WSJ writes that gas taxes make sense

Posted by Jerome a Paris on February 9, 2007 - 4:27pm

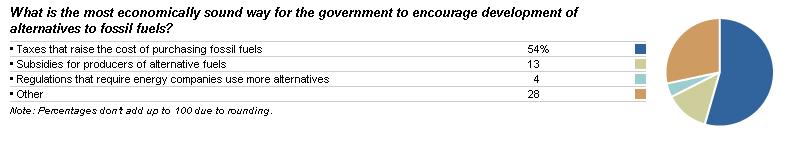

The above numbers come from a poll of market economists who are asked their opinion on various macro-economic topics (click on pic to enlarge).

So, that's 3 reasons (beyond the fact that it's in the WSJ) not to think it's a good thing, right?

- poll

- market

- economist

The core issue is that energy is currently not priced correctly, and is thus cheaper than it should be - and we therefore, naturally, use more than we could and should.

Now I know that saying that it is "cheaper than it should be" sounds pretty bad, so let me explain.

We ARE paying more for our energy than we think we are. It's just that this cost does not appear as a monetary price when we actually buy the gas. It is paid in indirect ways:

- taxes to subsidize oil and coal companies

- taxes to pay for the military forces that ensure the security of maritime lanes (and occasionally occupy oil-rich countries)

- higher interest rates that increase the price of other investments, if the above is paid by government debt rather than taxes (if the government borrows a lot of money, it crowds out other borrowers and makes it more expensive for all to borrow, ceteris paribus)

- lifes of soldiers involved in the above

healthcare costs for asthma patients and other pollution related diseases

costs caused by global climate change (cf NOLA)

That cost is not borne by the consumers of the oil/the gas. It is disproportionately borne by the poor (cf NOLA, cf Iraq Vets, cf Bush tax breaks). But it's not valued.

A policy that forces energy sources to reflect their indirect costs does not make those energy sources more expensive, it only brings in the open costs already incurred in another way - and it allocates that cost to those that are actually using the energy, thus ensuring that they are actually responsible for what they do and, more to the point, that they have the incentive to do something about it - because they're the ones with the best ability to influence their use of energy.

A gas tax is a very effective way to translate the indirect costs of burning oil into an actual monetary cost borne by end users, so it is a rational economic tool (to "internalize externalities") in econospeak), and it is not altogether surprising that economists would support it.

Two points are worth bearing in mind.

The first one is that it is a great thing that economists are finally recognizing that there actually are externalities associated with gas use. That's thanks to "hippies" and "green extremists" and other similarly blighted progressives repeating that simple message for a long time, being ignored, insulted and demonized for a long time in the process - but prevailing because they were right. As we have lots of other ideas that are in that "pipeline" toward public acceptance, this is an optimistic thing to note.

The other is that market economists are, naturally, driven by money, and find decisions made purely on monetary considerations to be good decisions. But effective does not necessarily mean good. Forcing only the poor to bear the brunt of an adjustment may be effective from the point of view of economics, but it's bad policy (and hopefully, bad politics as well). And yet that's the logic behind a lot of reforms that say: let markets act.

Famines are efficient market solutions to food scarcity.

People freezing to death ecause they are unable to pay for heating oil is an effective market solution.

Thus a gas tax cannot and should not be enough, if it is ever used. It should always be accompanied by measures to help alleviate the monetary pain it will cause to the poor - tax reform to change the burden on the poor, use of the tax receipt towards investment that provide substitutes (public transport, help to save energy at home, etc...)

One of the reasons I support the gas tax is that in fact it is not, in itself regressive - it only makes the regressive nature of the cost of oil *appear* more starkly. That means that, politically, it cannot happen without a package to change that fact - which will help to change the underlying regressive status quo.

As you know, we are trying to restart the Energize America work on dKos. EA does NOT include a gas tax, because discussions here made it clear that it would not be supported politically. But it does include a number of measures aimed at making, in less direct ways, the externalities of some of our favorite energy sources appear more starkly, and at encouraging behavior that avoids the sources of energy with the most hidden effects. That includes incentives to use less energy, or more of the better sources of energy.

The important thing to flag is that we must keep up on the idea that some forms of energy uses have very high hidden costs, already borne today by the poor and the weak, and thus that it is progressive politics to tackle that - and that it requires a coherent, global programme (a 'holistic' approach, would say A Siegel), and not simplistic solutions.

