DrumBeat: March 13, 2007

Posted by Leanan on March 13, 2007 - 9:56am

International Energy Agency Warns On Sharp Oil Stocks Falls

The International Energy Agency warned Tuesday that global oil and fuel inventories were being sucked lower at an unusually high pace this year, leading it to fret about demand being met in the coming months and amplifying the need for more crude from the Organization of Petroleum Exporting Countries.The agency's widely-anticipated monthly assessment of the global oil balance said that stockpiles of crudes and fuels held by the Organization for Economic Cooperation and Development group of industrialized nations were falling at a pace of 1.26 million barrels a day so far this year and could spell the largest stock draw in a January-to-March period in more than 10 years.

The IEA, which represents the energy security interests of the OECD, also red- flagged an unusual draw down in crude stocks.

Oil climbs after IEA asks OPEC for more

Oil prices rose above $59 a barrel Tuesday after the International Energy Agency said the world would need extra OPEC oil in the coming months.

Saudi Aramco to cut supply to Asia by 9%

Customers will receive less crude oil as Saudi Aramco complies with Organization of Petroleum Exporting Countries' production quotas agreed last year. The oil producer is cutting exports of its heavy crude to Asia after demand fell as the refining profit to process that grade declined.

Saudis send signal with supply cut for Asia refiners

"It seems a technique to defend oil prices around a US$60-a-barrel level ... cutting Saudi heavy's supply volumes more than others, and selling more expensive Saudi light and extra light," another source said.Other traders said the deeper supply curbs from OPEC's most influential member is a message for the group to fully comply with agreed reductions.

Scientist Says Sea Level Rise Could Accelerate

"What we're learning is that ice isn't slow. Things can happen fast," [NASA oceanographer Eric] Lindstrom said."If the (polar) ice sheets really get involved, then we're talking tens of metres of sea level -- that could really start to swamp low-lying countries," he said.

Richard Heinberg: Comments to the National Petreoleum Council

On October 5, 2005, U.S. Energy Secretary Samuel Bodman requested that the National Petroleum Council conduct a study of global oil and natural gas supply. The motivating concern stated by the Secretary was an investigation into the timing of and responses to peak oil—the plateauing and subsequent decline of world oil production.

Growing political risks imperil oil sands profit, report says

Alberta oil sands producers face growing political risks that could significantly erode their profit margins, and slow the pace of development, says a report from UBS Securities Canada Inc.

Saudi Aramco: 1Q 2011 Start to Karan Gas Output

Aramco has given companies until March 20 to submit bids for the contract to provide project management and front-end engineering design services for the company's first-ever offshore gas field scheme, according to the official documents....Due to Saudi Arabia's rapidly rising gas requirements, the Karan project is being "accelerated," targeting the first quarter of 2011 for start-up.

Shrinking farmland and increased demand is making meals more expensive, raising concern that social unrest will emerge among rural people living on 3,587 yuan, or $463, a year. The central bank will put 5 billion yuan into credit cooperatives in grain-producing regions to boost lending to farmers, the People's Bank of China said.

Farmers Gear Up to Plant Massive Corn Crop

A burgeoning ethanol market has the nation's farmers gearing up to plant massive amounts of corn this spring, creating shortages of some popular biotech hybrid seeds. While growers should still be able to find plenty of corn seed to plant, it may not be the variety developed for their season or bred with the genetic modifications they want to combat insects and diseases in their region, experts said. "It is a nationwide problem. One reason it is so severe in Kansas is that a lot of the seed available for us is being used to replace cotton acres in Texas and Mississippi. But the shortage is nationwide," said Terry Vinduska, the sales representative for Pioneer Hybrid International in Marion.

Titans make Africa their stomping ground

Recent events, not helped by former ambassador John Bolton's antics at the United Nations, may cause some to dismiss the efficacy of US diplomacy to achieve anything beyond elite acquiescence. But those who think so would do well to recall America's long-standing ability to ingratiate itself with supposed "inferiors" when the geopolitics is right.

Chavez touts regional gas export group amid domestic deficit

President Hugo Chavez is portraying Venezuela as a natural gas powerhouse and is pushing for a regional exporters' group despite a deficit of the fuel back home.

Dutch PM voices support for coal-fired energy

Prime Minister Jan Peter Balkenende supports the construction of coal-fired power plants if the greenhouse gas CO2 released is stored in underground former gas fields.

Some experts say high demand could push pump prices past last year's highs. Others say relief is in sight.

'India to be a power surplus country'

Energy-hungry India, which currently faces huge power deficit, will become an electricity surplus country in next four-five years, Power Minister Sushilkumar Shinde told Rajya Sabha today.

Fusion Energy One Step Closer to Reality

A project by University of Wisconsin-Madison researchers has come one step closer to making fusion energy possible.The research team, headed by electrical and computer engineering Professor David Anderson and research assistant John Canik, recently proved that the Helically Symmetric eXperiment (HSX), an odd-looking magnetic plasma chamber called a stellarator, can overcome a major barrier in plasma research, in which stellarators lose too much energy to reach the high temperatures needed for fusion.

Driving a nuclear-powered car may sound a bit like something out of Thunderbirds, but it could soon be a reality if the oil industry's nuclear overtures come to anything. That's one prediction in Trading Climate Change, JP Morgan's latest contribution to the City's voluminous output on the impact of global warming.

Oil region looks to the future

Since 1959, Daqing has produced about 1.9 billion tons of crude oil. Notably, during the period 1975 to 2002, Daqing maintained an annual oil production of no less than 50 million tons, creating a world record.Concerns that Daqing was on the verge of depleting its natural resource stocks surfaced when output began to decline in 2003.

But Gai Ruyin, Party secretary of Daqing Committee of the CPC, brushed aside concerns, saying Daqing's future was more secure since the recent discovery of large oil and gas fields in the region and new "exploitation technology".

Halliburton's not alone in move to region

A number of other Houston oil-field-services firms, including Baker Hughes and Schlumberger, have recently opened or expanded offices in the United Arab Emirates. And their goals are all the same: to be near oil-rich nations in the Middle East and to increase their business in the quickly growing Eastern Hemisphere.

Texas grid says TXU unfairly raised prices

An independent monitor for the Texas electric grid said Monday that TXU Corp.'s wholesale power subsidiary, because of its large size, was able to raise power prices unfairly in 2005, costing wholesale power customers about $70 million.

Efficient methods could bail out biofuels

A new, more efficient method for manufacturing biofuels could generate enough fuel to supply the entire U.S. transportation sector while sharply reducing the amount of raw material required to make it, researchers said on Monday.

Britain proposes legal limits on carbon emissions

Britain on Tuesday became the first country to propose legislation setting binding limits on greenhouse gases as it stepped up its campaign for a new global warming pact to succeed the Kyoto Protocol.

Pelosi Reveals Who's Who On Global Warming Panel

The best-kept secret on the Hill -- the full membership of the new committee on global warming -- is no longer secret. House Speaker Nancy Pelosi (D-Calif.) has announced the 15 members of the committee, formally known as the Select Committee on Energy Independence and Global Warming.

Emission Caps unlikely without Bush help

Democrats running Congress will likely not be able to pass climate legislation with mandatory limits on "greenhouse" gases without help from President Bush, the chairman of the Senate's energy panel said Monday.

How do investors factor climate change into their stock-picking equation?

After years of warnings from environmental and socially responsible investing groups, it seems that corporate America is catching on to the risks of climate change. Investment banks, insurance companies, and big investors are taking a close look at the greenhouse gases that companies are emitting. So how can you avoid a portfolio meltdown if the planet heats up?

Apart from the need for drinking water, 80% of the country's power has traditionally come from hydro-electricity. And, the current boom sectors of the economy - agro-exports and mining - also absorb huge volumes of water.

European businesses go green fast

While in some cases there is still a yawning gap between rhetoric and reality, European businesses are rapidly going green -- albeit driven more by profits and regulations than a desire to do good.

CEO: Locking in energy prices pays off for businesses

Illinois businesses that don't lock in their energy prices are taking a risk, said the president of an energy company that hopes to do business in the state.

