Peak Oil Booklet - Chapter 2: Is This a False Alarm?

Posted by Gail the Actuary on July 17, 2007 - 11:30am

This is a continuation of the booklet discussed previously. A PDF of this chapter is included at the end of this story, if you would like to share it with others.

Chapter 2: Is This a False Alarm?

As we look at the answers to these questions, we will see that the production decline discussed in Chapter 1: What Is Peak Oil? appears to be nearly immediate. Available methods for offsetting this decline appear to be too little, too late. This time the alarm is real.

1. It seems like people thought we were running out of oil in the 1970s, and then all of our problems went away. Why is the situation different now?

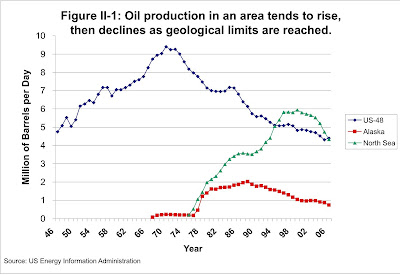

Let's look again at the graph of oil production for the US-48 states, Alaska, and the North Sea:

When US oil production began decreasing about 1970, there were still several sources of oil that could be ramped up:

• Saudi oil production could be increased, in a very short time frame.

• Alaskan production could be ramped up, once the pipeline was finished

• North Sea production could be started

Now we have reached the point where both Alaskan and North Sea production are declining. Saudi production also is declining, and there is suspicion that this is for geological reasons as well.

Discoveries in recent years have been mostly small fields or have been in places where oil is very difficult to obtain. In either of these situations, huge expense is required for very modest payback. We are running out of reasonable places to drill more wells.

2. What is the situation with current world oil production? Are major oil-producing regions having problems with production?

Six out of seven of the major oil producing areas are either reporting declining production, or have reported problems that are expected to lead to declining production in the near future. These six areas account for nearly half of world oil production. There are many other smaller areas with declining production as well. Thus, it appears that peak oil is very near at hand, and that large production increases from new sources will be needed in the next one to four years to prevent peak oil.

Based on data of the US Energy Information Administration, the largest oil producing countries / areas in 2006 were

• Russia - Increasing production, but future problems expected (9,247,000 barrels per day)

• Saudi Arabia - Declining production (9,152,000)

• United States - Long-term declining production (5,136,000)

• Iran - Declining production (4,028,000)

• China - Slight increase in production (3,686,000)

• Mexico - Largest oil field peaked in 2006 (3,256,000)

• North Sea (Norway, Great Britain) - Declining production (4,343,000)

Saudi Arabia used to be the world's largest oil producer, but its production has been declining since late 2005, so it is now second to Russia. Its production decline is supposedly voluntary, but analyses such as this one and this one suggest that there is a geological basis to its decline.

Russia is now the world's largest oil producer. The fact that its production has been increasing is one of the reasons we are not yet in deep decline. Russia's Alfa Bank is now warning that "production stagnation is unavoidable" reflecting "a higher proportion of water in the declining output", so it appears that this source of increase will be disappearing soon.

Mexico's production is now declining because of the decline in its largest field, Cantarell. The one country not included as having production problems is China. Even this classification is borderline. Oil production in China for the first three months of 2007 increased by only 0.3% over the corresponding period a year ago--hardly enough to matter.

With six of the seven major oil-producing areas having production issues of one type or another, a huge amount of oil from new sources is needed very quickly if worldwide production is to continue to increase. This oil is needed in a short time-frame -- the next one to four years. Production later will help mitigate the decline in production but is unlikely to prevent peak oil.

3. If we really want more oil, can't we just increase production in the areas where we have been drilling? I've heard that there is still quite a bit of oil left in the ground when we finish drilling.

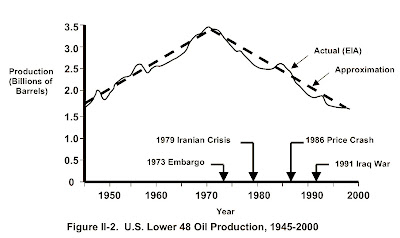

Yes, there is still quite a of bit oil left in the ground - generally at least 50%, and sometimes as much as 90%, of the oil originally in place. But wanting to get more oil out doesn't seem to have a big impact. This is a graph from a report prepared for the US Department of Energy by Robert Hirsch, Roger Bezdek, and Robert Wendling in 2005. It shows that US energy oil production in the lower 48 states continued to decline between 1970 and 2004, regardless of external events.

4. Won't higher prices result in greater production?

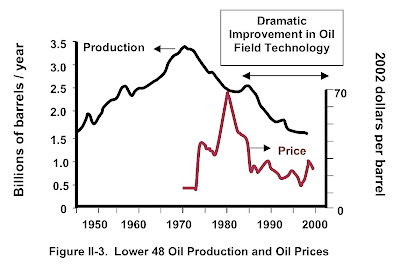

This is another graph from the report mentioned above by Hirsch, Bezdek, and Wendling.

This graph seems to indicate that for US-48, price changes have had very little impact on oil production.

Also, if we look at world oil production in Chapter 1, Figure 3, we see that volumes have been approximately flat over the past two years, even though prices have been in the $60 to $75 per barrel range - very high by historical standards. With these high prices, OPEC has not offered to raise production and, in fact, reduced production targets effective November 2006.

5. Won't better technology solve our problems?

Given where we are today, it seems unlikely that technology will prevent peak oil. It may help mitigate the down-slope after peak. Some considerations in saying this:

• Technological changes seem to have had relatively little impact on US 48 states production, as shown in the graph in Q4 above.

• Liquid fuel substitutes for oil all have challenges of their own. All are expensive using today's technologies and are expected to be slow to scale up. Biofuels tend to be very land intensive; coal to liquid has serious climate change issues.

• Technological advances are having some benefit (for example, deepwater drilling), and this is reflected in the numbers we are seeing. We need much, much more, however.

