What Can the Commodity Market Tell Us About Peak Oil?

Posted by Gail the Actuary on October 4, 2007 - 10:30am

This is a guest post by Shunyata. Shunyata is a manager of financial derivatives with training in financial engineering, actuarial science, statistics, and mechanical engineering. While he does not work directly with commodity markets, his background in financial engineering gives him insight into the operation of oil markets that may be helpful.

The observations below represents Shunyata's opinions based on his study of commodity derivatives to protect his personal interests. Commodity derivatives are exceedingly complicated, and his direct expertise is with respect to financial derivatives. This post is not intended to represent investment advice.

What Can the Commodity Market Tell Us about Peak Oil?

Market Consensus

A common view is that market prices reflect the market consensus about future prospects. This is a dangerous misunderstanding from several standpoints.

Consensus is an equilibrium statement, but equilibrium is non-existent in reality. There is the obvious problem of new information constantly disrupting the market. More importantly, the market contains a hidden, complex structure of players:

• There are large, in-the-know entities who act opportunistically, seemingly at random;

• There are hedgers who react to market moves mechanically and in unison (no disparagement intended);

• There are diverse small players who respond slowly in diverse ways, etc.

The existence of discrete blocks of players who act in different trading volumes executed over different time scales guarantees that prices will deviate significantly from fundamentals and suffer unexpected corrections. From a theoretical standpoint, you can find these ideas in Sornette, Why Markets Crash: Critical Events in Complex Financial Systems. From an eminently pragmatic standpoint you can find these ideas in Taleb, Dynamic Hedging: Managing Vanilla and Exotic Options.

Even in equilibrium market consensus does not hold for derivatives.

Futures Contracts - Introduction

A common derivative is the futures contract where, loosely speaking, we agree that at a specified future date you will give me one unit of something (a unit of the S&P500, a barrel of oil, etc.) at the ‘future’ price we set today. Because this agreement deals with a specific date, we talk of a ‘futures curve’ that shows the exchange price people are agreeing to for exchanges occurring today (this is also called the spot price), one or three months from now (this is also called the front contract), six months from now, etc.

And, being standardized contracts, futures are typically defined only out to five or ten years. (Savvy readers will note there is a bit of hand-waving here but the intuition reasonable. For a more complete discussion of commodity futures contracts and quoting conventions see Geman, Commodities and Commodity Derivatives).

Replication Cost as a Driver of Futures Costs

Stepping away from the complexity of commodities for a minute, consider the agreement to exchange one unit of the S&P500 on a specific day three months from now at a specified ‘futures’ price. Interestingly, the price of this transaction has virtually nothing to do with the consensus expectation of S&P500 levels three-months from now! Why? I can borrow money, buy the item today, hand it over tomorrow, and use the money you give me to pay off my loan. I just need to make sure the future price we agree to pays off my loan. Then the whole thing is a zero-sum game. (Clearly this is theory. In reality the smaller fish lose a little bit every time.)

This mechanic is called market replication and replication cost is a pivotal driver in any future or derivative price. (See Baxter and Rennie, Financial Calculus: An Introduction to Derivative Pricing for an approachable introduction to the theory of replication. But be forewarned that there is a lot of artistic praxis involved as well.)

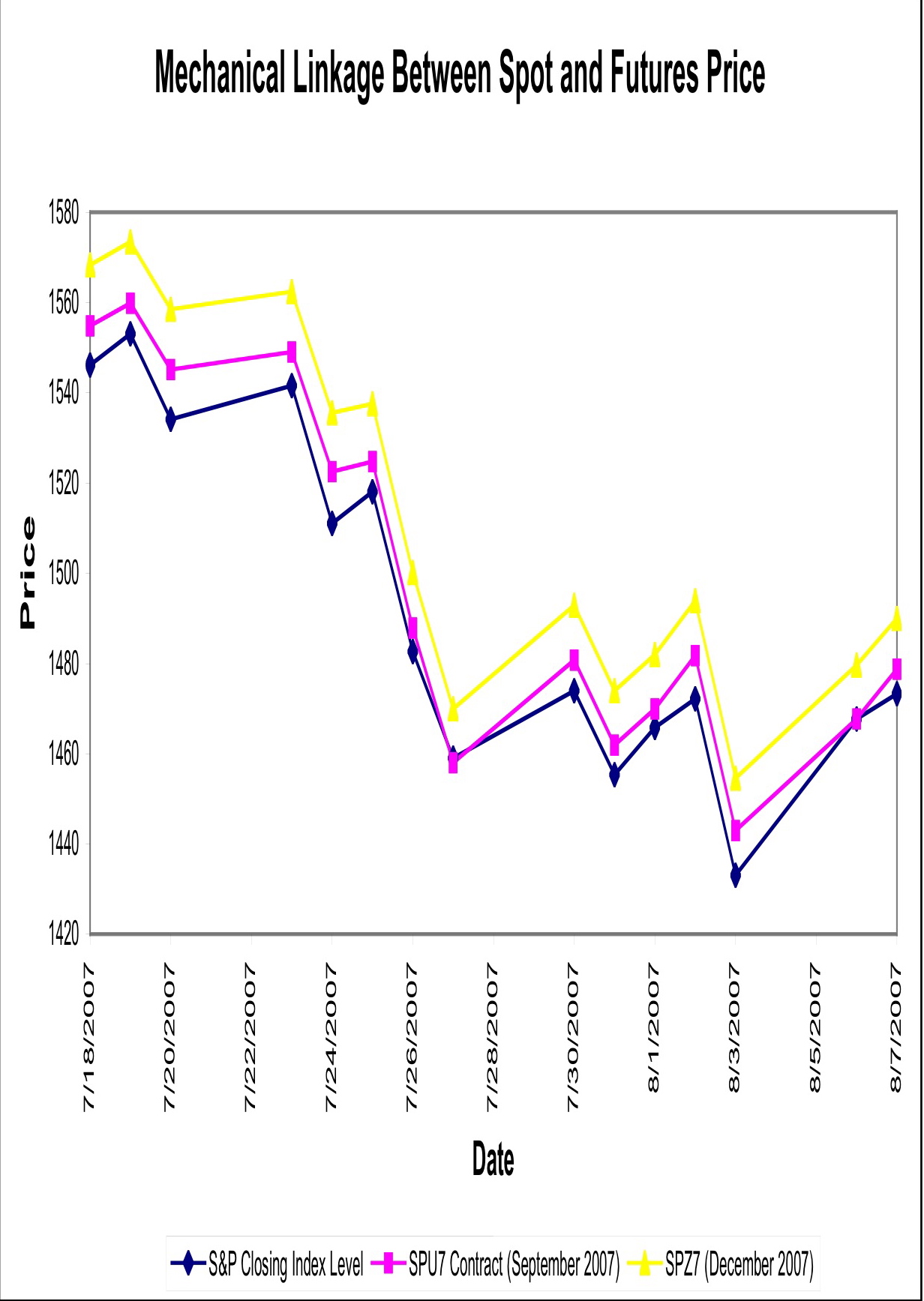

If we think through this mechanic, we can see that futures should be more expensive than the current spot price because that loan has to be paid back with interest. In fact, you can see this lock-step replication cost linkage between today’s S&P500 level and the price of S&P500 futures.

Figure 1: Mechanical Link Between Spot and Futures Price for S&P 500

In short, the ability to replicate derivatives (the work of so-called Wall Street Rocket Scientists) guarantees that all prices are self-consistent, and perhaps all equally delusional. Put another way, replication works to keep RELATIVE prices all self-consistent, but the ABSOLUTE LEVEL of prices is completely driven by fear/greed, supply/demand, etc. It isn’t anchored by anything except willingness or unwillingness to speculate. Couple that with the market structure issues noted above and any notion of consensus is out the window.

Difference Between Commodity Futures and Financial Futures

As if all of this weren’t complicated enough, commodities such as oil are significantly different from securities like stock shares, and it is very important to remember this.

Commodities are consumables; new units of commodities are produced, delivered to the marketplace for exchange, and then destroyed (hopefully to produce something of value). This creates an entirely different dynamic than a stock market where the same pot of IBM shares is effectively around today and five years from now. A commodity futures contract is an agreement involving a unit that may not even exist today!

Consensus Oil Price

It is important to understand that nationalized corporations and government entities control much of the world’s oil production (think Aramco, Pemex, etc.) and consumption (think the Air Force, strategic petroleum reserve, etc.). This means that there can be sudden and profound upsets to the production/consumption flow of the dynamic pot of commodity units.

As such it seems that oil futures might be more linked to consensus - but consensus about what? There are three elements here:

• Cost to produce,

• Ability to deliver, and

• Demand for the product.

Who exactly is controlling the production/consumption flow? And who, therefore, is controlling the price?

