Peak Oil: The inflationary case

Posted by Stuart Staniford on April 12, 2006 - 4:51am

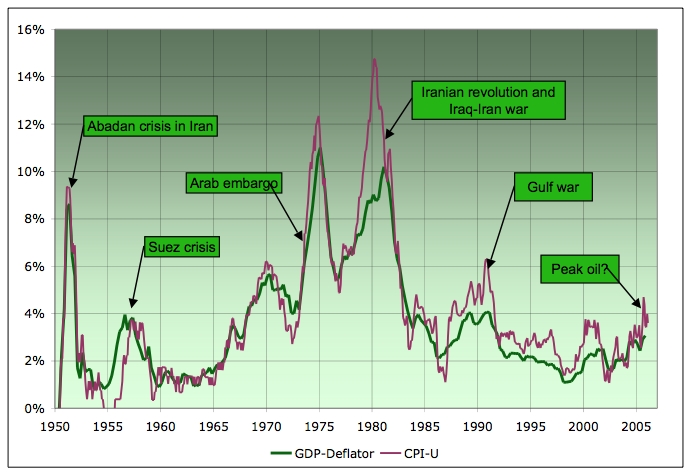

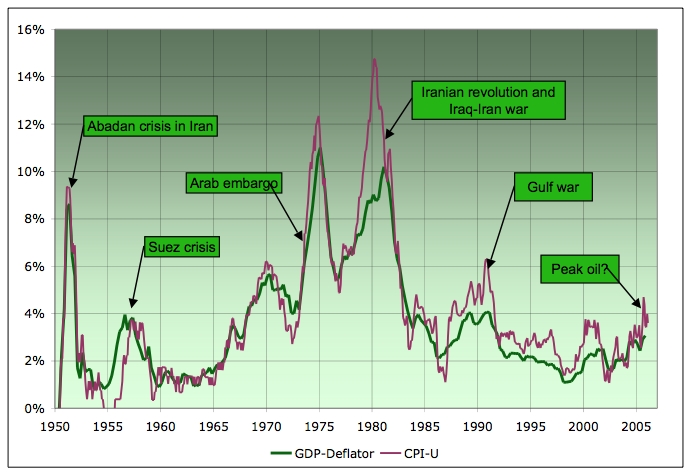

- The Abadan Crisis when Mohammed Mossadegh nationalized the Anglo-Iranian oil company, which provoked the British to embargo Iranian oil. This ended with the US-British backed coup that deposed Mossadegh.

- The Suez Crisis in which Egypt nationalized the Suez canal, the major supply route for oil to Europe, provoking an alliance of France, Israel, and Britain to militarily seize the canal, before being obliged to withdraw under threats from the Soviet Union and the US. The canal was then placed under control of the first United Nations peacekeeping operation.

- The Arab Oil Embargo

- The Iranian revolution, and closely following Iran-Iraq war,

- The 1991 Gulf War following the Iraqi invasion of Kuwait in August 1990.

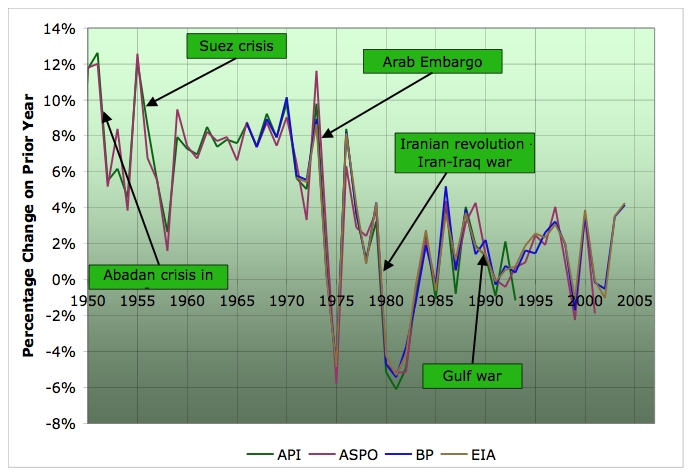

Many economists would argue that the absence of big inflation peaks since the early 1980s means that inflation expectations have been conquered, and that things are fundamentally different now. I don't altogether dismiss this, but at at minimum it hasn't been tested by any good-size shocks. The only oil shock since the early 1980s was that associated with the Iraqi invasion of Kuwait and the first Gulf war. As the following graph shows, as an oil shock, that was nowhere near the monsters of old (if we measure the magnitude of an oil shock by the change in the growth rate of annual global oil production that it produces).

Percentage change in average annual oil production from one year to the next according to various estimates. Click to enlarge. Believed to be all liquids, except API line is crude only. EIA line includes refinery gains, others do not. Sources: ASPO, BP, and EIA.

I suspect that if we had had any really big shocks, we'd have had a lot more inflation. Even the events of 2005, when the growth rate in global oil production certainly slowed sharply, are not close to those of the 1950s or 1970s. And indeed, so far we've had only a modest uptick in the inflation rate.

In passing, I would just like to note that the difference between the two inflation lines in the graph suggests that that inflation is a somewhat imprecise quantity - different agencies can come up with numbers that are only roughly similar by using different definitions. There are considerable difficulties in principle in measuring inflation associated with the fact that dollars in one era are not really commensurable with dollars in another era, since they represent the right to buy a slice of qualitatively different mixes of goods and services. The various agencies have methods of interpolating, but there's something fundamentally subjective about deciding how much a new 1950 car is worth compared to a new 2006 car. Thus I think the inflation rate should be viewed as having an error of a percentage point or two, which means that long-term comparisons of prices are very approximate. This is because those uncertainties compound over time. For example, saying that oil is still cheaper than in 1981 is probably a fairly meaningless statement, as the difference in price is likely smaller than the uncertainties in the compounded inflation from that time to this.

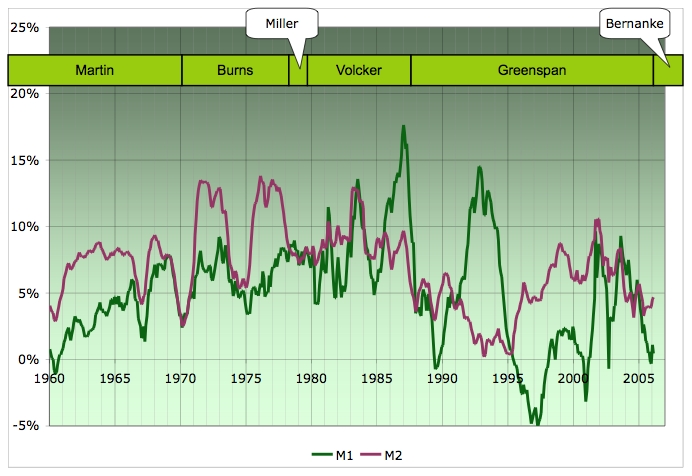

Economists are fond of arguing that inflation is mainly a function of central bank policy - easy or tight money controls whether there's inflation or not. While I think there's been something to this over the long haul in the distant past, and certainly in cases of hyperinflation, it doesn't seem to have been as important as oil shocks in US inflation in recent decades.

Here's the growth rates in the two most common measures of money supply: M1 (notes, coins, and checking account balances) and M2 (M1 plus savings account balances and small bank CDs). M1 is directly controlled by the Fed via open market operations. M2 is not (since reserve requirements on savings accounts and CDs are zero).

Money supply growth. Percentage growth from same month in prior year. Eras of different Fed Chairs labeled above. Source: Federal Reserve Bank.

Again here's the inflation picture for comparison. I don't see any close correlation. The oil shocks look far more explanatory of the details of the inflation graph. There is an upward bulge in the money supply centered in the 1970s, but it's not clear which way the causation runs - when inflation is high, the money supply needs to be increased just to keep the amount of money available constant relative to price levels.