Canary Islands: Hot and hotter - Climate change is upon us

“It’ll be a steady progression,” [environmental director Juan Carlos Moreno] said. “Each year the effects will be more discernible and slowly but surely our climate will change, with greater contrasts throughout the year.“We are trying to alleviate catastrophic consequences,” he continued, “with programmes aimed specifically at establishing which form of vegetation is best suited to warding off the worst effects of desertification. We are also encouraging the clearing of ravines to free them up so rainwater will flow downhill unimpeded.”

Okinawa Governor to Inspect Disputed Senkaku Islands

Okinawa Gov. Hirokazu Nakaima said Monday he will inspect the disputed Japan-controlled Senkaku Islands from the air Tuesday, despite a protest from China which also claims them.Nakaima has repeatedly voiced his desire to view the islands -- part of the prefecture -- as well as a disputed Chinese gas field in the East China Sea from aboard a U-4 multipurpose jet of the Self-Defense Forces.

In the present-day world we are deeply concerned with energy. Because the sources of energy i.e., the gasoline products, the petroleum products and even the nuclear energy-provider uranium have a certain finite reserve limit that are found naturally on earth and also their reserves are being depleted due to rampant extraction and usage.

US Senate to Unveil Bills on Oil Leases, Climate Change

Senator Jeff Bingaman, the U.S. Senate's top lawmaker on energy policy, is aiming to unveil a bill later this month that would address what he describes as "the royalty mess down in the Gulf of Mexico" followed by one in April that would address global warming.

Wind energy essential to New Zealand sustainability

A leading international expert in renewable energy has warned New Zealand that it must set clear, defined targets for renewable energy if it wants to avoid an energy crisis in the near future.

Premier Indian steel group to pull out of Nepal

One of India's prime steel manufacturers, the Rs.60 billion Bhushan group, has decided to pull out of Nepal because of the prevailing political, power and labour problems.

...Nepal's electricity authorities have begun enforcing a 40-hour weekly power cut in Kathmandu valley and a lesser outage in the districts to cope with a mounting power scarcity caused by a lean monsoon.

Ticking time bombs and last-minute escapes

But so pervasive have these themes become in American film and literature that much of the public has up until recently unreflectively embraced the idea that all emergencies will be met with unparalleled heroism that leads to the right solution--no matter how hastily and tardily conceived. Perhaps the purest example of this (and maybe the most ridiculous) is the long-defunct television show "MacGyver." For those who weren't watching television closely in the late 1980s, MacGyver (played by Richard Dean Anderson) was a secret agent who didn't carry a gun. Instead, he was amazingly resourceful in crafting weapons out of materials on hand--always, of course, in the nick of time.

Australia's Oil, Iron Ore Output Hit by Cyclone George

Australia's oil production has been cut by the storm, with floating production vessels disconnecting from their buoys and sailing out of the path of the cyclone.

In the summer of 1988, Hansen had what a talent agent might call his breakout moment. He stood before the US Congress and warned that the human-induced greenhouse effect was underway. At the time, many of Hansen's colleagues thought he'd gotten too far out in front of the science. And perhaps he had, a bit—but it also took some vision to put the issue on the map. Hansen, the New York Times noted, had "sounded the alarm with such authority and force that the issue of an overheating world has suddenly moved to the forefront of public concern."

First Draft of an article I'm working on follows. Any comments?

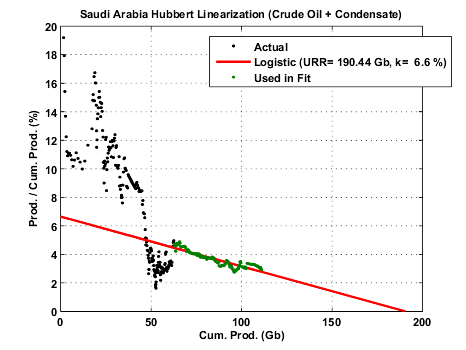

Note that a couple of people commented yesterday that the HL method may be too optimistic.

Could Saudi Arabia Be More Than 70% Depleted?

by Jeffrey J. Brown

In the captioned article, I argued, based on “Khebab’s” technical work, that Saudi Arabia in 2005 was, based on the Hubbert Linearization (HL) method, at the same stage of depletion that the prior swing producer, Texas, peaked, in 1972.

Because we have so much data for Texas, we can get a fairly accurate estimate of Ultimate Recoverable Reserves (URR), probably about 62 billion barrels (Gb), or what I will call Probable URR.

In the article, I noted that Texas peaked in 1972 at 57% of probable URR. Recently, Robert Rapier, on The Oil Drum, has raised some questions about what could have been predicted prior to the Texas peak. As a result of the questions that Robert raised, I have gone back and reexamined the data, and I have come up with some troubling conclusions.

When I first did a HL plot for Texas, I used the data from 1958 through 2004 to get an estimated URR of 66 Gb. Khebab used a slightly different set of data to get an estimated URR of 62 Gb. In any case, the Texas data show a strong linear pattern from 1958 to 1965, with an inflection from 1966 to 1972, where the plot again showed a strong linear pattern.

Qt is an estimate of URR, based on the HL method. If we focus on Khebab’s HL plot, a linear plot using the 1958 to 1965 data would have given us a Qt that is reasonably close to the Probable URR. However, if we use the 1958 to 1972 data, it would give us a Qt of about 85 Gb, about 37% larger than the Probable URR.

Saudi Arabia has shown a strong linear pattern from 1991 to 2002, with an inflection from 2002 to 2005. If we use the data from 1991 to 2005, it suggests that Qt is approximately 186 Gb.

However, if we use the Texas model, and discount the recent inflection, which is probably an artifact of the swing producer maximizing production prior to the peak, it suggests that the Saudi Qt is only 150 Gb, which in turn suggests that Saudi Arabia is now over 70% depleted, with about 40 Gb in remaining recoverable reserves.

Texas:

http://static.flickr.com/44/145149303_e59bbf9890_o.png

Saudi Arabia:

http://static.flickr.com/52/145149302_924470eaa7_o.png

Jeffrey J. Brown is an independent petroleum geologist in the Dallas, Texas area.

E-mail: westexas@aol.com

WT:Your article is well written and easy to read. It appears that you are unsure which HL is more accurate, so I would mention both along with the average of the two methods (64-65% depleted).

Brian,

I think that Robert and I were both on the right path, but we were asking the wrong questions.

IMO, the right question is: What portion of the Texas HL data set prior to 1973 (when the decline started) would result in a Qt estimate close to 62 Gb? The answer is the strong linear data set on the Texas plot from 1958 to 1965.

The implication of this is that the 150 Gb estimate for Saudi Arabia is probably more accurate than 186 Gb, which puts Saudi Arabia at about 73% depleted, which means that we are really, really screwed. In any case, if you plug in the recent production data, they would fall close to the 150 Gb projection.

IMO, this is not a drill. I think that the crisis is upon us, and I think that it will be worse than most of us have been estimating.

Your analysis is excellent. I see people using every upward deflection of the HL curve as proof that the URR is larger. This is wishful thinking. The system is closed as far as the oil is concerned so there cannot be only positive deflections. You demonstrate that in all likelihood the URR is estimated best by HL data that arises during the normal production regime and not forced transients when production stalling starts to become apparent. These forced production regimes show increased production and delay the peak but they do not create new oil. What you extract faster today, you will have less of tomorrow.

Of course if we had enough HLs for enough fields "deflections" could be studied -- average length, degree of deflection, etc.

It would be nice if some HL curves were shown for truly end-of-output conditions. In the Texas case I expect the HL curve to start heading down in the next few years for a URR below 70 Gbl instead of keeping at its 2006 trend towards a URR higher than 70 Gbl.

Now I'm really worried. I already felt your export model was 100% right on and was a stark warning, but if SA is really 73% depleted, we are screwed.

Watching all of the geopolitical jockeying that has been going on the past 5 years amongst the major world players, you can't help but come to the conclusion that something major is up. Before that, gas was cheap, oil wasn't in the news, and there was RELATIVE world peace.

