Uncertainties About Russian Reserves and Future Production

Posted by Dave Cohen on February 16, 2006 - 7:14pm

The world needs every barrel of Russian oil. With growing Chinese and Indian demand and the insatiable appetite of the United States, markets will be tight and even more reliant on the Middle East. Given today's high oil prices, Russian companies and the Russian government believe that they can fund a good part of new developments and even infrastructure projects themselves. Additionally, Chinese and Indian companies, with the strong backing of their governments, are ready to do business with Russian companies and the Russian government. Their investment criteria are more in line with the approach favored by their Russian hosts. Skills as well as money will be crucial, however, and they bring few. If as a result Russia cannot sustain its current oil production level, this will negatively impact world oil markets.This post takes no official position regarding Russian reserves and predictions about their future production. Lately, there has been controvery regarding some statements made by westexas who, using some data modelling being worked up by Khebab, is predicting a rapid decline in Russian production in a pretty short timeframe. Naturally, if this does occur, the world could be in for a very rough ride. Here, I will present the best data and estimates I can find outside the world of Hubbert Linearizations to give TOD readers a chance to consider the uncertainties surrounding Russia. I should also mention that HO did a post It would be nice, but... back in October covering some of these issues but not in this kind of detail.A faltering Russian oil sector would be a disaster for the world economy as well as for Russia itself. President Putin must recognize that he needs a petroleum sector with well-managed and well-capitalized oil, gas and pipelines. He is well within his rights to want the state to dominate it, but it must be managed efficiently. The Yukos affair, as well as infighting in the Kremlin and a lack of transparency and predictability, indicates that he is going in the opposite direction and could hurt Russia's interests as well as the world's if he does not correct his course.

Estimates of Russian Reserves

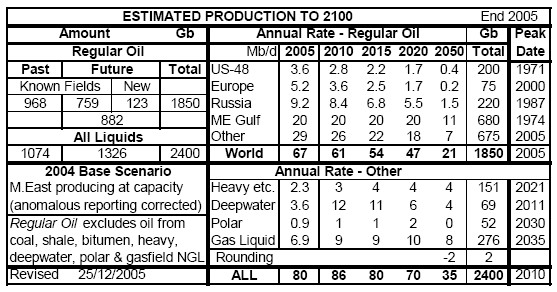

There is a large range of estimates of current Russian reserves. I'll take my initial data from an excellent paper Can Russian Oil Growth Be Sustained? by Erik Janssen of Clingendael International Energy Program and add some additional sources to his. Shortly, I'll add in what ASPO has to say as well. Here are the various reserve estimates in billion barrels (Gb) from that document.

Oil & Gas Journal 60 (proven SPE)

John Grace* 68 (proven SPE)

World Oil 69 (proven SPE)

British Petroleum 72 (proven SPE)

10 largest Russian Oil Companies 82 (ABC1)

E Khartukov (Russian Oil Expert) 110 (ABC1)

United States Geological Survey 116 (proven SPE)

Ray Leonard (MOL) 119 (ABC1)

Wood Mackenzie 120 (proven SPE)

IHS Energy 120 (ABC1)

M. Khodorkovsky (former Yugos) 150 (he's in jail)

Brunswick UBS (consultants) 180 (proven, P50, P5 SPE)

DeGolyer & MacNaughton (audit) 150 to 200 (proven SPE?)

* This estimate was given to me by Stuart (personal communication) from Grace's book Russian Oil Supply - Performance and Prospects, which I have not read.

As you can see, there is a high camp and a low camp which we can arbitrarily split down the middle at about 100 Gb. The Society of Petroleum Engineers (SPE) method of accounting reserves, which is less strict than the SEC definition,

...classifies reserves into three categories: proved, probable and possible. For the oil industry, the proven category is the most important and is used to inform investment decisions by producers and investors. The SPE defines proven reserves as those quantities of oil, which by analysis of geological and engineering data, can be estimated with reasonable certainty to be commercially recoverable, from a given data forward, from know reservoirs and under current economic conditions, operating methods and government regulations. [ie. there is a 90% certainty that quantities recovered will meet or exceed the estimate]On the other hand, the bizarre ABCD system of reserves estimation was developed under the old Soviet Union and crucially does not take commercial factors into consideration. The Russians consider ABC1 (there is a C2, D1 and D2) to be equivalent to an SPE proven reserves estimate. This is disputed by analysts and is the reason why the Russians are becoming more open to outside audits of their reserve numbers. Importantly, there is disagreement about the C1 category. As Janssen reports, these are geologically evaluated reserves for which engineering data show partial recovery. The Russians want to count 75% of the C1 reserves as proven but even the liberal IEA "argues that only 30% of C1 reserves can be regarded as proven under the SPE system".

What does ASPO have to do say about all this? As you can imagine, they are low end people (under 100 Gb) but they have revised their numbers in recent years. In December of 2004, Colin Campbell reported on The Status of Oil and Gas Depletion in Russia in which he presents this overview.

