Saudi Arabian oil declines 8% in 2006

Posted by Stuart Staniford on March 2, 2007 - 11:10am

At that time, while the conjunction of declining production and rising rig counts was striking, I wasn't ready to draw firm conclusions on the data through August-October (depending on agency). Recently, Jim Hamilton raised the same questions:

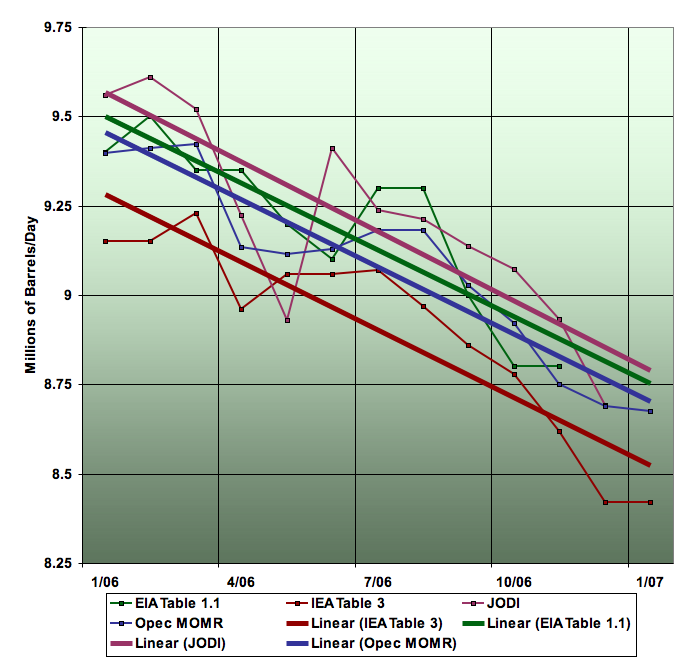

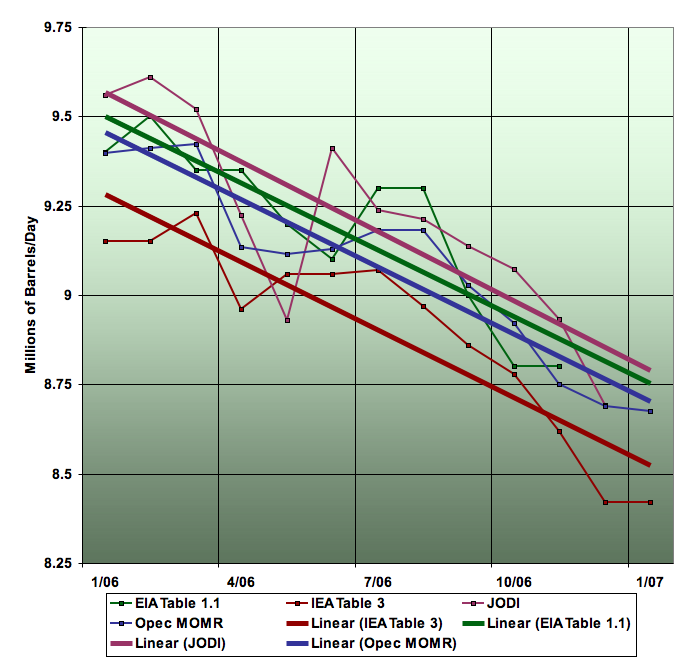

The first possibility is that the Saudis could still pump 10 mbd or more today if they wanted to, but they are cutting back production and exploring like mad because they put an extremely high value on having 2-3 mbd of excess capacity. If so, the recent price behavior suggests that the reason they would seek such capacity is not because they want to stabilize the price, but because it puts them in an incredibly powerful negotiating position. For example, the ability at any time to flood the market could be used at an opportune moment to undercut expensive alternatives such as oil sands that require an oil price over $50.What I did in this post was to look in more detail at what happened from the beginning of 2006 on, which is when the apparent decline begins. I added data from a fourth source (the OPEC Monthly Oil Market Review), and for each of the four sources of data, I fit a linear trend:The second and more natural interpretation is even more disturbing: the mighty Ghawar oil field is already in decline, and the Saudis don't want anyone to know.

The resulting graph is extremely striking, I think. The four different sources all estimate Saudi production slightly differently - they fluctuate in different ways month to month, and disagree over the absolute level (that last may be differences in exactly what is defined as oil). However, the regressions make clear that all four sources are in strong agreement about the nature of the decline. The slopes of the lines are very similar.

The implied decline rate through the year is 8% ± 0.1%. (Note that the year on year decline from 2005 to 2006 will only be about half that, as the decline only began at the beginning of 2006). As far as I know, there are no known accidents or problems that would explain any restrictions on oil supply, and the Saudis themselves have maintained publicly that their production is unproblematic and they intend to increase it.

It's interesting to note the pattern in the underlying data where declines start, are interrupted in the middle of the year, and then resume. I take this to be due to the coming onstream of the 300kbpd of liquids from the Haradh III megaproject:

HARADH, February 08, 2006 -- In a record 21 months from approval of funding, oil started flowing through the new Haradh gas-oil separation plant (GOSP) from several of 32 new wells that will feed the facility.It seems this did not do more than briefly interrupt the declines. We can get a clearer picture as follows. What I did was average the EIA, IEA, and JODI series for 2005 and 2006 into a single estimate. Onto that, I've hand drawn a couple of guidelines that are 300 kbpd apart vertically:...

Full production will be attained by the new plant within the second quarter of 2006.

My intepretation is that the bump in the middle of the year that separates the two lines is due to the impact of Haradh III coming on stream. So that tells us that, given some extra production capacity, Saudi Aramco immediately threw it into the production mix. And the effect of that? It lifted the plummeting production curve up by 300kbpd, but did nothing to change the gradient of the plummet. That suggests that the Saudis had nothing else to throw at the problem.

It also suggests that last year's underlying Type II decline rate, before megaprojects like Haradh III, was 14%.

Overall, I feel this data is clear enough that I'm willing to go out on a limb and conclude the following:

- Saudi Arabian oil production is now in decline.

- The decline rate during the first year is very high (8%), akin to decline rates in other places developed with modern horizontal drilling techniques such as the North Sea.

- Declines are rather unlikely to be arrested, and may well accelerate.

- Matt Simmons appears to be right in Twilight in the Desert, but the warning did not come until after declines had actually begun.

I suggest that this is likely to place severe political strains on Saudi Arabia within a year or two at most.

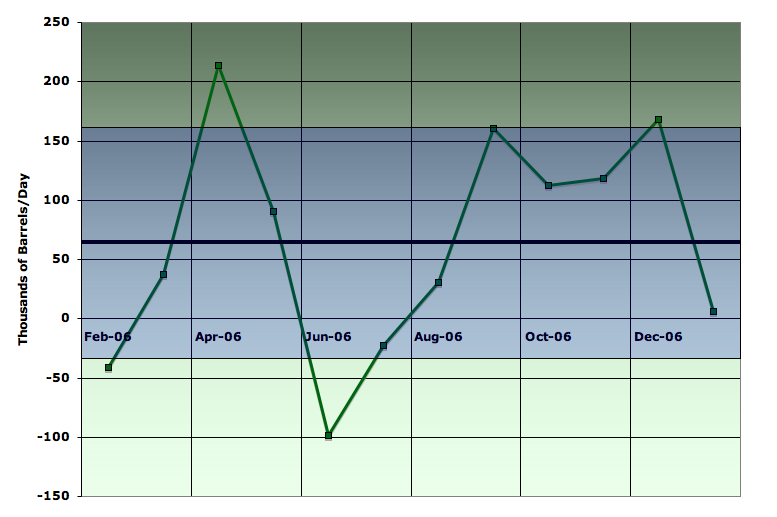

I also looked at the question of whether there is any evidence for the idea claimed by OPEC that the Saudi's deliberately cut production starting in November. Specifically, I constructed a series that represents the average decrease, month-over-month, in the four series. That data looks like this (the blue box is one sample deviation up or down from the mean - the heavy black line).

As you can see, November and December are statistically indistinguishable from the collection of other months. There is no statistically significant evidence for the idea of any cut in those months other than whatever ongoing process controls the production declines. The most notable feature of the graph, the large jag downwards in the middle of the year, again appears to be due to the impact of 300kbpd of new production from Haradh III. The production data simply don't support the narrative that the Saudis were going along producing fine and then deliberately cut production in November to help support prices.

This raises the question of whether OPEC, taken as a whole, deliberately cut production in November/December.

