National Petroleum Council Report Based on API Call and Report Review

Posted by Gail the Actuary on July 21, 2007 - 9:30pm

On Wednesday, I participated in a bloggers conference call sponsored by the American Petroleum Institute (API). The main topic was the National Petroleum Council's report "Facing the Hard Truths about Energy". Participating in the call were

• Rod Nelson - senior VP for technology and strategy, Schlumberger Limited (for NPC)

• Tom R. Eizember - senior planning advisor, ExxonMobil Corporation (for NPC)

• John Felmy - chief economist, API

• Ron Planting - statistics manager, API

• Byron King- The Daily Reckoning

• Ed Morrissey - Captain's Quarters, Heading Right, and Blog Talk Radio

• "McQ" - The QandO Blog

• Gail Tverberg - TheOilDrum

In this article, I will discuss the NPC's report, based both on a review of the report and what I learned in the call. The conference call also included discussion of API's June 30, 2007 statistics for the US oil industry, but I will not discuss these, since they are similar to EIA's (high crude oil inventory, low gasoline inventory, etc.).

A Step in the Right Direction

Based on the conference call discussion and my review of the report, the NPC report seems to be a step in the right direction. Since the NPC is an industry group and has always provided optimistic forecasts in the past, it shouldn't be a big surprise that it doesn't go all the way to peak oil indications. But it very definitely starts talking about peak oil indications, and includes peak oil indications in its range of indications. It also recommends taking many of the same actions that one would expect based on peak oil indications.

Report Objectives

The "key questions" to be addressed by the NPC report were

• What does the future hold for global oil and natural gas supply?

• Can incremental oil and natural gas supply be brought on-line, on-time, and at reasonable price to meet future demand without jeopardizing economic growth?

• What oil and gas supply strategies and/or demand-side strategies does the Council recommend the U.S. pursue to ensure greater economic stability and prosperity?

A few things to note:

• The request relates to oil and natural gas.

• The question about future supply is about future global supply, even for natural gas.

• There is no time frame given. The authors chose a 2030 time-frame.

• The request is broad enough that the NPC interprets the request as permitting the use of estimates of others, without doing an analysis of who is correct and who is not.

What NPC in fact does in this report is show ranges of both supply estimates and demand estimates. These estimates are from as many sources as possible, including ASPO organizations. There is no attempt to judge whether one estimate is better than another. NPC's conclusion, based on comparing a range of supply estimates with a range of demand estimates, is that there is a significant chance that by 2030 we will come up short both in terms of oil supply and total energy supply (not said in so many words, however). NPC then provides a list of recommendations to try to decrease demand and increase supply.

Let's look at some particular areas of interest.

Oil Supply

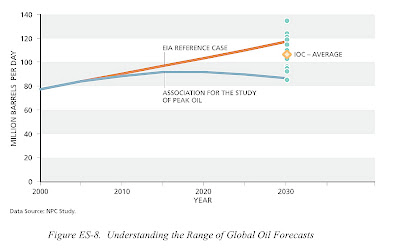

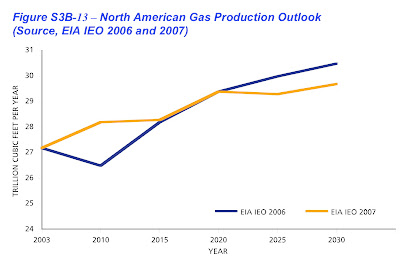

The main oil supply graph in the executive summary is this one:

This graph shows ASPO and an EIA indications and the range between them. Thus, the report is, in effect, giving equal weight to ASPO and EIA, which is about as good as one might hope for in an analysis that bases its analysis on projections from a variety of sources, without review.

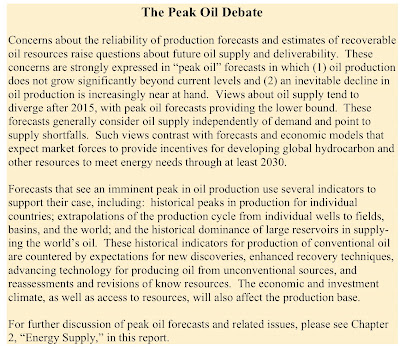

The graph is followed in the executive summary by this write-up about Peak Oil.

Thus, any reader of the summary report gets an introduction to peak oil, written in such a way that peak oil sounds like at least a possible alternative.

The oil supply situation is summarized in the executive summary as follows:

There is uncertainty about the potential of the oil resource base to sustain growing oil production rates. Additional uncertainty surrounds the industry's potential to overcome multiple increasing risks, including access to promising areas for development, and the rate and timing of investment, technology development, and infrastructure expansion. The study observed a range of oil projections from less than 80 million to 120 million barrels per day in 2030. This wide range results from differing assumptions about these uncertainties.

Thus, the study never picks a single number as its estimate - in the write up or on the graph. It only shows ranges including the ASPO estimates.

During the conference call, I asked how the projected range compared to the indications of IEA's recent Medium Term Oil Market report, with indications through 2012. The NPC representatives said the IEA 2012 indications correspond well with the predicted range at 2012.

Natural Gas Supply - World

Natural gas supply is discussed less than oil supply in the executive summary. What is said is

The natural gas resource appears more than adequate to meet the increased natural gas production typically anticipated by energy outlooks over the study period.

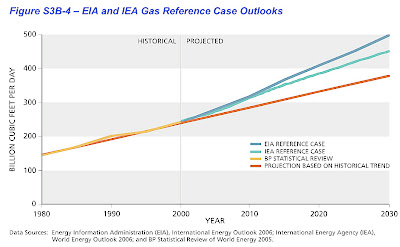

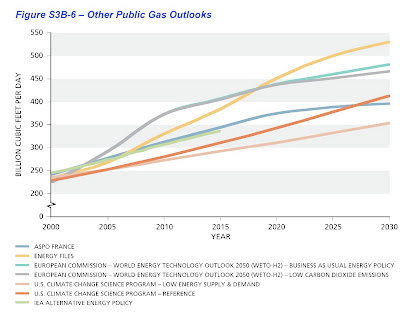

This statement only makes sense if one remembers that the "key question" that was asked was about global natural gas supply. In the body of the report, we find these graphs of expected world natural gas production:

The upper graph shows EIA and IEA projections, plus expected based on historical growth. The bottom graph shows some other projections, including ASPO France's. Since all of the projections show significant growth in natural gas production, no problem is seen with world natural gas production.