There are many observations to be seen in this table. Note also the production estimate for 2010--but we will talk about daily production numbers below. First, the cumulative production to date (presumably through 2002?) is 127 Gb for Russia. Second, the estimated reserves duplicate the OGJ results but add from future production an additional 23 Gb (excluding Polar oil and NGLS) for a URR total of 210 Gb for Russia. So in 2003, if we add in Russia's production from 2003 to 2005 as reported by the EIA, we get a cumulative production of approximately 137 Gb up to the present time. This is reasonably close to the 142 Gb estimate that westexas is using based on Khebab's data. We could call it a wash and say 140 Gb through 2005. However, I must add that Campbell also says this.

We add to this [the 60 Gb estimate in the chart above] 30 Gb of Arctic oil, together with substantial deposits of heavy oil in Eastern Siberia and NGL from gasfields, which are here excluded from Regular Oil by definition. The total therefore approaches the 100-120 Gb, as reported by Yukos. The jury is still out but we think that this assessment is reasonable in terms of order of magnitude.The last ASPO newsletter makes an upward revision of the estimated Russian URR.

So, we see that the final URR is revised upward to 220 Gb which still puts ASPO as a low end estimator but still very close to what the Russian NOC's (combined) are estimating. Now, if we assume a cumulative production of 140 Gb with an estimated URR of 220 Gb, that puts Russia at 64% of depletion as we enter 2006. Finally, I will mention a reputable high end source, Ray Leonard, now with MOL (Hungary) but formerly VP for exploration at Yukos. From his ASPO Lisbon presentation (ppt) in 2005, he notes the following

Two sets of calculations: Russian C1(proven) accurately measures reserves without economic filter while SPE and SEC measure economically recoverable reserves and actual developed reservesSo, the takeaway message is that Russian reserves are large, the gap between SPE and Russian reserve accounting systems is growing smaller but also, most (over 80 Gb) Russian ABC1 reserves are in the mature and evermore difficult to develop regions of Western Siberia and the Volga-Urals basin (see Leonard's slide 3).C1 Russian reserves are 119 billion barrels

As development of past five years has taken place, gap between SPE and SEC numbers and C1 is narrowing

Proven reserves are concentrated in West Siberia with about 70% in difficult to produce reservoirs

Questions About Future Russian Production

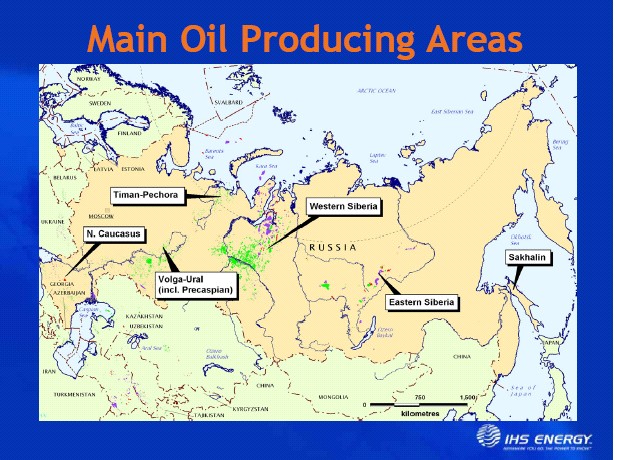

First, let's look at a map of the main oil producing regions of Russia from Russian Oil –Current Status and Outlook by Dr.Theodor Felder of IHS Energy (thanks to HO for this link).

Figure 1 - click to enlarge

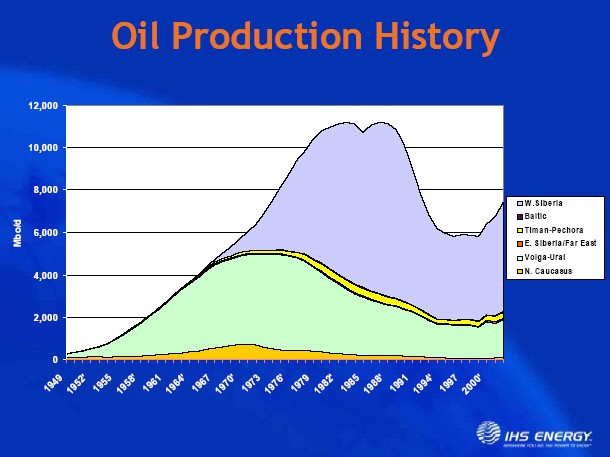

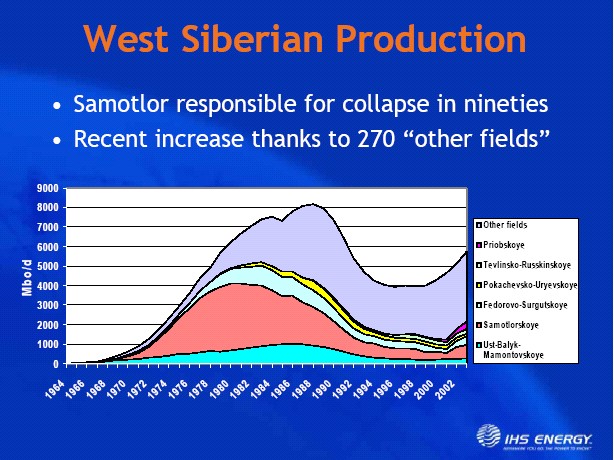

These next two figures show the recent Russian production history as a whole (Figure 2) and particularly in the Western Siberian basin (Figure 3).

