How Oil Exporters Reach Financial Collapse

Posted by Gail the Actuary on April 15, 2013 - 6:02am

Recently, I explained how high oil prices can bring on financial collapse for oil importers. In this post, I’ll discuss the flip side of the situation: how oil exporters reach financial collapse.

Unfortunately, we have many examples of countries that were oil exporters, but are dealing with collapse situations. Egypt, Syria, and Yemen all have had political disruptions since 2011. These may not be called financial collapse, but they all took place as the country’s oil exports decreased and as the price of imported food rose. Another example is the Former Soviet Union (FSU). It collapsed in 1991, after a period of low oil prices, in what looks very much like a financial collapse.

There are several dynamics at work in the financial collapse of oil exporters:

- Oil exporters are often dependent on oil export revenue to fund government programs.

- The need for government programs grows as population grows and as the price of food rises.

- The amount of oil that can be extracted in a given year often declines over time, as initial stores are depleted.

- Exports often decline even more rapidly than oil supply, because of rising oil consumption as population grows.

In general, high oil prices are good for oil exporters (except the effect on food prices). At the same time, oil importers strongly prefer low oil prices. As a result, we end up with a price tug of war between oil importers and oil exporters.

One additional issue is declining Energy Return on Energy Invested. Countries often have the option of reducing their rate of decline by adding production in areas which are more expensive to drill (say deeper, smaller locations offshore Norway) or by using enhanced oil recovery methods. Such approaches add costs (and energy use), and further add to the price that oil exporters need for their product.

Egypt, Syria, and Yemen

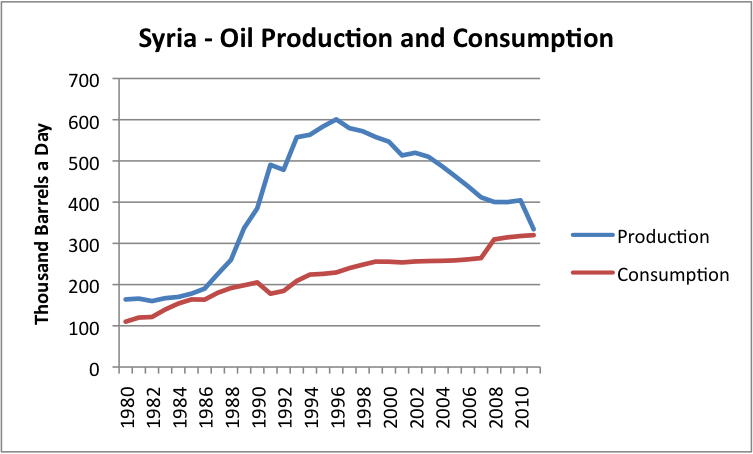

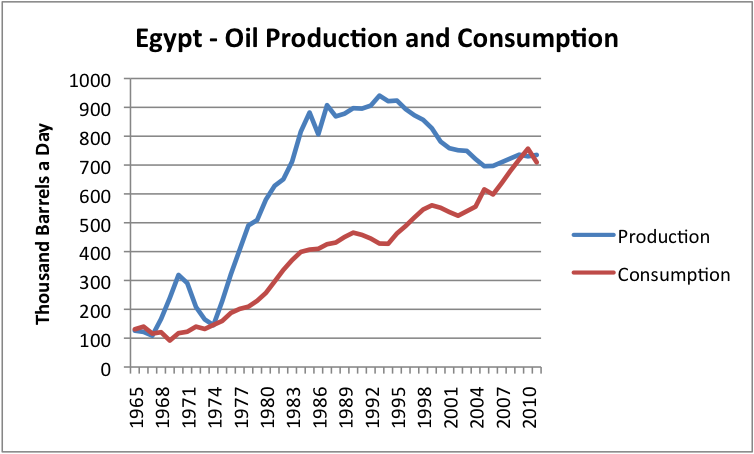

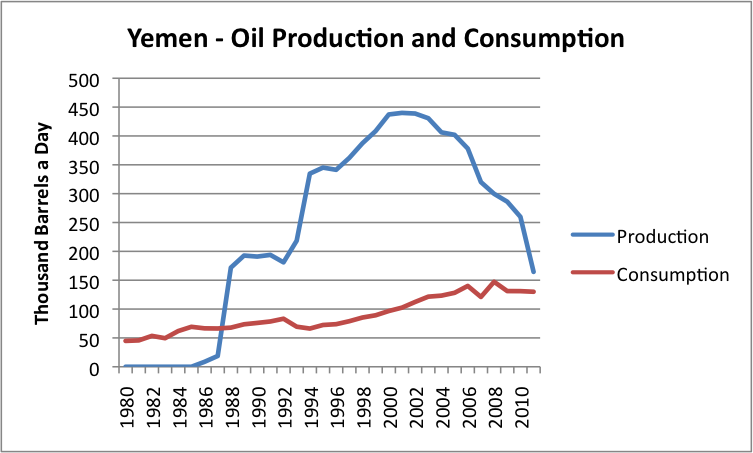

Egypt, Syria, and Yemen are three countries that the press would say are suffering from the continuing impact of the Arab Spring revolutions, which began in 2011, or of civil war. The similarity of the oil production and consumption charts for the three countries (shown below) suggests that declining oil exports likely played a major role as well.

In all three countries, oil production rose and then began to fall (Figures 1, 2, and 3). At the same time, oil consumption rose. The two lines–production and consumption–come very close to meeting in 2011, indicating that oil exports are at that point dropping to 0.

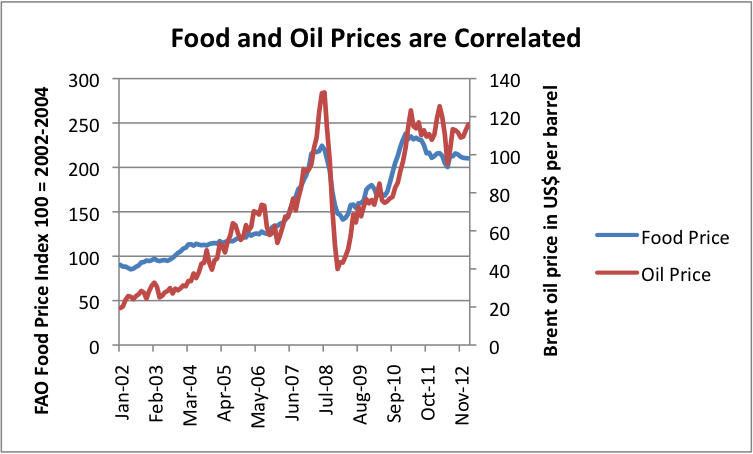

To make matters worse, the three countries are in an arid part of the world, where a large share of food must be imported. Oil prices and food prices tend to rise at the same time (Figure 4, below). By 2011, both food and oil prices were high. In fact, both prices have tended to stay high. Now, these countries find themselves with the unpleasant problem of paying for the higher cost of imported food (grown and transported with oil), so indirectly they are becoming an oil importer instead of an oil exporter.

Faced with less revenue from oil exports, and higher prices of food imports, these countries find themselves with a permanent mismatch between revenue and expenses. Part of the revenue mismatch relates to subsidies offered to poor residents. With higher food and oil prices, the funding needed for subsidies rises rapidly, even as oil exports drop to close to zero.