There is some evidence of a very slight acceleration in November of a process of declining production that was ongoing throughout the second half of 2006 (and in to January of this year). This excess decline does not exceed 200 thousand barrels per day. On the whole, media coverage of OPEC production cuts appears to be almost completely unmoored from the data the agencies are reporting. The entire "production cut" may be a public relations exercise to disguise other processes.

Finally, it's interesting to note this Saudi Aramco press release celebrating their achievements in 2006:

2006 was a year of outstanding accomplishment. That was the message coming from the Feb. 21 meeting of the Executive Committee (Excom) of the Board of Directors in Dhahran. “The company reacted rapidly to changes in global crude oil supply and demand during the year,” said president and CEO Abdallah S. Jum‘ah, relaying the results of that meeting in a teleconference Feb. 25. “Ambitious programs were proposed to expand future crude oil production and gas processing capabilities, and for increasing refining capacity both in the Kingdom and overseas.”and

Among 2006 accomplishments were the optimization of upstream operations, and development and depletion strategies to meet crude demand and increase maximum sustained capacity to 10.7 million barrels per day (bpd).I'll bet $1000 with the first person who cares to take me up on it that the international oil agencies will never report sustained Saudi production of crude+condensate of 10.7 million barrels or more.

Hit reddit, hit digg, hit your favorite link farm! :) Send it to slashdot, metafilter, del.icio.us, stumbleupon, etc.

Make sure you send this to big and small media alike, send it to your friends, office holders, whatever. This is big news and this analysis needs to be read.

Let's get Stuart as many eyes as we can.

The articles of 1 and 2 march both reached the frontpage of Reddit. Congratulations to all contributors, keep up the momentum.

the good news is that those Kellog Brown and Root detention camps are going to be up and running just in time for this.

http://news.pacificnews.org/news/view_article.html?article_id=eed74d9d44...

Ah Yes. A fellow chimp.

==AC

Well, some of us, including Darwinian, have been out there on the limb for quite a while. Of course, I was just building on work done by Deffeyes & Simmons, primarily using Khebab’s HL graphs.

One point about Simmons’ book. When he wrote it, and when it was published, Saudi Arabia was still showing near record high production levels.

http://www.theoildrum.com/story/2006/1/27/14471/5832

Hubbert Linearization Analysis of the Top Three Net Oil Exporters

Posted by Prof. Goose on January 27, 2006 -

Guest post by Westexas

http://www.energybulletin.net/16459.html

Texas and US Lower 48 oil production as a model for Saudi Arabia and the world

first published May 25, 2006.

Jeffrey J. Brown & "Khebab", GraphOilogy

WT: What I find really interesting is that as Russia has surpassed KSA it is being portrayed in the MSM as the new "oil giant". I think you were saying that the HL method has Russia as 95% depleted. Not even a whiff of this possibility is hitting the MSM.

Based on the HL plot, Russia is now on the order of 90% depleted (at least from mature basins).

Also based on the HL model, Russia has been making up for what was not produced, following the collapse of the Soviet Union. IMO, they should start showing a sharp decline in production, probably this year.

Because of higher domestic consumption, Russia reported about a 2.4% decline in net oil exports, from 2005 to 2006, even though they reported higher crude oil production.

In any case, as I predicted in the January, 2006 post, Saudi Arabia and Russia joined Norway in reporting lower crude oil exports.

My usual disclaimer: I started studying the Net Export issue because of some of Simmons' early work, and my conclusions were based on Khebab's HL plots.

In the Land of the Munchkins little Dorothy was a giant.

Question of the day - How many of you oil guys can get out on that limb before it breaks and hits the MSM firmly between the eyes?

Here is some positive breaking NEWS -

Solar giant Solar World annonced plans to build the US's largest solar cell factory. In Hillsboro,OR 20 miles west of Portland, OR

http://portland.bizjournals.com/portland/stories/2007/02/26/daily39.html

Saudi Arabia, tank farms, new production and new oil fields.

On yesterday’s DrumBeat, Leanan posted two links on Saudi Arabia. The first stated that Saudi Arabia had increased crude oil production to 10.7 million barrels per day. The second link was more clear and stated that Saudi Arabia had increased production capacity to 10.7 million barrels per day. The latter figure was no real shocker since that is about the same production capacity that the EIA has been claiming Saudi has all along. The latest EIA Short Term Energy Report says Saudi has 1.7 to 2.2 mb/d in excess capacity of crude oil. And that figure has increased as Saudi production has decreased to hold Saudi capacity between 10.5 and 11.0 mb/d.

But nevertheless some people got very excited over that number and suggested that Saudi may be actually producing 10.7 mb/d and storing the excess oil in tank farms. Roger Conner suggested:

Highly unlikely. The amount of storage capacity Saudi has is no secret. They have 33 million barrels of storage capacity at Ras Tanura and another 17.5 million barrels of storage capacity at the export terminal of Al Juaymah. (Pronounced Jo-Ama) At these export terminals, different tankers are loaded with different grades of oil, according to what the customer has ordered. The tank farms here hold this oil in order that every customer can be accommodated. There is probably another 10 million barrels of storage capacity located around the country but these tanks would be special purpose tanks located at gosps or holding oil for power and desal plants. And, according to Matt Simmons, Saudi has another 10 to 15 million barrels of tanks, which they rent, in Rotterdam and the Caribbean.

It is extremely unlikely that Saudi has built millions of barrels of new tank farms for the sole purpose of collapsing the price of oil by dumping excess oil on the market. If they built such a giant tank farm in the last couple of years, we would know about it.

The tanks at Ras Tanura and Al Juaymah would normally be kept near capacity anyway, to be used for the express of offloading oil to tankers. But yes, they could be used to flood an extra million barrels per day or so on the market for a month or so. But that would not collapse the oil market. Push it down a bit for sure, but not enough to cause an outright collapse.

One more point concerning Saudi Arabian oil production. This was posted a few days ago:

Saudi went deep into the heart of the Rub al-Khali to find this little patch of oil. The “Rub al-Kaali represents one of the most extreme areas in the world with summer temperatures shifting from below 0ºC at night to over 60ºC at noon. Dunes can reach heights of more than 300 metres.” Needless to say this is one of the most inhospitable places in the world to drill wells and to lay pipelines. Yet this represents the extremes Saudi will go to in order to produce just a little more oil. But they are said to have 264.2 billion barrels of proven reserves.

Proven reserves means they know exactly where this oil is. To produce it, they would just have to go to a spot they already have plotted on the map, sink a well and produce more oil. Yet they do not do this, they instead go deep into the Rub al-Khali, search for years, (they were exploring the Rub al-Khali when I was there over twenty years ago), until they find a tiny patch of oil, then crow about it to all the world. Something here just does not make any sense.

Ron Patterson

Saudi Tank Farms

http://lcweb2.loc.gov/cgi-bin/query/r?frd/cstdy:@field(DOCID+sa0071)

Simmons on Saudi Tank Farms

http://agonist.org/story/2005/6/6/151857/0004

Rub al-Khali

http://lexicorient.com/e.o/rub_al-khali.htm

"They have 33 million barrels of storage capacity at Ras Tanura and another 17.5 million barrels of storage capacity at the export terminal of Al Juaymah"

I disagree on this point and I will elaborate: The oil could be pumped back into the ground of a depleted oilfield of high porosity where it would be possible to inject water and easily extract that oil again. Voila: a big oil tank. And how big? Massisve? It took me 45 seconds to formulate this idea so feel free to shoot me down:-)

Marco.

The oil loss, back into the reservoir, would be too high. This is really a function of grain size and permeability in the reservoir. Some of the oil would be left behind in the pore spaces in the rock. Note that this is not a factor in tanks farms and underground salt caverns.

I really need to order, from amazon, that book you reccomended!

Why do I envision in my mind's eye a giant squirrel wheel with a gigantic squirrel running madly on it?

Because your medication is far too strong.-)

Something like this?

HONG KONG -- A health club here is hoping that a car battery, some StairMasters and dozens of gym rats can help ease the world's energy problems.

Rita Wong is doing her part. One evening recently, the fit 27-year-old, dressed in black spandex, pedaled furiously on an elliptical machine at the California Fitness health club. As she worked up a sweat to a Madonna song blasting on the gym's sound system, the energy she created was transformed into electricity and stored in a battery that powers some of the gym's lights.

tinyurl http://tinyurl.com/27gexy to the wsj article

Fantastic work !!!

With my prediction of a peak in prices between

Feb 15- March 15 looking great maybe we can combine this information to guess at the next price peak.

