More on Natural Gas

Posted by Heading Out on November 21, 2005 - 10:48am

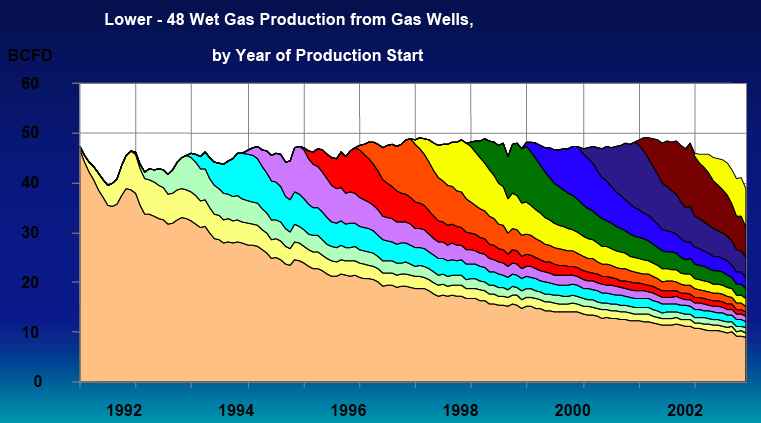

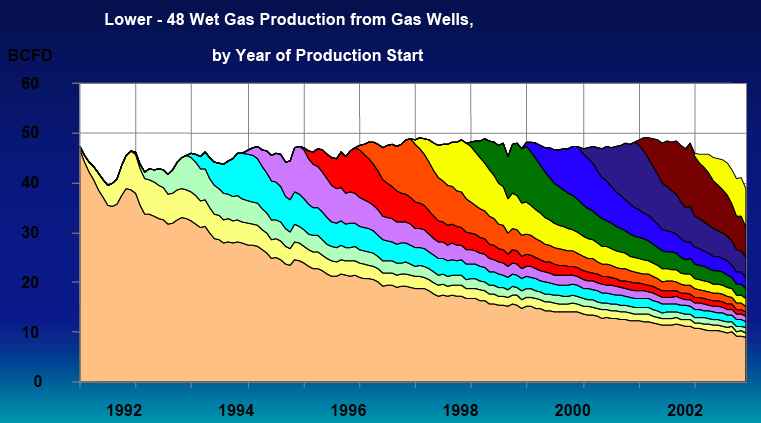

Jerome a Paris has an excellent summary article on natural Gas, with some impressive, though discouraging, graphs of production. He cites two sources that are worth following up in their own right. There is a pdf on California by David Maul, which has, in slide 10, the grim picture of the declining life of annual gas discoveries.

He also cites a paper on Texas production that covers much of the story from that part of the world. Put together they emphasize how hard folks are having to scramble to keep us afloat in natural gas. With decline rates of up to 45% the supply is critically dependant on new drilling and with smaller and smaller fields being tapped and lasting shorter periods of time, this is not a game with a foreseeable happy ending. (Thanks for the pointer jkissing)

He also cites a paper on Texas production that covers much of the story from that part of the world. Put together they emphasize how hard folks are having to scramble to keep us afloat in natural gas. With decline rates of up to 45% the supply is critically dependant on new drilling and with smaller and smaller fields being tapped and lasting shorter periods of time, this is not a game with a foreseeable happy ending. (Thanks for the pointer jkissing)

"Production of natural gas from January to September inclusive was 0.1 percent down on the same period last year, at 465 billion cubic meters. In September 2005, natural gas production dropped 5.2 percent compared with September 2004, and it dropped 2.8 percent from the previous month.

According to Russia's energy ministry, 468.928 billion cubic meters of natural gas were produced in Russia in the first nine months of this year, 0.66 percent more than in the same period of last year."

(http://top.rbc.ru/english/index.shtml?/news/english/2005/11/10/10165934_bod.shtml)

So not much LNG from Russia in the future, neither for Europe to compensate for the loss of North Sea production.

This has direct bearing to the US gas situation because part of the LNG should come from Russia. Where do we have free new gas capacity to provide for the LNG? In the Middle East, mostly. The more likely scenario is the gas-using industry to move out from the US - as it is right now. This might have far deeper economic consequences than oil prices.

This is my gut feeling on the figures given how inaccurate numbers are bandied about as proven fact. Has Russia got large amounts of natural gas? Yes. Is it is large as reported (1694 Tcf)? Probably not. Will all of that total reported reserves of gas, be drilled and supplied to the markets in the East and West? No. That is not to say that Russia has large amounts of natural gas, but will it be feasible to extract the gas and bring it to market?

I have also noticed (probably along with most TOD readers) that USA has had about 9 to 10 years reserves of natural gas for the past several years and it looks like it will have 9 to 10 years reserves in a few years time as well.

Because NG was cheap in 2000, a lot of new gas-fired power plants have benn built. It demonstrates that market mechanisms alone are not enough to solve our energy problem. Very often, short term views prevail leading to bad choices.