1. Historically, the cost to ‘stick a straw in the ground’ has been quite low so oil prices have been quite low. However, as more straws are required, are harder to stick in, or harder to locate, we should expect futures prices to rise.

2. Commodities are exchanged at specific physical locations. Bottlenecks getting material into and/or out of these specific locations can cause counter-intuitive price dislocations for contracts specifying exchange at these locations. (This is why we talk about Brent Crude, WTI Crude, etc. And obviously physical bottlenecks aren’t a problem for an electronically designated share of IBM stock.)

These distribution bottlenecks are part of the reason why Cushing (Oklahoma) oil has historically traded at a premium to Brent (UK). Infrastructure restrictions made it difficult to move desired quantities through the system so that local buyers were forced to pay a premium to obtain the availably supply. For a discussion of this see this article.

3. Finally, if substitutes are available, significant price increases can create permanent alterations in demand. This will tend to hold futures prices lower.

Replication cost is also a consideration, but historically it has been much more expensive to purchase oil today, store it securely, and deliver it at the settlement date compared to producing it and directly delivering. When replication isn’t practically feasible, then consensus has the ability to drive price. We just need to figure out whether production, distribution, or consumption is in control. (In the future, however, if lower levels of production are more proportionate to storage capacity and cost, replication cost may become more important and moderate the impact of consensus.)

How Do Oil Futures Actually Behave?

So how do futures prices actually behave in the market? Can we tell who is driving the price and what does this tell us about our spot on the Peak Oil timeline? Of course no one really knows and the trinity of supply, delivery, and demand makes it difficult to decipher what is driving futures prices. Furthermore, our ability to construct a posteriori explanations is limitless, rather like seeing animals, faces, etc. in cloud patterns. Nonetheless, let’s see what we can divine.

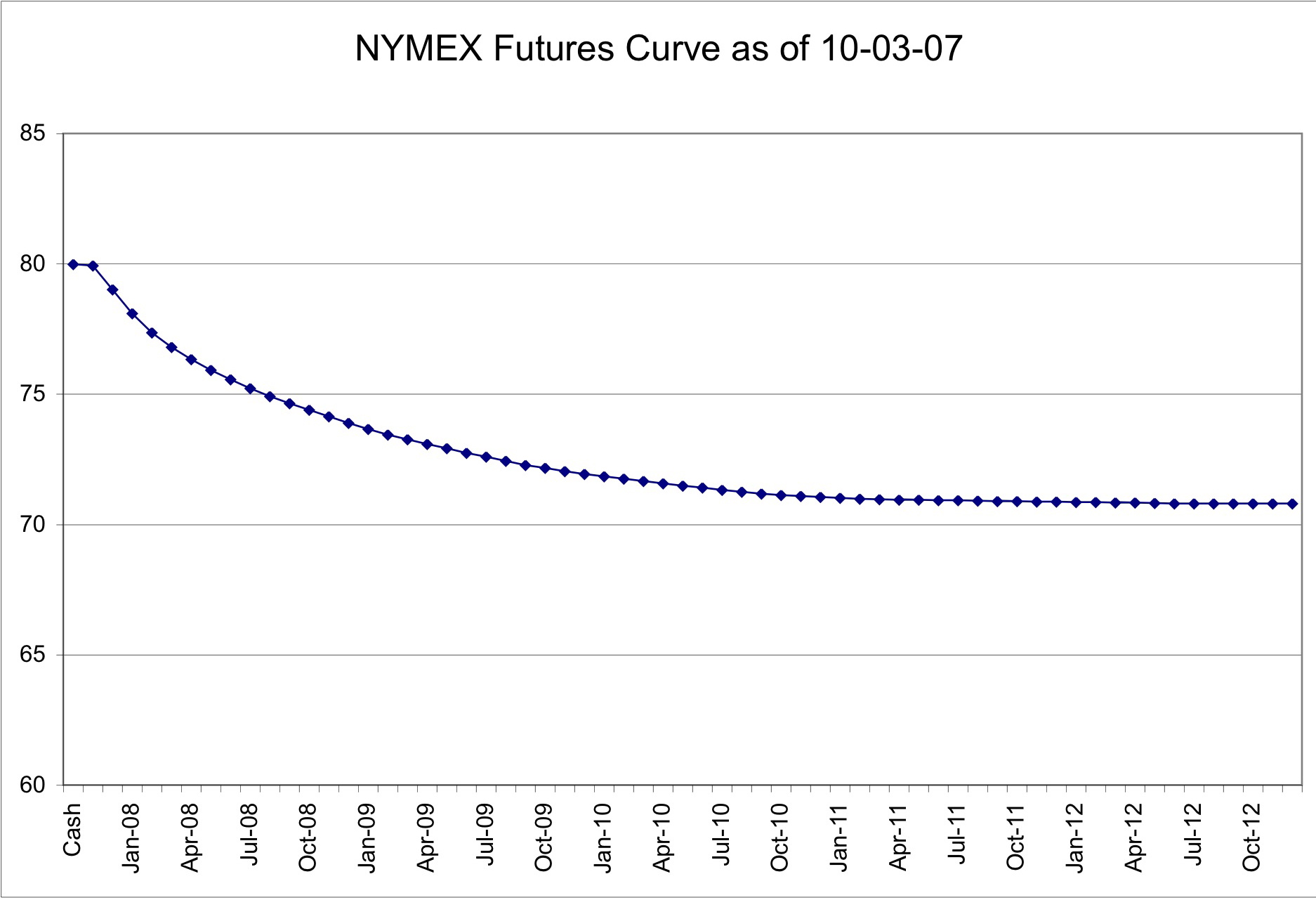

Oil futures prices are usually LOWER than today’s purchase price. Sellers usually agree to sell their oil tomorrow for less than it is selling today. This situation is called ‘backwardation’ of futures prices. This pattern is shown in Figure 2 below. Prices tend to decline between early contract dates and later contract dates.

Figure 2: West Texas Intermediate Oil Futures Curve as of August 31, 2007

So why should future production generally trade at a discount to today’s oil? Doesn’t this imply that oil will be MORE plentiful in the future? The most common speculation is that the futures market is driven by producers who are willing to pay an ‘insurance premium’ to guarantee future revenue. Presumably producers have been worried about prices dropping below current levels, or even below their production costs, and have been eager to “pre-sell” at acceptable prices negotiated today.

