Net Oil Exports and the "Iron Triangle"

Posted by Sam Foucher on July 13, 2007 - 10:00am

As Matt Simmons pointed out several years ago, the critical problem with post-peak exporting regions is that we would have two exponential functions (declining production and generally increasing consumption) working against net exports. From the point of view of importers, it is quite likely that we are facing a crash in oil supplies. In my opinion, what I have described as the “Iron Triangle” is doing everything possible to keep this message from reaching consumers.

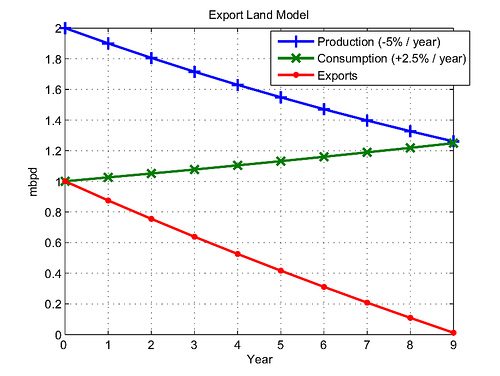

In an essay posted on The Oil Drum blog in January 2006, I warned of an impending net oil export crisis, and I used what I called the Export Land Model (ELM) to illustrate the detrimental effect on net oil exports of declining production and increasing consumption. Figure One is a simple graph that illustrates the ELM.

Figure One

Also note that the percentage of production that goes to consumption at the start of a production decline has a significant effect on when a net exporter becomes a net importer.

For example, the top five net exporters, in 2006 (Saudi Arabia, Russia, Norway, Iran and the UAE), consumed about 25% of their total liquids production. Offsetting this, many of the top exporters, based on our mathematical models, are at fairly advanced stages of depletion, especially the top three (Saudi Arabia, Russia and Norway), which showed a combined 3.8% decline in net oil exports from 2005 to 2006 (EIA, Total Liquids).

In any case, the answer to the question of how much oil would be exported from the ELM follows (I based URR on Texas URR versus peak production):

Assumptions:

- URR 38 billion barrels (Gb), peaking at 55% of URR (approximately same range as Texas and Saudi Arabia, based on the premise that Saudi Arabia has peaked);

- Post-peak production decline rate of 5% per year (approximately the same range as Texas, historically, and Saudi Arabia, currently);

- Post-peak rate of consumption increase of 2.5% per year (less than half the current rate of increase in consumption for top exporters).

Results:

- Net exports go to zero in nine years (note that the UK went from peak exports to zero exports in about six years).

- From Year Zero and Peak Exports on the ELM, only about 10% of remaining recoverable reserves would be exported.

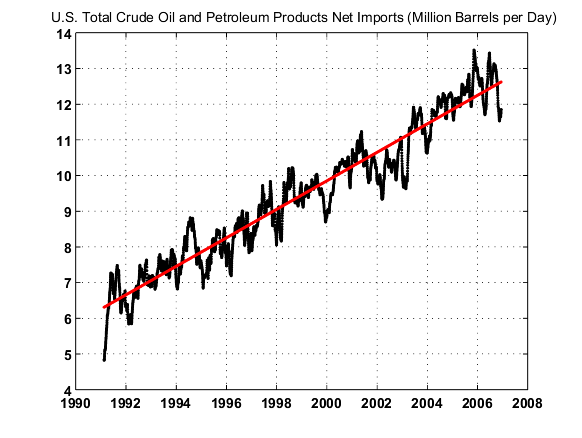

Figure Two

Figure Two shows Total US Crude Oil and Petroleum Product Imports, which have increased at about 5% per year since 1990.

In my opinion, we will see an epic collision between the conventional wisdom expectations of a continued exponential rate of increase in net oil exports, versus the rapidly developing new reality of an exponential decline in net oil exports.

My frequent coauthor, Khebab, is presently working on some mathematical models for production, consumption and net exports by the top net oil exporters. Based on the data that I have seen so far, it will not be a pretty picture. I suspect that the models may show that not much more than 25% of the remaining URR in the top net exporting countries will be exported.

In regard to discussions of Peak Oil and Peak Exports, I have described what I call the “Iron Triangle,” which consists of: (1) Some major oil companies, some major oil exporters and some energy analysts; (2) The auto, housing and finance group and (3) The media group.

If one resides in the oil industry leg of the Iron Triangle, and if one has concluded that Peak Oil is upon us, or extremely close, does one say, "We cannot increase our production," and thereby encourage massive conservation and alternative energy efforts, or does one say "We choose not to increase production and/or we are temporarily unable to increase production for the following reasons (fill in the blank)?"

The latter course of action would tend to discourage emergency conservation efforts and alternative energy efforts, and it would encourage energy consumers to maintain their current lifestyles, perhaps by going further into debt to pay their energy bills, and it would in general have the net effect of maximizing the value of remaining reserves.

I always find it interesting that people like Matt Simmons (who are encouraging energy conservation) are widely blamed by some critics for high oil prices, while some major oil companies, some major oil exporters and some energy analysts are--in effect--encouraging increased energy consumption.

The prevailing message from some major oil companies, some major oil exporters and some energy analysts can be roughly summarized as follows “Party On Dude!”

Meanwhile, over on the other two legs of the Iron Triangle, the auto, housing and finance group is focused on selling and financing the next auto and house, and the media group just wants to sell advertising to the auto, housing and finance group. The media group is only too happy to pass on the “Party On Dude” message to consumers.

To some extent, what we are seeing across the board, from large sectors of the energy industry to the auto/housing/finance industry, media and beyond, is the "Enron Effect," i.e., many people know that we have huge problems ahead, but their paychecks are dependent on the status quo.

The suburbanites are caught in the middle of this, although they have a strong inclination to believe the prevailing message from the "Iron Triangle." As in the movie "The Sixth Sense," for most of us the automobile based suburban lifestyle is dead, but we just don't know it yet, and we see only what we want to see.

However, it is increasingly difficult for many suburbanites to ignore reality as it slowly dawns on them that Jim Kunstler was right when he said, “Suburbs represent the biggest misallocation of resources in the history of the world.” We shall probably soon see that hell hath no fury like a Formerly Well Off suburbanite who just had his SUV repossessed and his McMansion foreclosed.

At least those of us trying to warn of what is coming can try to be ready with a credible plan to try to make things "Not as bad as they would otherwise be,” when it becomes apparent to a majority of Americans that we cannot have an infinite rate of increase in the consumption of a finite energy resource base. How's that for a campaign slogan?

I recommend FEOT--Farming + Electrification Of Transportation (EOT), combined with a crash wind + nuclear power program.

Alan Drake has written extensively on EOT issues, for example in “Electrification of transportation as a response to peaking of world oil production.”

In simplest terms, we are soon going to need jobs for hordes of angry unemployed males, and in my opinion “FEOT” is a way to put them into productive jobs.

On an individual basis, I would also recommend “ELP,” which is summarized in the following article: “The ELP Plan: Economize; Localize and Produce.”

Good luck to all of us. We are going to need it.

Jeffrey J. Brown is an independent petroleum geologist in the Dallas, Texas area. His e-mail is westexas@aol.com.

Jeffry, Thanks. I really appreciate your hard work and the work of Khebab on this problem.I'm with you on the cascading effects of depletion.

First question: Many exporters have very small internal economies and no surplus for export except oil. Will they therefore export all their remaining oil? I feel this is more likely in countries where a small elite controls the country and has massive overseas investments-like Kuwait, Saudi Arabia and the kleptocats of Nigeria.

Second question: Many countries that export production are building or have built refineries and petrochemical complexes, as they want the refining markup as well as the production markup. Saudi Arabia and the United Arab Emirates are both in this category. Does your decline in exports include net products, or is it crude plus condensate only?

Bob Ebersole

The EIA tracks production and consumption in terms of Total Liquids. Let's assume that we have production land and refinery land. Let's ignore refinery gains, transportation costs, energy used in energy production, etc.

