The Game is afoot, or another look East of the Caspian.

Posted by Heading Out on April 6, 2006 - 11:43pm

However, it is a small paragraph in the story that caught my eye.

In recent years Russia has boosted gas supplies by squeezing Turkmenistan to sell gas to Russia at a deep discount. But Turkmen gas production is poised to decline, and Turkmenistan's gas industry is barely functional because the country's political environment is scary for long-term investors. Other Central Asian suppliers, notably Kazakhstan, are unlikely to be able to bridge the gap.And this seemed odd to me, since Tuesday's post was all about Turkmenistan agreeing to sell China some gas. So I thought I'd, as they say, take a closer look.

UPDATED to include some Gazprom info.

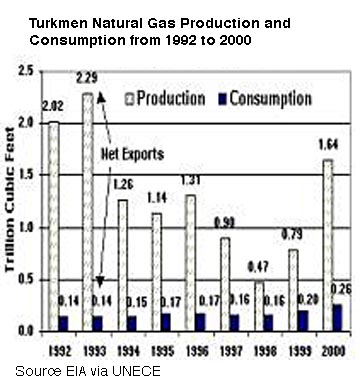

It is ranked as having either the fourth or fifth largest reserves of natural gas, with reserves of 2 tcm (trillion cubic meters) (the CIA), 5.5 tcm the Jamestown Foundation, or 8.1 - 8.7 tcm Library of Congress. It exports around 38.6 bcm per year, and uses around 15.5 bcm itself (CIA), for a total production of around 55 bcm.

Historically the natural gas has been sold to Russia, and the Ukraine, but very much under the thumb of the Russian purchasers. As the EIA notes

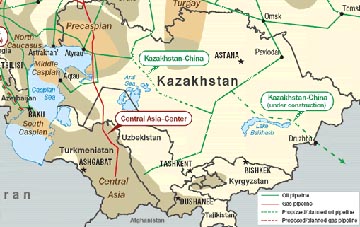

Prior to 1997, the only option for exporting Caspian region natural gas was via the Russian natural gas pipeline system. Although over 2 trillion cubic feet (Tcf) of Caspian Sea region natural gas was piped via the Central Asia Center gas pipeline in 1990, exports fell to 0.3 Tcf in 1997 when Russia's Gazprom, which is a competitor with Turkmen natural gas and owns the Russian pipelines through which Turkmenistan exports, denied Turkmenistan access to the system over a payment dispute.

(Source EAI)

(For those like me who have problems with conversions, 1 Tcf is roughly 30 bcm). The story from the Research Divn of the Library of Congress is slightly different.

In 1992 gas production accounted for about 60 percent of GDP. As a result of a dispute with Ukraine over payments for gas deliveries, in 1992 gas production fell by 20 billion cubic meters to around 60 billion cubic meters. In the first eight months of 1994, transportation restrictions forced Turkmenistan to cut gas production to 26.6 billion cubic meters, only 57 percent of the production for the same period in 1993. An additional factor in this reduction was the failure of CIS partners, to whom Russia distributes Turkmenistan's gas, to pay their bills.

With limited ways of selling its gas Turkmenistan was stuck with selling it through Russia, with 918 bcf staying in Russia while 117 bcf went on to Ukraine during 2000. Exports continued to rise by about 25% a year. The UNECE continues the story.

In a bid to secure a market for its natural gas, on May 14, 2001, Turkmenistan agreed with Ukraine on a major natural gas export deal. Under terms of the deal, Turkmenistan will provide Ukraine with 8.83 Tcf of natural gas between 2002 and 2006. Turkmenistan will sell Ukraine 1.41 Tcf of natural gas in 2002 and 1.77 Tcf in 2003, with remaining deliveries to be agreed later. Turkmen officials signed the deal on the condition that Ukraine makes timely payments for supplies. Ukrainian officials agreed to pay for the Turkmen natural gas 60% in cash, with the remainder paid for through participation in 20 construction and industrial projects in Turkmenistan worth a total of $412 million.