Okay, no rest for the weary. Back to the farm.

Cheryl

Hi Cheryl,

BTW, I meant to say how much I enjoyed your talking about your gardening success with the neighbor girls. Much support.

Thanks! We've worked our butts off the past year. Digging holes in lava by hand is no small task. But we've planted more than 50 fruit trees, and in less than one year at least 30% are already productive. We have fresh juice and fruit every morning.

We still have about 50 mac nut trees, so although they are a bitch to crack by hand, we do have a source of oil and essential fatty acids. And when avocados are in season, they can't be eaten fast enough by the whole population here. Most of them rot on the ground.

The vege garden has been out of control and we can't give it away fast enough. My husband keeps joking, "but the seeds are so little." It helps that he has a green thumb. I would never have been able to do this by myself, so hats off to an old man who is willing to do massive amounts of physical labor every day. It was my idea and I made this whole adventure happen both financially and physically and told him he was either with me or without me, but I was packing up and going. Needless to say, he's here.

I figure we will be in a good position when the SHTF, but the biggest worry will be all of the have-nots in the area. We can help some, but not all of them. And as I've mentioned before, while we are working our butts off, most of our neighbors are drinking beer and watching ESPN. The other night the Twilight Zone episode about the bomb shelter and the neighbors who didn't prepare was on. Gave me the willies. There are a lot of retirees here who just don't seem to have a clue--they think they are going to live out there retirement with ease.

I do suspect that when TSHTF, many of the retirees will leave. Right now it is still very easy to fly back and forth to the mainland to see family/friends and get medical care that isn't available here. I think many of the retirees will go back to the continent to be close to family and medical care.

It's of note that the airline industry has had major fuel problems the past few years, with many airports running out of fuel. About 1 year ago, the main island carriers, Aloha and Hawaiian Airlines both cut back dramatically on inter-island flights. It should have been a wakeup call, but it wasn't. Since I'm a former air traffic controller, I kind of follow stuff related to the airline industry. It never ceases to amaze me at how ill-informed most everyone is. Pretty much everyone thinks it is and will forever be "business as usual."

Nice work, Jeffrey.

Gremlins appear to have eaten my copy of Twilight in the Desert. I seem to recall Simmons starting with the pre-ARAMCO-nationalization reserve estimates and coming up with something in this neighborhood.

As mentioned yesterday, coupling HL with other estimation methods can help select a good data set to use.

Let me see if I follow this logic:

Observation: Texas production will seemingly max out at about 62 Gb. The 1958-2004 Texas HL analysis gives a bit more than that, but there is a linear region prior to peak (6-7 data points) which seems to give an intercept closer to 62Gb.

Conclusion: This short linear region is more "Hubbertian" than the inflection (never mind the error bars on the value of Qt from so few data points, or what it means for that line to have a different slope than the latter 25-year linear region).

Observation: Texas was the swing producer. KSA is now the swing producer.

Conclusion: The inflection period reflected Texas' efforts to maximize production prior to the peak. Thus, the HL for KSA should also show a "Hubbertian" region followed by an inflection as they try to maximize production prior to the peak. Indeed, HL for KSA has a linear region from 1991-2002 followed by an inflection, which can be ignored in estimating Qt.

My Observation: To me, this underscores RR's point that concluding anything definitive from HL of KSA's production data is very problematic. WRT Texas, it seems more likely that, if production for any time period follows a geology-constrained model (Hubbert), it would be right before and over the peak--before they knew what was hitting them. Before then, production was constrained by the TRC. With KSA, you seem to want to focus on a decade when oil prices were crashing through the floor, call that the Hubbert-constrained region, and write off the upswing that happened as prices were climbing. In effect, you're saying that ramping up production after years of steady production, for whatever reason, is a sign of desperation. I would call it wanting to take advantage of increased demand.

Because of the economic and political factors that it cannot account for, the Hubbert model clearly cannot explain production trends over certain time periods, and there is no justification for excluding data which doesn't fit your expectations. Just because it's linear on an HL plot doesn't mean that it is "Hubbertian".

You should read my posts on Roberts thread. This is exactly how HL should be used. I.e only use the points that fit the underlying assumptions not try to fit all the data.

You need reasonable and defensible criteria for excluding points. But the is the right way to do HL.

If you want to use all the data even if it does not fit the criteria for HL then use a different model.

Assumption: KSA is peaking.

Test: use only data points that show KSA is peaking.

Conclusion: KSA is peaking.

Brilliant.

This is a combination of the logical fallacy of Begging the Question (assuming what you're trying to show) and of the data-analysis fallacy of Cherry-Picking (only using data that shows the conclusion you want).

The result is a completely invalid method of analyzing data. Let the data tell its own story.

Well, you can do that...but it ain't science, pal. In the words of a 70's glam-rock band, "You're fooling yourself and you don't believe it".

Wasn't it John F. Kennedy who said:

Let's all do our part to perpetuate what ever delusions we have, lest they be forgotten and fall away into the dust bins of history.

Praised be the giver of all BS. Amen.

(BTW, there is overwhelming scientific evidence that my deity, the Holy BS Giver exists. Just look all around you. The proof is there. The Flying Spaghetti Monster, on the other hand, is a fraud. ;-)

Can you repost this out of the drumbeat as a regular article soon.

Also I mentioned buried in Roberts thread just recently.

http://www.theoildrum.com/node/2357#comment-168542

This may be relevant.

the most important concept i get from HL is that as basins, regions and the globe matures the size of the fields discovered gets smaller, resulting in a peak. i tend to give less weight to the statistical evaluation of production/demand data sets.

some think that "new and improved" technology will somehow result in ever increasing production capacity. but wait just a damn minute: HL, has historical "new and improved" technology built in. sure, we will see "new and improved" techniques and we have seen tremendous impovements in technology in the past , generally resulting in an ability to find ever smaller reservoirs.

we should not loose sight of the fact that ghawar was discovered based on surface geology, the new and improved technology of the day

The International Energy Agency warned Tuesday that global oil and fuel inventories were being sucked lower at an unusually high pace this year, leading it to fret about demand being met in the coming months and amplifying the need for more crude from the Organization of Petroleum Exporting Countries.

They (and the WSJ, who also mentioned this in 2 articles) must read TOD, because that's exactly what I said yesterday. :-) Saudi will be called upon soon to produce. We will know by June whether their current decline has been voluntary, because starting in late April to early May, U.S. demand will sharply pick up.

Here are some excerpts from one of the WSJ articles that one of the TOD readers e-mailed me this morning:

Tell me if I'm wrong here but didn't KSA cut output in advance of the agreed OPEC time to cut. Wasn't this touted as "the market is oversupplied" and that made sense at the time? If the opposite situation now exists does the reverse now apply? Just curious, maybe the 'new price floor is higher, say $100, and we just haven't been informed...yet.

Yes, and that was only a few months ago. Yesterday we also had the news that they were cutting some long term contracts by 10%.

I agree with Robert, we will know the answer this spring, and I completely agree with Jeffery's export model. We appear to be at peak or past peak, and the heavy geopolitical jockeying for oil reserves seems to confirm those suspicions.

I have a oil-production question. Yesterday, it was mentioned that Saudi Arabia's production cuts in April are primarily with respect to their heaviest quality of crude. If the cuts are due to supply issues, shouldn't the cuts be with respect to the types that are in shortest supply - presumably the lighter grades? One of the articles above suggests the pattern of cuts is to provide higher average revenue.

The lighter grades are more profitable. Remember, they are trying to make as much money as they can. They want to squeeze that last dollar out without collapsing the world economy.

I have the same question. If they are cutting "involuntarily" you would think it would be the light grades. Making money would not be the issue.

Perhaps they're saving the heavier stuff for later, when *any* oil will be valuable.

Perhaps they are experiencing difficulties producing the volume of heavy oil consumers are willing to purchase.

I do not think this is likely but maybe they are selling some of the heavy oil to refineries who contracted light oil and refineries that contracted heavy oil get less.

What would the refineries who contracted light oil do with the heavy oil that maybe SA is selling them?

