A Critique of the 2006 EIA International Energy Outlook

Posted by Stuart Staniford on June 21, 2006 - 10:38am

Freddy Hutter kindly emailed me to point out that the US EIA released the 2006 International Energy Outlook (IEO) yesterday morning. This is an annual exercise they have been doing since 1985 to project energy supply/demand out into the future - currently to 2030.

As you can see - the future is bright to the EIA, unless perhaps you own beachfront or stormbelt property, in which case expect lots of wind and water. It will perhaps come as no surprise that I don't agree with their projections. Below are some critiques (mainly confining myself to the oil supply issues - others may want to take on the other fuels).

- In the 1980s, they underestimated how fast market economy energy use would increase (ie they were slow to recognize the recognize the resumption in growth that would follow the retrenchment in the late 1970s and early 1980s after the big oil shocks).

- In the early and mid 1990s, they overestimated FSU energy use, and underestimated Chinese energy use. (Ie. they didn't foresee the severity of the collapse of the Soviet Union, and didn't recognize the strength of the transformation of China following the reforms of Deng Xiaoping).

- In the late 1990s, they overestimated energy use growth, as they didn't foresee the effects of the ruble devaluation and the Asian flu.

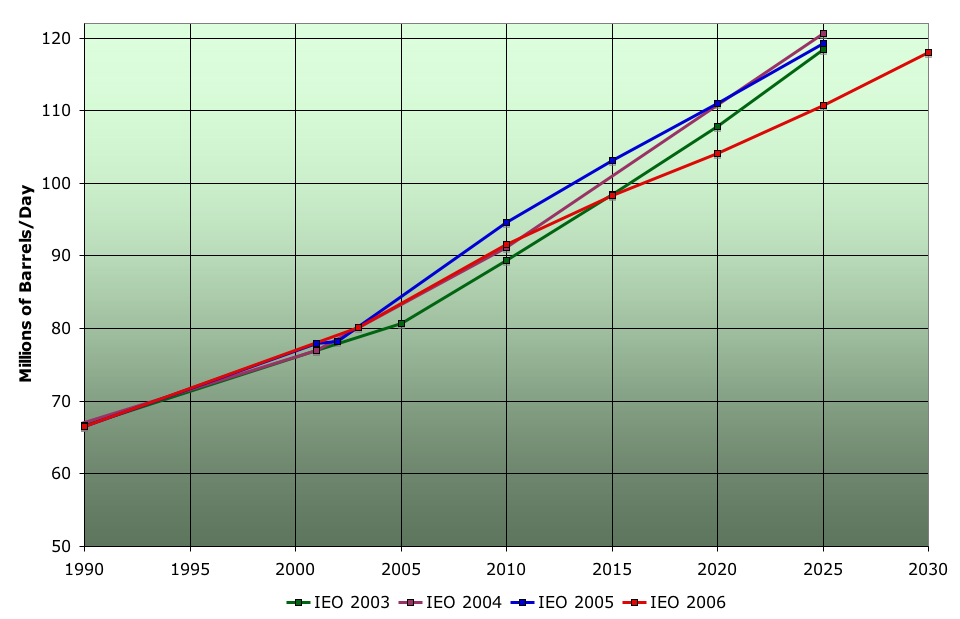

The comparison of IEO projections and historical data in the context of political and social events underscores the importance of those events in shaping the world’s energy markets. Such comparisons also point out how important a model’s assumptions are to the derivation of accurate forecasts. The political and social upheaval in the EE/FSU dramatically affected the accuracy of the projections for the region. On the other hand, if higher economic growth rates had been assumed for China, more accurate forecasts for that region might have been achieved. It is important for users of the IEO or any other projection series to realize the limitations of the forecasts. Failing an ability to predict future volatility in social, political, or economic events, the projections should be viewed as a plausible path or trend for the future and not as a precise prediction of future events.With that in mind, let's have a look at how their forecasts for oil have been evolving. Here is projected total oil supply from the last four annual editions of the IEO.

The changes are very small until this year, but they were anticipating slightly more oil in the mid-future. This year, higher prices have caused a reduction of demand a couple of decades off, but the difference only amounts to a few percent per decade. In short, they are only acknowledging very mild implications for the future growth of oil supply of current high prices and the associated production plateau.

In particular, peak oil is dismissed in a single sentence: the last one in this paragraph.

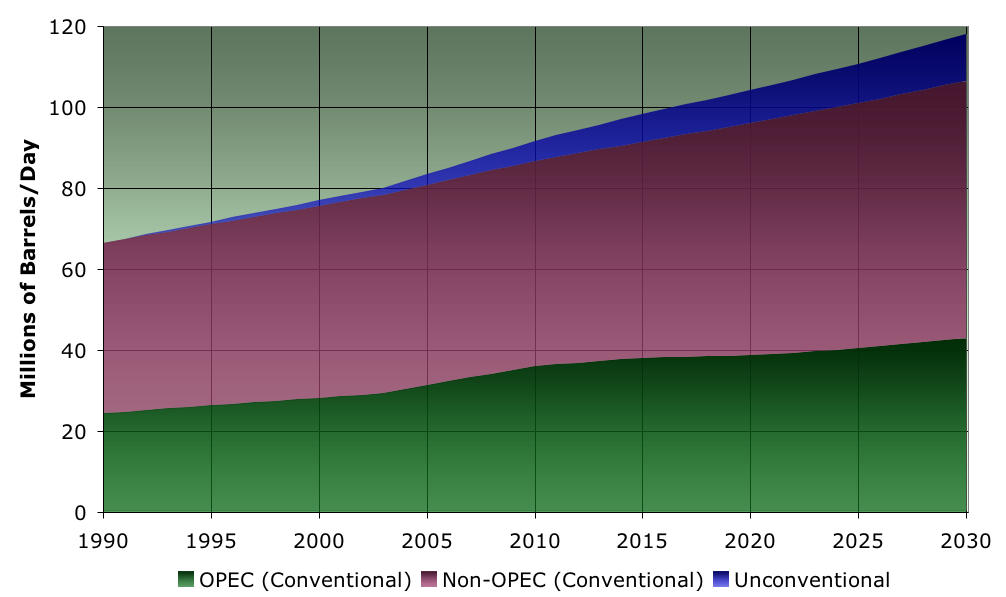

It is important to note what this approach did and did not assume. A business-as-usual oil market environment was assumed. Disruptions in oil supply for any reason (war, terror, weather, geopolitics) were not assumed. It was assumed that all non-OPEC oil projects that show a favorable rate of return on investment would be funded. For the period out to 2030, there is sufficient oil to meet worldwide demand. Peaking of world oil production is not anticipated until after 2030.But if we start to dig into where they think the supply is coming from, more interesting things emerge: things that might cause one to question the story-line. This next graph shows their decomposition of supply into OPEC, Non-OPEC conventional oil, and unconventional oil (tar sands, biofuels, GTL and CTL).

