Predicting the Past: The Hubbert Linearization

Posted by Robert Rapier on March 12, 2007 - 12:21pm

Part I- Texas Myths

Like Cindy Crawford, I have done quite a bit of modeling in my career. However, mine has been in front of a computer. There are various types of models. They can be empirical, such that you curve fit data without having a clear explanation of the underlying mechanisms. Or they can be theoretical, in which the system is modeled according to the governing scientific principles and mathematical equations.

However, one thing is critical to keep in mind. If you are going to use the model for forecasting, the model must be tested. Testing the model is called “validation”, or sometimes “back-casting.” This involves feeding the model real data, and observing how well the predictions match up with the observations. If the predictions match up on a consistent basis, and any large variations are explainable, you have the makings of a predictive model. If you have not validated your model, or if you have attempted to validate it and found that the predictions were inconsistent, the model should be used with caution (if at all). In this essay I have done some back-casts on the Hubbert Linearization (HL) model and attempted to use it to make predictions using historical data.

Qt and Peak Production

I am unaware of a case in which a country has completely run out of recoverable oil and had Qt verified by the HL method. However, there are plenty of examples in which a region’s production profile follows the expected path determined by the HL. There are also many examples showing that a region’s production peaked at very close to 50% of Qt. Quoting from an article by Jeffrey Brown and Khebab:

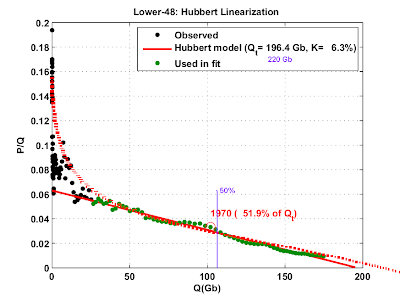

With time, a HL data set starts to show a linear progression, and one can extrapolate the data down to where P is effectively zero, which gives one Qt, or ultimate recoverable reserves for the region. Based on the assumption that production tends to peak at about 50% of Qt, one can generate a predicted production profile for the region. The Lower 48 peaked at 48.5% of Qt.

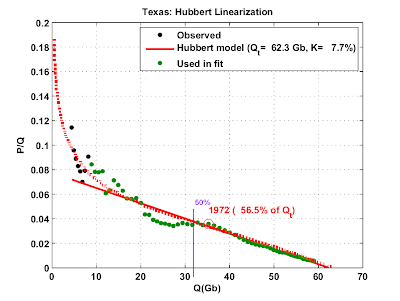

Some areas have tended to peak at a higher % Qt than others. It is commonly claimed that Texas production, for example, peaked in 1972 at 57% of Qt (the reason for the qualifier will become apparent later in the essay). The fact that Texas peaked later than most regions is sometimes explained by the fact that prior to 1972 Texas was the swing producer, and production was regulated. This situation is similar to that of Saudi Arabia, so Texas is often used as an analog for predicting Saudi Arabia’s peak.

So far, so good. But the astute reader may wonder “Can the value of Qt change significantly over time?” If the answer is “yes”, then the inevitable follow-up is “Then how can I be confident in using the HL to predict a peak?” I will attempt to answer these key questions by looking at the evolution of the HL for Texas over time.

Evolution of the Texas HL

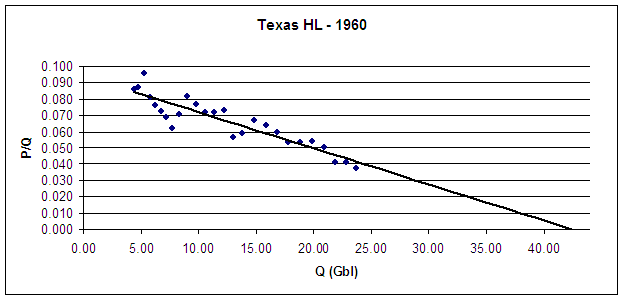

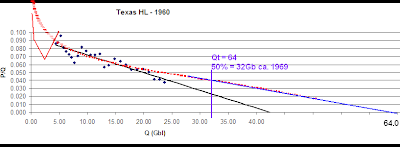

I have retrieved historical Texas oil production records and modeled a series of HLs at various time periods. According to a 1956 Hubbert paper, (1) Texas had extracted approximately 4 billion barrels of oil prior to 1935. Beginning in 1935, we have annual production statistics that take us through the end of 2006. (2) Therefore, we can construct a series of HL curves. To avoid any bias on my part, I had Excel extrapolate the line and make the forecast once there was a relatively smooth trend. Let’s take a snapshot from 1960:

Figure 1. Hubbert Linearization of Texas Oil Production Using Data Available in 1960.

As you can see, we have a nice trend. In fact, the latest 10 points are reminiscent of today’s HL of Saudi Arabia. The points have settled down and are staying pretty close to the line. So, what could we say in 1960? Qt as determined in 1960 from the intercept above is 42.5 billion barrels (Gbl). Texas crossed 50% of Qt in 1957, and by 1960 was at 56% of Qt – almost the same value as today. Surely peak was imminent. In fact, if you look at the data, Texas clearly peaked in 1956 at 1.079 MM bbl/day. By 1960, Texas was down to 892,000 bbl/day. It had undergone an annual decline of 5.5% for 4 years, and was well past 50% of Qt.

In 1960, we could have said “Texas oil production peaked in 1956, as predicted by the HL method.” But as we know, that’s not at all what happened. That would have been forecasting the peak 16 years too early. So let’s fast-forward to 1970:

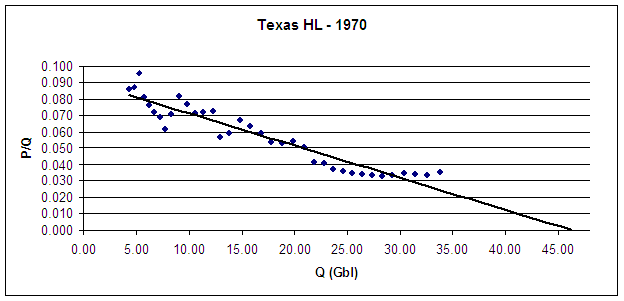

Figure 2. Hubbert Linearization of Texas Oil Production Using Data Available in 1970.

Well, that’s not very helpful. Our Texas HL in 1970 is much more muddled than in 1960. The 1956 record was broken in 1968 – twelve years after the 1960 analysis indicated a peak. We are starting to see some points rise above the line and extend Qt out further than was implied in 1960. The trend line that Excel drew is now forecasting 46.25 Gbl as our URR. That puts production in 1970 at 73% of Qt. The last 14 years had been spent well above 50% of Qt. But, the last 4 points – starting in 1967 – seem to indicate that Qt may end up being even further out than we thought. Now remember, it’s 1970. What exactly about this curve would indicate that we are 2 years from peaking?

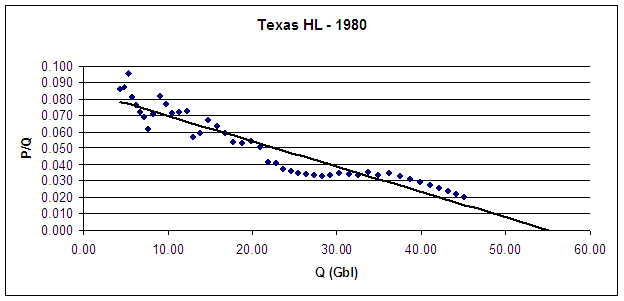

Let’s jump forward now to 1980:

Figure 3. Hubbert Linearization of Texas Oil Production Using Data Available in 1980.

Qt continues to grow. Excel is now forecasting Qt at 55.5 Gbl. The trend toward a higher URR is evident. The last few points imply that the forecast will grow to 57 Gbl. If so, our 1980 HL would put Texas’ 1972 peak at 63% of Qt. So, not only do we see Qt growing with time, we see that the % of Qt when the 1972 peak occurred is getting smaller. So, can we forecast the 1972 peak by 1980? No. We have already seen a case where the 1956 production record wasn’t broken for 12 years. The % Qt during that time was well over 50%. The % Qt in 1970 had climbed to 73%. Yet that still didn’t enable us to call peak. On what basis could we have done so in 1980? We have now gone through 24 years in which we could say “peak might be here.” To suggest that we could have made any other forecast at that time is wishful thinking.

