Credit markets: 'Don't panic', they beg

Posted by Jerome a Paris on August 10, 2007 - 9:45am

Something is happening in the credit markets...

(Note: this text was written Tuesday. For a more polemical take written this Thursday, taking into account the most recent developments of the day (including the unprecedented $130 bn liquidity injection by the European Central Bank) you can go read this new story on European Tribune.)

on the front page of the Financial Times, 7 August

on the front page of the Financial Times, 7 August

The above is the price of corporate loans in the secondary market - i.e. on the market where banks trade IOUs from corporations. If you have a contract that says that a company owes you 100, you can usually sell it (to other banks or financial investors) for 100 or thereabout - a bit more if the buyer thinks the interest rate on the loan is really good, or a bit less if it thinks the interest rate is not quite enough to cover the risk that the company might go bankrupt before paying its debt back.

As you can see above, the price of an IOU of 100 dropped brutally this month from 100 to 95 in the US (and to 97 in Europe). This is the lowest level ever for that market, and an unprecedented drop.

This is a credit crunch.

As gjohnsit chronicled in this recent diary, this means that banks no longer want to lend money to corporations. Almost no new debt was issued for the whole week. And banks that had underwitten loans (i.e. committed to lend) are now unable to sell these commitments down to other investors. Rumors puts such commitments at $300bn; at the 5% discount that such loans now carry, as per the graph above, that's a potential loss of $15bn for these banks if they want to dump that paper (they may decide to sit on it not to take any loss, as after all the borrowers have not defaulted, but that will weigh heavily on their balance sheets and at the very least will freeze a lot of capital and prevent them from doing new business).

Analysts everywhere (those that mocked the Cassandras that have said for a while that markets had gone crazy) have been forced to acknowledge that there is a brutal repricing of risk, and a new, sudden, unwilligness by banks to fuel the buy out craze - the debt-fuelled purchases of corporations by private equity funds at ever rising valuations. However, many are still calling this "healthy": a belated, but reasonable, return to normal after some excesses. (This is also what was said about the housing market before it claimed its first victims in the subprime lending sector this year). Some are even saying that all is well:

Don't Panic About the Credit Market

Housing and debt markets are not that big a part of the U.S. economy, or of job creation. It's more likely the economy is sturdy and will grow solidly in coming months, and perhaps years.

Unlike the 1998 seizure in credit markets to which many are now drawing comparisons, reservoirs of global liquidity are full to overflowing, not empty as they were that year. The deep 1997-1998 Asian crisis has been replaced with an all-cylinder boom. Unemployment rates are falling all around the world, while China's equities have continued hitting new highs.

Mr. Malpass is chief economist at Bear Stearns.

Bear Stearns? The same Bear Stearns that has lost 25% of its value after two of its mortgage funds collapsed? The same Bear Stearns that has been put on 'negative watch' by the rating agencies (i.e. they are looking into bringing its rating down)? The same Bear Stearns whose boss has been doing the rounds on Wall Street begging for other banks not to dump them?

Jimmy Cayne, chairman and chief executive of Bear Stearns, has been calling round other Wall Street chiefs to reassure them about its financial health and to head off a crisis of confidence in the bank.

Mr Cayne phoned Stan O'Neal, chief of Merrill Lynch, on Friday and has asked for a meeting with Chuck Prince, Citigroup's chief.

"Asked for a meeting?" The CEO of one of the biggest banks around is no longer able to talk to the CEO of Citibank? How scary is that?

The head of risk at a leading Wall Street bank said (...) it could be "a bit like a run on the bank" with the threat that clients, counterparties and lenders would pull back quickly if they lost confidence.

When top names talk about lost confidence and a bank run, all alarm bells should be ringing... So yes, you'd expect an all out attempt to shore up confidence, and all possible rosy arguments being brought up. But, seriously, Chinese equities?

Of course, financial players have been quick to cry for mommy and hope already for some kind of government bail out:

US stocks rebounded [on Monday] as financial shares gained ground on hopes that Fannie Mae and Freddie Mac - the giant government-sponsored mortgage companies - would help stabilise credit markets.

(...)

Fannie and Freddie soared 10.4 per cent and 7.7 per cent, respectively, as investors bet that their funding advantages would help them profit from the turmoil. Because of their links to the government, Fannie and Freddie are able to raise money more cheaply than other companies that buy mortgages, either to hold as investments or to package as securities for investors.

Investors were also reacting to speculation that the companies would be given greater opportunity to buy mortgages by their regulator, the Office of Federal Housing Enterprise Oversight.

A government bail out of the financiers that have stupidly bet on ever rising asset prices would be a major scandal, but pressure to do so is likely to increase as the crisis spreads. A bank run would indeed require public intervention, but major losses by banks, funds and other investors should certainly not trigger any kind of help, despite endearing pleas such as this one:

For once, wisdom is coming from the editorial pages of the WSJ, which apparently still host some consistent monetary hawks, and share my views on "Bubbles" Greenspan:

As always amid a credit turn, the pleas for easier money are rising. We're even hearing nostalgic cries for the return of Alan Greenspan, who is remembered fondly for supplying liquidity during the credit crises of his era. But what these cries forget is that the Greenspan Fed is one reason for the current mortgage mess. It's tempting to blame Wall Street and other bankers for all those bad residential loans, and they are paying the price now. But they were also lending into a housing asset bubble fed by easy monetary policy. Risky mortgages always look better when home prices look like they'll never decline.

Current Fed Chairman Ben Bernanke was along for the Greenspan ride, so he's hardly blameless. No doubt he'd love to play the hero role now, signaling easier money this week. However, he'd have to do so at a time when the dollar is weak, oil is at $78 a barrel, and commodity prices in general are roaring. Mr. Bernanke and the Fed might have more room to maneuver this week had they been tighter earlier. But now they can't afford to ignore global dollar weakness. The run on Bear Stearns would look like a Sunday stroll compared to a global run on the dollar.

And it seems that Bernanke has heeded such advice today, by holding Fed rates steady and maintaining their tightening bias. While acknowledging the recent economic downturn, the Fed has decided it cannot ignore the monster it unleashed earlier and needs to bringdown to size.

A couple of economists commenting on this have the right words:

"Bernanke tied to the mast, the FOMC remains deaf to the song of sirens" -- to borrow from Homer's Odyssey. Markets are like the sirens, and Bernanke and the FOMC are Ulysses and his crew, steadfast with their policies, not giving in to cries from the marketplace; economic data and credit events to date do not warrant rate cuts or neutral bias just yet. Zoltan Pozsar, Moody's Economy.com

(...)

Unless one believes the Federal Reserve to be a collection of utter buffoons, one must now suspect Bernanke and company fully realized they created a credit monster with a 1% Federal Funds rate and that they knew they'd have to clean it up at some point. Chip Hanlon, Delta Global Advisors

What this means is that the inertia of big financial masses is such that the asset price inflation continues to seep through into actual goods inflation, thus preventing a lowering of the rates. The need for the USA to fund its current account deficit by foreign investors also militates against any rate cuts (as they would cause a drop in purchases of US Treasuries, and a further weakening of the dollar) Finally, of course, the need to not cause any further panic (we're close enough to that, as suggested above) also pushes against any decisions which would be seen as an acknowledgement of the gravity of the situation. Better to do as if all were fine, for now.

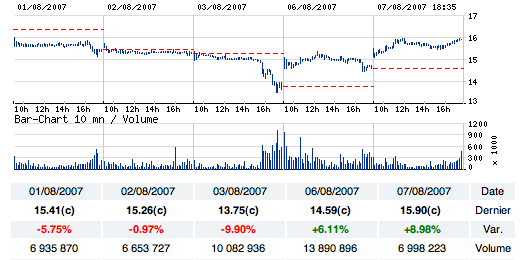

The most likely consequence is going to be more volatility, as investors become increasingly unsure of the "real" value of financial assets and buy or sell on the slightest whiff of danger or comfort, as the following graph, which tracks the share price of Natixis, one of the biggest French banks, shows:

Enjoy the ride. And don't panic!