Energy policy should focus on these costs, and ensuring that all Americans (and all Westerners), not just those that can afford to ignore the problem by paying more, pay their share.

Folks, consider this a reminder to positively rate this articles (using the icons under the tags in the story title) at reddit, digg, and del.icio.us. Also, don't forget to submit this to your favorite link farms, such as metafilter, stumbleupon, slashdot, fark, boingboing, furl, or any of the others.

These posts are a lot of work, and the authors appreciate your helping them get more readers for their work however you can.

l1 l2 l3 l4 l5 l6 l7 l8 l9 l10 l11 l12 l13 l14 l15 l16 l17 l18 l19 l20 l21 l22 l23 l24 l25 l26 l27 l28 l29 l30 l31 l32 l33 l34 l35 l36 l37 l38 l39 l40 l41 l42 l43 l44 l45 l46 l47 l48 l49 l50 l51 l52 l53 l54 l55 l56 l57 l58 l59 l60 l61 l62 l63 l64 l65 l66 l67 l68 l69 l70 l71 l72 l73 l74 l75 l76 l77 l78 l79 l80 l81 l82 l83

Now if only the weak and the poor could hire a lobbyist in Washington, or two... the world would be a better place for it.

I agree with some of your points but would add that it is not just the poor who pay for cheap energy. It is also the rich who can (still) afford to waste it. Much of the money soccer Mom/part time SUV driver pays at the pump leaves the country. Much of it never comes back. Some of that money could stay in the US and build infrastructure for energy independence. Instead we are exporting our own chance to become energy independent for a short term convenience. That's what I call short sighted.

Sigh... and yet here in Georgia the Republican legislature thinks it is the height of market freedom to completely eliminate the gas tax and replace it with a sales tax on all goods and services in order to increase funding for roads. They're also talking about building a six billion dollar tunnel under the city (though it will end up costing much more than that) to ease congestion. Afterall, it worked so well every other time the roads were expanded. At least with the tunnel they claim it will be paid for with tolls, thought if the tolls don't cover the costs, the government will have to make up the difference whereas if the tolls return a profit, it will go into the pocket of the developer in the private-public "partnership". Isn't it great to be able to invest with someone else responsible for all of the risk?

I think Macquarrie (the world's largest independent infrastructure financier) Bank did this in Bremen.

It didn't work, the cost of the tunnel toll was too high so people didn't use it.

On the other hand, the Toronto 407 highway did work: the government signed a 99 year lease with no regulation on tolls. Since the parallel untolled highway is jammed, the tolls have gone through the roof.

Another common trick is the Birmingham Bypass one. Trucks do far more damage to a road surface than cars-- (the damage is as a cube of the axle weight, so a 3 tonne truck can do 27 times the damage of a 1 tonne car). So the company running the Bypass priced trucks off the road-- they go by the free government paid for road.

We have lots of public private partnerships here in the UK for schools, hospitals etc. Basically they are a way of transferring fiscal burdens onto future taxpayers. The 'risk sharing' element is often quite illusory.

Georgia being Georgia, cutting the gas tax will be quite popular. Ironically, the poorest people don't even have cars, or don't drive much if they do, so it doesn't help them much. But they would never vote Republican (or even vote, in most cases). Whereas the suburban-dwelling SUV driver is a key Republican demographic, ditto the rural voter with a pickup truck. Roll on Georgia!

Taxes are a nasty solution in many ways. On the one hand, consumers don't like them. On the other hand, goverments are known to *not* be very efficient in their use of tax moneys.

I wonder if instead of *doing* something to inflate the price of energy (like levy taxes), we should stop exerting ourselves to keep the price down. Governments do a lot of things to encourage resource development.

Anything that keeps oil in the ground, will encourage the development of renewables as prices rise.

BTW, James Hamilton of Econbrowser came out yesterday in favour of a tax on imported oil and against ethanol subsidies.

http://www.econbrowser.com/archives/2007/02/ethanol_subsidi.html

However, an import tariff on oil would also tend to spur domestic oil production.

An import tax is my preferred solution too. The extreme volatility of oil and gas prices combined with the politicle hatred of the Majors and the foreign national oil companies makes it more difficult for independents to raise money,and makes the investors take a short-sighted view of investments in solar and wind.