Production Land produces 2 mbpd, and ships all of it to Refinery Land. Production Land consumes one mbpd of product, and Refinery Land consumes one mbpd of product.

So Refinery Land ships one mbpd of product to Production Land, and consumes one mbpd domestically.

On a net basis, Production Land shows a net total liquids export rate of one mbpd, and Refinery Land shows a net total liquids import rate of one mbpd.

Following is a slightly edited copy of a post I made on the 7/12 Drumbeat, regarding the ELM:

If I recall correctly, at the beginning of 2007 the EIA was going to track net production with regard to other liquids (notably biofuels).

I think they already have enough data for inputs and outputs, and publish them so that we can see how the inputs and outputs "net."

Would you re-post the diagram from yesterday showing the actual production, consumption, and export figures for Mexico against the ELM shown above? I think it makes a stronger case for a theory when current date fits the model.

Flavius Aetius

Khebab,

Could you post your graph on Mexico's production, consumption and exports?

I'm not sure it's a completely accurate picture because Mexico is also importing petroleum products (and growing) but I don't have time to redo this chart right now. Also, only consumption numbers for total products are available from which I roughly deducted a crude oil equivalent (by dividing volumes by 1.1). Consequently, this chart has to be taken with a grain of salt.

I'm just eyeballing it, but it's interesting to note that although the predicted exports go from 2mbpd to 1 mbpd from 2004 to ~2011, the rise in the price of oil to date keeps the export income relativity healthy.

I wonder what the 'income' lines would look like. Pretty ugly as you go from an exporter to an importer (If you can afford to import at all.)

It'd be interesting to see a few predictions of oil income, based on a range of price targets for 2020 (Say $75 to $300)

Production peaked in 2004 but profit may have peaked in 2006 because so far prices in 2007 are not higher than in 2006. Problem is that Mexico's importation of oil products is growing rapidly so they reach a negative trade balance sooner than we think (2010?).

This is the important graph. I think if you did this with KSA you will see that their investment in Petrochemicals is going to pay off even as crude oil exports decrease. Iran I don't think so. Norway I don't know. Some of the other Persian gulf countries are also investing heavily in petrochemicals.

The ones without significant petrochemical investments and significant imports are going to be the ones having problems.

Venezuela ??

Where did you find this info btw ?

Take quarterly data for Mexican oil consumption (all products) from here: http://omrpublic.iea.org/omrarchive/12june07tab.pdf page 3 Here's the data):

1Q05 2.04

2Q05 2.11

3Q05 2.06

4Q05 2.10

1Q06 2.08

2Q06 2.02

3Q06 1.99

4Q06 2.03

1Q07 2.08

2Q07 2.05

and do a linear regression. The result: a decline of 4,000 barrels per quarter, with an r squared of .104 (which is pretty low).

So, we don't see rising consumption. Are the IEA's projections wrong again?

As I noted down the way, the top 10 net oil exporters, inclusive of Mexico, showed an annual rate of increase in consumption, in aggregate, of 3.3% per year, from 2000 to 2006. Just the increase in consumption by the top 10 from 2000 to 2006 is equal to all of Nigeria's net exports in 2006.

Ok. Does my data and analysis look ok to you?

Bob,

In regard to your first question, in post-peak exporting countries, I think that we will see Phase One and Phase Two.

In Phase One, their cash flow from export sales will increase, even as their net exports decline--because of higher oil prices.

In Phase Two, their cash flow from export sales will decline, as their net exports continue to decline--because rising oil prices are not sufficient to offset declining net exports.

It will be extremely difficult--if not all but impossible--for exporting countries to curtail domestic consumption in Phase One.

And even in Phase Two, I expect to see massive resistance against efforts to curtail domestic consumption, probably leading to varying amounts of violence.

Also understand that as time goes forward the demands for investment in the oil industry to maintain production only increase. Look at Mexico and Venezuela and now Russia as example where needed investment is not forthcoming. As a country moves from phase 1 to phase 2 pressure to lower investment in the oil industry to continue to support internal projects only increases. Here Venezuela is the poster child.

So its reasonable to expect that as time goes on these countries will not reinvest in their oil infrastructure at anything like the rate investments where made in the western nations at the same time that the amount of needed investment is doubling or tripling in price because of the intrinsic nature of oil in our economy.

We have already seen the costs for investments in oil infrastructure spiral out of control as high oil prices and demand cause more general inflation.

I'd like to see some projections on when a country moves from phase one to phase two.

Finally I think the market will remain fairly clueless about ELM for some time and thus we can expect oil to remain under priced vs the real price needed to prevent exporting countries from going from phase one to phase two with the potential for major cutbacks in investment.

So in my opinion the market by underpricing oil will force most oil producing countries into a phase two situation far sooner than most people realize. I actually think we are already in phase two since we have every indication that all the major oil producing nations are pulling back rapidly on re-investment in the oil industry. At that point ELM becomes a optimistic model probably highly optimistic as producers continue to cut so they can get back into phase one growth.

We have every indication that we have already entered this war between and unrealistic under priced market and producers steadily cutting to get the large profits they need for internal use at phase one growth rates. At this point only a rapid repricing of oil above that needed to get back too phase one along with continued strong demand at the higher price point will spur a reversal of this game of chicken.

See Iran for early Phase 2.

Indonesia, deep into Phase 2 (and importer of oil by quantity, but still a SMALL exporter by value due to high quality oil produced) endured blackouts rather than buy heavy bunker oil while waiting for new coal fired power plants to be completed.

A worthwhile point of discussion is when will the Phase 1 to Phase 2 transition take place.

My guesses:

Mexico within 2 or 3 years.

Venezuela just after the next Presidential election in about 5 years.

Russia within eight years, but more than three years.

Oddly, Norway, with the HIGHEST gas taxes in the world, could be said to be in Phase 2 and never in Phase 1.

I expect 70% or so of Norway's remaining URR to be exported, the highest in the world.

Best Hopes for doing SOMETHING now,

Alan

Norway is rather a special case. Due to their low (c 5m) population the percentage of total prod'n available for export remains high well into their decline phase. Their population is relatively stable and living standard already among the world's highest. It's also one of the last places you'd expect to see unrest, quite unlike many ME states.

Phase One could last a very long time. My guess is that we are likely to see price spikes to high levels that will be sustained ($100-200) and this will generate tremendous income and raise living standards significantly in exporting countries everywhere but Norway. The difference between $40 oil and $150 oil offsets a lot of years of 5% production declines as far as net income goes.

Prius / Suburban = 4.6

Ken

Westaxas,

I'm wondering what the real shape of the production curve will look like. As countries get past peak production, and especially then they get to Phase Two, it seems like we will be seeing more "above ground" disruption. Thus, at some point production is likely to drop more than normal decline rates would suggest.

It also seems like there will be other changes that make the model more complex. Exports will more likely to go to favored countries - ones that can provide things the country needs, like military protection, medicine, and food. Other non-favored countries may see their imports drop much more rapidly that the model would suggest.

I agree, and as I suggested down below, I suspect that the US is basically making "an offer that they can't refuse" to Iraq and Saudi Arabia, since oil prices and inventories would suggest that oil exports to Asia should be going up, while Saudi Arabia and Iraq are cutting exports to Asia.

The Neocons might argue that things are going according to plan regarding Iraq and oil exports to the US. As I have previously discussed, the flaw in their plan may be the willingness of the American military to continue to put themselves in harm's way to keep H2 Hummers well supplied.

This ELM is the most”in your face” -way to understand the realities concerning Peak oil – after peak that is. It is simply not possible to go wrong in understanding where this will go … and a sample-ELM-chart should be laying on the table of every decision-makers of this world

Cheers Jeffrey J. Brown / Khebab - and not least Westexas

I think that there is a lot of resistance to this concept, even within the Peak Oil community, because the implications are so dire, but as I previously said, I'm sorry to be the bearer of bad news, but sometimes reality sucks. There is just no way to sugarcoat the effect on net exports of an exponential decline in production and an exponential increase in consumption in exporting countries.