Unfortunately disagreements over payments have continued. First in the winter of 2004

In December 2004, Turkmenistan halted gas supplies to Russia and reportedly demanded $60 per 1,000 cubic meters (35,300 cubic feet). Turkmenistan presumably expected that the perceived inability of Gazprom to meet its export and domestic commitments without Turkmen gas volumes would force the Russian giant to offer better terms. However, Turkmenistan failed to force Russia to pay more for Turkmen gas, as Gazprom passed through the 2005 winter season of peak demand for natural gas without Turkmen supplies. Subsequently, in April 2005 Russia and Turkmenistan agreed that Gazprom would make all payments in cash instead of the earlier barter arrangements, yet the price remained the same: $44 per 1,000 cubic meters.The situation deteriorated further with the clash between Ukraine and Russia gaining the attention, among others of The Energy Bulletin as the debate over price escalated. Unfortunately for Turkmenistan, the solution allowed Russia to sell at world price, while using the cheaper Turkmen gas to keep the average price at $95 per 1,000 cu.m.. That debate is not over. The price itself was not actually fixed

The next day, on Feb. 2, RosUkrEnergo agreed to stipulate in a contract that it will supply gas to Ukraine at $95 per 1,000 cubic meters during the next five years. However, RosUkrEnergo reserved the right to boost the prices if Turkmenistan, the main gas source for the company, moves to hike the prices.And so the debate continues. Novosti had two stories on this in the past two weeks.The issue is sensitive for Ukraine, whose chemical and steel companies would become unprofitable if gas prices exceed $95, analysts said.

Under a bilateral treaty, Turkmenistan is to ship 40 billion cubic meters of gas at $50 per 1000 cu m in the first half of the year and at $60 per 1000 cu m in the second. Turkmenistan's foreign ministry earlier said that Ukraine was delaying payment for natural gas shipments and threatened to cut off supplies unless the Ukrainian side cleared the outstanding debt. If that were to happen, it would be the second time a supplier had turned off the taps to Ukraine, as Russian energy giant Gazprom cut supplies on January 1 amid a bitter dispute over prices for natural gas supplies. . . . . . According to Turkmenistan, Ukraine's debt stands at $158.9 million and the country's foreign ministry said a failure to settle the debt could place energy cooperation in doubt.This was followed by

Ukraine's prime minister said Wednesday his country's debt to Turkmenistan for natural-gas supplies stood at $68 million, and that it would be paid off by supplies of industrial goods.Unfortunately the attitude of the Ukrainians to such debt is not reassuring to Turkmen"As of this moment, Ukraine's debt to Turkmenistan stands at $68 million," Yuriy Yekhanurov told a Cabinet session, adding that Kiev had already ironed out all its problems concerning natural gas supply obligations with Ashgabat.

Turkmenistan says Ukraine's debt currently stands at $158.9 million, and President Saparmurat Niyazov has urged Ukraine to pay up.

(On) or the issue of 7,8 billions of cubic meters of Russian natural gas, that had allegedly disappeared while being transferred through the Ukrainian territory.It is no wonder that Turkmenistan is becoming frustrated with customers to the North and West, and so it is again trying a harder line. From Radio Free EuropeThat of course is incorrect. However, the specifics of the gas transit system does not allow refuting this fact easily. Should Ukrainians have dealt with the issue in a more professional manner, the myth would be damaging to Gazprom itself.

First of all, if the gas was stolen -- that should have happened before 2005, when other people were governing Ukraine. And let us remind the reader, that Gazprom was supporting these people.

Therefore, the question shall be posed to the great friends of Russia like Kuchma, Yanukhovich and Boiko (former chief of Naftohaz). And there are all reasons to suspect, that like any other transaction in the sphere of fuel and energy the `steeling' of the Russian gas resulted into the personal benefit of the top Russian and Ukrainian government officials.

That aim was demonstrated again on 10 February, when Niyazov announced on national television that Turkmenistan intends this autumn to raise the export price of its natural gas from $65 to $100 per 1,000 cubic meters. This gambit comes at a time when Turkmen gas is increasingly tied into a complex international equation, as a deal recently brokered between Ukraine and Russia depends on cheap Turkmen gas. Under the deal, Ukraine would pay an average price of $95 per 1,000 cubic meters in 2006.Such a price hike would pinch Ukraine's economy painfully. Ukraine is slated to import 17 billion cubic meters of Russian gas and 39 billion cubic meters of Turkmen gas in 2006, according to the news website gazeta.ru. A 53 percent increase in the price of Turkmen gas would raise the average price Ukraine pays for its total imports from Russia and Turkmenistan by 20-25 percent, from $95 to $114-119 per 1,000 cubic meters. Other estimates run higher. An unidentified source in Gazprom, the state-run Russian company that handles gas exports, told the Russian business newspaper "Vedomosti" that if Turkmenistan charges $100, Ukraine would have to pay $130 for imports.