Figures 2 & 3 - click to enlarge

Before we talk about specific regions and prospects, let's show a list of predictions of future production in the next 7 years or so. There is a lot of variance but not as much as you might expect.

Future Russian Production Predictions

Colin Campbell (2004) 10/mbpd in 2010 & declining thereafter

ASPO February 2006 8.4/mbpd in 2010 & declining thereafter

PFC Energy** 10/mbpd in 2008 (conditional)

IEA 10.4/mbpd in 2010 & increasing thereafter

Ray Leonard (MOL) 9.3/mbpd in 2010 & declining thereafter

DeGolyer & MacNaughton* 10.0/mbpd by 2012 & maintained thereafter

* From Western Siberia only! Taken from What's Russia Really Sitting On?.

I should also mention that DeGolyer & MacNaughton do independent audits (pdf) for TNK-BP (see below).

** This is from J. Robinson West of PFC Energy (link cited above). What he actually says is this

THE RISKS in Russia are large and could mushroom. The impact of the Yukos affair, combined with under-investment and the poor management of the Russian petroleum sector in general, is serious. PFC Energy estimates that Russian production, now 9.3 million BPD, will peak at just over ten million BPD in 2008. Without a huge infusion of capital, technology and management for further exploration and production, Russian production may hit a lower peak and begin declining sooner. Billions will also be needed to expand export capacity. Without a stable legal and operating environment, Russia will fail to meet its production targets. This in turn could damage the Russian economy and the prestige of the Putin Administration.Let's look at each Russian oil basin separately (as shown in Figure 1) and try to discern what is going on there and what the future production might look like.

The Western Siberia Basin

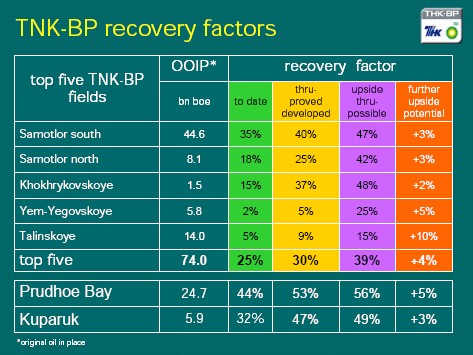

I can not emphasize enough that almost all of Russia's production increases in the last 5 years have come from the Western Siberia basin in the Khanty-Mansiysk Okrug region. The conventional view is that about 2/3rds of Russian oil production comes from this region and that it contains the same percentage of Russia's reserves--whatever they are! This is due to a number of factors which I'll review below. This is shown clearly in Figure 2. A superficial view of the situation associates production in this area generally with the Samotlor megafield, which is in decline. However, as Figure 3 clearly shows, the new production since the early/mid 1990's declines have come from 270 other fields in this vast region. There are a number of operators there--two of the most prominent are TNK-BP and the Russian NOC LUKOIL. TNK-BP has taken over a number of mature fields in both Western Siberia and the Volga/Urals basins. Figure 4 below shows TNK-BP's internal projections (big pdf) about their primary Western Siberia projects. (Hat tip to Jerome a Paris at DailyKos 1/26/06).

As you can see, to date the fields shown have a 25% recovery rate (= 18.5 Gb) and using the techniques listed below, TNK-BP expects they may get an additional 10.36 Gb from these fields (the 39% recovery rate) which includes an additional 5.35 Gb from Samotlor South. How are they doing this? Here's what they're doing (slide 40).

- waterflood optimisation

- hydraulic fractures

- idle well recovery

- electric submersible pumps (ESP)

Salym Petroleum Development NV is a company established on a 50:50 basis by Shell Salym Development B.V. and OAO NK Evikhon controlled by Sibir Energy. SPD holds production licenses for all three of the Salym fields, which are located in the Khanty-Mansiysk Autonomous Okrug in Western Siberia, 190 kilometres from the town of Nefteyugansk. It includes West Salym, Upper Salym and Vadelyp.Skrebowski lists Salym as coming online in 2005 with the daily production figure cited above and a URR of 0.8 Gb. And there are many, many other new fields though these are most likely not "large" fields (>75/mbpd) since Skrebowski does not list them. He does reference Uvatskoye (2009 with 0.2/mpbd). This TNK-BP Uvat project is in the Tyumen region of Western Siberia and represents another of the new projects expected to add to future production in this region.Development and production from Upper Salym has already begun, and Vadelyp production is due to start in 2006. The production from West Salym, the biggest in the Salym group of fields, is expected to peak with at least 120,000 barrels per day by 2009.

The Uvat project embraces 7 license areas comprising 8 fields and 29 promising geological structures with recoverable reserves of 60 million tons of oil and prospective resources of 200 million tons of oil. The project implies construction of 300 km of pipelines, more that 500 km of roads, and 200 km of power transmission lines in the Uvat District. Nowadays, TNK-BP is very active in this region. In the beginning of this year, Sibneft won the tender for the development of the Zimneye field.Generally speaking, since this oil basin is vast and geographically isolated, a lot of investment in infrastructure (pipelines, processing facilties) must be built to produce these fields as the Uvat project just mentioned makes obvious. To find out what LUKOIL is up to, read here and here. The bottom line appears to be that LUKOIL is just now learning how to apply a large set of EOR techniques to its production in Western Siberia beyond simple waterflood techniques they had been using since the 1980's. I would say it's fair to conclude that as goes Western Siberia, so goes Russia. To be fair, it is hard to conclude from all this information what the daily production flows will be from this region in the near future.

