IEA Monthly Report

Posted by Stuart Staniford on March 14, 2006 - 2:56pm

Just a quick note that the IEA have come out with their latest OMR. They have revised January production down by half a million barrels per day to about 84.1mbpd. Their initial estimate for Feburary is 84.6mbpd. Bottom line: the bumpy plateau continues.

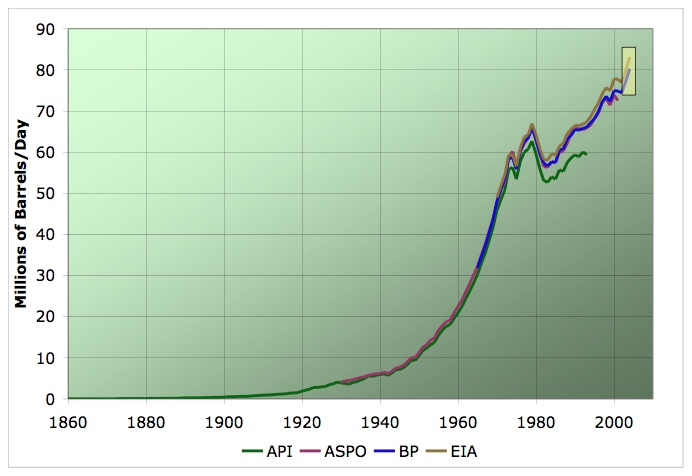

This is how the graph above fits into the larger history of world oil production (the little yellow box is the graph above).

Average annual oil production from various estimates. Click to enlarge. Believed to be all liquids, except for API line which is crude only. EIA line includes refinery gains, others do not. Sources: American Petroleum Institute, ASPO, BP, and EIA.

See link below :-

http://ogj.pennnet.com/articles/article_display.cfm?Section=ONART&C=DriPr&ARTICLE_ID=250242& amp;p=7

Seems Venezuelan oil production is not high enough, so taking the 600,000 bpd of 8 - 9 API and adding it the ordinary OPEC quota is okay.

http://www.eluniversal.com.mx/miami/17376.html

The oil fairy is not coming.

There is much to be learned from fairy tails. Gretel is one of my heroes, and Hansel was not a quitter either.

I find it hard to forgive their father, however, for agreeing to abandon his children, but the stepmother's reasoning was rigorous: It is better for some to starve than all to starve.

Hmmmm, the size of the ``find'' sounds like dreaming. But the tantilization may clear out opposition to neoliberal policy.

The real issue is not the last 15 or so months, but the next 12 to 24. If we stay on the bumpy plateau through most of that period we'll still see rising oil prices as demand is ever-more constrained by supply. And there will surely be additional mini-shocks created by political upheavals and natural disasters, even if Bush doesn't invade Iran.

I doubt we'll see an appreciable increase--I'm guessing no more than another 2 or 3 mb/d. My hope is that we tread water at about the current production level long enough to make significant improvements in our consumption patterns and overall non-renewable energy efficiency.

I see Russian--peaked next year. I see Cantrell declining faster than anticipated.

I see optimists pointing at the naked king.

There is of course a climb due solely to the recovery of the hurricane damaged fields, which accounts for over a million bpd. If you look at the specific numbers from different areas, however, OPEC is decreasing and specifically Saudi is declining every month. This is even before loss from Cantarell has even started to really register.

I agree with those who say too soon for conclusions but very intriguing.

Just out of curiosity, what is a sufficient amount of time to identify a convincing flat trend? These graphs indicate seventeen months of no growth in production. Obviously no one can conclusively say what tomorrow will bring.

As to "Just out of curiosity, what is a sufficient amount of time to identify a convincing flat trend?". I think it all depends who you are talking to. I think probably there'll have to be at least several years of downward movement in production numbers before sceptics would be silenced. At this point, we can't convincingly rule out some further upward movement, though I'd personally be surprised if it were more than a couple of mbpd (and even that much I would assess the balance of the evidence as against it).

I doubt the plateau will be very long (since it requires large opposing but balanced forces to maintain it). Either some strong source of increasing production will enter the picture and we'll resume going up, or before too long the decline rate will start to overwhelm the increasingly tired existing sources of production. I wouldn't give the plateau more than another couple of years at the outside - probably less.

Snow tells Congress USA is out of cash here

US Senate is starting to realize oil is not well with oil and NG business here

Murphy was right, everything goes bad all at once.

Oh when will they learn?

When will they learn?

(Where have all the flowers gone?)