In the face of global warming our uses of electricity need to be scrutinized.

See article 'Plugged in to Global Cooling'

The "hockey-stick" diagram, the poster child for the IPCC's claims about global warming, certainly seems to be based on scientific fraud.

My passion for the environment is not solely based on my love of nature. It is based on a selfish desire to live my life in a world free of man made contaminants that are poisoning us and the rest of the life we share our planet with. My world view is based on the premiss that everything in our universe is interconnected. We all know that trees and other plants do convert carbon dioxide into oxygen. Deforestation and poisoning of the soil and water diminish the ecosystems ability to process all of the excess carbon dioxide we have been spewing into the atmosphere. I know this is an overly simplified version of the reality. The reality is much more complex......

This line of thinking is enough for me to believe in Global climate change. Am I making to many assumptions? Are my observations faulty?

Disclaimer:

I am an artist not a scientist. My beliefs and opinions are grounded in personal observation, study and intuition. This line of thinking is enough for me to believe in Global climate change.

The low price of NG was not the only reason utilities went with gas turbine generators when adding addtional generating capacity - the other reasons being lower relative capital costs, minimal air emissions problems, and short construction lead times relative to coal-fired plants. Overall, the economics were quite favorable, and from a purely economic standpoint they were the right decisions at the time.

However, look at the pickle we are now in regarding tight NG supplies. This is a perfect example of how short-term economic decisions don't always lead to the long-term correct decision. The 'market' can only be trusted to handle the short-term, not the long-term.

And until about 2000, the energy industry truly believed that we had hundreds of years worth of natural gas. They knew about depletion, and after what happened with oil, they surely knew it would happen with natural gas as well...but they honestly believed that it was decades, even centuries distant.

That's what I find really scary. They didn't see it coming, even with the best technology money could buy, and more info that we have about any other area on earth. If they didn't see the peaks for U.S. oil or North American gas until they hit them, why should we believe them when they say we have hundreds of years worth of coal left...or that Saudi Arabia has hundreds of years worth of oil?

BTW, originally they had lots more natural gas fired power plants planned. They were cancelled, at a cost of millions, when they realized they wouldn't have any fuel for them.

This pretty interesting, and kinda related.

Some links:

http://www.sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive/2001/06/04/BU85569.DTL&type=te ch

Exodus' Bay Area operations consume 12 megawatts of electricity -- as much as 12,000 houses. And data farms typically rely on diesel backup generators in case of a blackout, which generate more pollution than most power plants.

http://www.io.com/~stack/viridian/archive/2001_03_18_viridian-archive.html

A giant server farm can suck up as much energy as a steel mill. Seattle, Austin, and Phoenix are all experiencing over ten percent growth in power demand annually.

http://www.kingcountyjournal.com/sited/story/html/37943

Twenty-seven or more Internet ``server farms'' proposed for the area could consume nearly as much electricity as Seattle and greatly magnify Northwest energy problems within two years.

On the other hand, had they listened to Matt Simmons, they'd have known that depletion was a big issue, and a rather unlikely explosion in the rig count was required to match demand, and that therefore prices were likely to rise a lot. Just as they did.

Depends on what horse you were riding.

Clinton/Gore made NG-fueled generators a campaign plank in '91. Wall Street jumped on it because NG/CCGT and dereg looked like a fast buck. The environmentalists signed off because it looked better than coal and nuclear. So long as there was plenty of cheap gas, it did have appeal I will grant.

From my position inside the nuclear utility business, I always saw it as a short term fix - a sugar rush. I argued with management when the rush began back in the early '90s about it all blowing up in our faces and it did. My former employer is just now getting out of bankrupcy.

Mr. Maul's powerpoint needs to be understood within the context of California politics. Arnold is behind LNG terminals but the guys at the California Energy Commission (CEC) where Maul works are not about to give Schwartzenegger any support or ammunition. The CEC has been living in a dream world since birth and has yet to understand or recognize the energy needs of the state. Note that there is hardly any mention of Alberta or its depletion rates - we get about a quarter of our gas there.

The Rockies do offer hope for a big gas resource for us but Clinton locked most of it up and what's left is being drawn to the East - Kinder Morgan has announced a big new pipeline for Wyoming to Chicago to tap into the gas that California has been thinking was for us - another point Maul ignores.

It sure seems obvious to me that California needs a bunch (4?) new reactors and we needed to start last year. And that's in addition to Arnold's LNG terminals.

Here's my take on California's energy situation:

http://www.energypulse.net/centers/article/article_display.cfm?a_id=788

http://www.icdp-online.de/sites/mallik/index/

Gas is easy to produce because if you put a piece of pipe with holes in it through a permeable rock formation with gas in it, and you keep a lower pressure in the pipe than in the formation, the gas will flow into and up that pipe.