However when the Turkmen tried this before Russia called their bluff, so this time they have a different answer. Two new pipelines are in the works.

The Turkmenistan-Afghanistan-Pakistan Natural Gas Pipeline Project (the Project) is a gas pipeline of about 1,600 kilometers that will transport up to 30 billion cubic meters of natural gas annually from the Dauletabad fields in South East Turkmenistan to consumers in Afghanistan, Pakistan and possibly India. The final cost of the Project is estimated at between $2.0 to $2.5 billion. The Project will take about three years to be implemented after all key decisions are taken by the cooperating countries.Construction is supposed to start this summer, and it will carry 20 bcm per year. And for the other, there are the Chinese

Since the mid-1990s, experts from the China Petroleum Engineering Construction Corporation have been reviving oil wells in western Turkmenistan with a total output of 2.3 million tons a year. Meanwhile, the China Petrochemical Corporation has been upgrading gas wells in the Shatlyk field with a total annual capacity of 3 billion cubic meters. . . . . . During talks between Kazakh President Nursultan Nazarbayev and his Chinese counterpart Hu Jintao in Astana in early July 2005, Nazarbayev said that constructing a Turkmenistan-China pipeline through Kazakh territory would be beneficial for all three countries.. The agreement for the pipeline is now in place

Chinese President Hu Jintao signed agreements Monday with the visiting president of Turkmenistan for the Central Asian nation to sell China natural gas to fuel its energy-hungry economy and to build a pipeline to deliver it.Thus the gas that Ukraine is relying on to keep it out of trouble is going to start heading East instead of North, and, given past practice, that can only bode badly for the reliability of supply to such places as Italy and the United Kingdom.

In the meanwhile, Gazprom continues its heavy hand, this time in a play to control the gas flow from Iran through Armenia.

Armenia will pay $110 per 1,000 cubic meters of gas, or about half the European average, but twice what the country pays now, Gazprom, the Russian monopoly, said in a statement.Gazprom, in turn, will buy a 24-mile section of pipe connecting Armenia to Iran -- the tiny and energy-poor country's only plausible alternative to Russian energy supplies. Also under the agreement Gazprom, through a joint venture, was granted a concession to build a second larger pipeline along this route.

There is indeed a new Great Game afoot, it's just that, at present, the cast is different this time around. Pity there isn't a Buchan, or a Kipling to keep us up to date in a more dramatic fashion. UPDATE Thanks to Jack Greene for direction to a couple of Radio Free Europe features. The first expands on Gazprom’s supply problems, and it’s anticipated answer.

Domestic shipments at regulated, reduced prices totaled 258 bcm in 2004 and 325 bcm in 2005, when they generated losses of nearly $1 billion, Prime-TASS reported on 29 November. Exports to the West, which account for the bulk of Gazprom's profits, are planned at 151 bcm in 2006 and set to rise to 163 bcm by 2008, Prime-TASS reported on 23 November. . . . . . . Gazprom plans to buy 9 bcm from Uzbekistan and 30 bcm from Turkmenistan in 2006, ferghana.ru reported on 23 January. Purchases from Turkmenistan are slated to go to 70-80 bcm a year by 2007-08, Prime-TASS reported on 30 November. With these boosts looming on the horizon, Gazprom hopes to expand the capacity of the Central Asia-Center pipeline, which links Turkmenistan and Russia through Uzbekistan and Kazakhstan, from current levels of 42 bcm/year to 55 bcm/year, and is considering another project linking Central Asia and Russia with throughput capacity of 30 bcm/year, Prime-TASS reported.while the second suggests that Gazprom has reached a peak production at 550 bcm.

With both the talents of Kim and Sherlock I think it would take years to figure out what is actually happening, because there are so many incentives for disinformation to be dissemminated--and also so much information that nobody knows or that somebody knows but has never been compiled.

How about, "a mystery inside an enigma"?