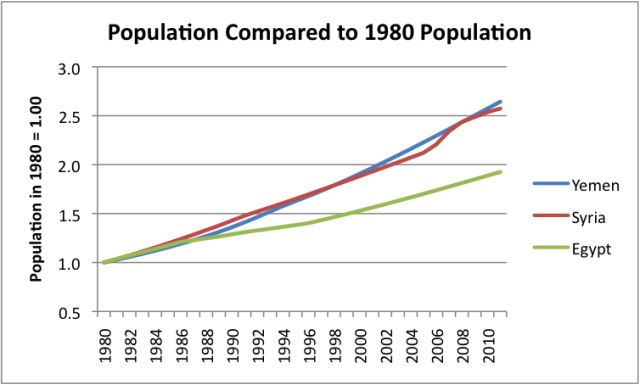

One issue that makes the situation worse is the huge rise in population that came with increased prosperity. Population has nearly doubled since 1980 in Egypt, and has more than doubled in both Syria and Yemen (Figure 5, below).

All in all, the situation is very bad. These countries admittedly do have other resources, such as grazing land for animals, food crop production, and in some cases natural gas exports, but the loss of oil exports puts a hole in their budgets. If oil production continues to drop in the future, both jobs and local oil consumption are likely to be affected as well. (This is a link to a post I wrote about the Egyptian situation two years ago.)

I tried to put together an index of the relative dependence of various countries on oil exports, by comparing the value of oil exports to Gross National Income. Based on exports before the recent drop-off, Yemen’s index is around 30%; Syria and Egypt are a little under 10%. The index no doubt understates the role of oil, because it does not include the oil the country uses itself, or the impact of any natural gas industry. It also excludes indirect jobs, like that of grocery store owner or taxi driver.

If Egypt and Syria are indeed collapsing with what seems like low dependence on oil exports, it makes one wonder about the impact if Saudi Arabia’s (index over 70%) or Libya’s (index about 60%) oil extraction would drop.

The Collapse of the Former Soviet Union

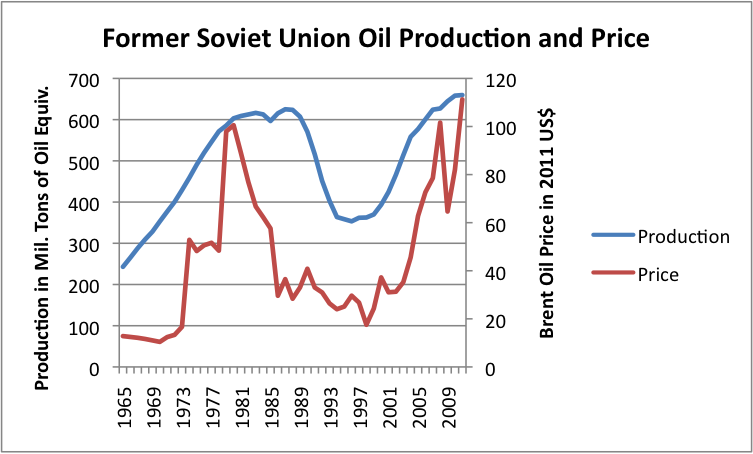

The Soviet Union was an oil exporter and a major world power, prior to its collapse in 1991. While there are many views as to what led to this collapse, one issue seems to be a drop in oil price in the early 1980s.

The drop in oil prices did not lead to an immediate decline in oil production (Figure 6), most likely because the cost of maintaining production on a field that has recently developed, is low for a few years. What is expensive is the up-front cost of bringing new fields on line. These were not added, causing a decline in production, after a few years.

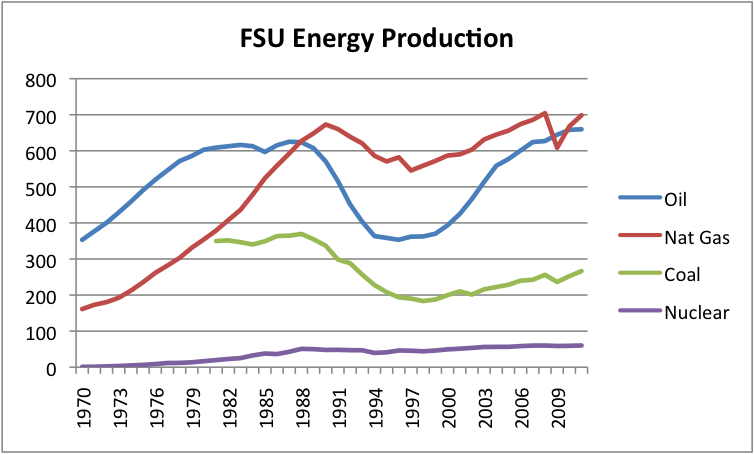

Russia’s energy data shows the marks of the financial collapse building, prior to 1991. Revenue from oil exports dropped in the mid 1980s, because of the lower oil price. Oil production started declining in 1987, four years before the collapse. Other types of energy production started declining as well, as if a recession were underway, pulling the economy down in all areas.

Every type of energy production (except hydropower, not shown) dropped back during this period, even coal and nuclear, with decreases beginning prior to 1991. Population growth started slowing prior to 1991 as well. Eventually, the government collapsed, after continuing recession.

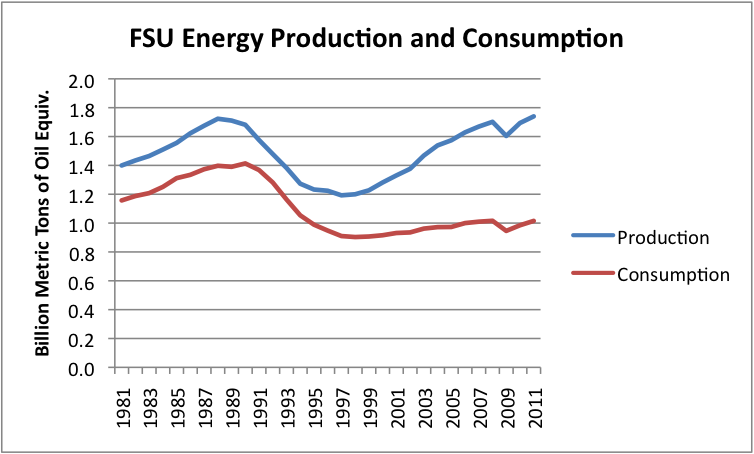

The FSU never regained its former stature as a manufacturing country, even when oil production rose, after oil prices rebounded. With little manufacturing, energy consumption has remained far below its pre-1991 levels (Figure 8).

I visited Russia in 2012, and saw for myself a little of the current situation. One problem is that its cost structure (based primarily on oil and gas which is now high-priced, and workers who need wages to pay for these fuels) is not competitive with the low-cost structure of the Chinese and Indians. Another issue is the poor condition of Russia’s infrastructure (roads, bridges, water pipelines, etc.) due to neglect during the time of its collapse. With the high cost of oil, it is expensive to make repairs and add new infrastructure.

In terms of my index, Russia’s oil exports now amount to a little less than 20% of Gross National Income.

Collapse in Countries with Declining Exports

Egypt, Syria, and Yemen are examples of countries whose exports have pretty much disappeared, causing great crisis. But how about countries with earlier declines in production? To some extent, there were not many problems in the 2003 to 2008 period, because declines in oil exports could often be offset by increases in oil prices.

One country that stands out, though, is Argentina, with problems both before and after the 2003-2008 period.

