US Petroleum Supply, Ethanol, and State of the Industry - API

Posted by Gail the Actuary on January 27, 2008 - 10:45am

On Thursday, January 17, the American Petroleum Institute (API) hosted another Blogger Conference Call. The purpose of this call was to talk about 2008 US statistical data regarding oil supply, and various related issues. In this post, I provide insights from API's bloggers call. Since most of the numbers are fairly similar to EIA data, I also look at longer trends using EIA data.

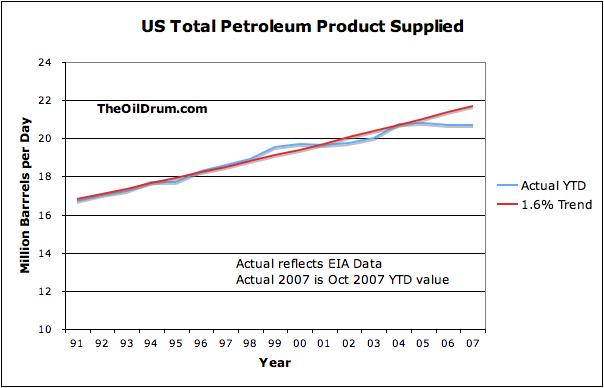

1. API Statistical Report: In 2007, total domestic petroleum deliveries were flat--marking the third year in a row for which they experienced only minimal growth or outright decline.

From the graph, what API says about level US consumption of oil products ("petroleum deliveries") being flat for the last three years is very much in line with what EIA is showing. US Consumption of oil products of all kinds (gasoline, diesel, fuel for airplanes, asphalt, etc) was increasing for many years, then leveled off in the last three years.

Analysis. To get an idea of how much current consumption is below that that might be expected, I fitted an exponential trend line to 1991 to 2004 data. Based on a comparison between this trend line and actual EIA data through October 2007, US consumption of oil products is about 1.03 million barrels per day, or about 4.8%, below what might have been expected, based on 1991 to 2004 data. Even though this is EIA, and not API data, I think that the two sets of data are similar enough for this type of analysis. (My analysis was done for this report, not the call. We received API statistical data the morning of the call.)

API Blogger Call

Before going too far, I should provide some information about the API blogger conference call. The call lasted about 75 minutes. The material related to the call (audio recording, transcript, and the documents we received in advance) can be found here. The participants in the call were

American Petroleum Institute

Jane Van Ryan - Host

Red Cavaney, President and CEO, API

John Felmy, Chief Economist, API

Ron Planting, Manager of Statistics, API

Bloggers

Alan Drake - The Oil Drum (non-staff)

Devil’s Advocate - Copious Dissent

Nate Hagens - The Oil Drum

Mark Hemingway - National Review Online

Byron King - The Daily Reckoning

Doug Lambert - Granite Grok

Bruce “McQ” McQuain - The QandO Blog

Ed Morrissey - Captain’s Quarters

Dave Schuler - The Glittering Eye and Outside the Beltway

Geoff Styles - Energy Outlook

Peter Suderman - FreedomWorks

Gail Tverberg - The Oil Drum

Brian Westenhaus - New Energy and Fuel

Carter Wood - NAM and Shopfloor.org

2. Price Elacticity of Demand

Alan Drake asked a question about oil price elasticity. Ron Felmey, Chief Economist for API, indicated that there was a new report out by the Congressional Budget Office (CBO) that gives some indications with respect to price elasticity of gasoline demand. The CBO report estimates that price elasticity is .06 over the short term. Over a longer term period, the CBO report assumes that people will buy new smaller cars. When this was considered, the long term price elasticity was estimated to be .40.

Analysis After the call, I made a rough estimate of oil price elasticity, relative to 2004 expected values. For the supply change, I took the decrease in supply of 4.8% relative to what would have been expected, based on 1991 to 2004 data, calculated in Item 1 above. I estimated crude oil prices to be increasing by approximately 80% between 2004 and 2007, based on EIA data. Using these two pieces of data, the estimated price elasticity of demand is then 4.8% divided by 80%, or .06. By coincidence, this is equal to the short term elasticity of gasoline estimated in the CBO report.

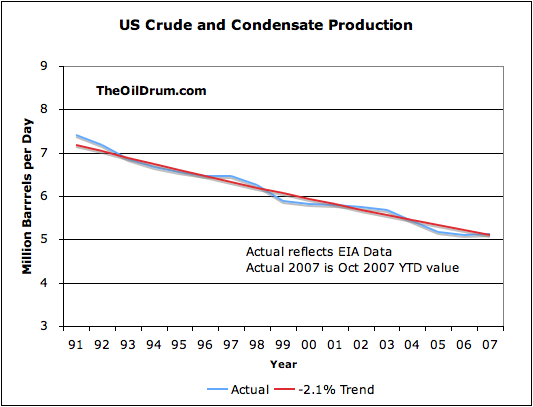

3. US Crude Oil Production

According to API, US production rose 1.1% in 2007, to 5.16 million barrels of per day. This is the first time production rose on a year over year basis since 1991, and was at least partly because of disrupted 2006 production in offshore and from Alaska pipeline problems. Crude oil production increases were seen in the Midwest and Rocky Mountains, and the number of oil wells reached its highest level in more than two decades.