"I see you stand like greyhounds in the slips,

Straining upon the start. The game's afoot:

Follow your spirit, and upon this charge

Cry 'God for Harry, England, and Saint George!'

"a riddle wrapped in a mystery inside an enigma" was Sir Winston Churchill describing Russia

Much can be learned from literature, and indeed I think for the Deep Universal Eternal Truths (DUETs) literature is at least as important as science.

KIM is a remarkable book, and if both the Russian and American leaders had read all of Kipling, then I doubt that either great power would have blundered into Afghanistan, as both of them did.

Also, IMO, Kipling's famous poem that begins, "East is East and West is West, . . ." is one of the most powerful antiracist statements ever made.

Currently I am rereading all of Joseph Conrad. Ohmigod, nothing is more relevant than "Heart of Darkness" to what is now happening in Nigeria.

Be sure also to read his classic, "North of South," but then again, you probably already have.

Brilliant guy, and iconoclastic to the max.

May I offer you a look from inside?

I think that outsiders don't understand the scale of changes in Russia.

Russia'00 and Russia'06 are two absolutely different countries.

Today Moscow in many aspects is like Berlin in 1932. And the process accelerates day by day.

Please, tell me that you are not serious.

Please.

When they will send me to America with a nuke in my bosom I swear I will bypass your house :)

But why on earth would Putin want to rule over non-Russians? He hates and despises non-Russians, as in Chechnya and would gladly use Stalin's solution to the Chechen problem if he thought he could get away with it.

When I say revanche I mean revenge towards good old enemies.

So Vlad the Putin is not a racist? Remarkable.

In 1932 Berlin, shiny new buildings weren't sprouting like mushrooms.

As I read the article, I contemplated the local news here in Minneapolis, MN, USA.

Is our state or local political establishment paying any attention to energy issues?

No.

Our political establishment is obsessed with a plan to raise money with a regressive sales tax to pay for huge new public debt (half a billion dollars or so)to build a new professional baseball stadium.

Meanwhile, our local NFL team wants as much or more for a new professional football stadium and sports-entertainment complex.

Our legislature just passed a bill to pay something like a half-billion dollars for a new football stadium for our University of Minnesota football team.

Meanwhile education, health care,community safety, and similiar needs go begging.

And the keystone of all of this is: energy and sustainable infrastructure are at best an afterthought or hollow attempts to "spin" the image that the political establishment is paying attention to these in the way one attends to paying for the care of a crazy aunt who insists inconveniently on living in the attic.

I do not want to divert attention from technical questions or from the "Great Game" underway as you describe it.

I simply am stunned by the ability we Americans have of completely divorcing ourselves from reality.

The matters of energy supply, depletion, consumption, distribution, and global strategy for powerdown ought to be front and center in our national and local public discourse, and yet are regularly relegated to "news" show (read "disinfotainment") sound byte complaints about the high cost of gasoline at the pump.

Keep up the good work! Perhaps more folks will engage in this conversation that matters so much.

Meanwhile, it looks to me like NG supplies are looking much tighter all the time. This should stimulate some good public discourse about a global strategy for equitably sharing energy supplies, eh?

the almighty dollar (and sex). Until the most holy temple of

the sacred greenback, the wallet, is clobbered, then

and only then will he/she pay any attention to anything

less sexy than a new sports stadium.

The average US citizen is a devoutly religious person, and

cannot be bothered with anything but the religion of money

and sex. If the high priests of the government want to commit

the country to war it's OK as long as comes with a vague

promise of protection for the holy dollar and something

sexy, like that new Hummer.

I am of course being ridiculous, but then I am a US citizen.

I can't help it. ;)

I believe the 'Great Game' that HO is alluding to is related to Zbigniew Brzezinski,advisor to three Presidents, former NSA head under Pres. Carter, and author of "The Grand Chessboard": an essential handboook of geo-strategic politics and brinkmanship. "Central to his analysis is the struggle for control of the Eurasian landmass, the "grand chessboard" on which America's supremacy will stand in the years to come."

Obviously, a tug of war is beginning between all these exporters [with Gazprom in the middle], and the importing landmasses of Europe, China, etc. What I would like to know is how many pipelines can have various sections of their flow reversed, or valved to send it in a different direction to maximize pricing competition? If natgas distribution infrastructure can be enhanced to make natgas nearly as fungible as oil: it automatically takes out most of the opportunities for corruption, political manuevering for advantage, and military grabs.