• If a major technological advance is made, such as inventing a way to extract significantly more of the oil that has been left behind, it will almost certainly take several years to produce the new equipment to implement the solution widely. Because of the likely timing of peak oil, such a new solution is much more likely to affect the down-slope after peak, than to prevent it. If the technological advance is significant enough, it is possible that it will permit oil production to increase again at some point in the future.

6. How about the Canadian oil sands? I've heard that production may triple by 2020.

While we hear a lot about the oil sands, the amount of oil they produce is not all that large. In 1997, oil sands accounted for 0.8% of world production. By 2005, production had grown to just under 1 million barrels per day, or 1.2% of world production. Even if production tripled, it would still be small compared to what is needed.

One factor impeding growth is the fact that current production methods require large amounts of natural gas, and this is in short supply. One idea under consideration is to build nuclear plants - eight would be required if production were to scale up to 4 million barrels a day. Given the time and expense of building nuclear plants, development is likely to take several years.

7. How about oil shale in the western United States? I have heard that there is a huge amount of this available.

Extraction of oil shale appears to be a very slow and expensive process. The methods under consideration require large amounts of energy plus a lot of water. In the West, the shortage of water is likely to be a major issue, even if the required energy can be obtained by building nuclear power plants, or by some other approach. At this point, no one is able to produce oil from oil shale in commercial quantities. It seems likely that it will take many years before even the level of production of the Canadian oil sands can be achieved.

8. How about the Jack 2 field? Newspaper articles in September 2006 seemed to say it would solve a lot of our problems.

The Jack 2 field is located in a very difficult-to-service location, five miles below the surface of the Gulf of Mexico and 175 miles from the Louisiana coast. It represents, at best, a small contribution to the oil needed to prevent a decline in world production. Newspaper production estimates of 3 billion to 15 billion barrels are for the whole region (rather than just Jack 2) and include natural gas as well as oil. If the estimated 3 to 15 billion barrels is actually oil, rather than mostly natural gas, it corresponds to 5 months to 2 years' oil usage by the US.

It is not yet clear that production will be economically feasible -- more appraisal wells are needed, and new equipment will need to be designed and built to handle oil in such a deep water location. If production is possible, it will almost certainly come too late to prevent peak oil. The cost of oil from such a location will also be extremely high, considering the cost of all the special equipment and the cost of insurance against hurricane damage in such a vulnerable location.

9. How about drilling in the Arctic National Wildlife Refuge (ANWR) in Alaska?

According to Wikipedia, the US Department of Interior under Gale Norton estimated that ANWR contained 10.4 billion barrels of oil, and that the maximum production from ANWR would be 1.4 million barrels a day. The US currently uses about 7.5 billion barrels of oil a year, so ANWR represents the equivalent of 17 months oil usage by the United States. The actual production would be spread out over a long period - at least ten years, but not starting until several years after work is begun. Maximum production of 1.4 million barrels would equate to about 7% of current US oil usage (or about 1.4% of world oil production).

Thus ANWR's contribution is likely to be small and come after peak has arrived.

10. How about drilling on the outer continental shelf around the United States? I understand that there is supposed to be quite a lot of oil there.

Based on this article from TheOilDrum.com, the Outer Continental Shelf (OCS) seems unlikely to contribute much oil for many years, because of the long lead times required in deep water locations. Special equipment will be needed, which will need to be designed and built. Thus, nearly all production is likely to occur after peak oil arrives.

The amount of oil available on the OCS is very uncertain. The current estimated amount of 115 billion barrels is the equivalent of about 15 years of US oil usage, or a little less than 4 years of world oil usage. It is not clear how much of this can be economically produced - production is expected to be very expensive. In some areas, ice cover for part of the year is expected to be a problem.

11. Aren't there quite a number of countries whose production is declining, simply because they are not investing in sufficient infrastructure and don't have modern techniques - for example, Iraq, Iran, Venezuela, and Mexico. If the US could help these countries with our techniques, wouldn't our oil problems be solved?

This would be great, but it is questionable whether it would work:

• The basic issue of peak oil is the fact that large oil fields that need minimal infrastructure are mostly tapped out. The remaining fields are less desirable for a number of reasons -- they are very small, are located in deep water or near the arctic, or involve very viscous oil or oil mixed with poisonous chemicals.

• In order to tap these remaining fields, a huge amount of infrastructure is needed. This will be very, very expensive.

• One of the major types of infrastructure needed is drilling rigs. Based on a presentation of Matthew Simmons, the supply of these is limited. Also, many of these are very old, and appear to be near the end of their working lives.

• US oil companies are very small in size compared to the National Oil Companies that are having difficulty developing the fields in question. With the lack of rigs, and the huge investment likely to be required, it is doubtful that our oil companies could do much to help these countries with lagging production, if they wanted. Furthermore, the petroleum engineers that would be needed to oversee such operations are also in very short supply.

• It is doubtful whether these countries would welcome our expertise. As a major purchaser of oil, it would seem to be in our best interest to abide by their preferences.

Links by question:

Q2-1: "International Petroleum Monthly-Oil Production" from US Energy Information Agency

http://www.eia.doe.gov/ipm/supply.html

Q2-2: "Nosedive Toward the Desert" by Stuart Staniford

http://www.theoildrum.com/node/2331

Q2-3: "The Status of North Ghawar" by Stuart Staniford

http://www.theoildrum.com/node/2441

Q2-4: "Alfa Report Sees Trouble Looming in Oil Sector", Moscow Times, 7/10/2007

http://www.themoscowtimes.com/stories/2007/07/10/042-full.html

Q3: R. Hirsch, R. Bezdek, and R. Wendling, "Peaking of World Oil Production: Impacts, Mitigation, and Risk Management", for US Department of Energy, February 2005.

http://www.hilltoplancers.org/stories/hirsch0502.pdf

Q6: Nuclear Power for the Oilsands

http://canada.theoildrum.com/node/2572

Q7: Oil Shale and the Future

http://www.theoildrum.com/story/2006/7/6/0472/48972

Q8: Jack-2 and the Lower Tertiary of the Deepwater Gulf of Mexico

http://www.theoildrum.com/story/2006/9/8/11274/83638

Q9: Wikipedia - Arctic Refuge Drilling Controversy

http://en.wikipedia.org/wiki/Arctic_Refuge_drilling_controversy

Q10: Deep Ocean Energy Resources-A Critical Analysis by Dave Cohen

http://www.theoildrum.com/story/2006/7/12/101236/478#more

Q11-1: The Peaking of OffShore Oil and Gas by Matthew Simmons

http://www.simmonsco-intl.com/files/Offshore%20Technology%20Conference%2...