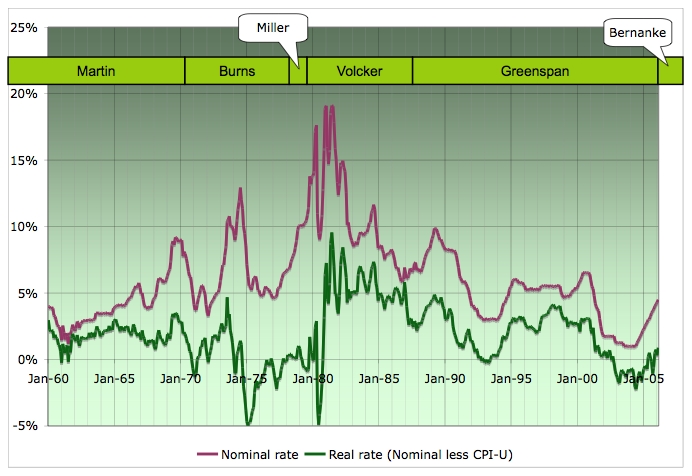

Then here's interest rates. Obviously, interest rates have a broader effect on the economy than their direct effects on money supply: they control the desirability of lending and borrowing in all kinds of credit. When I look at this next graph, I see a relationship between inflation and interest rates, but the interest rate peaks lag the oil shocks, and then interest rates and inflation go up together. What it looks like is the oil shock causes inflation, and then the fed raises interest rates to rein it in again. (Caution: the interest rate graph only goes back to 1960, but the inflation data goes back to 1950)

Effective federal funds rate (source: St Louis Fed), together with real interest rate computed by subtracting CPI-U inflation. Eras of different Fed Chairs labeled above.

It's also striking how low real interest rates are still. No wonder Americans are borrowing like crazy.

So what would a deflationist peak oil story look like? Well, here's an outline story about it. I'm not close to evaluating this quantitatively yet, so take it for what it's worth - it could easily be wrong in important respects.

The idea is that deflation occurs because of major failures in the banking system causing a contraction of the supply of credit to the economy. In the US great depression, lots of banks actually went under, causing a fairly short sharp deflation. In Japan in the 1990s, the government propped the banks up, meaning they were just stuck with large volumes of bad loans and couldn't do much new lending. This led to a long slow deflation.

In the US, after the great depression, bank regulation was greatly tightened up, FDIC was set up etc. We haven't had deflation since. However, what has happened in the last twenty years is that we've started securitizing mortgages and selling the risk on the credit derivative markets. A lot of it has been bought by a completely new and unregulated animal: hedge funds. This has led to decent volumes of fairly risky mortgage lending that would not have been countenanced decades ago.

Suppose peak oil is initially inflationary as above. In consequence, the Fed has to raise interest rates a lot more than the markets are counting on to counter the resulting inflation. Since around 40% of recent mortgages are ARMs, this causes massive strain on household finances in those houses, and leads to a much higher level of defaults than markets had been counting on.

Since hedge funds are new, have been growing like topsy, and are unregulated, there's probably a good deal of craziness happening (it always goes down like this: think joint stock companies in the seventeenth century, junk bonds in the 1980s, dot-coms, Enron, etc in the 1990s). The hedge fund boom is probably likely to end in tears at some point, just out of the general nature of financial humanity.

So then if we start to get major failures in hedge-fund land, either the Fed has to step in and prop them up, or it lets them fail. Either way, there's likely to be a sharp contraction in mortgage (and probably other) lending - much worse than the ending of the housing bubble by itself would have occasioned. That is strongly deflationary.

So that's kind of the story - an initial burst of inflation and high interest rates pokes a big hole in the credit markets, which then contract enough to more than offset the inflationary pressure.

Could this happen? I don't really know, but I'm sure you'll have opinions. The floor is yours.

Debating whether or not Oil is inflationary, is not the question. The price of oil and the future scarcity of it, is unmistakenly inflationary. Now if one wants to add the US FED printing presses or whatever, you have a double or triple whammy.

Because the Government is no longer producing M3 money figures for the public, one can easily track inflation by the price of Gold. As Gold inches over $600 an ounce and on its way to $1,000, you can deduce, there is alot of inflation going on. If anyone still has money or investments in paper assets, unless they are good mining companies or oil service stocks.....you would be wise dumping everything in Gold and Silver bullion.

Unfortunately, the coming Inflationary Sprial and resultant Depression will be like no other felt in history. If you can find an old-timer who lived during the depression of the thirties, they will tell you how rough it was. Today, we do not have the billions and billons of untapped barrels of oil, millions of tons of metals and minerals that have been consumed in our Wonderful World of Suburbia. What we have is many more millions of people living in places that will not be able to sustain them. There will be an all out race out of the Suburbs.

Those who lived in the depression days of the thirties, were considered lucky. They were lucky because they had decades of Dam Building, Highway building, Residential, and Commercial building, Manufacturing and etc. Today, our future will be nothing more than a glorified "ROAD WARRIOR" type of existance. Get ready, because playing video games and driving out to eat and to a movie will be things our children will be told around the woodburning stove fire.

I am not bullshitting - I experienced all these things.

Helping my mom clean hotel rooms (the original spoken contract was $1 per room but it became merely the chance to get some of the food the visitors often left behind), experimenting with new foods (I gained much respect for the humble sweet potato, the young leaves are like a starchy spinach) and learning the finer points of hitchhiking (which almost no one seems to know how to do now, you need to hitch at places that are natural stopping or pausing points for cars you amateurs).

I imagine a possible future being like the worst of the 70s. Whee.

It's an interesting discussion, but in this case, I am not going to even try to PRETEND I know the answer...it just brings up more questions...

>oil consumption as a percent of GDP growth is lower than it was even in the 1980's due to efficiencies...this has to have an effect as the oil price does not go as directly right into the price of everything

>likewise, oil consumption has dropped as a percent of electric power production, which in the old days was to blame for everything..."you know, the oil price goes up, and it costs more to refridgerate your food, or to process shampoo,etc....that linkage is now much looser...

What we might want to look at is average btu price, which would include oil, natural gas, coal, propane and even nuclear...and compare that composite average to inflation....it could be interesting. I am becoming less fascinated by oil and more fascinated by this "all liquids" catagory, crude oil, LNG, pipeline nat gas, gas to liquids, Diesel and bio Diesel, alcohols, propane, etc. It seems like these are and will be even more so in the future, interchangable, and that "light sweet crude" is becoming just one sliver ofa broader spectrum of fuel switching...once coal to liquid comes on (and GHG be dammed, it will!), and you end up using coal to make Diesel and GTL to make fertilizer to make corn or soybeans to make fuel...the mix and match will be become extraordinarily confusing! The greatest inflation is going to be in processing/refining equipment, pumps, pipes, valves and cookers and boilers, already racing upward in price.

Here is an interesting link on the government stats that we are expected to take a gospel

http://www.gillespieresearch.com/cgi-bin/bgn

http://www.weedenco.com/welling/Downloads/2006/0804welling022106.pdf

Williams is associated with the Gillespie site you posted.

They are already telegraphing the hoodwinking! Network-level

TV commercials for a popular dollar store chain are advertising

specials for their brand authentic 'Meat Flavored" Marinara Sauce.

Watch "Repo Man" again. Soon we may be allowed to stand in

queues for Fresh, Generic brand 'CANNED FOOD'.

Best get your real food act together while you still can.

I have been thinking about this for a while and I keep coming back to the same conclusions...

In order to put the whole issue on a proper footing I first considered that money is not the base currency, energy is...

Whit that in mind it strikes me that both inflation and deflation are likely depending on the subjects exposure to energy imports...

Let me explain my thinking...

If you are a net energy importer then the pressure of inflation is from the price you have to pay to get access to the energy that is required for everything... Thus you suffer inflationary effects...

On the other hand if you are a net exporter your internal energy costs are largely down to the cost of production and as such the HARD limiting factor of energy cost falls to that base. In the previous case you would have to pay the full market value which would be much higher the the extraction costs due to supply and demand... In this case the withdrawal of credit, if it oocurred would more likely cause local deflation...

Does this make any sense and if so does this then mean that a widening gap of prosperity will appear between energy importers and energy exporters... Obviously this is a relative concept in that the ratio of exported to imported energy for the subject will lessen or wrosen the effect in the appropriate direction...

I guess what I am trying to say is that I think both inflation and deflation will take place in different areas or jurisdictions according to their energy wealth, the only real wealth...

Regards

Jon

The question in my mind is whether it is possible for the US economy to survive as consumer spending drops - regardless of price cuts.

The assumption being that the interest hikes will 'cool the inflation'. So joe public takes it in the nuts twice.

Also, re further up this thread, I too am sure that true inflation is in fact nothing like the posted official rate.

This is a neat way for TPTB can extract wealth.

I am well aware of stagflation since I lived through it. FWIW, I also lived through rationing during WWII. Although I wasn't that old, I saw how it impacted my family.