Argentina’s oil production hit a peak in 1998, and began dropping in 1999. Oil prices were at an unusually low level in the 1998 to 2002 period. This timing coincided precisely with it first economic crisis, which came in 1999 to 2002. Oil prices rose in the 2003 to 2008 period, and Argentina’s problems seemed to disappear.

Now Argentina’s oil exports are very low, and in 2012 and 2013, the country is again having financial problems. Argentina’s economy is well diversified, so a person wouldn’t think that oil would play a big role. (My index of the role of oil exports was only about 2%, as of 2008.) But oil problems overlay any other problems a country may have. If a country has a tendency to overspend its income, or over-promise subsidies, any reduction in oil income will tend to magnify this effect. When making plans, it is easy to overlook the fact that the benefit from oil income is temporary.

Target Break-Even Brent Oil Prices

Many large oil exporters include revenue from oil exports in a country’s annual budget. This is quite different from the cost of pulling the oil out of the ground. It is the money governments collect, as taxes or revenue sharing agreements or leases, to support their programs. With rising population, and often with declining exports, oil exporters find that they need higher prices each year, just to make their budgets balance.

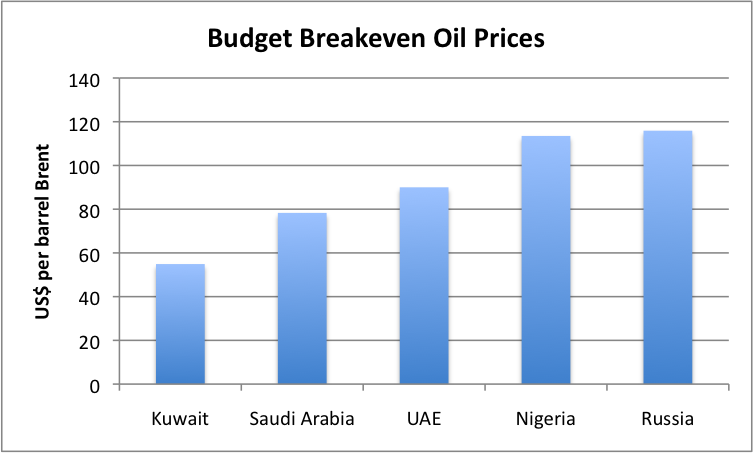

Figure 10 provides some Deutche Bank estimates of budget break-even oil prices.

Note that the indicated break-even prices for Nigeria and Russia are above current Brent price levels. (The current Brent Crude oil price is $106.) An estimate from Energy Policy Information Center (EPIC) shows Venezuela’s break-even price to be a little higher than Russia’s, and Iran’s between that of Nigeria and Russia. According to EPIC, Iraq’s break-even is in the $80 to $100 barrel range. The Saudi Arabian oil minister was quoted on January 16, 2013 as saying that the country needs oil prices averaging $100 barrel.

One concern is that these break-even prices will keep rising. Another concern is that countries “at the margin” will find it difficult to reach their price targets.

One country of concern is Venezuela. It has a very high break-even price, and recently underwent a leadership change. It also has a tendency to spend oil revenue, even before the oil is pulled from the ground, through loan programs from the Chinese.

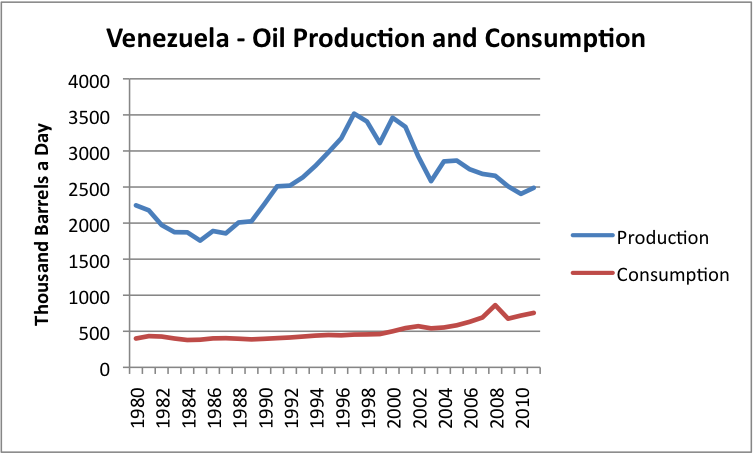

Venezuela’s exports are lower than in some previous years (Figure 11, above), but with the rise in the price per barrel, the dollar value has perhaps risen–this really depends on the price negotiated by China. With funds spent before the oil is produced, Venezuela can easily get itself into a trap, if “regular” oil production drops, or if it is difficult to ramp up new planned production.

Venezuela’s oil export index is about 20%, which is similar to Russia’s and Norway’s.

In general, oil exporters with declining oil production face worrisome situations. Reduced oil exports present a drag on the economy unless oil prices are rising rapidly. If oil prices do not keep rising rapidly, oil exporters will need to cut back on social programs–something that will not be well-accepted by citizens. Furthermore, adding new industries to take the place of missing oil supply may be difficult. There may even be a reduction in oil supply available to world market, if civil disorder causes a loss of production which would otherwise reach the export market.

This post originally appeared on Our Finite World.

Good article!

A very successful business man I once had the pleasure of meeting made a comment that stuck. "There are two things good for business, cheap money and cheap energy." Meaning the environment created by this situation was good for the conduction of business as well as good for the business it self - internally/externally bullish. I do not recall that he meant that they must occur at the same time, which I would consider helpful but required at the time (2001).

Lower standards on lending was the chosen way to overcome the increase in energy. Borrowing only pulls future consumption forward in time. Debt based economic activity is measured the same as non debt based activity, but is not the same if you look at it in a holistic manner, which we don't.

You could also say an FF based economy pulls forward economic activity in time. We are resistant to the only option we have, reducing energy consumption, and everything that goes with it.

You have spotted three examples where the true apex has been reached, debt can no longer cover it up.

Good point! And I think the government knows that it can't fix the oil price, so it tries to fix interest rates lower, to try to offset the damage done by high oil prices. It sort of works a bit. But it is really hard to get growth, with high priced energy. Reducing energy use is likely to lead to lower growth, and more problems repaying the much debt that is outstanding.

You could also call debt a promise. There is a major question as to whom we will keep our promises to and who we will not. The people who have forgone consumption in exchange for a promise might find that they get nothing in exchange for something or a lifetime of hard work for nothing. It is easier to not keep promises to the elderly and people living in other countries so I would guess that they are the ones who have far less than they imagine they have.

What you are saying is there are too many promises to keep them all. Some people have paid into a system, US - Social Security.

I wish I had some sort of answer because then I could prepare myself. There have been a few analysts that I have admired such as Meridith Whitney saying there would be a municipal bond crisis, and she would have been right except for all the interventions. So how do you prepare when what is logical and realistic can be altered and voided?

Jeffery Brown's comment - "get yourself on the non discretionary side of the economy" is by far the clearest and cleanest bit of good advice I have ever heard.

Trying to save or invest as an individual currently is realistically impossible. There is a great TED talk on high speed trading. This is not investing, it is computer program financial warfare, and you cannot win, it is better to not play.

I think investment is pretty clear. Get out of the bond market, it will totally collapse. Debt now has no fundamental value, it's worthless. Get out of the stock market, it is pumped higher with high frequency trading by the Fed and it will have a major crash soon. Get out of cash since when the deflationary crash happens, revenues will go down and the only way to prevent everyone, including governments, from going bankrupt, will be even more money printing which will cause massive inflation and eventually hyperinflation.