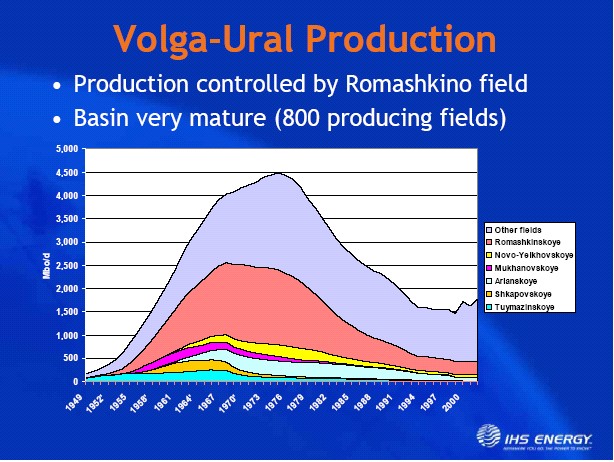

The Volga/Urals Basin

According to IHS Energy, the Volga/Urals basin contains 18% of Russia's reserves--21.6 Gb according to their own estimates. Here's the picture--it's not pretty.

Figure 4 - Click to enlarge

Romashkino, the big field in this region, is clearly in decline though there has been a slight uptick in production from other fields recently. Frankly, I have little more to say about this region. It is the most mature of Russia's oil basins and there don't seem to be any exciting new developments there. TNK-BP is among the operators managing fields there and presumably using EOR techniques to squeeze out what production they can get.

The Timan/Pechora Basin

IHS Energy puts 8% of Russia's reserves in the Timan/Pechora region. The "big news" is Rosneft/Gazprom's Prirazlomnoye field just offshore in the Pechora Sea. Skrebowski lists proven reserves of about 0.61 Gb but estimates vary. This is really the first Russian polar continental shelf project to get under way. However, this is not surprising given the geology. From this older source.Three structural stages are recognized in the sections of the Barents and Kara Seas. In the Barents Sea region the lowest is basement, which consists of rocks of various ages. The middle is represented by Paleozoic carbonate and clastic rocks of the platform cover; it is an offshore continuation of the Paleozoic rocks of the Timan-Pechora oil-gas province of northeastern European Russia.Consequently, the offshore area is considered underexplored and many new "plays" are expected. However, what's happening in this region is a mystery. From Smoothing over Russian Subsoil we learn

Most likely, the fattest piece of the unsold Russian subsoil to be auctioned off in 2005 will be the Trebs-Titov group of oilfields that also includes the four segments of the Central Khorever Plateau in the Timano-Pechyora Province. As expected, the amount of oil in the ground is left blank here, however, the Kommersant courteously informs the prospective buyers that the starting price is $419 mln. with $1.8 per one tonne of the oil reserves.So, what's going on in this oil basin is very much up in the air. Finally, Skrebowsky mentions two potential projects (no date). The first field is Val Gamburtseva field (Nenets Autonomous Region) with an estimated 0.6 Gb of proven reserves. The second is the Kharyaga field with an estimate of 0.71 Gb and currently producing 0.03/mbpd. (Skebowski lists this as having reserves of 5.2 Gb! This must be a mistake in his megafields document unless my information is wrong.)Anyone familiar with the Arithmetics gets the idea that the deposit contains approximately 230 mln. tonnes (1.68 Gba) of oil. This kills two birds with one stone: the secret is still kept as ordered and the amount of oil in the ground can be estimated. These oilfields contain 6 months of Russia's oil supply at the current rate of extraction.

The director of the Russian Natural Resources Ministry's department of natural resource exploitation regulations, Sergei Fedorov, shares the view that the situation with the depletion of Russia's oil reserves is quite sad.

"There are very few vacant oilfields left in the state's oil fund, 92% of Russia's oilfields have already been auctioned off. Of the remaining oilfields the large ones are the one in the Nenets Autonomous Area (the Trebs-Titov group of oilfields), the Chayandinskoye in Yakutia, and the oil and gas reservoirs on the sea shelf. The rest are small oilfields."

The Eastern Siberia/Far East Oil Basins

This section concerns the Eastern Siberian basin (see Figure 1) and the Sea of Okhotsk which includes the Sakhalin oil fields. I've lumped them together just for convenience--they really are separate producing regions. However, IHS Energy claims that the two basins together comprise 3% (3.6 Gb) of their estimated 120 Gb total reserves estimate.Sakhalin is a more complex oil & gas basin than most people realize. There are actually at least 6 separate regions, some of which are divided into multiple blocks as shown in this graphic. So, we can refer to Sakhalin N (1,2,3...).

Figure 4 - click to see the original source

Sakhalin 1 is already producing but being developed in phases. Recoverable reserves are standardly put at 2.3 Gb.