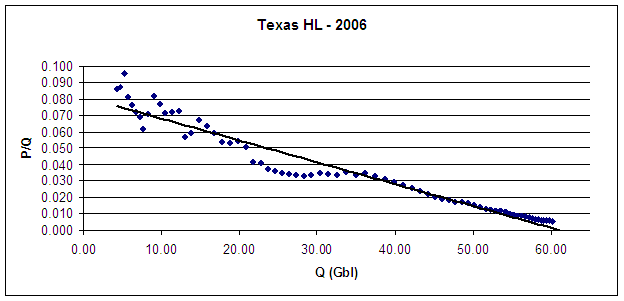

So let’s skip to present day – end of 2006:

Figure 4. Hubbert Linearization of Texas Oil Production Using Data Available in 2006.

Qt is now at 62 Gbl, but look at those last few points. They are once again pointing to a higher Qt. Some time in the 1980’s, as production continued to fall, we could have finally said “1972 was the peak.” But the % of Qt for the 1972 peak is still a moving target. Today, the 1972 peak clocks in at 58.3% of Qt – not far from the value in 1960. In 1980 it was 63% of Qt, and in 1970 it was 73% of Qt. Therefore, the claim of “no examples of large producing regions showing sustained, steady increases in production past the 60% of Qt mark” is clearly wrong. Texas showed steady production increases past the 60% mark of Qt, because it reached that level in the early 1960’s. Texas even showed production increases past 70% Qt, as it reached 73% two years prior to the production peak.

Implications for Saudi

So, is Saudi like Texas in 1956, or is Saudi like Texas in 1972? Or is it like neither? The HL can’t tell us that. This essay should make clear that confidently predicting a Saudi peak on the basis of the Texas HL is nothing more than an exercise in faith-based forecasting. The only reason that the Texas HL looks as it does is because we have decades of data points following the Texas peak. But what is missed is that the HL has changed greatly from the time Texas actually peaked. So the Texas HL at its peak looked nothing like the Saudi HL of today.

It is invalid to use three decades of hindsight for refining the Texas forecast, because we clearly don't have the same option with Saudi Arabia. Yet some argue that the Saudi peak can be forecast with confidence using the knowledge obtained from the case of Texas – a region in which the uncertainty of the method spanned almost 3 decades.

So, the HL has shown that it is good at forecasting the past, but can be very unreliable for predicting the future. In Part II, we will examine the evolution of the Saudi HL over time.

Note

For those who may be unfamiliar with my position, this argument in no way diminishes my belief that we need to take action right now concerning oil depletion. I am merely evaluating one of the tools that is used to forecast peak, and trying to determine whether that tool can give us any precision on forecasting a peak in Saudi Arabia. My conclusion is that it can’t, but we will look at the specific case of Saudi Arabia in Part II.

References

1. Hubbert, M. King. Nuclear Energy and the Fossil Fuels. Paper presented at an American Petroleum Institute meeting in San Antonio, Texas. March 7-9, 1956 p. 10.

2. Oil Production and Well Counts in Texas 1935-2005, Railroad Commission of Texas, Accessed March 2007 at http://www.rrc.state.tx.us/divisions/og/statistics/production/ogisopwc.html

Insofar as I know, I have never argued that the pre-peak Texas HL plot was stable, or that one could have accurately predicted the Texas peak, using the pre-peak data.

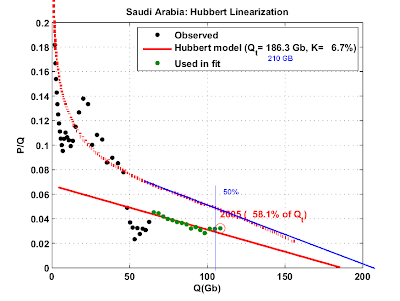

I have argued that we can--in retrospect--determine at what stage of depletion that Texas peaked. I have also argued that the Saudi HL plot is much more stable than the pre-peak Texas HL plot. The small change in deflection in recent Saudi data was also seen right before the Texas peak.

Hubbert, using some mathematical methods (estimating the area under a production rate versus time graph, which is what HL does), stated, in 1956 that the Lower 48--inclusive of Texas--would peak in 1966 if URR was 150 Gb and in 1971 if URR was 200 Gb. A one third increase in URR only delayed the estimated peak by five years.

The post-1970 cumulative Lower 48 production (again inclusive of Texas) through 2004, using only the production data through 1970 to generate the model, was 99% of what the HL model predicted it would be.

This is the method that can't be used to predict the Saudi decline, even as production is declining as predicted?

http://www.energybulletin.net/16459.html

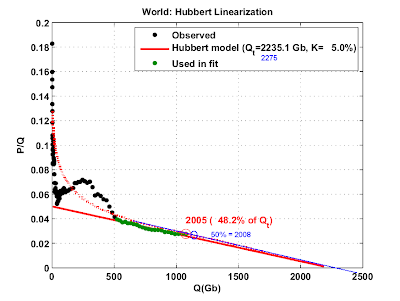

Judge for yourself how stable the following HL plots look (all done by Khebab, all on the same vertical scale):

Khebab's HL plots:

Texas:

http://static.flickr.com/44/145149303_e59bbf9890_o.png

Saudi Arabia:

http://static.flickr.com/52/145149302_924470eaa7_o.png

Lower 48:

http://static.flickr.com/45/145149304_a4a72211e6_o.png

World (C+C+ NGL):

http://static.flickr.com/54/145149301_b930ef7bc4_o.png

(GreenMan tiptoes through a minefield in attempting to comment)

If I am understanding your point, you are saying that a stable HL plot is necessary before it has predictive ability?

The Texas HL, as analysed by Robert, did not have predictive ability until well after peak, at which point the HL plot stabilized, and can be used to predict future production and Qt?

Do we have a mathmatical definition of the requisite "stability"? Could we give some metric of "stability quality" to a particular data set as a way of expressing confidence in its predictive ability?

Of the four plots you offered, Texas, KSA, Lower 48, and World, the Texas HL was unstable prior to actual peak, the other three seem to be stable, but the peak of KSA and World are debatable, in fact, the primary topic of debate. That leaves only one data point, Lower 48?

Robert ended his essay saying his next target would be HL plots of KSA. Perhaps we need a similar analysis of Lower 48, since that now seems to be the sole case in which we had both stability prior to peak and clear (in hindsight) peak?

I suppose we could throw the North Sea in there, as well, though you did not mention it in your list. I think we are all comfortable saying that the North Sea is past its peak. Did its HL plot prior to peaking exibit stability? How far in advance?

Is there a suitable data set for Prudhoe Bay? Or is that folded into the data for the rest of the US? Or can it be obtained by subtracting Lower 48 from total?

Is instability in an HL plot solely a factor of having been a swing producer, or are there other factors? For example, could we hope to do a predictive HL analysis on Iraq given its history of war and sanctions?

I guess the point of this is trying to answer the question "for a given data set, how confident can we be in the predictions it makes", and can we come up with a definite mathmatical expression of that confidence?

Do we have a mathmatical definition of the requisite "stability"? Could we give some metric of "stability quality" to a particular data set as a way of expressing confidence in its predictive ability?

Exactly the right question to ask. I think Stuart is looking at this. We have been discussing this essay some via e-mail, and I sent him my Texas data set so he could look into it.

I guess the point of this is trying to answer the question "for a given data set, how confident can we be in the predictions it makes", and can we come up with a definite mathmatical expression of that confidence?

Bingo! Give that man a cookie!

Could you come up with a non-linear, asymptotic formula that would fit better with the observed increase in URR toward the end of the cycle? It's been many years since I saw the inside of a math classroom, so it's just a thought.

It never gets much consideration IMO is the impact of technology. I fully understand the law of diminishing returns but some of the most productive improvements had to come into play at some point.

I don't understand how this would not add both to peak production and URR as what ever the (____)became widely accepted. The increase in production should generate somewhat of a addition to the curve.

I'll venture into hand slapping territory and speak on DelusionaL's point.

If there is a impact of new technology on the HL result for Texas, wouldn't this impact come into play earlier on a Saudi HL and result in an increased stability of the curve compared to the Texas HL? Am I correct in thinking that Saudi oil came 'that much' later in the game?

A kid with a question should also show up with a toy in hand, so hope this at least is new:

http://www.energyandcapital.com/consumption.php

Very cool! Thanks.

