Bringing the OPEC production numbers per well up to date

Posted by Heading Out on December 18, 2005 - 12:52am

There are a couple of comments, however, that make these numbers only a guideline. Firstly there is a big difference in some countries between the flowing and the artificial lift. The obvious example is Indonesia, where the ratio is around 9:1 for artificial lift. This had significantly lowered the oil/well numbers relative to those that Matt Simmons quoted.

The second difference relates to Saudi Arabia. The confusion there relates to the Neutral Zone, between SA and Kuwait. The oil for this is shared, and the share shows up in the production of each country. However the number of wells and rigs are separated out for that zone. I included them in the Saudi number - since SA is tagged to the zone in the table, but it may not be totally accurate. But you know the assumption.

First, is the amount of oil per well before or after Gas Oil Seperation Plant (GOSP), that is, discounting the water and associated gas that passes through the well head but then has to seperated by GOSP?

Secondly, water injected. If there has been any educational benefit to us all, (even those who do not accpet the overall premise) of Matthew Simmons' book, "Twilight In The Desert, The Coming Saudi Oil Shock And The World Economy", it is to point up just how wide a band production of an oil field can be manipulated by varying the amount of the water injected.

Allow me to quote a fascinating excerpt from the book itself, these remarks regarding the "Berri" oil field, one of the "royal four" super giant fields in all of Saudi Arabia,

"Following production startup, the high initial reservoir pressure went into rapid decline, falling from almost 4,000 psi in 1970 to 2,600 psi in 1973. At this rate of descent, the reservior would have reached bubble point pressure within two years. To prevent this, a peripheral water-injection program was began in 1975.

The water-injection program enabled a significant increase in production at Berri:

*Prior to water injection,Berri produced 155,000 barrels a day in 1973 and 300,000 in 1972.

*After water injection began, production rose to 800,000 barrels a day, in 1976." (Simmons)

Note the spread: 300,000 to 800,000 barrels a day!

With water injection, the pressure was driven back up, so the need for extra wells was reduced greatly. Each well could still produce at full output on the retention of very high reservior pressure. A "well count" would have been completely useless in explaining the status and the health of the Berri field.

To demonstrate this, and to sound the sad warning, let us just go ahead and finish the paragraph from which the above quotes and numbers were cited:

"In 1977, less than two years after the start of the injection program, water began to break through in the first row of producing wells nearest the flood front. Initially, the completions in the wet zone were plugged off, and the wells were recompleted in drier zones higher up the wellbore. A moderate amount of water production could be tolerated in each well once wet crude handling facilities were installed at the Berri Gas & Oil Seperating Plant (GOSP) For some time therafter, the typical water cuts stayed around 20 percent, although the flood front was advancing rapidly to the crestal area."(Simmons)

Now you see why I stressed the "before or after "GOSP" issue. This is not some minimal thing, of only a few percent. Notice that in this case A FULL FIFTH of the oil passing through the wellhead would have been water, and had to be shaved off in the GOSP (!!) Some say the water cut in many mature Saudi fields may be as high as one third now, or 33%.

Let us close with the obituary for a peaked and declining field: "The available record of Berri's production history contains the following benchmarks:

*In 1976, Berri's output peaked at 800,000 barrels per day and then began to decline rapidly.

*By 1981, when Saudi Arabia's overall oil output peaked, Berri's production had already fallen by 30 percent.

By 1990, 25 percent of Berri's producing wells had totally watered out, choking off the oil flow and forcing Saudi Aramco to shut in the wells." (Simmons)

That folks is what "peak" and "oil depletion" really look like out at ground level, in the oil fields. The above is certainly being played out all over the middle east and the world at this moment. Witness, the recent adjusting of water injection and drilling volume of the "Burgen" field in Kuwait, in which in a matter of months, the output was "adjusted" by first, 5%, then 10%, the 20%, before Kuwait Oil Company announced that Bergen was peaked, and would never again deliver more than 80% of it's former top production, and all indications is the production will continue to drop, and if known history of peaked fields holds true, the decline will accelerate quickly. Now recall, this is the second largest field in the world, behind only Ghawar in Saudi Arabia.