Analysis A 1.1% increase in production is not very much -- about 56,000 barrels a day. Even this appears optimistic based on EIA data through October, which is only up by 0.3% or 13,000 barrels a day from the 2006 total. (API and EIA agree on 2006 production.) Oil production in the Rocky Mountain area and the Midwest have been increasing for years, by very small amounts on small bases. If these areas increase by the amounts they did in 2005 and 2006, we would expect about a 25,000 barrel per day increase in 2007 in the Rocky Mountain area, and 10,000 to 15,000 barrels per day increase in the Midwest. Most likely the biggest reason for the indicated increase in production is because the 2006 base was affected by lingering impacts of the 2005 hurricanes.

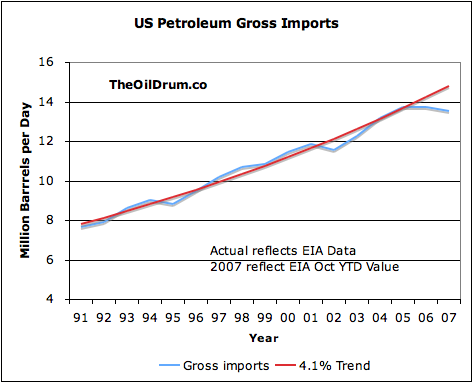

4. Imports

According to API, total imports of petroleum for 2007 fell 1.9 percent from 2006's peak. At 13.7 million barrels per day, they were still the third highest level ever and accounted for about 65 percent of domestic deliveries. Crude imports declined 1.0 percent, while product imports fell 4.5 percent.

Analysis The decline in imports is significant, because imports have been rising by more than 4% per year since 1991. Comparing the actual 2007 EIA imports to the trend lines suggest that 2007 imports were about 1.28 million lower than would be expected based past experience, or an 8.6% shortfall. This shortfall (which is on gross imports, rather than net imports) is sufficient to explain the shortfall in total product supplied of 1.03 million barrels a day, shown in Item 1 above.

On the conference phone call, I pointed out that the lower imports were likely related to the fact that fewer exports were available on the world market, because world production was flat to declining. John Felmy agreed that this was a factor.

5. Drawdown of Inventories During the Year

According to API, "Mid-year, U.S. crude oil inventories had reached their highest monthly level since 1991 at 355 million barrels – but then fell by more than 60 million barrels to end the year at 294 million barrels, the lowest level since January 2005. However, that was still roughly in line with the five-year average for December. Distillate inventories closed the year at 137 million barrels, down 4.9 percent from a year earlier, but with inventories of ultra-low sulfur diesel reaching an all-time high of over 70 million barrels. Gasoline inventories exceeded year-ago levels at the end of December by 1.3 percent, at 215 million barrels."

Analysis There was a fair amount of discussion about this during the call. Basically, when prices were high at the end of the year, people drew down their inventories. This helped keep product supplied up, even when imports were low.

6. Ethanol

According to API, "The figures cited here include gasoline that contains growing amounts of blended ethanol, amounting to well over 400,000 barrels per day in 2007. If ethanol is excluded from the calculations, total domestic oil deliveries for the year would actually have shown a half percent decline."

Analysis Based on EIA data, I would estimate US ethanol production would amount to 420,000 barrels per day in 2007, which is consistent with API indications. Last year's US ethanol production amounted to 319,000 barrels per day, based on EIA data, so the difference is about 100,000 barrels a day. The 100,000 barrels per day increase during 2007 is about 0.5% of total petroleum products supplied of 20.7 million barrels a day.

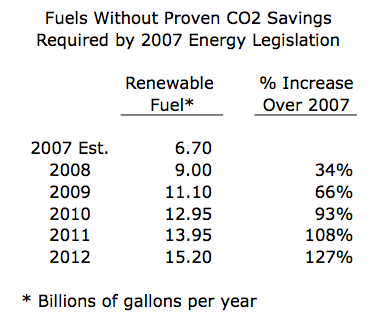

7. Ethanol mandates

API is very concerned about the mandate included in the 2007 energy legislation that requires that ethanol production be ramped up very quickly, starting in 2008. The general biofuel category, which includes corn ethanol and most biodiesel produced today, is required to ramp up as follows:

There are many issues involved -- the difficulty in growing sufficient additional biofuels, the conflict with food production, and the difficulty in transporting all of the ethanol and blending it into the end products all around the country. When the initial mandate was passed, there was at least a little excess capacity in ground transportation that could be utilized. Adding this so much more ethanol so quickly will very badly strain the system.