Following is a copy of a post I did yesterday, regarding ELP:

I’m left wondering how realistic the exponential increase in consumption is post peak oil, or even as national export revenues decrease. Let’s assume that Russia for example has peaked and is in decline – let’s also assume the world has peaked. In this scenario I can’t see Russian internal consumption continue to increase exponentially. If the global peak initiates a global recession-depression it’s unlikely that any country will continue with exponential economic and oil consumption growth (major oil exporter or not).

I’d agree with the model pre global peak, but I’m not convinced by the constant internal consumption growth rate in a post peak world.

Is Mexico’s consumption still increasing?

Mexico's consumption hasn't continued to grow irrespective of their peak as ELM assumes.

Mexico's economy is tightly coupled to the US economy. And worse tightly coupled to the housing bubble. Mexico was the number one benefactor of the housing bubble. What your seeing is the housing bubble crash and illegal aliens no longer committing fraud using no doc loans to buy homes in Mexico and working building houses here. Needless to say the housing bubble crash is causing a major recession in Mexico right now.

Once this clears you will see demand grow esp as some illegal immigrants move back to Mexico to weather the storm as its cheaper to live.

Because of this tight coupling you need to correct ELM. I think you will find growth turn around and Mexico start various monetary games to paper over this housing lead recession.

If you adjust for the devastating effect of the end of the American housing bubble on Mexico's economy you will see that demand remained strong and increasing.

The EIA shows the following for Mexican consumption:

2004: 1969 mbpd

2005: 2078

2006: 2029

So, consumption is up over 2004, but down relative to 2005. However, in this respect, Mexico is pretty much alone. For example, another exporter in the bottom half of the top 10, Kuwait, showed a 17% year over year increase in consumption, while the top five, in aggregate, showed a 5.5% year over year increase in consumption.

As Memmel pointed out, a plausible explanation for Mexico is the decline in money shipped home from migrant workers in the US, as home construction employment has tapered off.

It's worse than that WT. The amount of fraud in OC and the IE using illegal immigrants is unbelievable. The money moving back to Mexico from honest labor is a fraction of that coming from fraudulent transactions around here. We are talking billions moving out of California into Mexico. I think few people have any idea what was really going on in California.

Illegal Immigrants with fake SS make the ultimate straw buyer.

Not to mention some of the legal Hispanic immigrants that used fraud to buy houses in Mexico and move back.

Sure the legit part is suffering.

http://www.lendingclarity.com/2007/05/01/employment-the-housing-bubble-a...

Most of the fraud rings in California have made heavy use of legal and illegal immigrants with false papers.

Remittances are dropping to Mexico for the first time since 1999. Remittances are second only to oil revenue in Mexico. So declining oil exports combined with lower remittances could be double bad for Mexico which could cut into national oil consumption economically by way of recession/depression. Does the ELM take this into account?

"MONTERREY, Mexico, July 12 (Reuters) - Stricter U.S. border controls and a housing slump are cooling the once red-hot growth in remittances migrant workers send to Latin America, challenging economies to cut their dependence on the money flows.

Cash sent home by Mexicans living abroad fell 5.5 percent in May, the first fall since 1999, and countries across Latin America forecast that the growth of remittance flows will slow substantially this year."

http://www.reuters.com/article/bondsNews/idUSN1240009520070712

Mexico was trying to get a drilling platform for its Maloob field, part of its KMZ program. There are a number of offshore Carribean fields not yet tapped. Development is not moving quickly enough to reverse the damage done by accelerated production from Cantarell.

Mexico has a literacy rate of about 90%. In Nicaragua the literacy rate was about 68%. Some illegal immigration was from Central America and the migrants did not know how to read or write Spanish or English.

And it is a cash economy where no one pays taxes.

The range is too short to infer a trend, only 2 years.

I'd have to think that oil exporting nations will behave like any other country when faced with recession. Inflate and invest to spur their economies. If oil revenues are dropping the only route open is to increase investment in expanding the other sectors of the economies. Oil producing countries are just as capable of deficit spending as any other. So if anything a global recession will simply encourage the countries to plow more resources into their local economies the only difference is they will be doing it from a deficit/inflationary approach. Short term increased demand for goods and services from these countries will lessen the effect of such a global recession.

I think Mexico is getting ready to enter this sort of deficit/inflationary spending phase for example so I expect the value of the peso to tank. Iran has been on this path for quite some time. Iran is flirting with hyperinflation.

http://www.jordanembassyus.org/01092007003.htm

Normal economic games apply equally to oil exporting and importing nations and outside of Iran most of the oil exporting nations have plenty of room to play games.

Consumption in some of the key exporters could continue to increase even if OECD nations are in debt / energy induced recession. We've seen WT's thread re Russian car sales, foreign vehicle sales there up 50% in past 12 months and several fold since 2002. It's hardly conceivable that all these new vehicles won't be used substantially; furthermore several key exporters have built up large currency reserves which will act as a 'cushion'.

Will they go guns?or butter?

there will have to be some kind of reaction to the gurrilla actions...will it be talk?economic assitance,butter?or will it start to get real real bad down south{guns}.. this could affect oil supplies more than any consumption models

Khebab has a good point. I went back and looked at the increase in consumption by the current top 10 net exporters, from 2000 to 2006. It increased from 9.1 mbpd to 11.2 mbpd, about 23% (EIA, Total Liquids), an increase of 2.1 mbpd. This is an annual rate of increase of 3.3%, and as one would expect pursuant to the ELM, their overall rate of consumption has increased, as cash flow increased in 2006 (because of high oil prices) even as net exports dropped.

What will happen to internal consumption in these exporting countries when oil prices hit the $100 to $200 range, even as their net exports continue to drop?

Look at Russia right now. Foreign car sales are going up at 50% per year--doubling every 1.4 years.

Chris,

I think that we will continue to export the problem to countries clinging to the lower rungs of the economic ladder. If the US doesn't collapse from its CDOs and its collapsing housing market, then we will see other small countries being priced out of the market. Onward to the material collapse.

The countries with oil to export will continue to grow their economies as long as we print fiat scrip and they are willing to take it.

But, if the economy tanks, then you will have massive demand destruction. This effectively extends the URR but it also results in the conditions we are all fearing -- collapse.

It also means that there will be enough oil left for dramatic and very destructive military operations designed to corner oil supplies. With enough civil disorder, the PTB will declare martial law. It is only a short hop to totalitarian government from there. The media will become even more the PTB's lapdog, and should we decide to take off the nuclear mittens, we will not be hearing about our use of nuclear weapons from the MSM.

Everyone loves to say it can't happen here. If you are one who says that, you are a fool. Tell that to a holocaust survivor. Tell it to the Chinese, to the Spanish, to the Russians.

Before various democratic movements arose late in our history, strongman rule was the rule, century upon century, millennium upon millennium. Though it will never be a cut and dried argument, we may be seeing or have recently seen peak democracy.

Consider the many new car factories being built in Russia and the increase in new car sales. Unless oil prices plummet (for a short time) due to a recession, car sales and consequential oil consumption will continue to increase in places like Russia

One aspect hardly touched on is this: the dire consequences of declining oil exports will be quite apparent sooner rather then later. Many Americans consider it a god-given birthright to be able to fill-up their SUV's and other toys with unlimited quantities of cheap gasoline. If its accurate that net crude oil exports will cease in about nine years, there will be disastrous responses starting almost immediately. In other words, life will not be unchanged until the last drop of crude oil is exported; it starts now.

Gasoline prices in the USA are climbing upward, but the full economic effects are just starting to be feft.