I'd like to suggest that the tax be revenue nuetral, and that the proceeds be invested in renewable energy, mass transit, buying out the mid-eastern ownership of our national debt and subsidies for energy conservation measures like hybrid vehicles. We're importing 14 million barrels every day and thats a phenominal drain on our economy, as is the horrendous cost of resource wars. Every penny we pay in interest to the Saudies and Kuwaities is going to support monarchies that hate us.

And as long as I'm king of the United Siates, I'd mandate that all cars and light trucks sold in the US must be diesel

-electric hybrids with a plug in capacity, or straight electric cars and scooters. Instead of widening roads, how about mandating all cars need to be 18" narrower, and include a congestion tax with electric scooters, autos exempt in all cities. Make all people who can't prove a business use for their light trucks wear a bumper sticker saying "I drive this because I have a small penis"

of course shortly after the bumper sticker law I'd expect to be asasinated...

I am in agreement 100% about an oil import tax. This would make those industrial and commercial users of oil share in paying for these costs associated with obtaining energy from foriegn countries. The less efficient transport modes, especially airlines and trucking firms, would object strongly. But, this import tax is the only politically acceptable way to promote the more efficient modes like rail and water. Perhaps a tax credit for the railroads to encourage them to install electrification for propulsion would be in order also.

The problem with increasing US domestic oil production is:

oil is an *exhaustible* resource (as we all know ;-)

so there is no particular reason to want the US to exhaust its resources of oil *before* foreign countries.

Better in fact the other way, whilst countries like Saudi Arabia and Venezuela are willing to ship the US oil, the US should take it with open hands/ports/pipelines.

So better a tax on oil use generally, than one simply on imports.

All your import tax would be doing is handling a short term windfall to the holders of existing US oil reserves.

Not sure this tax can be revenue neutral if you are using the proceeds to fund things. The idea of revenue neutrality is to reduce other taxes to make up for the increased oil import taxes. You can't have it both ways.

the trick is to specifically tie the tax to a benefit that the taxpayer can recognise.

In the case of a carbon tax, the trick is to rebate all of the revenues either by lowering social security contributions (both employer and employee), which are highly regressive, or by rebating the revenue as an annual dividend to each citizen (as they do with oil and gas revenues in Alaska).

Either way, citizens who spend less than the average on energy, benefit, regardless of their income level.

(this is less true in the SS case but:

- most citizens work

- most citizens pay SS

- SS is a regressive tax, that discourages employment and lowers wages (true of all payroll taxes) and therefore reducing it should increase employment and drive wages up

For those who do not work (eg the retired) to the extent that the CPI rises, their indexed benefits will also be increased. There may, however, be some groups that need specific compensation).

There is an economic loss associated with any tax (arising from the change in consumption of a commodity that it spurs) but if the income is directly rebated (as above):

- the distortion is minimised (because incomes haven't been changed much)

- in the case of the payroll tax, the problems with that tax are sufficiently large that a reduction in that will have its own positive benefits, which offset the cost of the commodity tax

An import tax on oil, with no equivalent taxes on any other fossil fuels, could be counterproductive. To the extent that this encouraged the use of ethanol, it will also increase the use of natural gas and coal, to wit, there are many ethanol plants in the works that plan to use coal to fire the plants. All fossil fuels needs to be taxed in accordance with their carbon content. Now, if ethanol is truly green and ethanol is truly green and has a really great EROEI, the proponents of said fuel have nothing to worry about, do they. He He.

That's what is done in good old Europe since decades. It is also the main reason that we have much less heavy SUV's over here. For the average consumer they guzzle too much expensive gas.

Money is a powerful aide to steer the population. The popularity of diesel cars here has financial origins as well. Diesel is taxed less (thanks to the trucking and transportation lobby), driving a diesel car pays twice: It consumes less and its fuel is less expensive.

Markus

Although diesel now costs 5-10% more than petrol, at least in the UK. The refineries can't keep up.

The state needs to get money somewhere taxes make a lot more sense than subsidies.

Just what are the external costs of fossil fuels? I've read that a $35/ton fossil carbon tax would cover it. What does that work out to per kwh or gallon of gasoline? If gasoline were pure carbon that would come to only 14c/gal. Not much of a deterrent.

See this great site by the EU: ExternE where you can find this report External Costs - Research results on socio-environmental damages due to electricity and transport (pdf) with this graph for power production:

In the context of current discussions of global warming, this chart completely baffles me. This thread will be stale long before a detailed analysis could be done, but the problem readily manifests itself on the back of an envelope.

