DrumBeat: June 15, 2008

Posted by Leanan on June 15, 2008 - 9:12am

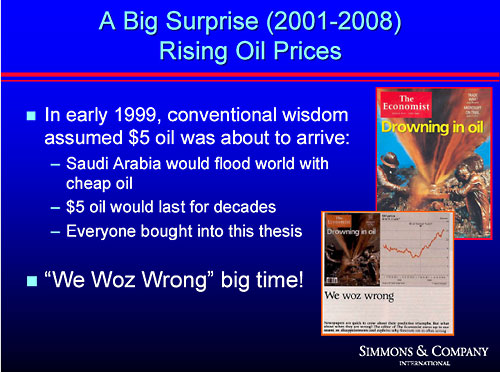

New Matt Simmons Presentations

●Quo Vadis Energy? (Will Dawn Follow Darkness As Twilight Of Energy Fades?)●The Unknowns In 2008: “Is $120 Oil A Blessing Or A Curse?” And Has Oil Peaked

●Oil And Gas “Rust”: An Evil Worse Than Depletion

Saudi Arabia yet to determine output hike size - TV

DUBAI (Reuters) - Top oil exporter Saudi Arabia was yet to determine the size of a planned oil output increase, Al Arabiya Television said on Sunday citing an oil ministry official."The kingdom was yet to decide the volume of the planned increase in its oil output, the official said, adding that determining any increase in output levels before the meeting of consumers and producers in Jeddah would be premature," Saudi-owned Al Arabiya said.

Yes, it’s a crisis – but liquid gold will also oil the wheels of invention

The telephone line was crackling when Daniel Yergin called me from Kazakhstan on Friday but there was nothing unclear about his message: oil is the new gold.It's the new gold because the black stuff has become a hedge against the dollar, a new asset class of its own. Yergin also says the price of oil is close to reaching what he calls its "break-point". This is when the price – the latest is $136 a barrel – triggers a sea-change in attitudes from governments, to car-makers to consumers. He reckons it won't be long before serious money goes into alternative energy sources and car-makers stop making vehicles like the Hummer completely. Consumers, he notes, are already filling their tanks with the same care as they would if petrol were, in fact, liquid gold.

Fuel strike: Tales from the forecourts of Britain

As the effects of the fuel tanker drivers' strike starts to bite, David Harrison reports from the front line of the dispute and finds drivers stoical and the strikers resolute.

Tempers fray as Shell strike begins to bite

Tempers frayed and frustration rose with the lengths of the queues on garage forecourts yesterday, with people hurling insults and vehicles literally scraping past each other as motorists jostled to get to the pumps.With striking workers continuing to blockade Shell petrol depots around the country, there were growing reports of panic buying and people travelling dozens of miles just to fill up. Supermarkets have said they struggled to meet demand, and some garages are predicting they will run out of fuel.

Australia: More lay-offs as energy crisis spreads

WESTERN Australia's gas crisis will hit hard this week as more businesses face the decision to shut down and lay off workers because of escalating energy costs, the state government says.

Australia: Consumer to carry cost of developing gas reserves: economist

An economist has backed the Federal Government's move to increase the pressure on energy companies to develop available gas and oil reserves, but says it would come at a cost to consumers.Federal Energy Minister Martin Ferguson was in Perth yesterday and said he would apply "use it or lose it" legislation more rigorously to encourage companies sitting on undeveloped reserves.

Asia's Subsidies Worsening Supply Crisis, Nestle Says

(Bloomberg) -- Asian governments should scrap food subsidies because they are causing price increases and heightening a global supply crisis, said Nestle SA, the world's biggest food company.

Asians Especially Vulnerable to Food Shortages and High Prices

With more than 60 percent of the world's undernourished people living in the Asia-Pacific region, the soaring cost of food is pushing many back into poverty as they try to cope with the increased challenge of putting food on the table.

Last week, the House of Representatives gave a big boost to the future of passenger rail service in this country. By approving the more than $14 billion, five-year spending plan by a veto-proof majority (which followed similar bipartisan action by the Senate last fall), Congress has not only taken a major step toward ensuring the survival of Amtrak but has also opened up opportunities for improved and expanded service across the nation and in Maryland.Trouble is, it's not enough.

Australia: Drivers slow to adopt ethanol

Only 26 per cent those surveyed said they buy ethanol-blend fuels, with 41 per cent of drivers saying they were unaware that the biofuel was suitable for their car and 26 per cent saying they were concerned about possible negative effects on their vehicles.

Freeing ourselves from the oil trap may be more realistic than we realize

For the purposes of answering the question about whether it is possible for the U.S. to be both carbon free and nuclear free, Makhijani assumed that nothing about our lifestyle would change – we wouldn’t ride buses more, build smaller houses or travel less.“If we do those things, it will be easier and faster, but I didn’t go there,” he said.

With gasoline topping $4 a gallon in many places, there's no shortage of advice from the financial experts: Try carpooling, biking or walking. Cut costs in other parts of your life. Eat out less and stop shopping. Carefully choose the brand and type of gasoline you use because some are more cost-efficient than others. Or just get rid of your car.Then I heard about "hypermiling," which involves changing your driving behavior to coax better gas mileage out of your car. Hypermilers do such things as drive slowly, brake as little as possible and limit their use of the air conditioner to save fuel.

Kuwaiti MPs file bill to cut oil output

KUWAIT CITY (AFP) - Opposition MPs filed a bill on Sunday that could effectively slash Kuwait's oil output if it is found that the Gulf state's proven reserves are actually much lower than official estimates.The proposed legislation, signed by four MPs, stipulates that annual oil output from Kuwait, OPEC's fourth largest producer, should not exceed one percent of proven reserves.

Saudi Arabia May Announce Oil Output Increase June 22

(Bloomberg) -- Saudi Arabia may announce an oil output increase at a meeting it will host in Jeddah on June 22 for oil producers and consumers because customers are asking for more crude, an OPEC official said today.There is more demand for Saudi oil from ``all over'' the world, the Organization of Petroleum Exporting Countries' official, who asked not to be identified, said in a phone interview. He declined to comment on the size of the possible increase, and denied reports that the Saudi Oil Minister Ali Al-Naimi would make a statement today on oil production.

South Africa: Why is the cost of living going up?

Welcome to Peak Oil! The basis of the argument of Peak Oil is that at some time during the extraction of oil from the oil fields there comes a time where one reaches peak production. There is a finite limit to the volume you can repeatedly pump out in one day, and once that peak is reached, you are on a downward trend for that field. Further, as one removes the oil from an oilfield that is in decline, additional discoveries of oil-fields are required to keep up with the demand. In the last few years, worldwide Peak Oil has been on the cards, with many predicting that it would occur in a window period, ranging anywhere from 2000 to 2040. By all appearances, worldwide Peak Oil appears to have been in 2005, around May. Since May 2005, the worldwide conventional oil production peaked at around 73 million barrels per day, with the balance (about 13 million barrels per day) made up through unconventional means. Adding to the predicament we face is the fact that the major oil fields have all peaked: Ghawar in Saudi Arabia, Cantarell in Mexico, Burgan in Kuwait; in fact most of the large oil fields have peaked with one exception, the Kashagan oil field in Kazakhstan, which was discovered in 2000.

Navies are facing a crises because of rising fuel costs. Last year, these costs went up fifty percent, and another 25 percent jump is expected this year.

Interview: Jerre Stead, chief executive of business information supplier IHS Inc.

Q: What about supplies? Where do you stand on the "peak oil" theory that production will peak in coming years and then gradually decline?A: Nobody doubts that oil is a finite resource, but the debate today is about the scale of that resource and how much of it remains to be produced.

We have conducted extensive analysis of future productive capacity based on developable oil reserves and future growth through exploration and technology advances. This indicates that oil production can grow until at least 2030.

Apocalypse Now? To hell with debate, what can the simple folk do?