Q11-2: "Labour and Skills Crisis Could Stall Oil and Gas Boom" by Booz, Allen & Hamilton

http://www.boozallen.com/media/file/Labour_and_Skills_Crisis.pdf

Link to a PDF of this chapter (reflects edits)

Gail: when you say this about nukes for tar sands:

would it not be more accurate to say something like: "Such an approach would likely take a decade or more to implement"

As far as I know it takes 5 years or so to actually build a reactor, plus the time required for design, permitting etc.

Permitting would be the big question mark. The BANANA crowd (Build Absolutely Nothing Anywhere Near Anything) would probably be able to prevent construction or at least drive up costs significantly.

Modern reactor designs (Gen III) have been built in roughly 4 years. GE's ABWR design[1] was built in Japan in 51 months - that's first concrete to commercial power operations (includes all the physics testing, piping checks, etc.). They got the facility itself up in 39 months (from first pour of concrete).

Potential bottlenecks on the materiel/personnel side include suppliers of the pressure vessel (no US suppliers left - Japan, France and South Korea can forge them), piping and wiring at a reasonable cost, skilled construction folks, etc.[2]

[1] http://npj.goinfo.com/NPJMain.nsf/504ca249c786e20f85256284006da7ab/5e5a0...

[2] http://biz.yahoo.com/seekingalpha/070529/36605_id.html?.v=1 (go to bottom of article, subheading "Bottleneck in the Nuclear Renaissance?")

Imagine a world without NIMBYs and BANANAs... well, maybe such is the case in regards to site selection for Coffeyville refinery and the Japanese nuclear power plant in recent news. I think it's too common to label concerned citizens as radicals and then when something goes wrong, people wonder WHY such safety concerns were not addressed in the first place.

Early days yet but what I've read about the Japanese nuclear power plant incedent so far says no big deal;

- A transformer fire, which could have happened at any type of plant.

- 2 small rad leaks, one trapped by the air filters in the plant, one small ocean release, both a factor of 10,000 under the plants permit limit, no human exposure, no measurable off site risk seen at this point.

- Some low level waste (i.e. dirty gloves etc) drums fell over (stand the drum back up), a few lids came off (stand the drum back up, replace lid, check floor with counter, decon. if necessary, remind staff about banding drum lids).

Obviously building a nuke plant in an earthquake zone is a calculated risk, seems from these news reports as if this plant came through with flying colors.

Radiation is released every day from coal plants at higher total levels, for some reason this does not get reported...

Of course, each side of the nuclear debate will take away what they will from the incident. The problem to me is WHO should be the one get to decide the "calculated risks" are acceptable for a specific site? If there were no NIMBYs, BANANAs, (or whatever negative labels people want to put on citizenry participation) to act as an opposing force to the vendors who are eager to promote the project, then descriptions like "pass with flying colors" would be the only news the public gets.

Coal, Wind, and even small-scale roof-top solar gets opposition from all sides, so nuclear is not the only red-head stepchild that pro-nuclear groups like paint. I believe Japan is much like France in terms of positive public opinion for nuclear energy. However, now, the news reports that its citizens' trusts are eroding, due to many incidents in the past (which of course, often get brushed aside as "minor" human errors). So what new terms can we dream up to ridicule the ex-pro-nuclear crowd?

My other point is that it is irrelevant how long a power plant can be build because of some "evil entity" obstructing progress, safety and trust should come first. If citizens know that they are not being scammed or held hostage by their power providers, I think any number of power plants can come online in a relative short time.

Valid points - but it comes down to who get's to decide and who get's to define the terms. Right now, those who create the headlines and those who edit the TV news reports get to decide how people will perceive events.

In regards to the Japanese situation, the plants actually operated in an outstanding manner. They were hit with a 6.8 earthquake and immediately shut down, safely. A few drums of Low Level Waste fell over and spilled liquid contamination into the sea. There is as much radioactivity in a shipment of bananas[1] (the yummy kind, not the concerned citizen kind), if not more, than there is in a typical LLW canister.

In light of those facts, what are the headlines that are being pimped out to the public?

"Japan Nuke Plant Leak Worse Than Thought"[2]

"Japan Company Admits Radioactive Leak Bigger Than Announced"[3]

Etc.

For someone who is not an engineer or familiar with nuclear science, such headlines are frightening and breed distrust. No one tells them that every second, their bodies undergo 6000 nuclear reactions, complete with gamma rays, beta particles and alpha emissions[4]. So how are they supposed to make a reasoned judgment?

Now, when power outages strike their towns[5] they may find incentive to dig deeper into the facts, but how many will really do that?

So, if I sounded a bit cynical, well, its because I am.

Back on topic, it still means that nuclear power has a huge barrier to climb in terms of public perception - all NIMBY or BANANA terms aside.

[1] http://jchemed.chem.wisc.edu/Journal/Issues/2004/Oct/abs1440.html

[2] http://www.guardian.co.uk/worldlatest/story/0,,-6788809,00.html

[3] http://www.jpost.com/servlet/Satellite?cid=1184672478639&pagename=JPost%...

[4] http://www.europhysicsnews.com/full/13/article4/article4.html

[5] http://www.yomiuri.co.jp/dy/national/20070719TDY03001.htm

Gail, in paragraph two of section 10 you left out the word "billion" behind 115 barrels. Also, in paragraph 11 you state there is a rig shortage. many people use the word rig to mean production equipment, while the major shortage is in "drilling rigs".

Bob Ebersole

Thanks for the assistance! I'll fix those items.