No idea i know nothing about it but if they get oil that are a little bit heavier i guess they try to find better oil or if there are no other surplus capacity they just have to use what they get, lower refinery utilization? Observe that i do not think this is the situation it was just an idea.

I should have posted this quote from a 2004 Report of the National Petroleum Council the first time around:

"Since crude oil quality varies significantly

from one supply point to another and refineries

are designed to operate using crude oil of given

qualities, sudden changes in crude oil supply could

cause a reduction in refinery throughput even

though there appears to be ample volumes of crude

oil available."

http://www.npc.org/reports/R-I_121704.pdf

Also of note in the Bloomberg story, Saudi Arabia is cutting back on its contracted deliveries of light oil to Japan.

Well, it seems clear the refineries were caught by suprise. They didn't ask for any of the reductions. The interpretation that it is due to reduction of demand is an interpretation being placed by outsiders. One report in the media says it is due to reduced demand, the other due to an "anticipated" reduction in demand. In either case, the refiners didn't expect the reduction or ask for it.

So this might suggest they are having difficulies.

I like this line in the Reuters story:

"Other traders said the deeper supply curbs from OPEC's most influential member is a message for the group to fully comply with agreed reductions."

Sheik Aramco: "You guys better cut more cuz if you don't we'll cut our contracted deliveries even more. So there."

I'm always amazed how some people (the traders, the reporter and his/her editors) manage to get paid for their analytical abilities.

Reducing inventories does not "stabilize prices"; it destablizes the entire system. What comes to mind is the early stages in the Bakhtiari scenario where the system bounces between relatively rigid supply and demand constraints and gets increasingly unstable.

Of course, what the article really means is "keep prices up". That will be a different dance.

cfm in Gray, ME

Of course, what the article really means is "keep prices up".

And that's the key. What Saudi would love to do, I am sure, is to "stabilize them" up around $80/bbl. What they want to avoid is stabilizing them at $40/bbl. Your perspective all depends on whether you are buying or selling.

When did they officially change the price band upward from the $25-$35 bbl?? Wasn't their production dropping even though the price had stabilized for some time at ~$60? Should we ignore their price band announcements (or lack of announcements) and look at their production to infer a price band? Obvious follow-up: Should we look at their production to infer the voluntary/involuntary nature of their production drops?

Much has been said about inventories and I presume that the issue of inventories ties in with the general perception that there is a 'refinery bottleneck' or at least when consumption is running as high as it ever has been this seems to be the case.

If there is indeed a 'refinery bottleneck' (when consumption is at peak and/or rising) this would, it seems, lead to great volatility in prices of finished product and maybe of crude as well. As inventories fall, prices rise, producers ship more crude until inventory rises, even though consumer demand may not yet be sated, crude prices fall because of high inventories, finished product prices rise (the current situation of the past week vis-a-vis prices). I would predict more steadily rising finished product prices (depending on the ephemeral 'demand destruction') but fluctuating crude prices in this scenario (basically Sailorman's forecast :))

Does this make sense to others ?

Much has been said about inventories and I presume that the issue of inventories ties in with the general perception that there is a 'refinery bottleneck' or at least when consumption is running as high as it ever has been this seems to be the case.

This affects finished product inventories, and they have been drawn down by a lot. Crude inventories tend to get held up by the refinery bottleneck, but the OPEC cuts have finally started drawing down crude inventories. For the first time in a good while, inventories upstream and downstream are starting to indicate some shortfalls in the not too distant future. That's why I say we will know by summer what's up in KSA.

Robert,

Thankyou for the HL analysis.

A question on todays concern of decreasing inventories and worries of increasing demand later this spring.

Could some of this not be a result of the abnormally warm temps this year advancing drawdowns and specifically consumer driving habits to levels we normally associate with May? Perhaps in March we are already in late spring demand and driving habits. I anticipate more "sightseeing" and visiting trips than usual, along with earlier field prep and seeding.

(its peak oilers filling thier own private storage)shhh...

Actually, I have a friend who has been burying 55 gal. drums on his property and filling them with gasoline.(Yes he knows it's not legal, he could care less.) I've been looking to buy a local gas station, filling the tanks, and never open for business.

Cid Don't know if he is familiar with 'shelf-life' fuel storage issues with the various blends?

http://theepicenter.com/tow021799.html

Thank You very much! So much for my gas station plans. I'll let him know and give him a copy of your article.

This applies to open containers of fuel. A sealed contain devoid of oxygen should last a considerable time. Although additives to the fuel that contain oxygen, or contain chemicals that react with the fuel can degrade it. Also some microbes (anarobic) can also process fuel and degrade it. Most fuel storage containers are not completely sealed to avoid rupture at high tempertures.

I believe if proper storage and handling measures are taken it should be possible to store fuel for much longer periods that suggested in that article. Ideally you would want to purchase fuel that does contain oxygenators, ethanol or other additives that would reduce the shelf-life. Racing fuel may be an option.

There is also a company that sells an extended life diesel (produced from Fischer-Tropsh) that sold for use in telecommucation towers that are equipped with backup generators. I don't recall the name, but I believe its in Wyoming.

FWIW: Storing fuel isn't really a long term solution since its still a finite resource. A better long term method is to look at gasification, athough this is best suited for stationary engines (ie generator).

a friend of mine has a 55 gallon barrel of gasoline too, but he also said the "shelf life" of the gasoline after it has been opened will be 30 days.

seems about right!

I am not sure, right now the subprime mortgage market is imploding (bye bye NEW). It could be just a matter of time before that is the pin that pricks the real estate bubble. Recession could follow, since housing is propping up the economy. The stock market is giving us the signal now. So we could have a recession induced demand destruction in combination with price rise in oil due to dollar devaluation in the face of a debt crisis. The end result is we are still in the same place as far as peak in October.

I agree that the stock market is giving us the signal that the trend has changed. IMO we'd be more likely to see a short squeeze in the dollar in the face of a debt crisis than a devaluation though. In a deflationary crash, cash is king. People would be selling assets in order to raise cash to pay their debts.

I think the price of oil will fall, but if purchasing power is falling even faster (as I expect to be the case), it would still be less affordable for most than it is now.

arent you discounting all those bales of cash ready to be dropped from helicopters ?

helicopter ben said let there be cash............and there was cash...............

oh, baby, that pin was pricked awhile ago :>>...subprime is imploding at warp speed..... ben, ben ...man the helicopters!

Asian stocks tumbling. Nikkei off 512 pts. Korean asset managers talking about PRIME loan problems in the US. Ghawar nosing over. WT said it. This is no drill!

http://www.bloomberg.com/apps/news?pid=20601087&sid=a86xJZh3_Nyw&refer=home

We have yet to see how the hurricane season unfolds. It was bad in 2005 when there was a La Nina, and last year was mild at least for the Gulf, but this year another La Nina is forming and it remains to be seen if it is bad again.

So it is possible that even with a recession, demand destruction could be overtaken by supply destruction.

I agree with RR (grudgingly) that this summer is likely to be telling.

There is another factor that hasn't really gone away, though it appears to be simmering nicely for the time being. It is still possible that this President against the will of the nation will strike Iran. That would surely lead to supply destruction, but it could then be argued as above ground and not below ground.

> am not sure, right now the subprime mortgage market is imploding (bye bye NEW). It could be just a matter of time before that is the pin that pricks the real estate bubble.

Looks like Congress has plans to stall an implosion by bailing out the subprime lenders. Currently there is a bill in the works (lead by Chris Dodd Senator from Connecticut) to spend up to $164 Billion to cover all potential bad subprime loans. Who needs Helicopter Ben when you have Senator "I Spend freely" use OPM to pay for the homes of subprime borrowers! Don't you wish you had a subprime loan that Uncle Sam paid off for you? aka Money for nothing!

Where does this money come from? You and other hardworking Americans by raising your taxes so You Can Work even harder to Pay Others to Live the American Dream? In the meantime Subprime lender Execs and investment bankers made fortunes by selling NINJA loans (No Income, No Job or Assets) that they knew were bad loans.