High fuel means food will rocket in price. You CAN grow food in your garden, safely, with good nutrition, even later feed the scraps to a couple of chickens. Those who have no garden, consider growing on your window sills, balconies, flat roofs. Even if you only grow herbs, you would have something to barter with others growing other things.

One year ago, the Peak Oil Task Force delivered a report to the City Council, but the whole region needs to mobilize. Think of it as a commuter version of "Some Enchanted Evening." At a recent graduation party in Cedar Mill, two neighbors squint at each other across a crowded kitchen island. Kinda scary, isn't it, they agree, about those gas prices headed toward $5 a gallon. Then a bit shyly, they circle a new question. Maybe it's time to take it to the next level. Both, they know, work downtown. Both leave home and return each day at roughly the same time. Turns out, they even park right next door to each other. Maybe this is a match made in post-Peak Oil Heaven.

That Buzz in Your Ear May Be Green Noise

If even well-intentioned activists are feeling overwhelmed, the average S.U.V. driver must be tuning out. And some environmentalists fear that the public might begin to ignore their message before any meaningful change can be accomplished. For them, it’s a time to reassess strategies and streamline their campaigns before it’s too late.

Localizing a global oil problem

You've heard it said that the world is flat – that today, all economics is global. Time to rethink that in light of the global energy crisis. The world is being rerounded, its horizons shrinking. Localism is the new globalism.Cheap, abundant and accessible fossil fuels allowed us to create a world in which we are relatively unconstrained by geography. That era is passing into history, and it is not likely this process can be reversed.

There is simply not enough oil being extracted quickly or inexpensively enough to meet global demand – nor, in all likelihood, will there be again. This is called peak oil. Last week, economic analysts said Americans have never before spent a greater portion of their income on energy costs. The sooner we come to terms with this reality, the sooner we can begin taking serious steps to adapt.

Malaysia Faces Bankruptcy If Oil Subsidy Continued - Finance Minister

HULU TERENGGANU (Bernama) - The country can go bankrupt if the government continues giving oil subsidy to the people, in order to cope with the global oil price hike, without sound measures to tackle the problem, said former Finance Minister Tengku Razaleigh Hamzah.He said based on information from Petronas and the oil production rate of 600,000 barrels per day currently, he opined that the country's oil and gas reserves would not be able to meet the demand in the next five years.

"After this, Malaysia will have to bear a high cost and depend wholly on oil imports to meet the local demand.

Oil: does anyone know which way the wind blows?

One of the more dire predictions comes from Jeff Rubin, chief economist at Canadian bank CIBC: "Four to five years from now, airports like Heathrow and Gatwick will be half-empty. North American airlines are already passing on fuel surcharges to customers. People ain't going to be flying because of the fuel costs, so half the airlines are going to go bankrupt."Mr Rubin says the only solution is for "people to get off the road". With supply not growing and the "world thirstier for oil than six years ago", he forecasts $225 a barrel by 2012. At that price, American motorists will pay the same amount to fill a tank as their British counterparts do today.

High oil prices are based on fundamentals not speculative bubbles

I don't wish to be rude. Al-Naimi knows a lot more about oil than me. But "fundamentals" are very much driving the market. And even if we do see more Saudi oil in the coming months, it's unlikely to lower the price of crude.

Oil crisis: £100 ($195) to fill up the tank? Just get used to the idea

Queues at petrol stations may be a chilling taste of things to come. Prices are soaring, experts warn of shortages ahead, and some say the world is running out of fuel. Already people are getting out of their cars and finding other ways to travel, while less scrupulous drivers are stealing diesel. Has the motor car just stalled - or are our driving habits changing for ever?

'North Sea oil will last for 100 years'

The north sea will continue to provide oil for another 100 years, twice as long as previous estimates, according to industry analysts.Dr Richard Pike, a former oil industry consultant and now the chief executive of the Royal Society of Chemistry, said: "Rather than only getting 20 to 30 billion barrels [from the North Sea] we are probably looking at more than twice that amount."

The Great Oil Deception: Part Two

"It is getting much more expensive to find Oil these days."While it is true that it is getting more expensive to find oil, one has to examine whether that increase is of a permanent nature as many argue. The reason that it is getting more expensive to find oil is mainly because service, drilling and other costs are sharply increasing. While this may seem like a circular argument at first, my intention is to demonstrate that the cost of finding oil is rising to a cyclical peak, and that it is not secular in nature.

Oil prices: Correction on cards

There are indeed parallels between the late stages of the dotcom mania and the current oil boom. Both mega trends were rooted in a powerful economic shift; the dotcom boom was associated with several technological breakthroughs and new killer applications that change the way we live and do things, the oil-led commodity boom is attributed to the emergence of China and India as economic powerhouses, and the decoupling of the emerging economies from the developed world.

With crude oil prices skyrocketing, companies are squeezing every ounce out of Bay area wells

Andreason said oil is getting hard to find in Michigan, and throughout the world.He and other area oilmen say they believe in the theory of peak oil, postulated by Shell Oil geologist M. King Hubbert, who predicted in 1956 that U.S. oil production would peak by 1970. Later, Hubbert predicted world production would peak by 2000.

"I think we're either at it or very near it," Andreason said. Alexander Cohn | Times PhotoJordan Hicks of Evart attaches valves that will connect a methanol scrubber, used to keep natural gas from freezing in cold temperatures, to the treater in the background.

"I've been in this business a long time, and I've worked all over the world, and I see the same thing everywhere. It's just harder to get out of the ground, even in the Middle East."

Gas Station Owner Joins Wisconsin Protest

With gasoline costing $4 a gallon, more than 20 union members rallied in front of a Madison gas station yesterday to protest John McCain’s proposed tax cuts for Big Oil while average working families strain to pay ever-rising prices....The gas station owner came outside and, instead of asking the protestors to leave, told them the skyrocketing gas prices had hurt his business. He even picked up a sign and joined the rally before going back to work.

Adapt or die: Future of big SUVs

NEW YORK (CNNMoney.com) -- Until recently, big SUVs had resisted the sales declines hitting their smaller, mid-size brethren. That was because large SUV drivers were hard-core - they really needed interior room and pulling power, and they weren't about to switch to car-like crossovers.But with skyrocketing gasoline prices, many big SUV drivers are rethinking those needs.

Costs and long equipment waits dog gold and all mining output expansions

High oil prices may spell the death knell for major new additions to global gold reserves, according to one of Australia's foremost equities analysts. Addressing the 2008 Paydirt Gold Conference in Perth, Western Australia, earlier this year, corporate analyst and equities market author, Peter Strachan, said oil-reliance could hamper future growth in gold production volumes.

Old Farming Habits Leave Uzbekistan a Legacy of Salt

Uzbekistan, a land-locked country that was once part of the Soviet Union, is home to one of the biggest man-made disasters in history. For decades its rivers were diverted to grow cotton on arid land, causing the Aral Sea, a large saltwater lake, to lose more than half of its surface area in 40 years.But old habits are hard to break, and 17 years after the Soviet Union collapsed, cotton is still king and the environmental destruction continues unabated, cutting into crop yields.

Starting to Think Outside the Jar

Glassmaking is a based on old, stable technologies that require lots of materials and energy. The basic furnace, which melts sand into glass at extremely high temperatures, hasn’t undergone a fundamental change since the 1850s. Furnace designers have long contented themselves with small improvements, such as using pure oxygen to improve energy efficiency.Today, glassmaking faces a technological upheaval that offers a reminder that “it is a mistake to assume that older technologies are less dynamic than new ones,” says David Edgerton, a historian at Imperial College in London and the author of “The Shock of the Old,” a history of the evolution of pre-electronic technologies in the 20th century.

China Increases Lead as Biggest Carbon Dioxide Emitter

China has clearly overtaken the United States as the world’s leading emitter of carbon dioxide, the main heat-trapping gas, a new study has found, its emissions increasing 8 percent in 2007. The Chinese increase accounted for two-thirds of the growth in the year’s global greenhouse gas emissions, the study found.

