A primer on Caspian Oil

Posted by Jerome a Paris on November 22, 2006 - 12:39am in The Oil Drum: Europe

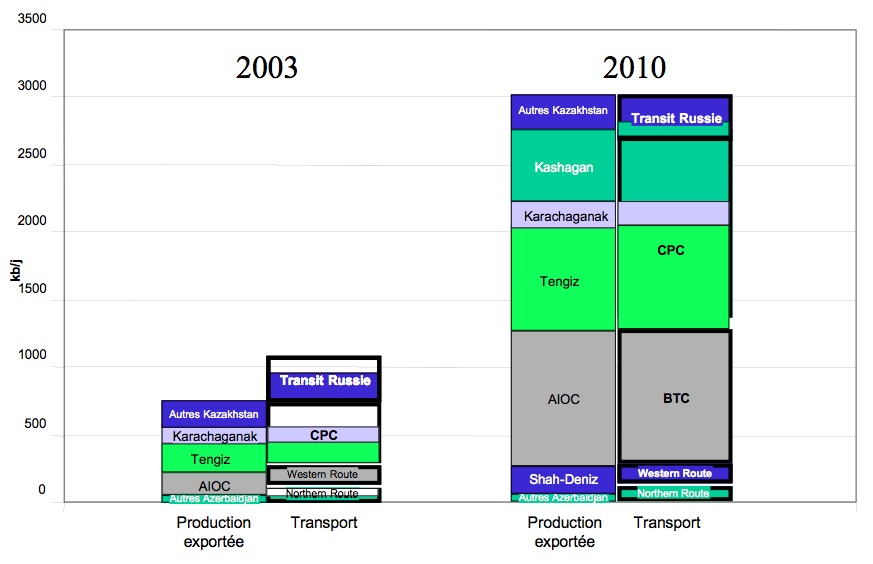

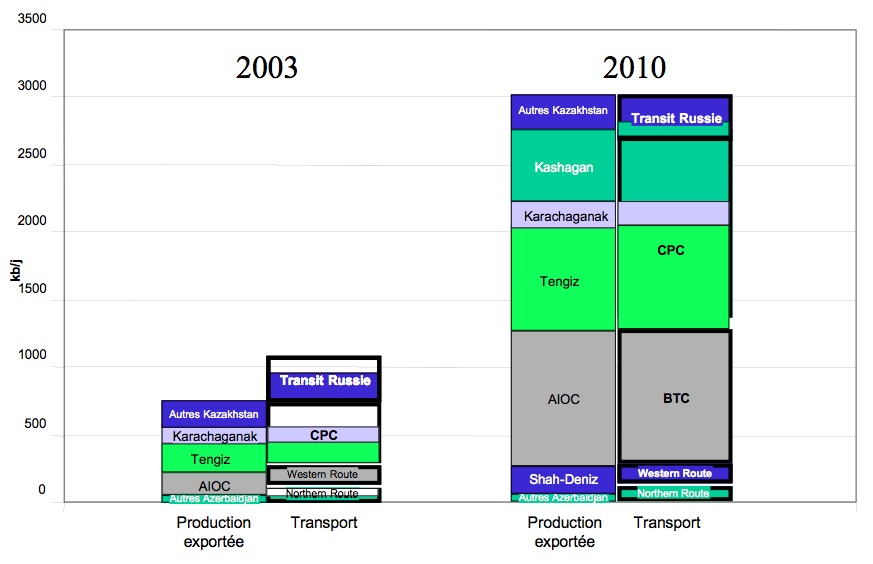

Graph by JaP. "kb/j" = thousand barrels per day. "Autres" = other

- the oil production in the region developped under Soviet times, and connected to Russia by oil pipelines. This concerns mostly Kazakhstan, Uzbekistan, and a very small volume of production from Azerbaijan. That oil is usually produced by the national oil company created in each of these countries to pick up the Soviet assets in the sector, and sold to (or through) Russia on the basis of bilateral governmental agreements. This sector is declining and is slowly being replaced by the third one below. Transportation issues that go with it are more and more resolved through the negotiations ongoing in the third bullet below;