For coal, the externalities shown add up to 3.5 € cents per kwh of electricity from coal. For a power plant efficiency of, say, 40%, that's 1.4 € cents per kwh of heat energy from coal. Since there is no column for oil products, let's just apply that directly to gasoline. A U.S. gallon of gasoline produces around 40kwh of heat energy, or, using the coal number as possibly an overestimate since coal is usually considered "dirtier", externalities of 56 € cents per gallon. That is about 70 U.S. cents per gallon depending on the exchange rate. And less than half of that owes to global warming.

Now, a gasoline or carbon tax that raised 70 U.S. cents per gallon of gasoline (or diesel) would not change behavior much - that much is already proven beyond doubt. The 33 cents or so for global warming would change it even less.

So here's my problem:

Many here, and perhaps you, yourself, have advocated hugely expensive increases in mass transit. But, at a guess, I'd say it costs an extra hour or two per work-day to use mass transit (unless one both lives and works in Manhattan, downtown Chicago or San Francisco, or some other well-served ultra-dense city core), and with an average car it might save a gallon or even a gallon-and-a-half of gasoline or diesel, much less with a Prius. (I'm not concerning myself with Hummer or Escalade drivers here, if they can't afford the fuel they couldn't afford the vehicle in the first place. Also note, in most places in the U.S., mass transit is creepy-crawly buses averaging maybe 7mph/11kph with stops - the odds that one of the few rail lines can take you where you need to go are risibly slim.)

These figures suggest that taking the advocacy at face value, people "ought" to value a gallon or so of gasoline or diesel as equivalent to an hour or two of their time. (I'm not concerning myself with ultra-long exurban commutes either - they are hyped but are still atypical.) That works out to US$15 to US$30 per gallon, using an average wage of about $15 in this country. Most of this huge number must be externalities, since the underlying price (ex taxes) right now is somewhere around US$1.70, and was under $3 even at the 2005 peak.

This discrepancy between the chart and the strident recommendation to expand mass transit is just astounding, a factor on the order of 30. Based on the chart, for example, it is apparently not worth doing very much to prevent global warming, which only accounts for 35 US cents per gallon. After all, carbon tax of that magnitude would impact hardly anything substantially, except perhaps for aluminum smelting, except that much of that, IIRC, is still done with non-grid hydro power.

So we have all this chatter about radical, time-consuming or expensive behavior modifications - buses, bicycles, working far below one's economic potential, etc. So what is going on? How do I reconcile this sort of panic with the numbers in the chart, which would be no obstacle at all to unlimited coal-to-liquids?

WTF?

Why does wind have a noise cost? They can only be heard within a few hundred meters anyway. Are they trying to say that all the other plants are silent within a few hundred yards? Turbine noise? Noise from coal trains?

Why are renewable power options held to impossibly high standards? Also, does anyone else feel that the health costs might be a bit off? How exactly does wind have the same health cost as coal? WTF. The EPA recommends that children and pregnant women severely restrict the amount of fish that they eat because of the methylmercury possibly contained within them. This mercury pollution can be traced back to coal emissions. How is this not an enormous cost?

Perhaps these problems magically do not exist in Germany.

The 'social cost' of carbon has been variously estimated at between $30 and $300/ tonne of carbon

($100/tonne of carbon = $28/tonne of CO2 emitted ie 1 tonne carbon= 3.667 tonnes CO2 emission)

http://news.bbc.co.uk/1/shared/bsp/hi/pdfs/30_10_06_exec_sum.pdf

page xvi $85/tonne CO2

There is a huge debate about what the right level is-- Nordhaus on the conservative (low) side and Stern on the high side. Stern wrote the Climate Change Review for the UK treasury which has just been published.

There may be other costs associated with burning oil, such as:

- National Security costs - costs of the US of securing its supply line to the Persian Gulf and involvement in countries there

- societal costs (eg less exercise) etc.

These are not reflected in the pure CO2 numbers above, which apply to global warming.

I don't have the formulas to work those out in terms of oil, gas and coal. One of those things on the 'to do' list.

As I have argued elsewhere, a gasoline tax is a poor way of fighting global warming. Gasoline is highly price inelastic.

By contrast, a carbon tax in the electricity sector could have big impacts, because there are plenty of low carbon substitutes out there (nuclear, wind, conservation etc.), but coal is just massively cheaper, if the CO2 is untaxed.