Jerome: Great post. Jim Willie feels that Fannie Mae will act as the vacuum cleaner buying up (quietly with taxpayer's money)the worthless mortgage bonds that no one wants to buy. It is always nice to be on the inside in the particular brand of crony capitalism (never give a sucker an even break) the USA seems to treasure. http://www.financialsense.com/fsu/editorials/willie/2007/0809.html

Brain--

The people running this Global Casino want us now to cover their losses--

So much for the mantra "let the market decide who is the best"--

The Iron Fist of the market should bloody a few noses, and maybe they will need to actually get a job--

Virtual wealth can dissipate in a instant-- just like it was created (and with very few actual atoms involved)--

Superstition based economics are now trying to deny thermodynamics--

This is at least the third time that I've seen funny money derivatives take the whole market down dangerously. Perhaps its time to make trading them illegal in the US markets.

The first time wasin the mid-eighties, when the collapsing price of oil and the bank lending and mortgage markets took down the real estate and oil exploration in Texas.

the second time was when the savings and loan crisis and Michael Milken's derivatives caused the sale of virtually every bank and savings and loan in Texas.

And, now's the third time. But, there's been a couple of others that seem similar, but complicated by fraud. I'm thinking about Enron and Long Term Capital.

Yeah guys, I know it is against your "free market" principles. But, its your Mutual Fund and IRA that's going to take the hit on this, while the Hedge Fund cowboys walk away with the profits from looting your mother's teachers pension fund. Sometimes we just need a little regulation. Bob Ebersole

"Sometimes we just need a little regulation."

Couldn't agree more.

The market is good system if you are using it to advance society. The market is not so good if your goal is to game it for personal gain.

From Bonddad:

"Thursday, August 9, 2007

Countrywide Financial Reports Major Disruptions

From the WSJ:

Countrywide Financial Corp. faces "unprecedented disruptions" in debt and mortgage-finance markets that could hurt earnings and the company's financial condition, the Calabasas, Calif., lender said in a regulatory filing. (Read the SEC filing)

......

Payments were at least 30 days late on about 20% of "nonprime" mortgages serviced by Countrywide as of June 30, up from 14% a year earlier.

.....

On prime home equity loans, the delinquency rate was 3.7%, up from 1.5% a year before. For all loans, the rate was 5%, up from 3.9%.

In a sign of the growing difficulty in selling loans, Countrywide said that it transferred $1 billion of nonprime mortgages from its "held for sale" category to "held for investment" in the first half. Countrywide marked the value of those loans down to $800 million. It also decided to retain as investments, rather than sell, $700 million of prime home equity loans, marking them down to $600 million. Countrywide has said many of those home equity loans were second-lien mortgages used by people who put little or no money down in buying a house.

Translation.

Countrywide is the largest home lender in terms of loan volume. If they can't et a deal done -- no one can.

Countrywide couldn't sell $1 billion of loans at a decent price. They cut the value

of these loans by 20% when they transferred those loans to their investment portfolio.

Countrywide couldn't sell $700 billion of prime loans, and devalued those by 14%.

That means the going price on both of these investments is probably lower than the devaluation on the balance sheet. Subprime loans are going for less than 80% of face value and prime loans are going for less than 14% of face value.

Simply put -- liquidity just isn't there in the market right now. And the crunch is getting worse because Countrywide couldn't sell prime loans."

"The liquidity just isn't there in the market right now." Disagree - the liquidity is there, but at a price. This isn't a "credit crunch," just a repricing of risk, an event that will indeed deflate the value of "assets" held on financial intermediaries' balance sheets. "Legitimate" credit needs will be met, a demand category that does not include Ninja (no income, no job, no assets) mortgage loans, all the nonsense going on with "private equity" (a retread of the good old LBO days), and other assorted misallocations of capital. Adding up what the Fed, the EU, and other assorted central banks have pumped into the repo market in the last two days comes out to nearly a quarter of a trillion bucks, hopefully not a number that will be annualized!

Retranslation :-)

Countrywide couldn't sell $700 Million of prime loans, and devalued those by 14%.

Subprime loans are going for less than 80% of face value and prime loans are going for less than 86% of face value.

If your mother is a teacher or otherwise has a pension, her benefit is guaranteed whatever happens to the fund. That assumes her employer doesn't go bankrupt or otherwise dump its obligations on the PGC.

If you invested your 401K or mutual fund in hedge funds or CDOs or toxic waste tranches, you can reap the worldwind. You pay your money, you take your chances.

Pension funds and the entire financial industry are already regulated out the ying-yang. Which doesn't prevent Enron from ripping you off. Or hedge funds from charging outrageous fees that some people willingly pay.

What sort of regulation do you propose? Making bad investments illegal? If you wish to make fraud illegal, that has already been done.

We need several amendments. I'm not a finance guy, I'm a contract specialist in the oil and gas industry, this isn't my area of expertise, but here goes:

1. I'd like to see the weird accounting go away that allows a company to book profits before the money is received. The counting your chickens before the egg is even laid-What's it called, Mark to Market?

2. Pensions and other funds where the money is managed by a fiduciary should have to disclose fully to the regulators and the beneficiaries

a. The name of any hedge funds and their country of registration. In other words, if they are operating under Panamanian registration to dodge taxes, or Bahamian so they can have bank secrecy, I want to know it

b.The principles in any hedge fund and their compensation from the fiduciary's funds.

c. their general type of business-oil and gas comodity speculation, investments in loan tranches, investments in any illiquid investment like working interests in oil and gas wells exploration funds, or loan products that are new and have never sold in a market

d. any commissions paid to the trustees, including things like golf vacations in Scotland or investment conferences at somebody's Alaskan hunting lodge

e. other involvements of the trustees with any of the principles of the fund-were they given a personal opportunity to get in on somebody's commercial real estate deal with 100% financing in exchange for using the trust fund's money in another commercial real estate deal with a big back in after payout?

3.participants in a company operated 401K, or a union pension fund should be offered easily transferred at no cost options like a mutual fund or inflation indexed treasury bond fund

4.. Boards of Directors or Fiduciaries should be liable for their mistakes, including liability that uses the assets things like their inhertited Testamentary Trusts to repay victims of malfeasance

5. a death penalty for corporations and people's careers. If a person uses a corporation to defraud others, the person should never be allowed to work in any financial capacity again. For example, any director of a company like Enron or Reliant or Duke should be prohibited from being an officer or director of any corporation. When a company like Reliant is found guilty of fraud like the California natural gas manipulation, all the officer's should be prohibited from being the officer or director of any other company, and the company sold to an honest company in the field, or the assets broken up and distributed to the victims, the creditors and the stock and bond holders, in that order.

That ought to be a pretty good start. The general principle is that the deals should be transparent, and Trustees and Boards shouldn't be allowed to shelter any assets from repaying injured parties. Let's allow people to know what their fiduciaries are really up to, and give them a no cost way of opting out.There's a lot of difference between a Bond fund in Treasury Inflation Indexed Securities, and a Bond fund in outlandish products that nobody can understand and are illiquid, like all the Tranches in the subprime loans. And last but not least by any means, why are corporations allowed to continue after they have engaged in criminal fraud? Why are multimillionaires on a board allowed to shelter any of their assets from the victims of fraud or gross stupidity? Why are corporate bondholders and lenders given preference in bankruptcys over victims of fraud?

1. Mark to market is something else. A lot of these toxic waste tranches don't have no markets to mark too. Ok, let's take a real world example. I go to the McStore and buy some McCrap on my credit card. A week later the McBank credits the McStore's bank account with actual money. A month later the McBank discovers the credit card number was stolen off the web. So they yank their money out of the account. When can McStore Inc. book the sale as profits?

2. Pension funds are regulated out the ying-yang. Not my area of expertise. They already file thousand page documents you can leaf through.

4. Board of Directors can already be sued for their mistakes. That's why your pension funds buys D&O insurance with your money. Don't you love when security lawyers vow to bankrupt a malfeasing company on behalf of the stockholders they allegedly represent.

5. The SEC already bars people from working in securities again. That's why the crooks have to keep finding new ways to scam people.

