Tech Talk - Future Natural Gas Supplies and Cyprus

Posted by Heading Out on April 1, 2013 - 1:57pm

This post began as a view on the developments in Cyprus and I am grateful to Gail for the suggestion. It is my fault that it morphed a little from that original simple objective.

One problem in marketing natural gas is that there is so much of it coming onto the market that this makes it difficult to set a price for future production. Even when the fields and reserves are estimated to be large, having some confidence in the price that the gas will bring in turn helps provide confidence with investors that there will be a positive return on the cost of bringing that gas to the market. However, once that initial commitment is made to invest the money, then the need for a return often drives an expeditious program to bring in revenue even if the market is already reasonably well supplied. Prices may then fall and the investment becomes a losing one.

The current cold weather in the United Kingdom and the threat of gas rationing has raised the price some 30% this month and the market appears lucrative. But the UK market, in the short term, can be rescued by 3 tankers of LNG from Qatar with more available if needed (provided it is ordered soon.) And then, though there remains a need to refill storage, the crisis will be over for now and the price will likely fall back, although likely not completely since the UK is in process of shutting down coal-fired power stations to comply with EU edicts and natural gas is the replacement fuel of the moment.

Looking further down the road, Centrica, a major energy supplier in the UK, has agreed to a 20-year agreement with a US supplier to buy LNG from the US (out of the Sabine Pass terminal). This would take a fifth LNG train at a facility where the first train is expected to come on line in 2015, and the second in 2016. Each train has a liquefaction capacity of 4.5 million tons pa or 220 bcf of NG, and customers have already been found for the first four trains – again for a 20-year period. The UK supply is therefore not anticipated to start until 2018.

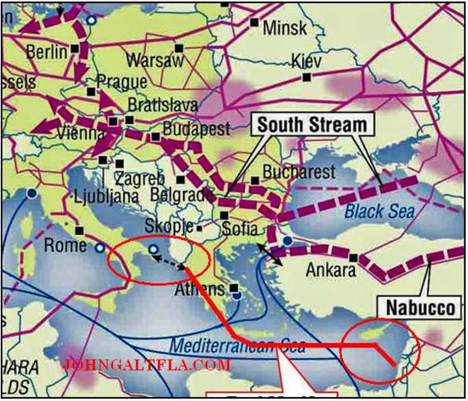

In the meantime, Qatar has no plans to increase production in the face of the overall growing glut in supply, although it potentially could. And this availability of alternate supply is not good news for the Big Daddy of natural gas exporters, those in Russia. Russia has already seen Turkmenistan sell its natural gas to China directly, rather than through Russian middlemen. To date this has reached 1.7 tcf with further expansion in the works.

To make the situation more volatile, the natural gas discoveries in the eastern end of the Mediterranean over the course of the last five years have been found to be of increasing size, as exploration continues.

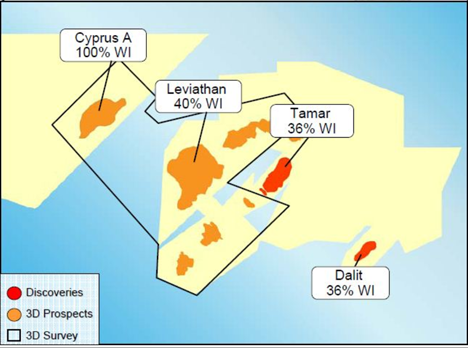

Three of these fields, Leviathan, Tamar and Dalit are in Israeli waters, while the fourth, Cyprus A, belongs to Cyprus.

In terms of relative size, Cyprus A is at 7 tcf, Leviathan was initially projected at 17 tcf, Tamar at 9 tcf and Dalit is at 0.6 tcf. Since the original projection, Leviathan has now been increased to 15 to 21 tcf, with a likely value of 18 tcf.

Gazprom, the Russian natural gas heavyweight has not been neglectful of these developments, occurring as they do in a region where it would not be difficult to challenge their supplies into Southern Europe. Thus Gazprom has been the high bidder in a project to float an LNG plant over the Tamar field and to liquefy that gas so that it can be sold into Asia. The goal for the start of that project is in 2017.