I believe that we will have hyper increases in costs (therby avoiding the debate about the definition of inflation) in all areas that involve energy with a true depression in most other areas. This is nothing like stagflation.

In very simplified terms, the service industries will die and the result will be massive unemployment, the financial sector will tank due to defaults and government activities will shrink dramaticly due to a lack of tax funds.

If you lived through rationing then you must be from this side of the pond.

What is your take on the current method on the measure of UK inflation? I assume you got the same kind of council tax bill I just got...

Actually, I'm in the US so I can't comment on the UK. The US had significant rationing during the war. Besides the booklet of stamps for various foods and gasoline, one of my "fondest" rememberances is "margarine" (which by the way was also rationed). You got this brick of white grease sort of stuff with a little packet of coloring that you mixed into it to make it not look like white grease but rather, yellow grease.

In driving, my dad tried to coast down any hill (in neutral) to save gas. At home, we heated with coal but I don't remember whether it was rationed - probably was. We were never short of food but we never had much food in the house.

During the stagflation period, I was the manager of a process development group and wages and prices were controlled. The only way to get a "raise" was for the company to offer rationales for additional reponsibilities or a title change. It was a strange time. My only real rememberance of that period was President Jerry Ford trying to intoduce his WIN program - Whip Inflation Now.

You learn something new everyday!

My Mum says thanks for the Spam. You can keep the margerine though

US society went through a significant change during WWII. My mom who had been an elementary school teacher had to quit when she got married because schools did not permit married teachers to, well, teach. She got a call after the war started from a principal saying she had to go back to teaching because it was her patriotic duty (since men teachers had been drafted)!

This kind of historical perspective is why I'm pretty gloomy about the future. My maternal grandmother grew up in a cabin in Ohio in the late 1800's. The local Indians came in after they went to bed to sleep by the fire - and this is a story by itself. My parents had no electricty as kids; only gas lights and "real" ice boxes. Electricity was a big deal. One of the things that speaks toward the future was something my great grandmother used to tell my mom and her sisters once they got "radio", "Watch what you say because they'll hear your comments."

My point regarding WWII and the past is that people accepted life as it was. You couldn't over consume because you were lucky to have food and a roof over your head. During WWII, there was a shared societal consciousness to do whatever it took to "bring the boys home."

I cannot conceive of this kind of, I'm at a loss for words here, action in a post peak energy world. Especially one with rampant financial problems. The real issue as I indicated in a post above, is whether this is still possible,

My mom still prefers to line-dry her clothes, but she has a sort of hideaway clothesline in a courtyard of the house...so the neighbors can't complain.

http://www.californiasolarcenter.org/solardryer.html

Todd:

The historian Christopher Lasch wrote a book The Culture of Narcissism which explores in depth the point you make about the contrast between the WWII era and the present.

I agree that from WWII up to the 1960s there was a strong sense of community cohesion. That has now been replaced by a "Me" mentality that is incomprehensible and will likely increase the social breakdown associated with PO.

When I saw myself in the mirror and saw a kid with a bulging stomach (NOT because it had food in it) and skinny arms/legs I knew I had to do something, I'd seen that in National Geographic. And I started working on foraging skills.

As an addendum to your post here's the last work of Andre Gunder Frank:

MEET UNCLE SAM - WITHOUT CLOTHES - PARADING AROUND CHINA AND THE WORLD

I believe it's not finished, Frank died soon after. It has a strong political content but it's worth reading all the way.

I'll see if I can find the historical M3 data somewhere and see if this train of thought bears any fruit.

I found the historical M3 data but some quick (and crude, compared to Stuart's) graphing didn't show any relationship so my prior thoughts are not backed by the data. I am going to look at it more but no longer expect to find such a relationship though there may be something else there. I had to convert the ASCII version of the file to a CSV file, then import that into OpenOffice and try graphing it. I tried charting the month to month rate of change as well as the change over the preceding 12 months but as I said, it didn't seem to show any relationship to Stuart's inflation data.

http://www.rrojasdatabank.org/agfrank/2004es02.html

"One resulting scenario is that this situation offers an opportunity for more productive and competitive Europeans to step in and replace the dollar with the euro and/or another as the world's reserve currency. However, the Europeans lack a strong state to do so. But a major step would be for Russia, OPEC and other oil exporters to price their oil in euros instead of dollars, thus increasing demand for the euro and sending the dollar crashing down. Iraq priced its oil in euros, and an important reason for the U.S. war against it was to keep others from doing the same."

In this particaluar article I believe he ignores that fact that Asia has 60% of the population for 10% of oil reserves. No way this century will be Asian.

Still a very sound macro-economic analysis.

I think that the inflation/deflation question is perhpas not the most important one. It is more important just to understand the massive pressures coming bear on our economy. With the Fed's recent decision to no longer track the M3, which tracks the total supply of money and is beginning to show a serious level on inflation, there are rumors on the net that a huge money printing campaign has begun. The reaction of economic policy setter to the immense pressures that are forming will (at first) dictate whether we have inflation or deflation. It seems they are implimenting an inflationary strategy. However, I think that this strategy will only allow the pressure to build a little longer, and periods of deflation are completely possible.

I think the most important thing is that it will be chaotic, unpredictable, and small perturbations may have the potential to swing the market and the money supply in drastic ways.

The point that MicroHydro makes below is a good one. Inflation is really a growth in the money supply (which was until recently best measured by the M3). The "inflation" caused by high energy prices that translate into higher prices throughout an economy is a different beast. But look at it from the point of view of the banksters:

1) high energy prices = higher prices on consumer goods

2) higher prices on consumer goods = people buy less

3) people buy less = economic slowdown

4) with the economy on such shaky footing with the housing bubble, massive trade deficit etc - economic slowdown may = economic crash

5) solution? "print" money like crazy

More money in the system means that higher prices can be offset by the fact that there is more money in circulation to pay those high prices. Of course, it is unlikely to work in the long run, if by "work" we mean that it keeps the economy operating in the way we have come to expect. More money supply means more "real" inflation, causing prices to rise even more, creating the necessity of printing more money to maintain the illusion of economic growth. This is really playing with fire, because if the currency massively inflates, it may lose its value completely. Thus, hide the M3 figure, cross your fingers, and hope for the best!

From The Organic Economy:

Money is created and issued by banks in the form of loans. These loans are the source of the money that circulates in our economy. The interest charged on loans is a key part of the growth economy.

Imagine a situation in which 10 people each borrow $10 from a bank. These 10 people form their own closed economy and money system. The terms of the loan are that each person has to repay the $10 at the end of one year, plus one extra dollar in interest, for a total of $11. Since there is only $100 in the system (10 people x $10), it will be impossible for 10 people to pay back $11 each - that would equal $110, more money than exists. The ten people must compete fiercely for money to repay the bank, and at least on of them will not be able to repay her loan. If 9 people each pay back the $11 they owe, that would equal $99 and there would only be $1 left for the last unfortunate person, who would become bankrupt.

Now imagine that six months into the year, 10 more people join the economy, each with a $10 loan. Suddenly there is $200 in the economy and only $110 of it will be due at the end of the first year. There is enough money to satisfy short term requirements, but still not enough in the long run. The amount of debt still exceeds the supply of money.

The money system of a growth economy is based on credit that is issued under the assumption that tomorrow's economic expansion will be able to repay today's loans. But what if tomorrow does not bring expansion?

In the inital stages of a growth economy, money that is borrowed can easily be used to increase the overall value present in the economy. It can be put to good use. When this occurs, the investement makes money, and the loan can be repaid. However, as we reach the limits of growth, money that is loaned can no longer be used with such a good effect. It is much harder to create "real" value. Thus, we have super-inflation of housing prices etc. This money is not creating real value, it is going into feeding a bubble.

The problem is that money must be issued at an ever increasing pace, as illustrated in the quote above. If it is not, when debts become due, there will not be enough money in the system to repay them. Thus inflation (in the real sense of an increase in money supply) is a necessity to maintain our growth economy. This is not a problem as long as this inflation approximately matches the growth of real value in the economy. But when real value does not increase with the pace of inflation, it is only a matter of time before the whole house of cards collapses. Inflation is the necessary policy of the banksters, but it is an open question as to how long this strategy will keep this illusory economy afloat.

This is obviously a huge and quite complex topic. I'd love to hear any thoughts or questions from the people in the TOD community about the possibility of an Organic Economy that does not base itself on the assumption of perpetual growth.