King Coal Country Debates a Sacrilege, Gas Heat

POTTSVILLE, Pa. — Over the last 150 years, Schuylkill County has been famous for a rare hard coal called anthracite that fed the explosive growth of the East Coast during the Industrial Revolution, fostered the rise of the United Mine Workers union and powered many of the factories that supplied troops through both world wars.Now county officials here are considering the unthinkable: converting from homegrown anthracite to natural gas at the county courthouse and prison. The proposal has led to outrage and soul-searching from state lawmakers and county residents who say it insults local history and sends the wrong message about the area’s leading export, which has been in decline for years.

Malthus redux: Is doomsday upon us, again?

That article is not properly taking energy into account.

Expressing the problem is dollars is entirely the wrong way to think about it.

Expressing the problem is dollars is entirely the wrong way to think about it.

but when all you have is a dollar, all problems look like they can be solved with economics.

Indeed...

But when water costs 150 dollars a barrel, things like pipelines and desalination plants might also cost more. This is the cranial fallacy most people make: they equate currency with value. The only currency worth anything now is oil. Time and time again one hears the continual myth that this and that alternative energy is just about to become 'affordable' once oil hits 80 ... a hundred ... or was it 120 dollars a barrel? Now we're at 140. Where are the promised, much hyped solarpanel farms reaching to the horizon? The coastlines dotted with endless windmills? The vast untapped mountains of 'unconventional' oil waiting to be dug in for endless oil? They are all victims to this fallacy. As the oil price has come up, so has everything else, from building materials (steel and copper) to manufacturing and transportation. At every step and stage and price of oil has inflated their costs and wiped away the competitive price difference. Tainter and the laws of unsubstitutability and diminishing marginal returns are here!

When oil barrel costs 200 - everything else will cost too much - and demand destruction will kick in to hold the price - for a while - since when you're past the peak, its all downhill from there - the question is - will demand destruction outpace production decline at any stage to actually lower the price - I'd say no IANAE/G

- Ransu

Crude oil as the liming factor for our complex civilization.

This is how it plays out. I'm no economist and don't know the proper terms or even if there's already a textbook that explains this much more throughoutly... (except maybe Tainter a little)

The principle of unsubstitutability states that as resource depletion progresses with increasing demands of growing population and complexity, a point is reached where ones abundant resource must be replaced by another either because it has peaked or because our demand has outpaced its extraction rate - the same thing really. Inevitably we always have a number of choices which are worse than the original - more expensive, less liquid, less plentiful, poor quality etc. And this keeps happening over and over again. This is the principle of unsubstitutability and no where is this more apparent and dramatic as in the case of crude oil - the golden liquid - only a few pence a cup - but able to transport us and our hunk of junk miles and miles.

Now that we have established that we are utterly dependent of crude oil, we can move on to the principle of diminishing returns. As our extraction rate becomes unsustainable and our hunger and dependence of the stuff just keeps going up, we inevitably start paying larger and larger share of our income, our scares resources, our opportunity - to this black liquid. The problem is that everything else is also dependent on the price of that liquid and the increases in costs go down the chain and branch out at every direction.

And now here's the catch that people miss out - there's a positive feedback from the mirror effects - when transportation costs increase due to increase in oil price, so will the transportation costs to do with surveying, drilling, pumping, refining, and distributing oil itself. In fact with every oil price increase, there will be a converging geometric series of price increases in all aspects of getting more black liquid, which will then echo back into the oil price and start down the same chain again. Currently following this loop back and forth fortunately converges towards zero - and it has to - because the only other mathematical alternative would be infinity - an infinite price for a barrel of oil.

Another way of putting it - and a much better way - which the economist don't like one bit - is to play this out in terms of Energy Returned on Energy Invested or EROEI. As our civilization matures towards a point where we spend all our time, energy and infrastructure just producing oil just to consume it - and consuming oil just to produce it - our other needs and become exceedingly expensive and downright impossible to meet. Food, water, housing, utilities, maintenance of infrastructure. And their complexity no longer produces more efficiency - so called advances in them merely patch up immediate emergency and creates more emergencies for the future. Deforestation, soil-depletion, water-scarcity, they haven't gone away, in fact they are getting worse as we head into the panic mode...

My personal estimate is - don't watch the oil price - watch the food prices - this is a Malthusian train heading for the Liebig's gorge - all cars are linked so its purely academic which of them crashed to the bottom first.

- Ransu

Inevitably we always have a number of choices which are worse than the original - more expensive, less liquid, less plentiful, poor quality etc.

Hold up here. This analysis falls flat when one considers whale oil VS kerosene.

It is possible the same can be said for wood VS coal - the volume of coal may have masked the dirty-ness VS wood.

Not to defend the entire argument that was being made BUT...

My take on it is that these things are neither good nor bad. It's basically a matter of what kind of stewards we are of the resources we have. This progression of resource usage versus our ability to discover replacements that won't destroy the other resources we depend upon, in a global economy with enormous momentum, is the real issue.

The era of cheap energy has fueled something spectacular comparative to all of human history. Civilizations have collapsed throughout history for many reasons including resource depletion. So it's not a stretch to imagine an economic butterfly effect with oil at the root of it. The world isn't going to disappear and the entire population won't die due to energy issues. However, things can get very bad, very quickly if we don't catch some lucky breaks along the way.

For all of the technology we have and for as much as humankind has evolved, we still are babes in the woods as far as societal structures are concerned. We've come a long way, but act too big for our britches (so to speak). I don't believe in complete doom and gloom after the Y2K fiasco. I don't have a great deal of respect for certain people in the community who are making money off of it either. I won't name names, but the are people who were in it for a buck back then and they are in the peak oil debate for a quick buck now.

I think it's good that a debate is taking place because it's our complacency that endangers us more than peak oil, nuclear states, or chicken hawk neocons in government. It's easy to believe something that is self defeating when we have imperfect knowledge of all the factors in play.

no we aren't. it's only 30% of our energy and we waste half of it just going to work by ourselves in big huge cars. we have plenty of fat to trim. electricity, conservation and demand destruction will ensure plenty of oil to get us where we need to go.h

Plastics, lubricants, pharmaceuticals, pesticides. nuff said.

we have recycling, reducing and reusing. we can make lubricants with other materials.

Don't you think the whales and seals have suffered enough in the past?

Yep.

The rapeseed plant hasn't finished it's suffering yet, nor have soybeans.

Graphite makes an excellent lubricant in very small quantities.

We have plenty of resources for our needs, it's just that most people have needs and wants mixed up and think they need that 40" flat screen TV.

have you followed solar stocks lately? they have zoomed up? solar and wind are growing at phenomenal rates. however, change won't happen overnight and I think you're setting up a straw man with the "endless" windmills.

do you see boone pickens is building huge windmills? that the largest windmill ever has just been constructed?

http://www.treehugger.com/files/2008/02/enercon_e126_largest_wind_turbin...

T. Boone Pickens Gets Into The Texas Wind: 4,000 Mega-Watts Worth

http://www.treehugger.com/files/2007/06/t_boone_pickens.php

or my my favorite, solar on big box stores! the irony.

Turning Big Box Stores into Solar Power Plants in California

http://www.treehugger.com/files/2008/03/big-box-stores-roofs-solar-power...

those much derided big box stores that peak oil is supposed to do away with may actually be little power plants. some day they may be big greenhouses that grow food with solar panels on the roof. btw- electricity can be used as a fuel. you take you electric bike to wal-mart to buy food and charge off the panels while you're there. brilliant.

the price of commodities tend to run together. most mines, even in the this era of high oil prices, are now opening up because the costs of commodities has gone up. they won't always run up at the same time but if mining costs are too high the mine shuts down until they come back in line. we must remember that there is always the demand side of the equation too. as the costs of oil has skyrocketing gypsum board and lumber are mired in the doldrums. we had a surplus of lumber even though oil is high. the companies are eating the costs and some will go out of business until supply and demand are back in balance.

can you actually prove that using a public companies earnings and annual reports?

of course they can most of the time, how else would we solve them?

why is it the only time economics gets respect around here is when high oil prices PROVE peak oil?

wake up John! Peak Oil isn't proven by economics. It's a mathematical fact. Its precise timing is up for debate and this site has seen extensive and wide ranging studies over the years of all aspects of resource depletion from theoretical to down to earth practical points of view - for example field surveys from satellites, analysis by oil geologists, public statistics and insider papers of the very oil companies producing the stuff - all pointing to imminent or post-peak situation.