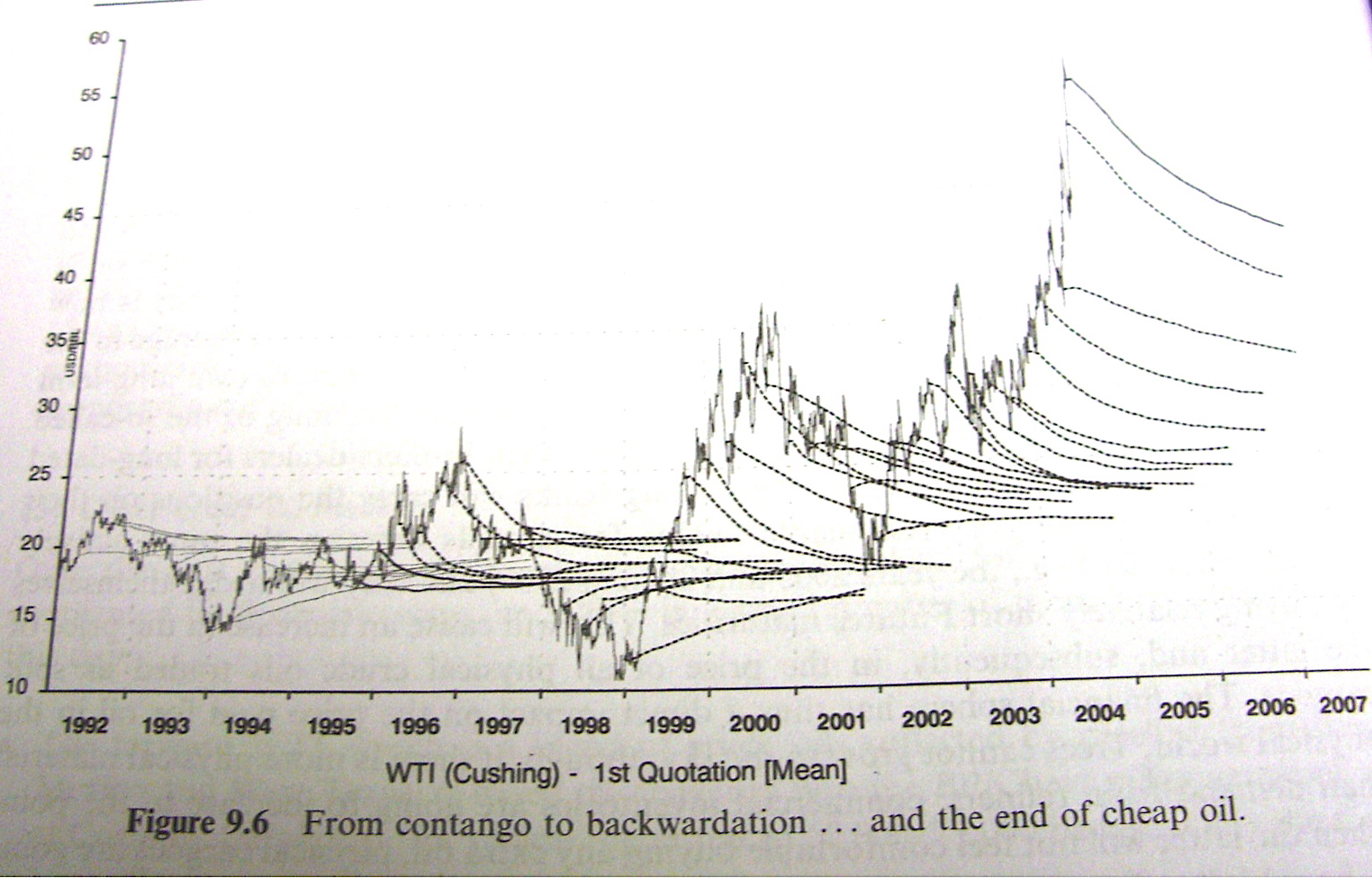

And there is some historical evidence that this view has historically controlled prices. If prices drop sufficiently below production costs, then buying oil and delivering later is feasible, replication should dominate prices, and futures should trade at a premium to current price. This is exactly what we see historically. Upward sloping futures curves only occur at the deepest dips in oil prices. This is illustrated from in Figure 9.6 from Geman, Commodities and Commodity Derivatives.

Interestingly, the market level at which dips trigger upward sloping yields curves has risen over time. It would be interesting to know what linkage there is between these increasing levels and increasing production cost. Perhaps some readers have this information at their disposal?

Oil Futures Prices Under Peak Oil

Under peak oil, we would expect to see more upward sloping futures prices (sometimes called contango), even when there are not price dips.

Under peak oil, the market will probably be driven by the demand side so that prices will tend to stay far above production costs (unless governments begin interfering too heavily, insisting upon affordability and protecting economic growth). And consequently discounted futures prices (backwardation) suggest that the producers are in control and all is well with the world… unless production costs are rising faster than the overall price of oil. Then producers would still seek “insurance” even as oil costs went through the roof and we should be worried indeed.

On the other hand, upward sloping futures curves (contango) clearly indicate that the producers are out of control -- the condition we would expect to see with Peak Oil. In 2004/2005 the futures curve became very steeply backwardated implying that market that producers were willing to pay a large premium to lock in pricing. Subsequently, however, the curve has flattened out dramatically even as we reach new spot price highs. Since production costs haven’t been coming down and market volatility hasn’t been coming down (so that producers are no longer concerned about buying insurance), we have a strong indication that demand is beginning to rule the roost.

Of course we don’t know whether demand is getting the upper hand due to demand growth or supply contraction. But I’m not sure I care. Being the hedonistic type, Peak Availability to Me Personally is all that matters – and it looks as if it is here. It will be interesting to see whether the price of long dated futures continues its trend toward contango and confirms my fears.

Hedging

So what can I do to protect myself over the long term? For non-commodity derivatives we showed that the replication concept is like a traffic cop keeping spot prices and futures prices in a fairly consistent pattern of relationships (…except when they occasionally depart dramatically and we seem surprised). And in this setup, hedging is quite feasible because I know the value of my futures portfolio will move in lock-step with current prices. (The discerning reader will note a slight gloss-over here but the intuition is accurate.)

For commodities, however, this self-enforced consistency is much weaker, and hedging is a more tenuous prospect unless one is content only hedging the next three months of consumption. The linkage between long-dated futures and spot prices is erratic indeed. As an individual, I may be willing to commit my capital to erratic, long-dated futures just so I have the insurance. For corporations, however, this noise makes quarterly earnings reports messy and no one is interested in that. Instead they buy their insurance one quarter at a time. And like the homeowner who waits until he smells smoke to purchase insurance (he pays a hefty premium), corporations will find themselves completely exposed when the conflagration gets really underway. A useful introduction to energy hedging may be found in Eydeland and Wolyniec, Energy and Power Risk Management: New Developments in Modeling, Pricing, and Hedging, although the presentation tends toward the academic side.

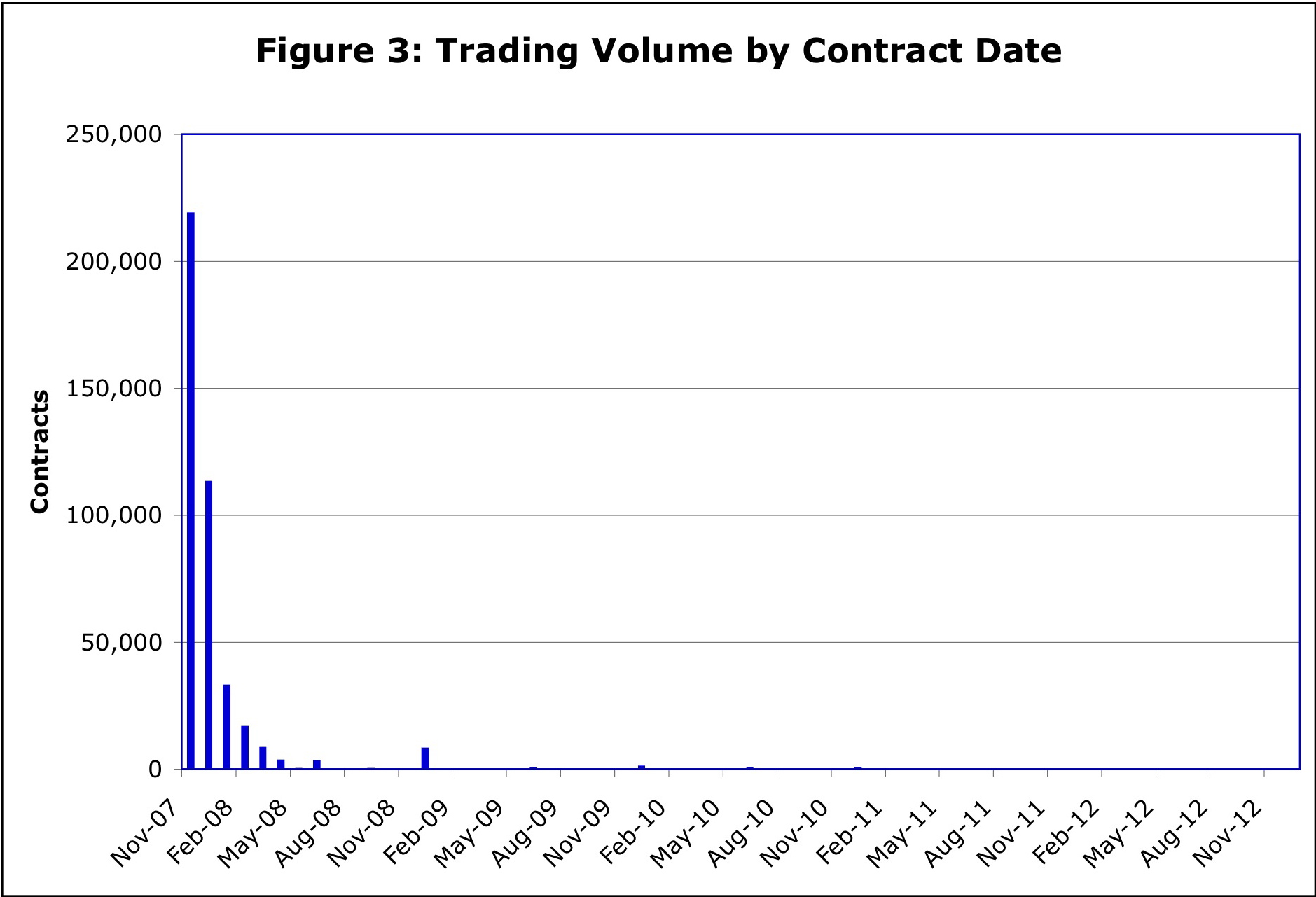

Figure 3 shows volume for Oct. 3, 2007 by contract date to December 2012 using data from barchart.com. (There is also a small volume of contracts to 2015, not shown on this graph.) There is virtually no trading volume for settlement dates beyond 2008!