According to the telephone discussion, waivers will be required if it is not possible to meet the conditions of the mandate--for example, not enough biofuels will be available on a particular date in a particular city for blending. It is not clear exactly what procedures will be required to get the waivers. It is also not clear that oil companies will know far enough in advance to request the necessary waivers. API is working on putting together a paper explaining the problems regarding the new ethanol mandate more fully.

8. Confusion of the public regarding the role of biofuels.

One of the bloggers (Devil's Advocate) brought up the issue of the people getting the impression that fossil fuels are bad, and that renewable fuels are therefore good. Advertisements fail to point out that renewable fuels are at this point nowhere near capable of replacing oil completely. Education is needed so that people understand the continuing need for petroleum.

9. New EIA Report analyzing oil industry costs.

Nate Hagens asked a question about data on the costs of finding new oil. John Felmy pointed out the EIA's financial reporting system (FRS). It shows very high finding costs for new oil in the Gulf of Mexico. When including production costs, the numbers are even higher

10. Terminology

One of the issues I brought up is API's use of the word "demand" for "product supplied". Back a few years ago when there was plenty of oil, demand really determined the amount of oil products supplied. Now, with oil in short supply and prices rapidly increasing, it seems like supply determines price. Demand decreases because the price is so high. I find it confusing to see demand used as a substitute for product supplied, especially when the interpretation of causality is questionable. These are examples of what I object to from API's materials:

The API statistics also showed that U.S. oil demand was flat in 2007, the third straight year of stagnant or lower oil demand in the world’s largest oil-consuming nation.

Given the higher domestic production and flat demand, total oil imports fell 1.9 percent from year-ago levels, though imports still cover about 65 percent of U.S. oil demand.

11. Shift in the mix of petroleum products supplied.

The shift was discussed both in the phone call and the reports provided. The Statistical Report indicates that distillate is in particularly high demand, with deliveries increasing 1.5% during 2007. Gasoline deliveries increased by 0.4% during the year. "Miscellaneous" products are tending to decline as a percentage of the total. API did not have finer detail for miscellaneous products.

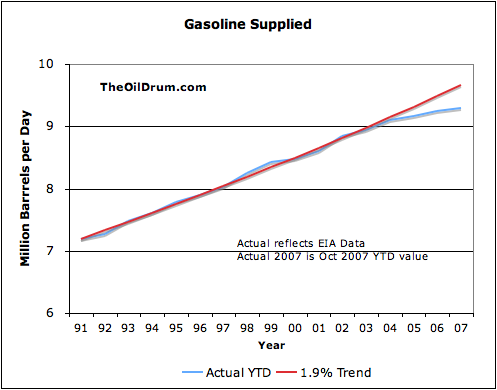

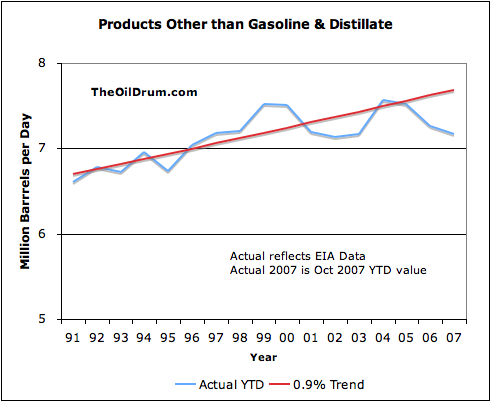

Analysis If we look at longer-term EIA data regarding petroleum products supplied, we see a similar pattern. The highest increase (2.6% per year through 2004) is in distillates (Figure 2). Gasoline supplied (Figure 3) is increasing at a slightly lower rate (1.9% per year through 2004). The other products supplied were growing most slowly (0.9% per year) and have dropped off most recently. Compared to the trend lines, recent production has dropped for all three categories. For 2007, EIA data shows distillate consumption is 4.0% below trend line expected quantities; gasoline is 3.8% below trend line expected quantities, and other products are 6.7% below expected quantities. These differences in supply shortfalls may help explain differences in price increases since 2004.

12. US Energy Association State of the Industry Forum

We were sent a speech which API's CEO Red Cavaney prepared for the USEA industry forum. This speech concludes:

What we need is a public policy framework to ensure future energy security for our nation. We need elected and appointed officials who understand the energy challenges we face. We need a greater commitment to increased energy efficiency. We need to diversify our energy resources, drawing upon the full range of energy sources, including alternatives. We also need to increase and diversify our oil and natural gas supplies, both within this country and abroad. And, we need to enhance energy technologies, remaining on the cutting edge of advanced technology. We need to get it right on energy. Too much is at stake for our nation to do otherwise.