The Project will be executed in phases. The initial phase develops the Chayvo field. Production from Chayvo started on October 1, 2005. The initial phase of the project will produce 50,000 barrels (6,300 metric tons) a day by year-end 2005 and 250,000 barrels (30,000 metric tons) a day of oil by year-end 2006 from the Chayvo field. Associated domestic gas sales will start at about 60 million cubic feet (1.7 million cubic meters) per day, and ultimately ramp up to 250 million cubic feet (7.1 million cubic meters) per day.Sakhalin 2 is not due to come onstream until 2007. The region is supposed to contain about 1 Gb of recoverable oil and Skrebowski shows a production of perhaps over 0.12/mbd. Shares of other Sakhalin regions (and contained development blocks) have been bought and some are still being bid on. It's a reasonable expectation that all of these regions will be ramping up over the next 5 years depending on the amount of investment from various sources. However, the numbers cited above just for Sakhalin 1 and 2 comprise 3.3 Gb of claimed recoverable reserves and there are at least 4 more regions to develop. So, either reserve claims for the various Sakhalin regions are exaggerated or IHS Energy underestimates the amount of recoverable oil in the Sea of Okhotsk (combined with Eastern Siberia). As a prospective area, this oil basin is just about completely explored and it is unlikely any new significant discoveries will be made there in the future.

Eastern Siberia is a different story. Development is just getting underway there, the fields are smaller and this oil basin is isolated and thus requires major investment in infrastructure to develop. Skrebowski lists Vandorskoye coming onstream in 2007 at a daily production rate of 0.22/mbpd and total reserves of 0.9 Gb of recoverable oil. This field is being developed by RosNeft.

The Vankorskoye field is based in the Turukhansky region of the Krasnoyarsk Territory (Siberia). Its oil reserves are estimated at 125 million metric tons, and natural gas at 76.8 billion cubic meters.Just recently, problems have arisen with a proposed pipeline Russia nixes East Siberia pipeline route that would run from Eastern Siberia to the Pacific Ocean. So, future development in the area is plagued with logistical problems.According to Zemlyuk, the project has a number of problems. For example, the oil transportation route has not yet been determined.

The vice president assured his audience that the Vankorskoye field could yield 14 million metric tons of oil a year. The company, he continued, had put $4 billion into the project and was planning to produce its first oil there in 2008.

There are other perhaps "giant" fields in Eastern Siberia including Verkhnechonskoye. TNK-BP is developing a pilot project due to be completed in 2008 there. This claim is made.

The Verkhnechonskoye field is the largest oil and gas condensate field yet discovered in Eastern Siberia. Development had been hampered for many years by an absence of transportation infrastructure but it has now become possible, following last year’s decision by the Russian Government to undertake the construction of the Eastern Siberia –Pacific Coast pipeline system.Again, this is a "wait & see" situation as far as the large-scale development of this and other fields in this basin go. All and all, Sakhalin development seems mature and progressing well. The same can not be said for Eastern Siberia.

The North Caucasus Oil Basin

This post is running long and I will give short shrift to the North Caucasus basis. According to IHS Energy, this region contains an overwhelming 1% of Russian oil reserves. Production has been flat for many years there. The only news worth reporting was the recently announced Filanovsky field discovery by LUKOIL in the north Caspian Sea area controlled by Russia.The new deposit is the largest oil field that was discovered in Russia over the last 10 years. Its probable reserves are estimated at 600 million barrels of oil and 34 billion cubic meters of gas. According to the company’s preliminary evaluations, maximum level of oil production at the new deposit will exceed 5 million tons a year, while accumulated extraction will amount to about 80 million tons.Otherwise, there's little else to say about this region.

Conclusions

Although at the beginning of this lengthy post I said I would take no official position about Russian oil reserves and production potential, this does not preclude me from having opinions. And here they are.- My position is in the high camp (over 100 Gb) on what the real remaining Russian URR is.

- Near-term future production depends almost entirely on activity in Western Siberia and Sakhalin. I think the overall production will be in the 9 to 10/mbpd range until 2010 and will decline after that.

- Longer term production will decline fairly slowly as the harder to develop areas (eg. Eastern Siberia, Timan/Pechora) struggle to get underway but, nevertheless, come online.

- This post has not even considered Polar Oil on Russia's continental shelves but what I've read leads me to believe that most of those new hydrocarbons will be condensates and NGLs. This subject deserves an entirely different post.

- Above the ground considerations (geopolitics and Russian internal politics & bureaucracies) were not extensively covered here but will be a major factor in future production of existing reserves. I recommend the Can Russian Oil Growth Be Sustained? quoted near the beginning of the post as the best resource to read on the subject. J. Robinson West's short paper is another good resource. Finally, you can read Why did oil production in Russia stop growing? (ppt) by V. Milov.

In the case of SA, there seems to be the possibility of some of the major fields going into decline. Perhaps one of the major accomplishments of the SU will have been in delaying peak there thru failing to develop the economy to European, never mind US levels of oil consumption?

Russia may not be ready to go over a cliff in terms of geological ability to deliver. BUT, Russia is not SA. The Saudis are far more vulnerable to Western (US primarily) bullying, and therefore far more likely to deliver as much as they can.