Just imagine what's going to happen when world net exports of crude oil decline by 10%, 20%, let alone when they stop altogether?

Dr. Duncan's Olduvai Gorge is beckoning humanity's survivors back home.

Flavius Aetius

As was noted, the impact of this effect depends hugely on the ratio of total production to domestic consumption. I need to play with Excel some more, but from what I can tell, if domestic consumption is more than about 25% of total production, then the total rate of decline of exports is much greater than the sum of the rates of production decline and consumption growth, which is the scary part.

So, a question for people who have more data to hand than I do: What is the actual situation in the major producing countries? What percentage of their production do they consume domestically?

For purposes of this question, refined products that are re-imported should maybe be included as domestic consumption, on the assumption that if oil is sufficiently dear, they will develop domestic refining capacity. On the other hand, that may not be practical in many cases. So I guess both figures would be of interest (i.e. with and without reimported refined products).

I'm not sure it's meaningful to distinguish between domestic consumption and exports when prices are the same in exporting and importing countries. Everyone using oil is subject to the same prices, and ultimately the same price rationing.

That said, there are major tax differences between exporters and importers, with most importers (ex - US) having rather high taxes compared to low taxes in exporters. This of course tends to favor increases in consumption in exporter countries.

Ultimately, the tax differential might not mean much, as low taxes in some areas will help drive prices higher, possibly until the tax becomes a relatively minor part of the total price. Price rationing will occur, whether due to taxes or to product prices.

Then, of course, we have those countries which sell oil domestically far below what it could be sold for export. Russia and several ME countries fit this mold, but the pressure to change will be intense. This policy may be phased out rather quickly going forward (it is already happening in Russia and Iran), leading to price rationing and a decline in domestic demand in these countries.

Generally speaking, supply ALWAYS meets demand at some price. However, the policy of low domestic selling prices in exporting countries may mean that all the price rationing is concentrated in importing countries. Could be quite a price!

One thing which might really press the message home is to calculate and show how much oil we have to discover and bring online to handle ELM and continue business as usual. Just eyeballing this is a ridiculous number about 25mbd over five years. I think if you take ELM and apply a cornucopia approach it will highlight how dangerous our current situation is.

I'd have to look but I don't think we have ever brought that much oil online that fast. Almost everyone acknowledges that outside of OPEC remaining oil will be hard to get and a lot are not happy with OPEC not developing the reserves they have reported. The ELM model can be used to show that even with the most positive outlook the task is huge.

If you follow the model out for ten years obviously we have to then bring on over 50mbd to continue to grow our oil supply this gets well beyond reality. HL or peak oil is then being used to calculate decline rates but I think its easy to show even if you discount peak the decline rates are reasonable and close to those used in the industry so closing this wedge by even dismissing peak is probably hard to prove.

At this point the number of scheduled mega projects is well known so its easy to show no matter how rosy your outlook we are going to have problems and they will increase.

And you can end with my favorite deniers of peak oil always like to point out above ground factors for why we are having supply problems. These factors won't go away after we pass peak in fact they will probably worsen. So real oil production over the next few years will be determined by both above ground effects and ELM. In addition a new above ground factor of countries seeking to optimize production of their remaining resources to support diversifying their economies will continue to grow, maximum exports will not be the highest priority.

Let them stew on that a bit.

WT - couldn't agree more on the ELM model. However, I seem to be one of the few TODers who has real problems with EOT. I can certainly see the electrification of heavy rail for goods transport but I believe that electrification of PAX transport is ill thought out.

Building trams and LR systems assumes that people have need for such transport to get to jobs or to purchase goods. This in turn assumes something akin to BAU, i.e., a consumer/service society/economy. I simply think that's a questionable proposition in an age of depleting resources. As I posted a while back about post-peak eduction, my own belief is the future will be radically different, making investment in PAX EOT a misallocation of funds similar to suburbia.

Todd

I agree somewhat but for a different reason but I think similar reason.

As peak oil plays out the nature of our population centers can and will shift dramatically. The population of California southern California in particular will probably drop substantially. This is true for a lot of our cities. So I don't think its prudent to use the current population patterns as a guide in developing local transport. As far as freight transport a port city is a port city and in effect always will be even if the population reduces to one focused on the port.

So I don't see any huge changes in the major freight routes these are basically fixed by geography.

However I do disagree with you for certain types of cities. Obviously ports will remain important and also cities with large amounts of natural resources. And of course a city lacking in these can invest heavily in transport to make itself an attractive place to live post peak.

Last of course the cost of building transport will only increase as peak oil progresses and we may well see our ability to do so decrease. This means that cities the preemptively invest in public transport may well be the only ones that have any even it its not laid out optimally.

Cities that come late may well face to high a barrier and be abandoned. It does not take a large out flux of people to crash the property values in a region. Look at Detroit.

Mike,

As you probably know, I'm in the collapse/dieoff group. I don't think cities have a future: Most don't produce anything; They require vast resource inputs from outside their boundries; They require significant infrastructure.

You basically appear to assume some sort of economic BAU will continue. I simply can't see that. So, I guess we'll just have to agree to disagree.

Todd

Not sure about BAU just that a good number of cities are geographically in the best place to have cities. No matter what we will have a decent sized city at the end of the Mississippi. New Orleans may get a lot smaller but you will have trade up and down the Mississippi and you will have a city somewhere near the mouth of the river. Alan can probably point out how much of New Orleans can be successfully hardened against strong hurricanes and the city could well move a bit.

These city sites may be gutted in war and rebuilt later maybe slightly offset from the original center but you will have a city at these natural locations.

I happen to think they will be abandoned burned and retaken and rebuilt to be honest but since your going to have a city in these areas a innovative city might manage to skip the above. I think New Orleans for example stands a good chance of not getting burned to the ground while Houston ...

But it may not be New Orleans. The Mississippi River wants to move west, and it's only a lot of taxpayers' money keeping it where it is. Even without peak oil, we would lose that battle eventually. With peak oil, it's probably going to happen a lot faster.

Actually we generate a bit over 200 MW (max) from the Old River Structure, and the addition of the hydroelectric plant (and extracting the energy) enormously stabilized the entire diversion.

Sorry, not in this century,

Alan

BTW, your link is pseudo-scientific clap-trap wiki that would not withstand good peer review. A number of facts are wrong.

I agree with Alan, the link is B.S. As an example, the site says that the Texas "Black Giant" oilfield is causing subsidence into the Gulf. There is no Black Giant oilfield, the closest thing to that name is that the East Texas Field was sometimes nicknamed the black giant. But, the East Texas Field is 300 miles inland from the gulf and has no subsidence I'm aware of.

They suggest abandoning New Orleans and building a new port at the mouth o

f the Atachafalaya (probably misspelled by me). They're obviosly not aware that Morgan City is already in that location and has an excellent port which mostly services the offshore oil industry.

The site is written by lazy morons who have never been to south Louisiana or Texas, yet are unafraid to offer opinions.

Alan Drake for President! He's a hell of a lot more even tempered than I am! Bob Ebersole

Neither of you has refuted my point. Unless we bomb each other back to the Stone Age, there will always be cities. But they may not be where they are now.

This is especially true in the United States, which is very young as nations go. We've built many of our cities in places that may not be sustainable in the post-carbon age. Especially if things unfold as James Hansen fears.

Don't argue about Nawlins :)

Seriously its not clear why its part of the US and will probably seceded first chance it gets. Its a special city.

Others like Memphis that have become anonymous towns could indeed move. In general however the ones along the Missouri/Mississippi/Ohio system are probably the most stable.

Others such as Dallas for example are iffy. In general the port cities will either make it or be rebuilt later as smaller versions of themselves. What I want is the pentagon plan leaked for which cities the plan to defend post peak you know they have to have one floating around it may be based on a Embargo but either way I'd love to know which ones they are interested in keeping at all costs. Are they willing to give up Sand Diego ?