Analysis This sounds like motherhood and apple pie, but it is surprising how far we are away from this goal.

Hi Gail,

It seems proabable to me that the Western oil will continue to increase. It is interesting that it is getting into the range where it can offset declines elsewhere. The Bakken formation is getting a lot of attention with estimates of oil in place moving towards 300 billion barrels. North Dakota is considering a state owned refinery to attempt to handle some of the new supply and there are a least a couple other refinery proposals. If consumption can be made to decline, this could put a dent in the fraction of oil that is imported.

Chris

I'd like to see 2007 data regarding Western oil, and look at information regarding expected future production. Talk of building a new 130,000 barrel per day refinery in North Dakota makes it sound like there is promise for increasing production.

I expect this would be fairly expensive oil to produce. Anyone have ideas on costs of production?

It looks like North Dakota oil production is increasing at about 10,000 to 15,000 bpd per year, although the net rate of increase may accelerate with time.

Two key questions: (1) Is it commercially productive across a wide area or only in discrete areas, e.g. on heavily faulted/fractured structures; (2) Can operators boost the recovery factor above low single digits?

And these are expensive wells. However, this--nonconventional oil & gas production--is the best thing, in aggregate, that the US OIl & Gas industry has left to pursue onshore. The other model is for generally small companies to look for small, high quality, missed oil and gas fields.

The idea is that there is a thin pourous layer between two shale layers and oil collects there. Horizontal wells are used with fracturing to get the oil out. People don't seem to be at all sure what fraction can be extrated but they do seem to be pretty happy with the production of the wells. The Canadian portion of the formation seems to be seeing the highest growth right now.

Chris

US OIl & Gas producers can and will make money by finding new small fields and exploiting nonconventional resources. The question is whether or not we can flatten or reverse the long term decline. From 2001 to 2006, US crude oil production fell from 5.8 mbpd to 5.1 mbpd.

That was what I was finding interesting, that the growing production is begining to show up in aggregate numbers. Any decline can be reversed if the decline continues long enough. A very small discovery reverses a decline that has fallen below the scale of that discovery. The numbers for the Bakken are larger than for KSA so the potential scale is large but I don't think we know about how much can be recovered. I think some Montana wells are beginning to decline now so there might be a way to make a informed estimate if the drilling methods are sufficiently similar.

Chris

Keep in mind that there is a vast difference between original oil in place estimates for a group of the world's best conventional oil fields and original oil in place estimates for a nonconventional shale resource play.

I think that is correct. I'm just not sure if this should be called a shale play since the drilling is not in shale but in dolomite and sandstone. I think this is why people are so uncertain about how to make a guess about the recoverable fraction. Estimates range between 50% and 3%.

Chris

The key point is that the Middle Member--the shaly dolomite/limestone/sandstone--is productive locally, presumably in discrete traps. The billions and billions of oil estimates principally come from extrapolating the shale thickness across the whole basin. Again, the two key questions are to what extent the shale members are commercially productive across a large region and what the recovery factor is going to be.

http://www.contres.com/index.cfm?id=50

The description, as I understand it, is that it is continuous so the oil does not pool up anywhere, it just fills the middle member. I think that the geology has been mapped so that it is more interpolation than extrapolation. Perhaps we won't know how much can be recovered until it is all recovered. The USGS is unwilling to publish the study it had done though you can read in on the web: http://www.undeerc.org/Price/

Chris

Okay, let me try one more time. From the excerpt above:

The middle member is not continuously productive across a widespread area--that is what locally productive means.

The shale members are continuously productive across a wide area.

The key question is whether the shales are commercially productive across a widespread area.

I think the Bakken formation would be an interesting topic for a TOD post or a guest post.

On the natural gas side, unconventional production has done very well, and has prevented a steep decline in natural gas production. We can't expect as much on oil, but every little bit helps.

I think I see where we are missing each other. My meaning is that it is spatially continuous. There are no places that it drains to, it is just one wide layer or trap. Your meaning is that the oil is located where it formed (or nearly so). My picture is probably too simplistic, as some areas will have more oil than others and those will be the commercial portions. This model is a little above my head but it might help you get a feel for what people are thinking: http://www.searchanddiscovery.net/documents/2006/06035flannery/index.htm

Again, what is interesting to me is that there seems to be something to be remarked on in the aggregate production numbers from the conference call. Perhaps this is a slow motion discovery that is significant. I'm paying attention because I'm trying to figure out how much carbon dioxide needs to be cleaned up. An extra 20 years of US oil consumption could be a problem.