Oilmanbob,

We lost the right to a corporate death penalty in 1886 when …

“…[A] two-sentence assertion by a single judge elevated corporations to the status of persons under the law, prepared the way for the rise of global corporate rule, and thereby changed the course of history.

http://www.ratical.org/corporations/SCvSPR1886.html

“The only explanation provided was the court recorder’s reference to something he says Waite said, which essentially says, “that’s just our opinion” without providing legal argument.” http://www.thomhartmann.com/theft.shtml

One further antiquated idea for this credit crisis thread….

U.S. Constitution, Article I, Section 10, Clause 1:

No state shall… make any thing but gold and silver coin a tender in payment of debt. http://www.usconstitution.net/const.html#A1Sec10

Explaining the US economy?:

"...glorification of that sort of gambling in "clever strokes" which constitutes the very essence of theft, swindling, and all sorts of similar anti-social deeds." Peter Kropotkin comments on prison systems and relevant inmates ca. 1899

Bob -

I liked to add a few refinements to your comments regarding how some avoidable financial mistakes has caused some serious pain in your lifetime.

Milkin didn't do derivatives, he & his cohorts at Drexel helped establish what we now term the "High Yield" market. (Back in the day, such bonds were termed "Junk Bonds".) Overall, the world is far better off with such a market. That said, the HY bond market is not for the faint of heart. Then again, neither are equity markets... Milkin got in trouble for using "inside" information to trade in & out of these bonds.

The LTCM mess was far, far more serious than most realize. The problem was the massive leverage on the part of LTCM, not the implied leverage in the derivative securities they held. The forced liquidiation of LTCM's large positions would have likely caused markets to "sieze up". For once, Greenspan did something right by organizing an orderly sell off of LTCM's book. (Yes, I made a a few bucks from taking positions off of LTCM. Ah, the good ol' days ...)

The current subprime mess was largely created by the Greenspan FED. The FED knew that a real estate 'bubble' was likely to occur as a result of their decision to lower rates to fight the 'Phantom Menance' of deflation. Moreover, the FED also knowingly chose to NOT act (i.e., regulate) lenders when the no-doc and Alt-A volumes started to explode. The FED could have easily nipped the current subprime mess in the bud. Greenspan "rolled the dice" and now we're all suffering for it.

The big losses on The Street recently have been in "stat-arb" books. It appears that many, many of these books were using VERY similar models. (I did stat-arb for a while in my younger days by the way) The last few days, these books have been "reducing risk" i.e., dumping their positions. A typical stat-arb book uses roughly 4-1 leverage these days and just look at all the volatility unwinding these books is causing. Just imagine what dumping the (up to) 100-1 levered LTCM book might have caused ...

I don't view the FED doing it's job as a violation of any free market principles. Don't apologize.

Not every hedge fund trader/portfolio manager is a "cowboy", though I do a know a few. We PhD guys in the financial markets are a highly varied lot: some of the absolute smartest people I have ever known have PhDs and manage money, but some of the absolute dumbest people I've ever known also have PhDs and also have been allowed to manage money ...

Sonic: You didn't respond to Bob's post at all. What you did write was another of your long winded posts detailing your impressive resume. Obviously Bob is clueless as he didn't do "stat-arb". We are very impressed that you made money from LTCM. Congrats.

BrainT -

Bob wrote " .. funny money derivatives take the whole market down ..." and " ... Michael Milken's derivatives ..."

and ".. now's the third time." as well as alluding to LTCM.

I addressed Milkin, LTCM, and the current mess. So, I did respond to Bob's post, just not every aspect of it. You are wrong, but I'm sure this isn't the first time.

Regarding my "resume", the references to LTCM and stat-arb were intended to communicate to the reader that I have first-hand experience with both subjects -- experience not likely possessed by others who post at and/or read the TOD.

So, what's your problem BrianT? My posts are infrequent and typically short. My post above is somewhat long, but not even the longest in this thread. Do you respond the same when others (like Bob or Robert R. or WT) mention, say, their oil related credentials? Or, when Don S., an econ guy, puts up a long post about economics?

From your posts in this thread you appear to be nothing more than yet another uninformed, conspiracy theory nut.

Sonic: Two points- 1. I consider myself to be a relatively well informed conspiracy nut 2. when responding to my posts you can use my handle-BrianT-no need to label me as the Brain (I don't call you the Silver Spoon baby.)

BrianT, as I said, I'm not particularly educated in financial markets, but that doesn't make me clueless, you arrogant pissant. I'm pretty observant, and expert in a number of areas of which you know nothing. But, more than that, I know my limitations and am willing to freely admit when I'm wrong.

If I were "clueless" I'd just take the Joe Sixpack attitude of dumping my savings in a mutual fund and allowing people to manage my money and charge me exhorbitant commissions, or even not having savings and relying on social security.

But true cluelessness is going around insulting people that you've never met, and assuming that because you have a specialists vocabulary in a particular area, that you are somehow superior to them.

Bob Ebersole

Bob: Relax-the comment was meant as sarcasm. I was insulting Sonic man, not yourself. I have no idea what you mean by a "specialists vocabulary".

Sonic -

What's your take on the dollar right now?

I'll take any dollar anyone will give me. I'm selling carbon credits. Cheap!. Soothe your conscious.

Precisely. There's huge difference between money and credit - credit is ephemeral and can dry up almost overnight as we're seeing at the moment. IMO the resulting debt implosion is only just beginning.

We're discussing the credit crunch in today's Round-Up over at TOD:Canada.

What about oil demand destruction by recession? If PO is in the past, a nice little recession could postpone the obvious effects PO for a while. I wonder if this crisis may be handled differently than we think?

It seems to be a common assumption that the Fed will NOT allow deflation. Bernanke has said so, and there is a clear pattern of inflating the money supply upon every financial crisis.

However, if the Fed were to fix everything by injecting massive liquidity and get the economy growing again, Peak Oil will become obvious much sooner. We know (or hope) the guys in charge understand Peak Oil. If they do, they may opt to let the economy flounder in recession for a few years. Widespread acknowledgment of Peak Oil could be put off temporarily because a contracting economy reduces demand for oil.

Does this sound plausible?

Racing: Not to me. IMO, the reason for the "emergency" mentality right now is that the connected are losing money as the financial markets seize up. The Fed's mandate is to work on behalf of the financial sector of the economy, keeping it healthy and increasing its wealth and power. If somehow the damage could be contained to Joe Sixpack and his buddies losing their homes and jobs, Bernanke would be talking tough about inflation and not budging at all. This is different-his friends and the persons that pull his puppet strings are actually losing money-he has his orders to do anything possible-the long term effects on the USA economy are never even considered. He just wants to put out the fire. IMHO, you are giving these puppets way too much credit.

That has the ring of a true statement.If it was just joe 6-pac loseing his ass-ets,no big problem...but now,some very weathy people might find themselfs on the wrong side of things and lose their respective ass-ets,why,send in the fed..bailout,bailout....must "stablize the markets".Funny,history has shown that the more controlled a market is,the more damage occurs when it slips the leash...and many have noted how controlled our market has been thru manipulation of futures contracts.Now all the birds are comeing home to roost.Get a big bag of popcorn,its going to be a show...

Hm, I think there are reasons they may let the whole thing tank: one is that it will be a lot easier to continue with war plans with large unemployment. There is a bitter war for power going on at the top. Not everyone at the top is going to be a winner. It's not just little guys (like us) that are going to get gored. The big money the in retail sector, the consumer market, some of the financial sector, all are going to get creamed. It's the big money in the military, energy and related sectors that stands to benefit. Something like that. I also see the possibility of inflation/deflation at the same time: food and energy go up, real estate goes down, services go down along with big increase in unemployment. My best guess.

Thanks all for the ideas. One more thing I'd add: financial markets hate uncertainty. Peak Oil (or the day it becomes widely acknowledged) is a huge uncertainty. The PTB might rather put it off as long as possible. As long as Joe 6 thinks everything is going to get better as soon as the recession is over, he'll stay cool and take his lumps. If he realized we could be permanently fubared (and he'll never be able to drive his truck again!), he's going to become very unpredictable.

hi racinginflation - you say ..

