Additional Iranian Oil Sanctions May Be Counterproductive

Posted by Gail the Actuary on June 26, 2013 - 8:46am

A June 6, 2013, article from Reuters is titled, “Lawmakers in new drive to slash Iran’s oil sales to a trickle.” According to it,

U.S. lawmakers are embarking this summer on a campaign to deal a deeper blow to Iran’s diminishing oil exports, and while they are still working out the details, analysts say the ultimate goal could be a near total cut-off.

My concern is that the new sanctions, if they work, will put the United States and Europe in a worse financial position than they were before the sanctions, mostly because of a spike in oil prices.

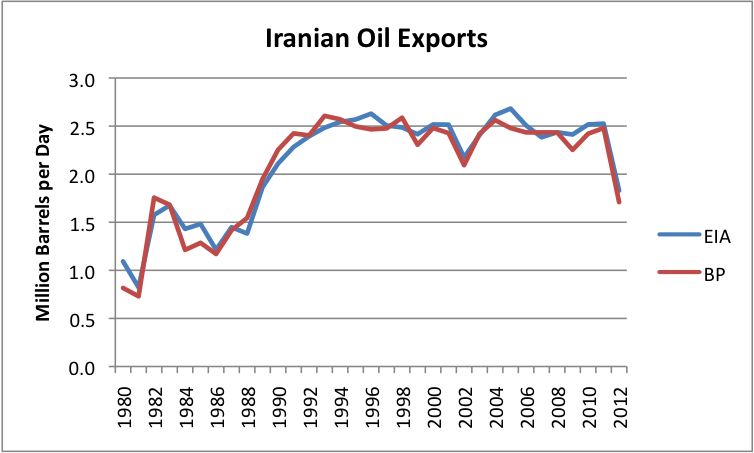

How much reduction in oil exports are we talking about? According to both the EIA and BP, Iranian oil exports were in the 2.5 million barrels a day range, for most years in the 1992 to 2011 period. In 2012, Iran’s oil exports dropped to 1.7 or 1.8 million barrels a day. Recent data from OPEC suggests Iranian oil exports (crude + products) have recently dropped to about 1.5 million barrels a day in May 2013.

If the ultimate goal is “close to total cut-off,” an obvious question we should be asking ourselves is whether it makes sense to handicap world oil production by close to 2.5 million barrels relative to 2011, or close to 1.5 million barrels relative to May 2013. Oil prices have spiked in the past when there has been an interruption in world oil supply. Why wouldn’t they this time? Furthermore, who are really handicapping: Ourselves or Iran?

Possible Alternative Sources of Oil Supply

I would argue that we do not have adequate sources of backup oil supply. We are operating too “close to the edge” when it comes to world oil capacity.

Saudi Arabia likely has some spare capacity. If we go by how much Saudi Arabia in the recent past has been able to increase its production, its short-term spare capacity would appear to be about 600,000 barrels a day–not nearly enough to offset the decline in Iran’s oil exports. The 600,000 barrels a day is calculated by comparing Saudi Arabia’s highest production for individual months of 2012 of 10.0 million barrels of oil a day with its actual production in May 2013 of 9.4 million barrels a day, according to the OPEC’s Monthly Oil Market Report (MOMR). Saudi Arabia claims to have capacity of 12.5 million barrels a day, but its production in recent years has never been anywhere near its claimed capacity, raising questions about the truthfulness of the claim.

How about exports from Iraq? This is a graph of oil exports from Iraq, based on EIA data.

Iraq is indeed adding a little bit to world oil exports–about 326,000 barrels a day in oil exports were added in 2012. But the wild fluctuations don’t provide confidence the trend will continue. It is possible to get a rough idea of what future increases in oil exports might amount to. The International Energy Agency (IEA) is targeting 6 million barrels a day of oil extraction for Iraq by 2020. (Dave Summers–also known as Heading Out–isn’t confident even this can be achieved.) Extraction at this level would mean oil exports of about 4.5 million barrels a day in 2020. The expected annual growth in exports from today’s 2.2 million barrels a day of oil exports would be about 283,000 barrels a year, between now and 2020. Even if this rate of increase in oil exports is achieved, it won’t handle the immediate need for close to 1.5 million barrels a day of oil exports if Iranian exports are taken out of the world supply.