Because of these projected increases, natural gas is seen as a growing source of energy in the future, helping make up for the relative lack of growth of oil. I have real questions about the reasonableness of this conclusion, but given the EIA, IEA and ASPO projections, I can understand this result.

Natural Gas Production - US

US natural gas production is not mentioned in the executive summary. In the body of the report, a graph is shown of EIA projections of future production:

Since EIA does not indicate a problem with future production, and there is no ASPO projection available, the NPC's write up gives only a hint that there may be problems ahead. The write up in the Supply Chapter in the body of the report says:

The forecasts analyzed for this current study largely agree that domestic conventional gas production will decline over the forecast period, assuming that restricted onshore and offshore areas will not be developed. The balance of natural gas supply to the United States over the next 25 years is generally expected to be met by a combination of three elements:

• Increased domestic production of unconventional gas (basin-centered gas, tight gas, shale gas, coalbed methane)

• Arctic gas resources from Alaska and the Canadian Mackenzie Delta, both of which require development and massive new infrastructure to bring gas to market

• Increased LNG imports.

Each of these elements may be subject to risks that make development slower or less significant that the forecasts assume.

I think this statement very much understates the problem. The NPC relies on projections of EIA, since it has no alternative projections. Without written documentation showing how bad the situation really is, NPC takes only a small step toward issuing a warning.

Supply vs Demand for Oil and Natural Gas

When NPC compares supply and demand, this is what the executive report says:

The world is not running out of energy resources, but there are accumulating risks to continuing expansion of oil and natural gas production form the conventional resources relied upon historically. These risks create significant challenges in meeting projected energy demand.

This is not a very direct way of saying that we are likely to run into problems with oil and natural gas production, but the effect is the same. The report then makes a variety of recommendations to attempt to increase supply and decrease demand. The writers of this report view the actions that they are recommending as similar to what they would recommend in the case of peak oil. In the body of the report, when discussing peak oil, this statement is made:

Peak oil forecasts project that oil supply will not grow significantly beyond current production levels and therefore may not keep pace with projected global demand; a peak and decline in oil production is inevitable and may be near-at-hand. The conclusions lead to calls to develop additional resources to increase supply, accelerate the use of unconventional resources as substitutes for oil, and moderate demand in order to bridge the supply shortfalls. Such actions generally converge with the recommendation of this study.

Trade

The report makes it very clear that continued trade is very important if energy supply is to meet energy demand, and this is important for US energy security. The executive summary then make a statement that I think is true, but is likely to be the downfall of this approach to energy security:

There can be no U. S. energy security without global energy security.

The report then does talk about trying to enhance global energy security.

ASPO Projections

As I read this report, it becomes clear that it is very important that correct ASPO projections (or peak oil projections from another authoritative source) be available for people preparing studies of this kind, and for other interested people.

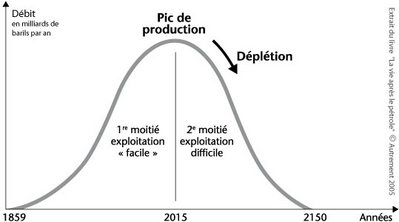

If we look at the oil supply chart near the top of this story, the ASPO oil projections quoted show a peak oil date of 2015, and expected oil supply of approximately 85 million BPD in 2030. The text of the report indicates that these projections are from ASPO France. These numbers sound high to me. The only oil projections I found on the ASPO France web site is this schematic drawing, with a peak date of 2015:

It seems to me that someone should verify that the ASPO France oil production numbers being used in the NPC graph are in fact the intended ones. If they are incorrect, the report should be amended before the final report is released in September. The "Peak Oil" write-up shown just below the oil supply graph also says that there is little divergence in forecasts between ASPO and the other organizations until after 2015. If this is not true, this should also be corrected.

Another projection shown in the report, that of Peak Oil Netherlands Foundation (shown on Figure S3A-17 of the report), shows expected total liquids of just under 80 million BPD in 2030. This is quite likely the bottom number in in the 80 million to 120 million BPD range quoted in the NPC supply paragraph above. This estimate is not much lower than the ASPO France estimate.

Now that evidence seems to be accumulating that peak oil may be at hand, it seems to me that we need to be increasingly careful with our peak oil forecasts. If we project peak oil in 2015, with production of 85 million BPD in 2030, people are likely to think that there is not much to worry about. The problem is still a long ways off, and the decline, when it finally does come, will be so gradual that we will only get back to where we are now by 2030.

If the evidence is for a significantly worse outcome than this, we need to say so. We need to have reports published in prominent places on the web sites of ASPO organizations showing when we expect peak oil to occur, and what the pattern of decline is likely to be. Perhaps a range of values is needed. If a fixed date is given, even a few years in the future, people are likely to think there is nothing to worry about until the chosen date arrives.

There is also a need for good published projections with respect to natural gas supply, by region of the world. If there are issues with projecting large increases in LNG imports, we need to saying this as well. Projections for both oil and natural gas need to include easy-to-understand explanations and graphs, so that lay people can understand them and news organizations using them can easily write a story with the information provided.

A Couple of Specific Points I Would Object To

This is a draft report. Presumably participants like Matt Simmons can object to errors prior to the finalization of the report. There are a couple of things in the body of the report that don't directly affect the executive summary that I think should be objected to.

Estimated Recoverable Oil

One is in "Supply Chapter, Section III.A: Oil and Other Liquids" on page 2 of 28, in Section 2, Crude Oil Endowment. Earlier in the section it says that the total conventional and unconventional oil in place endowment has been variously estimated at 13 trillion to 15 trillion barrels. If one includes all the tar sands, oil shale and the like, I think one can get to a number like this. It then defines recoverable resources. At the end of this section, it says:

Generally, about one-third of the oil in place is currently assumed to be ultimately recoverable. This assumption yields an estimated 4.5 trillion barrels of conventional and unconventional Ultimately Recoverable oil.

Lumping convention and unconventional together and applying a one third factor seems absurd to me. In the sections that follow, the authors talk about "Unconventional Oil Endowment and Recovery" and "Conventional Oil Endowment and Recovery". The first of these sections talks about the difficulty of recovering unconventional oil. The second offers some specific estimates of different agencies regarding conventional recoverable oil. I would leave out the section I quoted above.