This is in violent conflict with their self-interest which would be to throttle back production and allow price increases to compensate for reduced production.

Russia is in a far better position to protect its self-interest in this regard. The balance of incentives, in their case, IS to not be overly zealous in meeting world shortfalls. What do they gain? So in that sense, Russia too, for slightly different reasons, cannot in any way be thought of as way of postponing the day of reckoning.

Of course, if an addict becomes desperate enough, a very well defended source of the needed substance becomes a target in defiance of all ordinary calculations of risk v. gain.

Sing a happy tune.

This is a very relative estimate. Former Soviet Union suffer severe deficit of foreign currency. There was a fixed official rate of exchange of the russian ruble (less than a ruble per 1$ as far as I remember) which was just what it says - official and nothing more. On the black market the ratio was more like 5 : 1.

For the Soviet government it was a much better deal to subsidise the costs of their oil industry (which were mostly in rubles) but keep those hard currency flows going in. I know this sounds strange for people that lived in free market economies, but that was what socialism was like - lots of control and mad economic decisions.

Actually this is my reason to be cautios about any simple modelling of Russian production.

"In the case of SA, there seems to be the possibility of some of the major fields going into decline."

I meant to say "into rapid decline".

Russia does not need to develop its oil resources to maximize production. It exports twice what it consumes at the expense of future domestic needs. Also, Russia does not need to advertise its reserves. This is something the have-nots (i.e. the west and others) would like since it would serve their interests. Bleating about Yukos and transparency by various interested parties is really rich. The management of Yukos was pumping billions of dollars each year into offshore banks and was accused of damaging fields by over-extraction. Another point of clarification, oil companies in Russia do not own oil fields they only have extraction licenses that the federal government can revoke.

I can appreciate all the work that went into this analysis. I'm saving this one.

Something that I don't think you mentioned is the technique that Laherrere uses of the discovery/production curve shifts to get an idea of time scale and magnitude of production levels and cycles. In his paper at the hubbertpeak site:

http://www.hubbertpeak.com/laherrere/PetRev200204.pdf

in Fig. 2 the graph is shown and one could presume that it is to some degree predictive of the coming second production peak. Although, as your analysis shows, Russia is huge and has unexplored potential. I suppose even a third peak might be possible.

ET

For anyone interested, I recently posted an historical account of Russian oil production and future prospects on my blog: http://oilpolitics.blogspot.com/. The reserve/production numbers are mostly from Grace's book Russian Oil - Current Status and Outlook.

As for the Russian political/economic climate going forward, I am relatively optimistic. Putin made his point with Khordokovsky (that oligarchs and politics shouldn't mix) and the investment climate in Russia is slowly improving. Putin himself has most often taken a middle ground between the oligarchs and siloviki (former KGB harliners, nationalists) and will likely pursue a 'managed capitalism' for the remainder of his term. This will help bring IOC's back into the country (in fact, I thought I read somewhere that Lukoil was about to pick a couple of foreign partners for one of the Timan-Pechora projects). The question is then who replaces him. Gazprom Chairman Dmitry Medvedev, who was recently promoted to first deputy Prime Minister (just before the Ukraine shut-off, go figure. . . ), is an early favorite. The other primary contender (also recently promoted to a Prime Minister slot) is Sergei Ivanov. Ivanov is the champion of the siloviki in the Kremlin, although he is moderate for that camp. While Putin would likely prefer Medvedev to Ivanov, the former, unlike Ivanov, does not have a natural constituency in the electorate.

Regarding the Hubbert linearization on Russia, I don't think this technique is appropriate simply because production has been constrained and the observed profile will be bimodal. Curve fitting is a maximum likelihood approach where there is no prior on the curve parameters and will produce suboptimal results when the residuals are non gaussian.

If we look at the different reserves estimates you are giving, we can design a rough triangular prior probability density function for the URR based on the different fractiles (F00= 127 + 60, F50= 127 + 113, F100= 127 + 180):

Using a Bayesian filtering technique (or sequential Monte Carlo Markov Chain (MCMC)) we can use the above prior to constrain the solution to fit in a valid subspace of solutions. I can't give all the details of this approach here, but the details can be found on my blog. The predicted production from this algorithm (called SBM-PF) is given on the figure below:

You can also look at the URR values derived from the Bayesian filtering:

The F95 value is 239 Gb (i.e. 95% of chance to have an URR > 239 Gb).

If we compare this Bayesian approach with the standard Hubbert linearization, we can see how the standard Hubbert linearization could potentially underestimate the URR:

Thanks, I was trying quite extensively to defend exactly the same point with my discussions about Russia with westtexas. Restrictiong the production for whatever reason skews the curve in a way that it seems that it has peaked and gives lower URR. Removing the production constraints resembles very much the discovery of a new field. After this has happened the curve heads to a secondary peak after which already you are able to extrapolate the true URR.

Uh, I think you may have switched some terms and made a typing error. You meant to write Russia is an open book compared to Saudi Arabia, right? You have noticed that Saudi Arabia's reserves are not open to independent audits and can change on a whim--especially from this man

He is much esteemed and beloved, of course. But see also Kuwait. I don't see BP, Chevron and ExxonMobil working with Saudi Aramco as they do in Russia.