- the gas production in the region developped under Soviet times, and also connected to Russia by (gas) pipelines. This concerns mostly Turkmenistan and Uzbekistan. That gas is almost exclusively produced by the national company, and also sold to (or through) Russia on the basis of bilateral governmental agreements. In the absence of the third sector like for oil, Russia has absolute power over these countries and their gas production, because they have absolutely no other choice. They would like to have other pipelines to export their production (for instance going South to India or Pakistan via Afghanistan), and some people seem to tell them that this would be possible, but IT IS NOT. I have written about this elsewhere, and will do so again in the comments if requested, but you need just remember one thing: the mooted pipelines through Afghanistan would be gas pipelines, not oil and they have no chance to being built for a very long time because nobody will pay for them.

- the third and most interesting sector is the new investments being made by Western Oil Majors to develop recently discovered fields, mostly in the oil sector. This is where most of our attention will focus, because that's what most of the diplomacy of the past 15 years has been concerned about, with two main topics (i) how to make the investments to develop production, and (ii) how to get the hydrocarbons to the market once produced.

I have some good news: Caspian oil is actually fairly simple to understand because there are only 5 hydrocarbon fields worth noting, and a couple of pipelines. So here they are:

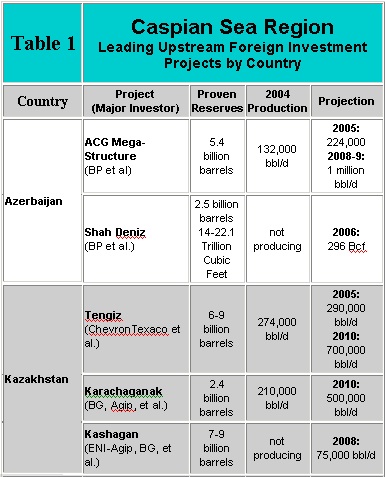

(picture from the US Energy Information Agency's Caspian area brief)

(table from EIA, same link as above)

(1) ACG (formerly, AIOC)

That's the big oil field just offshore of Baku in the Azerbaijan sector of the Caspian Sea. It is currently the only field in Azerbaijan with proven oil reserves, despite massive exploration campaigns in the past 10 years. It is currently being developed by a Western consortium led by BP (which includes Unocal (now Chevron), ExxonMobil as well as a number of other companies), under a contract signed in 1994 (and which is public, you can download it here, along with a ton of other documents on the project). It has an estimated 5 to 7 billion barrels of recoverable oil (slightly less than what is hoped to be found in ANWR, to give you an idea). It has been producing small volumes, about 100 to 150,000 b/d, since 1998, which are exported by a small pipeline going to Georgia, the Baku Supsa (the "WREP" in the map below). They also have the right to use the Baku-Novorossisk pipeline going through Russia (the "NREP" in the map below).

Big investments are underway to bring production to above 1,000,000 b/d in the next couple of years. Whan I say big investment, I mean big: more than 15 billion dollars will have been spent by 2010. Most of that oil will use a new pipeline, the BTC (see map above, and more detail below) which was completed last year and has recently entered into operations.