On the back side of a declining resource prices tend to fluctuate wildly I've posted before that the overall movement of oil is controlled simply by how fast a tanker can deliver and return. This gives a rough 3 month internal per tanker.

Which leads as I explained in other posts to a cycle of 3 price peaks a year post peak. All quit rough but reasonable.

So given the information provided by Stuart and the above post we can assume that the best that can happen this summer

is a 30 day "tank" surge from KSA. In other posts I'd estimated that they could surge for up to 60 days. This would be a combination of drawing down their tank storage and pumping full tilt at a level that damages the fields.

Next you have to add in WT export land model and the collapse of Mexican production.

What all this means I think is that we can expect prices to decrease soon in the early spring bringing us off our current peak or they plateau at around 70 a barrel. I cannot see them dipping below 60 ever again. This puts the next peak in price at around June 15 to July 15 maybe shifted slightly later if SPR draws are initiated early.

So given what has just presented we can expect a small surge form KSA in the next month or two that will dampen the rise in prices we see right now and could cause a small dip.

This surge will end and we should see a very strong summer peak passing 80 a barrel with ease and headed for 100.

This will generate demand destruction finally leading to a drop and probably quite a few draws on the SPR.

And finally we get our new depletion driven peak in the fall as people fill any storage the have in preparation for winter. Oil will begin to behave like NG with full production of the entire year required to meet the demand peaks.

I don't think demand destruction from recession will be enough to hide this geologic signal. Note that 2007 would be the last year that we actually can smooth oil supplies if KSA is in decline. In 2008 we will not only see stronger price swings but real shortages begin to develop. 2009 would be the first year that Peak Oil gets attention from the MSM as a potential problem :)

Expect political upheaval in Mexico and KSA by 2009.

Finally the key is too expect a surge from KSA in the next few months but this means nothing and won't last the summer its a mix of emptying tanks and overproducing fields. Also they may start dropping some support for internal consumption to redirect some oil to export. Maybe WT could see what that would gain by moving say 10% of production to exports I'm not sure how many bpd this would be. It would cause tension internally but it would help hide their depletion for a little longer. Politically KSA has to show some sort of surge soon. They may briefly show 9 or even 10 mbpd.

Now if KSA can't even do this mini surge ....

Why?

Oil supplies aren't all that tight. People have more-or-less adjusted to $50-60/bbl levels, so why would SA want to disrupt that? Just to prove they can?

Doubtful. Very few people doubt their ability to do so - SA has announced voluntary production cuts, and I'd bet at least 95% of the people who are aware of Saudi production levels have little reason to disbelieve them. Regardless of how much people at TOD may believe SA has something to prove, SA isn't all that interested in what we think.

Until the summer rise in demand starts kicking in, there's no reason to expect much increase in Saudi production. And maybe not even then if the US housing situation turns out worse than expected.

In my opinion if we are truly post peak.

We will see a brief respite in price increases towards the end of march-april then its going to go to the stratosphere this summer. 100 plus easy and fast. Their is a really good chance that 70 will be our new low and our dip won't dip.

KSA must "open the taps" to show the world they can still produce but its a charade based on drawing down tanks overproducing fields and potentially taking supply away from the internal market.

Bush will open the SPR to "help" while KSA increases production and they probably will claim a lack of tankers for sending the oil since they have not used this excuse yet. Or maybe a bunker fuel shortage.

I'm pretty certain it will be some sort of claim based on transportation since they have not used this card.

Worst case Bush will attack Iran if needed. I'm sure he is praying hard for some reason to open the SPR to cover KSA.

We are peak oil aware its not shocking to us but I assure you once the MSM realizes that we have peaked we will see a strong political backlash.

KSA will make a charade of increasing production for a few months. But 60 days is about all they have IMHO.

This does not invalidate Stuarts graph in the least.

My point is KSA must and almost certainly will show some sort of increased production as prices cross over 70 this summer but its not based on real capacity its a sham.

I have no qualms in saying that if we are post peak oil prices will reach highs not seen before only a major effort on the part of KSA to show a fake production increase and SPR releases will keep it from spiraling out to 150-200 this year. If Stuart is right the first big one is this summer.

A fall peak is also a must as the SPR and KSA tanks are refilled.

Next year the party is over.

memmel, you get points for sheer cojones. You've really put them on the block, so to speak.

So has Stuart...this is what is truly scary. Stuart does not put his reputation on the line unless he's pretty confident. Now, mix in some nasty weather this year on top of the geologic constraints and this beast has a probability of breaking out.

I am 100% sure that PO awareness is this year. Whether we are at true peak or not will be of little consequence when a majority reacts to the reality of PO.

Tom Whipple is smack dab on target and right now is the best media mouthpiece that understands TOD and takes it serious. Kudos to you Tom because I know you are reading here. Keep up the good fight on the information front lines. There is a time and place where certain messages reverberate through the noise of disinformation. That time is fast approaching.

po awareness probably needs the market to accept that sa is going down for the count... not clear that even steady decline will establish that this year given that they will continue saying 12Mb/d by 09. People will believe what they want to believe - oil/sa is like a religion.

Again, why? That you personally consider something to be important does not mean someone else "must" do it.

KSA storage capacity is (according to other posters in this thread) only about 60Mbbl. If they really are in 8% decline, they'll be down to 8Mbbl/day by summer, so any storage-driven increase over current levels won't last for more than two months. If we see an increase over current levels for more than two months, then, KSA is not declining as you suggest.

We shall see.

I don't think that's right. A smooth 8% per annum decline would take it down to about 8.15 mbpd, if they were at 8.5 at the end of 2006. There'll be fluctuations, of course, so we could probably only start to think of further confirmation at the end of the year.

I'm rounding for simplicity, of course.

Depends on what happens. If, for example, there's a strong demand increase as we hit summer and nobody else (e.g., Russia) steps up to the plate, there'll be substantial pressure on KSA to open the taps.

If they do - for a sustained period - then we'll have one answer. If they don't, then we'll have additional (although not conclusive) evidence of another answer.

Of course, an economic lull in the US could potentially prevent demand pressure (both directly and due to knock-on effects in China), so there's no guarantee we'll see KSA tested thusly this year. A continuing decline over the course of the year would be pretty indicative, though (depending on the global oil supply situation.)

Do you have a typo in the above paragraph? Did you mean "plateau at around 60 a barrel"? Otherwise I am a little confused by how the plateau can be 70 when the current spot price is around $62.

Sorry I don't know how to explain it but the peak may turn into a plateau or drop slightly and plateau higher than 60.

Its a shoulder peak. The question is whats the new base price going forward its somewhere between 60-70 so depending on how things go price may stabilize at 70 i.e not drop from the peak price that should happen in the next few weeks. Or they could climb a bit more and drop back to 60.

In short we don't know what the floor price will be a bit later in the spring when production is geared up for summer but demand is briefly behind production capacity.

I'm not trying to call price points just trying to map the expected price oscillation signature of peak resources to oil prices. The base frequency of 3 peaks in prices a year with a higher valley price is I think intrinsic and valid for the oil supply if we are post peak.

What you are saying is that if the analysis holds out, the US presidential election in 2008 (and some other national elections due around the same date) will end up being predicated on dawning realisation of peak oil.

That's an important fact to note, not only if you are a candidate, but from the wider perspective of the reaction to the news.

Is there a prefered course of action to address the short and medium term impacts of such news? Do we know what that is? Because if we do, NOW is the time to be drawing that into a coherent package and making it available to be wrapped into candidate platforms.

Its all very well talking about the academic aspects of peak oil, its another to do something positive about it.

We have a winner :)

I almost came out and said it. But yes at the end of the day GW has to figure out how to game peak oil so it benefits the Republican party. The only positive is it will blind side Democratic candidates. American's become very aggressive when they can get cheap gas for their SUV's. So I think the show with Iran is aimed and timed to precipitate a crisis in conjunction with the new peak oil awareness that will occur at this time. Realize that trouble in Mexico will hit hard about this time too.

Seldom are Americans willing to abandon a political leader in a time of crisis so the trick is to get every thing to come together so the republicans can look like the good guys to scared SUV/McMansion owners. The Democrats will face a tough choice with the Mexican/American vote and problems with the surge of illegal immigrants from Mexico.

A lot of crap is being done now so the Republicans can win the 2008 presidential elections at almost all costs.

Understand that by 2012 we will probably be under some sort of martial law or elections will be canceled because of violence. So whoever wins in 2008 will run the country for a looong time. It's the last election with a semi-functional American middle class so its really the prize of the century.