An Arkansawyer here,

The MS River Delta can be recreated ( and is) anywhere a stream

moves into a pond.

The fan is always evident. The MS River fan has a name. It's called

the Barataria Terrebonne Estuary (BTE).

The "Top" of the fan in the MS Delta is atthe Old River Control Complex.

The Atchafalaya on the West of it, the MS River'scurrent location the East.

The River now is appox. 300 ft above the BTE.

It wants to fall into it. Only the Corpis stopping it.

An ex. of how easy it would/will be:

And all it takes is to blow the South levee at flood across from the Bonne Carre Spillway just up from NO. NO would be saved.

The Corp would never be able to capture it again.

The Petro Chem Complex including BR's XOM refinery would then be unuseable.

Which is why you have a choice, NO or the River. But not both.

<"Either they don't get it or they just don't care,"http://www.alternet.org/katrina/29274/?page=2> said Mark Davis, director of the Coalition to Restore Coastal Louisiana. "But the results are the same: more disaster."

So stop the repairs; put the brooms and chain saws away. Close the few businesses that have re-opened. Leave the levees in their tattered state and get out. Right now. Everybody. It's utterly unsafe to live there.

To encourage people to return to New Orleans, as Bush is doing, without funding the only plan that can save the city from the next Big One, is to commit an act of mass homicide. If, after all the human suffering and expense of this national ordeal, the federal government can't be bothered to spend the cost of a tunnel from Logan Airport to downtown Boston, then the game is truly over.

Anyone who doesn't like this news -- farmers who export grain through the port of New Orleans, New Englanders who heat their homes with natural gas from the Gulf, cultural enthusiasts who like their gumbo in the French Quarter -- should all direct their comments straight to the White House. But don't wait around for a response.

And BTW, NO isn't the only city in danger from subsidence:

Sunday, January 21, 2007

Subsidence: Houston is Sinking

Houston Satellite Image - Data from USGS.

High Resolution ImageLots of attention goes to subsidence reports for New Orleans, but Roy Dokka, an engineering geologist at Louisiana University is switching the channel to another city -- Houston.

According to Dokka portions of Houston are sinking at a rate of 1/2 inch per year. Combine that with rising sea level and you have a huge problem. This sinking of the city has made flood plain maps out of date and storm surge models inaccurate. Both now understate the actual risk.

Some of the sinking is natural subsidence and part is caused by ground water pumping. The subsidence problem was recognized decades ago and in 1975 the State of Texas created the Houston-Galveston Subsidence District to limit the amount of water withdrawn. Unfortunately the subsidence problem continues and Dokka is trying to focus renewed attention upon it.

Read the full story about Houston Subsidence at MySanAntonio.com.

Memmel,

Where will the Californians go? What will they do once they get there? Who will accept them?

You have to think holistically.

I believe that we have enough land to feed everyone without FF. The trick is coordinating the movement of millions of people, building new shelters, teaching these people how to produce food through permaculture, teaching people blacksmithing, fish, animal husbandry, weaving, cobbling, food preservation, medicine of any kind, etc.

Problems include: Conflicts over land ownership. Not enough instructors, not enough heirloom seeds, not enough clean water resources, not enough willpower, not enough thought about where we want to head as a species.

Of course, we will not do what needs to be done. The "free marketeers" will see to that. I predict that the invisible hand of the market, also known as nature, will sweep the slate clean. Things will sort themselves out. The market for human beings is shriveling up. Nature ain't buying our product anymore.

Living uncomfortably close to Santa Anna California I have no idea. I know I'm going to get the hell out of here soon. My wife has some family ties here and I'm working on getting her family to realize the situation. In the meantime I'm enjoying the sunshine since we have had no rain.

Seriously though from what I've seen most people with ties to Mexico are heading for Texas in droves. People not from California which is a lot are heading back to their home states most of this is housing bubble related. About the only people not moving are the retired Prop13 guys but quite a few of these HELOC'd like mad and are loosing their homes. HELOC's were huge here in Orange County because no one one could afford to pay the taxes if they moved because of Prop 13 so they HELOC'd the hell out of most of the homes around here. A lot of these people are retired or close to retirement and will be loosing their homes so I don't know what they will do. In any case at least for Orange County the blowout of the housing bubble is the primary problem not peak oil. I think people just now started hitting the credit cards for gasoline as the HELOC money runs out.

I'd not be surprised to see 10% of the state goes bankrupt and starts turning in their homes over the next few years so I'm not sure how this will interact with peak oil. Basically peak oil and higher prices are just going to cause the credit cards to max out faster and homes to go into foreclosure faster. I actually live in Irving and poking around on Zip Reality I've not found a single house sell since April in most of the city. Only some really high end homes and the last of the flips and the last bits of fraud are moving.

Orange County is housing bubble central so thats going to dominate the local economy and I'm sure the rest of California.

Yet again the crazy housing bubble has a interesting peak oil effect. It boosted the Mexican economy as oil was slipping and as it collapsed it forces a lot of people to leave California before peak oil really starts biting.

nationally the effect is probably for a lot of people to move to apartments closer to work as they lose their homes.

For those that took the money and ran they have paid off homes in other states so they are in good shape to weather peak oil. Also note a lot of suburbia will be hammered as empty homes burn or are taken over by squatters.

Its not the way I would have handled peak oil but Machiavelli must be bursting with pride. But as you work through the outcome of the housing bubble you see a pattern from the willful destruction of suburbia that actually makes us better post peak.

Interesting ...

Needless to say I don't think we need to alert our government to the dangers of peak oil they are well ahead of us. As far as I can tell the US government initiated post peak plans right after 9/11.

I second this read as I also have lived through it.

Sold my houses in Santa Monica several years ago, the ex tried to ride it longer and now can't give her houses away.

The story in Cali, longterm, is water (or, the lack thereof). There just is not going to be enough, from the snowpacks in the Sierras to the Colorado, for civilization to keep going. I predict a rather ugly scene.

The bubble also made it so easy to disregard the initial price increases in gasoline. If your house was going up in value 50K per year, what did an extra $50 per week in fuel costs matter. It was simply irrelevant, and fuel efficiency was clearly for people who didn't own a home.

Now, with property values falling, credit tightening and interest rates rising, people are having to pay for fuel with money they actually earn. Price rises will hopefully have the effect of causing people to even consider the possibility that we might be starting to run out.

Hybrid sales are a mere 1%. You are seeing more of them in LA, especially in trendy areas like Santa Monica, but nothing that makes a difference in overall fuel efficiency.

Prius / Suburban = 4.6

Ken

The illegals, and many legals, from Mexico and central America do not want to be here. I know quite a few and to a man they would much rather be home. They are here for the money. Remove the profit motive and they are gone.

Molly Ivins, RIP, hammered this theme since the early 80's. No need for fences or new legislation, enforce the existing laws on employment, and zip, problem solved. No $, no motive.

You'll like my new novel, "World Made By Hand," set in the post-oil future in upstate New York, specifically Washington County, between the Hudson River and the Vermont border. Life has changed, the population is reduced, but the people are carrying on. I may post some excerpts on my website soon.

Jim Kunstler

Saratoga Springs, NY

I meant to mention that the Simmons/Kunstler symposium in Dallas on November 1, 2005, was a prime example of the "Iron Triangle" at work.

We had a leading energy expert, Matt Simmons, and a leading expert on New Urbanism, Suburban Development and Energy Impacts on the Suburbs, Jim Kunstler, together at one event, attended by people like Boone Pickens. All of the local media were notified. That afternoon, Jim sat down for an hour long interview with members of the Dallas Morning News editorial board. The sole local media coverage of the event was by the SMU student newspaper and the following interview on the local PBS station.

Matt and Jim calmly and logically explained precisely what the problems are that we are facing. At the conclusion of the Q&A, Matt Simmons said that "If we do nothing to address Peak Oil, Jim Kunstler will have turned out to be an optimist."