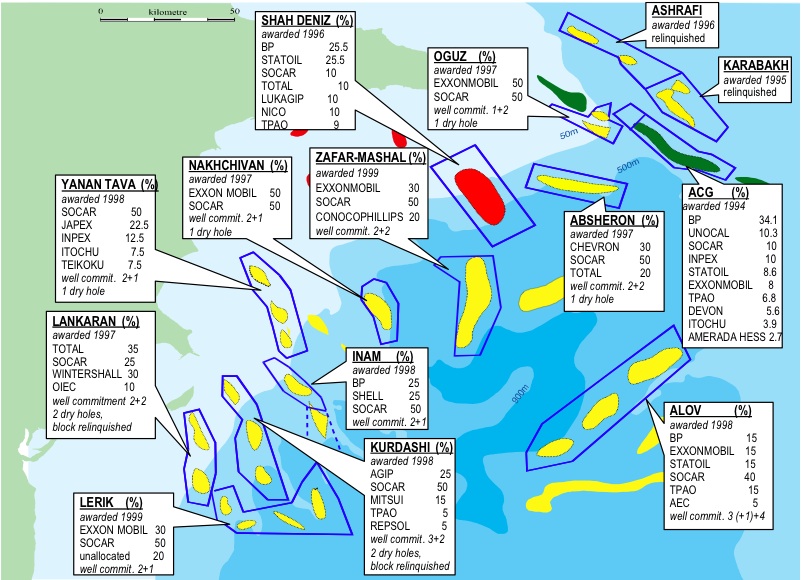

And THAT'S IT for Azeri oil. At least 20 PSAs were signed, each involving one or several exploration wells and all except Shah-Deniz, a gas field described below, (ACG had been discovered a number of years earlier) came out dry of with insignificant volumes of hydrocarbons and were abandoned. This map, from 2003, shows the whole sorry end to the Caspian oil boom of the 90s.

(2) Shah-Deniz

It's a big mostly gas field offshore Azerbaijan. Gas was not the best of news for the oil companies, as the markets are very, very far away. The consortium is also led by BP (with Total, Statoil of Norway, TPAO of Turkey and OIEC of Iran) and it has managed to go ahead with the development of the project by signing a contract for the gas with Turkey (although there are doubts about Turkey's need for that gas).

BP has agreed to build a gas pipeline in parallel to the BTC oil pipeline to bring the gas to Turkey, as shown above, and they have a contract to sell that gas in Turkey (I'll write more about the "war to bring gas to Turkey" in another story). They are now hoping to build new pipelines from Turkey to central Europe to be able to give more value to that gas. That project is still in its early phase (you can find more details by clicking on this link which refers to its codename: Nabucco (pdf, 280 kb), which includes the map below) but is backed by all the national governments involved and by Gaz de France, so it is likely to go ahead in the near future.

(3) Tengiz

A big onshore oil field in Kazakhstan - one of the biggest in the world, developped by a consortium led by Chevron (and including ExxonMobil and Lukoil and ENI of Italy), with about 9 billion barrels of recoverable reserves (another ANWR). Although Chevron came in in 1993, they have had a really hard time with that field, as they had no way to export the oil anywhere. They have used amazing ingenuity to sell their oil (including owning most of the railcars of the former Soviet Union during the 90s - about 9,000, to sell their crude by rail, or sending barges all the way to Finland by the canals of Russia) but this has seriously limited the production of the field. Now that the CPC pipeline has been built (see below), they are ramping up production, which is expected to reach 700,000 b/d in a few years. It is the big field on the Eastern shore of the Caspian Sea (inland) on the map below, from Rigzone

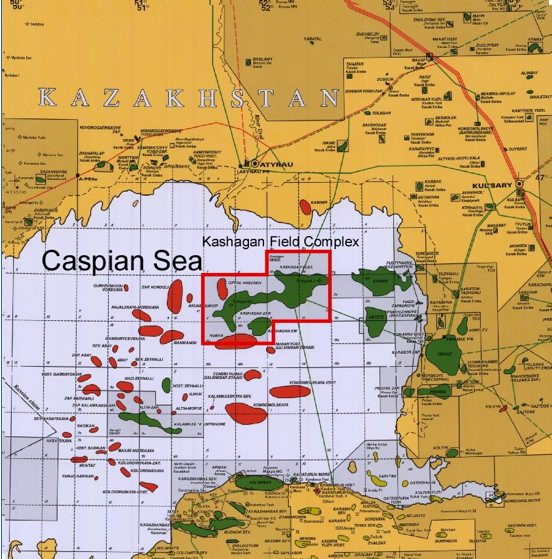

(4) Kashagan

The biggest oil field to be discovered in the world in the past 30 years, it is in the North of the Caspian Sea, in the Kazakh sector (as shown on the map above), and it is being developped by a consortium including all the big majors - ExxonMobil, Shell, Total, ConocoPhillips, ENI and Inpex, with ENI, the Italian group, as the operator (Exxon did not want Shell, Shell did not want Exxon, and ENI was smarter than Total to be voted in...)). BP and BG were initially in but sold their shares in recent years. With 9-15 billion barrels of reserves (exploration is not totally complete), it is yet another ANWR fully in control of BigOil, but it is very, VERY, challenging technically (very high pressures, located in an areas which is at times seawater, ice, mud or any combination in between, and far away from any infrastructure of any kind in an area with a very tough climate) and it will need to find export routes for its production (a combination of CPC and BTC is likely to start with)