US: Congress Challenges Oil Executives on Profits

by Jad Mouawad, The New York Times

Excerpt:

Senator Specter's proposed legislation would also permit the government to take legal action against the Organization of the Petroleum Exporting Countries for fixing oil prices.

"One of the biggest causes of high crude oil prices is the illegal price-fixing of the OPEC cartel," said Senator Mike DeWine, Republican of Ohio.

March 14th, 2006

More pandering by a Congress that is obviously nothing but willfully in denial on oil supply issues.

or perhaps no one is stating it is signifant but just offering it as an observation.

Perhaps you have not read Stuart's excellent post on "Why peak oil is probably about now".

If this little plateau is just a mere pause on the great IEA hike towards 120mbd by 2030, then why are oil prices so high? Why are long term futures higher than the short-term ones? Do you not think that the market is trying to tell us something.

Can you point to similar little plateaus in past few years that had similar record-breaking oil prices?

More importantly, with many of the world's super giant fields peaking at the moment, where do you think all this oil is going to come from?

don't get me wrong, i think we are at peak... or past it... i'm definitely a doom and gloomer when it comes to this (and climate change and... alot of things... peak everything).

i did read stuart's post and i don't think we're going to see any great increase in production. definitely not. i fully expect to see a continued plateau and a sharp decline before too long. i'm simply suggesting that it's a tad too early to... er, celebrate (and yes, the sooner we end this burning of carbon-based fuel the better so i do mean celebrate... though i suspect it may be too late in terms of climate change... shame we did not reach global peak 40 years ago).

At least they're consistent. I wonder if we could do the historical analysis and predict that revision before they make it

The increase from 75 to 84 million per day in the last few years was from extra capacity in the system and not new production which is not going to come on line any time soon and then will only serve to make up for loses in existing capacity.

The point is as follows: with oil at $60+ a barrel and demand destruction an issue if they could get oil down to $55 they would. Why? To prevent demand destruction, research or expanding use of alternative energy sources.

The facts are: (1) there just is NOT any spare daily production in the system as it stands today and (2) any new daily production in the coming years will just offset the lose built into the system from various peaking large fields. Moreover, who knows what would happen if (2) Iran's supply was cut off; (2) a war blocked oil tankers coming and going from the area; (3) Iraq's 1.7 went offline due to a civil war; (4) an event in Saudi cut supply; (5) another bad hurricane season or any number of other issues.

If anyone has specific evidence of increased daily production in the next two year except for the Saudi 200,000 to 300,000 increase, let me know!

One answer appeared on the news tonite in the form of bird flu. The scientist threw out some numbers that you can choose to accept or not, but he said that if bird flu becomes airborne and infectious to humans with the same level of virulence seen in birds, that up to 50% of the population could be killed. This got my attention, even though I did not accept his figures as reality any more than I accept the doomsayers here at TOD.

I believe we should consider the possibility of a global pandemic that results in a major reduction in the global population. I am thinking in terms of 5-15% fatalaties or more. This would have a major impact on global economies and oil consumption. Yes, it delays the inevitable, but a major loss of life (~15%) would delay it several decades for sure. I have structured, as I am sure others here have, my investments around the idea of $100+/barrel oil prices. the possibility of such an event does give me a bit of pause and makes me feel that preparing for such an eventuality is prudent.

If the delay in peak oil is pushed out to ~2030, the odds of us having developed, through nanotech and other advancements, alternative means of energy production that may make the dependency on oil much less and delay peak oil even further, or even relegate it to a non-issue status.

Best,

Kevin

That is sort of what happened after the Black Death killed 30%-50% of the population. The shortage of peasants encouraged more mechanization.

"NOTE: In accordance with Title 17 U.S.C. section 107, this material is distributed without profit or payment to those who have expressed a prior interest in receiving this information for non-profit research and educational purposes only. For more information go to:

http://www.law.cornell.edu/uscode/17/107.shtml

Money and Markets Monday, March 13, 2006

Dear Subscriber, snip From the relative peace and quiet of my home in Palm Beach Gardens, I see a new

storm on the horizon that most people seem to be ignoring:

Iran's President Ahmadinejad is marching ahead rapidly with a master plan to take over Iraq, with major onsequences for investors.

His special operatives have fanned out all over the country, training Iraqi militias and directing political assassinations. His military allies in Iraq - powerful Shiite militias originally founded in Iran - already dominate Iraq's Interior Ministry and most of Iraq's

police force.

His favorite Iraqi political party, also founded in Iran, was the outstanding winner in Iraq's latest elections and is already the strongest in the country.

