Further to your comments on Gazprom

Posted by Heading Out on October 22, 2006 - 11:59pm

UPDATE: The situation may be a little more critical than I had thought according to the new article from Radio Free Europe .

EES head Anatoly Chubais is concerned. He has placed the blame for the potential gas deficit squarely on Gazprom, which controls 25 percent of the world's gas reserves and 94 percent of Russia's natural gas. Chubais has said that Gazprom is unable or unwilling to supply generating companies in Russia with enough gas and this has forced them to buy more-expensive diesel fuel to power their plants. . . . .Chubais told the "Vedomosti" business daily on September 28 that when he met with Gazprom CEO Aleksei Miller to discuss this problem, Miller told him to switch to other fuels.

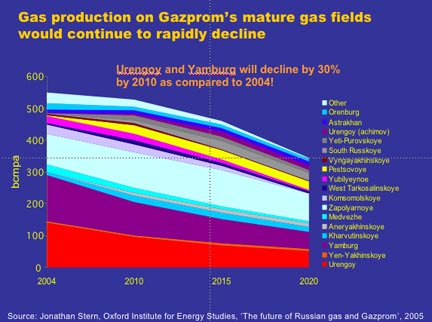

He looks at production from the major fields in Russia, and gives a plot that looks remarkably like some plots we have seen of production closer to home.

The concern that is expressed is that Gazprom is not making the investment in new field production that is required and that, for example, the 3 Yamal fields that should have been starting production in 1995, are now apparently not slated to appear on line until the 2011-2012 timeframe. Given that we have seen other project deadlines apparently slip, then the concern again begins to arise as to the reliability of gas in the shorter term.

This is a concern in Russia also, on Thursday President Putin gave a deadline for a plan to forestay a gas crisis. For while energy demand has, until recently been growing at 2%, in the last nine months it has jumped 4.8%. As the BBC note

According to the International Energy Agency, Gazprom has commissioned just one new gas field in 20 years.There is a concern that Gazprom is investing too much overseas, in places like Bolivia and Venezuela, while neglecting the home front. Given that Russia continues to allow Gazprom the ability to deny its pipelines to its competitors, and that Russia is still very loath, if not increasingly so, to allow foreign access and investment, perhaps the future is growing dimmer faster than we had thought.And it says that could lead to a shortfall because three of the company's most important fields here in Western Siberia are now in decline.

"There could be quite a large gap between what Europe needs and what Gazprom is able to produce, assuming there is no investment in new production," one analyst told the BBC.

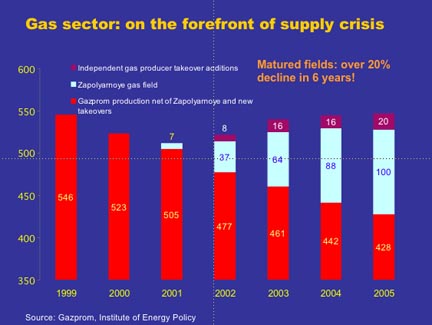

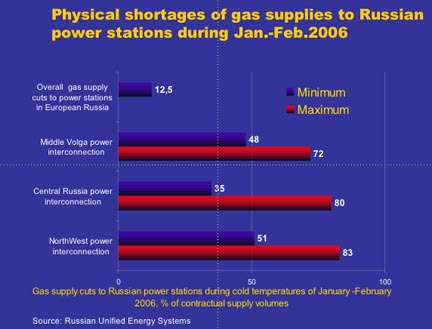

October is rather late in the year to have to be trying to ensure this years gas supply, and when one considers the shortages from last year, one can imagine that some mayors over there might be anxiously concerned that this year may bring more worries. The numbers from last year, as reported by Milov, are not encouraging, and they don't make me a Russophobe.

Space and time doesn't let me do more than direct you to the rather lengthy but very detailed different view of the situation that Don in Colorado pointed to, which gives a more global view to what is going on in Russia.

Crafty also has a lengthy and detailed review, which is less optimistic about Yamal than some, and concerned about Shtokman. It's a pity that it was so far down - so go read, if you haven't. And be amused by Putin's Smile.

And again, thanks to everyone for the comments, they are all appreciated.

Which leads to once again... how many years till nations start to deny any exports of oil and gas?

Once the public comes to grip with depletion...and peak, there will be a realization that if they sell their oil and gas they are selling their future....better to hoard it all as long as possible.

Do you think the Canadians will be happy they sold their treasure of gas for a few dollars 20 years from now?? When they have no gas for heat??

They will be pissed off.

And when the nations start down the road of resource hoarding is when WW3 stars in earnest.

I think about that here in Arizona, where folks in Phoenix and Tucson and Yuma use Canadian gas to dry their clothes, even in the summer, when the air outside is about the same as the air inside the dryer.

Someday the Canadian gas will run short, and they will be cold; while Arizonans will actually have to step outside to hang up their clothes to dry.

The question to me isn't whether we can go about doing things in different ways, it's a question of whether people will realize it. For example, when gas is $5 a gallon will people slow down and drive 55 MPH for better fuel economy, or will they still speed down the road at 85 MPH paying the equivalent of three times as much on fuel?