(See here for a larger version with full explanations

Note that BG have sold out of Kashagan and have updated the linked map since I copied it)

(5) Karachaganak

A big, mostly gas field in North Kazakhstan near the border with Russia, it is being developped by ENI, BG, Chevron and Lukoil. As a gas field, it is heavily dependent on Russian gas monopoly Gazprom (the gas is currently being processed at the nearby Orenburg Gazprom plant), but the consortium is strong enough to negotiate decent terms and to buld its own infrastructure. As the field contains both gas and condensates (i.e. good quality oil) which have to be produced together, the consortium has initially focused on selling the oil on the world markets while handing over the gas at a low price to Gazprom. The oil goes into the CPC pipeline. They are currently building a gas processing plant in order to at least be able to produce oil without depending on Gazprom.

Pipelines

So this bring us to the pipelines. I'll focus here exclusively on the oil pipelines. The gas side here requires a lot more detail and I'll have a go in a later story.

There are a number of existing ones, most of which go through Russia and are thus considered by the oil majors - with reason - as unreliable. They have thus made a lot of efforts to find new routes.

A simple solution would have been to ship oil to Northern Iran (where Iran's refineries are) and swap it for Iranian oil produced in the south of the country. This made good sense for Iran, which would not have needed to ship its own oil for the production in the South to its refineries in the North, but it is not possible under the current US sanctions regime (ILSA). This solution would be partial anyway as the capacity of the Iranian refineries is no more than 800,000 b/d and they would have needed significant investment to be able to use the Caspian crude qualities.

So with Russia and Iran out, this left only the Western (and at a later point Eastern to China) routes. An additional problem is that of the Bosphorus, which already sees a significant volume of oil tanker traffic, which the Turkish authorities were keen to not see increase. Bringing in an additional million barrel per day or two into the Black Sea (on the coast of Georgia for instance) would have created a real danger for Istanbul and this was thus strongly opposed.

Thus came to birth the BTC, which goes West from Azerbaijan, through Georgia, and then South through Turkey to the Mediterranean. It was built by a consortium led, again, by BP (which, interestingly, is different from either the ACG consortium and the Shah-Deniz consortium, something which had sometimes unexpected consequences - another story in waiting again).

You can find a massive quantity of information on the project starting from here, but the main thing to know is that it has a maximum capacity of 1,000,000 b/d, a good chunk of which will be filled by ACG oil to start with, and by all the liquids Shah-Deniz can produce. It has cost close to 4 billion dollars to build, half of which was financed by international banks with the participation of the World Bank and the EBRD.

You've probably heard nasty things about the project because it has been used as a target by a number of NGOs that absolutely want the World Bank to stop financing the energy sector, and they tried to show that such projects were tremendously damaging to the environment and to the local populations. They've put pressure on the World Bank, on the commercial banks and on the oil companies, thankfully to no avail (this is not the topic here, but I do intend to write more about this and explain that "thankfully". In the meantime, you can go see the envirionmental reports on the BTC site linked to above, and otherwise google "Extractive Industries Review" or "Equator Principles").

The other big pipeline in the region is the CPC (Caspian Pipeline Consortium) which, as you can see on the maps above, does go through Russia and does bring oil into the Black Sea. It nevertheless has the particularity of being the only privately owned pipeline on the territory of Russia (something that they really don't like and are trying to undermine at every turn, especially these days as an extension is being discussed). It was built (and paid for) by a consortium led by ChevronTexaco, and currently has a capacity of 450,000 b/d, due to be increased to 1,300,000 b/d. It is used for oil from Tengiz and from Karachaganak.