You could invest in real assets like farmland. But it could be taxed away if you buy too much of it. Other than that, it's physical gold and silver, purchased anonymously if possible, stored outside the banking system. It's worked for millenia, why not now?

Sure everything's being pumped up with interventions from central bank money printing, to keep the system together, but that doesn't change the fundamentals. All the intervention does is stretch the rubber band even tighter so that when fundamentals inevitably reassert themselves and the rubber band snaps, as they will at some point in the next couple years, then the crash will be even more catastrophic. Be on the right side of that crash.

Your sum up what I feel- there is no safe place to hide. With Cyprus taking deposits, I wonder why there hasn't been bank runs. Denial runs deep. They will eventually loose credibility and legitimacy as time goes on and it will eventually correct as you say.

I read something new to me on gold this week. Banks trade with each other- sometimes overnight. When the basis of the debt obligations becomes suspect then gold is more fluid, as it's rating is known. Gold converts into any currency on the planet. How gold works inside the major banking system, and how that effects the price. I found this interesting to say the least....

http://www.alhambrapartners.com/2013/04/15/we-have-seen-gold-prices-act-...

Found this today, key takeaway for me was "...deficit spending is nothing but deferred taxation..."

"Empirical studies cannot be used to settle points about economic theory. It should be obvious that deficit spending is nothing but deferred taxation. And obviously, since government spending has no concept of the categories of profit and loss, such spending is typically a mindless waste of scarce resources. No bureaucracy has any inkling of opportunity costs or consumer wishes. The spenders are saying: government bureaucrats know better how to allocate resources than the private sector. Perhaps, but certainly not in this universe."

From 'Mish'-http://globaleconomicanalysis.blogspot.com/

It is debatable that all spending is wasteful, clearly some is needed such as common roads. But the idea that we will be paying this bill later makes me wonder exactly who will pay, with what, and how. Printing money is the stealthy way of taking our purchasing power vs. confiscation that might lead to unrest.

As a fiscal conservative, I can understand "deficit spending is nothing but deferred taxation". However, when strong gdp growth was the norm this was not actually the case. Governments thought of their accumulated deficits not in absolute terms but as a percentage of gdp. It was sufficient to simply balance the budget and then economic growth would magically shrink the debt as a percentage of gdp. No need to run a surplus and actually pay down the debt! It's an entirely different ballgame now that econmic growth is low or zero but governments haven't figured that out yet. It's going to be a sobering moment when politicians realize these debts are not going to go away on their own and we are actually going to have to sacrifice to pay them off.

Since the General Fund has been papered over with "stolen" assets from the Social Security and Medicare Trust Funds...now that the bill is coming due the PTBs are simply trying to murder both of them (but in the future) rather than call for higher taxes to cover the pinched funds.

This is a devilish situation because the people who are now retiring have benefited from the theft of the trust fund through reduced taxes/increased services (at least the wealthy have) and they also want the money that was supposed to be there.

What the politicians are calling for is basically keeping payroll taxes the same but cutting benefits in the future - what is this but deferred taxation pushed onto the younger generation? Even worse, it's paying for services young people are likely to never see to cover the debts of old people who benefited by that debt.

It's like if your crazy old grandmother grabs some cake and eats it and the store owner comes over and goes "You have to pay for that!"...you don't get any cake and yet you're still left paying for it!

Just to say that your words struck a chord. I have seen things similarly in terms of human economic growth being all about space/time-shifting resource consumption:

Normal trade-driven growth is about shifting resources around in space so we can exploit them better (often at the expense of others). We've maxed out on that now. But we can also shift resources in time. Like you say Debt-based growth is shifting resources from the future into the present, but I've always seen FF based growth as to do with time-shifting resources from the _past_ into the present.

What sucks is that we're reached peaks in the possibilities of both space- and time- resource shifting. Hence the (inevitable) collapse.

Ben

Thanks, yes I can see the FF part as past(stored energy) moved to present. I guess I was thinking about the years it will take to re-create that FF supply in the future, none the less, I agree we are in deep denial about our current place.

We really don't have many realistic options given the inertia that exists in all our large social structures. Talking about reduction, "less" stuff, will not get you campaign contributions to win an election. I see any form of political activism as a complete non-starter, the problems are simply beyond the ability of our leaders.

Our individual time is better spent elsewhere, doing things individually and locally.

As you say our ability to shift things around is coming to a close.

How so? Debt doesn't change the amount of resources available; all it does it change who owns them.

If the US government borrows $1T from US citizens to pay extended unemployment, that doesn't somehow take oil from the future. It (a) gives unemployed people a larger share of the US economy this year, and (b) gives those lenders a larger share of the US economy in the future. Consider if that lending was a gift instead; the immediate consequences would be the same, but with no added debt.

Debt can increase energy demand, but only by shifting purchasing power to people more likely to use that money to consume energy. E.g., if I take $10 from under my mattress and lend it to someone who wants to buy gas to roadtrip, the transfer of money increases the economic demand for oil. That's not a necessary feature of increased debt, though; if instead I borrowed $10 from someone to stuff under my mattress, and as a result he couldn't buy gas to roadtrip, the increase in debt would come with lower oil demand.

Yes, government spending is real, whatever the funding source.

The problem with debt instead of taxes is that it creates the impression that we have more money than we do: people hand over their money without realizing that it's not being invested, it's just being consumed. People think they're saving, when they're not.

To some extent it's a scam by the wealthy: instead of paying taxes, they get a t-bill, which is an asset.

Now, if interest rates go to zero, then debt doesn't cost government much, but it's not a great way to do things. Taxes (or a combination of borrowing and taxes)are better.

Yes, taxes might reduce aggregate demand a bit, but then we wouldn't be making false promises to future generations about the return on that borrowing.

That's what the US did in WWII - it's much more sensible to tax the rich than to borrow from them and have to pay them a revenue stream forever. The rich disagree, of course, which is the problem.

Nick,

Very good comments, that is what borrowing for consumption does, it creates the illusion that everything is fine for a while. Then the debt builds, the rich are richer at everyone else's expense and the country grinds to a halt.

Debt does change the amount of resources available by way of giving fiat money to those people doing the extraction, to encourage them to work harder and extract more. The promise is, if you extract more now you get extra money and can save for a comfortable retirement. An empty promise if the resources are depleted at that point!

That assumes that the people doing the extraction are saving their income. I'd be surprised...

You're conflating two different things:

Thing #1: taking on debt

Thing #2: spending more on resource extraction

#2 will indeed lead to more resources being extracted, due to simple supply and demand, but that would be true even if no debt was being taken on.

#1 need not lead to more resource extraction unless the effect of the debt is to shift purchasing power to people who are more likely to spend that purchasing power on resources. For example, if $1T were borrowed to give to top bankers as a performance bonus, and if those bankers just stuck the money in T-bills, there'd be no extra resources extracted, despite the large amount of additional debt.

Excellent post, Gail.

I knew Angentina was raising the ante over the Falklands/Malvinas recently because of poor economic figures, but I hadn't relaised that they were another ELM basketcase. I assumed that they were angry because we were finally making semi-serious attempts to prospect for oil around the islands ourselves.

The topic is fresh in our minds at the moment, as we are burying the Iron Lady tomorrow, who finally succumbed to rust. I am now nervous that our current PM, a lightweight and deeply unpopular right winger will attempt to emulate Her Ladyship and rescue his hopeless poll ratings by triggering a small patriotic war over a place of very little importance.