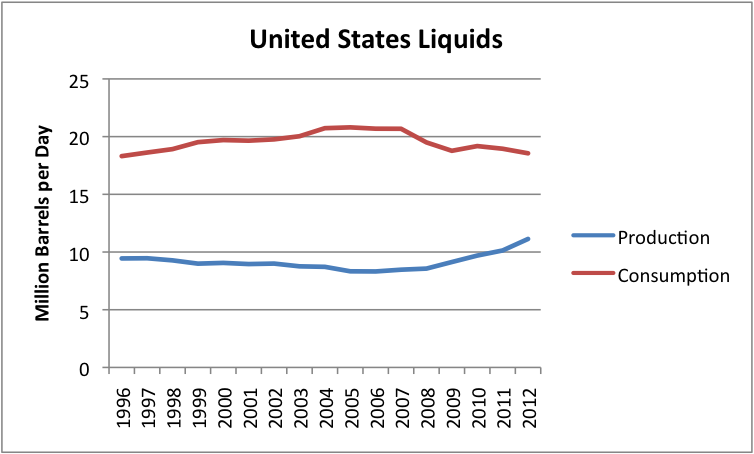

How about the supposedly miraculous growth in US oil supplies? If we look at the actual data, we see that the United States is still a major oil importer, even when such sources as “biofuels” are included in the total. (Imports are the gap between the ”consumption” and “production” lines.)

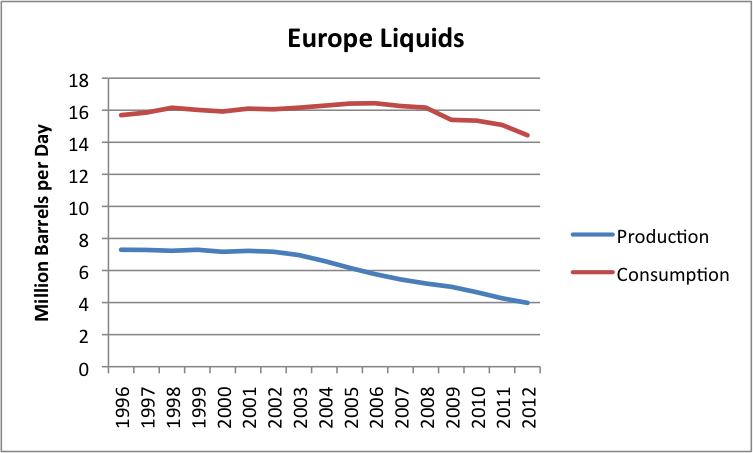

At the same time, Europe keeps falling behind farther, so it needs increasing amounts of imports.

Thus, even if the US’ need for imports is declining, Europe’s need for imports is increasing, as is the need for imports to Asia, including China and India. Losing part of the world’s oil supply makes it harder to get enough imports, without oil prices spiking again.

If Oil Supply Cushion is Less

Suppose that we somehow, miraculously, take Iranian oil exports off-line and find enough substitute supply without oil prices spiking too badly. We know too well from experience that there is the distinct possibility that part of current oil supply will later be taken off-line, for some unplanned reason. This might be another Arab Spring revolution, or perhaps fighting may break out between two oil producers. Or the United States may have a bad hurricane season. So even if oil prices don’t spike immediately, removing what little spare capacity there is, increases the likelihood that oil prices will spike in the future, from some unrelated cause.