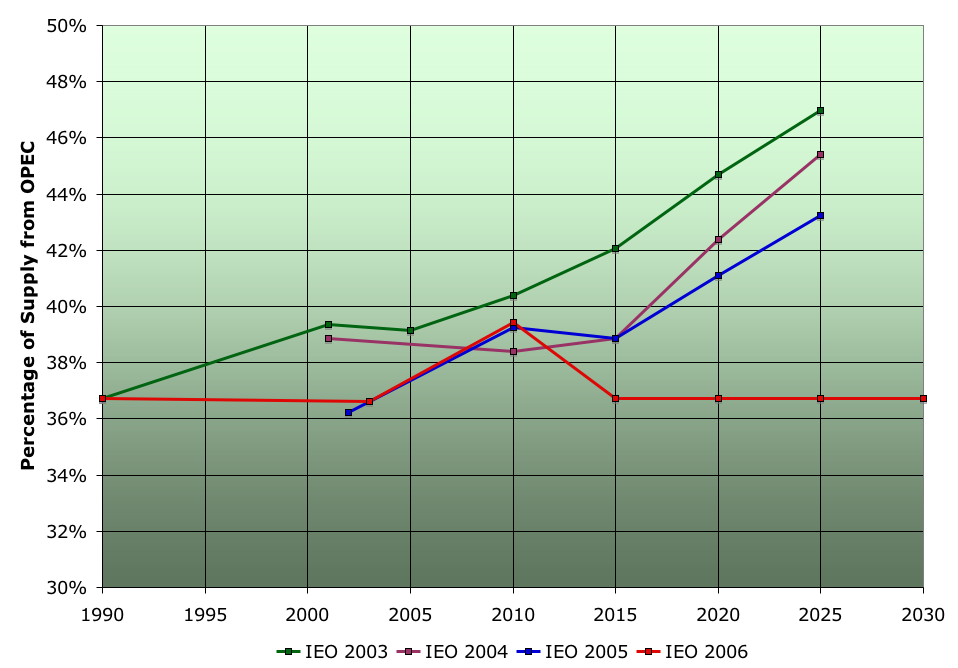

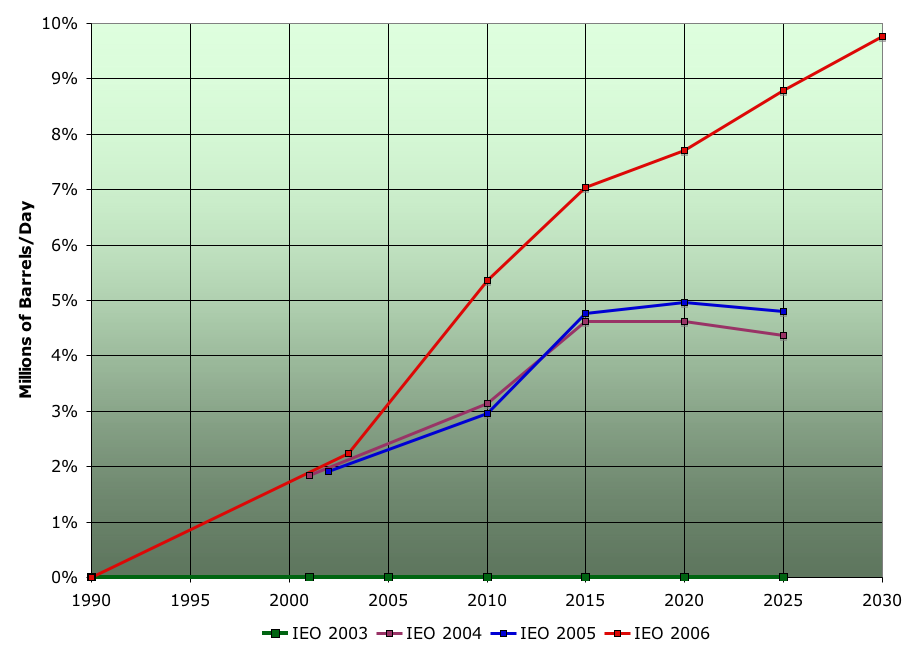

Clearly, unconventional sources are regarded as a small but rapidly growing player, and OPEC supply is expected to grow rather slower than the other components. Interesting. Even more interesting is to look at the changing assumptions about OPEC over the last few IEOS:

Question: what will the 2007 assumptions about future OPEC production look like?

Obviously, EIA has been getting steadily more pessimistic about OPEC with each year from 2003-2005, but then they really whacked into it this year. This is perhaps not surprising given the very public comments from senior OPEC figures that Western projections of OPEC production were unrealistic. However, the most recent curve looks highly suspicious. It jumps up from 36.63% in 2003 to 39.4% in 2010, and then falls back to a flat 36.74% in 2015-2030. That 36.74% figure is numerically identical to the value in 1990. In short, those OPEC production numbers didn't come from some complicated model of OPEC reserves and decision-making. Instead, they came from a fixed percentage of the top-line production.

I think this tends to support what many of us suspected about the EIA projections: they start with what they think will be a politically acceptable demand projection, and then tweak the supply assumptions to add up to that.

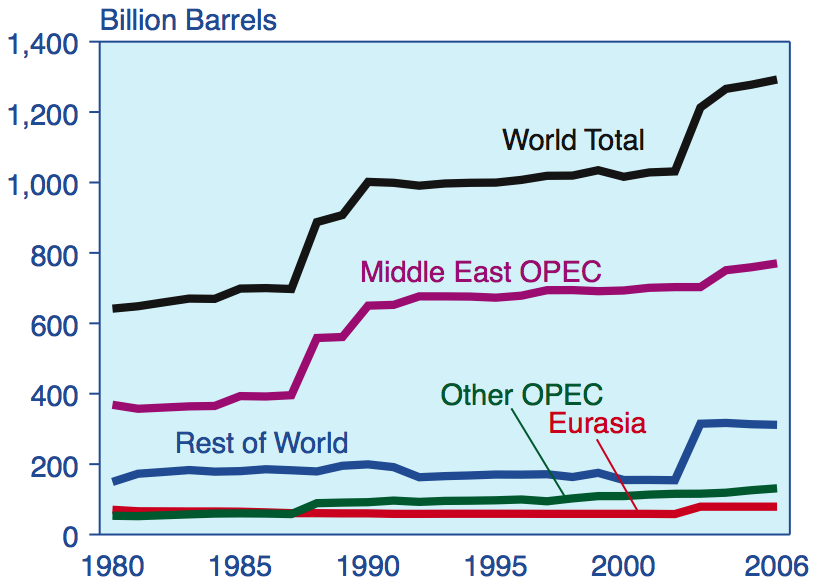

Speaking of made-up numbers, the elephant in the room now gets faintly outlined, though not actually honestly acknowledged and discussed. This graph is in the report for the first time (at least in recent years):

However, there is no discussion of whether or not those 1980s-era OPEC reserve revisions are credible or not. The diplomatic calculation seems to have been made that it just isn't nice to accuse a set of important suppliers of lying about the data, so instead of questioning whether that oil is really there or not, EIA and IEA couch it in terms of OPEC being unwilling to make the required level of investments to produce it. At least some distance to recognizing reality has been covered this year, though I suspect there is further to go.

However, in order to make up the gap required now that OPEC cannot be the main solution to future growth in supply, severe strain is being put on the rest of the projection assumptions. For example, consider the assumptions about the North Sea:

In the IEO2006 reference case, the decline in North Sea production is slowed slightly relative to past outlooks, based on the implementation of strategies for redeveloping mature fields. Production from Norway, OECD Europe’s largest producer, is expected to peak at about 3.6 million barrels per day in 2006 and then decline gradually to about 2.5 million barrels per day in 2030 with the maturing of some of its larger and older fields. The United Kingdom sector is expected to produce about 2.2 million barrels per day in 2010, followed by a decline to 1.4 million barrels per day in 2030.What planet are they living on?

UK production is already far below 2.2mbpd, and it's on track to decline to 1.4mbpd in the next year or two, never mind 2030. Likewise, it's hard to see Norway doing 3.6mbpd this year, and very hard to see production holding up above 2.2mbpd for the next 25 years. These assumptions seem ludicrous.

Also in the "what are they smoking?" category are these assumptions about Mexico:

The IEO2006 reference case assumes in the sustained higher world oil price environment, Mexico’s state oil company, Pemex will successfully lobby to use a larger portion of its profits to fund exploration and production investments and thereby increase production in the long-term. Production in Mexico exceeds 4.0 million barrels per day by the end of the decade and continues increasing to 5.0 million barrels per day by 2030, despite the anticipated decline in production of Mexico’s largest oil field at CantarellAnd I hear that Dr Pangloss is soon to be appointed President of Mexico.

Here's the assumption about what proportion of oil supply is going to come from unconventional oil. This includes biofuels, coal-to-liquids, and tar sands.

As you can see, EIA is assuming that prices are going to stay high enough that unconventional sources are profitable to develop, and that we will need them in much larger quantities than was assumed a few years ago.

Here are the price assumptions:

All my graphs above are for the reference scenarios, and in that scenario, prices drop in the near future, but stay in the $50-$60 band. Wouldn't want to deliver any bad news about near term gas prices to the political appointees, now, would we? The high case looks like a lower bound to me.

In summary, the EIA is now assuming less OPEC production and higher prices in the future, causing more use of unconventional oil. However, this is assumed to have very slight effects on overall supply, and no material impact on economic growth. Individual detailed elements of the projection are looking increasingly implausible, and I expect significant continued movement in the projection over the next few years as it slowly catches up with the unfolding reality.