Double post.

Gail,

In several places you mention high costs. It might help your readers to understand the relevance of Jack 2, for example, if you could put a tentative dollar figure on developing that field. Maybe compare it to something onshore or in shallow water. Perhaps add some thoughts on insuring a deep water investment.

Whenever I talk to folks, they don't get the financials. They simply don't translate drilling 35,000 feet to $6/gallon gasoline.

Hi Gail,

For a more general audience or for those of us who try to keep up, but are not quite so inside the loop, would you briefly identify:

#2 - Alfa Bank - what/where is this?

#8 - Jack 2 - what/where is this?

Thanks!

Alfa Bank is Russian bank. According to this website,

Gail, the water is about 1 1/2 miles deep, while the total depth of the well is about 5 miles deep. Water that deep has about 10,000 pound per square inch pressure, and divers can't work in it-any subsea work has to be done by robotics or submarines. Its going to be a real technological feat to complete the wells.

Gail,

Your booklet is a great way to get the word out and preach beyond the "choir." For that reason, I do think these small points of reference are important. My background is media, not geology, still I have no recollection of the 2006 coverage of Jack 2. Oil simply wasn't on my radar last year.

Editing possibilities:

JACK 2

Jack 2, an exceedingly [or similar adjective] deep oil field off the Louisiana coast, represents...

Jack 2, a deep and difficult to reach oil field off the Louisiana coast, represents...

The Jack 2 field, with a well 5 miles below the surface of the Gulf of Mexico off the Louisiana coast, represents...

ALFA BANK

Russia's Alfa Bank is now warning that...

More to the point....

Jack 2, for which reliable production technology does not exist...

I changed the Alpha Bank reference the way you suggested.

I changed both the question and answer to the Jack 2 question (#8).

Let me know if you like this better.

Hi Gail,

Yes, that change to Jack 2 makes more sense to me. Will's suggestion - "Jack 2, for which reliable production technology does not exist..." - may be "more to the point" for some people, but I think the specificity that the Q&A now contains is more concrete for the general reader.

Another suggestion: Anytime you reference the past on a web site as you did in the second part of your question: "Newspaper articles last year seemed to say..." it's better to include the "when" -- "Newspaper articles in September 2006 seemed to say..." You can't guarantee when someone will read your brochure, thus "last year" doesn't provide a real-world time frame.

Most people writing on the web don't think to add dates to web sites or in PDF files. In the olden days of print media that annoying work was the job of editors and production staff. Moreover, each edition had a date in an obvious place (May 2007; Vol. 7, Issue 12) that could be referenced.

Given that PO discussion is ALL about time - what did they know and when did they know it and when will life as we know it all go to hell in a handbasket, I suggest being a nerd about dates whenever possible.

Many thanks for tolerating my picky comments.

Good point. I changed the reference to September 2006.

Those wells at Jack cost $100 million dollars just to drill, test and case (run pipe), and thats without production equipment and a pipeline. A 20,000 ft well onshore would cost about $4 million dollars, and the production equipment can be bought off the rack or used, and quite possibly is near a pipeline.

its a big difference, and Chevron has not elected to complete the Jack 2 well yet or drill any additional wells, although Devon is going to drill another appraisal well. That may change as oil goes north of $100/bbl.

Bob Ebersole

Gail, thanks. I think this is going to help a some of people who want to learn go from a state of ignorance [not a pejorative in this case] to reasonably well informed about the geological and technical challenges of the production side of peak oil.

To build on what Bob has written, my understanding is that although Jack 2 produced oil [or a reasonable facsimile thereof] during the test, oil was present at that depth only because of an anomolous temperature gradient. The bottom hole temperature was lower than one would normally expect at that depth. Deep wells are way out of my league, but the presence of exploration targets at extreme depth in general portends better prospects for natural gas than for oil.

OTOH, unless there is some other magic at work, gas in that location would never be produced at anything like $6 per thousand.

I suspect[as does Bob] that Jack 2 will be be developed if appraisal wells produce similar results, but cheap oil? Hardly.

Bob, I had not heard that Chevron was throwing in the towel [at least for now.] It makes you wonder what they were hoping to find. Could Jack 2 have actually been a flaming diappointment?

I'm not sure how question #5 relates to #10 in the first chapter. Do you want to deal with substitutes here, like electric and hybrid-electric vehicles?

As I noted in my suggestions for chapter 1, #10, it certainly looks like these will work. The problem is the transition, in which such vehicles might take 5-10 years to make a real difference. Still, that's an important difference.

I will save this for later.

I think it will take at least 10 years for electric cars to have an impact - probably more. We have to design them, then build factories, and then build the replacement cars, all in a resource constrained world. I believe there is also some question as to whether we could really make batteries for 100 or 200 million cars - some of the necessary materials are in short supply.

I think Liebig's Law of the minimum is likely to come into play in many ways. For example, I expect that world trade will drop greatly. Automobile parts we are accustomed to importing now will need to be made in this country. We will need to have sufficient materials mined or recycled in this country to make batteries and other necessary parts.

Well, there are a lot of things here. I’ll make brief comments, then try to flesh them out later, or answer questions as they arise.

“it will take at least 10 years for electric cars to have an impact”

True, to have a large impact. OTOH, they’re already having a small impact - hybrids are partially electric vehicles, and they’re selling at 2% of new cars. Most of those are Priuses (Prii?), which have double the MPG of competing cars, and can be converted to plug-ins (PHEVs) quite easily. Hybrid sales are rising by 55% per year, and accelerating.

“We have to design them”

That’s not a big deal. EV’s have been around for 100 years. Optimizing them to take advantage of the latest batteries, for maximum competitiveness, takes a couple of years.

“then build factories”

That takes maybe a year more. You don’t have to build factories, just adapt current ones.

“and then build the replacement cars”

They’ll be easier to build than current cars: EV’s, even PHEV’s are simpler than ICE vehicles.

“all in a resource constrained world.”

They’ll use fewer resources than existing vehicles, except arguably for the batteries.