Except, now, our navy and long range air power are far weaker than they were even 30 years ago.

The Export Capacity Index (ECI):

A New Metric For Predicting Future Supplies of Global Net Oil Exports

http://aspousa.org/2013/02/commentary-the-export-capacity-index/

Excerpt:

WT

I was thinking about your ELM model, and the predictive power of your six country analysis vs the world. there are two factors that are different in the subset vs the world

- the oil companies, or "oil department" of the govt in those countries were limiting their investment based on projections of future returns. so technology would be stable

- those countries were working in a stable monetary environment vs the world. they had no influence on world oil prices - what they would get

so in a fixed, closed set, the decline makes sense

in the world, by contrast, there are no limitations on where to prospect, where to develop, what technology to use, or how much to throw at it

I guess I'm trying to explain to myself why the world production curve has not begun to trend down after 8 years, and has actually trended up slightly

the six countries were faced with a simple version of EROI and responded logically

I don't know when the world will hit that wall

I also wonder what oil price the UK needed to sustain our government spending on oil taxes when we peaked in the year 2000. I know at the time the government was paying down on its debts, but soon after government borrowing started growing exponentially and is still growing today, 3 years into our own austerity programme.

I have never seen an extimate, but it was probably quite low, perhaps $20.

Oil exports at their peak were very small compared to the size of the UK economy, but I expect there was still some impact. I have not learned to find and use non-US data was well as I might. Rising debt when resources are depleting is not really a good sign. It is sort of like a person reaching retirement age, and adding more and more debt. Doesn't work.

The fact the local economy can run without importing is also a significant impact. The exports it can do based on cheap oil are an indirect way of exporting oil, with added value. I know UK has a destroyed almost all of it's industry, but at the end of the day even services are an exportation mostly based on oil. And the fact UK is quite energy efficient increases the added value.

And the Great British "Spring / Autumn " revolution because we too had a drop in oil exports lead to ....

Drum rolls.....

The Great British public rioting for trainers and mobile phones.......

who said we're sunk

Argentina invades the Falklands again - whos gonna stop them? got an app for that ! ;-)

Forbin

Egypt and these other countries facing dire prospects should be warning signals for the US as we temporarily stave off collapsing oil production with shale oil. Instead of investing in Green Transit Egypt built a huge Auto Addiction beltway for the affluent which now requires driving to get anywhere in the Egyptian version of suburban sprawl McMansion type development. Egypt also fostered overconsumption of their oil by subsidizing fuel prices making the suburban sprawl more feasible and attractive. And finally instead of investing when they had a surplus in solar thermal electrical plants in the desert, distributed solar thermal and pv for residences, Egypt was provided billions upon billions every year from the US Military Industrial merchants of death for more weapons. Now Egypt faces real pain from their total lack of planning for the realities of Peak Oil and Climate Change. How will Egypt afford these investments now? They already wasted billions on more Auto Addiction which is now embedded and except for the hydro from the Aswan dam have done little or nothing for the Green Transition.

It is a tale which needs to be told as a warning to the rest of the world.

And now they have had their 'revolution' they have replaced their miltary backed patriarchal pro-Western leader with a military backed patriarchal pro-Islam leader who is suppressing women's rights and actively promoting a return to very high birth rates to accelerate their already unsustainable population growth.

The only thing between Egypt and anarchy in the streets is hard cash subsidies from their OPEC allies.

Egypt is also facing the prospect of a reduced wheat harvest do to lack of fuel to produce it. That will send the price of bread up the price of cooking gas and imported food. That will definitely send the people back out into the streets. Look for it late this year, early next year.

I think the level of energy use and transport Egypt will be able to support in the years ahead will be quite low. Most transport will need to be by walking and animal pulled cart. Perhaps bicycle operated transport.

I think there is a danger with "Green Energy" programs to aim too high. We imagine that BAU can continue. Even transit programs are too expansive to put in and maintain, I expect. What we are transitioning to is essentially no fossil fuel energy. It is hard to do very much with this kind of world.

Well it is always about political choices isn't it?

If the US had actually invested its billions to Egypt in meaningful investments like

Green Transit, distributed solar or solar thermal plants instead of billions for ever more weapons there would be an alternative. It is absolutely critical to realize the mantra of Thatcherism, Auto Addiction and Empire of "There Is No Alternative" is quite blatantly false.

As was mentioned by myself and other TOD posters at the time it is simply obscene that US tax dollars are still going to $1.3 Billion in "aid" to Egypt for purchasing the tools of death from the Merchants of Death:

http://www.nytimes.com/2012/03/24/world/middleeast/once-imperiled-united...

That $1.3 to $2 Billion US "aid" could have been redirected to helping long-term sustainability of Egypt's economy as their people increasing face hunger and starvation. Sunpower could send solar panels instead of Boeing sending jets...

No Maggie et al THERE IS AN ALTERNATIVE!

And we better start moving that way if we are to maintain a civilized life worldwide and even planetary survival...

The military aid to Egypt is also part of the Camp David Peace Agreement. We can't just walk away from that without significant consequences. You don't see too many Israelis complaining about such aid.

The USA takes care of a peacefull Egypt as long as the Suez Canal is needed to bring in ME oil. That is not "long term".

Lets face it the Camp David agreement is about bribing Egypt to maintain Peace with Israel. Egypt and in particular the people would much rather be bribed with sustainable investment which would resolve their current shortages rather than more military aid to the pockets of the repressive and corrupt Egyptian military, the likes of Mubarak or US merchants of death.

The Marshall Plan succeeded after World War II because it was mainly about CIVILIAN aid not just useless military spending to line the coffers of the

military-industrial complex. Indeed both Germany and Japan were discouraged from rebuilding their military

That is a good point. Now it seems like military "aid" funds one of the few remaining US industries--military weapons.

Both of you bring up very good points! Yes, much of the Camp David accord has been about bribing Egypt not to attack Israel. (And let's not forget that we also give Israel the same amount or more of military aid!)

But does Egypt need that military aid these days? No. So why not alter the plan to give them aid to help them transition to a more sustainable economy? Granted, I'm sure many Egyptians won't like that because that means Israel gets more military toys than they do. But at this point they gotta stop with that childish nonsense and do what is best for your people and not perpetuate some stupid rivalry.

I was an ardent peak oil believer but such predictions are now beginning to look foolish. The Brent price of crude oil has failed to rise above $120/barrel and is now falling again. The all time high price of oil in US $ was 5 years ago. The Bakken shale oil boom in N. Dakota and the shale NG boom that started in 2008 was not predicted by anyone here. What other expensive sources of oil are waiting to be exploited?

Solar power has now reached grid parity in countries like India without subsidies and has reached grid parity in the US with Federal subsidies. Electric cars will become very popular once cars like Nissan Leaf install better batteries and extend their range to 150-200 miles. In much of the world it is still BAU although growth has slowed down in developing countries and nearly stopped in developed countries. There are more car owners every year in developing countries and in every city the streets are clogged with traffic.

So when is this end of the world supposed to happen with people riding bicycles, camels, bullock carts and donkeys instead of cars?

"So when is this end of the world supposed to happen with people riding bicycles, camels, bullock carts and donkeys instead of cars?"

About the same time that it becomes glaringly obvious that humanity's overshoot condition is far more systemic and much deeper than even our most talented critical thinkers were able to fathom, and they begin to run for the exits only to discover there are none ;-/

I know you are kidding but in the end the people who think BAU will continue for the rest of their life may turn out to be smarter than us after all!