Actually I think KSA will mount a mini surge this summer and we probably will open the SPR because of supply irregularities or some other made up reason. I'm not saying oil wont go to around 100 a barrel but consider this.

they have 33 million barrel plus in storage these can be drained giving about a month of production from storage at 1mbpd. They probably are resting some wells these can be tapped and I'd assume they would produce at a decent rate for say 1-3 months before dropping off. Say this give 500kbd and finally they can overproduce the rest of their fields for a brief time giving another 500kb back off a bit on the storage to 500kb for two months and they should be able to fake about a 1.5mpd increase in production. The US can step in and open the SPR to help calm the price.

I think they are doing everything they can to prepare for this have turned off any well that could profit from resting.

So I don't think we will know this summer but we will have a strong suspicion. But if I'm right about the fall then at that point we are screwed.

Also note if oil rises over say 80 the whole rest of the world will be over producing and we will get more demand destruction.

So I expect the good olde college try from KSA.

Actually I think KSA will mount a mini surge this summer and we probably will open the SPR because of supply irregularities or some other made up reason. I'm not saying oil wont go to around 100 a barrel but consider this.

I have thought this as well, but the news seems to be that they (OPEC) are shorting the world demand by more than 1MBD. If this depletion trend accelerates, the drip could become a bloodletting. Also in the first quarter, the oil demand is typically 2MBD less than summer and winter and 4MBD less than fall when heating oil tanks are being filled.

KSA could open the spigots on their reserves, as you say, and still be well behind the demand curve.

That is totally false.

Check out the IEA's figures on global demand. Using Q1 as a baseline, we get:

2004

Q2: -1.5MB

Q3: -0.5MB

Q4: +1.7MB

2005

Q2: -2.2MB

Q3: -1.3MB

Q4: -0.4MB

2006

Q2: -1.7MB

Q3: -0.9MB

Q4: +0.5MB

Predicted demand for 2007 follows exactly the same pattern:

Q2: -1.8MB

Q3: -0.3MB

Q4: +1.2MB

Why do people make up nonsense like this when the real data is so easy to get?

Why do people make up nonsense like this when the real data is so easy to get?

Just what do demand figures mean when the supply numbers are different?

I claim that by 2004, the numbers were already skewing by high price. Anyway, the demand figures somewhat misleading since the supply figures are the oil that was used.

I imagine that prior to 2001, that we had a decade of use that went went down in spring, up in summer, further up in fall and like summer useage in winter.

Your numbers about demand are nonsense, and unrelated to oil used. If you want to bandy words a little longer, I will try to find the source of my numbers. I may have read them on TOD.

Storage change. Table 1 of the IEA reports I linked to.

Incorrect - see the IEA reports I linked to.

Nobody cares what you imagine, especially not when all the real data is a single click away.

That would be a good idea. Perhaps then you will realize that you're spouting nonsense, and hopefully will stop spreading misinformation.

Here's a link that supports what I said, since you are policing TOD, though I can't find the exact quote I was looking for, this is close enough.

http://spectrumcommodities.com/education/commodity/charts/cl.html

I still assert that the last three years have been skewed by high prices, but the 17 year seasonal chart shows roughly the pattern I claimed.

And since we're sharing here's one for you.

http://www.latimes.com/business/la-fi-chevron15mar15,1,1095736.story?col...

Could correct for storage increase 2/3q, draw in 4q.

When you do that, you get oil supply, which is much more stable than oil demand. For example, from 2006:

Demand

Q1: 85.0

Q2: 83.3

Q3: 84.1

Q4: 85.5

Supply

Q1: 85.2

Q2: 84.9

Q3: 85.5

Q4: 85.3

Storage

Q1: 0.2

Q2: 1.7

Q3: 1.4

Q4: -0.2

Table 1 of the IEA report, p. 43

The reference I found says Ghawar produces sour light (1.66% sulpher, 34 gravity), so if this reservoir were crashing one would think it was this grade that would be in short supply... Confounding this, all regions do not produce the same grade.

Odd, when commodity prices are in contango, it is in one's interest to keep the commodity in storage so as to get a higher price for selling for it in the future. But the Saudi's want to keep inventories low to keep prices high. I wonder who is going to win this battle.

Dammit no one has taken my bet that KSA will say they are comfortable with a base oil price of 70. I'm running out of time.

I posted this late yesterday and wanted to call it out again:

Can any experts out there tell me why ARAMCO needs to hire a cavitation engineer in a hurry?

Hmmmm...the link to the book has mysteriously changed to the below message since last night:

This one works though:

http://www.amazon.com/Cavitation-Reaction-Engineering-Plenum-Chemical/dp...

That is interesting, but maybe they sold out of them after your post on the Drum. The TOD should get money from Amazon if the click-through generated a sale. I went directly to the book, but at 267.00 a crack I bet they did not have a lot in stock. Somebody besides me as to do the research Google cavitation reactor oil which will generate numerous links. The process seems to have broad applications, so it may not be related to extraction process, but who knows, as I was "left behind" when I graduated with a Geology degree in 1986.

They probably want him in connection with the new giant petrochemical plant they are building in Ras Tanura. Or perhaps it has something to do with water treatment as Saudi is injecting more and more water into their reservoirs. And of course more water is being produced produced with the oil (the water cut is rising). And this water is then retreated and reinjected back into the reservoirs. Also potable water is an ever increasing problem in Saudi Arabia as the population continues to explode.

http://www.amazon.com/Cavitation-Reaction-Engineering-Plenum-Chemical/dp...

Ron Patterson

What papers has he published for peer review? That should tell you a lot more.

The web page of a cavitation reactor supplier.

Greg, thanks for the link. After reading it I think it is highly likely that the cavitation engineer is to be employed in the water/oil seperation process. As their water cut rises they probably wish for a more efficient and quicker water/oil seperation process.

Ron Patterson

. . . on their way to the 99% water cut that we see in the East Texas Field.

Whatcha think of the 150 Gb URR estimate for Saudi Arabia (up the thread)?

It does seem to be another data point, doesn't it?

WT, several questions...khebab, on january 8,2007, posted the following HL plot:

...which , i believe is a monthly HL graph, since he refers to monthly data in his narrative. this plot has a URR of 190 gbbls. 190, 180, 150?...what's a mother to do?

a second question, about voluntary vs. involuntary saudi cuts. if ghawar is crashing or at least turning over in it's production output, and we learned that it is cutting back in it's supply to asia of heavy crude, does that jive with ghawar being a supply of light crude? if it was losing ghawar production, as well as the other super giant fields, wouldn't it not be able to supply light crude , rather than heavy?

If memory serves, I think that this second plot was for crude + condensate, using a different data base from the first HL plot, but I could be wrong.

And as Khebab would be the first to tell you, all of these estimates are well within the margin of error.

In any case, the Saudi plot has always shown a strong linear trend, so the question is whether Saudi Arabia is around 60% depleted or closer to 70% depleted. In either case, I think that they are in terminal decline.

The only new wrinkle I have thrown into the debate is that I think that the stable HL linear data, prior to the Texas peak, is actually giving us a very good idea of the Probable URR.

yes, i agree that 60-70% doesn't much matter , the larger story is not good. ...and the second question, anyone?

Thanks for the info...it was just a rather odd development and didn't know much about what a cavitation engineer would be doing with ARAMCO. Better ways of separating water and oil makes sense.

Dissolved gases in oil pipelines?

Report from the Front: High Commuting Costs Push Rural Property Owners Past the Tipping Point

(Well, with the bubble all but finished, and the stock market looking like a parody of itself, maybe only Mad Max can save us.)