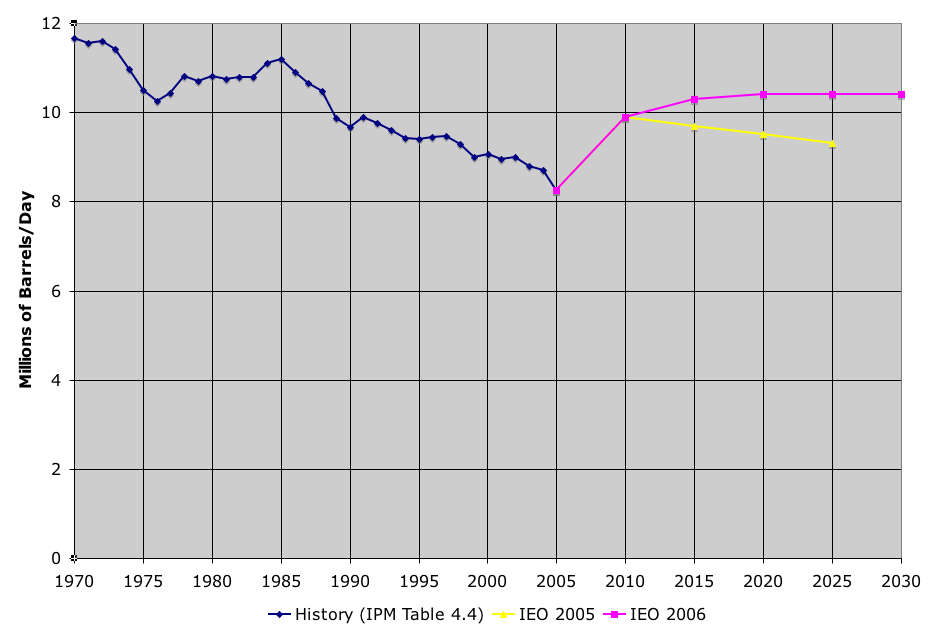

Update [2006-6-21 18:52:53 by Stuart Staniford]: Here are the assumptions for future US production.

Note the bump in historical US production from the late 1970s on is due to the startup of Alaskan production. Apparently, the EIA has found a domestic oil source significantly better than Alaska, and production from it will be starting soon.

Great analysis as usual! Please email John J. Conti [the director, and lead editor], and ask him to intelligently defend this expenditure of our taxdollars by debating TODers online. IMO, since he is a paid public servant: this is the least he could do for us taxpayers.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Thxs for the support of the idea of EIA principals debating online. Anybody can generate statistics and graphs-- the value [or nonsense] becomes apparent by carefully detailing methodologies, sources, verifiability, etc.

Data freaks, who possess the willingness to carefully explain their results, is what ultimately shifts people's permeability to accept new evidence. I am very thankful that Key TODers like Stuart, RR, et al, are generously forthcoming in answering questions. The EIA should be required to do the same by appointing an official spokesperson here on TOD to either enhance or diminish their credibility.

Chris Skrebowski is trying to do the same with his latest article on Energy Bulletin:

http://energybulletin.net/17422.html

I suggest that his article should be read by all, and be a stand-alone thread here on TOD.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

The projections for OPEC increased production

seem unlikely, but those for non-OPEC are

incredible. It seems that the EIA wanted the

sound bite that goes out to the MSM to be "Full

steam ahead - there is plenty of oil until 2030!"

The fact that there are no credible prospects

for supplying all that oil is an inconvenience.

While those who follow oil production data

quickly see that the North Sea projections (as

just one example) are ridiculous and patently

untrue (according to EIA's own data for 2005!),

there is an excellent chance that MSN journalists

are too busy to dig and will just take the happy

projections and print the message.

Rosy projections are one thing - but this kind

of "double speak" from a Government Department

is scary!

- The world is a better place because it is prepared to start a global nuclear war on 3 minutes notice...

- The "corner has been turned" in Iraq

- It's more important to preserve Corp. property rights than to treat 20,000,000 + people with AIDS who can't afford drugs

- It's a very bad idea to provide information about effective means of birth control and STD prevention to the worlds poor.

- It ought to be easier for a straight guy to aquire a machine gun than for a gay guy to aquire a marraige certificate

So, really, how much scarier could it get?By way of analogy: If I were to be walking down the street and see a dog come running towards me foaming at the mouth I suspect I would be scared, and with good reason. It would, on the other hand be both silly and unhelpful to feel hatred towards the dog.

Having fear i.e. being scared of something, is often adaptive behaviour in the evolutionary sense of the word, whereas being in a space where fear engenders hate can be quite maladaptive.

Hope this clarifies my position for you.

You hate him for his freedom.

-----------------------------

^^^^^^^ Sarcasm Alert ^^^^^^^

Whoever the Pres. of America is there will be a guy following him around for the entirty of his term with "the football" (The gadget that starts world war 3). Thus only an agent of intense evil can agree without reservation to be the President of the U.S., but more to the point Americans have collectivly embodied evil in their state structure because it contains the football carrier. To the extent that they are not working to dismantle this structure they too are agencies of evil in that they enable it at the least through their inaction.

Many of the things discussed here have echos of this: food vs feed stock for biofuel, environmental impacts such as Global Warming, "Demand distruction" in the global south etc.

We really need to start owning the evil inherent in the ways we consider going on these things if they are worthy things for consideration by human beings, in my opinion.

Please keep in mind that Bush has very low approval ratings, so while you(we) may not like him I don't think it fair to lump us all into a shitty box.

It would appear also that there are alot of people trying to get into the US. It would appear that they do not agree with you.

Bad isn't bad except by comparison, look at the opertunity that doesn't exist elsewhere.

Nonsense. Bush IS the problem with America. Polling throughout the free world prior to Bush were very positive; polling after Bush and his illegal invasion of Iraq became overwhemingly negative. That's a fact.

Delusional said:

Everything is known by comparison, Delusional. Mobility is the norm now. Talented people from say, Bosnia (oops, a Muslim world), or India or VietNam or S.Africa, or wherever, are looking to upgrade. Don't take it as a compliment that people are still coming here - many are also going to quality destinations like Australia, Germany, Canada, Ireland, Israel, Hong Kong, Bejing. Although I don't have a cite at the ready, there is evidence that the US under Bush and Cheney have persuaded many bright scientist around the world to seek opporunities elsewhere. Gresham's Law says bad money drives good money out of circulation (eg. silver coins are now hoarded). A corollary suggests bad leaders drive good human capital out of the country.

I don't think Tom meant that as a hit on all Americans, but rather as a general polemic on the policies adopted by the US government (which presumably acts in the name of the American Public,) and the elite that determine those policies. Capitalism is taken to be democratic, while it is one of the most undemocratic means of governance.

You may find "The Strange Language of Capitalism" an interesting read.

Caesar always says his legions are there to bring peace and justice. He just doesn't mention that he has to make desert in order to do so.

I guess it is pointless to rant about it, but IMO we need to take a deeper look at the brainwashing that is in place. For me it poses much bigger long-term dangers than the depletion of hydrocarbons, which in other circumstances would not present such a huge problem by itself.

Aldous Huxley wrote a book back in the mid sixties called the Witches Of Loudon, which was about a historical demonic possession frenzy in France in about the 13th or 14th century.

In part of his analyses he examined the madness of crowds and how they are manipulated, and even more particularily how nationalism can become a false religeon. He asserted that this worship of the state was the distruction of the Greek democracy in the Peleponesian wars. I believe we are at that state in the US now, with such inanities as a "flag burning amendment" and the number of people that worship the state and all its actions.

We have, through our own laziness, allowed a bunch of totalitarians to take over in Washington and they will stop at nothing to retain power. This obfustication about crude supplies is just today's manifestation. The automobile industry in America cannot admit that their model of how to run transportation is not working. I mean really, 400HP SUV's flying down the Highway at 80 MPH, or sitting motors reving in a 500 foot swath of concrete and steel polluting the atmosphere.The major gasoline marketers and refiners are just as delusional, because if they admit even to themselves that our hydrocarbon addiction is bankrupting us and their companies will not survive it is emotionaly intolerable and will cause the stocks to decline as investor's realise that Exxon and Shell and Chevron are like the tobacco industry-doomed and only worth the dividends.