"I know you are kidding..."

Only in part, suyog. Just trying to maintain a sense of humor in the face of humanity's multiple predicaments.

"...but in the end the people who think BAU will continue for the rest of their life may turn out to be smarter than us after all!"

...only if you equate 'smarter' with being more selfish and delusional. Ignoring that many western lifestyles are, at once, essentially stealing from the past, present and future is neglegent at best; criminal if one views the issue honestly.

Do you realize that your comment is kinda obscene ? Do you grasp that demand destruction through high oil prices is not a legend ? And much more importantly, have you looked at world oil production figures ?

Yes, I know all about it. But that doesn't contradict anything I just said. For most people it is still BAU. The shopping malls are full, restaurants are full, latest smart phones are selling like hot cakes. A lot of our economic problems are due to excessive debt and job destruction due to outsourcing and automation.

I can sense that you are angry. But you gotta admit that the doomers were wrong. Even in a poor country like Bangladesh they have traffic jams and shopping malls full of people. LOL.

If you want I can send a copy of my ELM for dummies PDF file. It's sort of a sarcastic parody based on westexas' and Jonathan Calalhan's more serious work.

Hint, the fact that even in a poor country like Bangladesh they have traffic jams and shopping malls full of people, is not necessarily a good sign at all.

I realize people think quick collapse means overnight but even a hundred years compared to the time it took other major civilizations to collapse is pretty darn quick.

When the bread and circus that keeps the poor from Bangladesh and other similar places entertained and fed starts to run out, watch out below...

Hi, I am interested in your ELM4dummies. Sounds like something very educative.

Hi Verwimp if you send me an note at my posted email I'll reply with a copy attached.

I know all about ELM, etc. The problem is that 10 or 20 years from now we could still have BAU and you could still say it is a slow motion collapse. If it is that slow, how do we know it is even happening or caused by peak oil? The developed world's main problem is excessive debt caused by very generous entitlement programs that are no longer affordable. Sort of like how GM promised overly generous retirement benefits during the good times and couldn't afford them when it declined. The West no longer has colonies or a monopoly on science and technology & is hobbled by high wages, entitlement spending and lots of regulation (try starting a business in France). Hence it cannot compete with the newly industrialized Asian countries. Add to it job losses caused by automation and outsourcing and many of our economic problems would exist even without peak oil.

If the collapse of civilization is very slow, doesn't that give us more time to find alternatives? Solar panels are already here and you can buy an electric car today that is cheaper than a gasoline car if your commute is not too long.

My grampa went through the depression. He used to say...if yachts were going for 10 cents apiece I would run up and down the dock yelling how cheap, how cheap. He still didn't have one thin dime to spend on anything.

Technology has stripped away the ability for many to hold a job and the trend continues. When they rise up to get their own electric car by force, the collasp will have begun.

It is slow, but punctuated with big steps down. We haven't gotten to the big steps down. Egypt and Syria and the Former Soviet Union all have seen bigger steps down, but even these are very incomplete. The Former Soviet Union was rescued by the rest of the world.

I think the term 'Attrition' may start being heard, BAU continuing in places where it can, ignoring attrition as something fixable elsewhere.

I know this mindset is accepted as gospel truth by the Wall Street-owned media, but I simply don't buy it. Entitlements for regular working class people is NOT what is primarily bankrupting our country, entitlements for rich people, banks and mega-corporations are. We spent close to $5 Trillion bialing out Wall Street after the "crisis" THEY caused due to financial deregulation and a colossal housing/credit bubble! We spent another $2 Trillion on an unecessary and disastrous war in Iraq. And it's amazing how close the $700 billion wasted on the Bush tax cuts for the rich comes to the estimated shortfall in Social Security and Medicare.

I don't agree. The shortfall comes on a year-by-year basis. I wrote about the issue back in November, 2012. Understanding our oil-related fiscal cliff.

If you add up the interest payed for federal debt since 1980 it will come close to 17 trillion.

It's a short term situation. Remember, we are at peak now, and will stay at this plateau for a few more years. Come back and talk about it in about 5 years when things start to roll off permanently.

We are in the midst of slow motion collapse. High oil prices don't really have to be very high. It may be that anything over $50 barrel is too high. Eurozone unemployment recently reached 12%. The US is struggling with getting employment up. The unemployment "rate" is lower, but that is because 20 to 24 year olds are dropping out of the wage force.

Part of our problem is concentrated in governments. They cannot collect enough taxes relative to the benefits they are giving out. As this resolves (taxes rise, benefits lower), the situation goes down hill. Repayment of debt also becomes more problematic.

What we know from past collapses is that they were financial collapses. Wage disparity increased prior to collapse, and wages of common workers fell relative to the price of food, and in our case, the case of energy to produce the food. It became harder and harder for governments to collect needed taxes. (See Secular Cycles). According to research on past collapses, they took place over something like 20 to 50 year periods. If our collapse started about 2006, we have maybe 13 to 43 years left. So you have time to wait until things completely fall apart.

Other posts that may be of interest are

Peak Oil Demand is Already a Huge Problem

How Resource Limits Lead to Financial Collapse

Slowdown already started a while ago, already 10 years ago when I lived in Canada things were slowing down.. Pizza guys didn't want to deliver too far away from the pizza shop. Today, I'm seeing a significant reduction in stock in many store shelves in Finland. Cars sitting unmoved, cars buried under snow, damaged cars sitting in empty parking lots.

That's the funny thing about oil and modern civilisation - most everybody in large western urban centers are dependent on mass produced external technology (much of which was invented before we were born) and fuel, and we never had any direct control or ability to produce our own food or transportation energy or heating.. all outsourced.

The fact that we can do so little ourselves is a big part of what makes this scary. With the Former Soviet Union, the people had their own gardens and were doing a fair amount on their own still.

13 to 43 years left? Really? Is that your prediction to total collapse? I did not think we had that much time-- 10 years tops but even that seems way off given that we would not have an economy right now if the the FED was not dumping trillions of dollars into the banking system...can anyone give us an actual total that the FED has spent so far....the world economy is like a drug addict addicted to the FED'S policy right now take that away and I think you would see the real decay....and not be talking about shopping malls in Pakistan as a measure of world economic health.

If we use the earlier estimate of 20 to 50 years, and subtract 7 from it, we get 13 to 43 years. My guess is that the shorter time-frame is more likely, because we can do so little for ourselves. If different parts of the world fail on different time frames, that could add to the overall timing.

The 13 to 43 years isn't to the beginning of the collapse, it is to the end of the "crisis stage," before the period between civilizations. So the time is to the end of the collapse, not until things badly start falling apart. I show one possible timing in this post. Peak Oil Demand is Already a Huge Problem.

and if other parts of the world fail that could subtract from our time frame....thanks for the link I have read that one; I really do appreciate your post and am I am glad you are out here taking the time to do these posts.

I was first introduced to peak oil in 2000 in an article I read in prominent magazine article although its focus was on if peak oil occurs where would you want to be to try and ride it out..have you done any post on that as to where one should be...in the world. I know you are in Atlanta but the south was written off as being too controlled by religious factions and not able to work in a socialist manner to combat the bigger social problems...

Don't look for electric cars to start mass production until more lithium becomes available.. then there's the copper wire for all those electric motors. I'm sure all the electric vehicles that are available are being sold.