I caught this on Democracy Now last night:

President Bush v. Hugo Chavez: A Discussion on the State of Politics in Latin America

Monday, March 12th, 2007

* Greg Grandin, professor of Latin American history at NYU and author of the book Empire's Workshop: Latin America, the United States, and the Rise of the New Imperialism. He also wrote "The Blood of Guatemala: A History of Race and Nation."

http://www.democracynow.org/article.pl?sid=07/03/12/1425231

One of the big selling points with respect to ethanol is energy independence and freedom from foreign supply. Well, that particular talking point looks to be losing some of its lustre given this overture to Brazil. This is just an admission that corn can't cut it. Also, sugar ethanol is helped by the near slave labor conditions in Brazil. It seems like we should direct resources away from ethanol and towards the ultimate foreign, and yet domestic resource, the sun. But even in that area we may be in trouble, given the rise of foreign solar pv producers like Suntech in China. I don't think technological preeminence in ethanol is going to give us the kind of edge the U.S. will need going forward.

But hey, as long as we're talking sugar, maybe it's makes sense to focus a bit on Cuba, which after all, would have lower transportation costs.

I agree with Grandin. And this is also a big investment opportunity for US capital. The only other really important stop on the trip was Mexico. But I don't know the agenda there yet. Keeping Obrador Lopez at bay has got to be a biggie though.

Possibly more upheaval in South Asia? :

http://www.theaustralian.news.com.au/story/0,20867,21378237-2703,00.html

Brother K, that's quite disturbing news. Messing with Pakistan could get ugly. or uglier... But this is a paragraph you don't see often:

"Thousands of lawyers clashed with baton-wielding riot police yesterday during a nationwide day of action against the sacking of the top judge. About 3000 lawyers wearing smart black suits and chanting "Down with Musharraf" dismantled barriers in an attempt to stage a sit-in outside the Lahore High Court building."

...insert lawyer joke here.....

Beyond all that, I certainly don't like the look of how things are developing. Gasoline up 50 cents in the last two months, and it's still basically winter. The IEA is begging for more crude from OPEC, and we all know how likely that is to happen. I'm beginning to think we might see gas this summer over $3.50, maybe even $4. And despite recent history, nobody is ready for that. So this year could be the two-by-four in the face that I've suspected it might be since '07 started.

May you live in interesting times.

"Nuthin' left to do but Smile, Smile, Smile" :-)

Gasoline is well over $3 here in California. This morning, I saw regular going for $3.19 at the discount places to $3.31 at Shell.

It jumped up quite quickly last week. Overnight it went up nine cents in Laguna Beach to $3.14 (if memory servers me correctly). Back up around San Francisco this weekend I saw several stations in the $3.00 to $3.30 range. An article I read somewhere attributed this to a refinery fire in Toronto as well as several refineries in California shutting down to switch to summer formulations in addition to people driving more due to the nice weather we've had.. Either way it points to tight supplies.

Hey I live in Irvine :)

Maybe we could have a meeting if their are enough Peak Oilers in the area.

Why not? I'm in San Clemente.

More incredible incompetence. If you want to do something like that you don't issue a press release. If you want to pressure the guy for more cooperation this tack is still ass backwards. If this is the best the US can do -- well, trouble comin every day

He has been getting friendly with Iran is what has brought this about. What's to keep him from say providing Iran with some nukes just to show his displeasure or perhaps launching a couple if it looks like he is going down?

Nothing prevents that. In past Musharraf has stated that if US enters hostilities with Iran he will side with Iran - unless he is deposed first. In the event of an attack on Iran a very good chance the fundies would take control in Pakistan. And of course should US attempt to replace Musharraf it would also most likely backfire and bring the fundies to power.

I was busy yesterday but have now read all the comments from the Huberts linerization post by RR and all the heated debates.

Some comments for Prof G, TOD managers, and frequent posters.

1) For all the heated debate between RR and Westexas there was overall civility and scientific discussion throughout. Testy, egotistical, hard nosed, etc. but no name calling.

2) This is much improved over a month ago. Thanks!

3) Much of what was discussed yesterday (by all posters) about predicting the peak was unchanged from 1.5-2 years ago. The same uncertainty remains in calling the world peak as at that time with one change. Most posters here are debating about 2006/2007 vs 2008-2010 timeframes. You know two years ago most posters and MSM statements were quoting 2020 at the EARLIEST for a peak. Not anymore

4) At the risk of having to defend myself with math against smarter posters I will restate some obvious concepts.

There is a finite amount of oil under the worlds large fields. There are decent estimates of this size and the HL method tends to bracket these estimates if used on different years of production.

The faster we pump the oil out of the ground the faster we deplete the reservoir. This rapid depletion may not be apparant to us if new technology maintains high production now, where in the past the field would have shown a decline based on the geology. This has great impact on the peak date (Ghawar and the World) and may shift it years left or right on the X axis.

I am a contrarian and don't believe that technology fixes are happening fast enough to keep up with our consumptive lifestyle. Therefore the longer and harder we work to prevent a peak in World oil production the steeper the back side of the curve will be.

This is the danger in spending too much time debating the peak date and putting it out there as a target for oil companies and bankers to keep shifting it to the right via ever more resource allocation, just to prove we haven't reached peak.

To me this is the crux of the Ropert Rapier and West Texas arguments. Westexas (to put words in his mouth)is damned scared (as I am) that the post peak is going to be a fast decline with lots of bad things happening. His data points to this and he wants us all to change behavior while we can.

Robert is not convinced of this scenario yet (to put words in his mouth) and wants a more measured critique of the analysis that points to a near term peak. He is concerned that miscalling the peak will cause more damage to the peak oil concept than actually being wrong and dealing with a peak earlier than he sees now. He doesn't subscribe, IMO, to the concept that calling the peak late in error will have catastrophic consequences. I disagree with this philosophy, but maybe he is correct and I worry about things too much.

These were the same issues discussed at this site in 2005. At that time there was consensus (if memory serves me right) that no method COULD EVER accurated PREDICT the peak. Too many things above ground influencing the models. The key is the general range of the peak and how long it takes to deal with a lack (notice I don't even say decrease) of increase in yearly oil supply. The Hirsch report says 15 years minimum to cope with peak oil.

So instead of us beating each other up on the 5% we disagree about on peak oil predicting, how about we reframe the debate. Who here thinks peak oil is going to occur after 2015? Because if it is ONLY 8 years away we are all in a world of hurt and way late in figuring out how to move goods, heat houses, grow food and generally rebuild an infrastructure using less oil per person than we have today.

No argument from me.

Needless to say, I think that the "stuff" is hitting the fan. I expect the pattern for quite a while to be: food/energy inflation versus auto/housing/finance deflation.

Regarding the Export Land Model, the front page of the WSJ has an article on the booming (energy driven) economy in Russia.

Robert is not convinced of this scenario yet (to put words in his mouth) and wants a more measured critique of the analysis that points to a near term peak.

Close. I want to demonstrate whether the techniques we are using can be used with confidence. If we claim a peak, and use the HL as a major factor in making that claim, we better be sure that it holds up. If you are going to call peak, you have to have confidence in the methodology. My post yesterday was an evaluation of one of the tools.

He is concerned that miscalling the peak will cause more damage to the peak oil concept than actually being wrong and dealing with a peak earlier than he sees now.

Again, close. I think we should be dealing with peak now. So the last part is wrong. But people aren't adequately preparing now. We need to convince people to do so. If peak is not now, and production rises next year, will we have a higher probability or a lower probability of getting people to deal with peak? So, we better have a high degree of confidence in our ability to call peak if we are going to go out on the limb and make the call that it is now. Doesn't mean that I don't believe the alarm shouldn't be sounded. That is my issue in a nutshell.

Robert,

Exactly. This is why I have always felt that we should tie the need to reduce oil and gas consumption to a much broader agenda than just peak.

Economic concerns, ecological issues, national security issues, the plight of the poor nations needing fuel (humanitarian issues) all cry out for reducing the horrendous waste of what is a valuable and strategic resource.

Even if someone could prove beyond a doubt that there was no danger of peak until past 2025 or 2030 (and no one has been able to, despite the CERA talk), we would still have dozens of good reasons to diversify away from fossil fuel, conserve, and engage in efficient and elegant design. Waste is never a good thing. Hit the waste first. Diversity of supply is almost always a good thing. Hit that hard. Peak now or peak later, the cause should be to husband resources as if they were actually valuable.

Right now, we do not treat oil, gas and energy in general as if they were actually valuable, but instead as a throwaway product.