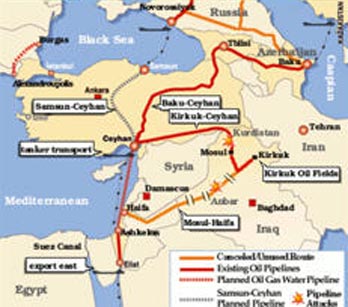

Turning to Leviathan, which is expected to come on line in 2016 with 750 mcfd being supplied to Israel. The interesting question is what to do with the rest. There is talk of a pipeline to run up into Turkey and thence on into Europe. This would have the advantage of further diminishing the European dependence on Gazprom and Russian gas, but there are some political problems. One is that the pipeline would run through the Greek-controlled waters off Cyprus; another is that Turkey gets most of its natural gas from Russia and Iran and they would be displeased (though it would help Turkey over the difficult problem of Iranian sanctions).

When one looks at the Cyprus field with these ramifications going on in the rest of the global gas market, it becomes a little more evident why Russia has not been willing to dash into the financial scene and bail the Cyprus economy out by buying a future stake in the Cyprus natural gas.

There was an alternative proposal (H/t Gail) for the pipeline to run instead through Cypriot waters and then on up into Europe directly.

With Cyprus in a financial mess, they offered their natural gas to Russia as part of the security for immediate help. In the end, Russia did not bail out the Cypriots. At the same time that Cyprus was talking to the Russians they were also talking with the European Union and it appears that perhaps the threat of Russian control of Cypriot gas helped expedite an EU rescue move.

There is, I believe, more in this for the EU than for Russia. The benefit to Russia would come more from controlling a relatively small amount of competitive natural gas at a time when they are trying to maintain the market for their own. And while they likely did not anticipate the hit that Russian bank deposits are taking, the overall cost to them does not translate into an adequate return on the investment that they would have had to make to keep Cyprus stable.

On the other hand, this has benefits for the EU if it can further expand the availability of an alternate source of supply to that from Gazprom, then they can possibly lower future projected prices for natural gas. Set against that is the history of Gazprom sitting on the sidelines waiting for an investment opportunity later in the game, and then stepping in and gaining control for a lower price. It will be interesting to see how this one plays out.

What are the plans in UK to use gas as a transport fuel?

Plans? Hahahaha. If there are plans, I am not aware of them. There are companies that will convert a car from petrol or diesel to running on gas (i.e. lpg), and there is a network of garage forecourts where you can fill up with gas (i.e.lpg), but the number of garages where you can actually refill is pretty limited. I only know of one garage with a lpg pump within 40 miles from where i live, out of hundreds that dispense diesel/petrol.

The government is pushing for the development of shale gas in the UK. Suddenly there is a mass of propaganda flushing through the MSM proclaiming the vast reserves/resources of gas underground that weil make the UK independent of Ukraine/Russia for gas supplies. Also there are new contracts to import gas (shale origin) from the US. Our electric generating stations are mainly to gas fired, apart from the development of a new generation of nuclear power stations., an amount of HEP in Scotland, and various renewable initiatives. But plans from the government for gas for transport: nada, niente, rien.

The UK energy policy is in complete disarray.

It has been left to market forces to muddle through - and a situation is rapidly arising where we will be at the mercy of the price of natural gas.

For power generation, there was no natural gas burnt until 1990, when the restrictions were lifted. Now we are rapidly heading towards a situation where over 60% of electricity generated in the UK will be reliant on gas.

Coal is rapidly being phased out here, with the older existing coal plants being given limited operating hours, or must close by 2015. The irony of this is that coal has recently become a cheap fuel again - whilst gas prices have risen.

The more modern coal fired plants have been upgraded to include flue gas desulphurisation equipment - and this will extend their operating life into the 2020s.

Our UK energy seems to be dominated by six corporations - who seem to act as a cartel, and drag their feet on innovation, leaving it to the last minute to invest in new generating plant and infrastructure. There is very little to choose between any of the companies - after all, they are supplying a similar product (if electricity can be considered a product). They are all tied to the same sources of fuel for generation - which is increasingly becoming natural gas - sourced on the open market - as the UK gas fields are in steep decline.

The next generation of nuclear seems to be in perpetual delay. The power generators seem unprepared to take the commercial risk, and some have dropped out from proposed joint projects.