The Role of Hedge Funds in Oil Futures

There has been a lot of speculation about the role of hedge funds on futures prices. The presence of hedge funds and other speculative buyers will tend to drive large scale cycles of buying and selling, and create increased market volatility, irrespective of the commodity itself. It seems to me, though, that the level of today’s oil is largely governed by production and use rather than speculation - volatility levels just haven’t increased all that much. If so, then either production costs are near $70 or demand for oil significantly outstrips available supply (or some combination thereof). In either case peak oil, global modernization, and population growth should force oil to continue its current upward trend until there is significant demand destruction (recession, the poor stop buying, pandemic, etc.) or an alternative is found (the Physics is rather stacked against this).

It would be nice to back up the hedge fund picture with hard data. To the best of my knowledge, however, this data is unavailable and any analysis is largely anecdotal. Hedge funds are extremely secretive and go to great lengths to hide their trading activity. An entertaining view into this world may be found in Lowenstein, When Genius Failed: The Rise and Fall of Long-Term Capital Management.

Impact of Peak Oil Availability on Other Markets

We should say something about the cross-linkage between oil and all other economic activity. Cell phones and iPods and didn’t arise solely from someone’s good idea; they arise from plastics, metals, and highly sophisticated manufacturing processes – all of which require vast amounts of energy to produce and function. And we aren’t just talking about luxury items. The energy density of ammonia fertilizer is roughly 50% greater than gasoline! (Do you remember the Oklahoma City bombing?) If energy supply is curtailed, agriculture is horribly exposed and Malthus will have the last laugh.

Finally, as we seek substitutes for fossil energy, we have linked the price of corn and sugar (and by displacement beef, milk, and all non-corn crops) directly to oil. I am reminded of the trader’s rule of thumb - in a blowup all correlations go to unity. This means that once Peak Availability hits, there can be no safe haven.

No wonder I sleep so poorly…

http://business.reddit.com/info/2wipc/comments

http://digg.com/business_finance/What_Can_the_Commodity_Market_Tell_Us_A...

if you are so inclined...

"I am reminded of the trader’s rule of thumb - in a blowup all correlations go to unity."

We need to talk more about Black Swans and Fat Tails.

I love talking about commodity markets.

BTW-There is a history of producers/speculators

being forced to sell.

And backwardation can signal an immediate demand which is

not being met. At the expense of later delivery months.

Arkansaw of Samuel L Clemens

Australia Beef Crisis Hits as Drought Decimates Wheat

Anecdotal evidence showed that many feedlots had completely closed down, including medium-sized feedlots, not just small opportunity lots, Weeks said.

Looming imports of grain -- only the second time Australia has been forced to import wheat since colonial times -- will not assist the cattle industry.

http://www.planetark.com/dailynewsstory.cfm/newsid/44567/story.htm

And it looks like less than 9.8 million tons will

be cut.

Maybe only 6.

Arkansaw of Samuel L Clemens

New News:

Australia Likely to Import Wheat

The consulting group Australian Crop Forecasters have indicated that they expect Australia to import wheat for only the second time in its history this season, following the extended period of drought that has reduced the wheat crop by around two-thirds, to 9.5Mt. It is reported that Australian farmers have been slaughtering livestock as they do not have enough feed for them, given the small crop.

And that makes approx. 4 million tons not factored into

this report:

Bloomberg.com: Commodities

The IGC (International Grain Council) expects Australia to produce 13.5 million tons of wheat, less than the Australian Bureau of Agricultural and Resource Economics' forecast of 15.5 ...

www.bloomberg.com/apps/news?pid=20601012&sid=aJMnE4fD.iBw&refer=commodities - Similar pages

Arkansaw of Samuel L Clemens

Well, at least the meat market should be well supplied then, at least for a while...

Great post!

Reinforces my resolve to track these things (as I have for awhile) to "tease out" patterns.

While absolute $/barrel volatility has increased, relative volatility (tied to the current or futures trading prices) have seemed to decline. And smooting over weeks (block or rolling average) also seems to keep one day from dominating and allow trends to emerge.

Unless we are actually in the market and purchasing oil (thus getting some sense of it's availability), the prices over the past couple of years do seem to give us some sense of what's actually available. Just look at 2006 as prices were taking off in the spring. The prices gave every signal that the markets were dramatically tightening while demand continued unabated and production was in a short decline cycle.

Certainly some of the current price is due to the weakening dollar (tracking the cost of WTI or Brent in € gives a somewhat different view of the oil cost structure) and we are also likely to see if the future prices go back into contango after whatever increase in oil output actually emerges from OPEC after November 1, 2007.

All the charts posted are unreadable. Hopefully, that can be fixed, because I would very much like to see them. Thanks.

Gregor

if you click them, they open a new window at original size...which is really small.

for the one chart, go over to barchart.com. For the others, we'll try to find a solution.

Figure 3 is now readable. It will be evening before Figures 1 and 2 can be fixed.

Awesome post. So what does your book look like? Are you hedging like a corporation, or are you comfortable with a fistful of Dec 15 Nymex crude? I can't imagine that you have no position, with all that you know.

The chart that provided the spot price along with the futures curves at selected points provides me some real insights. I'm not quite sure where to get the data, but I'd love to create a price chart that had both the spot price and the longest-dated contract price at the same point in time, and see how they moved relative to each other. I'd expect the spot price to move more dramatically due to transient conditions (hurricanes, etc).

I wonder if the path over time of the long-dated contract price might end up providing an interesting proxy for "real" oil prices with the transient problems factored out. For instance, over the past few months I've noticed spot prices fluctuate by as much as $15, while the long term contract moved by perhaps $4.

As disclosed in my post, I have no credentials with commodities and I am NOT making any investment recommendations.

Yes, I do hold private positions and have for a couple of years now. Unless one is very aware of the factors affecting the production-delivery path and the consequences of rolling contract maturities, however, I wouldn't recommend investing in commodities directly. Small things can quickly blow up in your face when it comes to derivatives!

I would love to get the data you mention, too. But unless you are in the industry you probably can't.

- Shunyata

Interesting discussion. One point: when you say "no safe haven", do you believe precious metals are not a safe haven for individuals, or are you referring to the economy overall?

At the risk of a trivial response, precious metals are only valuable when there is demand for them. In a peak oil world, do you expect the demand to remain strong and preserve value?

I would think that undeveloped land would be a far better value proposition, but that is only my naive opinion.

- Shunyata

Mining is very energy intensive, so peak oil would generate supply shocks and demand shocks. If the supply shocks overwhelm the demand shocks, prices would go up and vice versa. Who knows how it would shake out?

I love your response; it dovetails with what I've been saying. If one has gold coins or bullion, one must sell them to pay one's mortgage or buy food. If more people are selling them to make ends meet than buying them for investment, then the price would go down.

I have gone for the undeveloped land, which we are doing permaculture orchard gardening on.

The land seems like a betteer idea to me, too although my money is going in assembling shallow US oil prospects for tertiary development. Cheap wells with a very high probability of economic success.

Gold and silver have no intrinsic worth, and a huge amount of speculaion in owning the. In the early 1990 gold got down to $280 US an oz. Its what-about $70 now, which sounds pretty good, except wasn't it about $1,000 an oz 10 years before that? So gold isn't a good store of value. Then ther's the problem of storage, If kept at home, there's a good chance of robbery, ect. If in the bank safety deposit box, what happens when the bank goes belly-up? How do you get your precious metals out? And on deposit with a government overseas? Your faith in human nature is profound if you trust the Government of South Africa over the US government.

I ran across a new oil and as lease provision on new oil lease, less than 6 months old, and was in the royalties clause. It stated that the Lessee (producer) owed royalties on the actaul market value of the oil and gas at the time of production rather than the price received. I did a double take, then sat down and thought about what it really meant. The way I interpreted it was the Lessor, the mineral owner had been paid royalties based on the sales price received for the oil which had been sold in advance to lock in a high price- a futures contract like described in the intro above- but had gotten stung as market the price rose above the contract value and the Lessor was mad and planning to stop that in the future.

I just reread that and it sounds confusing, even to me and I wrote it. So I'll give a hypothetical example but with names changed to hide the unindicted co-conspirators.

The Lessor, the mineral owner owns minerals in several different oil leases. On one a company has been paying royalty based on a 30 year old lease contract, and then decides to sell the producing lease to the Highbinder Oil Company. Highbinder, in order to get cash to finance their trade, presells the oil as a future for $40.00 a barrel. But in the next couple of years the oil price goes up to $80/bbl, but the lessor is only receiving royalties for the oil at $40/bbl because the Lessee presold his oil, even though his neighbor across the fence is receiving royalties based on the new market value of $80/bbl. Needless to say, he's hot and may even get a lawyer and sue the Highbinder oil company for the rest of his royalty. Its similar to the take or pay royalties that sank the gas pipeline companies about 25 years ago in Texas.

