POLL: CLV08 went through $102/bbl..so, in the next 60 days, the front month price of CL will...

Posted by Prof. Goose on September 11, 2008 - 7:30pm

hit $113 before it hits $91

35% (1050 votes)

hit $91 before it hits $113

30% (923 votes)

stay in a trading range between $91 and $113

25% (754 votes)

it's still all geopolitics and other "above ground factors," so what does a price signal mean anyway?

5% (160 votes)

it's all about the declining dollar and specs...

5% (147 votes)

Total votes: 3034

In our last poll on 11 AUG, 26% of you predicted that CL would hit $102 in the front month before it hit $126, and 42% of you predicted that CL would hit $126 before $102.

In the three polls prior to the last three, the results have predicted 10% rises within 60 days of each poll and were on target, and now our last three polls have witnessed 10% declines, which a majority have missed.

Past performance is not a predictor of future values, YMMV, and as it says in the disclaimer, nothing here should be construed as investment advice.

Where's my "I'm feeling lucky" option?

So when will the massive increase in oil prices resume?

When the dollar starts dropping again.

Well, if you have several central banks selling everything and buying dollars...

The value of the dollar increased drastically during the Great Depression. As the money supply constricted, jobs were cut, and wages were reduced 25% to 50% across much of the economy. A dollar could buy a lot, but there weren't many dollars in circulation. My grandmother tells me of the years of barter when there was essentially no US currency in circulation in rural Mississippi.

Debt was a major defeating factor for many people. Family incomes plummeted. Prices plummeted, which sounds good. But their debt and payments stayed the same. Imagine most Americans maxed out on their debt today trying to cope with pay cuts and layoffs in their families.

If peak oil brings another depression, or if something else does, oil and everything else will be cheap for those who actually have money.

The Fed caused the Great Depression, or at least made it much much worse, through tightening of the money supply. Assuming they learned a lesson, and it wasn't done on purpose, it shouldn't pan out the same. Helicopter Ben admitted the Fed culpability.

http://www.worldnetdaily.com/index.php?fa=PAGE.view&pageId=59405

I think if the Fed had played the same games our 1929 stock market crash would have already happened.

This has to be the single greatest myth told about the Great Depression --and mainly circulated by "privatize profits, socliaze losses" corporate socialists and pro-Wall Street revisionist historians.

The reality is almost the exact OPPOSITE: the Fed's (and Wall Street's) too-EASY monetary policies and extreme "hands-off" laissez-faire approach to regulation directly contributed to the Great Depression. Speculating on margin, the euphoric belief that the stock market would "only go up" and that stock prices "reached a permanently high plateau" drove stock prices absurdly high and eventually sowed the seeds for credit collapse (sound familiar --as in housing bubble?).

Had the 1920's-era Fed done it's supposed job ("taken away the punchbowl", reigned in stock speculation, heavily restricted trading-on-margin, raised bank reserve requirements, raised the Fed Funds rate early --well before the collapse), the Great Depression may likely never have happened, or at the very least, would have been much, much shallower.

Booms and busts (or "panics" as they used to be called) have occurred throughout recorded history, and this fact is the very definition of the "business cycle". There's no stopping them from happening altogether. About the only thing government *can* do about them is to implement policies designed to reduce the magnitude & duration and blunt some of the nastier social consequences; mainly regulation aimed at reigning in rampant speculation, credit/securities fraud, and reckless lending.

Unfortunately, what we have today is the exact opposite of that: government whose policies actually AMPLIFY boom/bust cycles and make them worse than they would otherwise be without government involvement.

ceiii2000, allow me to recommend some weekend reading for you:

http://www.amazon.com/Road-Serfdom-Fiftieth-Anniversary/dp/0226320618

http://www.amazon.com/Devil-Take-Hindmost-Financial-Speculation/dp/04522...

http://www.amazon.com/Irrational-Exuberance-Robert-J-Shiller/dp/07679236...

http://www.amazon.com/Creature-Jekyll-Island-Federal-Reserve/dp/09129862...

http://www.amazon.com/Greenspans-Bubbles-Ignorance-Federal-Reserve/dp/00...

Hey hey HARM,

I have to agree with you, but be careful asserting what caused the Great Depression unequivocally, historians are still to this day debating the reasons.

The similarities between then and now are pretty striking though. There was a huge and reckless boom in the economy, the stock market, and the creation of credit and debt. The economy was "globalized" or interconnected to a very large degree and there was a ubiquitous belief that the future would be bigger, brighter, and better than the present. People got carried away and then...

Something went wrong. The stock market crashed, people stopped borrowing, prices fell, output dropped, credit dried up, wages fell, people were layed off, banks failed, companies failed, and global trade barriers went up and trade went down. Then the situation exacerbated itself for several years. Coal consumption dropped by 30% peak to trough if memory serves.

This time it's a little different. But, like before we got carried away with a huge globalized boom driven by continuously expanding credit because we came to expect the future to always be better than the present so we borrowed heavily from that future.

Then something went wrong. Again the USA started it all off. We started two costly wars and then food and energy prices shot up and the subprime fiasco caused asset prices and debt to over shoot and then falter. Then credit dried up and banks failed. So far that's all we know of the story.

But, huge booms are followed by huge busts. A global recession at the very least, I personally think it will be the second great depression.

Looked at in from an economic perspective oil prices should be going down because the economy is contracting. On the other hand peak oil means that the oil supply isn't going to hold and prices should be going up.

It all comes down to rates of change. The question is which is going to contract faster, the economy or the oil supply? Is this just a pull back or the beginning of a larger trend? Sadly, I don't know. I do know that in the long run peak oil is going to be the more powerful force, but how long before that happens?

-Tim

Thanks for comments, Tim --point taken.

Unfortunately, I have to agree that we're probably not going to escape a long, deep recession this time around, though (peak oil aside) I'm not certain we're staring down GD2 just yet. This is the largest speculation-driven housing/credit bubble in my lifetime, and possibly since the Depression itself. With the stock market, USD and consumption going nowhere (except down) and most commodities in blow-off mode now, what else can come to the rescue? Like many here, I keep hoping there might be a boom in alternative energy (and I'd include next-gen nuclear in that category), but the P.O. clock is ticking, and there's not much political courage to go around these days.

"Interesting times" we're living in, for sure.

Within 3 weeks, but make it 2 instead. :-)

Soon enough. After the refineries come back online and China returns. By the end of September prices will be higher than they are now, and I feel a MASSIVE increase is in the cards until the end of the year.