Only EDF (Electricite de France) seems committed to nuclear - and currently operates 15 plants in the UK http://www.edfenergy.com/energyfuture/edf-energys-approach-why-we-choose...

All but one of these plants will close by 2023, and there does not appear to be a credible nuclear replacement plan.

Natural gas is the preferred fuel for home heating in the UK. Building additional gas fired generation plant, to replace the coal plants will only put more demand on this fuel source.

There has been much hype about UK shale gas being the great saviour - but there is no guarantee that this will ever be produced in quantities sufficient to replace our rapidly declining gas fields. Our government however, seem to want to talk-up the possibility of a new boom in UK shale gas - possibly to divert attention from their total lack of a long term energy policy.

The UK has very little natural gas storage (unlike the 90 days held by France and Germany). With this extended period of cold weather, we have got very close to supply shortages, and have relied on tanker deliveries of LNG from Qatar, to help make up the shortfall. These tankers were diverted from mainland Europe - as they could secure a better price in the UK.

http://www.zerohedge.com/news/2013-03-27/guest-post-second-lng-super-tan...

"The more modern coal fired plants have been upgraded to include flue gas desulphurisation equipment - and this will extend their operating life into the 2020s"

2020Vision, it's actually more complex than that. FGD covered compliance with the Large Combustion Plant Directive - those that didn't upgrade got 20,000 hours up to the end of 2015, and three of those are already gone (RIP Cokenzie, Didcot and Kingsnorth).

Next up is the Industrial Emissions Directive, which is similar to LCPD but goes much deeper and effectively requires Selective Catalytic Reduction to be fitted by 2015 or else plants can take an opt out that will this time give 15,000 hours remaining life (it's slightly more complex than that, there's a third option allowing plants to wait and see on very limited running hours or chose to run enduringly as a limited peaking plant). Interestingly this impacts the older generation of gas plants as well affecting about 9GW of CCGT plant, some of which has already mothballed itself due to low spark spreads (short run profit margins for gas plant).

With spark spreads where they are today, not a single one of these gas plants has the remotest intention to fit SCR, and we can expect the whole lot of them to opt out which means they will be forced to shut by 2022 at the latest (but in reality will burn their hours much earlier).

Dark spreads (short run profit margins for coal plants) on the other hand are huge at the moment, they are like pigs in muck (and incredibly smug about it as well). YET, with one exception (Ratcliffe owned by EOn), the coal plants are not fitting SCR either, and with only 2 and a half years until the cut off, most are probably already too late to continue operating seamlessly, although a couple who have at least made a start by getting planning permission and doing FEED studies could probably be ready by mid-2016 if they started soon. They WON’T start soon though, they aren’t even considering it. 2016 is going to be a very interesting year to say the least, something will have to give.

Why is this happening? Because the UK government has announced a "Carbon Floor Price" of £16/tonneCO2e this year, escalating by £2/tonneCO2e per year thereafter until 2020 and by £4/tonneCO2e per year after that. In other words - if you believe the government (which I don't, but power firms have no choice but to) - it's only a matter of time before coal becomes hopelessly uncompetitive with gas, and therefore there is no business case to invest the billions that would be required to upgrade the fleet with SCR (Ratcliffe made their investment decision before they knew about the Carbon Floor Price).

This is all earth moving stuff, at least for us Brits (I'm sure the rest of the world couldn't care less). Something literally has to give. For all the media coverage around Hinckley Point, by far the most dramatic events in our market revolve around the coal stations and in particular the conversion of 3 out of Drax's 6 units (2 GW of capacity) to 100% biomass. This has started now, and the first unit is firing up with wood pellets as I type. Consider this for a moment; Drax is the biggest coal station in Europe, the jewel in the British crown, our most efficient coal plant and the lynchpin of the UK power grid. In the midst of the highest operating profits in their 30 year history, they are taking a unit that was precision engineered to burn coal and switching it to burn 100% wood pellets, every last ounce of which will be imported. To do this, they will sacrifice around 20% of their generation capacity (on that unit) and about 2% efficiency (out of about 41%). Huge new port and wood pellet storage capacity has already been built in the UK and US, and the Drax company itself has started construction on 2 giant pellet factories in the US Gulf of Mexico. It's a breath-taking gamble, this Drax unit is twice the size of any unit that has ever been converted from coal to biomass. They are literally stepping into the unknown and yet not only have they already practically committed themselves to convert another 2 of their units, other opted-in coal plants are lining up behind them, notably Eggborough and Rugeley. Including the two opted-out plants (Tilbury and Ironbridge), 7 GW of coal generation has converted or is actively seeking to do so. This will all depend on an astonishing 30m tonnes of annual wood pellet demand, equivalent to 60m annual tonnes of green wood, all of it imported, most of it from North America. This requires a 3,000% increase in the current export market.