North Sea Description

Another section that I find misleading is one Stuart Stanford commented on earlier. It says

Peak oil forecasts are concerned about the ability to extend and apply experience from mature areas to less produced areas. As a hydrocarbon province matures, production transitions from large reservoirs to smaller, less prolific, and possibly higher cost reservoirs. In the United States, for example, production from smaller and mature reservoirs dominates supplies. Peak oil forecasts assume that remaining smaller reservoirs will not compensate for declines in the larger reservoirs, resulting in declining conventional oil production in the near future. However, the North Sea has seen the evolution away from larger, depleted fields to smaller fields that can be brought online using existing infrastructure. North Sea production has actually been sustained for many years at significantly higher levels than was generally thought likely in the 1980s and early 1990s. Production growth from 1990 to 2000 shows how production in mature basins can revive as a result of new technology, price, or market dynamics.

While it is probably technically correct, it is misleading since it does not talk about the steep decline since 2000. I think it should be removed.

Charts that Others Object to that I Can Live WIth

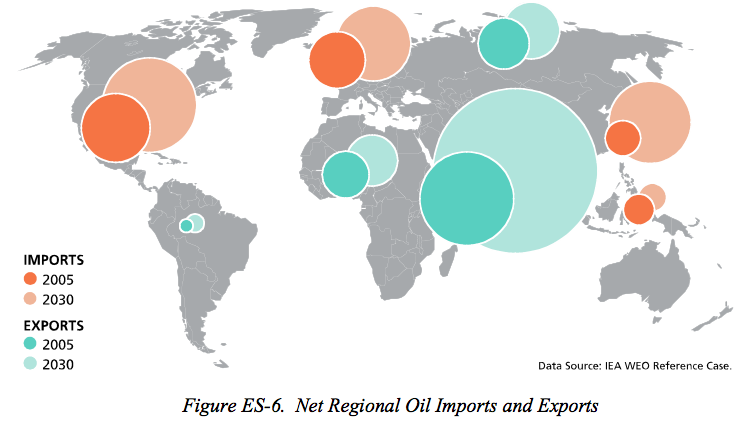

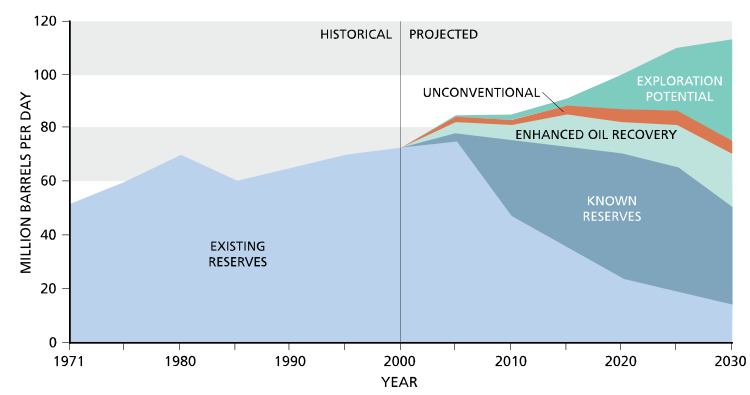

There are couple of charts that others have called objectionable, including this one

and this one:

If one reads the executive summary, the top chart is characterized as "one projection of significant changes" in exports /imports, and is clearly labeled as showing IEA data. It is now numbered ES-5.

The bottom chart seems to have been included in earlier drafts, but is not included in the current draft of the Executive Summary. Thus, it is already out.

For the foreseeable future, I will be placing a reddit tag here in the first comment for readers to use if they are so inclined. Please use this one instead of the one under the title of the post. Here is that link:

http://science.reddit.com/info/280sz/comments

Also, we ask that you please do spread our contributors' work around the web if you are so inclined: digg (which seems to be accepting our submissions again), stumbleupon, etc., all of them help--even posts from the past that you have found insightful.

Anything to get as many eyes for our authors' work as possible.

Gail,

Nice writeup. I skimmed the NPC report last night and I agree that it is quite jarring in several places, as opined by ThatsItImOut on another thread. The NPC seems to be moving slowly in acknowledging the scope of the problem, but there is a clear sense of urgency in terms of the actions they are recommending.

PG,

I'm sorry this is off topic, but I don't know where else to put it. I have never done reddit, digg it, etc. on any of these articles and I have no intention of doing so. This brings up the question of why you are asking us to do this. You seem to very interested in the growth of this web site, and I'm trying to understand why. Part of the Oil Drum mission is

From the "raise awareness" part of this sentence, I assume your goal may be to reach as large a target audience as possible. I question whether this is possible or even desirable. I don't think this is ever going to be a general interest web site, nor do I think it should strive to be. I would suggest that a good goal would be to try to reach a key audience in government, industry, academia, think tanks, mainstream media, and so forth, rather than the average person wondering why gasoline is so expensive. You may or may not agree with this, but if you do, you ought to be far more concerned with exactly who is visiting your web site than with your total number of visitors.

Again, sorry for an off-topic post. Perhaps deleting it or moving it elsewhere would be best so it doesn't dilute Gail's thread.

Calorie,

I am a member of the general interest public. Normally I don't "dilute the thread" like you are worried about, but this time I needed to comment. My apologies to those who get irritated by tangential comments.

Honestly I don't understand everything on this site, I'm a swimming teacher not a geo-physicist. BUT I have a stake in this peak-oil issue as much as anyone else. I heat my home, drive my car, and benefit from petrochemicals in many other ways. The more educated I become, and the rest of the masses, about one of the key issues facing civilization this century the more prepared I am to make decisions. For example I could pressure my senator or congressman, or decide to bike to work.

Being elitist just creates barriers, and if you're interested in finding solutions and planning for the future barriers won't help. Give the ordinary guy some credit, some day you might want the general public to understand the issues. Ignorant people might be annoying, but the people who have knowledge should be open to sharing it.

So you're a swim coach.

Let's assume you teach teenagers.

One day, out of the goodness of your heart, you lend your car to one of your adolescent charges.

He calls you from his cell phone.

"Look coach, things may get a little bumpy going forward, but trust me, the fundamentals are still all here."

"Whada ya mean fundamentals? Is my car still with you?"