I just did the following back of the envelope calculation for a post on a prior thread:

Based on a 2005 population estimate there are 26,074,906 Iraqis. If the cost of the war is 2 Trillion ( and this may be an underestimate as the full cost of equipment replacement and the lifetime costs of the disabled and injured are yet to be tabulated) then the estimated cost per Iraqi is $76,702.09

Omitted from this figure is the cost associated with British and other country participation.

Imagine what that amount could have accomplished if it had been invested in America and her people.

If I'm reading this article correctly, and I consider the source to be reputable, the numbers are indeed awful, and not just financially. But the "cost of the war", to date plus 2007, is shown as somewhere around 25% of 2 trillion, and the equipment replacement costs not included in that are shown as very small in comparison. So was the 2 trillion number aggregated with other figures not related to the war?

The six to seven percent interest (rate will go higher as dollar inflates compared to foreign currencies) on the federal debt, the current means to finance this Iraq war, will double the price from 1 trillion to two trillion in 9 to 11 years.

PaulS - The 2 trillion estimate is derived from a study by Nobel Laureate Joseph E. Stiglitz and Harvard budget expert Linda Bilmes as reported in the NYT. I no longer have access to the NYT link but did find this URL:

http://www.tpmcafe.com/story/2006/1/5/11510/30624

Also found this PDF of the report citied above:

www2.gsb.columbia.edu/faculty/jstiglitz/cost_of_war_in_iraq.pdf

For a cost estimate based only on Congressional appropriations to date (excludes cost of post war medical treatment and replacement of armaments. Does include costs associated with reconstruction. Does not include Afghanistan) see this URL for a running total:

http://nationalpriorities.org/index.php?option=com_wrapper&Itemid=182

The congressional appropriations figure is closer to your 25% of 2 trillion figure than the range of estimates provided by Stiglitz and Bilmes. The long term cost of medical treatment and the need to replace almost all equipment utilized in Iraq due to high wear rates were the key drivers of their higher estimate.

The conflict is not yet over so the final total remains unknown. A further factor is the potential for the scope of the war to expand to a regional conflict but I don't think anyone has begun to cost that.

Cheers!

Also, wouldn't it have made more sense to just bribe Saddam to play nice? With respect to the investment, it would have been benefifical only if the Bush government were not in control of handing out the funds. This administration is just a giant ATM machine for Bush and Cheney's cronies. Katrina, anyone? How's that goin'?

The first one is that it is a great thing that economists are finally recognizing that there actually are externalities associated with gas use. That's thanks to "hippies" and "green extremists" and other similarly blighted progressives repeating that simple message for a long time, being ignored, insulted and demonized for a long time in the process - but prevailing because they were right. As we have lots of other ideas that are in that "pipeline" toward public acceptance, this is an optimistic thing to note.

Love this revisionism (and the passive aggressiveness). Externalities is itself an economic term and has existed for a long, long time. In fact, much of the modern work done on externalities that are commonly discussed on the Oil Drum was done by Ronald Coase who received a Nobel prize in 1991. He published papers that describe the proper way to handle things like pollution. Look it up, but you won't find any 'hippie' ideas in there.

Did you invent the internet too?

You're forgetting one bit in my sentence: "associated with gas use". The "hippie" bit is to consider that using energy might have externalities. Sure, some economists were discussing it, but it had not reached the mainstream. The Oil Drum itself is suspiciously hippie, in its subversive approach to a respected industry...

To be fair - this was written for DailyKos, thus the polemic tone. I probably would have put it slightly differently if I had written it for TOD, but the editors asked me to psot it as it was. Sorry for the passive aggressiveness (it's kinda my trademark, apparently)

"Sure, some economists were discussing it, but it had not reached the mainstream."

Huh?

You might want to take a look at this:

http://72.14.253.104/search?q=cache:ZPlSJJy0DVIJ:planung-tu-berlin.de/pr...

This German source says that there is a tax on oil since 1879. Since 1/1/2003 every liter of gas is taxed with 1.305DM, which would be roughly 70 Eurocents, I believe. That would be some $3.15 in tax alone per gallon.

I guess the economists in Europe were either not included in this poll or they must be disagreeing with their governments for over a century on this one... even with the most conservative ones like the Nazis, who happened to have raised the tax in 1936 and expanded in to diesel in 1939...