As of economics themselves - even without peakoil, current status-quo economics is past the point of damage-control - debt based fiat/banking systems, uncontrolled mindless global market mechanisms - unable to respond or insure against deliniar events, unpredictable consequences, positive feedbacks. If peak oil and global warming we're at our door step, economics would be there just behind them to take us down. Start by reading Tainter's analysis on diminishing marginal returns - The Collapse of Complex Societies, ISBN 978-0-521-38673-9

and yet high gas prices are cited as proof of that mathematics. it's all about supply and demand.

peak whale oil wasn't the end of lighting.

Sure. Microeconomics is well understood and proven to work at the first order.

Anything beyond that and you are dealing with a cross between psychology and meteorology of which many professional practitioners seem immune to confronting the nature of their field and insist on applying pretty formulas that the mathematicians and physicists leave lying around willy-nilly looking for a curve fit instead of a fundamental comprehension of what in the Dickens is actually happening on the ground and building their own.

And peak whale oil indeed, we just managed to find a bigger whale to pull the oil from.

Whale oil wasn't nearly as important as petrochemicals are to modern society and global trade. Global trade is critical for the US considering that we don't actually make much any more.

Economics doesn't solve problems. People solve problems. Economics is the solution people cam up with to address a problem, how to exchange goods & services. Economics loses my respect when it becomes a religion. People appeal to the "invisible hand" as if it were a deity who was going to intevene and fix whatever is wrong.

As long as demand is reasonably elastic & supply is effectively unconstrained, an economy will fall into something of a steady state (a.k.a. status quo, BAU). However, when supply becomes constrained (or demand outstrips the possibility of adequate supply), you start getting into "fat tails", and conventional economic theories (religions) become essentially worthless.

it does. look around it has given us just about everything we see.

the contempt for economics is always simmering under the surface. doomerism is a religion also.

Spoken like a True Believer.

Blessings of the State. Blessings of the Masses.

Thou are the subject of the Divine.

Let us be thankful we have Commerce.

Buy more. Buy more now.

Buy And Be happy

yes, thank god we have commerce. ironic that you use a computer to voice your contempt of economics...as if cheap computers fell out of the sky...

"buy and be happy"

well I don't know about that but whatever.

By economics, you do mean neoclassical capitalist economics, don't you? None of that pinko John Maynard Keynes heresy.

Give me your economic explanation for the Great Depression, and then tell me why the classical economists didn't see it coming.

All you need to know about the Great Depression is here.

America's Great Depression by Murray N. Rothbard

http://www.amazon.com/Americas-Great-Depression-Murray-Rothbard/dp/09454...

my personal causes of the Great Depression.

1. natural boom and bust dynamics made worse by #2 and #3.

2. Federal Reserve's expansion of the money supply

3. the government responses to the depression

IMO, the Austrian school is the most reality-based economic system out there. However, Libertarians do have a tendency to turn it into a political religion.

The proximate cause of the Great Depression was WWI. Britain & France had bankrupted themselves and were deeply in debt to the US. Part of the reason the Treaty of Versailles was so harsh was because Britain & France wanted to use German reparations to repay American bankers. Germany didn't have any money, being bankrupt as well, so it borrowed from the US to pay Britain and France, so they could pay the US.

This is the sort of circular debt scam bankers love. And the resulting debt bubble did drive some wild economic growth in the 20s However, the banking system collapsed after Germany defaulted. The US was still trying to patch up the reparations issue in 1929 (q.v. the Young Plan). Central banks were part of the problem, but the Great Depression was not an American phenomenon. The US was essentially collateral damage to what was fallout from WWI.

The Austrian school economists are the absolute worst when it comes to reality checking their pet theories. The insistence that economics ends at the Thought Experiment stage is their big weakness, as anyone who may suggest the possibility of testing one of these theories against reality is promptly shouted away as vigorously as an Abiotic Oil cornucopian would be here.

Thought Experiments work beautifully for picking out ideas that are obviously wrong but they have serious problems when it comes to picking the right idea out of a set of plausible alternatives.

They also have big problems when applied from invalid starting assumptions, and the Austrian School has an abundance of those kicking about their living room as well. The hubris that because the Chicago School of economics is obviously wrong and since they aren't the Chicago School they must be right is only the most striking of these assumptions.

I'm not sure what part of my post was doomerish (unless you think the idea of limits to capitalism equates to doom), but I agree that doomerism can be a religion. Modern apocalyptic trends very much has their roots in Christian eschatology (however, just because something has religious roots, doesn't mean it is wrong).

On the other hand, I realize that free-market capitalism requires certain special conditions (lack of government interference, relative peace in the home country, including elastic supply & demand). You can call that "contempt" I suppose. I call it being reality based.

Modern world:

God = Money

Creed = Free Market Capitalism

Churches = Shopping Malls

Congregation = Consumers

Morality - none just profit.

"With the decline of the primitive world, and with the rise of kingship men came to imitate kings in order to get power. ... And so the pursuit of money was also opened up to the average man; gold became the new immortality symbol."

"Let us see how the ritual fascination of money began in the ancient world, and how it took over as an immortality focus in itself. One of the fascinating chapters in history is the evolution of money -- all the more so since it has yet to be written, as (Norman O.) Brown says. One of the reasons it isn't written is that the origin of money is shrouded in prehistory; another is that its development must have varied, must not have followed a single, universal line. Still a third reason touches closer to home; modern man seems to have trouble understanding money; it is too close to him, too much a part of his life. ... But beyond all this, ... the reason money is so elusive to our understanding is that it is still sacred, still a magical object on which we rely for our entrance into immortality.

"Put another way, money is obscure to analysis because it is still a living myth, a religion. Oscar Wilde observed that 'religions die when one points out their truth. Science is the history of dead religions.' From this point of view, the religion of money has resisted the revelation of its truth; it has not given itself over to science because it has not wanted to die."

"Hocart ... suggests a common origin for his the gold coin, the crown, and the halo, since all these represent the sun's disc. ... The great economist Keynes agreed that the special attraction of gold and silver as primary monetary values was due to their symbolic identification with the sun and the moon, which occupied a primary sacred place in the early 'cosmic government' cosmologies."

"Currency, then, seems to have had its origin in magic amulets and magic imitations of the sun which were worn or stored because they contained the protecting spirit powers. If gold had any 'utility,' as Hocart says, it was a supernatural utility."

"If gold was sacred, we can now understand -- with Simmel and Hocart -- how it was that the first banks were temples and the first ones to issue money were the priests. With the ascendancy of priestcraft it became the priests themselves who monopolized the official traffic in sacred charms and in the exchange of favors for gold. The first mints were set up in the temples of the gods, whence our word 'money' -- from the mint in the temple of Juno Moneta, Juno the admonisher, on the Capitoline Hill in Rome. Forgery was sacrilege because the coins embodied the powers of the gods and only the priests could handle such powers; we get the same feeling about counterfeiters today, that they are practising an unspeakable usurpation of hallowed powers.

"The temples, then, were clearinghouses for money transactions, just like banks today.

"It was surely not lost on the priests -- the first leisure class -- that the tiniest quantity of sacred gold-power could bring in huge amounts of food and other stuffs. Priests may have talents for dealing with the supernatural, but they have very human appetite (and often lots of it); and if they have the leisure to ply their trade, it is because since earliest times they have convinced their fellows that it is important to assure that leisure by bringing part of the fruit of the sweat of their brow to the priests. And so the food producers must have brought food to the temples in exchange for prayers and sacrifices being performed on their behalf. Also, it must have worked the other way too: gold was a fee paid to the priests for his intercessions with the invisible powers. ... Whence the tradition of the earliest coins being imprinted with the images of gods, then divine kings, down to presidents in our time. All visitors to the most holy temples could bring back with them gold encapsulations of sacred power that would keep them safe throughout the year."