Even more reason why the Democrats need to get policy acts together. There may not be much difference between the two parties, but they are marginally less likely to drop the bomb on someone who won't give up their oil quietly.

And don't over estimate the importance of the US (after all, in world terms their power has a close sell-by date on it). There are a number of other elections around this timeframe that will get determined by real issues and real problems for the first time in ages.

The peak isn't important per se, its the gradient of the decline and the shape of our reaction to it that define the shape of the future.

Important questions.

My prediction....Obama is the only one with enough savy and raw, instinctive trust to pull this off. He can brush aside attacks like they were flies and he can think on his feet.

You get the subliminal feeling he is telling the truth...people are lusting for someone to give a damn about them.

He will the ONLY candidate that has a chance to pull the diverse groups of people together. And he can talk about energy to people in a fashion they understand.

He will be the only chance this country has to avoid all out martial law.

I happen to agree. One thing a lot of people forget is America has a lot of fine cracks like a porcelain vase that been dropped a few times. These can be exploited to destroy the vase or they can be annealed Obama seems to be and annealer type.

Obama is pledged to the corn lobby, among other crippling flaws in depth of perception.

that's what happens when your constituency is Illinois...

now, as for a national constituency...that of course is a different matter.

Oh please... God bless the idealism. Obamma will invade Nigeria the same as Rudy- or anyone else. The democratic party can't even agree on incresing milage standards. Hardly a recipe for me to be enthusiastic. Bash/blame Bush or the republicans all you want. I suspect the problem is really in the mirror.

So I think the show with Iran is aimed and timed to precipitate a crisis in conjunction with the new peak oil awareness that will occur at this time.

Right, it has nothing to do with Iran building nuclear weapons, which should be obvous to anyone with a secret decoder ring and a Dan Brown book.

Understand that by 2012 we will probably be under some sort of martial law or elections will be canceled because of violence.

Yep, and we'll all be eating Soylent Green and chanting "IGNORANCE IS STRENGTH!" The survivors will envy the dead.

Your oil analysis is interesting, but your political analysis is just babbling paranoid lunacy.

More likely, we'll just see a perfectly rational political and market response: increased use of renewable and nuclear energy as oil prices rise, and more development of alternate extraction technologies.

Well, I don't hold out any hope for rational political responses. Market response isn't rational, either, it's based purely on the profit motive. Nuclear can't just be ramped up, though I'd expect to see an increase in the planned use of nuclear. Renewables that can be expanded are a tiny percentage, at the moment, so any significant decline in oil is unlikely to be made up by renewables, especially as there isn't much renewable liquid fuel that doesn't require oil to produce.

I was at ARAMCO in 1980/81 - before I got kicked out (much to my relief) for having an airline girlfriend.

I remember at that time seeing the giant machines they had for traversing these amazing dunes in the Rub al-Khali (the Empty Quarter).

At that time, the Americans, who more or less ran the show, explained that the Saudis were desperate to find oil outside the Eastern Province (i.e. the Shia province).

Saudis from Riadh and Jeddah feel quite out of place in the Eastern Province. The inhabitants of Eastern Province feel quite uncomfortable, or worse, when they have to visit the capital, Riadh, on official business.

In fact, the Shia do all they can not to have to overnight in Riadh - they have to get the last plane back. Quite odd considering they all, supposedly, are citizens of the same country.

Alfred, this new field is entirely within the Eastern Province. Over half the Rub al-Khali is located within the Rub al-Khali, the rest is in the Central province where Riyadh is located. The only oil in Saudi ever found outside the Eastern Province were the Hawtah Trend Fields, discovered in 1989. They are located just south of Riyadh.

The southern end of Ghawar juts into the Rub al-Khali and the new patch of oil is 70 kilometers Southeast of the southern tip of Ghawar.

Ron Patterson

http://en.wikipedia.org/wiki/Ash_Sharqiyah_Province

"Citizen" doesn't mean much in SA; it's still very tribal. Saudis have few rights, especially women, who have virtually none (it is not uncommon for "disrespectful" women to simply vanish in the desert).

There has always been a lot of fear of a "Shia crescent" forming.

Ron,

I cannot and will not disagree with your analysis per se, it is a good one, and of course Stuart is always on top of things...we will just have to wait and see.

This may be the end of the Saudi road as far as having the production clout to pull it off (we all know that day has to come...when is the question), but I am still very cautious about them.....I am an old man, and the spectre of 1982 still haunts me....

Roger Conner

Remember we are only one cubic mile from freedom

FWIW:

http://fe1.news.re3.yahoo.com/s/ap/20070226/ap_on_re_mi_ea/saudi_frenchm...

"The area where the attack occurred also is home to oil installations, which are part of the Strategic Oil Storage Project — a massive underground facility that includes five sites across the kingdom."

I thought I recall a note about KSA claiming new production expansion from a very old depleted field and Simmons claimed this field was used as as an undergound storage facilty. Although Simmons might have referring to Natural gas storage.

I don't believe that KSA is stockpiling oil to drive crush prices. I do believe that they are probably slowing stockpiling some oil to cover for short term emergencies or for future planned maintaince. At best probably enough to cover production for a coupe of weeks for unforseen events.

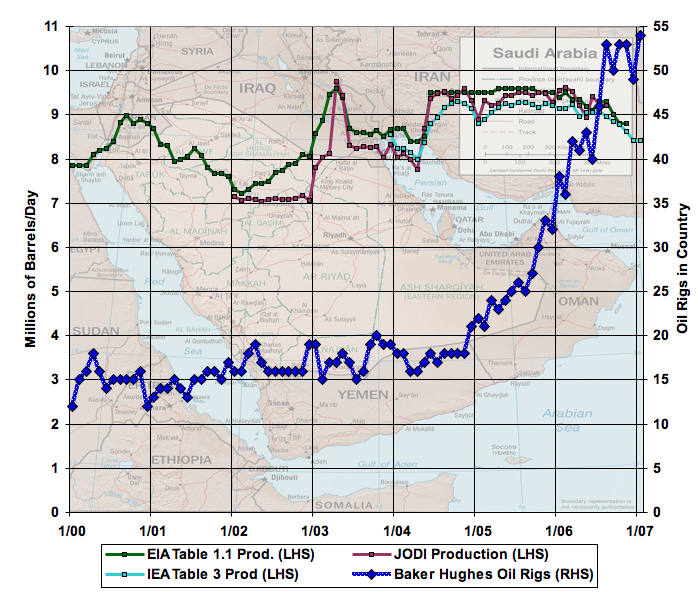

Here’s the IEA 10 year time series, are we in a new regime or does this just represent more of the same? Maybe after seeing how the world managed with the jump from $20 to $60, the Saudis would like to see if $90 is sustainable?

Source: IEA Supply

Chris I think the real big difference, more than the oil price, is the rig count. It's really up there in the sky.

This point is the important piece to the puzzle. Cuts and increases that are independent of the ocean rigs are understandable. However when you are cornering the rig market and you either cant, dont, or wont produce more with the rigs, which choice appears more logical?

I think Tate hit the nail on the head. Why grab all of those rigs and not produce with them. SA is producing full tilt and the increased rigs are not able to make up the decline in the other mature fields. When you start piecing the information together you begin to see how scary this whole situation is.

Chris:

I would like to, but don't have time to, respond at length with additional graphs. Let me just quickly outline my response to your points:

My own conclusion has been for some time that there was no evidence that they had any spare capacity any more. Al-Naimi has been quoted saying that they no longer saw themselves as a swing producer.

Of course, I'm interpreting all this in the context of background that we generally know there are question marks about the future of Saudi production - significant parts of Ghawar have been documented to be depleted, the new megaprojects are almost all reworks of fields which were developed before and didn't produce terribly well, Hubbert Linearization has said Saudi Arabia is probably close to peak, the 1980s reserve increases, etc.

I should add that Heading Out has, for some time, been pointing out that the arithmetic of the planned megaprojects, the Saudis own statements about their depletion rate, and their planned capacity simply didn't add up, and were shifting over time, with more and more of the projects being projected to cover depletion, rather than increase capacity.

I meant "decline rate", not "depletion rate".

Stuart,

I am sure you are aware but others might not be that Haradh and Haradh 3 are part of the southern portion of Ghawar and are not a new field. Also backing your assumptions are the fact that they had to increase water injection in Ghawar last year by another 2.5 million barrels per day.

An A.A.P.G link I have have shows that in 2004 Ghawar had produced about 79 billion barrels and had 17 billion left to produce. 80% depletd.