:-)

That is absolutely false. The only thing that may not have reached the mainstream is discussion of externalities in "mainstream" media.

I took environemental economics in the early 1970s. I can assure you that the economic analysis of externalities was quite well developed at that time. There is very little new in the way of theory; what may be new is the political ability to actually apply some of these theories.

Jerome: There are several reasons why the WSJ would print a graph showing 54% of polled economists believe a gasoline tax is a good idea, as well as why those 54% responded as they did.

That does not mean a gasoline tax is necessarily a good idea.

Gasoline in the US already is taxed (at several levels): how have the current taxes improved the situation of American dependence upon gasoline (and thus oil and thus imported oil?) Say, if $.50/gal is not changing current society, what makes you think $.75/gal (for example) will make a significant difference?

When the problems faced are physical (e.g., geology) or structural (e.g., how humans build their cities) what makes you think that a simple method of redistribution of one nation's income/wealth will solve the major issue at hand (that being, modern society designed for, and existing upon, a rapidly diminishing resource)?

Also I want to mention that your article is a bit disappointing in that the themes still appear to be punitive actions against those whom you believe are evil: the rich, Bush&Co, oil companies, etc., rather than address the physical problems to be solved (if indeed they can be.) That is, you are in the blaming/scapegoating mode, rather than clear and constructive thinking. Indeed, your statement

on the face of it is confused - how can the "cost of oil" be of a "regressive nature" when most peak oil commentors agree that oil is too cheap, and *you* believe oil products are too cheap and thus the price should be raised?

If indeed the original thesis is that oil is not priced properly, and that it is priced too cheaply to correctly be used, then the idea of an import oil tariff might be a better approach. This was broached recently over on the Econbrowser website, but without any great detail.

1. Taxes should reach several dollar per gallon (they are there already in Europe, and they are not sufficient). In fact, what matters are regular increases, because people quickly get used to any level of oil prices, if stable.

2. about the cost of oil, it's not confused, it is precisely that we are paying our oil in indirect ways. It is too cheap in monetary terms. We are paying its real price, just in very indirect (or delayed) ways - with those paying the price not necessarily being those that enjoy burning the stuff. The tax hikes allows to reduce that discrepancy, by allocating more of the monetary cost to the actual consumer, who can then adjust its demand.

Maybe being "in Japan" has colored your view of taxes and energy in the US. Nearly every state has laws mandating all or nearly all (90% plus) of gas taxes collected be used ONLY on road and highway maintenance & improvements. Over 80% of the federal gas tax is likewise used on more and bigger highways.

In my home state of Missouri not only does all the gas tax get used for highways, but a portion of the general sales tax through the use of "revenue bonds" is also used to improve roads/bridges/highways. Almost no state transportation money (less than 2 or 3%) goes for mass transit in Missouri. This arrangement is typical for nearly all US states except California, New York, Illinois, New Jersey and a couple others.

One of the more distressing things I witnessed during the last run-up in gasoline prices is that we (here in the USA) moved a lot closer to lowering/eliminating gas taxes than to raising them.

Given the near-consensus, if I may assume that amongst our community here, that prices will rise again soon, how likely is it that Joe six-pack and Jane valium will support increased taxes on top of higher prices on top of slumping economy?

And by the way, Keithster, tell me when TPTB, corporate America, and 'mainstream' economists ever gave a rat's ass about externalities? Except how to externalize every possible expense onto the world while maximizing profit. Don't be such an assh**e. Because someone writes a paper on it doesn't mean it's a common business practice.

We all know who's been agitating for more complete accounting vs. atmospheric/environmental dumping, hidden gov. subsidies ("socialize the costs, privatize the profits") and the lot.

Hello TODers,

Bring on the high gas taxes to promote Detritus Powerdown! I already have my scooter, wheelbarrow, and bicycle--Let's Go!!! Now I just have to convince my local motorcycle & scooter dealerships to open a chain of Hell's Angels gas stations for gastheft prevention.

Repost of Sept. 2, 06 posting:

----------------------------------------

Awhile back, a fellow TODer was considering the storing of 40 gallons of gasoline at his house. My advice was basically DON'T DO IT--much too dangerous.

I suggested he shift to bicycling, car-pooling, mass-transit, and/or purchasing a small motorcycle or scooter, and keeping one paid-off vehicle for moving large loads or a full carload of people when the need arises.