Marco.

"How dare Russia not invest properly. Don't they know it's our gas?

Marco."

It's a bit bigger and more complex than that:

Russia is coming to the breakpoint, and are going to have to decide whether they want to be seen as a "reliable supplier" or whether they want to go "nationalist" and retain their gas for themselves, and/or use it as a political weapon. This is very important.

Russia has the right to take the nationalist path, as does any nation. But if does, it cannot be considered a reliable partner and supplier in long term contracts and obligations, which is the stock in trade of a reliabel resource provider. This is what all nations with energy resources are going to have to decide. In two of the three posts, prior this one, the subject of 'resource nationalism" is being touched on, and has been touched on often on TOD.

However, we must remember that gas/oil in the ground does not provide income. And no nation can burn it "now" in the immediate sense, so they are left with a decision, that being whether to sell it abroud to help raise cash, or to hoard it, and do without the income. As of this moment, there are other competitors out there who are willing to or must sell oil/gas for income. If a nation takes the "hoard it" path, or attempts to play politics with the resource, they will quickly be seen as unreliable as an energy provider in the short term.

This is particularly important in the case of natural gas, because if a supplier proves "spotty", they can create a catastrophic failure for their customers, even a deadly one. If in the heart of a record winter, the gas supplier decides to flex it's muscle, or has a massive supply failure due to lack of commitment and investment, they can literally freeze their customers to death.

One thing is certain: No nation can have it both ways. This is what OPEC and the Saudi's found out in the 1970's, when they openly played the "oil card" in the Yom Kippur War in 1973. After the Arab boycott of Western nations, the Western customers went on a mad dash of investment and contracts with non-OPEC nations to supply oil, viewing OPEC as an un-reliable supplier.

It took OPEC two decades to fully recover their reputation, and they have had to make serious commitments to restore their customers. That is why they do not so easily play the oil card now.

Venezuela, despite it's differences with the U.S., has likewise been cautious in giving up its status as "reliable" supplier. After all, what else do they have to sell....likewise, our Russian friends. Have you seen many Russian or Venezuelian cars or TV's lately?

Surely an indication of how certain the markets are that nations who rely on oil and gas as their essential source of income is the latest yawn at Saudi and OPEC commitments to cut production by some 1.2 million barrels a day. The price continues to be weak on oil futures, indicating that the big players in the market not only do not believe OPEC supply is going to fall for geological reasons (i.e., peak) or logistacal problems (machinery, investment, workforce issues), they do not even believe the Arabs can bring oil/gas production down much even if they want to!

The belief seems to be that the nations of OPEC need the money that oil provides as badly as we need the oil.

Roger Conner known to you as ThatsItImout

Which is true. Look at the demographics of virtually any major oil producer.

The only exceptions would be the Gulf States (ex Saudi Arabia) and they are struggling to build a 'post oil' infrastructure eg Dubai, Abu Dhabi as their native supplies deplete. True even of Kuwait.

Iran, (Iraq), KSA, Nigeria, Venezuela all have high birth rates, high percentages of the population under 21, massive unemployment. They have no choice but to pump oil.

Russia runs the central government on oil revenues, so does Alberta and Norway.

This is also true for most of the minor oil producers.

We choose to buy the Gas from them. Why? because there is no one else to buy it from. If you do not like a shop you buy somewhere else. And if you can't then you have to lump it. Tough. Are you telling me that there is pleny of gas elsewhere? I can assure you, in Europe there is not.

"After the Arab boycott of Western nations, the Western customers went on a mad dash of investment and contracts with non-OPEC nations to supply oil, viewing OPEC as an un-reliable supplier."

So are we making a mad dash for the arctic? And can it supply 28MBPd?

"Have you seen many Russian or Venezuelian cars or TV's lately?"

No, but i haven't seen many British or American cars lately either :-).

As for the Saudi announcement not affecting price, i'd previously posted that I though there was $20-$25 riding on the price graph, so if 'they' bail we see corrections.

It will be a while before 'they' jump back on the rollercoaster again. Remember that's not the only thing recently that should have put the price up but didn't. Theres been PLENTY of bad stuff happening and no reason for let up in demand. No recession ......yet! Right now the market is defying logical explanation.

Marco.

IMHO the real stock deals are in first class oil service companies, folks like Schlumberger and Baker-Hughes. Peak oil is a reality, and they will stay busy at high rates for the forseeable future.

Russia has less leverage, long term, than it thinks.

The really big problem remains liquid transportation fuels, and whoever can make those really win.

If Putin can convince Europe and North America to go the converation and alternate renewable energy route, I think I'm going to be a Putin fan.

If say Russia decide to go national - to use their resources domestically - they can still benefit enormously on cheap energy.

They can compete in energy intensive industries, for example aluminium, and sell the products of those industries at market prices, but probably with less costs due to cheap energy. This way they can so to speak still export energy, in form of energy intensive products.

So, many countries have more income than they need and meanwhile are beginning to worry about their reserves and future production, something they never did before. Imo, opec will find it easier than ever to maintain their new quota. They do have a need to be seen as reliable suppliers, but they also see that new supplies are not materializing, and further want to restore a little clout to their org.