“ I believe there is also some question as to whether we could really make batteries for 100 or 200 million cars - some of the necessary materials are in short supply.”

Lithium could be a temporary bottleneck. OTOH, it’s fairly abundant - we’re mostly talking about capital expenditure lag, like most commodities. Further, there are a number of competing chemistries, including next generation lead-carbon batteries (lead is very abundant) - see http://www.fireflyenergy.com/ffy.html . Firefly's chemistry reduces the lead by 2/3, and greatly extends the cycle life. OTOH, even currently available, conventional lead-acid batteries would be practical and cheaper than gasoline at current prices: they would just be inconvenient, as the batteries would need replacement periodically.

“I expect that world trade will drop greatly. Automobile parts we are accustomed to importing now will need to be made in this country. We will need to have sufficient materials mined or recycled in this country to make batteries and other necessary parts.”

Are you concerned about fuel availability for world trade? Have you seen a thorough analysis of this problem? Though I’ve seen this discussed often, I've never seen actual, quantitative analysis.

Long distance shipping costs are a very small % of product costs (well below 1%). Water shipping in particular will be unaffected for many decades: fuel cost is in the range of only .1-.2% of product costs; an insignificant 25% cut in water travel speeds would reduce energy consumption by a further 50%; the residual bunker fuel commonly used for water shipping is hard to use for other things; and wind power can be added as a modular addition to reduce fuel consumption. Long haul trucking in the US will be hurt, and rail and water shipping will expand, but I don't see much effect on global trade, except for relatively few very low-density items, like some produce.

There are no longterm, or technical barriers to PHEV’s and EV’s. There is a short term problem ramping them up.

Not really

fewer new car buyers are considering a hybrid

Define easily. A PHEV conversion for a Prius currently adds $30k to the price of the car.

And I have yet to be convinced that any of these new battery techs are road worthy. We've had this discussion before. Its a long way from 2 cells in you drill to 2000cells in your car.

Plug in Hybrids are 5-7 years out from mainstream production at best.

http://www.flickr.com/photo_zoom.gne?id=470905587&size=o

At least Toyota Advanced Vehicle engineer and spokesman Bill Reinert doesn't seem so optimistic. He does a great job highlighting the engineering challenges you seem to think are so trivial.

http://video.google.com/videoplay?docid=-2558276641904882805

Yes, really. You're comparing apples & oranges. The article said the following: "Fifty percent of new vehicle shoppers surveyed said they are considering a gasoline/hybrid electric vehicle. That's down from 57 percent last year." That means that currently 2% of buyers are buying hybrids, and 50% are considering them. That's a lot of room for growth.

Further, people are considering them slightly less because they've become aware that many currently available hybrds are "power" hybrids, optimized to use their greater efficiency for more power rather than MPG, and because Toyota is having trouble ramping Prius production up faster than (only!) 100% growth per year, which was the growth rate for the first half of 2007.

"A PHEV conversion for a Prius currently adds $30k to the price of the car."

Where did you get that price? A123systems conversions cost less than $10K, and the price is high because the large format batteries are still very new, and being produced in very small volumes. When I said the conversion was easy, I meant that installation is easy - just a few hours. Prices still have to come down in the next several years, which they will.

"I have yet to be convinced that any of these new battery techs are road worthy. "

There's no question that the cells are ready. The battery packs aren't. But..that's engineering, requiring no breakthroughs. Tesla has already done it for conventional li-ion's. Furthermore, conventional lead-acid would do just fine, if necessary. Heck, look at Jay Leno's 100 year old EV - works just fine, with the original battery. Li-ion's are just better, and GM (and other car companies) doesn't want something adequate, they want something clearly better than ICE vehicles.

"Plug in Hybrids are 5-7 years out from mainstream production at best."

Well, first, the panel that produced that chart was very "bullish" on PHEV's, and 2nd, rather than showing a picture that is "at best", the chart is conservative. You can see that clearly by looking at the first "demo" stage. This stage has already occurred, but the chart places it in 2008. GM says they expect to have the Volt on the road in the 1,000's by 2010 (which matches the chart), and I think they're trying to beat that, but don't want to tip their hand. Three years from now is what they allowed people to believe several months ago, when they said they were following a normal new-car production plan, which would take about 3 years. But, in fact, they are following an accelerated plan, doing final engineering (primarily of the battery packs) in parallel with production planning. That's expensive, and very unusual. Finally, GM says they plan to have sold 1 million in 5 years after production - that fits with the chart. That's a heck of a lot more than is suggested by "5-7 years out from mainstream production", which I think implies volumes getting up to maybe 20k per year, like the 1st year of Ford's 1st hybrid.

Toyota seems oddly hesitant about plug-ins. They've been dismissing them for years. Now, they seem to be stuck by a commitment to conventional li-ion's, which have a much greater fire hazard than the newest generation. At the same time, they've been hit with a large number of recalls lately, and seem to be afraid of taking any risks.

Perhaps they're afraid of cannibalizing sales of the Prius and the hybrid design, which they're rolling out to all of their cars over the next 10 or so years.

In any case, Toyota is hesitating, and GM is pushing forward as fast as they can. GM has been hoping to leapfrog Toyota (and other Asian manufacturers) for a while - that's why they've been pushing fuel cells as hard as they have. Now they see PHEV's as their chance, and they're going for it.

Reinert's discussion is interesting. Realistic, even surprising honest at times (like the comment about lobbying, and SUV buyers being “sheep meant to be shorn”) but in many places misleading in defense of Toyota. For instance, he talks about 5 year development cycles: well, that's a corporate choice. That could be compressed to 3 or 4 years: it would cost something, but not that much in grand scheme of things. It would certainly be cost-effective from the larger society's point of view. He talks about vehicles "hanging around" for 15-20 years. Again, true but misleading, as newer vehicles get used much more: those less than 6 years old account for 50% of mileage. He talks about CO2 emissions from coal plants, as Toyota likes to do - again, misleading (that’s a long discussion). He talks about CARB mandated EV’s not working out - not really true (GM now admits that killing the EV-1 was their mistake, and an enormous one).