Now I haven't seen any lawsuits like that-yet, but I expect we will. So you guys buying stock in companies that presell their oil and gas as futures need to take that potential liability into account. And, if you own a minority interest in the Working Interest and the Highbinder Oil Company has presold your oil too and left you with owing royalties on the landowners oil while not receiving any benefit from the futures contract too, need a lawyer. Just seeing that lease clause proves som attorney is already thinking about that kind of lawsuit. Bob Ebersole

Shunyata, I'll suggest that as long as there is ANY commerce being conducted well into the downslope, US silver coins (junk silver) will be happily accepted almost anywhere anytime in the US. They are of a standardized size and weight and are instantly recognizeable.

Barter is not always practical or efficient; if in a given year my main agricultural surplus is, say, apples, I'm screwed if someone has something I need but doesn't want apples in trade. Silver coins were quite popular in agrarian communities long before oil wells were invented and will be long after the last one dribbles to a stop.

PlAN, PLANt, PLANet

Errol in Miami

Shunyata, thanks for an interesting post. You say you have no dircet experienece in trading commodities derivatives - and nor do I, so we're in good company.

I'd like to make a point about the cost of production. In the past it was true that when the oil price went up, high cost US production would come on line, increase supply and the price would drop and so on. That was in the days of 10 to 30 $ oil. The major oil cos are still budgeting projects around $35 and herein lies a major disconnect between supply and the market.

I'd guess that on average Saudi production costs are less than $5/bbl. But Saudi Arabia has more to run on its oil revenues than just oil fields - the whole country runs on this revenue. And this brings me to my main point, and that is the roll of OPEC and KSA in particular as swing producers. Global spare capacity is now so tight that OPEC is basically in control of the market. If KSA decides for whatever reason to drop production, price will go up and vice versa. One problem the market is facing right now is also tracking the $. The oil price has not risen as much in Europe as in the USA owing to $ depreciation.

Where am I heading with this? I think KSA now wields enormous power in oil markets. There are those who believe they wield no power as events are now out of their hands - but I don't concur. What I see in the production chart is a possible trend of rising bottoms in Saudi production. Each time they cut to support price they are having to cut less deeply. There have been four cyclic cuts this decade. Big problems arise when Saudi no longer has to cut production to support price - and it looks like that day is fast apparoaching (15 nov 2011 - private joke with SAT).

I'd also just repost this chart from Luis which shows the oil price falling in Au currency since mid 2005 - but that it is rising again.

http://europe.theoildrum.com/node/3021

I agree with your comments about "safe havens" - land is probably best, gold is good for trinkets - but uranium at $75 a pound looks like it is worth a punt these days.

In terms of investments, isn't the best safe haven from Peak Oil, uh, oil? There are many Oil and Gas trusts both here and in Canada that will let you buy reserves. An example is Penn West Energy trust (PWE) that has 1P + 2P reserves of 2 bbl/share, with a share going for $31. Yes, they're depleting, but unit holders get the revenues, and Peak Oil awareness is coming faster than the depletion.

Perhaps an even better safe have are trusts heavy in natural gas reserves - natural gas is not up to where its historical ratio vs oil should be, and sooner or later it will revert as peak oil awareness comes.

In a Peak Oil future, the only commodity or asset that counts for anything is oil and its proxies.

Yes I agree. In the UK you can buy rolling futures of Brent and WTI contracts - and of course a stellar array of oil cos. I guess my main point is right now historic precedents may get blown out of the window and I'd prefer invaluable uranium (nu.l) to essentially worthless gold. Gold is a manifestation of greed that consumes vast amounts of energy to produce - and that's it.

Gold is a manifestation of greed that consumes vast amounts of energy to produce - and that's it.

Gold is a manifestation of lack on confidence in paper currency. If peak oil makes it very expensive or difficult to mine gold, then the above ground stock of gold is going to be even more valuable.

I find it amusing that you consider gold intrinsically worthless, while advocating oil company stocks and rolling futures :-)

Gold has been considered valuable for 5000 years, does not rust or corrode, is easy to store, is not affected by fraud, its supply cannot be inflated by central banks and does not fear counter party defaults. The only problem with gold is that it does not pay interest. That is why you can't keep all your money in gold.

What is the intrinsic worth of any stock or future?

Suyog - I was being provocative and serious at the same time.

By a handfull of people from a global population measured in millions for much of the time?

Thinking way into the future - say 2025 - what would you rather own? Land on which you can grow food? Uranium which you can sell to a power company to make electricity from which you can make fertilizer and all sorts of other fuel and power. Or gold, which you can just look at, and hope no one steals? I dare say by then folks may be more inclined to steal your carrots than your gold?

But the point you make about paper rolling futures is well made - who knows what lies behind these SECURITIES - LOL - from the land of Northern Rock - turned to sand in the space of days - which brings us back to gold?

We don't know what the world will look like in 2025.

At least for the next 5 years, gold, gold mining stocks, Canadian oil & natural gas royalty trusts, oil & natural gas company stocks (e.g. Encana), railroad stocks (e.g., BNI) and cash (some combination of US $, Canadian $ & Euros) seems appropriate.

Don't you agree?

Suyog - whilst frequently fishing for tips, I usually try to avoid discussion about investment strategies on TOD. But I don't disagree with what you say here.

Over a year ago I converted many investments to cash and have since distrubuted that cash among several, large banks that are underexposed to mortgagaes and "private equity" deals.

I used to punt on small stocks, but am aware in a downturn they are often hit hardest and so am now focussed on larger companies. I'm also shy of companies that are over exposed to political risks. In the O&G sector I like STL.Ol, ECA.TO and BG.L group. TLW.L is my O&G punting stock - sittting on new discoveries in Ghana and Uganda.

I think JK's rational on gold detailed below is certainly worth considering.

gold aprox $800/ oz.

Oil Aprox $80/barrel

Triuranium octoxide at aprox $80/lb.

Good land 10 acres aprox = $800,000 (where I live)

or 10,000 barrels of oil,

or 1000 lbs of Triuranium octoxide

or 62 lbs gold

"Here jack, I would like to buy your land" .... go figure!

or should we be thinking in terms of cows? Maybe one should start storing cows in their apartment till they have enough cows to buy that land, "Holy sH!t Batman! Look at the pile of manure in this cave". Apres le deluge, gold I think could be Royal. depending on the circumstances.

Not in a major depression. I could see the price of oil (in current dollars) easily dropping by more than 50%. Gold could also do that, but first it needs to achieve its true value, which is at least 4 times the current value.

I own ERF, PWI and PWE. PWI jumped 32% last week when it was bought by a company in Abu Dhabi :-) I can see this happening more and more in the future. As new oil and natural gas finds dwindle, there will be more acquisitions of existing properties by cash rich enterprises. Even if they don't get acquired, I don't see how one can lose by buying oil & natural gas royalty trusts that pay between 10%-14% dividends in Canadian dollars.

Canadian trusts were hurt last year with a change in tax law that will make it much harder to replace their falling reserves with new fields. Personally I like a few US E&P's... IMO producers will not see serious changes in tax laws, and a few of these are expanding reserves. I like gpor (oil) and gmxr (ng). I used to like ard, but the price has risen so much that it is no longer a bargain. Good luck.

Regarding the SA production chart: somebody (can't remember if it was you) said he thought the fall in SA output y/y was too fast to be natural. IMO the chart you post shows that the decline in 01/02 was much more rapid. It would be interesting to see past declines, those which we now agree were voluntary, and compare the decline rate in those periods with the current one. IMO when SA decides to cut output the decline is almost immediate... how long, after all, does it take to turn off the tap?

Regarding gold: it is easy to place a value on something, eg gold, in line with one's own thoughts of intrisic value. What is the value of lipstick? Quite a few billions are spent on them each year. What about post peak? Well, gold and cosmetics were big items before oil was discovered in PA, both in the distant past (plenty of both were found in Tut's tomb) as well as throughout modern history. On what basis would the future be different from the past? Imagine for a moment a future with very expensive oil and little faith in fiat currencies. What might an oil seller demand for his dwindling supply? Food and protection, of course, but what after that?

Investors have shunned gold since the peak in Jan 1980, and with good reason - gold has performed poorly against nearly anything you can compare it with, from oil to silver, from wheat to land. HIstorically, investors buy gold when they fear inflation, ie the rate of increase in the cpi is greater than short term interest rates (which may be true now, gov statistics are suspect) and/or when investors lose faith in a major currency (which is certainly true now.) Gold took off exactly one year ago, when the dollar decline accelerated. GOld is up 25% as the dollar is down 12.5% vs the Euro (a more modest 7% trade weighted, likely meaning we will buy less from Europe, and sell them more, while trade with asia, mostly pegged to the dollar, will remain relatively stagnant.)