The sun god of Egypt held out the salary of immortality. For the faithful who not only believed that you can get something for nothing in this universe, but also happened to have handy a few of his earthly golden tokens, he delivered a bonus right here on earth. The bonus was even better than the salary because you could enjoy it immediately. That something for nothing was compound interest on loans. The pyramid says it all.

~Ernest Becker, Denial of Death

We don't solve physical problems with economics, we solve them with physical work.

Economics can play as a mediating party, but do NOT confuse it with physical work.

If you have trouble understanding this distinction, I understand Ayres' paper Accounting for Growth.

http://www.iea.org/textbase/work/2004/eewp/Ayres-paper1.pdf

As for getting love, science gets love here. Most of economics does NOT fall into that category. Real science makes singular, non-random and accurate predictions a priori, not post hoc.

Most economic theories makes multiple conflicting predictions and plenty of economists make them post hoc (completely useless reductive bias). Some of those economic guesses are bound to be half-right, but science it does not economics make.

That's why, no love - at least from me - at least for most branches that are NOT based on physical reality.

Now lets see what John15 has to say on actual privatized water.

http://www.washingtonvotes.org/2005-SB-5113

http://www.citizen.org/documents/Bolivia_(PDF).PDF

http://www.pbs.org/frontlineworld/stories/bolivia/

(Jonh15 can't seem to be bother to comment on what he advocates - privatized water. )

no it isn't because that's how we allocate scarce resources. how else would people give up SUVs or stop building 10,000 square foot homes?

True but $150 a barrel for water suggests a fiat currency debased to worthlessness, knocked way out of stable value range.

You aren't directly addressing the point in relation to the original article; if you've got an economics argument that actually addresses it I would be interested in it. Implicit in Leanan's point is that expressing prices in dollars lacks any contextual information: at that point will I be wallpapering my room with dollar bills because they're worth so little or will the US economy be in such a depression that anyone who's not rich can't afford to spend 150 dollars on anything? More importantly, it lacks relative context: if water is 150 dollars a barrel, what will a barrel of oil or a kilowatt/hour of electricity cost? In particular, what if they're even more expensive than now relative to the price of water? At least analysing things in terms of energy suggests that the energy required for building and maintaining pipes piping water from melting icebergs the economic system will probably find it preferrable to try and reduce population and expend the energy on less intrinisically energy intensive things than pipe arctic water.

One of my prejudices is misuse of the term "infinitely", so I'm already disinclined to think the article writer has any clarity of thought, but if there's a more reasoned response as to why talking about dollar values in isolation is meaningful I'm interested.

We allocate scarce resources according to a value system, one of which is the fiat monetary system. When that system becomes unstable, ie. the potential future value of the currency uncertain, people turn to other forms of currency: other currencies, gold, silver, commodities. However other much more important properties of currency are liquidity and fungibility - land, real-estate, crops, animals, might all maintain their value and be more stable, but current global or even just regional markets would not be able to function with such awkward currencies.

John, you are forgetting that all systems, despite what is the mode/vehicle of trade, can be treated as economic systems. Recommended reading: Limited Wants, Unlimited Means - A Reader on Hunter-Gatherer Economics - John Gowdy (a Professor of Economics BTW)

Allocating resources using wealth works when lack of access to the resource doesn't kill you, or make you destitute & miserable. When it does, people will become violent, and you will lose the essential stability necessary to have commerce at all.

If we don't adopt some way other than money to allocate food & energy, our society is finished (unless technology, the other big modern political religion, comes to our rescue and lowers costs).

any other way than money would be a bigger disaster than anything capitalism can cause.

and money is ? gold, silver, paper ?

money is gold and silver mostly.

John, John, John. You need to educate yourself. Spend 45 minutes and do so.....

http://video.google.com/videoplay?docid=-9050474362583451279&hl=en-CA

I liked the graphic of the bankers with bicycle pumps. Never knew why they use the term "inflation" before :)

So then I don't have the right to revolution against an economic system that says I do not deserve survival?

John15, I'd like to understand the economic arguments and how they way in on things. Unfortunately I don't respond well to the tactic of "proof-by-bombast" (and that's on either side of the argument about PO), but you never seem to actually give more detailed, reasoned, checkable answers.

but you never seem to actually give more detailed, reasoned, checkable answers.

He's only smart enough to spout what others have said, not smart enough to defend the positions he thusly takes.

Not the 1st here, won't be the last.

I don't know what more you guys want me to say. I figure it's pretty easy to figure from zimbabwe to the Federal Reserve causing the housing bust we're in to see that central planning doesn't work. most of the time it's all about the market and that's been proven over and over again in almost every example.

john15, you are spouting drivel.

An example to the contrary of "...the market and that's been proven over and over again in almost every example." is the Great Depression. It occurred in a time when the governments of Britain and the USA were both far more laissez-faire than now, and yet there was a major economic downturn due to market collapse. Blaming the Fed is ridiculous -- money at that time was essentially gold as it backed the US dollar and the British pound. Therefore what's left to blame is the economic system itself.

The current financial imbroglio in the USA, and elsewhere, is the result of capitalists' greed leading to fraud to acquire more money for themselves. You can refer to market.ticker.denninger.net for an excellent explanation of the situation.

Where did "central planning" come from? This whole thread descended from whether dollars (rather than energy expenditure, sustainability issues, etc) were the best way to think about societal and long-term financial viability (ie, no pulling an BCCI or Enron) of various projects, with you asserting that thinking about things in dollars is always the right way to deal with things. You seem to flit from viewpoint to viewpoint rather than actually set forth a case. It's this that's why I really don't get on well with economists: they wanna win the argument rather than actually understand what's happening, and to do that they constantly change what they were arguing.

That's how we are _used_ to allocate resources*. I can also guarantee you that in Weimar Republic or modern Zimbabwe people do not use funny money to allocate resources.

The unit of currency becomes something else. Of course there will be markets and economic activity, but many of the more complex economic theories will stop working, because people will be even further removed from such theoretical fallacies like "economic rational behavior" or "optimal resource allocation through fiat money based banking systems".

Further, beyond peak it is very unlikely that fiat system based on exponentially increasing debt load borrowed from the future can survive. It is thus almost guaranteed that all derivative financial economic theory will fall apart. All those twenty-five sigma events that were supposed to only happen every twenty five thousand years will become everyday occurrences.

That's why people won't be using them anymore when reality becomes too far removed from economic theory.

This reminds me what my math lecturer once told me: crap thinking hidden behind semi-sophisticated math is still crap thinking. This applies to a lot of microeconomics, I'm afraid.

Time will test a lot of economical thinking soon enough and I don't believe the results will be particularly pretty.

* As a though game, try starting to think resource allocation and production in terms of kilo joules. You will find it a refreshing exercise. The unit does not inflate, it cannot be printed, it cannot be fractionally-reserve banked, conjured up magically in level 3 category book keeping nor can it be leveraged via debt. It requires a different type of thinking compared to fiat currencies or debt. And it (energy) runs the world, not money like so many people fallaciously think.

oh it will. it may be 100 years before we go back into debt like we are now. I bet people thought we'd never get back into debt again after the great depression but we did.

In this respect you may be right, but I hope you are not. Time will tell.

However, for the hypothetical period of shrinking energy resources, I see debt based inflationary fiat expansion as unlikely to work without pervasive social unrest. How's that for a sentence in social sciences of the dismal variety :)

Well, during World War II we allocated some of them using ration cards instead, because we couldn't withstand a Confederate-style inflationary spiral during wartime, nor could we afford for survival goods to run out for the industrial workers whose wages were frozen.