Chris,

This is a wonderful graph. But some people might say that Saudi oil production has declined before. So how do we know that this time the decline is permanent?

Can you please plot the spot price of crude oil on the same graph so that everyone can see that in the past when Saudi production was declining, the price was falling.

Thanks for your efforts.

This is in now way conclusive, but we must consider that the demographic situation (and resultant pressures) inside Saudi Arabia provide a different background to this decline compared to past declines.

Here's a link to a graph of Saudi population increase:

http://en.wikipedia.org/wiki/Image:Saudi-Arabia-demography.png

Population has doubled from 13.5 million in 1985 to more than 27 million today, and the rate of increase is only accelerating (population increased 23% since 2000, and continues to increase by rougly 3% per year!)

In addition, the number of the royal family on "official stipends" in excess of $100,000/year has mushroomed to over 5,000.

This represents a huge and continuous revenue demand on the Saudi government--they must keep essentially buying off both of these groups in order to maintain their currently tenuous control. Most problematic is that the general standard of living has begun to decline (along with quickly rising unemployment among young males), and the low-6-figure stipend granted annually to peripheral royalty is no longer sufficient to buy their loyalty (but it is sufficient to make them potential financiers and organizers of an internal opposition).

Viewed in this light, I think that we must be very skeptical of any theory that suggests that the Saudis are voluntarily forgoing any significant levels of revenue for anything other than a couple of months (this includes voluntary OPEC cuts, storage for a surge at a later date, etc.). Their regime would struggle to survive such a move--not matter how wise it may otherwise be.

I think that this background adds some weight to Stuart's conclusion that this is not a voluntary decline.

HIGH RIG COUNTS are the tell.

Off the cuff, the previous declines appear to have been composed of straight line segments - e.g., cut 100,000 bpd every month, with a resulting sharp peak. This latest decline appears to have a more rounded peak, and a gradually increasing decline, more like a natural process. Admittedly, that's reading a lot into the above graph.

The last year looks eerily smooth. The volatility and sharp peaks are gone. Just a smooth downward exponential.

Even though I don't think that Hubbert linearizations for countries have 100 % predictive powere (more like 50%, think of double-peak countries like UK) I have to admit that the last part of the SA graph looks different.

http://static.flickr.com/55/145186318_27a012448e_o.png

You need to add 2006 to that graph.

Stuart

I always enjoy your posts. Thanks for the time you generously contribute to us all.

I think your post is a little cautious. Last mar they produced 9.5, they acknowledged 8.5 in jan, so 10% in ten months = 12%/year, and this after bringing new production on line... imagine what the decline rate would be if they did nothing...

Have thought for some time they are in blind panic mode.

Thought they would have more rigs by now... of course, everybody wants a few more rigs...

We are seeing the same thing everywhere, whether drilling for oil in sa or for ng in the us; more rigs = less production.

Mmm. The danger of taking two points and differencing them is your estimate is then very subject to noise (since there are quite a lot of fluctuations month to month). That's why I fit lines to the data and then estimate the number for that (the lines drops 0.75mbpd in a year, and 0.75/9.5 = 8% near enough). The idea is that the lines smooths out the noise and finds the underlying trend. The fact that all the data report the same trend (even though they obviously have different ways of assessing Saudi production, since they have different noise) gives me confidence that the trend is really there, rather than an artefact of the badness of one or another production estimate series.

Is it possible that your straight lines are disguising an accelerating trend?

Interesting.

Isn't the 9.5-10 mmbd figure close to the same figure at which the US peaked in 70-71?

Interesting.

Yes, the C+C peaks were very similar, as are the Qt estimates.

Khebab's HL plots put Qt estimates only 10 Gb apart, 196 for the Lower 48, 186 Gb, for Saudi Arabia.

Two reasons for the sharper post-peak decline rate for Saudi Arabia: (1) Saudi Arabia, like Texas, peaked at a later stage of depletion, and (2) Saudi Arabia counted on one field, Ghawar (which Ron and I think is crashing), for half or more of their production.

Hmm. Makes sense, given the US URR of 220Gb +/- and KSA's alleged 269Gb.

another reason for sharper decline, as you have mentioned elsewhere, is the prevalence of horizontals... not so many in the us pre 1970. This new tech will cause world wide production to decline at a higher rate than some expect.

Interesting point. Isn't it also the case that deep water experiences a high decline rate? Do we know what percentage of production employs horizontals?

Will world PO be visible in hindsight? I agree with your and now Stuarts conclusions. I can't get past that "giant sucking sound" of money leaving the economy. Oil price increases will equate to an "energy tax" or a "pay cut" either way both leave less money in peoples pockets.

Add nat. gas, ARM's, housing price resets, it just looks bad heading forward.

Yes...the dots painting the pictures are becoming so numerous at this point that they are becoming lines....and those lines all have a slope less than 0.

Thanks for an interesting and decent methodology analysis (i.e excellent for a website!). This is THE thing to keep the eyes on. It is astonishing that SA is slowing down (maybe true? maybe at least half-true!), russia EXPORTS less, and Norway we know pretty well, and Cantarell is at least in the news. Hmm... I think it's time to prepare, Ive been following peak oil for a year or two, and this is enough for me to ACT 2007.

Time to start considering a lower energy availability the next couple of years. No thourough analysis in the news...incredible.

I go for gold, oil service companies, no debt, companies with resources in "safe" places. US and US$ is gonna take a hit.

The stock markets too in general (UK). It's a strange world.

Good luck and be careful out there. One more peak-oiler believes the first crunch is here.

You should probably put a time limitation on that bet, otherwise you will never be able to collect.

Ha ha.

I imagine he'll negotiate a contract since they'll have to define sustained as well.

Gentleman,

We can create some derivative contracts and I will do this for you for a small fee....much easier, you'll get rich!

Dear Stuart,

Thank you for your clear and cogent analysis and the graphs and numbers to back it up.

It's interesting and makes one sit up and take notice, one also can't help thinking, is this really it? Are these numbers correct? Can they be interpreted in another more benign way?

I'd really like your work to be shot down in flames by someone and in double-quick time! Because, if you are only half-right we are in deep trouble.

If information like this is picked-up by the mainstream media in the current financial climate what happens to the stock market? One thing is pretty certain, the American army will never really leave the Middle East, they are there until the oil isn't.

Actually, it appears US intelligence regarding Iranian oil has finally convinced them there's not enough left to make it worth it to invade. Thus, the new talks. Let us redeploy as Venezuela and Bolivia are in great need of Democracy.

Is this just your opinion, or is there a report to that effect? Please provide a link if so.

Ha...no, it just follows BushCo common sense.

AMAZING!

That is an incredible graph!. I am a scientist and it sure looks like a forced decline. Stuart, this is a news bomb.

Thanks once more for your work Stuart. I truly hope you’re wrong, this is really bad news.

I think you made a your point by showing that there isn’t a concerted production cut by Saudi Arabia, but 8% is a big big number for a decline rate, especially onshore. From the few sources I know Ghawar was supposedly still highly reliant on secondary recovery methods (water injection) just a few years ago, which wouldn’t result in such high decline rates.

As we have talked countless times here at TOD, for a reported OOIP of 720 Gb, Saudi’s ultimate stays somewhere between 190 Gb and 260 Gb (~ 27% to 37% recovery factor). So in fact they can be past the 50% of Qt (midpoint of depletion).

Last year we had news of China returning Saudi oil back to its origin – it was to heavy (or sour) for them to refine. So my reasoning is this: Saudi light crude oil production is crashing, and besides some (who knows how much) heavier oil spare capacity, they don’t have buyers for it.

Saudi Arabia will know invest heavily on pre-refining infrastructure to convert that heavier crude on lighter, easier to sell molecules; later they will probably help with heavy oil refineries abroad. So I think that in the future we might see Saudi Arabia recovering from those 8%, but since we’re talking of lower quality crudes, not enough for me to take that bet.

Twilight in the Desert extensively discusses that the Saudis have been redrilling their fields with horizontal multilateral wells for a number of years. So there is reason to think declines might go fast once they went.

Where is Down Under? I would like his take on your analysis since he seems to have inside info. on Saudi production.

Stuart, your posts are always a treat. Here's someone who hopes you post more often again - and I'm certain that I'm not alone.

Here are two questions:

1) Is there any easy way to graphically compare the rigcount/production decline situation currently afflicting SA with the parallel situation that unfolded in Texas during the 70s?

2) Is there any reason to believe that the 8-9% annual decline rate in SA will become a permanent state of affairs over the next decade or so?