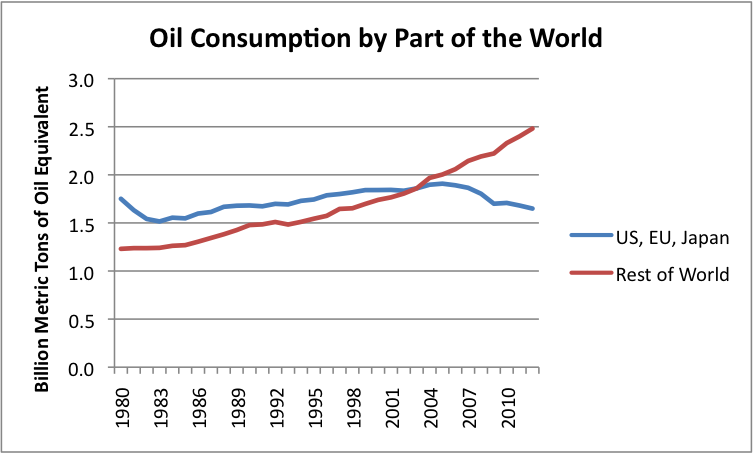

Who gets hurt with an oil price spike?

The countries that are most hurt by high oil prices are the big oil importers–the United States, the European Union, and Japan. We can see this with recent experience, shown in Figure 6 below. Oil prices have been high since 2005. These high oil prices have led to a cutback in consumption by oil importers, even as other countries more-or-less sailed along. The countries with lower oil consumption since 2005 are precisely the ones that have had problem with recession. See my post, Peak Oil Demand is Already a Huge Problem.

If oil prices rise, more money will be transferred from oil importers to oil exporters. Oil exporters, such as the members of OPEC, will benefit. Of course, Iran itself will not benefit. Oil importing countries that have been having trouble with their debt loads are likely to have even more difficulty, because their citizens are made poorer by high oil prices.

How Badly Do Sanctions Really Hurt Iran?

The sanctions cause Iran to leave its oil in the ground until later. While this hurts the Iranian economy now, the oil will still be there for extraction later. With the fields “rested,” Iran may even be able to increase the amount that can be extracted later. If oil prices are higher later, Iran will get the benefit of the higher prices. The oil supplies of other countries will also be more depleted then, so it will have more of an advantage than it does now.

With all of the sanctions against Iran, the country has been encouraged to ramp up its natural gas production. It has also increased its fleet of natural gas-powered cars, so that it has more such cars than any other country in the world. Iran is also refining more of its oil, making itself less dependent on gasoline imports. Making these changes now makes Iran more self-reliant in the long-run.

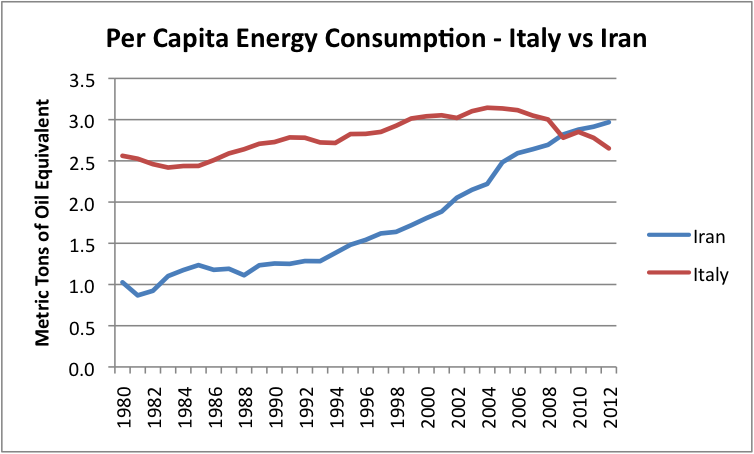

A person might think that all of the sanctions to date have significantly reduced the standard of living of a typical Iranian. If this is true, it is not showing up much in the data. Prior to 2012, the economy had grown consistently for two decades. The sanctions led to an estimated decline in real GDP of -1.9% in 2012, according to the CIA World Fact Book. Iran’s per capita use of energy has been rising, and continues to do so, even in 2012. Its per capita energy use is now higher than Italy’s.