China returns? Where did China go?

China is on vacation in the Bahamas.

The poster, eastender, I believe is referring to China's Olympics. Prior to the Olympic games, China was heavily importing oil and distillate. During the games, China greatly reduced their imports. They shut down factories. I am guessing, the Olympics were like a national holiday and that ports were slowed or shutdown as well. Now, China’s demand is coming back on-line.

Maybe not until after the Paralympics finishes?

No, she wasn't on the beach today

Ed

That's easy. Never. When McSame and the Holy Barracuda get to drillin' there will be ample supply to see us through till rapture time.

Perhaps price will start back up when some feedback loop starts to bite hard enough that the current trend is broken. As the price is destroyed, there will be many different incentives/forces that will result in production to decline.

The price of oil won't stop diving until the world economy pull our of ITS dive. When that will happens depends on how far the economy has to fall (may be years).

The "declining" dollar option needs to be changed to "changing" dollar.

You calling us a bunch of Yergins?

I've started buying DBO and UNG - ETFs based on oil and natural gas futures contracts. If prices fall, I'll just buy more in small tranches. Reasoning being that long term, the underlying commodities will be much more expensive. And if the dollar loses value, I'm also protected, there.

To gasogynist,

I hope you'r still reading this.

Can you email me a little more explanation about DBO and UNG and which market has them? My email is in my profile.

The real question is can intervention in the oil and currency markets keep the price down until the November election is passed.

When OPEC say they are going to cut 500,000 barrels and nothing happens - you know someone has their finger on the scales.

you know someone has their finger on the scales.

Exactly, and OPEC is reacting to it by putting their finger on the other side.

The releases from the SPR of late have been done with broad coverage in the media. Also, traders are all aware of the pre-election effect.

The hammering of the shorts was a manipulated event, took a lot off the table on the short side, and made many gun-shy.

TPTB can and do make their wishes known when it suits their purposes. They have been taking some serious losses as of late, and have sent a very strong back off signal. Like a wounded large animal surrounded by wolves.

Surreal isn't it. Can it go till Nov 26 ? No I just can't see this continuing that long however it probably really depends on hurricane damage over the short term. As long as US Refineries are not in full operation and the US is releasing from the SPR then oil demand will be low.

The bigger question is product supplies to the US over the next month or two. The US should be entering the winter with dangerously low fuel supplies of all types so life's going to get interesting.

Now as far as the supposed OPEC cut I think it really depends on the type of oil. Loosing 500 kbd of heavy sour production probably is not a big deal the heavy sour market is esp well supplied given that the complex refining in the US is crippled so we are swimming in heavy sour.

Now as far as overall supply everything I have shows that we had a significant drop in light sweet exports first half of the summer followed by a surge in light sweet during the second half. This is what knocked the oil prices down but now its in the past regardless of the state of the US refining industry.

To get the price down into the 80-90 range we need one more surge of light sweet with the US in the shape its in it probably does not have to be near as large as the last surge but to keep prices low through October and into early Nov we have to see one more significant increase in light sweet production.

If we get it then we can expect prices down around 80-90 if not lower through Oct at least.

On top of this we should be able to expect the dollar to continue to strengthen esp agianst the Euro so currency condition will favor a even lower oil price. I expect the dollar to continue to strengthen significantly over the next few months. Gold and silver should repeatedly set new lows. I think we will see some serious dumping of gold and silver onto the markets by the CB's or some other entities.

On a bigger scale we probably will see the Feds and FDIC take more aggressive action agianst insolvent institutions showing that they are on the ball cleaning up our financial problems. All the solution will mysteriously work out in the 2009-2010 time frame similar to the bailout of the GSE's. Each one of these house cleaning actions will cause a rally in the stock market as its hailed as the bottom. Given that we probably will be in worse shape at that point I'd suspect that these bailouts will unravel in 2009 but thats the far future right now. We are seeing this with Countrywide for example its starting to unravel now but it took a while.

However all of this seems to really depend on one more significant injection of light sweet crude without it I think the chances of being able to pull off this whole plan becomes very difficult.

I still don't see it continuing to work through Nov 26 but if we don't get one more slug of oil it won't even make it into Oct.

Now I think all of this is being done for a reason and I expect war with Iran since for a lot of reason I'll not add to this post everything thats happening right now is pretty much a one time deal.

And finally on the demand side if demand is being driven down by high prices then low prices will result in a rebound in demand. Given I drive drive once or twice a week from Irvine to San Diego I've got a pretty good personal VMT meter at least for the 405 California demand has rebounded significantly from what it was earlier this summer and seems to be back to normal. All thats missing right now is the construction traffic but that not coming back.

Memmel-

I hear what you are saying about demand bouncing back up, but there are a lot of other things beside price at the pump putting downward pressure on gas and oil consumption -- like job insecurity, mortgage defaults, etc.

Anyway, three factors: plateauing production, shrinking demand, and manipulation -- well four, OPECs decision to hold to quota, i.e. effectively cut. I can't think of a better recipe for generating unpredictability, or chaotic behavior as the cognoscenti would put it. Short term that is. Slightly longer term is easy -- plateauing and decline will win out.

Memmel

Where do you get your light sweet info from? Can you post a graph? And where do you think the next 'surge' is coming from? Was the previous 'surge' KSA releasing stock?

I am intrigued that your theories (perfectly logical) re the impact of the light sweet/heavy sour split seem to have been 'overlooked', but then again a lots of people are quoting 85 mbpd world crude oil production when we know its not all 'crude'.

To me from a resource point of view it makes sense that the light sweet was produced first and that as we move through the resource the quality will drop, these factors (like net exports) are a more subtle (and therefore pernicious) threat.

Neven

Basically I have a model that indicated a significant supply of light sweet was taken off the market or was unavailable earlier this year from about Nov of 2007 till June of 2008. My model predicted that prices should have leveled out in May about 120-130 if the supply of light sweet crude was normal.

Eventually the market was hit with a surplus of light sweet starting in about July through August in total looks like at least 30 million barrels.

This could have come from a number of sources but first and foremost in my opinion Ghawar went into decline this year and addition I suspect about 500 mbpd or so was stored for about 6 months and additional source would be early production from Khursaniyah.

http://www.zawya.com/Story.cfm/sidv51n24-1TS01/SecCountries/pagSaudi%20A...

And a host of stories with Khursaniyah reported to be at full production then not at full production certainly given its highly probably that some production could have been online for a while I estimate 200kbd.

Also of course on top of this problems in Nigeria further exaberated the light sweet oil situation.