"Yes coach it's still all here right under my watchful eye. Relax."

"So why are you calling?"

"I just wanted to give you an update on our inventory situation. The inventory is all here and we plan to move it forward on schedule, albeit the schedule may experience some above ground contingencies and undulations."

Now given that he is sub 25 years old and you are a "teacher", you already know he is snowing you and in truth your car is toast.

But what if he wasn't a teen angel? What if he was an "energy expert" like say Mr. Daniel Yergin and he was assuring you the "fundamentals" are all there? What if he was Mr. Steve Forbes of Forbes magazine and he was assuring you oil will go down to $35 before it ever rises above $45 and all those Peak Oil people are kooks?

In simple English, it is the oil magnates who are giving you a snow job and it is the people here who are trying to draw out the real numbers from out of the swamp of disinformation.

Now getting clean numbers is tough because there is a lot of muck and uncertainty out there. But here are some fundamentals: 1) Mankind has not found any new major/giant oil fields in the last 40 years. All oil fields die, some more slowly than others. The big oil field in Mexico is dying. Texas started dying back in 1972 and is still on its long slow slide down into the abyss. "Technology" hasn't come through to save any of the oil fields. "Government" hasn't come through. Are you understanding which way the waves are moving in our global swimming pool? The big splash is in the Iraq corner because that is one of the last remaining backups. After that, there is mostly a bunch of fake swimmers pretending to do the crawl through hot air.

Did he really say that?

Yep, he sure did. When the Marxists invented the term bloated plutocrat, they must have been thinking about Steve Forbes.

He's as dumb as Bush. He just inherited the magazine.

Bob Ebersole

Trust, but verify.

Here you go buddy:

1. Peak Oil Forum 2002

2. Pickens v. Forbes 2007

3. Recollections of a Wall Street Examiner

4. Do your own search

--Have a Good Steve Hunting Trip!

My point was digg it or reddit can only help increase the chances that the average person will see this site and that I think that is a good thing.

SynchroGENized:

Welcome to The Oil Drum ! I'm very glad that you decided to join us, and hope that you come away with a good feeling about our forum.

Gail The Actuary, who is the author of the keypost at the top of this thread, has written some clear, easy to understand materials-try looking back to early this week and you'll find some excellent material she's writing to serve as a primmer about peak oil. If you have questions about any of the technical stuff on this blog, please ask them. I think you'll find most of the folks who hang out here are knowlegable and happy to explain jargon and provide information.

The whole concept of peak oil is pretty simple. There's a limited amount of oil on the planet-most of the people here think its around 2 trillion barrels. We've used about half of the conventional crude, and we think that production will soon be going down because of geological restraints.We used the cheap, easy to produce oil first because it was the most profitable. Meanwhile, world population and consumption are growing exponentially-There were 2 billion people here in 1950, 6.5 billion now and estimated 9 billion in 2030. And they all want a car and a new house.

So in the future oil is going to cost a whole lot more, and there will be shortages with horrible consequences unless we conserve and switch to alternative fuels.

It's simple and it's complicated.

When The Oil Drum (TOD) launched a couple of years ago, the chief editors used to give us amateurs tutorials about the oil industry: What is oil? How does it form? How do you find it (discovery)? How do you drill down to actually get it (boring)? etc., etc.

Many of us have read those tutorials.

We take it as a given that everybody else has also.

My recommendation to you is to first learn how to answer the above basic questions before making up your own mind about the Peak Oil theory.

I'm wondering if anyone kept bookmarks on some of the really old TOD tutorials?

At the top of the main page is a table with various TOD links. In the lower right corner, find this one:

Tech Talk

It goes to a page linking all, or many, of the industry tutorials which have appeared on these pages.

| The problem will solve itself.

| But not in a nice way.

Step Back,

Excellent point! I was also a very early visitor and poster at TOD. I clearly remember asking questions about production, reservoirs, and the like, expecting one of the resident oil experts to provide the answer. Often there were multiple answers and discussion about what the real numbers were and how to assess the validity of the sources. It was a wonderful learning experience for me (and I think others) that has now been relegated to premises - no longer needing discussion.

For me it was the process of verifying the premises that convinced me of the problem facing us. I always read TOD and other sources from the perspective of how all this application of money, technology, war intervention and the like will change the premise 'that the ability to deliver more oil in the future on a daily basis is no longer possible'. That is my testable hypothesis. I am looking for someone or some data to prove it incorrect.

The issue, for me now, is that contained within this simple premise is a very large background of information about things like permeability of rock, the price of drill steel, extraction rate vs oil in place, refining capacity of light sweet vs heavy sour, and a myriad of other tidbits that are required to convert a hydrocarbon deposit in the ground to gasoline in the tank. Without understanding these details it would be easy to convince me that more oil could be produced.

I suggest all new people to the Peak oil issue visiting TOD spend significant time researching these gritty details. They are all stored somewhere on TOD if you can just ferret out the threads. IMHO, TOD is the best place to find the technical answers presented in layman's terms.

NC,

One of the "Peak Oil Primers" (by Wolf-at-the-Door) has a Jargon page that may be useful to newcomers:

http://wolf.readinglitho.co.uk/mainpages/jargon.html

Calorie

I work in the federal government, although not at Energy or Interior -- do I qualify? or not?

I don't know how to adequately describe a contango or a backwardation, let alone explain the impact of geological structures on the development of oil and our ability to extract it. However, I am smart enough to understand that the oil companies are not the de facto spawn of Satan, and that the prices we are seeing at the pump are occurring due to economic, and perhaps geological, reasons that defy feel-good responses like suing the pants off of OPEC for price increases.

I have spent the past 37 weeks of my membership trying to promote an understanding of the peak oil issue, with varying success and using TOD as my primary source for information. It has been extremely helpful and many of the articles that Leanan posts are not aimed at technicians, which means that I and my peers will understand what is being discussed.

Please don't assume that the general public cannot be educated and cannot get an understanding of the issue. If that were true I suspect Portland Oregon would not have shared its report on the risks of Peak Oil and invited comment. Evidently they have more faith in the general public than you. Try to give the rest of us credit for using our heads for something more than a hat rack.

synchroGENized and Kheris,

Thank you for your comments. If I may ask, how did you discover this web site? Did it come to you or did you come to it? If you found it via one of the referral sites like reddit or digg then I stand corrected. If you came to it through a search engine or another energy blog such as WSJ's energy roundup or R-Squared, then I would argue that my point stands. My guess, and I could be wrong, is that trying to generate traffic by getting high rankings on the referral sites is not going to be very effective. A far better strategy, in my opinion, is to get noticed, referenced, and summarized by the major media outlets with strong online presence. One of the best things that has happened to this site was to get listed by WSJ's energy roundup.