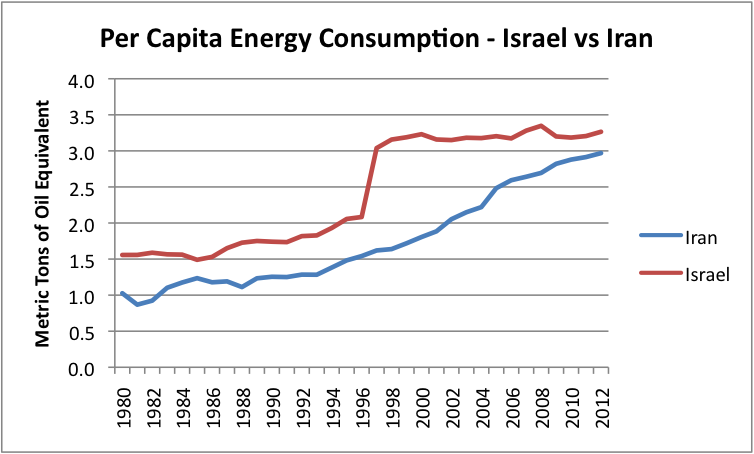

There are obviously any number of other countries that Iran’s energy consumption could be compared to. If we compare Iran’s energy consumption to Israel, Iran’s per capita energy consumption is a little lower.

Messing with Iran’s Currency

According to Bloomberg News, Useless Rial Is U.S. Goal in New Iran Sanctions, Treasury Says. According to the article:

“The idea is to cause depreciation of the rial and make it unusable in international commerce,” he said. “On July 1 we will have the ability to impose sanctions on any foreign bank that exchanges rial to any other currency or that holds rial-denominated accounts.”

The move is intended to toughen sanctions that so far failed to press the Islamic republic to halt its nuclear program. According to the Treasury, the rial has lost more than two-thirds of its value in the past two years, trading at 36,000 per U.S. dollar as of April 30, compared with 16,000 at the start of 2012.

Interesting! Isn’t devaluing the currency exactly what Japan and all of the countries doing Quantitative Easing have been trying to do, perhaps to a lesser degree? As a result, Iran’s stock market has been soaring. Iran is a country that has two export products that other countries want to buy: oil and natural gas. It has little debt, and in the past has been running a budget surplus. Making more rial to the dollar makes imports to Iran more expensive, but exports more competitive in the world marketplace. This is precisely what other countries have been trying to accomplish.

I am skeptical this rial marginalization will work. Will these changes make any difference, in terms of trade with China and Russia? For that matter, will countries that want to buy natural gas from Iran stop trading with Iran? There are ways around any barriers we put up. The US dollar is the world’s reserve currency, but it is already under pressure in that role. Doesn’t all of this messing with the rial lead to more pressure to move away from the US dollar in its role as a reserve currency? Countries that have products to sell that are in short supply globally can usually find a way to sell them. The countries that seem to have much worse problems are those with nothing that the rest of the world wants to buy–Greece, Spain, etc.

Conclusion

All of this posturing looks like a power struggle between the East and the West. The techniques the West has been using so far haven’t been working all that well. The plan is to step up the same techniques, in the hope they will work better. It is not all that clear that they will–if they work, they may quite possibly backfire, because we are working with world oil supply, in a world where oil supply is still constrained. Reducing world oil supply by the amount of Iran’s oil exports doesn’t help the West at all.

There have been a lot of exaggerated reports, seeming to suggest all is right now with world oil supply. The danger is that US leaders are now starting to believe what they read. Supply is now available, because of high price. Price is high because of the problem of diminishing returns leading to ever higher prices required to make oil extraction profitable for exporters. Demand is now down in the West, because high prices are leading to job loss and recessionary forces there. Pushing the world further in this direction is hardly helpful.