The future is unknowable; that is the one and only thing we know for sure about the future;-)

Note that multiple scenarios can all be correct if they happen in sequence. For example:

- Crash in housing prices leads to stock-market crash, severe recession, greatly increased unemployment, reduced demand for oil and hence lower oil and gasoline prices for a few years, to be followed by

- Extremely expansive fiscal monetary and fiscal policy to reduce unemployment which, with a time lag of a year or two, which then leads to

- An abrupt shift in expectations for increasing inflation that fuels another borrowing binge and tight monetary policy with skyrocketing interest rates to combat the inflation and

- A 1980 type of situation, with inflation in double digits and the prime rate above 20% which causes

- an even more serious recession/depression with unemployment rising to 15% and beyond, which triggers

- Deficits in the multitrillion dollar range financed by the Federal Reserve giving up the battle against inflation by montetizing the national debt in a despairing attempt to prevent a spiralling downwards into depression and deflation.

- Then TSHTF.

We live in inreasingly uncertain times. Rather than obsess on "What is going to happen????" be flexible and ready for inflation or deflation (even though I think deflation is extremely unlikely), oil at $200 per barrel or oil at $20 per barrel (for a few recession years), and the collapse of the real estate market over the next couple of years which will have enormous financial repercussions.One topic that I think has received insufficient attention is that the financial collapse of residential real estate in the U.S. could lead to a crash in the stock market of 1929 proportions. Note: I do not assert that this WILL happen, but I do believe that it is not especially unlikely.

IMO the Fed will do whatever is needed to prevent a deflation that could result from financial collapse--and that means that Ben and the rest of the Board of Governors will load up the helicopters with cash to "bomb" the cities if necessary. (Compared to other wasteful programs of the federal government, dropping cash from helicopters is a both effiecient and effective way to redistribute income and stimulate the economy. It probably will not come to that, however.)

I agree completely that meeting uncertainty with flexibility is very good advice. Minimizing the consequences of being wrong is a good idea as well. If you take either an inflationary of a deflationary strategy to it's logical conclusion (for inflation max out debts on purchase of real goods, for deflation sell everything and hold liquidity in preparation for asset price collapse across the board) you would be in very serious trouble if you turned out to be wrong. You could even be in trouble if you turn out to be right if reality ends up being more complicated than you expected (and reality is almost always more complicated than humans expect).

For instance, if you hoarded gold in anticipation of hyperinflation and did end up in a hyperinflationary scenario, gold ownership could be declared illegal and being caught trading it for the necessities of life could incur severe penalites. If you had bought a large amount of real estate, your property could be confiscated or made the subject of punitive taxation which you might no longer have the uncommitted cash to cover.

If you were sitting on a lake of liquidity in anticipation of deflation and deflation did in fact occur, holding on to your collection of uncommitted choices for long enough to use them as prices bottomed out could prove to be as difficult as holding on to a handful of water for a long time. It would almost certainly attract the unwelcome attention of cash strapped governments unable to meet their obligations who would probably find a means of taxing it out of existence. You might also find that the things you were waiting to buy until prices fell are no longer available due to the collapse of the companies that made them.

Either way, you would be trying to maintain a disparity of material wealth in comparison with the general population, which is as difficult as trying to hold on to a concentration of heat in a sea of cold. In other words, you would be fighting entropy, which requires constant vigilance as to impending changes in relative value and an ability to switch between stores of value without sacrificing too high a percentage of that value in transaction costs. The risks are far higher at every turn than most people in developed societies are accustomed to.

Given the difficulties of maintining a disparity of material wealth, I would argue that knowledge, specifically knowledge as to how to provide for oneself from one's surroundings and make do with very little, is the one of the best investments one can make. Knowledge can be shared without being diluted and can't be confiscated. I would also recommend being debt-free (I'm expecting deflation), having the equipment necessary to provide for the essentials of one's own existence and having emergency supplies of essentials. A crisis of any kind could mean having to look after oneself and one's family without the usual regular inputs for a significant period of time.

Personally, I think this is very likely.

Buying a lower-priced house now for no money down might be a way of hedging this bet - I did it. I still can't believe that lenders are currently willing to allow things like 80% primary and 20% second loans with large amounts of closing expenses allowable for rolling over into the loans as a "seller contribution." Just be prepared to hold on to it during some weird times, and make sure that it doesn't have a "call" provision (these days a call provision is rare, except for sub prime).

Historically, this is nuts! But hey, I used it and I would like to say something to the "system," "Thanks! And don't worry, our payments will always be on time - no defaults from these campers."

I sure hope that none of the retirement plans and IRAs that are holding these (super safe, they say) securitized loans don't get hurt...

Inflation, classically means one thing only: the expansion of money supply. In modern times the broadest measure of money supply, M3, would be the correct metric. Note there are many ways to grow the money supply now, including monetization of treasury debt created by defict spending.

Inflation does NOT refer to increases in wages, consumer prices, the Dow, or housing prices. All of these things are symptoms of an expanded money supply. If the money supply were not being inflated, it would be impossible for the aggregate value of these metrics and assets to increase.

The Greenspan era was NOT a low inflation period, despite the tame CPI. Instead the increase in money supply was funneled into asset bubbles (bonds, stocks, housing) and to growing the dollar reserves of Asian nations.

There has NEVER been a deflationary (negative money growth) period in the past 60 years despite several recessions and cyclical bear markets in various real and paper assets.

What happens in oil shocks is that many paper assets decline and consumer prices rise, but that has nothing to due with monetary inflation, that is simply a reallocation of the pool of money. However, the happy periods of asset bubbles with low consumer prices are experienced differently by the masses than expensive commodity eras. When the Dow goes from 1000 to 10,000, everyone with a 401K is happy, so that is not called inflation on TV. When the house you bought in Ohio for 80,000 in 1981 is valued at 240,000 in 2006, you are happy, and the media doesn't call that inflation either. When your stock portfollio declines and petrol, bread, and butter cost more, then you are unhappy, and the guy on TV will tell you that is inflation. But it is all the same.

There is an overwhelming case that monetary inflation will continue to accelerate even if unlimited supplies of oil appear tomorrow. This is due to the need to inflate to devalue debt, a Ponzi scheme that is reaching endgame independently of resource issues. This is too complex for a post, but there is a law of diminishing returns for debt fueled economic growth. As the end stage is approached, the ratio of debt created/GDP increase goes parabolic, and this is seen in the record of recent decades in the US.

Rescouces: Anything from the Austrian School of Economics, founded by Ludwig Von Mises

The numerous essays by Jim Puplava's group http://www.financialsense.com

IMO, we are going to see relative price increases for food and energy with relative price decreases for almost everything else, independent of the money supply (unless we go into German style hyperinflation I suppose). The debt load is going to have a powerful deflationary effect on prices as people try to liquidate assets to pay off debts--and to pay their energy and food bills.

To put it in simplest terms, you want to be affiliated with food and energy producers; you do not want to be affiliated with (most) housing and auto companies.

Also, our GDP is very "soft" in the sense that a majority of Americans live off the discretionary income of other Americans. We are witnessing the beginnings of a very painful transition from an economy focused on meeting "wants" to an economy focused on meeting "needs."

One piece of advice for high school and college students looking for summer jobs: send them to a farm.

Rising food and energy costs;

Rising health care costs;

Rising taxes, especially property taxes;

Increasing competition for jobs, i.e., deflationary pressure on hourly labor rates.

The only logical response is to cut spending as fast as possible. Economize, Localize and try to become a net Food or Net Energy Producer.

In terms of M3.

If the banks start tightening their own lending practices, there will be less money on the market. Less money supply is (in your definition) deflation. A very possible/probable future.

And this growth in money supply is larger, the more realistically we define money.

Characteristically, the more important the statistic the less we are encouraged to know about it. The Fed will no longer publish M3. Estimates of inflation which would be still more informative, taking into account all the ramifications of the derivatives industry, are not even collected.

The problem with the Austrian school is that too often,their economists prefer the world of apriori theory too engaging with the facts of our predicament. As Cicero would say, they live in the Republic of Plato, not the dungheap of Romulus.

If the amount of available goods and services goes up by 5%, money supply should also go up by 5% in order to achieve a stable general price level. Easy to see in a simplified economy where only bread is transacted. If you have 10 breads and 10 $ in circulation, 1 bread = 1 $. If you have 20 breads and still 10 $, 2 breads = 1 $, i.e. 1 bread = 0.5 $ (deflation).