One more thing. When I mentioned that the target audience for this site is probably not "the average person wondering why gasoline is so expensive," I didn't mean to imply that the average person is not smart enough to understand this stuff. I meant that the contributors, as far as I know, are not trained journalists and are probably not going to do as good a job communicating their message as trained journalists. The articles here are both too long and too technical. To get this material into the "general interest" arena, I think the site needs to attract top quality writers who are good at sourcing highly complex material and presenting it in a concise, easy-to-understand format.

Calorie,

I'll second that.

A lot of readers here at TOD are scientists, engineers, computer wizards, etc.

It doesn't blow them away when someone posts a chemical formula

CH3-CH2-CH2-CH2-CH2-CH2-CH2-CH2-CH2-CH2-CH2-CH3

or a math equation

y= A*e^-(kt)

But think about your average swim coach.

This stuff may sound like a lot of hooey.

Maybe we need a TOD-Lite site?

Not really. They can just jump in and sink or swim :^)

Just point 'em to the Tech Talk link on the main page and give 'em the laws of thermodynamics:

That, and children are much faster learners than adults ...

Thanks DIYer. Those Tech Talks in the early days of TOD were really educational. Note how few comments there were back in '05.

I read Kunstler's book The Long Emergency, that's what got me started. I do believe he mentioned TOD.

Calorie wrote:

Been thinking a LOT about this.

I disagree with you that this isn't a general interest website, in that, we are doing what we are going for the general interest.

I am an educator, it's what I do. As I have said a few times of late, I consider TOD a seminar beyond all seminars. Ideas are freely exchanged, materials are offered, time is given.

The blogosphere is a public endeavor in that regard, I can't (and don't want to) restrict who comes here and who doesn't. I can restrict who posts if needed, but I don't even want to do that.

It takes a lot just to be able to understand what TOD is trying to do. It takes investment, critical thought, but it also takes an integrative acumen that not very many people have. We're trying to help make that happen.

Most people aren't "dumb". They simply model the world in a different way than you and I do.

For example, some people ask themselves, "Whom should I trust and how do I determine if someone is trustable?"

Why do you think CNN news bills themselves as the "most trustable" source of information?

Some people like to think of themselves as the in-charge customer and all the world as being there to service them. We report, YOU decide (fox news).

Many different people, many different internal models.

With regard to the ASPO peak date, I would have assumed they would use the usual ASPO graph as shown in their newsletter

eg http://www.aspo-ireland.org/contentFiles/newsletterPDFs/newsletter79_200... which shows a peak in 2011.

Anything else would seem to be misrepresentation. Obviously the longer oil production is forecast to rise, the less of a problem it is at a future date (which maybe their intent).

Personally I think ASPO overplays the non-conventional, but that's another story.

Yep, I was right.

Here is their graph ES-8 but with the real ASPO graph overlaid (I think its basically in the right place).

I've included all the way up to the ASPO NGL numbers, which seem to tie up with their assumptions of what constitutes oil (same figures for past production).

Upshot is their straight line graph and the ASPO forecast diverge about twice as much. Its also worth noting that they're scale tends to smooth out things and make things look more gentle than they are.

Thanks for posting this. I've tried to check it and it seems about right to me. I've linked it at my Real Energy blog along with some comments on the key findings of the NPC report.

It is my understanding that all of the ASPO organizations are separate. The newsletter is the ASPO Ireland newsletter. It says one thing. Each of the other ASPO organizations say whatever they choose - which my have nothing to do with the ASPO Ireland (Colin Campbell) amount.

Indeed, but when you are talking about an ASPO forecast you are generally talking about that made by Colin Campbell et al, as seen in the newsletter. Its disingenuous to pick some other prediction because it happens to diverge less. I for one have never seen an ASPO Paris prediction before.

Gail:

You picked up the same points I noted, in particular the North Sea Description. The US lower 48 (excluding the GOM) has produced about 70 GB since the peak in 1970 (and up to that time it had produced approximately 96 GB from 1859 through 1970).

Just as growing consumption rates shorten the time for depletion (at current rates), declining production extend the time to depletion. But, the period of less than 10 years since the North Sea peak is hardly a glowing example (they might as well use the US lower 48 if the want to illustrate keeping production up, if only for a little while after the peak and the effect of adding new fields including Alaska and the GOM).

Good work!

Gail:

Great work! I appreciate the voice of sanity and balance that you bring to these discussions.

As I've been trying to emphasize for the last couple of days, I think this report is a real milestone in discourse about peak oil and the energy situation. They've shown respect for the peak oil position instead of the sneering attitude of some of our critics in the past. It really opens the door for discourse about energy policies.

I just hope we can all develop an agenda for change that we can all present and implement.

I agree with you about this report being a real milestone. I hope peak oil people will calm down and read it, rather than dismiss it out of hand as being written by folks on "the other side" of the issue. We need to learn to work together.

I have to agree with Bob on the sanity and balance point. I think it's critical for people to recognize that many people concerned about peak oil are very rational, reasonable, intelligent, etc. etc.

Smokey,

The other guy's aren't the enemy! We're just arguing about the timing of the peak and the best mitigation strategies. The cornucopians put an awful lot of faith in finding new oil, new technology, and unconventional sources, while we think the prudent thing is to start mitigation as soon as possible by developing renewable and sustainable alternatives.

Believe me, twenty years after the peak nobody's going to care, unless we do nothing. So let's get some common goals and work towards a decent future.

Bob Ebersole

Thanks Gail for pointing out the concerns of the report. I think Scott Gill would or may have something to do with the ASPO France data, I hope :) He sourced out the data.

Secondly, there is that 6 letter word again called "Growth".

On a weekly basis the words "supply, demand, growth, peak-oil" are all mentioned in varous articles, however the general public is not aware of it- case in point, the CEO of our company as of 1 month ago never heard of the work peak oil, or as I put it to him, "supply/demand issues with oil".