Here’s a telling quote from another news story about plug-in conversions: “The conversions, however, void the Toyota warranty for the vehicles. "The official me says you shouldn't be doing this," said Bill Reinert, a Toyota engineer. "The unofficial me says these guys are cool, but the official me has to win out." “

The bottom line, is, he says “PHEV’s are near”, and clearly Toyota is heading in that direction. Like GM, Toyota wants to reduce any pressures that might cost them something, and wants to lower expectations. But, this is really quite positive.

The point of the article was that interest in hybrids is cooling. And it is, mostly because people are getting a better idea of the true millage. Part of it is because of the power vs efficiency trade off of some hybrid models. Part of it is the new EPA millage calculations. And part of it is people are learning the efficiency is only in city driving and that hybrids are actually penalized on the highways. Thing is most Americans do a lot of highway driving.

Plug in hybrids are going to have all those disadvantages plus one more even bigger one. A PHEV is useless for any household lacking an outlet where they park their car. That's a lot. I haven't seen any decent data but my WAG would be maybe half.

The GM volt is a car that doesn't exist and never will. It was an empty shell with a golf cart engine. It was a PR stunt to counter "who killed the electric car" and you and just about everyone in the press are reading too much into it. GM is about the last manufacture capable of producing such a vehicle.

The batteries need more than just engineering, which in itself will take 4-5 years. The newest greatest battery techs are just barely up to the job if at all. The real world is a very hash environment.

Your bit about a car battery pack being "easier" than a drills is just plain wrong. I don't even know where to start deconstructing that one.

As for the price of a prius to PHEV conversion, just google it. There are a handful of companies that will do it and it's priced about $30K. Even your $10k number is outrageous.

You are right that canceling the EV1 was a huge mistake for GM, it was a huge PR mistake. Commercially the car was a tremendous failure even in sunny warm California. It was completely unsellable anyplace else in the US.

I think like a lot of non-engineers you tend to overlook the difficulties in developing new tech for the market. These difficulties are even greater in a market as large and punishing as the US auto market.

The bottom line from Reinert's presentation is not that PHEVs are near, its that significant engineering challenges need to be overcome before there vehicles are ready for the market. BTW I think 5-7 years is "near" in auto industry terms.

My, oh my. We are far apart. I have to say, I disagree with most of what you said, which seems odd to me. I would have thought most of this stuff was obvious. I'm amused that you assume that because I disagree with you that I'm not technically qualified. In fact, I am an engineer, and I would have guessed that you were not. I guess this is a measure of how much we disagree. Well, let's take things on point at a time. I suggest we try to give references, links, and numbers, so as to not keep going around in circles:

"...interest in hybrids is cooling. And it is..."

Well, it dropped from 57% to 50%, which is probably just barely statistically significant.

"Part of it is the new EPA millage calculations. "

IIRC, the average MPG dropped by 16% (from about 27 to 23), and the Prius dropped by 25% (from about 60 to 45), reducing the Prius advantage from 133% better to only...100% better.

more soon...

I bet we're not as far apart as you think. Perhaps I just a lot more skeptical of some of these numbers I keep reading and you are a bit more optimistic. You say 3-4 years, I say 5-7 years, its not a huge difference.

You are optimistic about some of this new battery tech. It does look promising. But I look at the spec sheets and see temp specs that are still a little short of what is needed for wide adoption, but not too far off. You see power tools as proof these batteries work. I worry about vibration issues on those thousands of welds needed to construct a car batter pack. You're right contractors are hard on their tools. But losing an $80 drill battery is a far cry from losing a $10K car battery pack.

I honestly thought I remember you being from the finance industry. What exactly is your field? I'm an EE and have some experience with battery tech.

Nick, while I have your attention I want to run this past you. I did a quick analysis a while back for EVs that showed an EV is only marginally more energy efficient than a conventional hybrid system or diesel. I would assume this would hold for a PHEV running in electric mode as well.

The advantage of an EV or PHEV in electric mode is the source of electricity is not restricted to petroleum as is gasoline production. But this is only beneficial if you view PO as strictly a liquid fuel problem and not as an overall energy crisis.

But you still have to plug these electric vehicles in somewhere, you still need to expand electric generating capacity and you still need to expand the grid.

If you generate your electricity inefficiently then yes, the usage becomes less efficient, not just in your PHEV but in your computers, your lights at home, everything using that electricity. But for one thing electricity is not constrained by the same sorts of efficiency limitations as an ICE. And for another thing, once I am using electricity I can choose any generating source so I can easily improve my efficiency without regard for the underlying energy source.

I find the argument about efficiency of current generating systems being used to discredit PHEVs as very suspect because the PHEV doesn't really care what the underlying generating system is.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

I didn't mean to say it discredited PHEVs, just that it was another thing to think about.

And like it or not we are stuck with our current underlying generating system. That can't be ignored and it is a huge issue.

PHEVs and EVs by themselves are not much of a solution to an energy crisis unless they are coupled with renewable power.

Fortunately, in the US we have a lot of surplus nuclear & coal generating capacity at night, and a lot of wind & coal to get us through the transition to wind and solar.

I agree, in the longrun renewables are the answer. PHEV's pair so nicely with renewables, soaking up their intermittency, don't they?

hmmm. my first draft was bad...I hope no one saw it.

Let's put it another way. A gallon of gasoline has 34 KWH equivalent. At 45MPG, a Prius uses about .75 KWH per mile, plus an 80-86% penalty for well to station. A Tesla uses about .25 KWH per mile, wall to wheel, with about a 33 generating efficiency and 7% transmission penalty.

I get the Tesla, at about .85 kwh/mile, vs .95 for the Prius, as about 10% more efficient than the Prius. That's pretty close.

Now, the question is, why does this matter. If you're concerned about peak oil, it doesn't.

If it's CO2, then it matters a little, but not much, as PHEV's would reduce CO2 a little with our current mix. I think the assumption of the Tesla analysis is that new generation is more efficient than existing. Fortunately, PHEV's would work really well with wind & solar, soaking up their intermittency.