With the two noted exceptions, the local media completely ignored the event. (Outside Magazine did run a story couple of months later.)

In any case, a link to a 11/1/05 interview with Matt Simmons and Jim Kunstler follows. If you wish, you can order a CD of the interview at the KERA website.

http://www.energybulletin.net/19686.html

Simmons-Kunstler interview

Glenn Mitchell and Jeffrey J. Brown, KERA/Energy Bulletin

(I have previously mentioned that my daughter and son-in-law, to their rapidly growing regret, turned down the opportunity to meet Matt Simmons, Jim Kunstler and Boone Pickens.)

Do I sense a TMA problem? Too many acronyms? BAU, PAX, EOT; OK I've no doubt been slumbering but there comes a point... The Export Land Model definitely deserves an acronym but only after it becomes common knowledge. Otherwise it just goes into the discard bin of insider acronyms. How the hell did we manage before acronyms?

Yes, it's time for TMA! I hereby submit to the Board of Acronymics for official clearance for TMA.

I'm sure you have a good point; I just didn't get it - and if I'm in trouble, I'm probably not alone.

I'm from the government, and I'm here to help. :)

Business As Usual

Passenger (search me how this one happened, but there it is)

Electricfication Of Transportation (given when first used, which is a style rule that should be considered the 11th Commandment in my opinion)

Have read too many government documents, I guess, deciphering acronyms from context almost doesn't break my reading pace anymore. :\

"Let us wrestle with the ineffable and see if we may not, in fact, eff it after all."

-Dirk Gently, character of the late great Douglas Adams.

If we're not careful, TOD could soon be reported to PASTA, (People Against Stupid And Trite Acronyms)

LOL :)

Relax, they're just TLAs (three letter acronyms)

As society restructures itself, the transportation needs will change.

There will still be a need to transport workers to the wind turbine factory, the prisons, the sugar refinery, the coffee roasting and processing plant (that addiction will not die quickly !), the cotton mill and cloth weaving mill and the clothing factory, the shoe factory, flour mill, steel mill, eyeglass frame factory, and much more.

Many of these places of employment will be new (the US has just one eyeglass frame manufacturer left, we will need several more) and they will gravitate to the places with non-oil transportation and good rail and water access.

If Phoenix builds a light rail system (one line under construction), the half million to 1 million (my guess) that may be left there in 2030 will likely be clustered around that system and either caring for elderly retirees (less energy to ship them south than keep them warm up north), working at the solar energy production plants, salvaging suburbia (or the university or state gov't). Even in a prolonged drought, natural water resources can support a smaller population with extreme conservation (drinking treated sewage, etc.)

Outside of Las Vegas, Phoenix is the most unsustainable city we have currently building Urban Rail. Yet, what they build today will likely still be in use 100 years post-Peak Oil.

*IF* we were building as much Urban Rail/capita now as the French (my hope and dream would be x3 to x5 as much/capita) some small % would end up being wasted. In most cases, the new Urban Rail would attract new businesses and other work places.

If 5% of the Urban Rail built in 2012 ends up being shut down in 2040 because of changes in Urban form, it will have served a useful purpose for a couple of decades and the rails, ties & rolling stock can be salvaged for use elsewhere (North Korea bought retired rolling stock from Switzerland and some used rail from (I think) Japan for a new light rail line a dozen or so years ago).

I think "over investment" in Urban Rail is as big a problem today in the USA as excessive walking and bicycling is.

BTW, cheap oil has allowed dispersion of manufacturing out into small towns to access cheap labor. I expect natural forces to pull those manufacturing jobs back in to larger cities. Manhattan was once a MAJOR clothing manufacturing center, and may be again.

Best Hopes for Urban Rail,

Alan

I think we might see a resurgence of the Northeast. Access to the ocean, good rainfall, transportation infrastructure in place, and plenty of good farmland. (granted, a good portion of that has been suburbanized) but that will likely be reallocated by dividing up larger homes into apartments, and using the rest of the neighborhood as food co-op land.

New York State has a decent, and little used, canal system.

http://www.nyscanals.gov/maps/index.html

New York gets 2 GW of hydro from Niagara Falls (when the tourists are not looking at it).

OTOH, large parts of Boston are below sea level and must be destroyed ASAP.

Best Hopes for Buffalo,

Alan

This is an excellent way of presenting one of the problems inherent with any finite resource that is used by both the exporter and importer. I'm certainly going to use the graphic when discussing the problem with family and friends (some of them are particularly hard-headed.)

One problem I have with the plots is that the percentage increase is only based on Year 1. The plot should have a curve to it and not be a straight line. This would present a slightly shorter timeline for when net exports reach 0.

I think you are making one or two very large, and very unsubstantiated assumptions here.

1) That oil exporting nations will be allowed to maintain, or even increase internal consumption, while everyone else suffers.

2) That the oil that is produced will be distributed equitably.

I'd suggest that what you are actually pointing out here is that a classical economics view of the problem, and approach, is an unacceptable scenario that you can expect there are plans in place to avoid.

Uhhhh Gary, just who is the "allower" here? We all know who the "decider" is, but he will soon be out of office. I really don't think there will be an "official world allower" to be found anywhere. Some might try but if they did that would only exacerbate an already bad situation.

Ron Patterson

Over the last 50 years we've tended to believe that negotiation and free trade are the motive forces of global society. However that's built out of relative resource abundance. Historically the phrase is "might is right". When it gets difficult, that mode will reappear.

Do you think the US is going to say to Mexico - don't worry, you can keep burning the oil that comes from the gulf, while we have riots due to rationing?

As soon as we invade a country and dramatically increase its oil production let me know. Don't forget to include the oil used by the invading army in your calculations.

http://www.peak-oil-news.info/military-oil-usage-statistics/

And include secondary usage to support the military. The surprisingly strong growth in demand in the US is almost certainly related to military support needs.

Export Land with military usage included is not pretty.

What the US has done is secure enough oil to ensure its military is supplied Iraq has nothing to do with domestic consumption. I'll give you that once you include all the secondary usage needed to support the military machine we might have a net exports of a few hundred thousand barrels.

We can ignore that Iraqi production formerly when to support domestic consumption.

But at least we have secured fuel for our military.

Yes we can and will probably invade more countries but I think it will be driven by the needs of the US military not the people right now we have enough oil.

What the US has done is to put its cards on the table that its major play in the game to come is military force. Never really much of a choice really; and please don't underestimate what an unleashed military can do.

Others will choose other means.

The point is that the game is one of gather and control for inequality - its not share and contract in free trade.

Garyp: The argument that the US military has not been "unleashed" has been used for about 45 years now. Short of an all out nuclear holocaust, the US military has shown what it can and cannot accomplish.

That is correct for now. However, once the people see the military as the ONLY way to secure the oil and their way of life, things will change. No more press or any unauthourized coverage like they've endured for so long. They will become more like Nazi Stormtroopers and the public will not care as long as the oil is ours. A city dares to shoot US soldiers??!? Goodbye city. It will get ugly but then that will be happening all over the world as well.

Look the US military will have to take on and increasing role as police not aggressors the attack forces needed are actually relatively small esp for military police work inside the US.

They needed to secure additional oil supplies to ensure continuation of the American/Military government. This critical mission has been accomplished. I see any chance of the US military securing oil for the population to use as practically nil they could care less.

The only reason they have to attack Iran is to remove the threat to their oil moving through the Persian Gulf. If they also eventually secure some Iranian production fine but they don't need it. So the reality is they will be quite willing to destroy Iran and its oil facilities if thats whats needed to protect Iraqi production. I actually expect for them to wait for Export Land to play out in Iran to be honest.

The US economy has to wean itself off oil anyway they have no real reason to waste resources better spend policing America chasing oil for the benefit of the consumer. The military however will remain addicted to oil for a lot longer electric rail does not solve their problems.