In manufacturing if the words are chosen correctly, the terminology get's through loud and clear. My point is the language of the final report will have to created in such a way as for the politicians and general public will understand, as well as the news media who monitor these committe meetings.

Regards

OCB

Thanks for the information about Scott Gill. I will follow up, either through ASPO-USA or directly. I have already talked to one of the ASPO-USA folks about the ASPO France projections.

Regarding the language, this report is written in "consultant-speak", so is not easy to understand. But I think the fact that the report recommends specific action is very important. This illustrates that the NPC feels the issue is important, and thinks that something should be done about it.

The earlier GAO report did not have these action steps, so it was less effective in bringing home the point that this is an urgent issue, and something needs to be done about it.

Strategic Reserves

What jumped out at me is the way Iran and Venusuela are picked out for comapring the sizes of the world OECD strategic stockpile and the US Strategic Petroleum Reserve. The world holding cover 18 months of having Iran off-line and the US holdings cover 16 months of having Venusuela off-line (p. 27 Executive Summary).

Depending on what they mean in their key recommendation:

"Integrate energy policy into trade, economic, environmental, security, and foreign policies...."

Other choices might have been a bit more diplomatic.

Bush is going in for a colon opp and handing power to DC, anyone else worried?

I heard the oil executives finally found an abundant supply of NG that they are going to tap!

PartyGuy,

Check out www.therigzone today. It says gas prices are going to be soft because of oversupply for the next 18 months. We've got a lot of natural gas, and its an important bridge fuel. Cars can be switched to LNG for about $2,000.00, and its cleaner burning and actually cuts down on engine wear. Boone Pickens is advocating switching to NG.

Bob Ebersole

I think the link is actually www.rigzone.com

We've already seen nat gas prices drop from $8.30 to $6.60 per ccf in the last month and a half possibly in anticipation of this additional supply. It will be interesting to see if they drop further. No hurricaines, so far.

I believe that a ccf is equivalent in energy to 5 barrels of oil; so $6.60 per ccf roughly equals $33 oil, a significant discount at these prices. Not sure how many cars could be switched to NG before these prices converge. Probably not too many.

But the NG Escalade driver could at least have a nice happy feeling that he is doing something to solve the problem!

CLZ09,

the approximation is 6,000 cubic feet of gas(6 mcf) is equivalent to 1 barrel of oil, so its the equivalent of $40 dollar oil right now, more or less. I could get a lot more technical, but thats the short and dirty way to figure, and its the way they convert to barrels of oil equivalent (BOE) on annual reports.

CLZ09,

the approximation is 6,000 cubic feet of gas(6 mcf) is equivalent to 1 barrel of oil, so its the equivalent of $40 dollar oil right now, more or less. I could get a lot more technical, but thats the short and dirty way to figure, and its the way they convert to barrels of oil equivalent (BOE) on annual reports.

Doubt it will stay weak for that long. i really think 6 is cheap given the macro picture. Too many possible bullish factors:weather,fertilizer use,power,heating etc etc. The fact is that we have committed to using gas for things that it never should be used for (ie non-portable apps.) Fertilizer demand should continue to be high w/ more and more mouths and ethanol insanity. A good hurricane would drive gas over 8 in a week IMO. I can see a floor setting in for a while but don't see it lasting anywhere near that long. Am buying UNG now.

Regarding the issues w/ contango,

http://www.marketwatch.com/news/story/uproar-over-pricing-performance-hi...

I consider it an imperfect but reasonable vehicle for playing gas directly w/o being involved in futures[In case you are right]. IF i can pick up 3/4 of the gain the price i consider it too have done the job. Was encouraged by the recent backwardation in oil at high prices. This caused USO to trade at a premium, so to speak.

Matt

That sick a***hole!

That's my bad joke for today at someone else's expense.

Bob Ebersole

All oil fields go into decline and it stands to reason that we have already found the big easy ones. So the projections for tougher sledding from now on sound realistic to me. Couple that with the fact that most of the oil will be in the hands of people that do not like us very much and you have quite a mix. Russia may not need nuclear missiles, they can just starve our economy and watch us collapse.

Thanks Gail. Looking at Figure ES-6, Net Regional Oil Imports and Exports, it would seem to indicate from the relative areas, that world production in 2030 will be 3 times what it was in 2005. However, despite ever more sophisticated exploration technology, discovery continues to be in steep decline and exploitation seems to be nearing its peak. I just cannot imagine what assumptions went into this figure.

This is based on IEA projections - they assume very high oil production based on optimistic assumptions about undiscovered reserves and reserve growth.

The graph emphasizes the fact that if we could get production to this level, we would be terribly dependent on reserve imports from less-than-friendly countries. Thus, we would still have big risks of outages.

Gail,

I remember last time Robert Rapier was on the API conference call there was eventually a transcript (which I read with interest). Wondering if you would be so kind to let us know when they release it--that is, if they in fact are still releasing transcripts. I assume it takes them a week or so to send it off and have it transcribed?

Also, thanks for all of your work, of course... =]

There is actually a transcript now. I didn't feel that the call went quite as well as it might have because we didn't have access to the report in advance, so didn't know what to ask questions about. Also, there were only four bloggers, and only two of us asked questions (Byron King and I).

The previous call I was on had an opening statement which kind of set the stage, and there were many more bloggers. I suspect some of the bloggers cancelled out this time because they didn't have the NPC report.

I didn't feel that the call went quite as well as it might have because we didn't have access to the report in advance, so didn't know what to ask questions about.

This is the main reason I didn't join this call. Also, my family is just getting settled in here, and that would have been an evening call for me.

You need some prep time. I don't like to wing it in these calls.

I think not using the 'official' aspo site is very concerning, and implies they are trying to have the po groups appear more optimistic than they are.

Re petroleum - I think there are 3 key issues that they cannot just "unconsciously" or without explicit recognition assume away. If they are to provide the honest, and not extremely misleading report that the country needs they must recognize and address these issues in the report.

1)Fig ES6 implies new discovery about 2x the total middle-east during the next 23 years. If it is there, why hasn't it been discovered so far? Why has discovery during the last 23 years been much lower and declining? What is suddenly going to change to cause such a dramatic reversal. They should at least present their reasoning.