But, of course, that would be the last thing any of the contending powers would consider. Any place without gasmeters in Russia and elsewhere should be installing them now to encourage conservation and assure a consistent revenue stream to encourage more detritus development. The potential US & EUR investors in Gazprom need to see a much more professional mngt. team so that they can confidently expect a reasonable return on their investment. The more politics mingle with natgas: the result is less action that needs to occur.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

http://en.wikipedia.org/wiki/The_Great_Game

"The Great Game is a term, usually attributed to Arthur Conolly, used to describe the rivalry and strategic conflict between the British Empire and the Tsarist Russian Empire for supremacy in Central Asia... "

The gas picture is becoming very gloomy for Central and Eastern Europe. Here in the West we are still relying on gas from North Africa.

http://www.npr.org/templates/story/story.php?storyId=5329461 for the audio.

1-Frozen Thermohaline Conveyer stopped

2-Underwater from sea level rising

3-destroyed by Hurricane-trapped sea heat from 1.

And BTW-that Turkmenistan to India Pipeline

has been on the drawing board since before

Cheney's Energy Task Force.

The Iran/Pakistan/India Pipeline will get built first-IMHO.

James

April 4, 2006 -- Chinese President Hu Jintao and his visiting Turkmen counterpart Saparmurat Niyazov have signed an agreement to cooperate against extremism, separatism, and terrorism.

An interesting link showing some Central Asian gas line connections is at:

http://www.rferl.org/featuresarticle/2006/04/5FD55560-230D-4FD4-883D-5ECDE068A0C1.html

Also see for a January 2006 view of this topic:

http://www.rferl.org/featuresarticle/2006/01/ccc5007c-e8bc-4a9d-8a7f-a36b3fa27b85.html

As most of you know, I have been pounding this issue relentlessly. To use an oil analogy, net exports are analogous to an oil column in a field with a gas cap--between a rising water leg and an expanding gas cap.

Consider the oil situation. The mathematical (HL) model suggests that Russia is facing the prospect of steep oil production declines. My case was bolstered somewhat when the Russian oil minister recently warned about the prospect of a "real collapse in oil production," if Russia doesn't launch a crash drilling program in frontier areas.

Just how steep can production declines be in large oil fields? Consider the Cantarell Field, the second largest oil field in the world. Following is an excerpt of an article on Cantarell by Tom Whipple, in which he summarizes the WSJ report on the leaked internal Pemex report on Cantarell.

Again, visualize world net oil export capacity as the oil column in Cantarell--a rapidly thinning interval between the water leg and the gas cap. Net oil exports go to zero when domestic consumption equals domestic production.

http://www.fcnp.com/550/peakoil.htm

Excerpt:

An energy consultant in Mexico City published parts of the study and later the Wall Street Journal got to examine the document. It seems there is only 825 feet between the gas cap over the oil and the water that is pushing into Cantarell from the bottom. This distance is closing at between 250 and 360 feet per year.

The more pessimistic of the study's scenarios have Cantarell's production dropping from 2 million b/d to 875 thousand barrels a day by the end of next year and 520 thousand barrels a day by the end of 2008.

It's no surprise that Turkmenistan, Kazakhstan and the Chinese have made a deal. Kazakhstan's position continues to get stronger. Better to make deals with the Chinese than get invaded by them. The reputation of Gazprom gets worse and worse. Russia has the largest natural gas reserves in the world yet they are reaching peak production.

Sigh. Maybe these Turkmen deals will get Gazprom off their sorry rear ends and stimulate some investment to produce all that gas they're sitting on. But at present, they are utterly corrupt. Maybe Putin should do something about this?The Ukraininans are no better and their energy usage is terribly inefficient. It's a pity that Europe is hostage to this situation since they are furthest downstream. Presumably, LNG will bail them out down the road just as planned for the US. For their sake, I hope they are making long term contracts with producers for LNG. The situation with Gazprom and the Ukraine this past winter was just the wakeup call they needed.