In all the world was probably down at least 1-2 mbpd in light sweet production from late 2007- mid 2008.

This was temporarily fixed with the surge sending prices spiraling downwards on top of this real market move caused by a real and significant albeit short term move in the supply of sweet light oil we had a comprehensive and systematic move in the financial markets to take advantage of this situation to set up the current bizarro world pricing situation.

The key point is it took real and significant injection of light sweet crude in the market to initiate the disruption it was not a pure financial play.

Important take home points is this is temporary if I'm correct about Ghawar being in decline then the additional production from Khursaniyah on a regular basis going forward probably won't make a huge difference say within 6 months. If Ghawar is really decline at say 10% then we should see a favorable light sweet situation for a short time at most. In a perfect world we might be slightly better off then in 2007 but in general we probably won't see perfect world conditions for long.

Now given this looking forward its fairly obvious if I'm right about light sweet that further declines throug 2009 coupled with say lost production in the GOM and problems in Nigeria should get us quickly back in the same situation we where in in early 2008 this coupled with potential NG supply problems makes it probably that we will have and extreme bidding war for light sweet start up again effectively any day now.

Note since Khursaniyah is not officially online if I'm right we have seen a steep decline in shipments out of OPEC the last few weeks and we have had damage in the GOM so the US is unable to receive oil.

On top of this the willingness of the US to open the SPR along with continued financial maneuvering have served to keep a lid on oil prices to the point that some people are questioning their sanity.

At the moment from the supply side the only thing keeping prices low right now is the US unable to import oil and refine it and the threat to open the SPR right now REAL oil from the middle east is not flowing.

I'm thinking that they can pull this off for a few more weeks because of the hurricane and if I'm right about a war with Iran we will see one more massive surge out of the ME as they empty storage and send every ship they can fill out of the gulf. Because of the current bizarro period of no oil but low prices KSA should be able to build up a smaller but healthy surge of light sweet say 15 million barrels or so.

I'd assume this surge will happen if financial control of the market starts to weaken or the war with Iran is about to start.

This surge should send oil down to 70-80 through this we also assume that the dollar continues its strong rise gaining say another 10-20% over the next few weeks.

Timing is not all that critical we can expect the oil price to remain low for at least another 2-3 weeks.

But at some point they are going to have to inject more real oil or the game fall apart.

I figure first week of October at the latest.

What "proof" do I have nothing but a synthesis of a lot of information and a gestalt I've created.

So its a figment of my imagination as far as I'm concerned.

However the number one fact that proves at least to my satisfaction that I'm right is a simple one

thats been lost in the sea of data.

Saudi Arabia is no longer shipping BITUMEN GRADE 60-70 or making cement.

http://www.gulf-times.com/site/topics/article.asp?cu_no=2&item_no=237004...

http://www.eceurope.com/tradeleads/details.htm?session=k-to-us.asp&searc...

http://bitumenexporter.blogspot.com/2008/06/bitumen-supply-demand.html

A lack of bitumen indicates problems inside the Kingdom not just export land.

If you'll pardon a newcomer question, when you talk about price, is it a futures contract price for delivery in 30 days? And if so, what are prices far forward saying?

With equities, one often sees overshoot on the upside, and then overshoot on the way back down. So a question in mind exists with regard to what is a "fair price" based on supply, demand, and average production cost.

But even if there is a little surplus supply, currently, I'm inclined to believe that Matthew Simmons is right in his view that world production is now peaking and that it'll soon be obvious to all.

And I would say that soon the easy "demand destruction" will give way to a very painful one. And oil might become too scarce and expensive to enable us to do the work we need to do to build up alternative sources of energy.

Price call it average price over three months or so. Better to think of it as a vector price direction and magnitude my concepts are way to rough to equate to even monthly price fluctuations. You could also think of them as bounds or midpoints etc.

Take the current price today and consider scenarios that would result in 160+ by December. This means a strong price spike given we can expect the price to remain low for a while longer.

Error bars say +/- 10 dollars or so.

Also note that conceptually over about 120+ we are seeing bidding wars develop amongst OECD nations for supply.

So 160 indicates the next level of bidding war is being entered this sort of price is where we start seeing marginal low income oil consumers in the wealthy countries getting squeezed out.

Of course programs like heating oil assistance etc although good socially result in even higher prices.

So basically as we enter into the 120-160 range you start seeing a increase in subsidies. Given that housing is now dead and the winter is not RV driving season or boating season it will be very interesting to see how supply and demand play out. Summer has in general a lot more elastic demand then winter.

From your third link:

"Saudi arabia has almost banned the export of Bitumen 60/70 , which considered as the raw material, obtained from the fractional distillation process, from Saudi Aramco . The penetration grade bitumen 80/100, prepared from the aforesaid raw material by adding additives, is the value added, before being exported."

I've bolded the parts I think provide a much simpler explanation, which is that the Saudis are shipping a value-added product rather than the raw material, as this allows them to build up their refining industry and make more profit from their oil.

This would be exactly in keeping with their efforts over the last few years to build a larger domestic refining and petrochemical industry. See, for example, this story from 2005 "Saudi Arabia plans huge refinery investments".

If they've been making big investments in refineries, then refining cheap products into value-added products would be exactly the kind of thing you'd expect to see, no?

(Note also that this grade of bitumen comes from the fractional distillation process. If you're claiming they're running out of it, you're essentially claiming that they're not doing much fractional distillation, in which case problems with low-grade bitumen would hardly be the first we'd hear of it.)

That's not what your link says at all. What it says is:

"What has reportedly aggravated the situation is the ban on cement exports from India, traditionally a big supplier to the GCC region and curbs on supplies from Saudi Arabia, the top cement producer in the Gulf."

Not only is it producing cement, it's the largest producer in the region.

What is true is that supplies to Qatar from Saudi Arabia have been curbed; considering the pace of construction projects in the region, this should hardly be surprising. As the header to that same story puts it:

"THE soaring cost of construction materials continues to pile pressure on contractors working on Qatar’s vast array of infrastructure projects."

Vast numbers of construction projects means heavy competition for cement supplies; this is not surprising.

Memmel,

I agree with you that the system is being gamed, but I don't think it's extremely likely anymore that the US or Israel will attack Iran. With each passing day, the circumstances for such an attack become less and less favorable (unless there's something I'm missing). I do think, however, that the "export land" effect is being overruled by certain Western elites who are manipulating markets, governments and supply in order to increase the chances for a U.S. presidential administration which is favorable to their interests in 2009. And like you, I don't think the game can last much longer. The latest EIA weekly report doesn't look very good - yet prices for crude and finished products continue to drop. If anyone knows how this could be something other than manipulation, please enlighten me. And what happens if Hurricane Ike does further damage to U.S. production and refining capacity?