Here is some stuff about Russia from

Peter Tertzakian's 'A Thousand Barrels A Second'

Pages 136-137

I was beginning to be worried by Westexas' concern that Russia would tail off much quicker than I'd expected - I'd previously thought there was probably 100+ Gb future production, glad that seems reasonable from your analysis.

There looks to be plenty of scope for that production to take quite a long time to get out, that may suit Russia's geopolitical plans ;) Lots of difficult fields, some requiring considerable new infrastructure, difficult climate / weather, only recently making much use of EOR.

Given the impoderables it's quite surprising that estimates for future peak production and date are so clustered. When compared with the wildly different predictions for future SA production I find that consensus on Russia rather reassuring.

In fact, I view this and HO's technical posts as a very valuable education, but one's I wouldn't dare to comment on.

The link should point to http://www.energypolicy.ru/epv.php?id=1001716 instead. This presentation from the Russian Energy Policy Institute offers cold comfort to those in Europe counting on Russian gas exports after 2007, when gas production is shown as peaking (slide 11).

That statement may be true if our purpose

is to keep the globalised consumer

society functioning as long as possible.

If, on the other hand, our purpose is to

provide a habitable planet for our

grandchildren. we had better leave the oil

in the ground. A preview of an article in

'New Scientist' suggests that conversion

of all available fossil fuel into carbon

dioxide will result in as much as a

13 degree Celsius rise in the average

temperature of the planet some time next

century. Well, we know what that will mean!

Of course, given the choice between life

for future generations and an opportunity

for continuation of an easy life now, we

can guess which choice will be made by

our so-called leaders.

The Russian's themselves are predicting reaching their peak in 2010 at a bit over 10 mbd

http://www.cia.gov/cia/publications/factbook/rankorder/2178rank.html

Official CIA estimate of proven Kuwaiti oil reserves: 96.5 Gb

http://www.energybulletin.net/12242.html

Excerpt on Kuwait Reserves:

"PIW said the official public Kuwaiti figures do not distinguish between proven, probable and possible reserves. But it said the data it had seen show that of the current remaining 48 billion barrels of proven and non-proven reserves, only about 24 billion barrels are so far fully proven -- 15 billion in its biggest oilfield Burgan."

According to the above referenced leaked internal report, actual proven Kuwaiti reserves are 25% of the CIA estimate.

Official CIA estimate of proven Russian oil reserves: 69 Gb

If we use the 1984 and earlier Russian data, the predicted remaining reserves, using HL, are about 18 Gb. This estimate is 26% of the CIA estimate of proven Russian reserves.

Using only 1984 and earlier production data to predict future production, actual post-1984 cumulative Russian production was 97% of what HL predicted, and as Russian production gets closer to where cumulative should be, the rate of production growth is slowing markedly. (Khebab did the work, and as noted above, he has his own opinions on the subject).

Using only 1971 and earlier data, actual post-1971 cumulative Lower 48 production was 98% of what HL predicted.

The argument will only be settled with time, but the conventional wisdom approach to reserve estimates doesn't have a real good track record--versus the HL method that has been proven to be extremely accurate in predicting cumulative production over very long time periods.

Stuart's HL post suggests remaining Kuwaiti reserves of about 40 Gb (41% of the CIA estimate).

don't interpret the silence as bad, Dave. I think it's more the notion that for many of us, it's that we didn't have much to add or improve the silence afterwards.

Russia is the lynchpin of non-OPEC production however and sometimes we tend to forget that about 62% of the world's daily production is still from outside of OPEC countries. This is especially important since a non-OPEC peak has been predicted by various sources around 2010.

Putin knows that Russia is in a good position to throw its weight around and nothing illustrates this better than the recent dispute with the Ukraine and all of Europe further downstream. This is the "weapon" that allows Russia to regain the prestige lost after the fall of the Soviet Union and its status as a world power. This geopolitical consideration is very important to the Russians. In fact, it's not inconceivable that in a more depleted world, they could become a "swing producer" in the decade after 2010 even if they have topped out by that point. This would be especially true if geopolitics in the Middle East turns out the way I think it will--badly, at least in terms of the interests of Europe and the US.

Your work here points up the achilles heal of what many people seem to be trying to do - which is predict the peak by picking the half-way point of ultimate production. Predicting ultimate reserves at a point short of 50% of ultimate production is a tricky business fraught with technical uncertainty, even with good data.

On a side note, PFC Energy is putting on a symposium here in Houston in a couple weeks that I will be attending. If you have any burning questions that you want to ask Robin West, Jerry Kepes, or Roger Diwan let me know.

Major capital investment, but doable for enough oil.

And perhaps even more alarming, it shows where strategic thinking is moving with the Peak Oil cat out of the bag...

http://www.infoshop.org/inews/article.php?story=20060215180623912

I think it is a chilling read, and evidence of what Peak Oil can quietly breed while we all move forward business as usual.

hmmmmm....

http://www.telegraph.co.uk/news/main.jhtml?xml=/news/2006/02/12/wiran12.xml&sSheet=/news/2006/02 /12/ixnewstop.html

Never assume that the people who control other countries are ignorant or irrational.