This is Iran's stealth war to take over Iraq. It's threatening to upend most of the Arab and Muslim world ... destroy any semblance of balance in energy markets ... send global inflation soaring ... drive interest rates skyward ... and catapult precious metals through the

roof.

It's a greater threat than al Qaeda or the Sunni insurgency in Iraq. It's even a greater threat than Iran's own showdown with the West over its nuclear power program.

And ironically ... Almost Everything We've Done - or Failed to Do - Has Played into Iran's Hands When we deposed Saddam, we flung open the guard gates of Iraq.

When we disbanded the Iraqi army, we fired the guards.

And while we've been fighting the Sunni insurgency, we let the Shiite brigades pour in from Iran.

Indeed, shortly after the U.S. invasion in 2003, as many as 12,000 armed men - Iraqi exiles and Iranian intelligence officers - crossed the border to seize Iraqi towns and government offices, filling the vacuum left by the collapse of Saddam's regime.

Then, to make it even easier for Iran ... We blindly recruited thousands of Iran-trained militia members into

Iraq's police force and army ... We hurriedly engineered popular elections that brought Iran's allies to power, and ... We naively applauded while Iran's closest allies took over critical branches and divisions of Iraq's new government.

Old Warnings I've been warning readers about the danger of a Shiite rebellion in Iraq since 2004.

And in August of last year, Time magazine warned the rest of America. They analyzed documents smuggled out of Iran. They conducted dozens of interviews with U.S., British and Iraqi intelligence officials. They talked to armed dissidents, Iraqi militias and even an Iranian agent. Their conclusion: "In their scope and ambition, Iran's activities rival those of the U.S. and its allies ... "There is a gnawing worry within some intelligence circles that the failure to counter Iranian influence may come back to haunt the U.S. and its allies,

if Shiite factions with heavy Iranian backing eventually come to power and provoke the Sunnis to revolt ...

"Says a British military intelligence officer, about the relative inattention paid to Iranian meddling: 'It's as though we are sleepwalking."

Now, just a half year later, the feared scenario is unfolding precisely according to the script: * Shiite factions backed by Iran have indeed come to power ...

*Those Shiite factions have indeed provoked Sunnis to revolt ... *And Iran's influence is already haunting the U.S., threatening to derail our last hopes for success in Iraq. Al Quds Right now, Washington still thinks al Qaeda is the biggest threat to America's interests.

In the days ahead, you're going to hear more about an organization that most Americans never knew existed: Al Quds. Unlike al Qaeda, al Quds is not a nationless, renegade band. It's a highly organized strike force now operating in Iraq under the control of Iran's elite Revolutionary Guard. And unlike al Qaeda, al Quds doesn't have to beg for refuge or financing. It gets all the protection it needs on Iranian soil ... and all its funding

from the Iranian treasury, which, in turn, is liberally lubricated with oil money.

Moreover, al Quds (meaning "Jerusalem") is not an upstart band. For about two decades, al Quds has been operating in Lebanon, providing military guidance and support for terrorist attacks against Israel, especially those carried out by Hezbollah and other Islamic terrorist

organizations.

For many years, al Quds has also been operating as an elite international hit squad, responsible for political assassination in Europe and the Middle East.

Most disturbing of all, al Quds is joined at the hip with the most powerful militia currently operating in Iraq - the Badr Brigade. Consider the facts: Fact #1. Both Iran's al Quds Force and Iraq's Badr Brigade were founded

in Iran in the 1980s, with the same goal: To establish Shiite Islamic Republics throughout the Middle East.

Fact #2. Today, al Quds operatives are embedded in the Badr Brigade nearly everywhere in Iraq.

Fact #3. The Badr Brigade, in turn, has deeply iltrated Iraq's national police force. Many say it is Iraq's police force. Fact #4. The Badr Brigade is also the military branch of the largest and strongest political party, the Supreme Council for Islamic Revolution in Iraq (SCIRI).

Fact #5. A person who has played a prominent leadership role in the founding and training of both al Quds and the Badr Brigade is none other than Mahmoud Ahmadinejad, now the president of Iran.

In short, Iran's forces are already in the advanced stages of their master plan to take control of Iraq. Why U.S. Officials Can't Stay Silent about This Any Longer

Until recently, top U.S. officials didn't want to talk about Iran's growing dominance of Iraq - let alone admit its obvious implications.

They figured they were getting cooperation from Iraq's Shiite militias against the Sunni-led insurgency. So they tried not to complain too loudly about their Iranian backers.