Export land is certainly a problem but the bitumen and concrete issues that show up lead me to believe deeper problems exist.

Originally I had thought this was all for the election but then I simply could not come up with a way to keep the price of oil low through the election I could well be wrong but the factors that I believe are causing oil to be priced low result in a strong rebound in prices before the election. Now I could have missed something but this and a lot of facts filtering in about the US military position in the gulf lead me to the conclusion that I war with Iran was far more probable.

As far as the hurricanes go the proof that prices can be kept low despite hurricanes is obvious its already happened. I'm in awe because its now a pure financial play but now Don Sailormans posts have been vindicated.

At the moment all thats keeping prices down is the SPR and pure financial moves as far as I can tell.

Show me how oil could remain low through Nov 26 and I'd agree its all about the election.

Memmel, thanks for answering my earlier comment. You bring up some good points. I had thought of the present price manipulation as a last desperate gamble, one in which the perpetrators are hoping as hard as they can that it will work. My belief that the whole game will unravel before election day was based on a belief that the manipulators had miscalculated what they could actually get away with. But I am curious: how would an attack on Iran benefit the Republicans or the Western economic elites, unless they were able to seize Iranian oil fields without much fighting or damage? It seems to me that such an attack would simply make losers of everyone involved. What are your thoughts?

Oil is not that important well to be clear light sweet crude is very important but outside of that the next most critical resource is Natural Gas. Iran is 100% about Natural Gas the oil reserve of Iran are secondary.

At the moment most of the worlds remaining Natural Gas is in Russia or Iran. Russia has nuclear weapons Iran wants them. We need Iran's natural gas before they get nuclear weapons or the world will be effectively controlled by these two countries within ten years. For a lot of reasons the window of opportunity to attack

is closing and as you note the moves to push oil down probably won't last much longer esp of course with the hurricanes. Technically the US is actually close to out of gasoline right now. I suspect whats going on is that some pipelines which have a lot of dead storage are being drained right now to prevent shortages. If this is true then it will take a while to refill them with product.

As far as the election goes if we are embroiled in a war with Iran and its setup to look like the US was unfairly attacked or US assets at least then Mcain is pretty much a sure bet.

Obama is not a safe bet for most people under these conditions he is the change candidate.

Julian Darley (HNfNG) says that Qatar has colossal natural gas reserves, roughly comparable to Iran's.

Also, it's a little late in the Bush administration to be attacking Iran. I would expect there to have been some buildup of public support, well in advance.

I would not assume that Obama will spare Iran, if he wins office. He'll be under the same pressures from America's ruling milieu to keep our mitts solidly on the oil and gas spigots of the Middle East.

market is pricing in a 5-7mbpd drop in world demand - hurricanes, hoarding, production cuts be damned....wildcard is china...(and maybe Ike)

Why do you say that?

Oil prices today are the same as they were in February; would that not suggest similar demand expectations to what they were in February? Did you see July as the market pricing in a 5-7Mb/d increase in demand? Or are you saying this based on something other than price?

Based on what we've seen here on short-term oil price elasticity (i.e., 0.05 or so), a 30% fall in price doesn't correspond to anything near a 5-7Mb/d drop in demand, even if this were a pure supply-and-demand story. Considering what else is going on (most other commodities down strongly, US$ up, etc.) and how rapidly the price rose and fell, it's highly likely that much of this was not about supply and demand, meaning there's even less of an implied drop in demand.

I honestly don't see how you could have reasonably come to your conclusion. Care to elucidate?

It has nothing to do with oil price. everything to do with deleveraging in financial community that was overweight energy. As I wrote about here, that extra price boost that hedge funds covering oil shorts caused in June would be amplified on the way down. As I explained in Hedge Funds, Hurricanes and Energy Markets, a small amount of capital can overwhelm fundamental physical oil supply demand in the very short run. We are dealing with the largest delevering in the history of the financial system, so whatever positions existed when the credit clerks came calling are being reduced, even if they are the 'correct' positions.

This is going to hurt the world economy badly, and the oil market (and gold, and corn, and 10 yr note, and copper, etc.) are looking at large demand reductions in 6-12 months time. (And as is typical, the stock market is the last to catch on).

Whether we actually do drop 5-7 million is not my prediction - Im just saying that market is pricing oil as if that were the case....US demand is already down 1 million barrels YoY.

Sure, but how do you go from that to "pricing in a 5-7Mb/d drop in demand"? How does "pricing in" not have to do with "price"?

Basically, it's not at all clear to me what you mean by "pricing in a 5-7Mb/d drop in demand", especially if it "has nothing to do with oil price". What do you mean by that phrase?

Indeed, a hurricane takes infrastructure offline and that means... the price falls? Conflict in Georgia... the price falls? OPEC cuts production... the price falls?

We did see a remarkable retreat before the last elections.

The manipulation of these markets is truly astounding. No matter what happens, they can create an 'explanation' for why oil has fallen again.

Here's my explanation for the talking heads:

"Sure, the hurricane was bad, but not that bad, so oil ought to be cheaper now that it will cost more to have it delivered and repair the infrastructure. Relax. We're going to drill everywhere, even where the oil is negligible. That added expense ought to bring the price of oil down further. But after the elections, no more promises."

Oil prices are due for a crash (for now) simply because of rising supply and falling demand.

According to a report released today, it's all the fault of speculators. The report, said from January to May index traders poured $60 billion into commodity markets, causing a big spike in oil prices. When Congress began holding hearings about speculation from May to July, traders pulled $39 billion from the market. The report was released as part of the effort by some members of Congress to crack down on what they believe is excessive speculation in oil markets.

So you can see the politicos really are helping to keep the price down and stop the poor consumers from being "gouged" as I think you call it.

Meanwhile, back in the United Socialist State Republic of America the comrades having nationalised Fannie and Freddie are on a much bigger bet, or leverage as the bankers call it, $200 billion against 6,000 billion. But don't worry gentle reader there are 6,000 billion of assets to balance the liabilities, never mind that nobody else would touch these "assets".

Tonyw we had a serious increase in exports at the same time this speculator crackdown was taking place it was not entirely market manipulation. In fact the oil market given the pressure on speculators has moved 100% in agreement with supply until the last few weeks. And the SPR releases can be pointed at to explain the short term pricing situation.