Stuart has done some work on stability analysis, but as you can see from the four plots, it's not hard to find the HL plot that was pretty noisy prior to its peak (and again, all four regions are--at present time--showing overall declining crude oil production). So, I wonder why Robert focused on that one plot--especially when Hubbert accurately predicted the approximate time frame for the Lower 48, inclusive of Texas?

The North Sea (EIA, C+C), on my HL plot, started showing a rock solid linear progression in 1988, until it peaked in 1999 (between 48% and 52% of Qt, just like the Lower 48), and production has precisely followed the predicted downward trend. Note that this was empirical. I did not predict a North Sea peak (although Matt Simmons did, using his own data).

According to Matt Simmons, the top oil companies working the North Sea--using the best data and personnel available--were predicting that the North Sea would not peak until after 2009.

All of the following regions have shown peak or plateaus, (with stable HL plots prior to the 50% mark) in close proximity to their respective 50% of Qt marks: Lower 48; Russia; North Sea; Mexico and now, the world.

Remember Khebab's prediction that Mexico would peak in 2006?

The two post-peak cumulative models we did were quite supportive of the method. The post-50% of Qt cumulative Lower 48 production through 2004 was 99% of what the HL model predicted (using only data through the 50% mark) and the post-50% of Qt cumulative Russian production through 2004 was 95% of what the HL model predicted (using only data through the 50% mark).

If our period of stability started in 1988, how much later was that stability evident? Are two years of stable data enough to establish stability? Three? How much is enough to say "we have stable data, now let's make some solid predictions"?

Perhaps another way of asking the same question might be "in what year, using only the data available up to that year, would we have been able to correctly call the peak?", with subsequent production data falling substantially onto the predicted curve.

The North Sea is a nice case to consider since, as far as I know, there were no above ground factors in its development.

As I noted in a separate post to robert, I see mexico as a better example for sa than texas. In addition to what I said there that, to me, shows sa/mexico to be more like each other than texas:

high tech simultaneous secondary and primary production

ultimate resort to high tech horizontals

each country has an old super giant field that dominates, rapid loss of which results in unavoidable peak

there is a further point, also different from texas, that is both are gov run and are, compared with what would have been done had they been exploited by private companies, starved of investment.

For all of these reasons, comparing the HL plots of sa/mexico may be informative. Can you resurrect and post the two?

And, I have a separate question; does the data suggest that the 'dog leg' up following a stable regime is predictive, not of higher Qt but, rather, that peak is nigh?

Thanks

We saw small deflections in the Texas and Lower 48 plots, right before the they peaked, much like the small deflections in the Saudi and world plots, right before they (IMO) peaked.

WT do you have the OIP numbers for Texas and can you give me

the % recovery factors based on the HL analysis ?

Thats the plot we need.

Mike, the problem with using recovery factors based on Texas is that we gutted many of our early-discovered giant fields with overproduction.

Secondary and tertiary production and Maximum Efficient Rate (of recovery) were all invented by my homies in the oil patch around here. As a consequence the is a recovery factor of the oil in place of about 1/3rd, while the mid-east and North Sea are getting about 50% of the original oil in place.

The Bureau of Economic Geology at the University of Texas should have the exzact figures you are looking for.

Right I forgot about this. We really damaged our fields early on. In a sense its a blessing since fixing the damage is probably what keep us going. I don't think Texas by itself is all that useful as a model past a certain point because of this.

For all of these reasons, comparing the HL plots of sa/mexico may be informative. Can you resurrect and post the two?

And, I have a separate question; does the data suggest that the 'dog leg' up following a stable regime is predictive, not of higher Qt but, rather, that peak is nigh?

Mexico did the dogleg up in 1995 resulting in a new stable regime with a Qt roughly twice what the previous data was pointing to, see my post from two month's ago:

http://www.theoildrum.com/node/2149#comment-144998

Thanks for the link. SO, mexico's HL is not a good predictor for sa, or at least not if sa has peaked.

Mexico, sa, kuwait, maybe china remain special cases with a super giant that dominates overall production; for each of these, the question is, when will the super giant go down? HL is probably silent on this issue. Ghawar and cantarell were produced with the latest high tech, meaning that the decline, when it comes, will dominate production and almost certainly signal that peak is here. We know about cantarell and mexico, daqing and china, burghan and, probably, kuwait. Ghawar remains veiled because of sa stonewalling, but precipitous decline would neatly explain sa production profile over the past year.

The early HL plot for Mexico showed a P/Q intercept of about 13%. While it is not impossible, 13% is unlikely.

Compare it to the P/Q intercepts on the four HL plots I have shown above.

Yet another example of a region: (1) Declining and (2) As predicted (by Khebab in this case).

Let's see, what's the score so far?

Notice a developing trend here?

Notice the escalating attacks as the reality of a near term peak becomes more apparent?

Notice the escalating attacks as the reality of a near term peak becomes more apparent?

You are taking this far too personally. I am not attacking you. I am pointing out that in the case of Texas - which you have indicated is reflective of Saudi - the HL performed very poorly at the time of peak. So, I am pointing out that we can't then have much confidence in using the HL to predict Saudi's peak. In turn you have resorted to "Who's right!" Come on.

You would have been right had you predicted Texas peak in 1956. You would have been right for 12 years. But you would have ultimately been wrong because you used a tool that is not very reliable for what you are trying to use it for.

On the other hand I think Stuart's work was very interesting, and this is by no means an answer to his posts. I still don't think the world has peaked, but the HL gives me absolutely no useful information one way or the other. The kind of analysis Stuart did gave me more to think about though.

So, one of us predicts the peak, and he is so far right, but you criticize the work, even as the Lower 48, Saudi Arabia, Mexico and the world are declining as predicted, based on Hubbert/HL models, and as the North Sea is following the HL model.

The other one observes that Saudi Arabia has peaked, and his work is more valid?

(BTW, Stuart posted an article last year, to the effect that we were probably at or past world crude oil production).

Somehow, I get the feeling that you are getting ready for the following admission:

"Saudi Arabia has probably peaked, but by God, Jeffrey's methodology was wrong."

Cut to new Titanic Scene:

Jeffery the problem is everyone that has confidence in HL has paired it with other data to develop that confidence and its not just QT.

In the case of KSA its the fact that

1.) HL is showing a peak about now.

2.) They are out of easy oil look at how they are drilling now and what they are producing.

3.) Ghawar has a rising water cut and is in decline.

They peaked.

You only need HL plus some other information and you can pick the right HL plot with almost 100% confidence.

I assert you need no more information.

WT

I'm just curious why the vehement tone in the responses to RR? It is possible to come up with the right answers using a wrong methodology. I keep reading the exchange between you and RR and I really don't get the impression that he thinks your answer is either right or wrong, but rather he has taken you to task about the path you took to arrive at your conclusion.

Ultimately you can argue that you are right in that dependence on fossil fuels needs to end ASAP, and the difference between now or 5 years from now or 50 years from now will in the grand scheme of things be a trivial detail.

Given the evidence I too think we are pass/at peak, but I understand from an academic point of view why models should be tested, analyzed and refined, and from what I read that is what RR appears to be doing.

You however seem fixated on being right, just for the sake of being right. Perhaps it is just a personal thing, but I like to be right including as to why I was right. And in RRs case I think he wants to be right down to the details in his methodology because he has the fear that crying wolf too early could cause resistance to a Peak Oil warning if this turns out to be a false Peak.

The media constantly bombards those "Peak Oil Nuts" as being whacks because from the beginning of oil there have been those claiming it will end tomorrow. Given the climate surrounding Oil and the competiveness surrounding this commodity today, this type of debtate takes on even more importance. RR has stated previously that his big fear is in crying Peak too early and giving ammunition to the opposing side which will in turn make it that much harder to convince people when the real peak will occur.

I can understand RRs hesitation and from a academic standpoint admire his humility and skeptism used in his efforts to forcast oil related events. RR has the mark of a true researcher, one who does not rest on his laurels claiming he has found the answer, instead he takes what he thinks is right, and subjects to even further scrutiny. Its an excercise I think is well worth doing, because if it turns out that this is a false peak, this community had best have moral fortitude and academic honesty to go back and admit they were wrong and review WHY they were wrong. During that process, it will mean that methodologies will need to be picked apart.

Amen

I totally agree - Robert's approach is IMO entirely correct, and he is to be highly commended in taking the line he has.

Beautifully put.

:)

That is funny....

Robert: "We sank in 2 hours, 23 minutes and twelve seconds and your math was wrong".