I'd say quite the opposite- when Peak Oil is understood for what it is - It will open the eyes to the fact of certainty, certainty for a less energitic future that is...

Right now the world economy has a “bad peak-oil disease” - and very few are aware – When the rest of the pack realizes this fact, world economy is rushed to the hospital for an overhaul and respirator – the big Question is when, and whether it’s spread to much ?!?!?

This ongoing Credit Crunch is to be seen as a minor flu...

The super Question though is - what's next ?

Rationing, restrictions, priorities, necessities- curb uprisings, ensure food supplies ....

ethanol for food, ban private cars - crash programs in speedy bus-constructions, work from home ...

EROEI scrutiny-programs -like have the WTurbine- and PV-manufacturers produce their products FROM "own energy", how does that play out, and so forth, bla, bla ?

Can the free liberal market-mechanisms actually handle expencive power at all ?

I think the uncertainty will be in how Joe 6 and the financial markets will react when they realize the certainty of PO. To me, people are very unpredictable.

As the information is distributed among the investors, the problem isn't so much that energy is expensive. An expensive input just re-jiggles the numbers so that items that are made with less energy, and items made to save energy become the engines of the System.

The real issue is the perception of energy supplies. Investments in general are based on the Perception of Perpetual Growth. This perception has always assumed an unlimited supply of energy from 'Somewhere'. Most recent has been cheap oil. Before that, investors counted on coal. Before that, they counted on people to have a lot of sex and 'Go Forth and Multiply' to create investment opportunities.

We have finally reached the point where the Perception is starting to fail. The last subdivision wasn't ever intended to be occupied; only to present the second-to-last subdivision buyers with the illusion of demand competition.

It's all lies. You just have to decide if you can make money as the lies are found out, or if you think you can join the New World Government and create new lies.

Soylent Green, anyone?

Actually, I'd say that financial markets love uncertainty - it gives them great opportunity to sell hedging instruments at inflated prices, trade them and play with volatility. The pros can more easily skim off the amateurs in such environments.

That's all true, but the markets don't love extreme uncertainty, otherwise why are the central banks pumping out all that liquidity the last few days? Bailing out the well-connected who made bad investments is only a small part of the equation. The rest of the markets have to be assured that everything is under control and that the problem won't spread.

In fact, all the automatic bailouts of financial crises have made the markets much too complacent, that's why players have been taking so much risk by buying sub-prime mortgages - they know that most of them will get bailed out. They like some volatility, but only within safe parameters.

It sounds plausible, racininflation, but I think it may be coincidental rather than a causitive factor. I still think peak oil is just barely on the radar of the powers that be.

They have a lot of the same causes, a 9 Trillion dollar debt, a negative savings rate for about 95% of the US families, a reckless borrowing of money for consumption, and importing 68% of our oil and about $600 billion of manufactured goods from overseas while refusing to conserve energy by buying reasonable cars. Its hard to just segregate one reason for the mess.

Bob Ebersole

Socialize the risk, privatize the profit. It’s a great racket if you can get it!

Shall we try for 4?

Let the casino stay open--

It keeps people from dealing with reality-

Perhaps PO has to be more of an immediate threat before they'd stoop to prolonging a recession to avoid it. It would be a pity if they engineer another short 1-2 quarter recession, then start another bubble that causes the economy and oil demand to accelerate. A long recession would be the best outcome, possibly, if it keeps oil demand down without wrecking the economy completely or collapsing oil prices - it will give the world that much more time to prepare and adapt.

"I still think peak oil is just barely on the radar of the powers that be."

This will disabuse you of idea that PTB have'nt PO on their radar...just read DickCheney's 1999 speech to Petroleum Institute in London. He laid it out clearly for all interested parties to grasp. Here's the link:

http://www.energybulletin.net/559.html

I would like to add to that speech a couple of snippets from the 30 July 2007 Newsweek review of Dick Cheney's authorized biography:

"Dick Cheney may be a taciturn man, writes author Stephen F. Hayes, but the vice president can become animated discussing doomsday scenarios."

"Cheney first embraced his belief in asserting executive power - the need for a strong president to rescue the country during crisis."

"In a revealing interview, Secretary of State Condoleezza Rice (at the time Bush's national-security advisor), told Hayes '[Cheney] read every intelligence report. I mean every intelligence report no matter how minor. So I remeber thinking he had an extraordinary memory...for all of these things.' "

Add all this up, and I think it's reasonable to believe:

Dick Cheney is fully PO aware, and is in the "doomer" camp.

If TSHTF during his watch, he will go for the "strong man" model to deal with the crisis.

God help us

Errol in Miami

Cheney spent a lot of time talking about GTL (gas to liquids). I assume the liquids are (or could be) propane? I haven't heard much about this -- is it moving forward, or was that just one of those flash in the pan ideas that didn't work out?

GTL is mostly about transforming natural gas (methane) into diesel.

Propane is made out of oil and condensate, generally , thats why its called liquified petroleum gas(lpg). The US Military runs primarily on diesel and kerosene (jet fuel), and I heard, although I can't recall the source, that it takes 14 gallons of fuel a day per man to keep a soldier in the field in Iraq. Considering how much the Hummers burn, whipping down dirt roads at 70 mph with an extra couple of thousand pounds of steel bolted on, and the huge amounts of fuel used by helicopters and jets, that doesn't seem an out of line figure.

Bob Ebersole

As we sleep tonight, this is what is happening on the other side.

August 10, 2007

AUSTRALIAN shares have plummeted this morning, shedding more than 2.5 per cent amid widening global anxiety over the sub-prime mortgage crisis.

Don't worry, be happy.

We're all in a big happy global economy now :^)

| The problem will solve itself.

| But not in a nice way.

Sydney is now off near 4% and there is blood in the street. All of Asia off over 3%. European Stocks lose 2% on open.

http://www.cnn.com/2007/BUSINESS/08/10/global.markets.reut/index.html?se...

Markets Now down over 3% across Europe

Thank you for the posting Jerome.

Assuming current trends will continue until the credit buildup is washed out,,what is the best course for someone that has cash to invest?

Any options besides a 5% bank CD?

Best Regards,

Gunga

Royalty trusts have been mentioned on this here (The Oil Drum) newsfroup:

http://en.wikipedia.org/wiki/Royalty_trust

There are, of course, many other investment vehicles as well...

| The problem will solve itself.

| But not in a nice way.

Don't put all your money with one bank.

Here's an interesting one for you. Do you think it's wise at this point to actually pull some cash from the bank and store it somewhere safe?

Hmm....

Most countries do have deposit insurance for basic bank deposits, so that should be safe, mostly, unless you go into doom scenarios, in which case you probably need to store tradeables for a barter economy rather than money which will likely be worthless.

I'm envisioning the possibilities of a level 7 (out of ten) financial meltown stemming from this credit bubble synergizing with peak oil to just about nuke banking, but not exploding so badly that dollars aren't still a medium of exchange. As such, with the widespread and tangled nature of the coming kaflooey...I imagine it's possible FDIC could be overwhelmed. I mean, the FDIC sounds all warm and fuzzy, but in a heavy collapse where all banks are screaming "help!" and the government is in deep feces itself is it really going to be capable of provide any protection?

The FDIC can't be overwhelmed because they have a window to the Fed. At some point, they can just monetize the debt. Then we get into Jerome's doomsday scenerio where there's no point holding dollars and you need barterables.

In accounts of <100,000 your dollars aren't any less safe in the bank. Whether the dollar becomes kleenex is another (t)issue.

Easy, short the financials...

Thank you SEC for removing the up-tick requirement. Makes the whole thing so much more manageable to short this thing into the dumpster, sigh.

What are the chances George W spends his entire vacation in Texas, and not rushing back to DC?

What's the chances we are better off with W at his ranch in Texas?

From PrudentBear.com:

Interesting, same buzzwords.