Real oil played a large role in the price movements it does not seem to be a market that can be manipulated purely using financial instruments. This is very important in my opinion.

Which releases? According to the SPR website, there hasn't been any drawdown in months.

Unless you mean the tiny releases in the last week due to Hurricane Gustav were responsible for the 30% price decrease in the preceeding two months?

Marathon to get 250,000 barrels of oil from SPR

http://www.chron.com/disp/story.mpl/business/energy/5989629.html

DOE to deliver SPR oil to Placid Refining Co

http://av.rds.yahoo.com/_ylt=A0geunmVyclI_HkBxTqNBqMX;_ylu=X3oDMTBxYWI3c...

Yes, those would be the releases due to Gustav that I was talking about. Check the links - both are from this week (Sept 8 and 11), and both explicitly say it's due to Gustav.

So, the question again: how do the SPR releases that happened this week "explain the short term pricing situation" that mostly happened 1-2 months ago?

Hi memmel,

As far as i am concerned the day to day prices are fairly irrelevent other than a decrease will send the wrong signals to people. To my mind the facts are oil is finite and we have burnt the easy stuff so it's just going to be in short supply. Graphing over a longer term the price will go from bottom left to top right with a few wiggles. IMHO severe depressions will slow this trend down and could even cause the price to go down to ??? ( a really low number:-) nevertheless in terms of peoples incomes a greater proportion will be used for fuel.

IMHO the sooner people, government start to make some realistic plans the better, even if in the long term we are all dead, since a steady slide will be better than a horrendous crash. I don't understand why it is so difficult to stop sales of new gas guzzlers right now, insist all new buildings are constructed to the highest insulation standards right now not in several years time, existing buildings are retro-fitted as best as possible.....

Absolutely. Obsessing over day-to-day or even month-to-month movements in price or supply is foolish.

The key point is simply that we use a lot of oil, and getting that oil is going to become harder and harder.

You can focus on whichever aspects of that you find most compelling (oil is finite, easy oil first, rising Chinese demand, controlled by unfriendly nations, etc., etc.), but they're all just variations on the same theme.

Tonyw, if the price rising to 145 was speculation and Congress' initiation of an investigation caused investors to pull enough spec money out to bring the price down (a scenario I happen to agree with) then shouldn't Congress pass legislation to reduce the chances of this type of speculation occurring again? Particularly if those higher fuel costs slowed the economy. There was a plan to increase the money required to purchase the oil futures from 5% down to 50%, which would probably do the trick. Do you agree?

More likely that any spec money that came out was due to hedge funds and others needing to pull money out of other investments to cover CDO and mortgage exposure.

Since most commodities had seen dramatic %runups they had the greatest profits to pull out there.

Congressional threats don't generally sway people until the legislation is signed and about to go into effect.

The money required to purchase oil Futures on the NYMEX has now been over 10 % for several weeks.

Most people would want to have more than that on hand anyway to avoid a margin call.

If they raised money requirements for oil futures anywhere near 50 %, the speculators would go to any other energy futures that did not have high money requirements, including putting money in overseas market accounts.

I would say ALL speculation on any futures requiring anywhere near 50%, would end immediately.

Note, I am not really making a comment on the effect speculation has on prices:-)

Since there seems to be a consensus that speculation drove up the price of oil & hence gasoline I would fully expect the politicians to SAY they will pass laws to restrict speculation or at least to initiate an inquiry. In an election year politicians must be seen to be doing all they can to "help" the people (e.g. drill everywhere), especially when the targets are the faceless speculators.

Please remember though that the US (USSRA) does not comprise the whole world, so a restriction in the US could cause speculators to look to use other markets. As prices have already come down there may be less pressure, do people now view $100 oil as normal or cheap?

Of course there are large oil using companies that sensibly need to hedge to avoid sudden changes to their business models and so their needs must be considered before changing the rules.

Oh yes, i think/guess de-leveraging has had more effect than any threat of possible future action by the legislators, when the short financials/long oil play turned it left many speculators scrambling to unwind their positions.

Exactly. keep in mind that we did a poll last december when oil was $95 and many forecast a spike to 140 and then drop to 70-80 due to a recession. peak oil means we are going down but it also means MORE than ever before...(but I think marginal cost has increased faster than I anticipated so we won't likely see the $70-$80 that folks are talking about (of course, barring short term deleverage impacts which could be $10 in either direction at anytime)

Nate

Isn't there a risk that if the price drops to near the marginal cost that future projects will canceled/delayed? This would then quickly revive a tight market and the price would bounce back up again.

I think we now have a situation of the economic havoc wrought by a high oil price interacting with the economic havoc wrought by potential shortages. Its like living in a room with a 5ft ceiling, every time you straighten up you bump your head but walking around hunched hurts your back, which pain do you prefer?

Neven

Oil is a very capital intensive industry, and capital is going to be increasingly hard to come by as the world economy deteriorates. I don't think most people are taking this into account when they look at future production. Of course, there will be a lag of some years before this is really felt, but I think the situation a decade out is made grimmer by the economic problems, rather than somewhat better (from reduced demand) as some people think.

How is "falling demand" being measured? Did China change its demand? We've seen the graph in previous posts of marginally less demand in Europe and the US being completely offset by China, and to a lesser extent, India. Has that changed in any substantial way? If so, time for a new graph.

Traffic is no different where I live. Demand destruction? Is that a just an abstract statistic or am I going to someday notice it on the freeway? Why would demand be less now that the price has dropped just before the elections? This is the time to drive! Drive everywhere--see the country. It's never going to be this cheap again!

And the same goes for flying! Don't miss your chance to see the world.

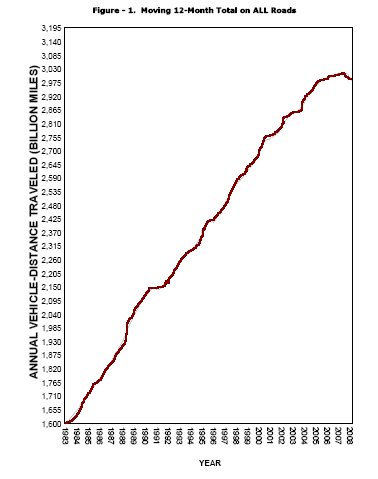

There is a significant decrease in miles driven in the US, the world largest gasoline consumer:

Excellent graph. But, my god, the drop is utterly negligible and can in no way 'explain' the price drop in crude oil futures. And again, the question is whether or not China's demand has offset this very small reported decrease in US consumption.