"this is only beneficial if you view PO as strictly a liquid fuel problem and not as an overall energy crisis."

That's what it is, at least for the US. We have plenty of sources for electricity. Coal, and to some extent natural gas, emit CO2, and that's bad, but we'll use them if we have to, which turns it into a climate change problem. I hope we move to wind & solar, though I think climate change is much harder to address than peak oil.

"But you still have to plug these electric vehicles in somewhere"

90% of US vehicle owners have offstreet parking. The rest will need some infrastructure buildout. Not that much, in the grand scheme of things: gas stations, parking structures, parking meters. It's done in Minnesota & Canada for engine block heating.

"you still need to expand electric generating capacity and you still need to expand the grid."

A recent DOE study found that we could replace 84% of our vehicle miles with EV/PHEVs, with current generating capacity.

A couple more thoughts:

“ Its a long way from 2 cells in you drill to 2000cells in your car.”

Actually, in many ways cars are much easier. Power tools have no temp or charge management, and tend to get run into the ground. Tradesmen are very, very demanding testers.

Take a look at gm-volt.com.

It occurs to me that there's an important distinction to be made here: Plug-in's (PHEV's) are "here". They're practical and real, and will make a big difference soon.

Pure electric vehicles (EV's), on the other hand, aren't really quite competitive yet. The large battery packs they need (to have convenient, 200+mile range) are still somewhat too expensive, and charging still takes too long to be convenient. They've been workable, and practical, for 100 years, but not sufficiently convenient to be competitive with ICE vehicles. That will change, but not overnight.

You may be thinking of EV's.

Gail, this is absolutely awesome!

I agree!

Well done Gail! Calm, measured and powerful.

Glad you like it!

At question number 11, you said:

Well, that answers the question, doesn't it? You shouldn't hide it below all those topics, with a lot of other information. The answer seems to be: "No, those countries have a big infrastructure, and US companies wouldn't be able to add much more".

Of course, then come all the other complicating factors you've enumerated.

One question I have is with respect to graphs. I nearly always make my own. That way I don't have to worry about copyright issues and I can make them say what I want.

The only exceptions I can think of to doing this are the two graphs in this chapter from the Hirsch report. They really are cutouts from a PDF of the Hirsch report. I would much prefer my own versions of the graphs.

What kind of graphics software do other people use to make graphs such as these? I am currently using Excel and I also have iWork, both for MacIntosh. I do have a Windows computer as well, so could use WIndows software if I needed to. When I have had articles published, I just let the magazines worry about making the fancy graphs - all I provided was the values.

I never would have graduated without Excel and still use it almost exclusively (so holler if it gives you fits and I'll take a crack at getting it to obey you). Others in my office, the more hardcore lot, swear by Matlab, though.

Edit: I realized that probably sounded condescending, which was not my intent. It was simply that you seemed unsatisfied with Excel output. There's probably very good reason for that, but there's an outside chance that I've been more warped to thinking in the approved Microsoft way and may be able to trick it into cooperating.

"Let us wrestle with the ineffable and see if we may not, in fact, eff it after all."

-Dirk Gently, character of the late great Douglas Adams.

Hi Gail,

For most garden variety charts, I use Excel or PPT. For certain specific types of charts, I use the graphics features in whatever statistical package I am using (these aren't the greatest).

As for the dual axis chart you mentioned from Hirsch, you can use the "custom feature" in the Excel chart wizard. A couple of the options in the wizard allow for an additional axis.

If you recreate the Hirsch lower 48 price & production chart, I would add a comment about the U.S. price controls on domestic production from late 1973 to January 1981. During this time, U.S. oil producers were constrained to a production price that was lower than the world price.

Debbie

Hi Gail,

As I mentioned in the previous story, for quick graphics I would recommend Gnuplot (http://www.gnuplot.info/). It may be a bit hard to get a grip on the beginning, but once you do master it you'll see that it can do wonders!

If you want top-notch publication-quality graphics and you're also willing to spend some time learning, then try Asymptote (http://asymptote.sf.net/). Check out the gallery on their website for some mouth-watering examples...

You mentioned that your husband uses LaTeX for document processing. If so, perhaps he is already using Gnuplot to chart graphs, since that is a very popular combination. (Both Gnuplot and Asymptote integrate very well with LaTeX).

In short: if you want a quick way to preview tabular data in a graphic way, the time spent in learning Gnuplot is well worth it. If instead you want to produce publication-quality graphs, then Asymptote is the way to go. (And they're both Free Software!)

Finally, I would stay away from Excel altogether. It is neither convenient for quick previews nor it produces good-looking graphics.

Thanks. I will look into those.

Interesting reads.

Mary Homan phoned. Next natural gas irp on July 27, 2007.

Fun to present The Oil Drum and Peak Oil ideas and links to PNM natural gas irp and electric irp.

How can this case for peak oil create a public policy tipping point? For example, when I hear economists babble about the significance of economic data and its impact on the arc of macroeconomics I more frequently hear a cacophony rather than the clarity of a single voice. I buy your message, but how can it survive first contact with "experts" and media talking heads who would reduce your noteworthy work to another prediction and not the warning that heralds an avalanche? I hope your work can be the catalyst.

John Q. Public and Gail

I would like to see this book sent to every member of congress. With any luck at all it could seriously influence policy makers. I'd be willing to kick in $100 for the effort.

Bob Ebersole

"Been there done that"

Every member got a copy of some Peak Oil 101 book plus a copy of the big oil poster thing. I believe it was Roscoe Bartlett who provided them. Net effect = zero.

Indeed.

They know.

They have made plans, for themselves.

Part of their plan is to feign ignorance.

The other part of their plan is to lie about what they are doing.

It is working, people who should be making their own plans are wasting time trying to 'educate' politicians.

They will take your book with a straight face and promise to read it.

They laugh behind your back.