2)Increased recovery due to new technology. It has not happened during the last 20 years, in spite of great advances in technology during those years, and high incentive, at least in the USA. What technologies do they envision, and where might they be applied?

3)There are now clearly 2 classes of reserves, fast recovery reserves, and slow recovery reserves. Tar-sands and oil shales are clearly in the slow class. It does not matter how large the slow reserves are, the rate of production is their important limit. These 2 classes must be presented separately, not lumped together.

I think it should be possible to insist strongly on these 3 issues being specifically dealt with, without being confrontational.

Murray

As far as technology goes we have made great strides in increasing production rate and also producing tight or hard to produce formations.

Advanced recovery methods almost certainly have allowed us to extract more oil out of some reservoirs at greater expense and a slow rate but they have helped.

Its not clear at all that reserve additions based on advances that increase the rate of extraction are justified time will tell. We are just now getting to the point where reserve additions made on the basis of technical improvements matter.

Overall technology cannot be dismissed but its not a cure all.

Murray,

I presume that you are talking about this figure:

This figure disappeared between the draft that some people saw prior to Wednesday and the draft that was released on Wednesday. This chart really explains the development of the top end of the supply range (EIA numbers), not the ASPO-France numbers used as the bottom end of the supply range.

Since this chart it is not consistent with the rest of the report (which uses a range, not the top end of the range) it makes no sense to include it in the report. It is unfortunate that this chart has gotten as much attention as it has.

Re petroleum - I think there are 3 key issues that they cannot just "unconsciously" or without explicit recognition assume away. If they are to provide the honest, and not extremely misleading report that the country needs they must recognize and address these issues in the report.

1)Fig ES6 implies new discovery about 2x the total middle-east during the next 23 years. If it is there, why hasn't it been discovered so far? Why has discovery during the last 23 years been much lower and declining? What is suddenly going to change to cause such a dramatic reversal. They should at least present their reasoning.

2)Increased recovery due to new technology. It has not happened during the last 20 years, in spite of great advances in technology during those years, and high incentive, at least in the USA. What technologies do they envision, and where might they be applied?

3)There are now clearly 2 classes of reserves, fast recovery reserves, and slow recovery reserves. Tar-sands and oil shales are clearly in the slow class. It does not matter how large the slow reserves are, the rate of production is their important limit. These 2 classes must be presented separately, not lumped together.

I think it should be possible to insist strongly on these 3 issues being specifically dealt with, without being confrontational.

Murray

Murray,

I've got to take issue with your second point. US production is at a rate about 1/2 of peak, the decline rate is 2% when the rate would have been 8% if natural depletion had occured, and although we have produced in the US 35 years since the peak, we have the same reserves as we did at the peak. Tertiary production works.

But I'd also like to note our consumption has doubled in the last 35 years, and enhanced oil recovery has only slowed the depletion rate.

Horizontal wells work, 3d seismic and infill drilling to produce stranded oil works, polymer floods, CO2 floods, Steam-assisted thermal heat works-they all increase recovery substantially. And they all cost huge money. The other difference I see besides rate of recovery is the huge cost increase in production. And thats the other issue I'd like to see addressed.

Bob Ebersole

We could not have the same reserves as at peak as there were already more than 70 billion barrels produced since peak. Nor are these the last reserves as there are ANWR, Lower Tertiary, and Bakken resources not yet proven. There were Atlantic and GOM shelf areas not open to drilling. There was much Rocky Mtn. acreage not open to drilling for concerns the wolves, coyotes, and other critters might be disturbed. The environmentalists had to reintroduce the wolf to areas where it had been exterminated/evicted from because they were deemed an important part of the nature and the environmentalists did not accept the theory that it would be bad for the rancher's sheep. The price of wool is high.

Rainsong,

I agree, but that's the reserve growth phenomenon that has been covered in some Key Posts on this blog.

Optimistically ANWR will take about ten years to peak, at which time it will produce about 1/15 the oil America needs.

Today America would need to find a new ANWR every 18 months just to maintain current production. To maintain 2% yearly growth in consumption (the norm since I've been alive) forever, we need to double production every 36 years.

After the first 36 years, we'd need to find a new ANWR every 9 months. After 72 years, we'd need to find a new ANWR every 4.5 months. I just can't imagine us finding something that big that often, faster and faster, until eternity. It is literally ridiculous as after just a few generations, we'd need to discover a volume of oil larger than Planet Earth every few months.

As for the environmentalists and coyotes, honestly how much power can be attributed to them? The world is awash in stories about how oil confers stupendous power - without even thinking I can mention Howard Hughes, Getty, Rockefeller, The Beverly Hillbillies... but I can't think of even one person who came to power through environmentalism - My hunch is that there isn't any money in it.

And if there is oil in the Rocky Mountains, and we aren't drilling it, I think it's because there isn't much money in it yet.

Bob, I disagree, but this is exactly the kind of civilized exchange we need. Since the peak we added a lot of North slope and GOM to reserves, and reserve growth in the USA has been due to SEC reporting requirements much more than better recovery. In 1998, when I got interested in this subject, USA URR was estimated as 210 to 230 Gb. Now TOD experts estimate it as 190 Gb. Technology has surely slowed the decline, but has done nothing I can see to increaase reserves. Also all the technology you list should already have been factored into estimated world reserves. What new technology is waiting in the wings to suddenly and sharply reverse a 30+ year trend? Also importantly for policy purposes, what shape of that reversal can be expected, an early step function, a gradual rise through 2030 (and what then?), or a sinusoidal rise and fall? I think this issue is central to the usefulness of the report. Murray

Very nice update!

One thing I thought about the peak oil "yellow box" is that given peak oil was directly mentioned in Secretary Bodman's request for a report, they ought to have devoted a substantial chunk of the executive summary to it, rather than leaving almost all the discussion to the Supply chapter.

for someone whos written a few posts on this site, I must thank Gail and point out that she had 3 posts on here this week - the ideas are important in themself, but to participate on the call, format, center, graph everything takes a GREAT deal of time.

Great work and thanks for your efforts Gail. Your the most benevolent actuary I know (and only one too..;)

Actually, the graphs were easier than that. I am just using the graphs from the NPC report.

I have been using a MacIntosh computer for these posts. I locate the page I want from the report, the select "print". Within the print menu, there is an option "PDF" which I select. Next, I choose the "Save to iPhoto" option. Once it is in iPhoto, I use the "crop" feature" to chop out the piece I want.