Water injection boosts reservior pressure and greatly boosts production from a given set of wells. It also reduces the warning time to nearly none, as peak nears.

Some say that the issue of oil depletion in general, and Matthew Simmons book in particular are too complicated and hard to understand.

Sadly, it is all too easy to understand.

http://theoildrum.blogspot.com/2005/08/updating-saudi-oil-production-plans.html

They clearly believe no increase in production from Ghawar is possible, but won't publicly say so in the way Kuwait finally acknowledged the peak of the Burgan field. The question we (and probably even they) don't know is how fast Ghawar's decline will be.

In my mind the problem for forecasting is this. Hubbert's peak and curves are based on the Texas model. Lots of wells, lots of decreasing production of liquids over time. This gives the nice (nearly normal) distribution of extracted oil liquids. A peak in the middle with long declines.

The water injection fields and wells will not produce this kind of normal distribution. It will be more of an upslope to a long plateau with a cliff drop off of depletion. The volume of liquids is pretty much maintained throughout. But once the water cut gets significant the oil liquids extraced drops much faster than the west Texas model would predict.

These water injection wells don't give us enough time to deal with declines. They just go from high producers to no producers in a few years. If policy makers think (believe, predict, etc) that wells and fields will decline like west Texas but many will really decline like the Berri field above, we are in a world of trouble.

This is my fear. Too many people are complacent based on declines documented with the U.S. data set. Not enough thought that things might be different the next time around. Even when the North sea field shows what can happen. That data set is ignored because it is an offshore field, with problems conviently laid at the feet of technology other than water injection.

Jahnsen told Energy: "Everyone knows now that the only way to increase oil production worldwide near-term is to get rid of the water. Environmental objectives are being achieved by default ... it has nothing to do with clear-headed management of the problem. This has become a water industry. Oil&gas is just a small part of it.

"For example, I'm working a lot with Saudi Aramco. Their problem is that they have four or five fields that are more than 50 years old. Process plant is designed for a water-cut of maybe up to 30%, but they have 70% and 90% water-cut in some places.

"Re-injection is one solution, but it's problematic and not as popular as it was a few years ago because some reservoirs have been ruined as a result. Installation costs are huge, too."

http://www.kenai-peninsula.org/content/view/249/79/

Name the largest field to be ruined by Water Cut to date-that's what I want to know, oh, and where BP's ThunderHorse platform is.

It kind of shows you how desparate they've become!

I seem to remember Matt Simmons saying something about parts of Ghawar producing over 65% water. In his book he said that the Saudis had the largest water extraction plant in the world.

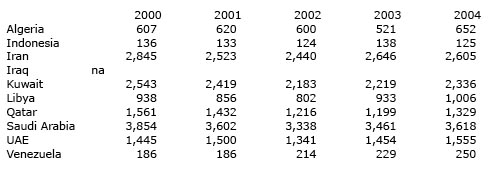

Looking at the table HO posted one would reasonably infer that well production is robust and holding up well. W have several conclusions that can be drawn:

- well production is good and reflects solid continuing production

- as above and more wells = more production

- enhanced recovery is skewing the data and there will be a price (faster decline) to pay

Your conclusion will not be based on the data in that table because it supports none of the above at the expense of others. If anything it is most supportive of the second, most optimistic, option above.I would say that well productivity, in the near term at least, provides little indication of what will happen. But we should continue to monitor it, it will help explain things after the fact, maybe.

Water. Lots of unknowns here, too. We know it is done and increases production rates. Beyond that we know very little. I guess we intuitively and logically feel (and there is some data) that it makes subsequent decline rates faster, perhaps much faster. The 95% cut from a North Sea field is no surprise - keep pumping while the economics work.

Ghawar is maybe the key experiment and no one is releasing enough data for us to work it out. I'd be surprised if they did this side of peak oil. I am suspicious by the big upsurge in demand for drilling rigs etc from Saudi, my guess is it fortells problems.

So, we will be in the dark until too late maybe. All I can say is: do your own risk analysis, you can't trust your government (or anyone else) to do it for you.