If we are very lucky, the United States’ stepped up sanctions could get Iran to back down on its nuclear weapons program (assuming it has one). But if we are less lucky, we may find ourselves with spiking oil prices. To make things worse, we may see the role of the United States dollar as the world’s reserve currency destabilized. It seems to me that we are playing with fire.

This post originally appeared on Our Finite World.

Who gets helped by an oil price spike?

Buying someone else's oil while saving your own would be the best long term strategy, but who believes we have one.

Because the atmosphere has a limited capacity for CO2, fossil fuel consumption will have to stop before all of it is burned. Who will have to leave their fossil fuel deposits in the ground?

I think this is a tactic by big oil to get prices up and over the oil they profit from by selling.

I seriously think that to the average consumer CO2 is back round noise. Their immediate concerns about having a job, paying bills, Kim Kardashian, and "I-stuff' trumps any long term planning. Happy talk about oil-shale gives the easier (cheaper) option of denial.

Nothing other than a profit motivation fits the story.

In the context of CO2 and global warming oil doesn't matter so long as coal production is increasing. That is because the CO2 problem is mainly about coal - it is a much more CO2 intensive fuel than oil joule for joule.

Oil exporters get helped by an oil price spike. If the currency of a country is declining, such as Iran's is, they would seem to be especially helped by an oil price spike. The spike means the oil exporter gets more dollars for each barrel of oil. If converting the dollars to rials, the country gets more rials for each dollar as well, they would seem to be better off in some respects. For example, it would tend to send stock market prices up, increasing the "wealth effect". If the country is not very dependent on imports, and is instead mostly self-sufficient with a fair amount of exports of various types, it could in theory be better off, even with falling number of barrels of exports.

So in a strategic sense Iran would benefit from our dumb diplomacy. They get more for the oil they can sell and save their oil for yet higher prices later and will likely receive military protection from someone in exchange for access.

Yes, lets punish Iran, raise the price of oil so that we can totally destroy 'discretionary' spending, raise unemployment, have the Fed buy more US debt and...and....and... Oh boy, that will teach them!

The whole thing is a major embarrassment. We're also over in Pakistan "helping" with their energy crisis which is mostly caused by our meddling with their relations with Iran.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/is...

Oh, and we rescued India from the horrors of Iranian gas as well, so they'll be importing more coal.

http://www.ibtimes.com/india-set-surpass-china-worlds-largest-coal-impor...

If you believe demand destruction is good for the planet. Bring it. For the US it would make the frackers of oil happy to have a price spike and get us closer to energy independance if the rig count spiked also. It would also be good for the electric car.

The inflation that we are talking about does not affect the government finances, it affects the citizens by raising their cost of living. If the citizens are not happy, their is a chance they may blame their government. This is slowly happening in Iran as we can see from protests that blow up from time to time, but they have been masters of the spin in blaming the west's aggression. They are not opposed to using brute force to stop protests as well.

Iran has the chance to be a great country, but the history with the U.S. and the West has been bad for over 70 years. One of our worst mistakes was supporting the Shah and his rise to power for our own selfish interests. And unlike our mistakes in Vietnam and elsewhere, the people in power have never moved on. I wonder if a revolution their would even change this, unless a much younger generation comes to power. A generation that does not want to repeat the mistakes of the Shah or the Ayatollah.

The history is this: Iran under a democratically elected government led by a man called Mossadegh nationalised the oil fields then owned by what is now BP, then a UK state company. This happened in the 1950's. Winston Churchill, then PM of Britain, was enraged and conspired, with the CIA, to bring about the downfall of the Mossadegh government and the subsequent installation of the Shah. Of course US and UK meddling in the region wasn't new, even then and the "Iran problem" can be directly traced back to this event. The US behaves shamefully all over the world, but especially in this region. If I am surprised about anything it is that the peoples of this region aren't more angry than they already are. Ham fisted US foreign policy in the region has contributed immensely to the radicalisation of Islam and cast a billion people back into serfdom. One of my sincerest wishes is that US readopts isolationism and takes all their troops home, including the withdrawal of all means of support for Israel. Of course it won't happen, but that is what I wish.