Chris

From peakoil.com: Finally, the Bakken makes the national media (NY Times). Lots of links there. Peak oil: Do you want it to occur? detoured into Bakken territory as well.

Also would love to see a TOD piece on this. API of 41 they say.

How much more of a drop in imports until the US is off non-Western Hemisphere production??

To answer my own question, this page puts non-Western Hemi imports at 7.49 mbpd for 2007:

http://www.eia.doe.gov/pub/oil_gas/petroleum/data_publications/company_l...

This is primrily: Saudi Arabia (1.47 mbpd), Nigeria (1.12 mbpd), Algeria (677K) Angola (513K) Iraq (495K), and Russia (422K). Thus, getting off non-Western Hemisphere imports would be tough, something like a 33% reduction in consumption. However, with further reductions of about 2 mbpd, the US could live without Middle East oil. That would be a nice headache to be rid of.

Yes, it is a fungible commodity and a disruption in the ME affects the global price, but one wonders how long post-peak the free market in oil will continue to operate as such.

I think they say they like $60/barrel oil.

Chris

I was wondering if this North Dakota oil is considered "west" or is it part of the 10,000 to 15,000 barrels per day increase in the "Midwest" described above. I'm not in the oil field myself but know many people who are in small scale oil and gas in SE Ohio and western West Virginia where there is a mini oil boom. There are many wells that had been abandoned in the 1980's that are now being pumped again. Also natural gas players used to be annoyed with their gas wells that also produced a little oil. They had major problems "disposing" of the oil by-product. Now they are happy to purchase and install tanks and have a truck pick up the oil once a month or so. I also know drilling in the area has doubled in the last 2 to 3 years. Granted the biggest one I've heard of produces 6 barrels a day. But this is an extremely old oil area having peaked in the 1890's. I can't seem to find data on Ohio/ West Virginia production and I realize the volume is inconsequential but I'm wondering if the data shows that an area 110 years passed its peak is capable of reversing the decline.

I was assuming North Dakota was in the Midwest. The EIA summarizes its data by PADD, and this seems to put North Dakota with the Midwest. I assumed they did the same.

My 10,000 to 15,000 estimate was based on production increases through 2006. The increase may be higher in 2007. I didn't have the data.

Regarding Current and Future Prices...

Rough projections from your data above suggest $5 per gallon gasoline by end of 2010.

From several sources (i.e. GE, DOE other companies etc.) by 2012--they state will be able to produce Hydrogen for less than $3/Kg (akin to $3/gallon).

Numerous Cellulosic ethanol projections (including DOE and several companies) are confident in producing cost around 2010 of less than $2/gallon.

Battery technology is clearly a player soon toward electrification of transportation with costs 1/5 or less than $3/gallon by 2011 (GM, others).

Wouldn't this accelerate and be beneficial in moving away from petroleum products?

If we can make to 2012...I'm actually optimistic of a constructive "Energy Revolution"!

Nichoman

I'd like to see the work behind these numbers. I suspect we are talking about receding horizons. (The estimates assume low oil and energy costs.)

Producing hydrogen is energy-intensive. I am sure that the $3/Kg cost does not cover building some sort of super pipeline system, to get this to the places where it would be needed.

I find it difficult to believe cellulosic ethanol is that far along. It is my understanding that current processes are very expensive. How about some links?

I agree with what Gail said. I really doubt that we will ever see hydrogen produced at low cost. Then there is the fact that most fool cell cars cost about 1 million a pop and none of these million dollar test cases has ever gone anywhere close to 100,000 miles.

Now battery electric vehicles powered by renewable energy just might be a solution for short daily commutes. I have built an electric motorcycle that has a top speed of 55 mph a range of 45 miles. I can recharge the batteries with the solar panels on the roof of my workshop. This past summer I drove over 2100 miles on solar power.

My current project is an electric car. When I finish the VW I will post the numbers on my web site www.zevutah.com

Some useful general links...use their search features for topics above as they have several articles from numerous sources and/or companies...

1.) Autobloggreen

2.) Energy Blog

3.) Green Ccar Congress

4.) Renewable Energy Access

5.) Free Energy News

6.) DOE -- Energy Efficiency and Renewable Energy

About the Hydrogen Cost...besides Googling try...

Popular Science Article

Nice Article About Hydrogen Refueling Station at...this is unofficially tied to Honda's Fuel Cell Car and Home Energy Station

Home Energy Station

Cost Of Electricity

Tesla Motors

Cellulosic Ethanol...

Cellulosic Ethanol Investing

Just a Start.

Nichoman

Thanks for the links. Some of them provide links to large numbers web sites in the area of alternative energy.