This dwarfs the new nuclear developments for both size, drama and immediacy - this is all happening now, not in several years’ time! Yet, it is barely mentioned in the media.

I think there is a certain amount of disconnection from reality in the planning process for this. I live in Canada, which is larger than the entire European Union and has individual islands which are bigger than Britain. Most of Canada is forest, but even through Canada's population is only a bit more than half of Britain's, Canada does not have enough biomass to supply itself with enough wood pellets to meet its electricity demand. Its forest resources are fully committed to supplying itself and other countries with lumber for construction, and paper for the media, and there are no surplus trees.

Fortunately Canada has vast rivers and huge uranium deposits, so 60% of its electricity production is hydroelectric and 15% is nuclear. The other 25% is supplied by fossil fuels and a bit of wind power, and there is potential for expansion for all of those. But not for burning wood for power.

Britain is a cozy little island with a lot of people and only a few forests left - I view it as just a large, well-maintained country garden with a lot of gardeners - so I don't think the idea of burning wood pellets for electricity is going to work. Importing wood pellets from the rest of the world is not going to work either because, frankly, the rest of the world has too many people and not enough surviving forests to keep it supplied.

Just as a sense of relative magnitude, Russian production was 647 bcm in 2011 or 22.85 tcf.

The entire estimated URR in the region according to the article is 34.6tcf ~ i.e. almost exactly 1.5 years of russian production. Yes, an important number for the populations involved but not game changing as far as the big picture goes...

Now, if we assume that Cyprus could sell all of its 7 tcf at say $15/mmBtu netting an optimistic $7/mmBtu for the country it would get 49 billion USD. Again not small change but these would not come immediately anyway. They would barely be enough to service the "bail in/out" debt...

According to an estimate from the USGS, the Levant basin holds 122 trillion cubic feet of gas. Some of that is also in Lebanese and Syrian waters, though.

Sgouris Thanks. Since we are living in the age of exaggeration and molehills into mountains, I am working at focusing on reality instead of the frantic feel good hype. In fact, I rank the majority of what I read as fantasy land. Five bucks, when you're making good money, is nothing but is experienced as a fortune when you're broke.

And on the other side of the world our legislators hem and haw about whether or not the state should fund a small diameter pipe from the North Slope to deliver gas to oil dependent Fairbanks, the rest of the Rail Belt and on to Cook Inlet tidewater (which is having an exploration rebirth and may have enough untapped gas around to reinvigorate its supply for a decade or few) or wait for the majors to run a big pipe to a liquifaction plant that would ship to Asia. Always a lot of hot air blown around when natural gas is the subject--especially in Alaska, where the local markets are small ane the resource base is world class large.

#1

For those such as tstreet who want me to name those here who are asking for, or actively working to get more Oil and Gas to be extracted, even though we know full well their damning effects on climate change, I'll start pointing them out. It's time to reduce our extraction rate, not increase it. The price needs to go up, WAY UP, to reduce demand.

I agree with this comment.

"Frankly, I don't give a good rats arse about the economy tanking. That is easier to deal with than 4 degree+ of warming!"

First time I've ever been given such a high number--I'm honored.

the comment you link starts out

Twenty years from now, I expect many folks, even TODers, will ask; WTF were we thinking?

Twenty years from now we will have come through, or not, the great bottleneck of ~2030-2035. A time by which even second hand societal memory of WWII will have almost completely faded away and population/resource strain will have really tuned the string to a high pitch. I was one of those who did the phony nuke blast drill hiding under a grade school desk when Kennedy and Khrushchev were button to button in Cuba. You might not be that happy when the sea anchor we've been is no longer keeping the bow to the breakers.