Whenever I watch a tv show with footage from the past, I keep an sharp eye out for prices in the past. From my observations, most stuff has inflated in price about 8% a year in the last 100 years. except electronics.

"America is not a young land: it is old and dirty and evil before the settlers, before the Indians. The evil is there waiting." William S. Burroughs

thanks Jerome

The chart and explanation is very powerful demonstration of what's really happening. Clearly the credit market for private equity has collapsed.

It may be too early to say, but do you think this credit collapse is also affecting real projects, like windfarms and other desirable corporate projects?

This reflects my concern about peak oil. As an engineer, I think we can easily keep society functioning in a reasonable manner on the downside of oil peak (radical conservation and efficiency could get us most of the way). The worry is that if a market collapse prevents the world from investing in the required infrastructure, then dealing with peak oil and climate change becomes very difficult.

cheers

Phil.

Personal observation.....I am a structural steel inspector these days{former nuke}I inspect steel highrises.This week I was speaking w/a superintendent of a large construction company here in the northwest.They had 6 BIG condoes...150 unit jobs....so many buyers{500+} they had a lottery for who got the units.The 150 who got the next building that was to start have not been able to complete financeing so the building is on hold,as well as the next 6 that they were ready to slam down

I was talking to our company pres{he is peak aware} and we both are wondering if this is true thruout our biz...if so work will get real slow,real quick.

From MAXSPEAKS:

FRONTIERS OF MACROECONOMICS

"Since the Fed and the European Central Bank have both started pumping out liquidity faster than Bill O'Reilly in a phone booth, doesn't that mean that monetarism and real business cycle theory are regarded with indifference by the people actually running the economy?

I'd like to know so I can go on ignoring that stuff. It reminds me of national security material the Gov keeps classified, even though it is fully known to our foreign adversaries. The targets of the concealment, or in the first case the myth-making, are the great mass of hoople-heads. Apparently including graduate students in econ depts."

I'm worried about the same thing. We're wrapping up drawings on a $50 million project in the Northeast US. We were told yesterday that the client has two other open permits but has yet to start construction on either of them. If clients are sitting on projects already designed, how likely are they to need new designs? The best we can hope for is to paid to "value engineer" and otherwise cut back the same projects.

Sorry, but I don't agree that wind farms are desirable, at least not on the scale that would be needed to make much of a difference. Windmills are fine at the single property level but IMO wind farms are just another form of blight. IT's just impossible to blend these things into the surroundings. The one that has probably been seen by the most people is the ALtamont farm in CA. What was once beautiful,rolling golden hills, the archetypal Steinbeckian landscape ("Pastures of Heaven") is covered w/ row upon redundant row of wind turbines. What a tragedy. For what? SO that we can keep power prices low and build bigger houses or build more long john silvers and staples?

Matt

Well Matt, if you don't like windmills we can always burn coal or uranium instead.

I only seem to remember the endless brush fires rolling up those golden hills.

Unfortunately, it's the old nimby thing. Someone has to take the hit, or better yet, everyone has to take the hit.

I would think a better argument against windfarms is the well chronicled deaths of migratory birds each year that occurs along the Altamont.

Finally, I used to marvel at the 100 windmills they put up along the freeway. Now in the 1000s, it's hideous. Glad I don't drive by there anymore except by accident.

(I know this is off the orignal topic, but it is reply to several wind discussion posts, and how rapidly the scene is already changing.)

jteehan said,

"Finally, I used to marvel at the 100 windmills they put up along the freeway. Now in the 1000s, it's hideous. Glad I don't drive by there anymore except by accident."

Yes, it's true....even the Greens have fallen badly out of love with their old darling the wind turbine....now when I try to do research on wind, I plow through as many stories of neighborhoods, townships, desert preservation societies, and ocean front property owners fighting the introduction of wind plants and wind farms as I do of technical breakthroughs involving wind.

There are seldom stories of pople arguing against the fossil fuel plants and generating stations cooling towers and smokestacks that come with them or anyone trying to fight the dozens of ethanol plants being slung up across the plains, or the coal mining operations and mountain top removal blasting....folks seem used to those. But wind....it is considered the evil of evil. Wind is dead. Just as it achieved real parity on power production cost, and technical and financial competitiveness, even its onetime supporters have learned to hate it. But the anarchist primitivists and their allies have not forgotten the old "heavy industrial" blight. They just know that wind is newest and weakest, unable to defend itself in the way the fossil fuel community can. They will turn to that fight another day. For now, it's the renewables that can killed in the crib.

I myself was once fascinated by the possibility of wind, my current website not yet remodeled to reflect more advanced thinking is still about a wind idea some partners and myself were developing. We have now come to accept that it will never be. The NIMBY problem, and massive opposition to the sight and sound of wind would make such an idea non-marketable, even if the economics and the technology worked perfectly (a daunting challenge in and of itself without terrible local objection to the construction of such a plant)

All roads in the renewable development will now have to go to solar. The potential is there, technically and economically. The designs will have to be very well thought out to be almost invisible. Black cells blended into roofing material on large warehouses, stores, industrial buildings and malls, and carefully disguised as shingles on houses...solar arrays in "brownbelt" abandoned areas of cities, hid in areas that are already so blighted that no one ever goes to look at them, abandoned railyard, warehouse and old industrial belts, and if in the desert, hid out on the corner of old military bases, and abandoned industrial areas of desert towns.

We are asking more of our energy production systems than sounds possible. It must not only be efficient economically and technically, it must be completely silent and invisible, a new kind of "stealth" energy, that cannot be seen, heard, and leaves no oder or fumes, but must always be there. We want to live in a fantasy primitive garden, but enjoy the benefits of a supra-technical world, able to communicate across the globe with voice, text and film, enjoy air conditioned and climate controlled comfort, and stroll among green gardens and glistening springs, but with perfect pharmacological drugs and health care.

Can it really be done? Artists, designers, technicians, please apply.

Roger Conner Jr.

Remember we are only one cubic mile from from freedom

NIMBY is so yesteryear.

It's BANANA

Build Absolutely Nothing Anywhere Near Anything

Yer behind as well.

NOPE

Not On Planet Earth

Or maybe

KELP

Kill Everything, Lastly People

I'm sure attitudes will change shortly after the rolling blackouts.

I would suggest that "Ground Source Heat Pumps" together with Solar Heating are more tenable for domestic energy use reduction. Solar PV is unlikely to play well due to its unreliability.

Transportation over 10 miles is likely to be the real problem though. Solar+supercaps+biofuel seems the most likely option, but only at a much reduced beat. No commuting long distance to work, or to friends at the weekend.

The thing to bear in mind is that at some point sentiment will switch. I expect to see the mob with the flaming torches coming for the Nimbys some years down the line.

PS Wind generation at sea is tenable, and on land once the decline bites and the Nimbys are strung up.

If we use fossil fuels to create renewable energy devices, we get a gain. By that I mean use fossil energy to create the PV panels and solar thermal collectors and then use those. If it takes 3 years to pay back the energy expended making the renewable energy devices and the expected life span of the device is 30 years, you have a gain.

FYI: Warranties on some solar panels are 25 years, and their expected useful lifetime is on the order of 50.

There is indeed incredible hostility to wind. It's irrational, irresponsible and disheartening, but wind is still being built in record numbers all over the developed world because:

- as you point out, it's close to full competitiveness (and would be if externalities were priced in and subsidies to oil & coal taken out);

- even better, it provides a wonderful natural hedge against rising energy prices: wind electricity will NOT get dearer over time, as price is not dependent on that of fuel, but only on initial financing conditions

- in many areas, especially rural ones, it brings (lots of) income, jobs and tourists with little or not adverse impact

- the financial world is fully behind the technology, and is investing massively, and will increasingly do so in today's context.

Jerome: are "initial financing conditions" durable if interest rates keep rising? I keep hearing of banks "calling in loans" - when can they do that, and when would they want to do that?

Once you've borrowed the money and spent it, you only have to repay it in accordance with the initial loan. We usually require fixed interest rates to be put in place to avoid interest rate risk, so the amount that needs to be repaid is fixed. As long as the price for wind power is stable (whether thanks to a feed in tariff or a PPA), or at least higher than a minimum level (usually 3c/kWh, so it's unlikely that market prices will be below that for long), then debt will be repaid.