"nor could we afford for survival goods to run out for the industrial workers whose wages were frozen."

have to ration goods because of frozen wages huh? *sigh*

Huzzah! Truer words have never been spoken here at TOD.

Sorry have commented and run, but my opinion was that I didn't like that story either! What caught my eye was the invocation of Malthus which was used in the last oil crisis. In that article when they talked about increasing farmed land, they didn't get at any of the chemical fertilizers and pesicides that are oil based, or the diesel engines they use harvest the food, or mine the phosphate. Pretty silly, I think that reporter was just learning about Malthus and thought it would make a great story but couldn't quite fit it in with the current crises.

There's a report in today's NYT about a survey of drivers and their response to the increased cost of fuel.

When Gas Prices Lead to Roads Less Traveled

In the survey, people were asked several questions about the changes they had made in their daily lives. The results show just how hard it is going to be for people to adjust to Peak Oil, as the replies indicated that only a small fraction had made any serious effort to make changes. I think this shows that there's lots of obvious conservation efforts yet to be undertaken, while at the same time it shows that more pain will be needed to get those efforts underway.

My vote is still on fuel rationing as the best approach, since the necessary increase in fuel prices would likely sink the economy, which is already in deep trouble.

E. Swanson

I found that article about the oil men in Michigan believing in Peak Oil consistent with the oil people I've spoken with (outside of TOD). I suspect it's one of those things like what happened at NASA where, if you ask the engineers what the odds of a fatality are on a space shuttle mission, they say something like 1 in a 100 which is relatively accurate. If you go up the management chain however, the perceived odds get lower and lower until they're "negligible". Management is just too far from reality to judge these things well, and also they probably have vested interests in not judging them correctly (e.g. stock prices).

http://news.yahoo.com/s/ap/20080615/ap_on_re_us/mexican_gas

"SAN DIEGO - If there's pain at the pump in the U.S., Mexico may just have a remedy. A gallon of regular unleaded gasoline in San Diego retails for an average price of $4.61 a gallon. A few miles south, in Tijuana, it's about $2.54 — even less if you pay in pesos."

"I used to buy exclusively in the U.S. before gas started really going up," said Patrick Garcia, a drama teacher at an elementary school in San Diego who lives in Tijuana. "Since then, I've been buying all my gas in Tijuana."

Haha..care to give export land model implications for that Westexas?

Does Mexico subsidize?

Gads...falling production and subsidies don't work (for long).

The national budget(~60% oil revenue) will hurt even more from this, if they keep it up.

And reduced demand destruction.

BAH!

Oil at $135 is ONLY 19 cents a cup...I think at this point it is almost time to CONFIRM humans are NOT smarter than YEAST! (thanks Bob!)

So that cup o oil is equal to about 30 man hours (based on 20,000 per barrel)

Times $7.00 min wage = $210.00

so $.19 to get $210.00.

Thats a good RoR

(wow I did the math thing)

More and more it is clear that oil energy, compared to human energy, is a bargain at almost any price. Thing is, as it gets more expensive, we have to personally do with less and less. I don't see that as bad at all -- at least in theory. But I fear terrible destruction in the wake of the race to the bottom

yes.

So, Mexico is subsidizing U.S. drivers. That is rich. Perhaps they need to take a fresh look at their subsidy program. In this instance, subsidies clearly make a difference in Mexican gas consumed and in total gas consumed because of the gas wasted waiting in line at the border and going to and from Tijuana. Another argument for start stop technology.

In Australia, the State of Queensland is already planning to check ID to make sure that undermenchen from other States aren't sucking on their subsidy...

It will be an interesting summer--and interesting subsequent summers.

How long until the Coyotes start running pipelines in their tunnels to smuggle gas alongside people?

The clock turns relentlessly backward:

High Fuel Prices Drive up Donkey Prices in Turkey

http://www.novinite.com/view_news.php?id=94055

Peak Ass?

ROTFLM-A$$-OFF

At least econ 101 theory still holds with elasticity of substitution. I perceive a whole new chapter in text books;

"Elastic Substitution of Hydrocarbon Traction Machines and Stinky The Donkey".

And then the enviro-nazis will have a whole new protest forum over noise pollution. Ever heard those animals when they get going? My parents have a farm across the road with a couple of donkeys, and what a racket.

Hah, yeah I spent a week in Honduras once and the chickens would keep cock-a-doodle-dooing in the middle of the night. The reason? They weren't used to the electric street light and kept thinking it was dawn starting about 3 in the morning.

As for donkeys -- when animals were used primarily for transportation, New York had a manure pile every city block. You want a recipe for disease? Try surrounding yourself with animal manure. From that perspective, cars were an environmental boon, or at least a public health one.

Was New York full of disease that has been shown to have been caused by the manure piles? You folks really need to get over your fear of animal poop. Those who are successful in the coming years (other than the elite) will spend a lot of time around animal poop.

And the elite will ride fine horses.

Twilight, yes, New York was full of disease. Go learn about cholera outbreaks in New York. While you're at it, learn about typhoid, salmonella, e.coli, cryptosporidium and giardia... in fact there are about 40 different diseases spread to humans from animal manure. Here's a link (biased source, but I don't have time to find something more unbiased right now). I suppose these things can be made sanitary, but given human sloppiness I'm guessing we will have to live with a higher rate of disease if we switch back to animal transportation.

LOL!

Too bad they can't plant a acre in 16 minutes, yielding 200 bushels "10000 pounds! a staggering yield" like in the King Corn documentary.

I wonder how long it will be before we start breeding Shire Horses again?

it would be about the same time that we start turning abandoned car's and suv's into arms and armor.

yes i know there is allot of guns and ammo about, but care to guess how many can make gunpowder?

or how many can make the kind that is useable for modern firearms?

at the same time how many know how to re-fit bullet's onto used shells?

Reloading can cut the expense of shooting and re-loaders are likely to be able to make ammunition for quite a while. However, the real limit with modern weapons is likely to be primers, not powder, as one might be able to make black powder from available materials. After all, black powder was first made hundreds of years ago. It's not a high tech process by any stretch. Got your Daniel Boone flintlock all tuned up? Got your lead stash and bullet mold? It's back to the future time!

E. Swanson

Got your lead stash and bullet mold?

Remember - Cars are a good source of lead. Batteries, and the old cars use lead in the body. Cast iron waste stacks use lead seals.

Don't forget to keep your powder dry!

Just watch out for the sulfuric acid in those batteries. Also, if you want a good scrounging place for raw materials, try to find an out of use dump. Just as old mine wastes are profitable nowadays, stuff people considered once garbage could be profitable. Of course you'd have to separate out all the toxic stuff...

take a random group of people from your neighborhood, then ask them to make black powder. very few people know how to make it now. and the home made stuff might not have enough power to do the job considering the smokeless powder we use now is more powerful and modern gun's are designed around it.

Remember the Star Trek episode where Capt. Kirk makes black powder from these mineral deposits he finds neatly lined up on a rock? (they looked like the rocks in Southern California, strangely enough)

Not only did he know the formula, he managed to cobble together a bamboo cannon and shoot the T-Rex looking thing that was chasing him :)

Hello TODers,

Hopefully, this news will induce many more purchases of wheelbarrows and gardening tools:

http://www.washingtonpost.com/wp-dyn/content/article/2008/06/13/AR200806...

------------------------

A Call for Composting

...The organic matter that Americans discard daily, including food scraps, yard trimmings and other biodegradable waste, comprises 23 percent of the U.S. waste stream. According to the Environmental Protection Agency, only about 2 percent of our nation's food waste is composted each year; in other words, we unnecessarily send 30 million tons of such waste to landfills annually....

---------------------

We have a lot of work ahead of us to ramp O-NPK recycling and gardening. Will a sturdy wheelbarrow prove to be more popular than a sharp machete'?

EDIT: I need some sleep!

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Maybe I should bump up my Compost Post.