Now lets look at gas hydrates. They are a solid in the ground. They occur in commonly non-permeable, mud-rich formations. To produce them you first have to figure out how to convert them in-situ from a solid into a gas which involves a wholesale change of the pressure and temperature conditions in the ground, then you need to get them to flow through impermeable layers to a wellbore.

Or else you can try to mine them. Your choice.

Are the latter discoveries just smaller, or are they being extracted that much faster and more efficiently.

Is this sort of picture characteristic of a region that is overall in the tail of its overall production?

-P

to the equivalent of $19 per million British termal units.

Provide source of your info of UK gas price, please.

http://www.bloomberg.com/apps/news?pid=10000102&sid=ac4mzZuZcylQ&refer=uk

We live in Michigan. Are LNG imports only for those who live by the ocean? Or is the US just one big pipeline?

Is LNG more costly than NG from the Gulf?

I guess that is three questions.

Thanks,

Rick DeZeeuw

eventually they will convince the regulators to grant them a surcharge to make them profitable again.

http://www.consumersenergy.com/welcome.htm?/eninfo/index.asp?asid=484

Consumers Energy Natural Gas Operation Statistics

Total Gas Customers 1.6 million

Residential (# of homes) 1.5 million

Commercial 110,000

Industrial 10,000

Counties Served (see Service Territory Map) 44

Annual Gas Deliveries 245 billion cubic feet

Purchased from supplier pipelines 230 billion cubic feet

Purchased and produced in Michigan 15 billion cubic feet

Record 24-hour sendout (Jan. 18-19, 1994) 3,184 million cubic feet

Average Annual Residential Use 109,000 cubic feet

Pipeline Distribution 24,000 miles

Pipeline Transmission and Storage 1,800 miles

Storage Field (working capability) 130 billion cubic feet

Rick

Did folks here go all the way through Maul's pdf document? from which I quote a bit --

Slides 6,7 -- West likely to have a moderate winter

Slide 11 -- California has ample surplus infrastructure capacity for this winter

Slide 14 -- California inventories are high

Slide 15

- NG fundamentals don't appear to support current market prices

- Other drivers have been used to explain current market price levels

- California is planning to pay higher prices

Slide 21 -- Fundamentals: Western supply, demand, and infrastructure look good and don't support current level of market pricesHere's a link again to that NY Times article Chilly forecast on natural gas. California is not mentioned but depending on the weather, shortages elsewhere are possible. We're about to get hammered in the Rocky Mountains, the Northeast, the Southeast and the Midwest but not in sunny California. There weren't any hurricanes out there! Supplies are ample. It's not their fault but they're paying the price. It's every state for itself.

The part I have trouble with is the next bullet point on slide 6 says "Snowfalls have started early...". Now, I don't know much about weather forecasting, but I would not think "Moderate Winter" would go with "Early Snow".

Lots of snow means lots of hydroelectricity when it melts in the spring and summer. We had a very wet winter last year, too. Huge spring flowerburst in the Mojave Desert after that wet winter.

On the other hand it didn't snow worth a damn last year in the Oregon, Washington, British Columbia, Idaho Columbia river basin and they are hurting a little for hydroelectricity. California imports electricity from the Pacific Northwest, so it evened out.

"Clearly the industry will need higher prices if it is going to sustain production with new drilling."

But, the US has already made the switch from 50% of rigs looking for gas to 90%. There are no idle rigs - if you are lucky enough to get one coming off lease it is because you outbid somebody else. Higher prices may come, but the higher prices will not result in much more production.

BTW, the paper shows current wells are producing a total of around 1bcf. My largest E&P investment is gmxrw. This small gas company is drilling in Texas' Cotton Valley "tight sands" just as fast as they can. Their results are around 1.1bcf/well, quite consistent with the paper.

They are desperately trying to find another rig or two as they try to take advantage of current high prices. Their jv partner may have located one short term, which they will share. Rigs are tough to find.

How is CA natural gas storage for this winter and what are the weather outlooks for the country?

Slatz

(a) reserves

(b) depleion

(c) cost of replacement ?

Cost of replacement is somewhat murkier, and grows as all reserve assets grow with climbing resource price and/or higher finding costs (drilling rig rental rates are near all-time highs, much to the delight of drilling service companies and their stockholders). Companies do report what they paid for reserve additions, or the cost to increase their "organically grown", or those found "through the drill bit" on existing properties, also found on the year-end statement and, for assets purchased during the year, in the quarterly statement.

Most companies use the calendar year, and these will announce the latest reserve and production changes between mid-january and end-march. For resource investors, this is the most exciting time of year as the investors critically compare their stocks against others.

The only place in America that has the ability to absorb lots of salt water in the creeks without pissing off the farmers in Alaska. Which has plenty of conventional natural gas.

http://www.ngvc.org/ngv/ngvc.nsf/bytitle/supplyfactsheet.html

Why would they state this??