The early HL plot for Mexico showed a P/Q intercept of about 13%. While it is not impossible, 13% is unlikely.

Russia's HL also has a P/Q intercept over 10%. Its predicted Qt is also likely to be inaccurate.

Notice a developing trend here?

The trend I've been noticing is the tendency for HL to produce false alarms 10-15 years before peak.

Dream on while you still can.

As I stated before if production was with 5-10% of peak 10-15 years before peak its not a false alarm. Its a good prediction.

The fact that we feel 20 or more years at peak is a long time is simply applying how we feel about time to a process.

Put it this way a mountain say spends say 30% of its lifetime within 10% of its maximum height this could be millions of years. But I think mountain weathering and HL are closely correlated and behave the same way. Other factors have to be taken into account to do a better prediction of when a mountain will reach its peak these are the filters I speak of.

But its the same problem and you can see HL is not something you discard.

Its not a personal attack. Stay focused.

I guess what I am trying to express is the contribution of "above ground factors" to noise in the production data.

For example, was Prudhoe Bay production ever limited by the throughput of the Trans-Alaska Pipeline? For how many years? By how much? Would that have contributed to false predictions from the HL plot? Or is it small enough that we would get good predictions anyway?

Would we get better results if we simply discard data points during points which are strongly impacted by above ground factors, such as for Iranian production during the Iran-Iraq war?

While not a mathmatical process, it could be documented. "I started with data set A, removed data points B2, B7, B8 due to clear above ground factors, and did my HL on the remaining points. The data points C1 through C12 exhibited stability quality XYZ, and I have used them to make the following predictions". Something like that.

Well, let's consider the two most stable cases, with essentially no material restrictions on drilling or constraints on production (other than as noted below): the US Lower 48 and the North Sea.

Both regions peaked in close proximity to their respective 50% marks, after showing solid linear progressions on their HL plots.

Within the Lower 48, Texas produced at less than capacity, i.e., it was the swing producer. This was the basis for using Texas and the Lower 48 as a model for Saudi Arabia and the world. Not to belabor a point, but Saudi Arabia and the world are declining as predicted (EIA, C+C).

Because of political problems, there have of course been huge swings in production, e.g., the Iranian revolution and the collapse of the Soviet Union.

But again, consider the Lower 48 and North Sea--developed by private companies, vastly different producing regions--yet they are both following the predicted downward production curve after peaking in close proximity to the 50% of Qt mark.

So, absent political/technical problems, IMO, large producing regions tend to show linear HL patterns and to peak and then decline in proximity to the 50% of Qt mark.

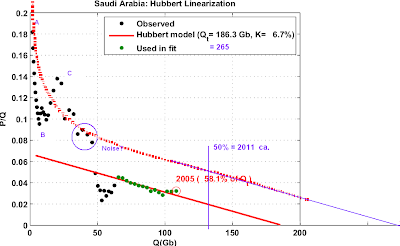

Westexas points at this HL for Saudi Arabia by Khebab:

Notice how the last 3 green dots are up a bit and are dragging the fitted line up. Suppose we had done this plot 3 years earlier, and didn't have those last 3 dots? Then the red line would have gone through just the other green dots, which are very close to a line. Looking at the chart, this would give a Qt of more like 150, compared to about 180 today. And that would mean that production as of 2002 would have been an even higher percent of Qt than what the chart shows in 2005! Probably over 60%. Especially coming after a couple of years of decreases, we would have had an even stronger case 3 years ago of saying that 2002 was the peak than we do today for 2005 or 2006, based on HL analysis.

So, even if true, we are talking about a 20% increase in URR?

Hubbert estimated that a one-third increase in URR only delayed the Lower 48 peak by five years. If the math is roughly the same for Saudi Arabia, we are talking about a difference of three years.

In any case, Saudi Arabia is declining as predicted.

This whole exercise is roughly akin to passengers arguing over how soon the Titanic will sink--even as water laps at their ankles.

In any case, Saudi Arabia is declining as predicted.

I think the whole point of this essay still eludes you. Texas declined as would have been predicted in 1956. It continued to do so for 12 years before breaking out to new highs. So, how can you tell where we are with respect to Texas production on the basis of the HL? You can't.

This whole exercise is roughly akin to passengers arguing over how soon the Titanic will sink--even as water laps at their ankles.

You keep saying that, but it isn't. I am still telling people to get on the lifeboats. I am just trying to figure out how much time we have to load the lifeboats. What I am trying to avoid is telling people we are going to sink in 2 hours if it's going to be 6 hours, because people might start jumping in 2 hours.

Robert,

---would have been predicted in 1956.

Did it get more predictive in 1969-70? WT has maintained that we are at/past peak at KSA then the question in my mind is how well did HL work at or near peak. Did it tell peak? IMHO this will tell us if we need to man the life boats so to speak. I will go back and reread your post looking for this.

I find it very difficult to believe that oil co.'s fly by the seat of thier pants, something isn't right here IMHO.

Hi Robert, Westexas,

I respect all your work.

I think you two miss each others point.

While RR may (probably is) correct that early HL predictions are inaccurate (20-30% off by the looks of it), Westexas' prediction is not *solely* based on HL, but also other observations which are difficult, if not impossible, to discount (as in Stuart recent analysis as well).

The predictive ability of HL will be lost on the MSM, reality will be the only fact they awake to. And debating CERA is a losing battle.

As RR stated earlier today, we may know soon if KSA can increase production, and, of course, if they can't the rhetoric will still continue...

I will gladly get into the lifeboat 6 hours before the ship sinks...I would like to have a seat and a life preserver, and maybe some rations(not many on a lifeboat). *Sorry a little humor*

I think I speak for many TOD'rs, we love and respect both your contributions, but it is hard to see either of you take the debate personally.

===================

It's all about population!

PS: Forgive me if you think I am out of line...as I am not really qualified even comment on both of your expertise.

Thanks, PTO, for expressing what I suspect many of us feel about these two articulate, smart gentlemen...but note I didn't throw in handsome.

I think I have seen on this board an updated graph of SA production trough 2006, and it showed the last point right on the red line..

Notice how the last 3 green dots are up a bit and are dragging the fitted line up. Suppose we had done this plot 3 years earlier, and didn't have those last 3 dots? Then the red line would have gone through just the other green dots, which are very close to a line. Looking at the chart, this would give a Qt of more like 150, compared to about 180 today.

You are stealing some of the thunder from my next essay on Saudi. :-) This anticipates where I am heading.

There is one thing that make me very worried about Khebab's HL plots. For Saudi Arabia only the last points are used and if the same thing is done with Texas between 20 - 40 Q(GB) you will end up with a much larger estimate. It seems like Saudia Arabia is overestimated.

Robert,

I appreciate what you are trying to say here, but it may (for the sake of balance) be worth emphasizing that it is equally invalid to use changes in the structure near the endpoint of a Hubbert Linearization plot to extrapolate to a large ultimate. For example, you could have taken the HL plot for 1970 as you did above, used the last 10 data points (1960-1970), and projected an ultimate that was for all purposes infinite. This would have been equally wrong as the under-projecting examples you have shown above. I have seen a number of instances where this has been done with the uptick in Saudi production in 2005 - as if that single datapoint somehow carries any information about the ultimate by itself.

The bottom line - prediction is difficult, especially about the future...

For example, you could have taken the HL plot for 1970 as you did above, used the last 10 data points (1960-1970), and projected an ultimate that was for all purposes infinite.

Yet Texas was two years from peaking. You are getting close to my point, which is: We don't know where on the HL Saudi actually is. The current stability of the Saudi HL in 2006 doesn't look much different than the 1960 Texas HL. In fact, the 1960 Texas HL was probably more stable than the 2006 Saudi HL. I can guarantee you just by looking that the r-squared of those last 15 Texas points in 1960 will be similar to the last 15 Saudi points - and the Qt is also very close.

I agree that with 30 years of hindsight, the Texas HL looks pretty stable. Has it been 30 years since Saudi peaked? When Texas peaked, it was over 70% of Qt. Saudi is less than 60% of Qt. All I have heard about for the past year is that we can use the Texas HL to tell us something about Saudi. Well, the Texas HL in 1972 looked nothing like the Saudi HL of today, did it? So, Saudi and Texas are apples and oranges.

You could have called a Texas peak wrong many times in the past by using the HL on Texas. You could have called it in 1956 and been correct for 12 years. So, in light of all of this, on what basis do we say that the HL can predict a Saudi peak? Claiming that it can is akin to a religious conviction in light of what I have shown here.