The war the Chinese bitch about, the one that gave the Russians the northern half of the Black Dragon River watershed, the present border, was between the Czar and the Manchus running China at the time. Not China, though they still sulk about it.

But in the thirties the power contrast between the Union of Councils of the Socialist Republics and some dinky little warlord was so great it's hard to believe there was a war.

On one aspect I do agree: the US is only useful for China while US consumers are a market to develop its industry. The time will come when China's internal market and others' will suffice and it becomes more in China's interest to do what they can to pull the plug on the US$ so that the US is a lesser demand on the energy supplies China will need. They are probably about ready to act should circumstances dictate, but would prefer to wait a few more years if they can.

It calls China a liar for reporting "their crude oil imports rose only 1.2-percent while their oil products imports actually fell 34-percent, and that total oil demand dropped by 0.3-percent." If so, it will become clear from the data soon enough. Perhaps they are just being effective at doing what GW Bush says he wants to do? It is clear that China are very aware of their dependence on imported energy, and the risks that entails, and are doing a great deal more than many countries to solve that problem.

Then it sees the construction of a pipeline from Siberia as a reason to suggest China might be interested in a war with Russia. Utterly bonkers!

China is very well aware that a fight with Russia, even if sucessful, is more likely to reduce their access to foreign energy. Besides, can you tell me when Russia was last conquered?

Nowadays wars seem to be fought more for ideological and internal political reasons than otherwise. All rational countries on this planet know that modern wars cost more in resources and destruction of resources than they gain. There does seem to be the occasional notable exception, however ;)

It is a chilling read, in the sense that is an example of the thinking we can expect in future, quite possibly within the circles of powerful governments. But as a scenario that I find credible: nyet, comrade!

You got the gist of why I posted - it's the simple fact that strategists are thinking these things worldwide, and "what-iffing" them.

But with respect to "Nowadays wars fought political and internal"; I should assume then that our current "War on Terror" has absolutely nothing to do with our petroleum predicament? I mean, even the White House now admits there were no WMD's, so exactly why are we there? I'm not buying the idea that King George had a sudden flood of patriotism and felt compelled to democratize Iraq. Why not an easier target - like Cuba? Ahhh...Cuba has no oil......

The current mini-war in Nigeria has nothing to do with resources?? And Iran is more threatening than Pakistan with nuclear power? C'mon - Pakistan is hardly a bastion of stability, yet we didn't invade them when they joined the nuke club. So what does Iran have that Pakistan doesn't?

I think maybe your "Nyet" might need to be witheld a bit, comrade... (smile)

The Nigeria war is not the kind of war I was alluding to (which was major state vs. state) but bears consideration. It is about the enrichment of the upper classes and continued poverty of the local lower classes whose resources are being exploited. I hail from South Wales, the same happened there and has shaped its political tone for more than a century and will do for a long while more, methinks. I wrote a brief tale touching on this a while back, you've tempted me to repost it on my blog so I hope you read and enjoy:

http://theslide.blogspot.com/2006/02/road.html

If production increases slightly to 10mb/d, will the export capacity grow accordingly ?

Internal consumption could stall at 2.6mb/d ? But if the growth rate of russia remains as it is now, or even increases, (because of the momentum of recovery and the increasing commercial exchange with china) will there be a proportionnal increase in crude consumption ? Between 2003 and 2004, internal crude oil consumption increased by 3,1%. (source BP statistical review). If this continues until 2010 internal consumption could increase to 2.9mb/d. With a 0.7 increase in production export capacity would increase by 0.3 mb/d. Could that offset the decline of export capacity in the rest of the world ?

http://www.energybulletin.net/2544.html

Published on 15 Oct 2004 by EnergyBulletin.net / EnergieKrise.de.

The Countdown for the Peak of Oil Production has Begun - but what are the Views of the Most Important International Energy Agencies

by W. Zittel, J. Schindler, L-B-Systemtechn

Excerpt:

The oil production of the Former Soviet Union peaked reaching a production rate of more than 12 Mb/day at the end of the 80's. Soon afterwards production collapsed by almost 50% within 5 years. The production peak at the end of the 80's had been forecasted by western geologists based on the depletion patterns of the largest oil fields [7]. However, the following production collapse during the economic break down turned out to be much steeper than expected. For this reason, Russian companies were able to stop this decline after the liberalisation of the oil market and to increase production levels again - in some years at double-digit rates during the last 5 years - with the help of international cooperations and investments. However, this fast recovery now comes to an end as the easily accessible fields have been developed and the financial and technological backlog is widely closed.

Recently the director of the Russian energy agency, Sergej Oganesyan, conceded for the first time that the growth rates of the past few years can't be repeated anymore and that in 2005 production will probably stagnate or even decline [8].

I am writing a homework paper on CO2 EOR and I cannot find anything on Russia. Does anyone know if the Russians are trying CO2 injections to boost recovery? Would CO2 work for the Russian fields. It is rather perplexing: the second largest producer has a problem with aging fields and I cannot find a word on CO2 injection projects.

Thank you in advance!

Best wishes,