This assumes the velocity of circulation of money remains constant, which is a reasonable assumption for normal situations. All this is summarized by the Fisher Equation of the Quantity Theory of Money, which in its old form is:

MV = PT

where

M = Money Supply

V = Velocity of Circulation (the number of times money changes hands)

P = Average Price Level

T = Volume of Transactions of Goods and Services

For Austrian followers - of von Mises, not Arnold i.e. - I know Rothbard bashed the Fisher Equation here:

http://www.mises.org/rothbard/mes/chap11d.asp

He is right in that the "Average" price level is not a rigorous definition and that V is not an independently defined variable. But I still find the equation useful. BTW, its modern version from Friedman is:

MV = Py

where y = real NNI = Net National Income in constant dollars

From good old GDP:

NNI = GDP + NR - CC - IT

where

NR = Net income from assets abroad (net income receipts)

CC = Consumption of fixed capital (aka D = Depreciation)

IT = Indirect taxes

By the way, the Money Supply in the equation is M1 except in countries where people can buy through direct electronic debit to their savings accounts, in which case M2 is the relevant one. It should be noted that Mn definitions vary by country. Notably for the US, dollars abroad (eurodollars) are only in M3, the cesation of reporting of which lends support to the notion that the game is to pay for the US debt (mostly in the hands of foreigners) and for the US trade deficit by happily printing dollars and sending them abroad to creditors and producers of real things (particularly oil).

Back to energy issues, a reduced availability of energy will result in the availability of less goods and services. In this case, even a constant money supply will be inflationary (less breads, same dollars). So, the conclusion of Stuart is right:

"What it looks like is the oil shock causes inflation, and then the fed raises interest rates to rein it in again."

Now to the deflation scenario, it's amazing that people with awareness of real issues like TOD'ers still consider it. Ask yourself the following:

Are the vast majority of Americans net debtors or net creditors? (Answer: net debtors)

How deep in debt are they in average?

How much of that debt is of adjustable rate?

Are Americans going to be hurt by rising energy costs (which will happen in real terms whether there is nominal inflation of deflation)? (Answer: yes)

Will it be in the best interest of the government/ruling elite/deep politics/whatever-you-want-to-call-them to add insult to injury to the majority of the people, already hurt by energy costs, by raising interest rates? (Answer: No)

Does it mean the US will have hyperinflation, defined as monthly inflation rate above 50 (fifty) %? (Answer: No. I suggested how it can play out here:

http://www.theoildrum.com/story/2006/2/6/232626/0516#56 )

Is inflation good for people in debt? (Answer: Yes. I quantified it here:

http://www.theoildrum.com/story/2006/2/6/232626/0516#27 )

Is inflation bad for creditors? (Answer: Yes)

Where are the majority of US creditors? (Answer: abroad)

Do foreign creditors vote? (Answer: in any case, in their countries ;-)

Will foreign creditors turn to the streets? (Answer: in any case, to their streets ;-)

Will the dollar drop in value relative to other currencies? (Answer: yes, but only relative to some currencies. Japan e.g. has fiscal and demographic problems much worse than those of the US, so they will probably print yen massively.)

What does that imply? All of the following:

a. that holders of US dollars and bonds will face untold losses

b. that Americans will be able to import much less

c. that China, etc. will produce much less unless they start producing for themselves at long last.

(Note that b. and c. above are in line with "balancing" a Peak Oil scenario.)

When financial players realize this, where will all the liquidity start going? (Answer: to commodities, related stocks, and currencies that cannot be printed: gold and silver)

The last question and the rest of the post is for gold bugs only.

Will Peak Oil bring about a new gold confiscation, a la FDR in 1933?

Answer: No

, contrary to what Roland Watson (newerainvestor.com) says.Why?

Because the 1933 gold confiscation, and the subsequent more civilized ways of keeping the public away from precious metals (the London Gold Pool of the 60's and the more recent ongoing covert manipulation denounced by GATA and recently publicly acknowledged by the BIS (see Appendix) had all one objective in common: to ensure the effectiveness of central banks' monetary policies to stimulate aggregate demand (consumption plus investment) and thus "foster maximum sustainable growth in output and employment" Bernanke, February 07, 2006, as quoted in. That sounds like quite a good endeavour, and it would certainly be if the Earth were flat and infinite. But it is spherical, and after Peak Oil, the "limits to growth" will be imposed by Nature, not by lack of demand. Therefore there will be no use in stimulating it, and so in fighting the shifting of assets to gold (and silver, though heretofore I will refer only to gold for brevity).

To see why you have to keep the public away from gold in order to ensure the effectiveness of monetary policy to stimulate demand, you have to know the concept of "dollarization". To non-economists: dollarization is the substitution of a country's currency by that of another country (usually the US dollar, more recently also the Euro) for one or more of the functions of money (first for store of value, then also for medium of exchange). Basically, as a Latin American (or Balkan, or FSU) government started to irresponsibly print pesos (or whatever), the public started to shift their savings to dollars (or Marks, in the case of Croatia e.g.), kept mostly outside the financial system ("under the mattress"). Then they started using dollars for big transactions (like buying houses or cars). That process advanced to different degrees in different countries, and exhibits hysteresis. With a high degree of dollarization, monetary policy loses all effectiveness in stimulating demand: additional injected liquidity just serves to raise the exchange rate. In other words, any excess peso people have in their pocket is used to buy dollars (or euros). In a very dollarized economy, Fisher's V depends not only on the interest rate, but also, and mainly, on the expected devaluation, the degree of dollarization of the economy, and the elasticity of substitution between currencies. It can become a very volatile variable.

Now, the key concept is: gold is to the dollar what the dollar is to the peso. If Americans started shifting their savings to gold, the Fed would no longer be able to stimulate demand by monetary policy. That's why letting US investors (who were financially smarter than those in other countries) shift their savings to gold was a no-no in 1933 (when lack of demand was the cause of the Depression), hence the gold confiscation. This can be deduced even from books for laymen like Krugman's "The return of depression economics". There he says something in the line of "Recessions are caused by people chasing too little scrip. The solution is to print more scrip." It follows that, if people are chasing a currency that cannot be printed, there is no solution. (Actually there is no fast solution. Even without any stimulus the US would have gotten out of the Great Depression in the long run. The problem was that for FDR any run longer than 4 years was just too long.)

Summarizing, "metallization" (coining that word for the shifting of savings to metal-denominated assets, metallization being to OECD fiat currencies what dollarization is to pesos) was unacceptable, because it meant monetary policy would be useless to fight recessions, which up to now were always caused by lack of demand. So, if governments and central bankers did not try to keep the public away from gold, they were not Keynesians. And, after the miserable failure of the London Gold Pool, if they did not do it in a covert way, they were incompetent. So GATA has been right all the way in that a manipulation was taking place, they just didn't know why.

But after PO the "limits to growth" (actually the "enforcement of negative growth rates") in economic output will not be the consequence of insufficient demand but of a relentless physical constraint from Nature, namely the decline in the production rate of fossil fuels. Stimulating aggregate demand with monetary policy will not be able to increase output at all, as no monetary stimulus can reverse the decline of an oil field, and no monetary stimulus will be necessary to increase exploration efforts since the price of fossil fuels will be high enough to do the job by itself. (The only investments that must be stimulated are those related to renewable energy sources, for whose financing the Central Banks should lend to the commercial banks at preferential low rates.) Therefore, there will be no harm to the system in allowing the investing public to escape from fiat currencies and park their savings in gold or silver, since there will be no benefit to the system in stimulating their consumption of goods (and there could possibly be some harm in that: when a pub is running short of beer, they wouldn't turn on the heater to make people more thirsty). That means:

a) that there will be no future gold confiscation. Even in the worst case (OPEC countries demanding gold for their oil) there will still be no need for confiscation: people will surrender voluntarily their gold at the service station, and Exxon will transfer it to Aramco. Why forcing (already discontent) people to do what they can do voluntarily?

b) that the manipulation of the gold price is bound to end. So, GATA was also right about that, again they did not know why. The only problem I see about that is how to communicate it to the public. Imagine a BIS/IMF/Fed/ECB/BOJ/etc. joint declaration stating:

"Up to know we have been carrying on worldwide monetary policies conducive to stimulating demand, in order to achieve maximum sustainable growth in economic output and thus in employment. But the relentless decline on the extraction rate of fossil fuels that was confirmed to start five years ago has rendered that endeavour completely futile, because, regardless of monetary policy, economic output will decrease year after year for several decades until we reach a really sustainable steady state. By the way, we have now realized that any activity that consumes fossil fuels is not really sustainable, therefore the economic growth we helped achieved while the extraction rate of fossil fuels was rising was not sustainable at all. We just hope you enjoyed it, and wish you all a happy transition to the brave new world.