This started me thinking about the squirrel in all of us; our genetic desire to hoard and protect our nuts as best we can. Can we harness this innate desire postPeak to our advantage?

POSTPEAK SPECULATION: Hell's Angels gas-stations!!!

Recall my recent posting where even the Governor was refused from purchasing gasoline at a regular customers only gas-station in the '70s energy crunch.

How about a nationwide chain of motorcycle and scooter only gas-stations that employed rough-looking, tatooed bikers as armed guards and cashiers? They would not have to worry about being robbed, nor refusing a car-owner who pulls in wanting a fill-up.

When the postPeak time arrives where gasoline prices rise faster than the opportunity costs of storage, or if rationing arises-- two-wheeled enthusiasts can safely hoard fuel by mutally pooling their efforts into these Hell's Angels brand gas-stations.

Remember the agonizing waits of hours in long gasoline queues--everybody hated doing this. Motorcyclists especially, because they had to just sit there for long periods, inching along, exposed to whatever weather was happening at that time [blazing sun, freezing rain, or snow].

Most riders mitigated this necessary waiting time by using their pickups in the queues, and filling extra 5-gal jerry cans to be stored at home for their bikes. Of course, this was a dangerous fire-hazard and sub-optimal: gas-thieves just loved stealing conveniently packaged and already filled gascans from a homeowner's backyard. Other bikers [concerned about home safety], would just siphon gas from their vehicles to their bike's gastank as the need arose. But this won't postPeak work if: thieves have stolen all your vehicle's gasoline overnight, as has personally happened to me years ago [Dirty Bastards!!!!!].

Thus, I surmise two-wheeled riders would gladly pay a small safety & convenience premium to quickly fill-up because their rides get superior MPG compared to the typical SUV & HUMMER.

The membership rules could be very simple at a Hell's Angels station:

First: two-wheeled customers only. Scooters, motorcycles, even bicycles with kicker motors would be welcome. No purchases by 4-wheeled cages allowed!

When rationing is imposed: a member will fillup his vehicle at a normal gas-station, then drive to the Hell's Angels station. He/she will then transfer whatever amount of gasoline they wish to this station's tank and be given a credit for this gallon amount. A typical pickup can hold 25-35 gallons: if the pickup owner is not going to be using his vehicle much, or if the govt. rationed amount is small-- it is not unforeseen for the owner to transfer most of his fuel to the Hell's Angels tank. You automatically become a preferred customer because it is your fuel contribution that makes it so!

If you do not own a vehicle, but own a two-wheeled ride, for a small fee you can become a preferred customer whereby you can prepay for your fuel, and the nationwide chain will use their purchasing power of all the riders to get you the best discount/gal they can, then store the fuel for you. Discounted nuts--who could ask for anything more?

If rationing has not kicked in yet, but you feel gas prices are going to rise fast: you can safely store cheap fuel for yourself by the method outlined above. In short, you create your own beneficial gasoline futures market strictly for yourself. Anytime you need a fill-up: you only pay for the overhead storage costs because you have already paid for the fuel.

Now the question arises on fuel storage times before the gasoline goes bad. Your fuel credit is tracked by computer nationwide and can be audited by you on your home-computer. You are free to purchase gas at any Hell's Angel station nationwide. Once you exceed your previously stored quantity you then pay the going market rate for gasoline until you get home to replenish your gas credit again. To do this, each Angels' gas-station would purchase some quantity of gasoline as a reserve for roving bikers passing thru. This should be sufficient so that the gas is used by all before it goes bad.

Okay, this is just a brief overview of this concept, but it offers many fire safety, theft prevention, and availability advantages for future postPeak bikers. It could also spur millions of people to get out of their cages and enjoy the savings and thrills of having their knees in the breeze. Just another idea of mine to help mitigate the decline.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

You are by far the most imaginative person on TOD. I love reading about your ideas...don't stop.

You need topless gas station attendents too, and make sure they're not the fat middle aged accountants and lawyers who I see at the Lone Star Bike Rally in Galveston. Is there a law that "bikers" have to be old and fat in the 21st century?

Raising the tax is one approach. In the end, regular folks won't be able to get to work while the rich and famous are still burning it up like there's no tomorrow. How about rationing? Everybody that works for a living gets the same amount. Everybody that doesn't work for a living gets half of that. Now you are influencing people's behavior regardless of budget....I know it's un-american.