Banks will certainly not call in loans that are performing well and not in default. Why create more problems where there aren't any?

Not in Texas !

Former Gov. GW Bush signed a bill that mandated a minimum amount of wind for the investor owned utilities and was other wise friendly to wind.

And as OilManBob, an oil company landman has noted, the locals love them !

Best Hopes for Texan Aesthetics !?

Alan

Well... I wonder if the texans would still love them if they did not bring some $3-4000/year per turbine in rent for the land owners. Just a minor cynical note, not anything constructive here.

Personally I'm OK with wind aesthetics especially on farmland or offshore but if you do the math, reaching half of our electricity would require much more than that. Especially after you factor in transmission lines and access roads. BTW until those "wind pools" are substantially depleted I am more inclined to accept at least some of the NIMBY movements like for example Cape Cod.

What's wrong with ranchers making money?

And, many of the windfarms are on land owned by the Permanent School Fund. The money goes for schools in the state and holding down tuition at our university system. Texas was an independent Republic for 10 years before joining the US, and we kept our lands and our debts incurred as an independent nation when we joined the Union. All other states except the 13 colonies were formed from territories owned by the federal govenment when they joined the Union, the feds retained the unsold lands, and they form the National Parks, National Forests, Military Reservations, ect.

Wind turbines are real property, just like houses,oil wells factories, and private land and the taxes help reduce the local's land taxes and provide funds for the counties and schools, even if they are on state owned land. There are no state ad valorem taxes, but they provide most of the revenue for counties.

In rural communities, decent jobs are scarce. The utilities hire and train local kids in well paying jobs that allow them to stay in the communities where they were raised. If the kids can't find a decent local job they move to a city and go to work selling cell phones in a kiosk at the mall, or working at some other fine "service" job. They join the Army and go to Iraq. If you were a rural person, which would you rather see your son or daughter do?

I think its the absolute arrogance of NIMBY people that offends other people. They drive through in a car spewing CO2, on a 150' strip of concrete, throwing trash on the highway and think that they have the right to tell local people what they can do with their property. They think their right to a view at 70MPH once every three years trumps a small town's right to have jobs for their kids and income for their kids and schools . That Teddy Kennedy's view from his yacht ,when he's sober enough to see, in Cape Cod is better than a wind farm offshore that prevents a strip mine in West Virginia from expanding is pure ,selfish arrogance by a rich man. I'm sorry, that's not enviromentalism, its selfish arrogance. It gives fuel to the liars like Rush Limbaugh denying global warming.

We live in a modern society that needs fuel. Windfarms harvest a renewable resource, provide minor environmental consequences, and affordable electricity. They help the towns near which they are built. The alternative is dirty coal, or brown outs, as nuclear plants are not being permitted and built and there aren't any dam sites left in the U.S.

Bob Ebersole

Right on.

Yes, that was a very good statement on the state of affairs in rural America.

OK then, let us clear, build or dam every single piece of land in this country. Let there be transmission lines from California to New York, hydro turbines on Niagara Falls, wind turbines in the Grand Canyon and geothermal in Yellowstone. Let there be light!

Isn't this what you are effectively suggesting? I thought I made my statement clear: I'm inclined to accept reasonable local (and non-local) opposition as long as there are viable alternatives. Even if we set aside nuclear for now, did we already built up the vast farmland of Texas, the plains of North, South Dacota, Iowa etc. etc. so that we are reaching to pristine places? I wonder - will there be a place where are our kids going to meet untouched nature if we continue like that? OK - it might be a little more economical, but is this question about money, really?

And of course there is nothing wrong of people making money from their land. I just can't accept the argument that you see people "like" wind turbines at its face value, when the same people are also financially interested. Have a good weekend.

Ket there be ... hydro turbines on Niagara Falls

The site of the first AC generating hydroelectric plant by Telsa & Westinghouse in 1895.

We currently have 4 GW installed (2 GW on New York side and 2 GW on Ontario side).

The flow over the falls is regulated for the benefit if the tourists (and preserving the falls from eroding into rapids by slowing erosion by 70%).

The technically easiest solution to reducing NG use is to run the Niagara hydropower plants full out during Peak Demand, instead of cutting back.

The site could, and should, be redeveloped for more power.

Best Hopes for Long lived Renewable Energy,

Alan

In 1890-s one of our most famous bulgarian writers wrote a documentary about his vist to the US. Basicly he glossed over the man-made 'beauties' of this country and spend a third of his book on the Niagara Falls.

It would be an irony if his grandsons will have to learn how it looked like only from his books or videotapes only... Energy is simply not everything, and some things are not worthed IMHO.

People may be opposing the Cape Cod development because there is the possibility that those turbines could be put in some more suitable places. To start all the NIMBY flaming rhetoric may be missing the point.

The point is, if there are more suitable places to put windmills, then put them there. I would not want to see windmills by the 1000s put in National Parks. That is not arrogance, that is just common sense. Let us tone down the rhetoric a bit so that we can see the facts and make some rational decisions.

Precisely

People may be opposing the Cape Cod development because there is the possibility that those turbines could be put in some more suitable places

HARDLY !

Certainly not in Massachusetts's !

http://www.awea.org/projects/massachusetts.html

And the highest power factor of all current & proposed wind farm projects. The best and most practical large scale wind resource in that state.

The central cause is uber rich sailors that do not want to sail around them. better to strip mine and warm the earth. They are barely visible from shore.

Best Hopes for Cape Wind,

Alan

MA would be a perfect place to build new nukes. They have the experience, suitable sites and the best nuclear engineering school in the MIT.

Only one of the new 1600MWt reactors would produce as much energy as 8 Cape Cods. BTW with the local opposition mounting I would expect this to be both the fastest and cheapest option from all.

Evacuation plans for a nuke would be unworkable in Massachusetts (REALLY difficult in the NW corner but MAYBE if one could find a source of cooling water).

I told you, no new nuke sites within 100 miles of a city of 1 million or more.

Northern Maine might work.

*BUT* even there, nothing before 2020 (if then). Cape Wind could have been operating NOW if not for unreasonable NIMBYs.

You opposition to wind seems based on the fact that they do not have nuclear reactors in their base more than anything else.

Nuclear reactors are the slow to come, gap fillers AFTER we build as much wind, HV DC lines and pumped storage as we can (and geothermal, hydro, etc.)

The truth is, the nuke industry killed itself decades ago. The baggage and after effects of that linger on. No trained personnel. few suppliers, hard to get financing (w.o gov't subsidies), etc.

Best Hopes for Wind with Nukes a distant Second,

Alan

Well there is the Pilgrim Nuclear Station which has somehow been working for 35 years now. Hope you are not suggesting stopping it, because we'll need 3 Cape Cods to compensate.

I was aware of it, and I am *NOT* opposed to nuclear power (other than counting on too much of it too soon).

But Pilgrim would be unlikely to get a license today. The evacuation issue.

Alan

OK let it be the evacuation issue, the waste issue, the planes-falling-from-the-sky or the Marsians-detecting-our-radiation-and-taking-us-over issue.

This country has effectively decided to let its energy infrastructure deteoriate and only the easiest and out-of-sight options to be picked. Working or not, enviromentaly destructive or not - doesn't matter. Out of sight out of mind.

Meanwhile the Chinese are planning for 50GW nukes until 2030, and the Russians for 30GW. I'm off to learn Cantonese, luckily I already know Russian, so I'm half prepared.

Under my proposed "go slow" on new nukes, we should have about 50 GW of new nukes by 2030 as well.

A few new nukes on old sites close to major cities; but no new sites within 100 miles of a major city.

Alan

Its easier to use nuclear power for combined heat and power if you build them closer to a major city. Its a shame to waste all that heat energy.

When are you going to start building the first large scale CHP nuclear plant in downtown Stockholm ?