Roger Conner Jr.

Remember, we are only one cubic mile from freedom

Along that line of "waste".... Team Bush doesn't expect to pay this $2.5T bill, but intends to walk. Perhaps to Paraguay. I'm dismayed that as we slide over the peak, our last good money is being thrown after bad. That's a consequence of our political system: road builders don't have enough work to do, so we subsidize them rather than cutting them loose. The whole "sunk cost" argument.

cfm in Gray, ME

Haliburton just moved to Dubai ..

why paraguay?

Robert,

Fair enough. I do understand your motives for the critique and also know you are concerned about the peak.

IMO we all should arrive at a consensus peak Range (say 2006-2010 or even 2006-2015) to get into the public's consciousness. Get it out there and move the discussion along to what this means.

Putting a range on the peak allows multiple analytical approaches (with scientific debate) to be used to determine if (or when) the peak has ( or will) occurred (occur). It also allows for a plateau or even double peak without CERA being able to claim peak oil is bunk.

In my mind a peak in 2007 or a peak in 2010 has identical ramifications for my family and household. There isn't time for me to do much structurally to reduce my fossil fuel usage at this date. There is plenty of oil for decades if we stop consuming it at such a ferocious pace. At this point in time we need to be working on solutions to collectively reduce our energy consumption more than we are working on energy production.

I do not see enough concern about energy conservation in the general public discussion. It is all about production. CERA, Exxon, and SA are on one side of the production debate. Kunstler, Simmons, Deffeys, and TOD are on the other side of the production debate.

The rest of the country and world is on the sidelines ignoring the debate because CERA, Exon and SA are winning the PR game that we have lots of time. Nothing I have read about oil supply or replacement technologies says we have lots of time. The time for analysis of the problem is over. The time for action in dealing with it is at hand. How do we convince people of this?

Two of my articles

http://www.lightrailnow.org/features/f_lrt_2006-05a.htm

http://www.lightrailnow.org/features/f_lrt_2005-02.htm

Best Hopes,

Alan

If you are talking about peak oil then the peak, so far was May of 2005. If you are talking about peak all liquids, then the peak, so far was in 2006.

But all this misses the point. Peak "whatever" is likely right now. That is we are on a plateau that we have been on for two years. The top of that plateau may tilt up slightly or down slightly but that makes no difference. What is a half a million or even a million barrels per day more or less. When we come off this plateau, by at least 1.5 million barrels per day, if we come off on the upside then peak will be later, but if we come off this plateau on the downside, then you will know the peak has past.

But as long as oil production moves sideways, as it has for two years, the more confidence we can have that we are at peak and the next major move is likely to be to the downside.

Ron Patterson

Agreed – peak “WHATEVER” is NOW!!

The following graph forecasts a total liquids peak of 87.5 Mb/d on July 2009. This peak is forecast using production from future projects (Skrebowski megaprojects database and other sources). Notice that the peak is in the middle of a slowly changing production plateau.

I t assumes that ethanol and NGL production increases to offset declining C&C production. It also assumes that Saudi Arabia has no spare capacity.

The C&C peak is 74.15 Mb/d on May 2005, and precedes the forecast total liquids peak by just over four years. C&C production is forecast to decline at -0.5%/yr. There needs to be a greater focus on the C&C production decline to create more awareness about peak oil because total liquids production is not showing evidence of any decline yet.

Robert, one thing I didn't see you address in your article yesterday was the rate of new discoveries in your 1960 example. Discovery will make URR a moving target. Wasn't the rate of discovery in 1960 a wee bit larger in Texas than it was in 1971-72?

Is there any data about discovery in KSA these days?

Robert - I absolutely concur with you on HL utilization and attempted Peak prognosis not to mention the post up on TOD ghost readers. It has become rather obvious from these observations and of those made outside the TOD community, that elements of our discussions are making an impact.

That said, however, I would also like to add that although it can be pretty exciting for those of us here to see their collective work come to fruition, the true prospect of Peak Decline occuring now -at least from my viewpoint being in the "attempt to mitigate" sector- is disconcerting to say the least.

Yes, I want TOD to be right.

No, I don't want TOD to be right... right now.

Here's why.

Regardless of the what personal opinion one may have on Peak Decline mitigation strategies -whether it be rail electrification, plug-in cars, powerdowns, depletion protocols, biofuels, conservation or any combination therof- it is the scope of the task at hand and the apparent timeframe allotted that negate virtually any deployable mitigation strategies we've got.

In other words, if TOD is right, then we may in fact be facing the worst possible Peak Oil scenario of all.

Hi Syntec,

I appreciate your thoughts here.

Re: "...it is the scope of the task at hand and the apparent timeframe allotted that negate virtually any deployable mitigation strategies we've got."

Well...how about coming up w. a "best strategies" list for "peak now"? There are a lot of things that may stretch out "peak", and/or there are always the unknowns of the future tense. Still... *someone* will have those strategies that *are* deployed/deployable (or at least the attempts for same.) Better we have some to put in their place.

In the US I have developed a list of Urban Rail projects "on the shelf" that could be "throwing dirt" in 1 to 3 years with completion after that. Rough cost estimate is $130 to $160 billion.

Add to this strong incentives for freight railroads to electrify, continued fast growth in wind turbines AND more pumped storage, more geothermal (ground loop) heat pumps (especially to replace oil heat), stronger CAFE standards NOW + gas guzzler taxes, plus more gas taxes on top of higher oil prices (I suggest phasing in $2/gallon for those that do not believe in PO, do believe in the tax man).

Off the top of my head :-)

Best Hopes,

Alan

Well...how about coming up w. a "best strategies" list for "peak now"?

I agree with Syntec that peak now would be very bad. If that is the case, there is only 1 strategy: Conservation. We won't have to convince anyone to do this. Price will force it upon them.

If the decline is slow, it might give people some time to adapt their lifestyle (more fuel efficient vehicles; different options for getting to work; etc.) and give us a bit more time to come up with some reasonably workable solution. But no matter what happens, people are going to have to get accustomed to the fact that things are going to be different. Their lives will be impacted.

The following list was composed by Lyndon Henry and the author (Alan Drake) from memory and likely overlooks some projects. The degree of engineering on file for each project varies significantly, and much of the information is dated. However, all of the projects noted below could start construction in one to three years if it was an urgent national priority. Just 90% federal funding (the same level of funding that built the Interstate Highway system) would get the vast majority of these plans built out quickly with many more additional initiatives.

A rough guess is that the projects below would cost roughly $130 to $160 billion to complete.

Albuquerque – Light Rail and Commuter Rail plans

Atlanta - Beltway Light Rail, Northern suburbs Light Rail extension, downtown streetcar

Austin - Two Light Rail Lines plus Commuter rail and downtown streetcars

Baltimore - East-West Light Rail Line, 4 mile extension to current subway

Birmingham AL – Streetcar lines

Boston - All rail plans promised as environmental offset to "Big Dig"

Buffalo - Planned extensions to current light rail subway

Charlotte - All plans currently scheduled

Chicago – Expansions to Metra, South Shore Line

Cincinnati –Light Rail plans voted down

Columbus OH – Light Rail and streetcar lines

Corpus Christi TX – Streetcar line

Dallas - All plans through 2015 and all 2015-2030 options (roughly 145 mile system)

Dayton OH – Streetcar plans

Denver - 117 miles of Light Rail and Commuter Rail (already locally funded)

El Paso – Downtown to Border Light Rail

Ft. Lauderdale – Light Rail and streetcar plans under active development

Honolulu – Line currently under development

Houston - All plans voted for, 65 new miles light rail 8 miles commuter

Indianapolis – Light Rail Line plans

Kansas City – Light Rail Line proposed

Las Vegas – Light Rail plans

Little Rock – Short extensions of existing streetcar line, Light Rail line

Los Angeles - Red Line "Subway to the Sea", Vermont Avenue subway, XX miles of Light Rail, electric trolley bus plan, electrify commuter rail