As it is, the reason Brent oil price is holding is because European prices for fuel (Europe has more cars than the U.S) are far higher than pretty much everywhere else and due to the recession.

http://www.bloomberg.com/news/2013-04-12/volkswagen-growth-slows-in-marc...

http://online.wsj.com/article/SB1000142412788732346860457824498163854041...

http://www.theatlantic.com/international/archive/2012/08/its-official-we...

From my ECI article linked above:

(Note typo on CNE chart. Time period for GNE, Saudi and ANE is 2005-2011.)

Note that the Global, Saudi and Available post-2005 CNE estimates are based on the 2005-2011 rates of increase in consumption, but the CNE estimates also, in effect, assume a slow but perpetual increase in production. It's likely that the rates of increase in consumption will slow, but it's also a pretty safe bet that we won't see perpetual increases in production.

Incidentally, China's 2005 to 2011 rate of increase in net oil imports (9.1%/year, BP) is below the rate of increase in net imports that the US showed from 1949 to 1970 (11%/year), when US production peaked. From 1970 to 1977, US net imports increased at 14%/year. Note that China's domestic production has been flat recently.

I completely understand this and agree with you. However, the US $ price of oil made a high 5 years ago and is 30% below its peak now. To most people the only thing that matters is price. If oil is available at a price they can afford, then it is BAU. Perhaps people have adjusted by trading their SUV for a Prius, but that is still BAU and shows that it is possible to adjust without leading to a collapse.

Also from the ECI paper:

The question is to what extent are many consumers in net oil importing OECD countries able to buy petroleum largely because of large scale deft financed deficit spending? And of course, Greece is an ongoing example of what happens when a net oil importing OECD country has trouble maintaining their prior levels of borrowing.

And the concluding paragraph to the ECI paper:

According to Walter Lord, author of "A night to remember," about the Titanic sinking, many passengers remaining on the Titanic ridiculed those on the first (and only partially filled) lifeboat to leave the ship.

The point you need to remember is that collapse doesn't necessarily come quickly. The problems of the higher price are transferred to the government. At some point, these issues make a problem for the government--they need to raise taxes or cut benefits. It is fixing the government problems that is likely to lead to collapse.

Gail: "The point you need to remember is that collapse doesn't necessarily come quickly."

Nor will it necessarily come evenly. Even in the Dark Ages the kings and other royalty were likely living pretty well.

Suyog: "Perhaps people have adjusted by trading their SUV for a Prius, but that is still BAU and shows that it is possible to adjust without leading to a collapse."

I seriously doubt this substitution has occurred given the VMT data and lack of other supporting sales data. It's more likely that the people who've been laid-off, under-employed, early retired, etc have been forced to cut back. When they dropped off of the radar they left more resources for the ones who weathered the first step down. It's basically a perfect "Catabolic Collapse" sequence.

http://thearchdruidreport.blogspot.com/2011/01/onset-of-catabolic-collap...

And of course, the average annual Brent price--which is far more indicative of what consumers pay in a given year, even in the US--was $111 in 2011 and $112 in 2012, versus $97 in 2008. Even with the current decline, the current Brent spot price is at about the same price as the annual 2008 price.

And if we look at monthly data, the monthly Brent price has exceeded the 2008 annual price of $97 for 25 months so far--every month since January, 2011, except for June, 2012, when it fell to $95, versus only six months in 2008 when the monthly price exceeded $97.

In response to suyog's comment:

Not sure about your neck of the woods but here in New Jersey I see increasing numbers of rickety bicycles usually with no lights riding narrow or non-existent shoulders on the sides of busy roads. Indeed one of my neighbors who can only afford 1 car has to ride his bike or take a 1 1/2 hour transit jaunt due to our terrible connections actually running Green transit to get to work so his wife can have the 1 car they can afford.

There are closed stores all over, in particular along exurban highways and strip malls. When they were interviewing young people at the height of the Occupy movement a number of them said they had to stop attending a more affordable community college when their car broke down and they could not afford to fix it and had no option to get to school without a car in the Auto Addicted USA.

A number of neighbors and friends have lost their permanent fulltime jobs and are moving to a series of projects if they can find work at all. Interestingly one neighbor a former manager and technical expert in the graphics printing industry has transitioned to house painting after his whole company closed down. Kunstler's "World made by Hand" in action I suppose...

The concern is how good the EROEI of solar thermal electrical plants actually is. That's what high investment costs really mean, you need a lot of energy to build those plants, very large compared to how much they generate every year.

So it does depend on how long their useful life end up being, if it's long enough, and if maintenance is low enough, then yes they are a significant gain.

But the trouble is that as soon as you need to add storage, the cost booms, which means the EROEI drops. The experience of Spain is quite worrying, their CSP plants are horribly costly compared to the amount of energy generated.

So in order to get more for each invested dollar, it's better to focus on areas where the solar energy can be directly used than generating electricity. Desalination plant can be a good option.

Once Upon A Time: The USA was the leading exporter of oil, yet there is no discussion of the economic downfall for the USA's Common Man since that ceased to be the case. I suggest an inward look since the USA is in no ways immune from all the negatives generated by oil extraction--political, social and economic. A look at how BP and Exxon have fared at the hands of the US government recently provides several distinct examples of those negatives.

I tried to look at when the US has been an oil exporter. As nearly as I can tell, it was prior to 1912, and also in the period between 1930 and 1947. The records kept in the early days were not all that good. Data for crude oil is available, but only partial data for products exported made with that oil.

The US was able to build its roads and electrical system, using the energy provided by oil and coal. It was also able to collect considerable taxes from energy industries, since they could make energy so cheaply. Now, the energy industry is far less efficient (since we extracted the easy-to-extract oil first). The government is now "hurting badly" and would like someone to tax. Oil companies are one of the few who can't hide offshore.

There are no easy answers, that I can see. We can't live with oil; but we can't live without it either.

There is also Indonesia which departs from the pattern by continuing to increase population and the consumption of crude oil

as their production declines and imports increase. From the Energy Export Databrowser:

Google Public Data Explorer: World Development Indicators: Indonesia Population

Google Public Data Explorer: World Development Indicators: Indonesia GDP per Capita Growth (Annual %) It is about 5% / year.

--

Indonesia: 138.6 people/km2 of land

2,700.6 people/km2 of water

Source: CIA World Factbook

Indonesia is a very large exporter of natural gas, coal and of wood (that they are cutting down in an unsustainable fashion from their virgin forests). These other energy exports have softened the blow of losing oil exports. They also did not export much oil to begin with, relative to the size of the economy.

I find the word "Exporter" a bit odd. Nehru once said, of Saudi Arabia in the 40's, that the reason it was so backward was that it "wasn't exploited by the West". The Saudi Oil Fields, as well as the country itself, was developed largely by Exxon as well as a dozen large Western Conglomerates. They did this to supply gas stations in the US and Europe. Exxon didn't think of SA as an exporter. In 1982, I can assure you, thre were VERY FEW Saudi's working in the oil industry.

To piggy back on your data, these countries evolve governments based on local culture. The problem is OUR culture developed their economies but eventally THEIR culture takes over. In the case of the Saudi's, this had led to a situation that is beyond weird. On the top, you have a Royal family that has a huge skimming operation,a massive "Sovereign Wealth Fund" that the people can't touch. The guy I worked for in Dhahran in 1985 lived in San Diego.