Oil demand is very inelastic so it takes a large price increase to affect demand.

I don't know about China, I have no data however last month it was question that China would stop subsidizing gas prices (http://www.thetruthaboutcars.com/china-to-kill-gas-subsidies/).

That drop is not utterly negligible. Perhaps you should look at that chart again. It is possible that what we're seeing could be the very top of a bell curve. Any number of things could happen that could cause that graph to spiral downward. I believe it is quite likely that it will. There is a lot of momentum behind a drop like that. If the momentum isnt taken into consideration, then economic policy shifts will not be effective.

Yes bout you have to interpret this VMT graph. My interpretation since the VMT matches perfectly with the peak in the housing market and decline is that its its driven by the collapse of the housing market. If you look back down the graph VMT flattened every time the housing market crashed. Given the size of the bubble not only a flattening but a decline makes sense but this started back in 2006 if prices are declining from this then they should have been declining all the way through 2007.

In any case if this interpretation is correct then VMT will now remain fairly flat to at best slowly declining despite the price of oil for quite some time say up to 200 dollar oil or so.

However despite this long term trend claiming it explain price action over a few months when its a multi-year trend with the price increasing almost the whole time is not correct.

VMT is not the reason for the recent price changes in my opinion it can be used to support a few month change in price.

How in the world do we know how many miles are being driven? Why not look at gas tax receipts for an accurate picture of demand drop? Total gas tax receipts are based on actual gallons pumped. Just divide by the tax per gallon to get the number of gallons used.

That would just give you fuel consumption; it wouldn't tell you anything about why fuel consumption has changed(miles travelled, change in driving style, the market share of different kinds of vehicles...).

Aren't drop "in demand" and drop "in fuel consumption" the same thing?

Am. Eco, I agree that "demand" and "fuel consumption" could be compared. But to analyze where demand is changing, miles driven is a good complementary measure. People drive with their tanks X percentage full on average(I think in Spain it's about 30%).

So you could drive the same but with your tank fuller on average. That would increase demand temporarily and not miles driven.

Presumably, to adjust for high prices people drive with the tank emptier (on average) before they cut on miles. So it does illustrate where people are cutting.

(whether the economic crisis or the price are behind it is another question ... and a survey would probably elucidate the answer a little).

The price looks set to continue falling as we're in a deflationary environment it seems. Given the credit contraction taking place. Even though the price is falling, it doesn't mean it's any less expensive in the sense that unemployment is rising globally and wages are pretty stagnant across the OECD. China's manufacturing index indicates that it is in a recession as well.

The trend is down. The rule in speculation is to follow the trend. Trends usually go much farther in either direction than most think.

The fundamentals and the news back up the downtrend. Hurricanes can't stop it.

The dollar is in an uptrend which makes oil cheaper. The economy is in recession with rising unemployment which is spreading around the world. This will reduce demand even though prices are falling.

Most speculators are Republicans and want them to win in November. They will run the thing down until after the election. Other commodities like the grains are also in a downtrend and will probably not attempt a recovery until after harvest pressures are off.

Oil frequently makes a low in January at the nadir of the driving season so the down trend should continue. There needs to be some kind of bottoming formation on the charts to signal the end of the downtrend but with oil making new lows this process hasn't even started.

More time is needed and that probably means the next uptrend won't start until spring driving season of 2009. New ethanol plants are still coming on line and the ethanol mandates are still in place putting more liquid fuel supply on the market despite the hew and cry of ethanol opponents.

If McCain is elected and the mandates are lifted, there will be less supply pressure holding down gas prices, but that presupposes a Republican congress that is anti ethanol.

The anti ethanol plank snuck through the convention without debate is not going over at all in the Midwest with many Republicans disavowing it. Sen. Grassley of Iowa being the most prominent.

No, oil is priced in dollars, it is more expensive for all the people who have to convert to dollars from their currency, for example the UK $ rate in the last year has gone from 2.11 to 1.76, it makes oil >16% more expensive, so the UK would probably demand less now than this time last year.

Also on top of that Brent was ~75$ bbl a year ago relative to ~$100 today, for the UK (and many other OECD countries) oil is massively less affordable now than a year ago,way above wage inflation.

Even for the USA oil is massively less affordable now than a year ago, also way above wage inflation.

People demand oil based products based on how much they can afford not it's price per se.

Actual bbl supply = Actual bbl demand = (% of income available to buy oil)/(cost of bbl of oil)

If either the cost of a barrel goes up, or the amount of income available to buy oil falls (say because of a recession or currency)then less will be demanded.

The cost of a barrel of oil just balances supply and demand, nothing more - the price tells you nothing about the actual ammount being traded.

Why is Dated Brent Spot $5 below WTI?

Dated Brent Spot 97.49

WTI Cushing Spot 102.28

Is there another squeeze dance going on?

The dated brent spot price is usually lower than cushing and nymex. It's probably less attractive due to a different composition(e.g. heavier or more sulfur).

Well I voted for $91

With the U.S current importing 1.2 million barrels a day less last week, there is less pressure on the international market.

But there again, I am always wrong on these polls.

Really good read:

http://www.reportonbusiness.com/servlet/story/RTGAM.20080909.wheinzl0910...

“My attitude is, goddamn it, they're good … it was brilliant.”

According to Mr. Coxe, the Fed's ultimate goal was to trigger a rally in financial stocks, which would, in theory, help banks hammered by the credit crisis raise fresh capital and repair their balance sheets. To accomplish this, the decision to support Fannie and Freddie was deliberately announced on a Sunday, which had the effect of maximizing the reaction from thinly traded financial stocks on overseas markets.

Because many hedge funds were using massive leverage to short financials and go long on commodities, when North American markets opened and banks initially rallied, the funds were forced to cover their short positions.

At the same time, the U.S. dollar was rallying because the risk of holding Fannie and Freddie paper had diminished. The rising dollar, in turn, made commodities less attractive, giving funds that were already scrambling to cover their financial shorts another reason to dump oil, grains and other commodities.

It ought to be clear that the answer to this poll is that NOBODY KNOWS! There is no rationality to the price of oil, nor much of anything else these days.

I would suggest that massive interventions and sub rosa manipulations, e.g. oil, gold, silver, mortgages, bonds, etc. the markets are fundamentally broken, reflecting primarily panic and confusion. Rationality has been lost, so market pricing in these times means very little. Last weeks big winners are this weeks big losers. The wise man takes his money off the table and stays home until the carnage has cleared.