Then they go back to work:

http://www.orlandosentinel.com/orl-bk-boballen071107,0,7769658.story

I think there will have to be some kind of crisis - no gasoline in several major Eastern states, or $7 gasoline, before the story gets out. Then people will want to read more. Since it takes time to written material together, I want to have something out in advance.

John Q. has a point. It's difficult to get beyond the perception of being ivory tower prognosticators, or more simply, crackpots. What's missing amongst the PO-aware is a grassroots movement screaming about evaporating oil. An agitated populace can help shake officials out of their stupor.

Look, the climate folks have their scientists AND the grassroots. Of course, IMO, they're doing their own avoidance. The discourse is mostly about "saving the earth" when people ought acknowledge that it's about saving the human race and all the other critters and plants we depend on for life.

Then there's PO, which is a much scarier story to tell and it's not nearly as fun as being green. But if some TOD folk want to kick-start the masses to move, then actions need to be taken on multiple levels. Gail's brochure is one path.

Next? Cross post MANY more TOD pieces to other sites, especially to the accessible audience on DailyKos.com - they have the traffic volume to move mountains. (Give Jerome a Paris a hand; otherwise he seems like a lone voice on DKos.)

I see many frustrated postings on TOD about trying to talk to friends - all about hitting a wall of resistance. Who's surprised? Who wants to hear that everything they ever hoped to do in their lives will shortly come to a miserable crashing halt?

Next? Write and distribute some "10 Tips" broadsides about PO along the lines of "10 Things You Won't Be Able To Do After The Peak" (Possible answers: Go to Disney World, fly anywhere for a family reunion, eat a kiwi fruit, heat your house above 55 degrees ALL WINTER, fill up your tank on one paycheck, go to NASCAR, grill Chilean sea bass, fire up the JetSki, take a Sunday drive with the kids, etc...). That's the subversive way to explain to Jane and John Doe how their lives will be affected.

It may be counter-intuitive, but one way to get around the avoidance is to start being funny along with the facts. Humor can be deadly serious and it can open doors. Anyone got a connection to Jon Stewart? How about lobbying for "peak oil" being a Stephen Colbert Word of the Day. Talk about truthiness!

Next?

(Oh dear, is my activist slip showing?)

I agree that we need to make the story available in many forms to many different groups. If humor is possible, that would be good too.

My Oil Quiz has been popular. It has been cross-posted a couple of places. If others would like to post it other places, I would not object.

I would hope that other TOD readers can help in this endeavor. We need lots of good ideas, and lots of people posting (or publishing) in different places.

Hi! I'm new here, although I've been active under this handle at daily kos for a few years and at slashdot for many years. I've been concerned about and reading and writing about peak oil for about three years now.

I think this series is a great idea and is shaping up nicely. There are times, however, when I think focusing on the peak and on production issues is the wrong focus. There is exactly one sure way to delay the peak TODAY. Conserve.

I think explaining peak oil is the right way to wake people up to the urgency of the issue. And I think new technology and alternative energy are key parts of planning, but I lived through the 1970s oil crisis and we haven't begun to take any of the measures that were taken then. And they worked. If you look at consumption graphs, they decline in the late 1970s. Some of that was recession, but some of it was the national speed limit, the implementation of CAFE standards, and the creation of a civic minded ethos of conservation.

I think I'd would be remiss to leave this out of a summary on the issue. How we drive is perhaps more important than what we drive. Passenger miles per gallon is more important than raw MPG. My 4Runner carrying 3 people is more efficient than my Prius carrying just me (although my Prius carrying 3 people really kicks backside!)

Please do stress energy conciousness and personal behvior at some point in your document.

I agree conservation will need to be a part of our future plans, and I will talk about that at an appropriate point.

I think right now the only variable that really matters is how much oil is pumped, because demand is so high. If you or I don't use the oil, the price will be a bit lower, and someone who can't currently afford it (perhaps in Africa or Asia) will use it. The people in Africa and Asia will probably make better use of it than someone driving a Hummer, but I don't think conservation will do a lot in terms of reducing the total quantity of oil used. A major recession, perhaps resulting from the implosion of the housing market, would make a difference.

Even if there is not a lot of chance that conservation will postpone peak oil, I certainly wouldn't object to our trying to use less. At a minimum, conservation will get us ready for using less in the future.

You make some good points.

Conservation would help make the downslope of production decline less steep. You are right about a recession leading to lower consumption which is a conservation effect in the short term. Long term oil conservation comes from changing the technology of transport vehicles along with changing to more efficient modes, as AlanIn TheBigEasy has advocated on TOD.

Back in the early 1980's GM and the Budd Co. (makers of locomotives and passenger cars respectively) did tests and figured a diesel powered passenger train could get between 300 and 500 seat miles per gallon. This is two and a half times better than your Prius. When the rail is electrified the oil consumption for the train passsenger goes to near zero.

Yes, conservation can make a big difference, but the fastest way by means of a severe recession is painful. Other means - CAFE standards, 55mph speed limit, carpooling, investing in more energy efficient transport modes(rail) - are inconvenient or require more tax money, something the public and US gov. aren't interested in doing until the gas pumps go dry.

I have to agree. Although we are closer to that than I thought. Yesterday I pulled into an SA to fuel up. The pumps were running slow (penny a second slow). An announcement was then made that the pumps were slow because the tanks were low. At just that moment the tanker truck pulled in. This is mere anecdote, and may mean nothing but poor planning by the store manager, but it reminds me how tenuous the whole system is.

The most damning criticism of the tar sands (from Alan Drake's letter to his brother article published here recently) I've read is that all it will be good for will be compensating for the decline in conventional Canadian production. Might lend a bit of impact to include that.

Excellent work!

No false alarm for these 600 workers of the Ford factory in Australia

http://abc.net.au/news/stories/2007/07/18/1981686.htm

Due to rising petrol prices and concerns about global warming, local car sales for big 6 cylinder cars have fallen to such a low level, that it is no longer worth while to maintain a V6 production line. Contrary to what Westexas recommends - a re-localisation - the opposite is happening: the fewer V6 engines are now imported from a factory with larger production numbers overseas, making them more economic to manufacture there.