Thanks for the information. I know I have heard the story before, but didn't remember the details. We seem to view the oil in the Middle East as "our oil," and that is a problem.

Gail

I will add my thanks.

Three old empires collapsed in World War One: Austro-Hungarian, Russian & Ottoman. The British Empire took over from the Ottomans both Palestine (BE already controlled Egypt) and Mesopotamia (Iraq)and key parts of the Gulf. Iran lay outside the Ottoman Empire. The present Iranian borders with Iraq & Turkey are roughly those of a treaty agreed in the 17thC. Iran is home to one of the world's oldest continuous major civilizations (ruled by a Monarchy). Between the World Wars an authoritarian shah 'modernised' and upset traditionalists:

After WWII, Iran nearly made it to become a Constitutional Monarchy.

Petroleum had become a key resource during WWI but was still little developed, even in the USA. By WWII, petroleum really mattered.

The handover by the British Empire to the Americans was a messy business post-WWII. (Bahrein was easy - the Brits pulled the flag down at the naval base and the US fleet moved in. Palestine was a lot messier and some of the other stuff including Iran did not get resolved until the mid-1950s.)

Quotes from Wikipedia

This was shown in

The Secret of the Seven Sisters

http://www.aljazeera.com/programmes/specialseries/2013/04/20134410523148...

I find the stated reason behind the effort to isolate Iran financially interesting, to say the least

http://www.aljazeera.com/indepth/opinion/2013/06/201362416818402701.html

IIRC the stated reason for the embargo(s) is to pressure Iran to not develop nuclear (weapon) capability.

Why does any country think that it can tell another country what to do, especially with respect to matters of the military/defense?

If Luxemburg told to US to get rid of all it's nuclear weapons what do you think the response would be?

And, please remind me, what is the name of the one country in the world to ever actually use nuclear weapons against CIVILIAN targets, timed to maximize the resulting firestorms?

WP

Thanks for the link. I agree that the issue is a proxy war, with the United States and Israel and some others on one side, and Russia and China and some others on the other side.

The following paragraph is somewhat overstated (having been written by an Iranian professor), but does point out some issues:

Gail, the Iranian prof's paragraph seems spot on to me and not in the least overstated. One can also ask the question: How many countries has the US invaded or attacked in the last 50 years? The answer is many. The answer to the same question asked of Iran in the last 300 years is ZERO. Look at what they do, not what they say. The US is the biggest problem in the world. It has the biggest military budget, by far, it has forgotten the rule of law, its gluttonous consumption of global resources, especially oil, has led to global recession and it was the biggest contributor to global warming until very recently. China is now assuming some of these dubious credentials but the US has much to do to get its own house in order.

It is not quite that simple. Although Iran has not invaded anyone else, they've run proxy wars or insurgencies in Palestine, Lebanon, Bahrain, and currently in Syria. They supported kidnappers and terrorists. There is the endless anti-Israel rhetoric. There was the bombing in Argentina. There is a reason that they came out as the least-liked nation in a recent poll (Germany was the most-liked). We certainly do not have clean hands either.

But both sides need to grow up and sign a grand bargain. Look Iran, you are correct that you have a right to refine Uranium. But the world doesn't trust you doing it. And look at Germany, Italy, and Japan . . . nukes are not even really worth doing. The are very expensive and can be quite dangerous. So why not do a deal where you get refined Uranium from Russia, you allow inspections, and the rest of us agree to drop sanctions. Why not? You've got plenty of oil and natural gas for energy, you really don't need the nuclear energy. And opening up the rest of the world would be a huge boon your people and to world peace.

But that is probably not going to happen. Why? Because having the USA as a boogey-man helps keep the Mullahs in power. And given our own theocratic lugheads in our Senate, I'm doubtful a deal would get ratified by our own government because our own lugheads love having the Iranians as a boogey-man to scare their supporters with. And our own lugheads would be loathe to help give Obama such a foreign policy victory. Yeah, our side is probably just as bad if not worse than their side as far as getting a deal done.