Impossible to win your bets when the myriad Ministries of Truth are lobbing Molotov cocktails around the paper factories.

If this choice is added to subsequent polls, I'll start voting....

True. And, we are pointlessly trying to measure the price of an intermediate product - subject to bottlenecks, politics and logistic issues, when it is the final product price that matters outside the industry.

If LOOP etc. is damaged, then end product prices could climb worldwide [because yanks buy our fuel], while crude prices fall. Thats not a conspiracy, thats a complex system.

I don't see any other way we have a stock market rally in this environment, than the FED firing up the printing press and flooding the market with freshly printed paper.

But in the end, maybe that's what they'll eventually do.

In the short term, Oil is anybody's guess, but we all know where its headed in the long run (supposedly). Declining growth in demand will not fall far enought to make effective use of the declining supply.

Miningoilgasguru

http://www.stockresearchportalblog.com/

I'm voting down again since I've been seeing big success on that. Soon I'll be a guru ;-)

Chris

I am just wondering about some of those guys who thought "buy and hold" was a no-brainer. That may be true in the long-term. In fact, I firmly believe the long-term trend is much higher. The short-term, however, can be brutal.

It's going to be very interesting now that Uncle Sugar owns Phony and Fraudie. Will they use it to blow another housing bubble? Drop interest rates and "make affordable housing a right for all americans"?

I don't see how they can resist now that F&F are now under the control of Barney Frank. "Conservatorship" was a clever trick for "Now we can do whatever we want. Wheee!"

In the long run . . . Yeah, we're all dead ;-)

Robert,

I'm just applying J. Richard Gott III's ideas on lifetimes: http://en.wikipedia.org/wiki/J._Richard_Gott#Copernicus_method_and_Dooms...

When the trend has been down a while, I'll probably start voting up. What I'd really like to see is $20/barrel oil because we've found the will to stop using it. http://mdsolar.blogspot.com/2008/06/oil-is-too-expensive.html

But, that would take some guts not just guessing.

Chris

Looks like I'm getting extra opportunities to vote again, three times so far.

Chris

Any comments on Dave Cohen's prediction that oil price will descend to around $80 in the next couple of years, due to economic recession? I have some trouble with his logic, as he claims that:

* "All liquids demand will likely not fall below 85.5 million barrels per day" (due to still-increasing demand in BRIC countries)

and

* "Oil demand will no doubt remain below global production capacity during the [economic] downturn"

- those two can only happen together if production capacity does not decline. And even then, if demand rises more than that minimum, it'll outstrip production, no?

The current fall in oil prices is much as expected. As I commented in the thread following the previous vote on oil prices I believe that oil prices will fall to about 80-90 USD/BBL and then start gradually trending upwards again. However, I may of course be wrong. Perhaps the reduction in demand is in fact so great that oil prices will be reduced further? Once again, let me reiterate that I believe that we are fairly close to Peak oil, but that I don't necessarily subscribe to the most dramatic views as to the effect of Peak oil.

I also believe that many of the members of the Peak oil community should look at themselves in the mirror and consider the damage that their over-zealous shouts of: "My forecast indicates that average monthly oil prices will never go back down to $102". Yes Ace, that is you I'm quoting. Or "We will never see double-digit oil prices again" etc. Such comments are just as stupid as CERA's constantly ridiculous overestimates of future growth in oil production rates.

The world energy balance is fragile. But with increasing energy prices we can all make HUGE cuts in our personal energy use. HUGE. Without much effort and without much change to our quality of life. I'm cycling more and driving less. So are a HUGE number of other people.

Have just been attending the Pareto investors conference in Oslo and during the introduction there was an intersting comment: "Oil prices are still at 100 USD/BBL but the markets are behaving as though they were back at 10 USD/BBL". There's some truth in that. However, oil prices have fallen by a third in a very short period of time and there are a lot of people now having to reconsider their overconfident predictions of continuous and uninterrupted increases in oil prices.

So folks: Let's keep up the excellent quality of debate here at the oil drum. Let's not make ridiculous predictions or come to over-excited and childish conclusions!

I won't say that I understand what the impact of the election will be on the price of oil. It could be that high crude prices might give a political party something to rally around. If history repeats itself, the price will stay in a perceived lower range. Unlike the last election, oil is a hot topic. I don’t understand the impact of the election on oil, but there are perceived facts that nag at me.

• Over the summer, Iran unloaded 28,000,000 barrels of stored (via VLCC or the like) oil on the market. (Bloomberg)

• Russia signaling $250 oil by next year.

• Russia influencing oil and gas flow in Georgia and elsewhere.

• OPEC reducing production.

• China and Asia's thirst for oil doesn't appear to have abated as it has in the USA.

• The relentless drop in the EIA USA reported crude oil and gasoline supply.

• The coming heating season with higher crude oil demand.

Pushing oil prices down is only, from what I perceive, demand destruction in the USA with perceived carryover to the rest of the world.

In the end, world GDP hasn’t be reduced by much. New higher efficient cars aren’t flooding the market to accelerate demand destruction.

Russia may want higher prices. From what I can see, they have nothing to lose from high oil prices and much to gain. Russia also has "the muscle" to demand higher prices.

I am not certain that the demand destruction in the USA was great enough to bring the USA demand in balance with supply.

I don’t think it is the dollar driving the price of oil. It is oil driving the value of the dollar.

.

In the end, supply and demand will win out. As for the recent push downward in price, I like to give speculators their due, demand in the USA waned, the oil bubble burst. The bottom in price will be found and I believe we are close to it. To honor this thread, I think the price of crude will stay lower for the next three weeks, $98 to $105, beginning to push higher prior to the election, by Christmas, there is more anxiety in the market and in the early new year, prices begin to move up more sharply.

"HUGE".

But maybe the flab won't be cut until it is too late - that is, until oil is $300 to $400 per bbl, at which time, the little remaining oil will be very costly to extract and won't be adequate to the task of building alternatives. Ask yourself at what gasoline price point will Americans curtail most of their driving?

I got the first poll wrong, but have been right on every one since... There is a downward trend which could well see oil drop to $80. This downward trend began at $147, so it's already gone a lot further than many expected. Anything below $100 is a bargain. Demand may will continue to slacken, but in the short term there are enough storage tanks and hedging contracts around the world that need to be filled that will keep oil above $91.

Russia, Iran and hurricanes aren't proving to be much of an immediate threat. Saudi's have got a little bit of spare production capacity. In the run up to the US elections, they don't want the US to be distracted by high oil prices, so oil has no chance of going anywhere near $120 in the short term.