If you've never composted there are some good ideas to be found in Permaculture Magazine(s). I just saw an in-situ design in this quarter's issue where you make a cylinder of mesh-wire and line it with newspapers and put it in the garden where you're gonna use it eventually......less schlepping that way.

Permaculture-wiki led me to:

http://www.spiralseed.co.uk/permaculture/ ( instead of the Sunday Funnies ? ) &

http://www.powerofcommunity.org/cm/index.php

which i find to be a very inspirational look at a potentially-positive post-PO scenario.

I said a month ago i was building a rotating drum composter (about 100ltr) and would post pics. Well it has been about 3 weeks since i started using it and it is incredible how fast the stuff is breaking down.

Combiantion or food waste (no fat/meat) and old bread, hedge trimmings and some grass and straw.

After only this short smell it is really satrting to smell sweet and musty. Mmmmmmmmmmm. I just pop the stuff in the 1sq ft hatch, close and roll a few times. rain is good so i let it get a little wet i will post pics with a week.

I've heard in ideal condidtions compost is possible in 8 weeks. - I'm sceptical so we'll see.

Marco.

What's the hurry anyway? Maybe it's cool, but composting for me has been as simple as three stakes in the ground connected with a semi-circle of chicken wire and then raking all my fall leaves into a big pile within. I did that last fall and have dumped all my kitchen scraps (and collected urine) into it. I expect it to be useful humus in 2009's planting season. There is almost no work involved in the process. I have torn it down and built it back again 3 times, but mostly cause that's fun :-)

Agreed. If you're not in a hurry, composting is really easy.

my firtst experiance of composting was putting stuff into a big black plastic drum with a lid. 2 years later the stuff still hadn't broken down!

It turns out that if you have one of these (that our local council supply for £5) you are meant to empty it occasionally, fork it over and refill - which I did not do!

I thought I'd experiment with some scrap deckuing I had to get rid of and i'm always fidgeting to make something.

Marco.

Post this article under, "The Tangential Effects of Rising Fuel Prices".

Deffenbaugh customers in Kansas, Missouri hit by new waste restrictions

--snip--

They need to use this resource and close some loops.

AUSTRALIAN scientists say they have developed a greenhouse-friendly way of turning green waste into fuel.

A more common approach to creating value from trash involves using the methane gas given off by organic waste to power a generator and produce electricity

Project converts biomass and food processing waste into useable energy

San Francisco's Innovative Composting Program

Fuel from Trash Will Power California Garbage Trucks

300 garbage collection trucks in California will soon be fueled by the same trash that they haul.

http://www.universityofcalifornia.edu/news/article/4263

Rat

technology will help us mitigate peak oil.

Yes, technology will work until it doesn't.

It will only get rid of some of the chaff that has been integrated into the system during the "cheap oil" days. The benefits of technology will only buys so much...it will very unlikely get us "all the way".

come on, you have to give me more than tech will work until it doesn't.

Rome had tech. Then it didn't.

"Rome had tech. Then it didn't."

link? the roads and some aqueducts are still there.

And you have no knowledge of what happened in, for example, the British Isles after the fall of the Roman Empire? You think that just because some relics of the infrastructure remains that there was no loss of technology? Ever heard of the "Dark Ages"? Hint: the sun still rose every day.

The recipe to make concrete was lost for over a millennium (and the new type was different from the Roman type).

I think Europe went without a new paved road for 800 years.

Alan

was it the recipe for concrete ? or portland cement? i believe the portland cement the romans used was the result of a limey layer of rock being baked by a volcano, pozzulana. the rock was ground up and mixed with water to make paste.

a snickers candy bar conforms to the definition for concrete: aggregate(peanuts) bound together with a paste(sugary gooey stuff).

We could do with an eight hundred year moratorium on paved roads in this country. How many acres per capita do we have now?

I will give you this, it depends on the rate of change in a given environment and the brilliance of the inventors developing the technology. At this point, I think the rate of change is going a little faster than our ability to stay ahead of it. Now, if we make a huge jump with fusion energy/technology or Tony Stark can truly miniaturize Arc Reactors, then perhaps we will all be saved in time.

Indeed it will (mitigate). My concern is that with the current financial mess, the capital may be hard to come by to actually develop the technology. We're on a slippery slope, and the capital situation isn't likely to improve until after we have the new technology...sort of a catch-22.

Doomer Fuel

Infection found in Canadian pig farms, pig farmers

Salmonella in tomatoes, staph aureus in pigs, BSE in cows, e.coli in spinach, etc., etc.

The common denominator, of course, is industrial mono-culture production methods which deny the importance, or even existence of "eco-systems".

Another "perfect storm." The other thing that makes industrial monoculture profitable is cheap energy and petroleum powered transportation. All of this will go away, but the obvious replacement -- permaculture techniques -- are not well understood, and many people seem to be highly suspicious of them.

And of course, even though small family farms are more productive per acre, they are not necessarily more profitable per worker -- hence the enduring success of corporate farming.

The future looks to me, at least, like it will more likely resemble Latin American latifundios more than the Jeffersonian ideal of relatively small proprietorships. And even Jefferson wasn't a big proponent of land reform in the modern sense of that term.

...more "Tangential Effects of Rising Fuel Prices"?? Every business, around the world, is looking to cut corners and save money these days since they have realized fuel prices have permanently risen. Keep in mind, many companies started doing this (like mine) 2 or 3 years ago. The fluffy, easy stuff has already been cut...we are now cutting into more necessary things.

Make me nervous going to a doctor, a hospital, or stepping on an airplane!!

"Make me nervous going to a doctor, a hospital,..."

If it's any consolation, after a year of banging my head against the wall, and telling one nursing administrator "Remember when I gave you EOS when oil was $45?", my hospital suddenly discovered energy. 2 weeks ago, I was still trying to push the locomotive by mice elf. Now, after said RN checked out last year's electric bill and found it was close to half a mil, it feels like the locomotive is headed down the mountain, and I'm trying to jump on.

"Tell us what you know about co-generation."

"Why don't we put solar over the planned new parking lot?"

" Turn off the lights and maybe you will get a bonus check next year, kiddies."

MRSA

The food system is broken

Cargill

ConAgra Foods

Unilever

Procter & Gamble

Nestlé

Kraft Foods

PepsiCo

ADM

Monsanto

Terminator Technology

All these corps. run on cheap corn/diesel.

I asked yesterday, when does the price of corn really start to bite into these guys margins? Is this the wrong place to ask this question? If it is could someone point me to a better place to ask.

A solution

SPIN

History is not predictive, but illustrative. Seems like there will be a general consolidation of many of those companies, who will will of course remain in control of the land resources -- and the rest of us will be relegated to serf status.

Similar consolidation of the financial sector will leave most of us outside the cash economy -- not so different from medieval Europe, I think.

Nestle at least put out regular updates on how they feel the food situation is changing.

Here they predict the present rise to the present in prices:

http://www.ft.com/cms/s/0/3a674134-2b1c-11dc-85f9-000b5df10621.html

Here they say they think prices will stabilise:

http://www.iht.com/articles/ap/2008/06/15/business/AS-FIN-COM-Malaysia-N...

And here they comment on the impact of biofuels:

http://www.foodanddrinkeurope.com/news/ng.asp?id=84175

I am not quite sure how statements 2 and 3 tie in together! - I also don't know how much impact oil has on their overall costs, but their statements are well worth keeping an eye on.

Re-engined Electric-Powered Moni Makes First Flight

Sat, 17 May '08

http://www.aero-news.net/index.cfm?ContentBlockID=38e6419a-47ff-4a55-a7b...

Other pictures: http://picasaweb.google.com/barowicz/FLYINGFFreeElectron

=======

Leanan...I'm starting to wear out my mouses' scrolly wheel getting through the drumbeat articles, are you getting better at finding stuff, or has the amount of articles really increased that much?

Whoa...Simmons is really sounding the ALARM with his new presentations. What's he know now that makes him so URGENT? Makes me wonder....

specific link?