So, what can be learnt from that?

- Western Oil Majors fully control the operations of the 5 major oil fields, so the region clearly falls in the sphere of influence of the "West". Chinese companies that tried to buy their way into Kashagan in 2005 were vetoed out by the other shareholders, despite massive - and very public - pressure from the Chinese government on Shell and others not to exercise their preemption rights. Azerbaijan and Kazakhstan have made an explicit decision to welcome foreign investment and will be richly rewarded for it. (Whether that money is wisely used is another issue, of course). The revenues are split using a standard instrument, the PSA (production sharing agreement), which allocates the oil produced first to repay the initial investments ("cost oil") and then as profit ("profit oil"). Host countries get a growing share of the oil as the fields produce and as prices go up. The marginal split usually gives more than 90% to the host country.

- Oil transit is also pretty much solved, with the CPC and now the BTC both in service. These two pipelines bring significant new volumes of (light, good quality) oil into the Mediterranean oil markets and are enough to transport the expected oil volumes from the existing fields. Oil majors have been smart enough to lead in parallel the investments in the upstream (production) and midstream (transport) and have thus been able to ramp up the production of their fields as fast as was possible under the circumstances (it still took time - more than 10 years for both ACG and Tengiz, with the same expected for Kashagan).

Graph by JaP. "kb/j" = thousand barrels per day. "Autres" = other

- Gas is still an almost completely blank field for the Western oil majors. They have not been really happy to find gas when they did, as it is a lot harder to manage (infrastructure is a lot more important and more expensive) and they have to face a much stronger adversary in Gazprom, the Russian monopoly, which controls both the existing infrastructure and the downstream markets in Europe. (The outcome of the Nabucco project will be interesting thing to see, as it would create a new (smallish) competitor for Russian gas in Europe).

- the Caspian oil will go entirely West for the next 10 years, but it is likely that the next route will go East to China. China is making a lot of efforts, especially in Kazakhstan, to procure some oil, but with uneven results. They have tried to buy out BG's stake in Kashagan, but the other shareholders exercised their preemption rights despite strong Chinese pressure (they threatened to kick Shell out of the Chinese refining business). Nevertheless, there is a strong strategic rationale for it to happen eventually.

Again:

- don't be impressed by big numbers. We're talking close to 50 billion dollars of investments underway. Which needed to be paid upfront before any significant volumes could be sold.

- please, please be wary of what you read on this topic. Too many people have other interests that you may not be familiar with and their public announcements should be taken with a grain of salt; don't believe that everything which is announced will happen; don't even believe that everything signed will happen. It's not because Halliburton is involved that it is necessarily a big plan to scam us off (KBR, the Halliburton subsidiary, is one of the biggest contractors for big oil projects, and one of a few to be in the competition. Please remember that they are paid by Exxon or ChevronTexaco and thus will not scam them like they seem to be able to do with the US government)

- finally: don't forget that people are going to these God-forsaken places to get the oil that YOU will be burning today, tomorrow and again. Before blaming them for providing a valuable service, remember that they are providing that service ultimately to YOU.

They can't be wholely concentrated on their oil only -- otherwise they will miss the winds of poltical change. There policy cannot be that of crisis managment. They should be smart enough by now to know that they should be building goodwill with not only the leaders but the population, otherwise in the future they may get kicked out.

If they do things right, not like how the did Iran, Iraq, they will be able to show Western Imperialism at its best, not its worst.

I am looking forward to your future posts on this

and related issues.

warmest regards

I am wondering, do you think the perception of western oil firms will decline/improve/stay constant concerning the profitability of doing business in Khazakstan going forward? How much different, really, is the political attitude and climate of the governments of Khazakstan vs Russia?

I reminded of a comment by a senior Chinese official who said "Investors are like Pigeons. One shock will scare them all away. Then when the governmental policy improves, they come back one by one."

I am looking forward to those follow up stories, especially the one about the rail cars and barges.

Demand is the problem, not the oil majors.