8-9% Will probably look like a great number in a 2 years try

14-30% declines as the horizontal wells water out. Ghawar is probably just starting into serious decline and it will go down hard later. Once Ghawars basically gone KSA decline rates will actually decrease back toward 8% probably and but at a much lower production rate. With so much oil coming out of one field the decline rates of the one field will swamp those of the others.

Maybe WT can comment on Texas oil production since it too had a few large fields the overall decline rate should have matched these fields declining on the initial downslope. The key difference of course is the production profile of horizontal wells vs traditional verticals.

“So that tells us that, given some extra production capacity, Saudi Aramco immediately threw it [Haradh III] into the production mix. And the effect of that? It lifted the plummeting production curve up by 300kbpd, but did nothing to change the gradient of the plummet. That suggests that the Saudis had nothing else to throw at the problem.”

Stuart, you’re one smart hombre.

You have a gift for data analysis.

Appreciate your time and effort.

For me, the lion's share of the credit go to Westexas, Darwinian, Khebab - they have been shouting from the mountain top for several months now about the peak in Saudi Arabia. Stuart has now added some more evidence to their points and conclusions.

MikeTor used the phrase "news bomb" above, and I have to say I agree with him. This looks an awful lot like the smoking gun. I think this is one of the most important articles I've seen recently. WT has said repeatedly that if Ghawar goes into decline, the game is over. This is the most convincing evidence of that situation short of an official Saudi announcement.

Added to Cantarell's woes and the ongoing slide in the North Sea, this looks to me like conclusive support for the stated opinions of T. Boone Pickens, Matt Simmons and Dr. Deffeyes - the peak has happened.

Is there any relationship to the "collapse" of Asian markets (perculating to the world markets) and what Stuart is talking about?

I know indirectly, it's all tied together, but could this all be directly related?

Just seems to be a HUGE coincidence!! Not the release of Stuart's article, but the information he is analyzing.

There will be those who pay attention...

One other question: Is there any reason to believe that SA geography contains dozens as-yet undiscovered fields that are an order of magnitude-to-two smaller than Ghawar (such as perhaps the one recently discovered in the Empty Quarter)? If so, can this be expected to significantly mitigate the current 8-9% annual decline rate over time?

i would guess that that is what all those oil rigs are trying to do, however there is a significant time lag between a new oil field being found and it producing at full capacity. Since the underlying decline rate appears to be around 14%, it is quite probable that new small finds would only be able to prop up the 14 to the 8% we are currently observing.

given that they were shouting about these other fields coming online, i doubt that they have found anything significant new, otherwise they would be shouting about that also.

I guess this is it. As Matthew Simmons noted, "if Saudi Arabia peaks, then categorically the world has peaked."

Oddly enough, today is the day I show my students "The End of Suburbia." I will follow that showing with your post, Stuart. I wish I had releases from my students, I would take a photo of them, and their gaping mouths, and post it.

Thanks.

The calls you get from parents after they ask their kids what the hell happened to them at school that day might be even more interesting.

Oddly enough, today is the day I show my students "The End of Suburbia." I will follow that showing with your post, Stuart.

Could you do me a favor and report back in tomorrow's drumbeat as to the reaction of the students?

TIA

John

I've used EOS in my writing class for three years now. The response is the same: most just get up and leave and open their cellphones in the hallway. There's two or three vocals students during the next class. "To him that has, more shall be given; and from him that has not, from him shall be taken, and that he has."

Hi b,

I've given some informal talks...I enjoy "low tech", white board and pen. I usually draw a (very rough) graph on each board...one of human pop. v. time, and the other of oil v. time (the latter one I say extends five miles out the room, w. the oil "window" being about an inch on the X-axis). I like to ask questions... sometimes begin w. "Why does the pop. curve rise to steeply...about here?" Or, "Have any of you lived in a so-called "Third World" country?" "Have any of you ever planted a garden?" "Have any of you ever had a conversation with someone in their 80s?"

my bet, is this time next week you won't have a job due to one or more complaints by parents.

We had a teacher back in the early 80s (11th grade) who showed us this kind of stuff all the time.

1) we (meaning the students) argued that Nuclear was the answer (like Hubbert did), which he considered objectionable.

2) He never lost his job because of it - even though he supported the liberationists in Nicaragua

3) More than 2 decades later we still don't have convincing sustainable alternatives, while solar and nuclear are still the best alternatives. Ok, wind has made a lot of progress..

Yes I agree. You teacher was remiss in not teaching you all about the Constitution of the United States and the amendments to it. Specifically the one about Freedom of Speech.

We don't lose jobs in the United States for supporting political movements. That is the beauty of this system and a reason to fight for it.

Futhermore you need to reevaluate your teacher's political position regarding Central America. He was on the right side. The Contras in Nicaragua were created by the CIA and were responsible for selling drugs to us. Money to help the Contras came from secret sales of weapons by our President Ronald Reagan to our enemy Iran.

Nuclear is not a 'sustainable' alternative. Certain estimates have the fuel running low in several decades with increased use. Only solar and wind are truly sustainable

pete

The best summary of nuclear power is by David Fleming, "Why Nuclear Power Cannot Be a Major Energy Source", April 06, at

http://www.feasta.org/documents/energy/nuclear_power.htm

From the introduction:

"It takes a lot of fossil energy to mine uranium, and then to extract and prepare the right isotope for use in a nuclear reactor. It takes even more fossil energy to build the reactor, and, when its life is over, to decommission it and look after its radioactive waste.

As a result, with current technology, there is only a limited amount of uranium ore in the world that is rich enough to allow more energy to be produced by the whole nuclear process than the process itself consumes. This amount of ore might be enough to supply the world's total current electricity demand for about six years.

Moreover, because of the amount of fossil fuel and fluorine used in the enrichment process, significant quantities of greenhouse gases are released. As a result, nuclear energy is by no means a 'climate-friendly' technology."

That claim sounds a lot like the ones issued by Storm van Leeuwen et al.

Those claims looked very fishy to me when I read them (seriously, who would assume that half of all uranium enrichment would continue to be done by gaseous diffusion when centrifuges use 1/50 of the energy — and why?) and I learned later that they have been thoroughly and conclusively debunked.

Here's the assay for Saudi Arabia.

The production mix is an important factor, in my view. I think it might explain a lot of what's going on. There's no disputing the data that we're looking at, there's only it's interpretation.

My suspicion has been that they can produce, but not sell, a lot of their crude because it is heavy and sour, as the assay indicates. This is one of the two primary reasons — the other being greatly increased internal refined products consumption — that they are investing heavily in a domestic downstream refinery business.

So, while this analysis certainly has a lot to recommend it, it may not be the whole story. The greater reliance of the world on lesser-quality crudes is a large part of the peak oil story. Saudi Arabia appears to be trying to switch to a "lighter" blend — see Greg Croft's Aramco Projects: A Closer Look. Of course, this article was written before the recent declines, but —

Now, of course, "The Ghawar field is the main producer of 34° API Arabian Light crude." — EIA.So, the lower parts of Ghawar (Arab Light) are no doubt declining and there is a lull in production while Saudi Arabia brings new Arab Light onstream (Khurais) and develops the ability to refine it's poorer grades. Arab Light is easier to sell and they are desparately trying to compensate for declines. Finally, I would never take your bet that Saudi Arabia's production will surpass 10.7 mbd.

-- Dave

The EROEI factor dealing with heavier, sour crude, coupled with growing internal demand and less export volume (per WT's export model) will cause KSA significant budget headaches I would think.

Not just SA's budget. Where in the world are the declines in eroi in SA (sour), in Canada (tarpits), in GOM (deepwater), in Venezuela (gunk), Iowa (ethanol), Iraq (democratization), etc., being offset?

On the matter of a coming spike in the oil price.

I think a price spike, if it comes, will be temporary. Simmons will never get his wish for $200/bbl crude oil. There is an underlying constraint on the oil price, which lies with declining eroi. As the energy intensification of energy production increases, less energy and less investment are available for the rest of the economy. The loss of investment affects the productivity of the rest of the economy, which is the greater part. The increased investment in the energy sector is not increasing productivity in that sector, either.

Falling economic productivity erodes buying power, and so price is constrained.

It is an error to look to the 1970's for guidance today.

The spike in prices then substantially affected many economies negatively. But high prices then were a problem because a great deal of friction existed in the re-circulatory mechanisms for petro-dollars. However, today, this problem has been largely overcome. It still remains a factor undermining the efficient functioning of the world economy, but a much diminished one.

Declining eroi, not high energy prices, provides a more adequate explanation for the economic downturn.