Now, however, Washington is finally beginning to recognize the problem more publicly: In recent days, America's ambassador to Iraq, Zalmay Khalilzad, has been

denouncing the virtual takeover of Iran's government by Iran-backed forces.

Last Tuesday, Defense Secretary Donald Rumsfeld accused Iran of infiltrating Iraq with paramilitary units "to do things that are harmful," specifically citing al Quds as the primary offender.

And just this past weekend, President Bush denounced moves by Iran to interfere in Iraq. But Washington is still not facing up to - or not admitting - the ultimate

danger: Iran and Iraq Will Form a New Shiite Islamic Alliance. They Will Control Oil Reserves as Large as Saudi Arabia's. And They Will Cause Turmoil in the World's Oil Markets.

The Shiites of Iraq have a very simple plan for us:

They will cooperate as long as we are helping them squash their Sunni enemies in Iraq. They will turn against us when they feel we're no longer on their side or they think they don't need us any more. And when we begin withdrawing from Iraq, they will rush back into the arms of their true allies, their fellow Shiites of Iran.

The end result will be the second Shiite Islamic Republic in the world - and a powerful economic, military and strategic alliance between Iran and Iraq that is extremely hostile to the United States.

Based on official estimates, an Iran-Iraq alliance would control 248 billion barrels of oil. That's far more than the oil reserves of Kuwait and the United Arab

Emirates combined. And it's nearly as much as the oil reserves of Saudi Arabia, officially estimated at 263 billion barrels.

Moreover, last week, Sean showed how independent estimates of actual oil reserves are, on average, only 55% of the official estimates, implying huge shortages in the future.

Regardless of which figures you use, however, the conclusion is the same: An Iran-Iraq alliance would control oil reserves that are nearly equivalent to

Saudi Arabia's. So now you have the full picture of Mahmoud Ahmadinejad's plan. He's moving to ...

*Establish a Shiite Islamic republic in Iraq ... *Unite Iraq and Iran in a Shiite alliance, and ... *Defy the West with one of the largest pools of oil reserves on the

planet. And now, you can start piecing together all the fragments: Ahmadinejad ... Iran's nuclear confrontation with the West ... the al Quds Force and suicide attacks in Israel ... the al Quds Force and Iraq's powerful Badr Brigade ... civil war in Iraq ... and back to Ahmadinejad. All connected. All intricately linked in one, multi-layered battle that's now looming. But there's more ...

Iran Is Spreading Revolution Throughout the Muslim World

According to GlobalSecurity.org, Iran's Revolutionary Guard has two offices dedicated to fomenting revolutions in the Arab world: the Committee on Foreign Intelligence Abroad and the Committee on Implementation of Actions

Abroad. Their personnel operate freely through front companies and non-governmental organizations. They use employees or officials of trading companies, banks,

and cultural centers. And not coincidentally, they have their greatest influence in the three other Persian Gulf countries with the most oil reserves: Kuwait, Bahrain, and the United Arab Emirates.

Their plan: Once a Shiite Republic is established in Iraq, they will move on to others. Right now, Security.org reports that the largest branch of Iran's foreign operations includes approximately 12,000 Iranians, Afghans,

Iraqis, Lebanese and North Africans who have been trained in Iran or in Afghanistan during the Afghan war years.

Today, these foreign operatives get most of their training in Iran, Sudan, Lebanon, and Iraq. They are supporting Hezbollah branches in Lebanon, Iraqi Kurdistan, Jordan and Palestine. Plus, they are helping Islamic Jihad,

another international terrorist organization, in many other Muslim countries, including Egypt, Turkey, and Chechnya.

This is a big network. And it's been in operation for a long time. Eleven years ago, for example, in April 1995, many organizations linked to international terrorism - including the Japanese Red Army, the Armenian Secret Army, and the Kurdistan Workers' Party - met in Beirut. The

meeting included representatives of the Iraqi Dawah Party, the Islamic Front for the Liberation of Bahrain, ezbollah, and, most prominently, Iran's Revolutionary Guard.

Members of these organizations then received military training at Revolutionary Guard facilities about 100 kilometers south of Tehran, including fundamentalists from the Persian Gulf states, Egypt, Algeria, Tunisia, and Lebanon. Iran even established a special camp near the

Ornotes River to provide training in naval operations, mines, and diving.

Tehran's obvious objective: To destabilize Arab Gulf states. To foment Shiite rebellions. To establish a virtual Shiite empire. The big tragedy: Even while we have been waging an open war against Sunni fundamentalists (the Taliban and al Qaeda), the Shiite fundamentalists

have been winning the stealth war. What to Do This adds a whole new dimension to the outlook for oil, gold and other

major resources.