They should not have campaigned against the truth. The should have accepted the truth and leave it up to us the consumer, to decided whether we wanted to burn up the planet or not.

I don't have that much more information on the railcars and barges. The fact is that Chevron did not get access to the oil pipelines (which were all going to Russia), and thus could only produce what they could transport in other ways.

- they used small tankers on the Caspian that would put the oil in Azerbaijan, either to be shipped by rail to Batumi on the Black Sea, or by pipe if it could be shipped under the azeri's rights to the Russian pipelines (with stiff fees if you can imagine). (Another solution used by others was to send the oil to Iran, to Neka, to swap for Iranian crude in the Persdian Gulf) but that option was not open to Chevron as a US company)

- they used barges going up the Volga and canals all the way to the Baltic Sea, sometihng that cost them 8-10$/bl

- they used Soviet railways to send the oil to Russian consumers (at Russia ndomestic prices) or to the Black Sea via Russia.

Anything that was cash positive was better than letting the field lay abandoned, even if it did not pay for the initial investment.Jerome, thank you for your hard work and open sharing of your insight on the Caspian production and marketing problems

Now just to have an idea, 3 Mb/d is less than 4% of 84 Md/d. All these fields together won't be enough to offset the current yearly depletion in existing fields...

A couple of observations from a geopolitical perpsective: Georgia is clearly key here in terms of getting this Caspian oil to western markets. It is no coincidence in my view that Russia is currently exerting enormous political and economic pressure on Georgia.

Last week it was reported that that the SUPSA pipeline (built and operated by BP I believe) had been diagnosed with some corrosion issues, despite only being operational since 1999, and had been shut down. The ACG consortium is now exporting its oil through the NREP pipe to Novorossisk (ie through Russia rather than Georgia). I know BP has had pipeline corrosion issues at Prudhoe Bay but those are on far older infrastructure than SUPSA.... I find the SUPSA problems suspicious.

I would not be at all surprised that BTC also experiences operational problems as it ramps up its export volumes, and would also see it as a huge and very vulnerable target for terrorist attacks. Again, given Russia's current approach to establishing regional dominance through energy economics, the provenance of any future terrorist attack on BTC should be questioned. I would not immediately link such an attack to Islamists (for whom an attempt to sink a tanker in the Bosphorous Straits would make more sense in terms of targeting the economy of the west), more likely to be perpetrated by North Ossetian separatists, wnd we know who supports (and finances) them... all roads lead to Moscow.

Russia has a huge amount to gain by being able to control the flow of exports from the Caspian. They need to bring Georgia under control to do this... I feel that we will see and hear a lot more out of this region in the future, and not all of it good.

Excellent Post! Could you please comment if the oilfield operators will try to recoup their billions$$$ of investment by immediately going to secondary, tertiary, and EOR drilling techniques, or have they learned their lesson in Yibal, and will VERY carefully manage these fields?

Do the owners of the very expensive & various pipelines have any contractual leverage over the oilfield operators to force them to keep pumping at an undesired high rate so that the transit fees will quickly recoup the pipeline investments?

Thxs for any reply.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

You ask this question...

Could you please comment if the oilfield operators will try to recoup their billions$$$ of investment by immediately going to secondary, tertiary, and EOR drilling techniques, or have they learned their lesson in Yibal, and will VERY carefully manage these fields?

...in a way that opposes secondary, tertiary, and EOR on the one hand, to careful management on t'other. I think there's a teeny misconceptionette here.

Secondary recovery techniques are basically pressure maintenance techniques, meaning water and gas injection. Most reservoir engineers would oppose them to primary recovery, also known as Blow and Go - meaning, produce the thing until pressure falls to the point where the wells won't flow any more. And go.

Correctly applied in a high-quality reservoir, water or gas injection can increase recovery from 10-15% of STOIIP (stock tank oil initially in place) to 30-40%. And the right time to start is before your production wells stop flowing of their own accord.

Add in tertiary processes (which in fields like these, far from gas markets, would probably be miscible-gas based) and you might get over 50% recovery. These processes work better in reservoirs with a connected oil body rather than flooded-out rock. So earlier equates to better here, too.