I don't think so but agree :)

The current economy is almost pure bubble and it was created via finical wizardry high commodity prices played a role in pricking the bubble they did not create it.

The greater reliance of the world on lesser-quality crudes is a large part of the peak oil story.

We drank the champagne, Royal Crown, and The Glen Livet.

We are now down to Cooking Sherry and looking REALLLL hard at that can of Sterno...

Say good night Gracie.

John

The further south you get in Ghawar, the heavier the oil gets and the higher the sulfur content. The northmost section Ain Dar, the oil is 34 degrees API and has a sulfur content of 1.66% The southmost portion Haradh produces oil of 32 degrees API and with a sulfur content of 2.15%.

Also the further south you go the average porosity and average permeability drops off dramatically. As a result the Average Productivity Index (BOPD/PSI) drops from 141 in Ain Dar to 31 at Haradh. And the average thickness of the oil column gets thinner the further south you go.

All this means that ARAMCO will get a lot less oil in the south end of the field.

http://www.gregcroft.com/ghawar.ivnu

Ron Patterson

Guys, I think we need to take a deep breath, step back and look at Stuart's numbers calmly and very critically.

I'm slightly disturbed by the reaction of many of the comments relating to Stuart's post. I think they are in bad taste, given the apparent seriousness of Stuart's message. I almost get the feeling that some people are almost, close to, glad for these indicators of a dramatic fall in Saudi oil production. There's no place for glee here! The 'collapse' of the largest Saudi old fields is, if correct, a turning-point in history for our civilization. It's a dark day, a day for mourning, not twisted, perverse, celibration.

Sure, it's tempting to shout, we were right, we were right all along! Still the potentially terrible consequences of being right will be of scant comfort to most of us going forward.

So, perhaps the best thing we can do is expend effort on a rigorous critique of Stuart's numbers and conclusions, rather than greeting them with something close to euphoria.

Re: I almost get the feeling that some people are almost, close to, glad for these indicators of a dramatic fall in Saudi oil production. There's no place for glee here!

No kidding.

I just posted my own analysis of this (in a comment above) and although it introduces a bit of complexity, the news does not appear to be good right now. I am not quite ready yet, as a wag once put it, to kiss my lifestyle goodbye, even though I'm not a heavy car user.

I'm not happy I'm pissed. Pissed because if we have figured this out correctly with limited information then the President of the United States must know the real situation. The world has probably been told the biggest lie of the century by not making this situation public.

And I'm fearful that a democratically elected government thinks it can get away with hiding this information. This means that they don't think democracy has much value in the future.

For better or worse the people should be the ones that decide their own future.

>I'm not happy I'm pissed. Pissed because if we have figured this out correctly with limited information then the President of the United States must know the real situation. The world has probably been told the biggest lie of the century by not making this situation public.

FWIW: "People, we are running out of energy" --Bush 2000.

Yes he danced around the issue with the hydrogen economy etc.

And other statements. On reason I believe we are right is from connecting the dots watching GW's moves. Iraq, Iran hydrogen economy ethanol fiasco Alaskan oil. In total they add up to a government that is very aware of peak oil and expects it to be soon.

The point is the facts need to be made public so the public itself can act.

They need to shoot strait and plainly show the evidence they have and let the masses start digesting the situation. And they should have done this years ago.

As I said my fear comes from the fact this is not happening which means the powers that be think that the opinion and votes of the masses are not important.

You know once peak oil becomes well understood a lot of people are going to look back and say hey you saw this comming how come you said nothing ? I have to think their will be a strong backlash just like the one starting over subprime lending right now.

"Pissed because if we have figured this out correctly with limited information then the President of the United States must know the real situation."

I think Bush et. al. are filth and foolz - especially his handlers (Bush is a low-IQ drone). They knew we were facing peak oil so they stole the election (clear in hindsight).

The gave lip service to our "addiction to oil" early on when proposing the no-go "hydrogen economy" and again more recently the "ethanol economy" (the "drunk" economy).

They needed a Pearl Harbor to galvanize public support for their "war on terror" so they manufactured or at least enabled 9/11. Interestingly, their 20-30 year time frame for their "war on terror" coincided with what will be the most traumatic period of our Post-Peak Transition.

Bush et. al. were incompetent to say the least. Instead of doing actual preparation at home (rail, alternative energy, cleaner coal tech, etc, etc) they instead made Grand Plans, that included invading Iraq, that were later found to be "delusional."

As David Hackett Fischer would say, "Wave Riders mistaking themselves as wave Makers"... or "the keystone cops take on Peak Oil."

I wonder if there is still time enough to impeach Bush for 3rd Degree Treason (and no "insanity" defence allowed - arrogant stupidity doesn't equal insane).

The administration as a whole has certainly figured this out. Bush himself probably isn't smart enough to do it on his own, especially given his unwillingness to read and dependence upon the opinions of a select few who won't tell him anything he disagrees with strongly. This makes him a really good front man, because he can speak the falsehoods and be absolutely sincere about them.

The title of worst president in US history is up for grabs!

memmel " then the President of the United States must know the real situation. The world has probably been told the biggest lie of the century by not making this situation public."...

Read Dick Cheney's 1999 Inst of Petroleum speech? I posted it yesterday and got negative response. He laid-out clearly the scene we see Mar 2007.

Look at this line:

"Oil is unique in that it is so strategic in nature."

Cheney is very literate. If you or anyone does not get the brute impact contained in those 11 words, above, look-up "strategic" in a thick dictionary, that gives its derivation and definitions.

The entire meaning revolves around military generalship and planning at the highest echelons.

Also, "Oil remains fundamentally a government business".

In 1999, he is telling his audience that the seat of the oil business is the federal government's business.

Whether or not you admire or agree with Cheney, he spoke soothe to his insider audience.

Hi reddot,

Thanks for your comment and I'd like to hear more. Do you think there's a way to deal with this? To address "peak"? To put it before the world? eg. "Oil Depletion Protocol". I'd like to hear more of your ideas for positive action, especially in regard to policy.

BTW, I've posted the link to Cheney's speech several times. Still, I appreciate the way you highlight certain sentences. "Brute impact" is an apt description. (Perhaps the reaction was just from the length of your post.) (Or was there more?)

My suggestion: Can you further develop your thinking here? In other words, take your assumptions as givens...Okay, what is possible? What next? What to try?

It's not clear to me what anyone knows or does not know, even if they "know". Lest that sound too much like another "insider" ("known unknowns", etc.), I mean by this that I consider the subject to be emotionally difficult in a unique sort of way (part of the problem.) The implications are (or can be) shocking, when people (in general) have few emotional resources to deal with shock.

In addition, many (most?) perhaps lack the background to have a context in which to interpret "so strategic". And then, there's the conclusion (at least mine), where strategies of the type Cheney refers to logically fail in the end.

Anyway, I mean to encourage you here.

Writerman: Likely a turning point for suburban sprawl. A turning point for "civilization" might need some reliable evidence submitted to appear credible (IMHO).

What would your reaction be if you KNEW that this information was being deliberatly held back from public view by government/MSM/commerce?

Marco.

It's high treason, pure and simple. The deception gives support to our enemies while our own government's policies, promoted by this administration since 2001, increase our dependency on them.

Writerman,

To quote Matt Simmons, if we do nothing to address Peak Oil, "Jim Kunstler will have turned out to be an optimist."

In any case, I have been--relentlessly; repetitively; endlessly--advising anyone who will listen to start downsizing.

http://www.energybulletin.net/19420.html

Published on 21 Aug 2006 by GraphOilogy / Energy Bulletin. Archived on 21 Aug 2006.

Net Oil Exports Revisited

by Jeffrey J. Brown

Westtexas,

I know, I know. I just felt that some people were reacting to Stuart's numbers somewhat 'oddly' for my tastes. Sure it seems almost odd to consider 'taste' and 'manners' when were talking about a truly stupendous moment like this, if the numbers are telling us what we think they are. Perhaps I'm just trying to hang on to traits of 'civilized' behaviour that are going to seem rather 'quaint' down the line.

I too have tried, almost without any success, to spread the word about our difficult position relating to oil and gas. I get absolutely nowhere. Perhaps that's my fault. Still most people I know, just don't get it at all.

Everyone I know is so fucking rich, successful and embedded in our consumer society, that they react like I'm nuts when I raize even the possibility that things ain't what they appear to be.

People I know have never been more affluent. Everyone has bought a newer and bigger car. Built a new luxurious kitchen or bathroom. Two of my friends have bought a new appartment in Berlin on top of their weekend cottages!