Last time I post this promise.

Oil in place estimates are fairly independent of production generally based on the reserve information gathered in the first few years of production. This information needs to be used to calculate a upper bound on reasonable URR.

This of course leads to a good reasonable guess on URR given our technology. Then we need to check HL stability with this upper bound included. I think that the second derivative of the production rate will give a minimum that agrees with OIP estimates plus the expected economic recovery factor.

Any data taken after this inflection point reflects advanced methods both increasing production rate causing increases in URR that may or may not be real. The point is that to reach that URR using these methods may mean production for hundreds of years this is not relevant. So another way to look at it is how many years at x production rate is required to reach the URR for a given field. As the production rate declines at a lower or even practically flat rate this increases to infinity.

Advanced recovery is financially feasible in America in the context of overall world oil production I just can't see these methods remaining important as the world moves away from peak.

Hello m,

I appreciate this point.

re: "Last time I post this promise."

Please keep posting this when it's relevant.

re: "...reserve information gathered in the first few years of production."

Is this known (sorry if you don't mind my asking)...in some cases? All cases? Known but not revealed?

re: "this inflection point".

Are you referring to: "a upper bound on reasonable URR"? (in your previous paragraph)

re: "So another way to look at it is how many years at x production rate is required to reach the URR for a given field."

Well-stated. Is it assumed in the models that X is fixed? (Again, if you don't mind the q - I'm learning.)

re: "As the production rate declines at a lower or even practically flat rate..."

Is this generally known (specifically) in advance? i.e. any way to know this in advance?

Reserve estimates are known from the beginning the quality is often low. Despite the slams HL has taken as far as I know it leads to better results then most of the official models.

Generally reserve estimates are revealed. In the case of OPEC the dubious nature of some of the reserve additions is cause for controversy. Also understand that a region like the US still has large reserves its just that the production rate has plummeted as the fields have aged.

The inflection point I'm talking about is caused by a field moving from primary/secondary extraction to more advanced stuff like steam extraction or simply being extracted with a 90% or higher water cut.

The good or cheap oil comes at a high production rate during the first phase of extraction you may still get a lot of oil from later methods but generally the production rate is low less than a tenth of what it was at peak. The only reason its a issue is it causes the URR to kick out since the rate of change in production flattens sending URR to infinity.

HL is unstable in this regime just as its unstable early in production. Point taken after enough fields are in final extraction mode probably should not be fitted using HL since it does not apply.

I assume your X is production rate and its not fixed but its declining generally in a linear fashion with a small slope.

The reason of course is their is a lot of oil still in the field and the depletion rate is close to zero.

HL is good for finding the URR of cheap oil not the final URR since the field production profile no longer fits the model.

Thanks, memmel,

re: "The inflection point I'm talking about is caused by a field moving from primary/secondary extraction to more advanced stuff like steam extraction or simply being extracted with a 90% or higher water cut."

Does this "inflection point" *necessarily* show up on a graph? Or, is it something that can be known only by knowing the history of the extraction methods employed on a particular field/(and/or region)?

(I.e., you are referring to something literal (about the physical means of production), then. (Yes?)

Does this necessarily show up in data if you do not have a source for knowing about it otherwise?)

The idea is its literal lets say a field goes to 90% water cut

and you are maxed out on water handling equipment then the rate of production is controlled by the rate you can manage the water not the amount of oil remaining.

For the most part. I think its easier to find out if a field is terminal and remove it from the HL analysis.

Note we have a lot of this in the US and thus the increasing URR its a bit bogus.

Hi memmel,

URReka! You've just turned on a light. There must be some repeatable process or behavior at work in order for HL to produce similar outcomes in different oil provinces. Is it below ground factors (geology) or above ground factors (people) or one driving the other? Here is a hypothesis:

The infrastructure put in place for an oil field closely correlates with the initial estimate of URR. URR(E) determines the size of the investment and thus the rate of extraction. This correlation will tend to produce similar production histories for different oil provinces and similar HL plots.

That is why HL works. Think about Prudoe Bay. What inputs set the size of the pipeline that carries the oil away? Somebody took the rate at which the fields could produce (acre feet, permeability) and URR(E) and came up with a flow rate which determined the pipe size. No one would put in a big pipe for a small field or visa versa. This stable relationship of geology driving investment size provides a [possible] explanation for the repeatability of HL plots. Colin Campbell has stated that BP's initial URR(E) for Prudoe Bay was spot on but they under reported at the start. Reserves rose as more was moved into proved as per SEC rules.

Above ground factors (demand) drives the rate of investment but URR(E) drives the total investment.

I hope Robert and westexas find this a plausable theory.

Collect your Nobel prize at the exit, memmel.

Hi Alan,

I'm just reading now, and don't know if people are still on this today. Perhaps bring it up again?

Rates proportional to size of the discovery go into the Oil Shock model. This leads to a solution in terms of conventional first-order differential equations.

There is also a mathematical equivalence between the size of a discovery and the number of discoveries in a given year. Either way works because we are dealing with a linear superposition of data sets.

I agree that the Oil Shock Model covers this, WHT, but you have personally often wondered what drives the Hubbert model into showing the accuracy it has shown. I think this explanation fits. Would one way to test would be to find a field whose URR(E) was badly underestimated and see how such a field played out over time? (Assuming we can find such a field?)

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I think Khebab's idea of Loglets also covers a superposition of data sets.

Yes, it will drive me insane trying to figure out why the Logistic model works as well as it does.

Unfortunately I can't answer your hypothetical question until I can get just a bit more insight into your premise.

Your model directly incorporates information about discovery. But even if the model fails to incorporate that information, it still exists and it governs the production rate of a given field. Assume I have a field that can produce 20,000 barrels per day but I err in my estimate of URR and therefore build infrastructure to produce 5,000 barrels per day. It does not matter one bit that the field is actually capable of producing 20,000 barrels per day because I am not going to be able to handle more than 5,000 barrels per day of production. So, even though this does not appear in the logistic model directly, it is still constraining that model in some manner.

We also know that in order to minimize both legal and economic risks, newly discovered fields are often reported as well below what they ultimately turn out to produce and are developed against this lower boundary rather than the upper. Again, while not explicitly stated, this constraint ends up impacting the production curve when you look back historically at that field. Again, the shock model directly accounts for this but the logistic model must account for this as well, even if implicitly.

I feel like I am groping around the edge of something here with regards to the logistic and can't quite fully put my hands on it but the above is my initial attempt to express these thoughts.

Would not the slope of the line in the Hubbert linearization be directly related to the initial assumptions that govern infrastructure building that then controls production flows?

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

This one is a cinch. Since the oil shock model uses a kind of Poisson (i.e Exponential) distribution of rates, I can easily adopt a lower rate field (say 5000) in the model. As long as some are low and some are high, I have a standard deviation equal to the mean which accomodates a large variance.

Thanks for the endorsement:)

Actually I like your concept. If you applied it to KSA then it seems they are far more interested in investing in Water handling than moving oil these days.

I think what your saying about looking at infrastructure is important please bring it up again.

Peak oil can easily be seen from infrastructure investment also.

Your the one with the right idea.

"So, Saudi and Texas are apples and oranges."

Hardly apples and oranges, I suspect. The same laws of physics apply to both fields. If HL is a reflection of geophysical processes, then I suspect there is a reasonable basis of comparison.

Incidentally, just how stable/accurate does a given model have to be? Weather forecasters miss forecasts--sometimes big busts--but continue to use the same models the very next day. Note that these forecast can sometimes have huge ramifications economically, personally and politically. Say either from a surprise storm, or one that was forecast to hit and didn't, with major and costly evacuations undertaken. And, yet, the models continue to be used, because they’re the best ones available. Has someone proposed a better model for forecasting future oil production rates?

You make some good points, RR, but I wonder at what point an insistence on perfection in modeling gets to an unrealistic, and unreasonable, level?

-best,

Wolf

You make some good points, RR, but I wonder at what point an insistence on perfection in modeling gets to an unrealistic, and unreasonable, level?

Perfection? They aren't even close. When Texas peaked, the HL looked nothing like today's Saudi HL. Yet we have been told again and again to look to Texas as a model for Saudi. So what is Texas supposed to tell me about Saudi, given that the HL in 1960 looked more like today's Saudi HL, and that Texas peaked at over 70% of HL, compared to 58% for today's Saudi? THAT is the point.