Both political parties are to blame, they are whore to the almighty dollar. And I'm sure I'll get nailed for this anti-american sentiment, but the Emperor has no clothes!

For example-- I build a barn and my neighbor helps me for free. he then builds a barn. If i don't help him he will never (probably ) help me again. If I do help him he will most likely help me again in the future.

so, I'm a politican, I want money for election. someone gives me $ . There is legislation that affect thier interests. They want my help. What do you think is going to happen?

It sounds better with a neighbor and his barn but the process is the same.

So, unless we get rid of private funding of campaigns this will continue in all it's differnt forms such as a shitty report in an effort maintain the status que for whoever gave to the election.

Marshall McCluhan made the point about 1970 that the medium is the message. Amost all broadcast and print media exist to sell commercials, for gasoline refiners and marketers and car dealers. The media whips up artificial fear and anger to keep us hooked into watching and avoids anything that offends any advertisers. They want every problem and every solution to be reduced to a 30 second intervel and shy away from any question or solution with a more complexity. We need to break up these media conglomerates and limit their size or our republic will continue to get worse.

But thank God for the internet, or maybe Al Gore. It enables people to communicate and self publish.

The attitudes of American do allow, even foster, evil.

An example that's really hit home with me is the recent realization that my older sister is, in fact, the embodiment of pure evil. How did I come to this realization? Well, it starts with the iPod. I forwarded her the article about the working conditions of the Chinese slaves who make the iPod, as a "whatta ya know" sort of thing, as she'd been considering getting one. She took that as an attack. You see, in the US, you either agree with a person completely and say so, or if you don't agree completely you still say you do, since anything but that is considered an attack. I had to do a lot of "patching up" after sending her that article, believe me! Well, the ensuing conversation resulted in her admitting her belief that the overriding principle in life is Convenience. Basically, everything to her, the meaning of life, is Convenience.

If you think about that, that is really the very core of evil. She, a prep-school kid who should have had some contact with the ideas of estheticism, (sp?) the self-sacrifices of many historical figures from Jesus to Gautama to Tolstoy, has as her core belief that, That Which Is Good Is That Which Is Convenient. This is the attitude of the Nazis who found it most convenient to work the Jews to death and burn 'em rather than at least send them to Madegascar, of the US which found it most convenient to nuke two Japanese cities rather than sacrifice more troops, your average limousine lib who sends in the convenient Red Cross payment in the mail while ignoring the poor and desperate in their own town, and every soldier, everywhere, every time, who found it more convenient to kill than to ask questions.

I guess Jello Biafra put it best, "Give Me Convenience Or Give Me Death", in the title of one of his songs. That's the core of American culture.

Not sure if Huxley coverd this in his book? but I know he was right into that sort of stuff...

It is quite difficult to acquire a machine gun in the U.S. (i.e. a full-automatic weapon). A semi-automatic weapon, however, is much easier. However, as with all things in our life, these weapons are regulated. What's next? Regulating knives? I'm all for limited government. Tell you what - when the government stops regulating my firearms, then it can also stop regulating marriage.

Robert Blanchard on EIA predictions regarding total Canadian oil production--conventional + unconventional:

The US Department of Energy/Energy Information Administration (US DOE/EIA) has a history of providing poor forecasts as illustrated in their International Energy Outlook 2003 (IEO2003) forecast for Canada. In the IEO2003 they stated:

"Canada's conventional oil output is expected to increase by more than 200,000 barrels per day over the next 2 years, mainly from Newfoundland's Hibernia oil project, which could produce more than 155,000 barrels per day at its peak sometime in the next several years. Canada is projected to add an additional 500,000 barrels per day in output from a combination of frontier area offshore projects and oil from tar sands."

Assuming the total increase of 700,000 b/d for Canada was for the 2003 to 2005 period, the US DOE/EIA was only off by 710,000 b/d. In 2003, Canada's total liquid hydrocarbons (TLHs) production was 3.11 mb/d and in 2005 it was 3.10 mb/d (US DOE/EIA data/I used TLHs data because they include NGLs in their forecasts), a decline of 10,000 b/d. If the baseline was 2002, then they were off by only 555,000 b/d. That's not bad for the US DOE/EIA. I had made what I thought was a good case in my book that Canada's oil production would not increase by anything approaching 700,000 b/d for the 2002 to 2005 period.

It is interesting to see that Canada's oil production decreased 29,000 b/d in 2005 (US DOE/EIA oil production data). Part of the decrease is due to prolonged shutdowns in production from oil sands operations, which seems to be a persistent problem. Production has also decreased in Atlantic Canada due to declining production from the Hibernia and Terra Nova fields (Hibernia actually had a peak of 204,264 b/d in 2004). Atlantic Canada's oil production declined from 336,885 b/d in 2003 to 304,847 b/d in 2005. The White Rose field was brought on- line in Nov. 2005 so that will slow the decline of Atlantic Canada's oil production.

The US DOE/EIA is projecting that global oil production will not peak before 2037. I would not bet any money on their forecast.

Roger Blanchard Sault Ste. Marie, MI

he said they just do demand projects and 'fill in' the supply side. Normally all the increases were assumed to be from the middle east. Maybe this time they have decided its going to be unconventional sources too. It is pretty rediculous, and should just be ignored as trash science.

I used to buy/sell books before the bottom fell out of that market. Hence, I used to handle, and temporarily keep and read, a lot of interesting books. The Signet Science Series, a bunch of little paperbacks, were great - I got a collection of most of these and they're well worth having if you ever see them at a garage sale or somewhere.

They're roughly 50 years old - started out in the late 40s or early 50s, I think were published up into the late 60s, most of the ones I had were early ones. AND, they were about the same science that's talked about as new now! Not computers and nanotech, no, and you won't find anything about the Space Shuttle, but the basic science that's "just discovered" is the same basic science that's "just discovered" in modern science books and magazines.

This gets back to the "peak scientific discovery" thread that we had going maybe a week ago. There aren't that many new things being discovered, but the powers that be have to have the masses THINK that all kinds of new things are being discovered and that we're a dynamic, thriving culture. Even though that may not be true.

Each thinks they are discovering something new.

Problem is ...

the waves are getting bigger and this beach (planet) is eroding away.

For most people and politicians both institutes are telling the absolut thruth on energy issues. Most goverments will base there energy policy on one ore both institutes forcasts. What if the two most known energy forecasting institutes are telling a different story?

For the Peak Oil Movement it would be of strategic importance to break the reputation of both the IEA and EIA.

The TrendLines cursory review of this morn's EIA IEO-2006 reveals that:

a) EIA joins ASPO & BP in increasing URR;

While on this topic, it should be noted that while many think it insignificant when some modelers have seemingly "no change", that is in effect a 30-bbl increase due to consumption over the past year.

b) On global production, the Reference case is down 4.5-mbd for 2015, but remains at the same projection levels for 2030; this is rather academic to us as we prefer to use their "High Price Scenario" in our Peak Oil Depletion Scenarios graph. There have been no variances to its production numbers thru the entire time series of that outlook.

c) Net effect of URR change on our Scenarios will be to push exhaustion out past the present 2130AD date with no change in the Peak Production date or rate of 102-mbd.

We will update the EIA OUtlook simultaneously with recent BP & ASPO amendments.

http://trendlines.ca/economic.htm

Let's get to 85/mbd first, OK?

Then we can take it from there. And IEA numbers that later get revised downward don't count.

If anyone predicts better than my trio, i'd sure like to know about it. Nitpicking about odd errors is disingenuous cuz it all works out in the end as their record plainly is illustrated.

Within each 24-month block of time, we see at least five new time line targets by EIA & IEA. And much as i admit they have glaring errors as pointed out by Stuart and others, their's are the only game in town. Absolutely nobody else can put claim to comparing to their long term accuracy. Nobody on earth cares about quarterly or annual deficiencies that are being discussed; 'cuz where they are low on one nation or category, they are just as unexpectedly high on others. In the end it is only the totals that matter.