Korg: This fantasy of military omnipotence has been going on for 45 years now. The last two major wars for the USA have involved the invasion of runts, pipsqueaks (Vietnam and Iraq). Even up against runts it hasn't worked out well. I think you are believing the press clippings.

I am not advocating this but historically, conquering societies that have succeeded in asserting control have often either used or threatened to use some form of genocide or ethnocide. The US military has never been in a position to do this (and hopefully never is) but any nation that would be willing to do this might succeed in asserting control over various areas.

The nation I see as most capable and likely to resort to genocide or ethnocide is China, due to its autocratic government and recent history of behavior. Russia has also demonstrated a willingness to go down that road at least a little ways in Chechnya. As I said, I am not advocating this but it seems a possibility unless we collectively arrive at a better and more peaceful solution.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Who knows. The first order of business for the military is to ensure the survival of the industrial military complex and protect their facilities. And as I said they will be oil based for a long time. What they do above and beyond that really depends. So far we have only see them cover their own ass so to speak. Genocide of some form is probably in our future some by the US military. But they could just as easily be Americans as any other nationality.

Always this strange fantasy that it is possible to secure an oil supply line from the Middle East to the US. It's impossible. The famous US military can't even secure the perimeter of the Green Zone in Baghdad. How are they going to prevent sitting-duck oil tankers from being zapped by anyone who has a cheap chinese Exocet-type missile?

The famous US Navy? The US Navy, in its entirety, can be sunk in 20 minutes by unstoppable Russian Sunburn and Onyx-class cruise missiles, or their Chinese equivalents.

The military is not and never has "stolen oil" for the good of the American People. They steal oil for the robber barons/big oil companies, who then sell it on the open world market and keep the proceeds. This has been going on for decades.

They need not ship directly just ensure a equivalent quantity of oil goes where they want it to go. Of course the use is not getting favored for imports or anything like that.

A good bit now moves out via pipeline to Turkey. I'd not be surprised to see that exports via pipeline to the Red Sea are actually viable now. We don't know if the Persian Gulf bottle neck has been bypassed. More than a few have wondered if Iraq oil is moving via pipeline to other ports.

In any case if its not its trivial to make it happen when the need of a incident in the Persian Gulf diminishes.

From your link, the US army uses about 160m*12% = 19m barrels of oil per year, or about 2.5% of Iraq's current production.

While I agree with you that invasion seems a questionably effective way to increase oil production, the amount of oil used by an army to do so is effectively negligible.

How much of the American GDP is devoted to military production ?

Come on you can't just look at final use its a huge complex that support our industrial system. And worse you just pick one branch of the armed services.

Whatever I hate responding you.

According to the CIA World Factbook, military spending worldwide ammounts to a staggering 741 billion dollars annually. This figure represents approximately 1.5% of the world's GDP of $49,000 billion ($49 trillion). The United States has a $277 billion defense budget which accounts for 37% of the world's total.

http://www.wisegeek.com/what-percent-of-gdp-do-countries-spend-on-milita...

Not this does not include expenditures by defense contractors themselves.

Is it really worth my time responding ?

That's silly. Even the official on the books budget for the US military is way over $277B, something pushing $500B. By the time you include stuff like Iraq/Afghanistan, DHS and the off-the-books stuff, it's pushing $1T. Just the US.

This is what politicians call "sustainable prosperity".

cfm in Gray, ME

From the President's 2008 budget:

By my reckoning, 2008 budget

$481.4 + $141.7 = $623.1

By the time the Congress adds it's jambon, it's expected to push $700 billion. Your tax dollars at work...

Man, once surrendering his reason, has no remaining guard against the absurdities the most monstrous, and like a ship without rudder, is the sport of every wind. -- Thomas Jefferson

Now add in the vast network of civilian support and the oil usage of the US military ranks high in the list of countries.

The reason we invaded Iraq was to ensure that US military might can be projected through out the oil wars. Its strictly to support the military industrial complex so far they have not considered the American public. But you can sleep safe knowing American military might will continue throughout the oil wars.

Production? Quite low. For 2007, the budget for military production in the US - counting the Procurement, R&D, and Construction categories - was $170B, or about 1.3% of GDP.

Total military spending estimates range from $430B (DOD-only) to $930B (everything possible, including much of the interest on the national debt), or 4-7% of GDP.

For historical comparison, DOD-only spending in the 50s and 60s was higher than the highest of those estimates (by %GDP), and only in the late 90s did DOD-only spending dip briefly below where it is now.

The most reasonable military spending figure in my opinion includes Veteran's Affairs (injuries from past wars) and all the supplemental bills for the current wars, and so runs at about $630B, or about 5% of US GDP. Historically, that's a pretty modest number - it's lower than the US's DOD-only spending from the 50s through the 80s.

You may think the US is doing stupid things with its military (and I'd agree), but evidence suggests that it's spending a relatively small amount to do so.

Feel free to explain your own theory and provide some evidence to back it up, then.

We were talking about the cost of the Iraq war. The cost is overwhelmingly paid by the US army. Ergo, I talked about the cost of the US army.

That would be because your posts are nonsensical rants bereft of any supporting evidence, and I have a nasty habit of pointing that out.

Don't agree? Then try providing evidence that backs you up.

The US used about 20 mbpd of oil.

7% of 20 = 1.4 mbpd

4% of 20 = 0.8 mbpd

Since the total US GDP is comprised of a number of components that var significantly in oil usage a simple percentage is not correct however since a lot of military spending is direct at procurement of goods and services its reasonable to expect the military and associated industries to be heavier oil users than a simple percentage would indicate. Thus supplies of between 1-2 mbpd should be enough to maintain our current military and on the high level will probably support another significant engagement.

Finally Homeland security expenses may not be properly accounted for in the above.

And even though you try to twist the conversation several times I stated that the oil coming from Iraq was sufficient to cover the needs of the entire military industrial complex the amount used in Iraq needs to be accounted for but so far if the mission was to ensure a secure supply of oil that could support the US military industrial complex for the next 20 years then the Iraqi missions was and is successful.

"I think you are making one or two very large, and very unsubstantiated assumptions here.

... nations will be allowed to maintain, or even increase internal consumption, while everyone else suffers."

IMO, the USA already maintains/increases consumption of oil (and other things) way above it's means and nobody tries to stop them!

BTW, I think the ELM applies to any resource that is traded between nations ... food comes to mind as an important import ... especially as the world population increases exponentially ... agricultural topsoil erodes ... fish stocks crash, etc etc.

Xeroid.

WT, thanks for this. Certainly looks like a huge wealth transfer to exporting nations. While they are still exporting that is :)

Please note that Total Crude & Product Imports (Fig 2) are now back above the 13 Mbpd level (and your red trend line) as of Wednesday's EIA report.

Gary & JN2,

It's kind of funny--regarding classical economics, Dave accused me having no understanding of economics.

Regarding where the exports go, I have noted that I think it is a little odd that while oil prices in Asia are higher than in the US (and crude oil inventories lower than in the US), Saudi Arabia and Iraq are cutting exports to Asia, in favor of the US.

That's kind of the point. Decisions are not being determined by classical economics, they are being determined by other demands...

BTW I'm not getting at anyone, just pointing out that what exportland says is that status quo in global models is not an option.

mutual back patting my friend.

until the exporters and the USA cannot band together to support the upper echleons in both societies, the back patting will go on!

economics of trade. the USA can enforce law/order while gaining a strong position for oil. what value this law/order has is based on a rational fear for ones life (royalty hate being hanged/chopped/killed/tortured).

simply put the USA can ensure future oil by propping up dictators and monarchs in the middle east. The dictators with the help of the USA can quell riots and destruct demand such that the USA gets the oil. The money in return can build outrageous palaces and fuel class imbalance!!

tada!

i call it the (democracy, military exporter, oil importer)-(dictatorship/monarchy, oil exporter, military/tech importer) relationship!