It directly threatens the entire Persian Gulf, where most of the world's oil reserves are located, implying a far greater risk premium than is currently built into oil prices. It also sets the stage for another major flight by international investors to safer havens.

Among the first to run will be wealthy individuals with substantial financial assets in the Middle East. national conglomerates, large financial institutions, and central banks will be close behind. All will do everything in their power to hedge against the rising risk. Many

will buy gold. So far this month, however, oil and gold markets have been quiet, even retreating. Typically traders don't look behind the scenes, as I have done

this morning, to see what the next act will be. They wait until it's on center stage. Then they react - suddenly and in unison. You don't have to wait for that moment. You can take advantage of the current lull to establish or reinforce core, long-term positions in the investments that are likely to soar in this rapidly deteriorating

environment."

Better get our roof top will mills now ...

Thanks from the agendas@todiscuss.com group

That being said, I am betting that oil will smash through $100 a barrel before any bird flu pandemic may arrive, but I could be wrong. Only time will tell.

IOW, peak oil may cause a pandemic.

The world has suffered periodic flu pandemics throughout the 20th century, and did not collapse. Even the worst case, the Spanish Flu, killed only 3%-5% of its victims. Today, I doubt the death toll would be that high, at least in Western nations. Medical technology has improved greatly since 1918. If there's a 15% fatality rate, I suspect it will be in the Third World.

Therefore wrt PO, Famine due to diminished fertilisers etc after peak oil would set the stage for any pandemic to be worse than it would otherwise be.

And then as it struck, crops went unharvested and rotted in the fields / were never planted. Famine , Pestilence and Death ride together.

The Population of England 1348-1901

Year Population Year Population

1348 5,500000 (1) 1811 10,165000

1375 2,750000 1821 12,000000

1450 2,400000 1831 13,900000

1500 3,200000 1841 15,900000

1570 4,160000 1851 17,900000

1600 4,810000 1861 20,606000

1630 5,600000 (2) 1871 22,712000

1670 5,573000 (3) 1881 25,974000

1700 6,000000 1891 29,000000

1750 7,000000 1901 32,527000

Note: 1348-1750 are estimates from various sources.

(1) 1348 The year preceding the black death.

(2) 1630 The English population finally recovers to its pre-black death level.

(3) 1670 1666 the year of the Plague. And the English Civil War 1640-45

It took 300 years to get to pre BD population levels.

The socio-economic effects of the BD were remarkable:

- Whole tracts of land and villages abandoned.

- Survivors were a lot wealthier from inheritances

- Laws passed to try and keep peasants on the land at pre BD wages. (these mostly failed)

- The 'Sumptuary Law' - Peasants stopped from dressing above their station in life.

- A general failure in Faith and the kick starting of the age of reason.

We REALLY dont want to go back to these times... Bird Flu, Peak Oil , whichever.From Monty Python and the holy grail:

'How can you tell he is the King?'

' - 'cos he is not covered in shit'.

My own reading (that concurs with that of many of the most prominent European historians and economic historians) is that one of the main results of the the Black Death was to help to destroy feudalism. In this regard it may have been as important, or even more important, than the use of gunpowder to change the nature of warfare. If this interpretation is correct, then, on balance, the Black Death may have been a good thing.

Another interesting case to examine is the drop in Ireland's population from about eight million to about four million in the years after the Great Potato Famine near the middle of the nineteenth century--a striking failure of perhaps the world's first "Green Revolution."

also, if a flu pandemic hits, people will confine themselves to their homes...they will drive less, go out to eat less, go out to entertain themselves less, etc. I have no doubts that a serious pandemic forestalls peak oil by a decade or more. My only question is the probability of such an event occuring, and no-one really knows the answer to that question.

I started this thread because we should at least be aware of the pandemic threat and its possible affects on the peak oil predictions.

What exactly are the particularly at-risk categories of the world population who are very likely to fall victim to such a pandemic?

Sure. Mature, much better. We need more mature fields, right?

Technology will save us, right?

Anyhow, there was also a picture with some data:

My simple conclusions:

- If oil price goes up, more wells are drilled.

- No need for tax hand-outs

- Production declines, independent of the number of wells

- North Sea production is now 6 years after its peak, with an annual decline of about 5%

- Technology does not stop the decline

The funny part is that in the same article, you get the rosy happy camper feeling that all is ok, while the data says exactly the opposite.