It's like their waltzing in a brilliantly lit ballroom to the music of Strauss without a care in the world. Part of this is because they are so damn busy at work they don't have the time to stop for a second and think. When they stop working, they want to relax or party, fuck reflection!

We have to remember that we live in the best of all possible worlds, and technology will almost magically come up with a solution to all our problems. Even our leaders, who may honestly make mistakes and even do ugly things are basically noble and their doing their best.

Sorry for the rant, only I'm beginning to feel the strain of bangning my head against a brik wall!

But that's exactly it: If one bangs his or her head against the brick wall of intractable denial and delusion long enough, then he cannot help taking a certain morbid satisfaction in news like this. One would have to be selfless to a saintly degree NOT to experience a "Schadenfreude"-type emotional reaction like this.

Writerman,

That's just how I feel. Not only are they in total denial that their cushy way of life could change, they always argue that technology will cure it all and there will be no problem. When I point out that we don't likely have enough time for technology to solve it except for a very small percentage of the population, they look at me like I'm nuts. When I suggest they sell their big SUV's unless they plan on living in them, the conversation is usually over -- and by that point I'm glad it is.

My conclusion is that most people are fat, dumb, and happy regarding the crises (yes, plural) about to hit us, and they WANT to stay that way. You can not enlighten someone who does not want to be enlightened.

I'm glad to see that TOD finally got over it s spate of peak oil denial shills and techno-optimists. If folks want to remain fat, dumb, and happy, so be it, just do not try to distract those of us who do not.

"I too have tried, almost without any success, to spread the word about our difficult position relating to oil and gas. I get absolutely nowhere. Perhaps that's my fault. Still most people I know, just don't get it at all.

Everyone I know is so fucking rich, successful and embedded in our consumer society, that they react like I'm nuts when I raize even the possibility that things ain't what they appear to be."

Writerman -

boy you hit the nail square in the middle - they treat you like you are nuts.

I have two schools of thought and they are not firm.

1) You need to tell them so you don't get the "you knew this was going to happen and you didn't tell me."

2) anyone you tell might assume that you made preperations and you will be target #1.

screwed either way imho.

D

Writerman,

There is lot of valuable information and analysis in the lead article and in the comments of others, especially WT, but because you didn't constrain your angle-saxon, it is not likely to find its way into a goodly number of schools.

Surely you have a book of synonyms. If the edit option remains open, why don't you use it.

from what i have seen i think the situation has changed too much to allow us to simply and painlessly go back to 'the way we used to live'

as he promotes.

our population is larger, our resources more depleted, and the earth we live on is not as fertile as it was.

the situation has changed and we have to stumble in the dark to find out how to live because the past is no longer applicable.

I am struggling to see how cities have any value in a post modern society.. Lets see, they grow no food, produce no goods, and suck up a lot of energy. The citizens there will all head to the hills.

It wouldn't be the first time, either. Reading some history (e.g. from Crete up to Classical Greece) yields perspective on something that ought to scare everyone - if we screw up, it will happen in our time.

I also believe that we have the technologies at hand which can push this point off indefinitely (how long have chlorophyll-using organisms been the foundation of life on Earth?). Whether we develop and use them in time is our choice.

Do you mean that we have the technologies to continue using resources, of all sorts, at increasing rates, indefinitely? Or do you mean that you think we have the technologies to put off at least an energy crisis for a few more centuries (assuming everything else somehow holds together)?

Engineer Poet appears to believe that if we choose the right technologies then we can continue to support a civilization of just under 7 billion human beings. Strictly with regards to energy alone, I agree with his answer but his answer is incomplete because it ignores a whole host of other issues, all rooted in overpopulation.

And Doomer Grey would appear to believe that Malthus was right and that the Earth can hardly support the ca. one billion people who habitated it at the time. I agree that the answer to peak oil will not come from engineering/technology alone. But I would disagree that overpopulation has much to do with the causes of the "host of issues". The present large population is rather the result of this very host of issues.

Malthus got confused between cause and effect.

Dearest Grey, hold up the tradition!

You are wrong. Oil is the only reason we have been able to grow enough food to increase our population to this level. Take away the oil, and you probably can't even support 1 billion people. Add to that the damage to the soil and we probably can't even support the population we had pre-oil.

"You are wrong"

And you are God, or did I miss something here?

Most of the essential fossil fuel in agriculture goes in as nitrate and phosphate. Both of these could be supplied by the energy remaining in crop wastes (esp. for maize); the only reason they aren't at the moment is that it's been cheaper to do it with fossil fuel instead of RE. Eprida is generating both fixed nitrogen and charcoal soil amendment from crop wastes, allowing corn to effectively self-fertilize in nitrogen while also sequestering carbon.

When the inputs are measured in pounds/acre and the biomass yields are in tons/acre, you don't even need an envelope to know which way the comparison is going to go.

Last, we could support 9 billion on a fraction of our current land area if we used algae effectively. Those techniques wouldn't even use soil. I'm not sure I'd want to live on the likes of shrimp or crayfish and tilapia for my protein, but it would sure beat starvation.

Fertilizer is not the only petroleum input to modern agriculture. Pesticides and fuel for farm machinery is also part of the mix. What you are saying is totally false. Support 9 billion on a fraction of our current land area? What have you been smoking?

Then tell me what's wrong with my data. Hyperlinks and supporting calculations here.

Note that I said "feed", not "indulge with a Western diet".

That you are both innumerate and scientifically illiterate is not my problem; it is your problem.

During Malthus life, total population was under 1 billion. In fact, as recently as 1930, total global population was under 1.5 billion (most estimates center on 1.3 billion). Yet in a mere blip of 77 years we have increased total human population by 400+% using the "green revolution" to feed those masses, a fact that is acknowledged by every major biologist in the world today.

If you don't understand that graph, see the quote from Dr. Albert Bartlett in my signature. Innumeracy and biological illiteracy are both correctable but only if you wish to correct those personal flaws.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I'm happy that my ability not to read lets me oversee the inacuracies in your post. Please check:

http://www.census.gov/ipc/www/worldhis.html

1800 (Malthus began writing in 1796):

low estimate (UN): 0,813 billion

high estimate: 1,125 billion

1900 (The Age of oil was just beginning)

low estimate: 1,550 billion

high estimate: 1,762 billion

1930

low estimate: 2.070 billion

1950 (After fighting WWII):

low estimate: 2.4 biliion

high estimate: 2.557 billion

Please read Malthus. His basic observation was that he was doing about 5x more baptisms than funerals..

And Grey, you are doing a very good job of keeping Malthus' tradition!

ps to both: notice that the graph above goes "exponential" well before the carbon age.

Go figure.

The knee in the curve coincides roughly with the Rennaissance and the discovery of the "New World" and also corresponds closely to the beginning of the coal age in Europe.

Let's grant 2.0 billion for 1930. Current estimates show a low of 6.5 billion today. That's still more than trebling the entire population in the space of one human lifetime. You are quibbling about minor details. Human population growth is exponential. It has reached a point where many scientists are now concerned about the loss of biodiversity, soil erosion, water table depletion, etc. It has even reached a point where the Pentagon is studying the impact of overpopulation as a trigger event for military actions.

Just as a note, in case this escaped your god-like powers of deductive reasoning, the carbon age does not coincide with the age of oil.

My original comment was that many of the problems we are experiencing today are symptoms of overpopulation. You argued that it is exactly the opposite - that overpopulation is a symptom of these other things. In fact, let me quote myself so that we don't have you performing further "creative" nonsense in this discussion:

Your response (minus the ad hominem crap) was:

So you are arguing that overpopulation is the result of oil depletion, coal depletion, natural gas depletion, fishery destruction, climate change, deforestation, water table depletion, topsoil erosion???? That's incredibly "creative" of you but certainly gets the cart before the horse and you won't find any but a tiny few (like yourself) who belief such nonsense. Clearly, human population is the driving force leading to fossil fuel depletion, fishery destruction, climate change, deforestation, water table depletion, topsoil erosion and a "host of other issues" that I referred to originally.

But by all means continue with the ad hominem attacks on people. Do that because you have no factual leg upon which to stand and that is all that you can do.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

By the way, which of the exponetially growing populations are you afraid of at the moment?

writerman: I almost get the feeling that some people are almost, close to, glad for these indicators of a dramatic fall in Saudi oil production. There's no place for glee here!

Like it matters what we feel at this point.

Pointing out manners at peak! LAUGH.

Great analysis Stuart. I echo Luis and Chris' comments that its bittersweet news.