Alan

Its not for me to build but in about 20 years Forsmark 1 to 3 ought to be due for the second turbine renewal and then it could be time to condense at district heating temperature.

I suggest building new reactors deep in bedrock. This probably favors pebble-bed units (the pieces are smaller, so smaller tunnels are required).

There were plans in the 1960:s to build a CHP nuclear powerplant in Värtan about 5 km from Stockholm city hall. A request for permit to build where done 1968 for an underground Asea Atom BWR designed on the Oskarshamn 1 with 360 MW electric and 1100 MW district heating output to be completed in 1974. The project got delayed, partly since there were no references to compare with and it was abandoned in 1971.

Instead were an oil fired CHP plant built that were completed in 1977 with 210 MW electricity and 330 MW heat. As curiosity it were build with black start capacity to be useful as an emergency powerplant for central Stocholm, a capability that has been retained over the years. I guess they in 1971 assumed that oil would continue to be cheap.

I have also read rumours of it being hard to plan the building within the restricted underground space. An odd idea were to backfill a building access tunnel with gravel and then have that gravel to act as a particle filter in case of preassure release during a major accident. That idea were later reused with building of a giant filter silo at the now closed Barsebäck plant. The other Swedish NPP:s got much smaller passive water scrub based preassure relief filters.

Asea Atom continued to develop undergrond district heating NPP ideas and the SECURE design were a passive safety district heating only design. It were almost sold to Helsinki in Finland when Chernoble gave a PR problem.

Earlier in the 1960:s there were a large bomb attack hardened underground 850 MW condensing oil powerplant built on the Swedish west coast in Stenungsund. Its even rumoured it where built with empty chambers below the chimneys for them to fall into if there would be a direct bomb hit during WW 3. 500 MW of the plant is still maintained as slow start reserve.

There were also a tiny underground heavy water nuclear powerplant running in Ågesta in Stockolm between 1964 and 1974 delivering 12 MW of electricity and 68 MW of district heating.

We can build a Nuke on Nantucket Island next to Kennedy's house. Windmills are out and we need the juice so...

When we have a continent wide surplus of wind, we can let the water flow @ Niagara :-P A SPECIAL occasion ! Thousands will cram aboard special trains to see it !

Alan (with a nip of sarcanol)

...solar arrays in "brownbelt" abandoned areas of cities, hid in areas that are already so blighted that no one ever goes to look at them, abandoned railyard, warehouse and old industrial belts, and if in the desert, hid out on the corner of old military bases, and abandoned industrial areas of desert towns.

Although they will still require constant monitoring. Note that copper thieves have already been electrocuted attempting to steal wiring from live nodes on the grid.

| The problem will solve itself.

| But not in a nice way.

That's a feature not a bug. The problem with brownouts is that it gives the thieves a chance to steal the copper. They can steal my wiring when the sun don't shine.

So, at night, then?

I didn't think of that.

I think any time will do. Solar panels operate in the 18-25V range and unless you touch the inverter it is unlikely that you will be harmed by the resulting current. In addition you have 2-3 hours before sunset when PV also do not produce much if anything.

My point being, if the scavengers aren't worried about rummaging around a 10kV substation, they won't dwell too much on whether they're stealing thin film or polycrystalline arrays. And 48VDC or less isn't going to put much of a dent in their numbers.

| The problem will solve itself.

| But not in a nice way.

My panels put out 360 volts and 10 amps. If someone wants to climb on my roof for a panel, their main safety issue will be golden retriever teeth.

I read a story not too long ago about how some police or FBI wanted to get into a building at night guarded by a few dogs. What they did is showed up at night for about a week, spent time just outside the fence, feeding the dogs.

After a week, the dogs happily let the police on the property.

Keep an eye on your golden.

Oh boy, my new friends are taking all my stuff. Goldens do not make watch dogs. They bark when someone sneaks on to the property and they beg for petting and attention while the owner gets a bead on the crooks.

Always train your dogs to ONLY eat from their bowl in a designated area. This is routine guard dog training.

How about circulating a petition against windmills across the country... and then using that list later to determine who may hook up to the grid, with anyone who signed it having to do without. The bird-strike problem is orders of magnitude less than the problems of carbon-fuel alternatives, even for birds. I remember being shocked when Walter Cronkite came out against them. "Cosmetic ecology" is quite irritating to me.

As is flat-out stupidity. Here in Hawaii, Geothermal has stalled because the "environmentalists" are opposed to it, and in favor of tanking in oil. Excuse me? I actually AM an environmentalist, but don't ever call myself one anymore because the term has been so degraded and caricaturized.

Cronkite is against them for the same reason that his buddy Ted Kennedy is: They are both sailboat enthuiasts, and don't want to have to sail their precious sailboats around any offshore WTs.

All of the workshops and servant's quarters to support the elites are always hidden well out of view from the mansion, you know.

Altamont really needs to be torn down. It's pretty much the only wind farm to have killed any birds, and it's old structures with small nominal capacity - which means that there is a need for hundreds of them.

Replace them with big modern turbines - a few big turbiens will provide just as much power, will be a lot more pleasant to watch, and will eliminate the main source of bad publicity for the industry.

I would think that this would be a positive financial step as well. The larger turbines are more cost effective in power generation and should be placed at the best resource areas. The old turbines might find niche applications where their drawbacks are not such of a problem. Holding good resources in thrawl to outdated technology is poor management.

Chris

Agreed about Altamont. Isn't it the Enron wind farm?

Bob Ebersole

I'm sorry , but looking at your car barreling down a strip of concrete, spewing hydrocarbons, is ugly. I don't see why you should have the right to drive in front of my house.

If you don't like looking at wind turbines, or oil wells, then shut your eyes as you drive past them. Your problem will soon take care of itself. Forget about a seatbelt too.

As far as migratory birds, modern wind turbines have been redesigned so that they have only three blades, which turn at a much slower speed, pose much less of a hazard to birds. The wind farms do studies which make sure that new wind farms are located out of migratory paths of birds.

And, just one little philosophical question-what causes more bird distruction-the climate change from the tons of CO2 that your car spews out, the habitat distruction caused by freeways, houses and strip malls, coal strip mines, or wind turbines?

Bob Ebersole

Thanks Bob. You said exactly what I have always thought.

A well put point on relative risks!

Also, bird/structure collisions involving non-wind-turbine structures appear to cause a considerable number of bird deaths. I find the excerpts I googled up uncertain: many refer to the current rate of deaths from turbines vs. other structures (in USA, less than 0.1% of fatal collisions are with turbines), but the fraction of structures which are turbines is rising.

Even so, a hundredfold increase in USA turbine count would mean that a large fraction of gereration came from wind, but a considerable majority of bird kills from structure collision would still be from other structures.

Cars directly kill 2 billion birds/year in collisions. We should ban jet planes too. They suck birds into the engines causing loss of avian life.

To the East of Palmerston North city in New Zealand, is one of our largest wind-farms. The local Real Estate agents advertise "view of the windfarm" as a POSITIVE selling point.

Sadly this attitude is not universal in NZ, as we still have locals in some regions protesting against windfarms as they might "spoil the view for US tourists", on whom they hope to base their future prosperity.

These windfarms will never supply all our electricity needs, but as long as they prevent or at least delay the burning of our huge lignite deposits, then I will continue to consider them a thing of beauty and practicality.

Merv

http://www.youtube.com/watch?v=LEaOkhWOZ1A

And doesn't that go for any large concentration of houses, cars, roads, factories, etc? The only really effective solution against sprawling infrastructure is depopulation. If only that could happen voluntarily..

Well, it may soon be all we have. Don't see the blight problem. Society has been able to pave over the USA with roads, telephone poles, cell towers, skyscrapers, etc. Don't see where a few windmills will make any difference. Be better if we could ramp up lots of CSPs, Concentrating Solar Power plants in our deserts. That would work. Store power in huge thermos bottles of hot oil (to drive the turbines at night). Send the power both West and East over huge high-voltage transmission lines. No environmental pollution, no noise, no engineering problems. So when are we going to start?

Not yet. I'm just signing a big syndication (billion plus euros) today and we have a nice oversubscrption - although banks took their decision in late July.