Since the referred monetary policies involved as an essential component a covert manipulation of the price of gold (and collaterally of silver) intended to suppress it, we apologize to all people involved in gold and silver mining for the inconvenience."

--------

Appendix: "The" acknowledgment of the "management" of the price of gold:

"The intermediate objectives of central bank cooperation are more varied. ...

And last, the provision of international credits and joint efforts to influence asset prices (especially gold and foreign exchange) in circumstances where this might be thought useful."

William R. White, Head of Monetary and Economic Department, BIS, on June 28, 2005 at the opening remarks of the Forth BIS Annual Conference - Past and future of central bank cooperation.

Bank for International Settlements (2006), "BIS Papers No 27 - Past and future of central bank cooperation - policy panel discussion. Fourth BIS Annual Conference, 27-29 June 2005".

http://www.bis.org/publ/bppdf/bispap27.pdf

Great post. It seems obvious that inflation and deflation must be defined with reference to the relative supplies of money vs goods/services. We will have less oil vs demand for oil, hence inflation of oil prices. We will have more human labor vs demand for human labor, hence deflation of the price of human labor. This could easily extend to goods/services where the human labor component is a greater share of the finished product/service than the energy cost.

I remember a friend of mine who visits India often telling me how they would have two laborers operating one shovel. One holding the handle in normal fashion, the other holding a rope tied to the blade to pull on when the blade was filled with dirt. I expect to see adjustments analagous to this in the US. It may easily become cheaper to hire twelve laborers to dig a ditch than to hire a backhoe.

Thank you for taking the time to type the full story in more detail. Beach Boy is of course correct. In the 19th century US, the increase in the extraction of coal, timber, iron, etc., was fairly well tracked by gold/silver mining so despite economic growth and population increase, price levels remained fairly stable the entire century.

"U.S. ringtone sales totaled $500 million last year"

http://money.cnn.com/2006/04/12/commentary/mediabiz/

That must fit into the picture somehow, maybe just as a curiosity (virtual money for virtual products), but to the extend we create a non-physical economy certainly we are less energy dependant.

"to the extent we create a non-physical economy certainly we are less energy dependant."

While it's worth considering that our 'virtual' universe is essentially nothing BUT energy.

I read the 'Cyberspace Declaration of Independence' some years ago, with its statements like 'ours is a world entirely of the mind/ pure thought/ those tied to the physical world don't fit, don't belong here, and never will! ' [..dad!] It was grandiose and belligerent, and seemed to take for granted the VERY physical reality of millions of miles of copper-wire, of hot little CPU's, of Appalachian Hills frying away in Coal-fired power-plants to keep the whole thing running.. and of course of the countless corporations, governments, deals, standards and ongoing creations that daily have brought the virtual plane out from the busy ovens of the physical world.

Many of those scifi things (and some science) go off on a rift about the univers (and life) being information. They do not disignate the lowest energy required to transmit (or build a market out of) that information.

Consider a hybrid car (with some honking 300V batteries) and then a cellphone (with maybe 3V batteries). Each one can move that scifi life/energy ... but with significantly different efficiencies.

If we are goint to ultimately make a renewable energy economy work (maybe 100 years from now, after the coal is gone/illegal), I think it will be a lot easier to to build it out of 3V devices (or even lower power) rather than 3000lb 300V monsters.

Ringtones, as much as they are meaningless luxuries, show that folks are out there putting food on the table by pushing around low-power bits.

And we'll find out just how much a luxury the Internet is, when TSHTF.

Let's remember that luxuries are not bad, it is rather the subset of energy-wasting, polluting, chid-killing, luxuries that we should oppose.

I have never bought a ringtone in my life, but I'm impressed that those guys can make something out of nothing. (no new energy wased or pollution created, they are just reorganizing the bits already in the system.)

Indeed, I expect Internet use to drop off sharply as the economy worsens. There will be more and more people who can't or won't pay $10-$40 a month for Internet service. That will put the ISPs in a bind; they may have to raise rates for their remaining customers, or go out of business. At the same time, content on the net will also decrease. People who don't have ISP connections at home will find it more difficult to post to blogs or maintain Web sites. People who don't have jobs won't be able to pay for webhosting for their personal sites. Companies will also be forced to cut back on the content they provide, as the ad revenue they get for it will be dropping. So the Internet will become less valuable, at the same time it's becoming less affordable.

Amazon: Truck goes from warehouse to house.

Shopping center: Truck goes from warehouse to shopping center. Customer drives car to shopping center. Even if it's an SUV, it gets better mileage than a big delivery truck.

As I've mentioned before, this has become a serious problem for highway engineers. eBay and Amazon mean we now have huge trucks going through residential neighborhoods, on roads that were designed for passenger vehicles. It's causing traffic and wear and tear that designers did not anticipate.

(I notice that when I (rarely) buy something from Amazon, the truck has other deliveries, even just in my condo complex)

Remember, there's room for improvement on the customer side of the equation, too. You can combine trips. Ride into town with a neighbor. Bike, take public transportation, walk. That's how it used to be in the old days (and still is, in very small towns).

Typically I bike or walk to the store, except in the foulest of weather.

Everything tends to run in families. She hung wash out on a line to dry, and so do I, except in the winter, when indoor drying racks work well to humidify dry air and to save money.

BTW, line-dried wash, IMO smells much better than the probably toxic scents put on Bounce and competing brands.

I haven't seen any analysis of goods delivery systems nearly rigorous enough to decide whether Amazon's or Walmart's distribution systems will be more likely to survive an expensive transportation fuels world. I'm inclined to use the past as prologue and believe that it's Walmart that will go away, as people decide they would rather pay more in delivery time than in personal fuel expenses to go to big-box stores. It wouldn't surprise me a bit in 20 years to make an order through the internet for a book on the collapse of big-box retail and to have the book delivered by train to my post office, and from there to my mailbox.

Put another way, which takes more energy, moving a boxcar full of 1000 books, or moving the cars of 1000 people to buy one book each?

http://www.oreillynet.com/pub/a/wireless/2004/01/22/wirelessmesh.html

... it might take a day for TOD posts to echo around the world, but that might not be so bad, from a productivity standpoint ;-)

$150 000 / 12.5 = $12 000

12 000 / 1500 = 8 times as exensive.

This should mean that the cost per tractor work equivalent has been nearly constant, nowdays tractors are bigger, more capable and more comfortable to drive.

A little tractor trivia to round out this rather esoteric economic thread:

I was quite surprised to recently learn that the first John Deere tractor (after it had acquired the Waterloo Boy Tractor Co in 1918) had a sturdy low-revving two cylinder engine. The engine had a distictive popping sound, and soon this tractor acquired the nickname 'Johnny Popper' or 'Popping Johnny'.

The interesting thing about this engine was that it ran on both gasoline and kerosene, fed from separate partitions in a common fuel tank. The engine was started on gasoline, and once warmed up was switched over to kerosene. A heat exchanger around the exhaust manifold vaporized the kerosene before it entered the engine.

The rationale for this set-up was that in rural areas gasoline at the time was much more expensive and harder to come by than kerosene, which had been used for decades in kerosene lamps. So what we have here is a very early example of a means of conserving a precious form of energy (gasoline) for a less valuable and more plentiful form (kerosene). An exercise in energy 'form value', if you will.

While I very much doubt one could pull off the same sort of thing with today's high-output, high-compression engines, it is a good example American ingenuity applied to an early energy problem.

You can get a 2wd tractor heavier and more powerful than either for less than $10k.

Michael Pollan, The Omnivore's Dilemma

which devotes a large part to the growth of corn in America and all the resultant problems such as pollution, obesity (secondary to cheap corn syrup in every grocery store and fast food product), the loss of the family farm, etc. This author was interviewed on Terri Gross's Fresh Air show on NPR last evening. There was no discussion of peak oil per se, but this author clearly gets the big picture of the non-sustainability of large-scale mechanized farming.