Can you recommend specific links that show low cellulosic ethanol costs in the near future?

Cellulosic Ethanol...

Cellulosic Ethanol Investing

The information on cellulosic is very dated. For instance, it still has Xethanol on that list, and they have imploded. They never did any of the things they promised.

Oil is a source of energy. None of these alternative are sources of energy. Where will the energy come from?

Natural gas in North America has peaked.

Coal peaks in ~2020.

Uranium peaks in ~2050.

I am looking for a comfortable bike!

There is a company claiming they'll do $1/gallon biomass based ethanol here.

Chris

I am having trouble making your link work.

Hi Gail,

I must have closed the html wrong. Try this:

http://www.wired.com/cars/energy/news/2008/01/ethanol23

Chris

I found the $1 gallon link from Drumbeat. The article is here. It links to this site.

According to the article:

According to the web site:

Something's strange about this. If you're going to the trouble of making syngas by gasification, there are more direct and faster ways to make ethanol chemically than by using microorganisms. Syngas is short for synthesis gas, after all.

Cellulosic ethanol at sub $2/gallon by 2010? I'm sorry, but this seems to be a Bush administration pipe dream. Also, you obviously have to convert for energy equivalence of gasoline which has more btu's per liter. Let's see some sources please...

FWIW:ethanol BTU content is roughly what 70% of gasoline? If burnt in designed for gasoline engines thats close to what you will get. It is claimed that ethanol can be burned in higher compression engines, which would give 90% as much motive power as gasoline. The higher efficiency nearly makes up for the lower BTU count. Of course these would not be flexfuel vehicles, any attempt to substitute gasoline for ethanol would be disatrous. But eventualy maybe we will have these things.

Except for cellulosic ethanol, the primary energy would still come from fossil fuels. An energy revolution can only be based on CO2 free energy. The hydrogen will in all likelihood be produced with electricity from coal fired power plants. The critical bottelneck is whether CO2 sequestration can be put in place in time. I doubt that those 3$/kg hydrogen include the cost of geo-sequestering CO2.

NASA climatologist James Hansen:

Quote from a letter to Chancellor Merkel

http://www.columbia.edu/~jeh1/mailings/20080122_DearChancellor.pdf

A lot of big money seems to be going to Algae from sunlight as an energy source.

Greenfuels technology for this was pretty comprehensively critically demolished, on this blog and in other places, but it relies upon complex tanks and tubing, which is difficult and expensive to clean.

In some systems open ponds are held to produce better results - see the informative comments by JoSmith in this blog:

http://thefraserdomain.typepad.com/energy/2008/01/30-mgy-biodiese.html#c...

I found particularly interesting the idea of having a structure with ponds vertically arrayed.

Since algae need around 1/10th of full sunlight to grow, and many of the problems are to do with churning the algae broth to make sure it all gets the right amount, you simply pipe the sunlight down to each of the ponds, where the algae grows unconstrained and needs simply skimming off.

A lot of work to be done yet, of course, but it does seem as though the technology has potential.

Hi Gail,

I created an oil price forecast based on your elasticity and growth rate, plus Stuart's logistic fit of world production (recentered around 2005). I start the prediction in 1997 and we get these values in adjusted year 2000 dollars. It is a little low for 2008, but the direction is correct. Not bad for a price prediction made 10 years in advance. Do you think I can charge CERA's fee of $100,000.00 per copy?

Here is the price data I used:

http://www.eia.doe.gov/emeu/aer/txt/ptb0521.html

And here is a contrasting set of price predictions made by the IEA starting in 1998. As you can see, no matter how much prices rose, the IEA just kept predicting prices would remain flat (or decline). Real prices have left the top of the graph. This graph was taken from the Energy Watch Groups report on oil production. www.energywatchgroup.org

Nice work! You can charge what you want. The problem is selling the copies.

Why is production of ethanol always stated in gallons instead of barrels? Maybe because it is a larger figure?

That's my guess. Besides regular biofuels, there are three other categories of fuels with mandated inclusion amounts. These are also stated in billions of gallons per year.

I would think that imported sugar cane ethanol would count as "advanced biofuel". Cellulosic ethanol, if it has enough energy savings relative to gasoline/diesel, is the cellulosic ethanol product. I expect biodiesel meting the emissions requirements would have to be from reprocessed vegetable oil or animal fats. If there were an efficient way of making biodiesel from algae, this would work also.

I may as well point the obvious out but the API are a bunch of gutless wonders for inviting the list of right-wing and libertarian creep bloggers to the gathering. They obviously know that information basically goes into a black-hole of nothingness if you give something to Special Ed and his ilk.

At least glad to see Gail and TOD there but nothing from the equivalent of the progressive side to balance out Cappy and the NRO dimwits shows just how slimy the API is.

