the export revenue.

It is a big business feeding the world too. Iowa grows more grain than all of Canada combined while at the same time just about matching China for soybean production. I'm sure that takes a tad bit of oil. Again so what. Industrial use within a country is a big part of what fires that country's GDP, what is consumed in that process rightly gets attributed to that country's per capita consumption. End use consumption numbers of course are important as well, but if a fair carbon tax were ever to be imposed worldwide it would still have to be added in wherever the fossil fuels were consumed with the increased price being passed down the line.

And of course a positive trade balance is sought after but is not achievable by all...and someone gets stuck paying the bill to be the cop that keeps a bit of lid on things so all that trade can slide along more or less unimpeded, that uses a bit of oil as well, again so what. As an old Chicago guy I worked with (who had left his deep south home in a hurry when a virile young man to keep from getting lynched--he'd crossed what was a very inflexible color line at the time) used to always say 'yous gots to pays the costs to bees the boss'...too much cost and the boss goes bankrupt, oh well.

I can only speculate on how they arrived at their numbers, but whatever they did, it produces misleading results. The Netherlands, Belgium, and a number of other countries have much higher consumption than you would expect given their culture and small population.

How much oil a country uses to make a living is what the numbers indicate, not how much oil the people use to go back and forth to the store and work or what holier than thou self image the country's citizens hold of themselves when it comes to oil usage. You cannot remove any resources used up during the manufacturing process from the domestic consumption of the country doing the manufacturing--doing that is what would be truly misleading. No doubt the numbers could be adjusted some in the case of fuel used in international transport since the receiver of the goods should share evenly with the shipper, fuel stops in the center likely should have their sales to the shipping fleet be considered exports--this adjustment would show up in the numbers for small and very small populations but would barely move the per capita oil consumption needle for the middle sized players and not budge it at all for the large and very large.

It is a dirty business you know.

Of course its all relative...but the cumulative effects not so much so. Ground water quality around refineries and legacy fields is not something the oil industry talks about much. The fact that we are running a cleaner ship than we had in the past while commendable hardly means the fossil fuel business has ceased to be dirty.

Oh, yes, the Virgin Islands. They had one of the biggest oil refineries in the world, put there mostly for tax reasons. However, it has been closed because of declining world demand and declining Venezuelan oil production - it was half owned by Venezuela's state oil company PDVSA. No doubt the next edition of the table will show the Virgin Islands with much lower per capita oil consumption since it is obviously based on refinery runs rather than true consumption.

Major oil refinery to close in US Virgin Islands

Of course the situation is not going to change. The government is not going to change down there to an appreciable degree.

spec - I’m not sure how accurate a picture I have of Vz but it goes: they are doing nothing to stabilize the production decline – the govt is heavily dependent of the oil revenue –much of the population is very dependent upon govt support – the govt is heavily in debt – the population is relatively unskilled as evidenced by the need to bring in a lot of Cubans help.

If that’s a fair profile then there should be significant changes in the future…either for the better or for much worse. As unsustainable as the US economy may be the Vz economy appears to be in much worse shape.

I think they do try to stabilize their production decline but they just can't produce their heavy oil as fast as their light oil wells are depleting. I also think the fast increase in consumption is not only because of subsidies. Chave's government improved much the situation of the poor - after more than fourteen years of his government there are simply more people who can afford a car - so it might be smart to create some kind of positive stimulation for those new consumers to buy cars with high fuel economy in contrast to a negative stimulation where only gasoline prices would be increased - the latter certainly would not be approved by the citizen. Anyway, Venezuela has quite a vast rail network and urban transport systems, including subways in some cities, so basically there are possibilities to slow internal consumption. Another advantage is that a vast part of their electricity is produced by water power.

Yes, between lack of investment and the loss of skilled people, their oil biz is stagnating. But that has been OK because oil prices have been rising while the production stagnates. But oil prices have plateaued. And this may start causing problems. But I think they'll try to handle the situation on their own and with some help from China for now. Maybe in a couple years when things are more dire will things start to change.

Yes, I agree that Venezuela, like Mexico, will, sooner or later, bring in capex, expertise, workers, foreign

oil companies, you name it to preserve current production levels. PEMEX has probably been a decade late

in taking this step in its Deepwater GOM. When Chavez took office, shortly thereafter, there was much bullish

talk from Venezuela about doubling the nation's oil production to 6 million b/d. Didn't happen.

Chavez is generally depicted as a buffoon in the American press, but watching clips of him pimping GWB as

the devil at the United Nations--"the devil was here yesterday, at this very podium, I can smell the sulphur still"--it is

clear that he had a first rate mind and a sense of humor, to boot. Leftist? Absolutely. Deluded buffoon... not so much.

Yes, I agree that Venezuela, like Mexico, will, sooner or later, bring in capex, expertise, workers, foreign

oil companies, you name it to preserve current production levels. PEMEX has probably been a decade late

in taking this step in its Deepwater GOM. When Chavez took office, shortly thereafter, there was much bullish

talk from Venezuela about doubling the nation's oil production to 6 million b/d. Didn't happen.

Chavez is generally depicted as a buffoon in the American press, but watching clips of him pimping GWB as

the devil at the United Nations--"the devil was here yesterday, at this very podium, I can smell the sulphur still"--it is

clear that he had a first rate mind and a sense of humor, to boot. Leftist? Absolutely. Deluded buffoon... not so much.

When you listende to him you could discover a man with a very fine and sensible rhetoric. Of course he knew when to lash out verbally and those words were the only ones that generally found their way into the northern media.

Yes, I've always thought that Hugo was a sensitive ninties kinda guy.