(a reminder to you all that everything can be exported, everything has value of a sort which can be bartered for)

the USA is probably getting a good return on investment as irrationality when bargining for ones life is quite common.

jbunt

When do we sell "short" the oil shipping company stocks? That is, at what point in time is the volume shipped (both from Producing Land and to Producing Land) at a maximum? Or are we there now?

A suggestion from the nuclear PR desk - never put the words 'crash' or 'accident' in the same sentence as the word 'nuclear' or 'power.' It makes people nervous, when really, they should just trust the nuclear power industry to do whatever it takes to earn money.

Oops - also, never use the word 'money' and 'nuclear' in the same sentence, otherwise people might think that the nuclear industry cares most about its profits.

Isn't that what they are supposed to do? You mean, unlike the oil industry?

They cannot make a profit if people do not use their product. If people do not trust them, they need to work to restore trust. That's how you make profits.

We have other institutions in society that are supposed to worry about those other values. Republicans will not be running the government forever.

Safety costs money - and besides, the risk is only theoretical, unlike the revenue stream.

Mountaintop removal in West Virginia is also profitable, it seems.

Profit is not the highest goal of human existence.

It just seems that way too much of the time.

Jeffrey,

Here's some charts that should interest you, the first two lifted from the Norwegian Energy Man's Blog:

http://energikrise.blogspot.com/

This first chart ceratinly shows net exports flattening the last couple of years. And my eye is also drawn to the importance of export growth from Russia over the last 15 years or so. This I imagine will shortly come to a halt.

The second chart shows some peak reality from 23 countries that have already passed peak. I have to say I am dumbfounded how anyone looking at this chart could fail to see that the same fate awaits the whole world.

Worryingly, UK, Mexico, Norway, Malaysia, Colombia, Indonesia, Denmark, Argentina and Egypt are all exporters or former exporters that are now in decline.

And so with Brent closing at $77 near worthless dollars the moment of truth for Saudi Arabia must be getting close. Saudi production has stabilised these last 4 months - where next? With instability in Iraq and Nigeria continuing and the US doing all it can to destabilise Iran, you get the feeling that Saudi will be called upon to increase production before the end of the year.

Can anyone fill us in on crude and products stock levels in the USA, EU, OECD?

Euan,

As they say, this is not rocket science, and as I have said several times, I am not really even doing original work, but it is amazing to me how many people, even in the Peak Oil community, are missing the significance of net export capacity. As an importer, two things are important: your domestic production and the amount of total liquids that you can import. Total world oil production does not really enter into the picture.

As I noted up the thread, it took all of Nigeria's net exports in 2006, to just meet the increase in demand by the top 10 net exporters from 2000 to 2006.

On a Days of Supplies basis, OECD stocks are currently in the middle of the five range, with the EIA projecting that they will continue declining. However, in the Pacific area, OECD stocks are toward the bottom of the five year range. Note that OECD countries account for about 58% of total consumption. I would expect non-OECD countries, generally poorer than OECD countries, to have lower inventories, but I don't think that we have much real data there.

I have pointed out an interesting anomaly: while oil prices in Asia are higher than in the US (and crude oil inventories are lower than in the US), Saudi Arabia and Iraq have been cutting crude oil exports to Asia, in favor of the US.

IMO, last year we saw Round One of the bidding wars for declining net export capacity, with poorer consumers being forced out of the market. I suspect that we are entering Round Two of the bidding wars, between richer consumers this time, with the US "encouraging" some exporters to send oil our way (by making them an offer that they "can't refuse.")

I totally agree, my only concern is the exporter’s assumed exponential internal consumption growth post global peak. I have a hard time accepting that global peak won't impact the internal economies of net-exporters and that their consumption will just keep increasing exponentially until one day it hits total production.

The internal consumption curve needs another parameter or two.

My initial plan, for our Net Exports Magnus Opus, was to use two rates of consumption increase, 2.5% and 5.0%. I suppose that we might look into using 5.0% initially and then 2.5%. But in any case, I think that the short term trend is pretty clear--domestic consumption in exporting countries, in the aggregate, is a run away freight train. We saw something like this in Texas in the Seventies. In the late Seventies, the world's largest Rolls Royce dealership was in Midland, Texas.

And just think of the enormous resentment in exporting countries, when they are told to reduce oil consumption, so that it can be shipped to the US, or elsewhere.

I hate to be a pedant, but this is not the first time you have referred to "magnus opus", and that's wrong: the Latin word opus is neuter, and the adjective attributive must agree with it. Hence, MAGNUM OPUS!

What would you guys do without us classicists...? :)

My apologies. My last (brief) exposure to Latin was during the Ford Administration.

I agree, it's hard to predict what will happen. It's almost certain that domestic consumptions would have to be reduced which means that heavily subsidized gasoline would have to be abolished in some exporting countries (Saudi Arabia, Iran, etc.). They are facing hard decisions and it won't be a smooth ride.

Right, you can't have an oil export driven economy if you don't actually export any oil. I guess one solution is a series of price rises so dramatic that the amount of exports needed to fund increases in domestic consumption is continually ratcheted down. Exports would asymptotically approach zero but never actually get there.

Ken

An asymptotic approach of internal consumption to total production seems more likely to me. Maybe the rate of consumption increase will be some factor of the value of exports, as export revenue dries up internal consumption growth with slow. I can't see the oil price having the dynamic range to make up much of the export decline. How true this is depends on the economies reliance on oil exports.

The UK was an exception as the exports, large as they were, were only a small part of the total economy. Other large exporters are far more dependent on their export revenue than the UK was.

This just means these producers will move to focus on value add petrochemicals instead of raw crude and fuel. Export land is focused on simply exporting raw crude. As long as these countries have remaining oil reserves they can readily reign in local use for gasoline and continue to have profitable exports of value add petrochemicals.

The petrochemical industry is not going away only the use of a valuable resource for transportation fuel. And in general unneeded wasteful use but thats a different issue. The petrochemical industry need only compete with biofeed stocks for the same products and should be profitable for a long time to come.

I'm defining petrochemical as basically any use for petroleum but fuel for personal transport i.e cars and electricity generation. This ties in with the obvious need to move to electric transport and to move off petroleum for electricity generation. Other than that we have plenty of oil for all our other uses and it will be competitive with bio feedstocks.

So your right they will continue to export just not raw crude.

That's a good point and could increase the possible dynamic range of the price quite a bit. An oil exporter could pull in and larger and larger share of the value chain allowing the profits to remain whilst the magnitude of oil decreases.

I presume however that the petrochemical (and refining) industry has a lower profit margin than the oil extraction industry or otherwise no producer would bother to export crude at all. The bulk of the whole oil industry’s profits come from extraction, the downstream stuff being less profitable?

To put it simply that was pre global peak. By pulling raw crude off the market the exports can adjust the profit margin of the value add chain to suite their needs to a point. They are limited only by competition with biological reduced carbon feedstocks and CTL. Even with these constraints they win on volume. So even for example if bio feedstocks are competitive they simply can't provide the volume the same goes for coal.

Recycling of petrochemicals would also play a large role.

Note that the other parts of the petrochemical industry have much higher profit margins compared to refiners in any case the dynamics change substantially post world peak generally in favor of the producer.

So yes they are not omni-potent but they will have a reasonable and robust route to continue to utilize their oil reserves to drive their economies. In the big picture I guess the only real reason they did not convert in the past was the profit margins where so high on crude oil pre-peak that it was not worth investing in advanced petrochemical plants.

Post peak with the choice of expensive investment in production to maximize decreasing production rates or investing in petrochemical plants using increased profits possible by letting production decline closer to the natural decline rate without trying to do expensive mitigation. I'd say the second route makes a lot more sense. By going the petrochemical route they can deal with declining output from their oil fields a long time from now say 30-50 years since the limiting factor will be the petrochemical plants for a long time to come.