- The spear thrower (or atlatl increases the effectiveness and efficiency of hunting medium-size and large game a great deal. Thus these game animals would become more sparse over time.

- The bow and arrow increases the effectiveness of hunting (over ordinary spears) very significantly for all sizes of game--and thus game would tend to become scarcer and scarcer over time, along with population increase based on this big technological advance.

Based on personal experience with profesionally made bows and arrows vs. homemade spears, harpoons, and spear throwers, you have to get very close to an animal with an old-fashioned spear, but with a bow and arrow, especially if you have a small team of people shooting many arrows, you can consistently bring down game of various sizes at a reasonable distance--perhaps 30 meters or even more, depending on expertise and quality of equipment. Personally, I have never mastered the atlatl, but I know other who have and who hunt effectively with this simple extension of the arm.For fun, try shooting arrows with barbs at the head and lines attached at the back part (like a small harpoon) at huge fish, maybe through the ice in winter. This is a big sport in Minnesota.

The Great Inflation - Part 1 (approx first 20 minutes of the broadcast)

http://www.netcastdaily.com/broadcast/fsn2006-0401-3.mp3

Interview titled "Inflation, deflation" with Dr. Marc Faber on Financial Sense Online.

http://www.financialsense.com/Experts/2005/Faber.html

As someone above pointed you, you have fallen into a common misconception that inflation is increases in price, wages, commodities, real estate, etc. True inflation always is, and always will be an increase in the money supply; the result of which is higher prices in commodities, real estate, wages, etc.

You can also not measure an increase in money supply by only looking at M1 and M2. You need M3 (which was no longer being published by the Fed starting last month), which includes the most popular way that the Fed injects money into the economy; repurchase agreements with banks.

I am going to stop here because the above two links to the MP3 files are so comprehensive on the topic that I can not do it justice by only typing a few paragraphs.

After you are brought up to speed on the "classical" economic definition of inflation and how it plays out in an economy, then we can move the discussion forward to the question "does high oil prices cause inflation or deflation?"

I do not quite understand what you are saying how bank repos would have less impact on M2 and M3. Repos increase bank loans, but unless those loans are turned into cash and deposited in a form that would show up in M1 or M2, you would not see it in those numbers. Those loans may be used to purchase real estate or sent overseas to buy plasma and LCD TVs.

M1: M0 + the amount in demand accounts ("checking" or "current" accounts).

M2: M1 + most savings accounts, money market accounts, and certificate of deposit accounts (CDs) of under $100,000.

M3: M2 + all other CDs, deposits of eurodollars and repurchase agreements.

Or is this just something folks have picked up from Jim Puplava and the Austrian Economics sites?

Fed Chairman Bernanke defines deflation as:

As far as I'm aware, that's the same definition that the Fed had in the 1920's. And the distinguished Austrian school economist Murray Rothbard doesn't seem confused either. From the introduction to the third edition of his book "America's Great Depression" (1975, page xxviii) he says: i.e. he separates the symptom from its cause.I'm not disputing the general thrust of the monetary argument for inflation, just the notion that the definition is wrong. Dual definitions make it very hard to debate the matter without having to constantly qualify what we mean.

And be careful - an expansion in the money supply does not necessarily lead to price inflation.

You make a good point, though, that "inflation" is too well established in its accepted meaning for a change to be feasible.

So the question at issue is whether the concept itself retains its former importance under today's conditions.

Economists of the Austrian school (which Dr. Marc Faber and Jim Puplava of Financial Sense Online subscribe to) see inflation to mean an increase in the money supply and that everything else is just a symptom of the increase in money supply. This would be considered the more "classical" definition that has existed through many centuries of economic writings.

The Keynesian theory (which is more widely held now and is the primary theory now taught in most business schools) is that inflation is broken down by three types:

Demand pull inflation - inflation due to high demand for GDP and low unemployment, also known as Phillips Curve inflation.

"Cost push inflation - nowadays termed "supply shock inflation", due to an event such as a sudden increase in the price of oil.

Built-in inflation - induced by adaptive expectations, often linked to the "price/wage spiral" because it involves workers trying to keep their wages up with prices and then employers passing higher costs on to consumers as higher prices as part of a "vicious circle". Built-in inflation reflects events in the past, and so might be seen as hangover inflation. It is also known as "inertial" inflation, "inflationary momentum", and even "structural inflation".

http://en.wikipedia.org/wiki/Inflation

A fair number of people believe that government support of Keynesian economists through appointment of critical federal posts and grants is an effort to shift economic thinking to Keynesian and neglect to teach opposing view points, such as Austrian economics. The purpose of this effort is to obfuscate that the true source of inflation is money creation by the Fed. It also happens that Keynesian economics supports fiat currency by a central bank, as opposed to gold back currency or gold itself as currency.

So on a lighter note I'd like to refer you the Bordeaux vintage chart, where you will see the quality of the wine vintages has improved vastly over the last couple of years.

http://www.bbr.com/GB/shopping/vintage-french.lml?ID=CQ01BX7KPF8001G

I don't know if global warming can claim the credit, but I feel reassured that at least some aspects of fine dining in the future will be greatly improved.

Have a good Easter!

http://globaleconomicanalysis.blogspot.com/2006/02/inflation-what-heck-is-it.html

If I understand correctly, he calls inflation an increase in the total money supply, which includes both money AND credit. Which is why he forecasts a deflationary end to this current bubble cycle. We simply have so many people and institutions so far overleveraged that before any re-inflation can take place, many of these bad loans have to get liquidated. And during the period of liquidation, people will not be taking on new debt, not even at an interest rate of zero. This is also understood by Keynesians, who called it a "liquidity trap"

Note that this was pretty much the way Japan's post-real estate bubble played out--even tho the central bank reduced interest rates to zero (they are still at zero today, BTW), they still suffered 10 years of deflation because no one was willing to take on new debt.

As a result, the total money supply contracted, because the fall in the amount of credit exceeded the amount of fiscal stimulous the government pumped into the economy (in the form of bridges to nowhere, etc)

My best guess for our future is that he the collapse of the housing bubble (now under way) leads to a rash of bankruptcies and foreclosures that becomes self-feeding (throwing more houses onto a saturated market), and we will see derivatives cause some "innovative" financial implosions. Deflation will be the dominant economic theme, but with rising energy costs as the icing on the cake.

Enjoy!

Someone better ask Prof Goose and the others to make the next thread a study of lyrics in the Sound of Music or something equally saccharine. "Some dough, a beer, a tank of potted sun. These are a few of my favorite things."

Or perhaps we could transition from a PO board to one reviewing the finer points of good Bordeaux.

As a good engineer, it is not to be expected that you are also a good salesman/fast-talking promoter. You may need to find an entrepreneurial partner--brother, sister, wife, uncle, friend of 10 years or more--somebody who you can trust and who is on the same wavelength you are. Here are some thoughts:

Land is good. Land can be used for trees, for a junk yard, place for storage buildings, to grow things to eat, and perhaps also for hunting and trapping.

Tools and equipment you know how to use are good, especially if you enjoy using them.

Services (for example, well digging, welding, cutting wood, carpentry, plumbing, wiring, pouring concrete, fixing broken things) are good.

The best kind of advertising is word-of-mouth advertising. Start small, with a very small investment and part time, and then gradually expand. Keep your prices low and quality high, and that way you will always have a backlog of customers waiting for your services.

A big problem with engineers is that they know what will not work; they tend to be rational and conservative--traits that interfere with successfully starting an innovative business.

Most innovation fails.

I think it makes more sense to do what is proven to work in bad times and good times--working as a handy-man, for example. Most important, IMO, is to follow your bliss: Do what you truly enjoy doing. For example, I'm pretty good at fixing boats but do not enjoy it nearly as much as teaching others to sail; hence I specialize in the latter activity.

Some of the best businesses you just stumble into. When I was a graduate student I used to help my foreign-student friends to edit their papers, because their writing skills in English were limited. It never occurred to me to take money for this, until one of my profs offered me some to help his new trophy wife with her thesis, and hence I discovered a silver mine: I charged $4 per hour, cash in advance, satisfaction guaranteed or money back for editing services. I had a good backlog and worked as many hours as I felt like--never did ghost writing, and if a project was very bad I recommended euthanasia as opposed to surgery. This was back in the days when fees at the U. of Calif., Berkeley, were $42.50 per semester, and my apartment north of campus was $72.50 per month. That same apartment now rents for $1,200 per month, and the last time I looked tuition fees were up to several thousand dollars per semester.