I'll go with avoiding an all out war as my first goal, and that makes for some tough calls along the way--always hoping for but never counting on the best. You make your own calls.

Since the 'twenty years...' quote started with me, I'll chime in with how I began the post:

"I think most regulars here understand the nature of the predicament; damned if we do, and all that. Reporting/discussing production rates and methods for increasing such shouldn't be interpreted as an endorsement, IMO."

I have to admit that I get uncomfortable with some recent remarks aimed at those here who are in the oil patch, not because I'm indifferent to our fossil fuel addiction and it's effects; I just don't want TOD to become a stomping ground for "Oil-Qaeda". I'm not sure what the point would be. Anyway, let he who is without sin cast the first stone.

And, they seem to care as much about, and perhaps appreciate more intimately, our predicament as/than the rest of us. Rock & Rocky's, W/T, H/O (and apologies to the unamed), et al's, insights have been a real resource for understanding just where we're at over the years. This is quite the respectable crowd of folks, folks, and I don't leave out the other end of the spectrum in that. Honestly, I'd like to see you all do a roundtable sometime, with Ghung, Ron, Twilight, RR, Gail, T.M., etc, I think you all know who you are, that could make for an interesting top-post. No idea how that would be moderated, haha. I can just imagine it on 60 minutes, MSM, lol.

Desert

edit: which is to say, I think the spectrum of thought-out ideas around energy here makes for a pretty round table. All of us. That's useful.

I didn't look that far up the thread--no doubt your time spent in the guts of the doomsday machine gave you insights I could never hope to have, though I was living in the UP when installing ELF into its chunk of the Laurentian shield was being proposed. Nothing like building a transmission system that would be nearly impervious to any attack and still be able to send target coordinates to the subs to highlight the insane knife's edge our lives have been perched upon.

On a lighter note I'll chime in with a seasonal comment though opening day isn't quite the national event it once was. I'm guessing this gem of folk wisdom has been around far longer than me but I first saw it on TOD.

Three home plate umpires were having a discussion on how they called balls and strikes.

first umpire

'I calls them likes I sees them'

second umpire

'I calls them likes they is'

third umpire

'They is likes I calls them'

Most of us have a fairly healthy mix of all three going on as we try to make sense of the world but some really lean heavy to the last view--though traditionally they put up the screen of 'a higher power' for camouflage.

I'm actually not distressed that augjohnson singled me out first, that shows my comments occasionally get read by someone other than myself and that they might just challenge 'religiously held world views.' But I've many, many posts here and I'm near certain none but me has read them all--my viewpoint has been relatively consistent and I'd hardly say it has been full steam ahead lets dig it up and burn it all. I doubt a single one of my many 'Alaskan coal posts' could be interpreted in that fashion by even the most devout 'eco jihadist.' Nick at the very least came to realize the 'geology won't save us' after digging into the coal numbers.

...and in that vein I can't say reading that Japan has successfully mined undersea methane hydrate came as welcome news...

ELF - wow - do you remember the "Teflon Sisters"?

Blessedly the U.S.Naval Extreme Low Frequency bases and infrastructure to communicate with the Trident submarines in real time (albeit as slow as molasses and tiny "words") is presently purged from the UP and the Chequamegon National Forest in WI.

One thing gone and two things pop up.

Cyprus is a divided island with big backing, including military, from a strong Turkey (still growing economy) for ethnic Turkish northern Cyprus. Turkey will be supplying a large pipeline of drinking water to the northern part. (Nice video by Faisal Islam on Channel 4 News.) Turkey holds the water supply for just about the whole region including Iraq(see below).

Incidentally, Brits still maintain an important logistical airbase on the island (hence the millions of euros flown out recently for Brit military personnel). Lots to play for in the eastern Med. Gas needs a mature retail market with pipeline grids and fine filigree retail outlets - otherwise it is not worth transporting. Jerome a Paris used to describe to us just how tricky it is to get long distance lines agreed and built.

http://www1.american.edu/ted/ice/tigris.htm

EDIT For those wishing to explore the wider energy situation in the Levant, now and future, Jonathan Callahan's excellent website has good detail and maps (NG pipeline options?). Syria holds a significant strategic position it seems?

http://mazamascience.com/EnergyTrends/?p=308