I save the chopped out photo to a web site, and link to it. Once you get the hang of it, it takes no more than 5 minutes a graph.

From the transcript:

I find these kinds of comments frustrating. I think too many people confuse "the concept of peak oil" with the belief that "oil production has peaked." By stating it the way they have, it makes peak oil sound very marginal. Yet, who doesn't actually believe in the concept of peak oil? They all do. They just believe the timing is not upon us yet.

Robert,

I think I understand what you're getting at.

It's like trying to say, I don't believe in "the concept" of the Tooth Fairy; I don't believe in "the concept" of Thermodynamics.

The whole phraseology is oxymoronic. How can one not "believe" in a "concept"? The only way you can't believe in it is if you don't know of its existence. But if you mention the concept's name, clearly you know the concept exists. It's a paradoxical statement.

On the other hand, I don't "believe" (heh heh) that all of us agree on the definition of PO being "the belief that "oil production has peaked." "

My suspicion is that each of us has a unique personal understanding of what PO is is but we don't have a commonly accepted definition.

In searching the internet for "peak oil primer[s]", I found a number of different angles (including your primer) each with flaws in phraseology that can easily lead a newcomer astray. Gail is trying to take a stab at it. Defining "Peak Oil" is more difficult than it looks on first blush. Two words, yet so much confusion.

More from the transcript:

Priceless.

Mr. Eizember is senior planning advisor for ExxonMobil Corporation. He and Mr. Nelson were the two representatives for the National Petroleum Council on the phone call. Ms. Van Ryan is the organizer/hostess for the call.

From the transcript:

Wow, Mr. Eizember nicely sums up the "thinking" at work here. This is illustrative how scientific data does not support their projections--since we don't have scientific data to use for oil production projections. We just have simple wishful thinking, tersely displayed in the above excerpt. Ironically enough, for CC they are all too happy to use the inverse logic, ie to discount real scientific projections as unwarranted. Of course the CC deniers will say that climate change projections are magical thinking... One can't win.

The gall is really amazing. Alas, the man is just doing his job...

Of course not.

That is what the 2nd Law of Thermodynamics says. Chaos inevitably triumphs over order. Mr. E. is tossing chaos hand grenades into the conversation so as to disrupt the flow, and his tactic is working. As to the man "just doing his job", it is possible that he actually "thinks" that way inside his head. He is telling you what he "thinks" and you're saying, no. On what scientific basis can we know what he actually thinks? We can't.

It's interesting that Sam Bodman's question concerned oil and gas but the report says that the world is not running out of "energy resources". It's almost as though the NPC is covering its ass, because they could point out that they didn't say that the world isn't running out of "oil and gas resources".

Re: Yerginomics

Gail says above:

It is unfortunate that this chart has gotten as much attention as it has

This is the chart:

Let me try to explain the importance of this graph. It is very simple, really. This is the only chart that the NPC had (in the draft) that explained how the oil supply might grow in the future. The NPC meant it as an "illustrative" scenario, so it gave us some insight into their thinking. Only this graph illustrates how peak oil might be averted. Otherwise, the NPC merely referenced peak oil in its range of forecasts, along with the EIA reference outlook. It goes along with this graph:

The second graph also shows the IOC range of forecasts. The first graph calls out Enhanced Oil Recovery (EOR) as key to increasing oil production. It is well-known to observers of the oil & gas industry that EOR is seen as an important part of the road to salvation out to 2030. We will recover more stranded oil in mature reservoirs, not produce new oil. We will raise recovery factors as prices go up in the future. This is pure Yerginomics. Envisioned, but currently unavailable, technology is the key.

This is the reason EOR is the subject of my ASPO-USA story Exaggerated Oil Recovery, and the reason why I reference the "missing" graph. We can safely assume that the NPC withdrew the graph that has gotten so much unfortunate attention because it was too specific about what the IOCs were thinking. It came too close to looking like a forecast. In the case of EOR, their previous reports made optimistic estimates for EOR production that did not come anywhere close to working out.

These details do matter.

I absolutely agree, Dave. As I pointed out in my analysis of the NPC report (Peak Oil By Any Other Name) their EOR claim was an obvious exaggeration, and I would lay money that they withdrew it for that very reason. I criticized it this way:

"enhanced recovery techniques": The historical experience of using enhanced oil recovery (EOR) techniques does not affect the date of the peak, nor the peak rate of production. It typically just extends the "tail" on the back end of the curve and increases the ultimately recoverable total. This graph seems to hugely misrepresent the role of EOR.

It's unfortunate that they just pulled that chart, rather than replacing it with something they could defend. It was really the most useful summary view of the situation in the whole report. Without it, you're left with another pile of estimates and no clear opinion on their best guess.

--C

Energy consultant, writer, blogger www.getreallist.com

We need an easy to get to FAQ for TOD. Something that sez "Start Here" or maybe "Read Me First."

TOD is a really, really big honking site now. Anyone who stumbles upon it will be greatly intimidated.

The FAQ needs to be readily identifiable and easily accessed for both TOD and Peak Oil.

There is a good Wiki article on Peak Oil. And there are several other truly great resources. However new readers generally expect a site FAQ to answer their basic questions like why does TOD exist, what is Peak Oil, Why should you care, etc.

This should be easy to accomplish. However the FAQ needs to be written for new readers.

I posted this in Drumbeat for today. Please consider it moved. Thanks!

One of the most telling things about the "chart" is that it mentions existing known reserves which as we all know include ficticious OPEC reserve numbers which, by the way get more fictitious, as a percentage, each year. To a great extent, the enhanced recovery numbers are also based on known reserves that are not there. I would have pulled the chart also.Nice work Gail!!!

"As I read this report, it becomes clear that it is very important that correct ASPO projections (or peak oil projections from another authoritative source) be available for people preparing studies of this kind, and for other interested people."

The ASPO data was delivered by Jean Laherrere from ASPO France (and international), whom was asked by the NPC to submit his data. To my recollection ASPO USA was also asked to submit data, but I am not so sure about that.

In regards to Gail the Actuary's post...Byron King has a new video out on Youtube. There is a new video out of Byron King’s speech, given at the Rim of Fire Conference in Vancouver (07/07)...

http://www.youtube.com/watch?v=7k91AUitdcI