Partly because I was quick and proficient at it I enjoyed editing academic papers, but I also helped seriously distressed people, and that made me feel good too. Perfect job: No overhead, no advertising, no partners, and I forgot to keep records or report income to IRS;-)

The problem/opportunity is that you need the BS artist to push the envelope. And if the engineer and that guy are peers in a partnership it's iffy who will dominate. Or if energy will just be wasted by deadlock. So, the working solution was often three guys.

I should mention that joke is the one the salesmen told, not something we engineers made up.

Nuclear powerplants, railways, etc, are a thousand times more expensive then what is reasonable to find investors for. Such businesses is for states and giants.

Playing survivalist on a farm could be a fun hobby but I hope to be more useful then that. Something that scales upwards and grows reasonably fast with a high upper limit must be a business idea that can utilize an inflow of capital and preferably customer money. Nothing is better then customer money.

I am a fairly good salesman and promoter, as long as I have a good product and dont try to sell myself...

Your first two ideas (which would work well in combination) look like almost sure winners to me. But the problem I see for you is that you would need years to develop such a business to the point where you could draw a reasonable income out of it.

As a young man, you quite rightly want and need income based on productive activities NOW, as opposed to five or ten years from now. For this to happen, you will probably have to go to work for somebody--corporation, city government, public utility, something like that. An alternative would be to go into a profession such as teaching: That is what I did, even though my earnings potential in finance were four to ten times what I could get working 180 days per year in a congenial job, where my days off corresponded to time off that my children had from school.

A big problem with starting a business and working to make it grow is that for success it becomes a total commitment: All your time and energy must go into the business, with almost none left for fun, wife, children, reading books, continuing your education, etc.

One of your skills is expressing your thoughts concisely and with great clarity in writing; this skill is rare. Is there much money to be made as an engineering consultant or technical writer in Sweden?

I'll let you know. I am reviewing The Coming Economic Collapse: How You Can Thrive When Oil Costs $200 a Barrel by Stephen Leeb who runs Leeb Capital Management, Inc.

Of course, in the vast majority of cases, one should bear in mind the truth of the old adage it takes money to make money.

Gratuituous picture.

Note here a "typical" weighting means for an inflationary environment; "aggressive" weighting means deflationary circumstances. These are the percentages from Stephen Leeb's THE COMING ECONOMIC COLLAPSE, page 194.

To position your portfolio to survive and thrive over the next few years, you should consider the following model:

Typical weighting (oil rising or falling moderately)

Inflation hedges

25% Precious metals (gold, silver and platinum stocks and bullion)

25% Energy (oil service, energy funds and alternative energy)

"Chindia" (China-India)

30% (Large cap American companies expanding into China-India)

Deflation hedges

20% Zero coupon bonds

Aggressive weighting (oil rising or falling rapidly)

Inflation hedges

10% Precious metals (gold, silver and platinum stocks and bullion)

10% Energy (oil service, energy funds and alternative energy)

"Chindia" (China-India)

30% (Large cap American companies expanding into China-India)

Deflation hedges

50% Zero coupon bonds

33% short U.S. Treasuries (90 day- 2 year)

33% Gold (bullion and stocks)

33% Energy

Looks like the economy can go in any direction and you are still "safe".

If economic structures are intact then I think price rises due to energy costs is inevitable with many cyclical time lags reverberating.

Consider a modern retailer:

Day 1, fuel increases 10% therefore:-

transport costs increase [1%] = price rise

glass/plastic increases [1%] = price rise

price index increases [1.5%], therefore minimum wage increase [1.5%] = price rise

price rise [2%] means price index increases [1%] - means 'real job wages' eg the oil industry or retail management [not minimum wage workers] get private sector rises [3%] = price rise [1%]

and so on in an endless loop of compounding into an exponential growth.

Let us give thanks for minimum wage regulations, otherwise workers really would be stuffed. Anyone above minimum wage but without wage bargaining power will see erosion in wealth.

* Many economists would argue that the absence of big inflation peaks since the early 1980s means that inflation expectations have been conquered, and that things are fundamentally different now. *

Prices have been generally falling in practical terms for 20 years at least in the UK.

We now get dirt cheap food, shoddy service, short life goods made abroad etc. This enables us to spend the remainder on housing costs, things we don't need

and taxes.

When retail prices rise I think there could be serious unrest

Here in the USA the minimum wage is NOT linked to the prices of essentials, thus minimum wage slaves are doubly stuffed. Anybody who does their own grocery shopping can plainly see that prices have been rising far faster than the official CPI. The problem with the CPI (or other offical stats on prices) is that the "basket" of items used for the calculation reflects some sort of current average lifestyle. The true impact on people varies with their actual personal "basket" of purchases. If food prices go up, the poor suffer more of an overall impact than the rich who spend a smaller percentage of their income on food. And as the economy slowly collapses, the old "basket" becomes less and less relevant. The claims that in our "new" economy energy is a smaller percentage of the total and thus less important are based on many errors, one of which is that that percentage can change (and has been changing) rapidly as energy prices rise, and spending on frivolous junk declines.

People who still have savings (other than in temporarily overvalued houses) do need to worry about how to maintain at least some of the value of those savings in terms of their power to purchase essentials. Buying durable essentials in advance may be good. Unless you are convinced that their nominal prices will fall. I doubt that will happen, except for housing. But if your house is mortgaged with a fixed rate of interest, then savings in the bank (a fixed nominal amount, even without returning any interest) that can pay X months of the mortgage now will pay X months of it later just as well, despite inflation.

Damn right. Instead of doing it myself, I'll let this guy do the usual rant about the CPI.

Now, what is priceless (no pun intended) is that the linked-in commentary is old (from the year 2000). So check this out. I rest my case.The Core Rate

He argues that one reason the government has so much incentive to fudge the numbers is the COLA on entitlements. If that's the case, they will only have more reason to fudge the numbers in the future.

I'm not at all sure we'll see retail prices rise: the customers who have to fill their gas tanks and heat their houses won't have enough money to buy all the junk they're used to buying.

Of course, faced with higer costs, the manufacturers and retailers will try to raise prices. I just don't think they'll be able to make price increases stick.

The result will be a very tough profit squeeze on manufacturers and retailers.

I don't expect unrest, either. There might be political action (windfall profit taxes, etc.), but most Americans have very much bought into free market ideas. They'll grumble and complain, but I wouldn't expect unrest from that quarter.

Most people don't catch the subtlety of this concept, and simply think that "printing money" is inflation. It's really about the comparison of two growth rates -- the economy and the money supply.

Now, on to the issue of "inflation" and peak oil, I believe it's important to avoid the word "inflation" in economic discussions because of mis-interpretations of its meaning.

How about:

- As the amount of energy supplied to the economy contracts, economic activity will contract.

- The Federal reserve will reduce interest rates in an attempt to remedy the decrease in the economy (the economy may have a negative "real" rate of growth at this point but the nominal measure may be flat or even rising).

- If the economy doesn't respond to the cheaper rates and typical increase in the money supply, then the fed will take more dramatic measures to keep the nominal size of the economy from decreasing.

It's this third step that is widely debated. Bernanke knows that a nominal decrease in the economy is very bad because it makes debt very hard to repay within the whole economy. This is also the crux of the "inflation / deflation" debate. Will the fed allow (can it prevent?) a nominal decrease in the economy after peak oil? Some suspect that step #2 above will not do it.History says the value of the currency will be destroyed. And the economy will tend toward a barter system -- exchange of goods on a relative value basis. After the currency is destroyed then people will demand a "hard money" system (I hope it's not gold, it's too "hoardable").

--------------

My belief is that the economy will adjust by eliminating wasteful economic activity at a rate that equals the energy decline rate. Here are some things that I think will suffer in making these adjustments (brainstorming here):

- interscholastic sports

- movie theaters

- pets

- non-major league sports

- travel

- entertainment (which requires any travel)

- frame shops

- "the arts" -- symphony, theatre, art galleries

- knick-knack shops

- concerts

- Nascar attendance

- leisure motorboating, jet skiis

- monster truck rallies

- theme parks

- home remodeling

- Chuck E Cheese's (go play outside Junior!)

- County fairs