These economists truly amaze me-- new gas tax dollars for Uncle Sam. To which, I presume our spendthrift leaders would reluctantly allow their arms to be twisted and agree to a "temporary tax" (if you truly believe there's any such thing as a temporary tax in Washington, I'll happily sell you a bridge to nowhere).

Such an incremental tax might indeed modify behavior for consumers and businesses, but unfortunately it will also increase Washington's addiction to gas tax revenue-- and increased government addiction to gas taxes is not a good thing-- it creates a huge bureaucratic desire to keep the oil flowing.

Instead how about a tax-revenue-neutral proposal? If we're trying to discourage one type of behavior in consumers and encourage others, then every dollar collected from increased gas tax revenues should be applied towards things like gas tax rebates for low income workers, credits for alternative energy investments, R&D incentives for long-term energy research, "X-prizes" for solutions to hard alternative energy problems, ...

It may be true that Americans are addicted to oil. And it may be true that Americans need to take steps to break that addiction. When Washington politicians pound their desks and wail about obscene Oil Company profits they somehow forget to mention that Washington taxes yield 18 cents per gallon, states & local taxes average 26 cents per gallon and the "obscene profits" that they talk about average 10 cents per gallon. If 10 cents of oil profits are obscene, then what does that make 44 cents worth of tax revenue? Who's wailing on all of our behalfs about that???

After decades of trying, and failing, is it really any wonder that our leaders in Washington have been completely unable to create a meaningful energy policy? They are conflicted! Is it truly any surprise that we were allowed to become more and more dependent on foreign sources of oil rather than years ago adopting a long and slow journey towards alternative energy sources? Our leaders are being paid very, very nicely to not solve the problem! Do they really want those quadruple-obscene gas tax revenues to stop flowing?? How else will they fund their personal bridges to nowhere??

So, increase gas taxes, sure. But if we do that, at least make it tax-revenue-neutral. Help put an end to Washington's gas tax addiction!

W.

So would high gasoline taxes lead to gasoline smuggling? How many gallons of gas can a person carry across the southern border?

Maybe 40 gallons in a dual tank light truck tanks.

One thing I don't see mentioned here at all is some variant of the cap-and-trade system. I think Leanan is usually the one that brings it up on this site.

The reason I mention it is that it seems economists are unanimous lately that cap-and-trade is preferential to carbon tax for tackling greenhouse gases.

Cap-and-trade for oil could act at the individual level, though this would likely be costly to administer. More reasonably, it could apply to import quotas. You could choose any annual target you preferred to control the 'addiction to foreign oil', be it 'hold the level of imports steady', or just increase it less than trend. Refineries bid for the right to import oil. Yes, I am aware this system provides a windfall to domestic producers, but, the way I see it, that just makes it more politically feasible (cynical, me? nooo).

Has anyone heard economists talking about a cap-and-trade for oil imports? If not, why isn't it being discussed? Are there reasons why it works for carbon but not for oil?

edit: it seems fitting to mention that the nearest thing to this cap-and-trade for imported oil that we have all heard about is the Uppsala Protocol... Although not cap-and-trade by nature, a local cap-and-trade of import quotas would be an effective way to implement Uppsala if ever at some time in the future "peak oil" became the more important issue as opposed to "addiction to foreign oil".

Dear WaltC and others,

I believe the peak oil problem is primarily a political problem. The simplest and probably only mechanism that will limit fossil fuel consumption in the long run is increasing the cost. The question then becomes how to persuade the public to accept a carbon tax, given that the future catastrophe has not yet caused them significant pain.

My suggestion is a revenue neutral, escalating carbon tax that is completely returned to the taxpayers as rebate, proportional to the social security payments each individual has made. Receiving rebates shortly before each round of carbon tax increase should decrease public resistance.

By using this tax to partially offset the social security tax, this proposal mitigates the regressive nature of the carbon tax by reducing the even more regressive social security tax.

Most young voters will love the tax as it provides a muscular method of reducing CO2 emissions, while reducing their social security payments.

Both the elderly and the poor will benefit, as the increasing costs of automobiles will drive towns and cities (maybe even the federal government) to support mass transit.

By reducing demand for oil, it is likely this plan will reduce the cost of oil, decreasing wealth transfer from Americans to oil exporting countries.

The trick here is to find a formula that is politically feasible.