Last year investors were said to have bought 10 tons of the 1600 mined, this year it is 300 tons, with the result that price is up 25%. How high might it go? Oil is close to the inflation adjusted peak, which would supposedly be around $106/b; if SA does not produce much more oil end year we are likely to reach this level soon. For gold to reach its inflation adjusted peak it would have to go to ~$2500/oz. IMO the only question is, will the dollar slide stop soon and, if so, why?

Resource companies leverage the resource price... small changes in price have a much larger change in net and, usually, share price. I like the US firm AUY best.

JK - yes it probably was me who said the recent fall in KSA production was too rapid to be natural decline. I'd agree the falls in 00-01 and 02-03 were more steep. But curiously, the current fall is more similar to the slide of 97-98 that took us into $10 oil. The current slide has halted and the next 6 months will be crucial to understanding where Saudi production capacity lies - I still fully expect to see thier production rising - so long as the wheels stay on the global economy - which I also doubt will happen.

I'd guess the Saudi's have the most sophisticated oil demand - supply model on the planet. Exactly how they behave will depend on a myriad of variables - including politics with the OECD and other consumers and OPEC members.

Ancient Egyptians dressing themselves in gold and lipstick - good taste I'd say.

As for gold as a store of value in a post peak world? I really really don't know. My gut feel is that past metrics may become redundant as food, heat and security take over. But in a world of barter, maybe gold will have a roll to play. On the other hand, in a world of rapidly expanding renewable energy, owning energy, geared into building new energy capacity may make more secure sense.

Excluding Buffett, most investors think in days, months or maybe a few years. PO may be at hand, but even if so we will likely remain on or near the plateau for a while, say thru 2012. In the mean time both investors and resource sellers will remain concerned re: the dollar so long as the US evil twin deficits continue as they are, and I see no end in sight. IMO the sliding dollar may even accelerate.

Consider that the current value of oil exports exceeds 1 trillion/y while the total value of all mined gold is only 60 billion/y. Oil exporters are converting dollar sales to Euros, either overtly or covertly, but they will be aware that the euro zone growth, and profits of eurozone companies, will be severely damaged if/when the US growth stalls or recedes... indeed, european exporters are already squealing on account of euro strength. Accordingly, and as part of their diversification strategy, it makes sense for oil exporters to divert a portion of their revenue stream into gold, and not least because the dozing gold buffalo has lumbered to its feet. Even a 5% diversion, say 60 billion, would be too much for the gold market or, to put it another way, such a diversion would IMO at least double the price (as noted in my previous post, investors buying 20% of new gold boosted price 25%.)

The point of the discussion was whether gold might be a good investment, presumably over just the next few years (in the long run we are all dead.) IMO gold will be an excellent investment over such a time frame. You mentioned uranium, which has already enjoyed a great run as investors consider the ending of bomb conversion... this could be a good move, but one less likely to interest ME investors, public or private.

JK - you've convinced me of the merits of Au in the short to middle term. It's an industry though I don't understand as well as oil. The sliding $ also muddies investment waters for non US these days. A lot of the gain in oil has been chewed by falling $. And I'm also told that buoyancy of US market right now is in part based on multinational earnings getting converted to $s.

However...

I'd imagine if ME investors showed too much interest here a few eybrows might be raised.

I thought that this was a very interesting story when it came out. It doesn't appear to be in dispute that the Saudis are short of natural gas. I have related a report that I am aware of that they are going to have to divert 500,000 bpd of liquids production to power plants and desalination plants in 2007 and 2008, because of shortfalls in natural gas production (which is apparently reflected in Rembrandt's estimate that Saudi liquids consumption is up at over 9% from 2006).

It is true that coal is cheaper that oil, but I assume that the Saudis will have to modify their power plants and desalination plants to handle coal, instead of natural gas, NGL's or petroleum.

Which raises an interesting question. If they have so much surplus liquids capacity, why go to the expense of modifying power plants and desalination plants to handle coal?

http://www.gasandoil.com/goc/news/ntm73016.htm

Arab energy giants eye coal imports

Burning imported coal instead of locally produced liquid fuels makes enormous sense, coal being so much cheaper. Indeed, it is hard to imagine a more efficient CTL process.

Importing coal in lieu of nearby gas, iran or qatar, maybe 1/4 the price of SA oil/therm, is a better question. Maybe coal FOB eastern SA is cheaper than qatari gas... it seems the required pipeline shouldn't be that long or expensive... or, maybe the saudis are floating the coal idea as a negotiating ploy.

RE: gold and silver. I don't thing anyone has mentioned the gold/silver 'carry trade' with respect to these precious metals. I don't think a similar situation exists with any other commodity. If someone know of one, I'd like to hear about it.

In the mid-eighties it seems some bankers got the bright idea to set up a gold and silver leasing scheme involving gold and silver producers. At first it seemed like a great idea. The banks, with tons of financially non-performing bullion in vaults could 'lease' this metal to mining companies who need to be able to guarantee a steady supply to the market in spite of the vagaries of the mining industry. A win-win situation, right? Well, at the ridiculously low lease rate, typically 1% or so, it didn't take long for other deep-pocketed players to realize that they could 'lease' a ton of gold, sell it into the market, invest the money and get 5%, 8%, 10% 'free' money. It also didn't take long for same gold/silver lessors to realize that if the spot price of the metal was lower (or at least, no higher) when they had to pay back the bullion, this was additional gravy. The result of all this was a de-facto conspiracy to both keep the price of gold and silver down and to empty both bank and government coffers of the precious metals. The other result is a potential time-bomb of a price spike when the actual supply wall gets hit. This is especially true of silver that is actually consumed and is actually more scarce in refined form than gold right now.

Just another way a given commodity's market price can get screwed up beyond reason and be far away from what most of us might consider to be rational fundamentals.

I've had no experience in this field. So saying, I've also decided to "hedge" against near-term oil price rise by buying a few out-of-the-money crude call options. Few people seem to be doing this, but the needs of an individual are somewhat different than the needs of a corporation.

With the world basing the value of futures contracts primarily on short-term considerations, it seems like a "buy and hold" approach which is informed by geology and 'peak oil' considerations makes some sense. It is relatively easy to buy options 3 years out, and a further benefit to the options from my point of view is that the US seems to plan to inflate its way out of financial trouble. Thus, as a play on declining export oil volumes and a sinking dollar, such options are kind of a "two-fer".

If I lose, I lose - but then, I will have presumably lost because the effects of peaking haven't been felt by that time. Just as if I live a long life, I will have lost the money 'invested' in term life insurance but won't be depressed about it. It ain't perfect, but I don't feel stupid yet.

Uh, what about interest rates, or opportunity costs? Not only are you betting that oil will rise, you're betting that it will rise faster than other investments. Granted oil prices have gone up in dollar terms by 20% this year, but is that likely to happen again?

Yes, that's all part of the bet, and I'm prepared to lose it. I'm certainly not putting all my savings into them.

For instance, in May I bought a Dec 80 call option for $1200. If WTI is 80 or lower I lose. If it's at $85 it will be worth $5000. Frankly, I just bought that one since I wouldn't put it past Bush to bomb Iran.

I have more that are DEC 08, DEC 09 and DEC 10. Between the falling dollar and the Export Land Model, I decided to make that bet. I like options, even though they trade at a premium, because my loss is limited to what I have already put down and I don't have a lot of $ to cover margin calls.

I'm actually surprised that more people on this site don't seem to be doing similar stuff. Being better informed doesn't constitute insider trading or anything. Perhaps they aren't talking about it, or perhaps they consider me foolhardy. But it isn't like I couldn't lose similar amounts in the stock market - and I have.

You know why I don't do that? Because we are all in this boat together and making money off of other people's misfortunes doesn't go over well with me. I don't know what else to make of that situation other than to blame it on the way I was raised.

There are at least a few of us here that enjoy problem solving for the sake of problem solving and leave it at that

Yes, but you're only taking the money from people who don't beleive in Peak Oil yet. And your purchase affects the market price. If market prices for oil options rise, that alone would be a powerful message to the global financial and business community. It would also have the effect of raising oil prices NOW, which would force more action to stop FF consumption.

And you get money.

Sounds pretty good to me.

If I understand options right, if oil is at $82 like uh today, that DEC 80 option is worth $2000. So you can take your $800 profit right now.

Volatility is your friend. Instead of holding a long term, slightly out of the money option until maturity, just wait for some local peak and close it out at a profit.

RobertInTucson

I haven't escaped from reality. I have a daypass.

Greenish,

This sounds like a reasonable idea to me - some upside with limited downside.

I am in the oil and gas business and I do indeed believe that the price of oil in 1,2,3 years will be higher than today.

How does one get started with buying oil call options?

Oh, and just as a PS: while there are definitiely cost premiums, I attach a real value to something more intangible: "who's taking the other side of the bet?"