It's at the top of today's drumbeat (at the time of writing). The graphic posted by Leanan at the top comes from this one:

The Unknowns In 2008: “Is $120 Oil A Blessing Or A Curse?” And Has Oil Peaked (PDF)

Rest of the articles are here

Page 19 of "Blessing or Curse"- notice a country missing>

USA annual production 5 million barrels.

Added annual income (following his math) $50 billion.

I live in the USA, but I don't feel much more wealthy because of this.

He's very clear with this

I have a very big objections to one of his points on page 18:

"-transforming poverty stricken oil producing countries into solid

low and middle class societies"

This is how it reads to me, and Geoffrey i'm sure you will agree!:

-transforming poverty stricken oil producing countries into solid middle class

oil consumers and net importers!! We really are screwed!.

Marco.

Does it need to be any different than what the rest of us know?

Personally, in my writing and public presentations, I'm bringing as much urgency as I can.

www.postpeakliving.com/peak-oil-primer

This Tuesday I will be presenting to the Marin County Board of Supervisors.

I will be bringing a great deal of urgency to the presentation, you can be sure.

-André

He seems to be far more in fear of an all out nuclear war heading straight towards us. More so than in previous presentations.

I agree. This presentation was kind of spooky. And Maine as the center of creativity and ocean energy idea...hmmmm.

Right...Matt does a pretty good job of staying on stat's and not getting too emotional. Now, something has changed and he's sounding a bit panicky. He's trying harder to get folks to listen and listen faster. He's upped the rhetoric.

'Spooky'? I'll say! A couple of Simmons quotes:

"Staying 'in the dark' will unleash the last war" and

"Let's not create a 'lights out event". I am too young!"

In bankerspeak, that's shrieking panic!

He's actually advocating military force to compel an accurate accounting of recoverable reserves; otherwise, obfuscators will delay action until it's too late.

I liked his comment on Jim Puplova's show in February. Jim had an energy roundtable with Matt, Robert Hirsch and Jeff Rubin, and he asked them if you were elected president this year, what would be the first thing you would do?

Matt's response - "Probably cry."

True, true....he does seem to be emphasizing the "more global resource wars" idea more.

Maybe one of his sources in the Bush Administration said something about Iran.

He *was* an advisor to Bush at one point. One could make the case that his advice might have contributed to the urgency for invading Iraq.

1. Just a reminder, thanks in advance for clicking the "SHARE THIS" buttons (which are available on all our posts) and vote for our work on various sites like reddit and digg. Those link farms help us get a lot more eyes, which means more ad revenue to support the site--it's worth ten seconds to do it, I hope.

2. TOD is on twitter now with our RSS feed: http://twitter.com/theoildrum. If you are a tweeter, erm twitterer, erm, give us a follow...and tweet your friends about our posts now and again. Already 170 followers!

3. If you have a blog, or are a member of a messageboard, or play at a link farm like metafilter or anything else, the more you plant links to our stuff that you like, the more eyes it gets...it's that simple. Every little bit helps. Submit our stuff to those link farms or use the ShareThis buttons found around each post, they're simple (as long as you are logged in to the respective sites).

4. Tell your friends! :) We really do need and appreciate your support. That and educating folks about the problems we face is what keeps us all going.

Thanks for hanging out, and thanks for making this all worth doing. I learn something here every day--and I apologize for these incessant reminders of things.

No need for apologies -- all of us need to thank TOD by making others aware. Be careful of what you ask for though -- awareness seems to be spreading, if the increasing number of posts is any indication.

I don't understand the business model, however. Seems like increasing traffic would just increase your bandwidth and costs, since none of us readers are directly paying for access.

Advertisers pay either by number of click-thrus or number of eyeballs. More traffic brings both.

The founders may also be subsidizing the cost of the website as their contribution to educating the world on peak oil.

This shouldn't be surprising. For instance, I give away a lot of my time for free to get the word out because my future is intimately bound up with that of my fellow travelers on this wonderful but suffering planet of ours.

How is the 503c coming?

Would love to donate.

Pete

Re: Scotland has 100 years of oil left.

Someone is seriously getting leaned on here. The propaganga is rife just now. june 2108 Diary for BP CEO reads:

"12 barrels on monday, 10 tuesday, rottfer domer, just 8 barrels on Wednesday. At $112,190 a barrel we are barely turning a profit here"

chortle chortle.

Greening the desert by squeezing water out of gypsum

Given infinite energy, we could have infinite potable water. I predict we will have shortages of both.

a gusher in drywall ?

Peak calcium sulfate.

Ha Ha.

Squeezing water out of Gypsum.

Ha Ha.

Gypsum:

http://en.wikipedia.org/wiki/Gypsum

We will be squeezing milk out of unicorn teats next.

Parade Magazine has a column by Marilyn vos Savant called "Ask Marilyn". Marilyn, according to the Guinness World Records, has the "Highest IQ". Anyway today a person asked Marilyn:

Marilyn's reply, or "non reply in my opinion":

First of all, though the geological process did began more than 3 billion years ago, organic matter has been creating fossil fuels for less than half a billion years. Also Marilyn should have pointed out that crude oil did not come from dinosaurs. The questioner made a very stupid mistake and Marilyn failed to correct it. Very disappointing coming from the person with the "highest IQ".

Ron Patterson

She has a history of making comments based upon very passing understanding of subjects, particularly higher mathematics, which are technical and wrong. It highlights that even if you are very intelligent (and I'm reserving judgement on that) you still need to have read, analysed and experimented in area to be worth listening to, rather than just having read some popular science articles.

Ron,

A bit of wisdom with humility has taught me over the years that although I may have a reasonably high IQ, I can be very stupid about other things. Just ask my wife.

I may have even coined the term "hydrogen economy" back in university in a paper I wrote (which the prof circled in red with the comment, "What does this mean?"), but now I realize I was sadly mistaken and misguided. However, I did get the first half right where I surmised oil was the foundation of our present industrial society.

We can't know everything and IQ is not a good indicator of contextual or experiential knowledge. Give her a break.

Marilyn's response was pretty scant, a quick talking point evasion, fitting in a 45 word limit and reader comfort level. You could probably get way more than a pint from a dinosaur, given how much a whale could produce. AFAIK fossil oil occured in a short geological time frame, devonian era etc, involving in some way the Tethyis, a pleasant, shallow equatorial sea.

Well no, you are thinking of coal, not oil. Some oil may have been formed during the Paleozoic but not very much. Most life, (algae), that eventually became oil lived during two periods of intense global warming 150 and 90 million years ago, during the Jurrasic and the Cretaceous.

Ron Patterson

dr price disagrees with you. he claims 500 gb in the bakken (mississipian/devonion boundary) in the williston basin alone.

please don't shoot (at) the messenger.

It is probable that the precursers for oil (trapped and cookeked kerogens) were around from about day two.

All you need are the right conditions:

Organic Matter

Trapping via sedimentation

Cooking at moderate temperatures and pressures

A reservoir

A seal.

Oil would as normal as any other geological process on earth, once the planet had calmed down enough to generate sedimentary processes.

3 billion year old oil would be unusual since the process of subduction would have recycled organic matter. At worst, it would be subducted under the continental crust. At best it would undergoe metamorphosis and be cooked out under high temps and pressures.

Most oil is recent - Jurassic , Cretaceous. Some Geologists I know would not even consider Jurassic and Cretaceous as Geology - More like Geography...

As for Ms von Savant I can only assume she is clever-stupid.

Personally I always thought that rat-like cunning beat IQ hands down :-)

"Personally I always thought that rat-like cunning beat IQ hands down :-)"

I prefer both

:>)

Marilyn's response is brilliant.

You and Mudlogger and others are doing the "male" thing - i.e., trying to prove you know more. Given a group of engineers/scientists that is very common (and I'm not saying it is a bad thing), but misses Marilyn's point.

Marilyn turns the question back onto the reader, and (1) asks him to consider the greatness of time and the trivially small finiteness of a human life, and (2) brings the (energy) problem home by implying that we may have used the resources available to us in only a few centuries.