I suspect that Texas production provides an idea about KSA's production in the same manner that a hurricane striking Miami in 1926 might inform about the consequences of a hurricane striking New Orleans in 2005. One can find differences in the specific details of the outcomes due to different geography, specific structural details of the storm, year of impact, etc., but in both cases, disaster resulted.

I wouldn't discount the Texas production profiles entirely in terms of estimating an outcome for KSA. Though I do understand what seems to me to be the core concern: timing. Right? This is still largely a debate about when world peak oil production will occur (if it hasn't already)? That usually seems to be the trick, doesn't it? In a forecast, "what will happen" is often the more accurate part--"when it will happen" is often more prone to error.

So... If HL doesn't seem good for the timing part of PO, then what other model might have a better track record for timing? Surely there are other methods out there?

-best,

Wolf

Has someone proposed a better model for forecasting future oil production rates?

Oh of course we have better models. My problem with the Logistic model is that it does not follow from any known physical process or first principles. It is simply a compact rate representation that produces an analytical result. Check out the Oil Shock model if you want to follow something from first principles; it doesn't disagree significantly with any of the HL numbers (BTW, I like your analogy to weather forecasting), but it gives the satisfaction that you can actually understand what is going on!

You can't get that fundamental understanding with the Logistic model because it never has made any sense apart from some empirical fit (like Rapier mentioned at the top of his post). This leads to a never-ending struggle to second-guess or doubt the feasibility of the approach. In my experience tracking physical phenomenen, I can't think of a worse (better?) example of a poorly understood heuristic than the Logistic model as applied to oil depletion (i.e. it actually makes a lot more sense when applied to biological population dynamics). Somebody on the Drum actually mentioned 1/f noise as another example of a poorly understood empirical observation, yet that one scientists can actually make sense out of from fundamental principles, and it actually accurately represents the observations. Alas, the Logistic curve may do neither apart from some coincidental equivalence.

Robert,

The Lower 48, inclusive of Texas, peaked within the time frame that Hubbert predicted.

Do you deny this?

What I have stated is that Saudi Arabia, in 2005, was at the same stage of depletion at which Texas peaked. I have further stated that the Saudi HL plot is much more stable than the Texas plot. You are therefore correct that the pre-peak Texas plot is noisier than the pre-peak Saudi plot.

Congratulations. You have gone to enormous effort to reinforce what I have long admitted to. Now, why don't you do this same analysis on the Lower 48 and the North Sea?

The Lower 48, inclusive of Texas, peaked within the time frame that Hubbert predicted.

Do you deny this?

Well, Khebab suggested lower down that he merely got lucky. But what I have addressed in this essay is the case of Saudi and Texas. Recall that you have told us again and again to look to Texas as an analog of Saudi. What I found when I modeled Texas through its peak is that it looked nothing like the HL of Saudi today. It has nothing to do with being noisy. In fact, the Texas HL in 1960 wasn't very noisy. The r-squared looks good. The %Qt is favorable to today's Saudi HL. So, by what objective criteria can I say that Saudi today is not like Texas in 1960? There are none.

You have gone to enormous effort to reinforce what I have long admitted to. Now, why don't you do this same analysis on the Lower 48 and the North Sea?

Not as much as you might think. I wrote this in about 3 hours on a rainy Aberdeen afternoon. Saudi is up next, and then if I think it is worth the effort I might tackle the others. But I am not sure that the North Sea with its double peak is going to be a good case.

But I am not sure that the North Sea with its double peak is going to be a good case.

That is an argument you must let RR put forward against you, WT..

And the think is, maybe the SA is not as depleted as it seems, this is the message RR is trying to spread.

But we must recognize that SA is much more dependent on one field than Texas, and after half a century operating, it wouldn't be susprising if it enters now the down slope..

Does somebody know when the East Texas field started to produce?

But I am not sure that the North Sea with its double peak is going to be a good case.

Double peak caused by a double peak in oil discoveries several years earlier. Apart from the fundamental problems with an immaculate-conception-based Logistic model, deterministic factors win out over stochastic considerations in the case of the North Sea.

As a MAJOR novice in all of this geologic modeling, it appears to me that the accuracy of the HL model varies depending on your goal. If you are trying to discern the peak of production, it seems to work fairly well. But if you are trying to determine the URR, it may not be as predictive. Am I understanding this correctly?

Cheryl

If you are trying to discern the peak of production, it seems to work fairly well. But if you are trying to determine the URR, it may not be as predictive. Am I understanding this correctly?

Not exactly. Here is the key point. When predicting, how do you determine the %Qt that defines peak? That's the thing. We have hindsight to guide us, but the point of this essay shows that leading up to and even years after peak the graph is changing so much you can't get a handle on things. Does a region peak at 50% Qt? 70% Qt? How can you tell? The difference can be 30 years.

Also, the moving URR affects the %Qt, which is the same as %URR. So if URR is changing - and it does - then %Qt evolves over time.

Okay, gotcha. That makes sense. Thanks!

But I do have one more question, and it may be too complicated to answer in a comment or may have already been answered elsewhere.

When an oilfield is discovered, how do they come up with their initial estimates of URR? I'm thinking of "Jack" right now. It seems that estimates are made on very limited data. Or am I confusing "probable" versus "proven" versus "URR" in that the first estimate is "probable" which becomes "proven" after some amount of production and that eventually leads to "URR"?

All that Hubbert Linearization does is fit the second derivative around the peak, i.e. the perfection of an inverted parabola around a maximum. The URR equivalence is secondary and it relates only to the choice of the underling Logistic model. If that model is wrong then all bets are off in making sense out of the URR and the halfway point for peak.

So as Rapier is showing, as the "perfection" of the inverted parabola starts disintegrating, due to an undulating plateau (for instance) the HL starts creaping right in time, making a mess of the Logistic-derived URR.

Face it that all the properties of peak=1/2 URR, etc. have to do with the selection of the Logistic model.

So to your question, a better model is to use a priori estimates of URR, in the form of discovery estimates (as for "Jack"), and then use something like the Oil Shock model to estimate the stochastic temporal dynamics as an aggregate of a set of discoveries plays out.

Thanks, that makes sense, although hopefully I'll never foolishly try to explain it to anyone...but that's what you guys do so well.

I have no idea what you said... but it made sense... the question is.. can you make a graph to illustrate the difference between that and the HL method.

These "linearized" models clearly don't follow a linear trend.

But what's the point of plotting something like this that's not linear? You just end up compressing and contorting the data for no real reason.

Notice the concavity up front. This gets swept aside for various reasons, yet it invariably shows up in real data.

So the difference between the methods amounts to plotting the modelled production rates using discovery data as a forcing function.

I think we are saying the same thing in a sense.

I'm saying that HL needs external factors to in a sense pick the right one your model includes one of those factors.

The problem is more realistic models explode as you try to include more factors. Above ground factors for example swing producer status. Recovery factors etc etc.

And at the end of the day the models don't seem to beat HL.

Esp if you include these other factors as simple data filters for HL.

Another problem is that the more advanced models use more data and are prone to be optimistic i.e the err on the high side.

While HL strength seems to me to be its error is balanced in the sense it goes low as often as it over estimates and predictable within 5% of peak.

This means its good for both putting a upper and lower bound on the peak and URR. More extensive analysis either ad hoc or numerical is needed to make the final estimate or in the case of HL pick the most favored HL plot out of a large set.

This goes back to what I've said ten different way HL coupled with more information to pick the precise peak is a pretty good simple model and in my opinion gives results within the error range of the data itself.

Its a bit funny since I know HL would behave as Robert has presented. I missed the tail issue and increasing URR but I did not take this to mean the model is invalid over its entire range. HL is basically correct we just need better defined filter criteria. Needless to say I think the rush to ditch HL is a bit premature.

I had been working on this as you posted:

I'm not satisfied with the lower 48, but the others seem to fit imo.

Thats about what I thought would happen. The point is HL is not garbage its useful. In a sense it measures peak of easy oil.

I like it. Where do the dotted red lines come from?

Stole it from you and stretched it.

Don't have the time nor the equiptment to do it myself.

And probably not the right formulas. But had it on the back of an envelope (looked mostly the same) before I read your post!

Cheers, Dom

That's a nice trick. If you just have the graph, often you can use something like Photoshop or Paintshop and change the background to transparency to give a quick and dirty fit. Many of these equations obey affine transformations so it works out pretty well.