Sometimes I'm just embarrassed by the pettiness and immaturity of my species.

You make good and valid points. War is a racket(not my quote).

It's always nice to rewrite history. We dropped the bomb to save U.S. lives. And it took more than 1 bomb to get the Japanese to agree on peace. So we could say that the Emperor allowed another 100,000 lives to die on his watch after we asked for their surrender after the first bomb. Or did Truman not wait long enough?

At that time, culturally, Japan would rather die with honor in battle than agree on peace. When mounted with a device that would wipe them off the map entirely without a loss of Allied lives and resources, they had a change of heart.

Why can the U.S. tell a country what to do? Or the Western Powers, or the U.N? If a country keeps ranting about how their mission in life is to destroy them and their allies, what do you expect them to do? Blow it off as posturing? Sit by and watch them build their weapons and programs because maybe they won't use them? You know who did that before World War II? All of Europe in regards to Germany. Detente does not work.

I have no idea what the solution is. MAD like we had with the Cold War for all nations that attempt to destroy another? Prevent the proliferation? Sanctions? We know so many countries are not responsible for the welfare of their own people. What rules get applied to them? It's an endless maze.

"I should have been a pair of ragged claws

Scuttling across the floors of silent seas." - T.S. Elliot

You're right. The US did a couple of hundred thousand people a favor by burning them to death. Clearly it was best for them - they would have wanted it that way. Obviously American lives are worth more than Japanese ones.

Rgds (not really)

WP

He specifically said that the bomb was dropped to save American lives.

And, most societies, past and present, have said "Better them than us." Most Americans would certainly agree that it's better for Iraqi and Afghan civilians to die than for Americans to die, although they might not agree with the ratios as they have panned out (anywhere from 100 - 1000 foreign civilians killed per 1 death in 9/11, depending on your sources).

You might not like the reasoning, but you have to acknowledge that it exists and that people inherently dehumanize people distant from them, both spatially and nationally/ideologically. The creation of the enemy, the Other, is innate in us.

The frustrating thing is that obviously you're right. Tribalism is a very strong force and to a significant extend shapes who we are as individuals.

Rgds

WP

The choice was not nukes vs never killing another Japanese person ever again. It was nukes vs bombing Japan until it had essentially no industry or transportation infrastructure, along with no ocean shipping. Tokyo and most major cities were already off the target lists because there wasn't much worth burning there anymore, and at the time of surrender the focus was on cities of 100,000 or so. The schedule was to finish with cites in another month, then start on land transportation. Submarines had already stopped almost all ocean shipping.

Do you suppose no one would have died under that scenario? Note that one night of conventional attacks on Tokyo killed around 100,000 people.

The Israelis have been claiming that Iran is 2 years away from creating a bomb since the mid 90s. I wouldn't worry about it too much.

It's imperial behavior. The US is doing what empires have always done (until they can't).

Yeah, there is definitely a counter-intuitive aspect about oil sanctions. Do they ultimately hurt the seller that can't sell their oil or help them? Certainly it causes them pain in the short term . . . but in the long run, they may end up obtaining much more money for their oil!

I make the same point about Venezuela and Chavez's incompetence. Sure . . . Venezuela's oil exports dropped. But since they kept so much oil in the ground, that oil is now worth much more than if they had sold it 8 years ago!

The same may happen with Iran.

So if we really want these sanctions to work, we should put the squeeze on and then negotiate a deal. If we just let it go on and on, they'll ultimately be the benefit much more than us. But to realize that, you have to appreciate peak oil . . . something many in government prefer to ignore and deny.

All the information in this most interesting article is correct.

However, I think the writer is constrained in her thinking. The objective of those in the West who advocate sanctions, wars and suchlike is to increase the price of oil - not to decrease it.