This ain't too hard for the API to make a balanced field. Here is an obvious list to choose from:

I can mention this list to Jane Van Ryan. She has been nice enough to invite more than one person from TOD.

As a practical matter, we energy-types tend to do most of the talking. I am not sure that the rest of the group understands things like "price elasticity" and "demand" in the economic sense, or that they have looked at the data very closely.

That's my point. They don't necessarily say anything because they know to STFU about writing about this stuff on their blogs. I follow Ed Morrissey fairly closely and the way the right-wing works, they basically all fall in step. So the thing about Ed is that through his radio shows and his blog, he never mentions anything about Peak Oil, preferring like his right-wing colleagues to talk about opening the Alaska Wildlife Refuge and the Iraq Oil for Food "scandal". The discussion always veers to how to serve the corporate interests and further the conservative agenda, which precludes any oil depletion topica.

Last time Ed wrote about this (he has been invited by the API twice now), he bad mouthed peak oil types as "scaremongers".

http://www.captainsquartersblog.com/mt/archives/015224.php

The first one I ever participated in, I noticed that other than me, things were definitely tilted to the right. I commented on it at the time. If I happened to be doing the inviting, I would invite the most hostile audience I could, and I would answer questions all day long. But that's just me.

I have skipped the past 4 or 5, because I don't want to seem too cozy with the API. I had intended to participate in this one, but I got called into a meeting just before the call was supposed to start.

We're counting on you Robert. This has to tilt at least neutral, if nothing else.

Distillate down Ethanol up. Wonder what they need to produce ethanol hmmmmmmm...

Ethanol is stupid it is a net energy looser...

converting a high energy product such as distillate into ethanol we are so F#$%@D

WE CANNOT GOT BACK TO HORSES they are the most efficient way to use bio fuels they only use 1/3rd of what they produce... THERE IS NO WAY WE CAN GO TO ETHANOL..

Over at

http://thefraserdomain.typepad.com/energy/

Where energy, especially alternative energy is the usual topic of conversation, we have become convinced that biogas (methane) is a much more sensible use for biologically derived energy. I think it is maybe twice as efficient to produce, and we can just feed it into the NG pipelines. But this would imply the end of BAU for automobiles although compressed NG could be used.

We need biofuels independent on fossil fuel inputs, in particlar oil, to run our farming machinery, otherwise we'll be in big trouble. Yes, biogas for CNG (compressed natural gas) is a good idea.

Farming machinery will be powered by mules.

Not engines.

Electricity is also a net energy loser worse than ethanol and no one complains about it. In fact many think it is the way out of the peak oil dilemma. No one is saying, except in straw man arguments, that we are "going to ethanol". Ethanol is a mitigating fuel more or less compatible with the current infrastructure of automobiles and grain production. It will reach a rather quick peak IMO. I find it odd that alternative fuels like ethanol must past tests of sustainability and such when fossil fuels do not have to meet this requirement. There is no more unsustainable fuel than oil. Life is not sustainable for us as individuals and yet we go on as though it were. Why can't we do the same with ethanol?

Electricity is also a net energy loser worse than ethanol and no one complains about it.

I tire of explaining this, but you can't use coal for the same things you can use electricity for. You can use natural gas, which is recycled into ethanol, for the same transportation purposes you use ethanol for.

Life is not sustainable for us as individuals and yet we go on as though it were. Why can't we do the same with ethanol?

Well, we surely will continue on with ethanol. It's far to embedded in farm politics. But the problem is that we waste time and money on false solutions, while the clock is ticking.

I agree in that electricity is a far better overall solution than ethanol. That said, ethanol contributes, to a much lesser degree. Ethanol is not an overall loss. According to a 2004 USDA study whose findings were repeated, ethanol produces 1.67 btu for every btu invested throughout its supply chain. So you get an energy gain out of the process.

For my part, I think that the end push should be for all electric transport. But ethanol, in my opinion, will play a part in buying time and keeping the system from crashing.

"According to API, "The figures cited here include gasoline that contains growing amounts of blended ethanol, amounting to well over 400,000 barrels per day in 2007. If ethanol is excluded from the calculations, total domestic oil deliveries for the year would actually have shown a half percent decline."

This is the first time I've seen this documented and quantified.

So blended gasoline does include ethanol.

I think the most interesting item is the 4% yearly increase in imports. Very soon, if not already, that will cease to be the trend.

South Africa goes for a bit of the technofix.

South Africa: Solar Traffic Lights to Ease Gridlock

http://www.nytimes.com/2008/01/24/world/africa/24briefs-traffic.html

A constant decline rate of -2.1% would be a curve on the graph, since your base is changing every year. Whether this would actually fit the data better, or be better for predicting the future, I don't really know.