Would i like to see the boobs cleaned up. Of course. Am i embarrased by them. Yes. But nobody out there is doing better. I have challenged the doomsters seven times at TOD to put forth a candidate for a modeler that represents their targets and i'll add that model to Peak Oil Depletion Scenarios. Nobody has taken up the challenge. The next EIA release is in February. Keep this post so i don't have to repeat it on that date.

Programming note: For those new to this discussion. Our 11 modelers do include the conservative outlooks of ASPO and Koppelaar and Laherrere. But doomsters here seem to have dismissed their projections as too optimistic as well. To not acknowledge the thankless work done by that group of three brings disrepute on man of the comments here and in fact reduces it to whining and wishful thinking. We know not what is their agenda. I presume it is clinical based.

I suppose it doesn't help matters any when you ask for modelers and at the same time disparage them as doomsters.

My preferred models are those that present their own work on URR and bottom up production estimates ... and the two should complement each other. One's URR should support the production estimate to exhaustion.

Some do lotsa work on URR, but not production. And some like Koppelaar do lotsa work on field/nation production estimates but not URR. And we marry some together.

My methodology leanings are presently awarded to Campbell and Koppelaar. Both seem to agree that URR is fundamental, but they seem to be await proof of URR before incorporating. The nature of this makes them vulnerable to revisions and a bias towards conservatism. I like a model that incorporates that revision history making it much more pragmatic.

Your own Shock model based on aspo may not be your favourite but it was the only one i could find that would be a candidate for TOD scrutiny or whatever. Again i apologize if your site navigation did not allow me to find your premiere model, but the shock-aspo was lacking i.e. it seems to show a peak in 2003 at less than 84-mbd. Dated Autumn/2005, perhaps it is a work in progress, but recent production data obviously eliminate it as a non-starter. Or it may be that u are using a less robust definition which explains your shortfall.

As said in my preamble, i will contact u, but i'm not sure why an offline discussion is preferred to TOD scrutiny when your very public taking up of the challenge probably prompted many here to drift over to your site as i did and i am quite sure that they have as many questions or more. It is a very nice site, btw. You have put much thot into this obviously and i was fascinated by much of your work-to-date.

cheers;

Do you believe that there is a URR that is subject to analysis? On another thread, I failed to relate your term "the golden effect" to Thomas Gold and the abiogenic theory of oil which caused me to go off on a tangent. If abiogenic oil exists in significant quantities [ a big "if"] it seems to me that at least some data would be necessary to establish a rational basis for projection of a meaningful growth for producable oil based on the theory.

Which brings me to the big question: If Gold and the other proponents of abiogenic oil are correct, where at depth are there (i) conditions that would not cause oil to break down, and (ii) reservoir rock with porosity, permiabilty [and presumably traps unless you believe the oil is distributed like sea water]? Even if the oil is there, unless it can be economically be produced from existing reservoirs, or is migrating toward more conventional reservoirs [at volumes that appear unlikely on a human time scale], what difference would abiogenic oil actually make in terms of the existence of a peak in oil production in the not too distant future?

The supposition that we are near Hubbert Peak for all liquids was based on Colin Campbell's ASPO estimates that we were near the half way consumption of URR. While we assumed that discoveries were near at an end wrt exponential growth, we forgot that higher prices were making previously dismissed fields extraordinarily lucrative (e.g. oil sands) and voila ... URR is growing like stink. And with it, the Hubbert Peak is moved outwards on the time line ... and many of us believe the Extraction Peak with it.

Ok, I declare that the world has 20 quadrillion barrels of oil left. Problem solved! After all, anyone who spouts a bigger bullshit number than the last big bullshit number gets embraced by Freddy as "proof" that URR is "growing". Put my name up in lights too, Freddy.

//End Sarcasm Alert!!

Sheesh, Freddy - what about Yibal (and all the fields like it)? Shell CLAIMED that reserves "grew" there but in reality that did not happen at all, did it? How many other claims of reserve growth are simply smoke and mirrors like Yibal, Freddy? The truth is that you won't know til after the fact and accepting such claims in the face of such monstrous failures as Yibal seems to be excessively optimistic.

Regarding tar sands, the logistics don't look encouraging, but extraordinary efforts are certainly possible.

`'The projections in IEO2006 are not statements of what will happen, but what might happen given the specific assumptions and methodologies used. These projections provide an objective, policy neutral reference case that can be used to analyse international energy markets. As a policy-neutral data and analysis organization, EIA does not propose, advocate or speculate on future legislative and regulatory changes. The projections are based on US and foreign government laws as of January 1, 2006. Assuming fixed laws, even knowing that changes will occur, will naturally result in projections that differ from the final data.

Models are abstractions of energy production and consumption activities, regulatory activities, and producer and consumer behaviour. The forecasts are highly dependent upon the data, analytical methodologies, model structures, and specific assumptions used in their development. Trends depicted in the analysis are indicative of tendencies in the real world rather than specific real-world outcomes. Many events that shape energy markets are random and cannot be anticipated, and the content and timing of policy developments, as well as assumptions concerning the future technology characteristics, demographics, and resource availability, are inherently uncertain.''.

Or short hand: Don't blame us.

The children of today have little interest in history and society will likely be able to support very few "non-productive" workers.

On the UK, surely they must know that their 2010 prediction represents a climb from 2006 production - are there any major projects underway that they can point to with optimism?

A lot of new licences are being awarded and the local papers are suggesting boom times ahead. Certainly, the service companies are very busy right now.

However, I should imagine that the situation will be like Texas at the peak: lots of drilling, but not affecting the overall trend.

At what point does mindless optimisim become criminal negligence?

The Buzzard Field is due on in late 2006 at 200K bpd. This will slow the decline for a couple of years(they hope). this field was discovered 5 years ago. No field produring over 100K bpd at present.

Decline rate in existing fields probably 15%.

Everybody is running hard to hold the decline at 7%.

The finds being made are small. The government and the industry talk up the future but the reality is decline.

The dti9UK government energy Dept) produces monthly output figures three months in arears so the data is available for anybody who wants to look.

http://odograph.com/?p=577

As for the graph showing Opec, non-OPEC and non-conventional production, I have no explanation.

- The total conventionnal oil produced from 1990 to 2005 is approximatively 420 Gb. The forecast from 2006 to 2030 predicts that an additionnal 870 Gb (more than three Saudi Arabia URR!) will be produced without any visible peak.

- The figure below about reserves is showing a world reserve around 1,300 Gb in 2006 (i.e. URR ~ 1,300 + 1,100= 2,400 Gb) which means that we will consume 870/1,300= 67% of our reserves in the next 24 years! or (1,100 + 870) / 2,400= 82% of the URR will be consumed in 2030 without experiencing any decrease in production rate whatsoever!

- Even worse, if we are taking out the 200 Gb dubious increase in Middle East OPEC reserves, we get (1,100 + 870)/(2,400-200)= 90% of the URR consumed in 2030!

Now, here is the problem:Never has been observed a production curve that is showing a production increase past the point in time where cumulative production is past 60% of the URR. The only possibility is that the world URR is in fact around 2,900 Gb and that a future 2,900-2,400= 500 Gb (+38%) jump in conventional oil reserves increase is waiting for us somewhere. Talk about an act of faith!

It is truly amazing that this stuff gets handed over by the ministry of information and then floated off to the public - probably without anyone in the MSM getting past the front cover of the report. "Oh this science stuff is so boring - now let's move on to Angelina's new baby..." etc etc

Could you kindly respond to kehbab's data.

Thank you,

Each of the last two figures is about 1-Tb above our Scenarios avg and about par with ExxonMobil as the two highest of our optimistic models.

The only way to challenge this kind of flagrant lie is to immediately try to get the truth out. Is the ASPO-USA or TOD issueing press releases on this?

Wind is doubling every 3 years, and solar every 2, and growth is likely to accelerate. Costs are falling, and the fall is also likely to accelerate (for just one of a dozen serious and credible companies see http://www.nanosolar.com/cache/sjmnwl.htm).

Wind is already on track for 40% of all new electrical generation in the US in 2006, and 47% for 2007 (adjusted for capacity factors). Solar is about 6% of the size of wind, and at current growth rates will catch up to the current size of wind in only about 8 years. In California PV is bumping up against the .5% net-metering limit, and growing just as fast.