What made me wonder about peak oil, as compared to resource depletion, was the first explosion of 'official' crude reserve numbers back in the 1980s. Not OPEC's - it was the USGS which suddenly found literally trilions of barrels of previously unknown reserves. And we, as a society, bought into it. To imagine a company like GM building products like the Hummer models would seem to be some sort of sick parody (remember the Sux6000 from Robocop?) for someone from 1982.

I am starting to have the same vaguely disturbing feeling about how much natural gas there is just waiting to be burned, requiring no real change in how we live, just don't worry about it, the experts are on top of it, don't believe that pessimistic romanticism about limits to growth.

This is not a feeling which rules out large changes in terms of facts - after all, natural gas in all its variations is certainly a major part of the carbon currently under the surface of the planet - but something else.

The same feeling of being lied to, for reasons which have much to do with the interests of people who have no interest in you at all. And the thought that at some point, what comes out of the pipeline is the only reality, regardless of the words, contracts, or new technology. And remember, there is just a flood of new oil production waiting to come on the market any year now, any year - except that what comes out of the pipeline does not seem to have increased, while the number massaging certainly has - the 'double counting' of corn ethanol being particularly cute - the oil used in producing ethanol is not detracted from production - it is added. Yes, America is growing stronger through more insane math - if I burn a barrel of oil to produce two barrels of ethanol, I now have three barrels available - see, buy 1, get 2 means 3 barrels on hand, right? Just like how a neg-am mortgage means you are growing richer by paying less - why rent when you can pay the bank an ever growing amount of money - ah, the wealth effect. Starting to see a connection? We were swimming in oil by 1987, and we are just about to start swimming (so to speak) in natural gas.

Personally, it always struck me how the Reagan flunkies got away with the in part truly made up USGS numbers - which the Saudis still cite as proof for their own estimates - without any penalty. After all, we get to pay the bill for what we have done since that time - many of the people likely responsible for such changes are probably now upwards of 60 years old, and quite honestly, they enjoyed the last 2 decades immensely, and when they die, they don't care about such trivial questions as their responsibility to following generations.

And some people think the Baby Boomers are going to have a pleasant retirement, just voting themselves whatever they want from people born after them. Personally, I think that is just about as much wishful thinking as those USGS reserve numbers.

Gazprom's chief executive, Alexei Miller, told state television that the company did not need "international participation." Chevron, ConocoPhillips, Norsk Hydro, Statoil and Total had bid to help develop the Barents Sea field's 3.7 trillion cubic meters, or 130 trillion cubic feet, of gas, enough to supply the United States for more than five years.

The Russian natural gas monopoly also said that piped supplies of fuel from the field to Europe would take precedence over sending liquefied gas to the United States.

http://www.iht.com/articles/2006/10/09/business/rusgas.php

"Anyone that thinks Russia is going to cede any meaningful control of its energy assets to outside interests is dreaming," said Stephen Leeb of Leeb Capital Management in New York. "They're much more interested in protecting these assets long-term than they are in exploring and developing them and using them for the world's interest."

Smart, they must protect their interests over the long haul. They know how quickly gas deposits can evaporate from corruption and theft. The Russians fought for tighter controls over Gazprom in the '90s and now Lukoil better watch out too. The kleptocracy they fear most is the US now.

See the first presentation on this page (in Russian): http://www.energypolicy.ru/pv.php?id=1002396 page 22. The financial model is only in Russian. It used to be in English but this presentation has been removed.

In an essay on the Ministry of Foreign Affairs website, Norway's public information director for petroleum says that "Norway...within a few years will increase gas exports dramatically and account for 30% of European gas imports". Production at the new Ormen Lange gas field, scheduled to come onstream next October, will reach about 70 million cubic metres a day, about the same is Norway's total energy demand. When it reaches this level, Ormen Lange would add about 30% to Norway's present gas production, which the BP workbook puts at 80 Bcm.

A second reason for the projected expansion of gas exports in Norway is related to gas reinjection at producing oil wells. The need for gas reinjection is declining along with Norway's offshore oil production.

Source

Norway asks producers to maximise oil production while considering economics and technological factors. As fields decline to the point where additional oil production becomes impractical, the gas formerly used to maintain formation pressure becomes available for production and sale.

Norway's production forecast reaches a plateau around 2011. We can ask how accurate their forecast is likely to be, especially in view of Cry Wolf's recent look backwards at the accuracy of their oil production forecasts. As with the oil forecast, the gas forecast includes production from undiscovered and contingent reserves, which are those for which a production decision or regulatory decision has not been made. However, the 1999 gas forecast, the black line in the figure below, showed a similar plateau below current levels of production.

source

In short the issue is whether the Russian consumer, industrial and retail, is less powerful than GAZP. I feel that economic reality will cause;

an increase in the gas price closer toward export netback parity,

an increase in energy efficiency

Whether the corresponding slackening of control over UGGS happens is a function of the severity of the "crisis".

I believe that Chubais at UES is preparing the groundwork for a blackouts in Moscow to occur over the winter due to lack of gas - always assuming the weather plays ball.