Oil will stay in it's current trading range. There is a greater chance of further falls than rises, but the limits to how far oil can fall are being tested.

After years of increasing at a double digit annual rate, the US money supply has suddenly gone to zero growth this summer - mostly due to the mortgage crisis. www.nowandfutures.com/key_stats.html

Naturally when there is no extra money, the average rate of inflation goes to zero. IMO that is the main reason we suddenly see a strong readjustment in oil and all other commodities. In real terms oil may continue to be more expensive than ever, but you may not see it show up in the dollar price.

The question is how long this deflation will last (i.e. how long will it take for the Fed to bail out the banks and inject all that money into the economy at taxpayer expense). I'm guessing that with all the debt America has available to monetize, it shouldn't take long before we are on our next hyperinflationary run.

Which way will oil go? Who cares, I am hedged so I win either way.

What everybody seems to be forgetting about demand is that it's not just the US that's going into recession--the rest of the world is too. Europe and Japan are going into recession (Europe's is likely to be worse than in will be in the US), and China's growth has slowed.

All this will slow demand, brining down price. Plus demand destruction has been particularly dramatic in the US, and a small dip in the largest consumer is more significant than a small dip in a smaller consumer.

"CL will hit $113 before it hits $91"

The chart below has been updated for the Sep 10, 2008 IEA Monthly Report

http://omrpublic.iea.org/

While it is true that OECD demand is being destroyed, non OECD demand remains strong. The IEA has forecast 4Q2008 total liquids demand to be just over 88 mbd, while August 2008 total liquids production was 86.8 mbd, a gap of 1.2 mbd. The IEA has revised down its demand for 2009 to 87.6 mbd which is 1% greater than its estimated 2008 demand of 86.8 mbd.

Oil prices are expected to start increasing very soon, remaining volatile over the next year, before resuming the long uptrend in late 2009.

Supply, Demand and Price to 2012 - click to enlarge

The above supply forecast assumes the forecast below for key producer Saudi Arabia. The forecast excludes natural gas liquids production which is due to increase significantly as Khursaniyah NGL and Hawiyah NGL projects should add about 0.6 mbd production. Unfortunately, almost all of this 0.6 mbd will be used by Saudi Arabia's power and petrochemical industries, and will not be available for export.

Saudi Arabia Crude/Condensate Production Rate to 2020 (including half of Neutral Zone) - click to enlarge

Ace as far as I know its impossible to get a good handle on the actual amount of light sweet oil available on the market however if you can think of ways to monitor this its important.

From what I can tell the price oil is driven at least for the foreseeable future by light sweet availability.

It could be years before overall oil availability much less total liquids begins to have as much of and impact.

After light sweet and tightly coupled is NG and heavy sour supply. As long as cheap NG is available then complex refining works fairly well.

But for at least the next year or two and maybe even three supply and demand for light sweet seems to be the dominant factor in the worlds oil markets. This of course sets on top or alongside export land and overall production.

Memmel,

Eni's World Oil and Gas Review 2008 has a wealth of information.

171 pages!

http://www.eni.it/en_IT/attachments/cultura-energia/analisi-economiche-e...

Here are a table and two charts of crude quality production. It appears that light sweet crude production rates have declined slightly from 12.9 mbd in 1997 to 12.4 mbd in 2007. Note that Eni has not classified the quality of 4.4 mbd production in 2007, as shown in the table.

.

.

Ace, I'm afraid you were wrong last time and will be wrong again this time! I'm also afraid I just don't believe your graph. If I've understood it correctly it indicates that as of from tomorrow oil production will start to fall fairly rapidly. I very much doubt that. Much more probable is that we bobble along on an undulating plateau between 85-95 mmbbls/day for another 5 years or so. Anyway, I'm still waiting with great expectations for you explanation of what's wrong with your forecast: After all you told us all after the last vote that:

"My guess is that oil price will "hit $126 before it hits $102". My forecast indicates that average monthly oil prices will never go back down to $102 :-) (Yes, I'm just rubbing it in :-))

Well never has just happened. So presumably your forecast is rubbish? :-)

There was a drawdown from oil stocks May to July, I see 30 million brls over that period; 325 -> 295.

http://seekingalpha.com/article/94900-oil-inventories

That coupled with $39 billion leaving commodities may explain why the oil price has dropped.

Petrol prices here in Wales are still high 114p / litre, say ~$8 / gallon. The increased prices for NG and electricity are still on despite the recent drops.

Best

"That coupled with $39 billion leaving commodities may explain why the oil price has dropped."

Where did it go (the 39 bullion bucks)? If you know, you could hitch your wagon to that horse and you could have a nice ride back up! :-)

RC

As the general consensus of comments has been a continuation of recent price trends, I will go out on a limb and say we start back up tommorow.

1) The weekly IEA report

http://www.eia.doe.gov/pub/oil_gas/petroleum/data_publications/weekly_pe...

2) There is, amazingly, a second major hurricance strengthening in the gulf headed for areas rich in energy infrastructure.

3) OPEC, as near as I can understand, says they will no longer cheat on quotas and this amounts to a =~ 500,000 barrel reduction in supplies

4) Prices have recently dropped precipitously

5) 100 is good round number for a floor

6) T Boone Picken's picks 100 dollars as a floor, I hear he's made some good calls in the past.

7) We've really ticked off Russia, a very major exporter of oil and natural gas

I hear they have just sent some long range Russian bombers to Venezuala for joint exercises.

8) The dollar would not seem to be able to continue strengthening indefinately in the face of mounting deficits and the largest ever?? (stay tuned) federal bailout in Fannie/Freddie

Can't think of two more. Really I think the PTB wish to see a strong dollar and 70-80 dollar oil for the elections (never want a hint of revolution around an election).

I think TPTB may have shot their load. It was better aim than dead eye Dick, (then again shooting a lawyer in the behind may go down as his one successful political legacy (sorry lawyers;)) But who could have imagined two major hurricanes in the GOM - remember what happened the last time this occured. The people with money will likely start to feel real greedy real soon, despite the playbook. I may be 180 degrees off, but looks like a decent time to make a prediction.

I make that 1.23 M b/d less by Christmas.

In the UK I'm more concerned with tight LNG supplies.

Best

Before this poll left the front of oildrum. We already need a new poll.

Oil has traded at 91.53 already tonight (Sept 15)

http://www.nymex.com/lsco_fut_cso.aspx