Astonishing and aggravating.

I've been rather critical of assumptions (and hopes) about the utility of wind and solar and think that EIA's assumptions about renewable growths are also overly optimistic. For wind, its only market is electricity and electric grids can only efficiently support a few percent of capacity as wind. Solar is also nondispatchable and very expensive on a kW-hr basis.

Solar is fine for domestic hot water and I advocate wider use in that role but that's a small market although currently served by natural gas in the US.

This raises the question of the units - quadrillion BTUs. Energy qualities measured in BTUs can be very misleading as a BTU in the form of warm water is not the same market value or utility as a BTU in the form of 120vac. I'll have to look at the report and answer my own question with an answer later today.

They did UNDERestimate future nuclear contributions. Domestically, we expect a 25% increase in nuclear output due to new plants by 2015 and more thereafter. Worldwide, the rapidly growing economies of India and China will be see their use of nuclear as a percentage of total electric power production grow as their total electric consumption grow. Hence, I see nuclear growing faster worldwide than total, gas, or oil energy use.

In other words, nuclear will be gaining market share rather than losing it as per the EIA.

On page 4 it says "Much of the projected growth in renewable electricity results from the expected completion of large hydroelectric facilities in non-OECD nations, especially in non-OECD Asia."

I guess all that noise against big hydro projects a few years ago blew over.

The EIA does go on with "most hydroelectric resources in the OECD nations already have been developed or lie far from population centers."

I'll look for the breakdown within "renewables" for hydro, wind, etc later.

From memory, the limit in New Zealand is 35% of total energy from wind without grid changes.

Jutland (Western) Denmark has run at 100% wind for short periods and is heading towards 2/3rds wind.

The % varies as low as 10% from different studies, but the "limit" is without changes to the grid. Change the grid and add enough pumped storage and the maximum is 100%.

New US nukes commerical by 2015 ? Perhaps one or two at most with more in different stages of construction. (I would bet money on zero new commercial by 6/21/2015). And many nukes are going to be retired so a net loss for nuke in the US for 2015.

If PV has a cost breakthrough (a maybe) then it will grow quickly. Wind is the major hope and nuke is a slow, laggard secondary choice (better than coal).

I'll believe it when I see it. On a rooftop. Until then, it qualifies as smoke and mirrors hype.

How much? My company just signed on to build 2700 MW in Texas, fixed price (with commodity adjustments) and levelized damages for commercial operation in 2014. There is an option to uprate this to 3000 MW. Expect many more such announcements this summer. The chairman of the NRC was just testifying in Congress that his staff was overwhelmed with applications. At this rate we only need 10 announcements to meet my 30% claim and the NRC is already expecting 15.

I'd say put your money where your mouth is but you lack one of those two ingredients in the scale needed to match the $5.2 billion of this contract.

I will grant that we are starting a worldwide boom in energy heavy construction - refineries, offshore oil platforms, gas pipelines, nuclear power plants - that will strain global capital, resource, and labor availablity. This may well impact construction schedules.

This is where my criticisms of renewables comes in - given limited resources, shouldn't we invest them where we get the most energy? I'd say building nuclear power plants and GTL plants are far better investments than windmills and solar panels.

The kinds of capacity constraints we have in GTL, wind, and nuclear on one side and solar on the other are completely different.

Big hunks of thick steel tube for GTL is a constraint. Isotope separation ability for nuclear is a constraint. Big rotating steam generators for nuclear and coal plants is a constraint. Very large aerodynamic structures for windmills is a constraint. Even cement is a constraint unless the housing boom ends.

Silicon is not a constraint for concentrator systems, only for roof top panels.

And I see GTL plants as a negative overall.

WT Towers have largely gone steel, but concrete can be used. They can be installed at the rate of a couple per week with a good team.

I seriously doubt that your first plant will be commetcial by 6/21/2015. Too many problems in getting nuke rated suppliers back on-line, NRC bureaucrats with new designs, local problems with NIMBYs, even nuke rated electricians, etc.

Perhaps a wager of 5 chares of Encana, adjusted for splits and if bought out; the transfer at price to the buying company ?

The reason is that the first plant will be my bread-and-butter for the next few years. If it crashes, I'm hurting too. Plus, if it is on line, I've just worked myself out of a job! (Of course, there will other projects)

If I take your bet and lose, I'm a double loser!

Financially, that's what called a high beta prospect.

And if I win and nuclear floods the market with electricity too cheap to meter? Ecana and the wind industry are bust, junk and/or bankrupt. I've won nothing from you but have double risk.

Rethink your terms and get back to me.

Global warming is a better example of an externality. The global cost of carbon emissions is not paid by the people emitting the carbon. Now, Canada is a Kyoto signatory, so perhaps they have regulatory mechanisms to rectify this externality and make companies pay the costs of their CO2 emissions. I don't know how it works up there.

Why do I write stories like my last one on using natural gas to produce the tar sands? Why does Stuart do great reviews like this one? Why does TOD exist? Why do I publish pictures of the planet Alderaan?

Because that planet doesn't exist. The EIA's projections are a fantasy. They will not exist as we can see from the convergence of data and theory on peak oil. The hope that the tar sands will some how save us does not exist.

False hopes get in the way of changing our way of life to combat the energy crisis and the climate change resulting from our crack addiction to fossil fuels. Time is running out. We need to make an orderly but quick transition to solve our immense problems and pinning our future on non-existent scenarios that maintain our addiction is getting in the way.

As far as hope goes, it's best to try and fail than not try at all. We owe that to ourselves and everyone who will come after us. I am unrepentent about coming off like a preacher here. I will continue to demolish false hopes where I see them and support legitimate solutions. This EIA report is criminally irresponsible. We probably need another press release on this one.

not when the so called hope digs us deeper then if we did not try it.

Great comment - I hope we are at a unique point in history and perhaps the 2007 or 2008 EIA report will be far more sensible. The current numbers are clearly fantasy to us but who else is recognising this? Any idea how we can expose the failings of the EIA to a wider audience?

We need to make the transition, but please elaborate a bit. Btw, the hopes are real; it's just the technology that is not.

However, there are many would say that things like solar and wind are not real. They will never amount to much more than a very small percentage of our electricity needs, much less overall energy needs. That, of course, begs the question, "what do you mean by needs?"

As long as we define our needs as just a continuation of the current trendline (like EIA), of course we are doomed.

Sadly, I think coal is real and the powers that be will burn it to the max to continue this joy ride to hell. The Governor of Montana wants CTL. Try to sequester the co2 from the liquid that will burned in cars. I guess the cars he envisions will be stationary. He talks a good talk with fantasy dreams of unlimited sequestration. But he's just like the rest as he mainly wants to sell all that Montana coal.

As for the nuclear plant additions, one plant accident will deep-six any of those plans. Given the possibilities - human error, war, terrorism, earthquakes, tsunamis - it is guaranteed to happen.

Maintaining and increasing the efficiency of the current plants would be the most reasonable policy to pursue. This would be followed by an orderly shutdown after we have converted to renewables.

Antoinetta III

I like what he does, and his conclusion is we should have some growth in supply till 2010, then things look worse.

Where I think his approach is inadequate is that by his method, there is no allowance for Ghawar, Burgan or Cantarell's production entering decline. Since these truly exceptional fields and others are only falling into decline about now, the historical trends he bases declines going forward on don't reflect the probable massive impact of their decline over the next few years.

When you consider this, is seems very unlikely to me we will get to 2010 before TSHTF.

Your post brings up a question for me, where are the error bars? (I don't mean from you but from these, so called, authorities.)

This is more than an academic question for me. I sit on the City of Austin's Resource Management Commission. As part of our effort to diversify our energy generation fuel base while preserving the environment, we have instituted a solar energy program with some pretty aggressive goals. As a result of this process, our muni, Austin Energy, commissioned a Value of Solar Study. (You can download this from Austinenergy.com.) This study is an attempt to put a current value on solar derived power.