On the other hand you have Mecca and the Whabbi's. This sect, which basically promotes worldwide terrorism would be tiny without the financial support of the Royal family.

In cases where the political and economic systems do not evolve together, you eventually come to a tipping point, whether that "wealth" be from oil, banana's or, as in the case of Cyprus, borrowing. Our worlds "systems" are really developed by engineers but are run by politicians and economists, politicians being narcassistic populists and economists, basically, simpletons.

The infrastructure built by Exxon, Bechtel and GE to service American gasoline customers, from drilling to shipping to refining, water injection, roads, electricity, rail.. are mind numbingly complex. When the oil begins to run out, the problems are left to be solved either by bean counters or members of the flat earth society.

The older I get the more I realize that "control" is an illusion. Politics is an epiphenomenon of economic systems combined with culture. These things grow together not unlike mice and foxes. But when they have an external source of growth, it's always a train wreck waiting to happen. Heaven only knows what horrors will be cast on countries like Egypt and Saudi Arabia when the manna foreign lands ends. In nature they would simply go extinct.

Thanks for your observations! I am afraid you may be right. I agree from what little I have seen of oil and gas installations that they are mind-numbingly complex.

You are also right about our current systems being developed by engineers, but are being run by politicians and economists, each with very serious knowledge level and motivational deficiencies. As you say, the oil exporters are kind of a train wreck waiting to happen.

There are enough analogies to the US and the EU though. Our politicians and economists aren't any better. I don't think the "train wreck waiting to happen" situation is unique.

Egypt is not the same culture as Saudi Arabia by far, with a few less autocrats directing them they could have been in a much better situation today.

Unfortunately that does little to help them solve the huge energy supply deficiency problem they are currently in front of.

I think the gist of this article can be best summarized with: Well duh!

Obviously if you "develop" an economy and grow a population around unsustainable resources, and even worse, energy resources, then why is anyone surprised when things fall apart when that resource gets depleted?

Somehow economists have managed to delude themselves into believing in pixie dust fairy tales and magic unicorns, how technology has somehow separated us from the laws of nature that are so blatantly obvious to anyone with more than 2 neurons allocated to understanding what's going on. Economists think that economic growth is good because it builds out infrastructure and raises people's standards of living, to "develop". The error they make is not understanding that this new infrastructure requires greater energy to run. So we're even worse of than we were before as a result of this "development".

Not to worry, technology will save us, as it responds to supply and demand. If the market demands more resources, then suppliers will produce more. Oh wait, isn't in the first law of thermodynamics which strictly prohibits energy production?

You think of way too many details, for most economists to ever consider. The situation is truly amazing.

Those oil production versus consumption charts are really damning! As soon as you go from exporter to importer, you are in for a world of hurt as you built you economy based on a massive subsidy. Every one of those nations has exploded into turmoil right as they started to approach that point. There is no more massive influx of cash that could be used as patronage and a way to pacify the angry public.

I wonder if the same is true of the UK right now. Some people point to them with their triple dip recession as an example of austerity not working. But I think they might not be a good test case since the peak oil issue is probably causing some of their problems. It was much easier when they make money exporting oil. Now they have to pay $100/barrel to import it. That is a whipsaw of change that is going to affect any economy.

The UK economy is pretty large, but becoming an oil importer certainly isn't helping the economy.

Well the UK, like Egypt had rioting on the streets when it went into import from export. And they also suffer under the illusion that politics is divorced from resources. Building on Jon Callanhan's work here's a summary of Thatcher and her following PM's careers that can be characterised like this:

How Thatcher got away with it, why Cameron can't, and what Blair wasted:

http://transportblog.co.nz/2013/04/12/oil-dependancy-and-the-wealth-of-n...

Yeah, although we think we are so sophisticated with out iPads & cellphones, people just don't realize how much of modern economies are literally based upon buried treasure that we need to keep digging up. Buried treasure that is finite and running out in some places thus causing them huge economic headaches.

But no one seems to figure that the lack of buried treasure and they instead trying blame interest rates, government spending (or lack thereof), China, etc.

Why wouldn't it be?!

http://i289.photobucket.com/albums/ll225/Fmagyar/OILELMGB_zps9b2c86a7.jpg

Its certainly time for Middle East and North Africa countries to start eliminating their oil consumption.

It's perfectly possible - so much of their oil consumption is for electrical generation (either with central plants or with local diesel generators) that can be replaced by cheaper solar.

China's E-bikes sell in larger volumes than ICE cars. Cairo would be much cleaner and quieter with EVs (it's almost impossible to sleep in downtown Cairo, if you're not used to the noise...).

Most of the fuel and food subsidies are wasted, as the majority of fuel is used by the middle class, not the intended target, the poor. They need something more efficient, even if a bit more complicated, that would provide income for the poor rather than subsidize highly inefficient consumption. Everyone would be better off.

On the first Russian oil peak and what the SU brought down:

[The former Australian Prime Minister] Howard said the Iron Lady, along with Ronald Reagan and Pope John Paul II, brought about the downfall of the Soviet Union "which is the single most transformative political event in my lifetime".

http://news.smh.com.au/breaking-news-world/celebrations-show-thatchers-w...

My comment:

It was lack of growing energy, not political speeches. East European countries were completely dependent on oil supplies from Russia as they did not have convertible currencies to buy oil on global markets. When West Siberian oil fields peaked in the mid 80s Russia could not increase oil supplies to its satellite states. So these communist economies - not the most efficient anyway - stalled. In particular, East Germany was under pressure as the public compared their living standards with those in the West, where oil was imported freely using the strong Deutsch Mark. Gorbachev had visited the oil fields and knew about the problem. The 1986 nuclear accident in Chernobyl was another blow. It showed that the design of these power plants was fatally flawed. So it was an energy crunch which brought down the Soviet Union. The most transformative event under energy illiterate Howard was the global peaking of conventional oil in 2006, which he missed - although first warning reports were published when he came to power 10 years earlier. As a result, his Resource Minister made wrong decisions to export Australian gas, instead of developing this precious resource as alternative transport fuel to replace oil. This irreversible legacy will one day put Howard on the wrong side of the history ledger.

Numbercrunching is here:

4/10/2010

Russia's oil peak and the German reunification

http://crudeoilpeak.info/russia%E2%80%99s-oil-peak-and-the-german-reunif...

8/7/2011

"Yes, Prime Minister", peak oil 2006 under your watch

http://crudeoilpeak.info/yes-prime-minister-peak-oil-2006-under-your-watch

6/5/2012

Howard's wrong decisions on offshore gas exports start to hit transport sector now

http://crudeoilpeak.info/howards-wrong-decisions-on-offshore-gas-exports...

I believe part of Yemen's decline is because of militant and terrorist activity in the region, crippling their oil facilities to result in near nil exports?

In any case, that country is a ticking time bomb. They shot themselves in the foot when they gunned for Iraq during the Gulf War, which led to ostracization and general isolation from the rest of the Arab world; Saudi Arabia in particular deported several hundreds of thousands of Yemeni nationals (labourers) from its soil.

Yet Yemen is today surviving on oil grants from KSA themselves. After all, it's in Saudi interests to keep the country stable - who wants a massive refugee crisis anyway? Similar to why it is in our interests to keep Pakistan stable (I'm Indian) and compensate it from being squished on the other end through an even more unstable Afghanistan. For a Pakistan that has crumbled into pieces would only mean large scale turmoil on our own land in one way or another.