Regarding that Turkmenistan - Afghanistan - Pakistan pipeline, maybe I'm just a pessimist, but that doesn't strike me as a particularly secure project, you know? Looking into my chrystal ball, I see payments to tribal warlords in the future. This will augment their considerable opium revenue.

Russian-Ukrainian gas deal - what's behind it? (Jan. 4)

Russian gas cuts - why there is no need to worry (Jan. 2)

Ukraine vs Russia: Tales of pipelines and dependence (Dec. 30)

The way China does things, they owned the gas fields with exploration and development contracts to guarantee supplies. The only thing negotiable is price.

The issue is not what China can pay for gas, it is - are they willing to pay more than Russia on top of paying for the construction of the pipeline

Remember energy security requires premium. Since the Chinese are already invested in that region, it is hard to see them operating without a pipeline.

Thanks for chiming in Jerome. You obviously know what you're talking about. Yes, Turkmenistan is run by a crazy guy, Afghanistan is - well - Afghanistan and Pakistan is not a model of political stability. (Which worries me a lot since they've got the Islamic Bomb).

The strong point to me are that the Turkmen obviously have the gas and can't be free of the Gazprom monopoly until they find another pipeline route out. Since they will have one (through Kazakhstan to China) -- and I believe that deal will definitely happen -- maybe there is less incentive to build the TAP. This gives the Chinese a strong vested interest in Turkmenistan's ability to keep a strong natural gas industry going many years into the future. As far as the TAP goes, India can put $2 billion up front if they get guarantees that the spur will be built to supply that gas. Or, the Chinese might be willing to do so and operate the pipeline. So, you've got the two most powerful burgeoning economies in Asia who appear to have a strong interest in both pipelines being built.

I'm not saying you're wrong--you may very well be right. I realize you wrote your post to counter paranoids who think the war in Afghanistan was about pipelines. I'm not one of those. I simply think the economics coming into play (along with future scarcity) will probably mean that both pipelines will get built.

Lately, the Russians and the Chinese are having a love affair over oil and natural gas. Gazprom undermining pipelines out of Turkmenistan would sour the current happiness.

As to Gazprom and their motives, I naturally defer to your more informed opinion.

I don't like how people think China will invade/attack Caspian or that they will win by out bidding Western Europe or US. These theories simply don't fit reality. Reality is that US and Western Europe pay more for gas and oil than China is willing to. All current contracts for oil and gas signed by China are for cheaper oil than G7 nations signed for. Since China is signing for cheaper contracts, they are forced to sign with states that US claim are not complying with human rights or other abuses. Other oil companies don't want to take the risk, but China is willing to. China also don't ask questions and willing to provide governmental aid. These aid if spread across future oil and gas production are still cheaper than US and Western European prices.

Now, the above discussion only valid on long term contracts. I do not have info on whether China went to Saudi and bought more expensive oil than US or Europe. I only know about long term oil and gas development contracts. Also, actual pricing is not public record, so it is based on hearsay.

Now about the Afghanistan/Pakistan/India pipeline, it ain't happening unless Turkmenistan opens up its gas fields for exploration. No bank is backing that one and India is not about to bank it themselves. China on the otherhand are banking it themselves, so a lot more likely to built the Turkmenistan/Khazikstan/China pipeline.

Also, Gazprom may have problems supplying gas, but there are a lot of stranded gas that if Gazprom invests in pipeline, they will have some more gas. BUT unless they discover some huge gas fields soon, no matter how much stranded gas they are able to grab, they will always fall short of ever increasing demands.

The Chinese are swimming in cash. Turkemenistan is currently run by a deranged man (or look here

President Saparmurat Niyazov --

officially known in his Central

Asian state as Turkmenbashi the Great

However, this will not last forever and since he is absolutely corrupt, large amounts of money could persuade him to promote greater E&P for natural gas. I believe this money will come from China (first) and India (later). Ironically, it is in the best interests of the US to see the TAP pipeline be built because it might bring more stability to these South Asia countries. And obviously, if Pakistan builds an LNG terminal, as Jerome mentions above, this makes Turkmen gas available globally. So, although there are practical & geopolitical problems (duh!), I believe the economics of exporting the gas will triumph in the end (whether it's bribes to Turkmenbashi the Great) or the NG needs of Pakistan, India and China.

I believe this is one of those "follow the money" situations because both the gas and the demand are there.

best, Dave