While I believe there are some errors in this study due to constraints placed on the authors by the muni, the largest component of value comes from avoided fuel charges due to solar generation. Even though AE makes their model private, I doubt any model that does not show me a track record or confidence intervals. This lack of error bars, self analysis of model efficacy and just plain ol' SWAGging seems to be endemic to this industry. (Which is shocking considering the big money being laid down on fuel and infrastructure...)

Therefore, since the largest component of value comes from a projection of fuel charges and results in a single number without any variability, I cannot in good conscience recommend this number to City Council.

So my question is: what kind of information (other than the middle case) should I be asking for? I have my own ideas but, while I'm trained in experimental physics and work as a software strategist, I expect that there are things I am not aware of in this industry.

Thanks for all of the good reports,

Andrew

One source of future predictions does in fact come with a very precise set of error bars. (I mean, the error bars are precisely stated, not that the predictions are precise.) This is price information from the futures markets. There are no markets at present to predict quantities, but there do exist markets that predict prices of many sorts of fuels, up to about six years out. This information should be a principle resource in any analysis of the kind you are talking about.

Futures markets predict the average expected price, and option prices then allow you to compute the implied error bars. It's a somewhat technical operation but the details are straightforward for financial experts.

Dr. James Hamilton of UCSD, an expert on oil prices and the author of the excellent econbrowser.com blog, had a good posting a few months ago looking at oil prices and computing their implied 2-sigma error bars (95% confidence interval). The article is here:

http://www.econbrowser.com/archives/2006/02/oil_at_1530_a_b.html

The bottom line is that the 95% confidence interval for oil prices in the year 2010 is: from $15 to $250 per barrel! And there's still a 5% chance of being outside that enormously wide range. Obviously this range encompasses oil which is fabulously expensive and would justify virtually any alternative energy investment, but also oil whose price is back to near the lowest it has been in history and which will bankrupt investors in alternatives.

Market prices derive from the bets of thousands of investors who are doing their best to make money and protect themselves against losses. They are the closest thing we have to unbiased, rational estimates. And here we see the truth, which is that it is impossible to predict the future with any degree of precision. If our various "expert" predictors were honest and objective, they would admit the same thing that the market is telling us.

Next time someone tries to tell you what is going to happen in the energy market over the next few years, just keep those figures in mind: $15 to $250. That's how wide a range the market says you require in order to have a 95% chance of being right. Unless your expert is similarly open-minded (and since such broad predictions are useless, no expert who spoke such a truth could get paid) I would take his predictions with a very large grain of salt.

http://www.dpo.uab.edu/~angner/pdf/overconfidence.pdf

Some excerpts: "Subjects who indicated that they were 100 percent certain that their answers were right were on the average correct 70 to 80 percent of the time."

"Incidentally, the clinical psychologists in his sample - a majority of whom had Ph.D.'s - were no more accurate and no less confident than psychology graduate students and advanced undergraduates."

"When subjects said the odds that they were right were 100:1, in order to be well calibrated they should have said 4:1; when they said the odds were 100,000:1, they should have said 9:1."

"When the doctors claimed to be more than 80 percent certain that the patient had pneumonia, X-rays confirmed the existence of the disease in only about 20 percent of the cases."

"The vast majority of drivers - sometimes more than 90 percent - say that they are more skilful than the median driver."

The authors summarize: "As we saw in the previous section, overconfidence has been demonstrated among experts and lay people, among the more and the less educated, among the well-informed and to the not-so-wellinformed, and in a wide range of knowledge domains... Overconfidence implies that the (possibly implicit) margin of error is significantly larger than intended."

All of this evidence - and these examples just scratch the surface - is in accordance with the results from the market, which by its structure avoids overconfidence and provides objective estimates of confidence intervals. The astonishing width of error bars from this objective source is surprising only because we as humans underestimate our own uncertainty by over an order of magnitude, according to psychological studies like those cited above.

The truth is that expert error bars and confidence intervals are essentially worthless in this field. Even if an expert analyst were able to overcome this ubiquitous error and deliver correctly calibrated confidence intervals, they would only reveal how worthless were their predictions and no one would pay to listen to them.

The truth is that the market just does not know.

Any hope of a district heating and cooling system at Seaholm (super efficient like the set-up at UT) ? Combined cycle co-generation.

Austin has a pretty large central chilling system for many downtown office buildings. Because of the way Austin Energy prices downtown energy, almost every new building has signed on to this service. Seaholm will also exploit this loop and may expand its capability.

As to low head hydro from Longhorn dam, that is not currently on the drawing board. (The dam may be owned by LCRA and, hence, unavailable for development by AE.

Andrew

Case A

All LNG terminals come on-line as scheduled and LNG is available to offload at them at 90% of capacity if needed. Canadian production declines slightly. Summer 2006 is average, Winter 2006/7 is almost as mild as last winter, Summer 2007 is slightly cooler than average, Winter 2007/8 is slighter warmer than average (colder than the two before). Recession in most of the period.

Case B

New LNG terminals have delays and no new ones come on-line. Spot LNG market is quite tight and cargoes hard to come by. Existing LNG terminals import at 2/3 capacity. Canadian NG production declines quickly & their exports to US decline significantly. Summer 2006 is third hottest in ten years, Winter 2006/7 coldest winter in last five year, Summer 2007 is second hottest on record, Winter 2007/8 in coldest in ten years.

Natural gas in Case B will be at least twice and perhaps three times Case A (IMHO). No heroic assumptions in either case, just the 10% case vs. the 90% case IMHO.

Austin buys some spot NG, most is medium term and long term contracts.

IMHO, now is a good time to lock up a lot of NG "just in case". Note the NG price spike to $14 last fall, tempered by a near record warm winter. (If the Artic cold had slipped over US instead of Russia, we would have had record cold winter).

I think a 10% case can be made for $20 NG and a 90% case for $6 to $7 NG.

And the strategy of 1973 is appropriate today. Cut NG use in an "average" year to <10% of total energy, expand transmission lines, and talk with LCRA about a hydro pumped storage site. (one with Inks Lake (old memory) is possible).

But wind instead of coal & nuke.

Solar is "cool", wind is economic. From memory, South Texas coastal wind is one of few to have max wind output in summer. AE should now start looking at summer wind production as a key criteria for new wind contracts. If Austin can buy 300 MW average summer output wind, that would be good IMHO. Buy & sell surplus wind when needed.

I think the clearest recommendation that your committee can make is NG is DANGEROUS ! The price MIGHT explode (10% chance ?) and like 1973, Austin needs to use NG for occasional peaking, load leveling and unexpected demand.

A small pumped storage unit (80 MW ?) could help some.

I would be glad to talk to you in a couple of days. send me a phone # to Alan_Drake@Juno.com

And add a hydroelectric generator to Longhorn !

But even if a Windfall Profits tax is passed, there has been no mention of natural gas. And I also figure there will be plenty of time to unload stock before the market snaps to reality. So if I'm so smart, how come I ain't big rich? Use your own judgement and do research.

First, we are buying as much wind as possible and they are looking at building our own wind farms so that we can capture those avoided fuel costs. Austin's Green Choice energy program is one of the largest in the country.

Second, I am pushing hard for Gulf Coast wind. Because coastal residents, except those living in oil towns (Baytown, Beaumont, etc.), have a NIMBY reaction to wind turbines, there is some pushback to building them. (Which, frankly, I don't understand. I find these farms a beautiful blending of technology and nature.) There is also the Altamont pass experience with endangered raptors being floated as a counter to te turbines. (Altamont turbines were much smaller and faster than modern turbines. Hence, modern turbines have much fewer bird strikes than Altamont.

Third, solar is, perhaps, premature for grid connected use. Yet, the arguments all depend upon a belief about the uncertain price of NG moving forward. BTW, the study does use the futures market pricing for the first five years. All of these price estimates are brought back to the present via NPV calculations. I would expect that the NPV would be a countervailing function to squash the error bars into ever diminishing importance as the numbers become more uncertain.

Fourth, I am also a strong proponent of buying more wind than we need and then selling that through the market to help us with peak load. (The arbitrage is subtle because of time shifting issues but may be doable.)

As to our NG contracts, I believe that most NG is not available on too long term a contract any more. That said I am driving an attempt to get some joint purchase contracts going between AE and the gas utility (Texas Gas Service). This offers both volume purchase economies and load leveling (AE in summer, TGS in winter) that are attractive to gas vendors and both customers.