I don't expect all sectors to be cut off from finance - in fact, projects with stable, predictable cash flows like wind power are likely to be even more popular with investors.

Also, stodgy, old-fashuioned banking, based on long term relationships and a detailed understanding of the underlying business is likely to come back in fashion - it usually does in times of turmoil.

On the other hand, banks are likely to be extremely reluctant to lend to anybody, so business will slow down, and conditions will become a lot tougher - no more 'cov lite', PIK (payment in kind) loans or other bubbly features, and higher margins. Frankly, it's not a bad thing.

Here's one I wrote 10 years ago, seems appropriate

Jam today, jam tomorrow,

selling the dreams, begging to borrow,

Future holds no time nor reason,

more, more, more or trial for treason.

Chorus

What virtue in the work we do,

is lost in search for revenue,

stolen from the ones in need,

to satisfy institutions greed,

around, round and round, around, round and round.

Build the roads, blacken the green,

drive the stake into the spleen,

give the freedom for restriction,

less, less, less charge for conviction

Chorus

Pedal power is all we need,

a revolution from the greed,

leave the smog and city grime,

freedom the binds of time.

around, round and round, around, round and round.

Records

The basic contention

we need to refute:

That wind farms are ugly

and babies are cute.

- burma shave

Nice lyrics [above]

It reminds me of a less subtle one from the wonderful Oysterband:

Jam Tomorrow

I was born, bred, burped and fed in a place that was not funny

The sun shone out of Thatcher's arse waving wads of money

My father told me not to fuss, never shirk the factory drudge

His generation steamed away, life bleached out in a 12 hour day

All went well with the witch's spell, fortune's fragrance wafted

Till the boom went bust in a cloud of dust and suckers all got shafted

Bastard this and bastard that, I even ate my bastard hat

Father would've won his bet, I was up to the neck in the same old debt

How they school you, how they fool you

How they take you for a ride

How the same old lardballs screw you

It's murder faking suicide:

HEY, HEY THE DONKEYS SAY

MILK 'N' HONEY'S ON THE WAY

EVERYBODY GET DOWN AND PRAY

IT'S JAM TOMORROW... SHIT TODAY

They could and they would 'cos greed was good

and life was made for shopping

All the prizes mega-sizes, all the lies just Wapping

Bastard this and basterd that, I even ate my bastard hat

Fathers ghost is laughing still to see me stuck on the same treadmill.

Superb stuff, continuing the theme, Thatcher et al, heres one of 7 year vintage

From the car to the couch,

TV dinner fulfills the slouch,

You're fit for nothing, you're fit to drop,

your lifes on credit you live to shop,

Get your arse into gear, your branded gear,

like cattle for the milking parlour,

consumer consumed by programmed ardour,

MY ENGLAND, OH MY ENGLAND, MOTHER OF DEMOCRACY,

DICTATOROSHIP HAS COME TO BE,

MY ENGLAND, OH MY ENGLAND, ONCE GREEN AND PLEASANT FERTILE LAND, TRADITIONS TORN UP BY DICTATORS HAND

Big brother corporation,

thought police for our generation,

Their press stares up our nation's anger,

with half truths, lies and propaganda,

orchestrating fears and fury,

in the name of justice without a jury,

We cannot think, we cannot say,

freedom to question has had its day,

MY ENGLAND, OH MY ENGLAND, MOTHER OF DEMOCRACY,

DICTATOROSHIP HAS COME TO BE,

MY ENGLAND, OH MY ENGLAND, ONCE GREEN AND PLEASANT FERTILE LAND, TRADITIONS TORN UP BY DICTATORS HAND

Like a zombie behind the wheel,

Speeding with retarded zeal,

English nation, forbidden notion,

scarificed for foreign promotion

As money mesasures quality of life,

Hard drugs, street crime guns and knife

Cut away societies very foundation,

realising Thatcher's idea of nation

We need conversion from teenage destruction

creative service for reconstruction

MY ENGLAND, OH MY ENGLAND, MOTHER OF DEMOCRACY,

DICTATOROSHIP HAS COME TO BE,

MY ENGLAND, OH MY ENGLAND, ONCE GREEN AND PLEASANT FERTILE LAND, TRADITIONS TORN UP BY DICTATORS HAND

Records

Looks like the Hedge Funds are still haemorrhaging badly.

Highbridge, Goldman `Quant' Hedge Funds Lose Money

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=arsD8QnMC6zw

Triumvirate of collapse - Economy, Ecosystem, Energy

Wow! Panmure downgrades Barclays and HSBC from hold to sell. Meanwhile the ECB says its ready to inject further liquidity into the system, $130b obviously wasn't enough to stem the bleeding.

Wonder what's happening with the insurance and pension funds which have been left holding non investment grade toxic waste after the downgrades, which of course they're not allowed to hold. Not only that, but the massive insurance claims due to all the wild weather, etc. must be causing liquidation too.

I also think many are missing something rather obvious regarding the Central Banks and that is they're in business too. They are not going to pile good money after bad, and they're not going to load up on worthless assets. If their attempts to halt a stampede is unsuccessful, then they're going to pull in their horns and look to their own survival.

Will the current liquidity crisis and the shear size of the implosion they're trying to ward off, simply overwhelm the Central Banks?

Triumvirate of collapse - Economy, Ecosystem, Energy

Jerome a Paris says,

"Enjoy the ride. And don't panic!"

After remembering that panic as a reaction seldom leads to good reaction, I thought about Jerome's closing line, and decided to take his advice.

When in these type of "disturbed" times, only one thing to do. Take a look backward over a bit of a longer distance. Get a feel for the lay of the ground of the ground so to speak.

Given that the centerpiece chart at the opening, the so called "flow loans" chart only goes back about 5 years, all post 9/11 territory, it is in many ways essentially useless. Who knows the parameters defining "flow loans". Certainly not I, but I live in the country.

The "bubble guide" chart is actually very informative, with bubbles over a wider time swing. Now we survived the Nasdaq bubble, the Japanese still seem to be able to make things pretty hot on GM and Ford, so we will assume they survived their bubble. The Great Depression....well, let's try to avoid that one of course, but the most interesting is the one still showing in full upswing, the Shanghai A share bubble.

China has achieved something that no nation to date easily achieves, in that even though we all can see they are in a massive bubble, the assumption must be that it is a neutron bubble, that is, when it pops, the rest of the world will be dead but China will stand mighty as the "21st century power"

Well, true enough, the U.S. pulled that off after the Great Depression, but it took a world war to do it.

So do we all accept there will be a "setback", a "downturn" or whatever you want to call it? The evidence says yes, we just don't know exactly when. How big will it be? The evidence says that what we have seen to point doesn't even begin to scratch the surface. What am I, some kind of doomer? :-O

No. Suppose I told you that the stock market will indeed drop by some one quarter to a third, give or take a few percent? Why would I say such a thing? Because historically, we have seen many of those. I challenge you to look at a max history of the dow. I am not going to waste my time pulling it up, you can do it on Yahoo finance or google or wherever for yourself. I did. The same is true of the Nasdaq. Even more fun is to look at any number of brand name companies.

I assure you that 2 or 4 percent is not a collapse. We have simply become babies.

Likewise, the "credit crunch". Right now of course, housing loans are said to be the culprit, or should I say the villian. There are stocks being yanked down that are so far removed from the actions going on in the housing markets that they might as well be on Mars, but the press is screaming the siren song, Credit collapse! Dow slides on housing news! Liquidity at risk!

The bubble builders of the media and the business press are doing their job, now as the bubble bursters. The time has come to shake out the little individual investor.

All this with the Dow still some couple of thousand points above one year ago! But this is not yet the apex of the shakeout. The capitulation is nowhere near complete. There are still folks saying, "don't panic".

Only when the last of the little believers are driven out, when NO ONE, I MEAN NO ONE will be caught dead with anything but a government bond or a CD as their absolute riskiest investment, and when businesses are on skeleton crews to try to cut costs, shedding everyone, trying to get one person to do the work of three, that's capitulation.