Louisville KY – Light Rail line plans

Madison WS – Streetcar and Commuter Rail plans

Memphis – At least two Light Lines in comprehensive plan

Miami - 103 miles of elevated Rapid Rail (subway type) + Miami Beach streetcar (already locally funded) 90% of the population would be within 3 miles of a station, half within 2 miles of a station

Minneapolis-St. Paul - Central Light Rail connector between the cities, Northstar commuter rail

Missoula MN – Commuter Rail

Nashville – Commuter Rail in process

New Orleans – Desire Streetcar Line, Riverfront Streetcar Line extensions

New York City - 2nd Avenue Subway, 3rd Tunnel under Hudson, Penn to Grand Central connection, Staten Island Light Rail, New Jersey Light Rail extension, commuter rail improvements

Norfolk – Light Rail Plans in progress

Ogden UT – Streetcar plans

Orange County CA – Center Line Light Rail plan voted down

Orlando – Light Rail plan voted down

Philadelphia – City Branch, Roosevelt Blvd. extension of Broad Street subway

Phoenix - 90 miles of Light Rail already approved

Pittsburgh - Two Light Rail Lines north from current, under construction line

Portland - Green Line (both routes, one funded, other "studied" for future), Streetcar both sides river

Raleigh-Durham NC – Streetcar plans

Sacramento – Additional Light Rail expansion

San Antonio – Light Rail plans voted down

St. Louis - All plans evaluated, perhaps 100 mile system

Salem OR – Streetcar plans

Salt Lake City - 90 miles of Light Rail, streetcar and Commuter Rail (vote soon to accelerate)

San Diego - Light Rail spur to North, another to West

San Francisco - New TransBay tunnel, trolley line, BART extension, eBART, Marin-Sonoma commuter rail, CalTrain extension to downtown TransBay Terminal

San Jose - BART extension, several Light Rail extensions

Seattle – Proposed north extension

Spokane – Light Rail line planned

Tampa – 1992 and later plans

Toledo OH – Streetcar plans

Tuscon AZ – Streetcar plans

Washington DC – Tyson’s Corner-Dulles extension, Purple Line, 40 miles of streetcar lines in DC, Columbia Pike Light Rail

Winston-Salem NC – Streetcar plans

Hi Robert,

and I appreciate your summing things up, NC.

re: NC: "Who here thinks peak oil is going to occur after 2015?"

Robert, the other day I think you posited 2016 as your upper bound. Would you stick w. this? (Or, put it in some other form, such as the percentages - sorry I can't think offhand name of poster/source - Shoppel? (sp)

I'll bring this up again it got buried in your other post.

I think that the methods and the data we have for predicting peak oil are not enough for a convincing argument.

Increasingly it looks like we are post peak.

We need to focus on a iron clad argument that we are post peak. The models should reinforce this argument.

For example lets say the data and all our models show the world is declining by say 6mbpd each year without KSA. This means KSA would have to increase production by 6mbpd every year. This simply is not physically possible thus we peaked.

This is doable.

Hi NC

I like what you have to say in your post but would like to throw something at you, working from your statement:

http://www.cge.uevora.pt/aspo2005/abscom/ASPO2005_Schoppers.ppt

I couldn't copy and paste the bit that interested me so will quote it as follows: from the article by Dr. Marcel Shoppers and DR. Neil Murphy. Pleasantly for us lay guys they end with afterthought #!:

2.5% chance the peak occurred by 2003

15% chance the peak will occur by 2006

50% chance the peak will occur by 2009

85% chance the peak will occur by 2012

95% chance the peak will occur by 2015

2.5% chance the peak will occur after 2015

Robert replied with the following statement:

"I do like that approach that you copied above where they give probabilities. Those probabilities are not too far from what I would suggest. That approach really emphasizes the urgency without the risk of credibility loss."

I Imagine Westexas while he might agree with the method, l doubt that he would agree with the percentages (nor do I). So anyway thanks for giving me the opportunity to get that off my chest. Let me know what you think even if you have to throw in a few terms like 'boneheaded twit'.

Here is an interesting collection of quotes from the 1920s and 30s related to the stock market crash of 1929 and subsequent depression. Never underestimate the power of self-interest and wishful thinking.

"We will not have any more crashes in our time."

- John Maynard Keynes in 1927

"I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future."

- E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"There will be no interruption of our permanent prosperity."

- Myron E. Forbes, President, Pierce Arrow Motor Car Co., January 12, 1928

"No Congress of the United States ever assembled, on surveying the state of the Union, has met with a more pleasing prospect than that which appears at the present time. In the domestic field there is tranquility and contentment...and the highest record of years of prosperity. In the foreign field there is peace, the goodwill which comes from mutual understanding."

- Calvin Coolidge December 4, 1928

"There may be a recession in stock prices, but not anything in the nature of a crash."

- Irving Fisher, leading U.S. economist , New York Times, Sept. 5, 1929

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."

- Irving Fisher, Ph.D. in economics, Oct. 17, 1929

"This crash is not going to have much effect on business."

- Arthur Reynolds, Chairman of Continental Illinois Bank of Chicago, October 24, 1929

"There will be no repetition of the break of yesterday... I have no fear of another comparable decline."

- Arthur W. Loasby (President of the Equitable Trust Company), quoted in NYT, Friday, October 25, 1929

"We feel that fundamentally Wall Street is sound, and that for people who can afford to pay for them outright, good stocks are cheap at these prices."

- Goodbody and Company market-letter quoted in The New York Times, Friday, October 25, 1929

"This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan... that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years."

- R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

"Buying of sound, seasoned issues now will not be regretted"

- E. A. Pearce market letter quoted in the New York Herald Tribune, October 30, 1929

"Some pretty intelligent people are now buying stocks... Unless we are to have a panic -- which no one seriously believes, stocks have hit bottom."

- R. W. McNeal, financial analyst in October 1929

"The decline is in paper values, not in tangible goods and services...America is now in the eighth year of prosperity as commercially defined. The former great periods of prosperity in America averaged eleven years. On this basis we now have three more years to go before the tailspin."

- Stuart Chase (American economist and author), NY Herald Tribune, November 1, 1929

"Hysteria has now disappeared from Wall Street."

- The Times of London, November 2, 1929

"The Wall Street crash doesn't mean that there will be any general or serious business depression... For six years American business has been diverting a substantial part of its attention, its energies and its resources on the speculative game... Now that irrelevant, alien and hazardous adventure is over. Business has come home again, back to its job, providentially unscathed, sound in wind and limb, financially stronger than ever before."

- Business Week, November 2, 1929

"...despite its severity, we believe that the slump in stock prices will prove an intermediate movement and not the precursor of a business depression such as would entail prolonged further liquidation..."

- Harvard Economic Society (HES), November 2, 1929

"... a serious depression seems improbable; [we expect] recovery of business next spring, with further improvement in the fall."

- HES, November 10, 1929

"The end of the decline of the Stock Market will probably not be long, only a few more days at most."

- Irving Fisher, Professor of Economics at Yale University, November 14, 1929

"In most of the cities and towns of this country, this Wall Street panic will have no effect."

- Paul Block (President of the Block newspaper chain), editorial, November 15, 1929

"Financial storm definitely passed."

- Bernard Baruch, cablegram to Winston Churchill, November 15, 1929

"I see nothing in the present situation that is either menacing or warrants pessimism... I have every confidence that there will be a revival of activity in the spring, and that during this coming year the country will make steady progress."

- Andrew W. Mellon, U.S. Secretary of the Treasury December 31, 1929

"I am convinced that through these measures we have reestablished confidence."

- Herbert Hoover, December 1929

"[1930 will be] a splendid employment year."

- U.S. Dept. of Labor, New Year's Forecast, December 1929

"For the immediate future, at least, the outlook (stocks) is bright."

- Irving Fisher, Ph.D. in Economics, in early 1930

"...there are indications that the severest phase of the recession is over..."

- Harvard Economic Society (HES) Jan 18, 1930

"There is nothing in the situation to be disturbed about."

- Secretary of the Treasury Andrew Mellon, Feb 1930

"The spring of 1930 marks the end of a period of grave concern...American business is steadily coming back to a normal level of prosperity."