I will drop you a line via email.

Andrew

Crane limitations on FM roads & rural roads also limit WT erection. A large rail based crane could service a series of 3 MW (or larger) wind turbines with the efficiencies that come from that.

A fairly slow rail line would likely be needed (or a second set of tracks, which UP would be VERY interested in).

The electrical transmission could be along the RR ROW and have economic value for transmitting power for others.

Also, low wind turbines are available (lower minimum generation speed, lower cutout speed).

Problem 1) It purports to calculate a present value of photovoltaic electrical generation. (More on the specifics later.) The purpose of such calculations is to provide an investment decision rationale - if the present value is greater than the present price, you got a positive return. the problem here is what about alternative investments? AE can buy wind, solar, gas resources, coal plants, nuclear, etc. How do these other alternatives compare?

Problem 2) The biggest component of PV is energy savings. This is exclusively from offset natural gas use over the next 30 years. However, there is no price forecast in the report to do any sort of sanity check nor do they assume heat rates, etc.

Problem 3) The assumption is that all the solar output will offset ONLY natural gas consumption. While the new STP 3 & 4 nukes will be baseloaded, output will auctioned. It will herefore lower electricity prices all the time.

Problem 4) One simplifing assumption I'd be leary of is that AE's load factor does not change. That is, the peak to average ratios are unchanged over 30 years. A large 24/7 load on the system would change the calcs.

Problem 5) This "environmental" credit is a complete boguosity. It seems to be based on what politically correct customers are willing to pay for "green" power. Hula Hoops used to fetch a premimum too.

Good points - The line loss analysis is useful although I can't vouch for the validity of the methods. Glad it was honest enough to use only AC-delivered as a metric of panel performance. I had no idea people would do otherwise - I always thought "nameplate" meant guaranteed nameplate output but I guess not in the renewables world. The authors also threw out claims for credits for disaster power and KVARs.

All in all, not in any way definitive as a basis for action although some decent corners of analysis.

Prediction - as time goes by, AE's ownership share in STP 1&2 will look better and better.

The United States has been in decline since 1070 but now we are going to suddenly turn it around and start increasing again. Nineteen of the thirty one major oil producing nations are now in decline but the EIA has almost all of them turning it around and increasing production again. Even India which peaked in 1995 and has been in decline ever since is expected to increase production by over sixty percent by 2030. Lotsa luck fellas.

Unbelievable. It truly would take a new Kuwait somewhere in the US to do this. It requires something about twice as big as Alaska ready to come on stream in the next few years.

The big question now is why. Why are they posting numbers that are clearly impossible. Why do they have OPEC producing such great numbers, over 50 mb/d by 2030? What motivates these people to post such absurd numbers?

Would you kindly respond to this post by Stuart?

Thank you,

Second, new sources from unexpected places (eg deep ocean) have made most of the difference between your favs and the more conservative, eg aspo. The problem with continuing to increase production yoy requires ever larger new sources and, meanwhile, the number of fields in decline are themselves constantly increasing... It is quite fair to ask where the new sources will come from, certainly beginning in 2010, which is when aspo (once again) sees a problem emerging. It is obvious your favs don't know where we will get two new saudis (or maybe 3 or 4, accounting for other field depletion); failing to even guess where the new supplis might be lurking shows you also haven't a clue.

I remind u et al of our early Depletion Scenarios that included a model called Aramco/EIA where we challenged the EIA Middle East forecasts and modified them for the our own new "model" to include the recent Aramco projections of 10 to 12-mbd targeting.

We deleted that "amended EIA" outlook when EIA came back with slashed figures the following year. We correspond with many of the modelers, trade data & altho we are not completely transparent and will arbitrarily revise a model to correct deficiencies, we are pleased that our work is causing somewhat of a merging of the models to a more realistic compromise of both camps.

Just saw the TOD UK blog on the upcoming ASPO Conf. in Pisa, Italy. I think it is essential that we get some KEY US TODers to attend. I am ready to give to the cause, where do I snail-mail my donation? Stuart & Khebab [for statistical modeling], RR [for alt. fuels], and AlanfromBigEasy [for mass-transit] are my choices [assuming their schedules are free]--saddle up, cowboys! These gents are also excellent writers for reporting back to us TOD riff-raff.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Charlie Hall of SUNY-ESF may be looking for some financial assistance getting to Pisa. I helped with last year's ASPO-Lisbon but it would be nice if we could share the load a little. I will be going and representing ASPO-USA. Charlie is a student of the great Howard T Odum and in turn taught Robert Kaufmann, Cutler Cleveland, Costanza, and many others in the energy academic field. If you are serious about helping please contact me - Dick Lawrence - at this email: Lawrence_01749 (at) yahoo.com.

Thanks for any help you can provide.

Regards,

Dick Lawrence

ASPO-USA

I wonder how much these guys get paid for this? I could do this stuff! I'm sure I've got a ruler in a drawer here somewhere ....

Ha Ha Ha Ha Ha Ha Ha

From BP Statistical Review: 2005 Australian Production 554,000 bpd down 32% from the peak of 809,000 bpd in 2000.

"You've got to accentuate the positive

Eliminate the negative

Latch on to the affirmative

Don't mess with Mister EIA!"

They published their quarterly Mineral Statistics on the same day as BP (2006).

This shows the latest Australian oil production March 2006 quarter way seriously DOWN on earlier predictions of an upturn to a second (86%) peak. We have fallen to 48.2% of peak in March 2000

http://home.austarnet.com.au/davekimble/peakoil/australia.oil-prod.quarterly.gif

That is 52% fall in six years.

ABARE also produces a Commodities report which in recent years has included a medium term projection.

These have been all predicting an upturn, while reality has given us a downturn.

http://home.austarnet.com.au/davekimble/peakoil/australia.oil-prod.forecasts.gif

When I asked them what was going to give the increase I got a half-hearted explanation about new fields "expected to begin producing in ... and full production in ..."

Elsewhere in this thread was a link to Woodside, where they were announcing lower production than predicted, due to bad weather and "problems".

It seems nobody wants to know the truth. We will get what we deserve. It was inevitable anyway.

Dave K

www.peakoil.org.au

LNG! Here's the Status of Proposed and Existing Facilities for LNG import receiving terminals for North America as of March 2006. All we need to know now is contracts in place, completion dates, etc.

Looks like a story here unless HO is doing one, I'll have to check with him. Look at the Canadian contribution in the figure. Lots of their gas is going to the tar sands but their overall production appears to have peaked and clearly so have exports to the US, even the EIA must admit that. Mysteriously, Mexican imports rise a bit until the LNG "kicks in". That's only a little over 4 years off. There's going to have to be a whole lotta shakin' going on to get that off the ground.

I wonder if the EIA report considered Sempra's recent application to double their terminal's capacity?

My interest is admittedly mercenary. How to make money out of obviously bad information and resulting bad decisions. I underwrite commercial real estate investments and develop long-term investment strategies. I believe that enough sustained and unexpected oil/gas price increase will reset people's live /work decisions. Any ideas?

Natural gas should do great, see my post and AlanFromBigEasy above on this same thread. Or look at the gas royalty trusts which combine a currency inflation hedge with a high return on investment. Crosstimbers Royalty Trust and Hugoton Royalty Trust are my favorites.

If you can purchase some royalties or minerals that are producing, do it. Working Interest participation in wells with 3d seismic is great if they aren't over-promoted. I will help you look at anything like that for a small fee. bobebersole2004@yahoo.com.

I'd sure be careful of any commercial real estate away from employment or any middle class or working class projected to be the clientel. They will get screwed as always, and will be holding the bag when the residential market collapses and the easy credit party ends.

They might as well have hired the Star Wars Fan Club to perform energy analysis.

Stuart is right, EIA does their best to please their political bosses. It's a bit like providing fantasy to the political wishful thniking.

http://news.yahoo.com/s/afp/20060622/wl_mideast_afp/kuwaitoiloutput_060622124022

So, how long a lead time do they need for preparing their report? The graph shows the oil price just peaking at $60 before beating a hasty retreat, yet the price of oil has been above $60 for months.