If you look closely, you can see the curve. If you restrict the domain of most any function enough, it looks linear.

Mark B is correct. The line really is a curve - on this restricted domain, it doesn't look like one.

Know what I say? It's pretty simple. We need to use less energy. Note that this is different from being "More efficient". It means doing different things that make more sense if, for example, you care about the future of the human race.

I see all kinds of discussion and analysis about switching out oil for "x", making "y" more efficient, and building more of "z".

Almost nobody, even those who are aware of the dire situation at hand, ever says we need to use less. Make do with less. Buy less. Eat less. Buy used instead of new. It's always about finding a new or more efficient way to do the same thing - the greatest example of course being the obsession of pouring all of our resources into keeping car-craziness going.

Some suggestions that I think make sense:

* More localized living with shorter distances traveled

* (leads to) Better opportunities of getting off our asses and using our own two feet to walk or bike

* Living in smaller homes and using existing larger homes for more people

* Turning off shower water when you're not rinsing

* Eating more fruits and vegetables and less meat

The real shame in all of this IMO is that we don't need to buy or build anything to slow the downfall of fossil-fuel powered life. We simply need to learn that we are going to have to make do with less, and then do that.

It's coming anyway.

Sadly, American Joe Six Pack is nowhere near comprehending this, and none of his leaders dare mention it, because if they did, poor Joe wouldn't vote for them. Even worse, Joe's nowhere near caring. He just wants to keep driving his F-150 everywhere, powered on gas that costs no more than 99 cents a gallon, without any consequences. So we'll continue our climb up the cliff we're about to fall off.

So, everyone ready?!?!

1!

2!

3!

CONSUME!!!!!!!!!!!!!!!!!1111111111111!!!!1!!1!11!!

You make a good point. But with an economy that is based on endless growth, what can you expect?

Single "rogue"(aren't they always rogue) traders being blamed

for the loss of 7 billion Euros.

We'll need $2-4 trillion by Summer to cover this derivatives insolvency

crisis.

And SocGen's up to their necks in this.

Expect financial collapse as the ratings agencies are under severe

pressure to hold AAA ratings on bankrupt entities.

Disaster.

But that certainly isn't what I want to happen. I don't want to see a die-off, though I do think it would be wise to start having fewer kids - say 1 batch or none. I make a very sincere effort to be more responsible, not just at home but at work and wherever else I may be too. I make an effort to educate people about it. What we really need right now is a general understanding that we have to stop infinite consumption in our finite Earth, whether that involves fundamental changes in our economy or not. Taking ten million plastic bags from the store, starting our cars early in the winter so they are cozy, using disposable batteries when rechargeables can easily be used instead, and sending all of our waste to landfills are a few examples of things we shouldn't be doing.

We need to become less consumer and more citizen.

The API does not include natural gas liquids in their calculations of petroleum production.

This week the EIA reported U.S. production of NGL's at 2,427 million barrels per day. This number was included in total liquids calculations shown by the EIA. There was some confusion as oil production was declining during some years, but overall liquids numbers continued to rise.

NGL's are more valuable than crude as they were lighter and required less refining to produce gasoline. It is surprising that ethanol was included in this report but NGL's were ignored.

That should be read 2.427 million barrels per day.

I'm not sure why the API didn't include NGL's in their numbers. NGL's were actually more disrupted by the 2005 hurricanes than crude oil. This is what the graph of US total liquids production looks like. The decline rate is lower - only 0.9%, because of the inclusion of NGLs.

I don't think ethanol does much of anything to the production trend. It mostly replaces MTBE. MTBE was about 300,000 BPD in 2000, and ethanol 100,000 BPD. Now Ethanol is a little over 400,000 BPD.

Hi Gail

Thanks for another fine, informative posting! I commend you for addressing the importance of clearer terminology - i.e. "product supplied" rather than "demand".

In a similar vein, I urge everyone to use the word "need" (and variations thereof) very sparingly, and use variations of "want" instead. We-the-people may "want" 20-odd million barrels of oil per day - and we may actually CONSUME that much oil - but we do not "need" all of it. Yes, we currently "need" some petroleum to get to work, produce and ship our food, power Medflight helicopters, etc. But playing on gasoline-powered toys, trucking bottled water and fresh lettuce thousands of miles, and mowing millions of acres of lawn are not "needs" - they are WANTS.

Meanwhile, thanks to much higher oil prices, many people in poorer nations are no longer able to purchase oil for their honest-to-God NEEDS.

Regarding the API speech by Red Cavaney - we need more than conservation, we must rediscover modesty, frugality, and enlightened self-restraint. And decoupling employment from resource consumption is the great challenge before us.

Hans Noeldner