Anyone selling long-dated naked crude call options doesn't believe in peak oil anytime soon.

Check out this US Carbon Footprint Map, an interactive United States Carbon Footprint Map, illustrating Greenest States to Cities. This site has all sorts of stats on individual State & City energy consumptions, demographics and much more down to your local US City level...

http://www.eredux.com/states/

I know very little about the commodities market. But I have some ideas and they may be true or false....

It seems to me that the commodities market surely started with agriculture. A farmer had some wheat and stored it in a bin...he found a buyer but the buyer didn't need it then...in this case the buyer was a flour mill...so the farmer and the miller agree upon a future delivery and a price.

All well and good..it then grew and grew and then the speculators stepped in...the speculators had no product and no real use for the product but just wanted to gamble..

The farmer CAN deliver and he can contract for say diesel fuel AND the farmer CAN take delivery because he does use diesel fuel...supply and demand....simple..

yet surely all the 'other' players have now muddied the waters and made it complicated. Many times the farmer takes a shellacking and perhaps sometimes the buyer/(miller) when his demand drops...but he still has to take delivery...

But then both parties can now perhaps sell their contracts and buy others and trade around...and a farmer can get stuck delivering on contract some $3 wheat when the current market is at $8/bu...that is expected...but how much of those prices are due to real need and how much is propped up by speculators?

This has just stepped beyond my knowledge base and I am sure many farmers as well who later just threw up their hands and rented out their lands.

If the speculators are making money by just gambling/trading..then surely someone else is losing money...I wonder who and why...most likely the farmers...for I have seen recently as last year when the farmers were yelling..."they are trying to buy this market cheaply" ....

It is no secret that for many many years farmers have been getting screwed on the prices for their crops...and no thanks to all the middlemen(distributors,advertisers,etc) we have to pay a lot for a very simple product made of just ground up grain yet they become rich while we the consuming public pay more and more and the farmers profit is slight and never increases and ....the nutrient value of the foodstuffs is basically trash...in fact bad for your health in many cases....

So we have a supplier and a long long chain..to the consumer...the supplier(farmer/cattleman/diaryman) just gets by...we the end consumers get less and less and it costs more and more and its value is less and less .........

AND the speculators and the food chain middlemen get extremely rich....

Thats what I see and hear....but as always I might have it wrong technically...but the end result is what I look at.

And did you discuss 'basis' in the crop commodities?

I think 'basis' is an additional variable amount in the price that the middleman(in this case the grain elevators companies) remove for their own from the farmers price...

Like corn basis in one area here was almost a dollar...so if future corn was $4.00 then the farmer only got 4-1=3. Oh they said that barge traffic and so forth were running up their costs...frankly I think it was more a con game.

Airdale

In short: the theory that is fundamental to current economics: that the market is a place where rational participants determine the price based on "rational" consensus on all information available for the past, present and the future, is a pile of crap. Surprise, surprise.

Thus the "rational players" argument against PO - that if it was true the producers would start withholding oil, becomes even more exposed in its idiocy and lack of understanding of how and why market participants behave. Clearly the market seems unable to "think" beyond the marginal barrel - and all of this is made sure by the uncertainty on both the supply and the demand side.

Absent a government policy to address the market uncertainty, we will know PO has arrived no earlier than after we've started forming lines in front of the gas stations. Actually I hear people in Iran, Maynamar and Indonesia are already learning that, though I suspect they have no idea what has struck them. I wonder, will we?

As mcgowanmc points out, I am a believer in the fact that the NORMAL state of affairs in a commodity market is to have a contango market, i.e., prices in the future are higher. The reason is, if someone wants to buy your product now, but receive it and pay for it later, you have cost of carry (interest & insurance) plus storage cost. Think of me wanting to buy your used diamond ring - we, agree on price, but I say I do not need it now, so you store it,, insure it, and I will pick it up in a year and pay for it then.

Backwardation, as mcgowanmc points out, generally occurs when the demand is so great, that people will pay to get the goods out of storage. That is, if you want to store it, look at all the cost to carry and storage costs that you will pay, and you will receive a LOWER price.

If you BELEIVE in Peak Oil, then a backwardated oil market is a GIFT FROM GOD!!! You believe that prices will rise, but the market says because current demand is so great, the price in the future is LESS!!! So, purchase an out-month contact 1 or 2 years in the future. It costs less than the current price, so, e.g., 2 years from now the price would have to drop below your purchase price (which is already lower than today's price) for you to LOSE money. YOU DID SAY THAT YOU DID BELIEVE IN PEAK OIL DIDN'T YOU?? WELL, YOU NOW HAVE A WAY TO COPE. IF YOU ARE RIGHT (TALK IS CHEAP) AND OIL GOES OVER $100 IN TWO YEARS, YOU WILL MAKE ENOUGH OFF OF ONE CONTRACT TO PAY THE GASOLINE PRICE INCREASE FOR 5 YEARS.

I do it mostly with oil & gas stocks. I am 66, and my energy bill is zero for the rest of my life (unless I screw it up and lose all of my profits over the past 5 years).

I thought backwardation existed because of interest rates - the carry cost of MONEY. Oil is cheaper in the future, because investors think that prices will be nearly-flat into the future, but in the interim they can earn more income from other assets. When there is any reason to think prices will be higher at any point in the future, that raises the value of ALL contracts.

The oil you buy for 2012 isn't being held in a tank somewhere, it's still in the ground, and that's where it's staying until the contract matures (or shortly before). There's no "carry cost" for leaving the oil there, and there's no acceleration clause - you couldn't demand that "your" oil be pulled out and handed over today, for you to keep in your own tanks.

Yes, a backwardated curve is a gift from God if you believe in Peak Oil. If you can take the volatility, you should should purchase long-dated futures. But the volatility on the ride WILL be punishing and an ordinary sized burp in the market near maturity can erase all of your hard-earned profit, even if you were right.

(I have assumed that you don't have a tank farm in your back yard, won't take delivery, and will be forced to liquidate your position at maturity and at market price, whether you like it or not.

- Shunyata

Based on the very low trades out at later contract dates, there are relatively few speculating in oil prices by purchasing late dated oil contracts. Can you think of reasons why this might be?

I know you said that sellers of oil only want to hedge for a month or two, but wouldn't there be others out there who wanted to speculate in the market - hedge funds, and possibly pension funds and insurance companies? Are there simply few contracts available for sale at late dates?

Also, if I were to purchase a contract for West Texas Intermediate for delivery in 2012, who would ultimately be behind the contract? Could it be a hedge fund, rather than an oil company? If so, wouldn't this be a problem if the hedge fund went out of business between now and 2012?

As I understand it: Because the market is settled daily, and traders are required to hold margin for each contract, the most it should be possible to lose is the last days trading. As your contract goes into profit, the hedge fund should be paying their margin-call each day. If they can't meet the margin-call, their side of the contract will be sold at the current market rate to another player.

--

Jaymax (cornucomer-doomopian)

Actually, the exchanges appoint AAA rated entities called "clearing agents" to handle the flow of trades, match buyers and sellers, and guarantee delivery.

When you place a buy order, the clearing agent takes your order, even if a seller isn't immediately available and personally guarantees that you will get delivery. When a seller later shows up, the clearing agent is off the hook.

Similarly, the clearing agent requires that you make regular contributions to/from a bank account (called a margin account) to effectively guarantee that the cash will be on hand to actually purchase a barrel of oil and deliver it. (I am not going into the full mechanics of margining here - too confusing.)

So you truly don't need to care who is on the other side. The clearing agent is guaranteeing delivery and has been collecting money along the way so there will be enough to purchase the oil at time of delivery.

Obviously the clearing agent has the ability halt trading if the market becomes too lopsided (many buyers with no sellers in sight, for example). This helps ensure that hedge funds can't get too out of hand.

- Shunyata

Low trading in longer dated contracts is not unique to oil. Eurodollar futures (think taking delivery on a truckload of Eurodollars) behave similarly with almost no volume past the first year or two, even though they are quoted out to 30 years!!!

Why should this be?

In the interest rate world, long-dated Eurodollar futures are redundant instruments that can be created from other, very liquid instruments in the market.

I don't know why this is the case for oil futures. Perhaps it is cheaper to get the long-dated oil exposure by directly purchasing oil assets. Perhaps speculators are more interested in the OVERALL LEVEL oil price over a long period of time and do not want exposure to the volatility of owning oil on a specific day. Owning an oil company would be more effective.

These comments aren't really well thought out. If I come up with something better...

- Shunyata

From Wikipedia:

Lots of links in the original on Futures Contracts.

So we can conclude that, as mentioned above, the market feels that oil and Eurodollars are in plentiful supply (relative to current prices).

NYMEX guarantees all contracts.