Hello there PeakPlus - ace charts with a somewhat familiar style. Would you care to add some narrative to the Saudi Arabian HL? It seems you are dividing the data between pre-1982 "unconstrained production" and post-1982 constrained production which is a smart approach, if so. You may want to consider the possibility that the pre-1982 data are also "constrained", i.e. Saudi only producing a handful of fields, and probably not pumping flat out.

On another subject - I sam your anotations to the iea production chart for Saudi - re the rising wedge and would agree this is as good an indicator as any for Saudi capability. If Saudi production breaks the lower support line it could be a sign of serious trouble.

ace charts with a somewhat familiar style.

Nice hack on my charts! :)

Thank Mr. Telescope! the curve's from him.

ps:

Trying to do a better one for Saudi Arabia.

Only have statistics back to 1960 though. Noticed that you have some (extrapolated?) pre-1960. Where they from? You got a table or something?

Cheers, Dom

Thanks Euan, very motivating to make me post again.

Got a day job, you know. And wife and kids for my "leisure" time.

re: "It seems you are dividing the data "

Exactly.

The question is, how early does a stress/HL work. Changed the chart to make the last four points "noise". My guess is that this is a bit optimistic, but why try fighting the charts? Besides, 2011 is not that far off:

Going back to Texas with the same question, the last three points being perhaps "noise" and also being what Hubbert saw ca. 1956 ...

I'm Eyeballing the whole thing, but I do that while putting up tiles in my bathroom as well.

re: "this is as good an indicator as any for Saudi capability."

No, it would only be a CONFIRMATION of what you think you already know.

re:"somewhat familiar style", are you referring to something I've missed or do you mean Hubble?

Cheers, Dom

Another problem is that the more advanced models use more data

But then Loglets use more data as well.

I kind of say ditch HL, but more as a way to get a fundamental understanding of production than anything else.

I have no problems with the more advanced models except that by introducing one factor say discovery and not say controlled production the model is biased. Once you go down that road you need to add all factors.

Other model although cool have to many tunable parameters.

And don't forget the noise issues.

What you need is a good model competition to find the simplest

model that can beat HL. With the noise in the data we don't need a complex model we need a simple one.

I suspect you could find a better equation I'm not sure it would have any more or less predictive power than HL.

HL seems to get the URR right within 5-10% thats pretty good

IMHO.

You make a good point that HL is not very accurate, and WT makes a good point that the 1970 texas HL behavour looks quite like what SA HL looks like now. Personally, I never leaned on HL, but attach more importance on SA cutting more, and earlier, than the opec agreement, combined with 3x rigs in 2 years.

So, you need more data to be convinced sa has peaked. Would the following bring you into the sa peak now camp, or would you still need more evidence?

SA production continues to decline, say 100k/d/month, resulting in around 7.6Mb/d end 07.

OECD stocks continue to decline, as forecast by eia, down another 80Mb end 07.

NYMEX price climbs past previous peak, say at least 80/b end 07.

It will be easy to convince me I'm wrong... don't need to see their promised 12.5Mb/d, 9.5Mb/d would be enough. However, I don't think stuart's straight line downward projection will extend much further, see ghawar going down 18%/y, balance at 6%, resulting in 7-8Mb/d 2008-2012, avg 7.6Mb/d, provided planned projects are on schedule and produce as hoped.

You make a good point that HL is not very accurate, and WT makes a good point that the 1970 texas HL behavour looks quite like what SA HL looks like now.

The 1960 HL of Texas is much closer to today's Saudi HL. Much closer.

As far as what would convince me, I outlined that in today's Drumbeat. I think we are about to find out.

IMO, Texas in 1960 is analogous to Saudi Arabia in 1990. While the data after 1960 are not great, they are much more stable than the data prior to 1960, and I would have shown a much steeper fit to the pre-1960 data than what you showed.

In any case, Texas--other than knowing at what stage of depletion that it peaked--is not the issue. Saudi Arabia is the issue.

Look at the post-1990 Saudi data. It's vastly more stable than the pre-1990 Saudi data. And I assume that you will agree that Saudi Arabia, after showing a solid linear progression since 1990, in 2005 was at about the same stage of depletion at which Texas peaked, thus the so far accurate model: http://static.flickr.com/55/145186318_27a012448e_o.png

Let me know when we see higher Saudi crude oil production (beyond the 9.55 mbpd that they averaged in 2005).

And I assume that you will agree that Saudi Arabia, after showing a solid linear progression since 1990, in 2005 was at about the same stage of depletion at which Texas peaked...

That's completely inaccurate, as I showed in the essay. Texas peaked in 1972 at over 70% Qt. It has retreated in the 35 years since to 58% Qt. Saudi today is at 58% of Qt. Had it been 35 years since the Saudi peak, then you would be correct. As it stands, if Saudi is peaking now it will have done so at a far lower %Qt than did Texas.

That's completely inaccurate, as I showed in the essay. Texas peaked in 1972 at over 70% Qt. It has retreated in the 35 years since to 58% Qt. Saudi today is at 58% of Qt. Had it been 35 years since the Saudi peak, then you would be correct. As it stands, if Saudi is peaking now it will have done so at a far lower %Qt than did Texas.

I think this nails it!!! Robert has convincingly shown that HL alone can't be used to reliably predict the peak. However I do believe that Saudi Arabia has peaked for several other reasons. They are declining at 8%/annum while the rig count has tripled and the price is high, their fields are very old, they cut two times their share of OPEC quota, they are unilaterally cutting shipments to Asian refineries, etc. etc.

I think this nails it!!! Robert has convincingly shown that HL alone can't be used to reliably predict the peak. However I do believe that Saudi Arabia has peaked for several other reasons.

While I don't think Saudi has peaked, what I have attempted to show in this essay is that the HL won't tell us either way.

I kept thinking about the old Superbowl/Stock Market predictor: If the NFC won, it was a good year for the stock market, and vice-versa. But in truth, this had no predictive value. If we really want to gauge the stock market, we look to factors other than who won the Superbowl.

I don't agree you did the right plots but not enough of them to see the trend. You need to do HL from 1960 to 1980 for every year and plot the URR estimates and peak estimates for these 20 years. You need 20 HL plots not 3.

Then I think you will see HL does a good job of bracketing the

real peak.

If anything the massive drilling campaign around the peak distorts the data making these years the worst to use.

This suggests that 1960-1969 and 1975-1980 are the stable regions.

The thesis behind HL is that if the field is in stable production i.e its been in production for a while and is developed at a stable rate and production is allowed close to a natural rate then you can predict URR.

In practice you need a good ten year span of stable production to get a URR estimate.

WIthout reading thru the drumbeat, it sound as if what I outlined would not be convincing to you.

Regarding HL, I can imagine SA as being particularly difficult because of the reliance on one field, ghawar. Even if we had good production data from this field, HL might not be reliable for a single field. WIthout ghawar sa is not more important than iran, not much more important than mexico. Regarding the latter, all agree that mexico is (just) past peak, and this country also has most production from one major field, cantarell, acknowledged to have peaked a year ago. So, comparing SA and Mexico HL plots might be interesting, particularly because mexico and sa have been using similar advanced techniques, such as combining primary with water flooding secondary, and ultimately resorting to horizontals, all absent in texas production prior to its peak.

Why might ghawar be peaking now? Well, imo resorting to horizontals announces that peak is not far off - there is no need to use such expensive wells if one still has a 1000-ft thick oil column available. Furthermore, the water flood used on this field sweeps oil towards the center, meaning that the producing area is constantly becoming smaller, accelerating rapidly towards the end. It is quite typical that when such production methods are used the decline, when it comes, is very rapid, say 15-20%/y.

WIthout reading thru the drumbeat, it sound as if what I outlined would not be convincing to you.

Now how could you know that without looking at the Drumbeat?

http://www.theoildrum.com/node/2360#comment-167865

Well, you did say such things would be convincing, but not at what point. Well, we'll just have to see. New reductions to asia are only coupled with 60 oil and 90Mb oecd stocks decline from last oct, so probably not yet. Maybe by fall.

Separately, I see reduced ng imports from canada, and have heard expectations for atlantic storms. Interesting...

Sounds like we need some error analysis. Can we at least place some upper/lower bounds on future production, QT, etc?