Increasing reserves by 200%? Now that sounds like careful management to me.. And just to pre-empt the storm of scepticism; these aren't very daring claims. Just elementary physics.

Thxs for correcting me on my misconceptions on modern oilfield extraction. Hope this info proves helpful to other TODers without real oilfield experience. Thxs

First time I recall seeing Myers-Briggs personality profiles on TOD! Maybe we should all get the test and disclose our profiles so we know who we're dealing with :)

JN2 (INFP)

http://www.atimes.com/atimes/Central_Asia/HK22Ag01.html

And then you went and said one thing that got my knee jerking:

the oil production in the region developed under Soviet times

Just a few years before the Sovs, in fact. Like, 1861. Looky here...

http://www.bp.com/liveassets/bp_internet/globalbp/STAGING/global_assets/downloads/I/IC_azerbaijan_fi eldtrip_presentation_slides_sept06_rashid_javanshir.pdf

...and scroll to Page 3. (The graph doesn't go back far enough.)

There are only two countries in the world that have ever been responsible for the majority of the world's oil production in one calendar year. One is the US, of course. The other would be... Az. In 1901. The modern large-scale oil industry grew up on the muddy shores of the Caspian in parallel with Texas, California and Pennsylvania.

Of course the winners write the history books, so no-one knows this nowadays. The Nobels, Rothscheilds and Shell shipped the stuff up the Volga to European markets. They had to invent oil tankers to do it. Dmitri Mendeleyeff got his start as works chemist at a refinery at Surakhany, next to the Zoroastrian fire temple that was built over a natural gas seep about 700 years ago. And Uncle Joe learned street politics by organizing the oil workers into the Baku Soviet.

Oil production dropped steeply after the Sovs crushed the nascent Azeri Republic in 1920 - with the unintended help of the well-meaning but perennially bumbling Brits. There's a lot about the Baku oilfields in The Prize - Yergin writes a good thriller when he isn't blowing fairy dust in the public's eyes.

When Jerome talked about Kashagan being very technically challenging you can see this on Eni's website

http://www.agipkco.com/en/what_we_doing/kashagan_en.htm

Manging of the High H2S (Hydrogen Sulphide) content (16-20%) seems like a real challenge.

There are plenty more facts to digest.

As I noted above, this is the only new one mbpd and larger field on the horizon, to replace the four current super giants that are almost certainly all in decline.

Also, to put the projected total Caspian Sea production in perspective, even ExxonMobil concedes that the decline rate from existing wellbores worldwide is as high as 6% per year. So, we need up to 5 mpbd of new (crude, condensate & NGL) production every single year just to match the depletion from existing fields. Or let me put it this way. All we have to do is to replace the productive capacity of the Ghawar Field every single year and we can at least maintain a stable production rate.

This is what happens when a region peaks. The new fields coming on line can't make up for the decline of the old, larger fields.

Re: Kashagan

That ENI link is quite good. Note that delays & inflation are now characteristic of this field. From here:

Also, see my story The Forest and the Trees -- the Oil News Imbalance for some additional details.I believe 2010 estimates (as reflected by the Jerome's first graph at the top) are overly optimistic.

It strikes me as very odd that exploration around Azerbaijan has had such a poor success rate - and that BP are the only comapny to be successful.

Max production from the Casiain seems to be constrained at 2.3 million bpd - the pipeline capacity.

BP and BG selling out of Kashagan seems to have been a good move. BG and Encana are two of my favourite mid size large caps - and they seem to be good at making these startegic decisons - which are hard to expalin at the time they were made.

I'm not 100% convinced by the arguments for the route of the BTC pipeline - the Bosphorous is not that narrow - and it still looks very strange to divert it all that way south through Turkey.

It looks like Burren Energy are going to struggle to get a market for their Turkmen gas. Any plans to build a pipeline across the Caspian to link into BTC II?

And what if they had the brains to confound everyone and make a deal with Iran to send the oil that way and swap it against the stuff currently going North in that huge country.

I mean Nixon went to meet Mao - is this that much more difficult?