Gail -

Very interesting post, and one which gives us a glimpse into the arcane world of commodity futures trading and derivatives.

But tell me something: what in hell's name is 'financial engineering'?

I happen to have an engineering background myself (chemical and environmental engineering), but in all my 40 years of engineering have never met a 'financial engineer'.

What does a financial engineer actually do: build financial pyramids?

Or perhaps the term, 'engineer' is used just a bit too loosely (as in a 'software engineer' not really being an engineer in the true sense of the word).

Just curious. And no, I am not being gratuitously snarky. It's just that engineers have traditionally been involved in (usually) doing useful things with the physical world. But it appears that financial engineering (whatever that may be), is not involved with the physical world, and it also appears dubious that it does much that is useful to society as a whole. So maybe instead of using the term 'financial engineering', it might be far more accurate and descriptive to call if something like 'financial conjuring'.

According to Wikipedia:

There are different aspects of financial engineering, and some of it is probably more conjuring than other. As with all kinds of projections, you have to make assumptions (such as: the future will be like the past; two different variables are "independent", or the underlying distribution for one variable is "normal"). To the extent that these assumptions are not really true, the model used for projections will have poor predictive value.

Oh, Ok, I get it, it's a lot like astrology.

It is more akin to selling used cars- if you are good at one, you will be good at the other.

So then, 'financial engineering' appears to be little more than a branch of financial modeling mainly geared toward making investment decisions.

However, since you have cited a reference, my dictionary (Encarta) defines 'engineering' as: "... the application of science in the design, planning, construction, and maintenance of buildings, machines, and other manufactured things..... "

Sure doesn't sound like the term 'financial engineering' too closely fits the general definition of engineering. Note that 'engineering' has a connotation of involvement in something physical, something that is almost entirely lacking in what a financial engineer supposedly does.

To my admittedly biased mind, calling a supposed financial engineer an engineer is akin to calling a gabage man a sanitation engineer. Or an auto mechanic calling himself an automotive phsyician. This is another example of how the financialization of our once productive economy has even debased our basic terminology and have given its practioners a degree of imputed respectibility that it hardly deserves.

I promise I will now turn my curmudgeon switch off for the evening.

What they are is salesmen- Willy Loman with more formal education. B/S terms- "warehousing", "securitization", etc. are literally being created daily in hopes of bamboozling the sheeple- "step right up and knock over these milk bottles with this baseball, win a big stuffed prize for the little lady".

Take it easy on the Financial Engineering jokes! I know the term sounds manufactured, but the disclipline really is engineering.

My mechanical engineering area of specialty is Control Systems - developing systems that measure, adapt to, and control random inputs. The classic example is the electronic controls that measure the motion of a rocket and continuously adjust the thrusters to keep the rocket vertical, rather like balancing a pencil vertically.

It turns out that the mathematics for control systems are identical to the mathematics required to "control" a noisy financial quantity. The market is the turbulent air flow, the trajectory is the desired financial result, and cash is the energy source that propels the whole thing. There are basic "physical principles" that drive the system. Instead of Conservation of Energy we have the No-Arbitrage Principal that states that we will find no magic money machines simply by simply trading in a really clever way.

The engineering title is completely appropriate and the mathematics is identical.

- Shunyata

Classic.

Don't feel bad. I'm an economist and economists are the butt of many jokes on this website.

Debbie

Thank you, Debbie. I needed that.

- Shunyata

My mechanical engineering area of specialty is Control Systems - developing systems that measure, adapt to, and control random inputs. The classic example is the electronic controls that measure the motion of a rocket and continuously adjust the thrusters to keep the rocket vertical, rather like balancing a pencil vertically.

It turns out that the mathematics for control systems are identical to the mathematics required to "control" a noisy financial quantity. The market is the turbulent air flow, the trajectory is the desired financial result, and cash is the energy source that propels the whole thing. There are basic "physical principles" that drive the system. Instead of Conservation of Energy we have the No-Arbitrage Principal that states that we will find no magic money machines simply by simply trading in a really clever way.

The engineering title is completely appropriate and the mathematics is identical.

But you must admit that this mathematical analogy has no place in modeling oil depletion, which really only has second-order effects in relation to economic considerations.

At best, you will find perturbations caused by economics affecting the rates of extraction. And greed drives extraction to the first-order which I think is more open-loop than not.

For the control system, what is your closed-world hypothesis? Do you treat the entire world as your feedback loop? This will never work because it is actually a collection of probably many feedback loops. The better analogy is to come up with a stochastic approach using a distribution of stimuli and more or less open-loop Markovian rate laws to model oil depletion.

The standard bottom line is unless TOD posters start showing their work, we will always be a bit suspicious of assertions, no matter what the credentials of the poster happens to be.

And I have to admit it that my inner engineering circle make many more jokes at the expense of geologists than economists. This has more to do with the indoctrination I went through at my own engineering school, where the term of endearment was rockheads for those that flunked out of freshman weeder courses. Economists were at least to be somewhat admired because they were trying to tackle modelling the intractable, if not impossible. I remember taking an econ class and the T.A. wrote a long equation on the blackboard, stepped back to gaze at it, then erase it with a dismissive "you really don't want to know what went into that formula at this stage".

I don't agree with the it must be physical for it to be real engineering assertion. That arises because there was nothing 'engineerable' that wasn't immediatly physical till recently. Now we've got computers and software, and engineering those is directly comparable to engineering any other DETERMINISTIC system.

But the financial system just isn't deterministic, at least not at the level we mere humans (even the ones who call themselves economists or financial-engineers) interact with it.

'financial-engineer' is just icky. and wrong. wiki reference notwithstanding.

--

Jaymax (cornucomer-doomopian)

Phosphates should be taken into consideration, as we need them to grow food:

Check out the chart on Potash of Saskatchewan for the year:

http://finance.google.com/finance?client=ob&q=POT

True, I will grudgingly concede that many aspects of the design of computer hardware and software does qualify as true engineering. However, to call investor-focused financial analysis 'engineering' is a gross misuse of the term.

Might as well call a psychiatrist a 'mind engineer', or a sex therapist an 'erotic engineer'.

You must realize that this little petty rant on my part is from a person who could once do complex calculations on a wooden slide rule. So perhaps it's just a case of creeping 'old-fartism'.

Thanks for the article. Very interesting. You suggest the following:

"It seems to me, though, that the level of today’s oil is largely governed by production and use rather than speculation - "

The futures prices drop about $10/barrel in the first 3 weeks of August. Given the liquidity concerns that were front and center during this same time period I wondered if it might be fair to describe this as the speculative portion of the price per barrel. Would you care to comment on this?

Dear BKelly,

I am not quite sure that I follow you. Can you elaborate a bit on how you have identified speculative pricing? Are you referring to liquidity in the oil markets or broader financial markets?

- Shunyata

I meant liquidity in the broader financial markets.

It may simply be that the corresponding drop in the wider financial markets during August caused this drop in oil due to expectations regarding demand. As demand didn't really drop though, I was wondering if a good portion of the $10/b drop in oil might be associated with speculators seeking to raise cash?

A hedge fund that is playing in commodities is unlikely to be playing in credit derivatives at the same time. It seems unlikely that someone was liquidating oil futures to cover margin calls on credit positions.

At the same time, however, a highly levered hedge fund will routinely rely on a line of credit to cover temporary cash flow demands. If these lines of credit generally dried up then they might start liquidating positions to generate cash.

My derivative trading is backed by a large cash accounts so I don't have to worry about these things and I am not too close to the travails of hedge fund operators.

Good thoughts, BKelly, and I will hold them with me as I try to make sense myself of what is going on around here.

- Shunyata

Gail,

Your section, Oil Futures Prices Under Peak Oil, was unclear to me. By what do you mean "under peak oil"- predicted market behaviors past peak or downslope? That you specify as backwardation, yet the term "with Peak Oil" is used next paragraph for contango.

I'm not really versed in this, though I thought futures price was supposed to represent spot price and the price of holding the commodity to specified date, making the future more expensive than spot normally. Nice that you cleared that up for the screwy picture with oil.

Do you have a definition of a hedge fund-say a collection of futures contracts of varying maturity? How are the arms bundled in these, or is that the $64 question-the how and amount of the bundle?

Shunyata - this was an excellent post!

I don't think the futures prices tell you anything useful, they are more closely related to the current price than anything else. If you look at the futures curves in fig 9.6, the future price predicted now is much higher 10 years ago. But you could tell that just from the spot prices.

No, the markets have no magic way of divining the future, and putting lots of bad opinions together does not create one good opinion.

I don't why anyone expects that the markets could tell us anything useful in the first place. Merely putting "futures" in front of "markets" does not create a special ability where none exists, otherwise I would call myself Super Bob and jump over tall buildings.