What do you think would happen to the oil price if there were no sanctions and no wars in the Middle East? The oil price would tank and the Canadian Tar Sands would cease to be economic as well as an awful lot of shale plays. Guys like Warren Buffett would suffer. The Saudis, Canadians, Emiratis and so on would suffer. These are precisely the same people who pull all the strings in Washington and some of them are the USA's "allies".

I mean, the probably-assassinated chief of Saudi Intelligence, Prince Bandar was nicknamed "Bandar Bush" for a very good reason.

http://www.guardian.co.uk/world/2007/jun/07/bae5

https://en.wikipedia.org/wiki/Bandar_bin_Sultan

I note that the Bin Laden family and the Bush family are substantial shareholders in the Carlyle Group, which is in turn a substantial shareholder in Booz Allen Hamilton - the employers of Edward Snowdon. These guys are masters in what used to be called rather cynically the "information economy".

Need one say more?

http://alexconstantine.blogspot.com.au/2008/07/private-property-seizures...

I suppose that that is a point that can be made. If demand is falling apart because countries are falling into recession, perhaps stirring things up helps raise the price, so that exporters are in a better position.

I have a hard time thinking that that is President Obama's view though. Maybe I am naive.

Who wants oil prices higher? Greg Palast suggested back in 'Armed madhouse' that the chaos of Iraq war II was partly designed to help keep oil from the market as long as possible ensuring higher average prices. Apart from oil companies, who else needs the higher price? The KSA is known to have quickly rising overheads and a falling EROEI, and might just try to keep it's protectors happy in the long run, as long as the US/UK etc keep the neighbours oil off the market..

Well for the North American players this is true (the need for higher oil prices) but the UK is a total patsy here; having pissed away the North Sea resource at ten bucks a barrel it now is a net importer and no kind of player what so ever.

Gail is right, sanctions only make Iran more self reliant and conserves their resource for another day. Good luck to them. Hopefully that day will also include a more democratic government there, but these sanctions will do nothing to bring that about but rather entrench the more paranoid current rulers. Average Iranians have good reason to see a western and Israeli conspiracy against them- because it's real!

This is a much older culture than ours and it will ride out current fashions in the west. Also the holder of energy stocks (real wealth) is in the stronger position that the wasteful consumer and importer of them. Time is on their side not on BAU western economies.

Adapt or die.

First, thanks for the informative article and a viewpoint I hadn't considered regarding the Iran sanctions. Thought provoking stuff.

I have a basic suggestion for graph clarity, specifically the two graphs comparing Production and Consumption (United States Liquids and European Liquids). I think a third line, probably called Imports, showing the different between Production and Consumption would be useful.

I just have a hard time visualizing the difference between the lines over time, especially for the US graph where both lines move up and down over time.

Thanks again for the article, it is appreciated.

Thanks for the suggestion. I suppose I have worked with these graphs long enough that "subtraction" is something I do easily in my head.

No offense, but this is way off topic. The real and only topic: Sanctions against Iran are illegal. Read the Non-Proliferation Treaty, with which the United States -- not Iran -- is out of compliance.

It is also against the law (see United Nations Charter and Article VI of the U.S. Constitution) to threaten war against another nation-state.

Interesting point.

Funny, a quick check of the exchange rate as of June 28, 2013 is 12,260 per dollar, not 36,000 or even 16,000.

It looks that way to me, too. It also doesn't look like that has been the huge change in value that was claimed. http://www.x-rates.com/graph/?from=USD&to=IRR&amount=1

Maybe we don't know where to look, though. Iran rial gains 15% since Rowhani win

Whoever heard of getting exchange rates from a Facebook page?

I think the actual turn by the US government is because there is a drop in the economic system in the major players like China and Europe. Even the BRIC countries are slowing down their growing due the inflation and less exports. So, once the market goes up again the US will "lose" that sanctions. Also, all the other countries won´t follow if they need oil, China, Russia and Europe will recover and they need commodities for that.