I swear someone else posted about the need for error analysis :)

A upper bound is possible via OIP estimates and a reasonable recovery factor. Advanced recovery may result in higher recovery factors but the EROI is poor and the whole world will at some point move to a EROI decline/maximum use pattern that is far more important than peak oil.

Only fission/fusion exhibit high long term EROI's with reasonable unlimited maximum production rates. Actually only fusion does fission just has a reasonably long depletion curve and high EROI. Wind/Solar etc all result in some sort of maximum thats the downside to sustainable energy its just that sustainable. And the EROI is lower than what we have today. Leading to society having to reinvest a significant amount of its production into the energy sector to break even.

How much is a issue I'm sure the EROIdrum will address in the future.

Hi m,

Second again. Thanks.

re: "A upper bound is possible via OIP estimates and a reasonable recovery factor."

Naive Q (asked above) - are these estimates always known? Known and not revealed? Or, what's the deal?

Yes they generally are known. In the case of OPEC they were inflated for political reasons.

My understanding I could be wrong on some of this.

Proven+Probable+Possible+Unrecoverable = OIP

Proven+Probable+Possible = URR

or more simply

OIP*recoveryFactor = URR.

The thing is the recovery factor changes and the break out of proven+probable+possible changes. Or in other words the OIP estimate can change in time. In general its pretty stable in fields that have been produced for a file since the nature of the field is well known.

Unrecoverable is a really big number generally on the order of 50% of OIP. Thus by playing games with the recovery factor and Possible you can easily double or triple your reserve estimates and its only a white lie. For some of the majors this can also result you drastically reducing your reserve estimates when caught. For KSA people seem to accept it.

In my opinion OIP is probably a pretty good number others with more knowledge can comment on this.

The important point is that only 50% of the Proved plus probable is going to be produced at high production rates pre and slightly post peak. So lets say on 25-30% of the oil extracted from a field is extracted during primary/secondary production the rest is extracted in a long tail.

We only care about this 25-30% of the oil thats extracted at reasonable rates. HL seems to be stable during most of this range giving a nice balanced prediction of URR and peak within 5%. Now I'm not saying you won't still be producing a lot of oil past peak most of the US is in this long twilight of production and we are still the third largest oil producer in the world. But that does not help us or the world maintain a ever expanding oil based economy.

Robert,

Very nice article. I am looking forward to Part II.

How does the HL analysis take into account the introduction of new technologies. If the earliest historical data is associated with mainly veritcal well and subsequent data is associated with newer technologies such as enhanced well placement, horizontal wells, multilateral or fish bone type completions, the production rates may be higher than the historical rates althought the ultimate recoverable has may not changed.

Suppose Saudi production may have started declining had wells continued to increase water cut and no horizontal drilling occured. By introducing horizontal drilling KSA avoids the water cut until later in life, when it may occur much more rapidly. Because of the new Technologies, We may see a production increase or stay the same leading to a conclusion that the ultimate recoverable may be larger than initially thought.

I don't know how the HL method would handle the technical influences that could be changing the dynamics.

How does the HL analysis take into account the introduction of new technologies.

That's part of the empirical part of the model. It could only deal with that when the technologies were observed as higher production. Over time that would skew the URR to a higher value, which would make the snapshot of a %Qt today that would shrink over time.

Heh. So your analogy with Texas would break down completely...

This, I think, is the seduction of the debate... The Saudi peak, when it comes, will be brutal. Ghawar will collapse at least as hard as Cantarell.

If Ghawar had indeed started its decline during the production push of 2006, then how would the Saudis have handled it? Would they have immediately announced it to the world?

... Or would they wait for high price to destroy demand, then cut production as fast as it could be replaced by other producers?

I know, you will reply "ah how convenient, demand declines just in time to cover the Saudi decline". But I find that answer rather facile. The point is, the Saudis haven't ever had to produce at such a rate before as they did in 2005/2006, and that would be a logical time for decline to set in.

But I agree, HL seems week as a predictive tool...

This is my complaint with the whole thing.

How can oil co.'s not know or at least have better data/prediction tools to choose from? They have to know where to drill, how to drill, and based on what?

If they know all of this then they should IMHO also make forcasts related to projected drilling rig availability, availability of crews, etc., etc.

First their is a reason for the terms wildcat and dryhole.

Drilling for oil is still a art.

Next your mixing in the decision to develop a field with its decline. And you mixing in field decline rates with something like HL generally better suited to producing regions since each field is unique.

In general they drill a few test wells have seismic info and lots of other studies most focused on the formation some giving density measures that relate to actually detecting the oil in the rock. This is to make the decision to develop the field. Once it comes online then production data and more information results in higher confidence in the actual reserves. I'd say their is still a fair amount of risk in the decision to develop a field.

This is my simple explanation from what I've read. We have some great tools for finding oil today and most of the earths major oil producing regions have been discovered and produced for many years so we have a lot of experience to use as a guide for new fields.

When a field will enter decline is still problematic I think

thus the heated discussion. I think a good estimate say within 5% of the peak production rate is easy to determine and HL by itself seems to be a good tool for this.

Memmel, Thank you very much for your reply. I get frustrated that this issue doesn't seem to end easily. Obviously drilling in known areas is safer, if I had to make that call I would probabaly do the same until the price got high enough that I could again justify the risk. God, I wish this was easier, and I bet they do too.

Robert one thing that needs to be addressed is technical advancements and economic factors to see how they effect your claims. The crash of the texas oil prices must have effected production during the 80's for example.

Finally you can use test data to drive the model a bit better make some assumptions that technology leads to higher extraction and thus increased URR etc.

I'd say that the problem is advances in technology result in a flattening of the production rate causing HL to over estimate URR as advanced recovery methods are employed.

Just as it not a good model when you don't have enough production data its also not a good model for URR when the fields are well past peak production if they are still produced using advanced methods.

You might want to look at California its still producing oil

and is a reasonably sized region or even Pennsylvania.

These regions span almost 100 years of production or more and are still producing we should see the same effects that your seeing and they can be attributed to newer technologies.

Next I'd like to see how the curve deviates from the theoretical on the downslope.

My thesis is the URR predicted by HL anaylsis using data say up to 60-70% QT based on known peak production is probably correct and deviations are caused by advanced methods that allow the oil production rate to stay higher than predicted by HL. The real URR is NOT increasing its just the production profile is deviating from the ideal.

Its common sense in a way to say that HL is inaccurate when their is not enough production data and that advanced methods can and do lead to higher extraction rates than HL would predict fore depleted fields. So if you assume that HL is inaccurate once what I would call heroic actions are taken to extract the oil that makes sense.

To take the case down to a single well a lot of wells in the US produce a few barrels of oil a day and have done this for decades a HL plot of one of these wells would go to infinity. So obviously we need a cutoff on the depletion side.

Whats not obvious is where you should stop using production rates.

The rate of change of production rate has a maxima at peak production and we should see some sort of minima post peak.

Can you graph the rate of change of production rate.

I need to see the acceleration curves.

The same could be done for URR.

Lets look at some second derivatives. Not sure if we get a clean derivative but I think we can get a decent cutoff.

In reality this just says you need to do generic filtering

high bandpass low bandpasss to remove the low frequency components that are kicking out your URR post peak.

The URR increase is a artifact of the model IMHO.

I started to dedicate this essay to you, as you have been asking for it. :-)

The URR increase is a artifact of the model IMHO.

Whether it is or not, the URR for the Texas HL increased by about 50% after the stable series from 1960. So, how much will the Saudi URR increase? It's been increasing in recent years according to the HL. Are we to believe that it is done, and we can make a call on %Qt? Based on the Texas HL, I think that would be foolhardy.

Can you add that second derivative post. I need to see the change in the change of the rate of production.

I'm confident that a data cutoff is needed as extraction at low rates implies recovery factors greater than 50% of the OIP and thus the steadily increasing URR reaching 100% OIP.

The doglegs that everyone is noticing are indicative of this effect. Since we are primarily interested in production around the peak the fact that Texas may be producing oil 5,000 years from now is not important.

Can we look at Romania maybe ? To determine a reasonable point for this cutoff you need to look at regions that are way way past their peak. You mad the assertion somewhere that we don't know of regions that are practically full extracted this is not true. They are smaller than Text but we do know a lot. Also plenty of individual fields have cycled through their productive life cycle.

So we can develop a strong case for this cutoff number.

Another maybe simpler approach is to assume OIP numbers are

driven more by geology than URR and you can say the cutoff